Thesis

In April 2016, the governor of the Reserve Bank of India (RBI) introduced an instant payment solution, the Unified Payments Interface (UPI). Programs like this have contributed to the digital empowerment of millions of Indians. In 2022, India had 89.5 million digital transactions, a ~$3 trillion digital payment market, and accounted for 46% of global real-time payments. India’s digital transaction volume has grown meaningfully, rising at a 50% CAGR from 2017 to 2022, and experiencing a 56% YoY growth from 2022 to 2023.

India’s digital payment revolution has one of the largest networks of micro, small, and medium enterprises (MSMEs) in the world with over 63.4 million registered MSMEs as of November 2023. With a growing variety of payment modalities, an increasing user base for these modalities, and increased rural penetration of digital payments, there is an increasing need for servicers in the space. However, business needs far exceed payment enablement, requiring other financial product offerings such as accounting, payroll management, lending, and customer enablement.

That’s where Razorpay comes in. Razorpay is an Indian financial technology platform providing end-to-end payment solutions that allow businesses to accept, process, and disburse payments. The platform is designed to manage the entire payment lifecycle for businesses, from a customer making a payment to the funds being deposited into the business's bank account. In addition, the company also offers neobanking and lending services. Razorpay’s goal is to simplify the payment process for online businesses and ecommerce platforms, making it easy, secure, and convenient to handle a wide array of payment methods, including credit cards, debit cards, net banking, and digital wallets.

Founding Story

Razorpay was founded by Harshil Mathur (CEO) and Shashank Kumar (Managing Director and former CTO) in 2014. The founders originally met while attending IIT Roorkee at the university’s innovation lab, SDSLabs, where Mathur was a member and Kumar was the vice president. During their time at university, Kumar conducted research at the University of Minnesota under Dr. Vipin Kumar focused on climate monitoring-related analysis, and interned as a software development engineer at Microsoft. Kumar proceeded to work at Microsoft for the first two years of his career, while Mathur started his career as a Wireline Field Engineer at Schlumberger, an oil & gas technology provider.

The two founders remained in contact, and, in 2014, decided to attempt to build a crowdfunding platform. While doing this, they realized startups and SMBs face a lot of trouble with online payment, and the US-based payment system was not ideal for Indian markets, in part due to the lack of credit card penetration (by the end of 2014, there were only ~21 million credit cards in India, while the country had a population of 1.3 billion).

Razorpay’s initial goal was to focus on creating a simple payment gateway for startups / SMBs. The main problem the founders observed for these small organizations was the cumbersome start experiences for payment solutions. In an interview from March 2015, Mathur said:

“When we contacted a few payment gateway companies, we were asked for our past operational records, presence of physical offices, security deposits, and very high set-up fees. Online reviews of most payment gateways in India confirmed similar bad experiences.”

After conducting market surveys and establishing a proof of concept, they decided to begin working on Razorpay.

In 2014, the company’s initial team consisted of 11 people living out of a single apartment as it tried to convince banks to partner and support its prototype. By the time it raised a Series A in October 2015, the company had a team of 15 and was expanding.

Mathur and Kumar were accepted into YC’s W15 batch, being just the second India-focused company to do so. They quit their jobs after being supported by Startup Oasis (jointly formed by Rajasthan Industrial Investment Corporation and IIM Ahmedabad’s Centre for Innovation Incubation and Entrepreneurship).

In June 2022, Shashank Kumar stepped down from his role as CTO and became “Managing Director”, where he’d think about long-term engineering goals and go-to-market strategy. Replacing him and overseeing the 800+ engineer team was Murali Brahmadesam, formerly at Amazon and Microsoft.

Product

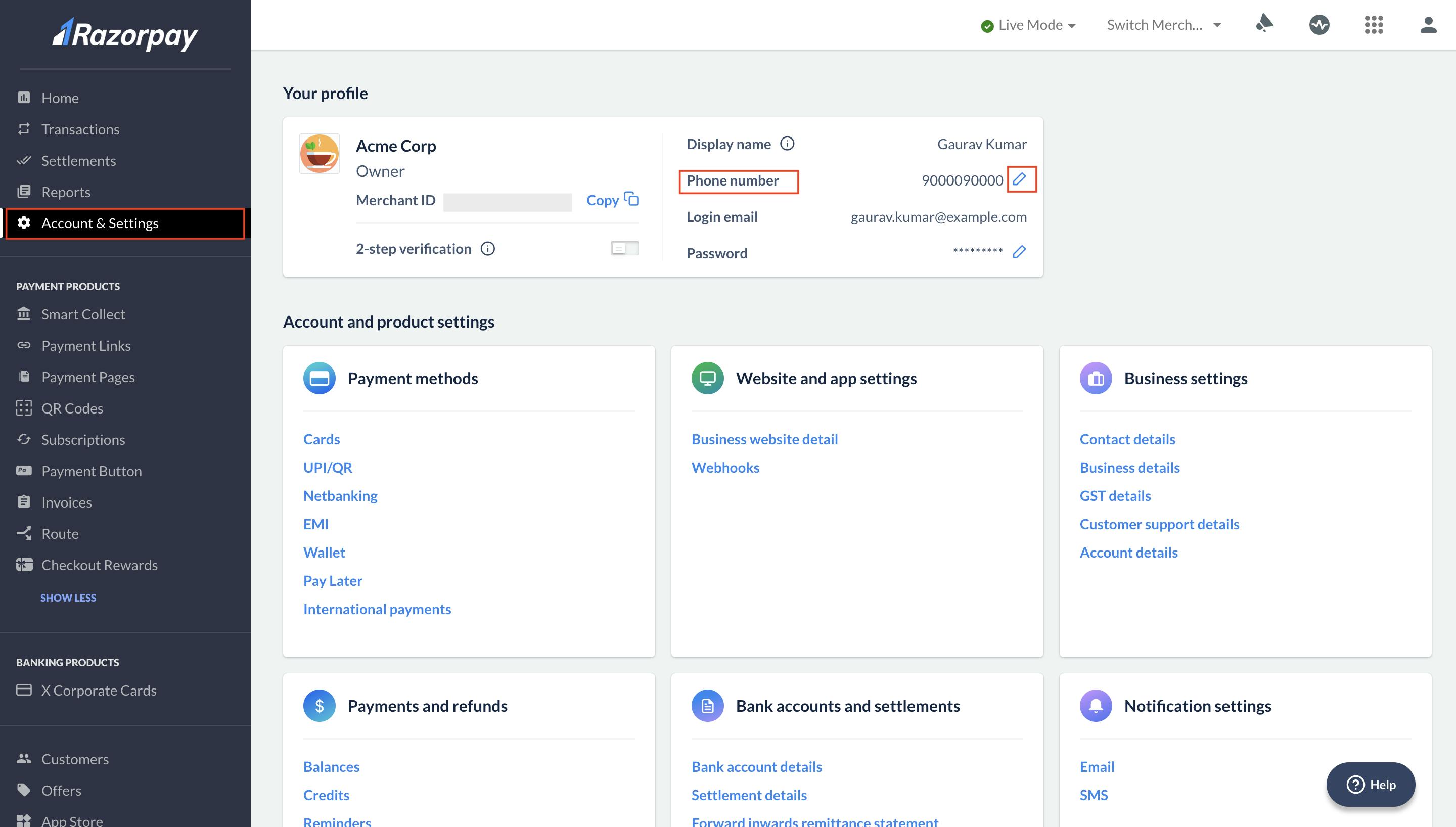

Razorpay’s offerings can be bucketed into a few different categories. The primary service that the company was founded on is its end-to-end payments solution, with control enabled via a user-friendly dashboard. As the company has grown, it expanded its offerings to also include neobanking and lending solutions

Source: Razorpay

The company’s flagship solution is its payments gateway. Its gateway has compatibility with several different payment modalities, including its Unified Payments Interface (UPI) for mobile payments. Razorpay claims it was first in the industry to allow UPI payments for merchants. This allows for mobile digital interbank transfers, credit & debit cards (Visa, Mastercard, AmEx, RuPay, and many international card providers), 50+ netbanking options, and nine Popular digital wallets (Amazon Pay, MobiKwik, Freecharge, etc.). Razorpay’s gateway also has compatibility with different payment structures, whether this be equated monthly installments (EMI) or virtual credit card pay later solutions.

Additional payment solutions include payment link, QR code, payment button, payment subscription, GST-compliant payable invoices, custom payment page, and international payment enablement. The company has several features to benefit both its customers and its end users, including flash checkout capabilities, eliminating the need for customers to enter card information more than once, and leading to stronger conversion (20% of shoppers abandon carts because checkout processes are too complicated), real time gross settlement for high value instant transactions, smart collect automatic reconciliation (identifies customers based on UPI ID), and more.

The company also offers PoS hardware and devices for payment gateway optimization. Its different PoS hardware caters to small stores, kiosks, and counter-top environments.

Source: Razorpay

Banking

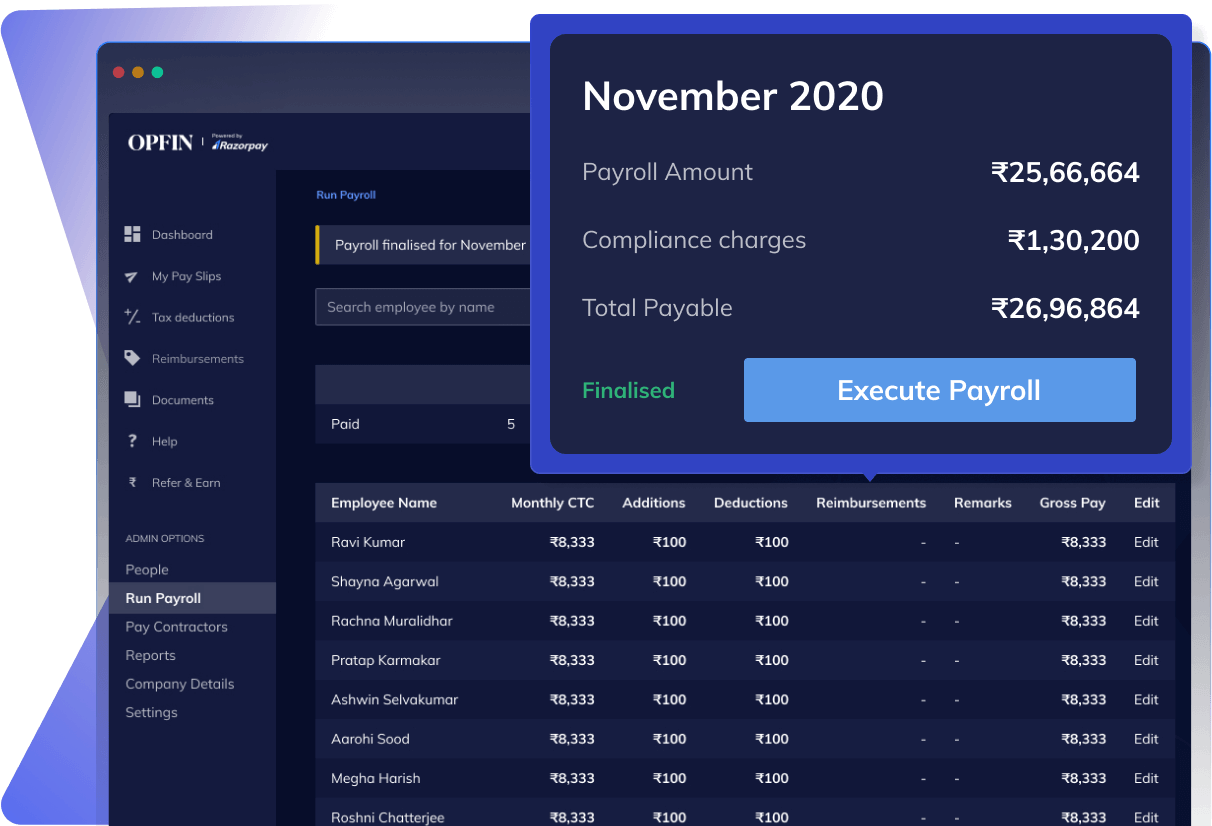

In 2018, the company launched RazorpayX, an AI-enabled suite of banking products for SMEs to accept payments, manage cash flows, reconcile transactions and enable flexible payouts. Razorpay’s partnership with RBL Bank is designed for MSMEs to use with features like higher transaction limits, premiere overdraft facilities, and fewer restrictions compared to personal accounts.

The company’s banking service also caters to expense payments for startups and small businesses, whether it be payroll management (now also for enterprises), vendor payments, or tax payments.

Source: Razorpay

Continuing the neobanking push in 2019, the company introduced corporate credit card offerings for startups and SMEs. The card is powered by SBM India, one of the largest APAC banks. The card integrates with the Razorpay payments gateway and RazorpayX banking hub for repayments. The offering gives control to startups, allowing for visibility on billed and unbilled transactions, limits for specific teams, add-on cards for additional team members, and rewards and cashback for all purchases.

Lending

Razorpay Capital, the lending branch of Razorpay, partners with banks and non-banking financial companies (NBFC) to lend at competitive rates. Its partners include Gromer Financial, LiquiLoans, SBM Bank, and TrillionLoans. Its lending services include working capital loans, corporate cards (under the RazorpayX product umbrella), and term loans. Razorpay Capital’s benefits include less costly loans, zero backlogs, smart budgeting accessible funds without long business history

Market

Customer

Source: Razorpay

Razorpay’s ideal customers include Indian-based marketplaces and startups that do not have the resources or desire to build a dynamic payment infrastructure for transactions. The company claimed to provide payments to over 8 million businesses as of February 2023, including Facebook, Loa, Zomato, Lenskart, Mirae Asset Capital markets, Indian Oil, National Pension Scheme, TataConsultancy Services, Swiggy, CRED, BookMyShow, Ola, Zomato, Swiggy, ICICI Prudential, and more.

There were 63.4 million MSMEs (micro, small, and medium enterprises) in India as of September 2023. While the majority (63.1 million) were micro-enterprises with 1-10 employees, 335K fell under the SME umbrella. Within this, there were 75K government-recognized startups.

The company has been successful in retaining its customers due to the diversification of its products. Rahul Kothari, COO of Razorpay, spoke about the company’s diversification strategy in November 2022, saying:

“[Merchants] don’t think of payments in isolation. They also think about managing their money better: they have to invest it, disburse it, pay their vendors, sometimes they have capital requirements, and need to pay their employees. As we saw all these different requirements of businesses, we also grew our entire strategy from being a payments company to being a one stack platform for end-to-end money movement for businesses”.

After targeting the SME and ecommerce players with payment solutions, Razorpay then capitalizes on higher margin customer banking and lending needs.

Market Size

As of 2023, India’s consumer market was the second largest behind China. By 2075, India could potentially surpass the US in terms of total economic size. India overtook China as the world's most populous country as of 2023. India's economic growth trajectory is, in part, being driven by advancements in communication infrastructure and education, increased capital expenditures by the government, and the creation of more job opportunities. Private consumption in India is forecasted to grow from $1.7 trillion in 2019 to $6 trillion by 2030.

In addition to growing consumption from consumers, the Reserve Bank of India has spearheaded several initiatives to further digitize and promote the inclusion of the payment system. Some of these recent initiatives include credit lines on UPI, UPI LITE X for offline payments and initiatives for conversational payments. Activity from the RBI has been a major tailwind for the growth of digital payments, which increased by 2.5x to $113.9 billion between 2021 and 2023.

With these tailwinds in mind, India’s payments market was $303.2 billion as of 2023 and is expected to grow at a 17.9% CAGR through 2030. For the lending side of the business, the market for MSME lending in India is set to become ~$600 billion by 2026. This growth is attributable not only to the government’s increased focus on accessibility or the increase in digital adoption but also to the development of strong underwriting algorithms and increased ticket size for digital lending. The digital lending market in India is expected to account for 48% of all lending transactions by the end of 2023.

Competition

The competitive landscape for Razorpay is highly fragmented due to the variety of products Razorpay offers. Each layer of the payments stack may have its own competition, and players may also try and compete with full-stack offerings. In addition, while Razorpay’s neobanking and lending services are still early, those product lines will also have their own unique competitive set.

Payment & Banking Platforms

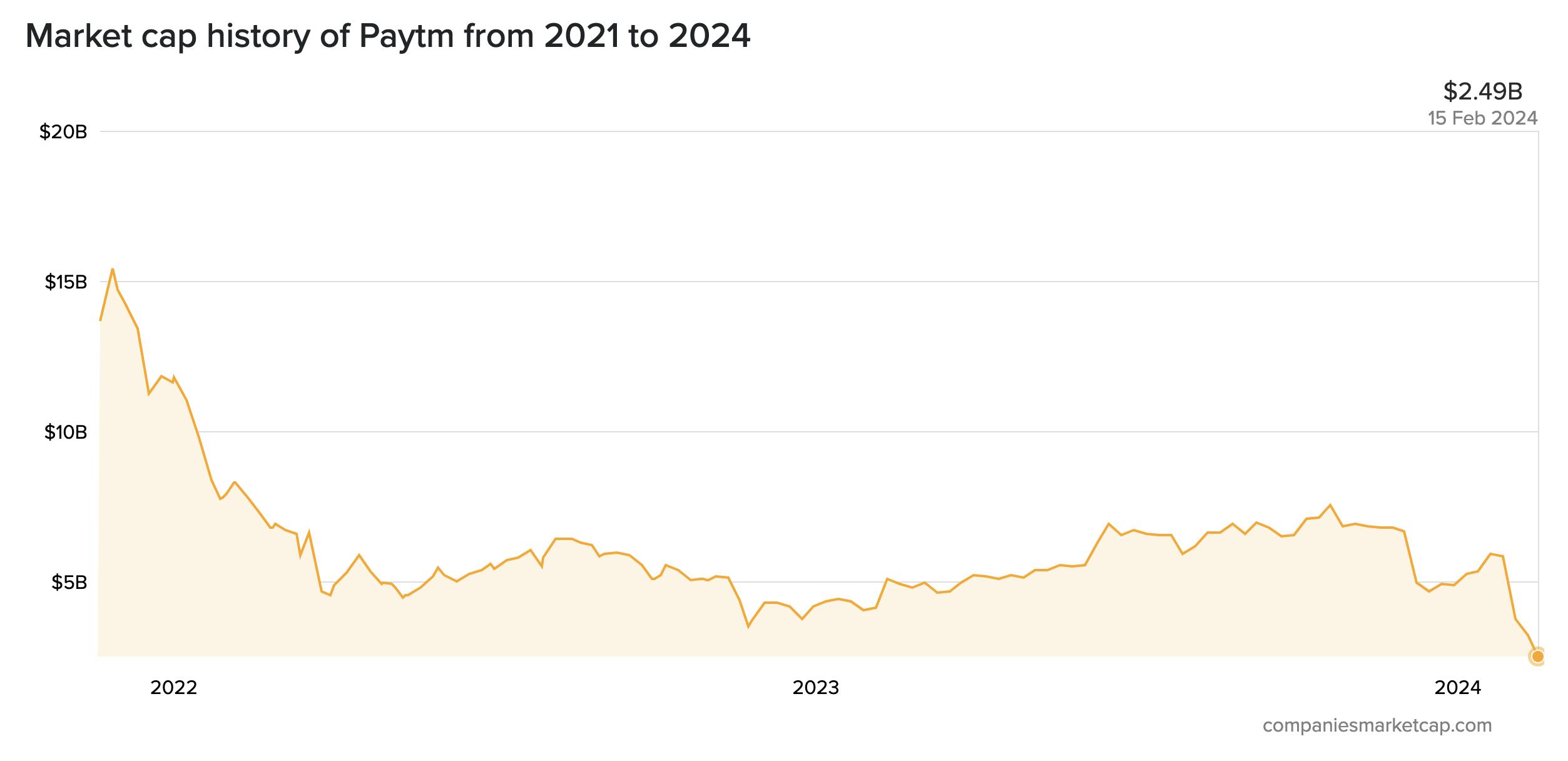

Paytm: Paytm was founded in 2010 by Vijay Shekhar Sharma and is headquartered in Bangalore. The company provides a digital platform for 333 million consumers and 26 million merchants, featuring payment, commerce, banking, cloud, and financial services, primarily earning its revenue from Indian customers. As of February 2024, Paytm is a publicly traded company with a $2.5 billion market cap, after going public in November 2021 and at a $13.6 billion market cap, and raising $1.1 billion.

One important feature of Paytm’s business is it accepts payments at a 0% fee with its Paytm wallet. However, while Razorpay caters payment services to online businesses, making it easy to embed payments on their digital platforms, Paytm’s services cater to both consumers and merchants with products like its mobile wallet.

PhonePe: PhonePe was founded in 2015 by Sameer Nigam, Rahul Chari, and Burzin Engineer and is headquartered in Mumbai. The company develops a mobile payment app aimed at simplifying digital transactions. For consumers, its product offering includes insurance, money transfer, investment, and shopping tools. For merchants, products include ad services, offline and online payment collection/acceptance tools, and digital lending. While historically relying on third-party payment gateways, PhonePe rolled out its own in-house payment gateway offering in June 2023. The company also recently expanded into hardware services, launching a PoS system for merchants in July 2023. Having raised $850 million in total funding, the company raised $100 million in May 2023 from General Atlantic at a $12 billion valuation.

While PhonePe has historically primarily focused on building an end-to-end payments solution for merchants, the company has recently made attempts to build out its product suite, trying to acquire lending startup ZestMoney in March 2023 to bolster its lending solutions suite.

PayU: PayU was launched in India in 2011 by Nitin Gupta and Shailaz Nag and is headquartered in the Netherlands. PayU operates as a global end-to-end payment gateway solutions provider. It specializes in enabling multi-modality payment solutions for online businesses. This is particularly useful for e-commerce platforms and other businesses that rely on online sales, as it helps to optimize the checkout experience for users, potentially increasing conversion rates and customer satisfaction. The company services more than 450K merchants, offering over 100 payment methods. The company has also expanded its credit offering as it continues to build out its product suite. In October 2023, the company indicated plans to file for a $500 million IPO by February 2024.

Instamojo: Instamojo was founded in 2012 by Sampad Swain, Akash Gehani, and Aditya Sengupta and is headquartered in Bangalore. The company provides a comprehensive ecommerce and on-demand payment platform that facilitates digital buying and selling. This platform supports merchants in managing their entire online business operations, from product listing and order collection to sales tracking, customer engagement, shipping arrangement, and various other business activities. The company does not provide neobanking but does offer small business loans via its lending unit, mojoCapital. The company had $8.4 million raised prior to an undisclosed venture round in November 2020 and a corporate investment round in June 2021.

MobiKwik: Mobikwik was founded in 2009 by Bipin Preet Singh, Upasana Taku, and Chandan Joshi and is headquartered in Gurgaon. The company offers an independent mobile payment network for simple online transactions, featuring a prepaid digital wallet, deferred payment options, transfers, loans, and investment services. Users can effortlessly make payments bypassing the need for credit cards or bank accounts. The company raised $20 million in June 2021 at a valuation of $736 million and delayed an IPO planned for 2022 due to poor market sentiment. Mobikwik differs from Razorpay in that the company primarily focuses on consumer payments, as their mobile wallet, credit/lending, and bill payment experiences cater specifically to individuals.

PayPal India: PayPal Iaunched its domestic payment service in India in November 2017. While it later shut down its domestic payment services in 2021, the company still facilitates international transactions for Indian customers on foreign websites, provides a payment gateway for merchants in India to accept international payments, and account management for MSMEs and enterprises.

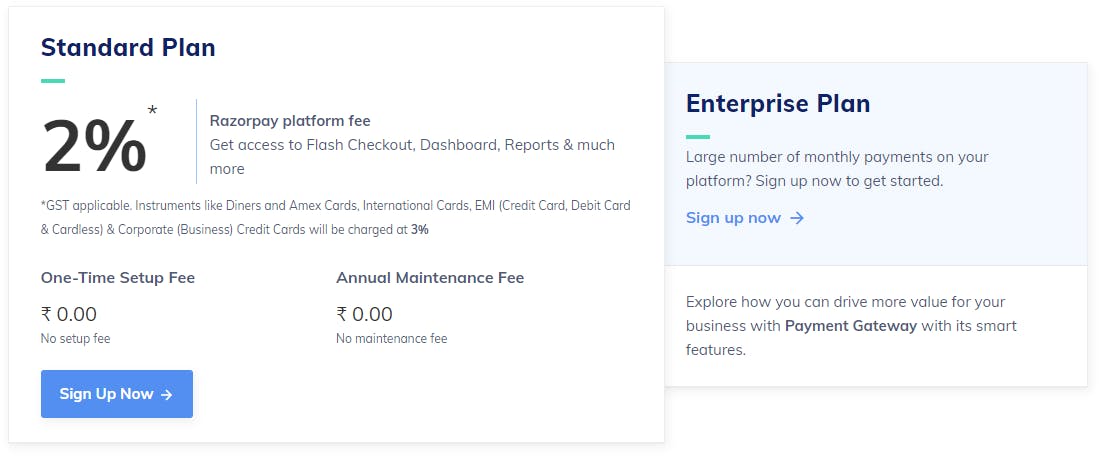

Business Model

Razorpay makes money through transaction fees. The company’s standard plan for MSMEs charges 2% + .36% goods & services tax (GST) transaction fees for domestic transactions, 3% +.54% GST transaction fees for international transactions (international transactions expected to make up 20% of Razorpay’s revenue by 2025), 1.99% transaction fees for debit card transactions, and 2.99% transaction fees for credit card transactions. The company also has an enterprise plan which has a pricing plan dependent on merchant size.

Source: Razorpay

The company also develops an API that allows businesses to embed Razorpay’s payment gateway into their websites and apps, and charges a 2% platform fee.

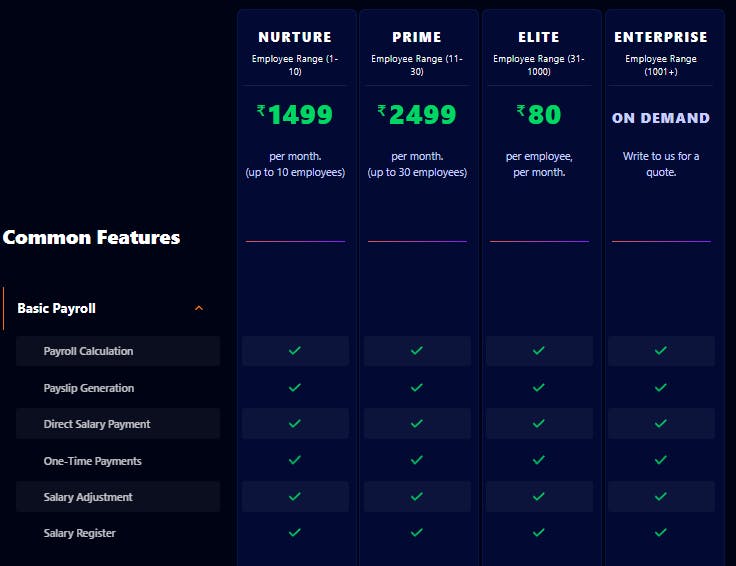

In addition, the company charges a subscription fee for access to its suite of payment solutions like QR codes, subscription payments, and payment links. Pricing is dependent upon company size. The company also charges a subscription fee for its payroll calculation and disbursement services, with different plans for MSMEs and enterprises.

Source: Razorpay

Lastly, the company operates a technology platform with end-to-end loan solutions, such as origination, management, and collection for seamless access for MSMEs through financial institution partners. The company collects revenue from interest on loans, with lines of credit starting at 1.5% (range of 0.5-2.5%).

Regarding the company’s expenses, most of the company’s expenses are attributable to bank fees and service charges (55.9% of total costs in 2022), and employee benefits (25.2% of total costs in 2022).

Traction

Razorpay saw total payment volume reach $100 billion in FY23, growing 65% YoY, with over 50K businesses using it. Razorpay has specifically captured a large portion of D2C market share, as it services 63% of India’s D2C Brands. Razorpay’s operating revenue in FY20, FY21, and FY22 were $61.2 million, $101.2 million, and $178.1 million respectively (76.1% jump from 2021 to 2022). Its expenses have also increased significantly, with FY20, FY21, and FY22 values of $63.2 million, $100.9 million, and $177.6 million.

Digital transactions grew 65%, while total transactions grew 78%. Additionally, the company’s different payment offerings saw significant growth, with EMI payments growing 705% YoY, pay-later optionality growing 520%, and e-mandate payments growing 152%.

Razorpay has seen adoption of multiple products across its customer base, with 65% of customers being integrated with at least three of its products. New products have also seen significant adoption. For example, Razorpay’s TokenHQ made it the first company to allow multi-card tokenization, with 20 million cards already being tokenized. In addition, Razorpay’s new AI payment gateway optimizer saw 50 businesses adopt it upon release in October 2023.

Razorpay’s business expands beyond India as well. In February 2022, Razorpay acquired Malaysian payments company, Curlec, which catered to 700+ businesses as of July 2023, and plans to service 5K businesses by 2025.

One growing concern for the company, however, is the revenue generated from new customers. The company’s revenue share from new customers shrunk from 30% to 12-15%, though the timeline for that change is unclear. This has lead the company to shift its focus more to maximizing value of current users.

Valuation

In December of 2021, Razorpay announced a $375 million Series F round funding that valued the company at $7.5 billion. The round was co-led by Lone Pine Capital, Alkeon Capital, and TCV. Existing investors who participated in the round included Tiger Global, Sequoia Capital India, GIC and Y Combinator. At the company’s $7.5 billion valuation at the end of 2021, that would represent an implied revenue multiple of 42.2x on 2022’s revenue.

Comparable public companies, like Paytm, have seen significant reductions in their market cap. Paytm has dropped from a high of ~$15 billion in late 2021 to a market cap of ~$2.5 billion as of February 2024, off of ~$1 billion of revenue.

Source: companiesmarketcap.com

Key Opportunities

International Expansion

Razorpay has already slowly begun to expand into emerging economies in Southeast Asia. After acquiring Curlec, a payment gateway startup operating in Malaysia in February 2022, the company launched Curlec by Razorpay in July 2023, servicing the Malaysian market as an international payments gateway.

While it took eight months to roll out services for Curlec in Malaysia, CEO Mathur states the timeline is now 4-5 months. Referring to the Southeast Asian payments market, Mathur said:

“India is still a big market for us, but I think we can replicate the success story in these markets too. One of the reasons for this is that many of the markets in Southeast Asia are going through the same journey in real-time payment transfer that India has seen 5-7 years back”.

The company’s ability to capitalize on emerging digitization in other counties will be critical as the company eyes new markets such as Indonesia, Vietnam, and the Philippines ahead of a potential IPO.

Beyond B2B Payments

Razorpay’s CEO has spoken on the potential for expansion beyond B2B payments into business-to-government (B2G) and even person-to-government (P2G) segments. In the same theme of being an all-encompassing payment solution for businesses, Mathur said:

“Business-to-government payments, or person-to-government payments is a huge opportunity. If you go beyond that we are doing a lot in the neo-bank and credit segment. Our aim is to be the single provider for money movement for businesses”.

Leveraging Government Infrastructure

In a country where the government has played such a crucial role in the development of payment infrastructure, maintaining connectivity with government payment facilities is essential. For example, Razorpay integrated with government-backed ONDC, where it’ll be the first payment gateway to provide reconciliation services to network participants such as buyers, sellers, and logistics partners. ONDC has the potential to increase India’s digital consumption by 5x to ~$340 billion by 2030, along with the fact that the network already takes 5-6K retail orders per day and more than 25K mobile transactions daily, the company has continued to successfully build off of India’s provided infrastructure.

Omnichannel Development

Razorpay’s overarching goal is to be the one-stop shop for anything related to payments. The company’s acquisition of BillMe allows Razorpay to enter the digital receipts market, expected to be worth $2.3 billion by 2027, and further develop offerings that will allow merchants to engage better with their customers. Whether it be AI-powered routing solutions for payment gateways, integrations with key business platforms, or automated escrow+ solutions, Razorpay continues to innovate its product suite to maximize value from existing customers.

Key Risks

Unit Economics In MSME Market

While catering to the MSME population has been a differentiator and successful pain point for Razorpay to solve thus far, there are two major concerns when servicing this market. Razorpay’s exhaustive suite of products is more difficult to cross-sell into micro and small businesses than large enterprises, leading to lower ACVs and LTVs for these customers.

Secondly, the mortality and churn of MSMEs relative to large enterprise customers are higher. With current difficult macro headwinds in India, there have been more than 10K MSME shutdowns from 2022 to 2023, up from ~6K the prior year. The implications of this are significant, as obtaining new customers is 25x more costly than retaining existing customers.

Cyber Attacks & Reputation Risk

While Razorpay has created many features that cater to ease of use for its customers, some of these pose additional cybersecurity threats that need to be mitigated. Razorpay has already suffered a cyberattack that persisted for three months in 2022 due to payment authorization vulnerabilities. The broader market is at risk in API enablement, which is expected to be the gateway of 50% of data threats by 2025, the full-stack payment ecosystem is ripe with cyber threats. API attacks in the financial services industry rose 244% in 2022.

The implications of this threat are significant. Consequences don’t just include remedial costs, lost productivity, and regulatory fines, but most importantly customer trust. With customer data being such a crucial element of Razorpay’s future development, the increasing threat of new methods for cybercrime remains a concern for Razorpay as well as other payment players globally.

Summary

Both consumer spending and the digital payments market in India are growing rapidly, creating a meaningful opportunity that many different service providers are competing for. Razorpay continues to expand its suite of products in an attempt to make it a one-stop shop for payments. The company’s success in innovating based on regulatory action has contributed greatly to the company’s availability to retain clients and cross-sell efficiently. With a push for international expansion beginning, Razorpay seeks to replicate its success in capturing market share of the emerging Indian economy across the APAC region.