Thesis

With the rapid development of American suburbs post-World War II and the concurrent large increase in car ownership, cities and towns across the U.S. introduced minimum parking requirements during the 1950s. These zoning ordinances required new buildings to include off-street parking lots. Parking occupies 30% of the average American city, with some studies estimating that eight parking places are available for every vehicle in the US. Parking surface area exceeds that of housing in Midwestern towns and metropolises alike. There are more than 2 million parking spaces in Philadelphia, 1.9 million in New York, and 1.6 million in Seattle and Des Moines.

The increasing demand for optimal parking space utilization globally is driving the growth of the parking management market. Authorities that operate parking spaces are increasingly investing in advanced parking management solutions as a result. The global parking management market grew from $3.3 billion in 2022 to $3.6 billion in 2023, and is projected to grow to $5.2 billion by 2027. Moreover, Americans spend an average of 17 hours per year searching for parking, costing an average of $345 per driver in wasted time, fuel, and emissions, and overpaying for parking; in total, this leads to $20 billion a year that goes to waste.

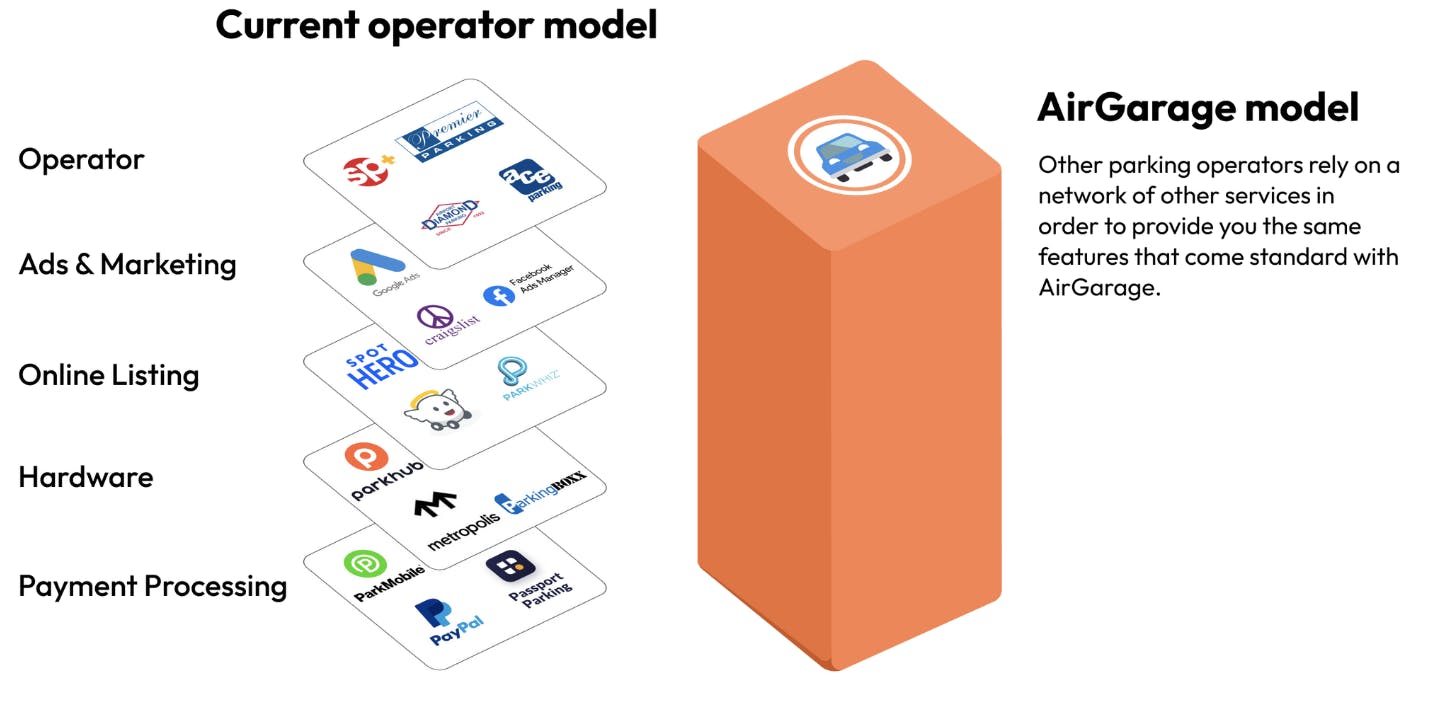

AirGarage, which is a tech-enabled service that takes a software-first approach to parking lot management, is positioned to take advantage of both of these tailwinds. It’s a two-sided marketplace with parking lot owners on one side and drivers on the other. For lot owners, AirGarage has created tools to help automate the operation of parking lots and parking garages, including payment collection, camera-based enforcement, and advertising across parking apps; but as a technology-enabled service, AirGarage doesn’t just provide tools, it also provides full-stack parking management. It also provides analytics to help owners understand occupancy and revenue trends. For drivers, the AirGarage app is intended to make it easier to find the best available parking spot nearby.

Founding Story

AirGarage was founded by Jonathon Barkl (CEO), Chelsea Border (CDO), and Scott Fitsimones (CTO) in 2017. The trio met and conceived the idea for AirGarage while attending Arizona State University, and pursued the company after leaving university; Fitsimones and Barkl dropped out, while Border graduated in 2018.

The company underwent several pivots since its founding in 2017. The original version of AirGarage while the founders were at university was to create a platform for people to rent out their driveways to college students who were paying exorbitant fees for on-campus parking. Barkl referred to this idea — a peer-to-peer marketplace for parking — as “AirGarage 1.0.” The team began by going door to door and asking strangers whether they could rent parking spots in their driveway, and 12 people said yes early on. In 2018, they upgraded from relying on driveways for parking supply to entire parking lots at churches, hotels, and other businesses that had never sold parking before. They managed the lots themselves in the Arizona heat. During this time, the team honed in on their software-first full-stack approach to operating parking lots and gained considerable traction until the first round of COVID lockdowns hit.

COVID lockdowns led to a sudden 90% drop in revenue due to a lack of drivers on the road, after which the company shifted its ideal customer profile. This time, the company sought to address the qualms of real estate owners in downtown urban areas who had leased their property to parking garage operators and now felt trapped as their tenants were reneging on lease payments they had agreed upon before the pandemic. Before the pandemic, the parking garage operators often took 100% of the revenue after the lease fee. AirGarage began offering a 70-30 split in real estate owner’s favor to address this pain point. As CEO Jonathon Barkl told Contrary Research, this shift led to “a stronger PMF than we were getting with the non-traditional parking lots like churches and businesses.”

Product

Management

Source: AirGarage

AirGarage handles the day-to-day logistics of managing a parking lot business, including payment collection, enforcement, and marketing. Its software-driven approach helps real estate owners lower operational overhead and increase net income, providing advanced analytics about how their parking spots are used. For consumers, it provides an easy-to-use parking experience.

Payment Collection

Source: AirGarage

After drivers pull into an AirGarage lot, they pay by scanning a QR code or texting “pay” to a unique phone number specified on a sign in the lot. They are then directed to a webpage with three form fields — license plate number, plate state, and credit card information — which they must then fill out to begin their parking session. Drivers end their session through a link sent to them via text message and are charged only for the time they use, subject to a one-hour minimum fee. Drivers can also download the free AirGarage app, which allows them to find nearby lots and save their information for future use.

As CEO Jonathan Barkl told Contrary Research in an interview, AirGarage also uses “LPR to automatically charge drivers once they are in the system, similar to how FastTrack or EZPass tolling works, to make it a completely hands-free, seamless experience for drivers once registered.”

Dynamic Pricing

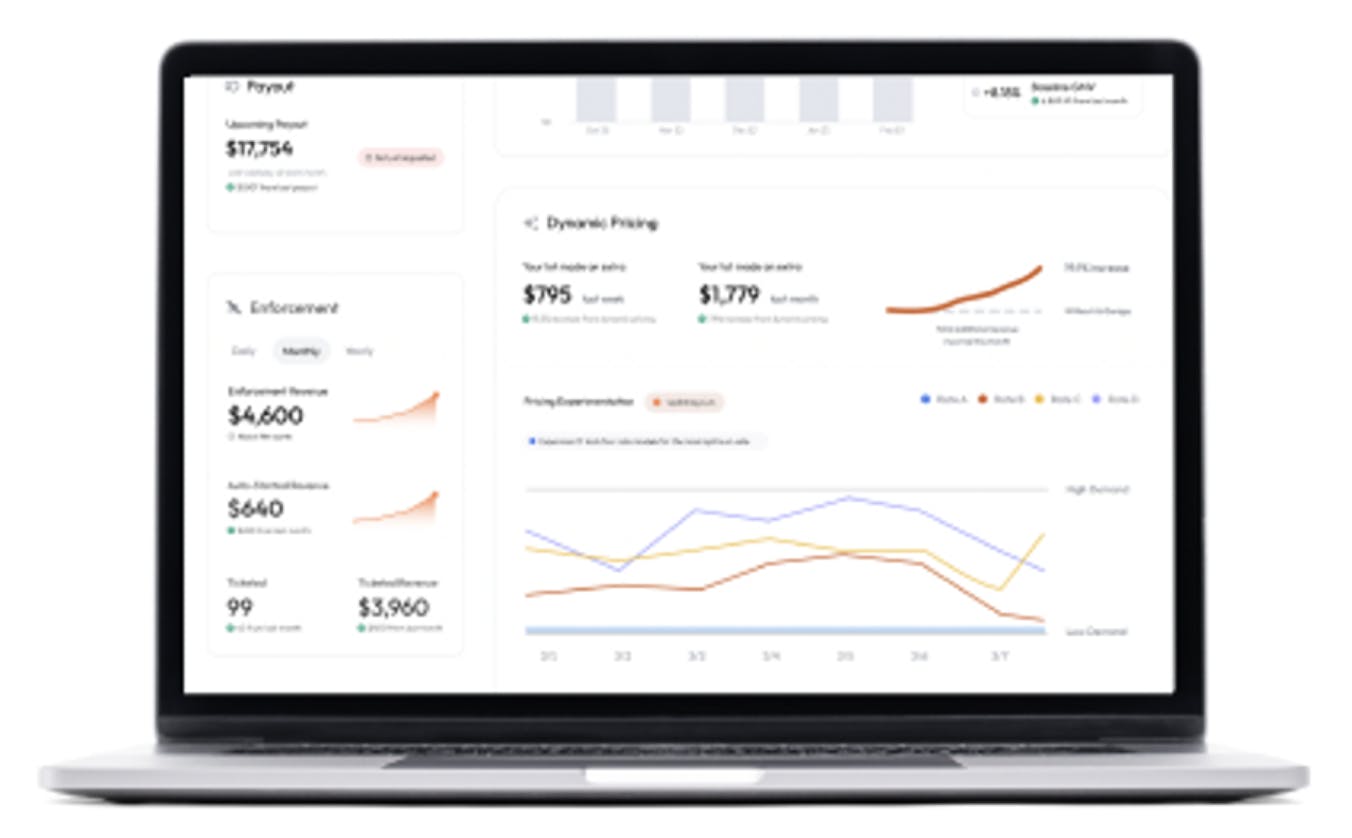

Source: AirGarage

AirGarage employs a dynamic pricing system that changes parking rates based on current occupancy to ensure maximum revenue during peak hours and attract more customers with competitive pricing during off-peak hours. This system also aims to enhance customers’ experience by making it easier for drivers to find available parking spaces, with the goal of increasing the possibility of repeat business and driver satisfaction. Dynamic pricing is also meant to help improve overall traffic flow by encouraging drivers to park during slower periods and increasing turnover during peak hours. An online dashboard gives owners access to advanced analytics to identify traffic patterns and drive continuous improvement.

Commenting on AirGarage’s dynamic pricing capability, CEO Jonathon Barkl told Contrary Research that:

“The important strategic difference for AirGarage’s Dynamic Pricing vs. what existed before in the industry is that, because we are full-stack and built a full technology foundation for our operations, we can dynamically price 100% of bookings in a location since they all flow through one payment system (AirGarage), whereas other parking companies really only dynamically price by partnering with SpotHero and dynamically pricing the small fraction of bookings that are made well in advance.

Our system means we collect data on bounce rates, driver retention and health, and revenue boosts from Dynamic Pricing that other companies don’t get, and we drive significantly more NOI increase as a result of doing this for all bookings instead of just a fraction (20%+).”

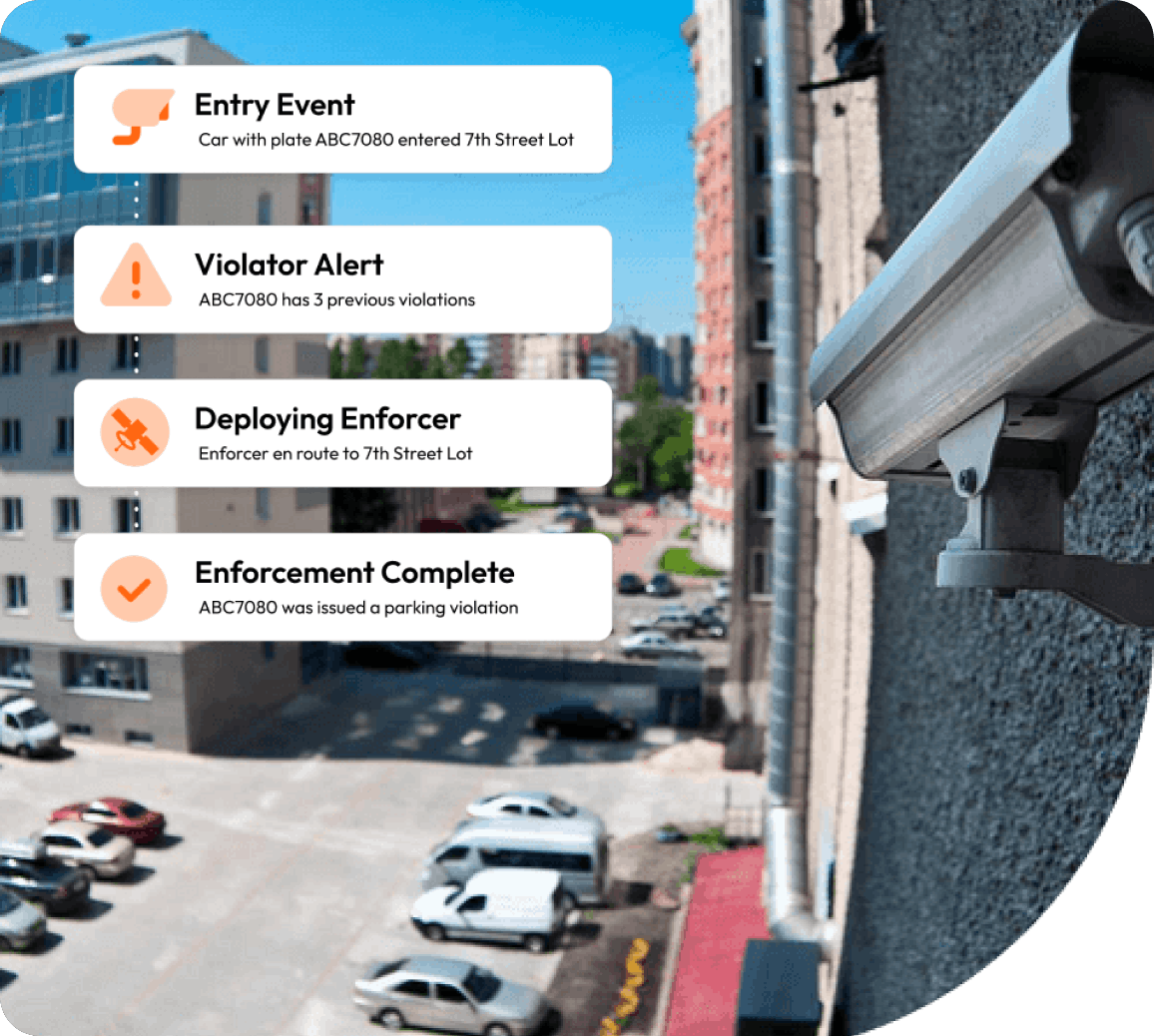

Enhanced Enforcement

Source: AirGarage

AirGarage employs license plate recognition (LPR) cameras to monitor driver behavior and enhance parking enforcement. The cameras scan the license plates of all vehicles entering and exiting the lot to see who has paid and who hasn’t, and can automatically start or stop rentals for drivers that have previously registered with AirGarage.

When violators are identified, the system immediately alerts AirGarage’s local, on-the-ground enforcement teams to issue citations or immobilize the vehicle. These enforcement teams are hired directly by AirGarage and are compensated based on the number of valid licenses they verify. The payment for this service is adjusted based on the parking lot's current occupancy levels. AirGarage’s online dashboard provides owners with detailed analytics, real-time monitoring, and alerts to inform them of any issues.

Advertising Partners

AirGarage Advertising Partners are parking marketplace websites and apps that help parking lots gain visibility with drivers already searching for a parking place. AirGarage offers integrations with SpotHero, Arrive, Google Maps, and other leading platforms.

AirGarage’s goal with a combination of this and other product features and operational features is to increase the dollar of revenue per square foot driven in each parking lot, according to a comment from CEO Jonathon Barkl.

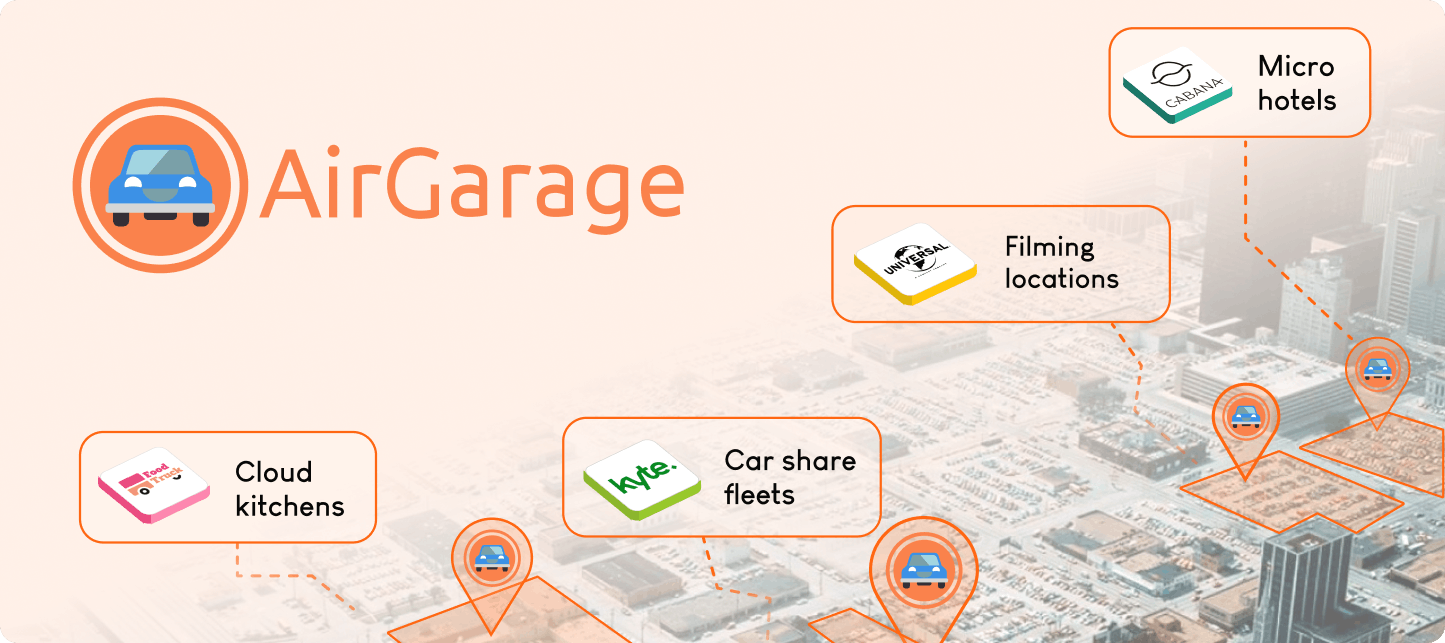

Location Rentals

AirGarage rents out around a quarter of its parking lots for alternative uses, such as filming locations. After a customer submits a booking form on their website, AirGarage provides on-demand quotes. Customers can scale space up and down to only pay for the real estate they use.

Market

Customer

Source: AirGarage

AirGarage operates parking lots for property managers and hotels, connecting these spaces to drivers and location scouts. In an interview with Contrary Research, CEO Jonathon Barkl described the market segmentation this way:

“55-60% of the people that own parking real estate in America is someone that just happens to own a piece of real estate. It's not their core business. The other 40-45% of the market is commercial real estate firms that own real estate generally, and also happen to own parking lots or parking garages because not a lot of real estate owners specifically just own parking. Parking is sort of ancillary to every other use case.”

Notable AirGarage customers include Starwood Capital Group, JLL, Marriott, Hilton, and Lincoln Property Company. Disney Studios, Netflix, HBO, Paramount, and Universal have also used AirGarage to book filming locations. Eventually, AirGarage wants to become an on-demand marketplace that serves anyone needing space.

Market Size

Parking takes up about one-third of land area in U.S. cities; nationwide, there are an estimated 8 parking spaces for every car. The global parking management market size grew from $3.3 billion in 2022 to $3.6 billion in 2023 at a CAGR of 9.8%. The parking management market is expected to grow to $5.2 billion in 2027. While the parking industry experienced a 50% decline in parking revenue in 2020 due to the COVID-19 pandemic, 50% of parking operators rebounded to pre-pandemic revenue in 2022. However, the demand for conventional parking spots may stagnate in the coming years if self-driving cars become a common mode of transport.

Competition

SP+: SP+ is one of the largest parking management companies in the nation and an incumbent competitor to AirGarage. It was founded in 1929 and pursued aggressive growth via an acquisition strategy. It uses its dominant market position to purchase all local competitors and maintain its hold on profitable lots by locking owners into long-term contracts. It has made over a dozen acquisitions in the last decade. In addition to their parking management services, SP+ offers Sphere, a suite of in-house technology solutions that helps clients deliver frictionless end-to-end mobility. SP+’s Standard Parking and Central Parking brands operate over 2.1 million parking spaces across 4.2K parking facilities, including shuttle buses at over 75 airports. SP+ also owns USA Parking System, a valet operator. The company IPO’ed in May 2004.

FLASH: FLASH is a parking technology platform that provides solutions for various types of companies, such as hospitality companies, healthcare institutions, airports, and universities. FLASH offers a suite of management capabilities similar to AirGarage including mobile payments, parking guidance systems, access control, revenue management, and analytics. It allows for real-time remote management capabilities and adaptability to mobility trends. It also differentiates from AirGarage by offering Hardware-as-Service and valet parking solutions. However, FLASH is not a parking management company; instead, it sells technology to parking companies and is not a fully-integrated stack. FLASH was founded in 2011 and has raised a total of $315.8 million in funding.

Passport: Passport is another parking management platform that offers mobile pay parking, parking enforcement, digital permitting, payments, and more. It works with universities, municipalities, and private parking operators. Like AirGarage, it has a consumer-facing app that helps drivers to find and pay for available spots. It was founded in 2010 and has raised $213 million in funding.

SpotHero: SpotHero is an aggregator and booking platform for parking. Like AirGarage, it helps parking operators list their spaces and make incremental revenue. Its consumer app helps people search and compare prices at thousands of parking facilities across North America. SpotHero for Business enables companies to offer employees a way to expense daily parking and other benefits, like being able to reserve parking near the office with pre-tax dollars. It was founded in 2011 and has raised $117 million in funding.

Metropolis: Metropolis builds payment infrastructure for parking facilities. Owners equip their parking lots with cameras that run on Metropolis’ proprietary computer vision software to create frictionless “drive-in, drive-out” parking experiences. It also helps local restaurants, coffee shops, and retail stores gain visibility on their mobile app. While each company’s go-to-market strategy varies, AirGarage and Metropolis both see parking as a stepping stone toward digitizing the physical world. The company was founded in 2017 and has raised $228 million in funding.

Vend: Vend is an end-to-end SaaS management and payments solution that changes how real estate owners, parking operators, tenants, and visitors interact with parking. Vend also offers FlexPass, a product that allows employees to share monthly parking memberships. It was founded in 2020 and has raised $3.8 million in funding.

LAZ Parking: Founded in 1981, LAZ Parking is another incumbent within the parking management industry. It operates over 1.3 billion parking spots across 3.5K locations in the US, with an annual managed revenue of $1.4 billion.

Business Model

The parking management industry primarily operates on two business models: (1) operators charge owners fixed payments on a cost-plus basis, or (2) operators pay real estate owners a flat lease and keep 100% of the revenue from operating activities. AirGarage generates revenue through a 70-30 gross revenue share model that aligns incentives between owner and operator. Depending on the lot, it dynamically prices its parking spots based on driver demand, with options to pay the hour, day, or month.

Other than employee compensation, AirGarage’s most pertinent operating costs are the capital expenditures it incurs when onboarding a new location, including the installation cost of signage and cameras and the removal cost of access gates. To operate existing locations, it bears the costs of maintaining its physical assets and paying its enforcement contractors. There are no setup, hardware, or other related installation costs for owners, and AirGarage is free of charge for drivers.

Traction

As of March 2023, AirGarage operated over 37K spots across 30 states, with over 1.4 million cars parked since its inception. AirGarage had at least 200 locations under management in January 2022, and has continued to grow since then. In February 2023, CEO Jonathon Borkl said AirGarage’s Space Force enforcement team’s income had increased steadily from August 2022 to January 2023.

Valuation

In October 2021, AirGarage raised a $12.5 million Series A round led by Andreessen Horowitz, bringing its total funding to $14.8 million. Founders Fund, Floodgate, and Abstract Ventures also participated. While AirGarage has not disclosed its valuation, FLASH, an AirGarage competitor, was valued at $1 billion after a private equity round in 2022. LAZ Parking was last valued at $4.6 billion and SP Plus is trading at a revenue multiple of 1.4x, down from 2.6x in March 2021.

Key Opportunities

Source: AirGarage

Customer Service

AirGarage has an opportunity to achieve more sustained growth than its incumbent competitors through differentiation via superior customer service. While incumbents rely on low-wage workers to perform repetitive day-to-day tasks to keep their parking facilities running, AirGarage’s software-first approach allows it to automate most operational processes. AirGarage can use this advantage to allocate more human capital toward customer service and building relationships with owners, which would lead to lower churn rates.

API for Space

As social and technological trends may decrease the need for parking space, the value of real estate with parking as its sole use case may diminish. AirGarage is positioning itself to take advantage of this demand shift, which will be another key area of opportunity. By leveraging data to identify time frames where a parking asset might be better utilized for another use case, AirGarage is building toward a future where real estate is digitized, flexible, and easily scalable. AirGarage could serve as a platform that connects people who need space with those who own it.

If it is able to achieve this vision, through AirGarage, users could quickly access physical space whenever needed and for whatever use case, whether for cloud kitchens, micro-warehouses, jewelry shops, micro-mobility charging stations, or autonomous vehicle fleets. The benefit of starting with parking spaces is that they are as fractional as possible regarding time and physical space. This scalability means that business owners don’t have to take on the risk of signing a long-term lease.

Ultimately, AirGarage aims to become an “API for Space,” enabling a proliferation of small businesses in the physical world akin to the boom of software companies that cloud platforms like AWS have enabled. AirGarage’s location booking service is a step in this direction, and Barkl says that as AirGarage continues to build its real estate network, it will continue to roll out more features toward this end.

Key Risks

Industry Consolidation

According to a senior national director of tech implementation at a large incumbent parking management company, the future of parking is one where the experience is fully integrated into cars’ navigation systems or mapping platforms like Google Maps. If this change occurs, the companies with the largest market share will offer the highest value proposition to navigation system providers, who may prefer to partner with a single parking management company. These companies build competing tech in-house and do not rely on third-party software providers. The risk to AirGarage here is that it will not be able to compete with more established players in the space or that it will be forced to sell itself to one of them.

Dependence on Contractors

Since AirGarage uses license plate recognition to identify violators rather than gates, the integrity of AirGarage’s enforcement system depends on its network of contracted gig workers, who are likely working multiple jobs. Whether this network is large enough and properly incentivized to move swiftly and with the necessary authority at scale remains in question. AirGarage may lose out on a sizable chunk of its revenues to violators if they cannot.

Enforcement in Cities

AirGarage’s gateless, attendant-less approach to parking management may make it a less relevant option for lot owners in larger cities. In New York City, for example, parking lots can rarely be left unattended because of how densely packed they are all the time. If AirGarage cannot find a way to cater to lot owners in cities, their TAM may be limited to less-trafficked lots in towns, small cities, and suburban locations. However, in an interview with Contrary Research, CEO Jonathon Barkl indicated that AirGarage has locations in every major city center.

Inaccessibility

Several local news organizations have highlighted anecdotes of drivers being confused by AirGarage’s cashless digital payment system, leading to fines that some deem exorbitant. Especially given that AirGarage’s gateless model might prove less effective in cities, a large portion of AirGarage’s addressable market may reside in smaller urban areas where residents may be older and less technologically inclined. In these cases, accessibility may be a real risk that AirGarage has to deal with.

Summary

AirGarage is taking on legacy parking facility operators like LAZ and SP+ to offer a streamlined technology-enabled parking experience. Rather than acting as a third-party point solution, AirGarage takes over the entire lot operations process in a way that aligns incentives between itself and the owners it works with. While the AirGarage team has demonstrated its ability to grow AirGarage’s existing parking business, its long-term goals come with a wholly distinct set of challenges, while also being ambitious enough to give the company potential for sustained growth and expansion into adjacent markets.