Actionable Summary:

As more of our lives are digitized, more of our lives are designed. The designer class includes everyone responsible for shaping an aspect of our digital experience–from the professional designer to the casual marketer. We can trace the principles that guide digital design back through history.

Cutting edge product design became prominent in physical products like IKEA and Nike in the 70s and 80s. The emergence of software and the internet brought the convergence of design and digital experiences.

Starting in 2007, the rise of mobile drove the consumerization of software. Broad mobile adoption drastically increased people’s immersion in digital experiences. In 2009, the average person spent ~1 hour a day in front of screens; in 2022 this had grown to over 7 hours a day. This created a greater need for well-designed software that is functional, intuitive, and delightful, elevating the importance of user experience (UX) and user interface (UI) design.

The earliest juggernauts of digital design, like Adobe, were born in the 80s. Products like Illustrator and Photoshop, which first launched in 1987 and 1989 respectively, were the first tools that translated design principles from physical to digital.

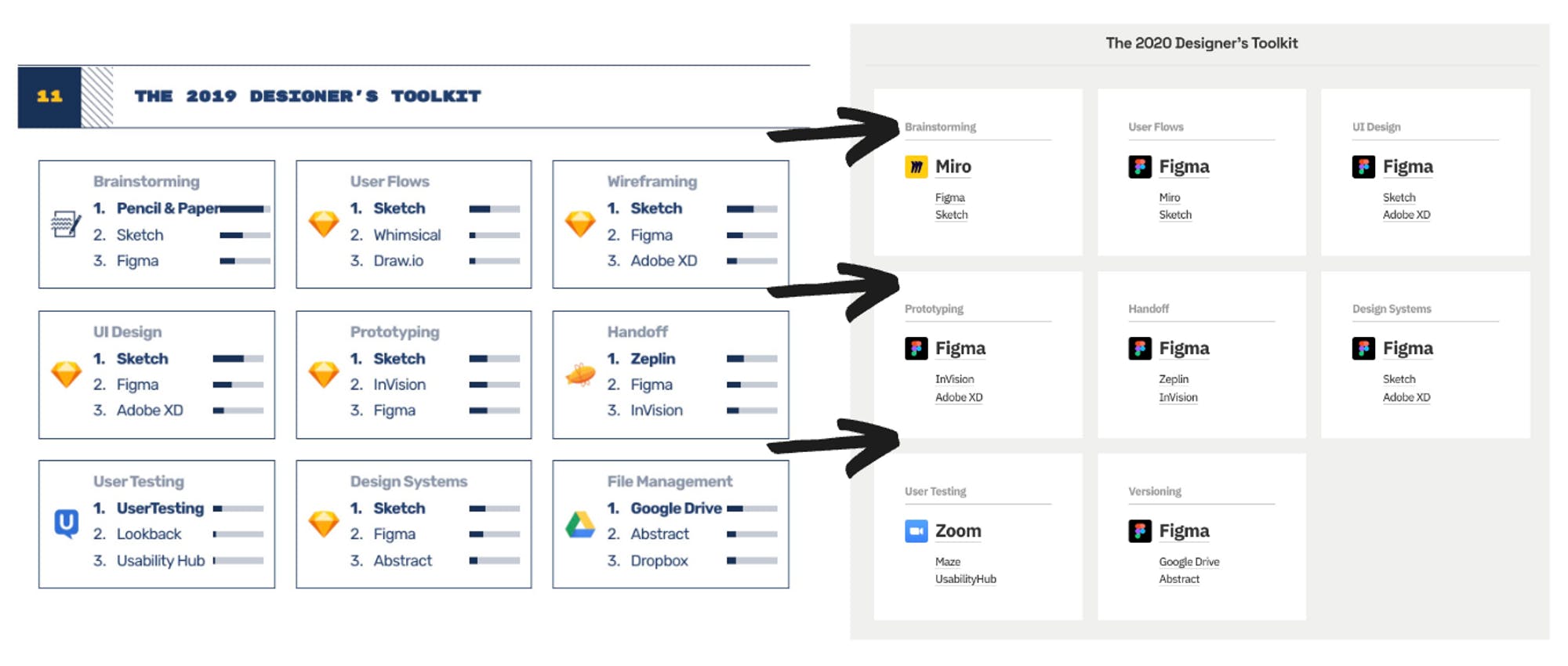

In the early 2010s, professional designers started to look for fresh, cloud-native, collaborative design software. While Sketch was a first mover, Figma captured a new generation of professional designers just as design in enterprise software was starting to become more important.

On the other end of the spectrum was the rise of the “citizen designer.” In 2012 Facebook hit 1 billion MAUs, with Instagram following suit ~6 years later. The ubiquity of social media turned everyone into a content creator. Canva became the tool of choice for these citizen designers as the long tail of creation started to take shape, culminating in 3.5 billion designs on Canva’s platforms in 2021 alone.

The last 10 years of design has been pioneered by these designer tools: arming the long tail of citizen designers on one hand and professionals on the other. Over the next 10+ years, the future of design will be defined by the dramatic implications of generative AI and OpenAI’s DALL-E-2.

Defining The “Designer Class”

As more of our lives are digitized, more of our lives are designed. The designer class includes everyone responsible for shaping an aspect of our digital experience–from the professional designer to the casual marketer. We can trace the principles that guide digital design back through history. From architecture to physical products, design has historically shaped every aspect of the world around us and has influenced how our digital experiences are designed today.

As the digital world has become more prevalent, digital design has become more important. At first, design was a “nice-to-have” in the early days of computers when you wanted to have your trash folder look like a well-designed trash can. As more and more of our lives are lived online and through screens, design has become a “must-have.” Consumers made choices based on design quality, and companies recognized design as an increasingly key differentiator. So what are the philosophies and tools that have shaped those critical designs?

In this deep dive, we’ll unpack the evolution of design philosophy from crafting physical spaces to the importance of user-interface and user-experience design. Three companies have played key roles in the last 50 years of digital design: Adobe, Figma, and Canva. We’ll also cover the differences in these products, and the fundamental segments of the designer class that each have evolved to serve. Finally, we’ll dive into the next 50 years of design and the rapidly changing forces that will shape how our digital experiences will evolve.

The Evolution of Design

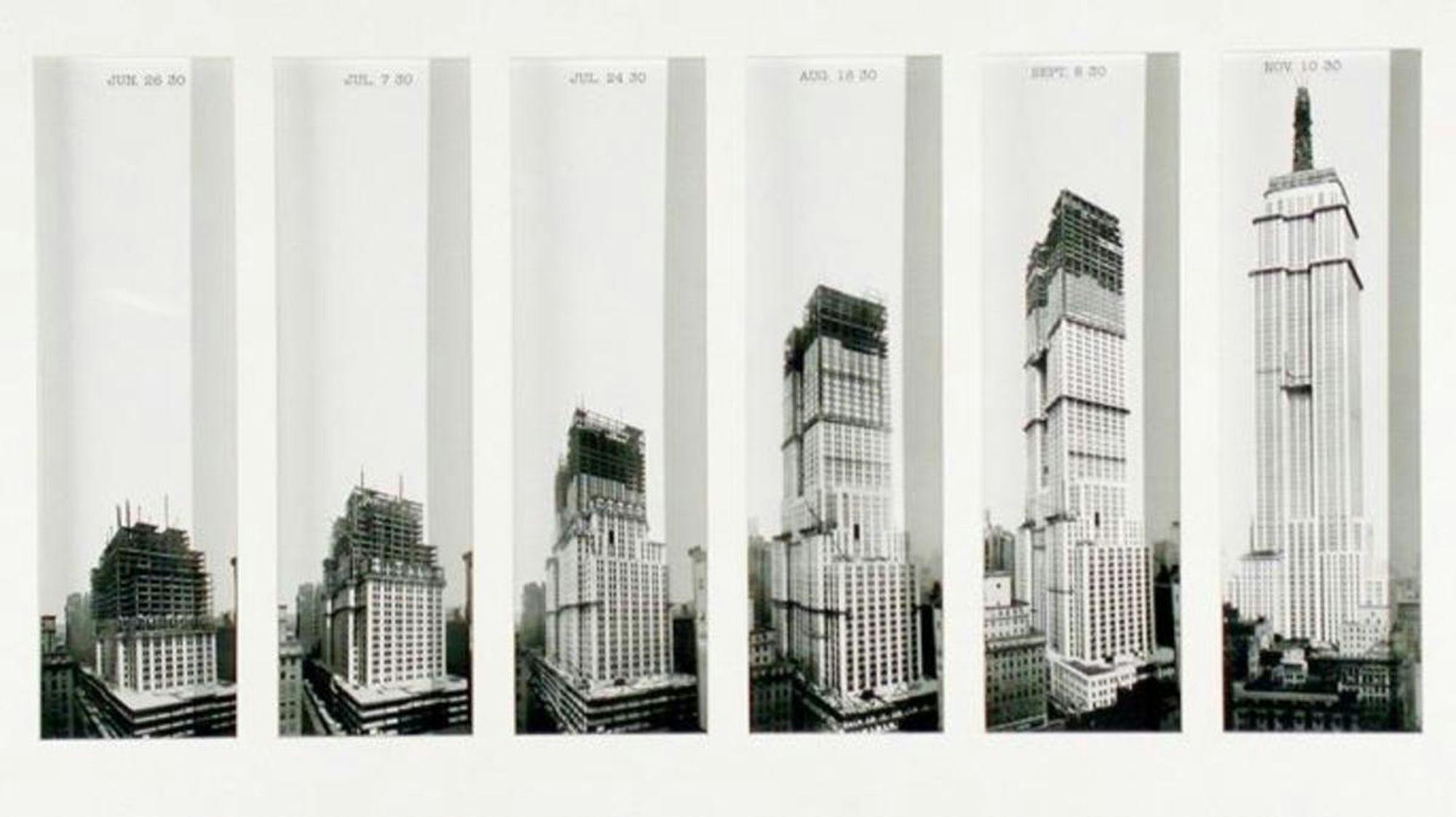

The early 20th century was shaped by the factories and efficiency of the industrial revolution. But when it came to beauty, people looked to awe-inspiring architecture like monuments, skyscrapers, and museums for the pinnacle of design.

Source: History.com

After World War II, the US entered an age of abundance. Access to education and homeownership became hallmarks of an emergent middle-class. For the first time in history, ordinary people could buy things based on more than just utility, making aesthetics more important than ever and causing design to start showing up in more aspects of everyday life.

The Progression of Design Mediums

Advertising: Anyone who has watched Mad Men has gotten a taste of the emotional storytelling that goes into selling something. As more people had discretionary income, they had more purchasing options. The quality of a brand, and the visual storytelling of their advertising helped people make what they felt were better purchasing decisions.

Source: Logomyway

Physical Products: That advertising did the trick in selling people more physical things and shaping the experiences around them. People shaped their homes and lives based on the stories they were told by advertising. What people owned told a story about who they were, and since the majority of life was lived in the physical world, people paid attention to what that story was.

Source: IKEA

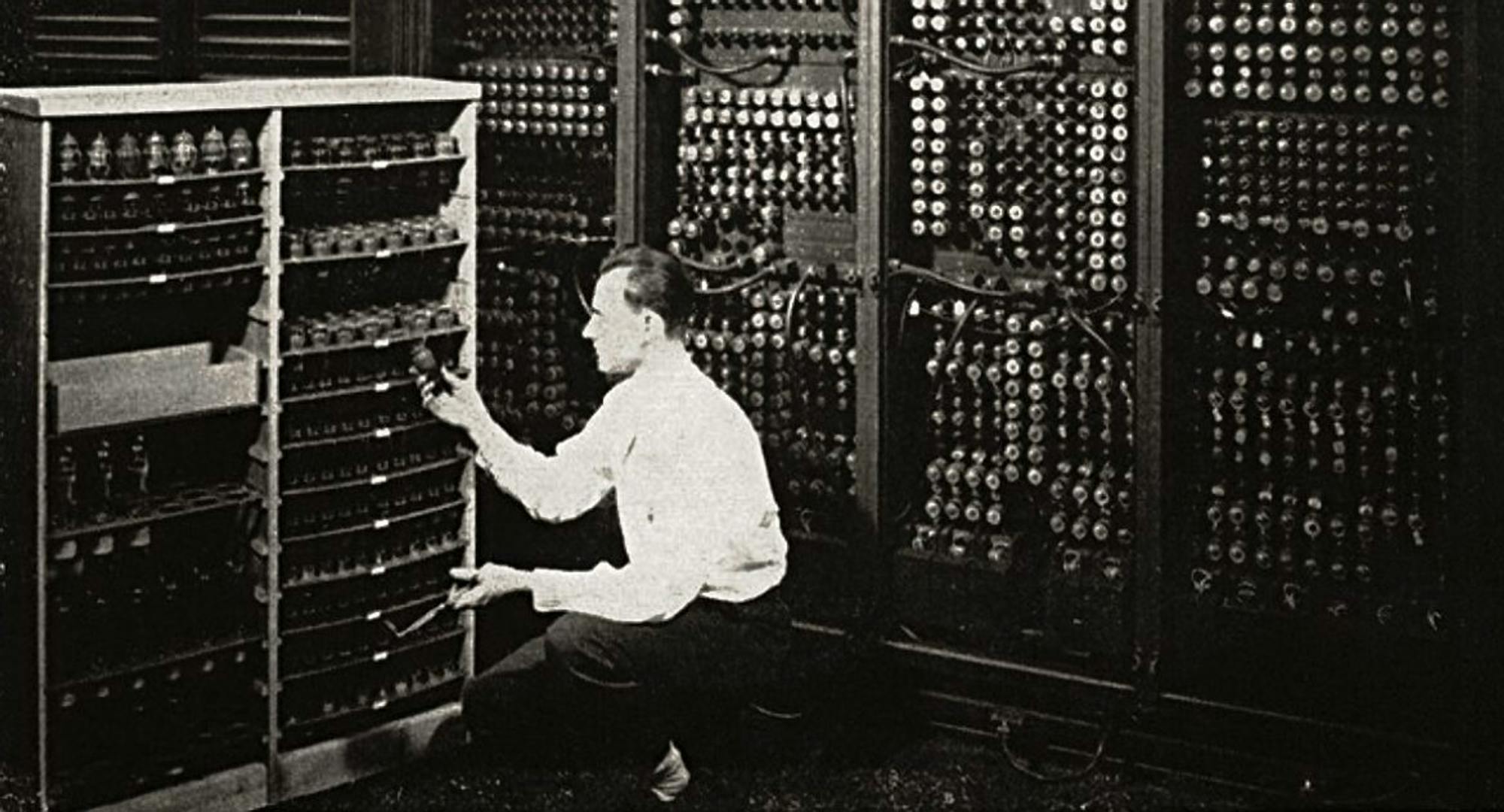

Digital Experiences: The world moved on to screens very slowly, and then suddenly all at once. It would be generous to describe anything about early computing as “well-designed,” at least not aesthetically. The vacuum-tubes of the first generation computer were all about function.

Source: Effectrode

Eventually, however, personal computers, and later the internet, would come to represent a radical combination of physical design, visual language, and functional capabilities.

Apple is often pointed to as one of the best representations of design, in part because it combines so many different aspects of thoughtful design (both hardware and software) in its products. On top of that, Steve Jobs is considered one of the greatest visual designers of the last hundred years. His philosophy on design shaped a lot of the digital experiences we take for granted every day:

“In most people’s vocabularies, design means veneer. It’s interior decorating. It’s the fabric of the curtains of the sofa. But to me, nothing could be further from the meaning of design. Design is the fundamental soul of a human-made creation that ends up expressing itself in successive outer layers of the product or service.” (Steve Jobs)

The same visual evolution is evident in Apple’s website as in the evolution of the Coca-Cola logo or the evolution of a fashionably furnished living room over time.

But when you look at every aspect of a digital interface, you see a much more complex experience. The buttons, the screens, the movement, the functionality, the logic – a well-designed digital experience puts the user at the center.

User Experience as The Center of Design

As people started interacting more frequently with screens, they started to form stronger opinions about what types of experiences they preferred. This gave rise to user interface (UI) and user experience (UX) design. UI/UX design was popularized by Don Norman, a cognitive psychology researcher who is widely regarded as the father of modern design. His book The Design of Everyday Things contains many of the fundamental principles of the field.

Some of the core tools for digital user interaction were popularized by Apple, starting with Steve Jobs’ famous visit to Xerox PARC where he saw the early designs that inspired Apple’s graphical user interface (GUI) and the computer mouse. When it came to visual aspects of user interaction and experience, Adobe was the early pioneer. Illustrator and Photoshop would become the core tools for visual design from their release in 1987 and 1989 respectively, and would remain dominant for the next ~30 years. In the late 80s, Apple represented exceptional design, and the company drove 29% of Adobe’s revenue. Apple, the standard bearer of design, had found their tool of choice.

When people found themselves with more discretionary income in the 50s, they had more choices of what physical goods to buy. When it comes to physical items, the selection can be quite large, but ultimately there are a finite number of product options to choose from. With digital products, by contrast, options are virtually endless; as of 2023 there are almost 2 billion websites on the internet and almost 3 million mobile apps available for download. Thoughtful design of the user experience has become more than a curiosity, and is now a fundamental point of product differentiation.

The introduction of mobile in 2007, and the popularization of social media in the early 2010s drove the consumerization of software. The rise of mobile drastically increased the time we spent with computers, and with that intimacy came a greater need for well designed software that is functional, intuitive, and delightful, elevating user experience (UX) and user interface (UI) design into key pillars in the tech industry.

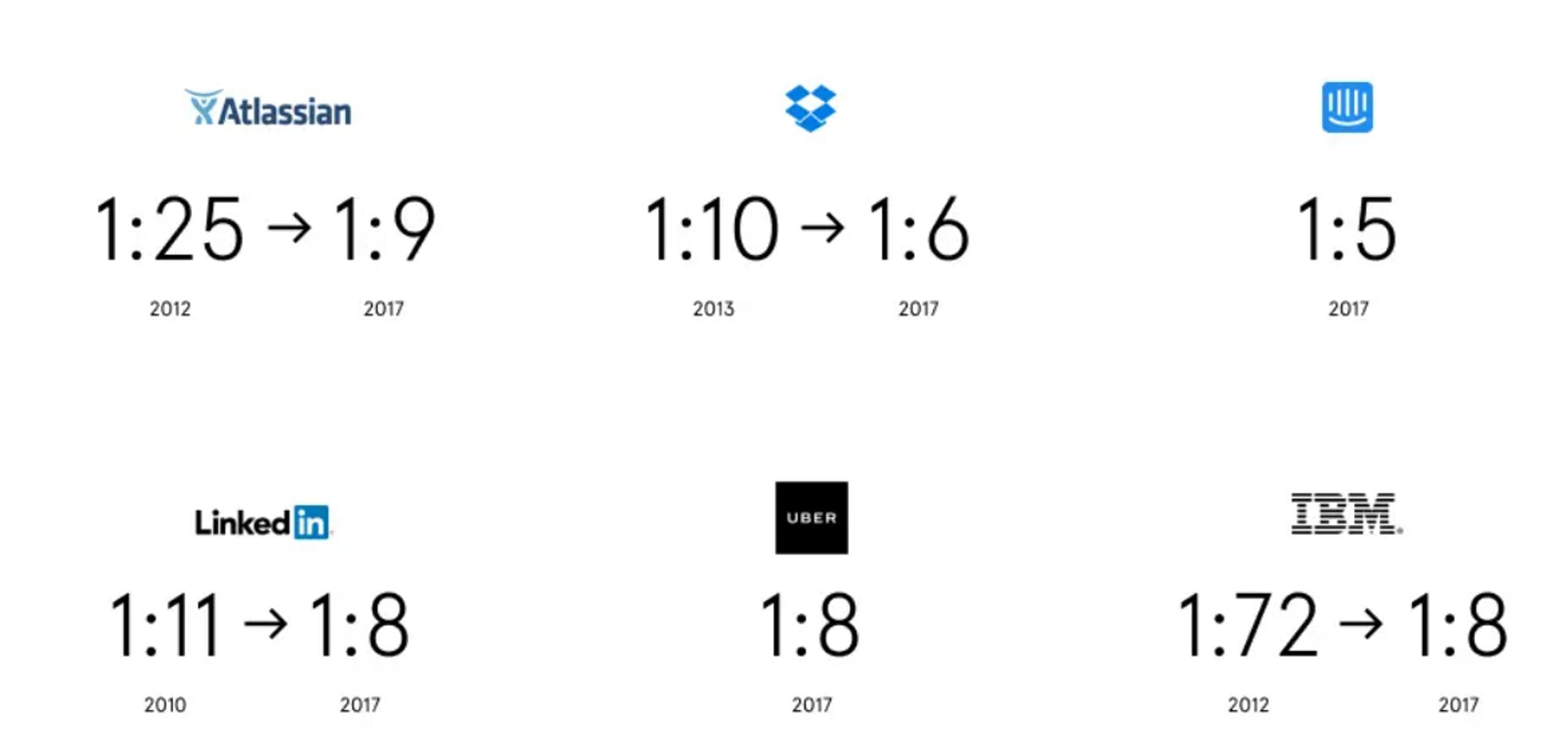

In 2019, Figma famously pointed to this trend as one key driver of their success. At this point, it wasn’t just consumer products and websites that had embraced the criticality of design. Enterprises also began to recognize that they were increasingly reliant on high-quality design to drive product differentiation. As a result, the ratio of engineers to designers working in enterprise teams grew more balanced, as enterprises like IBM or Atlassian increased the number of designers on their teams.

Source: Figma

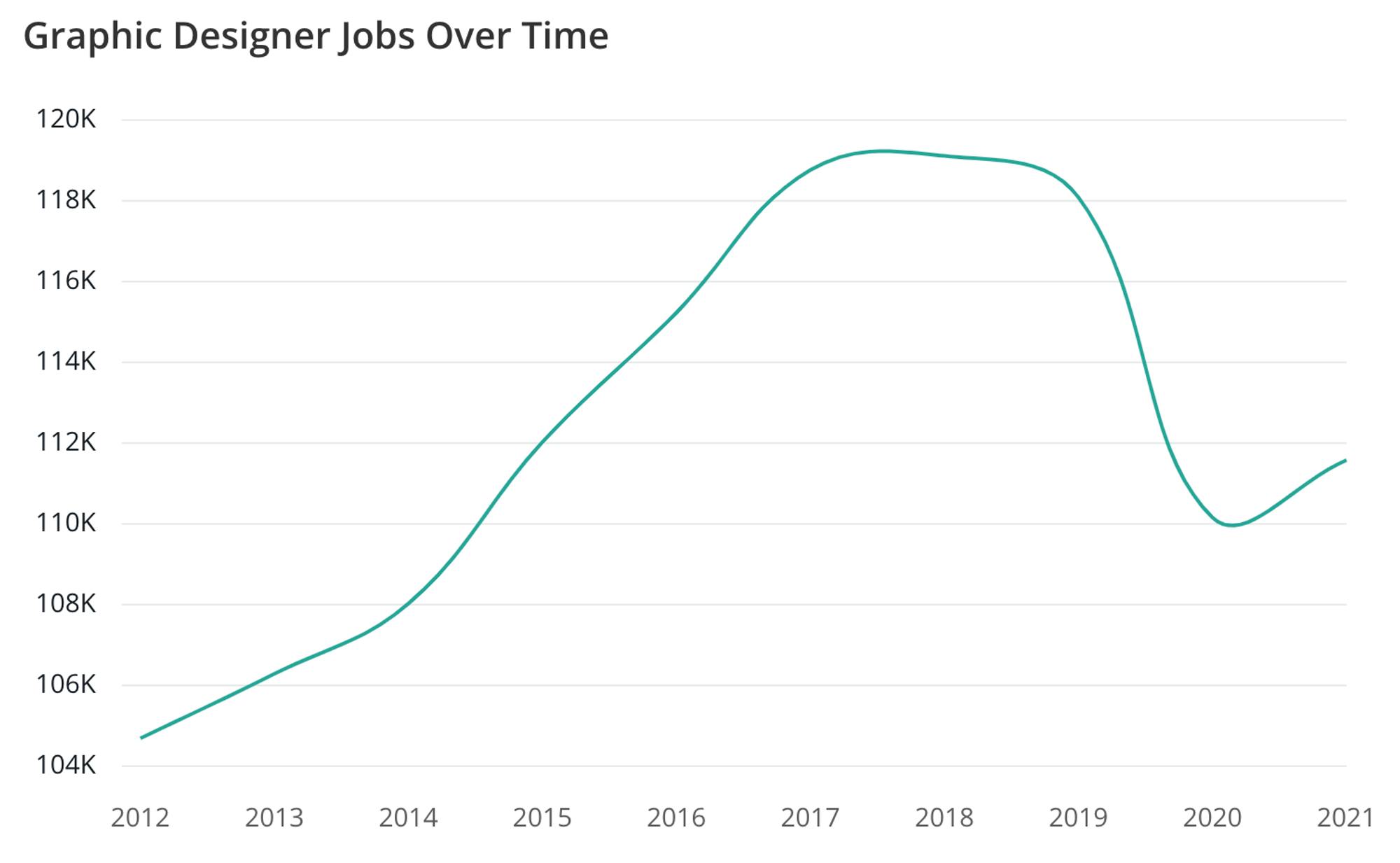

The number of jobs for designers throughout the tech industry ballooned in that same period. And, while they saw a COVID correction like a number of other roles, design roles including graphic design, product design, and UI/UX design roles are among the most in-demand tech roles for 2023.

Source: Zippia

Design: The Essence of Communication

Steve Jobs described design as “the fundamental soul of a human-made creation that ends up expressing itself in successive outer layers of the product or service.” Dylan Field, the CEO of Figma, defines design in a similar way, even going a layer deeper:

“I think of design [as] creating a visual language that people can latch onto in order to solve a problem. In software, that means that I've got something that I want you to be able to do with my thing I'm creating, I'm trying to create the best visual metaphors for you to latch onto. Depending on how far down the stack you go… it doesn't stop necessarily with the creation of a visual asset or artifact. Really, design is thinking about the entire software development process, end-to-end.”

As we unpack the rise of the designer class, the same dynamic plays out in different use cases. Whether it’s professional designers or everyday users, well-designed visual mediums are used to communicate something specific. “Citizen designers” come in many forms, but what they have in common is that they’re looking for a way to clearly communicate something visually. Canva has become the tool of choice for these types of creatives by owning the mindshare for a wide variety of use-cases.

Source: Twitter

Three companies represent the story of design over the last 50 years:

Adobe, which became the elder statesman of the design world

Figma, the rising star of the professional designer

Canva, the toolkit of the citizen designer

Each of these important companies represents a different aspect of how design has expanded to include every aspect of our digital lives.

The Adobe Empire

Adobe was born out of the work of John Warnock and Charles Geschke, who prior to founding Adobe were working at Xerox PARC developing Interpress, a page description language (PDL) that described the appearance of a printed page in higher resolution for printers.

When Xerox proved slow to commercialize their work, Warnock and Geschke made the decision to leave Xerox and build their own company, which became Adobe. Their first product was a very similar language to Interpress called PostScript:

“[PostScript was] a device-independent programming language between PC and printer that could describe text, graphics, and images on one page. PostScript, along with the Apple Macintosh graphical user interface and laser printers, launched the desktop publishing industry in the 80s.”

By 1989, Adobe had grown to ~$100 million in revenue across 30 customers, with Apple singlehandedly representing 29% of the company’s revenue. Over the course of the late 80s and early 90s, Adobe had one of the most impressive product velocity runs of any software company in history: three products launched 30 years ago that still remain relevant, and generated billions in profits in 2022.

These included Illustrator and Photoshop, which not only established Adobe as the leader in visual design software, but also defined the core aspects of design for decades: vector-based editing software (Illustrator) and pixel-based editing software (Photoshop).

These two design functions would be fundamental aspects of Adobe’s early applications, but more importantly to the future of the design world, understanding them is essential to understand how Figma would eventually come to disrupt Adobe.

Vector-Based Software (Illustrator): Allows users to create and edit vector graphics (graphics made up of lines and curves) rather than pixels. Ideal for use in designs that will be printed or displayed in different sizes, such as logos, icons, and infographics. Vector-based editing software typically includes tools for creating and editing shapes, paths, and text, as well as tools for applying colors, and gradients.

Pixel-Based Software (Photoshop): Allows users to create and edit images made up of pixels. In contrast to vector graphics, which are made up of lines, pixel-based images are made up of a grid of individual pixels, each with its own color value. Commonly used for editing photographs and other images that contain a high level of detail. Pixel-based software typically includes tools for adjusting the color, brightness, and contrast of images, as well as tools for applying filters and other effects.

Adobe From 1990 - 2015

In the wake of losing Apple as their biggest customer in 1989, Adobe’s growth started to slow down. But Illustrator and Photoshop would become foundational industry tools. In 1991, Adobe went on to launch Adobe Premiere (video editing software) and in 1993 launched the Portable Document Format (PDF).

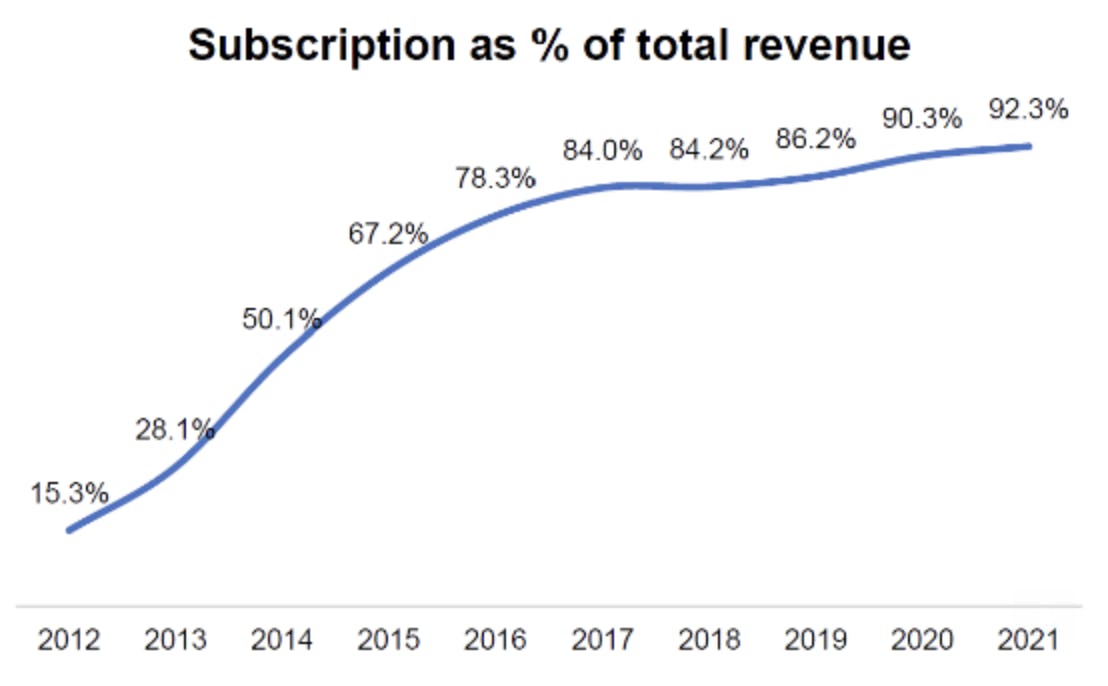

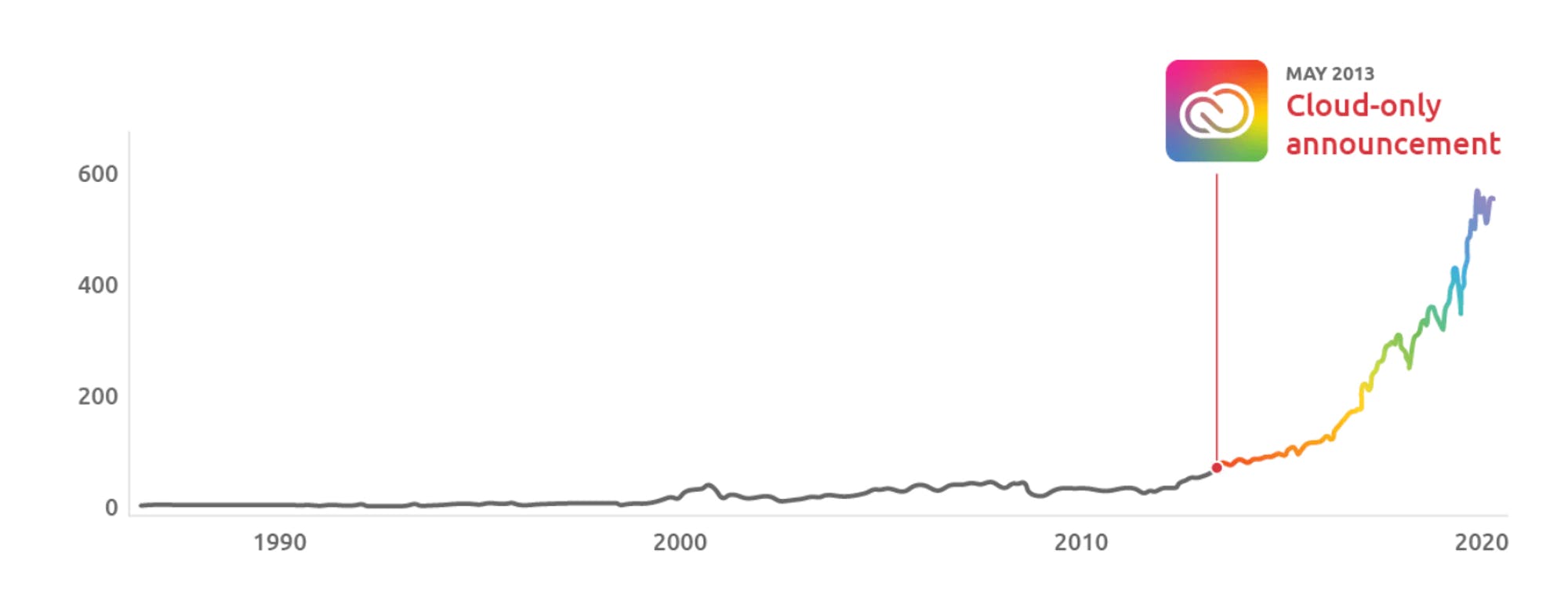

After launching products in the 1990s that remain household names into the 2020s, Adobe largely stagnated during the early 2000s. In 2007, Shantanu Narayen became CEO and is still leading the company as of January 2023. One of Shantanu’s biggest accomplishments was transitioning the business to a subscription model.

Source: MBI Deep Dives

By 2012, Adobe took a turn when they pivoted to a subscription bundle with the launch of the Adobe Creative Cloud. The company’s stock began to rise unlike ever before, peaking at a $317 billion market cap in 2021 before dropping to ~$160 billion as of January 2023, along with most SaaS companies that experienced a 2022 valuation correction. That transition has also enabled Adobe to increase their growth rate from ~7% annually in the early 2000s to 20-30% in the 5 years after 2015.

Source: LaunchNotes

Adobe in 2023

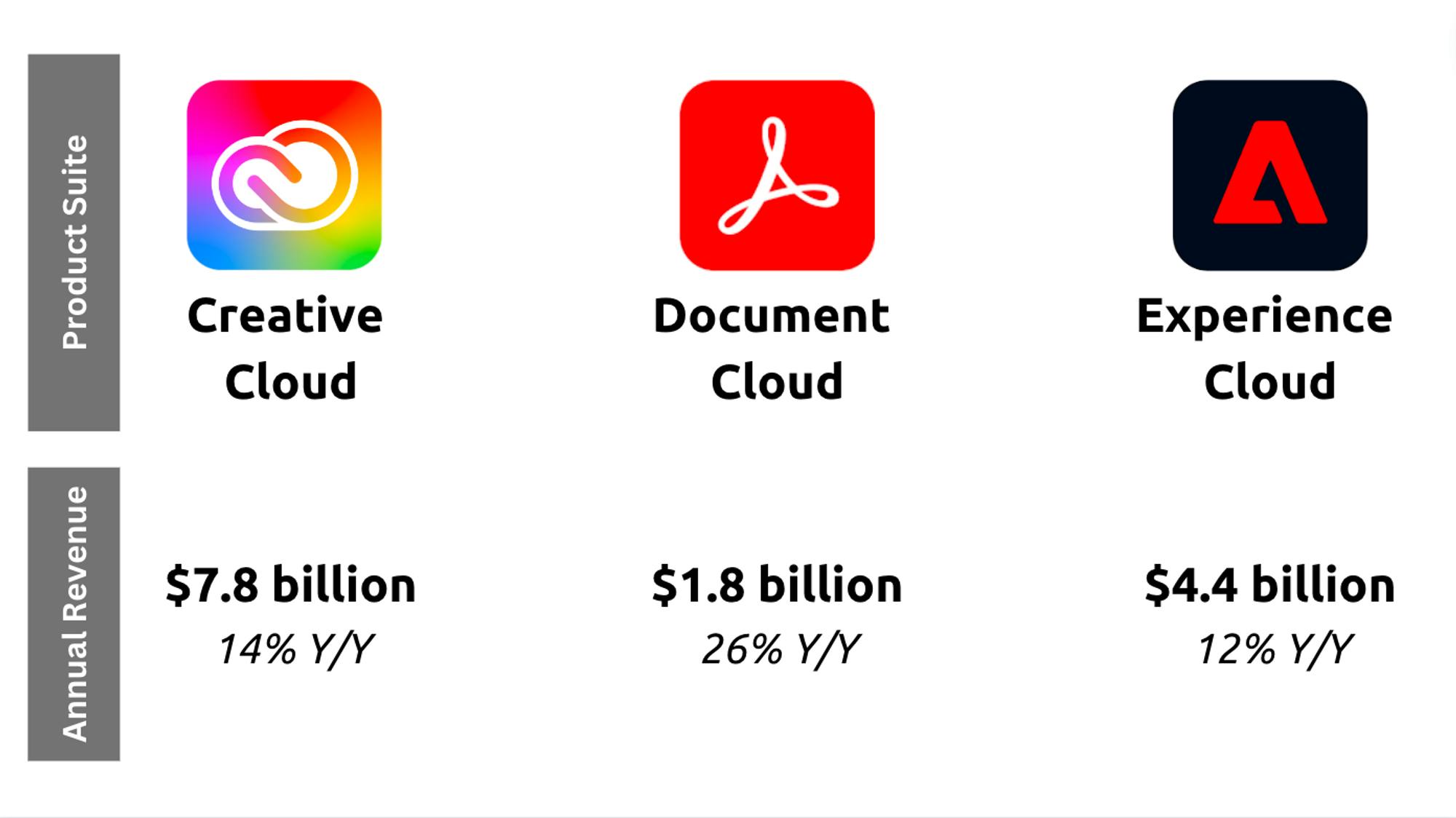

As a result of this evolution, Adobe’s business in 2023 looks quite different from what it was a decade ago. The company generated just over $17 billion in revenue over the course of 2022, with ~$7 billion in free cash flow. Today, Adobe’s business can be broadly categorized into three main segments: (1) Creative Cloud, (2) Experience Cloud, and (3) Document Cloud.

Source: Adobe, as of 2022

More than 50% of Adobe’s revenue comes from the Creative Cloud. Estimates put Creative Cloud’s subscriber base at ~24 million across its core products, which include:

Adobe Photoshop: A tool used for editing digital images and design applications as well as improving image quality.

Adobe Illustrator: A vector graphics editor commonly used to create and edit digital graphics, such as logos, illustrations, and artwork for all kinds of media both in print or online.

Adobe InDesign: A desktop publishing software program primarily used for printed artifacts like posters, flyers, brochures and magazines.

Adobe Premiere Pro: A video editing suite.

Adobe’s Enduring Empire

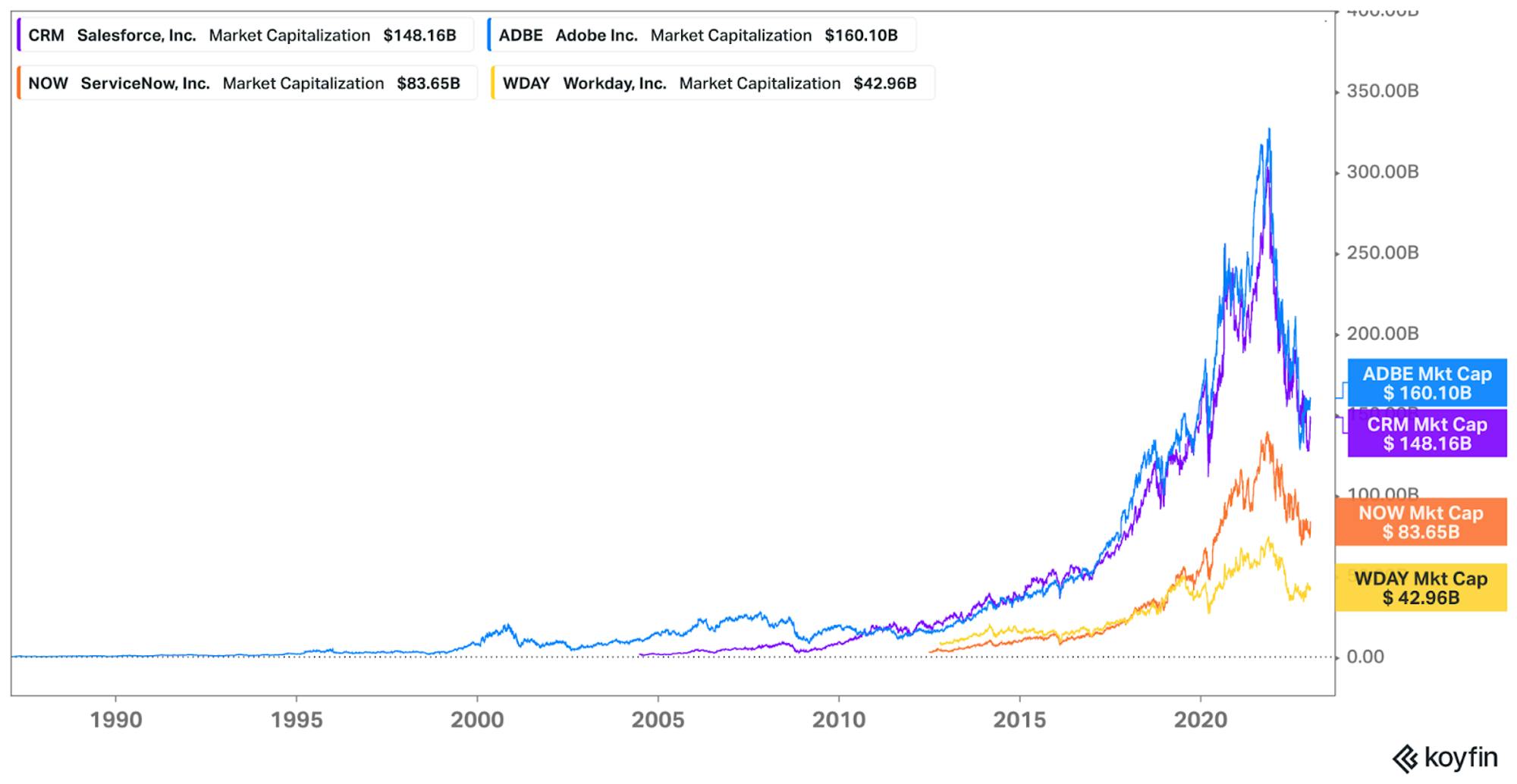

Source: Koyfin

Adobe is among the core pillars in application software alongside companies like Salesforce, Workday, and ServiceNow. As of January 2023, Adobe’s market cap has managed to stay above every other company on that list at $160 billion. It can be difficult to summarize the breadth of Adobe’s platform and the role the company played in shaping the digital world over the last 40 years. But with the advent of the cloud, increased emphasis on collaboration, and more rapidly shifting appetite for digital experience, Adobe is increasingly struggling to remain relevant.

Adobe’s competitive advantage in the world of design software has historically come from its brand power, first-mover advantage, effective distribution partnerships, and core competency in building tools for designers. The launch of Adobe Creative Cloud solidified the company’s shift to subscription revenue, with its all-in-one bundle for creatives. The combination of its established moats and strategic changes over the last 10+ years have enabled the company to survive several decades while generating high returns on equity in excess of 30%.

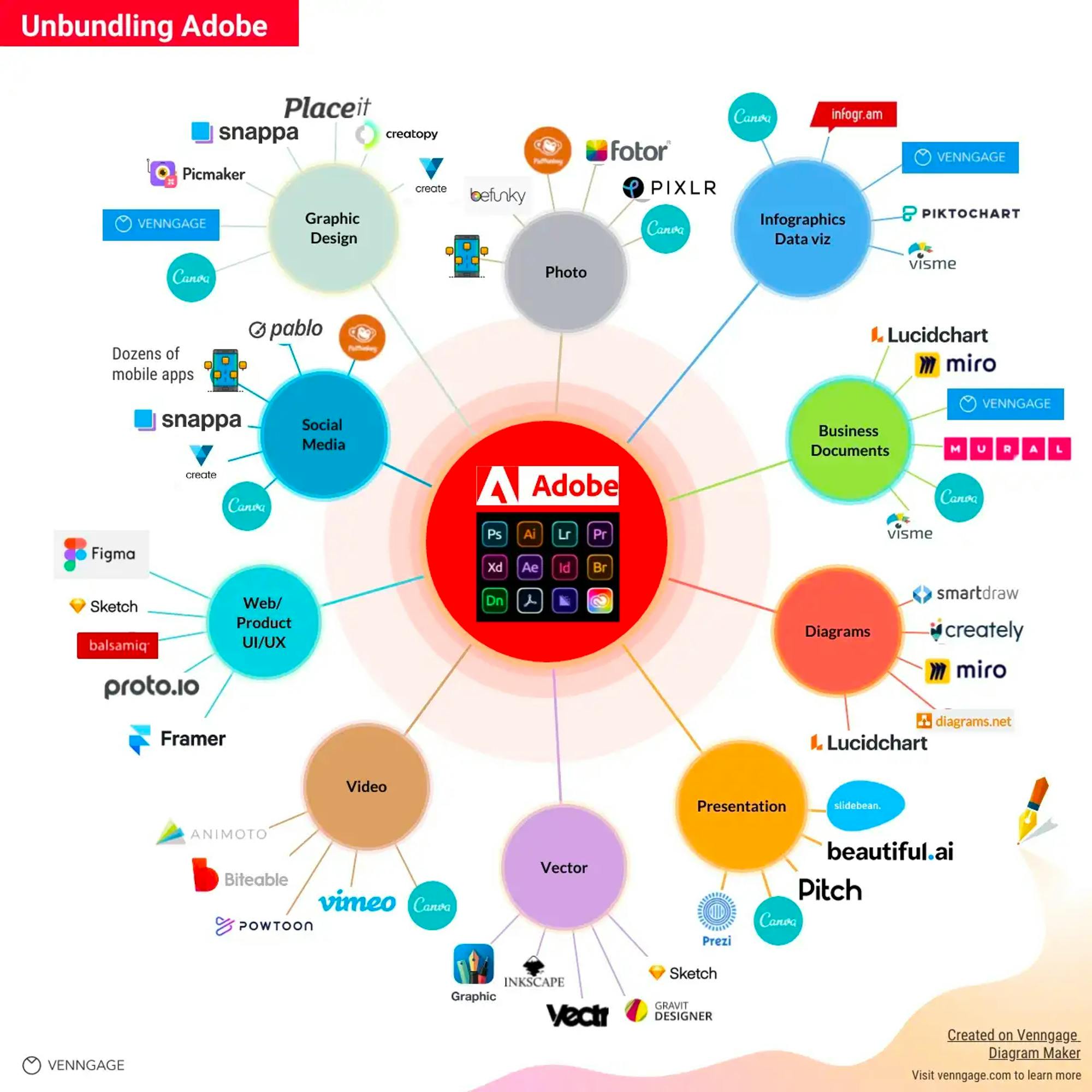

Adobe’s success at bundling its products has also invited unbundling as users' preferences for their digital tools have evolved. Different companies have emerged to attempt to carve out aspects of Adobe’s product suite and offer them as standalone products. Adobe has simultaneously been fighting to better bundle its products while also fighting off a number of threats to make its products less relevant.

Source: Venngage

Adobe, like every large industry incumbent, is always in danger of failing to disrupt itself and remain at the forefront of their market. For example, Adobe missed the initial days of the internet in the early 2000s. Collaborative software, like Google Docs, has been around since 2010. Meanwhile, Adobe launched AdobeXD, their collaborative design tool, as late as March 2016. That gap opened the door for startups like Sketch, Invision, and Figma, which all launched between 2010 and 2012.

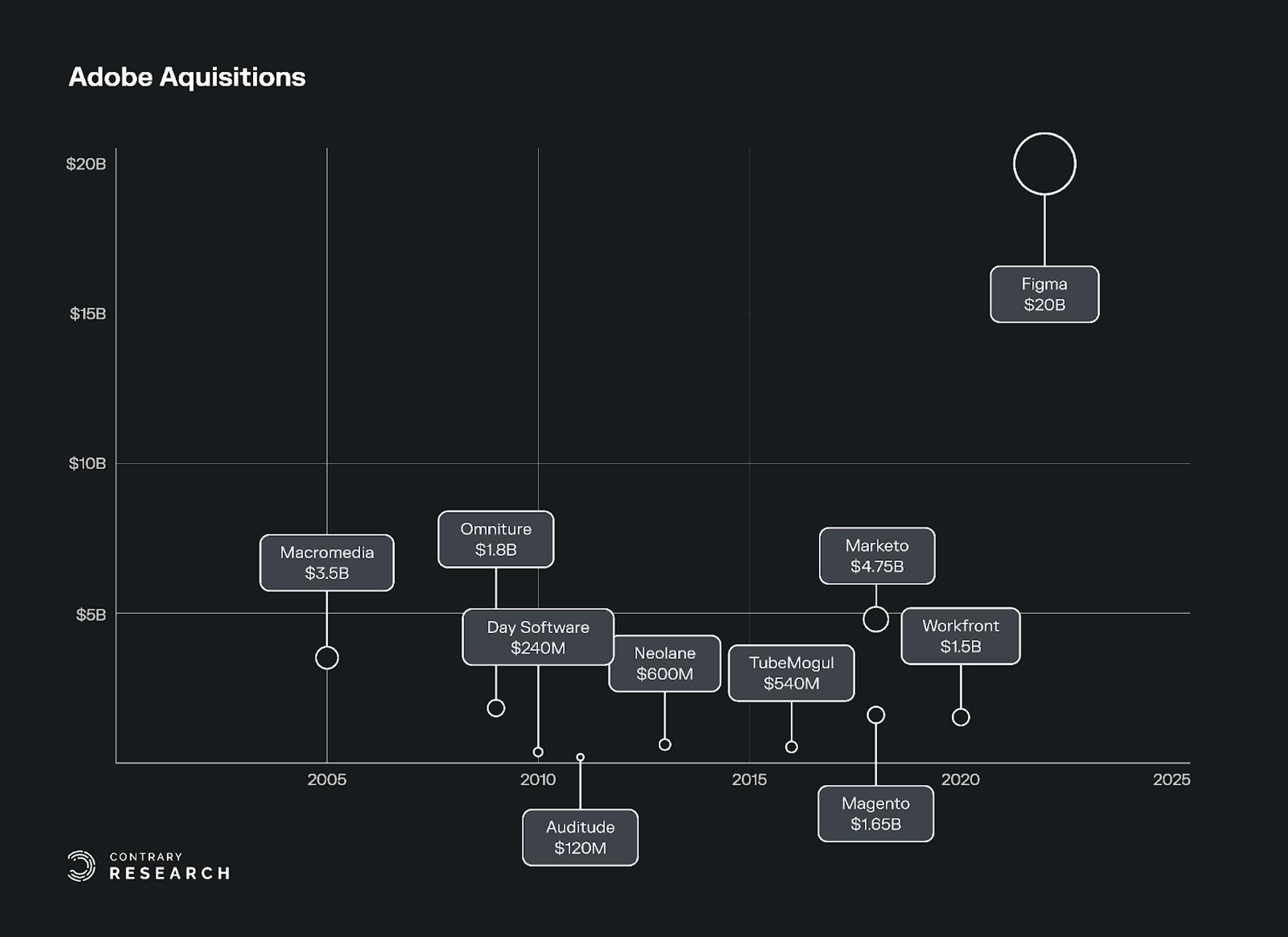

Today, Adobe points to Figma, which it acquired in 2022 for ~$20 billion, as just the next story in their ongoing rise to dominate the digital domain. The company’s investor presentation, below, outlining the acquisition’s rationale shows Figma as the natural next step in Adobe’s history.

Source: Adobe

But in reality, Figma is not “just another notch” in the Adobe story. Figma is an order of magnitude larger than any acquisition Adobe has executed before (the only acquisition in the double-digit billions), and represents a fundamental bet on the future of Adobe as a company and design as an industry.

Source: Contrary Research

Hunter Walk described the likely logic behind Adobe’s acquisition of Figma as “what percentage of our market cap do we need to spend to protect the rest of it?” He goes on to explain:

“Figma had crossed the ‘this matters to Adobe’s future’ rubicon. They hit $400m ARR and were continuing to double. Figma revenue, independent of margin, was increasingly displacing revenue that might have gone to Adobe, or more specifically, creating pricing pressure on Adobe. It was a product designed natively to be collaborative, to be easier to use than Adobe’s professional tools, and without the baggage of features and nomenclature leftover from years of software releases, platform shifts, and business model changes.”

So what was it that made Figma so special in the design world, that it would represent an existential threat to the rest of Adobe’s business? The traditional designer was evolving to become the integrated designer, and Figma was the only company positioned to take advantage of that.

Figma and the Age of the Integrated Designer

The world of design, for the first 30 years of Adobe’s life, was largely one operational silo among many. Designers at most companies sat in a room, crunched through the mockups, and sent it down the value chain. As design started to evolve from a box to check into a measurable point of differentiation, designers needed to step into a much more collaborative environment.

Figma planted their flag early, declaring their vision to become GitHub for designers. GitHub’s role in the software development lifecycle is critical because of the ability it offers for one developer's code to become accessible to any number of other participants. Figma recognized that multiple types of designers would become more important, rapid prototyping would only get faster, and other stakeholders like engineering, or management would become increasingly involved in the design process. That was the ethos that Figma was born out of.

Founding Story

In 2012, Figma founder Dylan Field was selected to participate in the Thiel Fellowship, a program created by Peter Thiel where students are given a $100K grant conditioned on them leaving school to begin working full-time on building a company. Upon receiving his fellowship offer, Dylan dropped out of Brown University and, alongside co-founder Evan Wallace, began exploring different ideas for what to build. They initially settled on starting a drone company after Dylan was inspired by a 3D demo Evan had built using real-time graphics in the browser, but the demo ended up playing a bigger role in their eventual startup than the drones.

Pivoting away from drones, Dylan and Evan’s next idea became the creation of an “Adobe Photoshop” built in the browser which would leverage WebGL (Web Graphics Library), a JavaScript API that allows developers to render 3D graphics within a web browser. WebGL uses the graphics processing unit (GPU) of a user's computer to display complex, interactive 3D graphics, without the need for additional plugins or downloads. This makes it possible to create highly detailed, interactive 3D graphics that can run in any modern web browser.

Before the development of WebGL in 2011 (only one year before Figma was founded), many developers used plug-ins like Adobe Flash or Java applets to render 3D graphics on the web. However, these plug-ins were often resource-intensive and required users to download and install additional software, which could be slow and inconvenient. Dylan and Evan set out to solve the challenges to high-quality in-browser collaboration for designers.

While that insight may seem obvious today, it was not immediately accepted as the logical approach to take. Adobe Flash was considered the only quality way to render graphics at the time. Nobody could imagine real-time graphics in a web browser, as is clear from Dylan’s description of the skepticism the company initially faced:

“For Figma, one thing that we assumed early on was that people will want to work in the browser and we can make that a great experience. That was something that everyone at the time thought we were a little bit crazy for. I remember early on in Figma's history trying to recruit people, and I would tell them, ‘Hey, we made this thing and it works in the browser.’ No one would believe me. This got to this point where I would have these first meetings with candidates and I would show up and the first thing I would do, almost just right after I introduced myself is I would get my laptop out and open it just to show them that it worked because otherwise, they just thought I was insane without actually seeing it live.”

You can still see the first demo that Evan Wallace made to demonstrate the ability of 3D graphics in the browser. As skeptical as people were of building in the browser, the idea of collaborative design in general was something foreign to most people, as Dylan explains:

“I think that similar to that was multiplayer, the ability to edit simultaneously. That was something where people, when we talked to them, only one or two designers would tell us, ‘Yes, we want the ability to edit simultaneously, we want multiplayer.’ We were very cautious around building it but as we started to really look into how it felt without multiplayer, the medium just didn't work. If you're in the browser and someone else edits the thing that you're using, you really want to treat it like a space rather than a tool that you're using one-to-one because, otherwise, your file's going to reload - it's just a really suboptimal experience. I think the browser really forces you to conceptualize tools as spaces, we went and we built it anyway even though it was unclear people needed it or wanted it. After we had built it and gotten it to the point where we had a prototype, we instantly realized that this was the right thing to do, but it was a bit of a leap of faith. I think that you have to dare yourself to be able to think more independently, otherwise, you only reach these local optimums instead of these global optimums.”

Both product decisions turned out to be accurate predictions of what designers were going to want. Figma’s traction after launch speaks to this. Figma was expected to generate ~$400 million in revenue for 2022, up from $75 million in 2020. While Adobe’s new revenue in 2021 alone was 12x the size of Figma’s entire topline revenue, Figma’s growth is exceptional. It took Adobe 8 years to exceed $150 million in revenue in the 1980s, while it only took Figma 5 years to hit the same milestone.

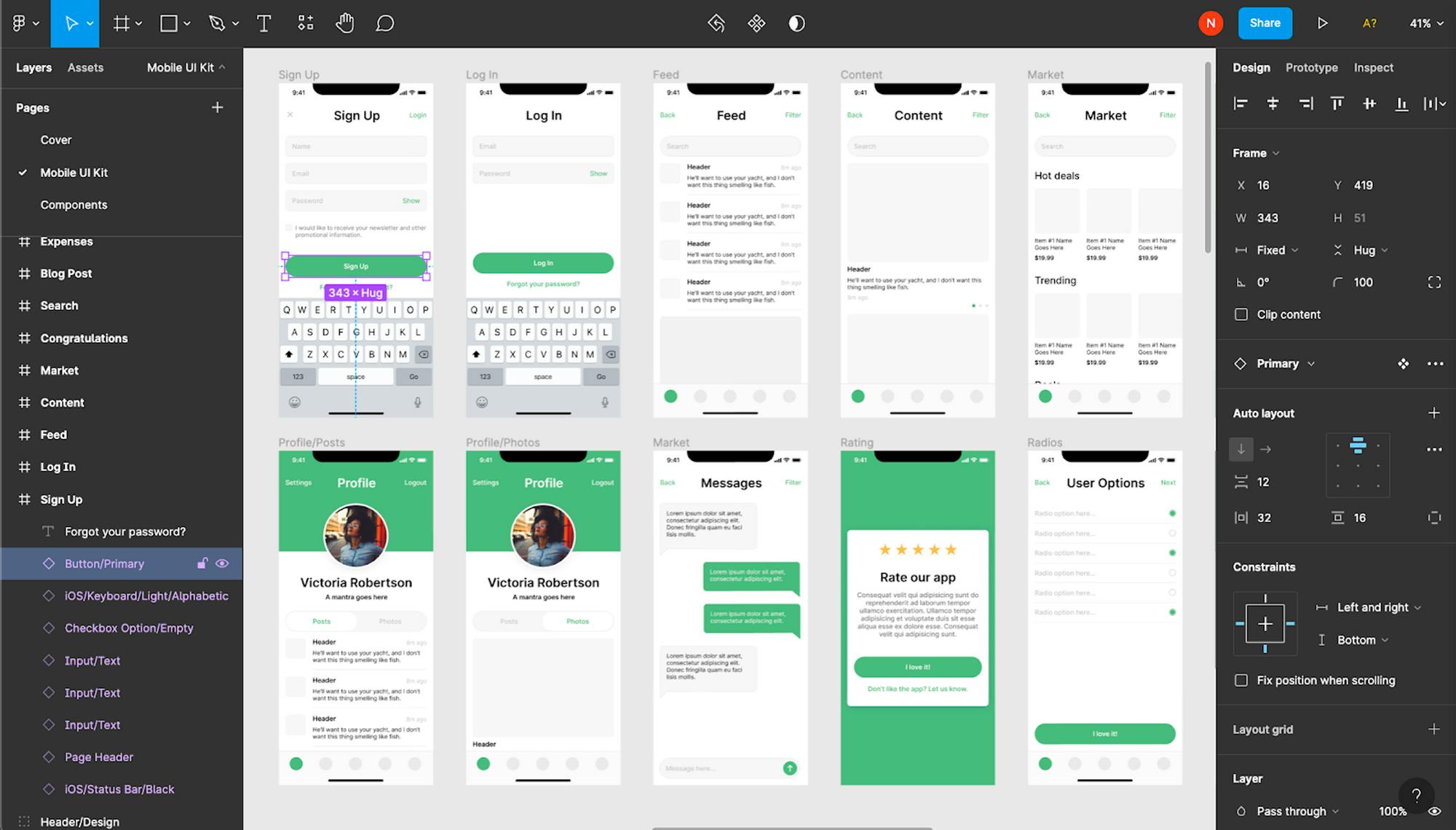

The Platform

Before Figma took over the landscape for preferred design tools, the company spent a meaningful amount of time building their product. From their initial launch in 2012 until their public beta in 2016, the Figma team were heads down focused on building a complex browser-based multiplayer design tool.

Today, Figma’s products extend from brainstorming to design systems. Figma’s initial core product focused on the design process, offering the ability to design wireframes and mockups, create prototypes, and quickly handing off completed designs to developers.

Source: Figma

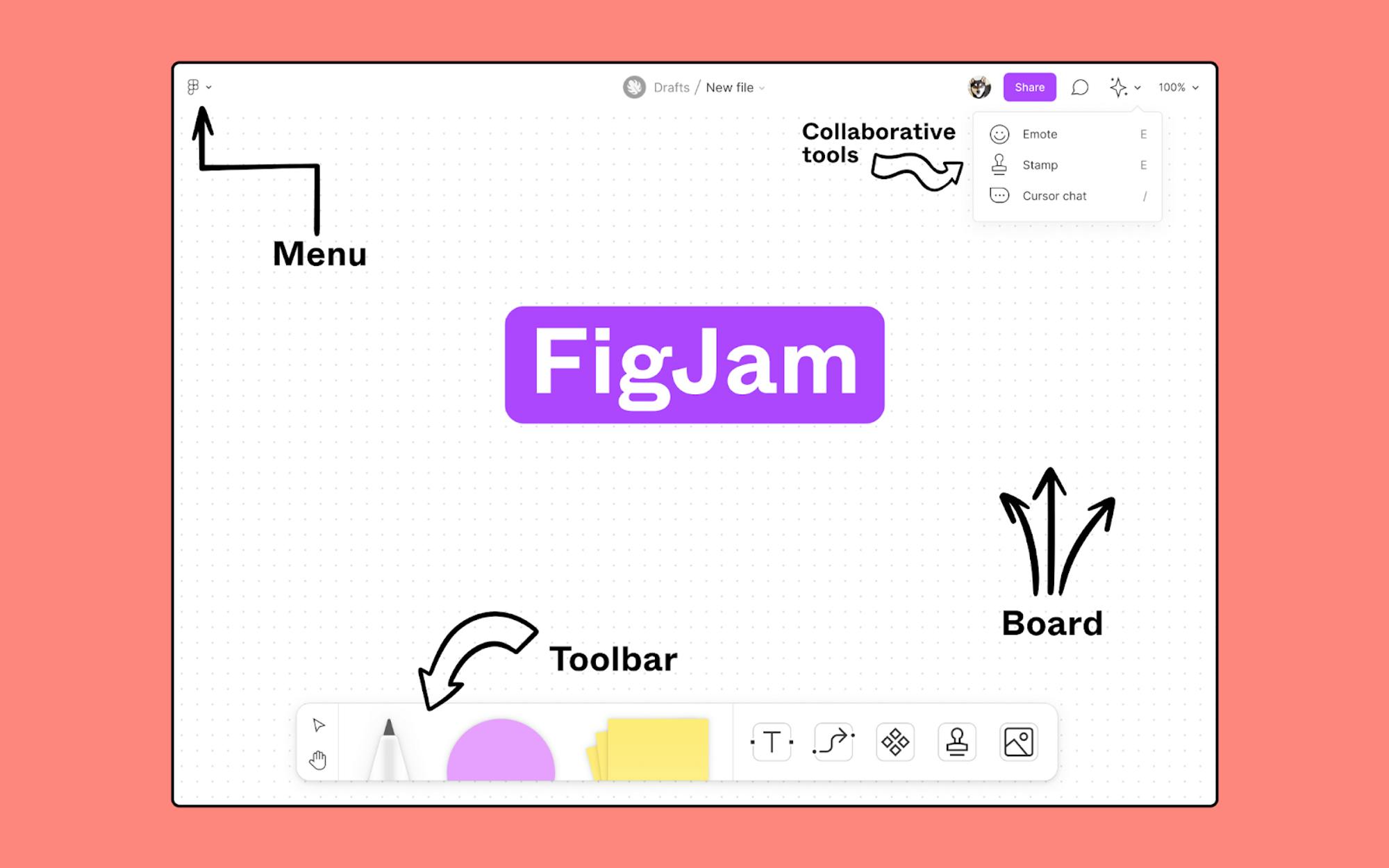

In April 2021, Figma launched FigJam, a whiteboarding tool, when the company realized that designers were also using its design platform as a space to brainstorm, workshop, and share ideas. FigJam allows teams to more easily brainstorm, plan, and collaborate as part of the design process.

Source: Figma

Competitive Pillars

Figma has remained a leader in the design market as the result of several strategic choices, all of which have been in place since launch and have compounded meaningfully over the company’s life:

Building In The Browser

Multiplayer At Scale

Community & Distribution

Building In The Browser: Figma leveraged a first-mover advantage to build out their platform in the browser leveraging WebGL. Sketch made it easier to design an application in one place, but did nothing to make it easier for teams to work outside Sketch’s Apple desktop app. Dylan Field responded to the question “what would be the hardest thing for a competitor to copy about Figma right now, even if they had had a ton of time and money and talent (like Adobe)?” with the following answer:

“The fact that we’re in the browser, I'd say, is our greatest aid, but it's also a ton of work to get right. To make things load really fast, you have to have one version of the product, most tools have updates, and maybe if you have plugins, those also have updates. In Figma, there's always one version for the app, and for plugins, and making that work correctly is very difficult. Multiplayer, of course, and scaling multiplayer is non-trivial.”

Multiplayer At Scale: Multiplayer is an important feature because it allows multiple users to collaborate on the same design project in real-time. This is particularly useful for teams that are working on the same project and need to be able to share ideas and make changes quickly and easily. Project teams of over 20+ are also able to track each other's changes as they are made. Dylan described the value that even legacy companies can get from multiplayer like this:

“For example, Kimberly-Clark, when the pandemic hit, they were trying to make it so that their order form was more simple so that people could get paper supplies with the toilet paper crisis. One thing that they had to work through was that they had this order form which was way overly complex. They were able to get their entire team in Figma, bring them all together, and then sort of work through how to get that form that I think had 13 fields in it together, to reduce it to five fields in order to place an order.”

Community & Distribution: One of the biggest competitive advantages for Figma is their loyal community of users. Figma has an official website for their community, but the value users derive in their day-to-day experience is just as important. Passionate Figma users are often more excited about Figma developments than they are new products from other companies. Figma has one of the largest Twitter followings among design tools with over 300K followers, and #FigmaTip is a popular hashtag. The company has nurtured a community built around support, understanding, and templates. The community also allows users to share any number of resources around what they’re creating.

Sketching The Competition

Figma was not the only player building tools for designers when it launched. Sketch launched in 2010, InVision launched in 2011, and Figma followed in 2012. While Sketch was a first-mover in new-age vector-graphics editing software, they were built specifically for the Apple operating system. Despite this limitation, Sketch was able to remain a top design tool as recently as 2019.

Source: Design Tools Survey from 2019 and 2020

Sketch decided to focus its product on user interface (UI) designs. While Sketch offered features like symbols and styles that allowed designers to create easy-to-maintain design systems, the macOS dependency was a big limitation compared to Figma’s browser-friendly product. Sketch also failed to launch real-time collaboration like Figma until March 2021, although Sketch was able to build a strong community of users and developers who created extensive plugins and resources that extended the capabilities of the platform.

Ultimately, Sketch’s MacOS dependency and lateness to real-time collaboration caused it to lose significant ground to Figma. As Stratechery’s Ben Thompson put it:

“Sketch was not a disruptive product: it was, like Adobe’s products, a desktop app; it just delivered a solution to an emerging product category that Adobe was slow to respond to. Figma, though, was something completely new.”

Not only that, but Sketch’s example also led Figma’s competitor, Adobe, to make a misstep, since Adobe paid too much attention to Sketch as the model for how they eventually built their competing product, AdobeXD.

Canva: Arming The Citizen Designer

In the last couple of years, Figma has taken up the majority of the oxygen in the conversation when it comes to the world of design. However, the increasing immersion of the world in digital experiences means that everyone has become a designer somewhere on the spectrum from citizen designer to professional designer. Dylan Field is the first to acknowledge this:

“There was a time when people wouldn't use word processing because they weren't professional writers, it wasn't like everyone used a word processor. Then over time, everyone started using a word processor. That said, it's not because you have access to a word processor, you are an expert writer. There are people that specialize in writing, and I see the same thing being true for design tools. It's going to become a core competency that everyone has to visually communicate, but at the same time, there will be people that specialize.”

In 2012, Facebook hit 1 billion MAUs; Instagram followed ~6 years later. The rise of social media turned everyone into a content creator. The long tail of creation started to take shape and would grow to the point where there were 3.5 billion designs on platforms like Canva in 2021 alone.

Canva has become the tool of choice for citizen designers. The idea to democratize design was at the core of Canva’s founding story:

“[Canva CEO Melanie Perkins] was teaching university design programs. In every class, she saw students struggle to even learn the basics. It took months to be able to create something that looked good. She realized that in the future, design would be very different. It would be collaborative, online and easy to learn. She asked herself, “Why shouldn't everybody be able to create beautiful designs?”

Historically, design had been limited to years of experience and technical expertise, or being forced to use limited tools like Microsoft Powerpoint. Canva set out to not just build a simple tool, but a universal tool addressing any use case a citizen designer could think of.

Founding Story

Melanie Perkins first built Fusion Books, a digital yearbook company, in 2007. That initial product was an application of a broader opportunity: people needed software to help them more easily create beautiful designs. Canva, in its current incarnation, was founded by Melanie Perkins, Cliff Obrecht, and Cameron Adams in 2013.

The initial core product was a user-friendly, drag-and-drop interface that made it easy for users to create professional-looking designs more quickly. The company has since grown to become one of the fastest-growing technology startups, and has received numerous awards and accolades for its innovative platform and user-friendly design tools.

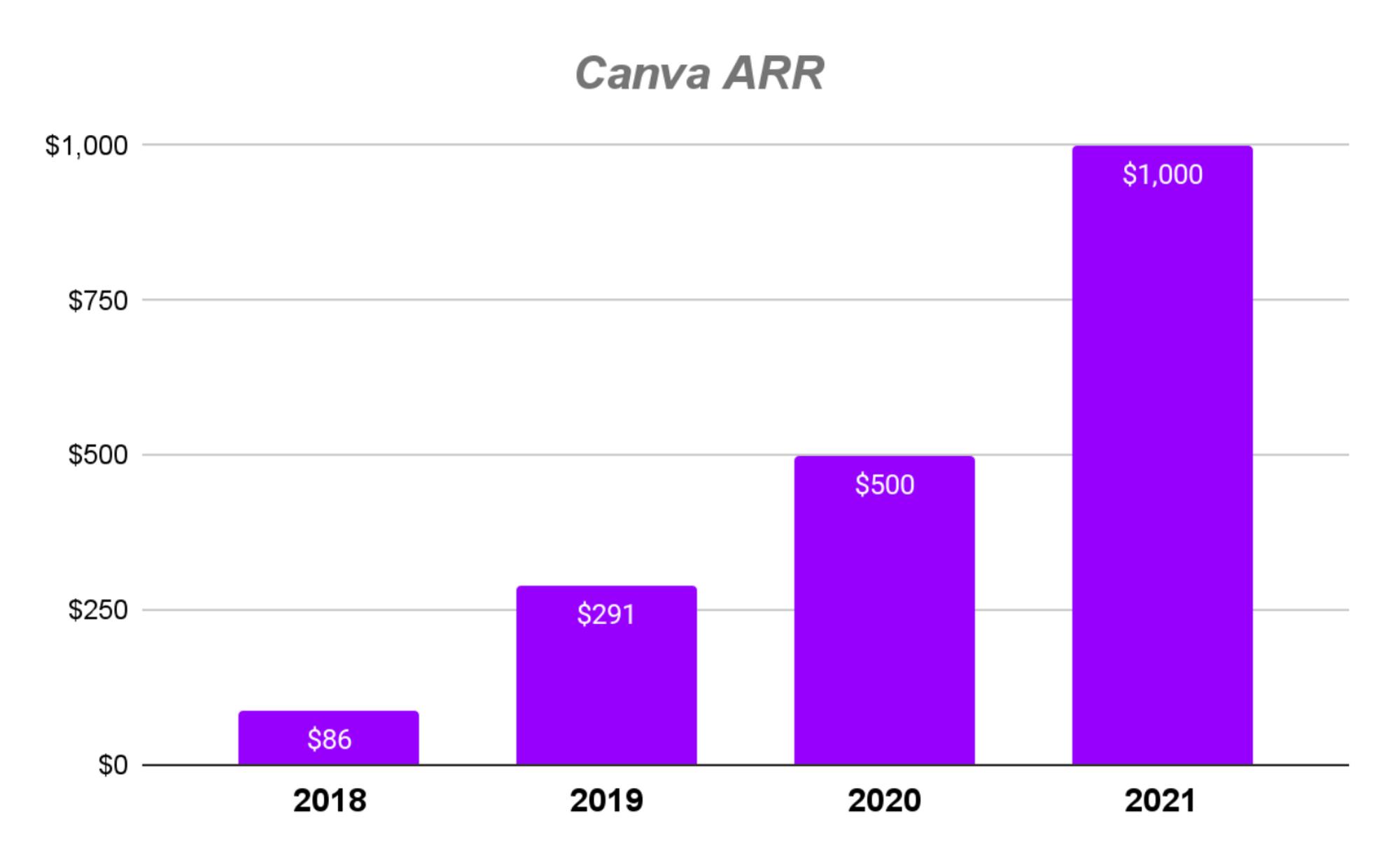

Source: Estimates from MBI Deep Dives and GetLatka

The business has grown to over $1 billion in ARR as of 2021, and is continuing to grow rapidly both in revenue and users, with 30 million monthly active users as of 2020. For context, Adobe took 17 years to reach $1 billion in revenue, while Canva took half that time. Canva has built their business serving citizen designers like content creators, marketers, and entrepreneurs and other everyday people trying to communicate visually, as opposed to more sophisticated professional designers; Canva also has over 4.4 million users paying for their Teams product, and 85% of Fortune 500 companies are among Canva’s customers, including FedEx, L’Oréal, and Salesforce.

The Platform

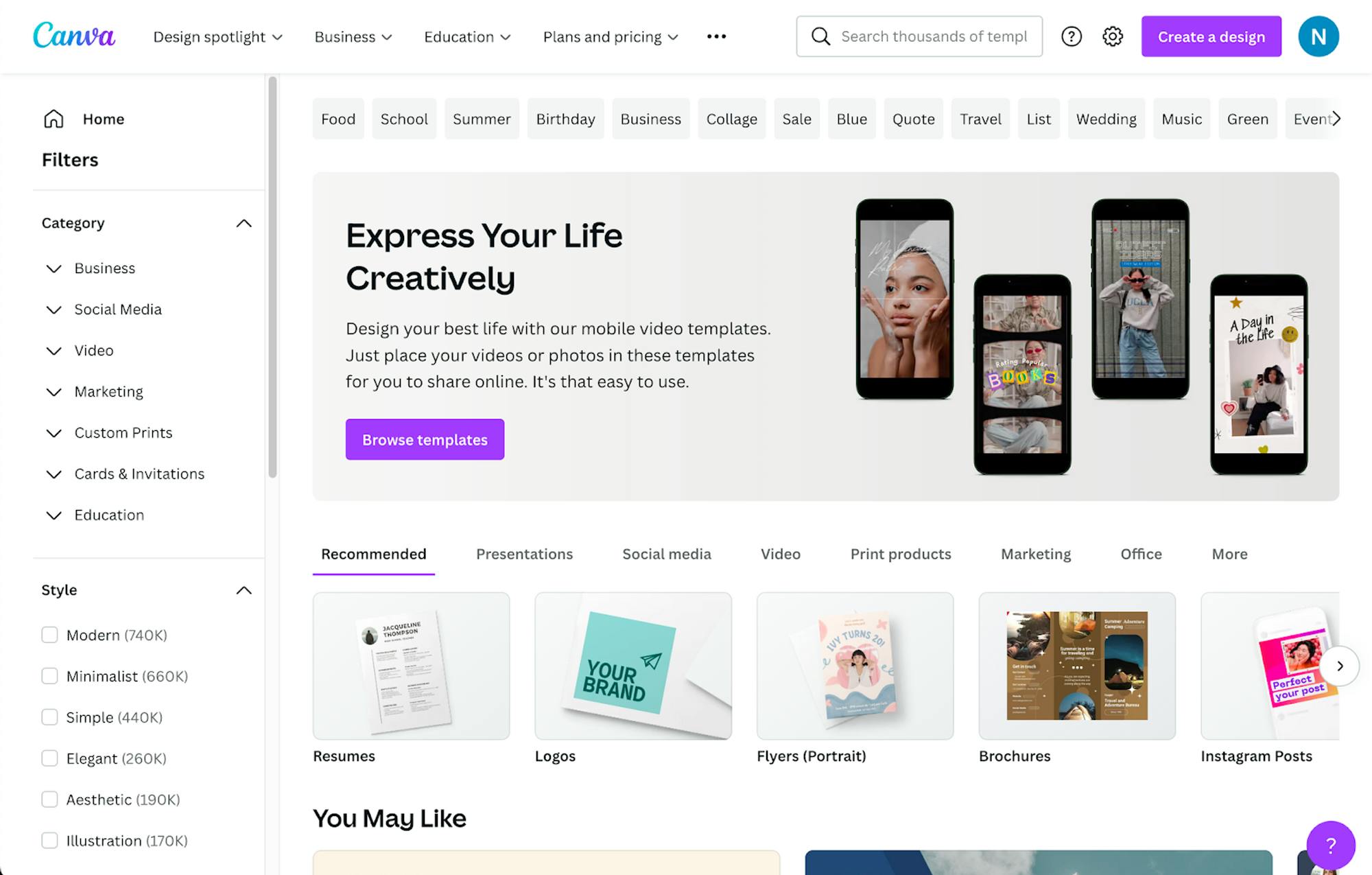

Canva is an online graphic design and publishing platform that allows users to create a wide range of visual content, including presentations, social media posts, posters, and more. Canva also offers a range of pre-designed templates, and a library of over 1 million stock photos, graphics, and fonts that users can use to create their designs.

Source: Canva

As of July 2022, Canva has over 100 third-party app integrations. Each integration makes it easier for users to import media, discover content, edit photos, and share and publish their designs. Notable integrations include Instagram, HubSpot, Box, and Slack. The Instagram integration allows users to create and share designs. Hubspot integrations let users share images using Hubspot social, emails, ads, and CMS. The Box integration enables users to keep all their Canva designs in one place.

Canva Creators is a marketplace for creators to share designs with Canva’s 65+ million users and monetize their design templates. A committee reviews all design templates before publishing them on the marketplace. Canva also offers Canva Print, an on-demand printing service. To start offering Canva Print, Canva partnered with companies already offering printing services such as Staples Canada. Popular print products offered through Canva Print include invoices, yard signs, banners, cards, business cards, canvas prints, and more.

Source: Canva

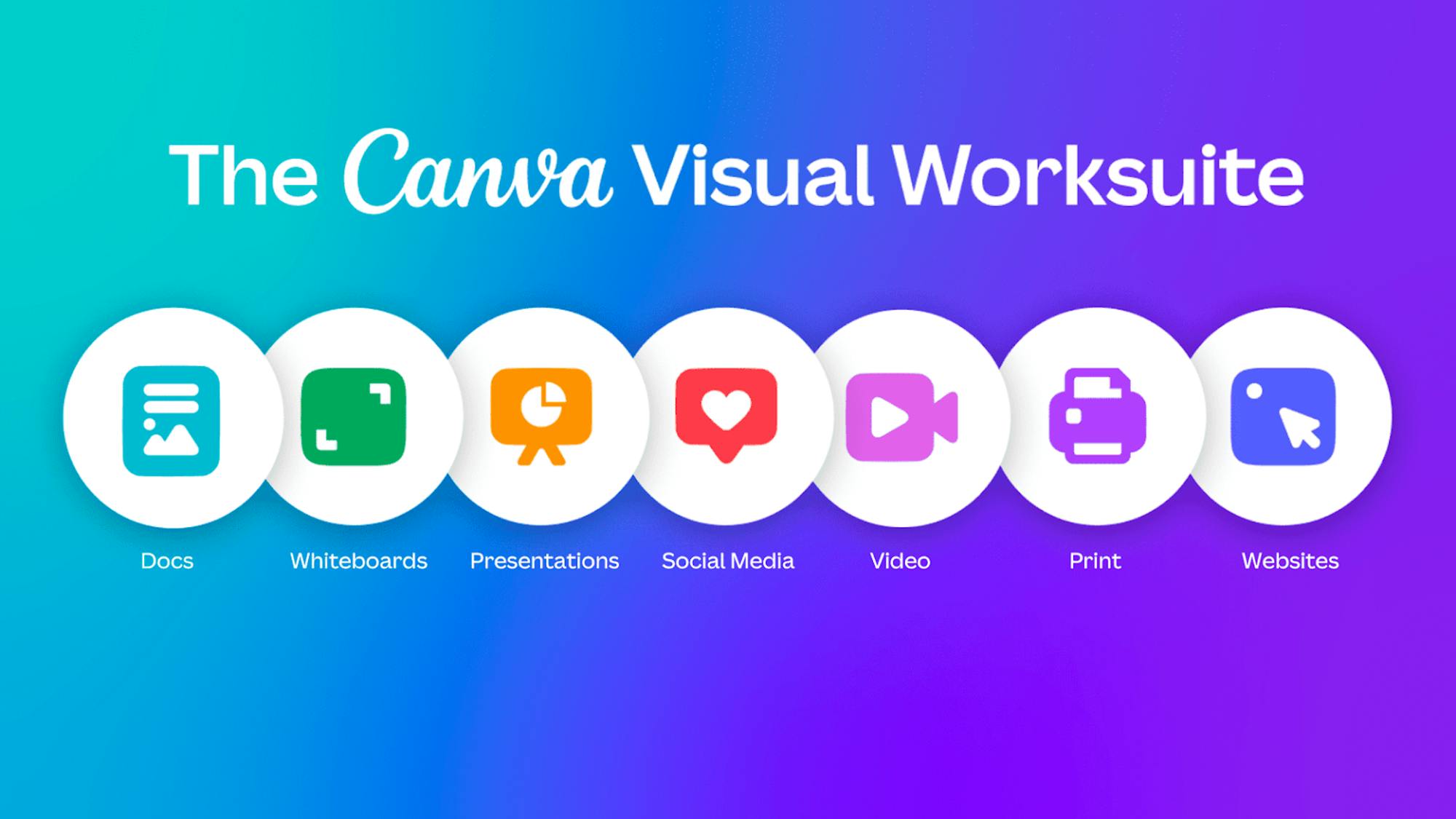

In September 2022, Canva announced its move beyond graphic design and into broader creative work, along with the launch of Canva Visual Worksuite. The newest product offerings included Canva Docs, Canva Websites, Canva Video, Canva Whiteboards, and Data Visualization, which comes from Canva’s acquisition of Flourish. Canva’s new product breadth puts them in competition with creator suites like Google Docs and Microsoft Office.

Competitive Pillars

When you compare the surface area between Figma and Canva, you see a very different dynamic. Canva has reached over $1 billion in ARR across 75 million active users. Figma has ~$400 million in ARR and 4 million active users. That represents an average of $100 in value per user for Figma compared to Canva’s $13 per user. Where Figma has maximized the value from professional users, Canva has been built on the value of the long tail of citizen designers.

Canva’s competitive leadership as a tool for citizen designers comes from a number of meaningful factors:

Addressing The Long Tail of Use Cases

Leadership in Design Mindshare

Community & Distribution

Addressing the Long Tail of Use Cases: Canva’s platform is not built for one specific type of design over another, but rather is meant to address every aspect of visual design. The launch of its Visual Worksuite further extended it into categories like video and website design.

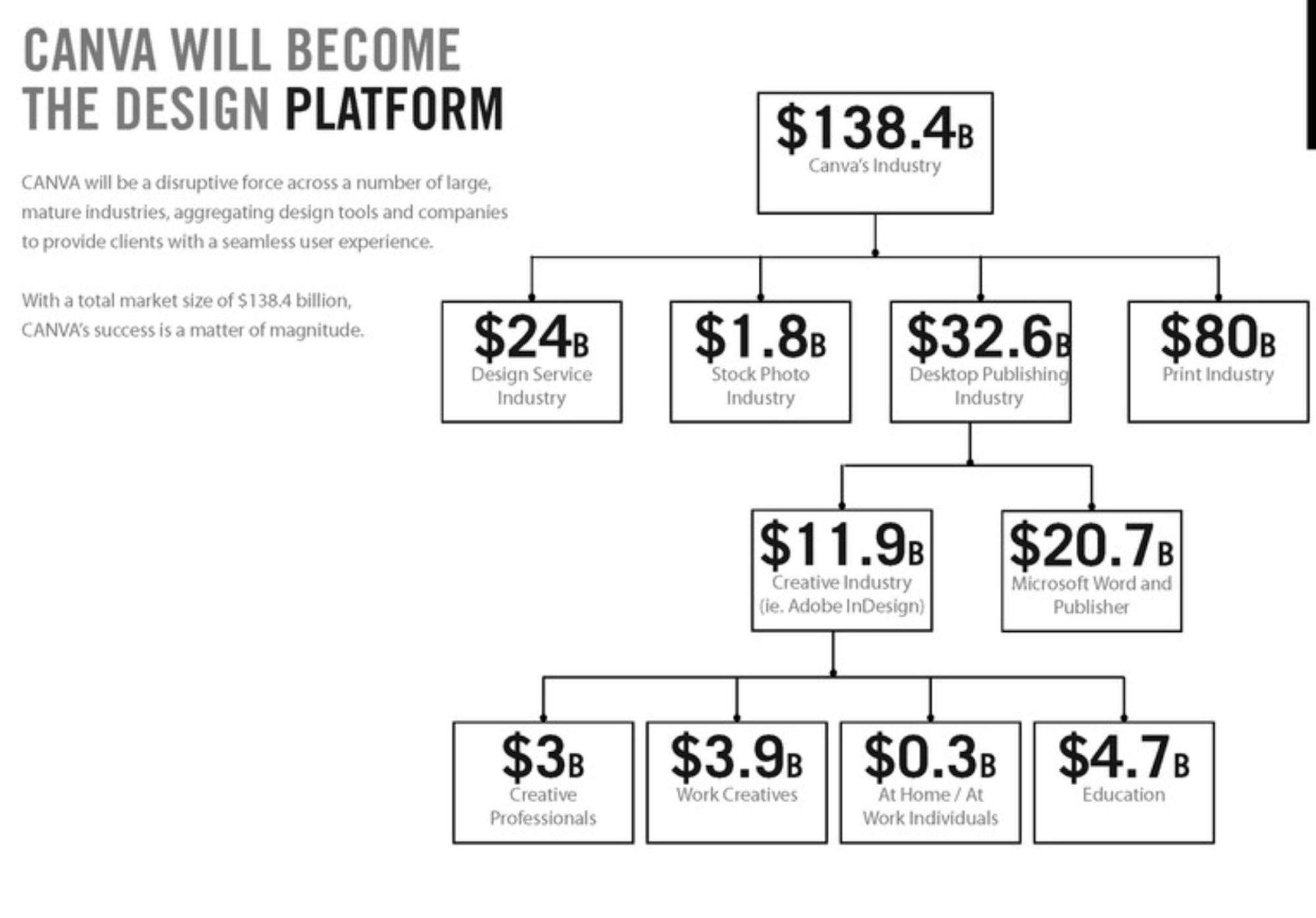

From early on, Canva outlined its market as addressing every aspect of the world of design. Canva’s vision was “taking on the entire world of design… beating Microsoft Office and Adobe and Google Docs and a bunch of other companies.” In Canva’s first pitch deck, Melanie Perkins projected their addressable market to be nearly universal across all categories of design:

Source: Canva’s First Pitch Deck, 2012

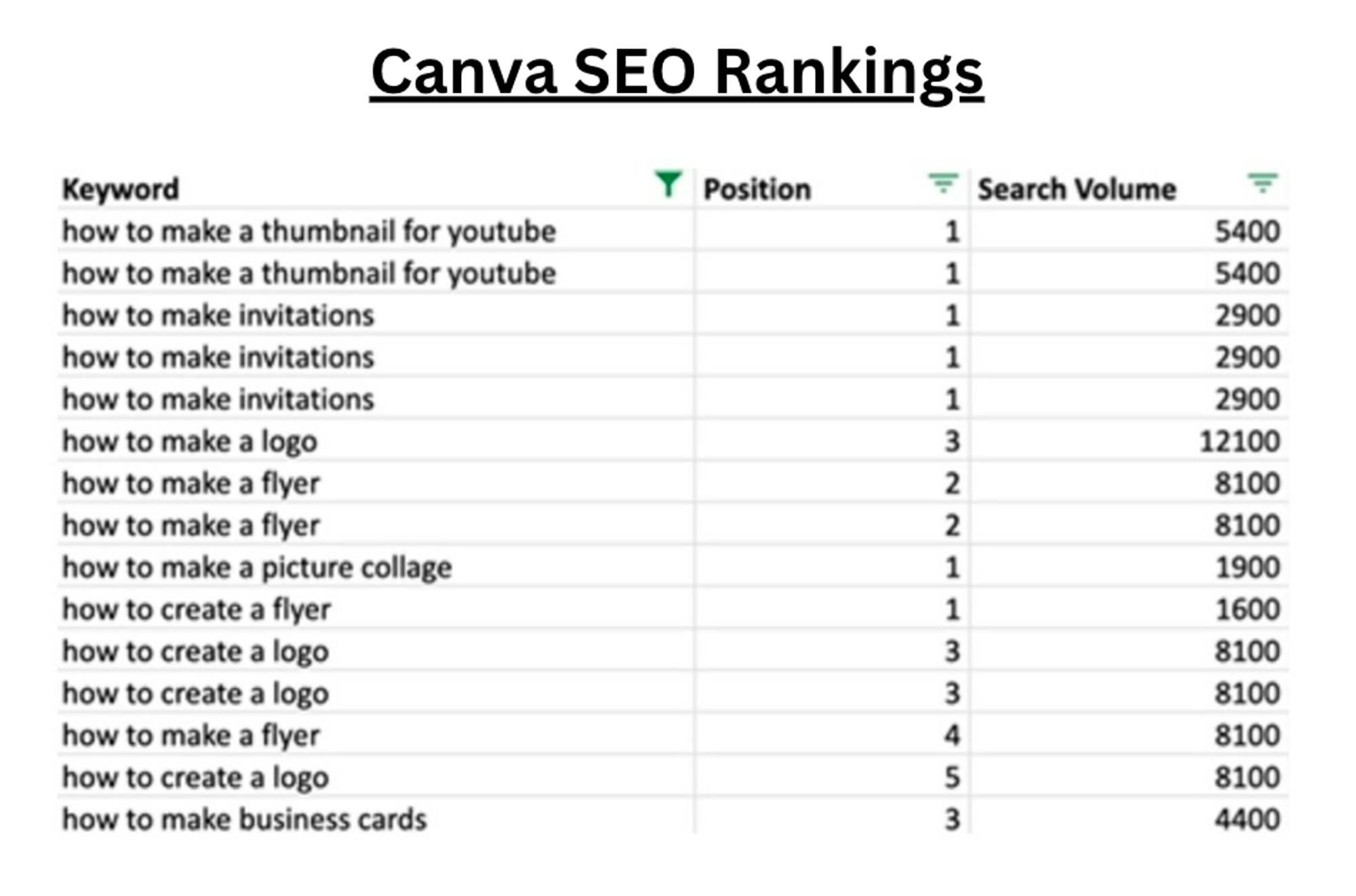

Leadership in Design Mindshare: The flexibility of Canva’s product to extend to all types of design allowed the company to address all types of designers. Rather than needing to own the market on specific types of design, it could focus on addressing all types of design with its marketing. Specifically, Canva has executed an extensive SEO strategy to associate their product with every design “job to be done” that a user could have.

Kevin Kwok laid out some of the key elements in Canva’s competitive strengths as it built up this massive collection of design mindshare:

“Canva’s distribution is driven in large part by their SEO. Unsurprisingly, the very same use cases people use Canva for are what people looking for design tools want to do and search Google for. With their product and templates built around these use cases, it’s easy for Canva to expose that externally and have lots of templates and examples ready to go for potential new users looking to do a specific design. Everything about their user acquisition and onboarding is built around the specific use cases people have and Canva’s atomic concepts. They are built around the functional workflows people have, whether that’s making a Twitter background photo, a wedding invite, or a keynote presentation. And Canva is committed to making that as easy as possible.

As they’ve grown, Canva has expanded its ecosystem by creating marketplaces and communities around templates, layouts, fonts, and more. Most users don’t want to build from scratch. With Canva’s marketplaces, there is an entire ecosystem of pre-built components they can use, both free and paid.”

Mostly Borrowed Ideas adds some additional context about Canva’s traffic in his deep dive on Adobe:

“For context, Canva already receives higher traffic than Adobe. While the traffic is largely similar in the US, the traffic delta is significantly higher in the international market. Perhaps not surprisingly, younger people i.e. 18-24 years old are some of the dominant users of Canva. And it’s not just all SEO game since as per Similarweb data, ~75% of the traffic to Canva is direct vs ~50% for Adobe.”

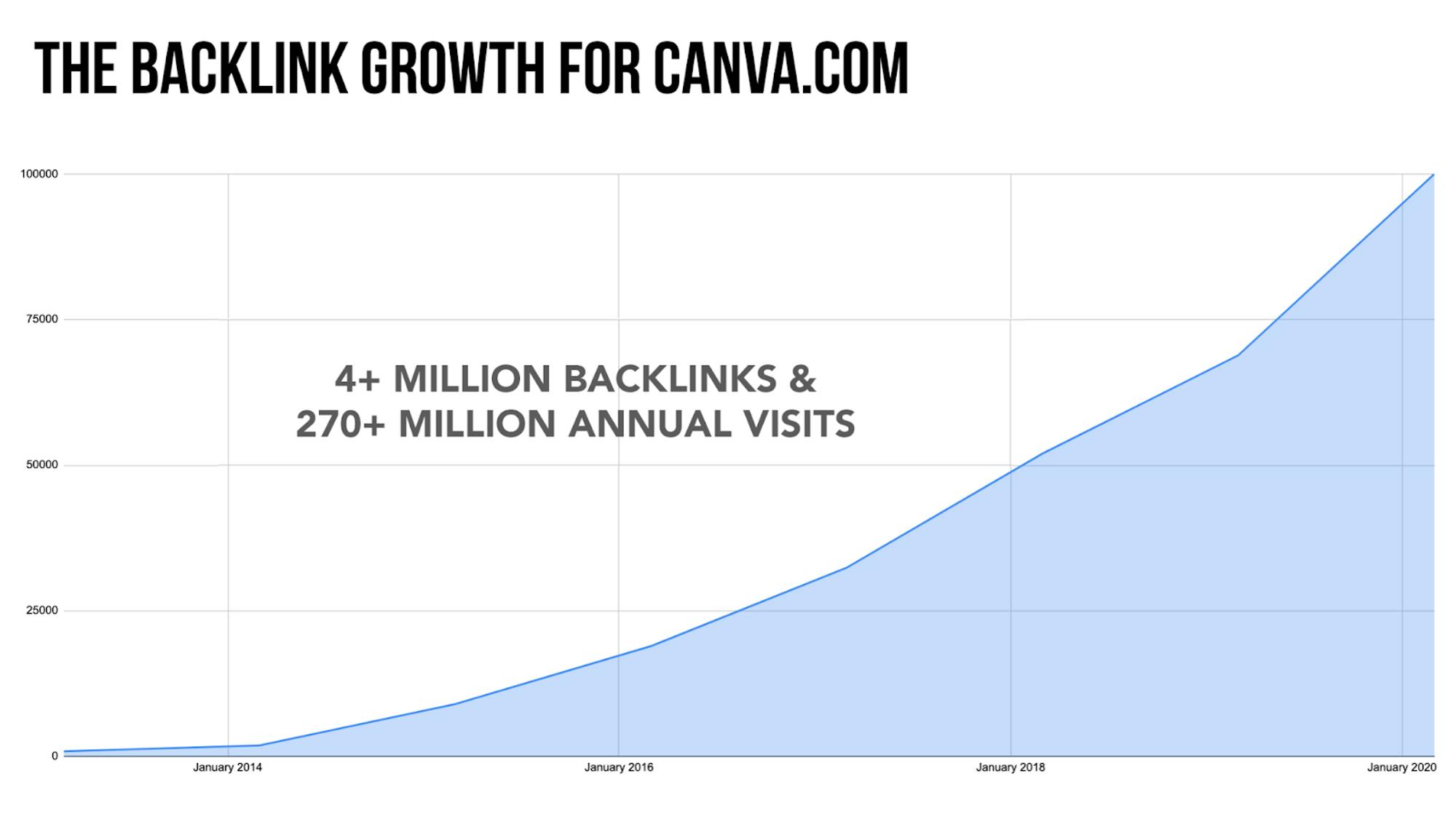

Canva has built a library of over 4 million backlinks that refer traffic back to Canva’s website across their hundreds of landing pages. For a topic as simple as “Invitations,” Canva has 70+ different possible landing pages, depending on whether you want to create baby shower invitations or BBQ invitations.

Source: Foundation

Community & Distribution: Within two years of being founded, Canva had already launched a marketplace. This evolved into Canva Creator, a place where professional designers can make money selling templates, graphics, or photos, with some designers making as much as $50K a year. Canva has grown its community of users from 6 million in 2015 to over 100 million per month as of October 2022.

Having an ecosystem of users across different design categories led to a powerful network effect that has made it difficult for new competitors to displace Canva. With so much coverage of so many different categories, and with users spread across each of them making templates, support content, and tutorials, it becomes much more difficult to replicate that level of distribution.

Microsoft’s Design Threat

Where Adobe has primarily served professional designers with specialized skills, Microsoft has been more well-known for addressing the long tail of users across most of their products. Office 365 is meant to be a collection of “low floor, high ceiling products” that are approachable for everyday users, but experts can also get extensive functionality from.

In the design world, Microsoft has never had a meaningful business in creativity software (even if you count Microsoft Paint). In 2005, Microsoft launched its Expression Suite to compete head-to-head with Adobe products like Photoshop and Illustrator, as well as website and video design products. In 2010, there was a rumored discussion of Microsoft acquiring Adobe, but nothing has ever materialized. In 2012, Microsoft shut down its Expression Suite, opting instead to deepen its partnerships with Adobe to act as distribution for Adobe’s software.

Since then, Microsoft has had limited exposure to the world of design. The company’s partnerships with Adobe have become more focused on marketing and data rather than design. While Microsoft was briefly in conversation to consider acquiring Figma, it doesn’t seem to have ever been a serious consideration.

Instead, Microsoft’s latest move into design would end up being more of a competitive threat to the generalist tools of Canva than the specialized products from Adobe and Figma. In October 2022, Microsoft announced Microsoft Designer, a design suite suited for “social posts, videos, presentations, flyers, and more. No design experience required.”

Source: Microsoft

The announcement of Microsoft Designer included a partnership with OpenAI and DALL-E 2 which allows users to create custom images using text or images. OpenAI has said that more than 1.5 million users are actively creating over 2 million images a day with DALL-E 2, including artists, creative directors, and authors. Both the interface of Microsoft Designer, and the AI-based image generator feel quite similar to Canva, which launched AI-based image generation in November 2022.

Despite the competition between large and small companies, the competitive dynamics aren’t as simple as the size of the company or the value of the end-market. Competition in the world of design comes down to what Kevin Kwok refers to as “atomic concepts” that define how each product is built:

“These companies [like Figma and Canva] have distinct atomic concepts from Adobe [and Microsoft]. The primitives that their products are built around are fundamentally different from those of Adobe’s product lineup. It’s these different fundamental atomic concepts that turn Adobe’s advantage of an established product and existing userbase into a weakness that hinders their ability to counter these upstarts. The opportunity for these new atomic concepts to thrive is driven by the new use cases and types of users unearthed during market transitions.”

Digging in to understand these differences is critical in understanding (1) the size of the opportunity that each company is tackling, and (2) the future of design in each category.

The Tool Belt of the Designer Class

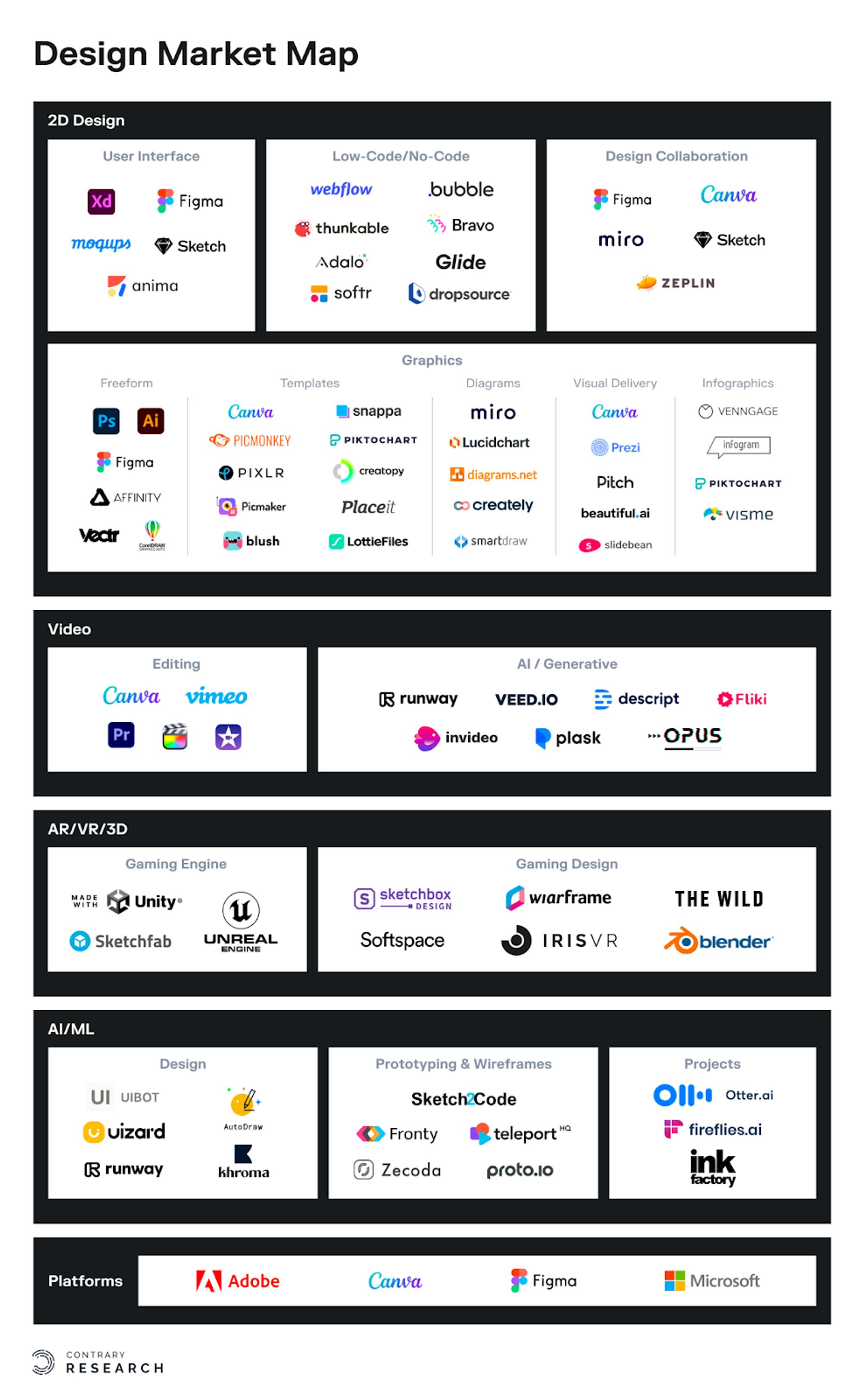

Across categories, players have emerged to own certain aspects of different kinds of design. The more digital surface there is to be designed, the more effectively a certain tool can own that category. 20+ years ago, designers would have been limited to an overly-complex tool like Photoshop, or an overly simplistic tool like Microsoft PowerPoint. But the landscape has changed.

Source: Contrary Research

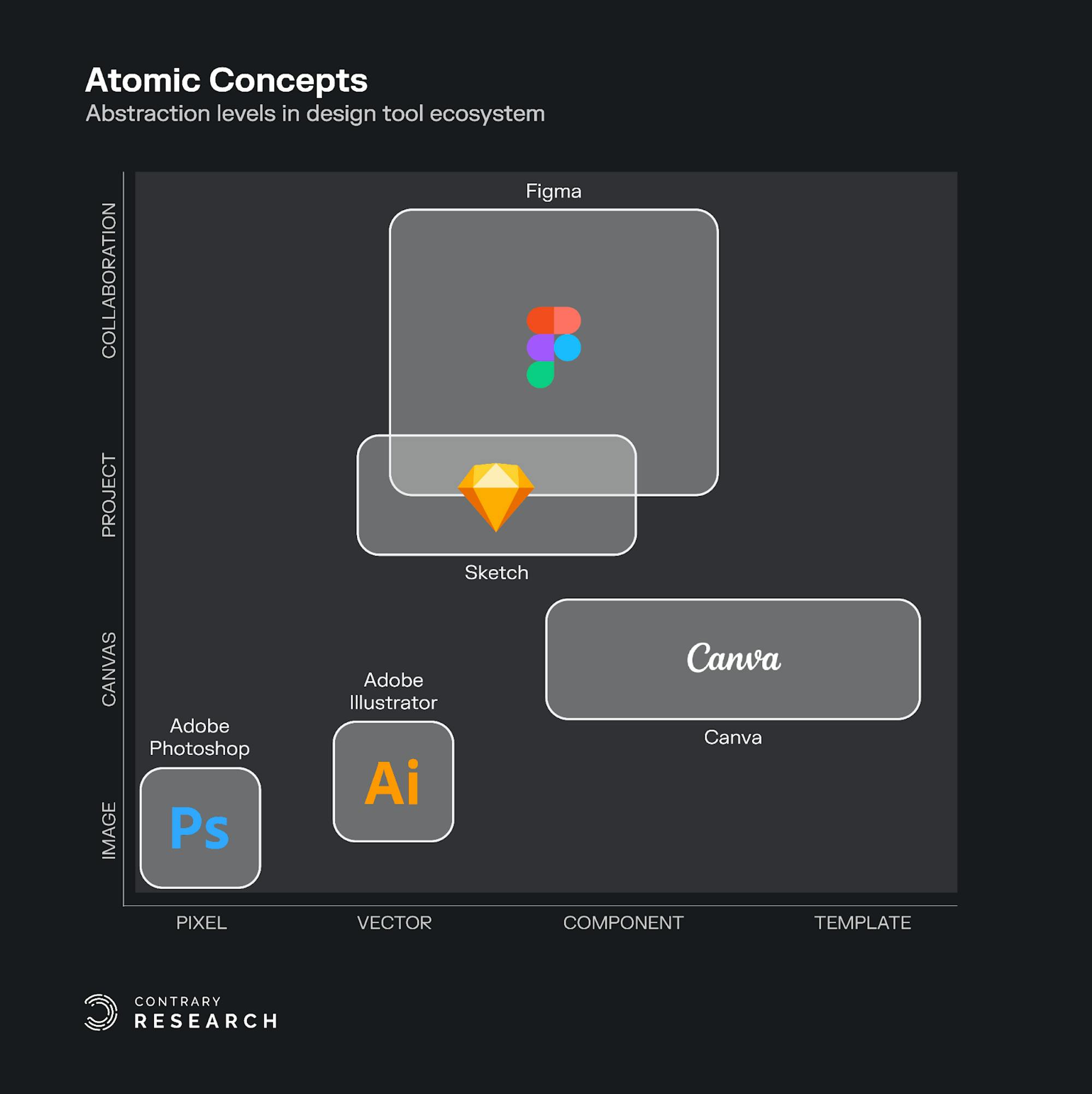

There are two meaningful drivers behind how these different design tools have oriented themselves. The first is Kevin Kwok’s idea of “atomic concepts” that each product revolves around. These are specific “primitives” that a more specialized design product attempts to emphasize in what aspects of design they own.

The second is around market positioning. Since designers now exist on a spectrum from professionals to citizen designers, companies that have placed their products on the spectrum with a focus on professional designers will have very different priorities in what their product includes, how much they charge, and how focused they are on multi-stakeholder buy-in. Products focused on citizen designers, on the other hand, will have an entirely different focus because of where they fall on the curve of designers.

The Landscape of Atomic Concepts

Source: Kevin Kwok

The evolution of the design market has extended in two different directions: (1) the working style of the projects, and (2) the underlying medium of the design. Historically, design software has been largely focused on pixels or vectors around specific images. As customer’s demands evolved they focused on expanding to more holistic projects (i.e. multiple stakeholders), and simplified building blocks (i.e. templates).

Kevin Kwok explains this evolving landscape as a function of customer’s evolving expectations:

“Changing customer needs are the largest source of entropy in markets. When customer needs rapidly change, there is less advantage in being an incumbent. Instead, legacy companies are left with all the overhead and a product that no longer is what customers want. There are many causes of changing customer needs. Often there are new and growing segments of customers with different use cases. Existing products may work for them, but they aren’t ideal. The features they care about and how they value them are very different from the customers the legacy company is used to. Companies resist changing core parts of their product for every new use case since it’s costly in work, money, and attention. But every once in a while, what was once a small use case grows into one large enough to support its own company.”

This is directly in line with Canva’s growth strategy. The Canva team seeks to identify the “job to be done” customers are attempting to address and then build their product around that use case. But this doesn't stop at the product, as Canva’s go-to-market strategy is structured around that use case as well. Figma also took aggressive bets (e.g. did people want to collaborate in the browser?), but they similarly paid off right into the “job to be done” demanded by customers.

As Kevin Kwok goes on to explain, Figma and Canva are both built around atomic concepts that were relevant to changing customer preferences, and this gave them a specific advantage against incumbents like Adobe. For Figma, that core concept revolves around collaboration, not because that was the only feature that mattered, but because it was a paradigm shift that shaped every other aspect of the business and ultimately became the core functionality that customers increasingly expected:

“When Figma first started, it was more directly a Photoshop competitor. Over its first two years, though, they shifted their focus specifically to designers working on the UI and UX of digital products as they talked to more potential users. Building out the product to enable collaboration uniquely was key to these designers. Doing this was non-trivial. The technical challenges to do so were very hard, though Figma was well set up due to Evan Wallace’s technical prowess and specific knowledge in new technologies like WebGL. Building for collaboration to its fullest extent has led Figma to rethink almost all of the company—leading to new pricing models, distribution models, and sharing form factors.”

For Canva, the advantage is the “jobs to be done” approach to customers needs that focuses on what the user is trying to accomplish, regardless of what the tool prefers (e.g. Photoshop’s expectation of vectors):

“Photoshop can do everything they want, but it is too low level. Photoshop’s atomic concepts are images and pixels. Editing at the pixel level is perfect for photos and image manipulation. Canva operates at a higher abstraction level—the one its users care about. Canva designs start with their purpose in mind, whether that’s designing a pitch deck, an Instagram post, or a wedding invitation.”

Beyond the different customer demands that each company was shaped around, they’re addressing fundamentally different formulas for market success in terms of both quantity and price.

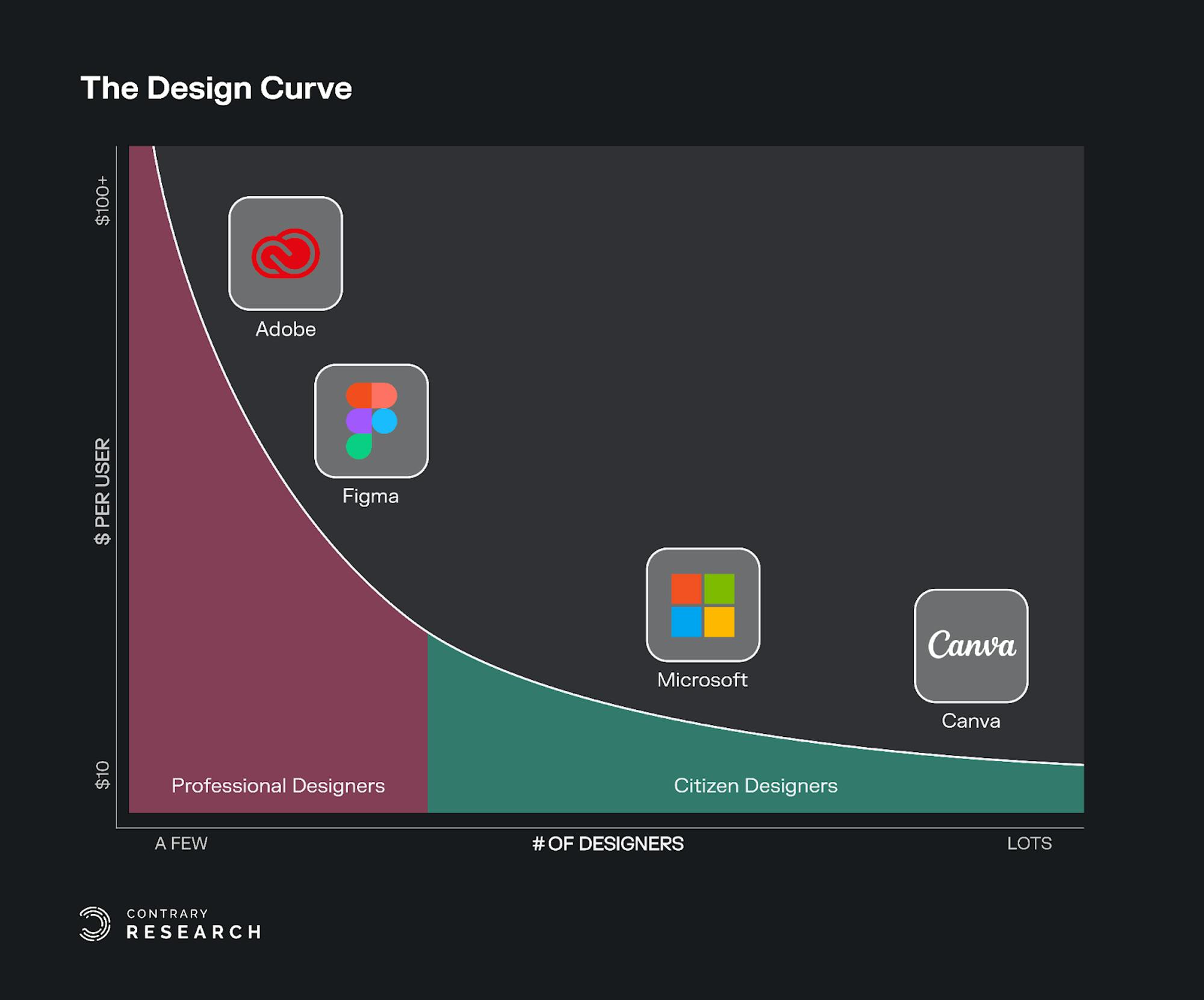

The Design Curve

Source: Contrary Research

Microsoft has failed to compete with Adobe for largely the same reason that Canva and Figma are unlikely to overlap in a meaningful way. The formula to succeed in high-volume, low-value markets is often antithetical to the formula for success in a low-volume, high-value market.

Microsoft’s strength has historically been distribution. Look no further than the upending of Slack in favor of Microsoft Teams. Teams has grown to 270 million users in 2022, compared to Slack’s 18 million. While Teams may not be the most performant tool, it is well integrated into the broader Office 365 ecosystem, making it better suited for larger businesses.

Adobe is quite different. While their products have also achieved significant distribution, their core competency has historically been around product quality. Photoshop and Illustrator are dominant, not because they’re the easiest to use, but because they’re the best tool for the job. Adobe had, for their time, built these products around the needs of most expert users, and were rewarded for it.

The curve in design has bifurcated into these two segments: high-value professional designers, and high-volume citizen designers. Professional designers represent anywhere from $100 to $1.3K+ ARPU for Figma and Adobe. Citizen designers may only represent a ~$13 ARPU for Canva, but there are significantly more of them. The product and distribution strategies of each are quite different, and both primed for success in an increasingly aesthetic world.

The Size of the Prize

Source: Adobe

Adobe estimates the market for professional designers at ~$25B across 68 million creatives. Figma has already demonstrated that their addressable market expands beyond just the designers, with two-thirds of their user base coming from non-designers.

The market for citizen designers includes what Adobe terms “communicators,” with 900 million content creators, marketers, and more. Generalist tools like Canva also address the broader consumer market with 4 billion possible users engaging with social media and other casual demands for amateur design.

As design has expanded beyond simple product design to include different mediums, that addressable universe has expanded. The rising demand for visual communication has led to the market that exists today, but what does the future hold?

The Future of Design

The last 10 years of design have been pioneered by creator tools: arming the long tail of citizen designers, and offering professionals more flexibility. As we look at the future of design over the next 10+ years, there are dramatic shifts coming with the rise of generative AI from companies like OpenAI’s DALL-E-2, and the exploding criticality of mediums like video, gaming, and 3D design.

AI-Driven Design

The progress in large language models (LLMs) has driven a leap forward in the quality of automatically rendered images. From OpenAI’s DALL-E 2 to Stable Diffusion, Midjourney, and more–generative AI is becoming a meaningful part of every design platform. Both Microsoft Designer and Canva have launched text-to-image generators, and large companies like Shutterfly have embraced DALL-E 2.

However, not everyone has embraced this technology so readily. Getty Images is, instead, suing Stability AI, the company behind Stable Diffusion for copyright infringement. Another generative AI product from Microsoft is the target of a class-action lawsuit as of late 2022. The biggest questions stem from how these models are trained, and if they’re based on the images and text of other creators, how are those creators being compensated?

Generative AI isn’t going anywhere. Design platforms have already embraced the implications, and started to integrate this technology into their products. The future of design will likely be driven by designers, but augmented by AI.

Wells Riley, Head of Design at Runway, and previously Head of Design at Envoy, describes the impact of generative AI on design this way:

“I think it’s more a question of ‘when’ than ‘if.’ In their current form these tools are mostly just toys… but toys often inspire people to create powerful tools that we can’t really imagine today. Humans will wield AI to make creative works like they do a brush or a mouse. In some cases, people are already doing this. But I think it will be better, less uncanny, and more creative. The humans will partner with AI to give it context, and a reason to create.”

From the perspective of the companies playing in this space, the real question will be whether large platforms like Adobe and Microsoft will be most well-equipped to build AI into their existing products, or whether platforms like Canva, or video-creation suite RunwayML can more effectively leverage the technology?

Evolution of Design Mediums

We’ve outlined the evolution of digital experience from simple, functional user interfaces to more beautifully designed user experiences. In the same way that the importance of visual imagery defined the last 10+ years of our digital experience, other mediums will similarly shape the future of our digital interactions. Canva’s suite is a good framework for the breadth of coverage that design will need to start better addressing: not only designs, and presentations, but documents, videos, websites, and more.

Video: Adobe and Apple have been in video editing for decades with products like Adobe Premiere, Apple Final Cut, and iMovie. Canva recently launched a video editing tool as part of their Visual Worksuite. While Adobe Premiere has 1/5th the monthly downloads of Adobe Photoshop, the importance of video is just getting started.

Platforms like TikTok have demonstrated the dramatic reach of video, with one viral video being able to generate 15 trillion impressions in one month. Platforms like Instagram and YouTube are attempting to capitalize on the rising importance of video as a content medium. The increasing relevance of video for consumers will have a similar lift for design platforms that Canva and Figma saw over the last decade.

Generative AI will also be laced into these new mediums. Platforms like Runway ML are infusing video editing software with AI, both to produce content and offer advanced editing features. Other platforms like Midjourney are able to create AI-produced concept art for films based on human-provided prompts.

Websites: When Microsoft shut down their Expression Suite, they not only got out of the design game, but out of front-end web development entirely. In a blog dedicated to exploring the functionality of the Expression Suite, one Microsoft user described the company’s exit from front-end creation this way:

“To put it in plain English: As of right now [December 2012] Microsoft no longer has a stake in the front end web development game. Expression Web has too many useful features to count, chief amongst them the seamless integration of advanced CSS tools that made it easy for novices and seasoned pros alike to build, dissect, troubleshoot, and publish standards based, future proof, and forward thinking CSS in a snap.”

Even Figma, while primarily used for creating visual experiences, emphasizes the importance of the design’s connection to web development as a whole:

“In Figma, the Code panel offers an easy way to extract code information from a specific page element. The code will be displayed by clicking on a layer.”

Platforms attempting to power the application layer of web development are taking different approaches as site builders (Squarespace, WordPress, Wix), no-code / low-code tools (Webflow, Bubble, Glide), and e-commerce storefronts (Magento, Shopify). Canva created a website builder because they recognize the direct connection between design and the interface to interact with those designs:

“Canva was born on the Internet, and as everything moves online, we believe the vast majority of designs and documents will be shared as dynamic and interactive visuals, instead of static documents. With Canva Websites, anyone can share their ideas as a customized website in a matter of minutes. No coding required.”

New Design Engines

As design has evolved to expand beyond static images to interactive experiences, consumers' expectations for their digital lives have continued to evolve. Gaming and AR/VR have emerged as a preferred type of experience, with almost 40% of the global population playing video games. New design tools, like Unreal Engine from Epic Games, have emerged as the foundation of this type of design:

“Unreal Engine is one of the most popular 3D game engines in the world, holding a 10-20% market share in the industry. Game engines are software development programs originally used to develop video games. Over time, these powerful rendering and visualization tools also expanded to support other industries, including architecture and manufacturing. Today, Unreal Engine is used in not only video games (Fortnite, Arkham Knight, Mortal Kombat X) but also film and television (The Mandalorian), automotive (Nascar, Ferrari), and fashion (Balenciaga).”

In the same way that broad design platforms, like Canva, have expanded from static images (presentations, flyers, posters) to active mediums (video, websites), there will be aspects of any leading design platform that will expand to include components of gaming as the next wave of consumer’s preferred mediums.

Who Is Holding the Brush?

Design continues to evolve as quickly as consumer preferences change. From architecture and physical spaces to digital visuals and interactions, design is a reflection of the modern world. The future of design will be shaped by multiple mediums and the increasing prevalence of generative AI. Design will become more personalized as the marginal cost of creativity drops dramatically.

Adobe’s acquisition of Figma will create a behemoth in the world of professional design. Figma can leverage Adobe’s superior distribution of over 25 million paid users compared to Figma’s 4 million users. Superior technology and extensive distribution will be an operational advantage for Adobe in solidifying their leadership in design. The only risk now is whether regulators will push to block the acquisition in 2023.

Meanwhile, Canva’s continued expansion of its platform has made it the most common tool for citizen designers. Canva’s success can be largely attributed to owning so much mindshare among would-be designers trying to get a specific job done. Microsoft’s partnership with OpenAI, their Designer platform, and their broad enterprise distribution will likely be a formidable threat to Canva as both companies battle it out to win over the long tail of citizen designers

The only sure thing in the world of technology is that more aspects of our lives will include digital components, not less. As those aspects of life become digital, the quality of the experience will depend on being well-designed and personalized. Design will play a critical role as companies attempt to set their digital experiences apart.