Thesis

In 2022, the cost of poor software quality in the US reached at least $2.4 trillion, with accumulated software technical debt growing to approximately $1.5 trillion. Software quality is assessed across multiple dimensions, including its adherence to industry standards and complexity in terms of its user interface, user experience (UI/UX), and underlying technical architecture. The ramifications of poor software quality manifest in various forms, including bugs and vulnerabilities, which undermine the design, implementation, architecture, or code. Technical debt accrues when hasty and inefficient solutions in scoping requirements, architecture, testing, or operational decisions are favored over sustainable ones.

Over the expected lifespan of a piece of software, nearly 50% of every dollar will be spent on isolating and fixing software issues. On average, developers in the US spend 20% of their time fixing bugs, which translates to nearly $20K per year in developer costs, based on the median salary of $100K. Managing these bugs may be mundane and frustrating, but it is integral to delivering a quality product to users. Companies that actively manage and reduce technical debt will achieve at least a 50% improvement in service delivery.

Addressing bugs is crucial not just for functionality but also for reducing user and developer attrition. 47% of users expect webpages to load within two seconds, and 40% will leave if loading exceeds three seconds. In addition, developer retention is often problematic, with an employee turnover rate of 21.7% among developers in 2022, compared to just 13.2% among tech employees in general that same year. Given the $50K average cost to hire a developer, investing in tools that enhance the developer experience is essential to minimize attrition and customer loss.

Sentry is an open-source error-tracking platform that provides software tools to minimize the time and effort it takes to detect, diagnose, and resolve issues in software applications. Sentry supports 4 million developers and 90K organizations in 146 countries, processing 790 billion events monthly as of May 2024. Its mission is “to eliminate the havoc and potential financial loss associated with defective software, by making best-in-class application monitoring available to all software teams.” The detection, diagnosis, and resolution of bugs are fundamental to maintaining and improving software quality and user satisfaction, especially as the number of software application platforms and products increases.

Founding Story

Sentry was founded in February 2012 by Chris Jennings (Chief Creative Officer) and David Cramer (CTO). The journey to founding Sentry began when Cramer, already involved in the Python developer community, developed the first version of Sentry at Disqus. This initial iteration of Sentry was designed to integrate easily into existing systems and gained traction among Python developers for its novel approach to error logging by grouping exceptions rather than sending individual emails for each.

Cramer and Jennings initially met through mutual acquaintances, collaborating on an open-source project before formally working together at Disqus. Their involvement with open-source tools significantly influenced their professional paths and the founding of Sentry.

The idea for Sentry sprang from mutual experiences and enthusiasm for open-source projects. It took approximately three years to transition from an open-source product to monetizing. The turning point occurred when Craig Kerstiens from Heroku approached Jennings and Crammer to create a Heroku add-on version of Sentry, offering them $5K per month. However, to join the platform, users needed to have a hosted service, and six to nine months after building out Sentry as a hosted service, the company was incorporated.

The name "Sentry" originates from an icon used in Starcraft. From the start, its mission was clear; to improve the process of monitoring application errors in a developer-friendly way. Sentry initially catered its tooling to Python developers but has since grown to support over 100 languages and platforms. As of May 2024, 90% of the platform’s users self-host on the free plan.

Jennings has been focused on Sentry’s design and user experience while Cramer, who initially served as CEO, stepped down in 2019 to serve as CTO. In January 2020, Milin Desai, a former VMWare executive, joined Sentry as the CEO. Desai brought over 20 years of tech industry experience and led VMWare through expanding into multiple new product lines in networking, public cloud, and developer tooling.

Product

Sentry aims to reduce the time and effort required to detect, diagnose, and resolve software issues, by providing real-time error tracking, detailed error reports with context, and integrations with popular development tools focused on swift identification and resolution of problems. As of May 2024, it has evolved into a product used by over 4 million developers and spans hundreds of languages and platforms.

Sentry offers multiple software tools that specialize in exceptions and application crashes, distinguishing itself from traditional error-logging systems that often mix informational messages with actual errors. This focus allows developers to address critical issues quickly.

Sentry’s mission is “to eliminate the havoc and potential financial loss associated with defective software by making best-in-class application monitoring available to all software teams.” Unlike legacy application performance management, logging, and systems monitoring, Sentry points to the root cause, empowering developers to quickly and efficiently triage and prioritize issues.

Error Monitoring

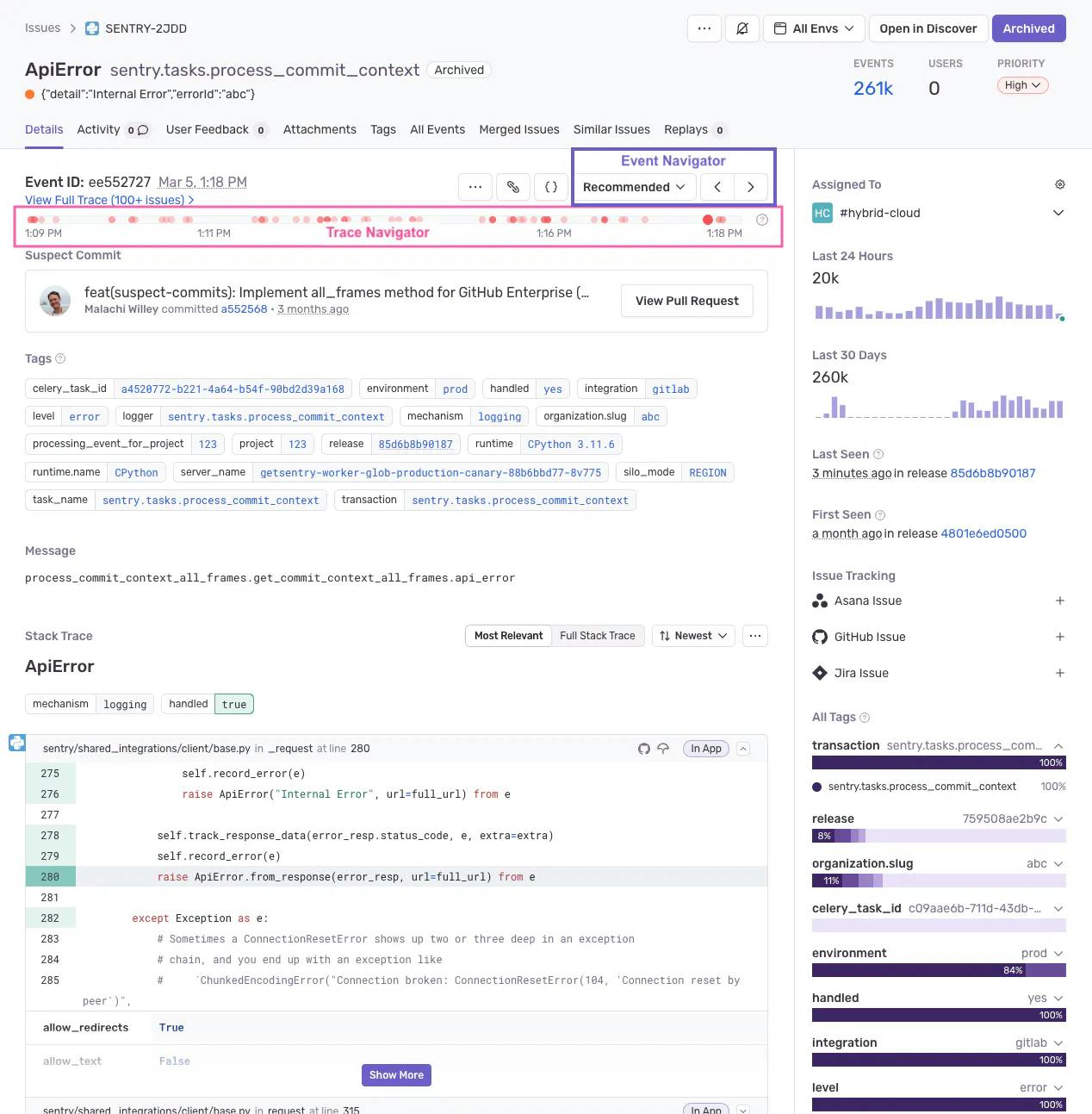

Sentry’s core product offering is error monitoring. It synthesizes data about application errors and performance deficiencies allowing developers to gather both the background and context of where exactly an exception happened in the codebase.

As of May 2024, Sentry is processing over 790 billion events per month. In a typical application, significant amounts of data are sent to Sentry. An issue in this context is a bug or problem within the app. Rather than logging each event as a separate issue, Sentry groups similar events into a single issue. This event stacking provides developers with a view of the frequency and scope of each issue, facilitating more efficient troubleshooting and resolution.

Source: Sentry

This feature displays the issue type, description, associated project, and timing for each issue, including the first and last time it was seen. If it is linked to an issue via a third-party integration such as Github, Jira, or Asana, it will automatically link it. This connection creates a consolidated hub of information at a developer’s fingertips. One of the primary components of Error Monitoring is the trace navigator or trace stack. The trace navigator is an abbreviated version of the trace for the current transaction. It shows the transaction’s beginning, ending, and additional components.

An important distinction is that tracing is not profiling; it focuses on what happened and when rather than how many times or how long. This log of events provides a path between system interactions and how problems in one system can create problems in another. For example, a simple, modern web application comprises the frontend (what the user interacts with), backend (what APIs communicate with), database server, and more.

Each component can be written in a different language on a different platform, each with its own errors. These errors are independent of the system, and tracing allows developers to follow the entire path between these components. In this view, a developer will see the line of code that sent the error, linked to a suspect commit; otherwise, the instance or developer responsible for the issue. As part of the error monitoring feature, Sentry offers an AI-suggested solution. It is an experimental feature that uses AI to explain an issue and propose a solution using OpenAI.

Session Replay

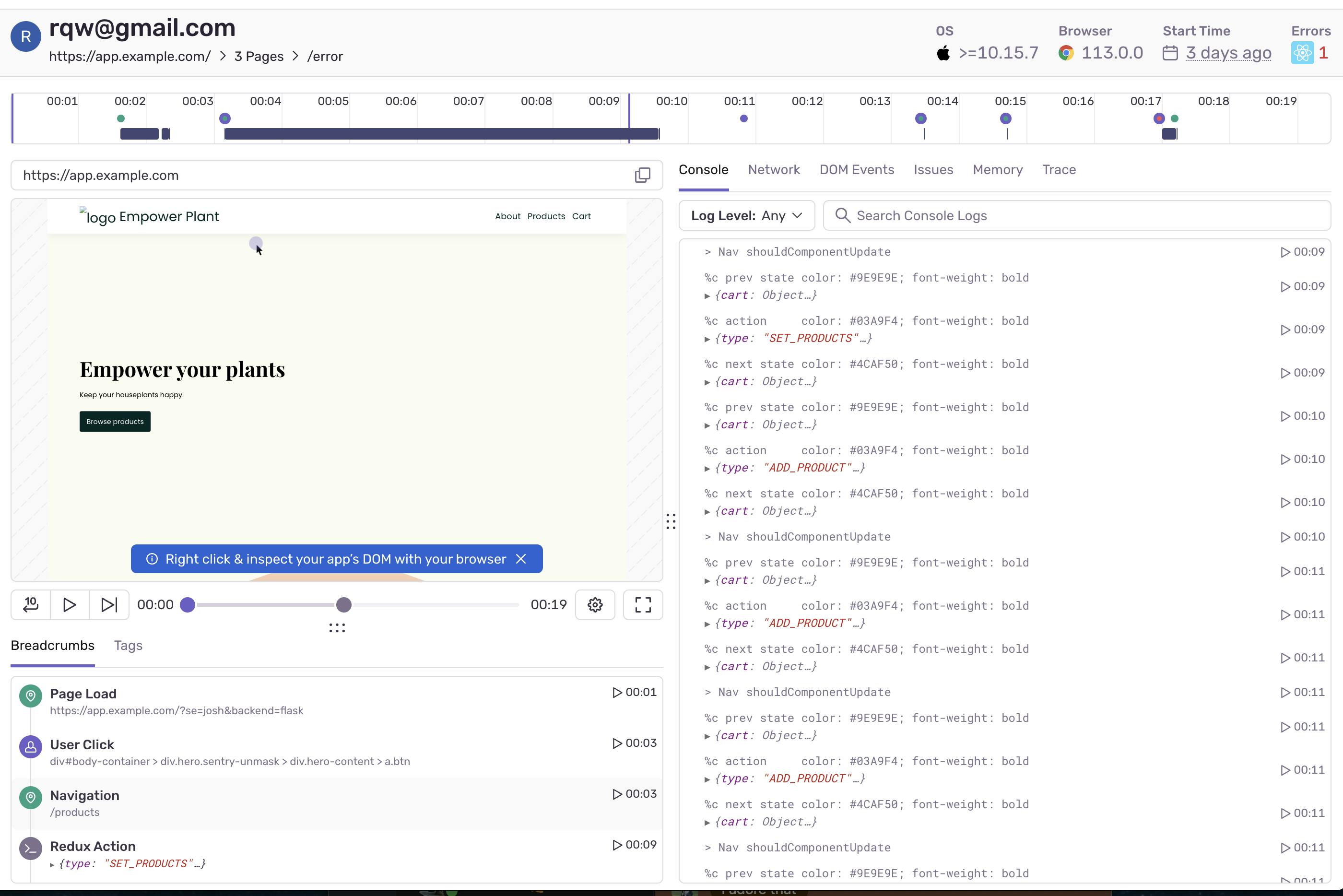

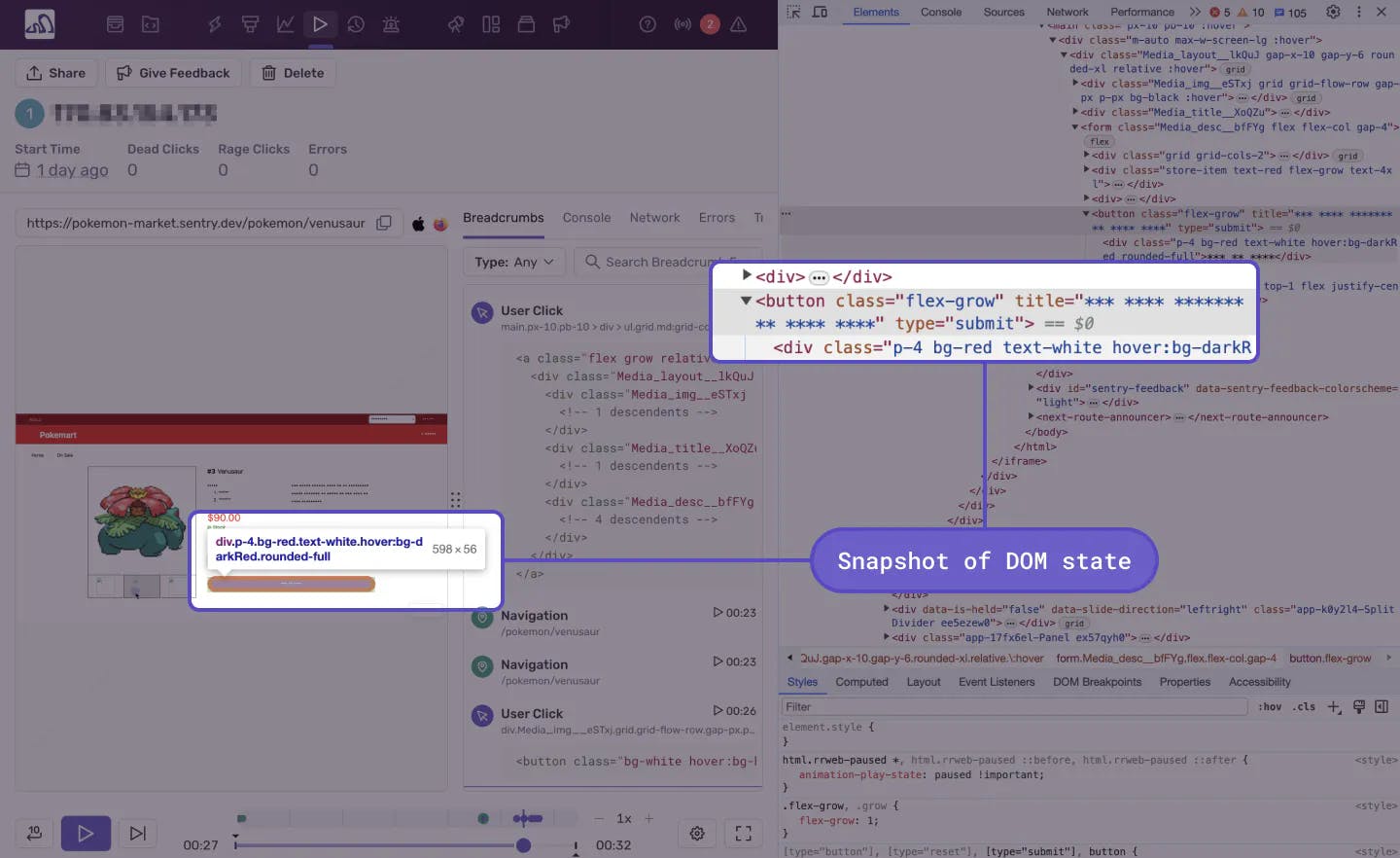

Understanding the cause of an error can be challenging without knowing the actions that preceded it, and contacting individual users to reproduce an error is often impractical. Session Replay enables engineers to view a video-like reproduction of real user sessions directly within the platform, rather than merely following a stack trace. Importantly, these replays are not video recordings but reconstructions built via snapshots of the web application’s document object model (DOM) state. The DOM represents the logical structure of a webpage, allowing for a detailed and accurate playback of user interactions.

Source: Sentry

During each step of the session replay, a developer can access network requests, DOM events, and console messages, effectively simulating the experience of having Chrome DevTools live in a production environment. This insight into how the DOM operates allows developers to precisely identify which element, button, or code triggered the issue, enhancing their ability to diagnose and resolve problems efficiently.

Source: Sentry

This feature enables developers to reproduce errors more easily. It is not confined to a single page; it encompasses page loads, refreshes, and navigations throughout a website. Navigational actions are stored as breadcrumbs to show when user interactions take place. Breadcrumbs are links that provide a chronological trail of user interactions leading up to the current page, offering a clear map of user activity.

The Session Replay feature was built with privacy in mind. Given that it is not a live screen recording, and uses the DOM, means that the data can be searched and stripped. Customers can access configuration options to scrub this data, both on the client side (what users see) and the server side (the database side). Session replays are stored for 90 days. This feature also allows developers to surface any common accessibility concerns by Web Content Accessibility guidelines.

Performance Monitoring

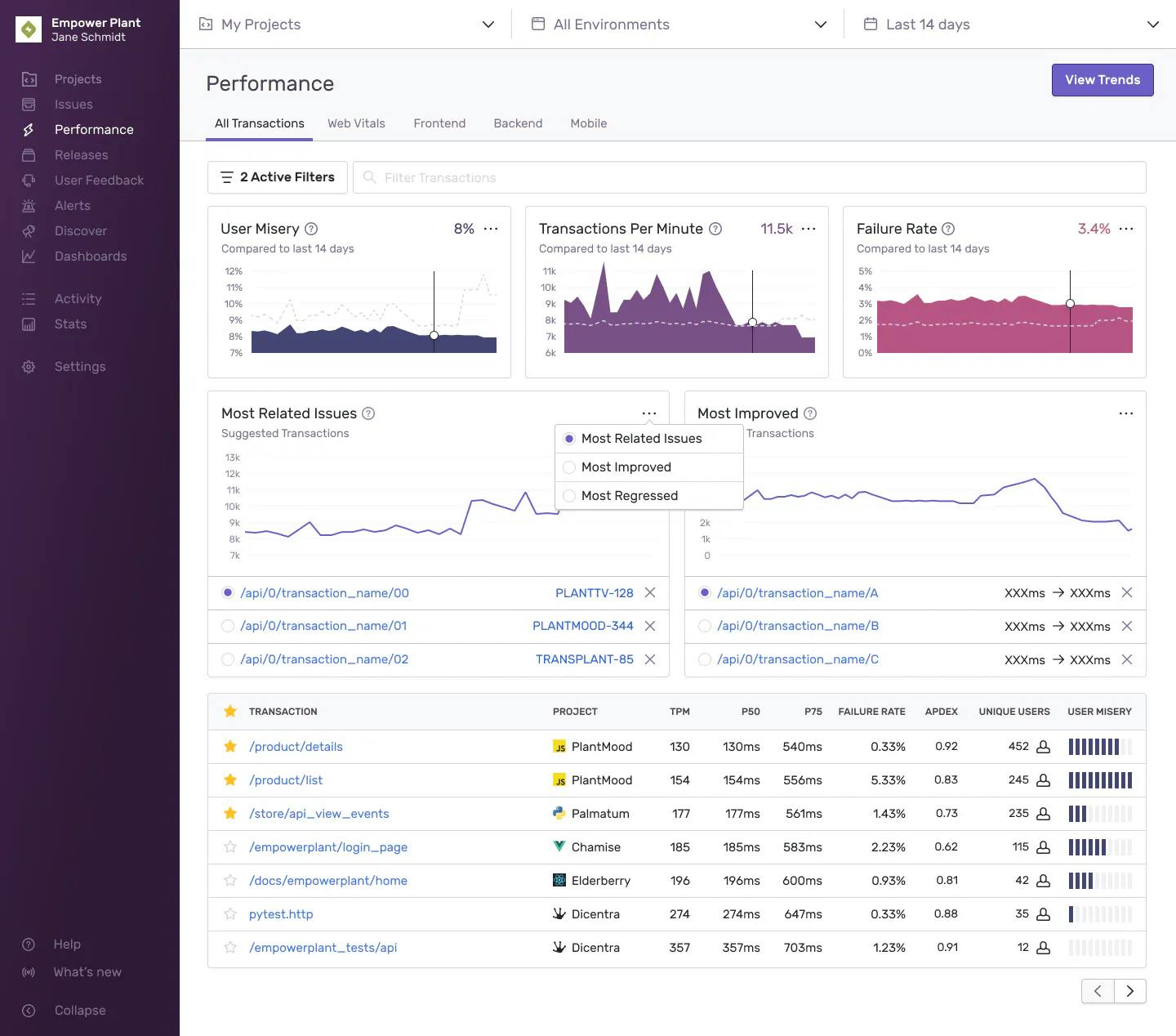

Source: Sentry

If an application takes too long to load, it can create bad user experiences. The performance page is the main view in Sentry for searching and browsing transaction data. In this view, a user can also explore metrics such as the Apdex, throughput, P50 duration, and User Misery.

Apdex: The apdex is an industry-standard metric for measuring user satisfaction based on application response times. The score ranges from 0 to 1.0, a higher score represents a better experience.

Throughput: Throughput indicates the number of transactions over a given time range.

P50 Duration: This value represents when 50% of transaction durations are greater than the threshold. For example, if the P50 threshold is 20 milliseconds, then 50% of transactions exceed that threshold.

User Misery: User misery is a performance metric that quantifies the impact of slow transactions on users. It measures the number of unique users who experience frustration defined by response times exceeding four times the acceptable threshold. The metric emphasizes transactions that affect a larger volume or proportion of users, meaning that a scenario with 900 out of 1000 users affected will yield a higher misery score compared to one where all 5 out of 5 users are affected.

Using the performance monitoring tool, developers can also trace back issues to identify poorly performing code. Each transaction listed provides a summary with the location of the associated code, users, and other pertinent information. The table and graphs provide an overhead glance at what API calls are causing the slowest transactions so developers can prioritize these issues and ensure that users get the best experience possible.

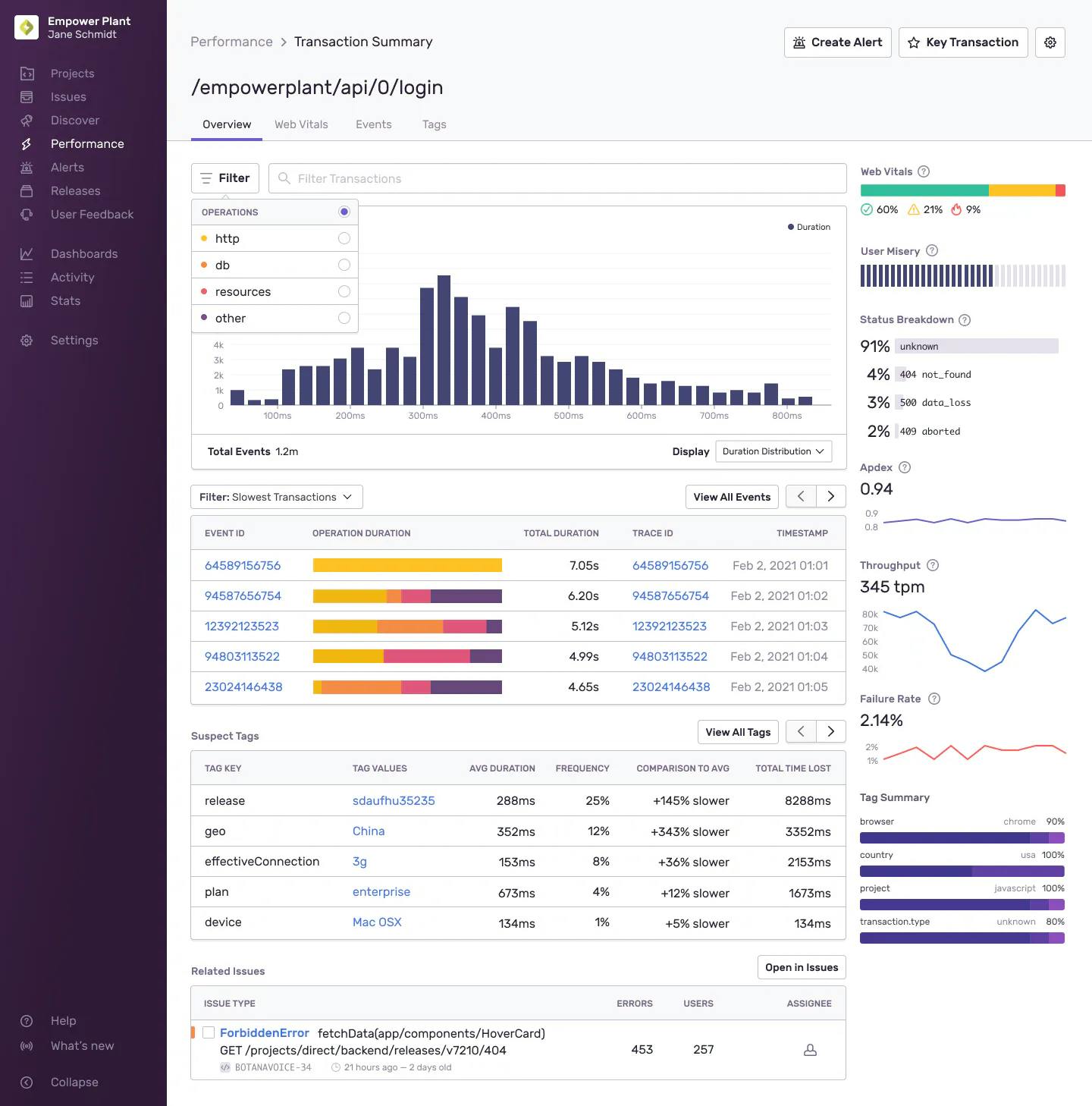

Source: Sentry

Each transaction represents a single instance of an activity like a page load or page navigation. Without these transactions, developers only know about errors when they happen and not before.

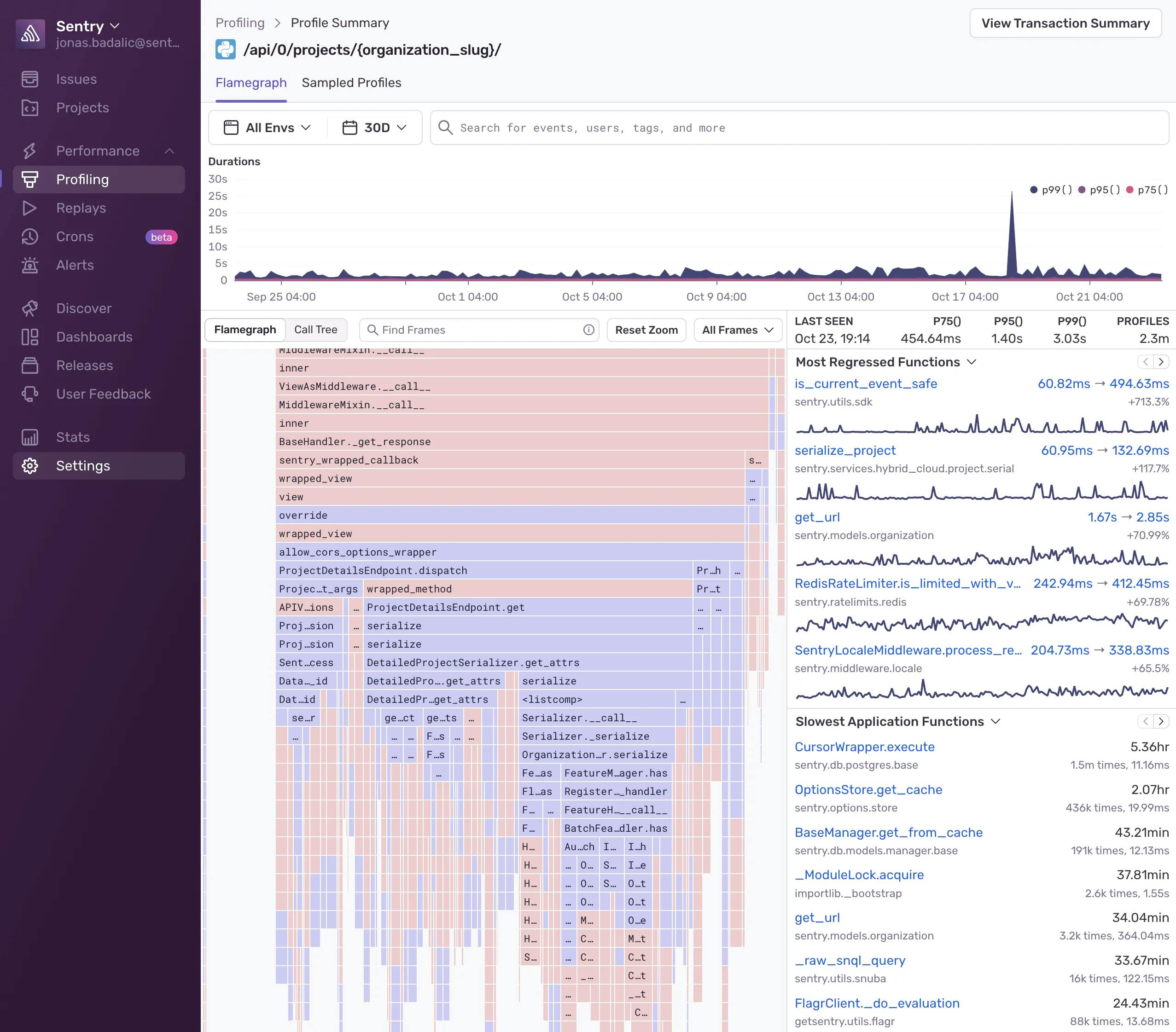

Profiling

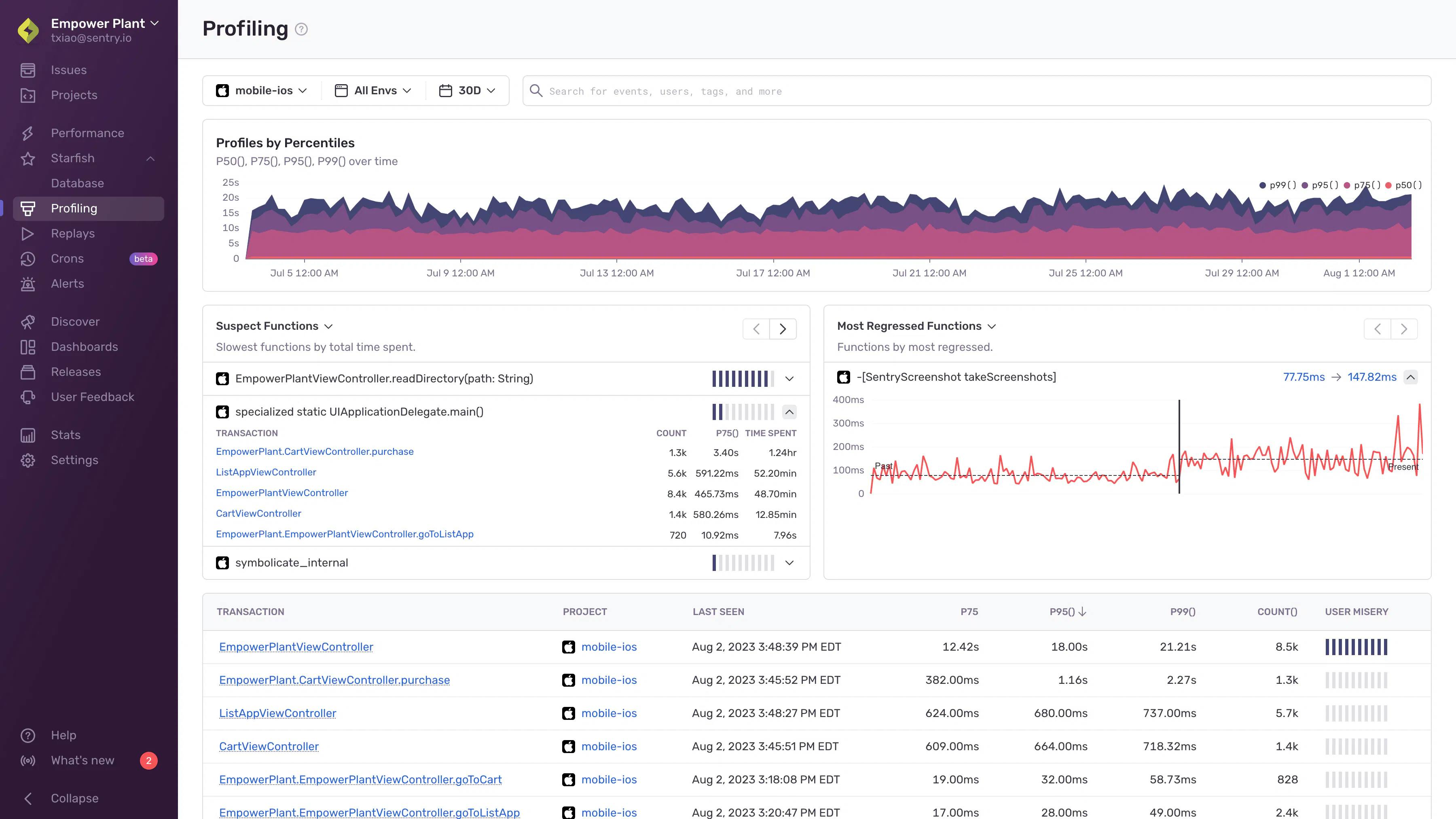

Profiling is crucial to performance management and becomes increasingly important as a product matures and grows in complexity. This complexity can lead to transaction regressions, potentially costing millions in lost revenue. These regressions can be linked to several potential causes, including constrained computer resources, such as memory or database performance. Profiling allows developers to accurately identify the reasoning, and origins and assess the severity of these issues, enabling targeted improvements to mitigate impacts effectively.

Source: Sentry

The profiling page provides information about profiles in an application, leading to the profile summary page, which includes information such as the slowest function, the slowest lines of code, or regressed functions.

Source: Sentry

The use of this feature workflow is more advanced. It provides precise code-level or low-level visibility into an issue, further than traditional tracing allows. Using this feature also allows developers to understand possible bottlenecks and continuously build in optimizations as part of the development process instead of accumulating technical debt.

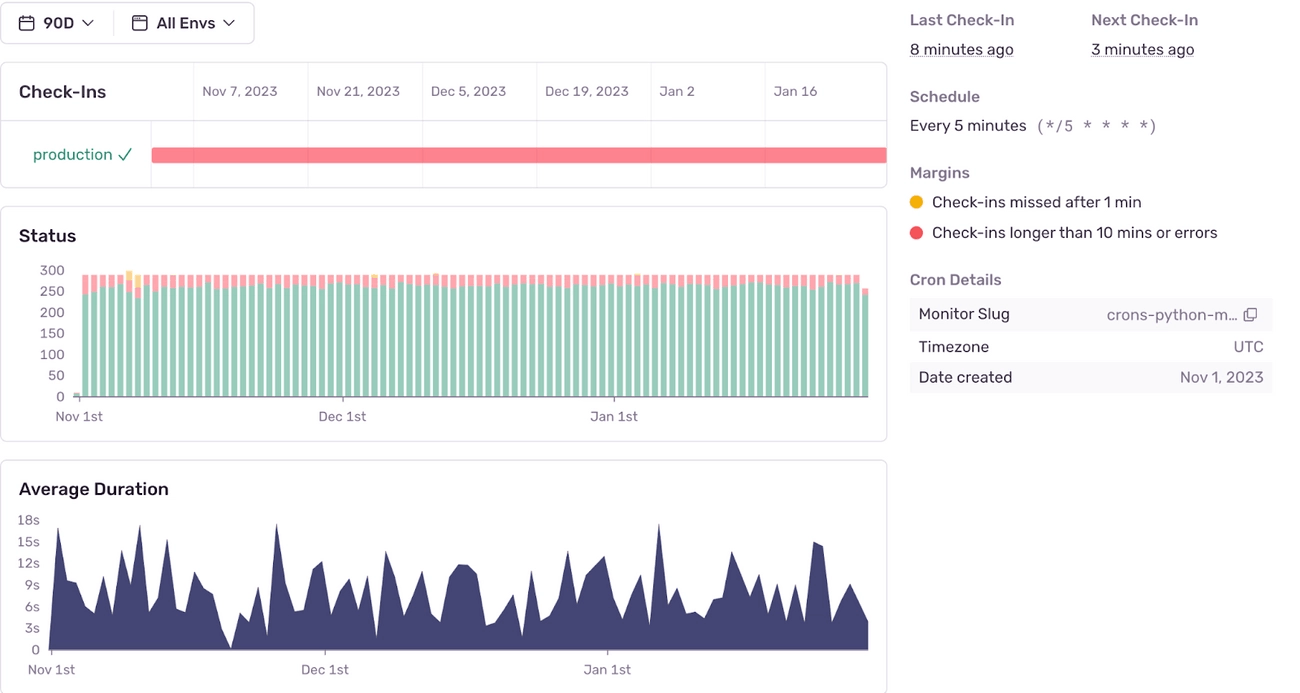

Cron Monitoring

Cron jobs are Linux commands that schedule specific tasks, like database backups. It’s imperative to monitor these because if an app were to go down or data were corrupted, these cron jobs can ensure that a developer operations (DevOps) team can resolve and restore lost data so the company is still able to function.

Source: Sentry

The tool provides a timeline with three different statuses:

Missed Check-In: When the cron job did not execute in the expected timeframe or frequency

Failed Check-In: When the cron job did not check in successfully

Successful Check-In: When the cron job did successfully check-in

Understanding the health of a cron job provides the ability to maintain better resource management and improved scalability to minimize performance issues that could lead to loss of revenue in the millions.

AI Monitoring

With the number of AI tool users globally expected to be 314.4 million in 2024, building tools to monitor AI usage is necessary. As such, Sentry has an AI monitoring tool in Alpha mode as of May 2024. This tool is intended to help developers understand what is happening with AI pipelines. It collects information about prompts, tokens, and models from providers like OpenAI. Some example use cases of AI monitoring include investigating reported issues with AI workflows by analyzing responses from Large Language Models (LLMs), understanding the cause of workflow failures due to high token usage, and identifying the slowest steps in a workflow to address prolonged processing times.

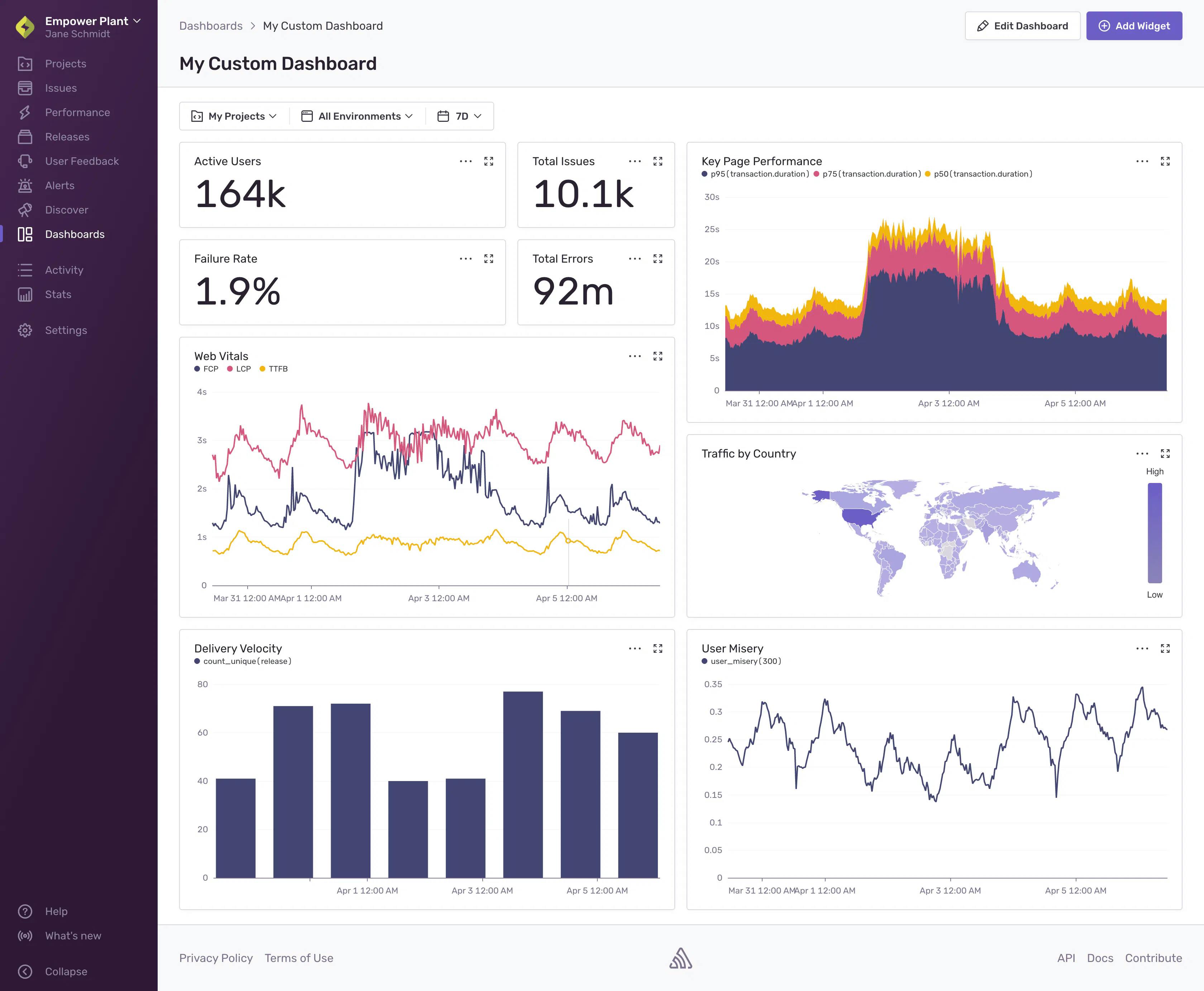

Dashboard Widgets

Sentry’s dashboards provide a broad overview of the application’s health, allowing individuals to navigate error and performance data across multiple projects. Users can construct these dashboards via Sentry’s Widget Library or create customizable widgets through the Widget Builder. These custom dashboards facilitate a clear, overarching understanding of multiple projects within an application, enhancing visibility and monitoring efficiency.

Source: Sentry

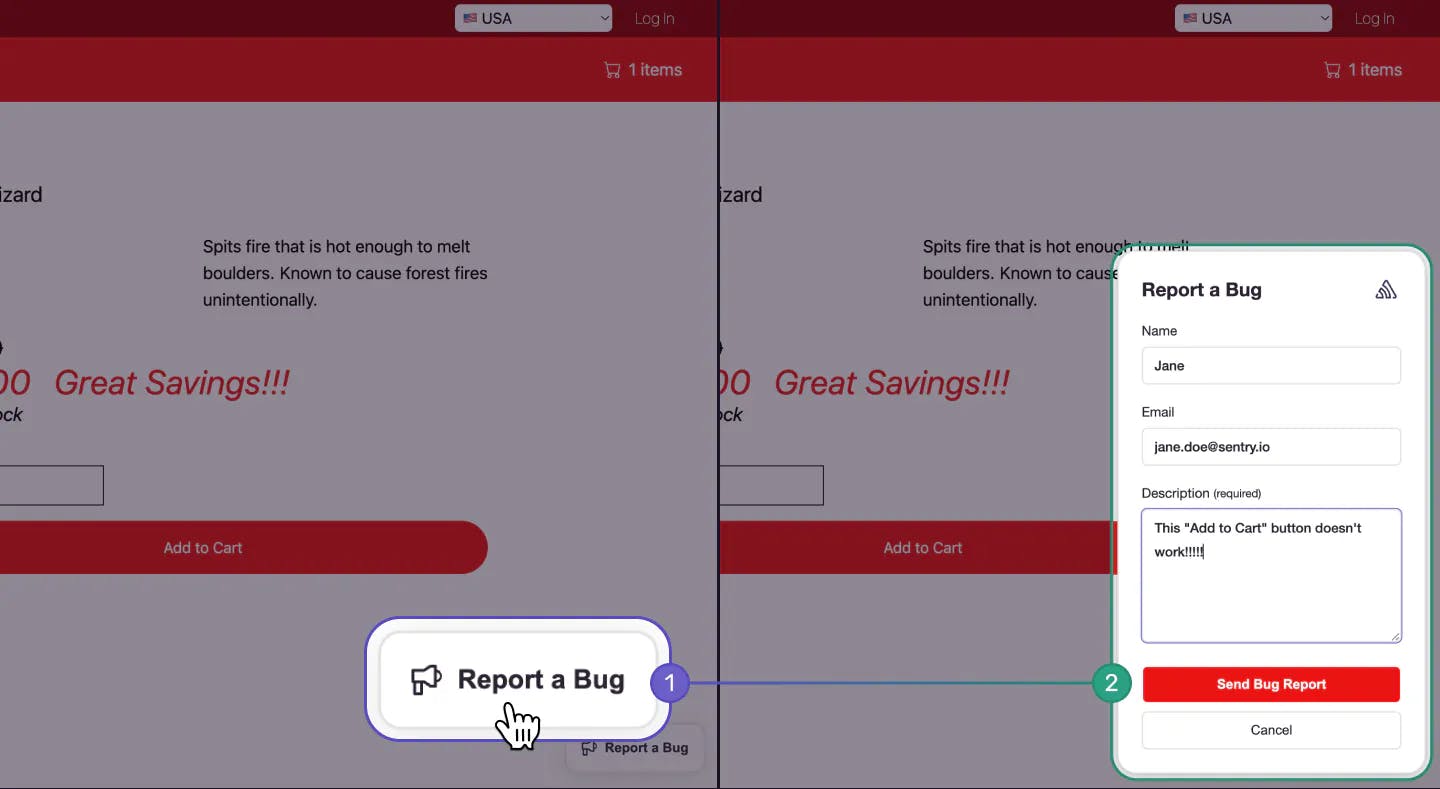

User Feedback Widgets

Sentry’s main purpose is to capture errors automatically thrown by an application. However, this does not capture broken links, typos, misleading UX, or broken permission flows. Sentry’s User Feedback Widget and Crash-Report Modal are both out-of-the-box components that can be embedded in a customer’s web application. This component lets the customer’s users report issues and then link the feedback to debugging context (i.e. errors or replays), allowing developers to get to the root of the problem faster.

An example is using a combination of Session Replay with the User Feedback Widget, building context behind what the user was trying to do before submitting a task. The User Feedback Widget is a persistent widget added to a web application and is meant to be an easy and fast way for users to report issues or provide feedback. The crash report modal is another feedback mechanism that pops up automatically in an event like an application crash.

Source: Sentry

Code Coverage

In 2022, Sentry acquired CodeCov, a tool for determining the number of lines of code that are tested. Testing code and seeing code coverage can give developers assurance and an extra set of reinforcements to prevent issues from going out. This accelerates remediation and enables better bug-free experiences for the end user.

Market

Customer

Sentry’s open-source and developer-first approach meant the initial customers were Python developers adopting error tracking and performance monitoring solutions for their platforms. It is estimated that Sentry’s self-serve model accounts for 70% of its revenue as of May 2024. Sentry also has an enterprise foothold, with customers like GitHub, Disney, Atlassian, Reddit, Slack and more. As of May 2024, Sentry has over 4 million developers and 90K organizations across 146 countries as customers, an otherwise large customer base.

Source: Sentry

Sentry’s origins as an open-source platform contribute to its ability to acquire enterprise customers. Since the self-hosted version is free, major companies like Instacart often adopt it and standardize its use internally. As these companies expand, it becomes more cost-effective to subscribe to off-the-shelf software, like Sentry’s hosted platform instead of maintaining it on their own. This progression creates a pipeline of potential accounts for Sentry. This approach is common with developer tooling, like Atlassian, GitLab, or GitHub.

Market Size

The software development tools market is growing due to increased demand for technology solutions that improve efficiency and customer experiences. This market includes essential tools such as compilers, debuggers, interpreters, linkers, and text editors necessary for application development and maintenance.

The broader market for application and software development tools was valued at $131.4 billion in 2020 and is projected to grow to $733.5 billion by 2028, representing a CAGR of 24%. This growth underscores the expanding reliance on digital solutions and highlights the potential market for Sentry.

Competing in the software development tooling industry, Sentry is part of a global market valued at $6.4 billion in 2023 and is expected to reach approximately $27 billion by 2032, with a CAGR of 17.5%. This growth indicates a rising demand for software solutions across sectors, highlighting the importance of proactive issue resolution to improve user experiences before issues arise.

Competition

Sentry is specifically designed for real-time error tracking and performance monitoring of applications. It provides developers with tools to diagnose and fix issues directly within their codebase, focusing on application health metrics like crash reporting, performance bottlenecks, and user impact. Across each of these functionalities, there are similar products that address similar value propositions. For some, like FullStory in session replay, Sentry offers integrations. Others have competitive products with Sentry.

Application Performance Monitoring

Grafana Labs: Grafana is an observability platform commercializing open-source IT systems monitoring, founded in 2014. It has raised a total of $535.2 million as of May 2024. In April 2022, Grafana raised a $240 million Series D round led by GIC Fund. Like Sentry, Grafana is an open-source software platform that supports monitoring, visualization, and metric analytics. It focuses on building UI dashboards and monitoring, whereas Sentry focuses on error tracking and rule creation.

Datadog: Datadog is a public company traded on the NASDAQ (DDOG), and as of May 2024, it had a market cap of $41.5 billion. It was founded in 2010 and competes directly with Sentry’s analytics platform. Like Sentry, it focuses on application performance across cloud monitoring, security, and analytics. Its differentiated focus is to be as comprehensive of a platform with its alerting features and incident management. Though flexible like Sentry, it does not have a clear pricing structure.

New Relic: New Relic is a performance monitoring, development, and sysadmin platform that uses telemetry. It was founded in 2008 and was publicly traded on the NYSE. It was acquired in November 2023 for approximately $6.5 billion by Francisco Partners and TPG and privatized. New Relic competes on application performance monitoring (APM) and observability. It offers real-time insights into an application's performance, such as response times, error rates, and throughput. However, it does not specialize in real-time error tracking and performance monitoring like Sentry.

Dynatrace: Dynatrace is a software platform that delivers analytics and automation for observability and security. It was founded in 2005 and publicly traded on the NYSE (DT) and, as of May 2024, had a market cap of $14 billion. It offers AI-assisted APM solutions through automation capabilities, unlike Sentry’s developer-centric tooling.

Log Management

Splunk: Founded in 2003, Splunk previously traded on the NASDAQ. It specializes in collecting, managing, and searching vast volumes of data. In March 2024, Cisco acquired Splunk for approximately $28 billion. Splunk focuses on big data analytics, network monitoring, and security, offering a suite of data visualization and operational intelligence features. Splunk excels in handling and analyzing large volumes of machine-generated data, offering powerful tools for log management, security information and event management (SIEM), and compliance monitoring across various IT and security operations. Its capabilities are oriented toward providing insights into system behaviors and security threats from a broad spectrum of data sources.

Error Monitoring

Rollbar: Rollbar is a real-time error monitoring software tool that intends to help developers deploy better software faster and resolve issues easily. It was founded in 2012 and has raised a total of $18.5 million as of May 2024. In March 2020, it raised an $11 million Series B, led by Runa Capital, Long Light Capital, and Blossom Street Ventures, and continued participation from Cota Capital, Bain Capital, and Patagonia Capital. It is focused on the aggregation of errors over anything else, whereas Sentry has a broader scope on a codebase.

Crashlytics: Crashlytics is an Android and iOS application focused on reporting real-time crashes. It was founded in 2011 and raised a total of $6 million before being acquired by Twitter in 2013 and then by Google in 2017. It has since rebranded as Firebase Crashlytics. It focuses on mobile applications, unlike Sentry, which is platform agnostic and covers over a hundred languages and platforms.

Business Model

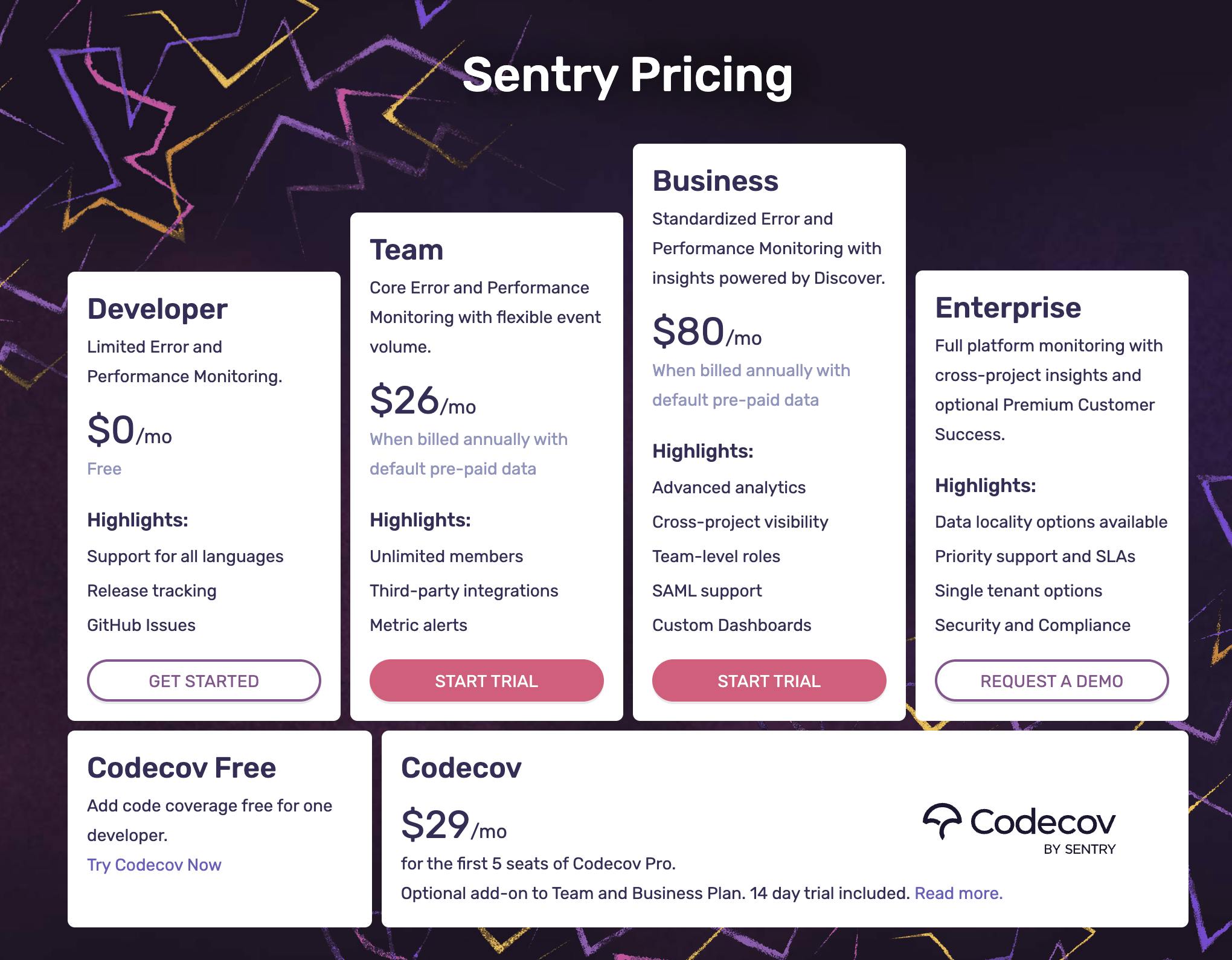

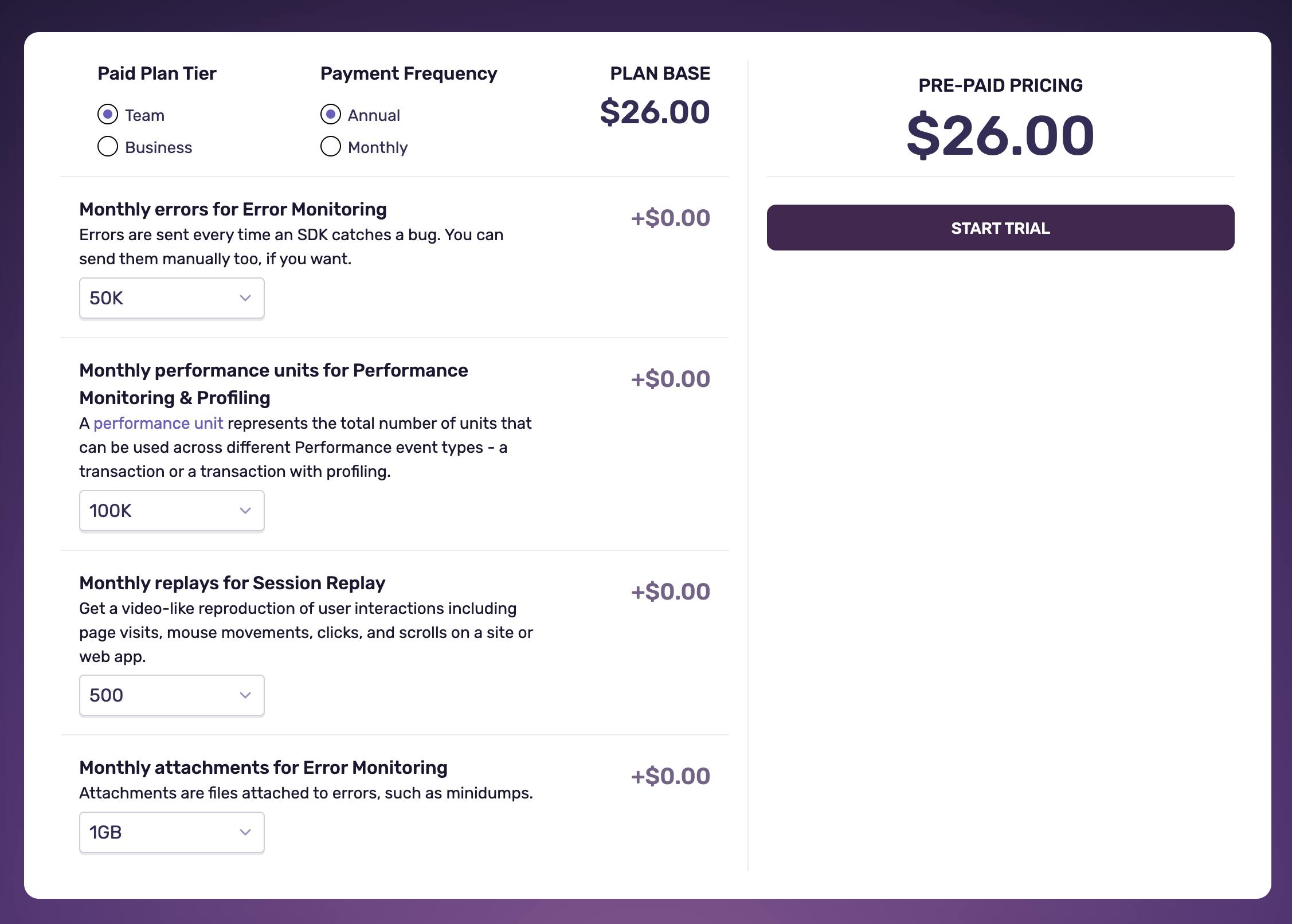

Sentry operates on a subscription-based freemium business model. A self-hosted version of the software is open-sourced and available for no cost. However, developers can pay a monthly subscription fee to get additional features and have their APM services hosted on the cloud by Sentry. These plans are flexible in their pricing and vary based on the features to be added. Its advertised prices are based on annual billing and default levels of data consumption.

Source: Sentry

As of May 2024, Sentry had four pricing tiers:

Developer (no cost): This platform is meant for a single developer. This plan offers 5K errors and 10K performance units, respectively. It has a maximum of 50 session replays and 30 days of data retention. On this level, there is no access to API integration or third-party integrations and no metric alerting.

Team ($26/month): This plan offers everything in the Developer tier, with higher quantities. It offers 50K errors and 100K performance units. It has a maximum of 500 session replays and 90 days of data retention. Users can access third-party integration. On this level, users can set up custom metric alerts through the platform and integrated tooling.

Business ($80/month): It has everything in the Team tier with the same limits. At this subscription level, subscribers also have access to advanced analytics, the ability to build custom dashboards, advanced quota management, and cross-project issues. Developers start having access to relay and single sign-on access through different platforms.

Enterprise: It offers all that Sentry offers, with higher levels of security and compliance and priority support with service-level agreements. It also offers an individualized experience, where customer resources and liabilities are not shared with other customers.

In November 2022, Sentry acquired CodeCov and offers it as an add-on for customers. As of May 2024, there are two levels of pricing for CodeCov:

CodeCov Free (no cost): A single developer can access code coverage analytics.

CodeCov ($29/month): This offers five seats of CodeCov Pro.

Source: Sentry

Sentry’s pricing has starter packages for the different tiers. However, Sentry offers the ability to price out a ‘custom plan’, remaining flexible in its pricing based on desired levels of error monitoring, session replays, performance units, and monthly attachments for error monitoring.

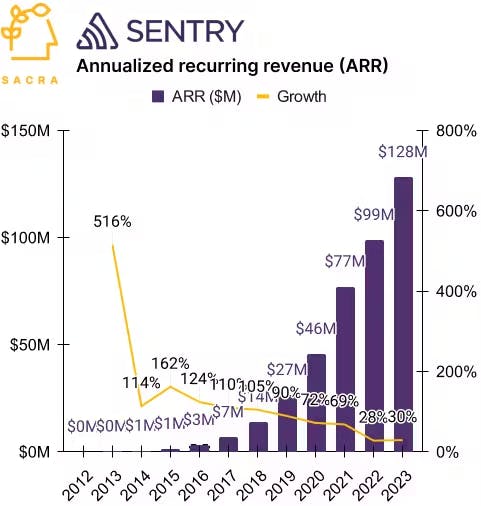

Traction

As of May 2024, Sentry had not publicly shared financial information. However, CEO Millin Desai stated in May 2022 that “revenue [had] more than tripled in just over two years”. It also reported a net expansion of ARR, increasing over 130% YoY, and processing over 790 billion events per month, with mobile events increasing by more than 100% YoY.

In November 2022, Sentry made a notable acquisition of CodeCov, a code coverage reporting solution. Sentry intends to offer this product to provide developers with further actionable insights into their workflows. Under Milin, Crammer, and Jenning’s guidance, Sentry has seen steady growth.

Source: Sacra

Sacra has an unverified estimate that Sentry had $128 million in ARR at the end of 2023, and was growing 30% YoY. As of May 2024, Sentry serves over 90K organizations and 4 million developers in 146 countries and has notable customers including Github, Disney, Atlassian, Slack, Reddit, and Microsoft.

Valuation

As of May 2024, Sentry has raised a total of $217 million from investors, including BOND, Accel, New Enterprise Associates, Slack, and K5 Global. In May 2022, with a valuation of more than$3 billion, Sentry raised a $90 million Series E co-led by BOND and Accel. This round closely followed a $60 million Series D the company had raised in February 2021, at which point Sentry had a post-funding valuation of $1 billion.

Key Opportunities

Leveraging Generative AI

Integrating AI and machine learning into Sentry’s services could enhance its competitiveness and efficiency. AI and ML, particularly, large language models (LLMs) can automate tasks such as code generation, bug detection, and error resolution, reducing the manual effort required from engineers and accelerating the development process. Sentry currently has an AI suggestion solution for error resolution and explanation using OpenAI’s model. However, a key opportunity as these models compete is to use a variety of lighter and more efficient LLM models or more curated models to generate solutions. Using Generative AI for predictive analytics could not only speed up the debugging process by up to 50% but also improves software reliability and user satisfaction.

Given Sentry’s access to error data from its AI workflow monitoring, it can leverage this information to generate detailed loss reports showing the financial loss to AI-related errors. For example, using pricing models for OpenAI’s GPT, Anthropic Claude, or Google Gemini’s model, Sentry could build straightforward reports to expand visibility into costs incurred from errors or optimize AI model selection by cost and error-minimizing.

Automated Testing

With CodeCov as a product offering, Sentry could apply its AI suggestion solution to build out automated testing or context clues for edge cases. An average bug found in early coding/unit testing takes 4.9 hours to fix, whereas an average bug found in a post-product release takes 15.3 hours. If developers can speed up error resolution in any way, they are saving money.

As software products grow, fixing tests to reflect these changes is important. It ensures that the code is up to date and the tests are testing the right things. In 2020, failing tests cost the enterprise software market $61 billion annually. Pruning unneeded code can save organizations money and reduce overhead when it comes to resolving technical debt, but it has to be done carefully. For example, in 1996 the European Space Agency lost $370 million in development time because it was thought that a piece of code was unused, but was used and unaccounted for.

Another example of lost value because of unaddressed code is bundle size. Bundle size refers to the amount of code web applications send to the browser. A larger bundle size generally equates to longer load times. Its impact, although seemingly small, as companies scale, can be significant. A 2013 book, Third-Party JavaScript, explains it this way:

“Companies with high-traffic applications save millions of dollars by tweaking and optimizing their performance. Google, for example, found out that a one-half-second delay in returning a search results page damaged user satisfaction, resulting in a 20% drop in traffic. And for a company that generates 95% of its profits from advertising, a 20% drop in traffic meant millions of dollars in lost revenue. Amazon did a similar experiment as well, and found out that even very small delays—increments of 100 milliseconds—resulted in a significant drop in revenue.”

AI can help with this by helping build tests that ensure the user experience is not degraded as the unneeded code is removed. As of March 2024, there is evidence that Sentry has considered these opportunities as it plans to launch new offerings: AI-powered Autofix for errors, alongside CodeCov’s pre-release focus.

Existing Data Foundation

To generate results AI models require large and diverse datasets for training and to make predictions, not to mention storage and data pipelines. As of May 2024, Sentry was processing 790 billion events per month and has developed a profiling tool to analyze why and when issues occur. Leveraging this dataset of errors, and access to CodeCov’s data on untested code, Sentry could publish a small model that could be leveraged as an integration or new product offering.

Smaller models are better as they consume fewer computational resources yet remain competitive, considering Meta’s Llama3 versus OpenAI’s GPT-4-Turbo. Although GPT-4-Turbo is rated higher for coding ability, Llama3 (70B) is significantly smaller. Parameters define the behavior of an LLM; each parameter is like a piece of a puzzle, and the more pieces there are, the better it can produce text. However, these pieces are also the factors that the AI system learns from, so the more specific they are, the better an LLM is at the specific task it is being trained on. GPT-4-Turbo is estimated to use 220 billion parameters, while Llama3(70B) uses 70 billion parameters. This is approximately a 68.2% difference in size from GPT-4-Turbo to Llama3 (70B). Smaller and more specific models are easier to fine-tune or refine and are more hardware-efficient.

As of March 2024, there is also evidence that Sentry has considered this opportunity as it plans to release its own fine-tuned models.

Low-Code / No-Code

Between the forecast period of 2020 to 2030, the market for global low-code development platform market is predicted to grow at a 31.3% CAGR, from $10.3 billion in 2019 to $187 billion by 2030. As the adoption of low-code and no-code platforms grows, Sentry has a clear opportunity to serve a broader, more diverse user base. Creating solutions tailored to these platforms allows Sentry to appeal to non-technical users who require robust error monitoring and performance insights but may lack deep coding expertise. This approach aligns with the trend of making development more accessible, opening up new market segments.

Additional Acquisitions

Sentry can continue to expand its growth through strategic acquisitions, building on its acquisition of Codecov, which enhances its offerings in code coverage analytics. By integrating complementary technologies and services, Sentry can strengthen its market position and broaden its solution portfolio horizontally while maintaining a focus on expanding vertically.

Key Risks

Open Source

Sentry's position as an open-source company is a significant part of its competitive edge in the market. This open-source approach allows developers worldwide to contribute to its platform, enhancing its features and capabilities through community involvement.

However, maintaining an open-source project comes with substantial challenges, particularly balancing the desires and expectations of the open-source community with the strategic objectives of the business. In the long run, meticulous maintenance and engineering efforts are continuously needed to ensure that new functionalities align with both community interests and business goals.

This delicate balance presents a key risk for Sentry as it navigates potential conflicts between open-source principles and commercial pressures. Being open-source often means top-of-funnel conversion from open-source DIYers to paid support. There needs to be a reason, and in a way, it can incentivize Sentry to develop poor software to convert these users to a paid use case. Sentry must manage these dynamics carefully to maintain its community support while achieving its commercial objectives, ensuring that its open-source nature continues to serve as a strength rather than a vulnerability.

Competition

The competitive landscape in which Sentry operates is marked by intense rivalry, with both large and newer players constantly vying to enhance their market position. Sentry faces significant competition from established firms like Dynatrace, Datadog, New Relic, Grafana, and Splunk, all of which have a strong foothold in the enterprise space and are well-equipped with robust technological capabilities and extensive market reach.

Being open source often means that Sentry’s product roadmap and how it can be built are on display. However, licensing is an option, as Confluent did with their Confluent Community license and MongoDB, which originally designed the SSPL.

Niche competitors like Rollbar target the SMB segment, potentially eroding market share that Sentry might otherwise capture. This dynamic competitive environment poses a key risk for Sentry, as these competitors not only share the market but also drive innovation and customer expectations at a rapid pace.

To maintain and grow its market position, Sentry must continually innovate and segment its offerings to meet evolving customer needs and fend off competitors equally eager to capture a larger slice of the market. This ongoing need to stay ahead in product development and market strategy is crucial for Sentry's sustainability and growth.

The Rebundling of APM

New startups are merging error tracking, logging, tracing, and other observability tools into integrated platforms, such as Highlight.io, which automates incident response by aggregating errors, logs, and metrics. This unified approach poses a potential threat to Sentry, which is known for error tracking and integration with leading logging and tracing tools. However, the market is nascent, and most teams prefer specialized tools for each function. Sentry must clearly define and broaden its offerings as the observability sector develops to maintain its competitive edge.

Summary

Sentry is a software company that provides developers with software monitoring tools. The company started with a mission to help developers “solve their own problems with an easy way to fix their own mistakes.” As of April 2024, it has succeeded in raising $217 million at a $3 billion valuation, serving 90K organizations in over 146 countries. Starting with an open-source platform and a single language, Sentry has expanded its product offerings to address customer needs in a fierce and almost entirely competitive closed-source market competing with incumbents like Datadog and New Relic. Sentry’s position in the software monitoring tooling space is dependent on leveraging emerging technologies like LLMs while balancing value and potential distractions from the open-source community of its product.