Thesis

With the installation of the first ATM by Barclays in 1967, the digitalization of banking and financial management began. Through the 1990s, this industry grew; Stanford Federal Credit Union became the first bank to offer an accompanying website to its customers in 1994, and just four years later, PayPal was founded. However, after the financial crisis of 2008, negative consumer sentiment towards traditional banking, new technologies, and regulatory changes encouraged new providers to enter the financial technology and services market. In particular, the widespread adoption of the smartphone following the iPhone release in 2007 enabled people to access financial services via the internet. This new technology, in turn, made it easier for providers to facilitate open banking, a practice that enables third-party companies to access financial data. This spurred the growth of Banking-as-a-Service (BaaS) platforms, which act as a type of “neo-bank” focused on delivering a faster, improved customer experience.

But with this growth came challenges. Since 2012, these platforms have paired up with small and mid-sized sponsor banks, which hold the physical money and oversee regulatory compliance. In other words, most of these fintech companies, such as Venmo or CashApp, are not banks themselves. Rather, they simply provide a digital interface and partner with FDIC-insured institutions that execute the actual monetary transactions. However, the sponsor banks’ FDIC insurance rarely extends to their partnering fintech companies, which has historically led to customer security and safety risks.

For instance, in 2024, when Synapse Financial Technologies declared bankruptcy, the trustee assigned to manage the company’s funds realized there was $96 million across all customer accounts that was unaccounted for. However, because the firm merely served as an intermediary between apps like Yotta and Juno and their banking partners, and the underlying banks hadn’t themselves collapsed, the FDIC insurance was not applicable, leaving that money inaccessible to customers worldwide. This raised concerns regarding the core stability of financial institutions and banking products. Hans Morris, a managing partner at Nyca Partners, said at the time about the lack of FDIC insurance for non-traditional banking instruments: “[the modern banking system that relies on fintechs and intermediary firms] is something that’s actually much more fragile than it appears to be.” Thus, a core trend in this industry throughout the twenty-first century has been the balancing act between growth and compliance risk.

Unfortunately, mitigating compliance risk is costly and resource-draining. According to one 2023 report, 86% of fintech companies reported paying more than $50K in compliance fines within the previous 12 months, with 60% paying more than $250K, and 37% paying more than $500K. During that same period, these same companies spent, on average, 35% of their budget on compliance technology. Yet despite this heavy investment in compliance teams and technologies, 2023 saw more than 10K complaints filed against fintech companies in the CFPB’s Consumer Complaint Database, an increase of 18% from 2022. These struggles with compliance are evidence that “even big, well-resourced companies still struggle with compliance, and the growing risks are elevating the challenges and costs.”

Alloy offers financial technology companies a centralized platform that manages end-to-end monitoring and authentication, allowing these financial institutions to outsource their most tedious compliance and regulatory processes to a trusted third party. In his 2008 Y Combinator Startup School speech, Jeff Bezos famously said, “Focus on what makes your beer taste better.” He gave the analogy of breweries, which at the turn of the 20th century, made their own electricity. But over time, as these breweries realized that electricity did not ultimately contribute to a better product for their consumers, they began to focus in-house resources on their primary product itself, and depended on external companies to provide electricity. Alloy is a company that empowers other fintech companies to do just that — focus their in-house resources on the product itself, and outsource compliance and regulation to a third-party provider. Laura Spiekerman, Co-Founder and President of Alloy, once said, “If we do our jobs right, we’re fully in the background, and you would never know we were there.” By behaving as a silent partner for fintech companies and banks, Alloy is involved in millions of transactions globally without most end users ever interacting with its platform directly. Thus, Alloy serves not only the direct needs of its customers (i.e., to stay compliant and secure) but also enables them to present as reputationally safe, proactive, and user-focused.

Founding Story

Alloy was founded by Tommy Nicholas (CEO), Laura Spiekerman (President), and Charles Hearn (CTO) in 2015 with a mission to “solve the identity risk problem for banks and fintechs.”

Nicholas and Hearn were classmates and close friends in high school, and attended the University of Virginia together between 2007 and 2011, with Nicholas graduating with a Bachelor's in African American Studies and History, and Hearn with a Bachelor's in Computer Science. Immediately after graduation, the duo launched their first venture together — The City Swig, an app designed to connect users to nightlife in their area. The City Swig ended up failing less than a year later.

In 2014, Nicholas and Hearn became the Head of Product and Lead Product Engineer, respectively, at Knox Payments, a platform aiming to facilitate digital financial transactions. Here, they met Spiekermen, a 2008 graduate from Barnard College with a Bachelors in Political Science & Human Rights who was then serving as the Head of Business Development & Strategic Partnerships at Knox.

Together, the trio worked on making transfers between banks and credit unions across a network known as the Automated Clearing House (ACH payments), instantly available to users, as opposed to the standard industry practice of a 24-hour buffer period to authenticate and validate the transaction. While developing this platform, they realized that more than software infrastructure, their paramount needs were all risk-related — user verification, anti-fraud due diligence, and more. Furthermore, they noticed that demonstrating compliance to auditors was often as time-consuming and expensive as actually being compliant.

At the time, fintech companies partnered with individual data vendors that were separately integrated by their in-house engineers. In its early days, Alloy struggled to gain traction amongst customers, who were hesitant to adopt an entirely new product or entrust legal compliance to a young and relatively inexperienced team. Fundraising was likewise challenging, with Nicholas saying that they “talked to 100 investors and received 100 no’s.” Despite these setbacks, the team continued developing their platform product and ultimately received support from Jenny Fielding to join the Techstars Accelerator in 2015. After Techstars, Alloy began building its sales and legal teams to assist with formalizing customer contracts, a development that ultimately led to it acquiring its first customers.

Nicholas has voiced his belief that the company culture of commitment and camaraderie has driven its success. As of April 2023, Alloy had expanded to 310 employees, with a focus on employee retention — in fact, Alloy’s Head of Personnel has remained with the company since Employee #12. Furthermore, Spiekerman regularly honors employees internally with the Turnaround Award— a prize for those who commit to the “grueling, behind-the-scenes work that it takes to bring something from bad to okay.”

Product

Most federal governments mandate three categories of compliance for financial service providers. The first, and most costly, is (1) Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance, which includes user identity verification, money laundering prevention, and reporting suspicious activity to relevant authorities. Secondly, fintech companies must comply with (2) Consumer Protection and Privacy laws, which requires these companies to obtain explicit consent for data processing, provide customers access to their data, and have established data breach notification protocols. Furthermore, this category of compliance may include laws mandating transparent and fair service provisions, such as mandated disclosures of terms and conditions, or policies forbidding false advertising. Finally, (3) Cross-Border compliance requires any international transactions to abide by the most stringent regulations held by either country.

Alloy services each of these areas of need, providing configurable platform solutions for understanding a customer’s identity, fraud, compliance, and credit risk throughout their entire customer lifecycle. They offer solutions in five categories.

Onboarding Solutions

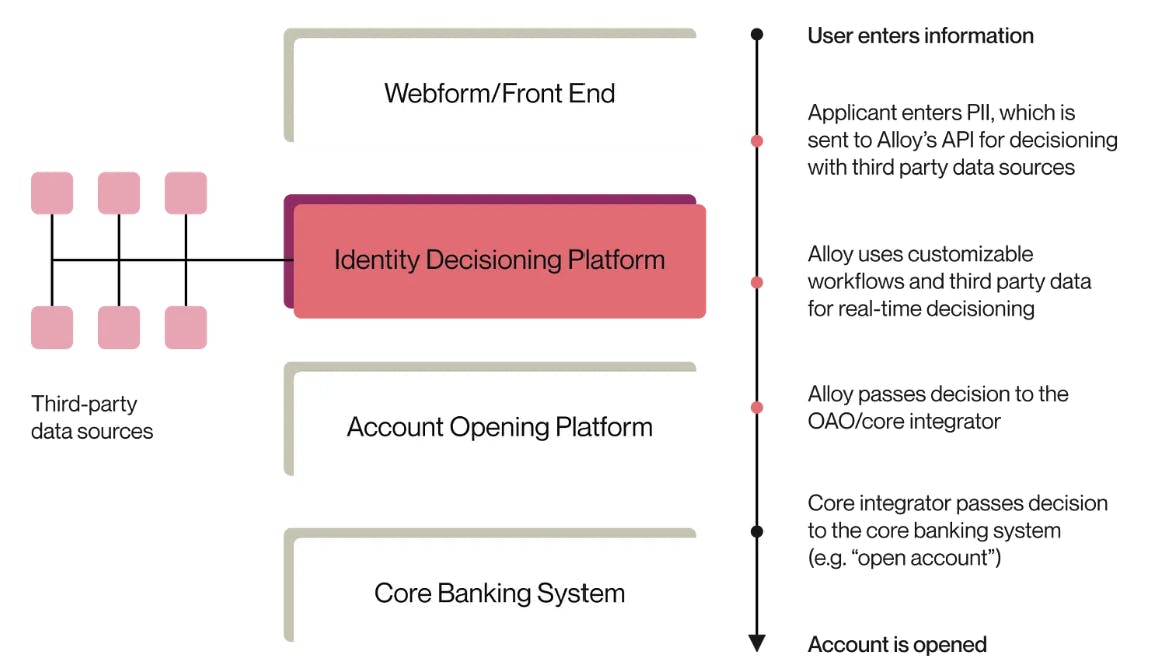

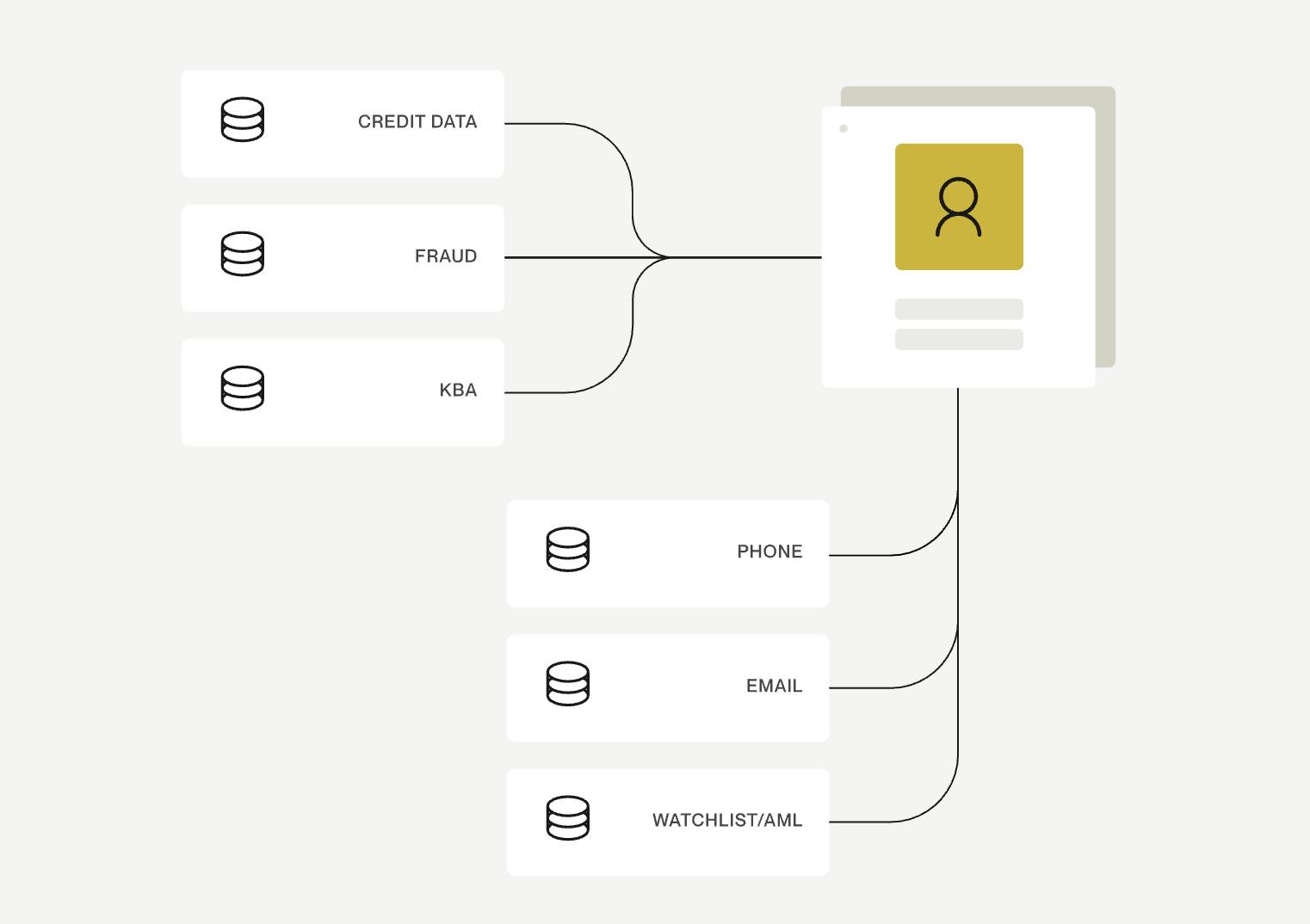

Source: Lightspeed

Alloy’s onboarding solutions primarily focus on digital identity and document verification in compliance with AML and KYC requirements. Traditionally, banks and financial institutions relied on large databases, such as those stored by major credit bureaus, to verify the identities of individuals attempting to create new accounts on their platforms. If that database had missing or incomplete information, however, the customer would be denied an automatic account and redirected to a manual review process. At this point, 80% of people exit the platform altogether, and each one of these abandoned customers translates to direct losses for the company and its partner banks.

Furthermore, studies have revealed that these denials were often false positives— for example, “thin file” applicants, such as young adults or immigrants, have less financial history with major national institutions, and are thus unlikely to appear in credit bureau databases. Similarly, renters or individuals who move frequently may be auto-rejected due to the address of the application not matching the address in the database.

Alloy’s platform hedges against this potential problem by sourcing information from over 200 unique data sources and compiling that data into one resource for bank and fintech companies. Thus, a larger pool of customers can be automatically verified, translating to direct revenue for fintech companies. An average of 33K applicants are auto-decisioned daily with Alloy.

Ongoing AML Monitoring

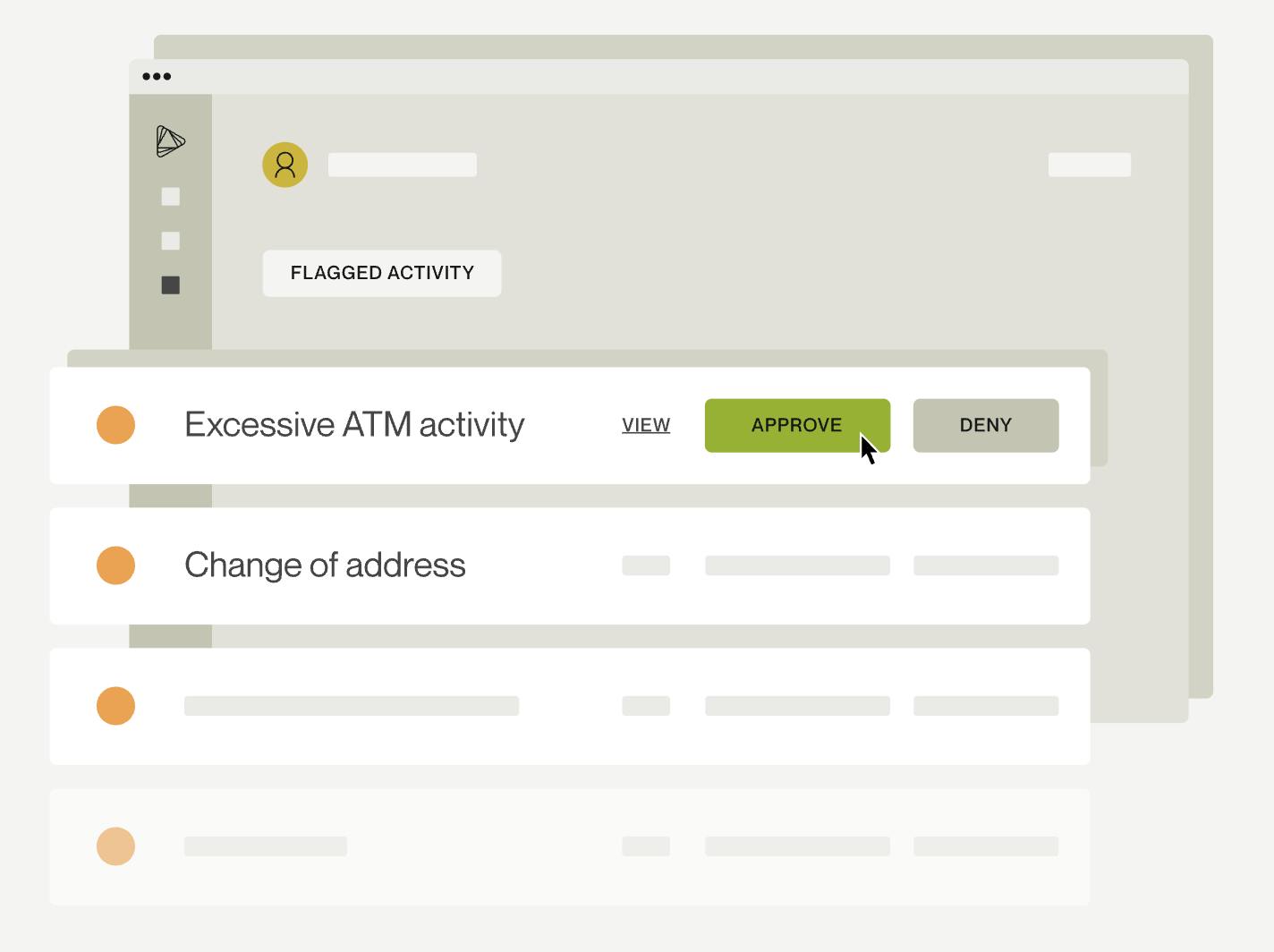

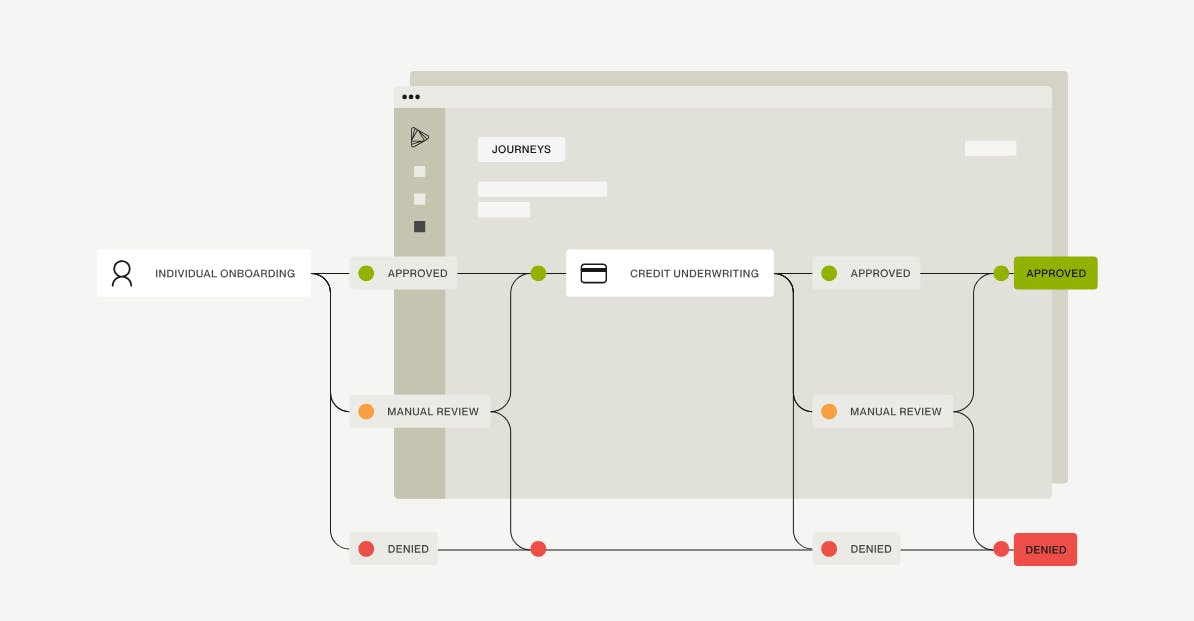

Source: Alloy

Alloy’s ongoing monitoring services extend past the onboarding process to report suspicious activity, maintain cross-border compliance standards, and automate fraud solutions in response to customer complaints. In this way, Alloy considers itself to be the “control center” that empowers its customers to make ongoing decisions about their risk and compliance profiles, rather than a one-time or annual auditor.

Furthermore, this decision engine is dynamic. At onboarding, Alloy collects data and determines a preliminary risk level for each customer. Then, as the customer continues being active on the profile, making both monetary and non-monetary transactions, Alloy is able to adapt, creating an evolving risk profile for each customer to more accurately predict fraud.

Fraud Management

Source: Alloy

Alloy's fraud prevention platform provides financial institutions and fintech companies with tools to manage identity verification and fraud risk throughout the customer lifecycle. The platform integrates over 200 data sources across 195 markets, enabling users to implement risk controls and verifications without extensive engineering resources. A low-code software development kit (SDK) and a comprehensive Testing Suite allow institutions to test and optimize fraud strategies before deployment.

The platform employs AI to offer actionable insights, assisting clients in triaging, adjusting policies, and conducting investigations. By continuously analyzing data collected during the customer lifecycle, Alloy's machine learning models assess risk at both the portfolio and individual levels. Features like the Fraud Attack Radar provide real-time alerts on suspected fraud attacks, enabling proactive responses.

Alloy's identity orchestration layer evaluates customer risk during onboarding, aiming to reduce instances of various fraud types and minimize manual reviews. The platform aggregates insights from onboarding and ongoing account activity to maintain an evolving view of customer risk, facilitating the identification and management of high-risk activities.

Additionally, Alloy offers guidance and documentation to assist clients in integrating its fraud prevention tools effectively. With a client base exceeding 700 financial institutions and fintechs, Alloy's platform is designed to adapt to evolving fraud threats while maintaining compliance and operational efficiency.

Compliance

Source: Alloy

Alloy's compliance platform is designed to assist financial institutions and fintech companies in managing regulatory obligations throughout the customer lifecycle. It offers configurable workflows that integrate Know Your Customer (KYC), Know Your Business (KYB), Anti-Money Laundering (AML) monitoring, and sanctions screening into a unified system. This integration aims to streamline compliance processes and reduce the need for extensive engineering resources.

The platform's perpetual KYC feature allows institutions to comply with cross-border KYC regulations from the onboarding stage, providing a comprehensive view of customer risk profiles. For business clients, Alloy's KYB capabilities enable simultaneous verification of business entities and their ultimate beneficial owners through a single API call, incorporating KYC, AML, and fraud checks to support complex workflows.

Alloy's AML monitoring tools come with pre-configured rules based on industry best practices, allowing institutions to monitor customer activities and flag potentially suspicious behavior. The platform maintains an activity history for all customer actions, facilitating compliance with global AML requirements and local regulations such as the Bank Secrecy Act (BSA) and the Proceeds of Crime Act 2002 (POCA).

The case management system within Alloy's platform enables users to investigate suspicious activities, collaborate with team members, and complete regulatory filings from a single dashboard. It supports flexible queues, automatic assignment capabilities, and customizable filters to manage alerts, investigations, and suspicious activity reports (SARs). Additionally, the platform's integrated reporting capabilities allow for the aggregation of suspicious activity data and direct electronic filing of SARs with FinCEN.

To address the dynamic nature of sanctions lists, Alloy provides configurable workflows for recurring, automated checks against the most current watchlists. This feature helps institutions stay informed about high-risk customers and ensures that non-sanctioned customers are not inadvertently engaging with sanctioned parties.

Credit Underwriting

Source: Alloy

Alloy's Credit Underwriting platform, launched in October 2021, offers financial institutions and fintech companies a comprehensive solution for automating credit decision-making processes. By integrating over 200 data sources—including traditional credit bureau data and alternative data such as cash flow, employment verification, and utility payment history—the platform provides a more complete view of applicants' creditworthiness. This approach aims to expand access to credit for individuals with limited or non-traditional credit histories.

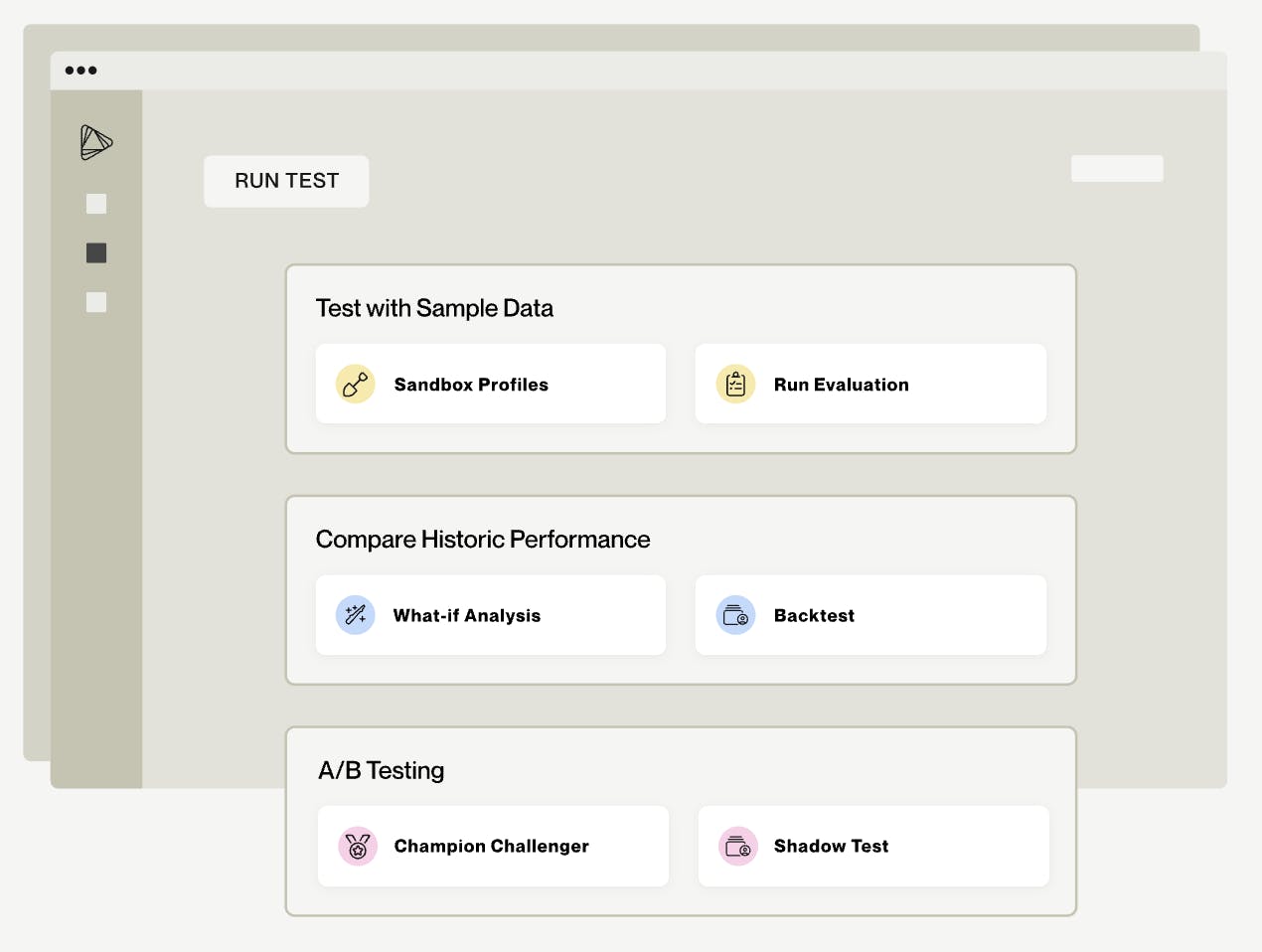

The platform enables users to configure credit policies into workflows without the need for coding, supporting both simple and complex decision models. It also facilitates ongoing credit monitoring, allowing institutions to adjust credit lines and offer new products based on real-time customer behavior. Features like A/B testing and backtesting help optimize decision strategies while maintaining compliance and operational efficiency.

By consolidating identity verification, fraud detection, and credit underwriting into a single system, Alloy's platform seeks to reduce operational friction and enhance the customer experience throughout the credit lifecycle.

Embedded Finance

Source: Alloy

Alloy's embedded finance risk management platform is designed to assist sponsor banks, Banking-as-a-Service (BaaS) providers, and fintech companies in managing compliance and fraud risks across their partner portfolios. The platform offers customizable, no-code rule sets and a centralized dashboard, enabling institutions to enforce risk policies at scale and gain comprehensive visibility into partner activities. This approach aims to streamline audit processes and enhance oversight without requiring extensive engineering resources. For fintech companies, this service provides security and mitigates against collapses like the 2024 Synapse Financial Technologies bankruptcy.

The platform integrates over 200 data sources, allowing for the orchestration of tailored risk policies that can adapt to evolving regulations and threats. This flexibility supports the scalability of embedded finance programs and helps future-proof operations. Additionally, Alloy facilitates collaboration between banks and their fintech partners by providing tools to customize compliance controls based on specific product types and maturity levels. This collaborative approach seeks to balance regulatory requirements with the need for differentiated customer experiences.

One notable feature of Alloy's platform is the parent-child account structure, which allows sponsor banks to define compliance requirements and propagate updates across all partner accounts simultaneously. This structure provides banks with the ability to maintain consistent compliance standards while granting fintech partners the autonomy to manage their own risk tolerances. The platform's design emphasizes the importance of aligning the priorities of banks and fintechs to achieve efficient and compliant onboarding processes.

Sponsor banks also experience value from this service. FDIC-insured sponsor banks often assume some portion of liability in case of partner fraud, and are thus responsible for assuring the quality and compliance of the fintech companies they collaborate with. Alloy enables sponsor banks to enforce “compliance and risk controls across their partner portfolios.” That is, sponsor banks using Alloy can enforce their risk policies at scale, clone rule sets across partner companies, and then aggregate their analytics into one, auditable document.

Overall, Alloy's embedded finance solution aims to provide a comprehensive identity risk management framework that supports the growth and compliance needs of financial institutions and their partners. By offering tools for policy enforcement, data integration, and collaborative customization, the platform seeks to address the complexities inherent in embedded finance ecosystems.

Global Identity Verification

Source: Alloy

Finally, Alloy is a global platform with the ability to meet compliance and regulatory requirements across 40 and 195 markets. These global features are centrally integrated, which enables compliance with local KYC and AML regulations, as well as ongoing monitoring for evolving threats and market opportunities within each of these markets for each customer.

Alloy’s system allows for the creation of customized workflows tailored to specific regional requirements, facilitating compliance with local regulations. Applicants are routed through appropriate verification flows based on their country code, ensuring that the verification process aligns with regional standards.

Alloy's platform is designed to be adaptable, allowing institutions to scale their risk management processes as their business grows and as regulatory landscapes evolve. The platform supports rapid configuration and deployment of additional anti-fraud measures, integration of new data partners, and expansion into additional geographies.

Market

Customer

There are three primary types of institutions that Alloy serves: banks, credit unions, and fintech companies.

Banks

In 2024, Alloy supported more than 600 financial institutions in automating fraud management and compliance processes. Traditional banks, including financial institutions whose primary service offerings are not digital, are able to use Alloy to adapt to the growing digital market. According to a 2024 report, 51% of sponsor banks’ revenue and deposits are driven by embedded finance partnerships, and investment in fintech by the traditional banking industry grew by 330% between 2020 and 2021. Furthermore, 65% of banks nationally entered into fintech partnerships between 2019 and 2021. However, some sponsor banks report fraud losses of $1 million or more, and over 25% of FDIC actions in 2024 were directed at sponsor banks. In other words, traditional banking is rapidly attempting to deploy and develop digital solutions, but is struggling to do so securely and without risk. Alloy directly addresses this.

Specifically, Alloy has an “out of the box” starter kit that is easily customizable to particular use cases and easily integrable with existing online systems. This facilitates faster go-to-market timelines for traditional banks looking to enter the digital markets. And for those already participating in the digital markets, Alloy’s support with compliance and risk mitigation enables it to focus all internal resources on keeping pace with evolving technology trends and customer needs instead.

For example, Alloy’s holistic solution helped Live Oak reduce fraud losses by 27%. And in addition to these direct savings, after partnering with Alloy to streamline customer onboarding and credit underwriting, Live Oak reduced investigation time by 30% and decreased manual review rates by 26%, thus saving the company labor costs and time, as well.

Other notable customers in the traditional banking industry include M&T Bank and 1st Bank.

Credit Unions

Alloy serves credit unions to build automated solutions that respond to fraud attacks, thus reducing the manual workloads of their in-house risk teams and improving operational efficiency. Elements Financial, for example, saw a 59% increase in automated account openings, a 40% increase in auto-approval ratings for new members, a 60% decrease in manual review rate, and a 50% reduction in manual review time after becoming a customer of Alloy.

For credit unions, Alloy offers several benefits: much like with banks, credit unions benefit from scalable, centralized, verified identity protection and security. Due to robust investment in cybersecurity and a technical focus, Alloy has become the industry leader in risk mitigation and compliance of financial institutions. And security, compliance, and customer protection are complex and central enough business operations that most companies are not willing to cut corners to save marginal amounts of money. Instead, they would rather partner with a trusted, reputable provider of compliance and security, which in this niche industry is Alloy.

Beyond this, Alloy’s credit underwriting services enable smarter, faster lending decision capabilities. By drawing from over 200 databases including rent histories, utility bill payments, secondary income sources like gig job platforms to paint a fuller picture of applicants’ financial histories, Alloy is able to more accurately and automatically make loan decisions.

Finally, for credit unions looking to experiment with potential new risk and compliance policies, Alloy offers a Testing Suite with a sandbox for application testing. By A/B testing, back-testing, and shadow-testing these policies prior to launch, companies are able to assure member experience and safety of their offerings.

Other notable customers include Suncoast Credit Union, Lending Club, and Navy Federal Credit Union.

Fintech Companies

Alloy can support fintech companies from their launch to growth stages, making this customer base the largest and most diverse. In 2023, 60% of all fintech companies were not monitoring all of their third parties for compliance, and those that did complete compliance checks performed sample surveys or single-time audits, rather than continuous risk monitoring.

For these companies, Alloy’s service offerings are vital: it can help fintech companies streamline and scale their onboarding processes, and Alloy’s “in-air adaptability” encourages faster deployment of novel technologies in early-stage companies.

Ramp*, one of Alloy’s customers, saw a 25% decrease in application review time and a 75% improvement in fraud detection efficiency through Alloy’s risk management services. Novo similarly reduced manual reviews by 50% and doubled their customer conversion with Alloy, and Brex automated over 80% of their account openings, growing from a private beta of 100 startups to serving thousands of customers in less than six months.

Other notable customers in the fintech space include Ally, Marqueta, Grasshopper, and Shopify.

Market Size

It is estimated that by 2026, global open banking transactions, which are transactions processed through an API, will reach $116 billion in volume, an increase of 2800% since 2021, and fintech revenues are forecasted to hit $1.5 trillion by 2030. The fintech market is poised to grow at a compound annual growth rate (CAGR) of 18.5%, from $215.3 billion to $751.5 billion from 2023 to 2032.

As of 2019, 64% of people worldwide had used a fintech application at least once, with $137.5 billion invested in fintech businesses that year alone. There will be an estimated 4.8 billion digital payment users active by the end of 2028. These estimates are conservative and likely understated, not only because most traditional banks have adopted and promoted digital banking, but also because digital banking solutions have a wider demographic base, especially amongst younger populations: amongst those aged 18-24, 51% trust fintech entities (compared to the 39% that trust traditional banks).

With this volume of transactions, compliance and risk management become priorities. As of 2021, identity verification was a $16 billion market, and by 2028, it is projected to be $87 billion. According to a 2021 survey by American Banker Magazine, financial institutions reported a 45% increase in identity theft and fraud reports. Nearly 40% cited ineffective technology in assessing and prioritizing risk as their biggest challenge. Thus, Alloy’s streamlined technology is responding to a real and pressing need in the market and enabling the continued growth of the online banking industry. As one anecdotal example of ROI for these solutions, for every dollar Consumer Credit Union spends towards its Alloy services, it saves five dollars in fraud losses.

Competition

Competitive Landscape

Alloy operates within the “RegTech", or regulatory technology industry, which focuses on harnessing the power of big data, AI, or blockchain technology to reduce financial risk and fraud while increasing regulatory compliance.

In this space, many leading enterprise technology companies have integrated regulatory services into their product offerings. For example, IBM offers comprehensive regulatory solutions, including advanced analytics and AI-driven compliance tools. Thomson Reuters likewise provides regulatory, intelligence, and compliance management solutions. However, in both these cases, regulatory services are a complement to the primary service that these respective companies offer, and are not the main product line.

This, coupled with encouragement and support by worldwide authorities for dedicated risk and compliance teams, has led to a 23.1% increase in the number of start-ups in the RegTech space between 2022 and 2023. Thus, as a result of the relative youth of this industry and the growth opportunities created by its recent new entrants, the RegTech market is moderately fragmented.

However, the customer base for regulatory technology services is relatively sticky; clients are unlikely to switch third-party compliance providers unless their current provider is failing, and with over 600 companies engaged in some compliance contract with Alloy, these relationships will enable the company to retain market share, even as the space becomes more saturated.

Furthermore, Alloy has built a product that is reportedly highly regarded and trusted within the industry. As of August 2024, the company reported zero product failures, data breaches, or security exposures since its inception, giving the company a strong reputation as a reliable service provider. And with rising fraudulent activities, growing demand for automation of compliance processes, and the increased consumer demand for instant financial transaction processing, the need for widespread infrastructure and real-time compliance is quickly becoming too important for most large companies to take risks with smaller, less reputable regulatory technology services.

Competitors

Persona: Persona is an identity verification platform founded in 2018 by Rick Song and Charles Yeh. The company specializes in providing customizable identity verification solutions, including Know Your Customer (KYC), Know Your Business (KYB), and Anti-Money Laundering (AML) compliance tools. Persona's platform is designed to help businesses securely and seamlessly verify customer identities, offering a range of verification methods such as document verification, biometric analysis, and database checks.

In April 2025, Persona announced a $200 million Series D funding round, bringing the company's valuation to $2 billion. This round was led by Founders Fund, with participation from Meritech Capital Partners, BOND, Insight Partners, Index Ventures, and Coatue Management. The funding will support Persona's mission to build the verified identity layer for the internet, enabling organizations to verify identities more efficiently and securely in an increasingly digital world.

Unlike Alloy, which focuses on identity decisioning for traditional financial institutions, Persona offers a more flexible and customizable platform that caters to a broader range of industries. Persona's emphasis on adaptability allows businesses to tailor their identity verification processes to specific use cases, making it a versatile solution for companies seeking to enhance their compliance and fraud prevention measures.

Onfido: Onfido is a London-based identity verification company founded in 2012 by Oxford graduates Husayn Kassai, Eamon Jubbawy, and Ruhul Amin. The company specializes in AI-powered identity verification solutions, enabling businesses to verify users' identities through document and biometric analysis. Onfido's platform is utilized across various sectors, including financial services, e-commerce, and sharing economy platforms, to streamline customer onboarding and compliance processes.

In April 2024, Onfido was acquired by Entrust, a US-based digital security firm, for approximately $650 million. This acquisition aimed to enhance Entrust's identity-centric security offerings by integrating Onfido's advanced AI and biometric verification technologies. Post-acquisition, Onfido's solutions have been incorporated into Entrust's portfolio, providing customers with a comprehensive suite of identity verification and security tools.

Unlike Alloy, which focuses on identity decisioning and compliance solutions for traditional financial institutions, Onfido's expertise lies in biometric and document-based identity verification. While Alloy offers a broader range of services, including credit underwriting and fraud detection, Onfido's specialization in AI-driven identity verification complements Entrust's security solutions, catering to a diverse set of industries beyond traditional banking.

Socure: Socure is a New York-based digital identity verification company founded in 2012 by Johnny Ayers and Sunil Madhu. The company specializes in leveraging artificial intelligence and machine learning to provide identity verification and fraud prevention solutions. Socure's platform, known as ID+, offers a suite of services including Know Your Customer (KYC), Anti-Money Laundering (AML) compliance, and document verification, aiming to enhance the accuracy and efficiency of digital identity verification processes.

In November 2021, Socure raised $450 million in a Series E funding round led by Accel and T. Rowe Price, bringing its valuation to $4.5 billion. This investment followed a $100 million Series D round in March 2021, which valued the company at $1.3 billion. Other notable investors include Bain Capital Ventures, Tiger Global, Scale Venture Partners, and Sorenson Ventures. As of 2025, Socure has raised a total of approximately $741.9 million in funding.

Unlike Alloy, Socure's platform emphasizes AI-driven identity verification and fraud detection across various industries, including fintech, e-commerce, and government sectors. While both companies aim to streamline onboarding and compliance processes, Socure's strength lies in its predictive analytics and machine learning capabilities, offering a broader approach to identity verification beyond the financial services industry.

Trulioo: Trulioo, founded in 2011 and headquartered in Vancouver, Canada, is a global identity verification company that provides electronic identity and address verification for individuals and businesses. The company offers services to help organizations comply with Know Your Customer (KYC), Know Your Business (KYB), and Anti-Money Laundering (AML) regulations, enabling verification of over 5 billion people and 700 million business entities across 195 countries.

In June 2021, Trulioo raised $394 million in a Series D funding round led by TCV, bringing its valuation to $1.75 billion. Other notable investors include Goldman Sachs, Citi Ventures, Santander InnoVentures, and American Express Ventures.

Unlike Alloy, Trulioo offers a broader range of services that cater to various industries, including banking, cryptocurrency, online trading, and wealth management. Trulioo's platform emphasizes global coverage and scalability, providing access to over 450 data sources worldwide to verify individuals and businesses.

Veriff: Veriff is an Estonian identity verification company founded in 2015 by Kaarel Kotkas and Janer Gorohhov. Headquartered in Tallinn, Veriff provides AI-powered, video-first identity verification solutions designed to help businesses combat online fraud and comply with regulatory requirements. The platform supports over 12K government-issued IDs across more than 230 countries and territories, and is available in 48 languages.

Veriff has raised approximately $192 million in funding to date. In January 2022, the company secured a $100 million Series C round co-led by Tiger Global and Alkeon Capital, bringing its valuation to $1.5 billion. Previous investors include IVP, Accel, and Mosaic Ventures.

Unlike Alloy, Veriff specializes in biometric and document-based identity verification across various industries, including fintech, e-commerce, and the gig economy. While Alloy offers a broader range of services, including credit underwriting and fraud detection, Veriff's expertise lies in AI-driven identity verification and fraud prevention.

Plaid: Plaid is a San Francisco–based financial technology company founded in 2013 by Zach Perret and William Hockey. The company provides a data transfer network that enables applications to connect with users’ bank accounts, facilitating services such as balance checks, payments, and identity verification. Plaid's platform is widely used by fintech applications like Venmo, Robinhood, and Coinbase to offer seamless financial experiences to their users.

In April 2021, Plaid raised a $425 million Series D funding round led by Altimeter Capital, bringing its valuation to $13.4 billion. However, in April 2025, the company completed a $575 million funding round at a reduced valuation of $6.1 billion, reflecting broader market conditions.

Plaid offers identity verification services that help companies reduce fraud risk and meet KYC and AML regulatory requirements. The company’s customizable online ID verification platform verifies identity data by comparing it against regulated data sources, authenticates various ID documents, and confirms liveliness through selfie verification. By analyzing hundreds of risk signals, Plaid aims to reduce fraud losses while protecting the customer experience and increasing conversions.

Unlike Alloy, Plaid's strength lies in its extensive network that connects a wide range of fintech applications to users' bank accounts. While both companies offer identity verification services, Plaid's platform is more broadly utilized across various fintech applications, providing developers with the tools to build innovative financial products.

Elliptic: Elliptic, founded in 2011, uses blockchain technology to make cryptocurrency transactions more transparent and uses ledger technology to keep crypto trading companies updated on AML regulations. In 2017, for example, Elliptic helped expose a fraudulent Bitcoin trading operation run by a group of Russian hackers. Information about the billion-dollar laundering scheme was used by US Special Counsel Robert Mueller to investigate Russian interference in the 2016 Presidential election and indict the group on fraud and conspiracy charges.

Elliptic closed $100 million Series C in October 2021 led by Evolution Equity Partners. Unlike Alloy, Elliptic focuses its product offerings on crypto-asset risk management solutions only, while Alloy is able to incorporate traditional banks and credit unions by focusing on a wider range of applications for compliance.

Enigma: Enigma is a business intelligence platform that takes large sets of available data on small and medium-sized business activity and analyzes it with AI and machine learning, then returns insights to aid the company’s financial and decision-making behavior.

The company was founded in 2014 and raised a $95 million Series C in September 2018, led by New Enterprise Associates. Enigma specializes in providing data solutions that help businesses understand their holistic financial health, which includes feedback on operational efficiency, while Alloy focuses on identity verification and compliance-oriented decision making for financial firms.

ComplyAdvantage: ComplyAdvantage has a proprietary anti-money laundering data feed that automates customer monitoring with KYC and due diligence tools that screen payments in real time. Its platform is currently used by more than 1K companies in the money-transferring and financial industries, including payments, stock trading, and even gambling. In a 24-hour span, the company’s AML database can analyze five million news articles across 200 countries and update 30K KYC profiles.

Founded in 2014, ComplyAdvantage raised $100 million at a post-money valuation of $445 million in May 2021. With AML and KYC compliance, ComplyAdvantage provides much of the same services as Alloy, but, as of 2025, has not expanded to incorporate credit underwriting in its service offerings.

Chainalysis: Chainalysis uses blockchain to stamp out money laundering, fraud and compliance violations in the cryptocurrency sector. Founded in 2014, it provides crypto investigation and risk solutions to government agencies, fintech companies, and consumer brands. With over 1K organizations across 70 countries as of April 2024, Chainalysis is a fast-growing and global company.

As of April 2024, Chainalysis had raised $536.6 million in funding across 11 rounds from investors including Coatue, Paradigm, Accel, Point Nine, and Irving Investors. Chainalysis was valued at $8.6 billion as of its $170 million Series F round in May 2022, making it a leader in the cryptocurrency investigation and risk management space. Unlike Alloy, Chainalysis does not cater towards any non-technology-based financial companies (i.e., traditional banks, credit unions, etc.). Furthermore, Alloy does not offer its services to government agencies, focusing instead on a B2B business model.

Business Model

Alloy offers a subscription-based revenue model, where clients pay a recurring fee to access the platform. Pricing is customizable, tailored to the specific combination of needs presented by each client, and depends on factors such as the size of the financial institution, volume of verifications and transactions handled by the platform, and range of services required. On average, annual contracts typically range from $120K-$150K.

By providing a “basic toolbox” starter kit for core identity verification services, Alloy is able to deploy and integrate tools for new customers rapidly, and then later expand the functionality of the platform to include additional, personalized fraud prevention and monitoring capabilities. This enables quick adoption and iterative deployment of the platform.

Alloy offers the largest network of third-party data partners in the industry, with over 200 independent data sources covering 195 markets around the world. Notable partners include ekata, LexisNexis Risk Solutions, Prove, Socure, and more. These databases are used to provide accurate, comprehensive identity verification, both during the onboarding process and when making credit underwriting assessments.

Ensuring safe, reliable software is the foundation of Alloy’s trust with its customers. In fact, CEO Nicholas has said that the company’s dedication to building and investing in an “excellent technical product” has driven Alloy’s long-term relationship-building strategy. In 2024, Alloy dedicated extensive resources to protecting the data and security of the financial information and transactions housed in the Alloy platform: Alloy’s services are powered by AWS cloud infrastructure, with a Virtual Private Cloud (VPC) delineating public and private traffic. Furthermore, separate VPCs exist for production and non-production (staging, testing, etc.) data and infrastructure, and all data is encrypted separately in transit and at rest. Finally, Alloy has an Intrusion Detection Solution (IDS) system that monitors and alters potential malicious traffic. These investments, while significant, have defended Alloy against attacks and data breaches, making the company a trusted brand amongst its clients and partners.

Traction

Source: Sacra

As of 2024, over 600 fintech companies use Alloy to outpace fraud, with a customer base that is growing fast. Between 2020 and 2021, the company saw a tripling in annual recurring revenue (ARR) and a 2x increase in the number of client contracts.

With many clients, Alloy is able to produce dramatic fraud detection results: Earnest used Alloy’s services to increase their automated approval rate by 56%, and Jetty increased pre-approval ratings by 35% with Alloy’s credit underwriting decision engine; Mountain America Credit Union reduced fraud by 29% after Alloy helped create a self-service application process designed to identify suspicious activity and reduce instances of fraud at origination.

According to one unverified estimate, Alloy generated an estimated $55 million in ARR in 2023, an increase of approximately 31% from $42 million ARR in 2022. In its 2021 funding round, the company was valued at $1.6 billion, representing a 73x forward multiple of the $21 million of revenue from that year. The company maintained gross margins between 50% to 60% during this time period, and as of 2024, it has sufficient cash for 2-4 years of continued operations.

Valuation

In 2022, Alloy was valued at $1.55 billion, with an estimated annual revenue of $55 million, reflecting a 28x revenue multiple. The company has raised eight rounds of funding, totaling $207.8 million. In September 2022, Alloy raised a $52 million Series C led by Bessemer Venture Partners, Avenir Growth Capital, and Lightspeed Venture Partners. Other notable investors from previous funding rounds include CANAPI Ventures, Eniac Ventures, Felicis Ventures, and Techstars.

Given its growth since, it is unclear what Alloy’s current valuation would be. The regulatory technology industry is still in its nascent stages, so few publicly traded, comparable companies exist. However, in the private markets, funding for regulatory technology has slowed. 2024 saw approximately $7.8 billion in private funding, a 35% decline from the $12 billion raised by regulatory technology companies in 2023.

Key Opportunities

Risk Decisioning Expansion

CEO Tommy Nicholas has spoken publicly about viewing Alloy as a centralized hub to support decision-making for fintech companies, rather than just a compliance software. In fact, the company has already taken tangible steps towards this goal with its 2022 expansion to include credit underwriting services, which enables Alloy to provide more sophisticated transaction monitoring and credit decisioning, in addition to its basic identity verification and fraud prevention services.

In the future, if Alloy continues to calibrate more precisely to the complex risk decisions that occur throughout a customer’s lifecycle, it could meaningfully expand its serviceable population to include the additional $33 billion market for fraud prevention and security.

Furthermore, far more industries require advanced risk profiling capabilities. Insurance companies, for instance, use a similar holistic lifestyle and financial health profile to price their insurance policies. Depending on how flexible the Alloy decision engine is built to be, the company may be able to switch across industries to serve risk decisioning needs for non-financial institutions, as well.

Professionalization of Digital Financial Fraud

Alloy’s CEO, Tommy Nicholas, said in 2023 about professional fraudsters: “Fraud has gotten bolder and fraud has gotten weirder. Over the last four years, it has gotten way bolder and way weirder.”

In 2015, the primary threat to digital payment services was identity theft, with malicious actors using breached data for harmful activities in illegal markets. Companies often successfully mitigated this by leaning on machine learning models to identify stolen identities. However, since 2020, fraud has become far more complex, with social media playing a large role in the coordination and professionalization of scamming fintech institutions. Fraudsters are also increasingly manipulating victims into committing fraud on their behalf, thus bypassing any security measures set up by companies.

Furthermore, AI exacerbates this issue: deepfake fraud has surged tenfold globally from November 2022 to 2024, and fraud losses due to generative AI are expected to reach a CAGR of 32% in the United States alone by 2035. Generative AI decreases the time required for bad actors to write and send phishing emails, generate fake images and sequence information, or automate repetitive behaviors like mining stolen data, creating spam identities, or inputting fake credentials en bloc to overwhelm digital infrastructures.

This creates an even more pressing need for true compliance and risk mitigation software, especially one that is centralized, user-friendly, and trustworthy. With the professionalization of acts of defrauding must come the professionalization of independent compliance management, and this is a significant opportunity for Alloy. With fintech companies and traditional banks increasingly unable to spend in-house resources on comprehensive risk mitigation, Alloy can meet the demand for competent counteragents against malicious digital fraudsters.

Globalization of Digital Financial Technologies

Since 2020, trends of open banking and alternative financial service providers have expanded and globalized. By 2024, India and China had established themselves as global leaders in fintech adoption, and because these countries lacked the physical banking infrastructure of the Western world prior to the adoption of these new practices, their populations rely on digital banking to support over 87% of their economic activity.

Given Alloy’s established global presence, the company could be well-positioned to facilitate and lead efforts to globalize digital monetary transactions. The company already provides global verification that abides by the regulatory requirements across 40 different countries and 195 markets. Continuing to expand geographically would not only democratize access to banking and financial technology but also significantly widen Alloy’s market size and potential customer base.

Key Risks

Competition From AI

As mentioned above, deepfake fraud has surged tenfold globally between November 2022 and 2024, and fraud losses due to generative AI are expected to reach a CAGR of 32% in the United States alone by 2025. This creates an opportunity for Alloy to become a vital instrument in fraud prevention, as most financial institutions and traditional banks are unable to dedicate the in-house resources needed to sufficiently mitigate these bad actors.

However, the reverse is also true: AI can be used to mitigate fraud as well. Banks can use machine learning models to recognize and explain fraudulent patterns in a dataset, for example, or to simulate fake documents to train models on aggregate data. With AI serving as an automation tool, the need for an end-to-end product that automates compliance may be rendered obsolete, as it may quickly become cheaper, faster, and just as accurate to simply train LLMs to respond and file compliance paperwork or collate hundreds of public datasets to provide decision recommendations on credit underwriting.

Revenue Concentration in Interchange

According to one unverified source, 60% of Alloy’s revenue comes from interchange fees from small to medium-sized businesses. These fees are transaction fees that a merchant’s bank account must pay whenever a customer uses a credit or debit card to make a purchase, and within the United States, are regulated by the Durbin Amendment to the Dodd-Frank Wall Street Reform and Consumer Protection Act. Prior to its enactment in 2010, the average transaction fee on debit card usage was $0.44. With the amendment, transaction fees are limited to a flat fee of $0.21 in addition to 0.05% of the transaction value.

As of 2025, this amendment only applies to financial institutions with more than $10 million in assets under management (AUM), leaving smaller to mid-sized banks exempt from this transaction fee limit. In 2022, there was support in Congress to enact legislation to expand the Durbin Amendment to smaller and medium-sized banks as well, which ultimately did not pass but reflects a desire by some representatives to amend this regulation. Should regulators choose to close this loophole, Alloy’s unit economics may be severely impacted, and the company’s revenue from these small to medium-sized banks may decline by almost 50%.

Summary

The CEO of Alloy, Tommy Nicholas, has said that “running a sponsor bank is inherently complex because [they are] banks [that] are highly regulated, working with companies that are often new, fast-growing, and creating entirely new ways for consumers to interact with money.” This sentiment is felt across the industry, with 90% of fintech institutions and sponsor banks finding compliance requirements challenging to meet as of 2024, despite significant investments made in risk management teams and technologies.

Unfortunately, the same survey revealed that almost 90% of respondents have increased their risk tolerance since 2023 due to increasing pressure to grow fast. These findings reveal that more stringent regulation doesn’t necessarily equate to more compliant financial institutions; rather, it has the potential to create an industry-wide culture where compliance violation fines are necessary, acceptable parts of success and growth.

Ultimately, it is the consumer most harmed by this; compliance violation fines primarily come from insufficient customer due diligence, failure to report suspicious activities to clients, and lack of transaction monitoring for fraud, all things that dire116ctly put consumers’ financial safety at risk.

To protect consumers while allowing the financial institution to focus solely on innovation, product improvement, and growth, Alloy brands itself as a silent partner to the fintech industry. Alloy is a company that makes other companies look better, building trust between financial platforms and their end-users without wasting their in-house resources on procedural risk mitigation work. If done right, end users should never know about Alloy — rather, they should just receive access to the banking and financial products they need, without fail or fear.

*Contrary is an investor in Ramp through one or more affiliates.