Thesis

In a 2022 survey of 355 companies across 10 companies and 42 industries, it was found that up to 68.5% of companies were planning to increase their spend on customer experience (CX) through 2025. In terms of their CX technology adoption plans, almost 80% of the companies surveyed were either already using Communications Platform-as-a-Service (CPaaS) or were planning to do so within the next couple of years. 75% of the companies surveyed, meanwhile, said that they were planning to integrate their customer interactions using omnichannel messaging.

From 2021 to 2022, 20.5% of these businesses increased their spending on CPaaS solutions. The CPaaS market was valued at $11.7 billion in 2022 after having grown 40% in 2021, in part due to COVID. CPaaS is expected to continue to see significant growth, driven by an increasing drive to personalize customer interactions and the greater affordability of cloud communication services.

MessageBird, which describes itself as an “omnichannel automation platform”, is a cloud communications platform that provides a range of communication tools for businesses to engage with their customers through various channels, including SMS, voice, WhatsApp, Facebook Messenger, and others. It also provides tools for building chatbots, managing customer support, and sending marketing messages. Further, the platform provides APIs and developer tools which are intended to enable easy integration with a business’s existing systems.

Founding Story

MessageBird was founded in 2011 by Robert Vis (CEO), after his previous company, an API payments platform called ZayPay, was acquired in November 2011.

During his time at ZayPay, Vis encountered a significant operational challenge in verifying users’ phone numbers through text messages for payment processing. The late arrival or loss of messages resulted in payment processing delays, leading to revenue loss for the business. Dissatisfied with the performance of the company’s third-party vendor, Vis wanted to create a platform that would facilitate seamless communication for businesses across multiple channels. To address this issue, Vis made the decision to develop an in-house technology stack and directly integrate with KPN, the leading telecom carrier in the Netherlands in 2011. This comprehensive technology attracted their former vendor, who became ZayPay’s inaugural client.

Following an investor offer to acquire ZayPay, Vis opted to sell the company. This led to the founding of MessageBird, which was a platform designed to connect businesses with their customers through various communication channels such as SMS, voice messaging, email, and WhatsApp. As Vis said in 2018:

“We don’t rely on a web of intertangled connections between carriers, gateways, resellers, and aggregators to deliver messages. We own the full stack. Because we’re uniquely equipped to deal with geographic complexities, enterprises - and, by extension, developers - don’t have to rely on middlemen, or run into issues with communication, deliverability, and cost at each handoff when they do business across borders.”

MessageBird bootstrapped for its first six years, over the course of which the company was profitable. In 2016, MessageBird was accepted into Y Combinator, and the company secured its first investment round of outside capital in 2017 from Accel and Atomico, raising $60 million in a Series A. In describing MessageBird’s approach to scale, Vis stated:

“I think we’ve done a good job of avoiding what I like to call the ‘too fast, too furious’ approach to scale. Even as a company that did business beyond borders from the start, with customers and employees spanning the globe, we staffed and spent based on business needs - staying as lean as possible for as long as possible, without sacrificing service and support.”

Product

Engagement

Source: MessageBird

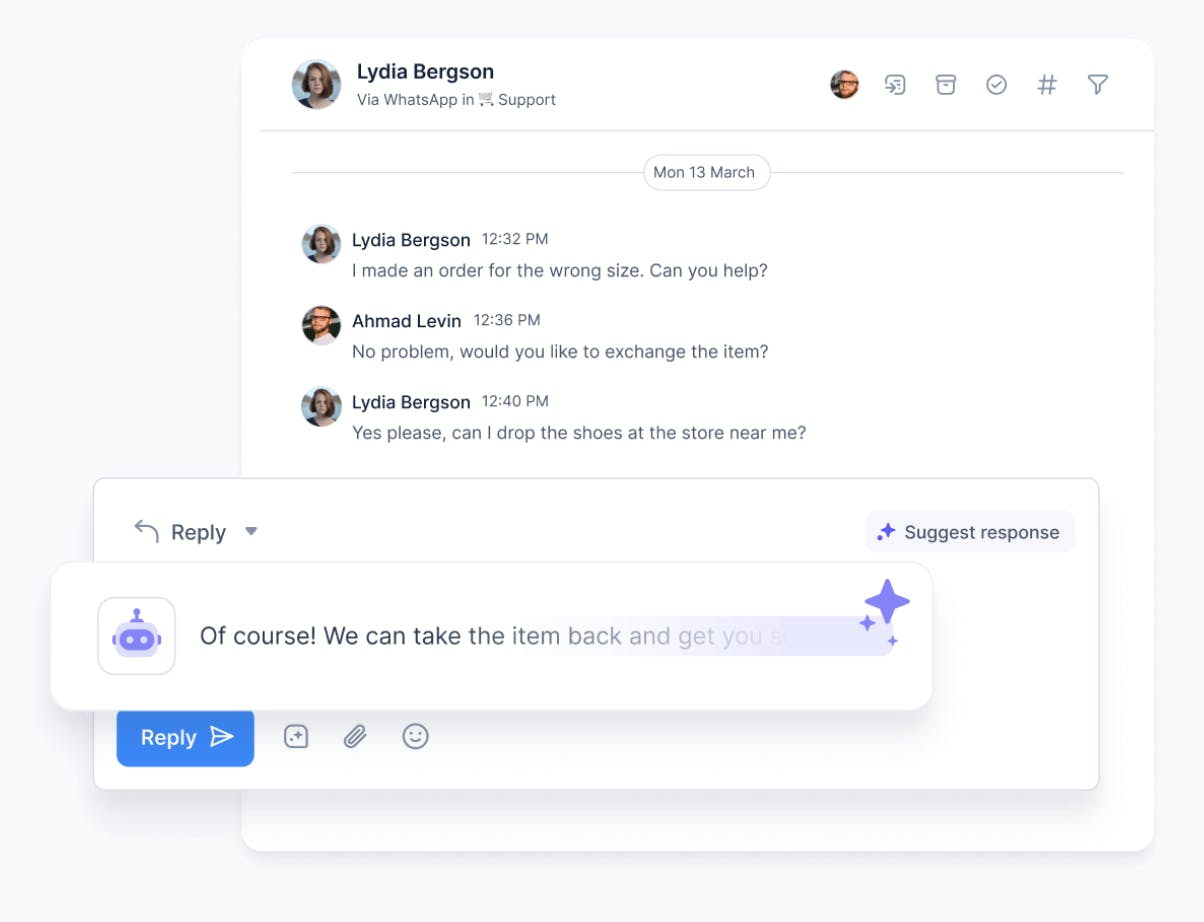

Inbox: MessageBird’s Inbox is an omnichannel solution powered by automation and AI. Users can handle customer inquiries from SMS, WhatsApp, email, and other socials in one location. Additionally, the inbox automates busy work using AI-powered chatbots and automated workflows for repetitive tasks, assisting users with quick-reply suggestions and corrected phrasing of drafts before a message is sent.

Campaigns: Businesses can customize content based on individual interests and preferences. The platform features analytics to uncover insights and optimize marketing efforts for maximum ROI. Marketing Automation allows users to build campaigns triggered by web tracking and other factors, while Broadcast Marketing allows for email and SMS blasts to the businesses’ customers. Buyer Journeys allow businesses to serve multiple messages based on audience engagement.

Flows: Flow is a no-code workflow and chatbot automation tool that allows users to automate workflows, orchestrate data, and create interactive experiences across channels without the need for a developer. Flow features a visual builder, customizable templates, AI-powered chatbots, and visual debugging tools. This allows businesses to tailor workflows in accordance to the needs of their industry.

Studio: Studio templates simplify omnichannel content production by allowing businesses to create message templates that adapt to each channel. The templates can adapt to each channel’s format and include media like videos and images. Templates are available in every communication channel, such as SMS and Instagram. Users can introduce variables into message templates, pull relevant data from contacts, and create custom approval workflows and routing.

Connectors: MessageBird’s Connectors allow users to integrate all the applications where they already use the data and capabilities with pre-built connectors for popular CRM, ecommerce, and marketing tools to create richer experiences. Users can connect and configure their customer data in hours, and build a 360-view of their customers for personalization and improving workflow efficiency. Custom connectors can also be built to integrate proprietary systems.

Contacts: The contacts offering allows users to consolidate data from any source into a single contact profile, distribute it to mission-critical tools, and enable personalized interactions at scale. Businesses can use data in automation to streamline processes to deliver personalized journeys, initiate flows as data comes in, and change direction based on the customer’s context. Contacts also enable businesses to create marketing campaigns, segment customers based on demographics, behavior, and preferences, and consolidate all customer data into a single view.

Omnichannel

Source: MessageBird

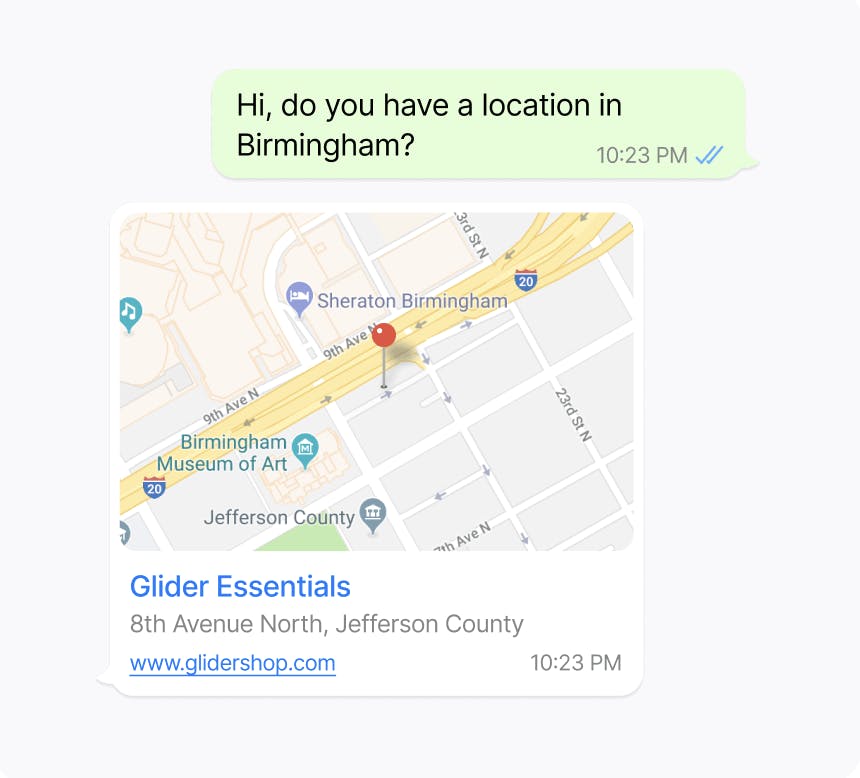

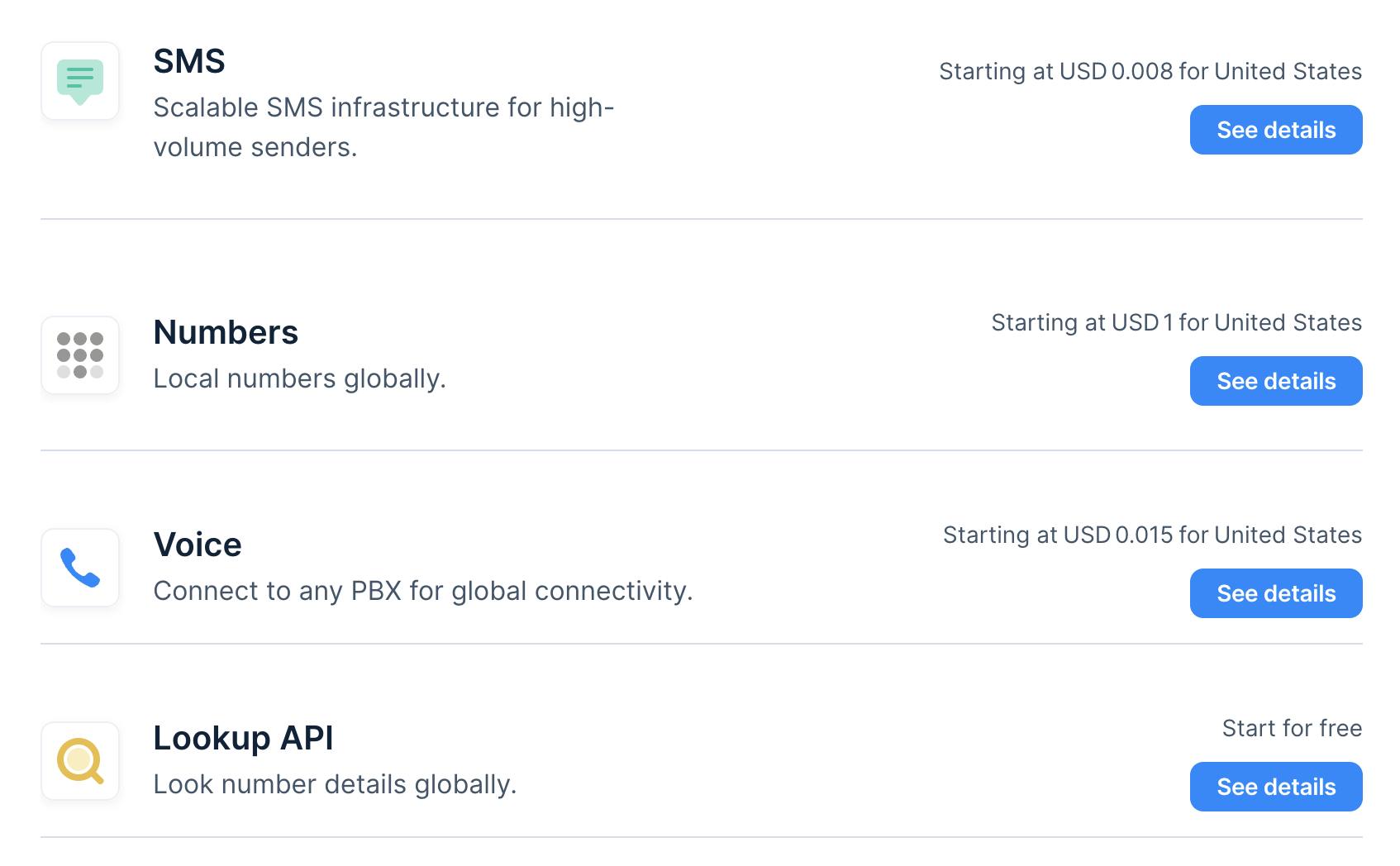

With MessageBird’s platform, users can reach customers through popular channels such as WhatsApp, SMS, Email, Mobile Push Notifications, Messenger, Google Business Messages, and Instagram Direct.

Connectivity

Source: MessageBird

SMS: MessageBird enables users to send and receive SMS messages globally. Users can personalize messages, segment their audience, and track delivery and engagement that customers have with the message.

Numbers: Users can set up numbers locally across 50 countries and 700 prefixes and area codes. Features also include choosing toll-free numbers with text or calling capabilities and assisted guidance with regulations. Users can also port numbers and use the platform’s porting service when the situation is more complex.

Voice: Users can create interactive voice response (IVR) systems, set up call routing, and deliver voice notifications to their customers. For private and secure exchange of information, users can also anonymize calls between parties. The Session Initiation Protocol Trunking feature provides cost savings to businesses by setting up VoIP to PSTN connections.

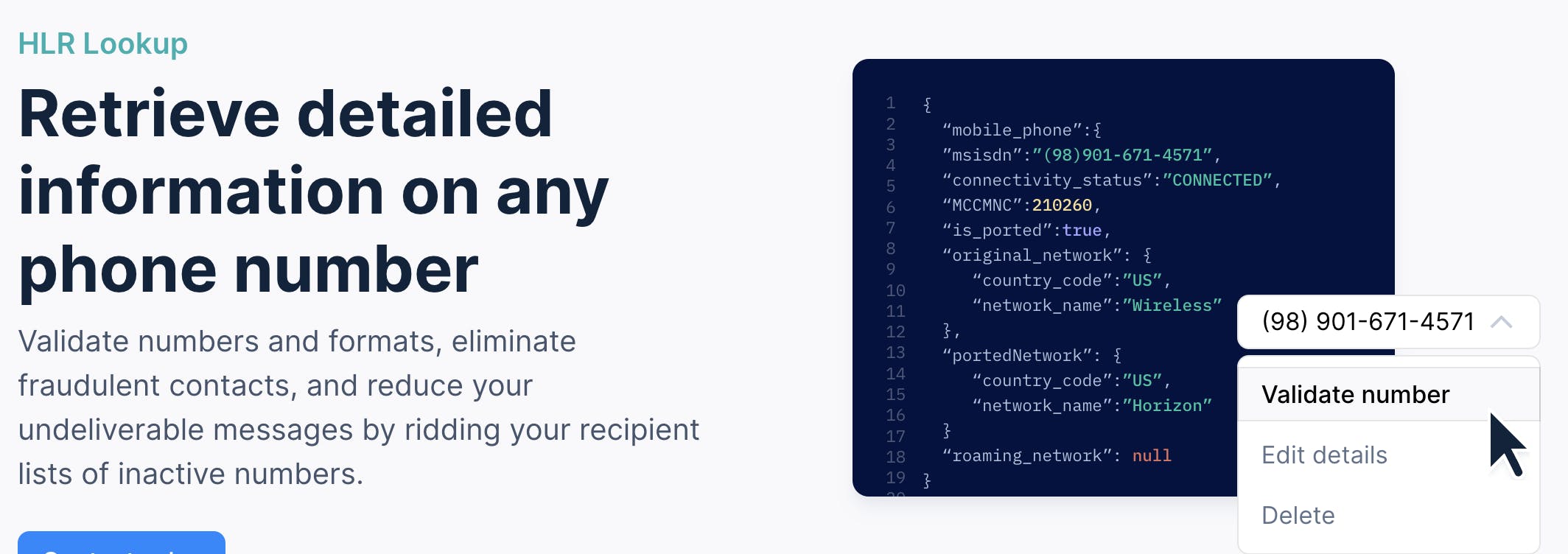

Lookup API: The Lookup API function allows businesses to reduce fraud risk and increase deliverability. Users have the ability to eliminate numbers that are no longer active or reachable and validate existing numbers into its database, ensuring accurate information is up to date.

Source: MessageBird

Cloud Sending: MessageBird’s Cloud Sending is an email delivery platform that, according to MessageBird’s product page, delivers 40% of all commercial emails globally. Businesses can ensure their emails reach the intended recipients’ inboxes with automated delivery optimization.

PowerMTA: PowerMTA is a self-hosted mail transfer software offering robust delivery capabilities that can manage large email volumes, monitor delivery performance, and optimize email deliverability. The system features granular reporting and proactive alerting that allows businesses to analyze per-domain, per-campaign, and per-recipient performance.

Momentum MTA: Momentum MTA is a customizable email infrastructure platform that allows businesses to scale their sending. Features include a message transfer agent for reliable email delivery at high volumes, international reach with support for Unicode characters, an Intelligence router for real-time data transmission, a policy manager for customized workflow rules, an outbound protocol manager for maximum deliverability, conversational support, and email encryption for security and compliance.

Deliverability Analytics: This product offering enables businesses to predict and optimize email performance by unifying email delivery, analytics, and a data footprint. Businesses can monitor email health, gain real-time visibility into deliverability and performance issues, and use engagement insights and spam trap monitoring to enhance email engagement.

Inbox & Competitive Tracker: This is a competitive email marketing intelligence solution that actively tracks millions of domains across 200K brands in 100+ industries. Key capabilities include journey mapping, brand comparison, advanced search, overlap analysis, scheduled reports, advanced search, and competitor tracking.

Recipient Validation: This product offering is intended to help businesses verify the validity of email addresses in real time. By checking the deliverability and quality of email addresses, businesses can reduce bounce rates, improve email engagement, and maintain a clean email list.

Email Design System Studio: The email design system studio is a collaborative and scalable email production tool for users to create email campaigns and collaborate with their colleagues on its email template designs. It enables teams to ensure brand consistency, save time with reusable email modules, and streamline the design and approval process. Users can maximize the capabilities of their email service provider by exporting send-ready HTML code with this offering.

Market

Customer

MessageBird's platform is tailored to meet the communication needs of both small and medium-sized businesses (SMBs) and enterprises. With the growing demand for enhanced flexibility in customer communication within enterprises, Communication Platform as a Service (CPaaS) has emerged as a solution. MessageBird serves a diverse clientele across various industries, including retail, e-commerce, logistics, financial services, hospitality, real estate, and healthcare. Notable enterprise users of MessageBird’s platform include Uber, Deliveroo, and Heineken. As of 2023, MessageBird has over 29K global customers. Its reach extends across more than 195 countries, securing partnerships with over 225 carriers worldwide.

Market Size

The global cloud communication platform market was valued at $4.6 billion in 2021, is projected to grow at 25.3% from 2021 to 2028, and is expected to reach $22.4 billion by 2028. Meanwhile, the CPaaS market was valued at $11.7 billion in 2022 after having grown 40% in 2021 and is projected to grow to $172.9 billion by 2032, representing a CAGR of 31%. Additionally, MessageBird has positioned itself to capture a larger portion of the global $350 billion customer service market with the 2020 launch of Inbox.ai, an external communication platform that facilitates conversational threads with customers.

Competition

Twilio: Twilio is a public cloud communication enterprise that allows users to develop robust voice, VoIP, and SMS applications using widely adopted web languages through its comprehensive web API. Founded in 2008, Twilio went public in June 2016 and has a market cap of $11.4 billion as of August 2023. While both MessageBird and Twilio provide SMS services, MessageBird offers a lower base cost per SMS.

Sinch: Sinch is a Stockholm-based cloud communications company founded in 2008 that helps businesses to connect with customers through messaging, voice, and video. The company went public in 2015 and has a market cap of $2 billion as of August 2023.

Infobip: Infobip’s omnichannel platform features SMS, MMS, Voice, Email, RCS, and live chat. Founded in 2006, the company has raised $800 million in total funding as of November 2021, with funds managed by Ares Management and BlackRock leading its $500 million debt financing round in November 2021. While MessageBird's usage coverage extends across various sectors such as lifestyle, consumer services, and education, Infobip stands out with its platform and tools tailored to the unique needs of finance, gambling, and media industries.

SendBird: SendBird is a messaging-as-a-service API that specializes in providing chat, voice, and video messaging solutions for mobile apps and websites. Founded in 2013, the company has $220.7 million in total funding. It raised a $100 million Series C in April 2021 at a valuation of over $1 billion, led by Steadfast Venture Capital, with participation from SoftBank Vision Fund, among others. Past investors include Meritech Capital, ICONIQ, and Tiger Global Management. SendBird's primary focus revolves around chat functionality, while MessageBird offers a broader range of communication services, including VoIP calls. Customers of SendBird include platforms like Reddit and Hinge.

TextLocal: Founded in 2005, the company was acquired by IMImobile in 2014 for $16.6 million. Textlocal's API allows businesses to set up automated bulk text messaging for clients and integrate their ERP data with personalized messaging plans. While both Textlocal and MessageBird cater to SMS marketing needs, MessageBird expands its communication offerings to include voice messaging, while Textlocal's focus is on texting, email, and voicemail. Users seeking voice messaging services would need to integrate with a compatible third-party platform when using Textlocal’s product.

Business Model

MessageBird generates revenue through fees for its B2B software solutions. Fees vary depending on the features used and messages sent and can be personalized to each business's specific needs. As of January 2023, before accessing the platform, users incur a one-time setup fee of $600.

Messaging & Voice

For SMS messaging, each sent message is charged at a rate of $0.008. Virtual numbers carry a monthly cost of $1, while voice numbers are priced at $1.50 per month. Inbound voice messaging is charged at $0.0033 per minute, and outbound landline and mobile calls incur a rate of $0.015 per minute. Text-to-speech voice messages are priced at $0.005 per message, and Home Location Register (HLR) requests are charged at $0.011 per request. Email pricing is determined based on the volume of emails sent per month, ranging from $50K to $5 million or more. Additional features such as inbox and competitive tracking, recipient validation, deliverability analytics, and PowerMTA come with variable pricing.

Source: MessageBird

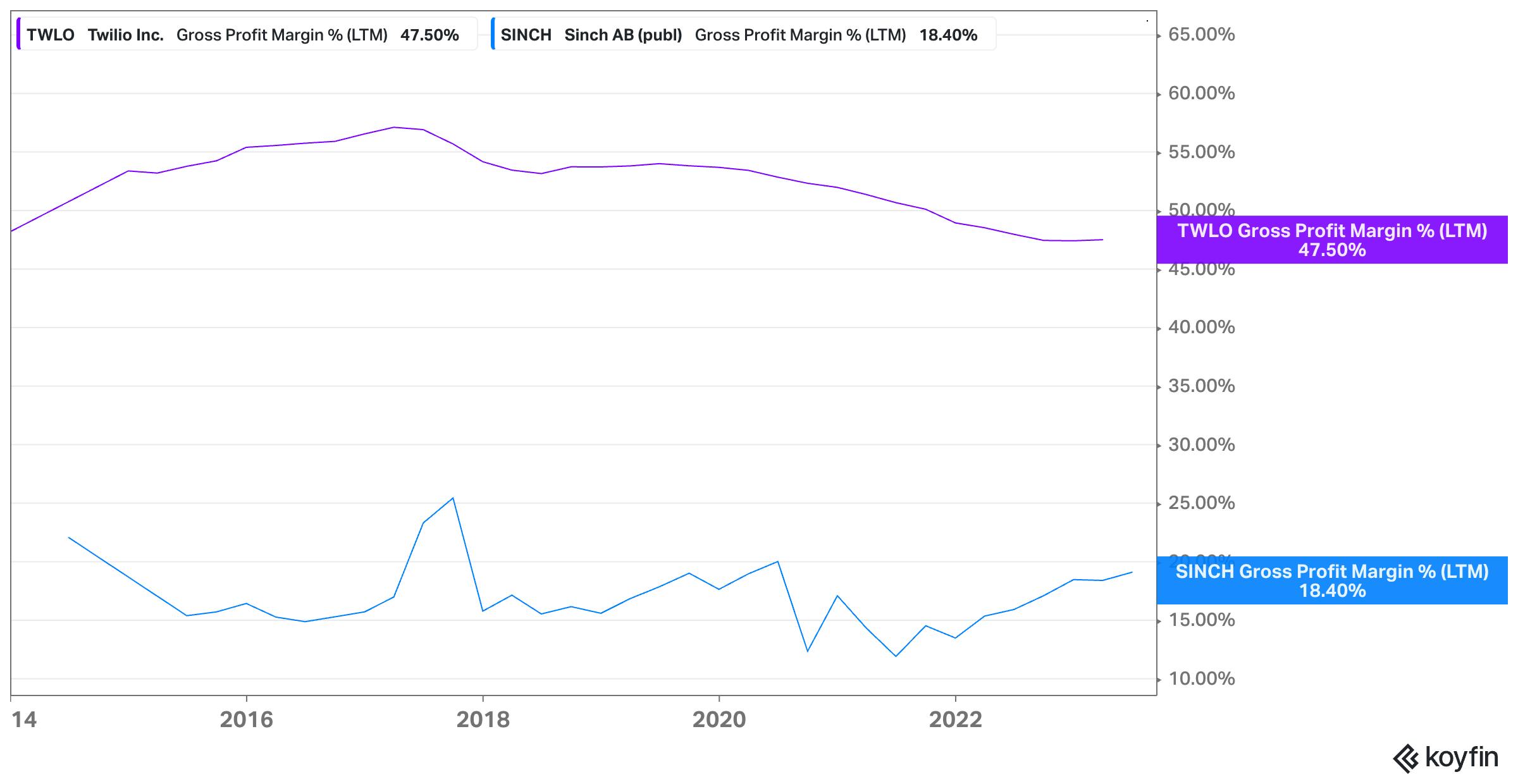

Part of MessageBird’s business model is dependent on telecom carriers. Initially, MessageBird partnered with KPN in Norway to deliver the SMS messages its customers needed to send. Since then, MessageBird has expanded its service to work with 225+ carriers globally. Each telecom carrier is the last-mile delivery mechanism for each SMS message. Those carriers charge a per-message fee. To illustrate this cost structure, there are two companies with similar business models to MessageBird; Twilio and Sinch.

Twilio, with customers based primarily in the US, sends over 100 billion messages each year. Twilio’s cost of goods sold (COGS) is primarily fees paid to “network service providers,” or in other words, carriers. In the US there were 335 million people as of 2023, but the majority of telecom services are provided by three companies: AT&T (45.9% market share), Verizon (29.1%), and T-Mobile (23.7%). As a result, Twilio is able to aggregate a significant volume of messages that its customer are delivering through a single carrier. That allows it to negotiate better prices, allowing the company to achieve ~45-50% gross margins.

Sinch, on the other hand, operates primarily in Europe. The largest country wholly in Europe is Germany with a population of 83.2 million, a fraction of the US. Across all the most populous countries in Europe (Germany, France, UK, etc.) there are a number of different telecom providers, such as Deutsche Telekom, Orange, Vodafone, and Telefonica. Just in Germany, where Deutsche Telekom is headquartered, the company only has ~37% market share. As a result, Sinch is less capable of negotiating pricing with a single carrier and therefore has gross margins closer to ~15-20%.

Source: Koyfin

While MessageBird’s gross margins are unknown, the necessary carrier costs that the company has to pay out for every message it delivers on behalf of its customers are a fundamental part of the business model. For companies like Twilio, even with higher gross margins than Sinch, it’s proven difficult for the company to generate an overall profit, which has impacted stock performance. This may be one driver for why MessageBird has expanded more broadly into internet-provided services like video and VOIP.

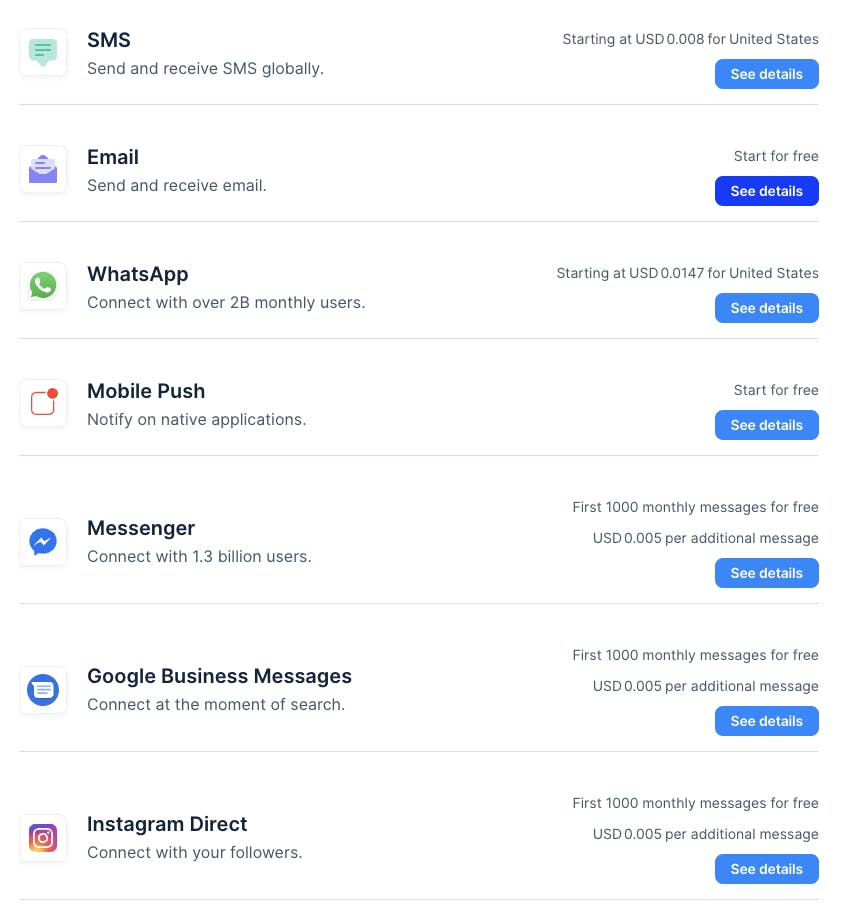

Integrations

MessageBird also generates revenue by charging users for omnichannel integration based on their desired applications and services. This includes integration with emails, messaging platforms, and various social media channels such as WhatsApp, Instagram Direct Messaging, and Messenger.

Source: MessageBird

Additional Features

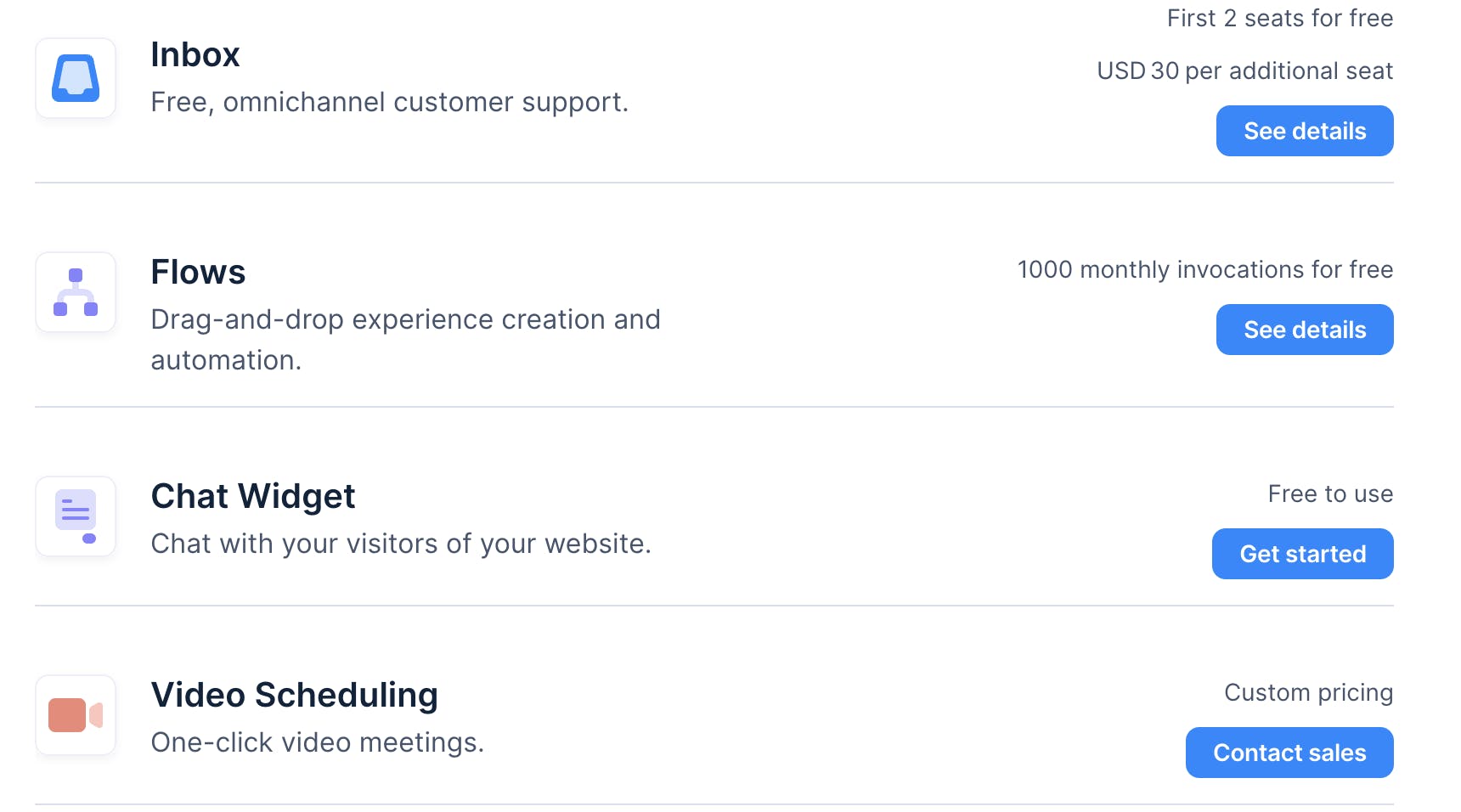

Additional features, such as inbox pricing, chat widgets, custom flow building, and video scheduling, carry associated costs. Up to two seats for inbox pricing are available for free of charge. The cost of flow building depends on the invocations used, and chat widgets are provided free of charge. Video scheduling is custom-priced based on individual business requirements.

Source: MessageBird

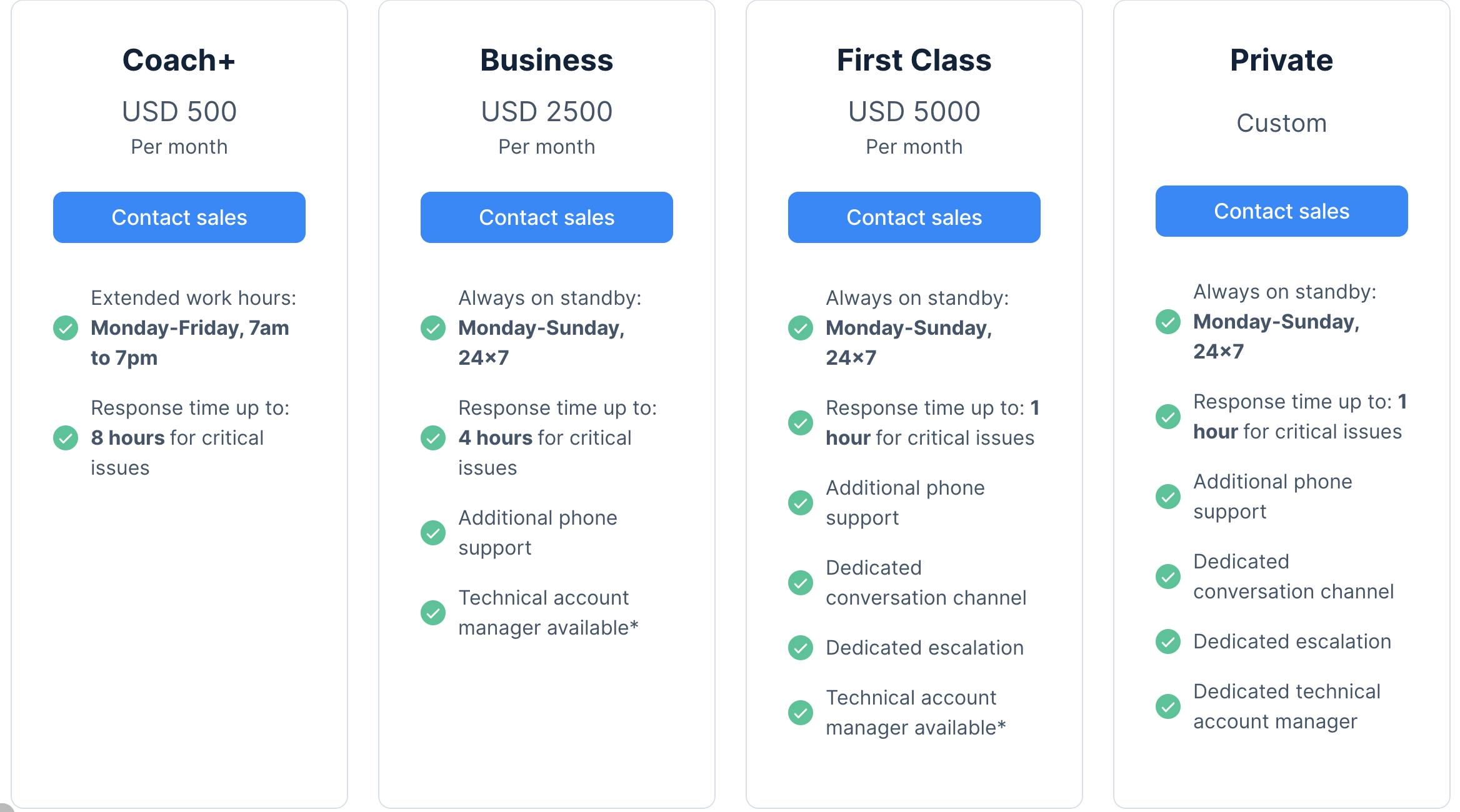

Customer Support

Customer support services beyond regular subscription are available at an additional cost. For weekday support with a maximum response time of eight hours ("Coach+"), an extra fee of $500 is incurred. The "Business" plan includes phone support and a shorter response time of up to four hours for $2.5K. The "First Class" package offers 24/7 support, a conversational channel, escalation, and a dedicated technical account manager for $5K per month. Users also have the option to customize their own support plan.

Source: MessageBird

Traction

MessageBird achieved profitability while bootstrapping for its six years prior to its $60 million Series A in 2017. Notable clients include Lufthansa Airlines, Heineken, Hugo Boss, Uber, Deliveroo, and Facebook Messenger. The company has over 29K customers as of August 2023. Its $200 million Series C funding round in 2020 helped expand MessageBird into the Asian market and partnerships with industry leaders like Alibaba and WeChat. Unverified estimates placed MessageBird’s 2021 revenue at $500 million.

Through strategic acquisitions, such as Hull.io in March 2021 and SparkPost for $600 million in April 2021, MessageBird has also expanded its presence in the US market, gaining an additional 25K customers and over 800 employees. MessageBird has offices in Amsterdam, San Francisco, Singapore, Bogota, London, Shanghai, Dublin, Hamburg, and Sydney as of December 2022. Regarding its customer acquisition traction, Vis attributed MessageBird’s success to listening to customers and working quickly to deliver what they need.

As Vis said in 2018:

“We’re mindful of the demands placed on developers today. We know how much is asked of them. So we’ve architected our platform with already-overburdened developers in mind - taking on the heavy technical lifting to free up their time and resources. It’s also why we’ve focused on the underlying infrastructure, instead of solely on features.”

Valuation

As of August 2023, MessageBird’s latest funding round was a $1 billion Series C extension in April 2021, which allowed the company to acquire SparkPost for $600 million after having initially raised a $200 million Series C round in October 2020. The extension funding was mixed between 70% equity and 30% debt, and participants in the round included Tiger Global, BlackRock, Owl Rock, Eurazeo; existing investors like Atomico (who led MessageBird’s Series A and Series B), Accel, and Y Combinator also participated. The SparkPost acquisition was meant to allow MessageBird to have a stronger presence in the US market and integrate SparkPost to multiple channels already available on the MessageBird platform. As of August 2023, MessageBird has raised a total of $1.1 billion.

Comparable public companies, like Twilio and Sinch, trade at ~1-2x revenues as the result of the company’s low gross margins. Depending on MessageBird’s margin profile, the company could trade at similar multiples were it to go public.

Source: Koyfin

Key Opportunities

Targeting Growing Markets

MessageBird can target rising markets like the creator economy (expected to be worth $104 billion by the end of 2023), the gaming industry (projected to be worth $281.8 billion in 2023) with tailored features to help increase market share. The creator economy is growing rapidly as more and more people are using online platforms to share their content and build businesses. MessageBird can help creators connect with their audiences, build communities, and monetize their content. Meanwhile, the gaming industry is a major driver of growth in the real-time communication market. MessageBird can help gaming companies improve their communication with players, build social features, and create more engaging gaming experiences.

Moving Upmarket

MessageBird also has the opportunity to grow in the enterprise market. Businesses are increasingly looking for ways to improve their customer communication and engagement. MessageBird's CPaaS platform can help businesses to do this by providing them with a scalable, reliable, and secure platform to communicate with customers across a variety of channels.

Increased Demand for Automation

In the post pandemic period, remote work has proven durable, with 16% of companies fully remote as of June 2023. This shift has led to a surge in demand within the cloud communications market. Cloud communications play a critical role in in the context of a fully remote company. For businesses, integrating cloud communications creates cost savings among other benefits. An essential component of achieving cost savings lies in the automation of operational processes. MessageBird has demonstrated its focus on operational efficiency through the introduction of Inbox.ai. With the growing prominence of generative AI, MessageBird can further capitalize on emerging markets and advance its existing AI capabilities for business automation.

Key Risks

Regulatory Environment

MessageBird's global operational presence necessitates strict compliance with country-specific regulations governing customer communication. Adhering to diverse compliance requirements imposed by federal, state, and local regulators introduces potential risks to MessageBird's business model. Notably, the European Union's General Data Protection Regulation (GDPR) enforces stringent data privacy laws across its member states, emphasizing the protection of personal data for EU residents. As North American data regulations differ from those of the EU, MessageBird must exhibit adaptability in its business model to navigate potential regulatory hurdles successfully.

Competitive Market

The CPaaS market is becoming increasingly crowded, with MessageBird facing competition from large and well-capitalized incumbents like Twilio and Sinch, as well as new entrants. This could make it difficult for MessageBird to maintain its market share, and it must find new ways to meaningfully differentiate itself from competitors and create defensibility.

Summary

The demand for cloud communication platforms, specifically Communications-Platforms-as-a-Service (CPaaS), has witnessed significant growth, driven by the escalating adoption of cloud communication solutions across diverse industries. MessageBird’s platform enables customer engagement across a multitude of channels, equipped with features such as automation, personalized messaging, two-way communication, and customer engagement tracking through analytical dashboards. With MessageBird's APIs and developer tools, users can integrate with existing systems, providing scalability, reliability, and robust security measures.