Thesis

Traditional application development often requires drawing up architectural diagrams and weaving together services across public clouds like Amazon Web Services, Microsoft Azure, or Google Cloud Platform. Integration of appropriate tooling typically takes deep infrastructure knowledge and full-time DevOps engineers to ship a simple app to production. Meanwhile, global spending on public cloud services was $490.3 billion in 2022, and the global DevOps market was valued at $10.4 billion in 2023

As development tools become increasingly powerful, new disciplines have emerged dedicated to configuring, maintaining, and releasing infrastructure. Over time, the industry has implemented additional layers of abstraction to make the tools and services more configurable and powerful. But that has only resulted in a convoluted web of tools that forces developers to engage in too many experiments with their configurations or to struggle with complicated dashboards. In addition, legacy solutions often have bad documentation, customer support, and bloated user experiences. This often requires enterprises to hire teams of cloud experts to ship simple apps.

Railway is a software deployment platform tailored for engineers to simplify the deployment of apps and services. Its goal is to make it easy for engineers to deploy infrastructure. The company enables developers to host their environments on Railway in the cloud, allowing them to provision databases and services without needing to configure them for different environments and access them from any terminal. With Railway, developers get support to deliver software through the entire application life-cycle through git native tooling, composable infrastructure, and built-in instrumentation.

Founding Story

Railway was founded in 2022 by Jake Cooper (CEO). Cooper started learning to code first-person shooter games in C++ when he was 13 years old. He quickly progressed from Visual Basic to jQuery, always eager to learn more. He describes first learning to code as a “magical experience.”

In college, he dove deeper into software infrastructure. While he studied engineering at the University of Victoria, Cooper worked remotely for Wolfram for two years. While there, he worked on the developer experience, improving Wolfram’s process for Linting, Docker, and Continuous Integration, which gave him the ability to simplify complex developer processes. He later worked at Uber on scaling the app's infrastructure for Jump bikes and scooters. Shortly after completing the project, however, Uber sold the app to Lime and fired most of Cooper’s team, after which he left.

After leaving Uber, Cooper used the time off to start fiddling around with projects. He kept running into a similar problem with everything he wanted to build, which was that deploying even a simple application required deep infrastructure knowledge and often a large number of DevOps engineers to keep up with best practices. Cooper built Railway to address the infrastructure bottleneck, describing Railway’s value proposition this way:

Railway today allows engineers to … ‘automagically’ receive industry best practices for building and deploying apps.

Product

Develop

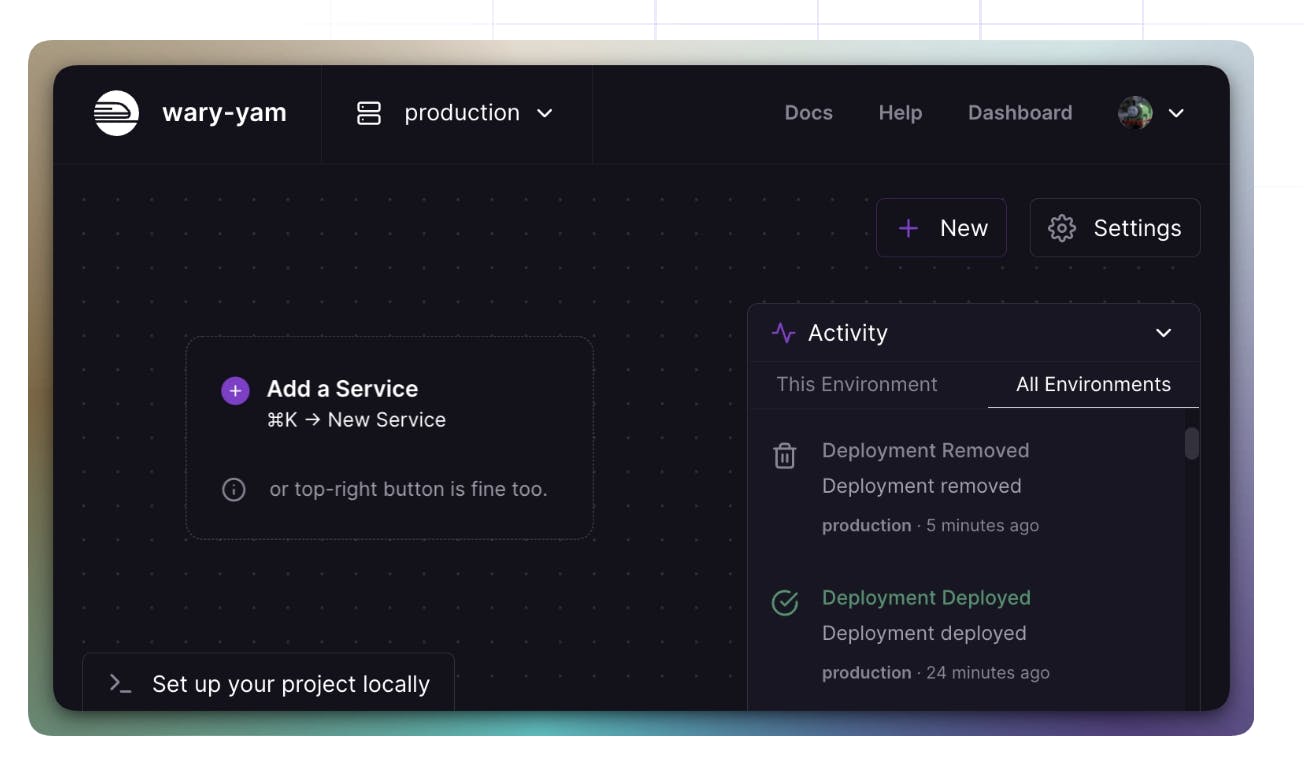

Project: Projects on Railway are the infrastructure that contains plugins, environments, and deployments for an app. Through the Project Dashboard, developers can create, manage, and delete projects, invite members to collaborate with them, transfer ownership, and view the activity feed for that project. They can also control which services and environments they use or select a service to view its configuration.

Source: Railway

Services: Services are deployment targets of the application. There are two kinds of services on Railway: deployment services and database services. Deployment services transfer the app's code from a development environment to a live one. They often include features like automatic updates when changes are made.

Railway can also be connected to code repositories like GitHub, which makes it easier for developers to manage, scale, and maintain applications over time. In addition to allowing customized deployment services, Railway comes with an optional pre-configured group of deployment services which can be helpful for developers getting started.

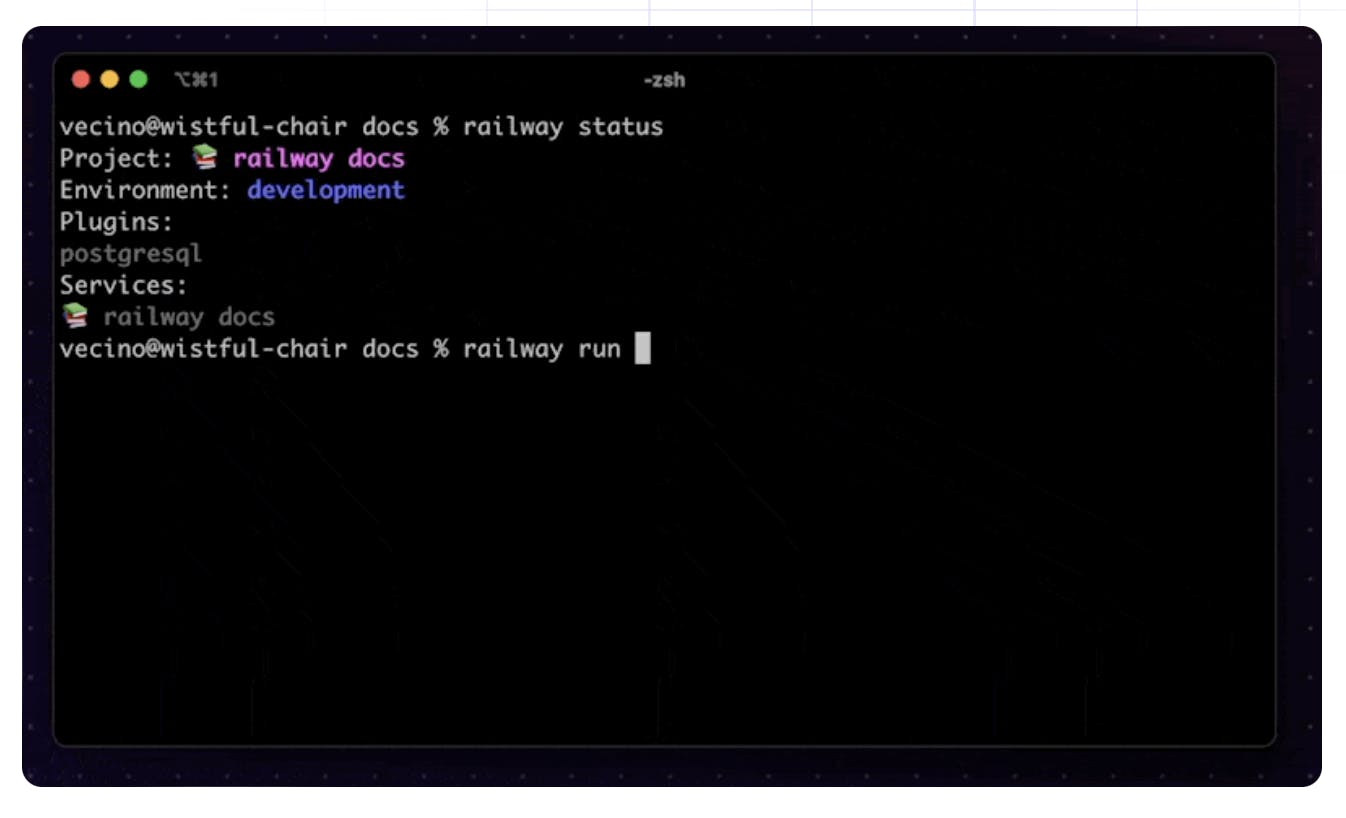

Command Line Interface (CLI): The Railway CLI lets developers interact with their Railway project using text commands. With the Railway CLI, developers can start new projects from the terminal, connect to an existing Railway project, get environment variables to run a service on their computer, and access a database in a project using an interactive shell.

Source: Railway

Variables: Variables on Railway are placeholders for values developers don’t want to write directly in their code, usually for security reasons. Developers can save variables for things like passwords, secrets, or configuration options in their environment that would not appear in public repos. At runtime, with proper access, the variables are made available to the application as environment variables.

Environments: Railway environments are separate copies of all the databases and services in a project. They give each team member a development setup identical to the real, live environment. Every environment has the same services, including databases, with a unique copy for each one. When developers deploy their app using Railway, it's tied to a specific Railway environment. They can choose which environment they want to use by using Railway’s CLI.

Deploy

Builds: Building code is about turning code into a runnable application. Railway uses Nixpacks to build and deploy code with zero configuration. Nixpacks was created by Railway as an alternative to Buildpacks. Nixpacks supports many languages out of the box, such as NodeJS, Python, Go, Ruby, PHP, Java, Rust, and more.

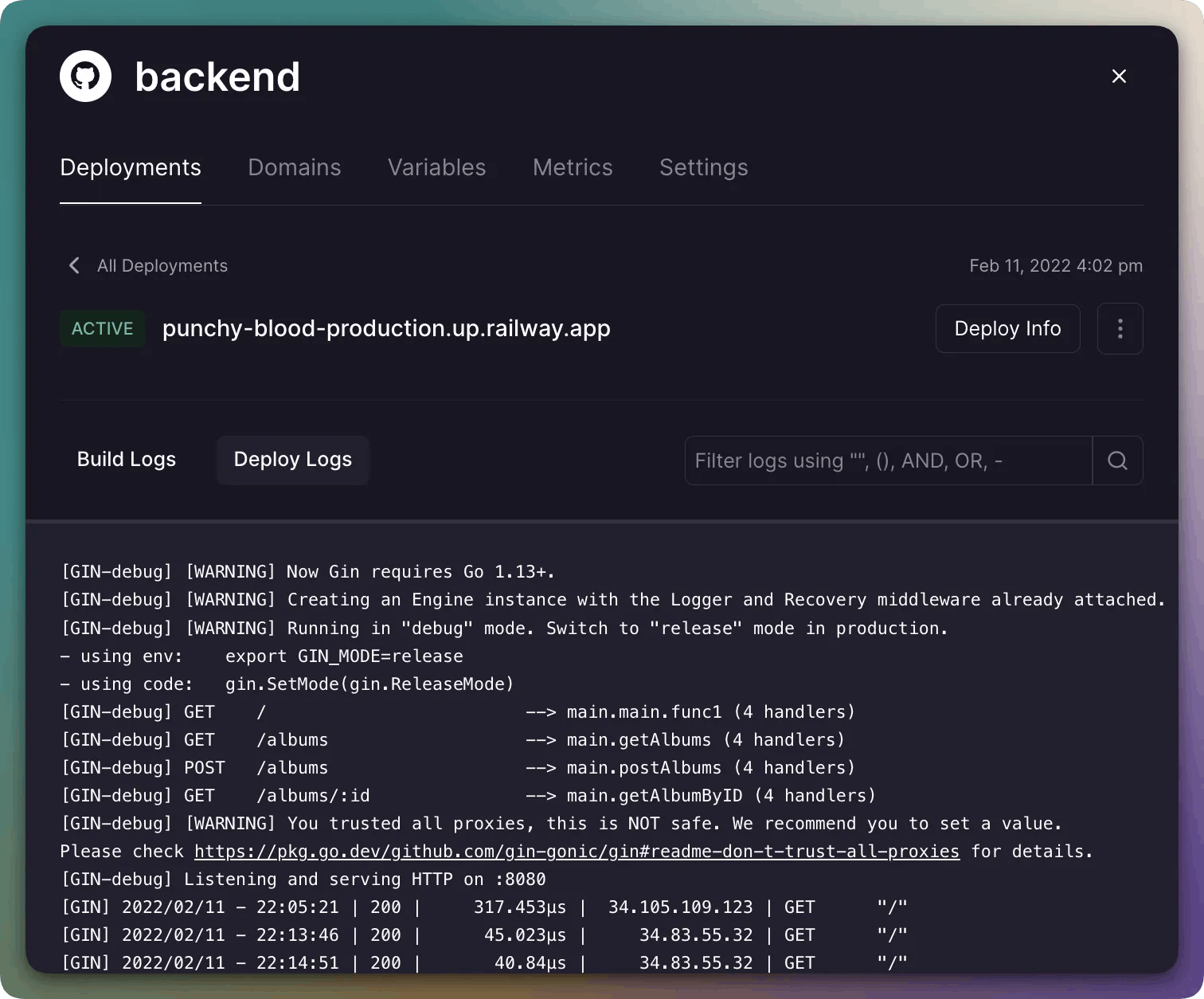

Deployments: Once a developer’s code is built, the next step is deploying it. Railway will do this by attempting to create a deployable Docker image containing the developer's code and configuration such that it will run consistently across different environments. Railway will then also check for any errors through its “health check” functionality and then deploy it. Once deployed, Railway allows users to see running logs of their applications to help with monitoring. Railway displays the last 10K lines of logs available for deployment.

Source: Railway

Networking: A core part of scaling certain projects is horizontal scaling. Horizontal scaling allows a system or project to handle a larger workload by distributing the load across multiple machines with the same functionality. Railway does not have its own implementation for horizontal scaling. Instead, Railway integrates with Cloudflare’s load balancer to achieve horizontal scaling functionality.

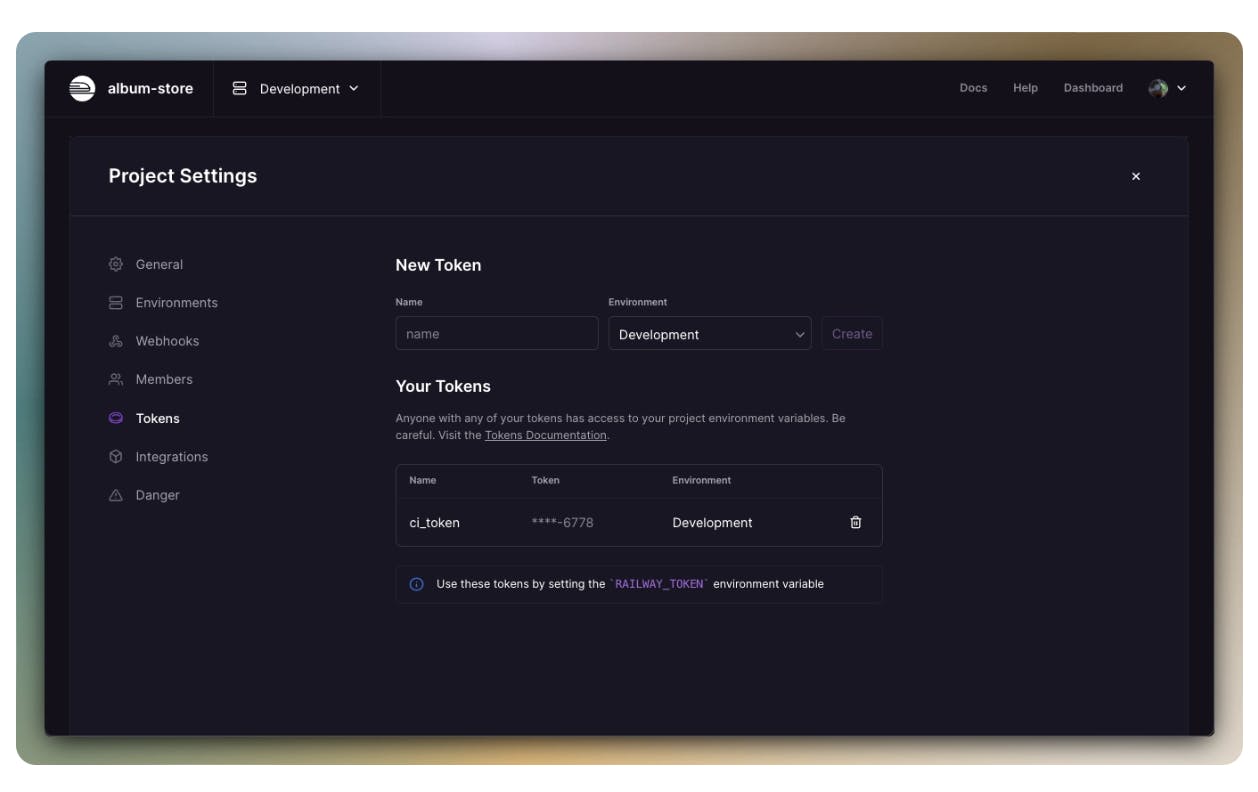

Integrations: Integrations connect a Railway project with other platforms or tools. Railway supports integrations with Vercel, GitHub, Doppler, and others through project tokens. These integrations allow users to deploy their frontend code, source their repos, manage their secrets, and access environment variables.

Source: Railway

Config as Code: By adopting configurations as code, all settings related to a project or application become transparent to developers as they are displayed within the version control system rather than hidden in an obscure user interface. This is particularly crucial for Railway users, who frequently have backgrounds in AWS, GCP, or Azure and may not be as familiar with Railway's UI. These users can more easily comprehend configurations when they are represented as code.

Deploy on Railway Button: Railway makes deploying any public GitHub repo easy with the Deploy on Railway button. Once clicked, the button will take the user to a Railway page where they can create a project, configure variables, and deploy the developer’s app themselves.

Databases

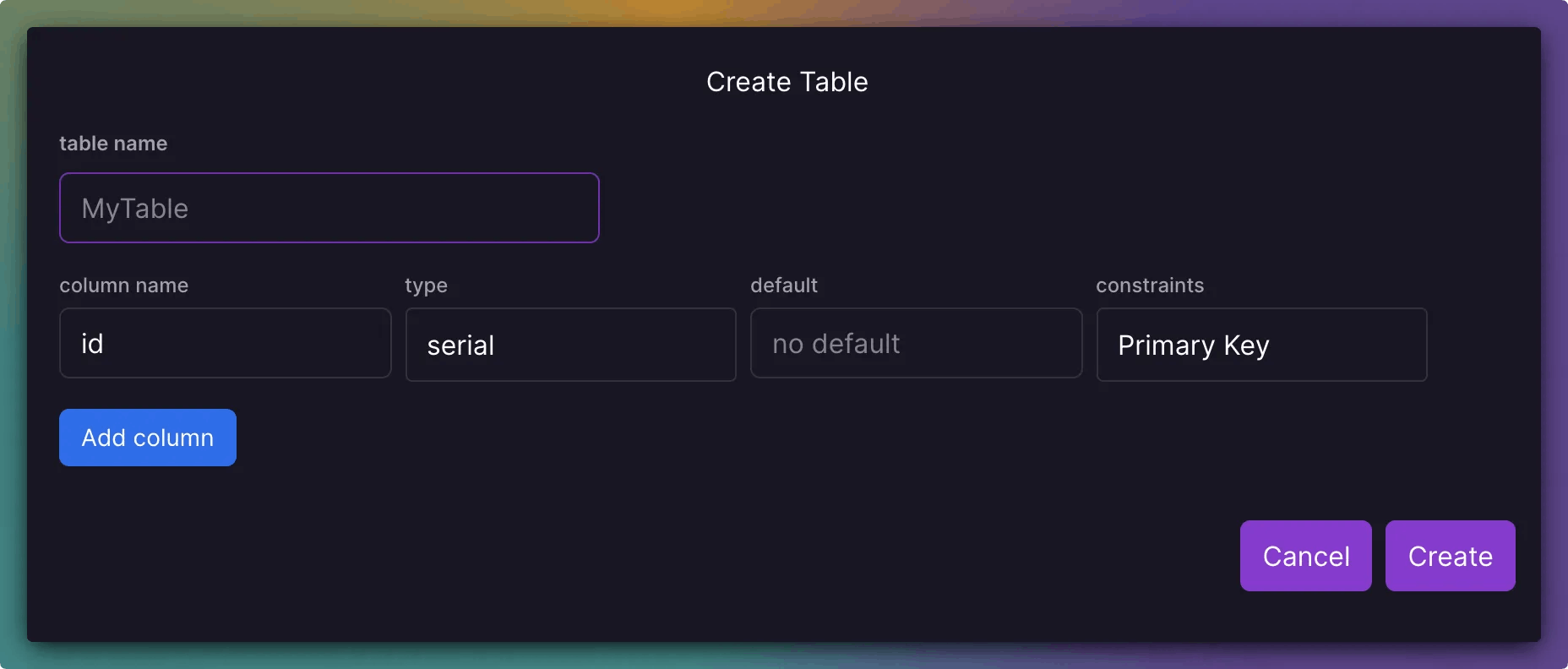

Railway has a built-in database management interface which allows users to perform common actions on their databases, such as viewing, editing, and querying the contents of their services on Railway. Railway also has PostgreSQL, MySQL, Redis, and MongoDB database services, allowing users to provision and connect to each database with zero configuration.

Source: Railway

Diagnose

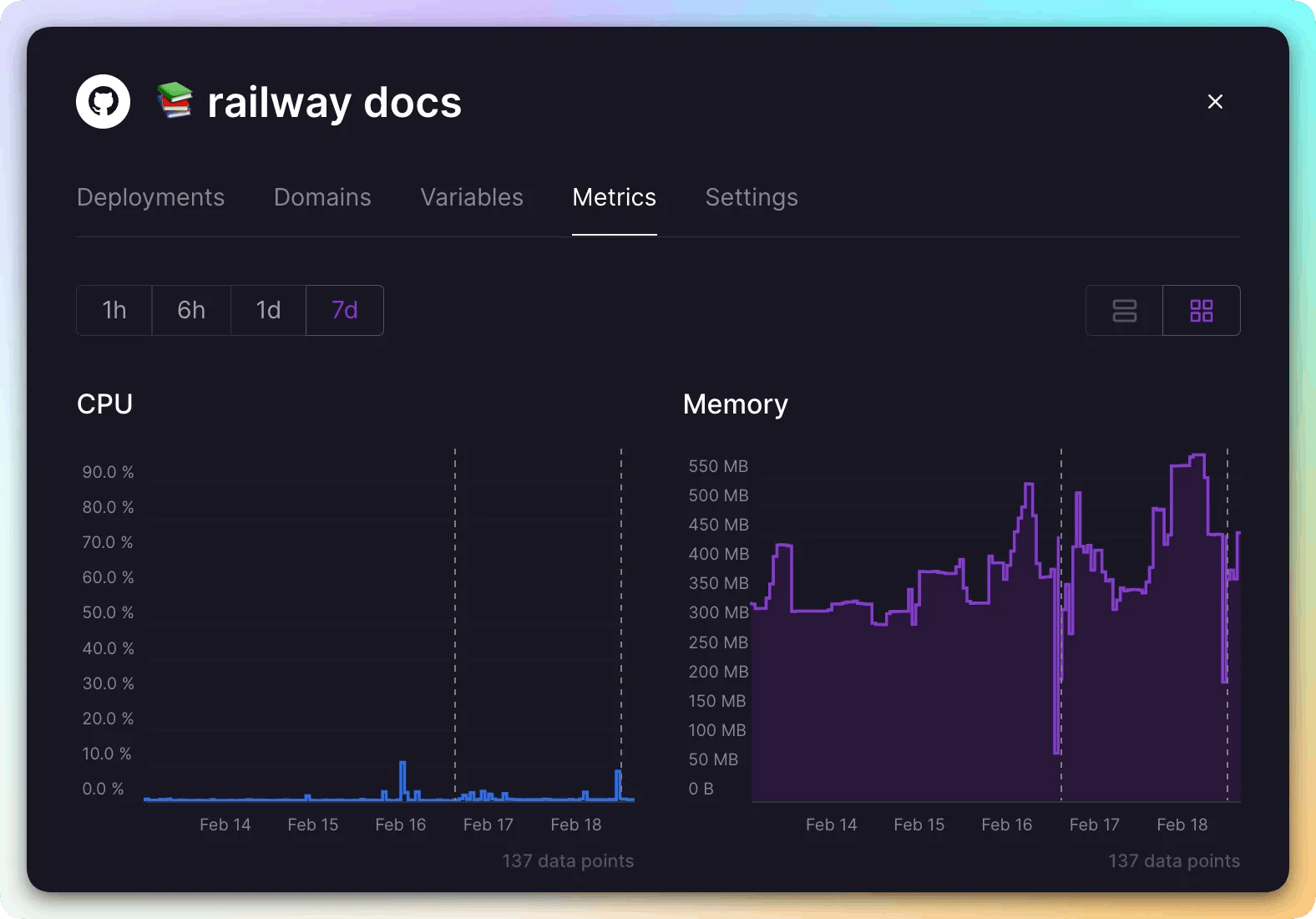

Metrics: Railway provides CPU, memory, disk usage, and network metrics on deployments within a service and presents them in easily accessible graphs. This information can be used to diagnose issues with a project's performance.

Source: Railway

Webhooks: Webhooks are a method for one web application or service to provide real-time updates or notifications to another application or service. Railway makes it easy to set up webhooks for Railway projects to Discord and Slack so all deployment notifications would instantly appear as messages in a developer’s Slack or Discord.

Market

Customer

Railway’s target market includes everyone from independent developers to startups that have raised series C or D funding. Railway plans to expand its customer base to include Fortune 500 companies that need to create internal tools quickly and easily. However, Railway cannot yet offer enough scalability for these Fortune 500 companies to use it as their main cloud provider. Railway’s customers include Atmis, Zora, StepZen, Slip, and more.

Because software infrastructure is so difficult to overhaul due to its intricate dependencies, and because of lock-in tactics from cloud providers, Railway has found early success in smaller companies that are just starting or have smaller codebases. It has also seen success with companies that work on new projects a lot, like product studios or consulting agencies. To succeed in bringing larger enterprises over, Railway will need to expand the breadth and depth of its offerings and make switching as seamless as possible.

Market Size

The global DevOps market was valued at $10.4 billion in 2023 and is forecast to reach $25.5 billion by 2028, representing a CAGR of 19.7%. Meanwhile, the global cloud computing market is projected to grow from $480 billion in 2022 to $1.7 trillion by 2029, at a CAGR of 19.9% during that period. The total addressable market for Railway could end up being this large if it continues to build out its product for larger enterprises and supports the regulated verticals like government and healthcare that it plans.

Competition

Startups

Render: Render is a startup that provides a cloud platform for developers to build and run their web applications and websites without managing servers, databases, or other infrastructure. Founded in 2018, the company has raised $26.8 million in total funding. Like Railway, Render offers instant infrastructure deployment and is generally a simpler alternative to AWS, Azure, and Google Cloud.

Zeet: Zeet lets developers generate infrastructure to deploy cloud applications to AWS, GCP, and other cloud providers instantly using pre-configured infrastructure or custom configurations. Founded in 2020, Zeet has raised $6.3 million in funding. Zeet does not have its own cloud infrastructure like Railway, so developers would still need to build on their own AWS, GCP, or a cloud equivalent account to deploy their application. However, it is still highly competitive in quickly provisioning infrastructure.

Incumbents

Heroku: Heroku was one of the first to offer a fast and easy way for developers to deploy their applications on the cloud using containers. Salesforce bought Heroku in 2010 for $212 million in cash. However, Heroku has not made much progress since then, and many customers have switched to other platforms, like Railway, with more features and capabilities. With that said, because of Salesforce’s large distribution platform, Heroku could still be considered Railway’s main competitor.

Terraform: Terraform, owned by HashiCorp, is an open-source infrastructure-as-code tool that lets developers build, change, and version cloud and local resources through code. HashiCorp was founded in 2012 and went public in 2021. While Railway is much more accessible with its user interface and ready-to-use environments, it does not have the same flexibility as Terraform. Terraform can work with almost any platform or service with an accessible API through providers, while Railway has limited platform integrations.

In addition to the competitors listed above, Amazon’s Elastic Beanstalk, Microsoft’s Azure App Service, and Google’s App Engine are all examples of platform as a service (PaaS) products that enable developers to build, deploy and scale web applications without worrying about the underlying infrastructure. They all support multiple programming languages and runtime environments like Java, Python, Node.js, .NET, and Ruby. They also provide features such as automatic load balancing, traffic splitting, logging, monitoring, version control, and compliance. While Railway allows developers to deploy to different cloud providers, all of these incumbent software deployment platforms would only allow developers to deploy their application on their platforms: Amazon’s Elastic Beanstalk to AWS, and Microsoft's Azure App Service to Azure, for example.

While Railway is not yet fully competitive with the major public cloud providers, especially for larger enterprises looking to build scalable applications, Railway is building towards a competitive suite of products with Railway V2. With Railway V2, developers will be able to build much more complex applications on as large a scale as necessary by implementing things like horizontal scaling and more server hosting locations, which would make Railway competitive with the breadth and depth of applications provided by the cloud giants.

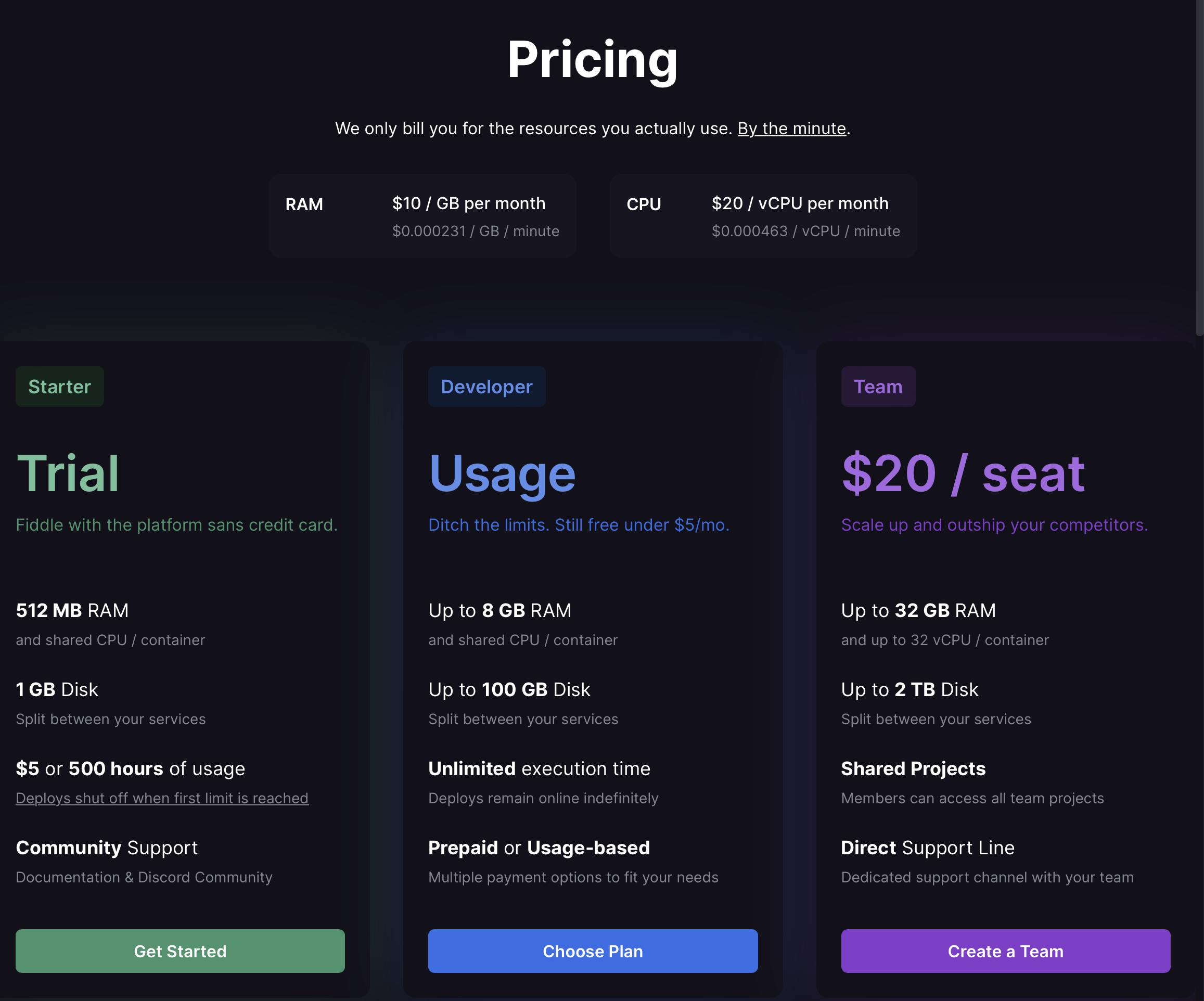

Business Model

Railway offers three pricing tiers: Starter, Developer, and Team plan for organizations. Beyond the free trial, which gives limited resources for developers to see if Railway is worth using, The Starter and Developer tiers have pay-as-you-go pricing, where developers and teams are charged for the RAM and CPU their applications use. The Team plan costs $20/seat monthly, while the Developer plan has no base cost. Railway charges per minute, but the prices are listed in months to understand better how much developers and organizations would pay.

Users on the Developer and Team tiers get increased levels of community support, disk space, shared projects, and other features. Railway also rewards developers who create and share templates for deploying applications on its platform. Developers get 25% of the money Railway earns from CPU and RAM usage by the applications deployed from their templates.

Source: Railway

Traction

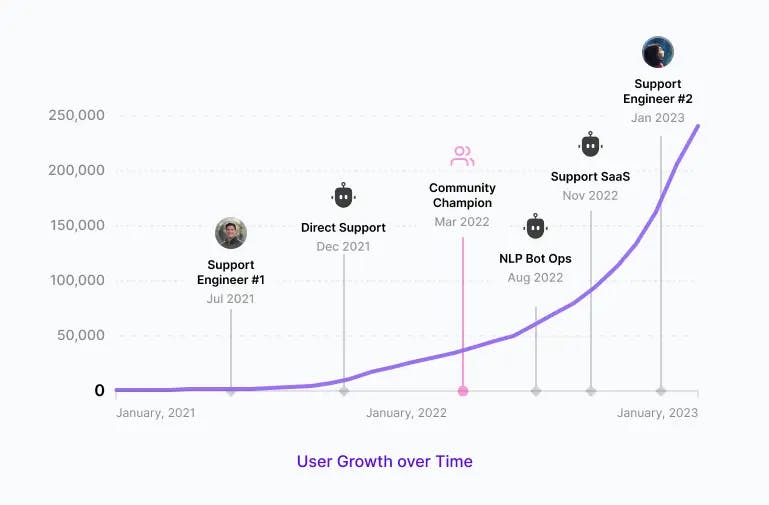

As of February 24th, 2023, Railway had 300K users, who were shipping more than 20K new applications daily.

Source: Railway

As of May 2022, the platform had over 1K people on paid plans ranging from high-growth companies to indie developers building hobby projects. During that time, revenue grew between 20% to 50% monthly. Railway said more than 50K developers had used it to launch more than 900K projects at the time.

Valuation

Railway has raised $24 million in funding. It announced a $20 million Series A round led by Redpoint Ventures in May 2022. Other notable investors include angel investors Vercel CEO Guillermo Rauch and GitHub co-founder Tom Preston-Werner. The valuation is not known.

Key Opportunities

Dependency Management

Railway seems poised to be not just an easy way to provision infrastructure like its competitor Heroku, but also to become a platform that can manage the dependencies between different cloud providers and services that developers use to deploy their applications more in-depth.

For example, if developers use Railway to deploy an application that uses AWS for compute, MongoDB for database, and Stripe for payments, Railway could handle the dependency management between these services, such as creating and configuring them, syncing the variables and secrets, and updating them when needed. Railway could also provide a Terraform-like layer that lets developers define their infrastructure using a simple and declarative language.

This way, developers could use Railway to deploy their applications to any cloud platform or service without worrying about the complexity of managing the infrastructure. This represents a significant opportunity as the creator of Terraform, HashiCorp, brought in $211 million in revenue in 2021, with Terraform being its premier product.

Vertical Expansion

Enterprises building for the medical field, government, and traditional banking cannot build their products on Railway because it does not satisfy the SOC2 and HIPAA BAA service agreements. These industries represent large amounts of revenue for cloud providers. A good example of just how much money they can bring in is the fact that in 2019 Azure won a $1.8 billion contract over five years from the Pentagon. Railway has stated that providing the necessary infrastructure for these verticals is on the roadmap. Once completed, these features could increase Railway’s revenue substantially.

Key Risks

Competition

When trying to take on incumbents, the question becomes if Railway's distribution will outpace the innovation of incumbents like Heroku, AWS, Azure, GCP, and Terraform. At the same time, other startups with similar levels of innovation to Railway, like Sequoia-backed Zeet and Addition-backed Render, are competing with it on distribution. So, to compete effectively, Railway must first beat incumbents and startups in distributing its innovation. There is a lot of money in cloud computing, but Railway currently does not support key developer needs like private networking, horizontal scaling, or docker compose. If Railway does not act fast enough to fill in some product gaps, Railway could lose core customers to both types of competition.

Lack of Support for High GPU Verticals

Companies looking to train AI models or machine learning algorithms requiring extensive compute would not be able to build with Railway as it is not yet capable of that level of GPU compute. With a more than a 10x increase in venture funding for AI and ML startups, higher GPU compute for cloud providers has become more essential. Railway could lose out on its next generation of customers if it does not build a high GPU compute alternative to, for example, Azure’s HPC cloud solution.

Summary

Railway is emerging as a promising competitor in the software deployment and cloud computing market, which is expected to reach nearly $600 billion in 2023 and triple in value by 2029. Currently dominated by big tech companies like Amazon's AWS, Microsoft's Azure, and Google's GCP, the market is ripe for disruption by a more developer-centric platform. Railway tackles the poor developer experience of deploying to conventional cloud services while streamlining the process of infrastructure provisioning and deployment with offerings like one-click deployments. With a rapidly growing user base, active customer support through Discord, and a template marketplace, Railway is carving out its place in a competitive market. However, questions remain about the company's ability to scale for larger and more regulated enterprises, maintain its unique ease and simplicity while expanding its product offering, and compete with the vast resources of established tech giants in the long term.