Thesis

The chemical industry is one of the largest markets on earth. In the US, it generated $5.2 trillion in revenue – approximately a quarter of the country’s GDP — in 2022. The US alone accounted for 17% of the global chemicals market in 2017, amounting to $765 billion in sales. Worldwide, there are thousands of chemicals companies selling hundreds of different specialty chemicals. There were three companies in the world that all did $90 billion in sales in 2020, and none of those three companies represented more than 1.6% of the entire industry.

Every physical product on earth is derived from chemicals. From shampoo to iPhones and Q-tips to automobiles, chemicals are in every process and product. Chemistry touches 96% of all manufactured goods. And yet, even though it’s one of the largest industries in the world, it’s still doing business the same way it did one hundred years ago — i.e., largely offline. As recently as 2016 74% of chemical companies still didn’t have any digital transformation initiatives. But things are starting to change. As of August 2022, 65% of chemical companies had finally acknowledged that digital transformation was going to have an impact on their businesses.

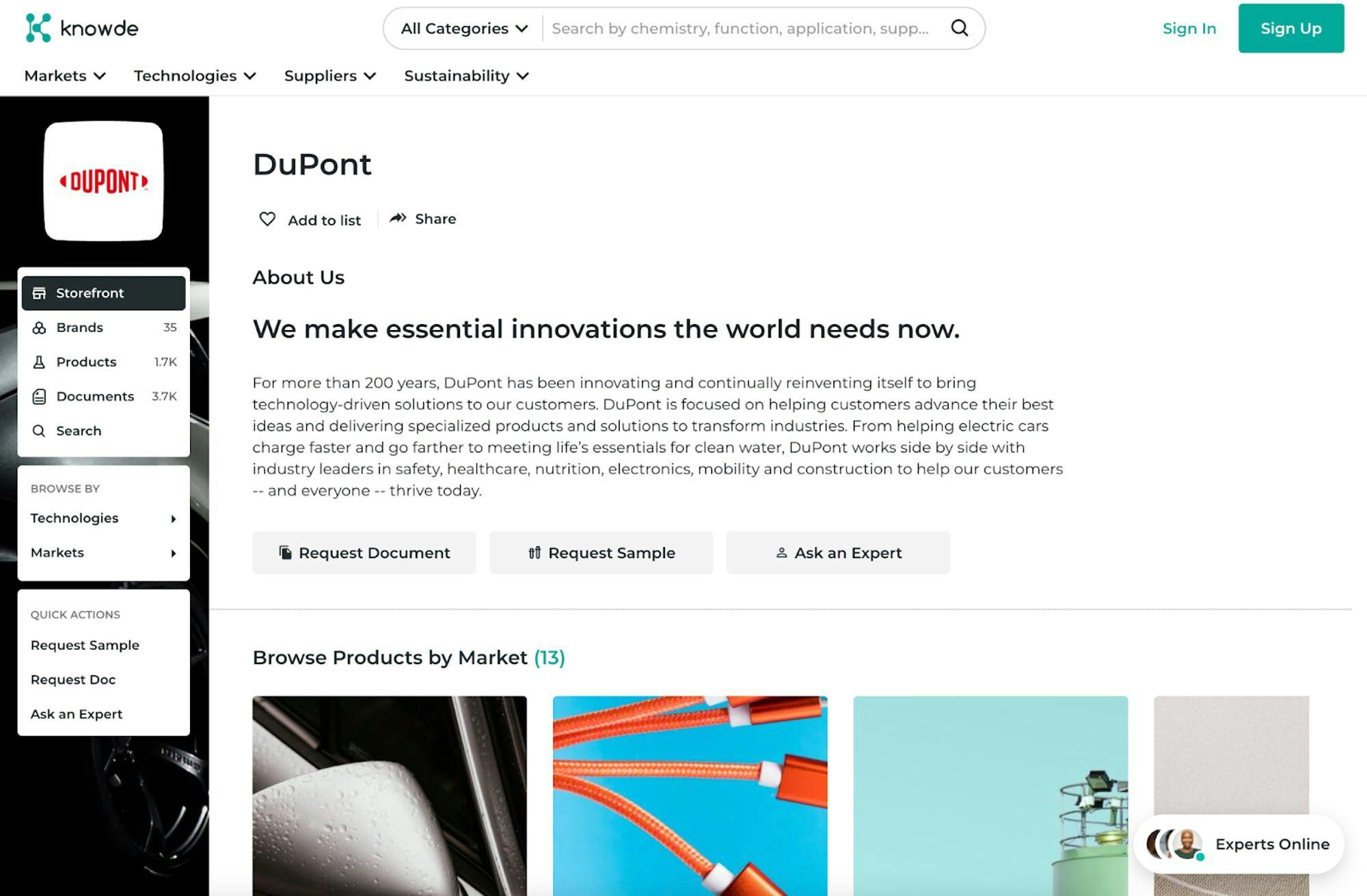

That’s where Knowde comes in. Knowde is an online marketplace for producers and buyers of ingredients, polymers, and chemistry. Knowde’s marketplace allows buyers to search, compare, sample, quote, and purchase products from thousands of producers in one platform. With more than 180K products and 8K producer storefronts (including DuPont, Dow, and Unilever), Knowde was the largest marketplace of its kind as of 2021.

Founding Story

Knowde was founded in 2017 in San Jose, California by Ali Amin-Javaheri (CEO). However, Knowde’s origin story traces back over forty years, beginning in Iran in the 1970s. It was at that time that, Ali’s father, Mehdi, realized that the science underpinning every physical thing on earth was chemistry. Mehdi attended the University of Maryland to obtain a degree in chemical engineering, and returned to Iran as an employee of DuPont, one of the largest chemical companies in the world. However, Medhi sacrificed his job to position his own family for future success. In 1985, Mehdi moved the family to the United States.

Ali Amin-Javaheri grew up around chemistry. He recalled of his father that “Chemistry was his life…he talked about chemistry all the time”. Almost naturally, Ali spent his free time as an eight-year-old in the library reading chemistry books and articles. He would pour over catalogs from the chemical sales industry, meticulously reading each and every supplier of the industry. Although Ali studied information systems as an undergraduate at the University of Washington in the early 2000s, he came across the offices of a company called ChemPoint. Amin-Javaheri recalled:

“I saw their signage and I was like, ‘Chem, that’s interesting.’ I remember going to their website—and it was a terrible website, 2001-ish—it talked about how they wanted to change the way marketing and selling is done in the chemical industry, and that they were hiring. I was like, ‘What… are the odds of me being in Seattle, where there is no chemical industry, running into a company like this?...I immediately applied.’

Ali remembered the catalogs he used to read in the library as a kid that described how the chemical sales industry continued to rely on in-person sales calls and conventions. He knew the chemical sales industry needed an upgrade. Over the next decade, Amin-Javaheri would hold virtually every position at ChemPoint, starting as an intern, becoming head of engineering, and eventually global head of sales and marketing where he helped the company grow revenues to $400 million. However, Ali became increasingly frustrated with the company as the focus shifted from a vision of changing the B2B chemicals space to financials and profits.

In 2017, after 11 years with ChemPoint, Ali convinced Wojciech “Wojo” Krupa, a friend from business school who had spent 15+ years building B2B labor and payment marketplaces for companies including LinkedIn, to join him in starting a new company as his CTO and co-founder. The duo also attracted Janakiraman Swamy, a former ChemPoint colleague (“the most technical person I’ve ever met,” according to Ali) as his chief knowledge officer, and started Knowde. They set out to build the first functioning digital marketplace for the chemical sales industry.

Product

Source: Knowde

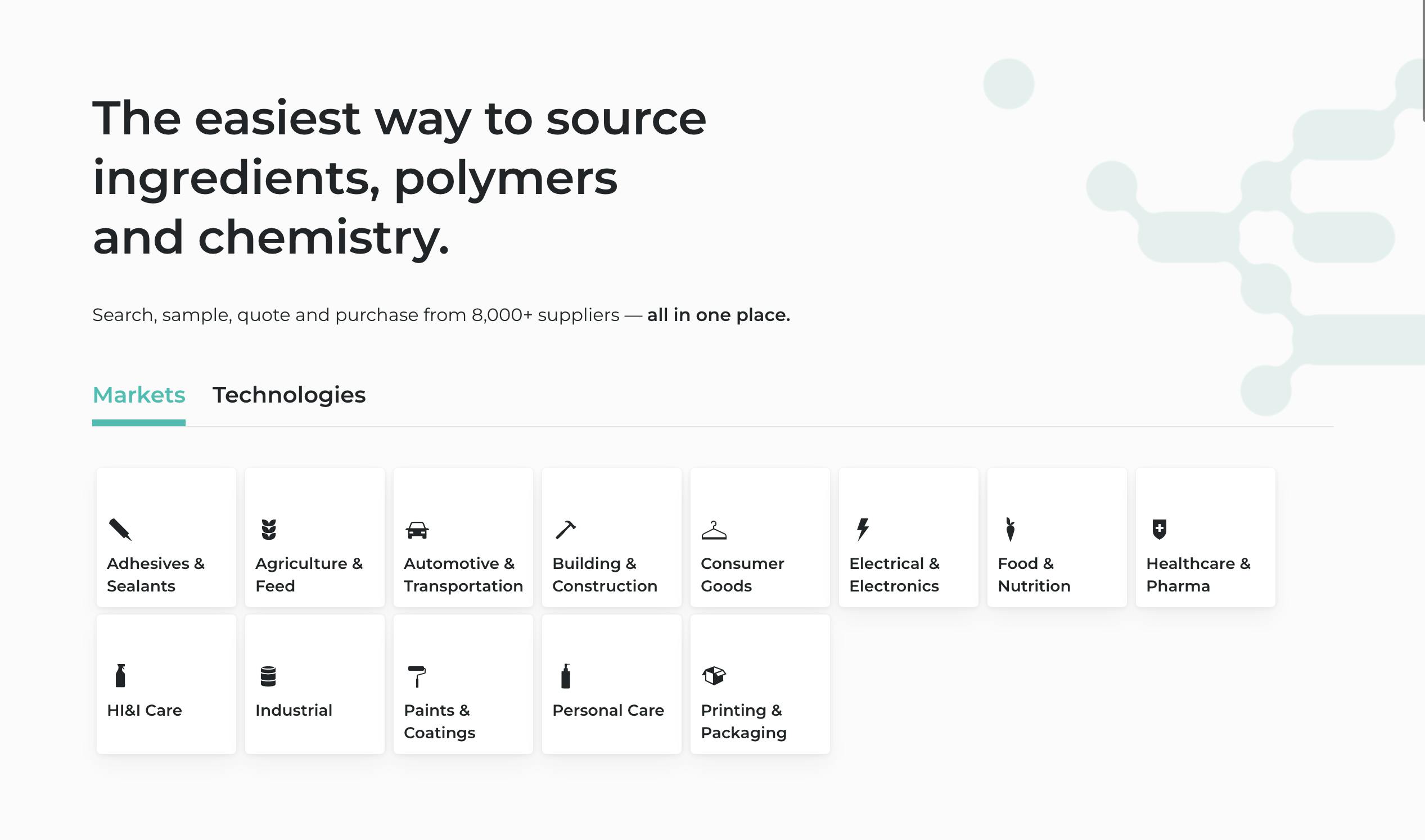

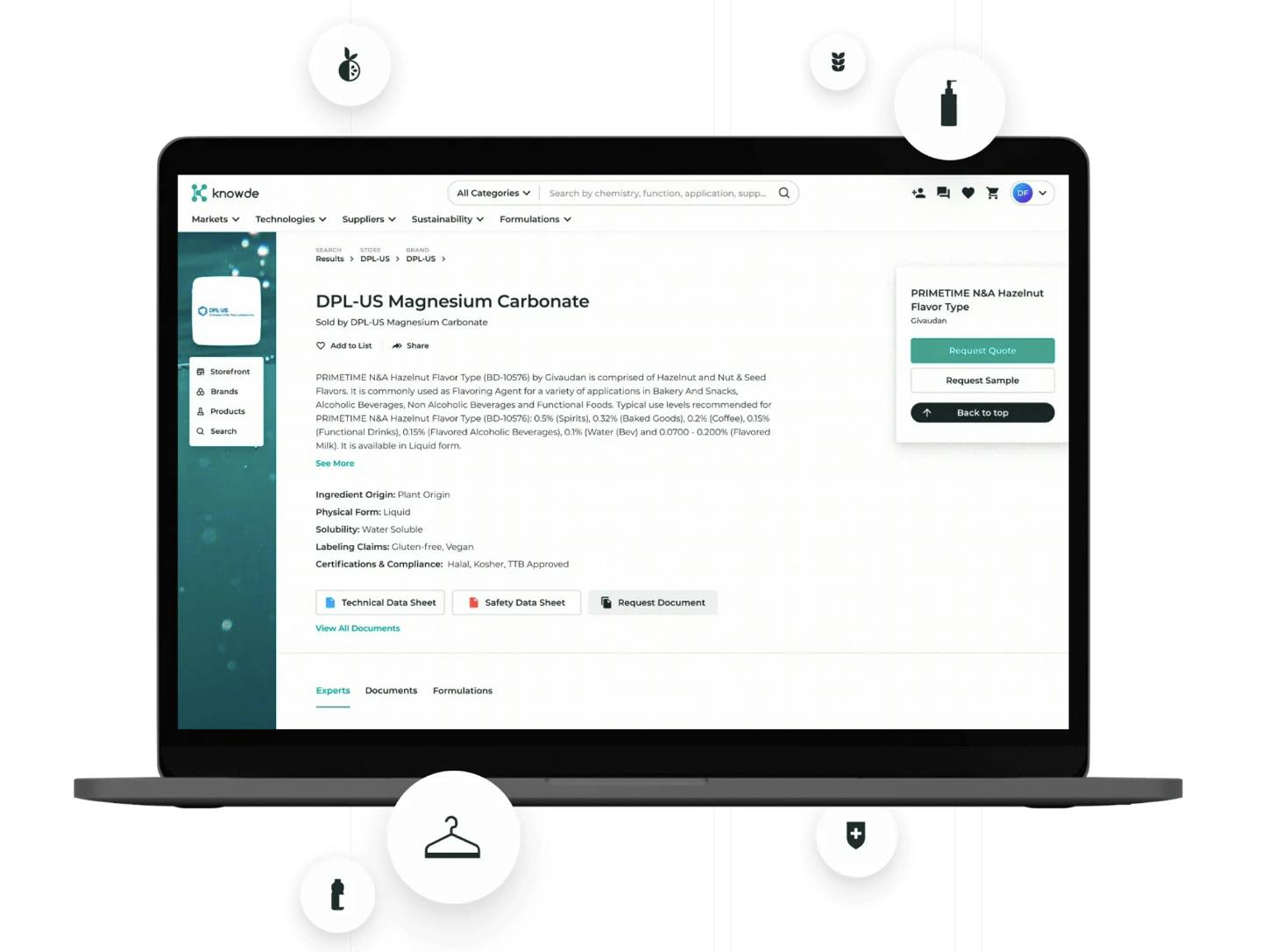

The value proposition of Knowde for buyers is that they can search, compare, sample, quote, and purchase products from a massive library of different vendors. Knowde’s platform can be broken down into a few components, across buyers and sellers.

For buyers, the product provides (1) search & discovery, (2) collaboration, and (3) buying.

For sellers, the product provides (1) digital storefronts, (2) marketing engagement/analytics, and (3) selling.

For Buyers

Search & Discovery

Source: Knowde

Knowde is building a digital platform for the chemical industry where buyers can search, learn, engage, sample, quote, and purchase from most major chemical suppliers. Knowde’s search functionality gives buyers the ability to explore according to chemistry, application, function, technical properties, and more in order to find the product they’re looking for.

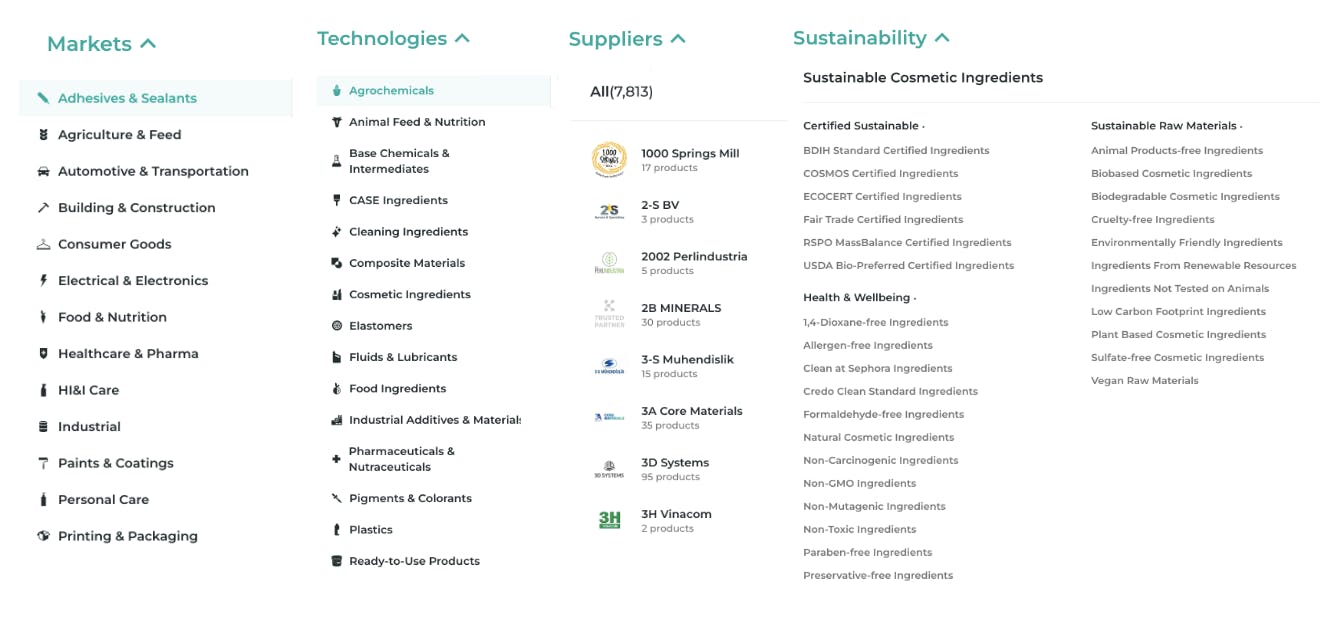

Knowde enables efficient search and discovery where customers can browse the largest catalog of ingredients, polymers, and chemicals. Knowde’s menu is broken down into four different groups: Markets, Technologies, Suppliers, and Sustainability. Its search engine offers granular filters to allow users to search by name, manufacturer, function, end-use, features, and more. With predictive algorithms designed specifically for every industry, Knowde can provide intelligent recommendations for users.

One component of a successful B2B marketplace is discovery. Buyers need to be constantly on the lookout for new suppliers and products that might boost sales. Suppliers and products need to be discoverable by buyers. Yet, in the chemical industry product discoverability was limited to physical product catalogs and PDFs. By putting product information online along with search filters and online payments capabilities, Knowde seeks to reduce the sales cycle and search costs for both sides.

The chemicals industry faced a more difficult obstacle than most other industries that have been digitized into an online marketplace. Every manufacturer and supplier has unique labels for different kinds of products. In a consumer-focused B2B marketplace, like Faire, a bedsheet is the same across basically every supplier. In chemicals, every supplier can have different words or labels for specific kinds of rubber. Knowde built a unique taxonomy that mapped every supplier’s unique vocabulary to a universal language for the industry; something that required the ingestion of millions of documents to normalize.

Collaboration

Source: Knowde

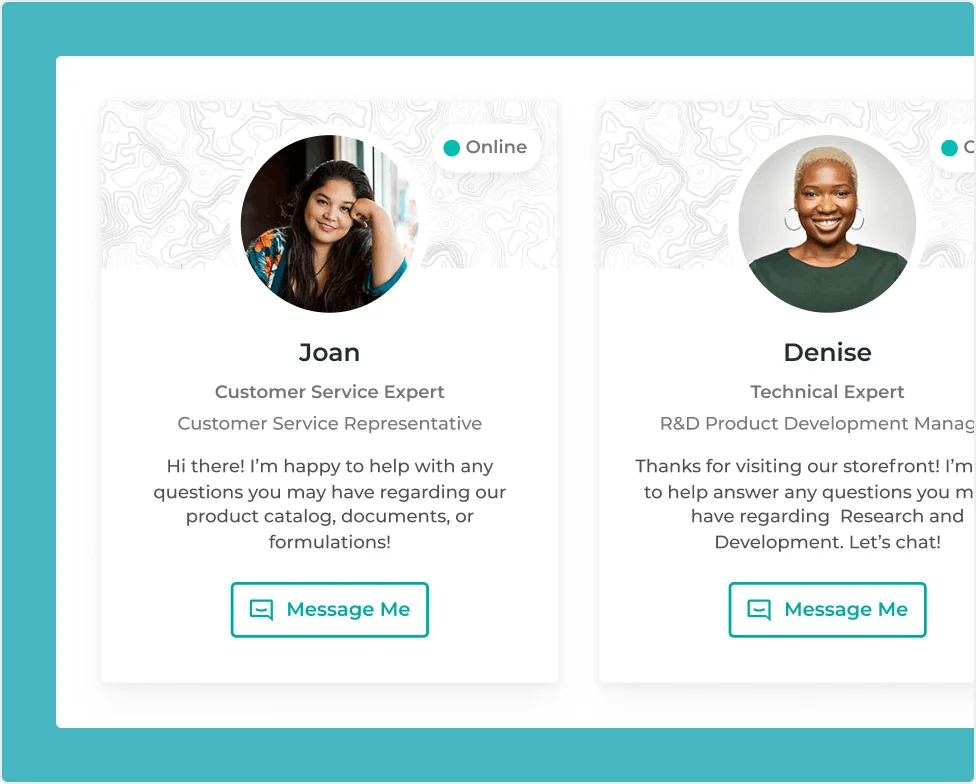

Knowde offers a collaboration and communication layer where customers can ask technical product questions, talk to sales representatives, and inquire about pricing. Knowde connects buyers with a supplier’s technical, marketing, or sales expert with questions. Knowde also offers a personal Knowde Concierge which ensures a timely response and is also available to answer questions 24/7. Customers can also request samples, quotes, and documents directly from the seller in a three-step ordering process.

Buying

Source: Knowde

Knowde allows customers to purchase from all of their suppliers on one site. On Knowde’s front end, customers interact with digital storefronts which are like Shopify storefronts for chemical suppliers.

For Sellers

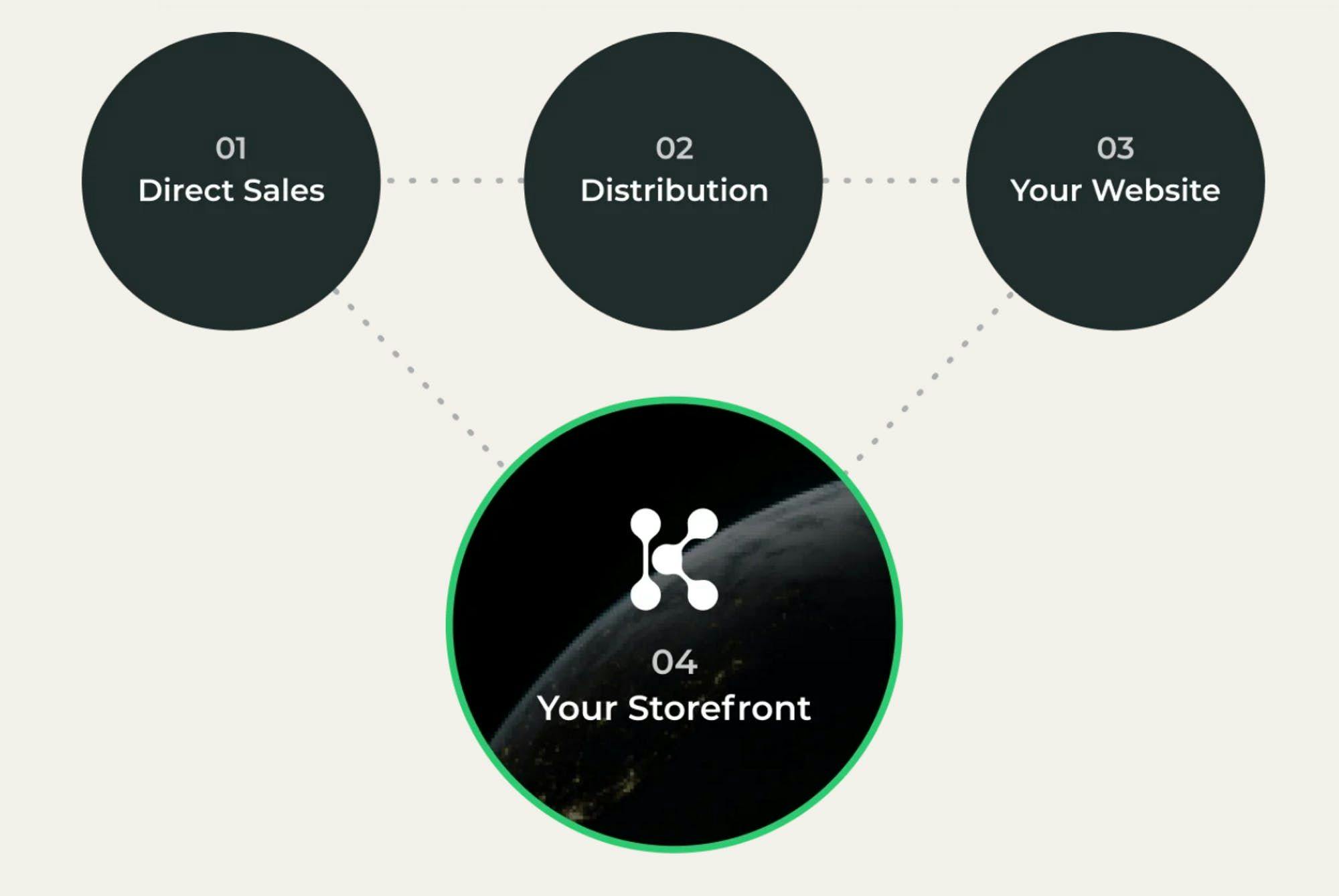

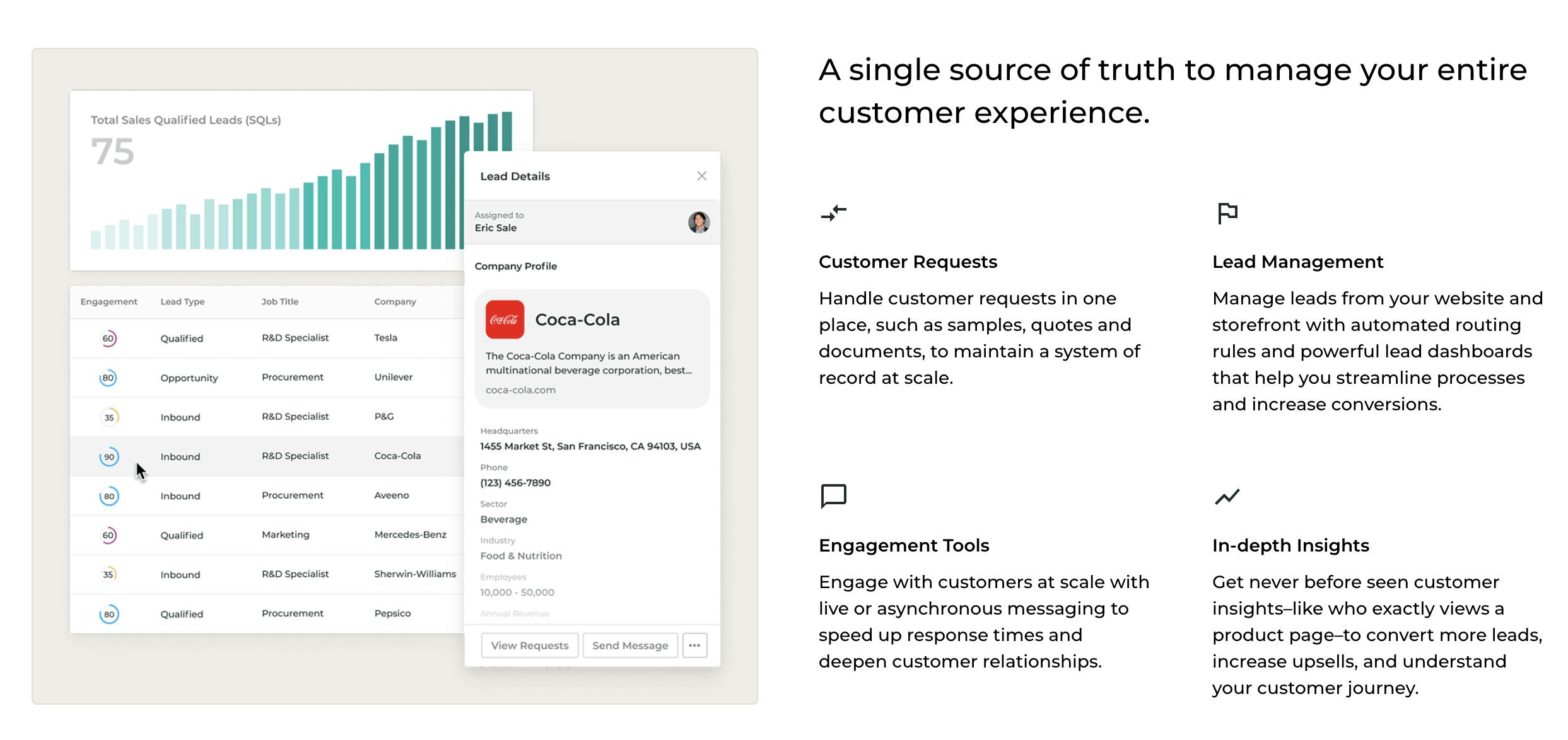

For chemical suppliers, Knowde is providing a full stack platform that digitizes the majority of the customer transaction. In an industry operating primarily off in-person direct sales, Knowde enables suppliers to not only digitize their existing customer relationships but to access customers outside their immediate network. The seller platform can be broken down into several main components: (1) digital storefronts, (2) marketing engagement/analytics, and (3) selling.

Source: Knowde

Source: Knowde

Marketing Engagement & Analytics

Suppliers can automatically nurture storefront visitors with relevant content and turn them into qualified leads. Knowde can provide targeted digital marketing and social media campaigns to support the sale of products, including self-service marketing automation and customer relationship management (CRM) capabilities.

Knowde offers access to the activity happening in a storefront like sales, requests, samples, and leads, and enables real-time interaction between customers and sales reps. Because Knowde has positioned itself as a one-stop shop, the company can become a central hub of discovery for buyers with intent. In a September 2023 interview with Contrary Research, Amin-Javaheri described the company’s use of SEO this way:

“A big play for us is all things SEO because all the product information is trapped in PDFs and a lot of times behind the firewall. That gives us an amazing opportunity which is that we can race out ahead and if we can unpack all this information and make it indexable. Then all of a sudden the the Knowde links in three years from now are like the Wikipedia links, and so that is our buyer acquisition strategy. These folks are online all the time browsing, looking, trying to figure out who's got what and why I should use certain products. Our objective is to drive them to Knowde and then make it really clear. Now that you’ve found information about eight products, you can click on this link to back out and go explore everything that you might also want.”

Selling

Source: Knowde

Knowde also provides suppliers with a back-office module to manage their sales efforts. Amin-Javaheri described the contrast to the existing selling process this way:

“Historically, this industry has been dependent on field salespeople, and that can be a very expensive way to interact with customers. Now, all of these chemical companies are trying to figure out how to interact with more customers by extending their reach—while doing it at a lower cost. And that’s where Knowde’s value proposition really syncs to the market.”

Market

Customer

As a chemicals marketplace, Knowde serves two primary customers: (1) ingredient, polymer, and chemistry suppliers and (2) R&D professionals and buyers of those ingredients, polymers, and chemicals. Chemical companies use Knowde to market and sell their products online. For buyers, Knowde provides a centralized destination to shop across a variety of chemistry suppliers. By helping pull this industry online, Knowde can improve the transaction experience in the industry.

The chemical supplier universe consists of 15K+ companies that provide every single ingredient, polymer, and chemistry that make up every physical product. As of August 2021, Knowde has brought approximately 20% of chemical suppliers onto the platform including some are the largest suppliers in the world like DuPont, Dow, Croda, Royal DSM, Roquette, Sasol, and Cargill. As of February 2023, seven of the world's 10 largest chemical companies could be found on Knowde’s marketplace.

Market Size

There’s been a substantial proliferation of B2B businesses using marketplace platforms to disrupt antiquated industries. B2B marketplaces like Flexport, Linkedin, Amazon, and Alibaba have become massive businesses, collectively valued at $7.9 trillion in 2022. However, one of the largest market opportunities remains unaddressed: the $5 trillion B2B chemicals marketplace. The chemicals industry, with $5 trillion in annual sales, is about 50% bigger than oil and gas, and 5x the size of the pharmaceuticals industry.

The B2B chemicals market tracks the entire world’s value chain from natural resources to chemicals used in all physical goods. Chemical companies use natural resources like oil and gas to make their chemical products while these chemicals are sold as solids and liquids to every type of manufacturing company. They are then processed or formulated to make every physical product on Earth.

The chemical industry is compelling not only because it’s one of the biggest but because it is also highly fragmented, which leads to a greater need for a new kind of marketplace. In 2020, there were three companies that all did about $90 billion in sales, and none of those three companies had more than 1.6% market share. There are 10K+ companies that generate meaningful revenue (over $100 million per year) in the industry and they all have massive product catalogs which makes it well-suited for a digitized marketplace.

Fragmented supply leads to powerful marketplace dynamics because a highly fragmented base usually means intense competition amongst sellers, leading to quick adoption of best practices to stay competitive. If sellers see an increase in demand after joining a marketplace, their competitors will quickly follow suit, leading to virality and efficient scaling. At a certain point, not being on the marketplace will be a structural disadvantage.

The B2B market across most major sectors of the US economy has undergone a digital transformation, often driven by digital commerce. Specifically, the chemical industry is progressing towards digital transformation. Over 84% of chemical customers felt half of their existing processes were digitally transformed in 2020.

The chemical industry has traditionally been dominated by in-person sales calls and conventions. The COVID-19 pandemic stressed the core transaction opportunities in the market. Supply chains were broken, making sourcing, and buying materials even more challenging. Being forced to transact online enabled less frequent in-person customer interactions, and opened the door to additional online volumes.

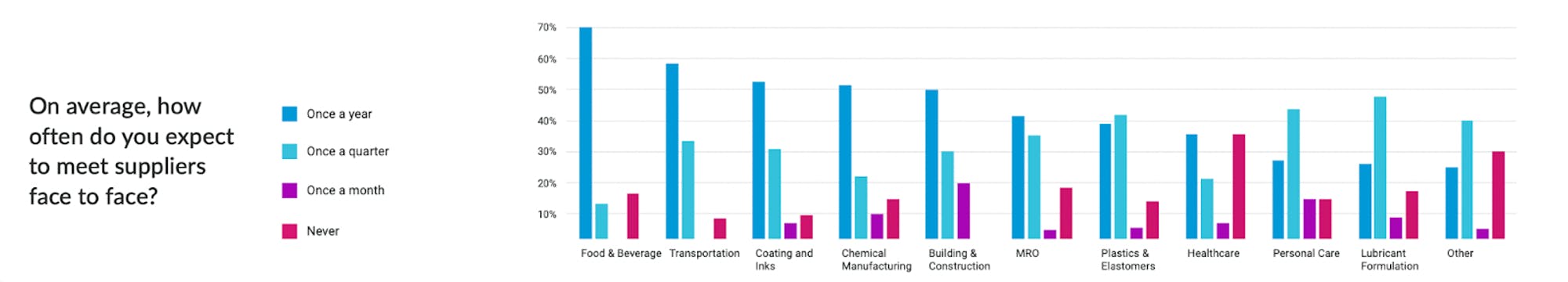

Source: ChemPoint

Knowde was there to enable the more flexible purchasing that was taking place during COVID, which Amin-Javaheri saw as the perfect opportunity:

“Serendipity is the right word for so much of Knowde’s story. A pandemic hits, which forces all of the salespeople to not be able to get in their company cars. Obviously, COVID has been disastrous, but I don’t know that this company could have been built without it.”

Competition

While there are some technology providers in the chemicals industry, Knowde’s primary competitor continues to be pen and paper. In a September 2023 interview with Contrary Research, Amin-Javaheri drove home this point:

“Most chemical companies in our industry still, to this day, do not have a CRM. They’re running multi-billion dollar companies without customer-facing tech. Founders say all the time ‘this is a paper and pen industry’, and they’re probably exaggerating a little bit. But in this one, it’s like Post-It notes and pencils, I mean it’s wild.”

In the dot com bubble, when Amazon was on the rise and popularizing the online marketplace business model, there were more than 15 companies attempting to build for the chemicals industry. Today, that number has dwindled dramatically to a few technology providers.

BluePallet: Founded in 2020, BluePallet is a chemical commerce platform, providing solutions for search, logistics, and transactions. Its marketplace provides a way to connect with an expansive network of buyers and suppliers that have been verified. BluePallet’s advantage is that Knowde's marketplace is used as more of a lead generation tool as it begins to ramp up its marketplace capabilities like transactions and financing, while BluePallet already enables those offerings. BluePallet has raised a total of $17 million in funding over three rounds. In November 2022, the company raised a Series A extension of $4.2 million from investors including Gradient Ventures and Vinmar Ventures.

ChemPoint: Ironically, ChemPoint, the company Amin-Javaheri left because their product development didn’t meet the potential he thought it could, is now one of Knowde’s competitors. As a wholly-owned subsidiary of Univar Solutions, ChemPoint markets and distributes specialty chemicals worldwide using technology to innovate and establish partnerships to drive growth. Univar did nearly $11.5 billion in sales in 2022 and has a market cap of $5.7 billion as of December 2023. Knowde has primarily been focused on North America and Europe, while Chempoint serves customers globally.

chembid: chembid is a vertical B2B search engine for raw chemical-based materials. Experts (chemists, formulators, product managers, commercial buyers) in the chemical industry use chembid as a digital tool to find chemical raw materials (e.g., coatings, adhesives, lab chemicals). Conversely, suppliers or manufacturers of chemicals can make their products easily visible online. Chembid is limited in its functionality and capabilities as it primarily serves digital matchmaking tool and a high-quality, reliable product data catalog.

Geo-specific competitors like Carbanio (India), Molbase (China), and CheMondis (Germany) have also begun to pop up across major markets, which could limit Knowde’s ability for geographic expansion depending on how quickly they gain traction. Other players in the chemical sourcing space as listed in a July 2023 study include GE, MP Biomedicals, ChemDirect, and Elemica.

Business Model

In a conversation with Ali Amin-Javaheri in 2020 after Royal DSM, ”a multibillion-dollar science-based manufacturer involved in nutrition, health, and sustainable living products,” opened a storefront on Knowde, Amin-Javaheri’s description of the business model of Knowde was summarized this way:

“A chemical supplier on Knowde pays a flat fee to create its online storefront. Once that storefront is up and running on the marketplace, the supplier pays an annual subscription to maintain their storefront and generate leads.”

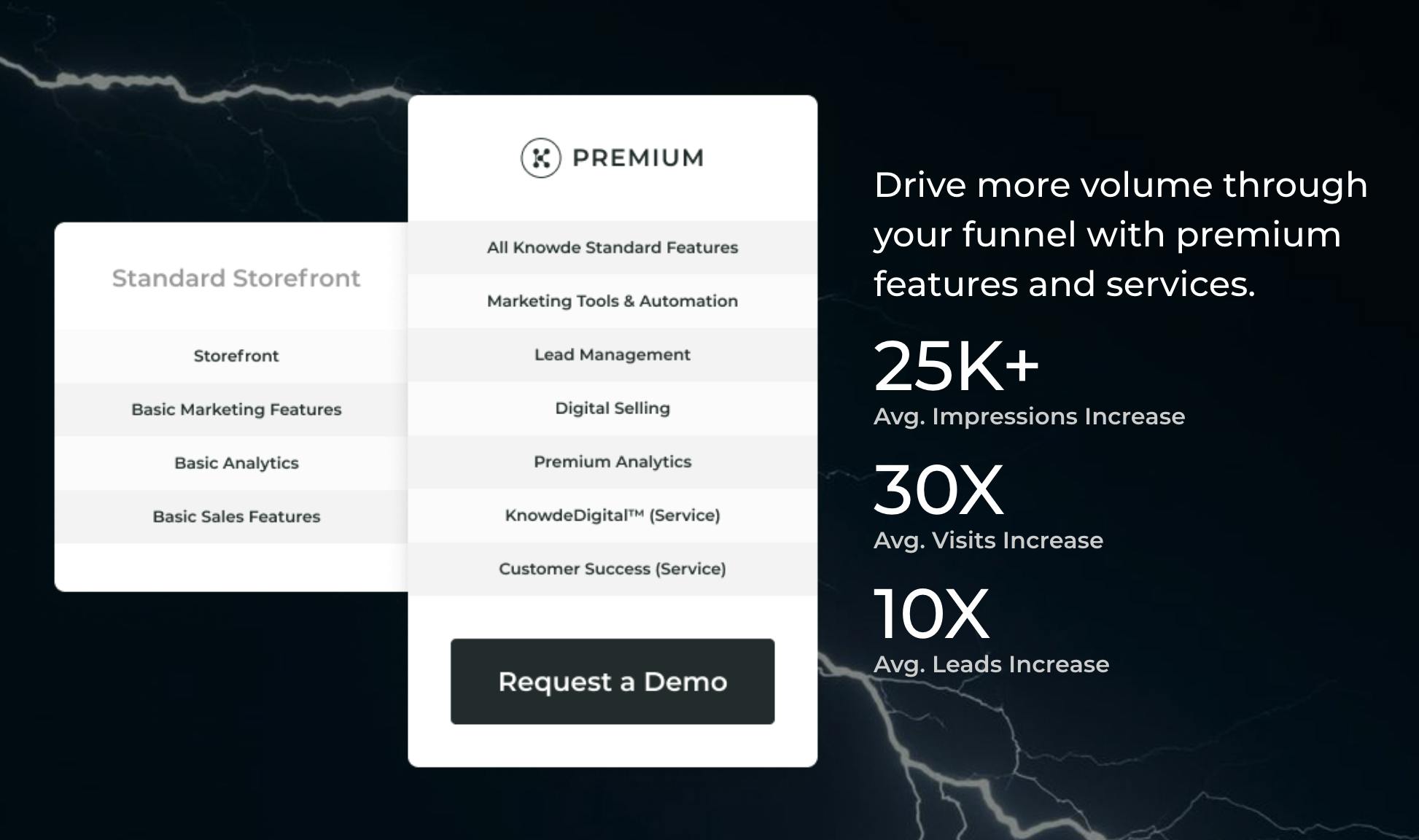

As of December 2023, Knowde is free for buyers, with all their revenue coming from sellers. Knowde also offers a premium service that provides a full suite of tools to help sellers attract more customer leads by 10x, grow their business, and provide more detailed analytics.

Source: Knowde

Traction

Knowde began by aggregating smaller suppliers. Over time, larger suppliers like Dow, Unilever, and DuPont have also become sellers on the platform. As of December 2023, the company had more than 8K suppliers in its marketplace, up from 4K at the beginning of 2022. Knowde is adding about six suppliers each day. Knowde’s onboarded suppliers span categories like food, nutrition, healthcare, pharma, automotive, transportation, and consumer goods. Knowde has mainly been focused on North America and Europe but in August 2021, Knowde shared plans to continue to push for geographic expansion.

As of December 2023, Knowde had over 180K products across 8K storefronts — more than any distributor, or marketplace. On average, one sales lead is generated every five minutes. In June 2021, it announced the addition or expansion of storefronts for eight major producers.

In June 2021, 10K R&D professionals and buyers were already on Knowde. In 2022, the company reported that this figure increased by 50%. As of December 2023, Knowde was seeing over 290K product searches per month with 1.2K quotes received in the same month. In 2022, the company saw a 70% growth in active suppliers on the Knowde platform and a 90% rise in online transactions. As of July 2023, Knowde had 118 employees (“Knerds”) across five countries and claims to be the largest marketplace of its kind.

Valuation

Knowde has raised a total of ~$91 million in funding as of December 2023 from investors including Coatue, who led its $72 million Series B round in August 2021. In August 2022, Knowde extended its Series B by an undisclosed amount from Alumni Ventures and Hedonova. Other investors in Knowde include Sequoia, Refactor, Bee Partners, and Cantos Ventures.

Key Opportunities

Product Expansion

The majority of Knowde’s product focus to date has been around building out the search and discovery function on their platform. As previously mentioned, Knowde had to normalize a significant amount of disparate data into a universal catalog for any supplier. Going forward, the company will want to continue to expand its product to add more robust functionality to things like engagement (see data and advertising below), as well as managing transactions (see facilitating transactions and financing below).

Building an Advertising Business

On top of Knowde’s data and buyer/supplier network, there is the opportunity to offer highly targeted ads for relevant players in their ecosystem. Amazon is one of the largest marketplaces in the world, and this has allowed it to build a meaningful advertising business, generating nearly $38 billion in ad sales in 2022. Sellers need the ability to target relevant buyers, and buyers want to be served relevant ads. Acting as the connective tissue in that exchange is complex, but can be meaningfully monetized.

Facilitating Transactions

Now that buyers and sellers are able to effectively discover each other on Knowde, there is an opportunity for Knowde to be more meaningfully involved in the transaction process. This could include ensuring its involvement in the actual payment processing, as well as quote management, managing purchase orders, and even providing logistics for suppliers, competing directly with third-party shipping companies.

Financing

B2B lending is designed to give small businesses the working capital that they need to grow their business. An example of B2B lending would be invoice factoring—where a factoring company will pay the business 80-90% of the total outstanding amount on an invoice that the lender will collect payment on later. As Knowde becomes more involved in the transaction, it can offer financing to its customers as a way to deepen its customer relationships and add incremental revenue.

Key Risks

Suppliers Building Direct Efforts

One of the reasons Knowde sits in an effective middle ground is due to the highly fragmented nature of the chemicals industry. That being said, some of the larger suppliers who are generating billions in annual revenue, could potentially look to set up their own digital storefronts and bring their online transactions in-house. The easier this effort is, the more it could threaten Knowde’s relevance as a marketplace.

Aversion To Technological Changes

Large industrial categories, like chemicals, are old-school and manual for a reason. Complex processes are very difficult to change, and chemical procurement is no exception. Despite seeing a 6.6% rise in IT spending in the industry during 2022, one survey found that 2023 saw a 0.1% decline due to “slower US economic growth and high interest rates.” Knowde could continue to face headwinds in helping to drive digital adoption if the industry remains opposed to the change. That being said, 94% of leaders surveyed in 2023 indicated that “AI will be critical to the success of their organization over the next five years,” so the delay could be short-lived.

Summary

The chemicals industry represents a $5 trillion global market and touches nearly everything including plastics, coatings, films, flavors, fillings, soaps, and toothpastes. Knowde is a digital marketplace for chemicals. The market is highly fragmented, with no player owning more than 2% market share. Knowde is focused on aggregating that supply and demand in order to better facilitate these transactions. The biggest obstacles the company will face include the manual nature of the industry, previously operating through pen-and-paper processes, and in-person sales.