Thesis

More than 60% of the US and 80% of global workers are deskless. The pandemic showed us how important retail, healthcare, food service, warehousing, and hospitality workers are to our daily lives. Employers face challenges in hiring, onboarding, training, and retaining these hourly employees. Since the pandemic hit, service work has become more dangerous and less appealing. In 2021, 64.6% of retail workers, 86.3% of accommodation and food service workers, and just under 40% of manufacturing workers quit their jobs.

Industries that hire a high quantity of hourly workers, including leisure and hospitality, healthcare, and retail, have consistently higher annual average job openings rates compared to the overall economy. This imbalance reflects that although companies want to hire hourly workers, they need help finding enough people to fill the open jobs. Job openings in these industries remained elevated throughout 2022 and 2023. Due to persistent demand for hourly workers, the leisure and hospitality sector became one of the US economy’s fastest-growing employers between 2022 and 2023.

Workstream is a mobile-first hiring and onboarding platform that automates slow hiring processes and helps businesses with large deskless workforces fill open positions quickly. The platform is used by more than 4K customers across 24K locations and helps hire front-line workers like caregivers, nurses, delivery drivers, restaurant staff, gas station attendants, and more. Its mission is to empower local businesses and deskless workers to do better work.

Founding Story

Workstream was founded in 2017 by Desmond Lim (CEO), Lei Xu (CPO), and Max Wang (CTO). Lim co-founded QuikForce, a logistics company that connects customers to movers. Earlier in his career, he was a product manager at WeChat, worked at Merrill Lynch, and was a venture investor for two years at Dorm Room Fund. Xu worked at Google for three years before starting a YC-backed EdTech startup, Emote. Wang co-founded VC.CN, which he describes as a combination between Crunchbase and AngelList in China.

Lim had been surrounded by hourly workers his entire life. His mother worked as a cleaner, and his father remains a package deliveryman, driving the same routes for the last four decades. To pay for his undergraduate degree at Singapore Management University, Lim took the money he saved up tutoring in high school and pooled it with two friends to start a Thai restaurant where he hired dozens of part-time staffers. This early exposure offered Lim a glimpse into the manual, broken hiring process for blue-collar workers at a young age. These experiences helped Lim understand the problems restaurants and other companies face when hiring hourly workers and inspired Workstream’s founding.

With cofounders Lei Xu and Max Wang, Desmond Lim launched Workstream in 2017. The founding team spent the early months going door-to-door among stores in Silicon Valley. They were able to land their first deals from franchise owners of a local Jamba Juice and Subway. Quick-service restaurants quickly became the bulk of Workstream’s customers. In October 2020, the company hit $1 million in annualized revenue for the first time.

Product

Workstream is an end-to-end software platform that helps companies recruit and hire hourly workers faster than traditional hiring processes. Workstream is not a job board and does not emphasize getting individuals into the hiring funnel in the first place; rather, the company focuses on pushing potential employees through the hiring funnel quickly with its suite of hiring and onboarding tools. The company currently has three main offerings to achieve this objective: 1) hiring, 2) onboarding, and 3) integrations.

Hiring

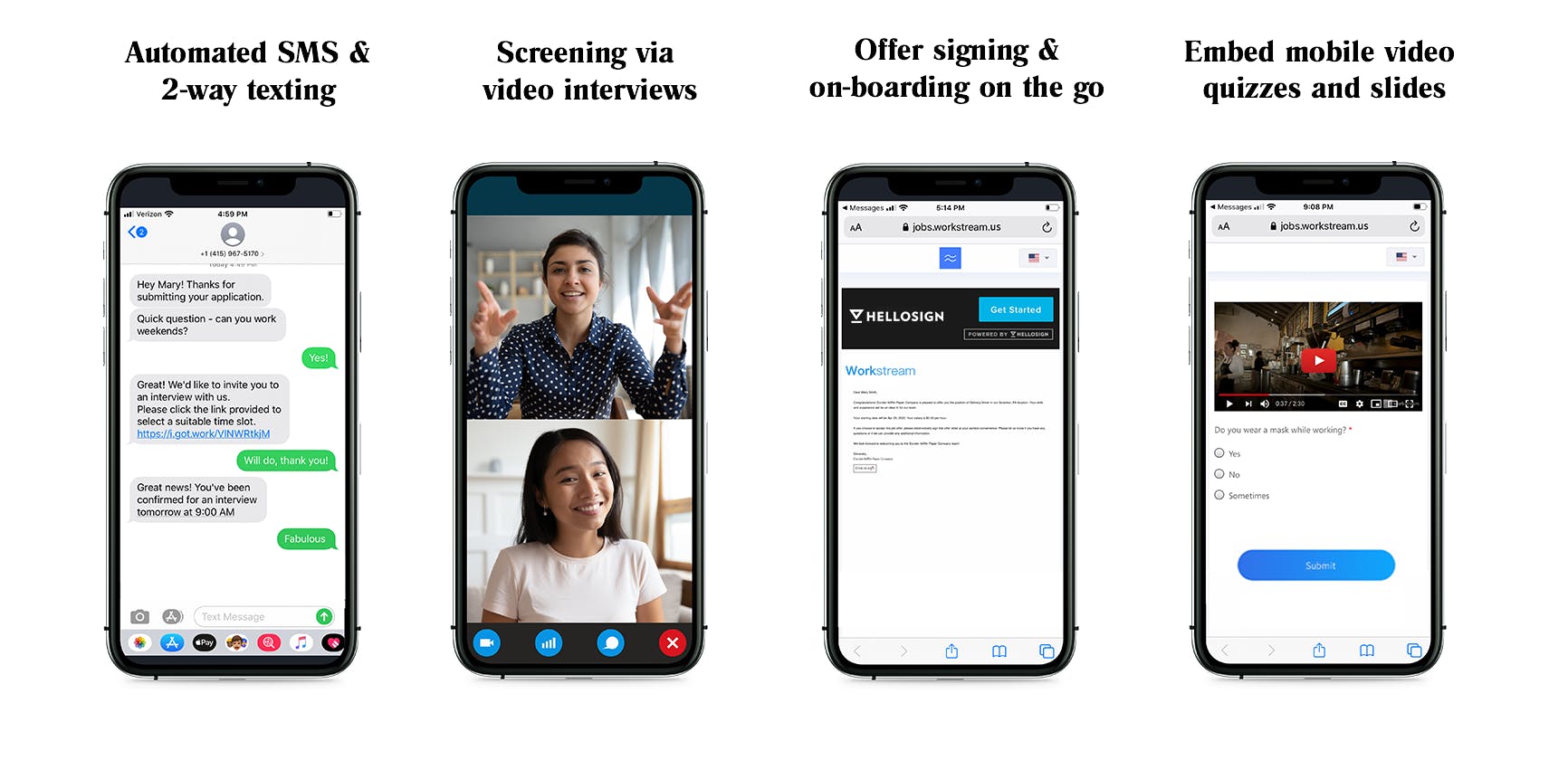

Workstream helps companies source new candidates by posting job postings on top job boards, engaging candidates using two-way text messaging, building a branded careers page, and creating “text-to-apply” posters for in-store hiring promotion.

Workstream can identify candidates that meet company requirements using Smart Screening, which utilizes a series of questions from the company to determine if a candidate is fit to proceed in the hiring process. Workstream also allows companies to customize hiring workflows and collect short intro videos from candidates to easily sift through applications for a given job posting.

Workstream makes scheduling interviews easy for both employers and candidates. For employers, Workstream integrates with existing Google or Outlook calendars to automatically schedule interviews during pre-approved free times. For job-seekers, Workstream allows candidates to schedule/reschedule interviews without having to reach out directly to interviewers.

Source: G2

Onboarding

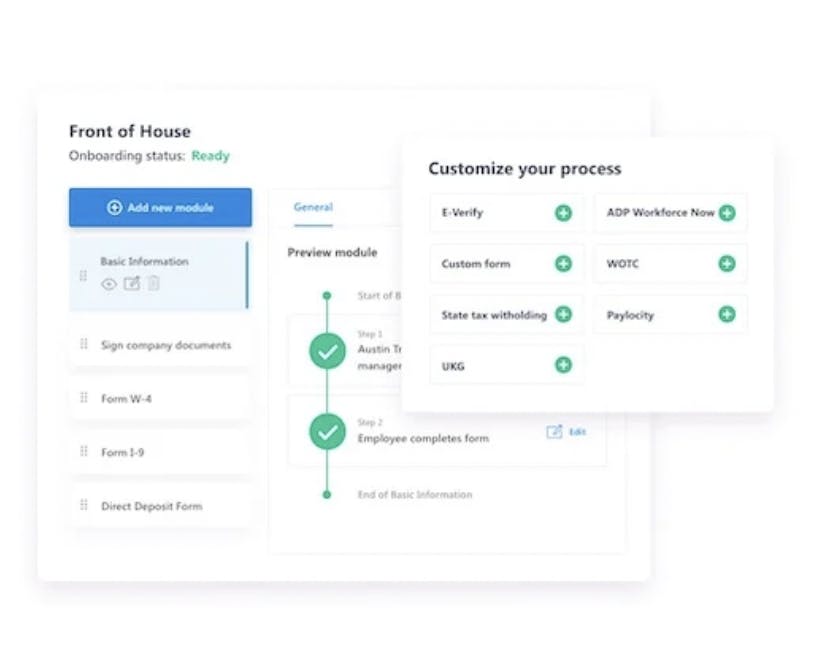

Traditional onboarding processes include substantial physical paperwork and can be delayed by the back-and-forth between candidates and employers. Workstream improves the onboarding experience by digitizing the process and by collecting and storing necessary onboarding materials for companies, such as tax forms and offer letters. In addition, Workstream allows companies to alter existing onboarding workflows and share training materials with new hires. These features decrease the burden of onboarding new hourly employees by removing unnecessary manual processes.

Source: Workstream

Integrations

Workstream integrates with HRIS/payroll platforms like ADP and Paycom, job boards like Craigslist and Indeed, and other technologies to help companies combine hiring and onboarding workflows with existing HR processes. The integrations feature enables users to sign in or create and authorize third-party accounts without leaving Workstream. Users can transfer employee data across the connected platforms and automatically kick off workflows during key hiring process points.

Market

Customer

Workstream targets customers that 1) hire hourly workers and 2) experience high levels of employee churn.

In the past, Workstream primarily targeted the restaurant industry, specifically quick-service restaurants (QSRs), because they traditionally suffer from high employee churn. Examples of Workstream customers within this vertical include Burger King, Dairy Queen, Jimmy John’s, Mcdonalds, Popeyes, and Taco Bell. However, following the company’s Series B extension in 2022, Workstream CEO Desmond Lim announced that the company was planning to expand into several other verticals that fit Workstream’s target profile:

“We are going to extend beyond restaurants into supermarkets, retail, hotels, auto, healthcare, and more.”

As of March 2023, the company served companies in seven main verticals (restaurants, hospitality, automotive, healthcare, manufacturing, warehousing, and retail). At this time, it had acquired new customers like Marriott International, Ace Hardware, UPS, and European Wax Center. By expanding into new verticals, Workstream has increased the size of its potential customer base and diversified away from its previous concentration in the restaurant industry.

Market Size

Due to Workstream’s emphasis on deskless workers, the total number of deskless workers in the United States and abroad is one way to estimate the size of the market that Workstream is looking to capture. Desmond Lim, the company’s CEO, estimated there were “2.7 billion deskless workers in the world and 70 million in the U.S.” in 2022. In 2021, the number of hourly workers aged 16 and older in the US was 76.1 million, representing 55.8% of all wage and salary workers in the country.

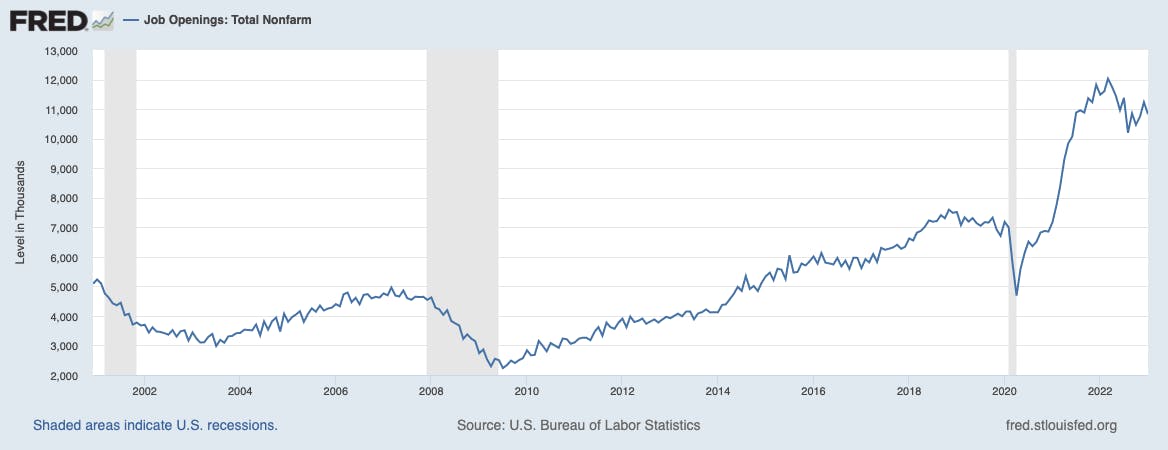

Total nonfarm job openings show that the number of open jobs in this category skyrocketed between 2020 and 2023. Even throughout 2022, with fears of a recession, this number stayed relatively constant and reached a record high of 12 million in March 2022 before decreasing to 10.8 million in January 2023. While all of these job openings are not solely for hourly workers, the figures represent how difficult it is for companies to hire workers in the United States, which is what Workstream aims to change.

Source: Federal Reserve Economic Data

The workforce management applications market was valued at $5.7 billion in 2021 and is expected to reach $6.8 billion by 2026.

Competition

Specifically catering to companies hiring hourly workers has limited the competition that Workstream will potentially need to contend with, a dynamic that Workstream CEO Desmond Lim noted in 2021:

“There’s a football field [of software products] for hiring software engineers. But if you think about hiring for this space, there’s very few of us — and I think that has really helped us to go far from a team point of view, client sales, and even trying to raise funding."

Hourly Worker Hiring Platforms

Paradox: Founded in 2016, Paradox provides a differentiated approach to hiring through Olivia, its AI recruiting assistant. This assistant aspires to deliver one-to-one candidate experience at scale and handles interview scheduling. It also allows human resources professionals to focus on human interactions while focusing on experience, automation, and intelligence. The company has a product built specifically for hourly workers. It has raised $253.3 million in total funding, with the most recent round being a $200 million Series C in late 2021. It works with companies like Wendy’s, Mcdonald's, Panera Bread, Five Guys, and more.

Talent Reef: Talent Reef’s product is similar to Workstream, including recruiting and hiring solutions for hourly workers, except for the company’s emphasis on employee retention through improving employee engagement. It was founded in 1997 and acquired by Mitratech in 2022 for an undisclosed amount. Like Workstream, its product covers text-to-apply, self-service interview scheduling, and automated onboarding paperwork to deliver a faster applicant experience.

Fountain: Fountain was founded in 2014 and focused on hiring hourly workers in industries similar to Workstream. Further similarities can be seen in the two companies' products, including mobile-first recruiting and customization of hiring workflows. Fountain raised $100 million in a 2022 extension of its Series C round, bringing its total to $219 million. It works with companies like Sweetgreen, Stitch Fix, Deliveroo, and Fetch.

Legacy HRIS Platforms

Paycom: Paycom is a publicly traded HRIS platform that provides a wide range of solutions for HR departments, including payroll and talent acquisition/management. The company was founded in 1998 and went public in 2014. Paycom’s platform is not industry/employee specific, although the company does work with restaurants and other similar industries to Workstream. The company made $1.4 billion in 2022 revenue and ended 2022 with a market cap of $18.6 billion.

ADP: ADP is a publicly traded HRIS company that offers payroll, HR, tax, and talent acquisition services. It was founded in 1949 and went public in 1961. Like Paycom, ADP does not solely target companies that hire hourly workers but do serve many of the same industries as Workstream. Recently, ADP achieved $16.5 billion in 2022 revenue and ended 2022 with a market cap of $99.1 billion.

While these companies technically provide competitive services to the Workstream product, Workstream does also integrate with Paycom and ADP to ensure that companies can use Workstream without interrupting other HR processes.

Business Model

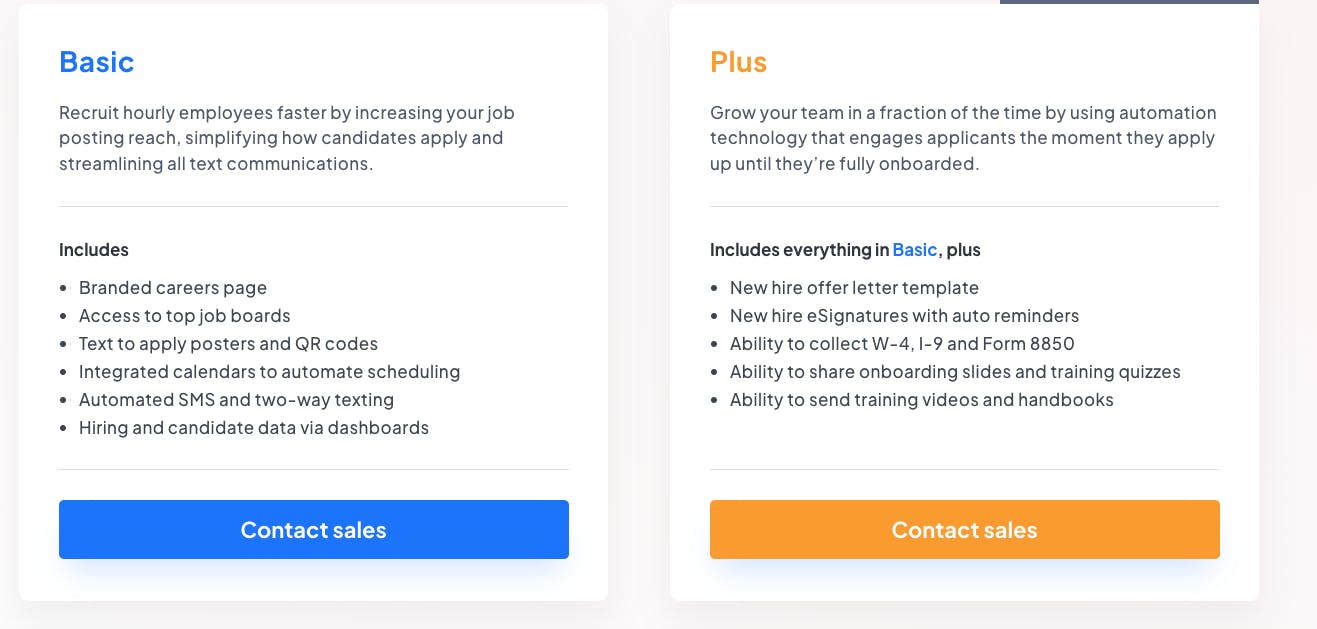

Basic: This plan includes unlimited admin accounts, basic hiring specialist guidance, and the company’s hiring services.

Plus: Plus includes unlimited admin accounts, prioritized hiring specialist guidance, and everything in the basic plan besides the company’s onboarding services, including collecting tax forms from new employees. This is the company’s most popular plan.

Source: Workstream

Traction

Workstream has experienced notable growth since its founding in 2017. Following the company’s Series B round in 2021, it disclosed that it filled more than 18K jobs in July 2021 alone, experienced 10x ARR growth between 2020 and 2021, and had acquired 1.5K customers across 10K unique stores. In September 2022, the company announced it worked with 170 of the top QSR brands, had grown revenue 10x in the past 18 months, and increased its customer base to 4K customers across 25K locations.

Source: Workstream

Workstream’s traction may be attributed to its ability to help QSRs and other companies hire hourly workers more efficiently. One customer, a maintenance coordinator at Burger King, described Workstream’s impact on its hiring processes in this way:

“We went from the lowest employment we had ever seen in over ten years to gaining employment at a rapid pace.”

Valuation

Workstream raised a $48 million Series B round in August 2021 co-led by BOND and Coatue, with participation from several other VC firms and notorious angel investors, including Zoom CEO Eric Yuan and DoorDash CEO Tony Xu.

Following this initial Series B investment, the company received an additional $60 million in a Series B extension round in September 2022 led by GGV Capital, which included participation from new and existing investors such as Founders Fund, Coatue, BOND, and Basis Set Ventures. While an exact valuation was not released, CEO Desmond Lim stated that this last extension round valued the company close to $500 million. These funding rounds brought Workstream’s total funding to $118 million.

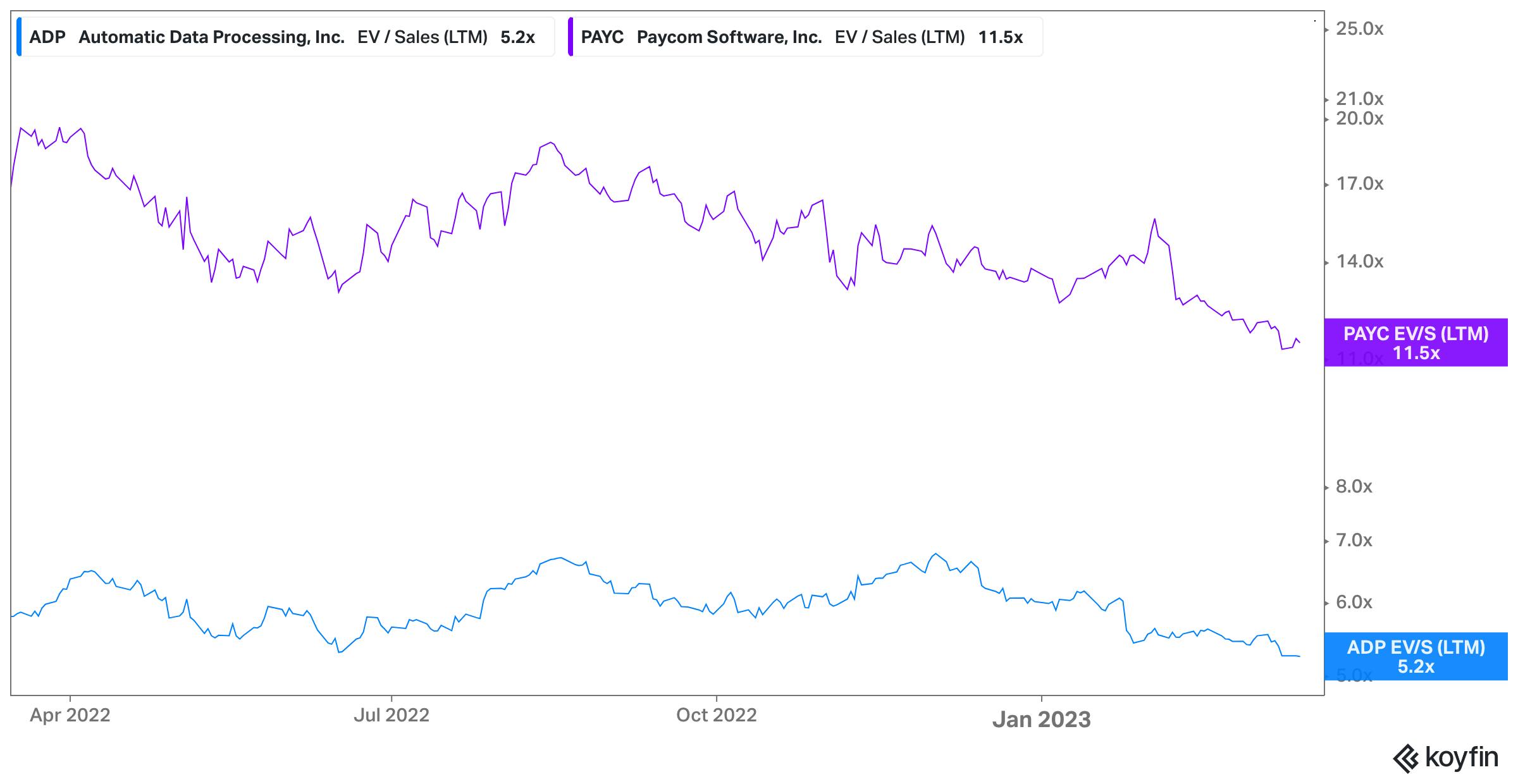

The performance of comparable public companies (ADP and Paycom) greatly differed between March 2022 and March 2023, a period of high uncertainty and turbulence in financial markets. For example, ADP’s LTM revenue multiple held relatively constant with slight losses over the period, while Paycom’s multiple decreased ~40% from its high in March 2022.

Source: Koyfin

Key Opportunities

Strong Labor Market

A strong labor market in the United States, categorized by low unemployment rates, provides an opportunity for Workstream as companies vie for a shrinking portion of unemployed people and require better tools to attract and hire talent quickly. Between 2020 and 2023, unemployment rates decreased dramatically after rising to 14.7% in April 2020 at the beginning of the Covid-19 pandemic. The labor market remained strong throughout 2022 and the first two months of 2023 despite rising interest rates and recessionary fears, with unemployment leveling at around 3.6%. If this continues, Workstream could benefit from companies seeking better alternatives to traditional hiring methods.

Industry Expansion

Workstream’s 2022 expansion into several new industries that hire hourly workers and future expansion outside of its core verticals represent opportunities for the company to grow its customer base. After seeing success in the restaurant industry, the company extended its hiring solution to cover 7 total verticals and has already brought on several noteworthy customers in these industries, including Jiffy Lube and FedEx. Almost every industry hires hourly workers in some capacity. One growth opportunity for Workstream could be expanding into more industries and capturing customers that do not fit under its main verticals.

Key Risks

Product limitations

Workstream is a point solution addressing the hiring needs of companies that hire hourly workers. While this focus helps the company differentiate itself from other hiring software providers, it risks losing customers to HRIS competitors, like Paycom and ADP, that can provide companies with a full suite of HR solutions, including hiring and onboarding. According to a former Workstream customer at a medium-sized retail company, the appeal of an all-in-one platform for HR and payroll outweighed the superiority of Workstream’s product targeting just hiring:

"We desired to have more of a big kid approach to HR and payroll, both in terms of compliance, but also all the different silos… So compliance and efficiency compelled us to go out looking for more of an all-in-one solution to human capital management. And there, we did go out to the market and kind of looked at all the different options. At the end of the day, it felt compelling enough to move off of all these siloed things into one new system. We chose Paycom for compliance and efficiency reasons."

While this customer noted that turnover at their company is lower than normal retail and that hiring wasn’t as high of a priority as other companies, this risk is still prevalent as Workstream competes with full-suite HRIS products.

Automation of Deskless Workforce

The fear of automation of blue-collar jobs and the resulting replacement of hourly workers has been around since the Industrial Revolution. Although the large-scale displacement of hourly workers has not occurred, a widespread push to automate industries that rely on hourly labor could create difficulties for Workstream. While many of its target industries, especially restaurants, haven’t incorporated much automation, this trend could change. For example, QSRs, including Chipotle and Sweetgreen, are testing automation in their restaurants that would cut down the number of hourly workers needed to operate a restaurant. Additionally, a 2016 study found that 73% of an hourly employee’s activities in the accommodation and food service industry, which are important sectors for Workstream, could be automated, the highest percentage of any industry.

Summary

Managing high turnover and hiring hourly workers has become imperative for organizations across several industries. While the Great Resignation highlighted problems centered around hiring and retention, the long-term trend of companies being unable to find hourly talent will likely continue. Workstream’s platform looks to simplify hiring and onboarding processes for these companies, enabling it to establish a stronger position in the growing market of hiring software for hourly employees.

After starting in the restaurant industry, the company’s expansion into six other industries has allowed it to add new users to its already impressive customer lineup, which includes Mcdonald’s, Subway, and Marriott. However, as it grows, it will face stiff competition from a long list of other players, including legacy HRIS software providers that offer a full suite of HR solutions. This competitive landscape raises questions about whether Workstream can continue successfully convincing companies that a specific, albeit superior point solution for hiring is necessary for their purposes, especially in a dynamic labor market.