Thesis

Grocery delivery is a growing market in the US. At the height of COVID lockdowns in May 2020, 40% of grocery shoppers tried ordering groceries online, up from 28% in 2019. Global ecommerce orders fulfilled by delivery grew about 77% from 2019 to 2021, with ~$30 billion worth of groceries delivered in the US in 2021. Furthermore, online grocery sales are projected to surpass 20% of total retail grocery sales by 2026. Digital grocery shopping is growing faster than in-store grocery shopping as of 2023 and makes up an increasing percentage of overall grocery sales in the US. In 2023, digital sales are expected to account for 11.2% of the $1.3 trillion in US grocery sales.

Another trend impacting the grocery market is a rising consumer focus on sustainability. By September 2021, 60% of consumers were concerned about food waste. The US wastes ~30-40% of its food, resulting in $161 billion of food going to landfills yearly. In addition, wasted food produces 170 million tons of greenhouse emissions annually as of 2022. However, an estimated 20% of wasted food is edible but discarded for purely cosmetic reasons, e.g. bent carrots or discolored apples. Moreover, inventory flow creates additional food waste by pushing out older excess items that are still edible.

Imperfect Foods, a sustainability-focused online grocer, was built to capitalize on the rising consumer preferences for both grocery delivery and environmental-friendly purchasing. It seeks to address food waste by sourcing groceries partially from “ugly” produce and excess inventory and delivering them to customers’ doorsteps. The company sought to build a sustainability-focused grocery delivery brand to win over the growing niche of environmentally-conscious online grocery shoppers. In September 2022, Imperfect Foods was acquired by Misfits Market.

Founding Story

In 2011, Imperfect Foods co-founder and former CEO Ben Simon and three other University of Maryland students started the Food Recovery Network to salvage dining hall food that would have otherwise been thrown out. In 2015, he started Imperfect Foods (initially called Imperfect Produce) with Benjamin Chesler (former COO and Chief Innovation Officer) and Ron Clark (former Chief Supply Officer) by buying fruits and vegetables at discounted rates from large farmers across the US and selling them.

Simon stepped down as CEO in 2019 due to health concerns. Since 2019, Imperfect’s C-suite has experienced additional turnover. After Simon left, Benjamin Chesler, the Co-Founder and Chief Innovation Officer of Imperfect Foods became interim CEO. In late 2019, Philip Behn (ex-Walmart SVP and GM) assumed the CEO role. Behn spent two years as CEO working on expanding the company into new states and product lines, followed by several rounds of layoffs as a result of the struggling expansion efforts until the board pushed him out in 2021. Steve Nave, formerly CEO of Walmart’s Global eCommerce, became Imperfect Foods’ interim CEO after Behn.

In 2022, Dan Park moved into Imperfect Foods’ CEO spot. He was the former CEO of BuildDirect Technologies, which was taken public in May 2021 at a $148 million valuation. Park was the CEO of Imperfect Foods from January 2022 through its September 2022 merger with Misfits Market, until December 2022. All told, between 2019 and 2022, five different CEOs have led Imperfect Foods, and half of its C-suite team has left. After the acquisition by Misfits Market, its CEO, Abi Ramesh, was set to take over as CEO of the combined entity.

Product

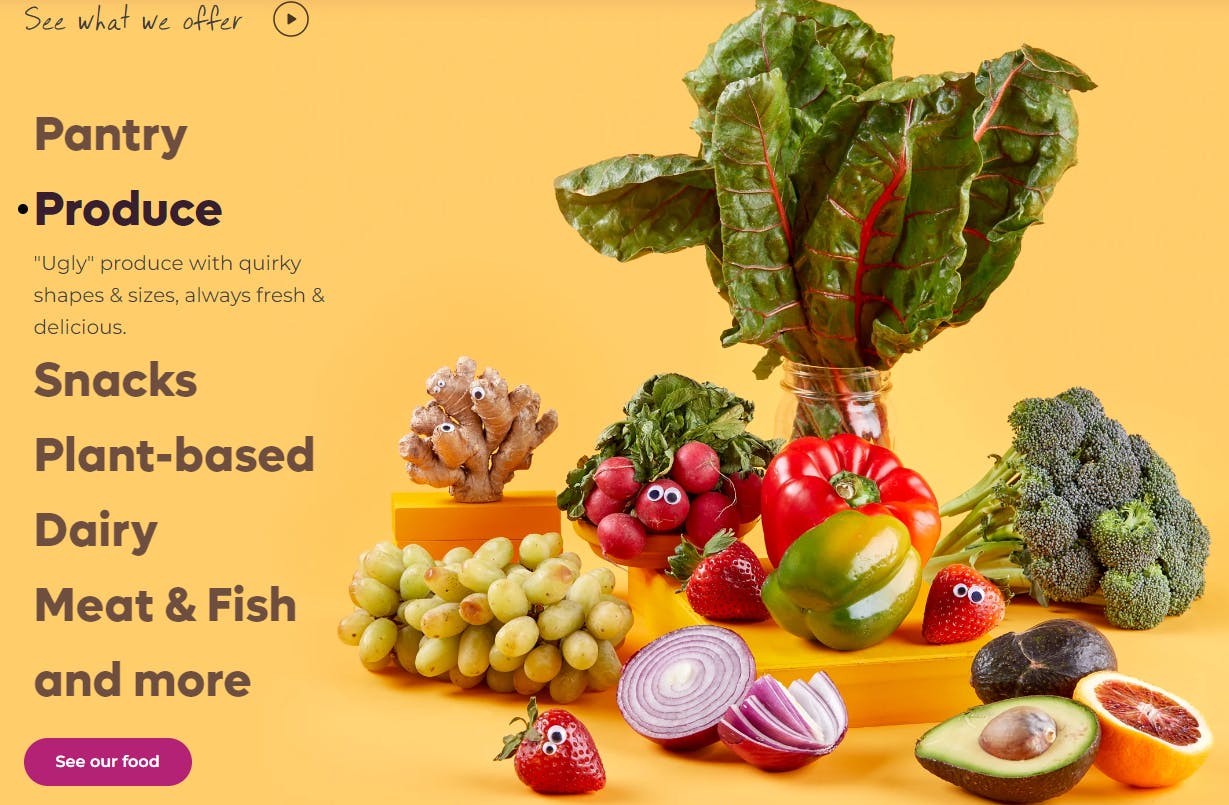

Source: Imperfect Foods

Imperfect Foods aims to be a convenient, sustainable, and affordable grocery delivery service. It offers a suite of products and direct-to-consumer delivery, attempting to replace customers’ trips to the grocery store. It also positions itself as a sustainable delivery option, with deliveries taking place in recycled boxes, delivery routes consolidated to minimize carbon emissions, and the company taking back packaging for reuse or recycling.

Imperfect Foods describes what makes food “imperfect” and therefore eligible for being sold as follows:

Cosmetic imperfections: Items that are “deemed too unsightly for regular grocery stores” and contain “small blemishes, scars, and wonky shapes” that can make the “perfectly good food harder for producers to sell.”

Leftover ends and pieces: The company says that some of its items “are made with a tasty mix of leftover odds and ends, like chocolate bars made with leftover chips and pretzels.”

Rescued ingredients: These are ingredients that come from orders that were canceled by buyers at the last minute and would otherwise by food waste if not “rescued” by Imperfect Foods for resale.

Size or weight imperfection: Food items like pre-made pies or pasta that don’t conform to standard sizes or weights.

Ugly produce: Cosmetic quirks that don’t affect the taste of a piece of produce, which can then be turned into another product like salsa or juice.

Upcycled ingredients: By-products that would normally go to waste, such as okara flour — a leftover from soy milk — which the company uses in many of its cookies.

Organic Produce

Source: Imperfect Foods

Grocery retailers typically don’t accept produce with cosmetic blemishes from their suppliers; as a result, suppliers will discard produce they think retailers will reject, accounting for up to 20% of all produce harvested.

When Imperfect Foods first launched, it only sold “ugly” produce with cosmetic defects like misshapen carrots or potatoes. Grocery retailers typically don’t accept produce with cosmetic blemishes from their suppliers, so suppliers often discard produce they think retailers will not take. Rather than allowing this blemished produce to go to waste, Imperfect Foods sold it directly to consumers through a subscription service. Each week, Imperfect Foods’s subscribers selected the groceries they wanted to be packaged and delivered to the subscriber’s doorstep.

Other Products

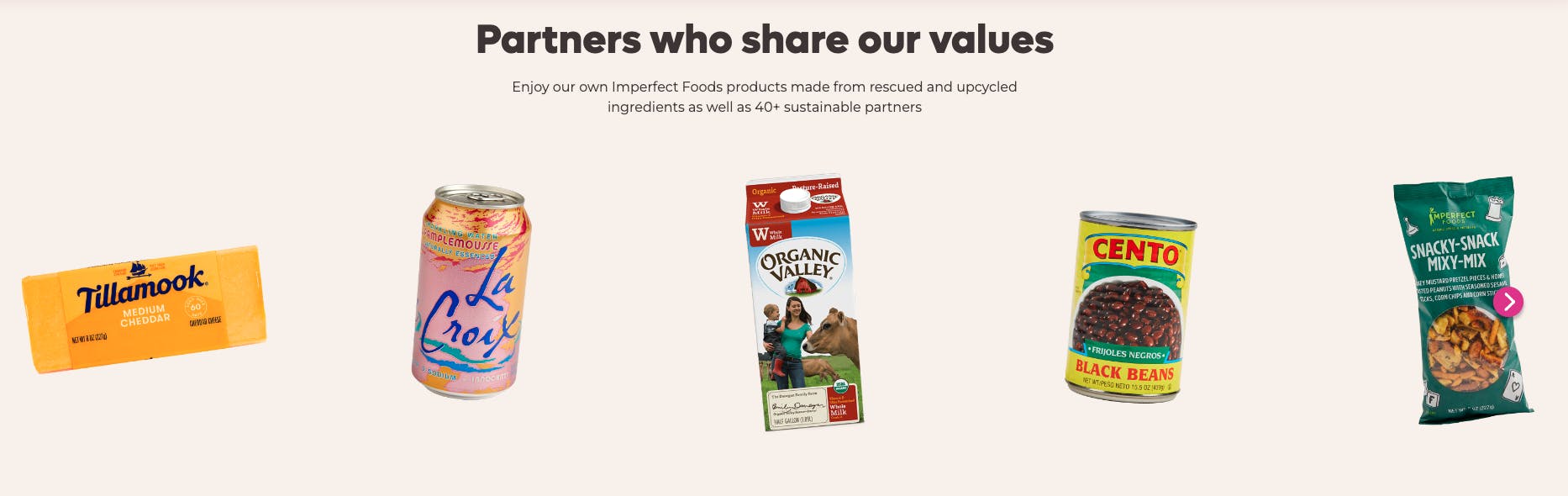

Source: Imperfect Foods

In 2019, Imperfect Foods expanded its product lines to include grocery staples like dairy, meat, and seafood; this is also when it rebranded from Imperfect Produce to Imperfect Foods. Some product lines included rescued goods like excess food inventory that would have otherwise become landfill waste. In 2021, the company also added a small lineup of wellness products such as facial oil, body butter, and soap. It also carries non-produce brands like La Croix sparkling water, Organic Valley almond milk, or Boom Chicka Pop popcorn that the company says “shares your values” as an Imperfect Foods customer.

Delivery Services

Source: Imperfect Foods

Imperfect Foods delivers its products directly to consumers through an online ordering service. On each order, users can customize the groceries they want. Each item is priced individually, and purchases come with a $5.99 **delivery fee. Imperfect Foods then packages and delivers the groceries to the customer’s doorstep.

Initially, to start using Imperfect Foods, customers take a quiz at sign-up about how they like to shop. They would then be assigned a shopping window and delivery day which depends on where they live. Every week, Imperfect Foods would assign a pre-filled cart of food based on the customer’s expressed preferences and on what’s in season, which could then be further customized by the customer. Deliveries would then take place on the same day every week to minimize carbon emissions.

In 2023, however, Imperfect Foods shifted towards more flexible pricing and delivery, it still recommends seasonal boxes with produce most readily available at the given time of year.

Market

Customer

Imperfect Foods targets grocery shoppers who want to make eco-conscious purchases and are especially concerned about sustainability, while also valuing the convenience of online grocery shopping and delivery.

The company appeals to its customers not only in the way that it sources its products but also in how it communicates its value proposition. As of November 2023, it features the fact that it has saved 166.4 million pounds of total food on its website homepage, and includes a slider animation that shows how buying from Imperfect Foods over time can both save time as well as save the environment.

Source: Imperfect Foods

It also appeals to customers by stating that:

“35% of the US food supply went unsold or uneaten in 2019. When you shop with Imperfect, you save food from waste, which conserves the resources that go into growing it.”

Imperfect Foods offers up to a 30% discount for seasonal waste products, but the broader set of grocery staples are priced similarly to retail stores. Therefore, a subset of consumers might be discount-driven. Still, the core customer group will likely resemble a family that regularly shops at brands like Trader Joe’s or Whole Foods: eco-conscious and interested in organic, sustainably sourced food.

Market Size

Grocery delivery is a growing market in the US. Global ecommerce orders fulfilled by delivery grew about 77% from 2019 to 2021, with ~$30 billion worth of groceries delivered in the US in 2021. Online grocery sales are projected to surpass 20% of total retail grocery sales by 2026, by which point the market is projected to be valued at ~$80 billion. Digital grocery shopping is growing faster than in-store grocery shopping as of 2023 and makes up an increasing percentage of overall grocery sales in the US. In 2023, digital sales are expected to account for 11.2% of the $1.3 trillion in US grocery sales.

Within this market, Imperfect Foods is particularly focused on sustainability, making it comparable to other grocery brands like Whole Foods and Trader Joe's, which had a combined market share of ~7% as of 2020. Extrapolating from this, Imperfect Foods’s core addressable market size is ~$5.6 billion of the $80 billion grocery delivery market.

Competition

Imperfect Foods primarily competed with direct competitors like Hungry Harvest and Misfits Market, before being acquired by the latter. Imperfect Foods was available in 43 states as of 2020, while Misfits Market operated in 48 states as of 2022. but both receive similar reviews as of 2023. Indirect competition comes from grocery delivery platforms including delivery companies such as Instacart, Postmates, DoorDash*, Uber Eats, etc., and larger retailers with delivery services like Walmart.com and Amazon Fresh.

Unlike its competitors, Imperfect Foods doesn’t charge a subscription fee and sells items at a discount compared to grocery stores. The company has worked out the “last mile” and “first-mile” logistics by buying directly from growers, which allows it to bypass grocery stores and transportation premiums. Imperfect Foods utilizes smaller distribution centers spread throughout regions and can minimize transportation costs for the last mile of delivery.

It also offers a more extensive selection of grocery items and customer service, which has been praised. Between Imperfect Foods and Misfits, customers seemed to gravitate to one or the other based on minor operational preferences like free delivery cancellations.

As supermarket chains like Kroger enter the grocery delivery market, smaller companies like Imperfect Foods and Misfits may struggle. It is heavily supplier-based, so the availability of its produce varies. Consumers pay similar prices for produce at Imperfect Foods and large discount supermarkets, so the latter’s established supply chains will allow them to offer products continuously and at similar prices.

Business Model

Imperfect Foods acts as an online grocer, taking the goods onto its balance sheet and making revenue on the prices sold to consumers. As of 2023, it no longer charges subscription fees and only charges delivery fees on orders that haven’t met a pre-defined shipping threshold. Its margins are calculated by the difference between grocery sale revenue and the cost of sourcing and supply chain operations.

Imperfect Foods sources most of its produce from California, where 80% of the US’s fresh produce is grown. The company works directly with about 200 growers as of December 2022. Approximately half of its suppliers are tiny, family-owned farms, while the other half are large farms supplying the retail industry nationwide. Imperfect Foods cuts out third-party transportation fees by buying directly from growers and handling transportation themselves. For other goods like meat and dairy, however, Imperfect Foods partners with farms like Clover, Petaluma Farms, and Nounos.

Imperfect Foods made its cold-chain and last-mile delivery supply chains to give it control over its quality, produce availability, and customer services. The company is trying to optimize its supply chain around an 80% stock rate and weekly deliveries instead of on-demand deliveries from grocery stores with a 90%-95% stock rate.

Traction

From 2019 to 2020, Imperfect Foods grew over 100% with $400 million in revenue by the end of 2020 and a $500 million revenue run rate on a subscriber base of 350K. However, most of the 2019-2020 growth came from a surge in online shopping after the onset of the COVID-19 pandemic. Sales and order growth began to slow by Q3 of 2020.

In July 2022, Imperfect Foods announced that it planned to vacate its 38K-square-foot warehouse in San Francisco and cut 50 jobs at its headquarters as a result of “shifting market dynamics. In September 2022, Misfits Market announced it was acquiring Imperfect Foods, and that the two combined companies were on track to generate $1 billion in sales by 2024.

As of Q1 2023, Imperfect Foods had saved over 172.6 million pounds of food, the equivalent of 143 million meals, and delivered to 400K users. This user base figure was up from 300K in mid-2022, which represented a 15% drop from its 2020 high.

Valuation

Imperfect Foods has raised $229.1 million in total funding as of August 2023. In Q1 2021, it raised a $110 million Series D to increase production capacity, expand private-label programs, improve the shopping experience, and support suppliers. The company was acquired by Misfits Market in September 2022.

The company’s valuation at the time of its Series D funding was $700 million. With a revenue run rate of over $500 million in 2020, its implied revenue multiple was .4x. By comparison, Misfits Market’s revenue multiple was approximately 10x as of December 2022. Instacart, meanwhile, had $2.6 billion in revenue in 2022 and was at a $7.2 billion market cap as of November 2023, implying a revenue multiple of ~2.8x.

Key Opportunities

Private-Label Products

There is an opportunity for Imperfect Foods to grow its private-label offerings. Private-label products could allow Imperfect Foods to grow its brand equity and sell products at higher margins. Private-label product sales open the possibility for Imperfect Foods to see the high margins of grocers like Trader Joe’s or Costco.

When Misfits Market announced it was acquiring Imperfect Foods, Misfits Market mentioned the robust private label business as one of Imperfect Foods’s key strengths. For comparison, Costco’s private-label sales represented 31% of its annual sales in 2021, and roughly 80% of Trader Joe’s products are private-label. If Imperfect Foods were to offer more high-quality, sustainable private-label products it could allow the company to see higher margins compared to selling non-private-label products.

International Expansion

As of November 2023, Imperfect Foods only delivers to the US, not including Alaska, Hawaii, or Puerto Rico. international expansion presents an opportunity for Imperfect Foods to grow. The proliferation of grocery delivery in Europe shows consumers are comfortable buying groceries online. Notable European grocery delivery startups include Gorillas, Getir, and Dija (acquired by Gopuff in 2021), and CrowdFarming operates in the EU and sources food delivery directly from farmers; however, there is room for Misfits Market and Imperfect Foods to establish an international presence.

Consumer Sensitivity to Rising Grocery Prices

Food prices in June 2023 saw a 5.7% year-over-year increase since mid-2022. Supply chain issues, energy prices, and other macroeconomic factors drove the price increases. Consumers are sensitive to increases in grocery prices. Consumers are sensitive to increases in grocery prices, and consumption volumes have declined as a result of inflation.

When grocery prices increase, surveys show over 50% of people switch to lower-priced brands, and 28% switch to private labels. Imperfect Foods can offer lower prices with private labels and have a low-cost sourcing model. As inflation continues to affect consumer behavior in the US, the company has a unique opportunity to seize market share when food prices increase.

Key Risks

High Degree of Competition

Imperfect Foods’ “job to be done” faces several competitors. Established grocers like Walmart and Stop & Shops offer online grocery delivery. Newser companies like Instacart offer delivery services with a large selection of products. Services providing an enormous selection of mainstream brands may crowd out the mass market, leaving Imperfect Foods to fill a niche for more environmentally friendly, local groceries.

However, competing for environmentally-conscious customers pits Imperfect Foods against large, brick-and-mortar grocers like Trader Joe’s and Whole Foods, along with Misfits Market and Hungry Harvest in the eco-friendly online grocery delivery space. Eco-friendly grocers like Misfits Market and Imperfect Foods are typically only a supplement to traditional grocery shopping because of their limited selections. As a result, the company may face a “race to the bottom” environment. It competes with competitors on cost, eating into its margins and long-term viability.

Operational Costs Threaten Profitability

Imperfect Foods’ operations are complex and need high up-front infrastructure investments. Since Imperfect Foods sources many products from local farms, its fragmented supply base requires work and capital to aggregate. Each relationship with a small-scale producer needs time and energy to establish and maintain.

Further down the supply chain, Imperfect Foods relies on capital-intensive distribution networks. It needs cold storage to keep the produce fresh. A performing cold storage supply chain is critical for grocery delivery companies. Imperfect Foods also sources most of its produce from California and distributes it across the US, which requires a significant investment in a cold storage distribution network.

Delivering products to the customer also requires robust management of last-mile logistics. Imperfect Foods manages logistics in-house to offer a high-touch experience for consumers (one of its competitive differentiators). Last-mile logistics management requires investing in physical assets like branded vans and routing technology. Imperfect Foods’s value chain therefore is capital-intensive and complex. Profitability may be far off, given the grocery industry’s operational complexity and low margins. Profit margins hover between 1-3% for grocers.

Geographical Concentration

Imperfect Foods’ last-mile delivery model requires a high density of customers. With low customer density, the company is not economically efficient. The business model of Imperfect Foods may only work in more urban areas.

The company’s distribution map shows that it focuses on serving urban areas over rural areas. Urban areas are also where Imperfect Foods faces the most competition and highest customer acquisition costs. Imperfect Foods may have challenges operating in high-competition areas, leading to higher marketing costs and reduced profitability.

Summary

Imperfect Foods is a leading brand for sustainable groceries. Its initial hypothesis was that Americans wanted to buy cheaper “ugly” produce and sustainable foods. However, its prospects for continued growth face stiff competition and trade-offs. The market size and reality of waste food consumption may force Imperfect Foods to remain a niche grocer for consumers. The company may need to redefine its strategy as it expands to compete directly with sustainable brands like Whole Foods. The 2020-2022 turnover of CEOs, culminating in its acquisition by competitor Misfits Market, represented a turbulent time for the company. Imperfect Foods struggled to understand its best product-market fit. The acquisition by Misfits Markets in 2022 can allow Imperfect Foods to continue to broaden its reach as a grocery brand.

*Contrary is an investor in DoorDash through one or more affiliates.