Thesis

Hiring people is critical for any business, yet the traditional background check process is often a major bottleneck. As of 2023, 95% of organizations conduct background screening, highlighting its central role in hiring. However, conventional background checks rely on slow, manual processes that can’t keep up with the speed of modern recruitment. Delays in screening can extend hiring timelines and cause companies to miss out on top candidates. At the same time, inaccuracies in background checks pose significant risks, from compliance violations to reputational damage. In an era where businesses must move fast, outdated screening methods are no longer sufficient.

Background checks have become even more critical as the workforce evolves, especially towards the gig economy. As of 2024, 24% of Americans had earned money from gig platforms, up from 16% in 2021, underscoring a shift toward on-demand work. This adds complexity to background screening, as businesses must screen a diverse and transient workforce quickly. Whether hiring for full-time, part-time, or gig roles, organizations face the same challenge: ensuring a reliable, efficient screening process that minimizes the risk of bad hires.

Bad hires can significantly impact a company’s bottom line, with direct costs such as recruitment expenses and salary payouts, as well as indirect costs like lost productivity and reduced employee morale. One 2022 study found that 44% of organizations believed “screening resulted in better quality hires.” Those benefits reinforce the need for thorough background checks.

Checkr addresses these challenges by automating 99% of the background check process after data retrieval, significantly reducing turnaround times and improving accuracy. With 97% of Checkr’s customers reporting faster results compared to competitors, Checkr’s AI-driven platform focuses on offering not only speed but also enhanced compliance, helping businesses reduce legal exposure and administrative burdens. By enabling companies to streamline the screening process and minimize errors, Checkr ensures that organizations can make smarter, more informed hiring decisions, ultimately improving their recruitment process and reducing the financial risks associated with bad hires.

Founding Story

Source: Checkr

Checkr was founded in 2014 by Daniel Yanisse (CEO) and Jonathan Perichon (former CTO).

In 2012, Yanisse and Perichon met each other and became good friends as they were coworkers at the same LA-based startup, Mogreet. Less than a year later, the company failed and they both moved to Deliv, a startup in the on-demand delivery space. During this time, Deliv encountered the challenge of hiring enough drivers for deliveries, and it was because the background check step was tedious and manual. Yanisse was asked by their CEO to find a better background check vendor, but in their search, they realized incumbent vendors used outdated processes, often even without proper APIs. Recognizing the need for a more efficient and reliable background check solution, Yanisse and Perichon began to explore ways to revolutionize the industry.

The co-founders identified a significant opportunity to leverage technology and automation to streamline the background check process. They envisioned a platform that could provide fast and accurate background checks while prioritizing user experience and data security. In 2014, Yanisse and Perichon founded Checkr, and their timing was fortuitous. They developed their idea for an API-based background check service just as the gig economy was beginning to take off, allowing them to capture a rapidly growing market opportunity.

In the same year, the co-founders participated in Y Combinator, where they focused intensely on achieving product-market fit. There, they were able to secure their first 10 customers and Checkr's approach gained traction, particularly among gig economy platforms emerging around the same time. The company's ability to provide faster, more efficient background checks aligned perfectly with the needs of companies like Uber, Lyft, and Airbnb, which required rapid onboarding of workers and service providers.

The founders' vision extended beyond just creating a faster background check process. They aimed to build a fairer future by designing technology that could create opportunities for all, including those with criminal records who often face significant barriers to employment.

Product

Checkr offers a broad background check platform designed to simplify and modernize the hiring process. The company's product suite is organized into four main modules that work together to deliver an integrated solution:

Engage: Tools focused on creating a transparent and positive experience for job applicants.

Verify: Background check services, including various types of screenings and verifications.

Decide: Solutions to assist employers in making informed and consistent hiring decisions.

Manage: Operational tools for ongoing workforce management and compliance.

Checkr’s goal is to deliver fast, accurate results through a vertically integrated platform with direct access to high-quality, up-to-date data. The company’s API and over 100 pre-built integrations are meant to address a broad audience of customers. Since its founding in 2014, Checkr has processed background checks for more than 100K hiring teams, reducing time-to-hire and expanding candidate pools. With an emphasis on compliance and fair chance hiring, Checkr attempts to enhance both efficiency and equity in hiring practices.

Engage

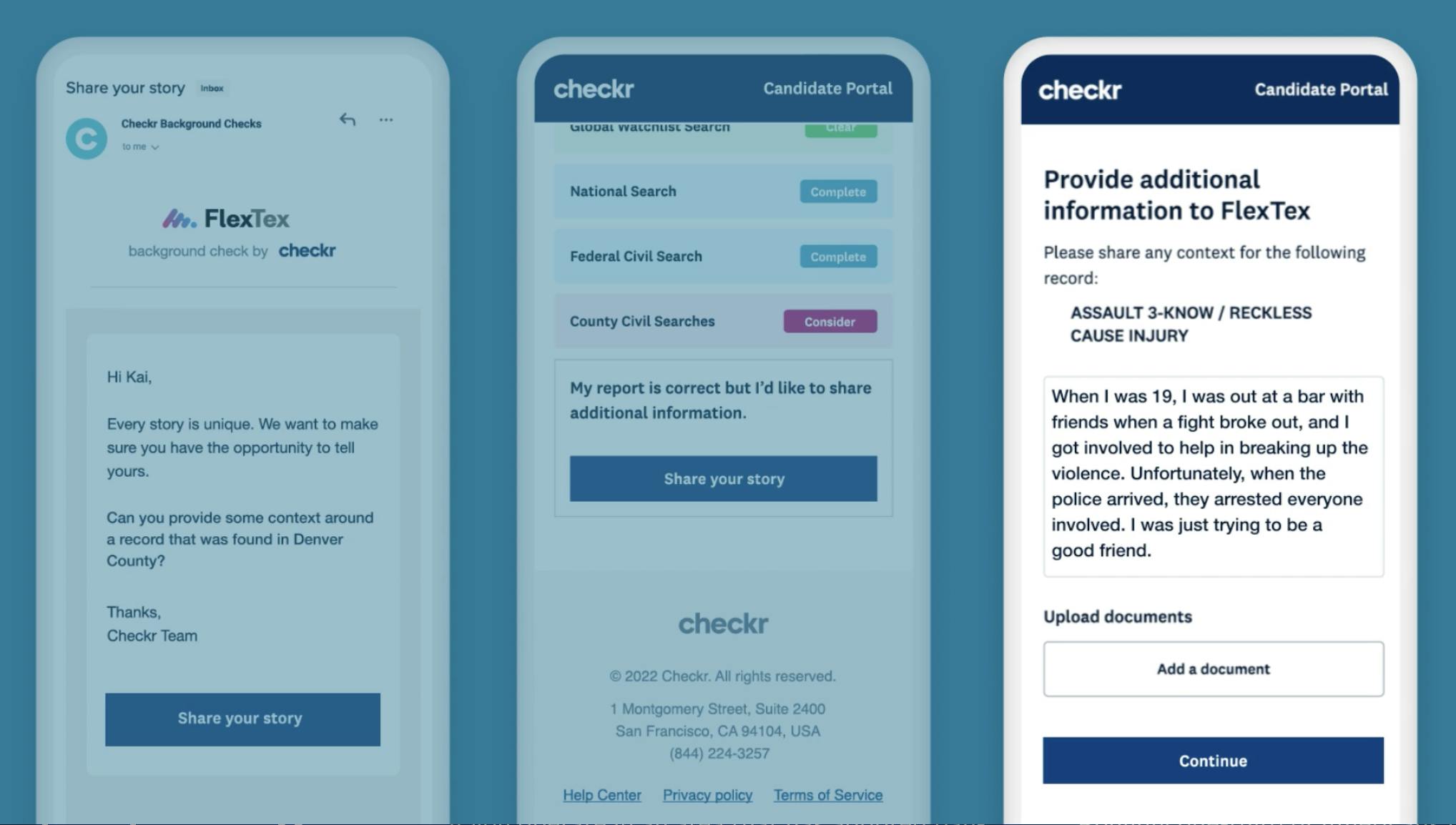

The Candidate Portal is an interface that allows job applicants to track their background check progress in real time. The portal aims to make the process as simple as possible, requiring no username or password, optimized for mobile, and populating data from integrated ATS systems. If candidates need assistance, Checkr has a built-in FAQ section and support team with multilingual capabilities for international candidates. The portal also enables applicants to view status updates on each component of the background check and download their reports once background checks are complete.

Candidate Stories is a feature that enables applicants to provide context for any negative items that may appear on their background check. This tool supports fair chance hiring by allowing candidates to explain past incidents or circumstances, allowing employers to consider additional information before making hiring decisions. Checkr partnered with Grammarly to offer free spelling and grammar suggestions to help candidates feel confident in their stories.

Source: Checkr

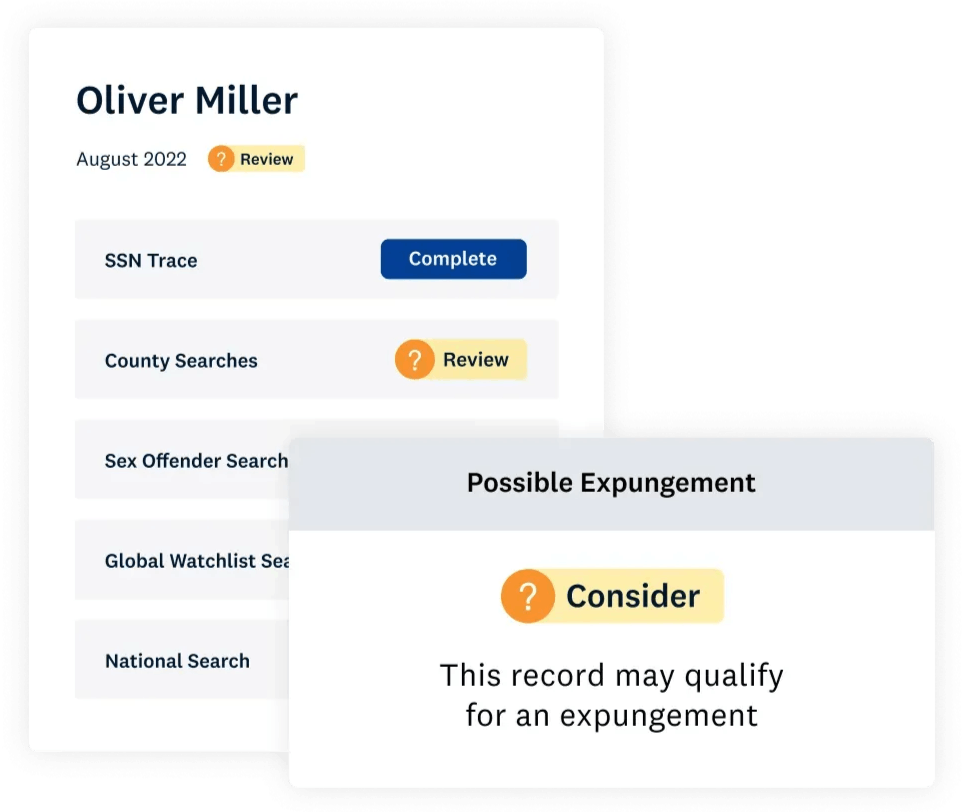

Checkr’s Expungements service is designed to support candidates in identifying and clearing eligible records from their background checks, though as of February 2025, it is only supported in California. Checkr identifies potentially expungeable records for its clients and notifies candidates directly through email and text. If the candidate wants an expungement and their record qualifies, Checkr passes their information to Avenues Legal LLP to assist with clearance.

Source: Checkr

Verify

Source: Checkr

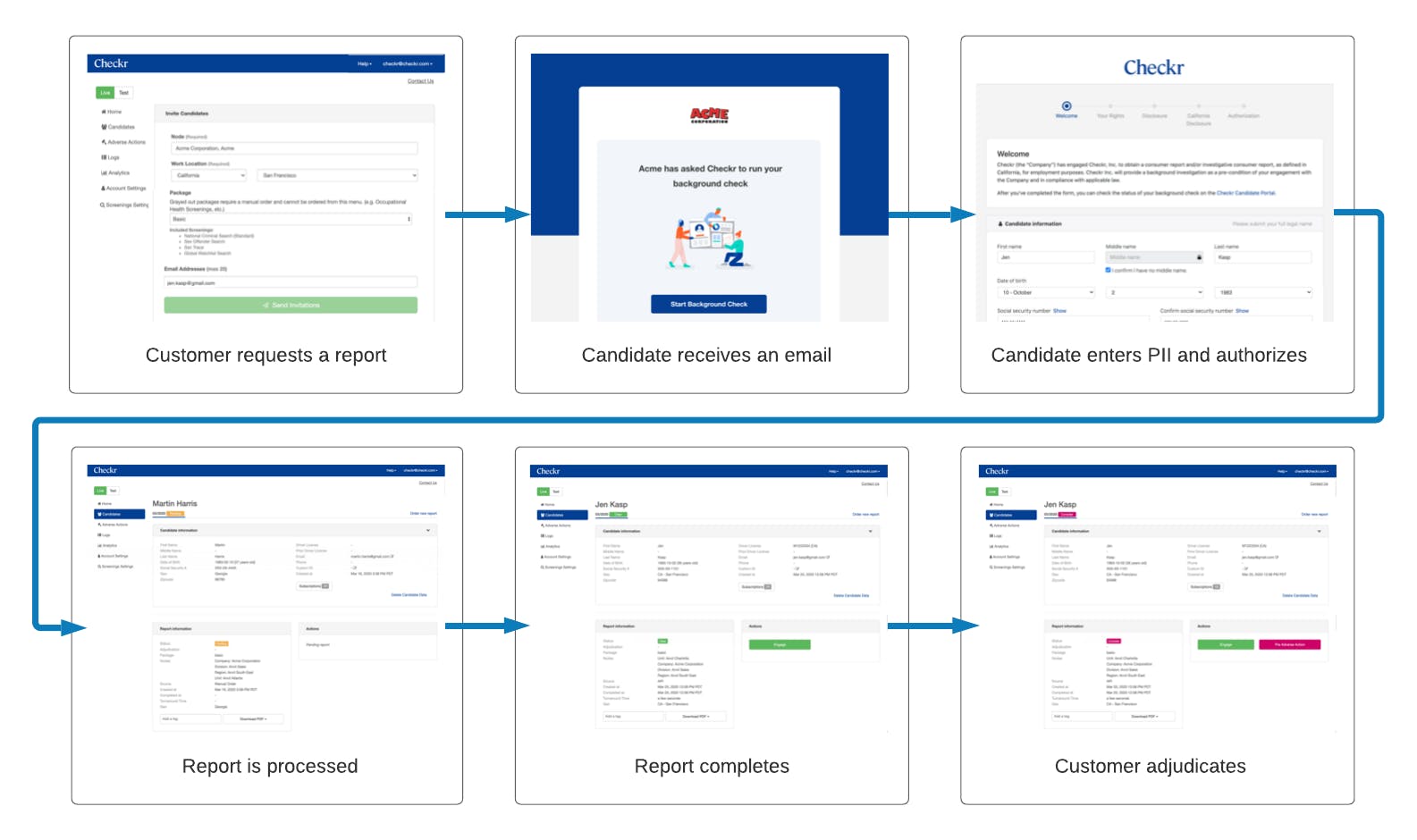

To initiate a background check with Checkr, employers can log into their Dashboard and select "Order background check." They then specify the candidate's work location to ensure compliance with relevant hiring laws and choose a screening package that aligns with their needs.

Employers can further customize the screening by adding specific checks, such as driving records or professional license verifications, depending on the role's requirements. After entering the candidate's email address, an invitation is sent for the candidate to provide necessary personal information and consent. Throughout the process, both employers and candidates can track the progress via Checkr's platforms, ensuring transparency and efficiency.

Source: Checkr

Checkr’s API enables the platform to incorporate background check functionality into various platforms. The company’s RESTful API allows developers to create and update candidate profiles, order reports, and receive real-time notifications via web hooks, facilitating more automated workflows. Additionally, Checkr's partnerships with industry-leading Applicant Tracking Systems (ATS) and HR platforms provide pre-built integrations that streamline the hiring process by consolidating services into a single interface.

Checkr leverages AI to enhance the efficiency and accuracy of background checks. Its Charge Classifier categorizes criminal charges from various jurisdictions, standardizing language and reducing manual review time. The platform's compliance engine stays updated with evolving regional laws, automatically filtering out non-reportable information to help ensure adherence to legal standards. By automating data retrieval and report generation, Checkr accelerates the screening process, allowing businesses to make hiring decisions more rapidly. Additionally, Checkr's data network continuously monitors multiple criminal data sources, enabling real-time updates and maintaining the relevance of background information. The goal of leveraging AI is meant to both streamline operations and promote fairer hiring practices by minimizing human bias and error.

Checkr offers different screening services for various use cases. As of February 2025, some of these use cases include criminal background checks, employment verification, driving record (MVR) checks, transportation (DOT) checks, drug testing, healthcare checks, education verification, and international background checks. Additionally, Checkr has created trust and safety screenings as a separate entity, Checkr Trust, which focuses on safety screening for large communities built on trust, such as vehicle sharing, online dating, and ridesharing.

Decide

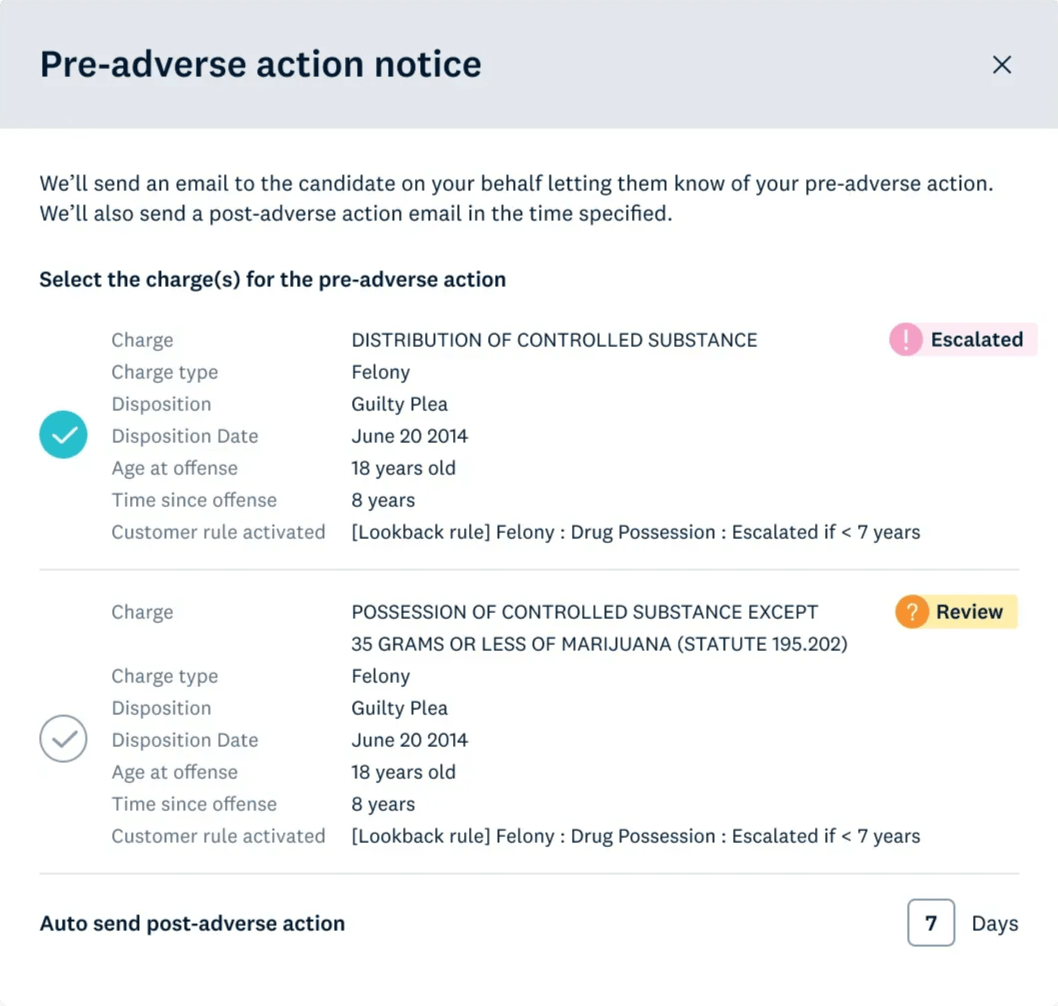

After verifying a candidate's background through various checks and screenings, the next step for organizations is to decide on the candidate’s suitability for the role. This decision-making process, known as adjudication, involves evaluating the background check results against the organization's hiring policies and relevant legal requirements. Checkr's Adjudication and Assess tools are designed to streamline this process.

Adjudication in Checkr allows organizations to review background check findings systematically, applying their criteria to determine a candidate's eligibility. The platform's built-in adverse action workflows support compliance by automating candidate notifications and managing mandatory waiting periods when a decision may negatively impact a candidate.

Source: Checkr

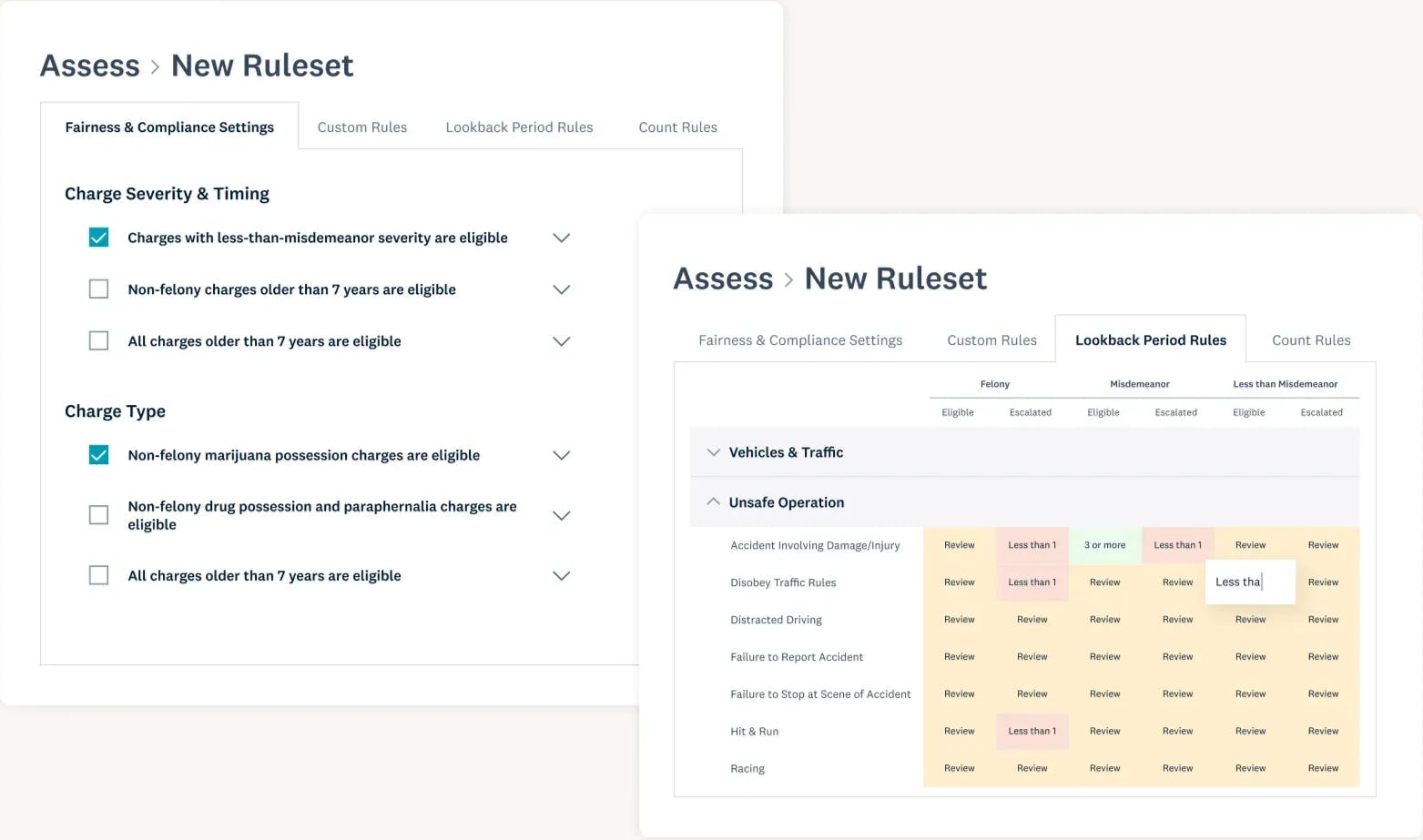

Checkr's Assess tool enhances the adjudication process by providing features that streamline and optimize background check evaluations. Key functionalities include:

Record Filtering: Assess allows employers to designate which records are irrelevant, minimizing their prominence to expedite the adjudication process.

Customizable Guidelines: Employers can codify their evaluation policies by specifying time frames after which certain records are no longer considered relevant.

Advanced Analytics: Assess provides analytics that allow employers to observe hiring patterns and predict the impact of changes to hiring criteria, helping to prevent the elimination of qualified candidates.

Automated Compliance: The tool includes a compliance engine built to account for federal, state, and local laws and regulatory reporting requirements, reducing the risk of human error and potential bias during the evaluation process.

Source: Checkr

Manage

Managing the post-hire lifecycle is crucial for maintaining compliance, ensuring timely payments, and gaining actionable insights into your workforce. Checkr offers a suite of tools designed to streamline these processes.

A Form I-9 is a mandatory document used to verify an employee's identity and legal authorization to work in the United States. Checkr's I-9 Verification service simplifies this process by allowing employers to import data directly into the form, reducing manual entry and minimizing errors. The platform also integrates with E-Verify, enabling employers to electronically confirm an employee's work eligibility with the US government.

Checkr Pay offers instant payment solutions tailored for the gig economy and flexible workforce. With the service, workers can access their earnings right after shifts, as well as discounted 1099 filing and tax management, enhancing their overall experience. Checkr Pay operates like a normal bank but skips the exorbitant fees of advances and payday loans. The service includes a customizable digital wallet, allowing workers to manage their funds seamlessly. When workers use their Checkr Pay debit cards for spending, Checkr generates interchange revenue, part of which it shares with the client company.

Checkr's Analytics tool provides insights into hiring processes, enabling organizations to identify bottlenecks, assess candidate quality, and optimize recruitment strategies. The platform offers customizable reports and dashboards, allowing users to track key performance indicators and continuously improve hiring workflows.

To maintain ongoing compliance and mitigate risks, Checkr offers Continuous Checks, a subscription service that monitors real-time data sources for changes in workers' records. This ensures that any new information, such as criminal records or driving violations, is promptly identified, allowing necessary actions to protect the brand and workforce.

Market

Customer

Checkr primarily serves businesses and organizations that require background checks for employment, volunteering, or other verification purposes. The company’s customer base ranges from small local businesses to Fortune 500 companies. As of March 2024, Checkr had over 100K unique paying customers who utilized its services within the previous 12 months. Its customers span multiple sectors, including Computer Software (14%), Information Technology and Services (12%), and Internet-based businesses (10%). More recently, Checkr has successfully grown its presence in non-tech industries such as retail, manufacturing, and hospitality. Notable clients include Instacart, Lyft, Asana, Brilliant Earth, Coinbase, Culver's, Domino's, Hot Topic, Ingles Markets, Kimpton Hotels & Resorts, Qualtrics, and Warby Parker.

Market Size

Operating within the global background check market, Checkr benefits from a rapidly growing industry. In 2024, the market was valued at $13.8 billion and is projected to reach $35.2 billion by 2031, expanding at a CAGR of 12.4%. This growth is largely driven by an increasing emphasis on risk management and the global expansion of businesses that require comprehensive background screening solutions.

In addition to background checks, Checkr is part of the employment screening services segment specifically, valued at $6.6 billion in 2023 and expected to reach $19.6 billion by 2033, growing at a CAGR of 11.2%. Within this space, Checkr holds an estimated market share of approximately 2.2%.

Competition

Sterling: Sterling Check, founded in 1975, focuses on background screening and identity services in the workforce management sector. Sterling provides comprehensive background checks, drug testing, identity verification, and workforce monitoring services tailored to meet the needs of businesses across various industries. Sterling Check went public in October 2021, raising $378 million in its IPO. In February 2024, First Advantage acquired Sterling for $2.2 billion. Sterling distinguishes itself through a customizable platform and a focus on compliance and risk mitigation, particularly for highly regulated industries such as healthcare and financial services. Sterling takes a traditional approach, leveraging decades of expertise and prioritizing comprehensive, tailored solutions for enterprises.

HireRight: HireRight, founded in 1990, provides global background screening services and workforce solutions. In June 2024, HireRight was acquired by General Atlantic and Stone Point Capital for approximately $1.7 billion. Before this, HireRight went public in October 2021, raising $422 million in its IPO. HireRight offers comprehensive background screening, verification, identification, monitoring, and drug and health screening services for over 37K customers across the globe. HireRight's platform is known for its comprehensive screening services and global reach, catering to businesses of all sizes across various industries. In 2023, HireRight screened over 26 million job applicants, employees, and contractors, while processing over 95 million screens.

Accurate Background: Accurate Background, founded in 1997, offers a comprehensive set of employment screening services, including criminal background checks, motor vehicle record searches, employment and education verifications, and drug testing. The company has raised a total of $5 million over two rounds. Accurate serves some of the world's largest companies, providing technology-enabled background screening solutions. Accurate Background distinguishes itself through its focus on technology-enabled compliance tools and its global reach, offering services in more than 170 countries.

Business Model

Background Check Services

Checkr operates on a usage-based revenue model, primarily generating income through background check services. As of February 2025, Checkr offers three main pricing tiers:

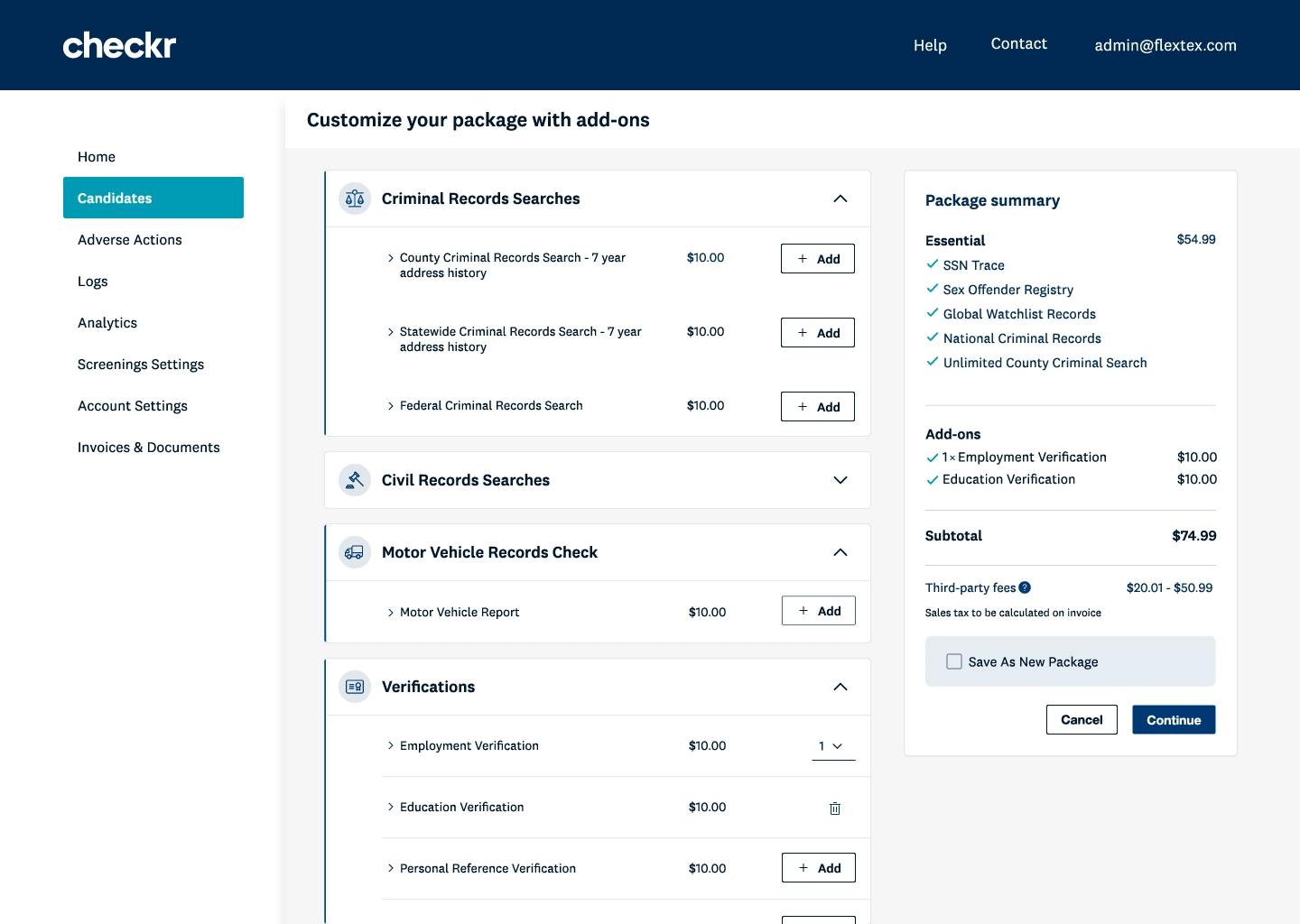

Basic+ ($29.99/report): Includes SSN trace, sex offender registry, global watchlist search, and national criminal search.

Essential ($54.99/report): Includes all Basic+ features plus unlimited county criminal search.

Complete ($89.99/report): Includes all Essential features plus unlimited state and federal criminal search.

Checkr also offers 30+ customizable add-ons, such as federal criminal searches ($10/check), motor vehicle records ($9.50/check), and drug testing (starting from $10/test). Checkr does not charge monthly or annual subscription fees; customers are only billed for the reports they order. For customers who order more than 300 checks per year, Checkr offers custom pricing.

Outside of the checks themselves, Checkr also offers other upgrades, like the three tiers for their Assess feature. With multiple tiers—Assess Lite, Standard, and Premium—customers can select the level that aligns with their organization's needs. Assess Lite, a free service, quickly identifies and minimizes irrelevant records, expediting the adjudication process. Assess Standard, a paid add-on, provides advanced adjudication optimization tools, including additional quick start guidelines and categories, reducing manual review time and enhancing decision-making efficiency. Assess Premium, also a paid add-on, offers up to 235 granular filters, the ability to craft multiple guidelines for roles and locations, and access to analytics, significantly reducing manual review and increasing consistency.

Checkr Pay

As of February 2025, Checkr offers two plans for its Checkr Pay service:

Basic Plan: This plan delivers core payment features, including free, instant bank transfers and digital or physical debit cards for workers. It supports same-day ACH and push-to-debit withdrawals, with integration through a RESTful API and React Native components. With 24/7 support and streamlined onboarding via Checkr's background check tools, it ensures a smooth and user-friendly experience.

Premium Plan: Building on the Basic Plan, they offer enterprise-level support with SLAs, VIP features like merchant cash advances, and flexible cash flow options. It also includes high-touch onboarding and customized product enhancements to meet unique business needs.

Checkr also generates interchange revenue when workers use the debit card for spending, though they share part of this with the associated client company.

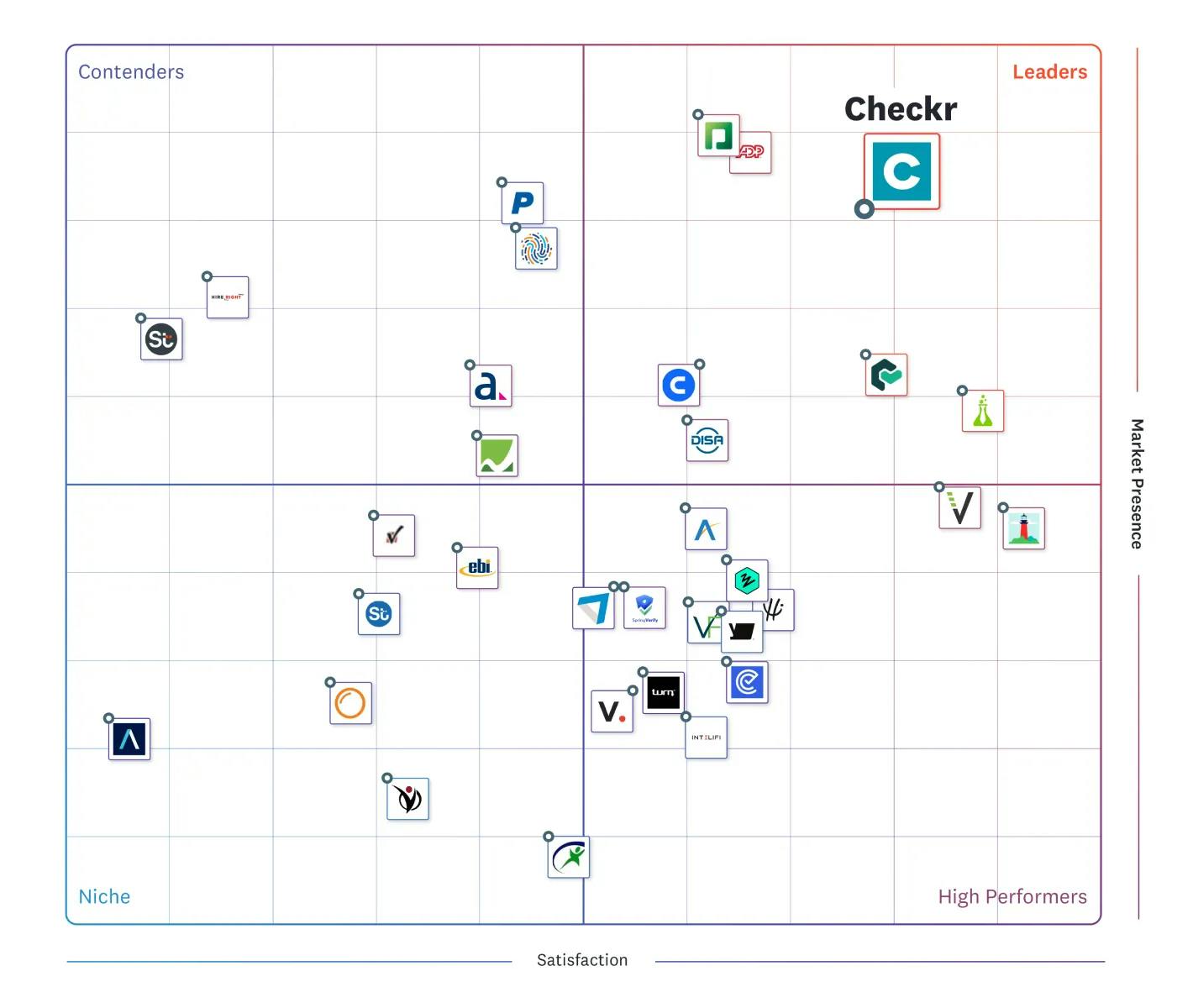

Traction

From 2020 to 2024, Checkr has been recognized as a G2 Leader in background checks, outperforming more than 150 competitors in product satisfaction and market presence. The company has also been listed on the Forbes Cloud 100 list for seven consecutive years.

Source: Checkr

Customers like Covenant Health experiencing a 78% reduction in turnaround time, leading to faster hiring cycles. Additionally, enterprise clients benefit from significant cost savings, like how restaurant franchisee Sailormen Inc. saves $10 per check. One Forrester study found that Checkr provides a 169% ROI for its clients, with businesses recouping costs in under six months. As of 2024, the company’s Net Promoter Score (NPS) of 60 significantly exceeds industry averages, demonstrating strong customer loyalty.

Checkr also collaborates with leading applicant tracking systems like Greenhouse, HR platforms such as Workday, and specialized industry platforms like Planning Center. The company’s partnership with CLEAR has enhanced identity verification, improving security and efficiency in background screenings.

Checkr generated $700 million in revenue in 2023, double its 2021 revenue.

Despite this growth, Checkr underwent a workforce reduction, laying off 382 employees in 2024—about 32% of its staff—to ensure the company's long-term stability. As of November 2024, the company had over 750 employees, with newly appointed C-suite executives, including chief product officer Ilan Frank, chief technology officer Luca Bonmassar, and chief operating officer Lindsey Scrase.

Valuation

As of January 2025, Checkr’s most recent funding round was an extension of its Series E in April 2022, raising $120 million and valuing the company at approximately $4.6 billion. Over the years, Checkr has attracted investment from firms such as Accel, IVP, Coatue, Y Combinator, T. Rowe Price, and Fidelity. In total, the company has secured $679 million in funding as of February 2025.

As of December 2024, a number of mutual fund investors in Checkr, such as T. Rowe Price and Franklin Templeton, estimated Checkr’s valuation to be between $368 million and $1.4 billion.

Key Opportunities

Further Expansion into Enterprise Markets

Initially serving gig economy platforms, Checkr has successfully broadened its client base to include large enterprises. This strategic shift has been instrumental in the company's revenue growth, allowing the company to diversify its revenue streams and reduce dependence on the gig economy sector. Enterprise customers typically require more comprehensive and frequent background checks, leading to higher revenue per client and more predictable, long-term contracts. This shift also presents opportunities for cross-selling additional services such as Checkr Pay and Checkr Onboard, increasing the lifetime value of each client. Additionally, by developing tailored solutions for industries like healthcare, finance, and retail, Checkr can further differentiate itself and solidify its position in the background screening market.

Developing a Comprehensive HR Platform

Checkr is expanding beyond background screening into payments (Checkr Pay) and onboarding services, positioning itself as a broader HR technology provider. By integrating these functions, the company can offer a seamless, end-to-end hiring and employment solution that positions Checkr as a one-stop solution for the entire employee lifecycle. This approach enhances data flow across HR processes, potentially leading to more informed hiring decisions and improved workforce management. A comprehensive HR tech stack also provides Checkr with a competitive advantage over traditional background check providers and opens new opportunities to serve small and medium-sized businesses seeking all-in-one HR solutions. Additionally, leveraging AI and machine learning for predictive analytics could enhance workforce planning and retention strategies.

Key Risks

Regulatory & Compliance Challenges

Checkr operates in a highly regulated industry where compliance with federal, state, and local laws is critical. The company must navigate a complex web of regulations, including the Fair Credit Reporting Act (FCRA), Ban the Box laws, and data privacy regulations. According to Checkr's 2024 State of Screening Compliance report, 51% of respondents either are not completely confident that their background check policy complies with federal, state, and local laws, or don't have a background check policy at all. This widespread lack of confidence in compliance suggests a complex regulatory environment that Checkr must navigate carefully to avoid legal issues and maintain client trust. Failure to comply with these laws could result in significant legal liabilities, fines, and reputational damage. Additionally, the rapidly evolving nature of these regulations, particularly at the state and local levels, poses an ongoing challenge for Checkr to stay current and adapt its services accordingly.

Data Security & Privacy Concerns

Checkr faces risks related to data security and potential technological disruptions. The company handles sensitive personal information, making it a potential target for cyberattacks. Data privacy and security are among the top concerns for employers using background check services. Any data breach or mishandling of personal information could lead to severe consequences, including legal action, loss of customer trust, and damage to the company's reputation. The increasing sophistication of cyber threats, coupled with the growing volume of data Checkr processes, amplifies this risk.

Economic Downturn & Market Volatility

Checkr's business model heavily depends on its clients' hiring activities. During economic downturns, companies often reduce their hiring, which could significantly impact Checkr's revenue. For instance, in April 2023, Checkr laid off 382 employees, representing 32% of its workforce, citing "economic conditions that have impacted companies' hiring". This demonstrates the company's sensitivity to broader economic trends affecting employment. The background screening industry is closely tied to employment rates.

In 2020, due to the COVID-19 pandemic, the U.S. unemployment rate peaked at 14.8%. Such sharp increases in unemployment can lead to a significant decrease in demand for background check services. As Checkr's revenue is directly tied to the volume of background checks performed, economic downturns pose a substantial risk to its business model. Moreover, the gig economy and freelance work, which have been significant drivers of Checkr's growth, may be particularly vulnerable to economic shifts. Any contraction in these sectors could disproportionately affect Checkr's business. The company will need to continue diversifying its client base and service offerings to mitigate this risk.

Summary

Checkr, founded in 2014 by Daniel Yanisse and Jonathan Perichon, provides AI-driven background check solutions designed to automate and streamline the screening process. The company serves a wide range of customers, including gig economy platforms and enterprises, aiming to improve the speed and accuracy of background checks while maintaining compliance.

As businesses increasingly seek scalable and efficient hiring solutions, Checkr is positioned to capture growing demand in the background screening market. Open questions remain around its ability to maintain a competitive edge, expand its product offerings, and navigate regulatory challenges.