Thesis

The financial services sector is undergoing a transformation as fintech companies innovate with new lending models, particularly in embedded lending and home-equity-backed credit products. Consumers are seeking faster, more convenient access to capital without the complexity of traditional loans, and fintech firms are addressing this demand by creating digitally streamlined platforms that allow for quicker approval processes, lower costs, and more flexible repayment terms.

The demand for alternative credit solutions is further amplified by the growth in consumer debt. Americans have $1.2 trillion in credit card debt as of 2024, a 54% increase compared to Q1 2021. Nearly half of U.S. credit cardholders carry balances month-to-month, incurring substantial interest charges. This presents a significant opportunity for lower-cost alternatives to the expensive credit card debt that many Americans are facing.

Simultaneously, U.S. homeowners are experiencing a boost in home equity, increasing total net borrower equity to $17.3 trillion in the first quarter of 2025. Approximately 48.3% of mortgaged homes are classified as "equity rich," with homeowners holding an average of $311K in equity. Despite this wealth, homeowners only have $406 billion in home equity line of credit (HELOC) balances as of Q1 2025. That’s in part due to the status quo for tapping home equity being too cumbersome. Traditional HELOCs can take a month to secure, require lots of paperwork and fees, and lack the convenient usability of a credit card. As a result, there is a growing market for innovative products that allow homeowners to unlock their equity more easily and cost-effectively.

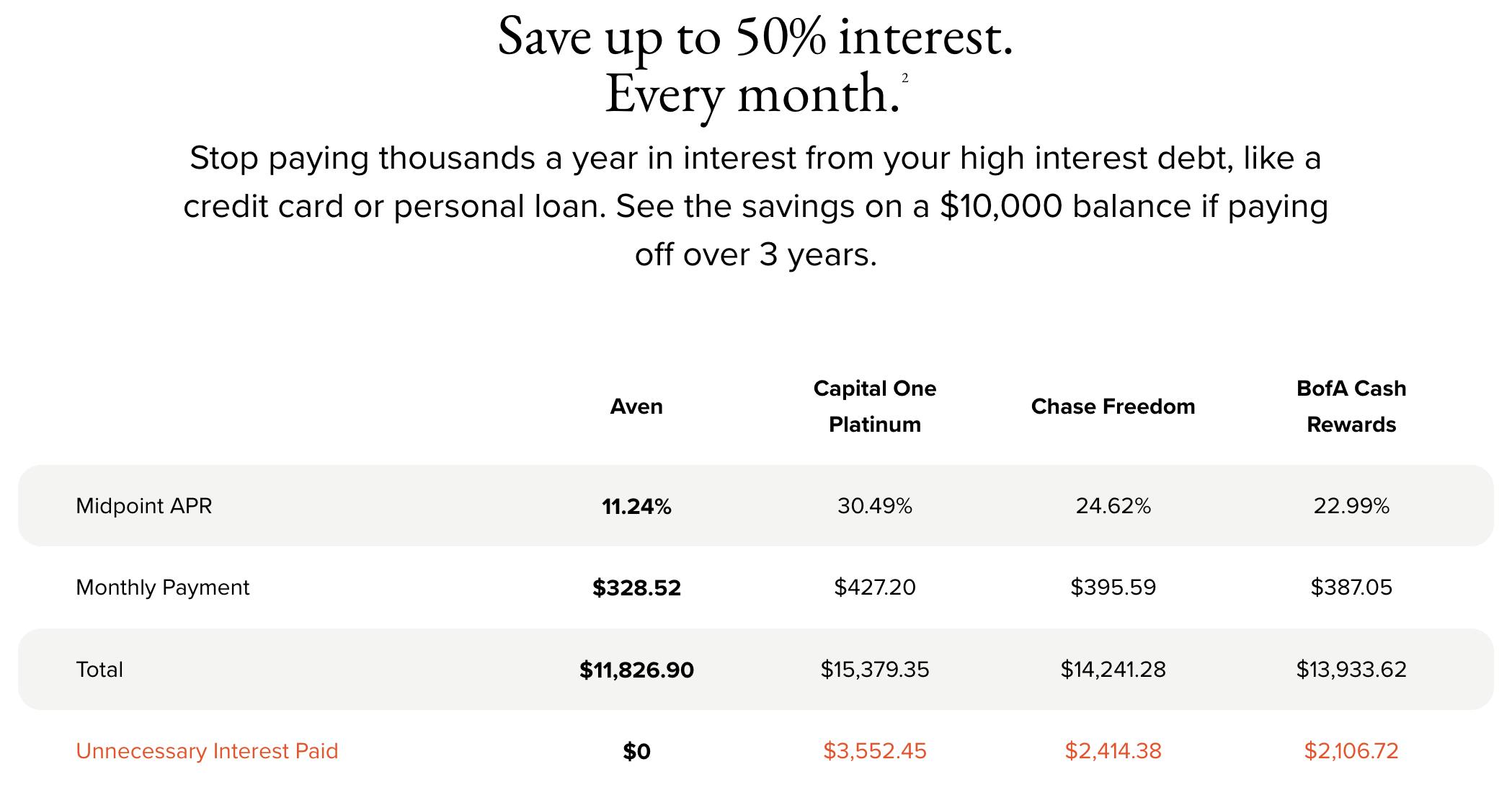

Aven addresses this need by offering a home-equity-backed credit card that gives homeowners a revolving line of credit at interest rates up to 50% lower than typical credit cards. Unlike traditional HELOCs, Aven does not impose annual, sign-up, origination, or prepayment fees. Aven’s goal is to provide homeowners with easier ways to tap into their home equity, and it has ambitions to become a broader platform for asset-backed consumer credit. It has discussed eventually launching products targeting the auto and mortgage refinance markets.

Founding Story

Aven was founded in 2019 by Sadi Khan (CEO), Murtada Shah (Co-Founder), and Collin Wikman (Head of Design). Khan graduated in 2008 from the University of Waterloo with a degree in computer engineering and then joined Microsoft as a program manager. He then joined Facebook in 2013, where he led projects such as the company’s search function, mapping features, and, most notably, served as the lead product manager for Internet.org. Shah, a serial entrepreneur and software engineer with a degree in electrical and computer engineering from the University of Alberta, had previously founded Serene Technologies and co-founded ETA Holdings. Wikman, who graduated from UC Santa Cruz with a degree in economics, brought a strong consumer design background, having served as Design Director at Square and Head of Design at Remind.

After leaving Facebook in 2019, Khan began exploring inefficiencies in consumer lending, particularly the misalignment between high-interest credit cards and the trillions in untapped home equity. Curious about the legality of a home-equity-backed credit card, he spent weeks reading the 850-page Dodd-Frank Act and consulted with the law firm Arnold & Porter, whose unofficial guidance confirmed there were no legal prohibitions to such a product. Khan, Shah, and Wikman spent five months studying the home equity lending space and nearly two years building the technical, legal, and financial infrastructure required to support a home-equity-backed revolving credit product. Their efforts culminated in the 2022 launch of Aven’s first product in California.

Product

Aven offers two core products: the Aven Home Card, a home-equity-backed credit card that provides flexible, low-interest credit, and Aven Advisor, a free, mobile-first financial insights platform designed to help homeowners better manage their finances. Together, these products reflect Aven’s mission to modernize consumer lending by turning assets into accessible, cost-effective credit. Aven is also exploring expansion into adjacent sectors, including auto-backed lending and mortgage refinancing, highlighting its goal to become a broader platform for asset-backed consumer credit.

Aven Home Card

Aven’s flagship product is the Aven Home Card, a credit card backed by home equity. Unlike traditional credit cards, which are unsecured and charge significantly higher interest rates, the Aven Home Card is secured by the borrower’s home equity, allowing Aven to offer materially lower rates. As of July 2025, the card’s APR ranges from 7.49% to 14.99%, depending on the borrower's creditworthiness. For comparison, the average APR on a standard credit card for borrowers with good credit stood at 23.9% in Q2 2025.

Source: Aven

As of July 2025, Aven customers get unlimited 2% cash back on all purchases and can draw from credit lines ranging from $5K to $250K. In addition, the application and approval process is fully digital and fast: customers can be approved in as little as five minutes, and the entire closing process can take just 15 minutes.

A key feature of the product is the Aven Simple Loan: a fixed-payment cash-out option that allows customers to convert a portion of their line into fixed monthly payments over 5 or 10 years. While a 2.5% fee applies to each cash-out, customers can benefit from predictable payments and potentially thousands in interest savings over time. For traditional revolving use, Aven does not impose annual, sign-up, origination, or prepayment fees, and only charges a $29 late fee if the minimum payment isn’t made.

To be eligible as of July 2025, applicants must meet the following criteria: be a US resident, have a FICO score or VantageScore of at least 620, have a combined loan-to-value of under 89%, and demonstrate sufficient income. Unlike traditional Home Equity Lines of Credit (HELOCs), which can take two to six weeks to close, often require minimum loan amounts of greater than $50K, and charge two to five percent of the loan cost in fees, Aven’s entirely digital process eliminates closing costs, removes minimums, and returns decisions nearly instantly. Behind the scenes, Aven uses a data and underwriting engine that pulls real-time home valuations from providers like CoreLogic, runs lien and title searches using proprietary lookup algorithms, verifies income and default risk, and facilitates digital notary signings and lien filings, all within a single user experience.

While the card can be used for everyday purchases, Khan emphasizes that most customers tap into their lines for high-value expenditures like home renovations, debt consolidation, or large family-related expenses like summer camps, making it more aligned with traditional HELOC use cases than everyday consumer spending. Aven partners with Coastal Community Bank and issues the card under license by Visa.

Aven Advisor

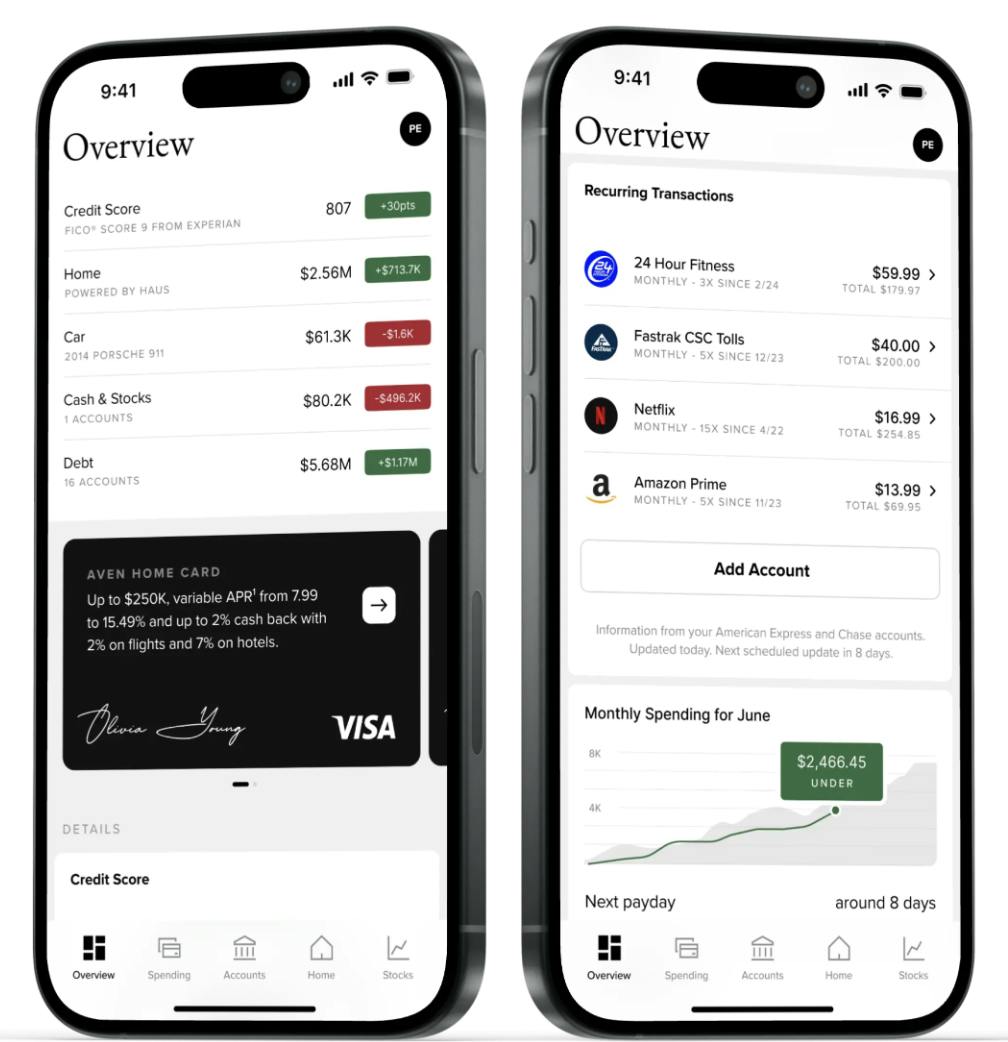

Source: Aven

Aven also offers a free, mobile-first personal finance platform called Aven Advisor, which has attracted over 160K members as of July 2024. The product is designed to provide homeowners with a real-time view of their financial health, going beyond standard credit monitoring apps.

With Aven Advisor, users can:

View their credit score & report every 7 days for free and be notified of any changes

Track their home equity value, as well as view nearby real estate listings and market trends

Analyze and optimize personal finances across bank balances, brokerage accounts, credit card debt, and vehicle value

Identify hidden subscriptions and recurring expenses by parsing transaction data

The app also includes gamified incentives. Qualified users can earn $5 in Starbucks credit weekly for continued engagement.

Market

Customer

Aven’s core customer base is composed of U.S. homeowners with substantial untapped home equity, strong creditworthiness, and a desire for more flexible and cost-effective borrowing options. The typical Aven user is a middle to upper-middle-class individual or household, with a six-figure annual income and a super-prime FICO score above 720. Aven’s product is particularly appealing for customers who need to finance large, planned expenses such as home improvement projects, medical bills, tuition, or high-interest debt consolidation, where a lower APR equates to meaningful savings over time.

As of June 2025, Aven’s Home Card has licenses in 45 US states and Washington, D.C. As of July 2025, in seven states, Aven caps credit lines at $100K due to state-level lending regulations or operational constraints.

In addition to the Aven Home Card, the company has broadened its customer base through the Aven Advisor. Aven Advisor, which has 160K users as of July 2024, attracts a younger, more digitally engaged audience who may not yet be ready to borrow against their home equity but are actively managing their finances and building toward homeownership.

Market Size

Aven operates within two established financial markets: credit cards and home equity lending. Its addressable market is shaped by both the existing HELOC market and the credit card market, each of which provides a foundation for Aven’s potential scale.

Home Equity

As of Q3 2024, total U.S. home equity stood at approximately $32 trillion, with an estimated $11.5 trillion in tappable equity, or the portion of home equity that remains after preserving a 20% cushion of home value and accounting for existing mortgages. The market for HELOCs, with which Aven competes directly, is smaller at $406 billion of loans outstanding as of Q1 2025. Homeowners are likely paying ~$33 billion in annual interest on the $406 billion of outstanding loans, assuming they are paying rates equivalent to the June 2025 average of 8.2%. This excludes fee revenue that occurs when a HELOC is originated.

Credit Card Debt

U.S. credit card debt reached $1.1 trillion in Q4 2024, with the average interest rate on revolving balances at 23%. Credit card companies charged $130 billion in interest and fees in 2022, and merchants paid $187.2 billion in processing fees in 2024, with roughly half of the purchase volume coming from credit cards. This implies the revenue in the US credit market is in the hundreds of billions of dollars.

Many credit card users who carry a balance are homeowners who would qualify for Aven’s lower-rate product. This presents a significant revenue opportunity, where Aven can serve as a low-cost alternative to traditional credit cards while using home equity to reduce borrower risk and lower the cost of capital.

Competition

Competitive Landscape

Aven operates in a competitive environment defined by established incumbents and innovative fintech startups. The dominant players in Aven’s space include traditional financial institutions like JPMorgan Chase, which controls approximately 21% of the U.S. credit card market by purchase volume as of February 2025. On the home equity side, Bank of America accounted for 6.2% of all HELOC originations in 2023. While these institutions benefit from national reach, customer trust, and integrated financial products, they are often constrained by legacy infrastructure and slow approval timelines. Fintech startups like Figure are emerging as competitors by offering online HELOCs with competitive rates and faster closings, while Point and Unlock target homeowners seeking non-debt alternatives.

Competitors

Figure: Founded in 2018, Figure is a fintech company that builds technology-driven financial products centered around home equity lending, digital asset marketplaces, and capital markets infrastructure. The company, launched by Mike Cagney, the former CEO and co-founder of SoFi, aims to modernize financial services using a combination of blockchain, AI, and advanced data analytics. Figure’s flagship product is its digital HELOC, which allows homeowners to access home equity quickly through a fully digital application and closing process. In addition to HELOCs, Figure has expanded into mortgage refinancing, personal loans, and crypto-backed lending, making it one of the few fintech companies attempting to build a vertically integrated lending ecosystem powered by blockchain infrastructure.

Figure raised $200 million in a Series D round in May 2021, co-led by 10T Holdings and Morgan Creek Digital, which brought the company’s valuation to $3.2 billion. As of July 2025, Figure has raised over $1.4 billion in total equity and debt financing from notable investors, including DST Global and Ribbit Capital. In July 2025, it announced intentions to go public later in the year. While both Aven and Figure focus on unlocking home equity as a more cost-effective alternative to unsecured credit, they differ significantly in product design and go-to-market strategy. Figure similarly offers traditional HELOCs with faster processing and a digitized experience than incumbents, but it does not offer a similar credit card product to Aven, and also charges origination fees and has minimum loan values.

Point: Founded in 2015, Point is a fintech company that offers a novel approach to home equity access through home equity investment (HEI) products. Instead of issuing loans, Point provides homeowners with a lump sum of cash in exchange for a share of the future appreciation in the value of their home. This model allows homeowners to tap into their home equity without taking on debt, interest payments, or monthly obligations, making it especially appealing to individuals who are equity-rich but may have limited income, high existing debt, or poor credit.

As of July 2025, Point has raised more than $539 million in funding across equity and debt, backed by investors including Andreessen Horowitz, Montage Ventures, and Inovia Capital. The company has also partnered with institutional investors to securitize home equity investments, helping to build liquidity in what is still a relatively nascent asset class.

Point uses an investment model, sharing the upside and/or downside of a home's value appreciation with no repayment required until the homeowner sells, refinances, or buys back the equity stake. This differs from Aven’s product, which allows homeowners to borrow against their equity.

Unlock: Founded in 2020, Unlock is a fintech company that enables homeowners to access the equity in their homes without taking on debt or making monthly payments. Instead of offering loans, Unlock provides home equity agreements (HEAs), which are a financing model in which homeowners receive a lump sum of cash upfront in exchange for a share of their home’s future appreciation.

Unlock raised $30 million in a Series B funding round in September 2024, and as of July 2025, it has raised $430 million in total funding. The firm targets homeowners who traditional lenders often overlook: those who may not qualify for a HELOC due to limited income or higher debt-to-income ratios but still possess significant equity in their homes. Unlock’s HEA is not a loan at all, as it involves no interest, no recurring payments, and no debt. In contrast, Aven caters to a more credit-qualified, financially active segment seeking flexible access to capital.

Traditional Banks & Credit Unions: Incumbent banks and credit unions remain the primary providers of the two products Aven blends: credit cards and HELOCs. JPMorgan Chase has 21% of the credit card market in 2023 based on purchase volume, followed by American Express (19%) and Citi (10%). Bank of America was the leader in the HELOC market in 2023, accounting for 6.2% of all originations, while PNC Bank was second at 5.1%. While these institutions benefit from national reach, customer trust, and integrated financial products, they are often constrained by legacy infrastructure and slow approval timelines.

Business Model

Aven’s business model is centered on generating revenue through interest on outstanding card balances, transaction fees, and interchange revenue:

In addition to interest income, Aven earns a 2.5% fee on cash withdrawals and balance transfers, which are popular use cases for customers consolidating higher-interest credit card debt or covering large expenses.

Aven also monetizes usage through interchange fees of each transaction amount paid by merchants when customers swipe their cards. These fees are shared between Aven, its issuing partner Coastal Community Bank, and Visa, under whose network the card operates.

Aven has lower interest rates than average because the home’s value secures its credit. Credit losses are expected to be lower than those of traditional credit cards, but they can still happen. If a cardholder doesn’t pay on time, it triggers a six-month period where Aven “attempts to help the [cardholder] recover and get back into a reasonable state.” If that doesn’t work, Aven can force a foreclosure on the home to get paid back.

Khan said in November 2024 that they “are not interested in cardholders defaulting” and they “want to ensure [cardholders] will have the ability to pay.” Khan said in July 2024 that Aven has had to force cardholders into foreclosure “a number of times,” and its default and delinquency rates are “in line” with those of traditional HELOCs when you compare them to consumers with similar FICO scores, Khan says. Aven also launched a “Foreclosure Protection Guarantee” in January 2025, guaranteeing foreclosure protection for up to $10K in balances if a cardholder loses their job for up to a year.

Traction

As of July 2024, Aven had annualized revenue $100 million and had more than tripled its revenue in the previous 12 months. It also had 33K cardholders and had issued over $1.5 billion in credit lines. In doing so, Aven has saved its customers over $100 million in interest payments, leveraging its lower APRs to reduce borrowing costs. Aven had a 4.9/5 star rating on Trustpilot as of July 2025.

Aven Advisor, Aven’s free, mobile-first financial tool, has attracted over 160K members as of July 2024.

Valuation

In July 2024, Aven announced its $142 million Series D round, co-led by Khosla Ventures and General Catalyst. The press release indicated Aven reached “unicorn status,” but the specific valuation was not disclosed. Aven has not released money raised or valuation data from its prior funding rounds.

Key Opportunities

Product Suite Diversification

Aven has signaled an intent to broaden its product offering into adjacent verticals. In July 2024, the company announced plans to develop both an auto-backed credit card and a mortgage refinancing solution, which will allow it to tap into new forms of secured credit while leveraging its existing infrastructure. These are large lending markets: the U.S. auto loan market has $1.6 trillion in outstanding balances as of Q1 2025, and Fannie Mae projected $529 billion in mortgage refinances in 2025. As consumers continue to seek alternatives to high-interest loans amid inflation and elevated rates, Aven can meet that demand with new offerings that preserve its core value proposition. Successfully entering these verticals would expand the company’s total addressable market, increase customer lifetime value, and reduce acquisition costs through cross-selling.

Enhancing Credit Card Value

As of July 2024, Aven has saved its customers more than $100 million in interest payments and grown to 33K cardholders. However, its credit card offering is simple compared to competitor offerings, with its main benefit being 2% cash back. Aven can lean into its brand of being the credit card for homeowners and offer things like category‑boosted rewards for home‑related spend (e.g., contractors, utilities, hardware stores). It can also offer similar benefits to other premium credit cards, like trip insurance, purchase protection, and extended warranty coverage.

Key Risks

Housing Market Downturn

As a lender whose loans are secured by real estate, Aven is inherently exposed to housing market risk. A sharp downturn in home prices or a broader real estate crisis could pose a serious threat. If home values decline significantly, the equity cushion behind Aven’s credit lines shrinks or even disappears, putting Aven’s collateral at risk. In the worst case, if a borrower defaults when the home’s value has fallen below the outstanding loan, Aven and its bank partner could face losses much like subprime lenders did in the last crash. If defaults rise, Aven would also have to go through more foreclosure processes, which are costly, lengthy, and potentially reputationally damaging. Aven does take precautions, like requiring minimum credit scores or maximum loan-to-value for approval, but this remains a long-term risk.

Banking as a Service (BaaS) Risk

Aven faces a complex and evolving regulatory landscape. One key risk is its reliance on other financial institutions to power its operations. Aven partners with Coastal Community Bank to originate its loans and issue its credit cards. This model, known as “Banking as a Service” (BaaS), has drawn scrutiny from regulators, and the collapse of Synapse and others has made clear the risks of fintechs relying on other financial institutions to power their core operations. If Coastal Community Bank were to face regulatory pressure or decide to exit the partnership, as it did with another fintech previously, Aven would need to quickly find another bank sponsor or pursue its own licensing, potentially disrupting operations.

Summary

Aven is a fintech company offering a credit card backed by home equity, allowing homeowners to access lower-interest, revolving credit by using their property as collateral. It competes across the consumer credit and home equity lending markets, alongside traditional banks and fintech startups. As of July 2024, the company has issued over $1.5 billion in credit lines, has 33K cardholders, and has $100 million in annualized revenue. Aven has a large opportunity in expanding to new secured lending products such as auto-backed credit cards and mortgage refinancing, as well as enhancing the value of its existing credit card. But while Aven’s product structure enables lower rates than unsecured credit alternatives, the company faces key challenges in navigating regulatory oversight, housing market fluctuations, and credit performance at scale.