Thesis

Until recently, the grocery shopping experience had remained mostly unchanged for decades. A typical run to the local grocery chain involved long queues, languishing searches through the aisles, and driving time. The increasing demand for convenience from consumers, coupled with advancements in technology, has created an opportunity for a more frictionless and personalized shopping experience for consumers via online grocery delivery.

Since its emergence, the global online grocery market has grown quickly and was valued at $315.2 billion in 2022. Digital grocery shopping is growing faster than in-store grocery shopping and makes up an increasing percentage of overall grocery sales in the US. In 2023, digital sales are expected to account for 11.2% of the $1.3 trillion in US grocery sales. While this figure lags behind other digitally mature retail categories in percentage terms, it’s larger on an absolute basis due to the sheer size of the grocery market.

The COVID-19 pandemic was an additional catalyst for the online grocery delivery market. Before the pandemic, online grocery appealed to more narrow consumer segments such as young urban dwellers or affluent families seeking the convenience of large-basket deliveries to their homes. Now, offerings have expanded to encompass more customer segments (e.g. older generations) and shopping needs (e.g. convenience items). The spread of click-and-collect delivery models has also helped grocery stores reach customer groups beyond urban centers in suburban areas, small towns, and rural areas.

Instacart is the leading grocery delivery company in the United States. The business is a marketplace that is comprised of (1) Instacart shoppers, who shop and deliver the actual groceries (2) local grocery stores that list and supply inventory, (3) consumers who shop and pay via the Instacart app, and (4) brand partners that buy ad spaces. The Instacart app allows customers to browse a wide selection of products from local grocery stores, place their orders, and have them delivered to their doorstep within hours.

Founding Story

Instacart was founded in 2012 by Apoorva Mehta (ex-CEO, ex-Chairman), Max Mullen, and Brandon Leonardo. Born in India and raised in Canada, Mehta graduated from the University of Waterloo with an engineering degree and worked for Blackberry and Qualcomm. He then moved to Amazon, where he was a supply chain engineer for Amazon’s ecommerce fulfillment system. Mehta left Amazon in 2010 to become an entrepreneur. He came up with 20 failed startup ideas before landing on Instacart. Among his failed pursuits were an advertising network for gaming companies and a social networking app for lawyers.

He eventually came up with the idea of an online grocery service and saw the opportunity to solve problems that people had with traditional grocery shopping. He wrote the code for the app's first version and placed the first order when it was ready. Then, he went to the grocery store, picked up the groceries, and delivered them to himself. That’s how Instacart started with one shopper in the summer of 2012.

In 2012, Instacart received an investment from Y Combinator after Mehta used the app to send a six-pack of beer to a partner at the incubator. Mehta met his co-founders, Max Mullen and Brandon Leonardo while wrapping up at YC. In the early days, when orders were received without a personal shopper available, Mehta, who did not have a car, made the deliveries using Uber. The idea quickly gained traction among busy professionals and people who found grocery shopping a hassle.

After almost 10 years, Mehta stepped down as CEO in August 2021 in order to start a new business, Cloud Health Systems, in the healthcare industry. Mehta was replaced by Fidji Simo, who was hired as CEO the same month. As part of Instacart’s IPO proceedings in September 2023, Mehta relinquished his executive chairman board spot to Simo.

Product

Instacart’s product serves four stakeholders: consumers who use the app to purchase goods, shoppers who purchase and deliver goods, retailers who stock the goods, and brand partners who use Instacart to serve ads for high-intent shoppers. Serving those stakeholders are what Instacart describes as the “key pillars” of its product: Instacart Marketplace, Instacart Enterprise Platform, and Instacart Ads. As the company wrote in its S-1 filing:

“Our solutions are underpinned by a shared foundation of technology, infrastructure, data insights, and fulfillment that leverages our scale and expertise specific to the grocery category.”

Consumers

Source: Instacart

The Instacart Marketplace app and website aggregates local grocery, retail, and convenience stores for on-demand delivery or pickup. Consumers can browse and purchase items and have them delivered to their doorstep within a few hours from national and regional grocery retailers such as CVS, Kroger, Albertsons, Publix, Sam's Club, Sprouts, and Wegmans, among many others. Consumers who have a car and don’t want to pay for delivery but don’t want to spend time shopping can also select grocery pickup.

Source: Instacart

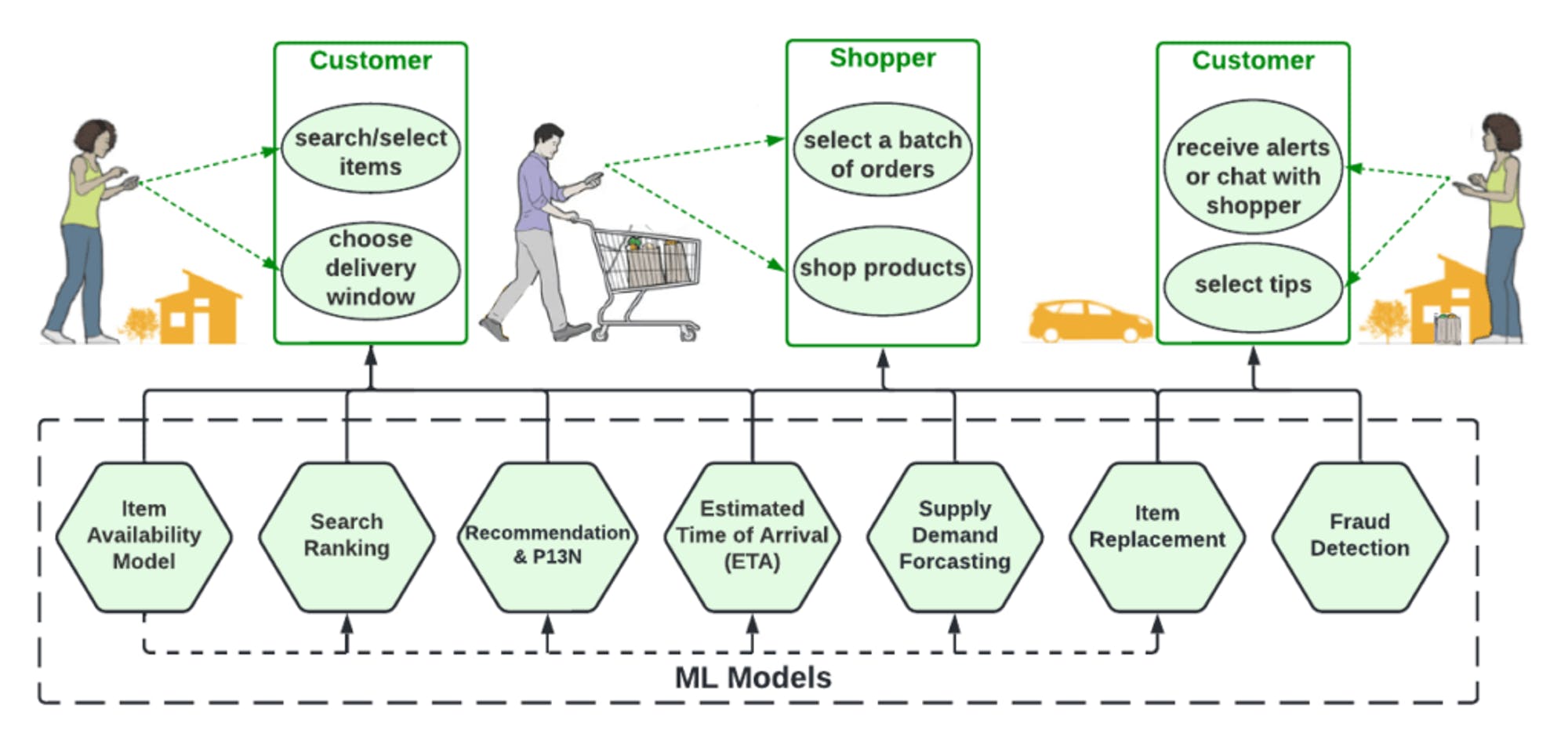

Instacart aims to provide a convenient shopping experience to its users and shows users a running total of the hours they have theoretically saved on shopping by using Instacart. It can predict the likelihood of an item being in stock by the time the shopper arrives to purchase it and saves customer preferences to identify backup products if the desired product is out of stock. The app also personalizes recommendations based on a user's shopping history, location, and purchase patterns and predicts delivery times. To minimize wait times for consumers, it picks the best driver for the job to deliver grocery orders as quickly as possible.

Shoppers

Source: Instacart

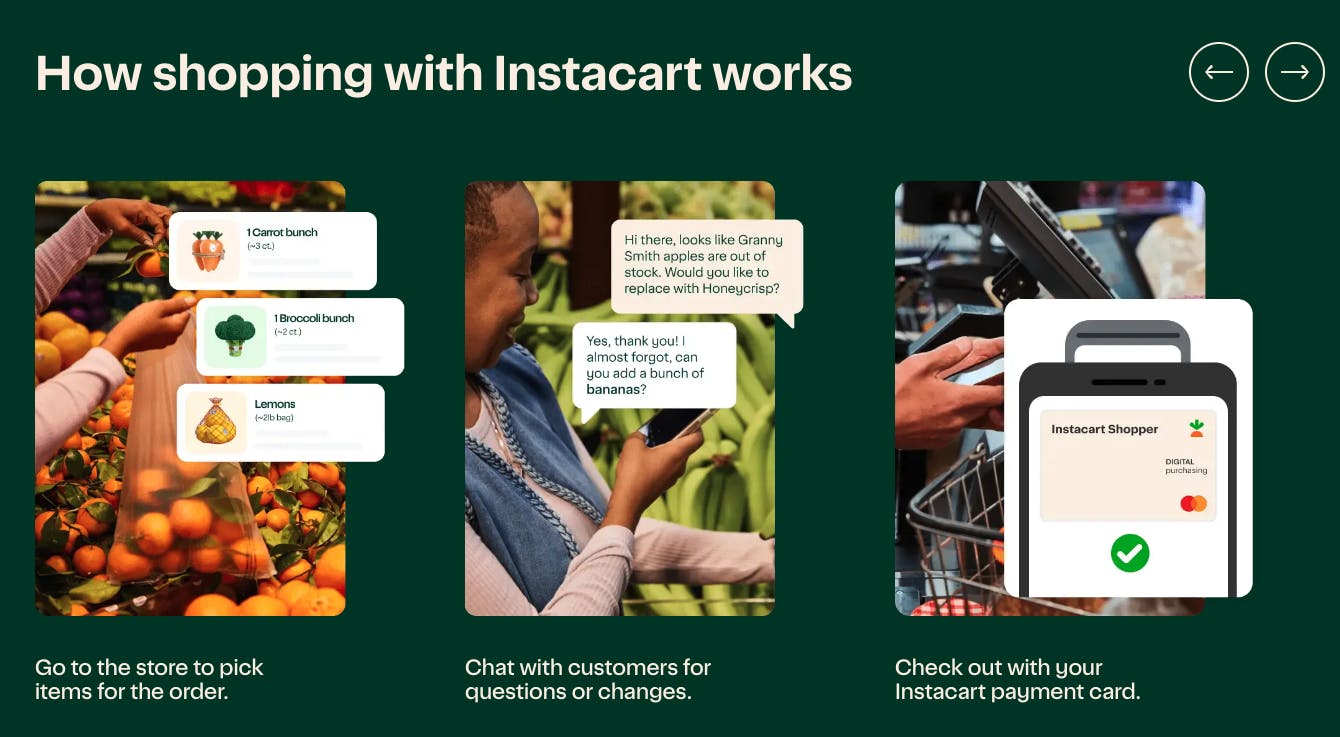

Shoppers on the Instacart platform can work on flexible schedules and choose when and how much they want to work. This flexibility, combined with access to a large network of customers, creates an appeal for workers looking for easy access to gig income. Gig work is often a source of income for the unemployed, those who live paycheck to paycheck (63% of Americans), or those who need a job that can adapt to their schedule.

Instacart has built technology to make its shopper workforce as efficient and effective as possible. It balances supply and demand to ensure there are always enough shoppers to fulfill orders promptly. When something happens to disrupt the equilibrium (i.e., bad weather, holiday, etc.), Instacart can scale up the number of shoppers.

The shopper-facing app and website also create quick routes for shoppers to find the necessary items and fulfill the order. If something is out of stock, it recommends a backup plan. Whenever a shopper needs to change the order or has a question, he or she can quickly contact the customer. The barcode scanner inside the app enables shoppers to verify that the item picked is the exact item requested.

Retailers

Source: Instacart

Retail or grocery stores that partner with Instacart are typically attracted by the ability to grow their reach through new sales channels on an established marketplace, facilitate on-demand delivery, and gain valuable customer insights. Instacart has established partnerships with leading grocery stores, which helps to ensure a steady supply of products for customers.

Brands

Instacart serves ad inventory on its app, website, and on the online storefronts of retail partners for purchase by CPG brands. Ads are served to customers in the act of shopping, which the company therefore classifies as “high-intent” customers. For CPG brands, driving discovery has traditionally been done through in-store, physical channels which imposed a high barrier to entry. Instacart seeks to serve brands looking to complement the traditional in-store discovery model with its ads product.

Instacart Marketplace

Instacart’s Marketplace product, which the company described as “the largest online grocery marketplace in North America” in its August 2023 S-1 filing, is its original, core product offering. It allows shoppers to browse, shop, and order groceries for pickup or delivery from national, regional, and local retailers through the Instacart app or website. Once a customer has completed their order, the marketplace draws on Instacart’s network of shoppers to fulfill the order.

Instacart Enterprise Platform

Instacart went beyond its marketplace model to become a technology provider to retailers with the launch of what it initially called the Instacart Platform in 2022 to help with online storefronts, fulfillment & logistics, brand ads, and inventory management. The company has unbundled the services it provides in its marketplace model so as to increase its appeal to retailers who want to use their digital properties to retain direct relationships with consumers. Instacart describes its Enterprise Platform as “an end-to-end technology solution that powers retailers across all aspects of their business.” Its components include:

Ecommerce: Instacart powers ecommerce storefronts for retailers like Sprouts and Publix, while also providing product discovering tools, merchandising, payment models, and loyalty-as-a-service.

Fulfillment: Retailers can use the Enterprise Platform to help them fulfill grocery orders placed at their stores directly with Instacart shoppers; they can also use an Instacart-provided API to help fulfill orders coming through online storefronts. According to Instacart, the retailer can opt to either use Instacart shoppers for fulfillment or they can use their own employees, or a combination of both.

Carrot Ads: Carrot Ads is Instacart’s enterprise ads offering, which retail partners can use to serve CPG brands’ ads on their own online storefronts. It also enables retail partners to serve targeted promotions to customers.

Insights: This aspect of the Enterprise Platform is intended to give retailers “real-time visibility into their operations” on key metrics such as item popularity, inventory levels, order sizes, delivery times and ratings, and sales.

Instacart Ads

Instacart’s ads platform, which is a separate offering from its Enterprise Platform “Carrot Ads” service, is described by the company as allowing “CPG brands to drive sales by engaging with customers who are actively shopping for products on Instacart.” It also aims to benefit customers by enabling new product discovery and savings opportunities. Instacart offers an array of ad products including sponsored product ads, display ads, brand pages, and coupons.

Market

Customer

Consumers

Instacart consumers are typically looking for a convenient way to shop for groceries and household items from their local stores without having to leave their homes. Customers can pick up groceries from the store, have them delivered for a fee, or subscribe to Instacart+ for free deliveries above $35.

This category of Instacart users can include all types of people, including those who place a premium on their time or who don’t have easy access to a method of transporting their groceries. According to Instacart, in-store shoppers spend ~60 hours per year shopping in-store; many of its products provide value by eliminating this time expenditure for users.

Instacart also offers a membership service, Instacart+, which the company claims provides $30 of monthly savings via its membership benefits on average. It also says that Instacart+ members shop at “more than twice as many retail banners” after joining Instacart+ than non-members.

Shoppers

Instacart attracts shoppers by providing workers with flexible opportunities to generate supplemental or primary income. Shoppers can choose to work as independent contractors and get paid per batch completed, or become an Instacart employee and get paid hourly (up to 29 hours).

The company claims that since its founding, shoppers have earned a total of more than $15 billion on Instacart. Within the gig economy, Instacart strives to differentiate itself as an employment option. According to the company:

“Shopping with Instacart is differentiated from other flexible alternatives, like rideshare or restaurant delivery, because nearly half of the time is spent in-store and the work can often be done throughout the day. Instacart offers shoppers a guaranteed minimum batch payment that we believe is attractive relative to others in the industry and also offers first-of-its-kind tip protection,62 covering a tip up to $10 if a customer chooses to remove their tip after delivery without reporting an issue with the order.”

Retailers

Instacart appeals to retail stores looking to expand their reach and customer base. With Instacart they are able to offer their products to a potentially wider audience which could increase their sales. Retailers can also use Instacart to streamline their in-store operations by having Instacart shoppers handle the delivery process.

Brands

Instacart appeals to brands by providing a new platform for advertising and exposure. Brands can reach new customers and promote their products, helping to increase brand recognition and drive sales.

Market Size

As of April 2021, Instacart was available to over 85% of US households and 70% of Canadian households. By mid-2022, Instacart had captured an estimated 3% share of the total grocery ecommerce market (up from 1% in 2019). Ecommerce orders fulfilled by delivery grew an estimated 77% from 2019 to 2021 and are expected to continue to grow.

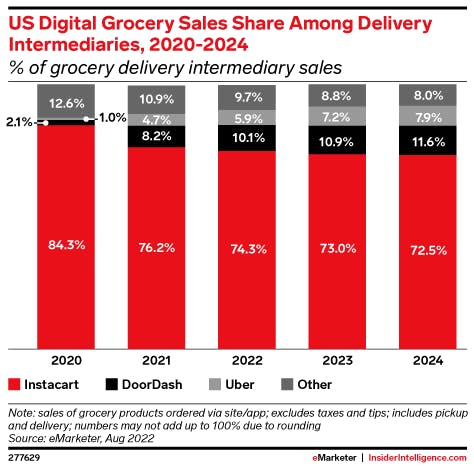

Source: Insider Intelligence

While Instacart still only claims a small portion of the grocery ecommerce market which is dominated by Walmart and Amazon, it is a market leader in the US third-party grocery delivery market, which is its niche of focus. As of the end of 2022, Instacart claimed nearly 75% of the market, followed by DoorDash*, which represents less than 10% of third-party deliveries. The global online grocery delivery service market, which was valued at $285.7 billion in 2021, is expected to grow at a CAGR of 25.3% until 2030.

As Instacart pointed out in its S-1 filing, grocery is the largest category of retail and represents a $1.1 trillion market in the US alone, but has been slower to move online than other retail categories with only 12% digital market penetration as of 2022 in the US (compared to 38% for clothing and 20% for home goods, for example). The company also points out that online grocery penetration grew slowly but is accelerating; it grew from 1% of sales in 2009 to 3% in 2019 (ten years to triple) but reached 12% by 2023 (quadrupling in four years).

Competition

Food Delivery Apps

Uber Eats: Uber launched an on-demand grocery delivery service via its food delivery app, Uber Eats, in 2020. As of July 2022, it had added 24K grocery stores to Uber Eats around the world, including Albertsons, Carrefour, Costco, and Woolworths. As of September 2022, Uber said its grocery and retail operations platform has grown to more than $4.5 billion globally, delivering millions of products from partners across 33 countries. Uber has been a public company since 2019 and has a market cap of $92.5 billion as of September 2023.

DoorDash: DoorDash, which was founded in 2013, launched an on-demand grocery delivery service in 2020. Its grocery partners include Albertsons-Safeway, Walgreens, and Wawa. DoorDash had more than 75K non-restaurant retail stores across North America on its marketplace as of September 2022. DoorDash went public in 2020 and has a market cap of $30.1 billion as of September 2023.

Retail Giants

Amazon: Amazon Prime members can order groceries and household essentials through Amazon Fresh. Prime members also have exclusive access to Whole Foods grocery delivery and pickup, but Amazon Fresh has a larger variety of items to choose from in multiple supermarkets. Depending on the order size, customers with orders worth less than $150 are charged between $3.95 and $9.95. Amazon was founded in 1994 and has a market cap of almost $1.4 trillion as of September 2023.

Walmart: Customers can get groceries delivered through Walmart Plus without a membership, but delivery fees range from $7.95 to $9.95. With the Walmart Plus membership, delivery is free. Walmart’s US ecommerce business reached $47.8 billion in 2022. With Walmart Plus, customers can shop for groceries and household essentials including brands only available at the retailer, like Sam’s Choice, Freshness Guarantee, Parent’s Choice, and more. Walmart was founded in 1962 and has a market cap of $438.3 billion as of September 2023.

Quick Commerce

Shipt: Shipt was founded in 2014 and bought by Target in 2017 for $550 million. As of December 2020, it delivered groceries and other items from 200 retailers. Its monthly or annual membership offers free delivery.

Jokr: Jokr a quick commerce company founded in 2021 and has raised over $400 million in funding. It said it was shuttering its New York and Boston deliveries as of June 2022 and leaving the US market altogether.

Gopuff: Gopuff was one of the earliest quick commerce players. It was founded in 2013 and raised over $3 billion in funding. The company delivers snacks, drinks, alcohol, essential goods—and, in some markets, fresh food with a 30-minute guarantee. In May 2022, Gopuff’s sales were 391% higher than in May 2019.

Getir: Istanbul-based Getir, last valued at $11.8 billion, has operations in nine countries including Turkey, the U.S., the U.K., Germany, and France. It expanded across Europe in 2021 and entered the US in 2022.

Business Model

Instacart runs on an asset-light model. It doesn’t house trucks or maintain warehouses but instead leverages an existing network of grocery stores. Instacart marks up items making them slightly more expensive than the same item in a store. Instacart states this price difference is usually as small as 5%, but others claim there is a 15% markup on grocery items.

Its subscription business, Instacart+ (formerly Instacart Express) offers premium features like unlimited deliveries, cheaper service fees, and no surge pricing. For $99 annually or $9.99 monthly, Instacart+ allows regular customers to save on fees, while providing recurring revenue for the company. According to the company’s August 2023 S-1 filing, Instacart+ members represented 57% of its gross transaction value (GTV), or $8.5 billion, and members generated 6.2x more GTV on average than non-members over a five-year period.

Users pay $3.99 for same-day delivery of orders over $35. The fees for smaller orders vary depending on location. Instacart+ members do not pay delivery fees for orders over $35. The service fee covers operations, background checks, support, and insurance and is 5% of the order cost. Additional costs are incurred if alcohol is purchased or the estimated order weight exceeds 50 pounds. Instacart+ members pay a reduced fee. Orders with a delivery window of 60 minutes or less incur a priority fee starting at $2 and increasing based on driver availability.

Retail partners may also use the Instacart Platform for logistics, analytics, and more. Brands that advertise their products on the app pay through a cost-per-click model. Instacart summarized its business model in its S-1 filing as follows:

“Our revenue consists of transaction revenue, primarily from fees paid on each order by retail partners and customers, as well as advertising and other revenue, primarily from advertising fees paid by brand partners. In 2022 and the six months ended June 30, 2023, our transaction revenue and advertising and other revenue were approximately 6.3% and 2.6% and 7.2% and 2.7%, respectively, of GTV.”

Traction

Instacart delivers to 13K cities across North America from over 75K retail locations. Delivering from 1K retailers and spanning 75K+ stores in North America, Instacart covers more ground than its direct competitors and has large partnerships (i.e., Costco, Walmart, CVS, Kroger).

In 2019, Instacart reportedly lost $25 million monthly, struggling to gain enough customers on its platform to reach economies of scale. Supercharged by COVID-19 pandemic-induced digitization and an uptick in the adoption of grocery delivery services, 2020 launched Instacart to new heights, recording its first profitable month in April 2020.

From 2019 to 2020, Instacart nearly doubled the users on their platform from 5.5 million to 9.6 million, requiring the company to increase the number of in-store shoppers it employed almost 4x from only 130K to 500K. Due to the pandemic, 48% of American adults ordered groceries at some point during 2020. From 2019 to 2021, the company tripled its market share to 3% (from 1% in 2019) of the total grocery ecommerce universe.

The company has ~21.5% share of goods sold through retailers like Costco, Kroger, and Aldo. Instacart reportedly reached a revenue run-rate of $1.8 billion in 2021, growing nearly 400% on a 2-year stack. However, growth decelerated to 15% YoY in 2021 after expanding nearly 330% in 2020.

As of August 2023, Instacart’s retail partners included over 1.4K retailers which together represented more than 85% of the US grocery market. The company reported that its GTV grew at a CAGR of 80% between 2018 and 2022 and that it generated $29 billion GTV in 2022. It also reported to have 7.7 million MAUs as of August 2023 who spent, on average, ~$317 monthly.

In addition, Instacart reported in its S-1 filing that 5.5K brands were using Instacart Ads and that since the founding of the company, the Instacart Marketplace had seen over $100 billion of GTV, more than 900 million orders, and ~20 billion items ordered. The company also reported that it had 4.6 million Instacart+ members as of June 2022 and that this had increased to 5.1 million within a year, as of June 2023.

Valuation

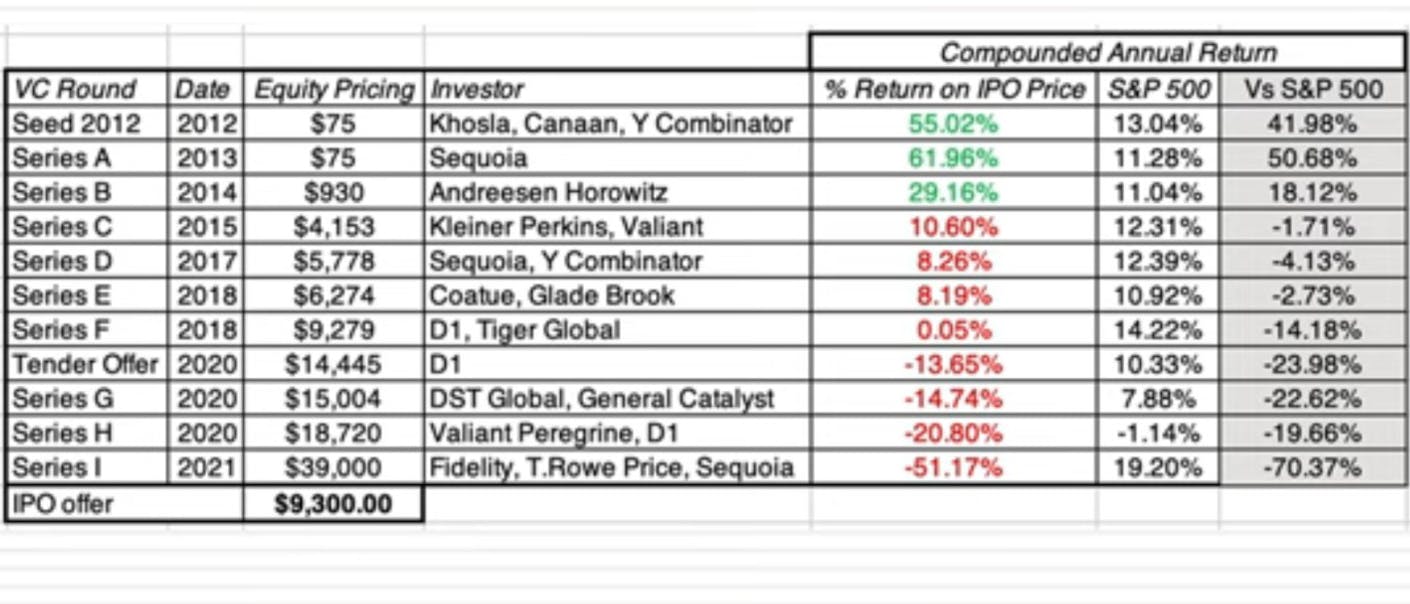

Prior to its IPO, Instacart announced a $265 million funding round from existing investors, including Andreessen Horowitz, Sequoia Capital, D1 Capital Partners, and others, in March 2021. That funding pushed the company’s valuation to $39 billion — more than double its $17.7 billion valuation when it raised its previous round of financing, a $200 million venture round in October 2020. This round brought its total funding prior to IPO to $2.9 billion.

As of the beginning of 2023, the company, previously valued at $39 billion, reduced its internal valuation to as low as $10 billion. It submitted an SEC filing to IPO in 2022 after hyper-growth in 2021 but submitted a draft registration statement in October 2022. Instacart went public in September 2023 at a market cap of ~$14 billion. This IPO price represented a significant loss for many later investors of Instacart, with its peak valuation private markets being almost 3x its market cap at IPO.

Source: Aswath Damodaran

Key Opportunities

Expanding Use Cases

Instacart sees expanding use cases and increasing accessibility as one of its key growth strategies. This includes investing in new fulfillment and in-store options, including affordable options like no rush delivery, next-day delivery, and pickup. It also intends to drive forward the online grocery market as a whole by growing online penetration with investment in incentives, marketing, and partnerships. With its enterprise platform, Instacart also intends to extend its offering to non-grocery retailers. The company believes it will partner with a greater number of non-grocery retailers over time.

International Growth

Though it announced plans to expand past the US and Canada in May 2022, Instacart has yet to push operations across American borders. The United Kingdom, France, and the Netherlands all show promising growth in the online grocery sector. India has also shown rapid growth in the instant delivery category, with companies like Zepto* leading the charge. The number of European grocery delivery startups has exploded since 2020.

Overall, it is estimated that by 2025 grocery ecommerce sales will account for 21.5% of all grocery sales. There is enough opportunity in the US to continue growth for Instacart, but delaying international growth allows competitors to stake their territory, powered by the number of users creating hard-to-fight network effects.

Product Expansion

Though Instacart has expanded its product catalog over the years, the diversity of products listed is still limited. It could offer more offerings like financial products to its shoppers. It could go beyond ads and insights for the brands that advertise on its platform. It could increase the scope of the platform to deepen its relationships with retail partners.

The opportunity to expand to different verticals also exists. It could compete with DoorDash, and Uber Eats by delivering restaurant-made meals, or it could pursue Blue Apron and HelloFresh by delivering meal kits. As many companies begin mandating a return-to-office protocol, corporate grocery delivery, and employee meal plans may be another business expansion opportunity.

Key Risks

Growth and Profitability

In its S-1 filing, Instacart itself admits that “we have a history of losses, and we may be unable to sustain profitability or generate profitable growth in the future.” It also acknowledges that its rapid growth over its history may be unsustainable going forward and that the scale the company has now reached implies a degree of complexity that “makes it difficult to plan for future operations and strategic initiatives.” Its unit economics are also an acknowledged risk, as the company also admits that “if we fail to cost-effectively acquire new customers… our business could be harmed.”

Intense Competition

Dozens of startups, retailers, and public companies globally are competing to bring groceries to people’s homes. Consumers can simply shop for the best discount forcing Instacart to either eat more losses or lose business. When it comes to a willingness to lose margin in order to outlast the competition, Instacart might be able to outlast upstarts, but the retail giants have considerably more resources to engage in the race to the bottom competition. Vertically-integrated delivery players have raised hundreds of millions of dollars to become the next generation of delivery-first retailers, posing an orthogonal competitive threat to Instacart’s model. As Instacart itself acknowledged:

“The markets in which we participate are highly and increasingly competitive, with well-capitalized and better-known competitors, some of which are also partners.”

Dependence On Retailers

Most of Instacart’s revenue is associated with the purchase of goods from large retailers. While these partnered companies benefit from the preexisting customer base on Instacart, they could follow Walmart’s example and build out their logistics network and digital storefronts. If most customers channeled through Instacart are loyal to big retail brands and the delivery service is comparable, these consumers could instead order directly from the retailer to save money.

For example, Heinen’s, a large midwestern retail chain, discontinued access to Instacart in February 2023, and instead opted to self-fulfill online orders and provide curbside pickup and delivery. The company itself acknowledges this risk by stating that:

“The success of our business is dependent on our relationship with retailers. The loss of one or more our retail partners or reduction in their engagement with Instacart could harm our business.”

Consumer demand

Supermarket News, NBC, and others have noted the groceries sold on Instacart see a markup of up to 25%, before the delivery fee, membership subscription, and tips to the driver. Per capita, disposable income dropped nearly 8% during 2022. Combined with mass layoffs and looming recession fears, consumers might look for more cost-effective ways to buy groceries.

Labor Disputes

Over 90% of Instacart’s shoppers are independent contractors, not part-time employees. Disputes over pay, working conditions, and benefits have been a source of friction for all companies with gig workers. In October 2022, Instacart was forced to pay $46.5 million after settling with the city of San Diego based on claims from Californian workers that they were improperly classified as independent contractors rather than as employees.

Summary

Instacart’s success has been predicated on creating tech-driven logistics hubs and leveraging valuable grocery real estate within a few miles of consumers. The average US citizen lives less than one mile from the closest grocery store, but that single mile can be a significant source of friction for many. Instacart’s customer and revenue growth since 2020 speaks to its product-market fit and the success of its go-to-market strategy. Despite the onslaught of competition from players like Amazon Fresh, Uber, and Shipt, Instacart is among the businesses that used VC funding to take market share. However, following an IPO that priced the company far below its peak valuations, its future growth profile is left in question after the COVID-19 pandemic tailwinds have subsided. Customer growth and market share gains were likely pulled forward. Thus, the focus has shifted to more revenue growth levers like advertising on the business-to-business side and subscription dollars on the consumer side.