Thesis

The smartphone revolution in America was sharp and sudden — from 2010 to 2017, the proportion of American smartphone users increased three-fold. In 2025, smartphones are nearly ubiquitous, with 90% of Americans owning one. Over time, Americans have increasingly used the convenience of smartphones for mobile shopping. In March 2022, 94% of consumers shopped on mobile. As customers shifted towards smartphones, so did their expectations for communication between them and brands. More than 90% of customers are interested in texting with brands.

This shift has created an opportunity for businesses to improve customer engagement. Broadly, customers are more responsive and less likely to unsubscribe from SMS messages compared to emails. For example, in 2021, the open rate for SMS marketing was around four times higher than email. Furthermore, in 2024, fewer than 5% of customers who signed up for an SMS marketing campaign unsubscribed, four times less than their email counterparts. Consequently, as of February 2025, the majority of companies expect to increase their SMS marketing budgets.

Attentive is an AI-powered SMS and marketing platform that enables brands to connect with customers through personalized messages. The company’s product suite provides tools for brands throughout the entire subscriber lifetime cycle. On the platform, businesses can (1) grow their list of subscribers, (2) create SMS and email marketing campaigns for subscribers, (3) provide customer support to subscribers, and (4) use a dashboard to manage subscribers and optimize future marketing campaigns. As of March 2025, over 10 billion messages are sent on Attentive annually.

Founding Story

Attentive was founded in 2016 by Brian Long (former CEO), Andrew Jones (former CPO), and Ethan Lo (former CTO). Ever since he was a child, Long had an interest in becoming an entrepreneur. This interest came in the form of countless different startup ideas, ranging from creating websites for businesses to selling sodas with varying levels of sugar. Long carried this interest as an undergraduate at the University of Pennsylvania, where he looked to gain the skills needed to achieve his entrepreneurial dreams. Unsure of which career to pursue out of college, he asked a friend’s successful father for advice on a first job. Rather than the traditional pathways taken by many of his Ivy-league peers, he advised Long to go into sales, where he would “understand the entire business.” Long spent four years in sales at both large companies and startups. Eventually, Long would become the Senior Vice President of Mobile at Crossboard Mobile (at the time, known as Pontiflex), a startup that pioneered cost-per-lead mobile advertising.

In 2012, Long applied this experience in advertising and sales to create TapCommerce, a mobile startup that enables businesses to retarget advertisements based on past user activity. At TapCommerce, Long hired both Jones and Lo as early employees. By 2014, two years after its founding, TapCommerce had ~30 employees and $2 million in monthly revenue. That year, TapCommerce was acquired by Twitter for $100 million. When asked about the sale of TapCommerce, Long says that, immediately, he was thinking about “doing something even bigger and more interesting [afterward].” Following two years at Twitter, the ex-TapCommerce team left Twitter to build that ‘something.’ At first, their project was called Franklin, an online platform for businesses to communicate and manage their frontline workers. During their first six months, the team utilized an NPS-like scoring system to measure customer interest and received mediocre reviews. At the same time, the group received a tepid response from potential investors. Long would describe these six months as an “abject failure.”

Although a communication platform between businesses and workers failed, companies expressed interest in communication between businesses and customers. Consequently, the trio pivoted to a different product: Attentive, an SMS marketing platform for businesses. Immediately, the co-founders received positive feedback from customers who submitted nines and tens on their rating system. Quickly, the team doubled down, and within a year of Attentive’s founding, Long hired four SDRs and a VP of Sales. As Attentive has grown from a startup to a company targeting an IPO, the founding team has stepped away from the day-to-day operations of Attentive. In 2021, Lo announced his decision to leave Attentive and became a founding member of NYC Digital Service. The year after, both Long and Jones left their original operational roles, with Long remaining as Attentive’s Executive Chairman. When asked about his departure from Attentive, Long responded “I have […] a yearning for bold and audacious company ideas” and “I love the zero to one, building, scaling, and operating the business.” As of March 2025, Long and Jones were both working on Adaptive Security, an AI cybersecurity company. Simultaneously, the board selected Amit Jhawar, Venmo’s former CEO and the President of Attentive, to be CEO in June 2023.

Product

Source: Attentive

Messaging

Attentive’s core product is SMS messaging between businesses and their customers. Attentive’s messaging product suite (1) provides the ability to compose marketing messages (2) ensures the delivery of messages, and (3) enables long-lasting customer communication.

SMS

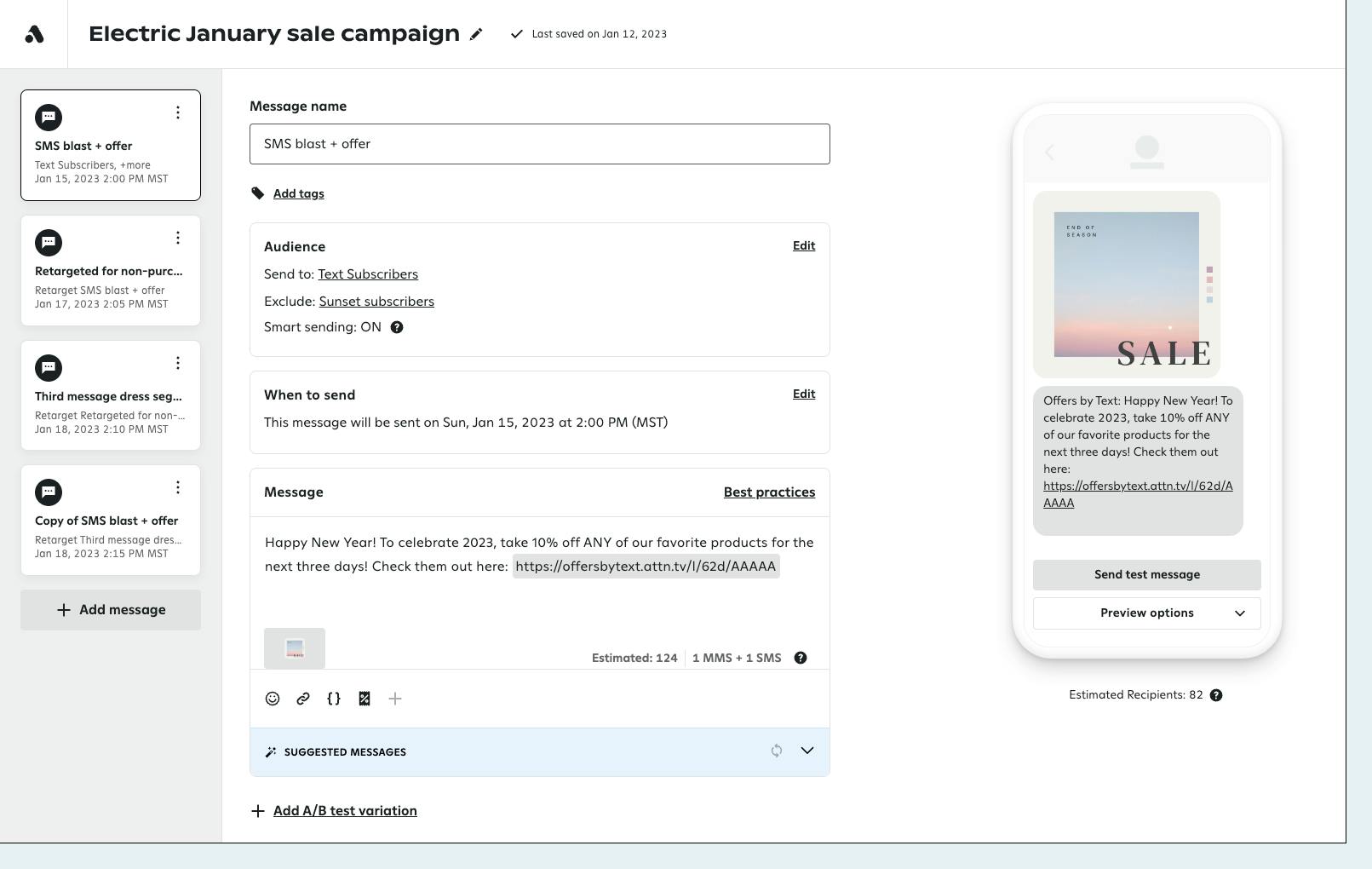

SMS communication on Attentive can be categorized into two message types: campaigns and journeys. Campaigns are one-time messages that are mainly used for promoting time-sensitive information such as discounts or new releases. With Campaign Composer, brands can write an SMS message, select an audience, and a time.

Source: Attentive

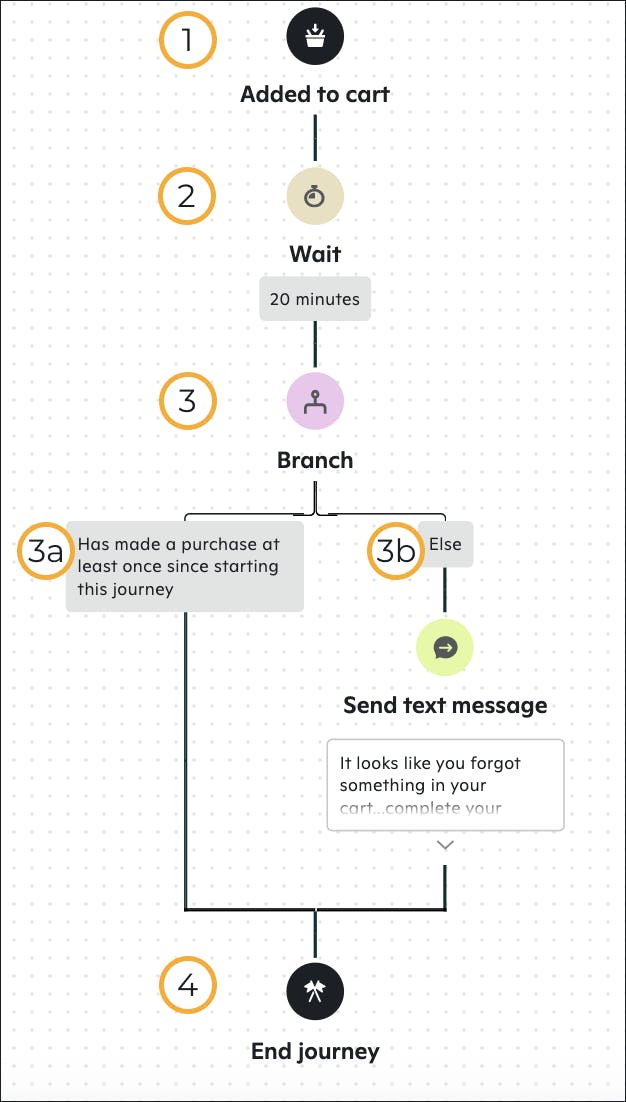

Journeys are triggered messages where companies can send messages depending on each user’s activity and characteristics. At the beginning of each journey is a trigger user action such as adding an item to a cart or opting into messaging. From there, the journey operates similarly to ‘if/else’ statements: depending on whether a user meets a condition, the user will experience a specific set of prompts. For example, in the image below, if the user makes a purchase, the journey will end. Otherwise, the user will receive a text message reminding them about their cart. These messages are best for capitalizing on critical points in the customer lifecycle such as new subscribers, an abandoned cart, and post-purchase messages.

Source: Attentive

Deliverability

Attentive’s SMS Deliverability product ensures a subscriber receives messages from brands. With Attentive, brands can send a virtual contact card and have subscribers save their number. This decreases the likelihood that a brand’s SMS marketing messages will be filtered out of a subscriber’s primary message inbox. Furthermore, Attentive partners with multiple aggregators and 80+ carriers to ensure SMS messages can be delivered during high-traffic times such as Black Friday and Cyber Monday (BFCM).

Lastly, Attentive equips businesses with the tools to avoid carrier spam filters. For example, carriers regularly filter messages with third-party link shorteners, due to their high use in spam messages. On Attentive, brands can use their built-in URL shortener to bypass screenings. Other features, such as Smart Sending and Quiet Hours avoid spam filters by limiting the number of messages a single subscriber can receive in a certain time frame. For example, in 2022 more than 1.6 billion messages were sent via Attentive on BFCM every year.

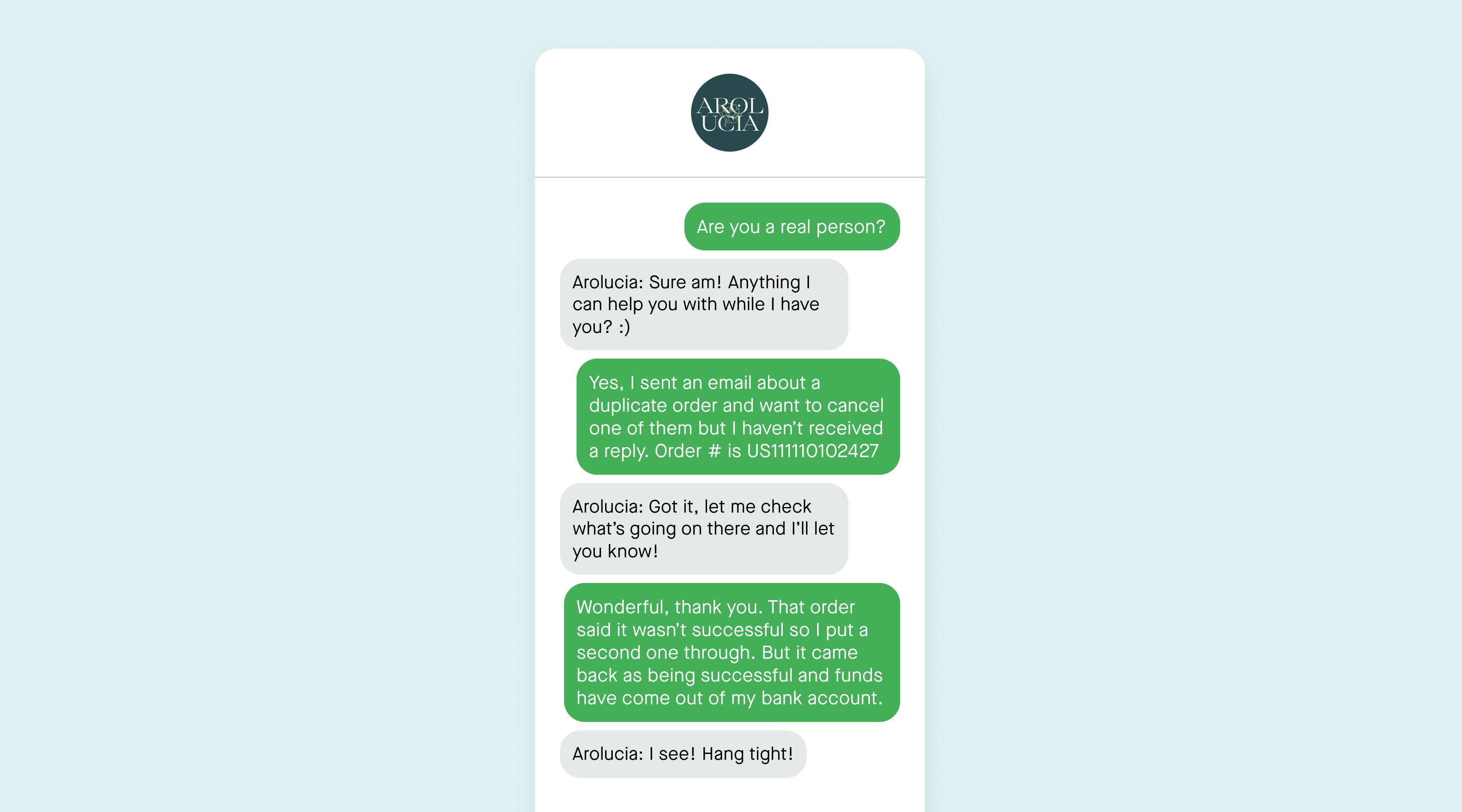

Concierge

Once brands create a relationship with subscribers, Attentive Concierge provides live responses and customer support over text to customers. Launched in 2022, the service was purely composed of on-demand agents that would respond to customer inquiries. Through Attentive, businesses can provide guidelines for these agents such as tone, voice, and deal offerings. The introduction of Attentive Concierge increased the number of touch points between consumers and businesses: in 2022, subscribers spent 50% more with brands that used Concierge.

Source: Attentive

In 2022, Attentive launched messaging services for email. Similar to its SMS product, brands using email can compose both campaigns and trigger messages for customers. Brands that have their SMS and email messaging on Attentive can consolidate data, improve customer targeting, and increase efficiency. However, email lacks the same support as SMS and does not have features such as deliverability or concierge.

List Management

Building upon its messaging capabilities, Attentive provides a suite of products to improve brand marketing before and after messaging. Before a message is sent, brands can use tools to increase their subscriber list. After a message is sent, brands can leverage customer data and user behavior to optimize message effectiveness while ensuring regulatory compliance.

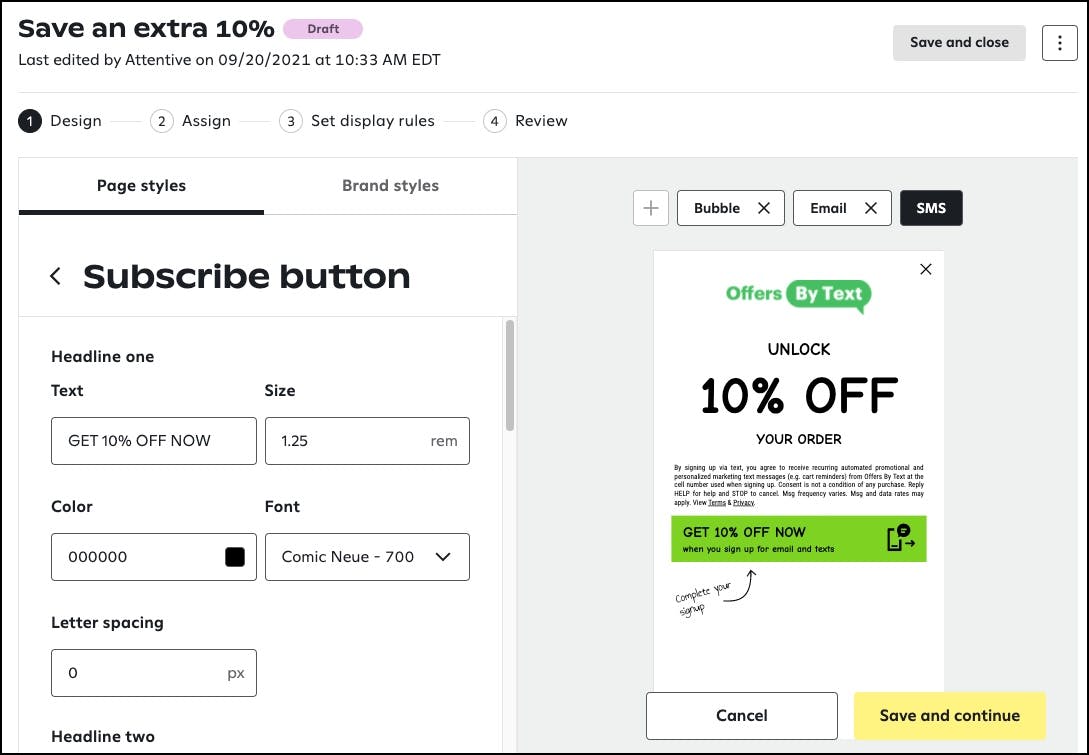

List Growth

With Attentive, businesses can design unique sign-up units: digital forms where subscribers enter their information. In addition to various templates, businesses can create and upload custom sign-up units for their brand. Beyond generic areas of customization, businesses can implement features that encourage customer enrollment such as ‘spin-to-win,’ a countdown timer, and social proof.

Attentive’s distinguishing feature is its patented ‘two-tap solution.’ The first tap is when users see an advertisement or post that prompts them to subscribe for more information. They subscribe by clicking on a call to action, which will opt them in. The novelty of Attentive’s technology is the two-tap portion. After clicking opt-in, a user’s text message app will open and they can immediately subscribe by pressing ‘send’. The key difference between the two is that the two-tap sends the subscription process, while the first-tap merely initiates the process. Consequently, this process does not require subscribers to input their phone number, preventing potential errors. On Attentive, as of March 2025, brands have recorded over 875 million SMS subscriber sign-ups and over 590 million email subscriber sign-ups.

Source: Attentive

After a user signs up, they can receive a pre-written ‘welcome journey,’ a series of messages where a business can introduce itself, present its offering, and send its contact card.

Attentive Signal

Source: Attentive

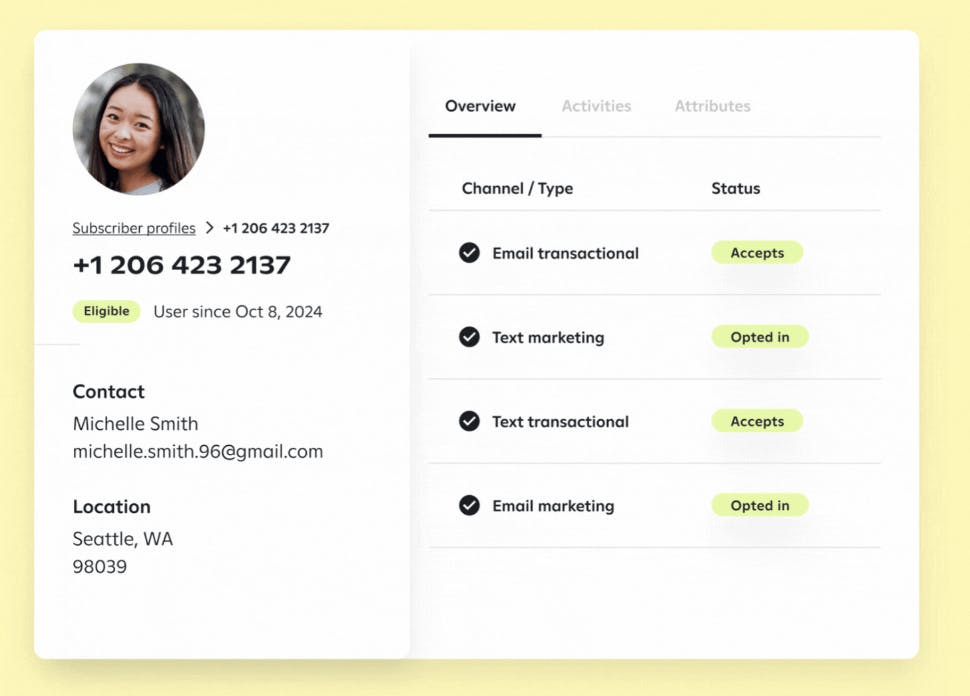

After customers become a subscriber, Attentive begins to collect subscriber data for precise targeting. Attentive Signal is an identity solution that enables marketers to identify and understand website visitors by collecting detailed data on their behaviors and preferences. This information allows for the creation of personalized experiences that resonate with each subscriber.

The solution employs server-side technology to set durable cookies, enhancing visitor recognition across devices, even without relying on cookies, by matching details like phone numbers, emails, and device information. It continuously captures events such as cart additions and product views, providing deeper insights into subscriber actions. This mobile-friendly approach leverages SMS and email engagement, along with various unique identifiers, to build accurate, cross-channel customer profiles. According to the company, implementing Attentive Signal has led to a 20% increase in conversion rates and a 95% boost in triggered email revenue for businesses.

In the past, Attentive has touted its Audience Manager, including the Attentive Customer Passport which can automatically create detailed customer profiles with zero and first-party data, integrations, and captured engagement. These ‘passports’ hold important customer information in the form of both actions and characteristics.

For example, different user actions include sending a reply, receiving a text, subscribing to an email, opening a link, making a purchase, and visiting a site. Various user characteristics include location, device type, operating system, sign-up source, recurring date, etc. Businesses can use this technology to construct hyper-personalized marketing campaigns/’journeys’ segmented on specific customer attributes. For example, a homeware retailer could segment their subscribers by type of furniture (bathroom, living room, etc.) and send specific item-related promotions.

Analytics

Attentive provides the tools to analyze, iterate, and improve a brand’s marketing campaign. Brands have access to a dashboard where marketers can view the performance of their campaign through metrics for variables such as revenue, subscribers, and messages. Brands can also request reports that provide more in-depth metrics such as the performance of automated messaging and individual conversations. Armed with this information, brands can run A/B tests to optimize their marketing campaigns where marketing teams can compare the performance of variables such as emoji use, length of message, GIF vs. image, etc.

Compliance

SMS messaging is highly regulated — violators of compliance regulations can receive large financial penalties. As a result, Attentive offers various services that enable businesses to meet regulations and avoid compliance. Attentive’s Litigator Defender automatically removes subscriber phone numbers known to be associated with SMS demands and/or lawsuits — as of March 2025, there have been over 55K known litigators removed from subscriber lists. Additionally, Attentive’s Enhanced Audit Assistant enables brands to quickly respond to Telephone Consumers Protection Act (TCPA) complaints. Under the TCPA, brands with SMS subscribers need to offer consumers a way to opt-out, violators can receive fines up to $1.5K per user. With Attentive, brands can quickly respond to these potential fines with records of opt-in and opt-out user activity.

Attentive AI

Source: Attentive

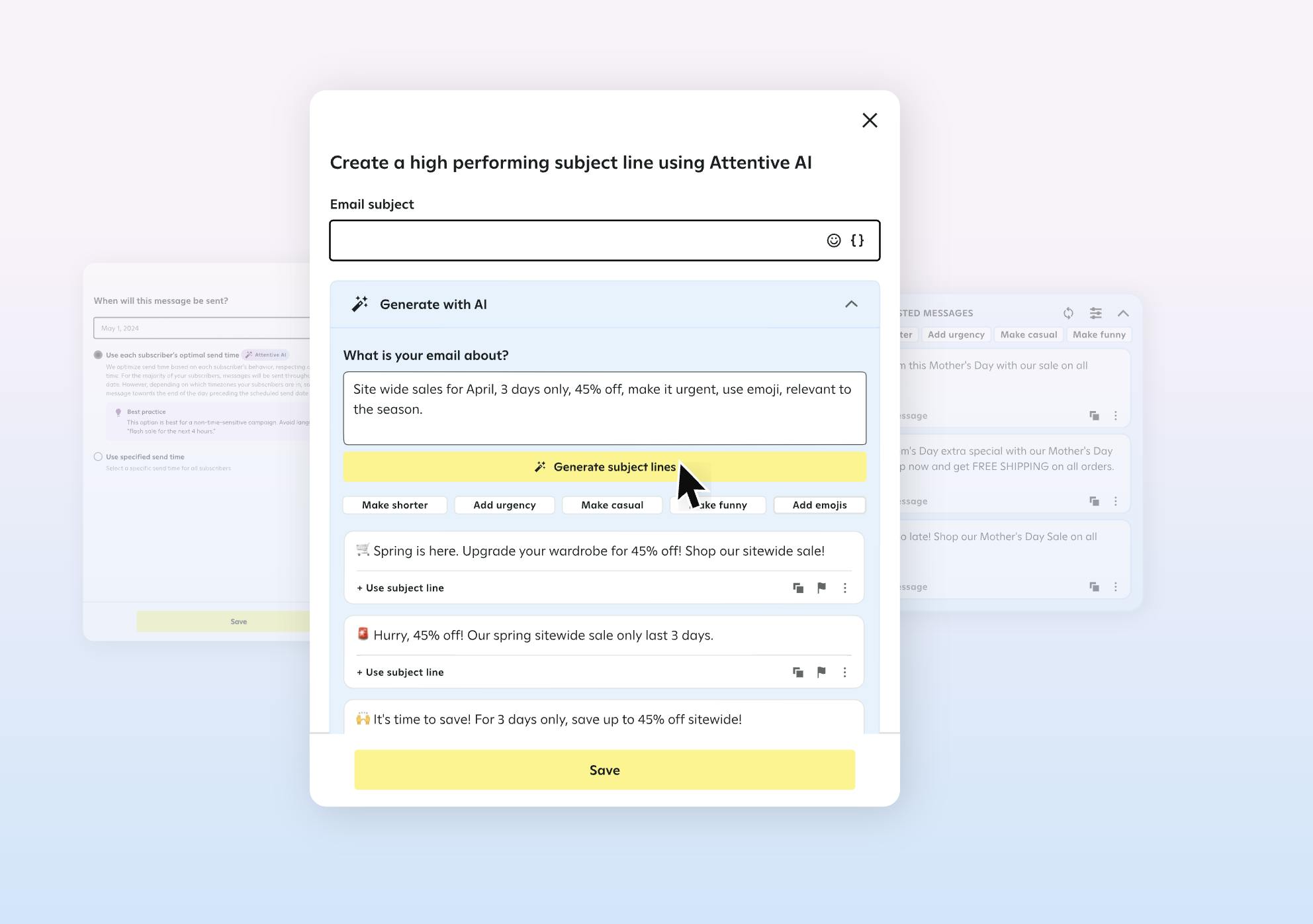

Attentive utilizes over 2 trillion data points and over 90 billion messages to train its AI, which is applied towards various different features in the product suite. Attentive AI is split into four different products: AI Essentials, AI Journeys, and AI Pro.

AI Essentials automates the process of composing a marketing campaign through Copy Assistant and Subject Line Assistant, which analyze previously high-performing content to generate message suggestions.

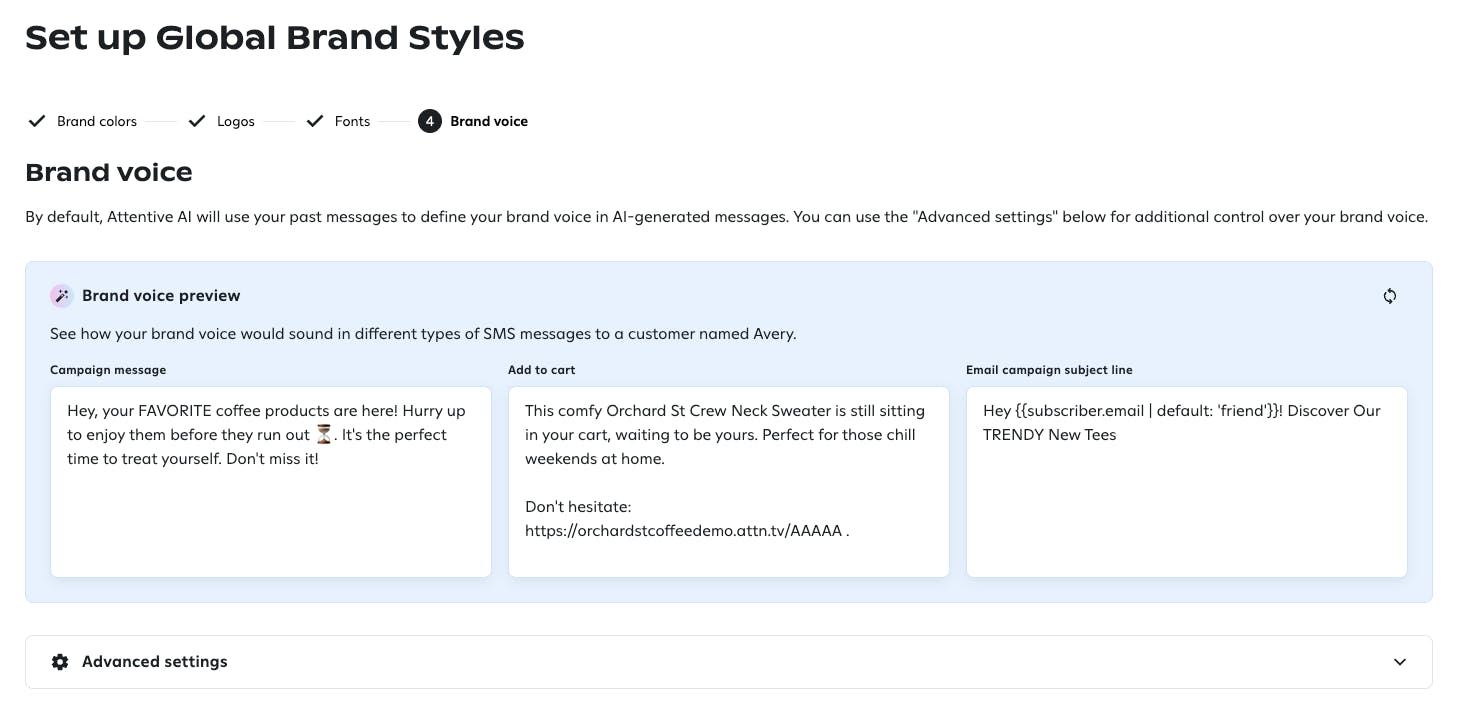

AI Pro optimizes these AI-powered marketing campaigns by improving customer targeting. The capability is a suite of four different tools. Audiences AI utilizes historical customer data to identify subscribers that are likely purchasers and remove unlikely purchasers from a marketing campaign. Identity AI recognizes lost subscriber information. When a user visits a brand’s site, Attentive collects data points such as IP address, carrier time, and user agent. If a user’s information expires, Identity AI can match the data with an existing user. Send Time AI takes into account a subscriber’s information such as location and historical campaign performance to determine an optimal message time for both SMS and email. Brand Voice AI utilizes previous successful messages to automatically generate messages for future marketing campaigns. Brands can alter Brand Voice AI by choosing important keywords, the use of urgency in messages, the frequency of emojis, etc.

Source: Attentive

AI Journeys applies these improvements in customer segmentation to triggered messages. Trained on user activity to optimize sales, AI journeys can suggest (1) when to send a message (2) how many messages to send, and (3) the content of a message. In 2023, Concierge was integrated with Attentive AI, the updated product responds to customers instantly with hyper-personalized messages.

Attentive AI automates and optimizes processes for brands across the entire marketing cycle. It has quickly gained traction, as of December 2023, 80% of existing brands on Attentive have used Attentive AI. In 2023, on Black Friday and Cyber Monday, there were 218 million messages sent by AI.

Market

Customer

Attentive targets brands within consumer verticals such as retail / ecommerce, media, travel, and restaurants. Attentive’s early entrance into the SMS market enables the company to sell its services upstream to “high-volume centers.” At the same time, Attentive’s intuitive product and white-glove services are sold downstream to SMBs that lack an employee dedicated to SMS marketing. As of March 2025, the majority of Attentive’s customers are reportedly small businesses with less than $50 million in yearly revenue.

Market Size

The marketing software market was valued at $60.3 billion in 2023 and is expected to reach $243 billion by 2032, growing at a CAGR of 15.5%. The market is still buoyed by the COVID-19 pandemic; from 2020 to 2022, there was a 43% increase in digital advertising. Future growth in digital marketing is driven by a market-wide shift towards automation — 87% of businesses plan to invest in automating digital marketing efforts. The smaller SMS marketing software market was valued at $10.5 billion in 2023 and is expected to reach $48.2 billion by 2032, growing at a CAGR of 23.08%. One driver behind this growth projection is the relative nascency of SMS marketing compared to broader digital marketing strategies.

Competition

Competitive Landscape

Attentive is competing for a slice of each company’s digital marketing budget. Attentive’s competitors span from smaller SMS-focused platforms like Postscript to larger public companies like Klaviyo with offerings across SMS and email. As the space has matured, the market has become highly competitive and concentrated. For example, in 2023, Attentive sent a cease-and-desist letter to Postscript over a case study with an ex-Attentive client. Furthermore, the commoditization of SMS has led to consolidation across the space. Smaller players, such as Emotive, have been reportedly squeezed out and, at times, been forced to downsize.

Attentive’s market position is defined by its early entrance into the space, two-tap technology, and ease of use. Started in 2016, Attentive was, essentially, the ‘first-to-market’ SMS marketing platform. Early on, Attentive quickly signed up new customers — a former employee revealed that they successfully converted virtually every business involved in SMS marketing that they approached. Furthermore, Attentive’s aforementioned two-tap technology reportedly helps businesses build their subscriber list faster. This is crucial because a business’s list size needs to hit a certain critical mass for substantial ROI in SMS marketing. Lastly, Attentive’s product is a personalized but also simplistic no-code solution that can be used by smaller brands that lack engineering resources. Each of these advantages, along with high switching costs, has led to a former employee describing Attentive’s market position in the SMS market as a “stranglehold.”

Competitors

Klaviyo: Founded in 2012, Klaviyo is an email-focused marketing platform for businesses and went public in 2023. As of March 2025, Klaviyo had a market cap of $10.5 billion. Before going public, Klaviyo raised $778.5 million from investors such as Accel, Summit Partners, and Astral Capital. An inverse of Attentive, Klaviyo began as an email-only service and branched out to SMS in 2019. Klaviyo’s long-term success has been defined by its ability to ‘move up-market’ to larger enterprise customers through its use of ‘enterprise pods’. In their S-1 filing from 2023, Klaviyo reported that it has 1.5K customers each with more than $50K in annualized recurring revenue.

Braze: Founded in 2011, Braze later went public in 2021. Braze provides a multi-channel customer engagement platform that offers SMS, WhatsApp, and email marketing. Unlike Attentive, Braze offers comprehensive cross-channel services, where marketers can create and implement a singular campaign across channels and native support for WhatsApp, which is critical for international expansion. Before it went public, Braze received $175 million in funding from investors such as ICONIQ Growth, Meritech Capital, and Spark Capital. As of March 2025, Braze’s market cap was $3.6 billion, down 61% since its IPO reportedly due to slowing customer growth.

Postscript: Founded in 2018, Postscript is an SMS marketing platform concentrated on ecommerce brands. Originally founded as a one-way customer messaging platform for Shopify brands, Postscript has built integrations and features geared toward the ecosystem. Furthermore, with Postscript Plus, companies with small marketing teams can partially or fully offload their SMS marketing needs. In June 2022, Postscript raised a $65 million Series C from Twilio Ventures, Expanding Capital, and m]x[v Capital. In total, as of March 2025, the company had raised $106.2 million from investors such as Greylock, Accomplice, Elephant, and OpenView.

Emotive: Founded in 2018, Emotive is a customer SMS marketing platform. A key differentiator is Emotive’s focus on conversational messaging, where customers can have 1:1 interactions with businesses. However, Emotive has reportedly struggled. In 2022, the company laid off 18% of its workforce, citing a shift towards profitability. In February 2021, Emotive raised a $50 million Series B led by CRV at a $400 million post-money valuation. As of March 2025, the company had raised $103.2 million from investors such as Mucker Capital, TenOneTen Ventures and Stripes.

Business Model

Attentive operates on a subscription model. Although Attentive does not list prices on its website, third-party sources list its plans as $300 a month, $.01 per SMS, and carrier fees. However, the actual cost can be dependent on the specific country and carriers. Attentive’s email service cost is related to list size, number of messages sent, and monthly spending. For example, a business that has a list size <12K and sends <120K messages will be charged $250/month.

For businesses, Attentive can be categorized as a middle-tier marketing expense. On average, Attentive customers spend <$10K per month during peak months (October to the end of December) and around $2.5K per month for the rest of the year. Critically, Attentive’s ability to offer detailed pricing based on the number of SMS messages is a comparative advantage to other services such as emails that are still credit-based for some competitors. Although Attentive has added an email product, the company’s origins in SMS remain the cornerstone of the business.

Traction

In 2023, Attentive reported having over 8K different customers, generating more than $20 billion in revenue for its customers. Notable customers include the Milwaukee Bucks, Hot Topic, and DIFF Eyewear. In 2022, Attentive hit $200 million in yearly revenue and was growing at a year-over-year rate of 60%. Importantly, Attentive has experienced strong growth in its areas of geographic expansion: in 2024, revenue from the United Kingdom and Australia has increased at a year-over-year rate of approximately 125%. In January 2025, Attentive announced the company had reached $500 million in ARR over the course of 2024.

Valuation

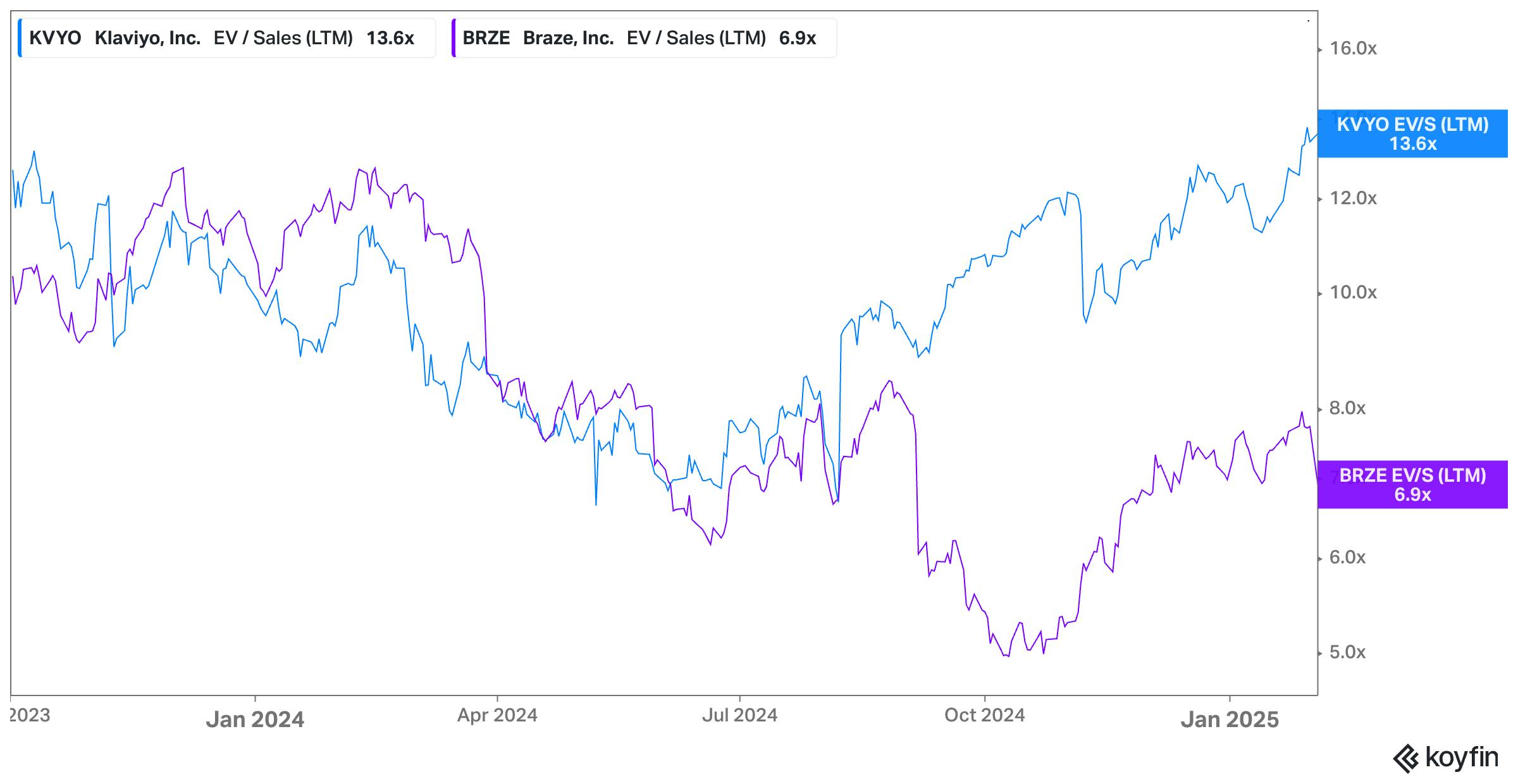

In June 2021, Attentive raised a $470 million Series E round led by Tiger Global Management and Coatue Management at an estimated $7 billion post-money valuation. In total, as of March 2025, Attentive had raised $922 million in funding. Given Attentive’s size, the company had planned for an IPO in mid-2024; however, the subpar performance of newly listed technology companies, especially competitor Klaviyo, deterred Attentive.

Based on the company’s $500 million of ARR in 2024, that would represent a 14x LTM ARR multiple at its prior valuation of $7 billion in 2021. However, in secondary markets, Attentive is valued at a range from $2.7 billion to $5.8 billion according to marks from mutual fund investors, like BlackRock. That would represent an LTM ARR multiple range of 5.4-11.6x. In the public markets, comparable companies like Braze and Klaviyo trade at a range of 6.9x to 13.6x LTM revenue.

Source: Koyfin

Key Opportunities

Leveraging AI

Although Attentive AI was introduced in 2023, it has quickly become a critical lever of the company’s success. The early results of Attentive AI are promising: customers have experienced an increase of 180% in online revenue and 160% in conversions. Furthermore, armed with AI, marketing teams will no longer need to operate in the minutia of a customer’s journey.

An employee at a competitor SMS marketing platform described the process as “more like a general film director rather than [the individual] set director.” Marketers can set the strategy and then immediately implement it. For example, with AI, a marketer at a cosmetic company could create a singular campaign that automatically recommends products for each different skin tone, rather than creating numerous individual campaigns. An AI-enabled marketing platform will perform at a high efficiency and require smaller marketing teams.

RCS

In July 2024, Apple announced the integration of Rich Communication Services (RCS) into iOS 18. This is one step of RCS’s global growth: by 2025, RCS is on track to have 2.1 billion users across the world. RCS is a form of text messaging that differs from SMS because of additional features such as the ability to send high-quality media. Furthermore, the adoption of RCS will further integrate and simplify the messaging process across different devices such as Android and Apple. With RCS, brands can send more interactive content such as carousels and polls to increase engagement. Lastly, RCS allows for better tracking and analytics that could be leveraged for AI-enhanced services. In January 2025, Attentive announced its continued work with Google to further drive adoption of RCS as well.

Key Risks

Compliance

SMS is a highly regulated industry, more so than other forms of digital marketing, such as email. Regulation requires businesses to receive permission from customers, demonstrating the importance of a user ‘opting-in’. Furthermore, due to SMS’ personal nature, certain topics are outlawed for texting. In October 2023, there was legislation to protect phone users from spam. Violators of certain regulations can face fines of up to $1.5K per text message — causing compliance to be a critical business concern.

In addition, regulations are constantly changing. In February 2024, the European Union (EU) implemented the Digital Services Act, which makes it easier to submit complaints and bans the use of sensitive data for advertising. Simultaneously, as of late 2024, the Federal Communications Commission (FCC) was considering regulation to require opt-in for AI-generated text messages. In the future, Attentive will continually face a dynamic regulatory environment that requires diligent compliance and a slim margin of error.

Commoditization & Margins

As the SMS marketing space has continued to mature, a lack of differentiation between competitors has led to a commoditized market where price is the distinguishing factor. A former employee of Attentive described the company as not “that much differentiated” from Klaviyo. Although there are high switching costs, both financial and regulatory, businesses can shop around for the lowest possible price.

At the same time, Attentive’s largest costs — carrier costs, the expense Attentive pays to mobile carriers such as T-Mobile and AT&T for each message — are increasing. This is because, in the short term, marketing platforms have limited bargaining power. These combined market dynamics create a race to the bottom and high variable costs that could hurt Attentive’s margins and profitability.

Complexity of Scale

Attentive’s GTM strategy, originally composed of generic SaaS sales tactics such as free trials, is poised to become increasingly less successful due to the number of competitors offering similar packages. The potential for geographic expansion is limited due to the level of complexity. If Attentive were to enter new markets, it would have to maintain compliance with various laws under different frameworks. Furthermore, Attentive would be forced to shift to alternate forms of messaging such as WhatsApp for India and WeChat for China. Each of these platforms has its own regulations that could be altered instantly. These are important considerations as Attentive has found success in the United Kingdom and expanded to 20 countries.

Summary

Attentive has positioned itself at the forefront of personalized, AI-driven marketing communications. While the company is capitalizing on growing demand for direct-to-consumer engagement and the shift towards mobile-first strategies, Attentive is facing lower margins due to minimal product differentiation and increased carrier costs. Attentive’s ability to navigate regulation, AI, and geographic expansion will define the company’s future.