Thesis

Simple transactions, like buying a cup of coffee, are not as straightforward in some parts of the world as in others. In Africa, due to a high number of abandoned POS terminals, high losses from fraud, and disconnection from the global payments corridor, transactions often fail. Adding to this issue, 57% of the population of sub-Saharan Africa remained unbanked as of October 2023. The banking system remains significantly undeveloped in several regions of the continent. Africa is still largely a cash economy as a result — only ~10% of transactions in Africa were digital as of August 2022.

These inefficiencies create fertile ground for fintech innovation; a 90% cash economy means there’s much room for growth in digital transactions. One report estimated that African fintech revenue could quintuple by 2025 to reach $230 billion. Meanwhile, the African fintech startup ecosystem is racing to capture the opportunity: between 2020 and 2021, the number of tech startups in Africa tripled to 5.2K companies, half of which were fintech startups.

Flutterwave is an API for processing payments that seeks to solve the problems currently afflicting Africa’s payments ecosystem. By building a seamless and secure payment infrastructure where it owns the entire transaction from end-to-end — from payment processing to gateway APIs to settlement — Flutterwave provides global businesses with a way to transact in Africa. It facilitates cross-border payment transactions for small to large businesses in Africa and also helps businesses outside Africa expand their operations on the continent. As of its latest round of funding in February 2022, Flutterwave was the highest-valued startup in Africa.

Founding Story

Flutterwave, a Nigerian company, was founded in 2016 by Iyinoluwa Aboyeji (former CEO), Olugbenga Agboola (CEO), and Adeleke Adekoya.

Prior to founding Flutterwave, Aboyeji co-founded Andela, a coding jobs and training platform, where he experienced challenges paying developers based in Africa — the firm was forced to process payments every 1-3 months to avoid incurring costs from transaction fees. Adding to the issue of high fees, payments would often take a long time to reach the local bank accounts of the recipient. As Aboyeji put it when he announced he was co-founding Flutterwave:

“Flutterwave is a solution to some of the major challenges I’ve witnessed while building Andela. Despite all the entrepreneurial spirit and expertise in Lagos, businesses still have trouble conducting transactions that are an afterthought in most of the world. It’s a problem that is prohibitive to the future growth of the continent, and one that we felt we could no longer ignore. So we decided to do something about it.”

Aboyeji began as CEO of Flutterwave but stepped down in 2018 after which then-CTO Agboola took over.

Born in Lagos, Agboola had an MBA from MIT and also worked as a product manager on Google Wallet. Before founding Flutterwave, Agboola had experience in the fintech space building having built products with several digital firms and banks including PayPal and Standard Bank. BAdekoya, meanwhile, served in prominent positions at several banks before founding Flutterwave.

All three co-founders had experience with the issues afflicting payments in Africa. Flutterwave was founded to solve the problem of payment system fragmentation in Africa by building a digital payments infrastructure that can connect to all payment solutions in the continent to bring about “a new wave of prosperity across Africa”. In April 2022, after having been CEO since 2018, Agboola came under fire in a scandal that alleged misconduct against him and Flutterwave, potentially tarnishing the company’s reputation within the African startup ecosystem.

In October 2022, Flutterwave appointed Emmanuel Efenure, Mastercard’s former Director of Customer Engagement and Performance, as Head of Risk for Africa. He had 22 years of experience in banking and risk management for over 22 years and was brought on to handle risk-related projects, processes, and operations.

In December 2023, Flutterwave brought on Amaresh Mohan as the company’s first Chief Risk Officer. He previously held the same role at GoTo Group, a large Indonesian company. Prior to this, he held leadership positions at Stripe and Paypal.

Product

Flutterwave provides payments products for individuals and businesses. The company initially focused on enterprise clients before considering small to medium-sized businesses (SMBs) and extending services to individuals in a bid to diversify its revenue streams.

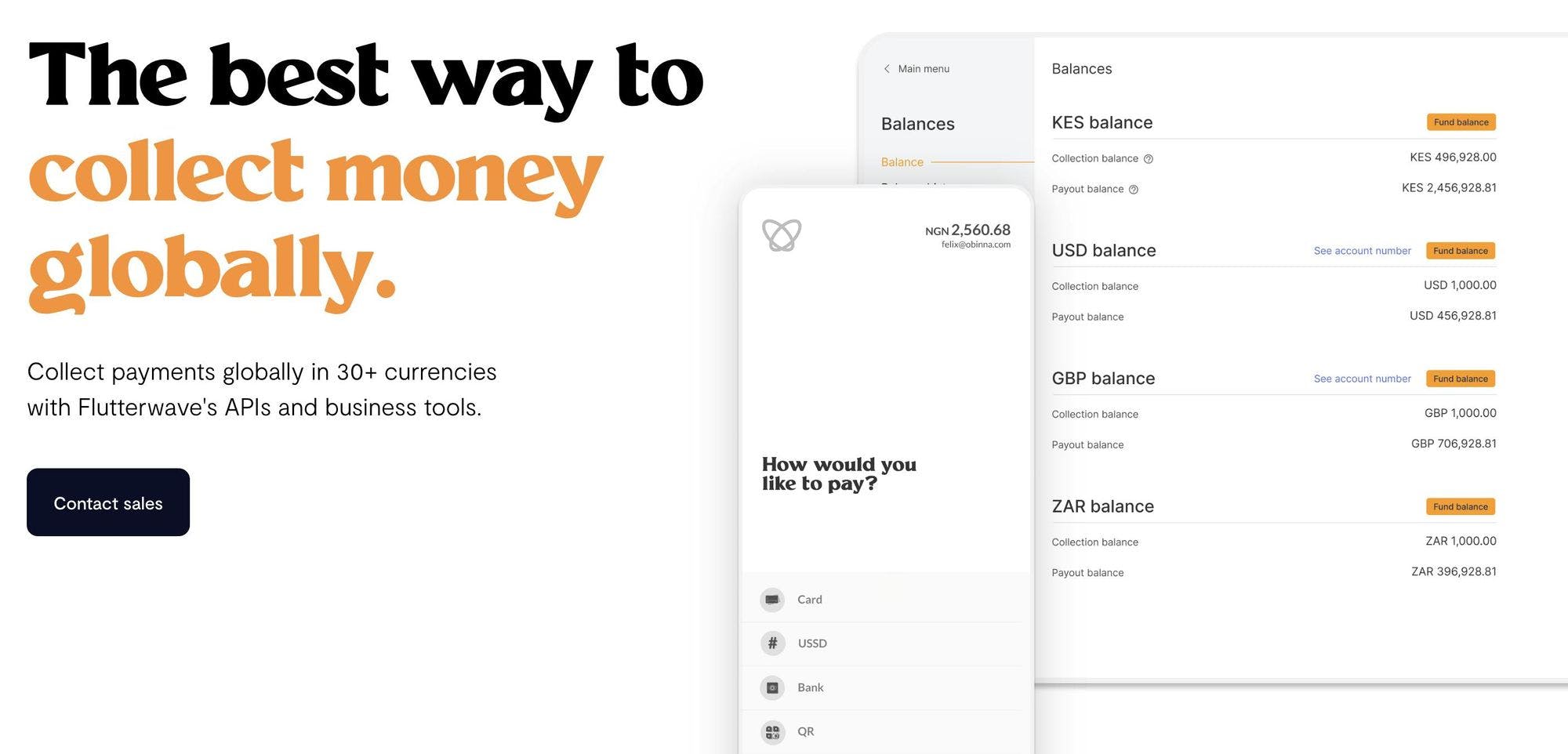

Flutterwave Payments API

Source: Flutterwave

Flutterwave’s core product is its payments API, which provides solutions that help businesses accept payments from their paying customers and send money to others. By integrating Flutterwave’s API into their product, businesses building a website, app, ecommerce store, or any online product can send or receive funds from their customers through supported payment methods which include card payments, direct debit, bank transfers, and mobile money.

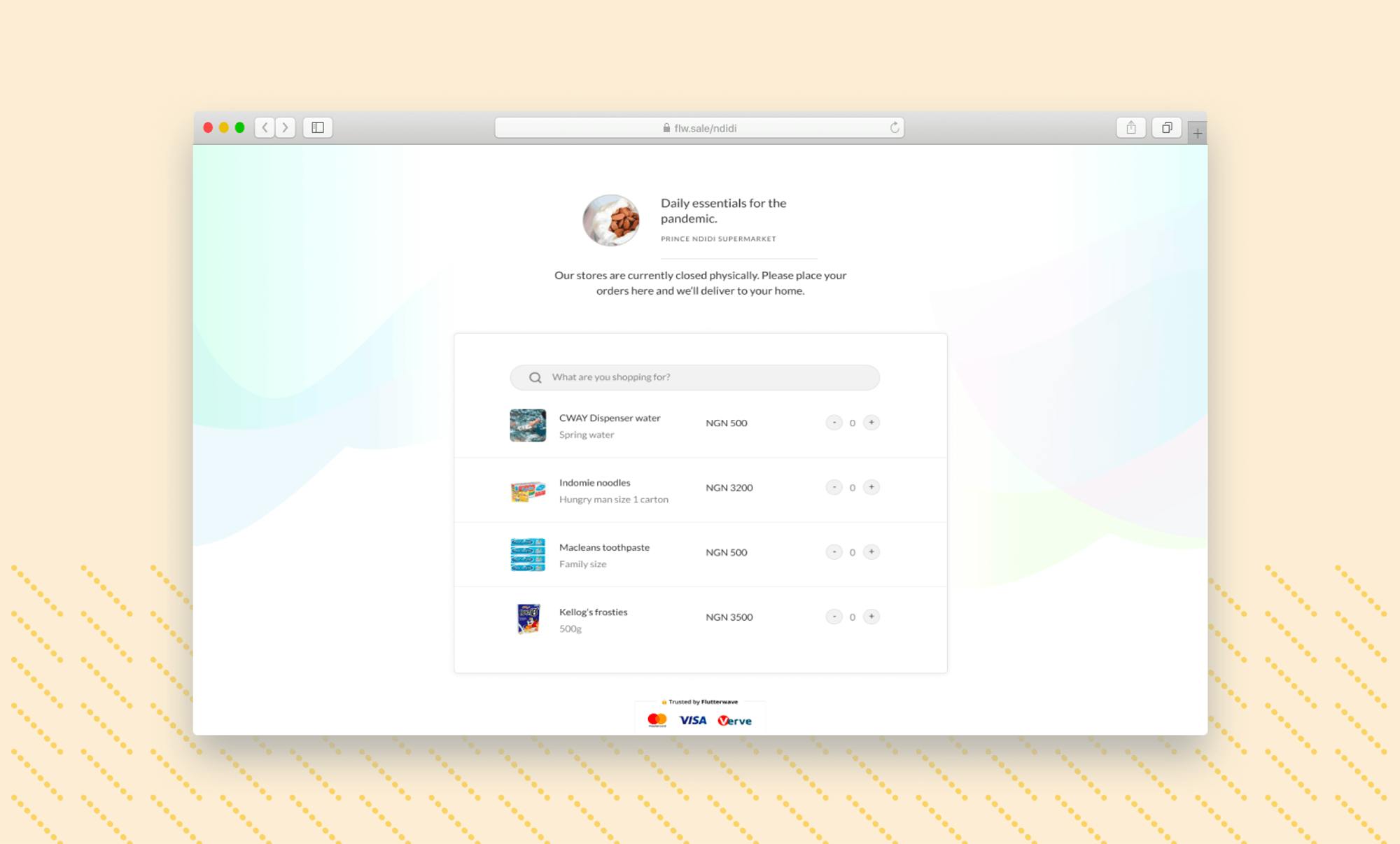

Flutterwave Store

Source: Flutterwave

Launched in April 2020, the Flutterwave store allows businesses to create a free online store that accepts payments through Flutterwave and connects vendors to Flutterwave’s online marketplace, which was advertised to have hundreds of thousands of buyers as of February 2022. Commenting on the store’s launch, CEO Olugbenga Agboola said in 2020 “it’s not a direction change. We’re still a B2B payment infrastructure company. We are not moving into becoming an online retailer.”

Users create profiles for free, list their products, and then link payment options from which Flutterwave earns commissions. Both physical and digital goods can be sold on the marketplace. Flutterwave works with third-party logistics firms to deliver goods on behalf of sellers and charges a delivery fee.

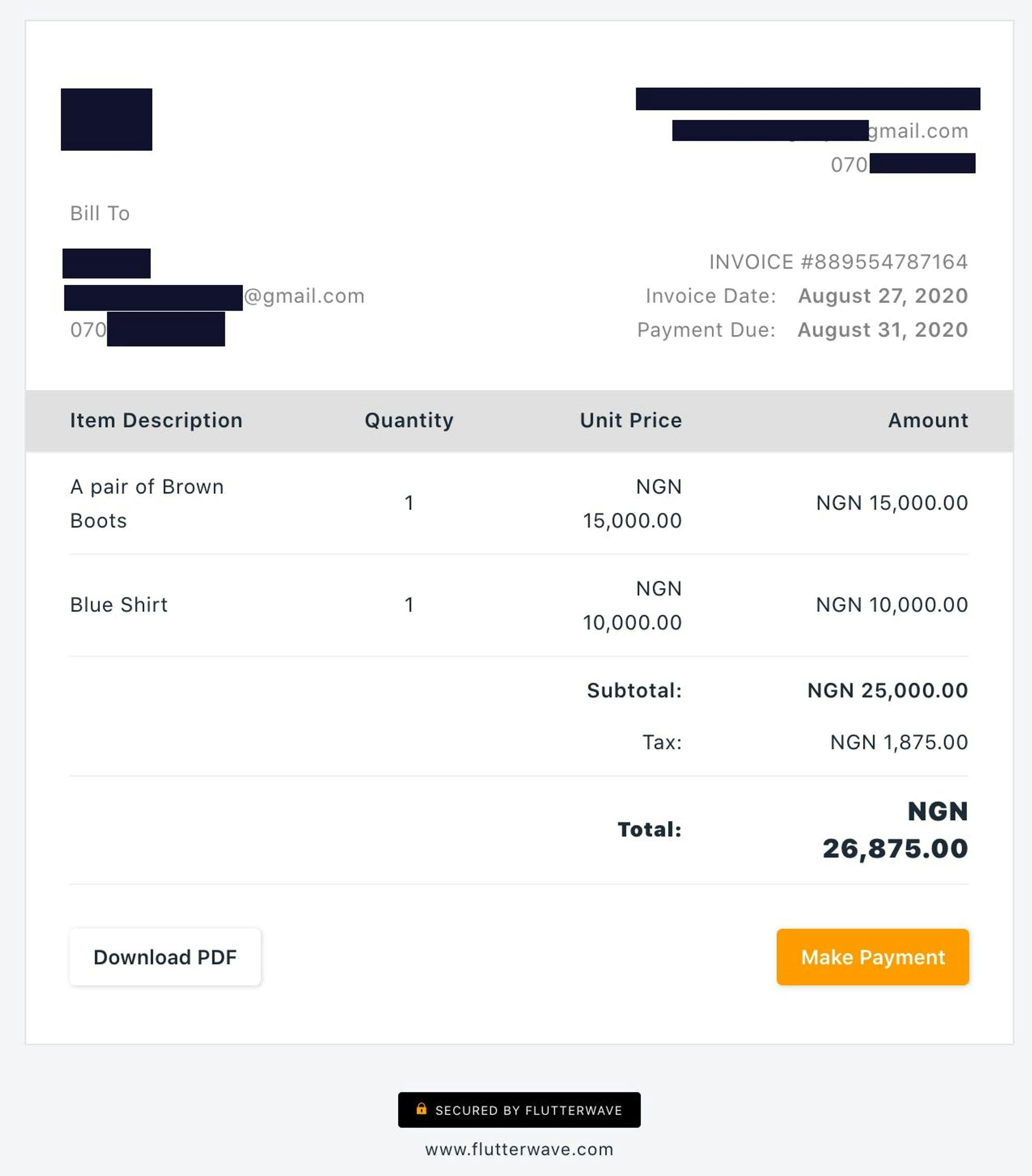

Invoices

Source: Flutterwave

Flutterwave Invoices is an invoicing solution with a secure payment option. It enables the creation of digital invoices that contain all the necessary information a customer needs. With this digital invoice, customers can pay directly from the email they receive the invoice.

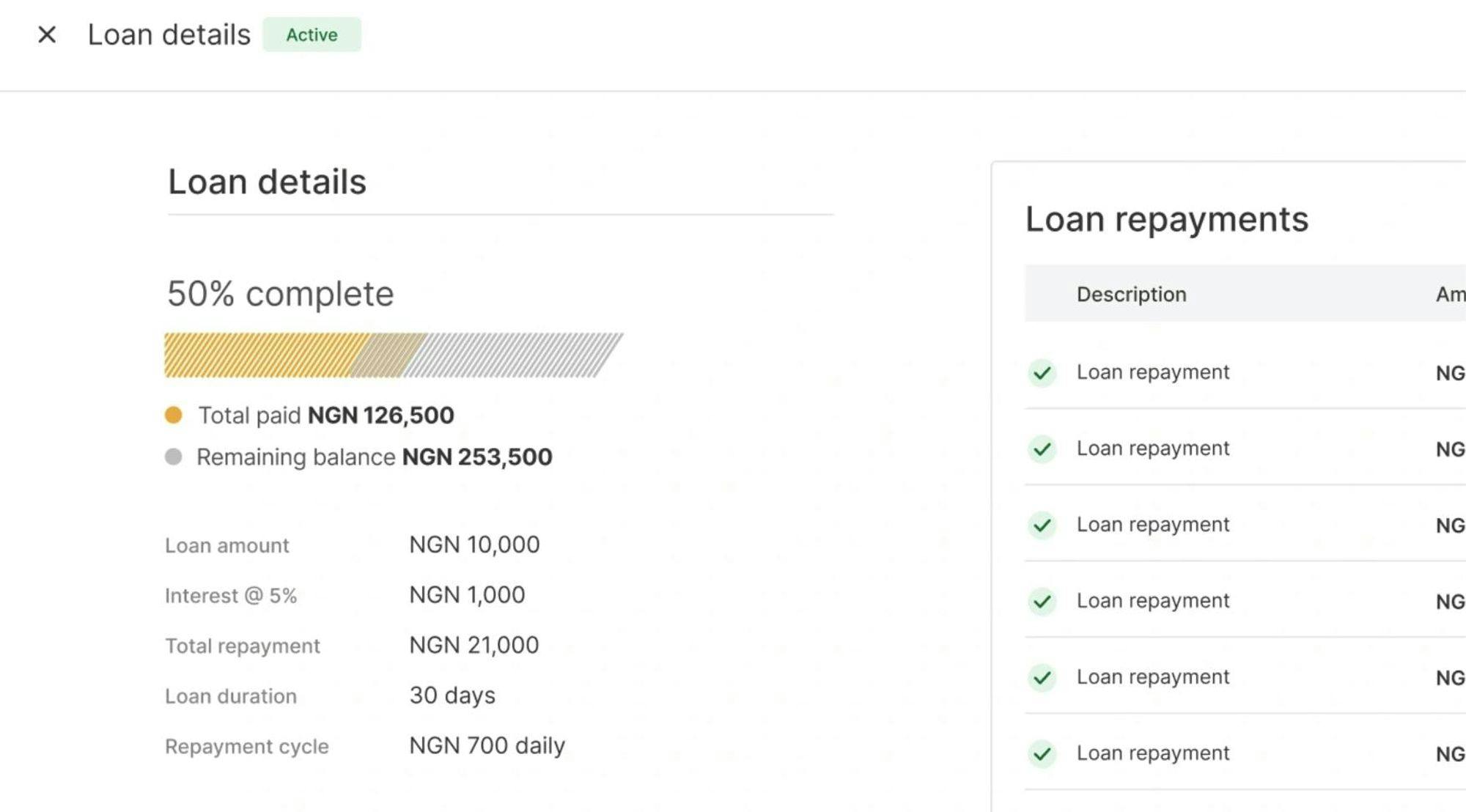

Capital

Source: Flutterwave

Flutterwave Capital gives customers “quick, flexible” loans to grow their businesses. The company says that small business owners can access loans through Flutterwave Capital without worrying about “collaterals, cumbersome documentation, and other stringent terms and conditions”. Eligible borrowers can receive loans in under 24 hours, with automatic repayment that varies by borrower and lender terms.

As of January 2024, Flutterwave states that Flutterwave capital is only available to businesses in Nigeria and that businesses are approved “based on their payment volume and transaction history with Flutterwave”. The company plans to eventually expand to other countries so that it can “cater to other businesses everywhere on Flutterwave. “

Send App by Flutterwave

Flutterwave’s Send App, a remittance solution that launched in the US in August 2023, is a mobile app that allows users to send money internationally to local bank accounts and mobile money wallets. Money can be sent and received from 29 countries across Europe, North America, and Africa as of January 2024. Transfers take place “instantly” and the app allows users to send up to $20K at a time for a flat fee. Recipients receive funds automatically converted to their local currency according to market exchange rates.

Payment Links

For businesses that sell online without a website, people who work remotely, and freelancers, payment processes can be lengthy and tedious. To solve this, Flutterwave offers a solution in the form of customizable payment links that users can create and share with customers from across the globe. Once payment is effected, it reflects on the Flutterwave dashboard.

Flutterwave Mobile

The Flutterwave mobile app, available on both the App Store and Google Play, turns any smartphone into a mobile POS, thereby eliminating the need for a physical POS. A payment link can be generated from inside the app and shared with customers to pay using their card as they’d do with a physical POS. Additionally, the app accepts various payment types including card payments, bank transfers, mobile money, and PayPal.

Grow

Flutterwave’s Grow product helps companies register and incorporate businesses in the US, UK, and Nigeria by handling paperwork and applying for company registration on behalf of their customers. The product lets users register their business “within 3 to 5 business days”, and users are offered a corporate bank account and international business card for free along with their signup. Flutterwave also provides users access to its growth tools.

Embedded Financial Services

Flutterwave’s embedded financial services product allows users to build apps with built-in fintech services like KYC, account opening, debit cards, payments, account servicing, and compliance.

Swap

Launched in September 2023, Swap grants customers access to foreign currency at competitive exchange rates. Swap was designed to provide individuals and businesses with an approved, secure, and reliable solution for accessing foreign currency.

Market

Customer

Flutterwave targets three distinct customer profiles: enterprises, SMEs, and individuals, and it organizes its website accordingly with dedicated product breakdowns targeted at each user type. Its customers are geographically diverse, with the company operating in 30+ currencies.

Source: Flutterwave

As of January 2024, Flutterwave says that it is used by over 1 million businesses, including large enterprises like Uber and Microsoft. Other notable Flutterwave customers, according to one third-party source, include AWS, Visa, PayPal, the United Bank for Africa, Booking.com, Salesforce, and Anheuser-Busch.

Market Size

Flutterwave’s addressable market includes almost all businesses in the 54 countries of Africa Notably, sub-Saharan Africa has around 44 million micro, small, and medium enterprises (MSMEs) as of 2021. Across Africa, these MSMEs provide 80% of jobs, and most currently don’t have reliable digital payment infrastructures as evidenced by Africa’s 90% cash economy.

57% of the population of sub-Saharan Africa, which totaled 1.2 billion people as of 2022, remained unbanked as of October 2023. As a result, only ~10% of transactions in Africa were digital as of August 2022. A 90% cash economy means there’s much room for growth in digital transactions. Driven by the demand for new financial services for an underbanked and cash-heavy economy, one report from 2018 estimated that African fintech revenue could quintuple by 2025 to reach $230 billion.

WIthin the fintech market, digital payments in Africa are expected to grow ~20% per year and reach $40 billion by 2025. Like most countries, Africa saw a digital pull-forward during COVID, with mobile money transactions in Nigeria alone doubling to ~800 million in 2020. As more transactions become digital, Flutterwave’s addressable portion of transactions increases as well.

Outside of its core African Market, Flutterwave also has expanded into India, the US, and Europe — making it a global fintech company. Globally, fintech revenues are projected to grow sixfold from $245 billion to $1.5 trillion by 2030. The more that Flutterwave can successfully expand its core business across geographies beyond Africa, the more it will benefit from the size and growth of global fintech.

Competition

Paystack: Nigerian company Paystack was founded in 2015 and has raised a total of $10.4 million. It was acquired for $200 million by Stripe in October 2020. Paystack allows registered businesses to take payments on their websites or mobile applications using credit cards, debit cards, money transfers, and mobile.

Interswitch: Interswitch, which was founded in 2002, established Nigeria’s first interbank transaction switching and payment infrastructure, leading to a widening of payments acceptance across the country. It has raised a total of $320.5 million in funding as of January 2024, with its latest round being a $110 million joint investment from LeapFrog Investments and Tana Africa Capital at an undisclosed valuation in May 2022.

OPay: OPay is a Nigerian company that was founded in 2018. The platform allows users to pay utility bills, transfer funds quickly and securely, bank offline, and save with friends and family. As of August 2023, OPay had close to 40 million registered users, and in 2022 it reached an annual transaction volume of $50 billion.

Chippercash: Chippercash is a cross-border P2P payment platform founded in 2018 in San Francisco that operates in the US and four African countries (Ghana, Uganda, Nigeria, and Rwanda) as of January 2024. The platform provides services in payments, investing, and business. It has raised a total of $337.2 million in funding as of January 2024 and was valued at $2 billion after raising a $150 million Series C extension in November 2021 from FTX.

Business Model

Flutterwave generates revenue by charging a fee on transactions. As of January 2024, it charges a 2.9% fee for local card transactions and a 3.8% fee for international card transactions. The fees charged on wallets, mobile money, and transfers to bank accounts domiciled in other countries vary from country to country.

Transactions have different limits depending on the type of account. The platform removes payment complexities by lumping together several payment options offered by different players in the continent into a single API. The strategic partnerships the company has built have been instrumental in scaling operations. Significant partnerships include VISA, WorldPay, MTN, Booking.com, Uber, and Paypal.

Traction

Flutterwave processes 500K transactions daily as of January 2024 and has over 1 million customers including notable companies like Uber and Microsoft; it also accepts over 30 currencies and processes more than 20 million API calls per day.

Meanwhile, Flutterwave’s ecommerce solution had grown to over 30K merchants by February 2022. Flutterwave’s fastest-growing product, Flutterwave Send, launched in December 2021, processed 4.7K transactions worth $3.6 million in the first full month of operation. The product attracted customers from the US, UK, and Nigeria.

As of March 2021, Flutterwave had processed 140 million transactions worth over $9 billion. By February 2022, the number of transactions processed had increased by over 40% to 200 million transactions with transaction value increasing by 78% to $16 billion. In the same period, the number of businesses that used Flutterwave’s different payment modes globally rose three-fold from 290K to 900K. As of August 2023, Flutterwave had processed over 400 million transactions in excess of $25 billion.

Valuation

In February 2022, Flutterwave raised a $250 million Series D that valued the company at $3 billion and brought the company’s total funding to $509.5 million. The round was led by B Capital Group with participation from Lux Capital, Tiger Global, Salesforce Ventures, Whale Rock Capital, and Glynn Capital.

The company intended to use the funds to expand operations in its current markets and establish new ones in Africa. The company executed on this vision in 2023, notably by expanding its US presence by securing 13 money transmission licenses across various states in the US in December 2023.

Key Opportunities

Strategic Partnerships

To provide financial services in Africa, Flutterwave has worked with leading international and pan-African technology and telecommunications businesses, including PayPal, MTN, 9PSB, and Airtel Africa. By interconnecting payment infrastructure between African banks and large companies, and by interfacing with international players, Flutterwave has been able to expand access to the African economy by enabling SMBs to engage in digital payments. Through additional partnerships, Flutterwave could extend to international companies, as well as broaden its customer base to include enterprises. Flutterwave can continue to double down on the opportunity to work with larger clients, both on the continent and internationally, to help cement its position and grow revenue.

Riding Fintech Adoption

As fintech penetration continues to grow in Africa, it presents an opportunity for Flutterwave to take advantage of an independent tailwind. Flutterwave is operating at a time when Africa’s large unbanked population is coming online. Africa has the highest percentage of unbanked people worldwide. The inflexibility of banks in reaching the unbanked, and the population’s lack of trust in the existing financial institutions presents an ongoing opportunity for Flutterwave because they solve such a critical pain point for the African economy, which is still in the early phases of going cashless.

Key Risks

Regulatory Challenges

The company has dealt with several regulatory challenges since its inception. The Kenyan Central Bank accused the company of conducting money remittance and payment services without licensing and authorization. Kenya’s Asset Recovery Agency (ARA) also accused the company of fraud and money laundering.

However, in March 2023 the case was closed and the ARA released $52.5 million of Flutterwave's funds in the country that it had frozen. Then, in November 2023, the ARA withdrew its second and only remaining case against Flutterwave, and it was ordered by the High Court of Kenya to release the remainder of Flutterwave's funds in January 2024. This comes at a time when Flutterwave is seeking to expand operations in Kenya.

The company’s relationship with banks is also under review by Ghanaian authorities as part of the surveillance of the financial system. Flutterwave has, however, secured a Switching and Processing License from the Central Bank of Nigeria which will allow it to facilitate transactions between financial service providers, merchants, customers, and other stakeholders without intermediaries.

Reputational Risk

Arising from allegations of financial and personal misconduct against the CEO, Flutterwave has had to deal with reputation issues that may have interfered with its plans to go public. Though the company denied the allegations in July 2022, it could continue to have far-reaching harmful consequences for the company down the line.

Stickiness of The Cash Economy

Cash is the leading payment option in Nigeria. In spite of the caution against the use of cash by the Central Bank of Nigeria during the COVID-19 pandemic, cash in circulation grew by over 22% between March 2020 and March 2021. Cashless transactions occur mainly in the major urban areas with shallow penetration in rural areas and small towns, and this may prove more intractable than anticipated.

Scaling Across Geographies

Although the market opportunity for fintech in Africa is large, there are existing infrastructure constraints in some regions. These constraints include limited payment rails, mobile phone network coverage, and internet penetration. This geographical variability may impact Flutterwave’s ability to scale a ubiquitous payments product across the entire region.

Summary

Flutterwave seeks to connect Africa to the global economy by providing businesses and banks with tools and technologies that facilitate secure and seamless payments. Unlike in developed markets, payment systems in Africa lack interoperability, a problem that banks aren’t in a position to solve due to stringent regulations that govern them. The available payment solutions work well in specific markets, but rarely beyond country borders. For instance, Verve Card works well in Nigeria, Mpesa in Kenya, and Tigo Cash in Chad. Flutterwave’s potential is to provide interoperability and help bring the African payment ecosystem online.