Plant agriculture, one of humanity’s oldest industries, has been central to the rise and fall of civilizations throughout history. Despite its central role in the survival and success of societies, agriculture’s own technological progress has been slow. Major innovations have been rare, with only two transformative periods in recent history. The Industrial Revolution of the 18th century, which introduced mechanized equipment, enabled a smaller share of the global population to work in agriculture and a larger share to work in manufacturing, while still feeding that population even as it grew. The Green Revolution of the 20th century, which raised farming yields using chemical fertilizers and pesticides, mitigated poverty and hunger in developing agricultural nations and increased agricultural yields globally.

Agriculture in the 21st century is already struggling to meet current global demands and may fail entirely based on future demands. That threat has prompted a reconsideration of ways to improve agricultural efficiency and output. Global food demand is expected to rise 51% by 2050 to feed a projected population of 9.7 billion. Meanwhile, the US farm economy and labor force are shrinking. The US lost 200K farms between 2007 and 2025. In 2024, there were 2.4 million open agricultural jobs, and 56% of farmers reported labor shortages. Immigration crackdowns have further reduced the agricultural workforce, with nearly 44% of farm laborers in 2020 estimated to be unauthorized immigrants. At the same time, this workforce is aging. In 2025, the median farmer was 58, and one-third of farmers were over the age of 65. Agriculture also has the highest rate of fatal occupational injuries in the US, adding to the difficulty of attracting new workers.

Economic pressures have only added to this strain. Plant agricultural inputs like fertilizer and crop protection systems have become more expensive, with fertilizer prices rising more than 15% annually between 2023 and 2025. As a result, 53% of farmers in North America expected lower profits in the next two years as of 2024.

We need a Third Agricultural Revolution to have any hope of feeding the planet in the future. Farmers and technologists alike are struggling to find innovations in agricultural operations that will make a dent. Automation, in particular, stands out as a potential solution. Farming is a function of inputs, tools, and labor. The Industrial Revolution provided better tools, and the Green Revolution provided better inputs. The Third Agricultural Revolution will have to tackle labor. By reducing reliance on strenuous labor, improving working conditions, and lowering costs, automation could reshape how farms operate.

The Existing Automation Landscape

Advocates for automation in plant agriculture aim primarily to replace humans in current agricultural operations or modify operations to reduce the need for human labor. Automation solutions range from semi-autonomous solutions, such as assisted steering on tractors, to fully automated robotics for tasks like weeding and spraying. Innovations in autonomous agriculture technology span the operational process from seeding and crop management to harvesting, sorting, and distribution. These technologies differ depending on the crop type, with vineyards, row crops, indoor agriculture, and specialty growers requiring different technologies for the physical and logistical differences in their operations.

As a collection, these technologies are referred to as “precision agriculture,” also defined as the tools and process that enable automation and involve collecting, analyzing, and acting on real-time data. This data can be collected through a variety of on-premise sensors as well as drones and satellites. Precision tools include both physical hardware and software that support decision-making. As just one example, it is estimated that 93 million gallons of starter fertilizer can be saved annually across US corn farms through precision techniques. Adoption of precision tooling is still in its early stages, with roughly 15% of farms using precision tools.

The existing landscape of plant agriculture automation can be broken down in line with the agricultural cycle, which consists primarily of: land preparation, sowing (planting), crop care, harvesting, sorting, and distribution.

Crop Life Cycle Management

Soil Preparation: The first step in readying farmland for the agricultural season is soil preparation. This process can involve clearing the land of debris from dead or dying plants, loosening soil for new plants, and testing and enriching soil nutrient profiles. Autonomous operations in this phase include self-driving tractors and robotic soil sample collection and analysis.

Self-driving tractors eliminate the need for human drivers of vehicles that plough, till, and harrow agricultural land. One of the primary benefits of self-driving tractors is the implementation of sensing systems that can determine where plots of land need more or less work, eliminating the need for human judgment. Another major benefit is the ability of vehicles to operate for longer periods of time, including through the night, without switching out operators. This is a logistical benefit, especially for large farms where thousands of acres of land require preparation, though these systems are best suited for farms with consistent internet connectivity.

Traditional tractor companies and startups are both pursuing autonomous operations. John Deere, a major tractor manufacturer, announced self-driving tractors in 2022, which are available to customers as new sales or upgrades to existing equipment. John Deere uses onboard AI-enabled decision making and 360-degree cameras. AgXeed, founded in 2018, has a fully autonomous tractor used for ploughing and ran for 24 hours straight in June 2025.

Source: AgXeed

Robotic soil sampling enables growers to monitor soil health over time by consistently sampling farmland and testing samples either internally or at off-premise labs. Soil sampling robots determine soil pH, nitrate levels, and other mineral levels. Companies like ROGO Agriculture offer such soil sampling robots with lower tested error rates than manual hand probes, auger, or hydraulic probe samples. The company offers reservations to farms (with discounts dependent on the time of year) for sampling using ROGO’s fleet instead of selling equipment directly.

Sowing (Planting): Planting seeds is the next step in the plant agricultural season. For farms with thousands of acres, planting requires large concurrent labor availability or missing out on the ideal timing for crop germination. One study from 2019 determined that corn crop planting in the US was no faster than in 1980, though this may be due in large part to limiting weather windows for planting each spring. Automated sowing operations aim to speed up this process by taking advantage of opportune weather windows.

Robots for automated sowing take the form of tractor-like vehicles, smaller ground vehicle robots, and even drone seed delivery systems. FarmDroid, founded in 2018, offers a self-driving tractor that automates sowing, weeding, and spot-spraying. Smaller autonomous robots can navigate between existing plants, like corn stalks, to plant cover crops, which protect soil from erosion, enrich soil nutrient profiles, and sequester carbon to improve annual crop yields. Cover crops have also been successfully planted with drones, eliminating mechanical compaction of soil.

Fertilizing & Pest Mitigation: Throughout the growing season, crops must be consistently maintained and monitored for threats like pests, diseases, weeds and infectious species, in addition to routine adjustments for seasonal temperature, moisture, and weather changes.

Startup Earth Rover produces the CLAWS, a camera-equipped rover that identifies weeds and kills them using electromagnetic pulses, removing the need for potentially carcinogenic chemicals or disturbed root soil. The rover can operate during day or night, and can kill 60 weeds per second. Founded in 2018, Carbon Robotics is another company that provides an AI-powered laser weeder, which is not self-driving but can be attached to the front of a human-operated tractor. Carbon claims that its equipment cuts weed control costs by 80% and kills 99% of weeds. The FarmWise Vulcan, a similar product, can cover three acres per hour and can operate in any conditions.

Source: Carbon Robotics

For vineyards, nurseries, and berry farms, companies like Naio Technologies provide autonomous crawling robots for both under-vine weeding and tasks like canopy management. Automated systems for tasks like pruning and variable irrigation are still in development as of October 2025.

Navigation: For all elements of crop management, autonomous navigation is a critical element of effective implementation. For seeding, fertilizing, and pesticide distribution, it is necessary to cover every part of a crop area without covering areas twice. Agritech companies use Global Navigation Satellite Systems (GNSS), Inertial Navigation Systems (INS), and Real-Time Kinematic (RTK) systems to orient and navigate farmland.

Global Navigation Satellite Systems (GNSS): these systems use high-precision satellite triangulation to pinpoint the location of equipment, enabling autonomous driving and distribution of fertilizer, seeds, and water depending on location.

Inertial Navigation Systems (INS): these systems use sensors like accelerometers and gyroscopes to consistently determine position relative to a starting point, which can be combined with GPS to provide high-precision location and trajectory data for equipment. These systems are most commonly used for equipment that is calibrated to follow set paths or that will operate in places where GPS signal is unavailable or unreliable.

Real-Time Kinematic (RTK): these systems use GNSS signals combined with real-time measurements from a fixed base station to calibrate position down to centimeters, compared to the meter-level precision of traditional GNSS systems. This makes RTK systems suitable for high-precision tasks like seeding and soil sampling.

Scouting

In agriculture, “scouting” refers to the process of distinguishing normal crops from those that are abnormal or defective, determining which plants or areas of a crop have been impacted by genetic abnormalities, pests, diseases, weeds, or other issues. Scouting takes place both during the plant growing season and ahead of harvest.

Orchard Robotics*, founded in 2022, uses machine learning to provide information on the health and number of crops using a tractor-mounted camera system called FruitScope Vision. This data is then stored and implemented in an OS called FruitScope Vault.

Source: Orchard Robotics

Another startup in the space, farm-ng, enables real-time phenotyping of plants within a crop using its Amiga electric rover. The system can also monitor crop health and outcomes, facilitating predictive breeding for future crop generations.

Autonomous robots scouting vineyards for grape diseases were reported in September 2025 to match human performance at the same task, doing the work of 4-5 humans. Similar robots operate on the ground in berry patches and other crop fields where fruit is difficult to observe, or from the air via drones.

Harvesting

Harvesting is the phase in plant agricultural production in which the fruits of the crop are extracted and sorted. Harvesting automation includes de-leafing robots, mechanical harvesting, mobile collection systems that assist human harvesters, and automatic sorting machines that separate sellable product from the total yield. These systems use robotics combined with computer vision and AI programs to identify produce and extract it from plants without damage to the product or the plant. This can involve a combination of suction cups, blades and scissors for snipping, and multi-finger grip arms depending on the crop being harvested.

One startup equipping agricultural operations with automatic harvesting hardware is Agrobot, which services indoor and outdoor berry farms with an automatic harvesting system which uses LIDAR to navigate rows of plants and color and depth sensors to identify the size and location of fruits to be harvested.

Source: Agrobot

Distribution

While agriculture distribution has started to see self-driving delivery trucks and robotic packing operations, the most widespread application of automation to distribution is automated tracking and inventory management. The Internet of Things (IoT) paradigm helps farmers track not only the location of agriculture shipments but also the humidity, temperature, and bacterial growth of their products. Similarly, automated weather tracking systems can help farmers adjust inventory shipping schedules, storage, or pricing in light of expected supply and demand dynamics.

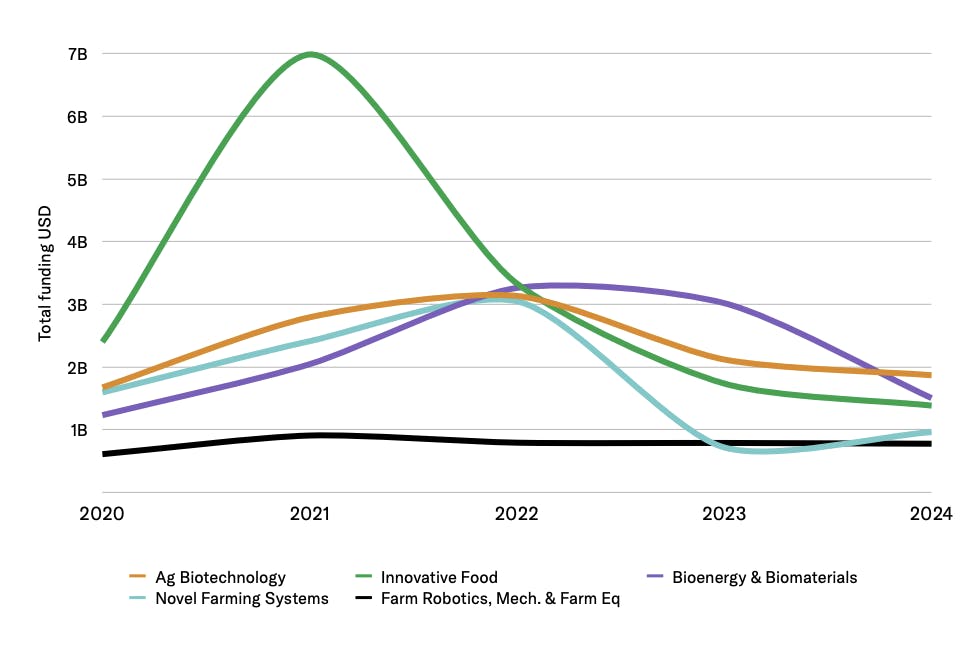

This overview highlights only a subset of the startups and corporations building autonomous solutions in agriculture. Globally, farm robotics raised a total of $774 million with 104 deals in 2024. The US made up half of the total global funding, with $345 million invested in farm robotics across 19 deals. Overall funding has remained relatively flat between 2020 and 2024, with a 9% increase in 2023 and 2% decrease in 2024 YoY. When compared to other agrifoodtech investments, farm robotics remains a minority of total investment. Agriculture biotechnology, which includes genetically modified crop strains that are resistant to disease and pests, is a substantially more developed market (shown in orange on the chart below, compared to the black line representing agricultural equipment automation and robotics).

Source: AgFunder

Barriers to Change

In theory, farms could automate the majority of manual labor and decision-making, only needing humans to oversee the processes. In practice, however, automation remains in its “infancy”, with less than 5% of farms using automation and robotics.

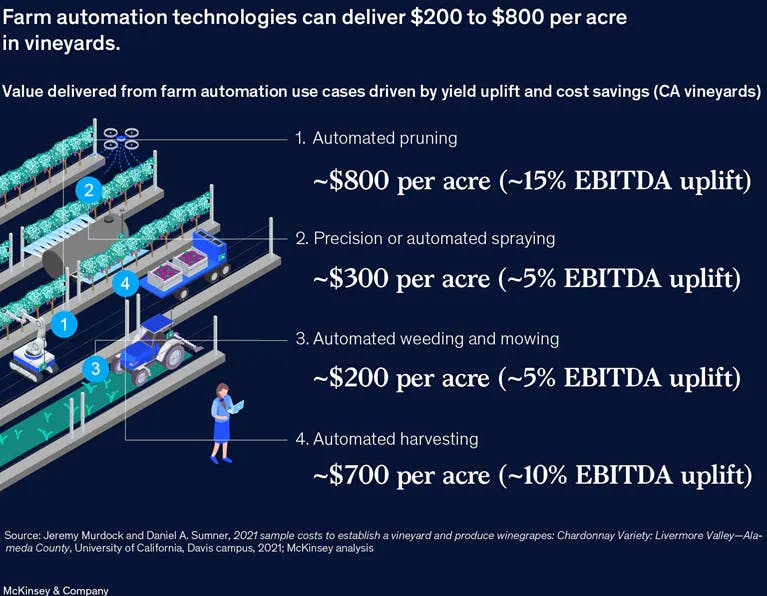

The largest barrier is financial, as automation and robotics require high upfront investment and ongoing maintenance. At the same time, the ROI is often unclear to farmers, especially for smaller farms with thinner margins. 50% of farmers are unwilling to pay anything for new technology, and when they do consider it, they expect a minimum ROI of 3:1. The graphic below shows approximate bottom-line benefits from the integration of agricultural technology to vineyards as of 2021.

Source: McKinsey

Given the upfront costs, large farms (>2.5K acres) are 45% more likely to adopt agtech solutions than small farms (<100 acres).

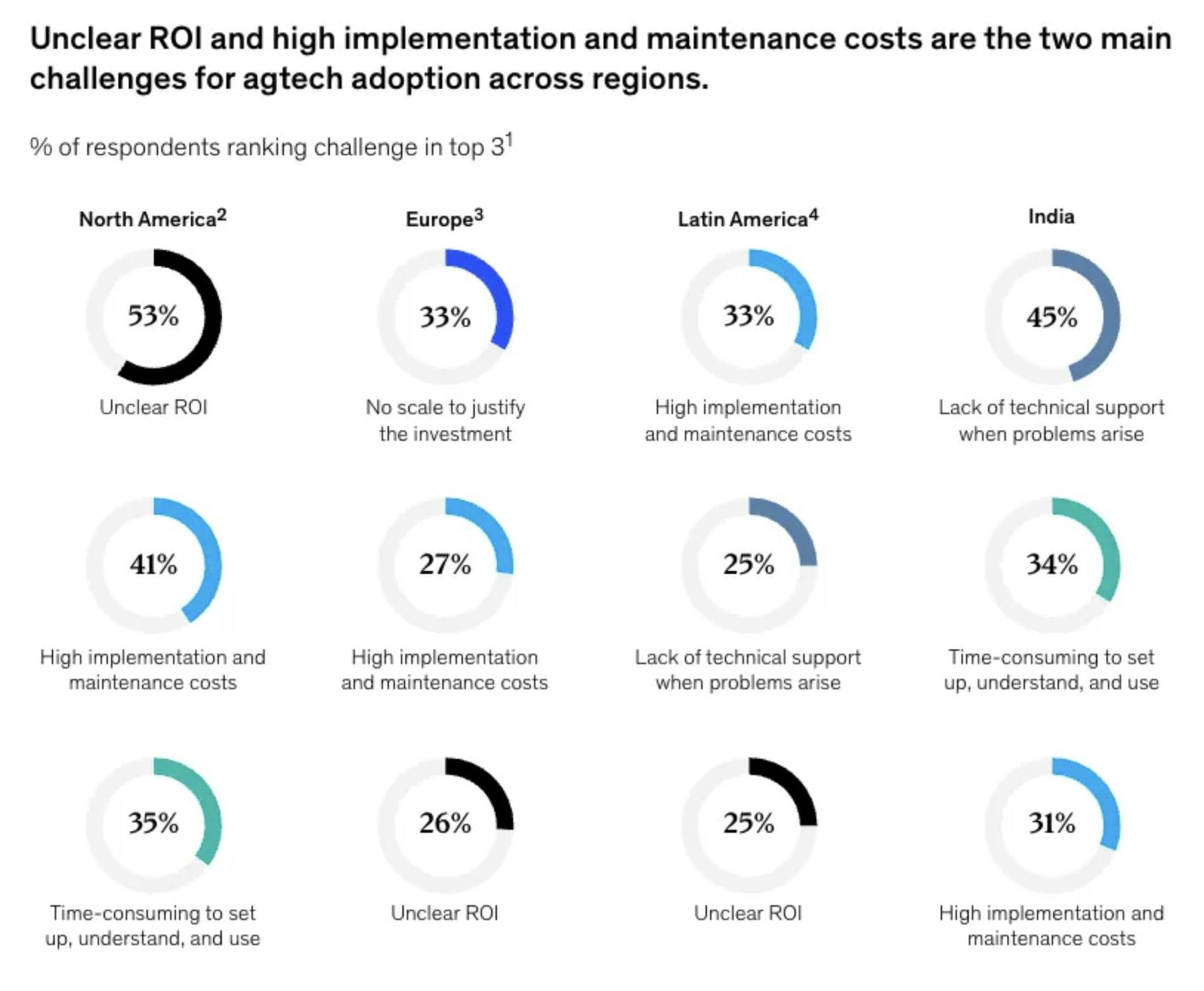

Source: McKinsey

Even when technology is available, implementation can be complex. Robotics and precision systems require additional training to operate, maintain, and integrate into existing workflows, creating additional friction for adoption.

Outlook for Automating Agriculture

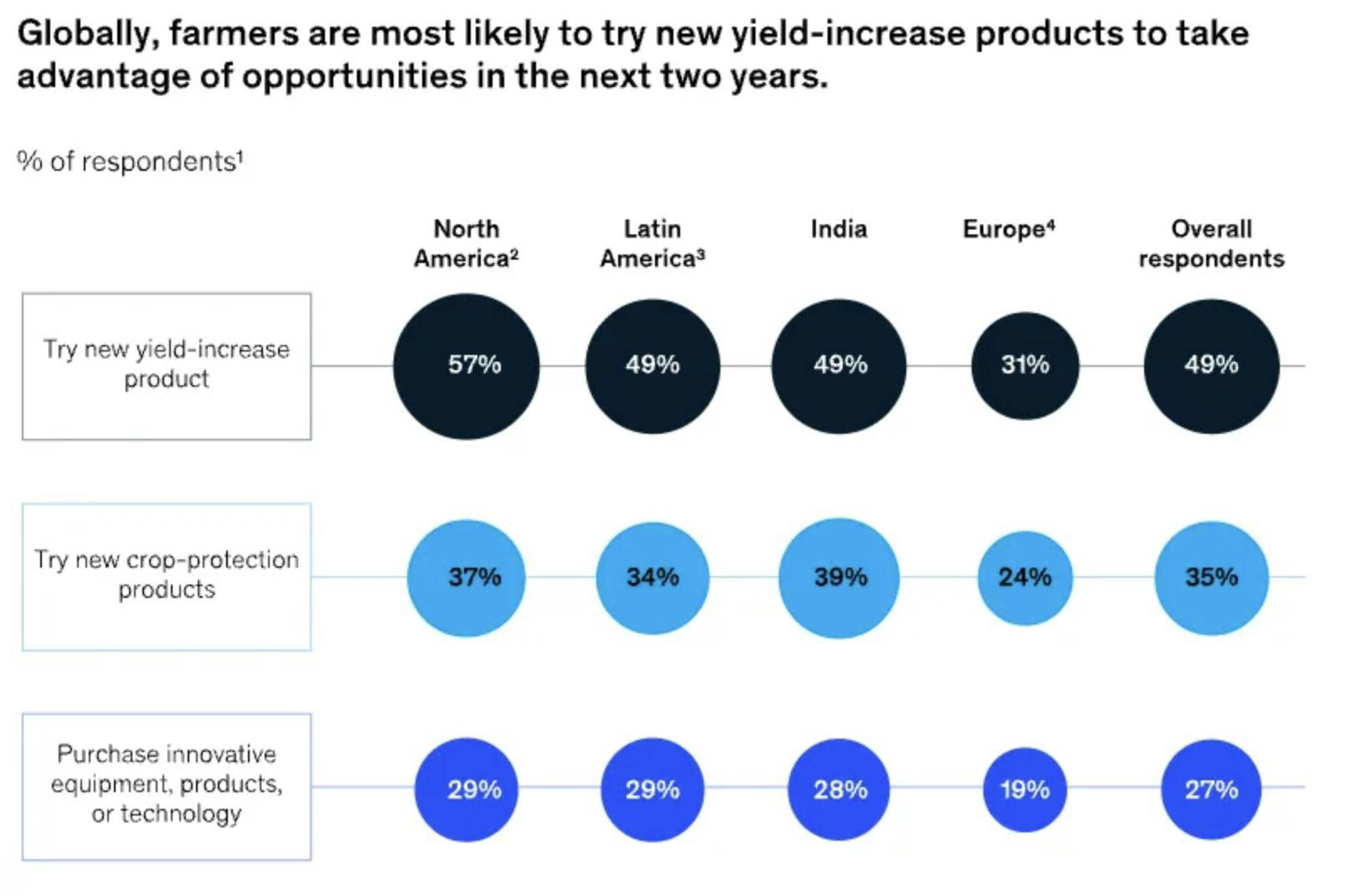

While current adoption rates remain low, farmer attitudes suggest room for growth. In 2023, 81% of large farms (>5K acres) were planning or using at least one technology in the next two years, with 76% of medium farms (2-5K acres) and 36% of small farms (<2K acres). Despite openness to adopting agtech, interest in robotics specifically is lower, with only 27% of farms globally expecting to purchase innovative equipment, products, or technology.

Source: McKinsey

This gap between general openness and robotics adoption is shaping how agtech companies approach the market. Rather than pushing large, one-time hardware purchases, many firms are turning to usage-based models that reduce upfront costs and make ROI more tangible. However, many external factors could underplay the improvements of using technology, such as extreme weather events, pests, and commodity prices. Pricing structures that allow for incremental adoption and low-risk entry are therefore more attractive. For example, Farm-ng’s Amiga (acquired by Bonsai Robotics in 2025) offers a modular robot, providing farmers with an affordable option for under $13K, with the option to upgrade parts over time.

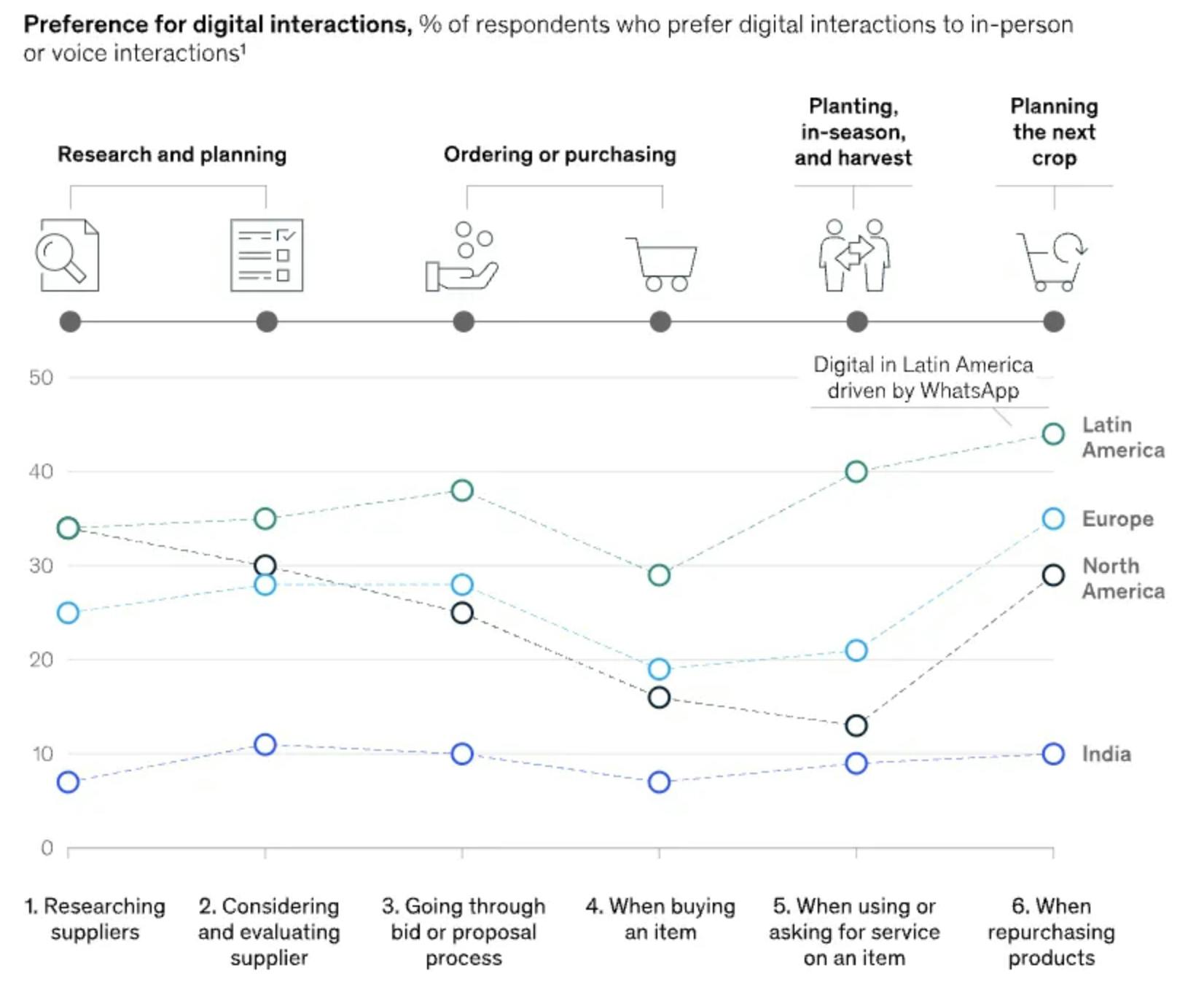

Another consideration is distribution and sales models. Fewer than 20% of farmers in North America prefer to purchase equipment digitally, indicating that in-person marketing and relationship-based sales are critical for adoption. For agtech startups, this means building strong regional networks may be more effective than purely digital strategies. Additionally, the abundance of information about different startups can make it daunting for farmers to evaluate and select technologies. This friction can be reduced by providing clear and accessible information to help farmers make a business decision.

Source: McKinsey

Finally, integration and centralization are important considerations in assessing the overall friction associated with adoption. Many startups offer separate automated solutions for various parts of the agriculture process. To increase adoption, platforms will be needed that unify these systems to reduce complexity. Platforms that can centralize data and automate decision-making can provide greater management ease. For instance, xFarm was founded in 2017 and provides an app service that can manage precision agriculture tools, machinery, and more in one space.

The Third Agricultural Revolution

While automation will look different across various sub-sectors of agriculture, it has the potential to solve some of the most pressing problems in the industry. Success will depend not just on the effectiveness of the technology, but also on how easily it can be adopted to fit the system of a farm. As innovators and farmers converge on new methods of soil preparation, sowing, monitoring, maintaining, and harvesting crops, agricultural automation presents a tangible solution to the labor force constraints impacting agriculture in the 21st century. Continuing to integrate automated systems to US farms will both decrease reliance on an aging and shrinking labor force and help automated agriculture companies achieve economics of scale.

*Contrary is an investor in Orchard Robotics through one or more affiliates.