Thesis

In 2022, only 28% of Americans had a “great deal or quite a lot” of trust in the public school system. The US spends $764.7 billion on public education annually via federal, state, and local governments, yet more than half of all US adults aged 16-74 lack literacy proficiency, reading below the equivalent of a sixth-grade level.

Much of the public distrust stems from long-standing stagnation or even a decline in the quality of American education. The National Assessment of Educational Progress showed a decade of stagnation in math and reading test scores in 2017 even before the COVID-19 pandemic, and the tests’ first results after the pandemic showed math scores for eighth graders had fallen in every state, with national math proficiency at merely 26% (down from 34% before the pandemic). Reading scores had also declined in more than half of states.

Beyond a lack of academic performance is a more general level of dissatisfaction that Americans are feeling with the education system. Only 42% of US adults surveyed by Gallup in 2022 were satisfied with K-12 education, which represents the lowest level of satisfaction in the past two decades. This dissatisfaction may hint at a broader issue with the premise of education in the US, with its focus on jumping through hoops like standardized testing, grades, and instrumental achievement for the sake of building an impressive college resume.

Primer is building a new education system for parents and students who want an alternative to what Primer CEO Ryan Delk, in an interview with Contrary Research, called the “public-private duopoly”. Its vision is to circumvent what Delk describes as the broken status quo of education in the US. As Delk told Contrary Research:

“The goalpost for success for K-12 education is going to college, and the goalpost of college is getting a job. This is myopic and soul-sucking. We believe that the goal of education should be helping kids reach their potential.“

Although it began with internet-only education products that were meant to supplement students’ educations, as of December 2022 Primer’s core offering is its in-person Microschools product.

Source: Primer

Founding Story

Primer was co-founded by Ryan Delk (CEO) and Maksim Stepanenko (CTO) in 2019.

Starting in kindergarten, Delk was homeschooled by his mother for about nine years in Florida. His mother was a former public school teacher and saw the system as inadequate. Later, he attended the University of Florida, dropped out, and moved to San Francisco to work in tech. There, his first job was working at a creator-focused startup called Gumroad before then joining storage startup Omni.

Stepanenko, meanwhile, attended a traditional school in Kyrgyzstan until the eighth grade, where homeschooling was illegal. He excelled in physics and won multiple medals in the International Physics Olympiads for Kyrgyzstan. He then went to MIT for his undergrad studies, where he interned at Google. He later spent five years as an engineer at Coinbase.

In 2019, Erik Torenberg, co-founder of On Deck, introduced Stepanenko and Delk. After discussing their interests, the pair launched Primer to create an online education alternative. The platform officially debuted in November 2019. In the early days, Primer rolled out a pair of free homeschooling resources for parents. A few months after launch, the pandemic saw the country enter a period of homeschooling, and Primer expanded its beta beyond existing homeschoolers. Eventually, in December 2022, Primer broadened its focus to addressing students through in-person Microschools, moving away from internet-only resources.

Product

Primer’s product has evolved over time. Originally, the core focus of Primer’s product was around providing parents the “full-stack infrastructure [to] make homeschooling a mainstream option for families.” The original product offered a Navigator, to help parents stay compliant with homeschooling requirements in different states, and a library of digital instruction resources. To augment the homeschool experience, Primer also provided interest-based clubs in order to “let kids go super deep in areas they’re passionate about with kids from all over the country.”

However, given the ambition of Primer’s focus on providing an alternative to the entire educational status quo, the company’s product has evolved to focus on a holistic experience for students, as opposed to supplemental offerings. As a result, in April 2022 Primer announced the launch of Microschools, after hiring Ian Bravo who had previously spent several years building successful Microschools in Florida.

Primer Microschools

As Microschools were rolled out in the 2022-2023 school year, Primer sunsetted its homeschooling and Clubs products in favor of doubling down on Microschools. In an interview with Contrary Research Ryan Delk, the CEO of Primer, described the decision this way:

“We decided to accelerate Microschools and pause the internet products, so now you can only access Primer as part of a Microschool. We want to solve the core fundamental problems with education, so rather than focusing on supplemental products we want to dedicate all our resources to solving the hardest problems in education.”

Primer opened its first Microschool locations in August 2022 located in Miami for students in third through sixth grade, with plans to expand to other states. These are in-person schools meant for 10-20 students. The experience is technology-enabled self-paced programs where students can progress at their own speed, and then be supported with one-on-one support from a Primer educator.

A typical day at a Primer Microschool can include team-building exercises, mindfulness programs like yoga, and goal-setting activities. Math, science, and social studies programs are facilitated by online instructors and offline work. Each student is also provided a laptop to access lessons and homework. Class sizes typically have a student-to-teacher ratio of 15:1.

Mission Maps

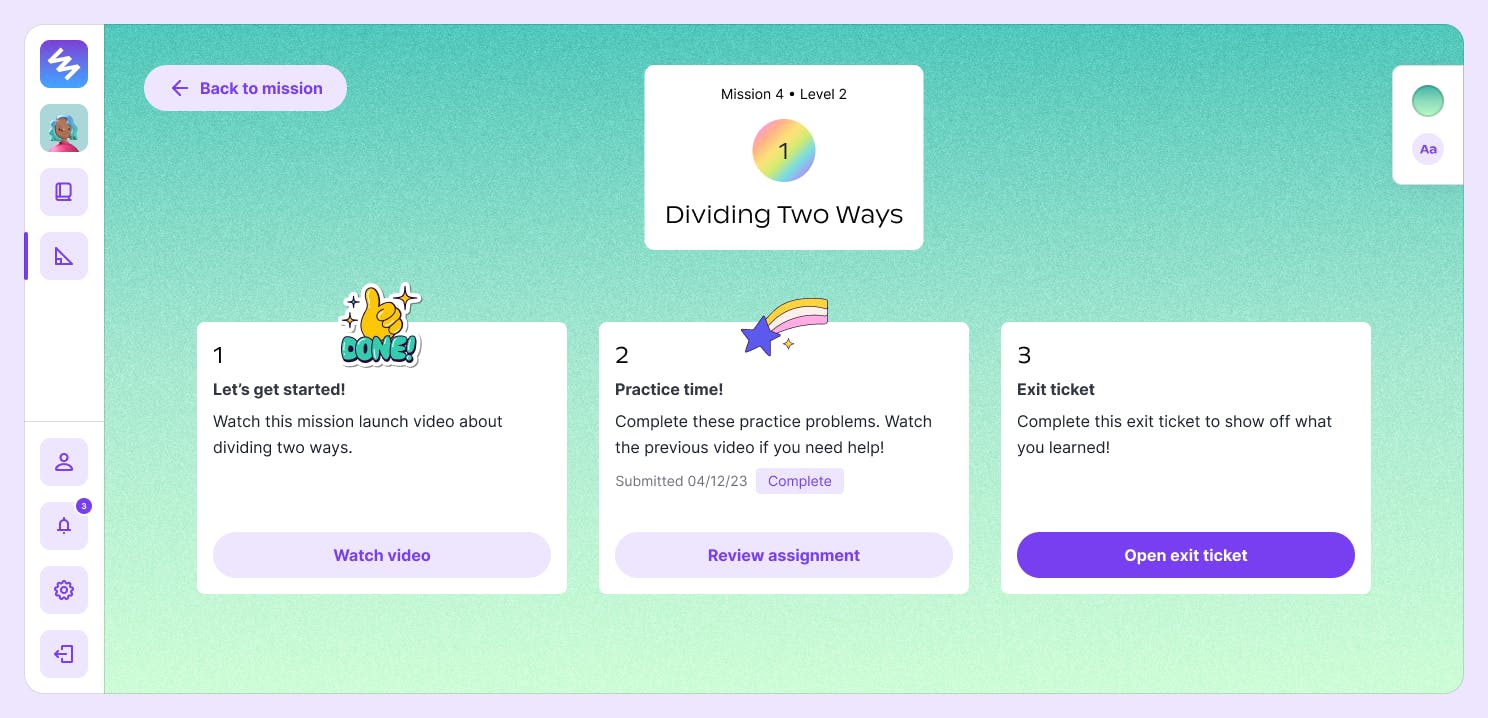

Source: Primer

Microschools’ online resources provide students with mission maps to guide them through specific learning exercises. These maps can include videos to explain key concepts, practice exercises to demonstrate what they’ve learned, and “exit tickets” as a way to confirm concepts are fully understood before moving on.

Launching Microschools For Educators

In addition to providing an alternative education to students, Primer is also focused on making it as simple as possible to create Microschools. Setting up a Microschool can take multiple years. Instead, Primer is focused on enabling high-quality educators to establish their Microschool in 30 days. Primer hasn’t talked publicly about this new product, but in an interview with Contrary Research, Ryan Delk, Primer’s CEO, described the product this way:

“We’re basically building Stripe Atlas for schools. If you’re a top teacher, you can apply and fill out one form. Then, we handle everything for you with the Department of Education, local zoning, State regulatory boards, and everything else you might need. We spin up the school for you. We’ll be able to launch 5K schools in a year, almost entirely through code.”

As part of building this product, Primer has hired Joe Lindsay, who previously ran operations at Stripe Atlas, and is hoping to do the same work for automating the Microschool startup process as he did for the business startup process at Stripe.

Market

Customer

Primer’s core customers are parents, teachers, and students. According to an interview with Primer CEO Ryan Delk, Primer serves students from kindergarten to the eighth grade as of April 2023 and will expand to high school in future years. Students that join Primer typically come from one of three backgrounds:

Homeschooling students whose families are looking for an alternative to traditional education.

Public school students who are being failed by their current schools.

Private school students who are looking to supplement their education by escaping what Delk calls the “traditional hamster wheel” of prepping for college after school.

Market Size

The number of homeschoolers in the United States reached 3.8 million students during the 2020-2021 academic school year, making up 6.7% of all school-aged children in the K-12 school system. The number of homeschooled students increased from 850K in 1999 to 1.7 million in 2016. The COVID-19 pandemic caused a major spike that doubled the number of households opting for homeschooling at the start of the 2020-2021 school year, representing an increase of 5.6% in the US. Meanwhile, the online education market was valued at $198 billion in 2022 and is projected to reach $602 billion by 2030, growing at a CAGR of 17.2%.

As Primer continues to expand its focus across students not only from homeschooling backgrounds but public and private education, the company will eventually address the ~50 million K-12 students in the US. The entire market for education services in the US represents a more than $2 trillion market. As Ryan Delk describes it, “non-public education makes up 1% of the entire market.” So Primer’s ability to address mainstream students that would otherwise attend public school is a key component of tapping into this massive market.

Competition

Direct Competition: The Status Quo

Primer’s focus is on providing a ubiquitous alternative education for students. As a result, the core competition that Primer is focused on displacing is the “public-private school duopoly.” Any student that can receive a higher quality education, and avoid the status quo options available to a typical student is seen as a win for Primer against the competition.

Adjacent Educational Players

Because of this focus on displacing the existing status quo in education, Primer’s primary competition is the incumbent educational providers, rather than other potential innovators in the space. Ryan Delk, the CEO of Primer, shared his perspective with Contrary Research on other alternative education providers:

“The education space is really collaborative, and there are a lot of really great people innovating at different parts of the market. There are very few people going after replacing the core educational system. The competition is the incumbent public and private schools. So I welcome anyone who wants to come help solve this problem.”

Some examples of innovative players that each have a unique take on changing education include companies such as Alpha School, Kubrio, Sora Schools*, and more. Ryan Delk points to other providers, like AltSchool, which later transitioned away from building schools and became more focused on providing software, as examples of companies that have attempted to innovate in this space in the past.

Alpha School

Alpha School is an alternative education provider based in Texas with three locations across Austin and Brownsville. The curriculum provides a combination of technology-enabled self-guided learning and instruction on a variety of life skills. Since being founded in 2016, the school has expanded to include both middle school and high school.

Kubrio

Kubrio focuses on providing personalized learning experiences for kids aged 8-18 and was officially started in 2019. It offers interactive clubs, boot camps, and nano courses. While Kubrio says that its goal is to replace the industrialized school system, the platform must be accredited. They believe there should be a distinction between learning and accreditation. It charges $2.9K per year. Kubrio’s offerings extend beyond interest-based clubs. Kids can bring their project, song, movie, game, or startup, and Kubrio will help them launch it.

Sora Schools*

Sora Schools is a virtual private middle and high school. Unlike Primer and Kubrio, it is accredited by Cognia, NCAA, & WASC. Its program serves students in grades 6-12, offering learning experiences to a slightly wider age range. It charges $12.5K per year in tuition. Sora was founded in 2019 and has raised $23.5 million in funding. Like Primer, its curriculum is designed around students’ interests and learning styles.

Acton Academy

Acton Academy is one of the largest Microschool networks and has been around since 2008. Acton is a learner-driven school aiming to help students find their calling through a quest-based curriculum that combines online game-based tools, Socratic discussions, and face-to-face conversations. The school charges ~$9.3K in tuition and has expanded globally. Like Primer, Acton uses technology to emphasize the importance of students taking ownership of their learning through the micro-school model.

Business Model

With the opening of Microschools, Primer charges tuition that can vary based on the need or eligibility for financial aid. The company’s goal is to build a “ubiquitous alternative” to existing education options that are actually accessible to every family and never turn a family away based on their finances. The larger vision is to leverage technology to create a low-cost but high-quality education that can be scaled quickly, with CEO Ryan Delk telling Contrary Research that it hopes to launch “5K schools in a few years entirely through code with very little human involvement.”

Primer offers income-based scholarships, and most students are on full-tuition scholarships. Primer emphasizes that some families at Primer pay $0 for their kids to attend Primer, and others pay full tuition out of pocket ($18.5K per year). The company says that “We’ve never once turned away a family for their inability to pay – never once.” In an interview with Contrary Research, Delk also said that the company works with voucher programs and ESA programs in places like Florida and Arizona to cover the tuition of families that need it.

Traction

As of April 2023, Primer has 6 Microschools in operation in Florida. The number of operating Microschools is expected to grow 4x over the course of 2023, with the total number of students growing 5-6x. In addition, Ryan Delk shared with Contrary Research that Primer’s top-line revenue is expected to grow 5x over the course of 2023, all driven by Microschools after the business sunsetted its internet-only products in December 2022 to focus entirely on the Microschools product.

Valuation

Primer raised a $15 million Series A in April 2022, co-led by Founders Fund and Khosla Ventures. Investors included Lachy Groom, Sam Altman, Kathryn Haun, Ryan Petersen, Tobi Lütke, Tony Xu, Amjad Massad, Julie Zhou, Howie Liu, and Shane Parrish. Its valuation was not publicly disclosed.

Key Opportunities

Creating Wider Distribution

Primer’s Microschool offering is meant to be a consistent experience as the company builds brand value. The focus is on having a scalable curriculum that can be taken to multiple locations, and prove successful with a variety of students. However, in the long-run, the opportunity for Primer to build more customizable educational experiences represents a significant opportunity as well. In an interview with Contrary Research, Ryan Delk, the CEO of Primer, shared his perspective on the way that Primer can broaden its flexibility in the future:

“We have a very narrow distribution of Microschools because we want the quality to be very high. But over time we want to widen that distribution so that teachers can serve core academics, but then augment it with something that the teacher is really passionate about. Farm schools, art schools, Chinese immersion schools, or whatever that thing is.”

Incremental Revenue

As Primer expands the addressable universe of students it can support, this also creates an opportunity for the company to generate incremental revenue by catering to families' evolving needs. Those needs can include more robust programs, hybrid Microschools, access to mentors, and other products or services that parents may be willing to pay more for in the future.

Key Risks

Fragmented End Market

Attracting and retaining families can prove challenging. Convincing families to switch from traditional schooling to Primer’s Microschools may require significant marketing efforts and a strong value proposition.

Navigating The Regulatory Environment

Primer may face regulatory challenges due to varying educational regulations in different US states. Compliance with relevant regulations is crucial as the company seeks to expand its reach and impact geographically in the homeschooling market. Proactive measures can be taken to minimize the impact of these risks to ensure continued growth, such as staying in lockstep with the latest policies being enforced.

Summary

Primer is focused on building a thoroughgoing alternative to the US education system. It started with internet-only products before pivoting to an in-person offering, Microschools. In tackling a large, regulated market with an entrenched incumbent such as the US public education system, Primer is taking an ambitious swing in a difficult space. While education outcomes have been stagnant and dissatisfaction with education is high, getting families to switch away from traditional options and successfully reaching scale are likely challenges the company must face.

*Contrary is an investor in Sora Schools through one or more affiliates.