Thesis

The global blockchain market was valued at $12.3 billion in 2023 and was expected to reach $289.2 billion by 2030, growing at a CAGR of 57%. This was accompanied by a growing number of transactions taking place globally using blockchain technology; a 2022 report predicted that up to 10% of global GDP could be associated with blockchain-enabled transactions by 2027. The decentralized nature of blockchain technology means that transactions are publicly recorded and cannot be altered, providing high transparency and immutability. However, this also means that any vulnerability in the system can have significant consequences.

Despite the volatility that has characterized crypto markets, there has been a consistent rise in the number of crypto adopters since the Bitcoin whitepaper was related in 2008. The global cryptocurrency market cap rose from $6.8 billion in April 2014 to $2.8 trillion in April 2024, having reached an all-time high of $3 trillion in November 2021. Meanwhile, there has been a consistent rise in the adoption of other blockchain-backed technologies such as decentralized finance (DeFi) and non-fungible tokens (NFTs).

The rise in blockchain and crypto adoption has brought increasing attention to blockchain security, as they present new opportunities for malevolent actors to exploit vulnerabilities in the system. For example, in 2019 hackers stole about $1 billion from crypto exchanges, while cryptocurrency holders evaded an estimated $25 billion in US tax liabilities. In 2021, the blockchain industry saw several high-profile security breaches, with losses totaling over $4.4 billion. $739.7 million was stolen in crypto due to security threats in Q1 2024 alone. In large part driven by these threats, the global blockchain security market was expected to grow from $2.2 billion in 2023 to $16.7 billion by 2033.

Chainalysis is a blockchain data platform that provides intelligence, risk, and growth solutions and services to government agencies, financial institutions, cryptocurrency businesses, and consumer brands. As of April 2024, the company enabled over 1K customers across 70 countries to investigate illicit activities on the blockchain, mitigate risk, comply with regulatory requirements, or fuel their growth. Its products have been instrumental in several high-profile cases such as the investigation into the Mt. Gox hack in 2017, the Silk Road darknet marketplace in 2020, and the FTX collapse in 2023.

Founding Story

Chainalysis was founded by Michael Gronager (CEO), Jonathan Levin (CSO), and Jan Moller (former CTO) in 2014. Before founding Chainalysis, Gronager had co-founded cryptocurrency exchange Kraken, where he served as CTO. Levin had previously co-founded and served as the CTO of Coinometrics, a cryptocurrency data analysis company, and Moller had spent six years at VMware as a staff engineer prior to Chainalysis, as well as having built the Mycelium cryptocurrency wallet.

Levin co-founded his previous company, Coinometrics, in November 2013 while studying Economics at Oxford, but the company shut down in October 2014. “It’s probably not the best idea to meet your co-founders on Reddit,” Levin explained in an April 2023 interview. In early 2015, he met Gronager and Moller, who were working on a similar project. This project utilized blockchain analysis to track crypto lost from Mt. Gox. This early crypto exchange collapsed in 2014 and lost access to hundreds of millions of dollars in cryptocurrency and cash of its over 24K customers. The three men teamed up and founded Chainalysis. By 2017, the company had located 650K missing bitcoin stolen from Mt Gox.

Chainalysis initially focused on identifying criminal activities, like Bitcoin thefts and black-market drug purchases. The founders then realized that the patterns Chainalysis could identify were valuable for more than just post-crime analysis. The company began helping money processors and traditional banks automatically meet regulatory requirements when opening accounts for cryptocurrency companies, such as ensuring the source of a client's funds is verified. By 2017, when the company announced it had located 650K missing bitcoin stolen from Mt Gox, Chainalysis was helping combat cryptocurrency crime. Chainalysis helps businesses, banks, and governments make “critical decisions, encourage innovation, and protect consumers” in the crypto/blockchain space.

Product

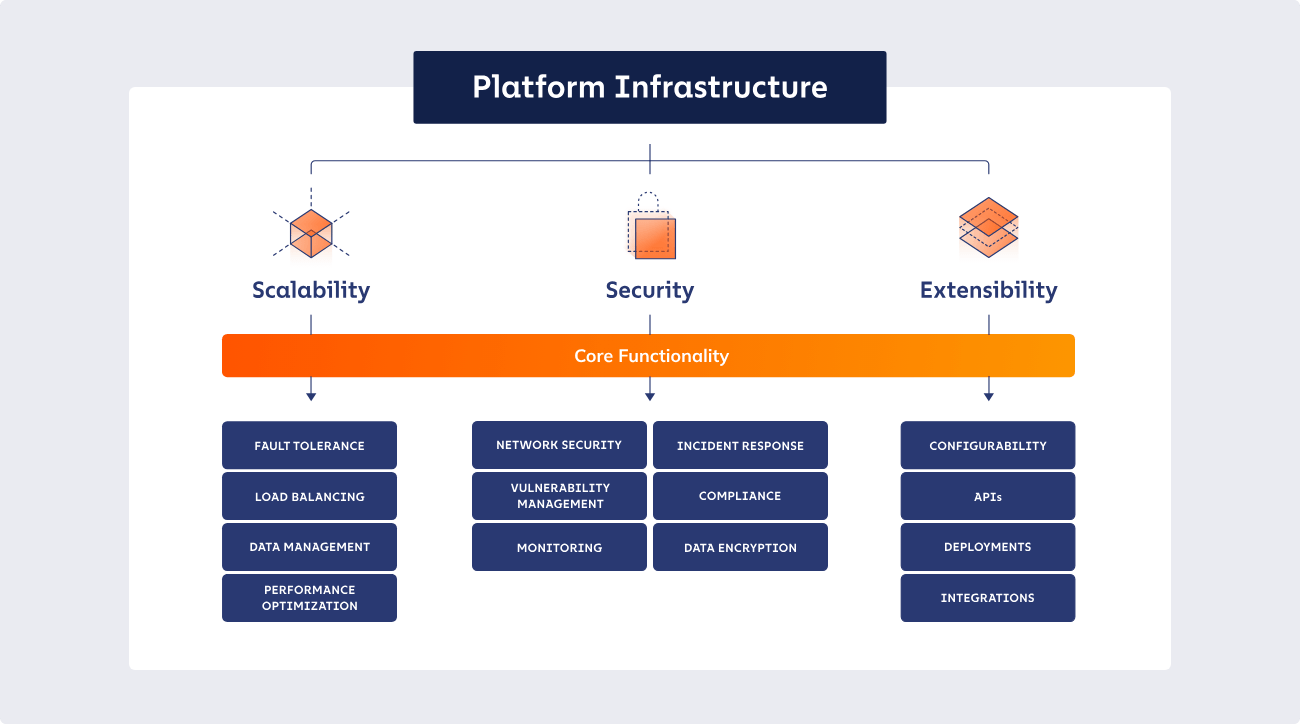

Chainalysis is a blockchain data platform. It provides intelligence, risk, and growth solutions and services to government agencies, financial institutions, cryptocurrency businesses, and consumer brands. The company’s platform infrastructure underpins all its offerings. It provides a scalable and secure environment that adapts to customer needs and increasing workloads through features across scalability (e.g. Fault Tolerance, Data Management), security (e.g. Vulnerability Management, Incident Response, Data Encryption), and extensibility (e.g. APIs, Configurability).

Source: Chainalysis

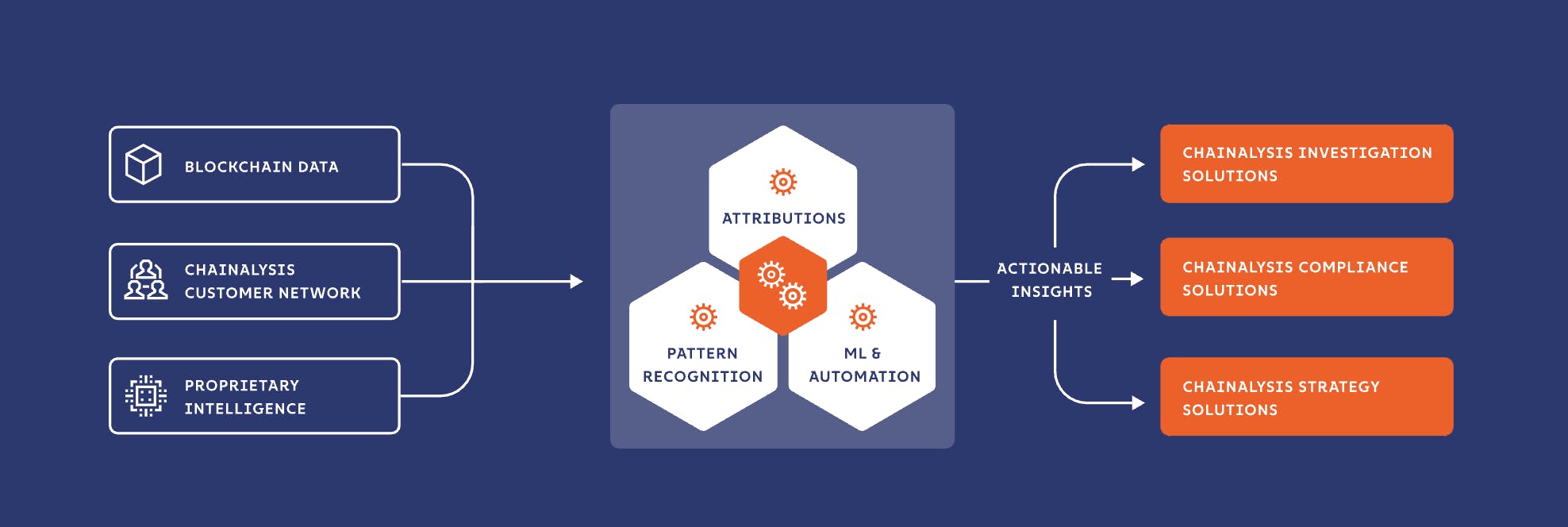

This platform, in turn, is fueled by Chainalysis Data, a blockchain knowledge graph that maps on-chain data to real-world entities, which the company continuously updates. As of April 2024, this knowledge graph is made up of data from more than 500 of Chainalysis’s web3, bank, and government customers.

The company gathers this data and then verifies all attributions “by combining automated intelligence, deep forensic expertise, and rigorous evaluation processes that ensure data integrity.” Chainalysis calls this “ground truth.” As of April 2024, the company had mapped over 1 billion addresses and 55K businesses and illicit entities, plus their associated smart contracts. Finally, Chainalysis pairs this data with ML models to automate manual workflows such as peel chains tracing, or identifying common deposits and withdrawals from mixing services.

Source: Chainalysis

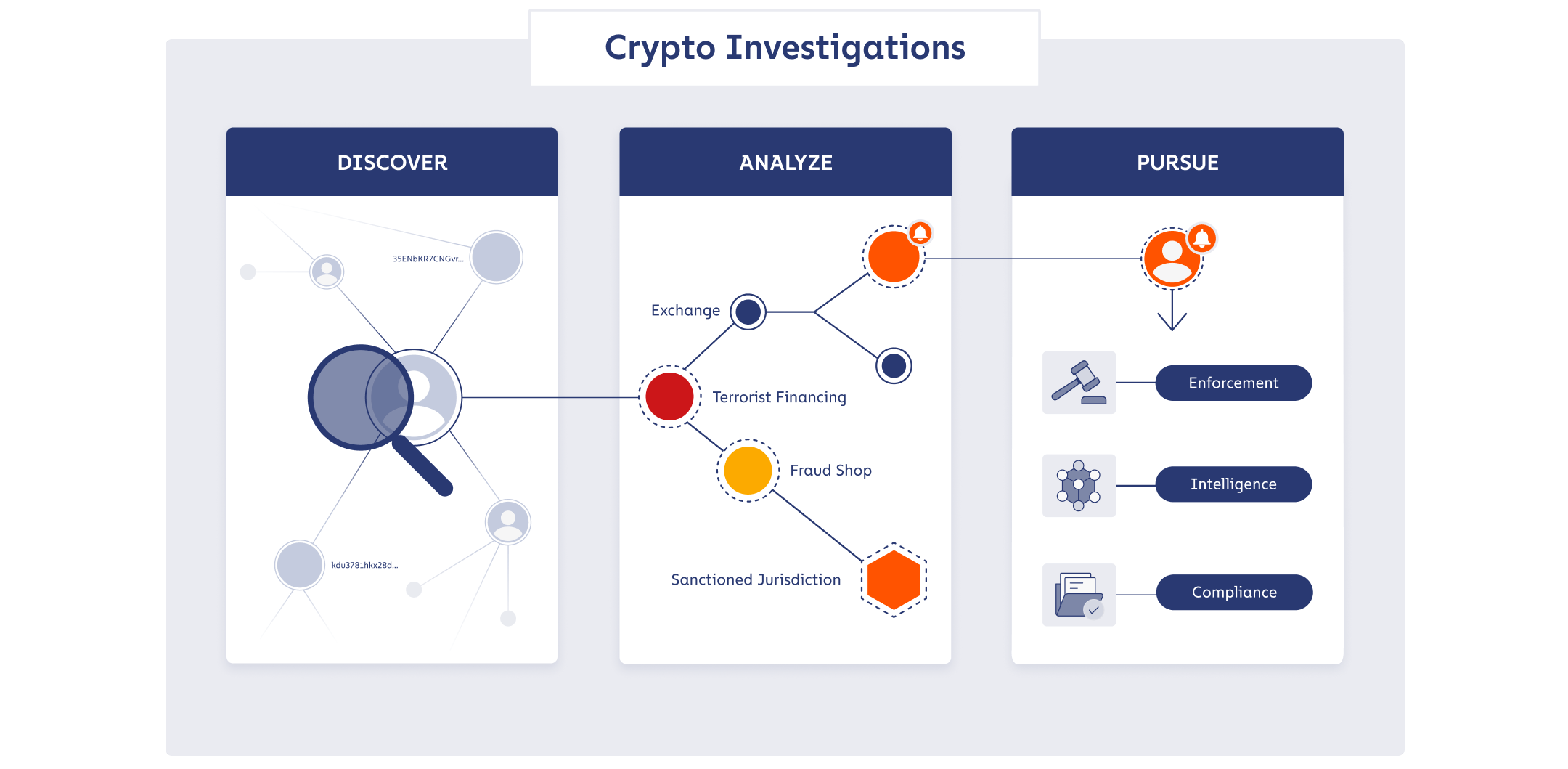

Crypto Investigations

Chainalysis’s Crypto Investigations solution helps customers discover, analyze, and pursue crypto-related intelligence, including crime-related and compliance-related intelligence. As of April 2024, this solution was primarily targeted at law enforcement agencies, tax agencies, regulators, and the private sector.

Source: Chainalysis

Law enforcement agencies use Crypto Investigations to combat and prevent crypto crime through focus areas such as financial fraud detection, terrorism financing, and fraud scheme identification. Key capabilities include:

Leads investigation: Customers can identify important insights quickly and prioritize cases based on the type of illegal activity or asset value using detailed data and analytics.

Tracking and tracing of funds: Customers can trace funds through different blockchains, tokens, and bridges to identify involved entities and points for legal actions in cryptocurrency investigations.

Target analysis: Customers can examine cryptocurrency transactions to determine the parties involved and reveal concealed connections.

Case development: Helps facilitate teamwork, exchange findings, and improve comprehension with visual representations that aid in presenting cases clearly and effectively.

According to Chainalysis, as of April 2024, more than $11 billion had been recovered by law enforcement thanks to this product offering. Users of the offering span tax agencies, private businesses, and regulators.

Tax agencies use Chainalysis’s Crypto Investigations to create accurate crypto tax reports and optimize revenue recovery through transaction analysis. As of April 2024, focus areas included tracking of crypto and digital asset holdings for tax compliance, tracing crypto transactions for tax reporting, tax evasion scheme detection, and recovery of tax revenues from undisclosed crypto assets.

Private sector businesses can utilize Crypto Investigations to strengthen their risk management practices and ensure compliance through due diligence and proactive fraud monitoring. Focus areas include background checks for crypto transactions, illicit activity monitoring, crypto-asset safeguarding, and regulatory adherence. Key capabilities include:

Asset flows and holdings monitoring: users can analyze digital asset transactions to identify policy risks, including the volume of transactions between areas and entities, and asset distribution, particularly among high-net-worth individuals.

Due diligence: users can detect illicit activities by recognizing behavioral patterns, receiving alerts about regulated entities' interactions with high-risk entities, and responding to anti-money laundering and counter-terrorist financing (AML/CFT) violations.

Blockchain analytics: this feature simplifies the interpretation of blockchain data to understand the transfer of value across entities, categorized into various sectors like DeFi, NFT platforms, centralized exchanges, sanctioned entities, and stolen funds.

Entity and asset risk analysis: users can examine entities and assets with higher risk profiles closely, following alerts from transaction monitoring to oversee compliance.

Finally, regulators leverage Crypto Investigations to ensure market integrity and effective regulatory compliance through focus areas such as illicit crypto activity monitoring, AML compliance enforcement, and overseeing crypto transactions.

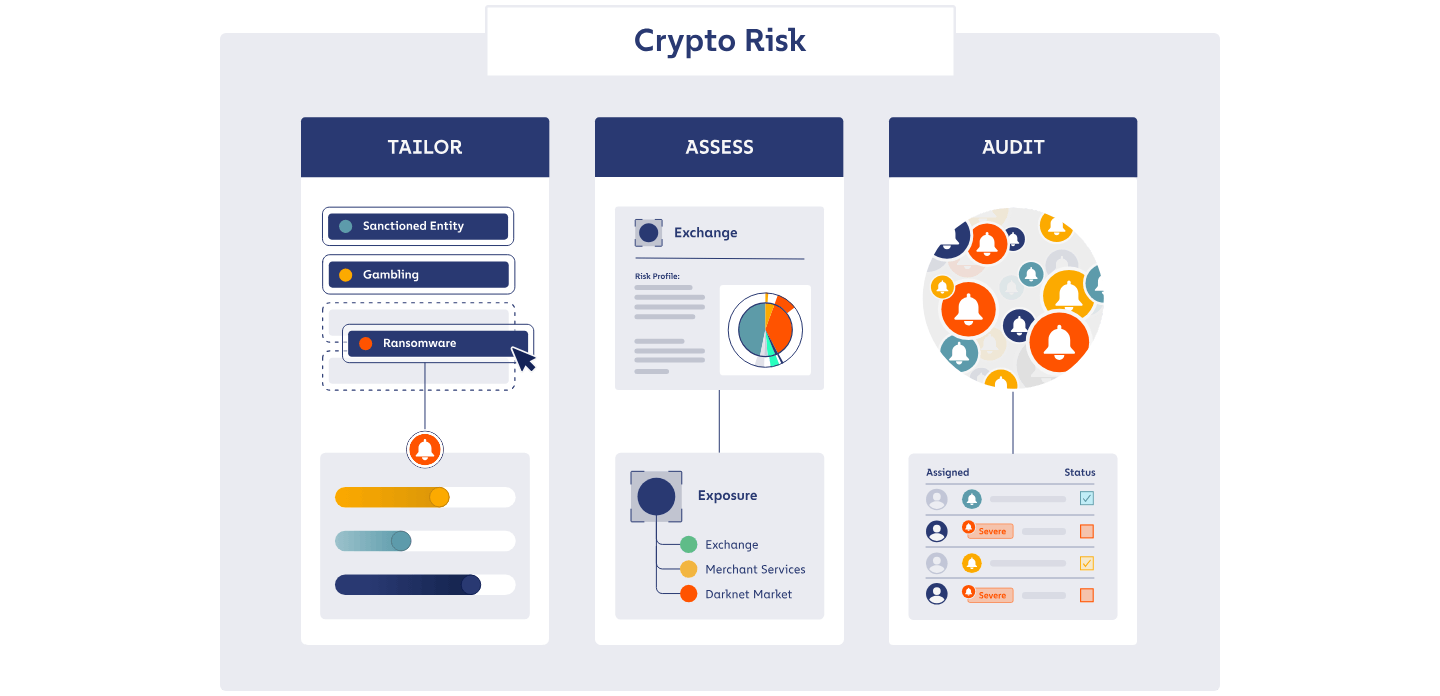

Crypto Risk

Chainalysis’s Crypto Risk offering allows businesses to “keep pace with crypto’s drive towards a secure, efficient, and compliant ecosystem.” This solution helps customers adapt to crypto risk, securing them against emerging illicit activity in their platforms. As of April 2024, this solution had been used to screen over $4 trillion worth of transactions in the previous twelve months, and over $250 million in transfers. The offering is primarily targeted at centralized exchanges, financial institutions, and crypto businesses.

Source: Chainalysis

Centralized exchanges use Chainalysis’s Crypto Risk to conduct due diligence on all transactions and entities in their platforms to protect them against illicit activities. The product also helps financial institutions focus on setting up proactive measures to identify and counteract crypto-related fraud, protecting their platforms against financial misconduct while ensuring adherence to regulatory standards. Finally, crypto businesses can use this solution to counter emerging hacking techniques and protect themselves from illicit activity.

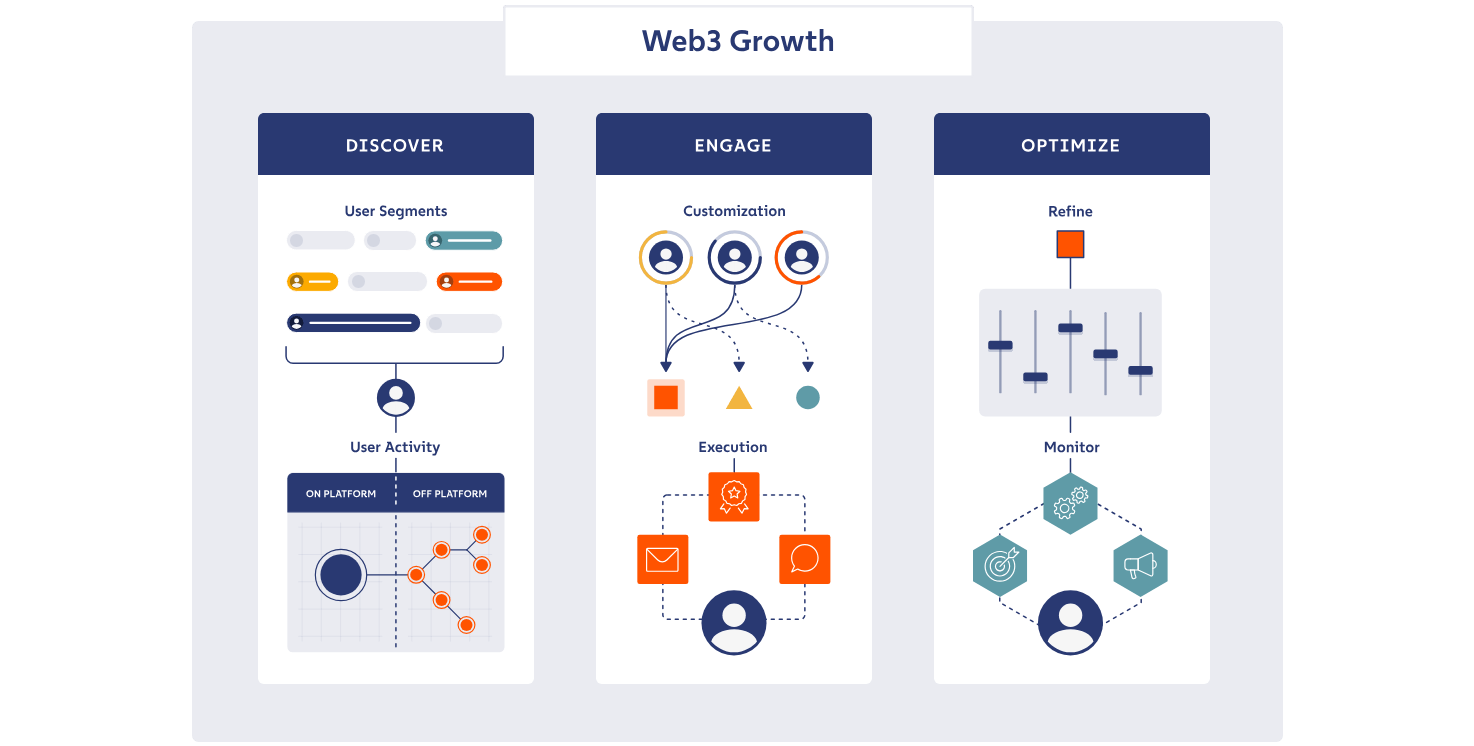

Web3 Growth

Chainalysis Web3 Growth solution helps businesses leverage on-chain user insight to increase customer engagement and success. As of April 2024, this solution was primarily targeted at strategy, marketing, and product teams.

Source: Chainalysis

Strategy teams can use Web3 Growth to access user insights, uncover business opportunities, and construct data-driven initiatives. With Web3 Growth, marketing teams can also gain a better understanding of their businesses’ users through cohorts of common attributes based on user on-chain activity.

Meanwhile, product teams can use Web3 Growth to monitor and identify new product and feature opportunities, as well as align R&D resources and investment with these opportunities, and find users to help test and iterate on product concepts to validate product-market fit.

Special Services

Alongside its suite of solutions, Chainalysis also provides several for-hire services.

Through its investigations & special programs, the company helps with cybersecurity breaches, ransomware attacks, cryptocurrency recovery, and blockchain data analysis, streamlining theft, and cybersecurity investigations. Similarly, its crypto incidence response service helps recover lost funds in incidents involving cryptocurrency theft.

Chainalysis also offers training and certification services. Clients can train with and get certified by the company to become blockchain compliance officers and regulators. As of April 2024, Chainalysis’s certifications included Chainalysis Reactor (CRC), KYT (CKC), Investigation Specialist (CISC), Ethereum Investigations (CEIC), Risk and Regulatory Training (CRRT), and Cryptocurrency Fundamentals Certification (CCFC).

Market

Customer

As of April 2024, Chainalysis had over 1K customers across financial institutions, government regulators, centralized exchanges, law enforcement agencies, tax agencies, consumer brands, and Web3 application developers. Notable customers included Square, Gemini, Rarible, Salesforce, Barclays, and Dapper Labs.

Source: Chainalysis

Chainalysis’s customers vary across the industries within which it operates, as well as across its products. The company’s Crypto Investigations solution targets law enforcement agencies, regulators, and tax agencies. As of February 2020, the company had as customers 10 US government agencies, including the US Internal Revenue Service (IRS), the US Immigration & Customs Office (ICE), and the FBI. These agencies had spent at least $10 million on Chainalysis tools as of February 2020. As of April 2024, other law enforcement customers included the Government of Spain, the Calgary Police Service, and the Australian Federal Police.

Chainalysis’ Web3 Growth solution targets strategy, marketing, and product teams in crypto businesses and consumer brands looking to transition into Web3. Its Crypto Risk solution targets centralized exchanges, crypto businesses, and financial institutions. For example, the company worked with crypto exchanges Crypto.com, Wirex, and Bitbuy, among others as of April 2024.

Market Size

Chainalysis’ efforts center around “paving the way for a global economy built on blockchains” through solutions across crypto risk management, crypto intelligence, and Web3 growth. Consequently, as crypto/blockchain adoption grows, so does Chainalysis’ potential user base.

Despite the known volatility of crypto markets, there has been a consistent rise in the number of crypto adopters and the global crypto market capitalization over the last ten years. The global cryptocurrency market cap rose from $6.8 billion in April 2014 to $2.8 trillion in April 2024, reaching an all-time high of $3 trillion in November 2021. The global blockchain market was valued at $12.3 billion in 2023 and was expected to reach $289.2 billion by 2030 growing at a CAGR of 57%. This growth is being driven by an increase in cryptocurrency usage globally, and the increase of blockchain applications in the financial and retail sections.

The global crypto security market — which is tied to Chainalysis’s crypto risk and crypto investigations solutions — was valued at $2.2 billion in 2023 and was projected to surpass $16.7 billion by 2033, growing at a CAGR of 22.2%. This growth is being driven primarily by an increase in security concerns over safeguarding crypto assets. The Web3 market — tied to Chainalysis’s Web3 Growth solution — was estimated at $400 million in 2023, and was expected to reach $5.5 billion by 2030, growing at a CAGR of 44.9%.

Competition

Elliptic

Founded in 2013, Elliptic provides blockchain analytics for crypto asset compliance. The company had raised a total of $100 million in funding as of April 2024. In October 2021, the company raised a $60 million Series C round led by Evolution Equity Partners. As of April 2024, its customers included Coinbase, Revolut, Unicef, Paysafe, and BitGo.

Like Chainalysis, Elliptic products focus on investigating crimes (Crypto Investigations) and helping its customers safeguard their organizations from crypto crimes (Wallet Screening, Transaction Monitoring, VASP Screening, and Holistic Screening). In January 2024, Elliptic announced a strategic push to expand its public sector practice to meet the increasing demand for crypto data from US national security and law enforcement agencies. In June 2023, Elliptic integrated AI into its toolkit for tracking blockchain transactions and handling risk detection. In contrast, Chainalysis had not announced plans for AI integration as of April 2024.

TRM Labs

Founded in 2018, TRM Labs is a blockchain intelligence company that helps financial institutions, crypto businesses, and government agencies detect and investigate crypto-related financial crime and fraud. It had raised $149.9 million in funding as of April 2024. TRM Labs had a $600 million valuation as of its $60 million Series B in December 2021. In November 2022, it raised a $70 million Series B extension round at an undisclosed valuation. As of April 2023, its customers included Shopify, MoonPay, Circle, Binance, and Anchorage. TRM Labs traced the flow of funds across 28 blockchains and over 1 million assets as of April 2024. According to an April 2023 article, TRM Labs was hired to work on FTX’s bankruptcy alongside Chainalysis.

Like Chainalysis, TRM Labs offers products that focus on investigating crimes (TRM Forensics and TRM Tactical) and helping its customers safeguard their business from crypto crimes (TRM Know-Your-VASP and TRM Transaction Monitoring). TRM Labs does not offer a Web3 product comparable to Chainalysis’ Web3 Growth solution as of April 2024.

CipherTrace

Founded in 2015, CipherTrace is a cryptocurrency intelligence company that helps customers enhance their crypto-related security and fraud-monitoring activities. It had raised a total of $45.1 million in funding before its acquisition by Mastercard in September 2021. As of April 2024, CipherTrace worked with banks, crypto exchanges, crypto wallets, crypto ATMs, and other Virtual Asset Service Providers (VASPs) to safely process cryptocurrency and digital asset transactions.

Like Chainalysis, CipherTrace offers solutions focused on investigating crimes (Inspector), helping its customers safeguard their business from crypto crimes (Armada, Sentry, Virtual Entity Risk Assessment), and encouraging the adoption of blockchain infrastructure (Professional Services). Unlike Chainalysis, CipherTrace integrates AI into its offerings; in November 2023, Mastercard partnered with AI platform Feedzai to expand CipherTrace’s Armada product, enabling real-time alerts to digital currency exchanges regarding suspicious transactions.

Business Model

Chainalysis generates revenue through two streams: products and services. It works with clients across many industries, including law enforcement, regulators, financial institutions, consumer brands, DeFi, centralized exchanges, and tax agencies. As of April 2024, there was no publicly available pricing data for Chainalysis’s products.

Source: Chainalysis

Alongside its products, Chainalysis provides the following services: Investigations & Special Programs, a Crypto Incidence Response service, and Training and Certification services. Although there is no publicly available pricing data for Chainalysis’s Investigations & Special Programs service, or its Crypto Incidence Response program, the cost of individual certifications offered by Chainalysis ranged between $399 and $1.4K as of April 2024.

Traction

Chainalysis made an estimated $8 million in revenue in 2018, a 96% increase over the previous year. In October 2020, the company announced 100% growth in recurring revenue YoY in Q3 of that year, expecting to double its revenue in both 2021 and again in 2022.

In November 2020, Chainalysis had 350 customers, 250 of which were in the private sector, and the remaining 100 in the public sector. This constituted a 65% increase over the previous year. By May 2022, Chainalysis had increased its customer count to 750 customers in 70 countries, a 75% increase since May 2021. The company doubled its private sector customer base during that period while tripling its financial services customer base to reach 100 financial institutions as customers. During the May 2021 - May 2022 period, Chainalysis increased the number of customers accounting for more than $100K in ARR by 75% to 150 customers. As of April 2024, Chainalysis had over 1K customers.

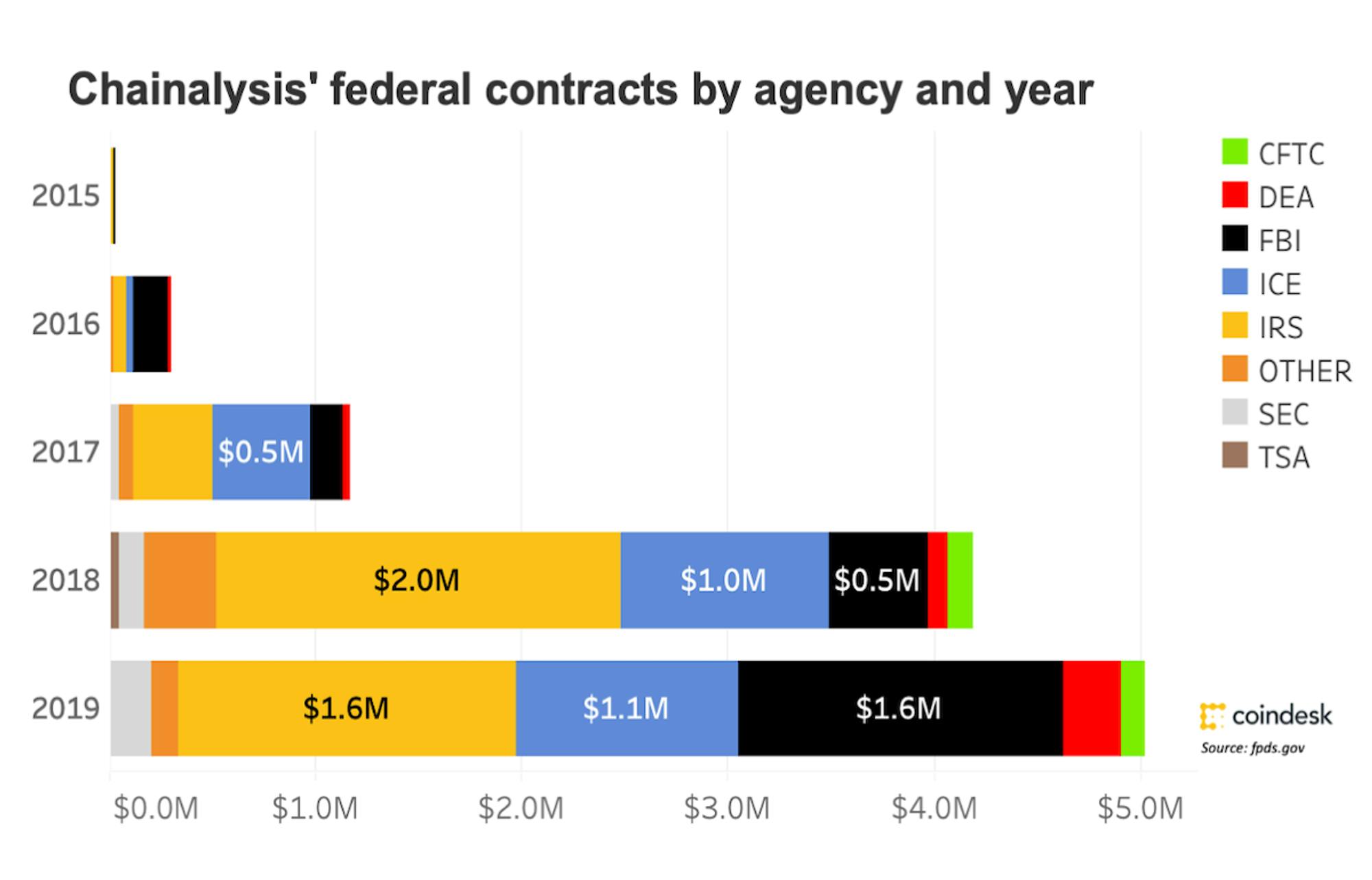

For its public sector work, Chainalysis closed a $9K data software contract with the FBI in 2015. As of February 2020, Chainalysis made more than $10 million in US government contracts since 2015. As of 2020, the company stood to take in a total of $14 million counting contracts with possible extensions. As of April 2023, Chainalysis had contracts with the US federal government worth $65 million.

Source: Coindesk

Chainalysis has also been involved in several high-profile criminality cases. In 2019, Chainalysis worked with US federal investigators to dismantle the largest child pornography website on the dark web. In 2020, the company worked with the US Department of Justice to seek forfeiture of 280 cryptocurrency accounts involved in the laundering of approximately $28.7 million from the North Korea-affiliated Lazarus Group. In November 2020, Chainalysis worked with US law enforcement agents to identify the largest cryptocurrency wallets associated with the Silk Road. In May 2021, Colonial Pipeline, a major fuel pipeline in the United States, was targeted by a ransomware attack; Chainalysis worked alongside law enforcement agencies to track and trace the Bitcoin ransom payments made to the hackers.

In February 2023, Chainalysis laid off 4.8% of its employees, reportedly due to the “collapsing private-sector demand as digital-asset prices and trading volume plummeted.” In October 2023, Chainalysis conducted a second round of layoffs, cutting around 15% of its staff due to market conditions. This reduced the number of Chainalysis employees from 900 to 750.

Valuation

As of April 2024, Chainalysis had raised a total of $536.6 million in funding across 11 rounds from investors including Coatue, Paradigm, Accel, Point Nine, and Irving Investors. The company raised three consecutive $100 million funding rounds: a Series C round in November 2020, a Series D round in March 2021, and a Series E round in June 2021. Chainalysis was valued at $8.6 billion as of its $170 million Series F round in May 2022.

Key Opportunities

Increased Market Recognition of Digital Assets

In January 2024, the Securities and Exchange Commission (SEC) approved the listing and trading of 11 spot bitcoin exchange-traded funds (ETFs) designed to track Bitcoin, with notable companies such as BlackRock, Fidelity, Invesco, and VanEck among those authorized. Additionally, in February 2024, Bank of America, Morgan Stanley, and Wells Fargo reportedly explored the inclusion of spot Bitcoin ETFs on their platforms.

The approval of spot Bitcoin ETFs signifies a growing recognition of digital assets, particularly Bitcoin, and reflects a shifting stance towards other cryptocurrencies. This, in turn, presents an opportunity for Chainalysis as it represents an expected increase in demand for blockchain compliance solutions as more traditional financial institutions venture into cryptocurrency markets, necessitating enhanced regulatory compliance, risk assessment, and monitoring services.

Growth of Illicit Cryptocurrency Activity

Given Chainalysis’s work with government agencies, its growth could be impacted by the number of funds associated with illicit activity within the blockchain. In 2022, the value of illicit transactions on the blockchain reached $39.6 billion, up from $23.2 billion in 2021. While the amount of illicit transaction activity decreased to $24.2 billion in 2023, Chainalysis cautioned in a January 2024 article that these figures represented the lower-bound estimates based on identified illicit addresses as of January 2024. The estimated amount, the company explained, is likely to increase as more addresses are identified as illicit over time. In this context, Chainalysis is well-positioned to assist an increasing number of institutions and companies in mitigating the number of illicit blockchain transactions.

Increased Regulatory Pressure for Blockchain Companies

One of the main challenges the cryptocurrency industry faces is a lack of regulatory oversight, which has led to concerns about money laundering, fraud, and other illicit activities. However, many governments and regulatory bodies such as the European Union, the United Arab Emirates, the UK, and the US are taking steps to establish guidelines and regulations for the industry.

For example, in January 2024, the US Securities and Exchange Commission (SEC) released an updated rule-making agenda regarding cryptocurrency trading, with plans to finalize rules by April 2024. These rules include mandating investment advisors to store customers' crypto assets with "qualified custodians", and expanding the definition of regulated exchanges to cover crypto entities, including DeFi projects. This presents a significant opportunity for Chainalysis, as the company offers tools and services to help businesses comply with these regulations.

Key Risks

Regulatory Uncertainty

Regulatory uncertainty and lack of standardization across jurisdictions pose a significant challenge to Chainalysis's position in the market. While cryptocurrencies have seen worldwide adoption, regulatory bodies are still grappling with how to regulate them effectively. A 2023 study found that “financial regulation policy uncertainty is negatively and significantly associated with the volatility of cryptocurrencies.” If regulations are too strict or inconsistent across different regions, the industry's growth and demand for Chainalysis services could be limited. In addition, changes in regulatory frameworks could negatively impact Chainalysis's ability to offer its services in certain jurisdictions. Moreover, if regulatory compliance requirements become too burdensome, businesses may seek alternative solutions that are more cost-effective.

Privacy Concerns

A key threat that could hinder Chainalysis’s growth is growing concern over privacy in the blockchain industry. Despite the transparency inherent to blockchain technology, users are increasingly concerned about how their personal information is stored and shared on the blockchain; in a 2024 survey, only 10% of participants asserted confidence in “the industry's dedication to data privacy and security.” If these concerns continue to grow, demand for Chainalysis services could decrease as businesses and individuals seek more private and anonymous transaction solutions.

Moreover, some cryptocurrency users may hesitate to use Chainalysis's services if they fear that third-party entities could trace and monitor their transactions. For example, in April 2023 Chainalysis and the ICE, one of its government clients, faced criticism from privacy advocates who feared that the use of blockchain analysis tools by agencies like the ICE could result in targeted actions against immigrants. To counter this, Chainalysis could rely on developing new privacy-focused solutions.

Summary

As blockchain technology adoption continues to grow, so does the need for security, compliance, and illicit activity detection solutions. Chainalysis aims to build a “global economy built on blockchains.” Founded in 2014, it provides crypto investigation, risk, and growth solutions and services to government agencies, financial institutions, cryptocurrency businesses, and consumer brands. Chainalysis has positioned itself as a trusted partner in this domain, working with over 1K organizations across 70 countries as of April 2024. However, to continue to grow, the company needs to successfully navigate blockchain’s regulatory uncertainty and growing concerns over privacy.