Thesis

Businesses often hire management consultants to make their processes more efficient. Until 2020, operations consulting grew at a rate of 3-4% annually. In 2019, Fortune 500 firms spent 1-3% of their budgets, averaging between $100 million and $150 million, on management consultants. However, 2023 saw a reduction in demand for management consultants driven by changes in the economy, leading to thousands of layoffs across major consulting firms such as McKinsey and Deloitte — in an industry that rarely sees such layoffs.

Instead, businesses have increasingly turned to digital transformation solutions, which are technologies that enable data-driven and digitized business operations. During the COVID-19 pandemic, companies were estimated to have sped up the digitization of internal operations, supply-chain interactions, and customer relationships by 3-4 years. One aspect of this has been the increasing adoption of execution management software, which is an emerging category of enterprise software that “integrates with applications and data sources to drive intelligent orchestration to improve business performance”.

Celonis is a German company that offers execution management software to help businesses improve their processes. Its process intelligence platform uses process mining to identify operational inefficiencies and develop strategies for optimization. The company has over 20 offices globally and more than 3K staff as of 2024. The company’s mission is “to help companies improve efficiency (and reduce waste) by providing a modern way to run business processes entirely on data and intelligence.”

Founding Story

The three founders of Celonis — Alexander Rinke (Co-CEO), Bastian Nominacher (Co-CEO), and Martin Klenk (CTO) — met as students at the Technical University of Munich (TUM). Rinke was studying mathematics, Nominacher was studying finance and information management, and Klenk was studying informatics.

In 2011, they were working on a project to improve customer service for broadcaster Bayerischer Rundfunk (BR) and were having trouble identifying how to do so. Then, they noticed that BR’s IT systems were automatically collecting data on its business operations and transactions, which they could use to analyze inefficiencies in customer service processes.

This was a timely discovery because, in October 2011, Dutch professor Wil van der Aalst released the Process Mining Manifesto, which introduced the idea of process mining as a research method that aims to “discover, monitor, and improve real processes by extracting knowledge from event logs readily available in today’s information systems.” The founders, who had read the Manifesto, applied this method to their consulting project and used the digital traces of BR’s IT systems to discover ways to improve BR’s customer service processes.

This experience motivated the founders to bring process mining out of academic circles and apply it to real businesses. After completing their studies in 2011, Rinke, Nominacher, and Klenk co-founded Celonis, working out of Nominacher’s apartment. In the first few years, they ran a bootstrapped company with the money they got from TUM’s EXIST founder scholarship. With large corporations such as Siemens trying their product as early as 2011, the founders did not have to take on external funding for the first five years.

The European headquarters of Celonis is located in Munich, close to TUM, which enables the founders to preserve a connection to the university and hire their students. Notable executive hires since the company was founded include Carsten Thoma, who joined as president in 2021; Vaish Sashikanth, who became the Chief Engineering Officer of Celonis in 2022 after formerly having been a VP of Engineering at YouTube; and Wil van der Aalst, who joined as the company’s Chief Scientist since 2021 and is the author of the seminal Process Mining Manifesto.

Product

Source: Celonis

Celonis’s core product offering is its process intelligence platform which uses process mining software and AI to create a digital copy, or “twin”, of end-to-end business processes. Businesses often suffer from inefficiencies in time or cost without understanding how best to eliminate those inefficiencies because of complex business processes. Celonis’s interactive platform visualizes business processes to help parse the root causes of business problems.

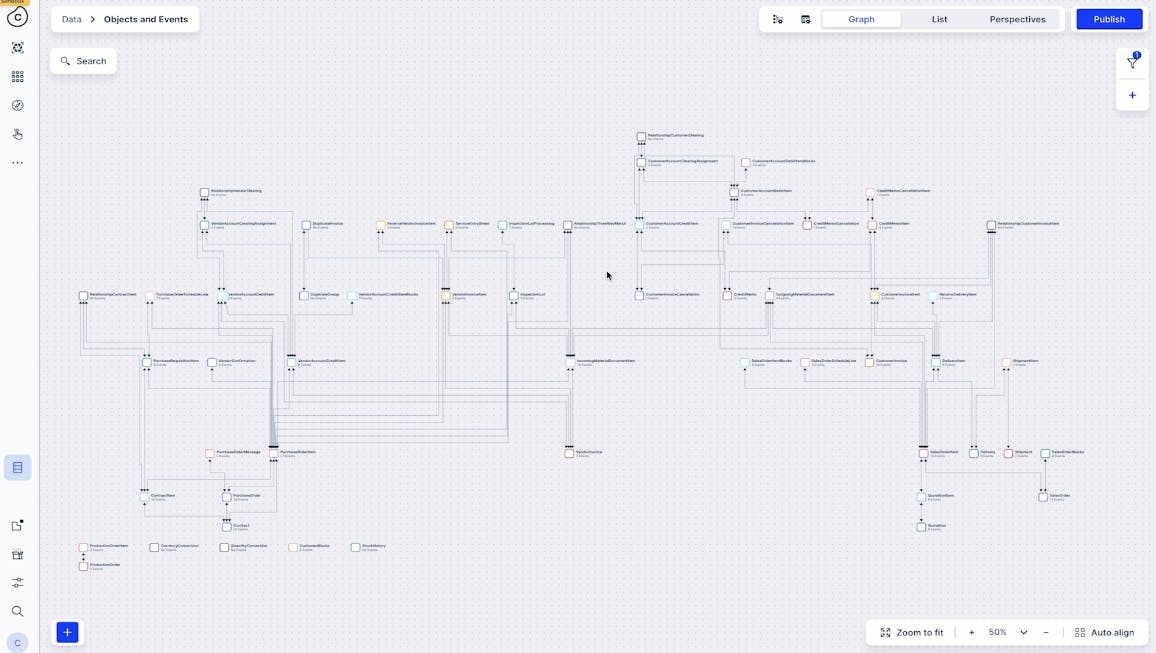

Process Intelligence Graph

Source: Celonis

Celonis’s process intelligence graph is used to map and analyze business processes. It takes in event log data from applications and systems a company already uses, transforms that data into standardized process data, and layers on Celonis’s process mining software and AI capabilities to capture real-time process performance. The graph allows businesses to access a digital replica of how their business processes work and track every object (e.g. invoices, orders) and event (e.g. order creation and invoice payment) in their processes. It also allows businesses to model future process changes by adding events or objects to the digital replica.

Process Analysis

Process analysis is the examination of how a business’s processes may or may not be meeting strategic objectives, intended timelines, or KPIs. To do this, Celonis offers several tools:

Process Explorer enables businesses to visualize and vet their process flows based on specific evaluation metrics they choose.

Celonis Studio is a drag-and-drop interface where businesses can create customized dashboards that yield a variety of analyses and charts that glean potential fixes for increasing efficiency in existing business processes.

Business Miner is a question-and-answer AI interface that allows businesses to draw insights into their processes and share them with other team members.

Process Copilot, another question-and-answer AI tool that provides insights into KPI trends and their root causes by developing charts and graphs.

Process Simulation allows users to forecast how changing conditions such as volume, resources, and working schedules would impact business objectives and process performance.

Process Improvement

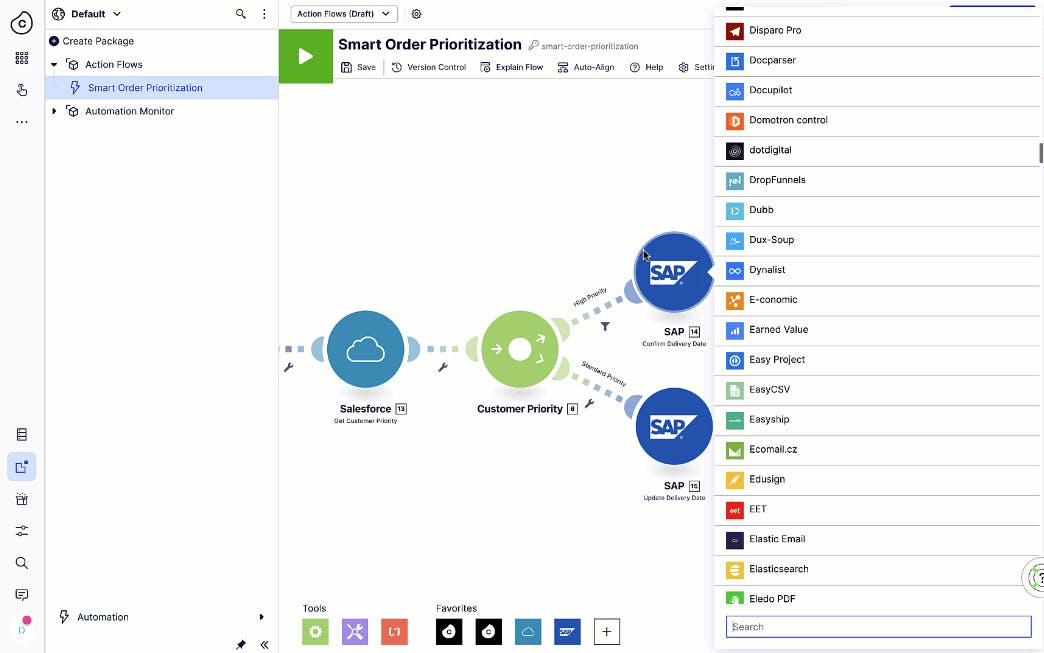

Source: Celonis

Process improvement allows businesses to deepen their understanding of existing processes and add new capabilities on top of them. Action flows enable teams to set up automated alerts for anything happening in their processes that they’d like to closely monitor.

Pre-built apps offer targeted solutions to common process challenges that could be integrated into existing processes in days or weeks. Celonis’s Process Designer and Process Navigator products, meanwhile, map entire organizations to define a business’ system architecture and track process changes to promote transparency and help teams adapt to change.

Process Monitoring

Process Monitoring checks adherence to process changes and captures the business impact of those changes. Adherence Manager is an interface that allows teams to track whether actual processes are in line with target processes using the Process Intelligence Graph. Celonis’s Transformation Hub, meanwhile, offers a dashboard that tracks the value created from process changes implemented with Celonis and elevates opportunities for further improvement.

Additional Process Intelligence Support

Celonis develops custom process solutions and offers learning tools, which include the following:

Celonis Marketplace, a digital library of hundreds of pre-packaged process mining apps and solutions created by Celonis and Celonis Ecosystem partners (e.g., SAP, IBM, Accenture). It serves as a central hub for process intelligence solutions such as customer service, inventory management, logistics, quality assurance, claims handling, etc. that customers could purchase on an as-needed basis.

Celopeers, an online open discourse channel where Celonis customers can get questions answered, chat with Celonis product managers, and share user experiences with peers. It serves as a community of practice for customers to leverage Celonis products and deepen their knowledge of process mining.

Celonis Academy, which consists of a free online learning platform offering 800+ interactive courses on process mining across seven languages and a series of instructor-led trainings (in-person, hybrid, or virtual) on how to use Celonis products offered in six languages. Part of the Academy offering is a Celonis certification that learners can pursue to demonstrate process mining expertise.

Market

Customer

Source: Celonis

Celonis’s customers include (1) enterprise companies with complex business processes and (2) service partners who use Celonis products to support their own customers. The first bucket of customers may have traditionally solved business problems by hiring external consultants, which is often expensive. The second bucket of customers includes consultancies like Accenture, who use Celonis products to unlock value for clients in more efficient ways.

Celonis serves 1.4K+ customers including large enterprise organizations and medium-sized companies in 16 different industries as of June 2024. Notable customers of Celonis include Dell, Johnson & Johnson, Vodafone, Pepsico, HP, Deutsche Bank, Accenture, and Cisco.

Market Size

The global process mining software market was valued at $1.7 billion in 2023. The market is expected to grow to $46.4 billion by 2032, demonstrating a CAGR of 44.3%. Growth in this market is being driven by companies increasingly leveraging digital solutions to improve all aspects of their businesses, as a part of the broader digital transformation market which was valued at $695.5 billion in 2023 and was expected to grow at a 24% CAGR to $3.1 trillion by 2030.

Competition

There are various vendors in the process mining market, each with a different focus and functionality, with most having capabilities that sit across process mining and process automation. Celonis is differentiated by the extent of its process mining capabilities as well as by the fact that it built its business around process mining while most others entered the market by acquiring process mining startups. In 2021, Celonis held a 44.4% share of the process mining market.

Incumbents

IBM Process Mining: IBM provides operating systems, middleware, database management systems, and analytics software. It entered the process mining market in 2021 when it acquired MyInvenio, a software company that offered task mining (using data to analyze the efficiency of a task), analytics, and simulation capabilities.

IBM’s process mining product leverages the company’s expertise in analytics and data management by extracting system data from enterprise systems and using a set of data transformation and cleaning functionalities to discover, monitor, and optimize business processes. The value-adds of IBM’s product are its integration with IBM enterprise software, its scalable process mining platform which can take in large and complex datasets, and its advanced AI and analytics capabilities that enable organizations to leverage predictive insights.

Alongside process mining, IBM offers a business process management platform and a set of AI-driven robotic process automation (RPA) solutions, which use bots to carry out repetitive tasks. As of May 2023, IBM process mining has a starting price of $3.2K per month for one analyst user and 20 million events.

UiPath: UiPath is an RPA business founded in 2005. It entered the process mining market after acquiring ProcessGold in 2019. UiPath is known for its AI-driven tool that offers an aggregated view of employee workflows to identify repetitive tasks. Its process mining solution is integrated into the UiPath business automation platform, such that customers could both engage in process mining analysis and design automated solutions for their business (e.g., using and monitoring the work of bots in their processes).

UiPath’s core competencies are automated data discovery and process flow visualization. It also offers UiPath Academy, which provides free RPA courses. By combining process mining with RPA, UiPath is able to offer a holistic set of process efficiency capabilities to its customers, who include global companies of all sizes across industries such as healthcare, professional services, manufacturing, and retail. UiPath went public in May 2023 and had a market cap of $6.9 billion as of June 2024.

SAP Signavio: SAP acquired Signavio in 2021 to provide process automation capabilities under the SAP software ecosystem. It offers a broad range of business process management solutions including a visual workflow designer, a process transformation suite that develops insights and supports process modeling and management, and an RPA platform.

It also hosts a collaboration hub to enable team-wide business process management. SAP Signavio does not have process mining capabilities as extensive as Celonis, but it provides broad access to process modeling and workflow management capabilities, offering a set of complementary tools to improve business efficiency, automation, process management, and process modeling.

Pegasystems: Pegasystems is an enterprise software platform founded in 1983 that provides business process management and workflow automation solutions. A key part of Pegasystems' growth has been acquisitions, of which it had eleven as of 2024. In May 2022, it acquired Everflow, a Brazilian process mining company that helped businesses to better understand customer journeys and identify root causes of inefficiencies using data analytics and AI.

In May 2023, Pegasystems launched Pega Process Mining, which visualizes real-time business processes and connects to AI models like ChatGPT via APIs to support businesses to easily identify, monitor, and tackle business bottlenecks. One of the benefits of its process mining solution is that it is integrated within the broader Pega Platform, which provides a series of low-code tools that enable businesses to automate repetitive or time-consuming tasks related to case management, risk compliance, and customer relationship management.

Emerging Companies

Apromore: Apromore is an Australian process mining provider that offers flexible pricing and user-friendly design, along with a no-code platform where users can engage in both task mining and process mining. It also provides various views of process analysis through dashboards, animations, and visual filtering. Apromore offers its software free of charge for customers in academia, a flexible licensing model for consultancies, and a subscription-based model for enterprises. It has raised a total of $22.6 million AUD in funding as of June 2024, with Salesforce and GBTEC as lead investors in its 2022 Series B.

KYP.ai: KYP.ai is a German productivity and process mining platform founded in 2018 that analyzes data on a business’s people, processes, and technologies, offering a holistic understanding of business workflows. Its Productivity 360 platform enables businesses to make decisions around boosting team efficiency and work-life balance, improving processes to increase ROI, driving user engagement, and deploying new technologies such as generative AI. KYP.ai has raised a total of €17.5 million in funding as of June 2024.

Business Model

Celonis operates on an enterprise software-as-a-service (SaaS) business model, where it sells its process mining software to enterprises at a fixed price. While Celonis does not publicly disclose its pricing, its software is estimated to cost $30K for a one-time payment of a one-year subscription with a three-year minimum contract term. Its pricing is based on two factors: the number of users requiring access to the platform and the data size the platform would need to host.

An optional add-on that could increase the price is a professional services manager the company provides to run strategic programs for customers and provide other wraparound implementation support Celonis also offers a free plan with limited functionality. Under this plan, customers can access visualizations, AI-driven analytics, and monitoring of existing processes as well as benchmarking of industry processes.

Traction

In 2021, Celonis had a 44.4% share of the process mining market. The company reportedly had $400 million of ARR in 2021, and unverified sources indicate that, as of 2023, the company had $771 million of ARR, growing at ~39%. Celonis also claims that it has generated more than $1.2 billion for customers across process improvements as of June 2024. It serves 1.4K+ customers including large enterprise organizations and medium-sized companies in 16 different industries. Celonis has also had meaningful adoption as a learning platform, with Celonis Academy serving 300K+ learners across 200+ countries as of June 2024.

Valuation

Celonis was valued at $13.2 billion in August 2022 at the time of its $1.4 billion Series D. However, it was trading in secondary markets at an estimated valuation of $7.7 billion as of June 2024. Based on the unverified estimate of Celonis' revenue in 2023 of $771 million, that secondaries market valuation would represent a ~10x revenue multiple. Its 2022 Series D valuation represented a 420% increase in valuation from its Series C round in November 2019, when Celonis raised $290 million at a $2.5 billion valuation. Notable investors include 83North, Qatar Investment Authority, and Activant Capital as well as angel investors Carsten Thoma (now President), Ryan Smith (CEO of Qualtrics), and Tooey Courtemanche (CEO of Procore). The company has raised a total of $2.4 billion in funding as of June 2024.

Key Opportunities

Growth in Process Mining Demand

In 2023, 61% of decision-makers were planning to use or were already using process mining. By 2025, 80% of organizations are expected to embed process mining for cost reduction and process efficiency in at least 10% of their business operations. However, there are obstacles to continued adoption. For example, in 2019, 52% of business leaders indicated that the unavailability of process mining tooling and expertise makes it difficult to use. By providing such tooling with its expanding platform, Celonis is well-positioned to capitalize on this market growth.

Growth Through Acquisition

Celonis has made four acquisitions as of June 2024. In 2020, Celonis acquired Integromat (now Make), an online automation system that enables businesses to automate processes across various applications. In 2021, Celonis acquired Lenses.io, a data streaming startup. In 2022, Celonis acquired PAFnow for $100 million, bringing aboard a process mining solution built on Microsoft Power BI that allowed it to reach the 97% of Fortune 500 companies that use Microsoft. In 2023, it acquired Symbio, an AI-driven business process management software that enhances collaboration among teams. It can continue to leverage acquisitions to expand its product suite and maintain or grow its market share by offering a more extensive solution than other competitors.

Key Risks

Pricing

Celonis offers process-based and volume-based pricing that is higher than competitors. For example, as of May 2023, IBM Process Mining has a price of $3.2K per month for one analyst user and 20 million events, which may be a more accessible and scalable pricing model than the baseline $30K for a one-year subscription listed for Celonis on AWS. Downward pricing pressures are likely to increase as new competitors arise.

New AI Entrants

AI may allow new process mining companies to emerge, increasing competitive pressure. Even if Celonis’s software is effective at mapping how business processes work, it still requires human operators to use the software to identify and implement solutions. This could be a weak point should competitors develop a more fully AI-driven process intelligence solution.

For example, Pega, a low-code platform provider, released Pega Process Mining in May 2023, which uses generative AI to automate data analysis and predict process behavior. While Celonis does offer tools with AI capabilities (e.g., Business Miner, which is a question-answer natural language processing interface that provides process insights) and has made acquisitions to boost its automation capabilities, it may need to consider embedding AI into its platform more integrally to remain competitive. Additionally, AI may catapult RPA software to become a top solution for process improvements, resulting in budget competition. In 2021, 92% of business leaders had already expressed interest in RPA as a business efficiency solution.

Summary

Celonis’s process intelligence solution uses data on business workflows to offer visibility on operational efficiency. Celonis offers a suite of products that supports businesses to visualize complex operational processes, identify inefficiencies, develop solutions, and monitor solution implementation. Its customers include large enterprise organizations and medium-sized companies, and it has raised a total of $2.4 billion in funding as of June 2024. While it was valued at $13.2 billion at the time of its last fundraising round, a 2022 Series D, it was trading on the secondary market at an estimated value of $7.7 billion in 2024. The company stands to gain from the rapid growth of the process mining market but may come under increasing competitive pressure due to AI and its pricing model.