Thesis

Immigration is driving demographic shifts in developed economies. In the United States alone, immigration accounted for 65% of population growth between 2021 and 2022, with projections showing that immigrants would represent 88% of US population growth between 2015 and 2065. This demographic shift presents a major opportunity for financial services to serve immigrants. Yet, 49% of immigrants surveyed in 2022 struggled to access basic financial services like credit cards, despite having established credit histories in their home countries.

This challenge stems from fundamental inefficiencies in the global credit system. When individuals move to a new country, they must rebuild their credit history from scratch — a process that typically takes seven to 10 years. Traditional credit scoring models, used by 90% of top US lenders as of 2023, require at least six months of credit history before considering a consumer "scorable." This creates a paradox: despite 59% of immigrants having had super-prime credit scores in their home countries as of 2024, they needed to rely on secured credit cards or higher deposits to build credit. Meanwhile, as of 2024, only 43% of lenders supplemented credit scores with alternative data in their risk assessments, while 78% remained tied to traditional credit-based underwriting.

Nova Credit aims to solve this cross-border credit problem. Nova Credit has built infrastructure to translate international credit data into a standardized format that domestic financial institutions can understand. The company has established partnerships with credit bureaus worldwide, creating a three-sided marketplace connecting consumers, international credit bureaus, and financial institutions. By solving the technical and regulatory challenges of cross-border credit reporting, Nova Credit is aiming to unlock financial access for millions of immigrants while helping financial institutions tap into a rapidly growing market segment.

Founding Story

Nova Credit was founded in 2016 by Misha Esipov (CEO), Nicky Goulimis (COO), and Loek Janssen (CTO). The three co-founders met while studying at Stanford University, where Esipov and Goulimis were pursuing their MBAs, and Janssen was completing his master's degree at the Institute of Computational Mathematics and Engineering. Each founder brought different perspectives to the immigrant credit problem.

Esipov, who immigrated from the Soviet Union at age three in 1990, experienced firsthand the financial obstacles facing immigrants. After graduating from New York University with a bachelor's degree in mathematics and finance in 2009, he worked at Goldman Sachs from 2009 to 2012 and Apollo Global Management from 2012 to 2014 before pursuing his MBA at Stanford University in 2014. Janssen, coming from the Netherlands, had a background in econometrics. Goulimis, Esipov, and Janssen had all experienced challenges around credit access as non-Americans.

The idea for Nova Credit emerged from a Stanford course called The Lean Launchpad. What started as a class project evolved into something much bigger as the team interviewed hundreds of potential customers and iteratively refined their product concept. The founders discovered that the problem of credit access for immigrants was far more significant than they initially understood.

A pivotal moment came when they realized the issue wasn't just a consumer pain point but also a significant concern for lenders. Goulimis recalls a particularly memorable incident when a Credit Union CEO desperately tried to reach her, demonstrating market demand for their solution. After encouraging initial feedback and market analysis, the team applied to Y Combinator and was accepted into the accelerator program’s Summer 2016 batch.

The founding team has evolved over time. While Esipov remained CEO as of December 2024, both Goulimis and Janssen left the company in 2024 and 2021 respectively, and transitioned to new roles. The company has attracted notable talent, including Nichole Mustard, Credit Karma's co-founder and former Chief Revenue Officer, who joined the board of directors in July 2024. The company has also brought on experienced leadership, such as Chris Hansen who joined in October 2021 as Head of Channels & Alliances and brings expertise from companies like Argyle and AOL.

Product

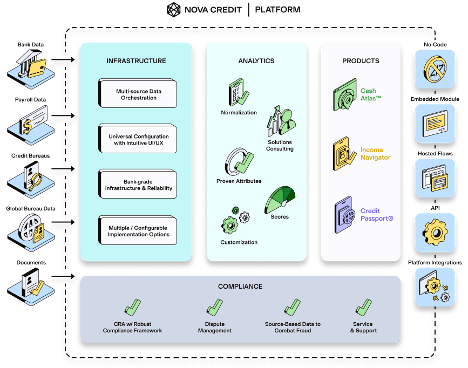

Nova Credit is a credit infrastructure platform that helps businesses access and analyze alternative credit data. The platform consists of three integrated core products (i.e. Credit Passport, Cash Atlas, and Income Navigator) that work together to solve the challenge of cross-border credit assessment.

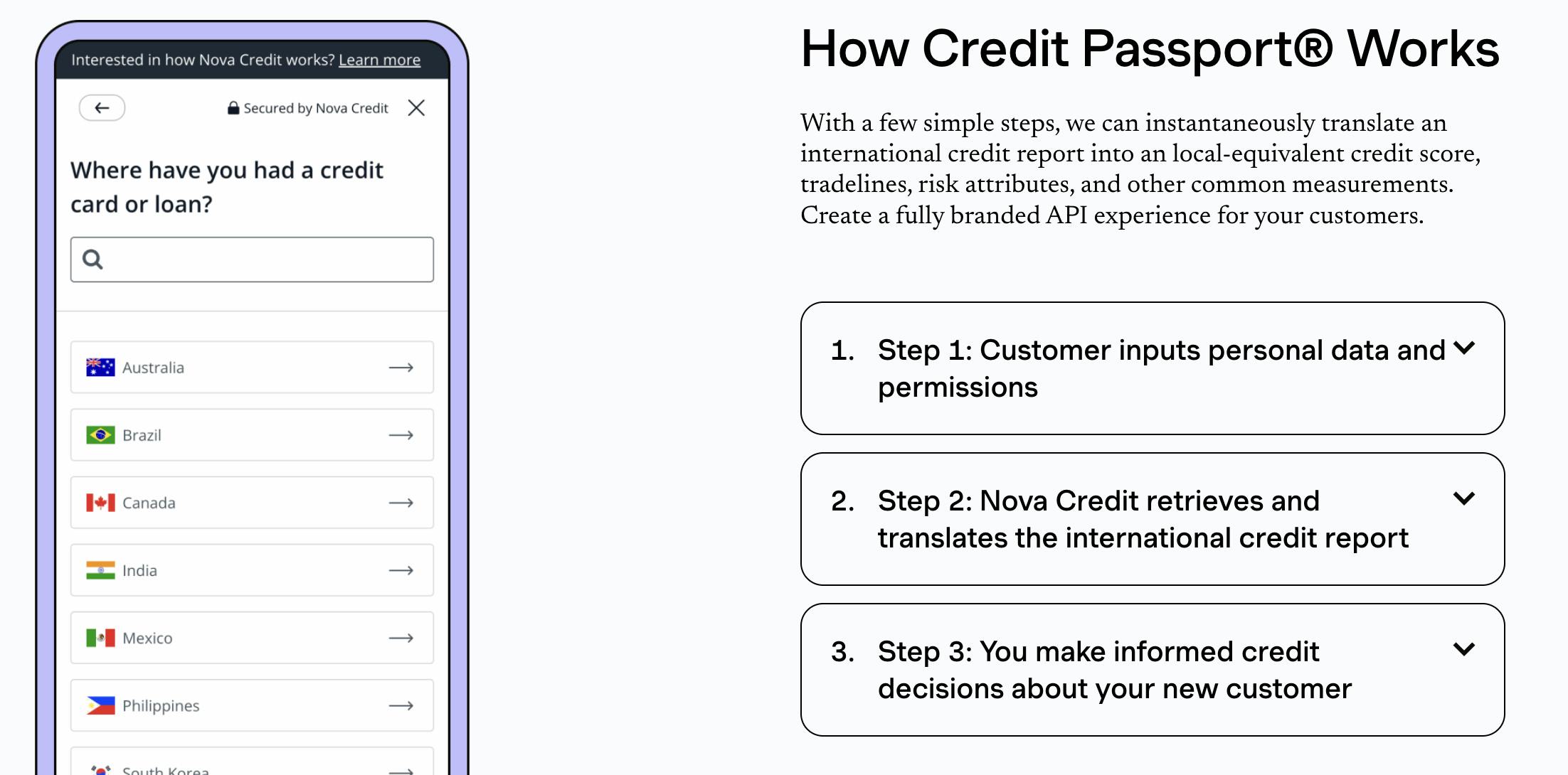

Credit Passport

Credit Passport, Nova Credit's highest revenue-generating product, enables immigrants to port their established credit history from their home country to their new country of residence. The system creates standardized credit reports by establishing data pipelines with international credit bureaus and translating diverse credit data schemas into a format that domestic financial institutions can understand.

Source: Nova Credit

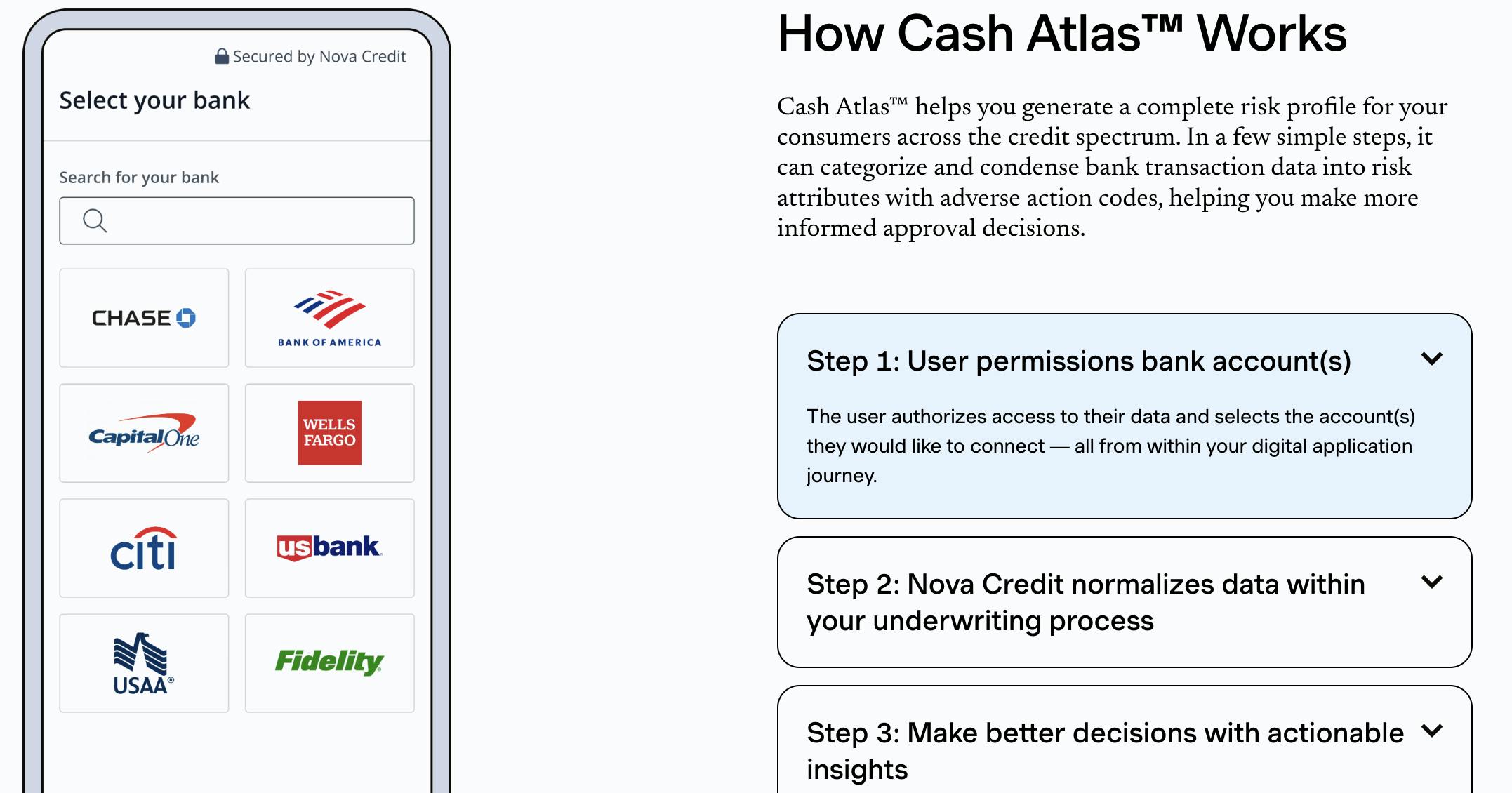

Cash Atlas

Cash Atlas provides credit risk assessment through the analysis of consumer-permissioned bank transaction data. It categorizes income, assets, and expenses, tracks money movement, and differentiates individual vs. joint accounts. With over 1K attributes and the NovaScore Cash Flow (NSCF) risk score, lenders can assess credit risk using bank data. The solution works alongside Credit Passport to provide lenders with a comprehensive view of an applicant's financial health.

Source: Nova Credit

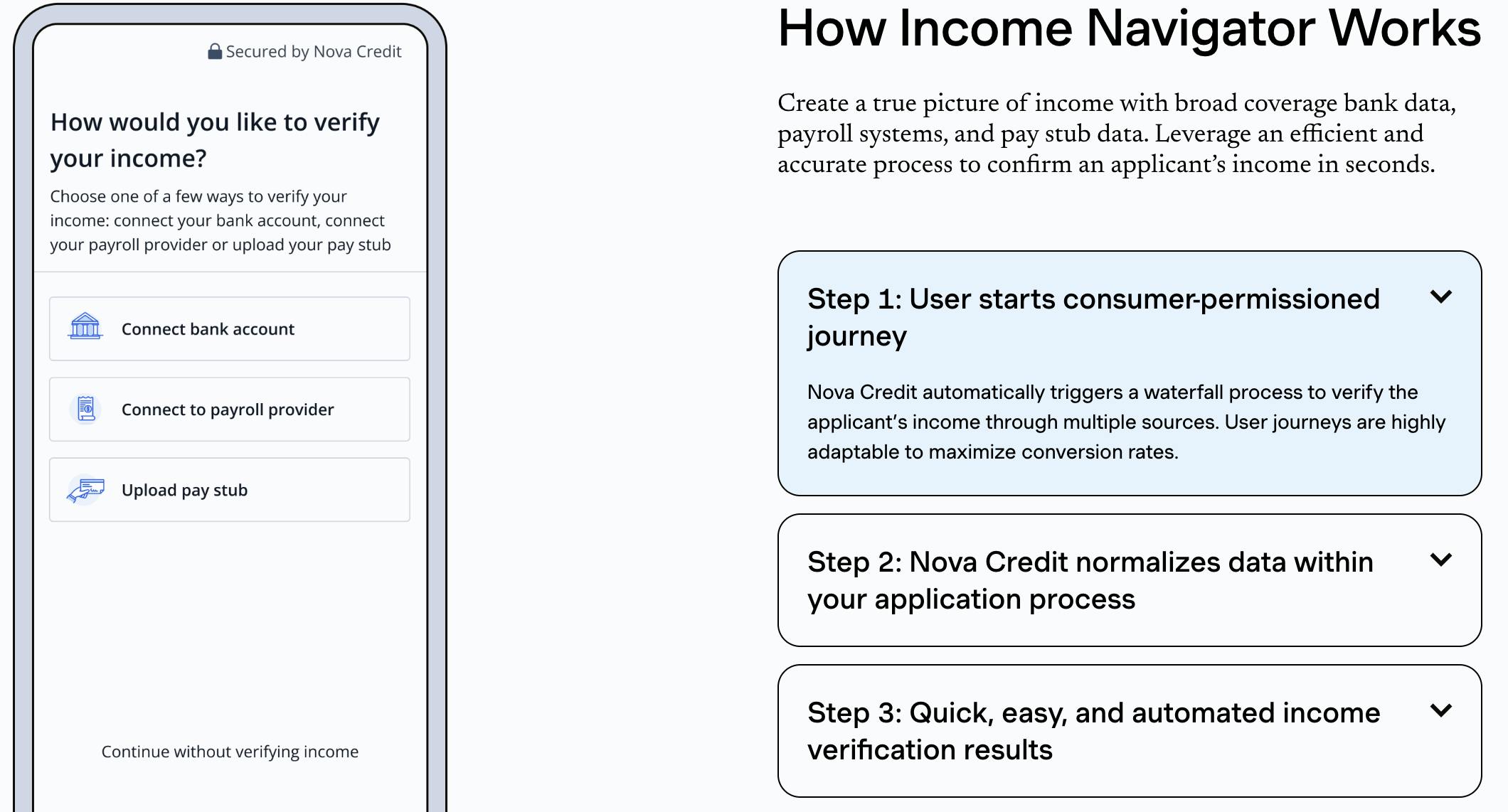

Income Navigator

Income Navigator rounds out the product suite by providing automated income verification capabilities. The system aims to streamline the assessment process by incorporating multiple data sources, including bank data, payroll systems, and pay stub information. This approach provided up to 98% coverage of the US market and improved conversion rates by up to 80% compared to traditional solutions as of December 2024. The system includes built-in fraud detection measures to ensure data integrity.

Source: Nova Credit

Platform Integration

Nova Credit Platform is the foundational layer that unifies the three core products into a single solution. The platform handles multi-source data onboarding and orchestration while providing embedded analytics capabilities like normalization and scoring. It offers deployment options through both no-code solutions and direct API integrations. It also maintains a compliance framework as a registered Consumer Reporting Agency.

Source: Nova Credit

Marketplace

Nova Credit Marketplace is a consumer-facing platform where newcomers to the United States can access financial products using their international credit history. The marketplace connects immigrants with various financial services, including credit cards, phone plans, auto loans, and student loans. Through Nova Credit’s partnerships with companies like American Express and Verizon, users can apply for U.S. credit cards and device financing using their existing credit history from their home country.

The marketplace operates through a process where users first select their home country to discover available products, then apply using their foreign credit history, and finally begin building their U.S. credit profile if approved. For international students, the platform offers specialized services through partnerships with MPOWER Financing, providing access to education funding without requiring a U.S. cosigner.

The marketplace is an extension of Nova Credit's B2B infrastructure, creating a direct channel for consumers to access the company's credit translation capabilities. While the platform is free for consumers to use, Nova Credit generates revenue through partner commissions when users successfully obtain financial products through the marketplace.

Source: Nova Credit

Market

Customer

Nova Credit serves five distinct customer segments. The primary customers are banks, digital lenders, tenant screeners, credit unions, and auto lenders, including traditional institutions like American Express, HSBC, and Scotiabank who use Nova Credit to expand their addressable market to immigrants and thin-file customers who have little to no credit history.

For example, before implementing Nova Credit, American Express struggled to properly assess credit risk for newcomers to the United States, despite this segment showing strong financial characteristics. As of 2024, 59% of US newcomers had super-prime credit scores in their home countries, with an average of 8+ trade lines, approximately five years of credit history, and an average US income of $110K.

After implementing Credit Passport, American Express discovered that accounts approved through Nova Credit's system were 79% less likely to become delinquent compared to domestic account holders with prime credit scores as of December 2024. The partnership helped American Express increase credit card approvals for newcomers by 54% in Q1 2022 compared to Q1 2021. These newcomer accounts also demonstrated lower revolving utilization rates than the average U.S. adult population.

The second segment comprises alternative and digital lenders such as SoFi and Earnest, who use the platform for more informed credit assessment. The third segment includes tenant screening companies like Yardi and property managers who use the platform for income verification. The fourth segment consists of credit unions like United Nations Federal Credit Union, which use the platform to evaluate loan requests for customers outside of the US. The fifth segment includes auto lenders like Autonomy who use the platform to issue auto loans and subscriptions based on credit risk data. Nova Credit has also further expanded into serving telecommunications providers, with Verizon being a notable customer.

These enterprise customers traditionally relied on conventional credit bureau data, which created a barrier for immigrants and those with limited credit history. The status quo forced newcomers to rebuild their credit history from scratch, a process that could take seven to 10 years as of December 2024. This inefficient system left financial institutions unable to serve potentially valuable customers and forced immigrants to start their financial lives over, regardless of their previous credit history.

Market Size

Nova Credit operates in two intersecting markets: the alternative data market and the broader credit bureau market. The alternative data market was valued at $6.3 billion in 2023 and was projected to reach $79.2 billion by 2029, growing at a CAGR of 52.6%. The alternative data market encompasses several key components such as satellite imagery, web traffic, social media activity, sensor data, and credit or debit card transactions. The market's growth is primarily driven by increasing digitalization, the rise of fintech, favorable government policies, expansion of the banking, financial services, and insurance sectors, and the rapid growth of e-commerce.

The traditional credit bureau market is substantially larger, valued at $122.4 billion in 2023 and expected to reach $223.4 billion by 2028, growing at a CAGR of 12.6%. The market consists of three main components: credit products (credit scores, reports, and check services), report types (corporate and individual), and end users (commercial and consumer). The market's growth is driven by increasing demand for credit cards, the rise of alternative data sources, digital transformation in banking, blockchain adoption for identity verification, and government initiatives promoting financial inclusion.

The total addressable US market is estimated to include 4.7K FDIC-insured banks as of 2023, 4.6K credit unions as of 2024, 650 tenant screening businesses as of 2018, and 100 mobile carriers as of 2024. The end-user market included 46.2 million immigrants in the United States as of 2022. Among such immigrants, 59% had super-prime credit scores in their home countries as of 2024.

Market growth is driven by several factors. Immigration accounted for 65% of US population growth (2021-2022), and immigrants were projected to represent 88% of US population growth between 2015 and 2065. The rise of open finance and regulatory support through initiatives like the Community Reinvestment Act is accelerating market expansion. According to a research study conducted in 2024, 90% of lenders saw alternative data as key for credit decision-making, indicating substantial room for further market penetration. Additionally, the company has expanded internationally to the UK, suggesting potential for global market expansion.

Competition

Traditional Credit Bureaus

Experian: Founded in 1980, Experian is one of the three major credit bureaus providing credit reporting and analytics services globally. The company had a market capitalization of $41.7 billion as of December 2024. While Experian has an international presence, it focuses on traditional credit reporting rather than cross-border credit portability. Experian introduced alternative data products like Experian Lift in 2020 and Experian Boost in 2019 to help lenders assess credit-invisible and thin-file consumers, showing movement toward Nova Credit's space but through a different approach.

Equifax: Founded in 1899, Equifax operates as one of the three largest credit reporting agencies globally. The company had a market capitalization of $31.4 billion as of December 2024. While Equifax has international operations across 24 countries, it lacks an integrated cross-border credit solution like Nova Credit.

TransUnion: Founded in 1968, TransUnion is one of the three top credit bureaus providing credit reporting and analytics services globally. The company had a market capitalization of $18.1 billion as of December 2024. TransUnion operates in over 30 countries but maintains traditional credit reporting models rather than offering cross-border credit portability solutions.

Immigrant-focused Credit Products

Welcome Tech: Founded in 2010, Welcome Tech provides a platform offering healthcare and financial services to immigrants. The company raised $35 million in Series B funding in 2021 led by TTV Capital, Owl Ventures, and SoftBank and raised a total of over $70 million as of December 2024. Welcome Tech grew its subscriber base to over four million between 2021 and 2023. Unlike Nova Credit's B2B approach, Welcome Tech directly serves immigrants with a consumer-facing platform offering various services beyond credit including health services and job advising.

Digital Lenders Leveraging Alternative Data

Petal: Founded in 2016, Petal offers credit cards to underserved consumers using cash flow-based underwriting instead of traditional credit scores. The company raised a $140 million Series D funding round at a $800 million valuation in 2022 led by Tarsadia Investments and raised a total of $992.6 million in funding from investors including Valar Ventures, Core Innovation Capital, and Trinity Capital as of March 2025. Unlike Nova Credit's focus on immigrant credit histories, Petal emphasizes cash flow analysis for domestic consumers with limited credit history.

Stilt: Founded in 2015, Stilt provides financial services focused on immigrants and the underserved. The company raised a $14 million Series A led by Link Ventures in 2022 and a $100 million debt facility from Silicon Valley Bank to expand its focus to include a B2B offering. As of 2022, Stilt had raised a total of $375 million in equity and debt financing since launch, with investors including Petrushka Investments, Hillsven Capital, and notable individual investors like Claire Hughes Johnson (former Stripe COO) and Ott Kaukver (former Checkout.com CTO). Unlike Nova Credit's focus on credit data infrastructure, Stilt directly provides loans to immigrants while also offering Onbo, a credit-as-a-service platform for businesses.

Tala: Founded in 2011, Tala provides mobile-first credit and financial services to underserved populations using alternative data from mobile devices. Tala raised $14 million in Series E funding in 2021 from notable investors such as PayPal Ventures, Kindred Ventures Revolution Growth, and Lowercase Capital. The company had raised a total of over $350 million, reaching a valuation of $800 million as of May 2024. While Nova Credit operates as a B2B platform that translates existing international credit histories for financial institutions, Tala takes a direct-to-consumer approach by providing microloans in emerging markets using alternative data collected from users' mobile devices.

TomoCredit: Founded in 2018, TomoCredit operates as a credit card provider targeting credit-invisible immigrants and international students using cash-flow analysis. The company raised $122 million in Series B funding and debt in July 2022, achieving a valuation of $222 million, with backing from Morgan Stanley's Next Level Fund and Mastercard. While Nova Credit focuses on enabling traditional financial institutions to serve immigrants, TomoCredit directly issues credit cards with no credit check requirements.

Business Model

Revenue Model

Nova Credit connects international credit bureaus with domestic financial institutions, serving as a three-sided marketplace for consumers, data providers, and data users. Nova Credit is free for consumers and operates a B2B revenue model, generating income through fees charged to financial institutions and businesses that request consumer credit data. The company pays a fee to credit bureaus for sourcing foreign records and charges companies that request consumer credit data for their due diligence processes.

For example, American Express wants to evaluate an immigrant’s credit history to determine whether the company should issue a card for an applicant. The company can use Nova Credit to source the credit history from another market and determine the borrower’s creditworthiness based on their domestic credit history data.

Partnership Strategy

Nova Credit has developed two key partnership models that enhance its product ecosystem. The first consists of Technology and Channel Partners who integrate Nova Credit's solutions into their existing platforms, allowing their clients to access credit risk data and better understand their customers. These partnerships help enable broader distribution of Nova Credit's products across various industries.

The second category comprises Data Partners, which includes credit bureaus from over 20 countries and U.S. data aggregators as of December 2024. These partnerships form the foundation of Nova Credit's global credit data network, enabling the company to access and standardize credit information from multiple international sources.

These partnerships create a network effect that aims to strengthen Nova Credit's core products. As more partners join the network, the company's ability to provide comprehensive credit assessments improves, making the platform more valuable for both financial institutions and consumers. The partnership strategy helps expand Nova Credit's global reach while maintaining data quality and regulatory compliance across different jurisdictions.

Traction

Nova Credit has demonstrated significant growth since its founding. From 2020 to 2023, Nova Credit grew revenues by 10x, unlocked over $10 billion in credit value for consumers, and served 7K+ customers worldwide as of December 2024. The company had approximately 100 employees as of October 2023 and remained relatively lean while planning additional hiring with its new capital. According to a statement made by Nova Credit’s CEO in October 2023, the company was estimated to reach profitability by 2024.

Nova Credit has secured partnerships with major financial institutions and service providers. A notable success case is American Express, which saw a 54% increase in credit card approval volume for immigrants in Q1 2022 compared to Q1 2021. As of December 2024, American Express accounts approved using Credit Passport were 79% less likely to be risky compared to domestic account holders with prime credit scores. Additionally, lenders had access to over 1 billion Credit Passport records as of 2022.

The company has also expanded its reach through strategic partnerships in 2024, announcing deals with HSBC UK for international mortgages and extending its relationship with SoFi for enhanced loan underwriting capabilities. As of October 2023, Nova Credit operated in five countries, such as the UK and Singapore, and had access to credit bureau data from 20 countries through its partnerships. For example, if a US citizen moves to London or Singapore, they can get approved for banking products internationally in those markets by leveraging Nova Credit’s solution.

Valuation

Nova Credit raised $45 million in Series C funding in October 2023, led by Canapi Ventures. The round included participation from existing investors General Catalyst, Index Ventures, Kleiner Perkins, and Y Combinator, along with new investors Geodesic Capital, Harmonic Capital, Radiate Capital, and Socium Ventures. The company had raised a total of $124.4 million across nine funding rounds since its founding, as of February 2025. The company was valued at $295 million after its Series B round in February 2020.

Key Opportunities

Global Market Expansion

Nova Credit has begun expanding into high-immigration markets beyond the United States, including Canada, Singapore, the UK, and UAE. This expansion aligns with global demographic trends, as immigration continues to drive population growth, accounting for 65% of US population growth between 2021 and 2022, 100% of Canada’s population growth between 2021 and 2032, and 92% of UK’s population growth between 2021 and 2046. The company's recent launches in these markets can help it capitalize on the growing need for cross-border credit solutions.

Expand Immigrant Credit Data Coverage

By partnering with more foreign credit bureaus, Nova Credit can increase its addressable market, serve a larger portion of the immigrant population in the US and other high-immigration markets, access a wider range of credit data, and provide more comprehensive credit reports to its clients. As of July 2024, Nova Credit services were available for US immigrants from 13 countries, although it claimed to have partnerships with credit bureaus across 20 countries as of February 2025.

Open Banking Evolution

The rise of open banking presents a significant opportunity for Nova Credit's expansion. With the Consumer Financial Protection Bureau's proposed 1033 rule that was finalized in October 2024, the US is moving toward enabling consumers to securely share their financial data with third-party providers, potentially accelerating the adoption of alternative credit assessment methods. According to a study conducted by PYMNTS Intelligence in March 2024, 46% of consumers have shown strong interest in open banking, with particularly high adoption rates among younger generations (72% of Generation Z and 66% of millennials).

Nova Credit's partnership with Akoya and integration of cash flow analytics may help the company benefit from this shift towards open banking and changing consumer behavior around financial data sharing. The company's Nova Credit Platform launch specifically addresses this shift, with features including multi-source data onboarding and embedded analytics. Nova Credit serves as a bridge between data and credit in the era of open finance, as evidenced by its partnerships with major financial institutions like HSBC and Verizon.

Regulatory Tailwinds

Changes in regulatory frameworks, particularly through the Community Reinvestment Act, are encouraging banks to expand lending to immigrants and meet the credit needs of people from all income brackets. This regulatory environment supports Nova Credit's mission, as the company operates as a registered Consumer Reporting Agency under Fair Credit Reporting Act guidelines. The company announced in 2023 that it has invested heavily in information security and compliance since its seed stage.

Key Risks

Data Quality and Compliance Challenges

Nova Credit may face challenges maintaining data quality and consistency when integrating credit information from multiple countries and sources. The company must establish robust data governance processes while navigating complex global regulations for credit data and privacy laws across different jurisdictions. The rise of alternative data sources, including credit builder products, soft inquiry data, and “Buy Now Pay Later” transactions, has made credit bureau data increasingly difficult to interpret accurately. Additionally, as a registered Consumer Reporting Agency, Nova Credit must maintain strict compliance with FCRA guidelines while managing disputes and adverse action notices.

Market Adoption and Trust

Establishing credibility as a new global credit bureau presents challenges. Traditional credit bureaus have established relationships and infrastructure built over decades. Nova Credit must demonstrate a compelling value proposition to drive adoption among financial institutions while building trust with data providers and lenders. The company must validate whether its business customers are generating substantial revenue from new immigrant customers and verify that the underbanked population represents an attractive target segment for banks.

Technological and Competitive Risks

The rapid evolution of open banking and alternative data presents both opportunities and risks. With the Consumer Financial Protection Bureau's 1033 Rule implementation, 81% of lenders express concerns about disruption to current protocols for consumer data security, according to a study conducted in 2024. The company must continuously invest in its technology infrastructure to maintain competitive advantages while facing potential competition from incumbent credit bureaus and fintech companies. Additionally, cybersecurity risks and inappropriate lending practices by under-regulated institutions could jeopardize trust in alternative credit assessment models.

Macroeconomic and Regulatory Uncertainty

Global economic conditions and regulatory changes pose significant risks. Rising delinquencies, elevated interest rates, and historically low demand in the lending industry could impact Nova Credit's growth trajectory. The company must also navigate intensifying international conflicts and changing regulatory landscapes that could affect cross-border data-sharing agreements. Furthermore, potential data biases could result in greater financial exclusion and feed distrust for new technology.

Summary

Nova Credit operates in the alternative data and credit bureau markets, providing cross-border credit infrastructure that translates international credit histories into standardized formats for domestic financial institutions. Through partnerships with credit bureaus in over 20 countries, the company serves US immigrants through three core products: Credit Passport, Cash Atlas, and Income Navigator. While early results show promise, with American Express reporting a 54% increase in immigrant credit card approvals using Nova Credit's platform, key questions remain about the company's ability to maintain data quality while scaling, compete with established credit bureaus, and generate sufficient revenue from its target demographic of US immigrants to justify widespread adoption of its solutions.