Thesis

The social phenomenon dubbed "hypebeast culture" is centered around acquiring high-demand fashion items like streetwear and sneakers. Hypebeast culture has gained popularity among younger generations, driven by social media influencer marketing and celebrity endorsements, with over 60% of streetwear customers having been under the age of 25 as of 2019.

Meanwhile, the lines between streetwear and luxury continue to blur with influence from fashion icons like Virgil Abloh. Luxury brands are releasing products that cater to Gen Z preferences such as comfort and individualism, and so Gen Z consumers are starting to buy luxury items 3-5 years earlier than millennials. These shifts have contributed to the growth of the global streetwear market, which was estimated to be worth $187 billion in 2022 and was projected to grow to $230 billion by 2028.

Hypebeast culture ultimately thrives on the excitement behind limited releases, especially for sneakers. This anticipation, coupled with the insurgence of bots that infiltrate retail releases and immediately sell out popular items, creates the need for a secondary resale market to provide access to exclusive brands.

StockX is an online resale marketplace for deadstock sneakers, streetwear, watches, handbags, and other high-demand, supply-constrained lifestyle accessories that become collectibles. It operates on a bid/ask model, where buyers place bids and sellers list items at specific prices. StockX authenticates items sold on its platform to ensure authenticity. The platform provides real-time market data, allowing buyers and sellers to make purchase decisions based on current sale prices and bid/ask spreads

Founding Story

Source: Leading Authorities

StockX was founded in 2015 by Josh Luber (former CEO), Dan Gilbert, and Greg Schwartz (President and COO). Design expert Chris Kaufman, who was the Chief Creative Officer of StockX until August 2022, is also credited as a co-founder of the company.

Luber, a long-time sneaker enthusiast, identified a critical gap in the secondary sneaker market: a lack of reliable pricing data which made it challenging for buyers and sellers to determine fair prices. To address this problem, Luber and a team of volunteers began scraping public data from eBay, analyzing over 13 million transactions. This effort led to the creation of Campless, a predecessor to StockX, in 2012.

When Campless was launched, sneaker enthusiasts didn’t have options to buy limited-release sneakers easily. They either had to camp out in front of retail locations or buy re-sold goods on eBay. The name “Campless” was a reference to consumers having to camp out for limited releases; the company’s tagline was “know more, camp less”. Campless offered pricing information on the growing secondary sneaker market.

Three years into running Campless, in 2015, Luber was approached by Dan Gilbert, who was the co-founder of Quicken Loans and the owner of the Cleveland Cavaliers, an NBA team. Gilbert already had exposure to the sneaker community through his sons and his NBA team. In March 2015, Gilbert sat down with Schwartz, co-founder of a social networking app funded by Gilbert's Detroit Venture Partners and soon-to-be co-founder COO of StockX, to discuss options for new business ventures.

The pair settled on an idea to apply stock market mechanics to the sneaker market. Recognizing their limited knowledge of the sneaker world, they found and got in touch with Luber, whose data-driven approach with Campless had made significant waves in the sneaker community. Little did they know that Luber had arrived at the same idea independently; namely, to create a trustworthy marketplace for sneakers and other coveted items. Schwartz humorously recounted how he and Gilbert "kidnapped" Luber after inviting him to a Cavaliers game, bringing him back to Detroit to work out the logistics of their new venture.

With Luber on board to become StockX’s founding CEO, Gilbert invested an undisclosed amount to acquire Campless. Luber then left his consulting role at IBM and relocated to Detroit, where StockX officially launched in February 2016 with six employees, including Gilbert and Schwartz, after months of beta testing. In a 2021 interview, Luber commented on the idea for StockX:

“The stock market has been the most efficient form of commerce for 200 years, and all we did was take these commodities — stocks and bonds, oil and gas — and point it to new commodities — to sneakers to streetwear and watches and handbags.”

Under Luber's leadership, StockX secured three rounds of funding including a $110 million Series C that valued the company at $1 billion in June 2019. The same month, StockX appointed Scott Cutler, a former executive at eBay, StubHub, and the NYSE, as the new CEO; serial entrepreneur Luber departed StockX in September 2019 to launch another startup.

As of May 2024, Cutler remains StockX’s CEO, and Schwartz is President and COO. Former Stubhub and Warner Music Group executive Adam Wandy was appointed CFO in 2023 and helps lead the company alongside CPO Stephen Winn, who has been with StockX since its inception.

Product

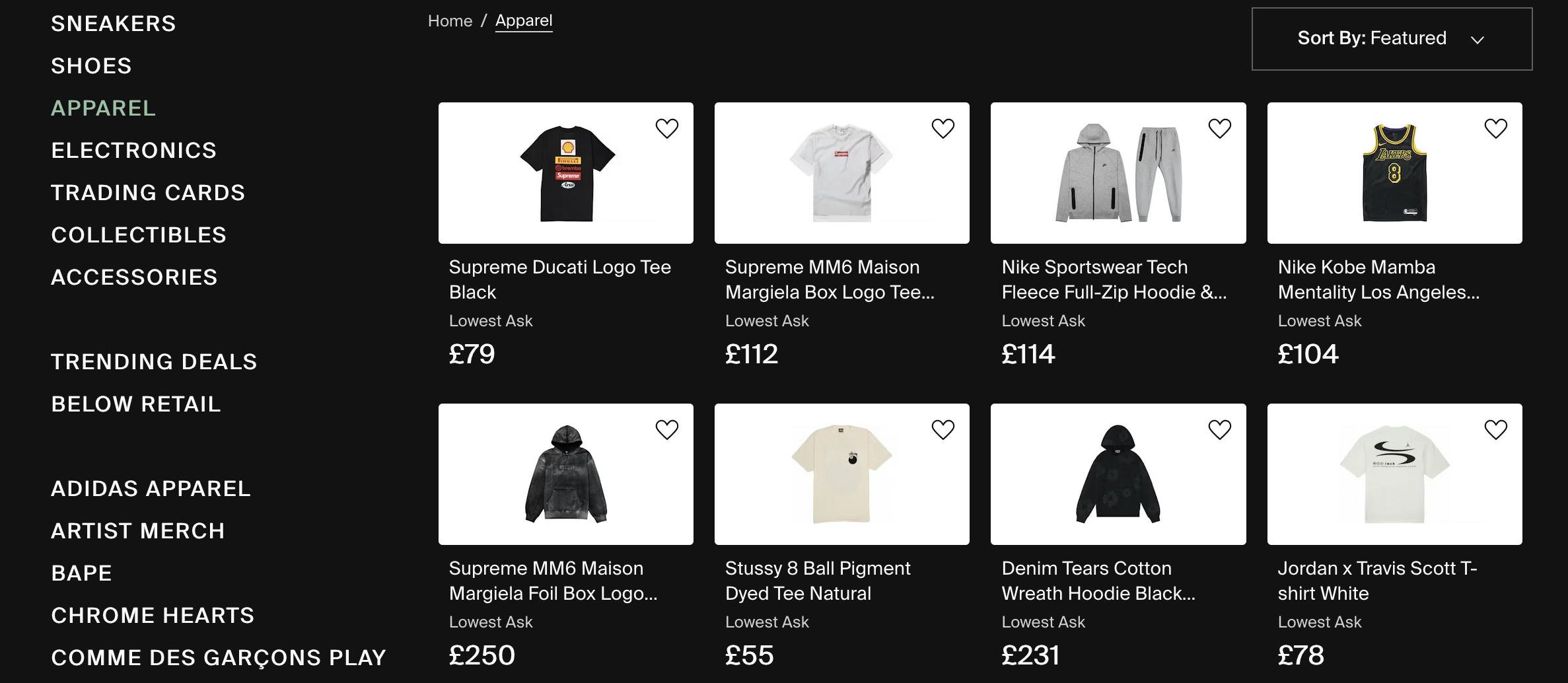

StockX is an online marketplace for lifestyle, fashion, and collectible items. Items available on the site include popular streetwear and designer brands, electronics, and trading cards. These frequently traded items are oftentimes pre-release, regionally limited, or “sold out” in retail channels.

Source: StockX

As of June 2024, the following brands are the most popular on StockX within their respective categories:

Sneakers: Nike, Air Jordan, Adidas

Shoes: UGG, Crocs, Birkenstock

Apparel: Fear of God, Supreme, Nike

Accessories: Supreme, Swatch, Telfar

Collectibles: Bearbrick, Lego, Kaws

Electronics: Sony, Apple, Microsoft

Marketplace

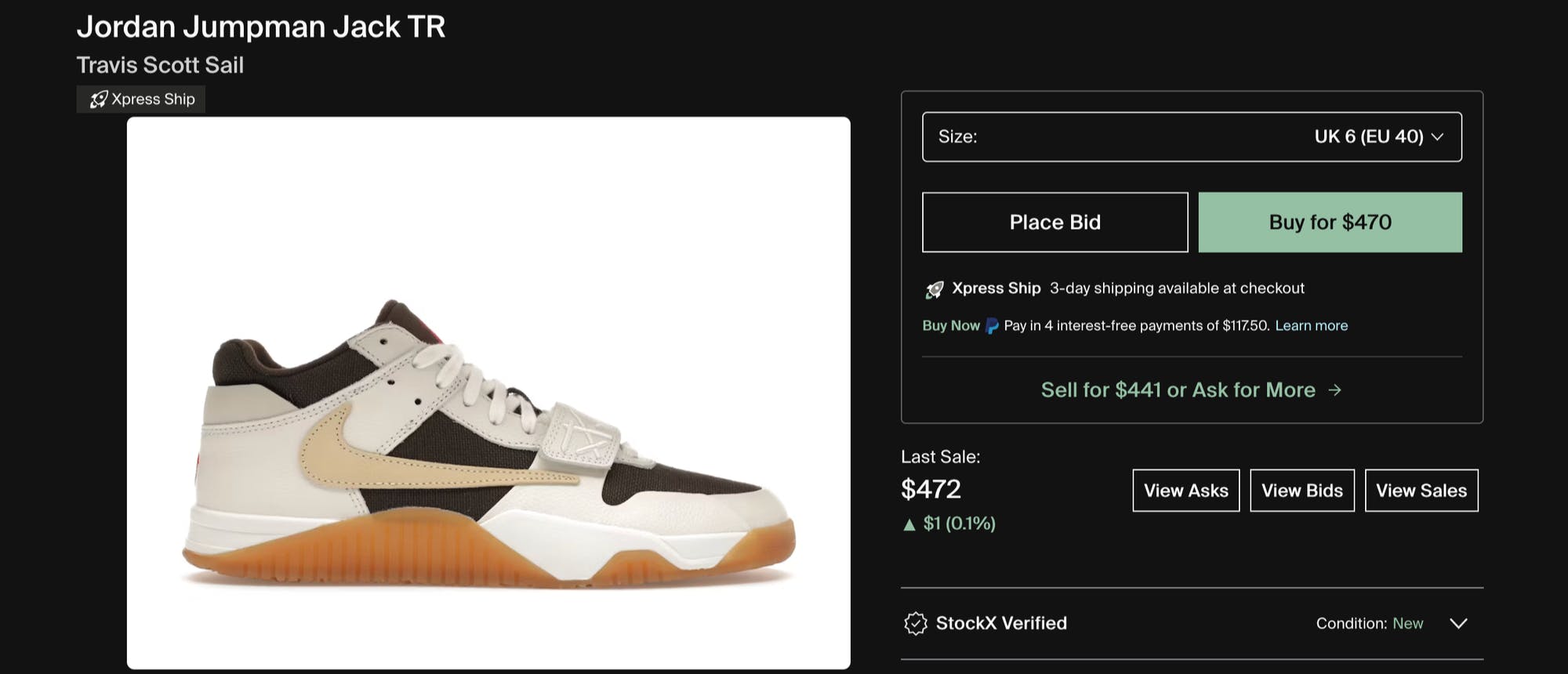

The StockX site runs on a bid/ask model: buyers place bids and sellers place asks. A transaction is executed when a bid matches an ask, which allows for market-driven prices that fluctuate due to demand.

Source: StockX

Buyers on the StockX marketplace have two ways to purchase items (i.e. “match with a seller”) on StockX. First, they can “bid” or make anonymous offers on StockX inventory which encompasses a “wide variety of shoes, streetwear, electronics, and collectibles”. Alternatively, they can utilize a “buy now” feature to buy an item at the lowest ask price without having to wait for competing bids.

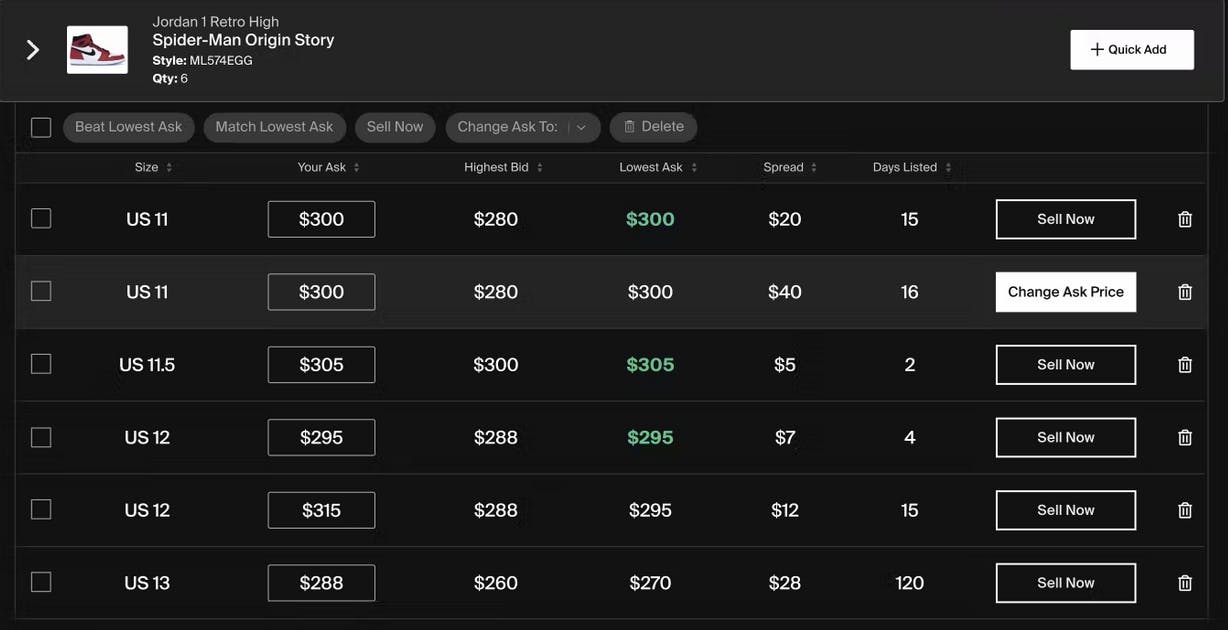

Sellers on the StockX marketplace don’t need to take product photos, share personal information, or negotiate. After they choose an item and set a price, they can let the auction play out. Otherwise, sellers can also choose an option to sell at the highest bid price to immediately make a sale. Sellers are sorted into different levels that progress as sales increase — allowing them to earn lower transaction fees, rewards, and advanced features.

Source: StockX

StockX offers a suite of free products only offered to professional sellers once they reach the threshold of 40 sales per month or $5000 worth of sales. Sellers meeting this threshold are designated as Level 3 sellers. The free products offered include the following:

StockX Pro: a bulk selling tool that streamlines processes for sellers to create and manage up to 100 listings at once. Besides hosting in-depth market data, StockX Pro also has logistics support for bulk shipping and low-ink labels to reduce seller cost and time.

Scout: an inventory management and cross-selling tool acquired by StockX in 2021; it allows sellers to track profit and portfolio market value and also provides end-of-the-year statements. The Scout app provides cross-listing capabilities on multiple platforms and also supports UPC scanning to track inventory.

StockX Developers: an offering available by request for high-level sellers. It includes seller APIs, batch and order management, and catalog APIs.

Source: StockX

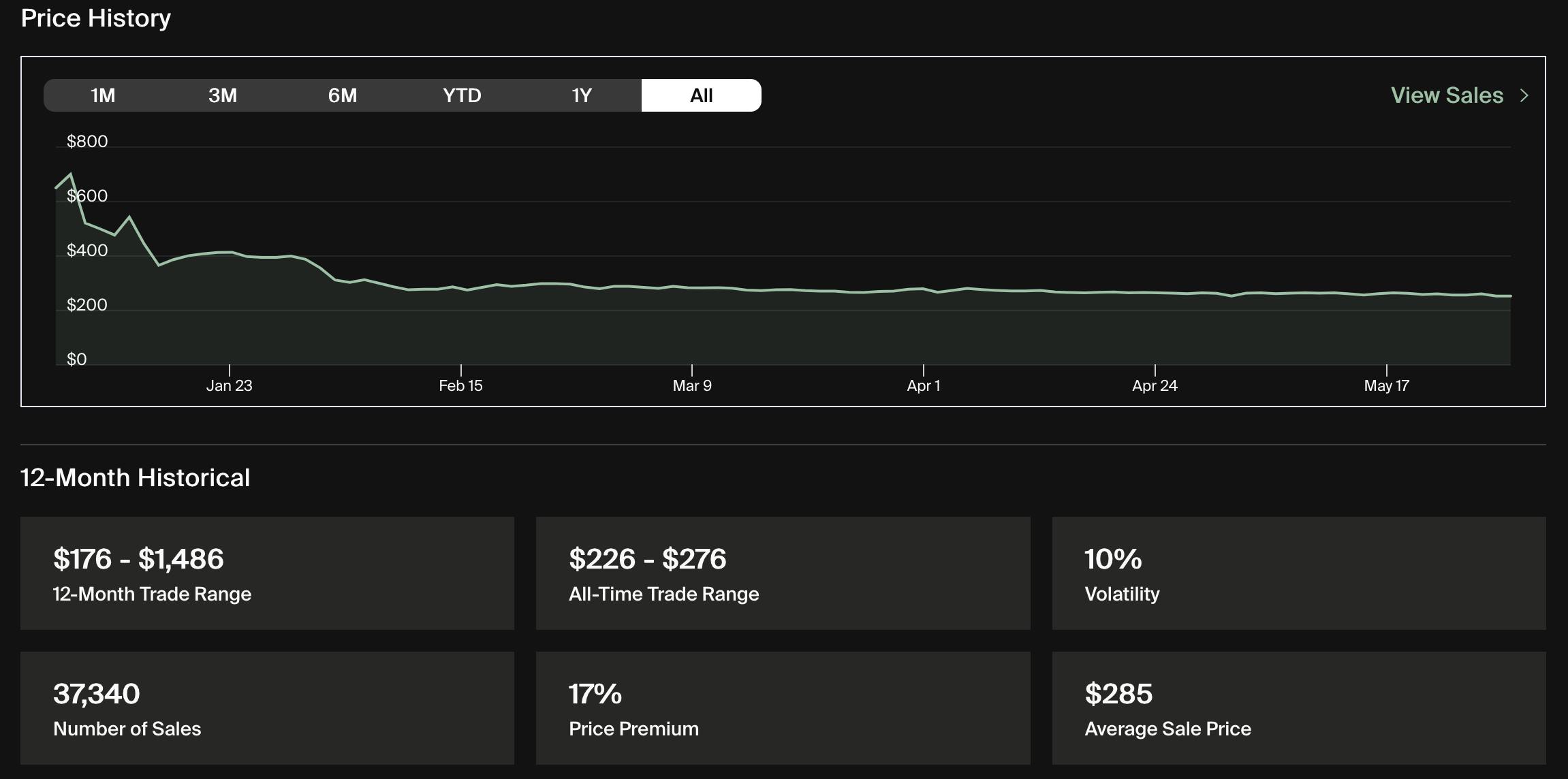

StockX also has a view that highlights trends for sneakers and streetwear instead of stocks and futures. Metrics on StockX include average sales price, resale highs and lows, and volatility to help buyers place bids and sellers place asks. These market insights allow viewers to determine if an item is overpriced, or if the price is likely to go up.

Consumer Goods IPO

Source: StockX

StockX allows companies and brands to launch an initial public offering (IPO) of limited-edition consumer products on its website. The first-ever consumer goods IPO occurred in 2016 with the debut of limited-edition products centered around the twentieth anniversary of Jay-Z’s first album, Reasonable Doubt.

StockX’s IPO process works like a company going public. Prior to the IPO, pre-bidders name prices, offering an initial valuation. On the IPO day, StockX ships the products to the highest bidders depending on available quantity, who can then resell the merchandise on StockX’s site. Since the advent of the consumer goods IPO, StockX has collaborated with brands to release exclusive items including Bowman Chrome X with Topps, Ben Baller slides, the limited edition New Balance 650 x No Vacancy Inn, and a TEAM WANG capsule.

Verification

After a transaction occurs, each item sold on StockX goes through a rigorous verification process at one of StockX’s 11 verification centers across North America, Europe, Asia, and Australia. One million items per month on average went through StockX’s verification process between June 2022 and May 2023. Every item must be brand new and must never have been used in order to receive the StockX Verified designation from one of over 300 authenticators, except refurbished watches and electronics. Verification of authenticity is important to StockX’s business and so the company appears to take it seriously; in 2023, StockX rejected over 325K products valued at a total of $80 million that were not up to the company’s standards.

StockX Magazine

Source: StockX

The StockX Magazine publishes market trends, product highlights, and buying guides. The magazine publishes featured series like its Big Facts series, which includes an annual report and verification updates intended to position StockX as an authority in sneakers and streetwear.

Market

Customer

StockX’s target customers include sneaker enthusiasts, streetwear enthusiasts, electronics collectors, and pop culture collectors. As of May 2024, StockX had 28 million monthly visitors to its website. The biggest source of site traffic came from the US which accounted for 44.8% as of June 2024, followed by the UK (5.9%) and Canada (7.7%). 61% of StockX traffic came from people ages 18-34, and 59.6% of traffic was male.

Customers value StockX’s prioritization of customer experience and some have expressed specifically for the platform’s data insights that show historical prices and item information based on demand. Because of this dynamic pricing, one buyer reported purchasing two pairs of Nike Vomero 5s on StockX for the price of one pair at retail value. And on the reseller side, customers who have previously bought counterfeit items on StockX oftentimes continue using the site, citing that the company is a “critical part of sneaker accessibility”.

Market Size

The global sneaker resale market is expected to reach $30 billion by 2030, which would represent a significant increase from its size of $2 billion as of January 2024. Furthermore, the global luxury resale market was valued at $32 billion in 2021 and is projected to hit $51 billion by 2026.

Meanwhile, the global streetwear market was estimated to have accounted for $187 billion in sales in 2022. In the US specifically, online resale platforms’ fashion sales are projected to reach over $23 billion by 2026, up from $14.1 billion in 2023. These trends highlight the growing demand for exclusive and trendy apparel, driven by a consumer base that values individuality, limited-edition items, and culture.

Competition

GOAT: GOAT was founded in 2015 as a marketplace to trade sneakers, apparel, accessories, and luxury goods. It operates on a similar model to StockX, but the key difference is that it doesn’t only sell deadstock items. In 2018, GOAT Group was created when its namesake company merged with Flight Club — a brick-and-mortar NYC sneaker consignment store founded in 2005. A year later, the company acquired $100 million in backing from footwear retailer Foot Locker.

In 2022, GOAT Group acquired Grailed, an online peer-to-peer marketplace founded in 2013. At the time of StockX’s launch in 2016, Grailed had 350K users aged between 18 to 35 as it offered hype gear with a digital authentication process rather than an in-person middle-man like StockX. As of May 2024, GOAT Group was comprised of four distinct fashion platforms: GOAT, Flight Club, Grailed, and alias, a mobile reseller app. The company has raised a total of $492.6 million in funding as of June 2024 and was valued at $3.7 billion at the time of its Series F in June 2021.

Stadium Goods: Stadium Goods, founded in 2015, is a marketplace focused on new and used sneakers and streetwear with an emphasis on sporting goods. It operates online and through its New York City store where it holds pre-authenticated inventory, a distinguishing feature from other competitors in the after-market luxury goods space like StockX that keep funds in escrow until verification is complete. Stadium Goods does not use a dynamic bid/ask pricing model and instead charges a commission on the listing price plus a monthly $2 fee per item for inventory over 180 days old. In 2018, Stadium Goods was acquired by online luxury platform Farfetch for $250 million.

eBay: Founded in 1995, eBay is an online bidding marketplace that has always included apparel and sneakers alongside a diverse range of consumer goods. In 2020, eBay announced that it would begin authenticating sneaker sales over $100 in the US, which it already offered for watches over $2K in value. eBay has a market cap of $27 billion as of June 2024, and its move towards conducting authentication put it into more direct competition with GOAT Group and StockX.

Business Model

Source: StockX

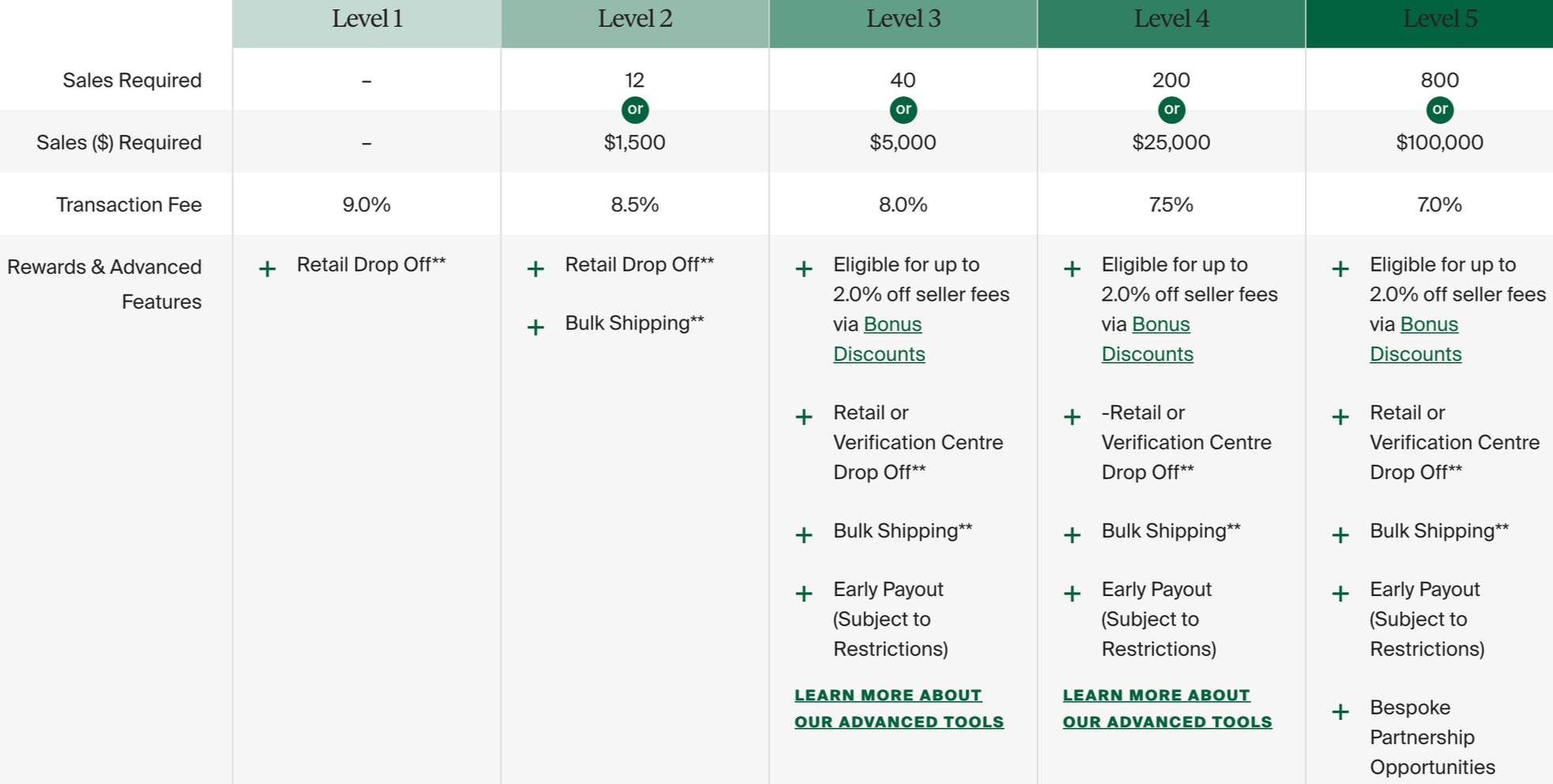

StockX is a consumer-to-consumer ecommerce marketplace that generates revenue primarily through transaction fees. For all StockX sales, there is a 3% processing fee on top of a transaction fee that is determined by a seller’s “level, which ranges from 1-5.

Sellers are incentivized towards bulk selling and increased frequency because their transaction fee reduces as they sell more. Seller activity that determines their levels resets every quarter.

Level 1 has no baseline sales requirement, and has a 9% transaction fee.

Level 2 requires 12 sales or $1.5K, earning a transaction fee of 8.5% and unlocking the bulk shipping feature.

Level 3 is for sellers who sell 40 items during the period, or $5K.

Besides perks from previous levels, Level 3 also includes eligibility for up to 2% off seller fees, early payout, and verification center drop-off.

Level 4 is for 200 items or $25K for a 7.5% fee, with no extra benefits compared to Level 3 as of June 2024.

The highest level, Level 5, is for sellers who sell 800 items or $100K in sales for a 7% fee and the added benefit of bespoke partnership opportunities.

Traction

StockX generated over $400 million in revenue during 2020, with over $1.8 billion in gross merchandise value. In 2023, the company reported that it had reached over 15 million buyers, 1.7 million sellers, and 50 million trades on its platform over the company’s lifetime; up from 12 million buyers, 1.5 million sellers, and 40 million trades in 2022.

StockX has also seen growth in its female user base; female users comprised 38% of StockX’s users as of 2024, whereas females only made up 25% of website users in 2018. StockX has also seen growth in its international presence. In 2022, international sellers accounted for around 50% of all StockX trades, up 25% from the previous year. 2023 saw new records in terms of international growth led by key markets: France, Spain, and Mexico.

StockX has also signed a number of high-profile partnerships. In May 2023, StockX signed a member loyalty partnership with Equinox along with eight other brands as part of its “Equinox Circle” program. In March 2024, StockX said it was “among the first” to launch an immersive shopping experience for the Apple Vision Pro.

However, the company has also had multiple rounds of layoffs. In April 2020, StockX cut 12% of its workforce “to ensure long-term sustainability”. In July 2022, StockX laid off 8% of its total workforce, citing macroeconomic challenges. Shortly after, in November 2022, it laid off a further portion of its workforce estimated at “under 80 employees”, saying that it was making “adjustments” to its corporate teams “to align with current organizational priorities”, again citing macroeconomic factors. Finally, in January 2024, StockX laid off around 40 employees including its CMO, saying that it was an organizational restructuring “to create a flatter, more streamlined organization that enables faster decision-making”.

While an IPO was rumored to be in the works for StockX in 2022, CEO Scott Cutler stated that this was not the company’s priority, as StockX aimed to focus on profitability over sheer growth.

Valuation

StockX has raised a total of $690 million over 10 rounds as of June 2024. In April 2021, the company raised a $60 million Series E-1 along with a $195 million secondary tender offering which valued the company at $3.7 billion, representing a 35% growth in valuation from its previous Series E round in December 2020, where it raised $275 million at a $2.8 billion valuation. Notable investors in StockX include Altimeter Capital, Dragoneer Investment Group, Tiger Global Capital Management, Whale Rock Capital Management, Battery Ventures, and Google Ventures.

Key Opportunities

Ongoing Expansion of Partnerships

StockX partnered with fitness giant Equinox on its exclusive Equinox Circle program in 2023, and the next year, StockX launched an immersive shopping app for the new computer Apple Vision Pro. Future partnerships with companies from diverse industries are likely to be a continuing area of opportunity, as they could enable StockX to improve its reach and solidify its position as a luxury goods reseller.

Targeting Millennials

Millennials were the largest generation in US history as of 2024. As they move into their prime earning and spending years, they could be more willing or able to spend on lifestyle products hosted by StockX such as sneakers, apparel, and collectibles. As of 2021, 70% of StockX users were under the age of 35, with the majority of app users under 25. By May 2024, 61% of StockX traffic came from people ages 18-34, but only 19.9% came from those ages 35-44 (older millennials). Growing its product base and changing its marketing strategy to target these users could provide a significant future source of growth for the company.

Key Risks

Proliferation of Counterfeit Goods

In 2020 alone, the fashion industry lost over $50 billion in potential sales due to counterfeiting. Seizures of counterfeit and pirated goods increased by a factor of ten between 2000 and 2018, according to the US Department of Homeland Security.

The growing appeal of counterfeits is driven by several factors, including the popularity of luxury goods among Gen Z. These “superfakes” have become so sophisticated due to advances in technology that even expert authenticators struggle to differentiate them from authentic items. Social media platforms like TikTok further exacerbate this issue, with videos showing where to purchase knockoffs that are then sold on platforms like StockX.

This presents a significant risk for StockX's business, as evidenced by Nike's 2022 lawsuit against the company. Nike purchased four pairs of counterfeit shoes on StockX, despite receiving a receipt stating that the shoes were “100% Authentic”. The lawsuit thus highlights serious flaws with StockX’s guarantee of authenticity, which forms the basis of its value proposition. Additionally, Nike included evidence from a reseller who bought 62 pairs of three distinct shoes from StockX, yet discovered that 38 of them were counterfeit — a failure rate of over 50%.

This situation undermined seller trust in StockX: certain items and styles, such as UNC 1s, Mocha 1s, and white-on-white Air Force 1s are began to be avoided by resellers due to their susceptibility to counterfeiting. The proliferation of counterfeit goods not only exposes StockX to the risk of larger lawsuits in the future but also raises questions about its ability to enforce quality control. StockX’s capacity to protect its market position and brand reputation may rely heavily on its ability to mitigate this risk.

Cybersecurity Threats

Cybercrime is a leading threat to ecommerce businesses and customers. In 2019, StockX experienced a significant security breach, where over 6.8 million records of private user information were stolen by a hacker. The company's handling of the incident may have further compounded the issue; instead of immediately informing customers about the breach, StockX prompted users to reset their passwords citing “system updates” without explaining the underlying reason. As the widespread use of AI increases the potential volume and impact of cyberattacks, future breaches or continued maladministration could deter customers from using StockX.

Summary

StockX has positioned itself as a “stock market of things” with an inventory of limited-release and other goods across an expanding array of categories and an expanding product suite for sellers. StockX aims to ensure price transparency and fair market value with its stock market-like model. By integrating fashion-forward advice and news into its website, StockX has fostered engagement with its growing global audience. However, despite ecommerce industry tailwinds and investment in new technology, StockX’s market position may be challenged by the influx of new competitors in the saturated space.