Thesis

Medical devices are an increasingly important and complex part of healthcare. The FDA authorized ~6K medical device submissions in 2022 alone, and the global medical devices industry was valued at $512.2 billion in the same year. Growth in this space has been driven by several factors, including the rising prevalence of chronic diseases like diabetes and a general shift toward home care versus in-hospital treatment. To effectively serve their patients, healthcare providers contend with a vast and growing array of medical instruments and appliances intended for a range of specific care scenarios.

For medical device makers, an effective field sales process is the best way to get their product in front of healthcare providers like hospitals, doctor offices, and urgent care centers. With the average cost of bringing a medical device to market being between $30 million and $54 million in 2022, a data-driven sales pipeline is important to achieving positive ROI for medical device companies. However, while commercial intelligence sales software is well-developed for pharmaceuticals, the medical device industry remains underserved thanks to siloed data and a lack of tailored solutions.

AcuityMD is a commercial intelligence platform tailored for the medical device industry. It describes itself as “medtech software to drive sales” that “transforms large amounts of healthcare data into intuitive workflows.” It seeks to help its customers prioritize high-value physicians, track product adoption, and predict demand. By providing information at each phase of the medical device sales pipeline, AcuityMD seeks to help its clients identify new healthcare providers and territories to focus their sales and marketing efforts.

Founding Story

Source: AcuityMD

AcuityMD was founded in 2019 by Michael Monovoukas (CEO), Robert Coe (CTO), and Lee Smith (Head of Commercial Development).

After graduating from Princeton University with an international affairs and public policy degree, Monovoukas worked as a management consultant at Bain & Company, where he focused on commercial strategy for medical device and biopharma clients. While working at Bain, he founded medical device startup Monolysis Medical with his brother Demetri Monovoukas in 2014. The company sought to develop an optical pen that could calculate the perimeter and area of a wound on the surface of a patient’s skin, which they named the WoundStylus. The venture was ultimately unsuccessful and folded in 2015. Monovoukas credits the experience with teaching him the fundamentals of entrepreneurship and how to sell to medical professionals.

The experience, in conjunction with his medical technology strategy work at Bain, also led Monovoukas to recognize the challenges involved in bringing new medical devices to market. He identified that medical device makers lacked services to track physician and product-level relationships, a marked contrast with the numerous software and data providers in the biopharma space. In 2014, he joined PatientPing, an early-stage startup that aggregated hospital data, in a business development and finance role. Monovoukas described the startup as “almost like a Twitter feed or a Foursquare feed to primary care physicians”. (PatientPing was ultimately acquired by Appriss Health — now Bamboo Health — in 2021.)

Monovoukas left PatientPing in 2017. With Coe, a sales engineer at Yext, and Smith, a marketing manager at Medtronic, he founded AcuityMD in 2019. The company raised a $7 million seed round in 2021, led by Benchmark. At the time of the raise, Monovoukas described AcuityMD as a data platform tracking the lifecycle of medical devices for healthcare customers including doctors and surgeons. As of December 2023, the company’s product has narrowed its focus to supporting sales and marketing teams in the medical devices industry.

Product

AcuityMD is a commercial intelligence platform for medical device companies. The company describes its product as a “MedTech commercial flywheel” powered by its MedTech data model. Its goal is to help identify high-value targets and opportunities for growth by integrating data about physicians, care sites, and products, derived from a pool of over 325 million patients.

The company’s data is drawn from the Centers for Medicare & Medicaid Services (CMS) and medical claims aggregators, providing end-to-end insights for medical device commercial strategy. AcuityMD’s offering is divided into four solution modules: targeting, markets, territories, and pipeline.

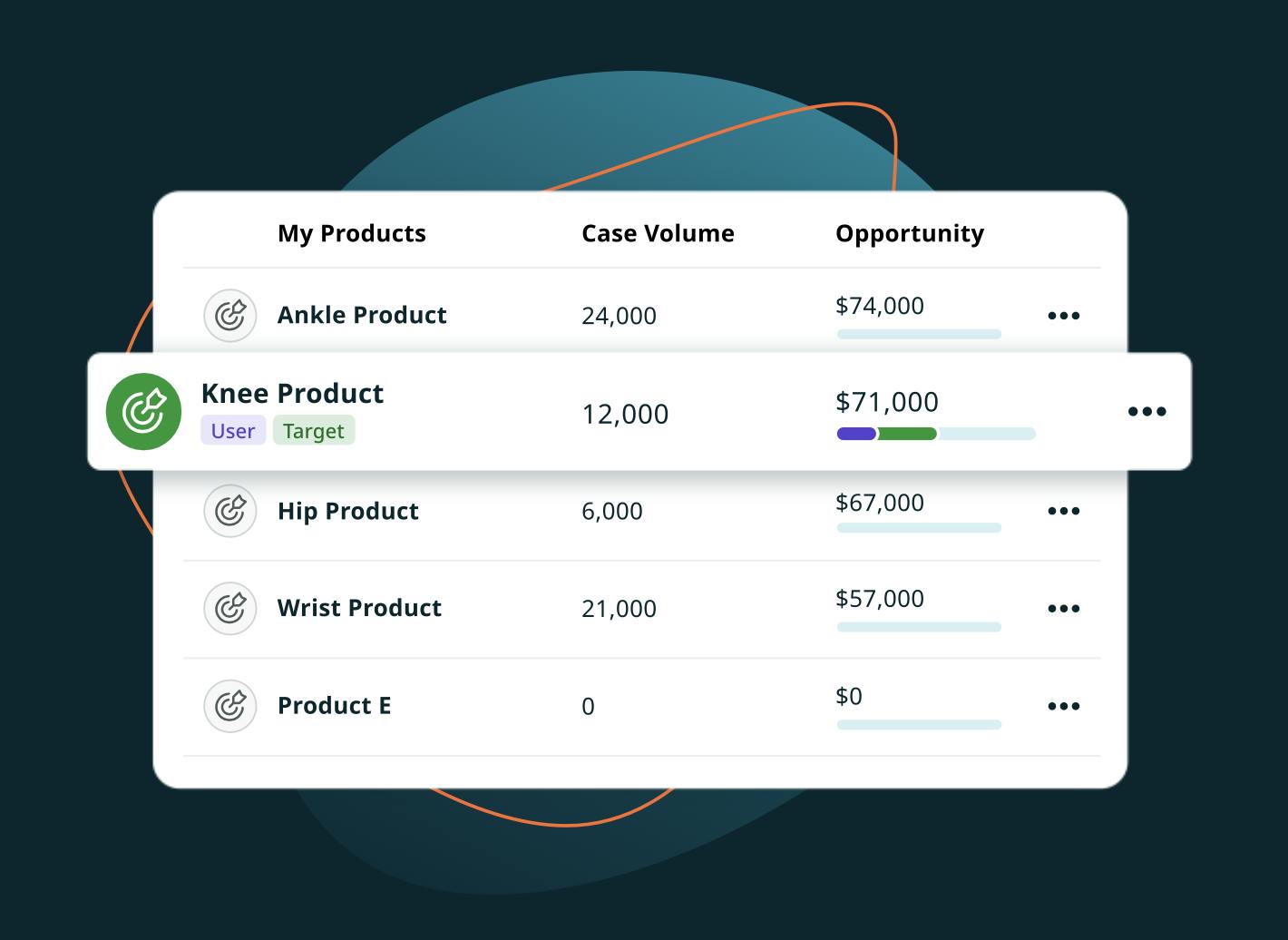

Targeting

Source: AcuityMD

AcuityMD's targeting solution provides medical device companies with data-driven insights to enhance sales strategy. The platform offers a feed of healthcare providers (HCPs) and sites of care (SOCs), including their procedure volumes, affiliated networks, and historical product usage. This data helps sales teams identify potential high-value targets and tailor their approach. It integrates with existing CRM systems, allowing for real-time data updates and better workflows.

Users can track opportunities through the sales process via a target list. The platform surfaces peer-to-peer connections — including publication co-authors and residency classmates — and identifies which providers are referring patients to target HCPs. Users can follow relevant trends and track when a target HCP begins operating in new sites and territories. With the information provided by AcuityMD, sales representatives can tailor their pitch to specific HCPs and SOCs.

As of December 2023, AcuityMD claims its solution has generated over $4 billion in total pipeline and enables a 25% sales increase for active users.

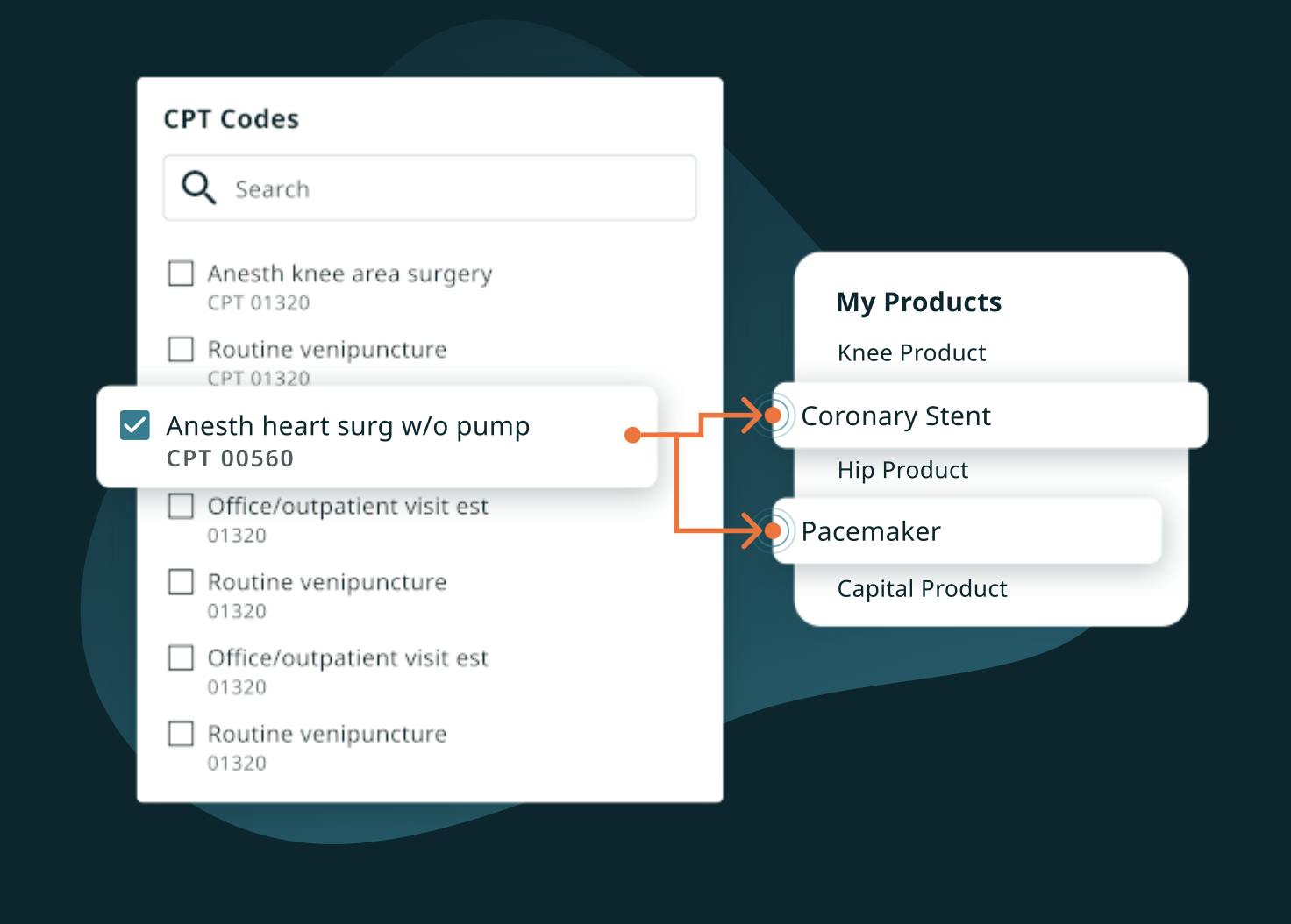

Markets

Source: AcuityMD

AcuityMD's markets solution enables medical device companies to define, size, and segment their target markets. For example, a user can search for a list of product categories or relevant procedures by “current procedural terminology” (CPT) code and view the projected size of the market. Additional filter options allow for segmentation across hospitals, ambulatory surgical centers, integrated delivery networks, and geographies. The platform facilitates more accurate targeting of ideal customer profiles and growth opportunities with product penetration tracking and trend-spotting capabilities. Users can see the types of procedures their target customers perform, identifying possible areas for market expansion.

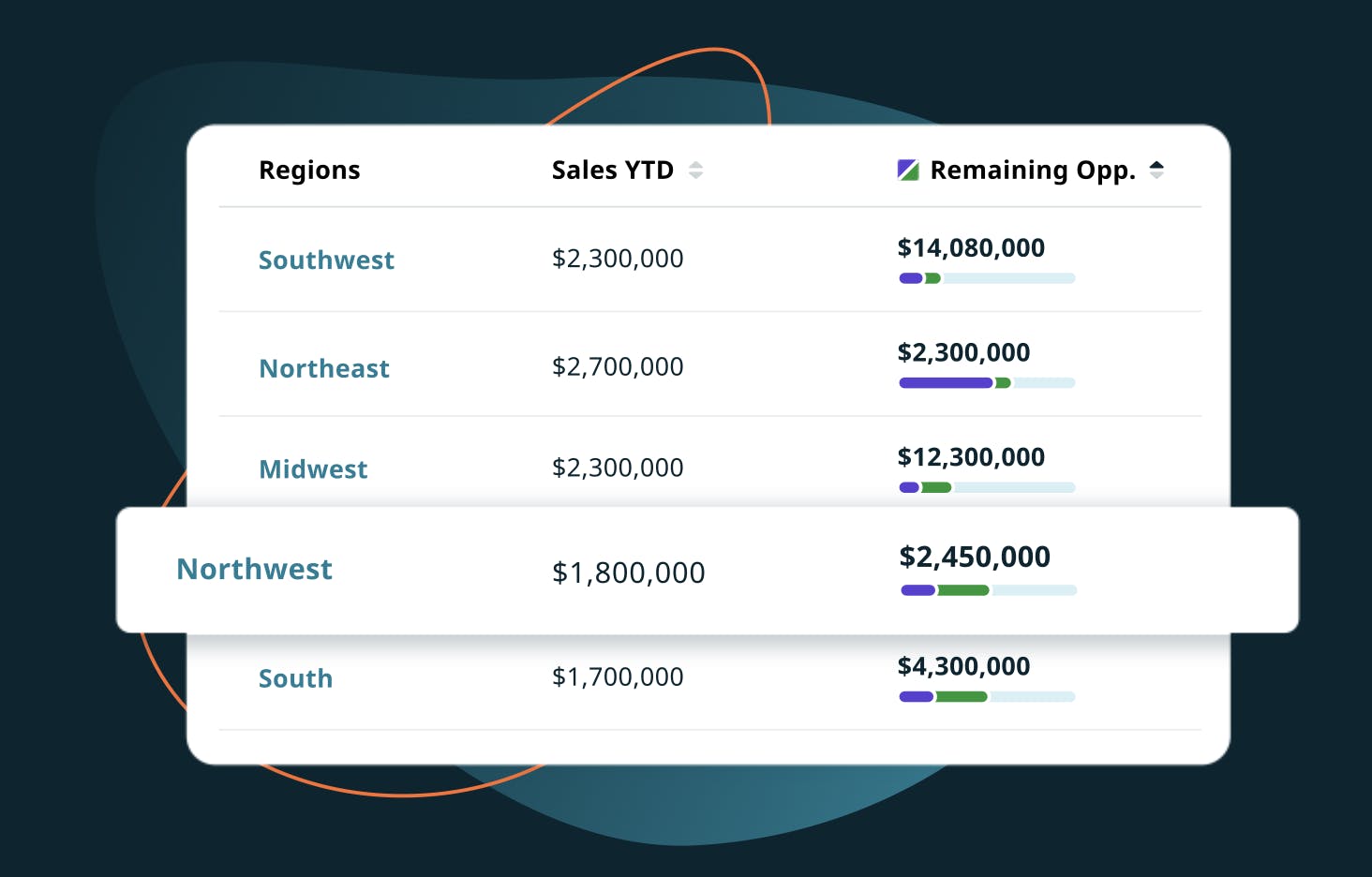

Territories

Source: AcuityMD

AcuityMD’s territories solution helps medical device companies optimize their sales strategy through region-specific data and insights. Users can refine their search by region, state, or zip code and compare sales and opportunities to best understand product penetration potential to guide resource prioritization. Insights include sales history, market size, and number of sites of care. Users can integrate data from their existing CRM or ERP, mapping existing territory and region data to maintain consistency across systems.

Pipeline

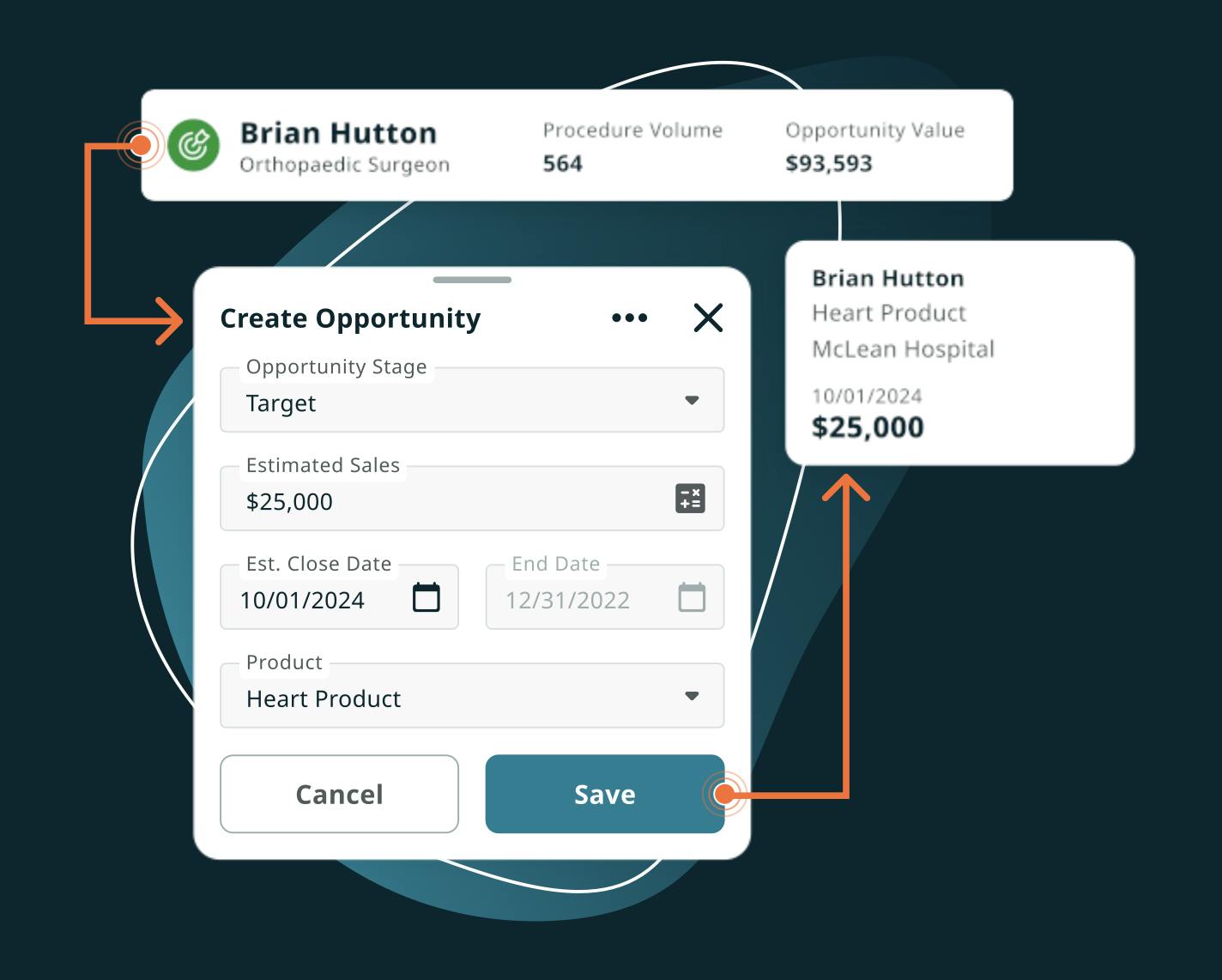

Source: AcuityMD

AcuityMD's pipeline solution aids medical device companies in optimizing their sales cycle and achieving revenue goals. It automates the pipeline process by identifying high-value HCP and SOC targets and providing information like procedure volumes and details. Customers can build sales forecasts, identify gaps in quota, and guide sales representatives to effectively fill their pipelines. It offers a full view of the sales cycle, from initial targeting to customer engagement, and tracks product usage and opportunities across various customer types and categories.

Market

Customer

AcuityMD serves medical device companies ranging from pre-commercial to enterprise-scale companies. These companies utilize AcuityMD's platform to gain insights into the healthcare market, particularly for understanding the adoption, usage, and performance of medical devices in targeted categories. AcuityMD’s specific customer profile includes sales and marketing teams within these companies, who use the data and intelligence provided by AcuityMD to build go-to-market strategies for their devices.

AcuityMD customers want to understand sales and product opportunities for their medical devices. In a June 2023 interview, an executive at an AcuityMD customer described their main priorities in using AcuityMD as gaining a competitive advantage for their sales team, enhancing targeting efficiency — including identifying which customers to target and why — and improving their general understanding of the market.

Describing the typical customer and use case of AcuityMD, Monovoukas said in 2022:

“[Our customers are] trying to sell and educate surgeons about which products to use in which settings. It is a very white-glove sort of hands-on sale, and they’re really good at educating and training surgeons on the latest technologies for their procedures. That’s the salesperson’s job, and they should be spending all their time helping in the field, helping surgeons learn about new technologies and get them trained and comfortable using those new technologies. Instead, because of the current landscape of software systems that the sales reps rely on, they spend their days in their office logging notes into a CRM. We’re taking valuable time where a sales rep could be educating a surgeon about a new robot that they can use.”

Market Size

AcuityMD serves the medical devices market. Globally, this market was valued at $512.2 billion in 2022 and was projected to grow to $799.6 billion by 2030, representing a CAGR of 5.9%. The growth of this market is being fueled, in part, by an increasing prevalence of chronic disease, with one NIH study from 2022 estimating that the number of Americans over 50 suffering from at least one chronic disease would grow from 71.5 million in 2020 to 142.7 million by 2050. The growth of the market is further being fueled by increasing emphasis on preventive measures and innovation in the medical devices space.

The company also operates in the commercial and business intelligence space. The global market size for this sector was estimated to be $27.1 billion in 2022. By 2030, the market is expected to reach $54.2 billion, representing a CAGR of 9.1%.

Competition

ClearSight Health: ClearSight Health is a Toronto-based sales enablement software company founded in 2020. Similar to AcuityMD, ClearSight Health offers a platform with territory-specific and up-to-date data on HCPs specifically for the medical devices industry. Like AcuityMD, this company leverages its system’s network effect to expand customer targets for users and facilitate networking. While the targeting features are similar, AcuityMD’s available data is much broader while ClearSight Health is limited to HCP-relevant information. ClearSight Health’s valuation or fundraising activity is not publicly known.

Definitive Healthcare: Definitive Healthcare is a Massachusetts-based healthcare commercial intelligence platform founded in 2011 that serves various segments of the healthcare space including biopharma, medical devices, healthcare providers, software/IT, and professional services. As of December 2023, Definitive Healthcare offers 23 different product modules providing insight across HCP group affiliations, patient population identification, and medical claims. The company went public in September 2021, raising $420 million. As of December 2023, Definitive Healthcare has a market capitalization of $1 billion. It recorded a full-year 2022 revenue of $222.7 million representing 34% growth from 2021. In an August 2023 interview, an executive at an AcuityMD client said they moved from Definitive Healthcare to AcuityMD because of better functionality and approximately 50% cost savings.

Zymewire: Zymewire is a Toronto-based sales intelligence tool built for developing pipeline leads in the biotech and pharmaceuticals industry. Founded in 2011, Zymwire provides sales signal information tailored according to therapeutics focus, drug delivery method, and geographic region. Its platform identifies and surfaces relevant stealth companies by tracking company formation documents, fundraising, and early-stage research. Zymewire serves over 350 customers as of December 2023, including Fareva, PCI Pharma Services, and Sartorius. Its most recent fundraising round as of December 2023 was in 2017 for an undisclosed amount and was led by the Creative Destruction Lab. Zymewire differs from AcuityMD in its focus on biotech and pharma as well as its focus on pipeline news, as opposed to general sales data.

IQVIA: IQVIA is a multinational, US-based company that provides analytics, compliance, and management solutions to the healthcare and life sciences industries. Founded in 1982 under the name Quintiles, it underwent a $9 billion merger with IMS Health in 2016. While IQVIA provides a wide range of services, its most relevant sales intelligence products provide insights across sales, volume, market dynamics, geographies, and patent landscapes. Unlike some of the other listed competitors, IQVIA’s data includes nearly all aspects of healthcare, including medical devices. IQVIA is considered the leader in commercial solutions for healthcare with a market capitalization of $39.3 billion as of December 2023. It generated $14.4 billion in revenue in 2022.

Business Model

AcuityMD operates on a SaaS subscription model. The subscription cost comprises a base platform fee plus a charge per user seat. The pricing structure of AcuityMD, while not publicly disclosed by the company, can be inferred from interviews with representatives of client companies. In a June 2023 interview, an executive at an AcuityMD client company reported a base platform fee of $25K for the growth tier and $40K for the full tier, with a $2K charge per user seat. In an August 2023 interview, a vice president at another AcuityMD client estimated their company’s total annual expenditure on the platform at ~$100K for 40 field sales staff.

Traction

In December 2022, AcuityMD reported an increase in ARR of 317%, with customer growth increasing by 253% over the same period, In August 2023, the company reported having 116 customers, with 50 signed in 2023. As of December 2023, the company reports it has facilitated over $4 billion in total sales pipeline. In August 2023, AcuityMD reported serving customers including Olympus, Ossio, Enovis, Palette Life Sciences, Spark Biomedical, and Miach Orthopedics.

Source: AcuityMD

Valuation

In May 2022, AcuityMD raised a $31 million Series A, bringing the company’s total funding to $38 million. Its valuation has not been publicly disclosed. The Series A was led by Redpoint Venture Partners, with support from Benchmark, which led the company’s seed round. Other investors included Ajax Health and Artisanal Ventures.

Key Opportunities

Wider Healthcare Offering

AcuityMD could see significant gains by diversifying into other healthcare product areas beyond the medical device sector. The pharmaceuticals market is projected to grow to $3.2 trillion by 2030, 4x as large as the expected size of the medical devices market is expected to be in the same year.

There is therefore an opportunity for AcuityMD to capture a share of larger, adjacent markets. A more comprehensive AcuityMD platform that tracks treatments and products beyond medical devices could better meet the diverse needs of customers in the broader healthcare sector. For example, AcuityMD could expand its MedTech data model to include pharmaceuticals, helping drugmakers understand and track new markets and opportunities.

Global Expansion

The US is the world’s largest healthcare market, with national healthcare expenditure reaching $4.3 trillion in 2021. For US-based medical device companies, the domestic market is the natural first choice for launching new products. For medical device companies based outside the US, penetrating the US market is a key priority.

AcuityMD has an opportunity to pursue global medical device makers looking to break into the US market. One example is the 2023 partnership between AcuityMD and FEMSelect, an Israeli company focusing on minimally invasive devices for women's health. In a May 2023 announcement, AcuityMD said FEMSelect had used its platform to identify 400 HCPs and 600 SOCs that could benefit from its tech.

As of December 2023, AcuityMD’s product is primarily focused on data and intelligence about the US medical device market. As part of a global expansion, it could also look towards aggregating international medical device data, assisting both US and global firms in selling their product in other territories. This would require partnering with robust healthcare data sources for those territories.

Key Risks

Dependence on Medical Devices

Due to its specific focus, AcuityMD’s fortunes are tied to the broader medical device market. Changes in the market dynamics or shifts in the priorities of companies within this space could affect AcuityMD's performance if it maintains its narrow focus. Given that AcuityMD had 116 customers as of August 2023, it could be vulnerable to churn and any downturn in medical device production and development.

In a June 2023 interview, a department head at an AcuityMD client mentioned that it could be harder to justify the ongoing cost of the platform unless the client’s business was expanding its line of medical products. This suggests AcuityMD is naturally better suited to the development of go-to-market strategies for new products rather than mature ones. This reliance on new development and new business further underscores AcuityMD’s reliance on the ongoing growth and stability of the medical device sector.

Increased Competition

The sales intelligence space in healthcare is competitive, and AcuityMD faces threats from both direct competitors like Definitive Healthcare and larger, less specialized data firms like IQVIA. Sales and marketing teams are unlikely to maintain multiple subscriptions across platforms if there is significant overlap in functionality and data, and AcuityMD could be vulnerable to a larger, more fully-featured platform developing a competitive medical device intelligence motion.

Tight competition in the space also presents a risk in the high cost involved in larger, more complex entities switching to new platforms. In a 2022 interview, Monovoukas acknowledged the challenge of getting sales teams to switch, noting that “it is a huge uphill battle to get the reps to change their behavior [and] to adopt.”

Summary

Developing commercial intelligence provides a strong advantage in a healthcare market defined by ongoing innovation and a complex product landscape. AcuityMD provides data and insights to drive medical device sales and help companies in the space develop targeted go-to-market strategies. Looking forward, AcuityMD has the opportunity to expand its offering — either horizontally into other areas of the healthcare industry or geographically into other global territories and markets.