Thesis

Historically, the cost of starting a business was quite high. For software companies, for example, starting a business included racking physical servers and investing in meaningful physical infrastructure before a company could even start building a product. That cost has since dropped significantly. From 2000 to 2011, the cost of building a startup dropped from an estimated $5 million to $5K. With the expansion of things like Apple’s App Store and cloud computing like AWS, that cost has only continued to drop. As the cost of starting a business drops, the level of competition in the market increases.

More competition means every dollar of revenue is harder to get access to predictably. According to a 2021 survey, a majority of firms miss the mark when it comes to measuring the accuracy of their revenue forecasts. Only 18% of respondents said their quarterly forecasts are within 5% of their actual revenue, with that number dropping to 15% for monthly forecasts. Most firms are off on their forecasts by 20% or more. Another survey of executives at more than 1.7K companies indicated that 85% of respondents believe their pricing decisions could improve, and only 15% have effective tools and dashboards to monitor revenue generation.

Revenue growth management (RGM) is a field that has sprung up to help companies better address the increased competition for every dollar of revenue. This includes addressing price changes, inventory levels, distribution channels, and market demand. As a result, the global market for revenue management is projected to grow from $19.3 billion in 2022 to $48.4 billion by 2032.

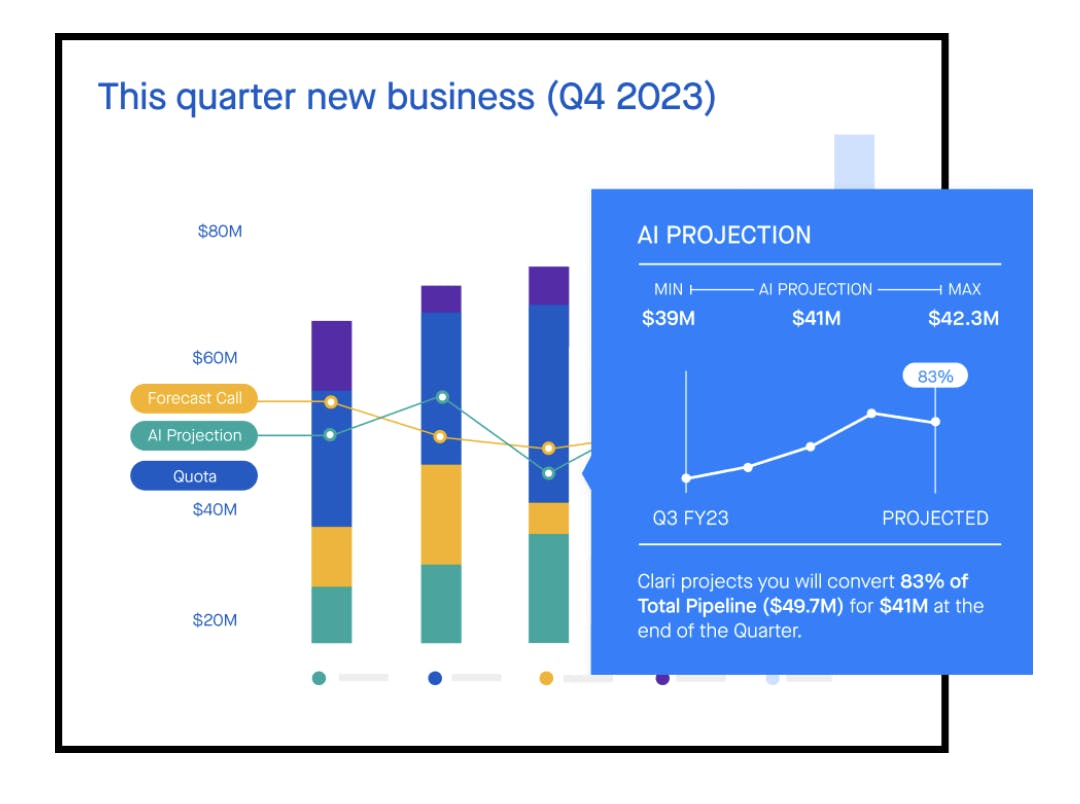

That’s where Clari comes in. Clari offers a suite of products designed to support the revenue management process. The company focuses on providing actionable insights for forecasting, revenue intelligence, and pipeline management. Clari has also leveraged AI, patenting technology in 2021 such as RevAI, into the Clari Revenue platform. One 2020 estimate indicated that automated revenue management platforms can help increase revenues by up to 5% in less than nine months.

Founding Story

Source: Clari

Clari was founded in 2013 by Andy Byrne (CEO) and Venkat Rangan (CTO).

Byrne studied economics at the University of Nevada (Reno) and later got his MBA from San Jose State University in 1996. In 1997, he was recruited by Jim Goetz, a partner at Sequoia since 2004, as a product manager for VitalSigns Software which Goetz co-founded. This was where Byrne met software engineer and chief architect Venkat Rangan, with whom he would co-found Clari more than a decade later.

Rangan, an IIT Madras graduate, got his Master’s in Computer Science from the University of Miami in 1983. After working in various roles as a software engineer, program manager, and Chief Architect at VitalSigns, Rangan co-founded Clearwell Systems in 2004 and simultaneously worked at Sequoia Capital as an entrepreneur-in-residence. Goetz, who worked with Rangan at Sequoia, recommended Byrne when Rangan needed a program manager for Clearwell Systems. Byrne later joined Clearwell as a VP in 2005.

Clearwell used machine learning (ML) to search digital correspondence during legal discovery, replacing what had been a manual process of searching thousands of pages. Byrne’s experience with AI and ML at Clearwell led him to a couple of realizations. As an entrepreneur and leader, he had spent his career nurturing sales and marketing teams and noticed (1) there always seemed to be too many clients and too much communication, (2) there was a lack of proper pricing and revenue information to make informed decisions, and (3) that customer relationship management software (CRM) implemented at the time was not effective in revenue forecasting. In a profile on the company by Sequoia, it was explained this way:

“Byrne was convinced machine learning could help sales reps close deals faster, drive more revenue and increase revenue forecasting, predictability and accuracy, what he calls ‘the golden triangle.’”

After Clearwell was acquired by Symantec in 2011, Byrne and Rangan began working on Clari, a revenue collaboration technology that gathered thousands of bits of sales-related data and applied AI to synthesize it and derive actionable insights for pricing and revenue. In this way, sales teams could “connect more deeply with people, not spreadsheets.”

In April 2014, Sequoia Capital provided Byrne and Rangan with office space and also led Clari’s Series A, in which the company raised a total of $6 million. Initially, attracting clients was a problem. Clari’s target demographic was sales reps. However, adopting Clari required these reps to change how they work and learn new systems and habits. As Rangan explains:

“The roadblock was that our product required a change in behavior of individuals.”

Byrne and Rangan pivoted to approaching sales leaders, which enabled the company to acquire its first 250 customers.

Since 2022, Clari has made two notable acquisitions: (1) Groove, a competitor and player in sales engagement, and (2) Wingman (now Copilot), a leader in conversation intelligence that allows Clari’s platform to analyze customer and employee conversation data, extract AI-driven insights, and predict revenue outcomes. With these acquisitions, Clari intends to support the entire revenue lifecycle and enable teams to make more informed business decisions.

Product

Source: Clari

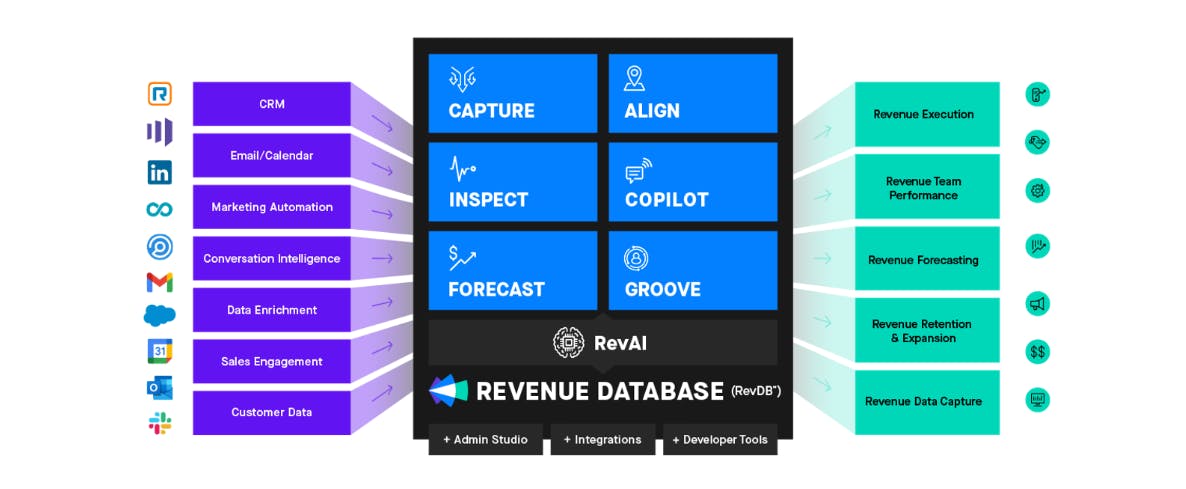

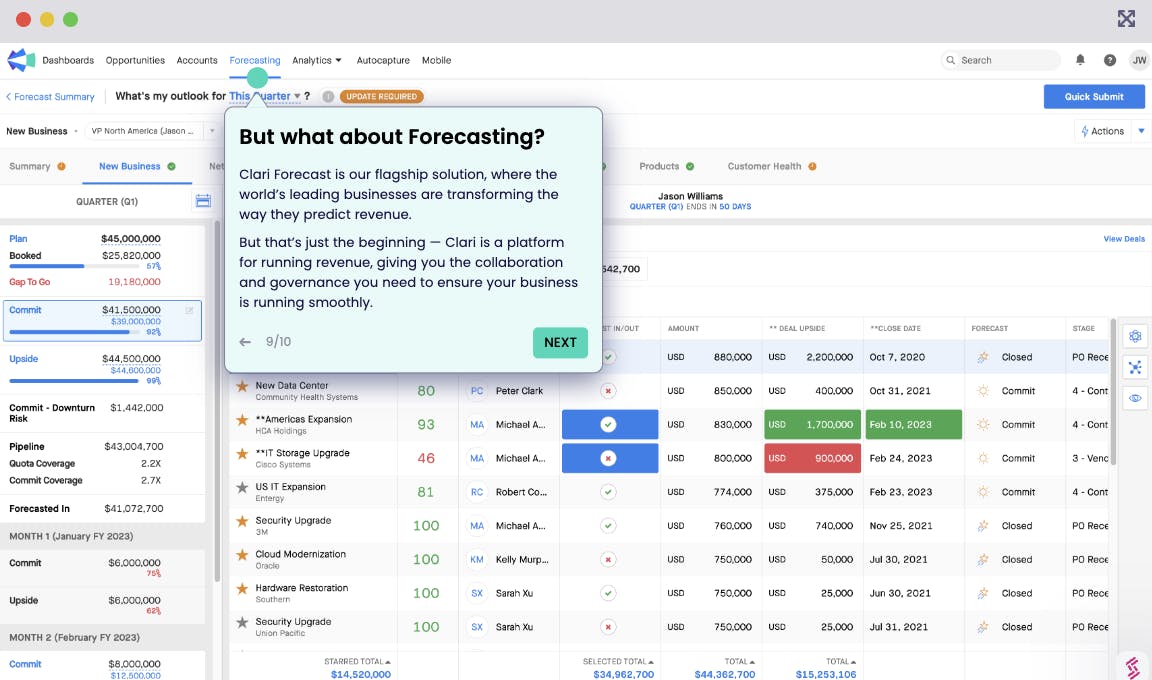

Clari offers a suite of products designed to support a customer’s revenue operations. It aims to manage revenue as an enterprise-wide process (spanning all revenue-critical employees) and not as a single department. This approach is characteristic of the modern Revenue Operations (RevOps) movement within RGM, which aims to connect sales, marketing, and revenue teams. While the company’s original flagship product was Forecast, the platform has since expanded across a number of different modules.

Capture

Source: Clari

Clari Capture reduces the manual work of CRM data entry by automatically capturing every revenue-critical signal to power a more intelligent revenue process. It captures deal activity across email, calendar, calls, and more while improving data quality and organization. This allows reps to spend less time crunching numbers and matching or organizing information. Clari Capture offers a more automated comprehensive record of revenue data that is accurately matched to the right account, deal, or opportunity.

Capture helps prioritize details in driving deals forward. It tracks metrics like who’s engaged on deals and what is missing, removing time spent on organization. As a result, teams can focus on building relationships with the broader stakeholders in the buying process. With a more complete record of revenue, Capture allows for the re-engagement of lost opportunities and the running of targeted campaigns using auto-captured contacts.

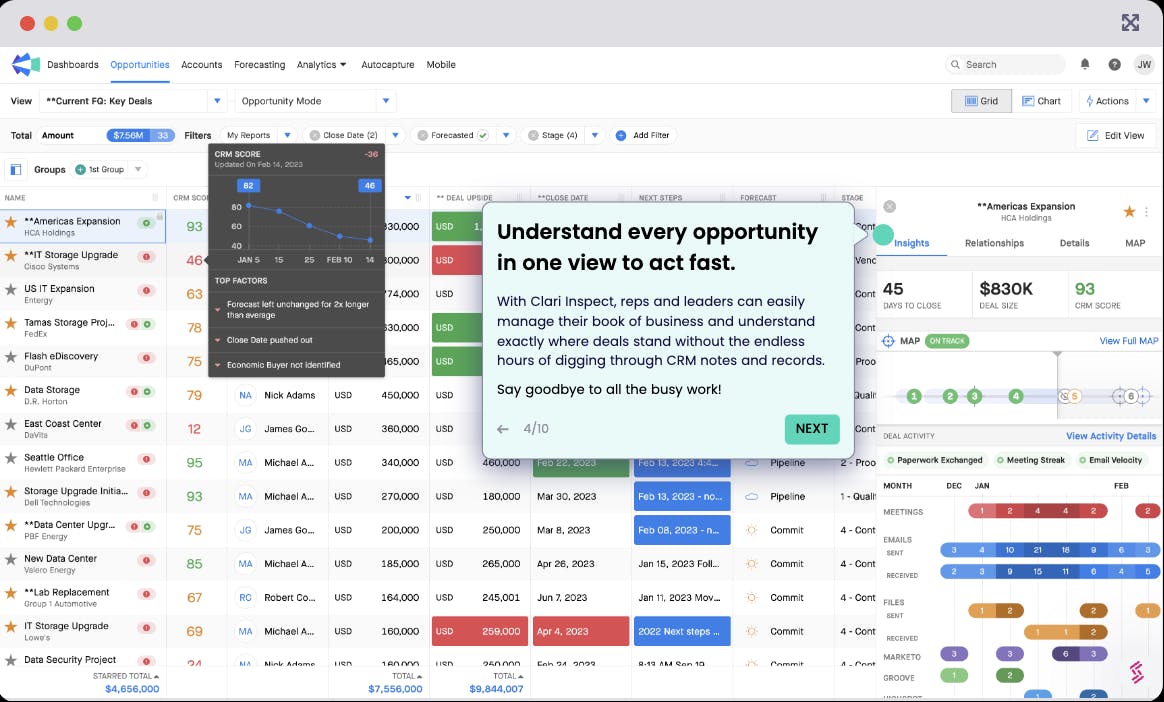

Inspect

Source: Clari

Clari Inspect enables customers to inspect business accounts and opportunities, spot risk, and take swift action. Inspect also provides AI-driven health scores for specific categories so reps and managers can invest time where it is needed the most.

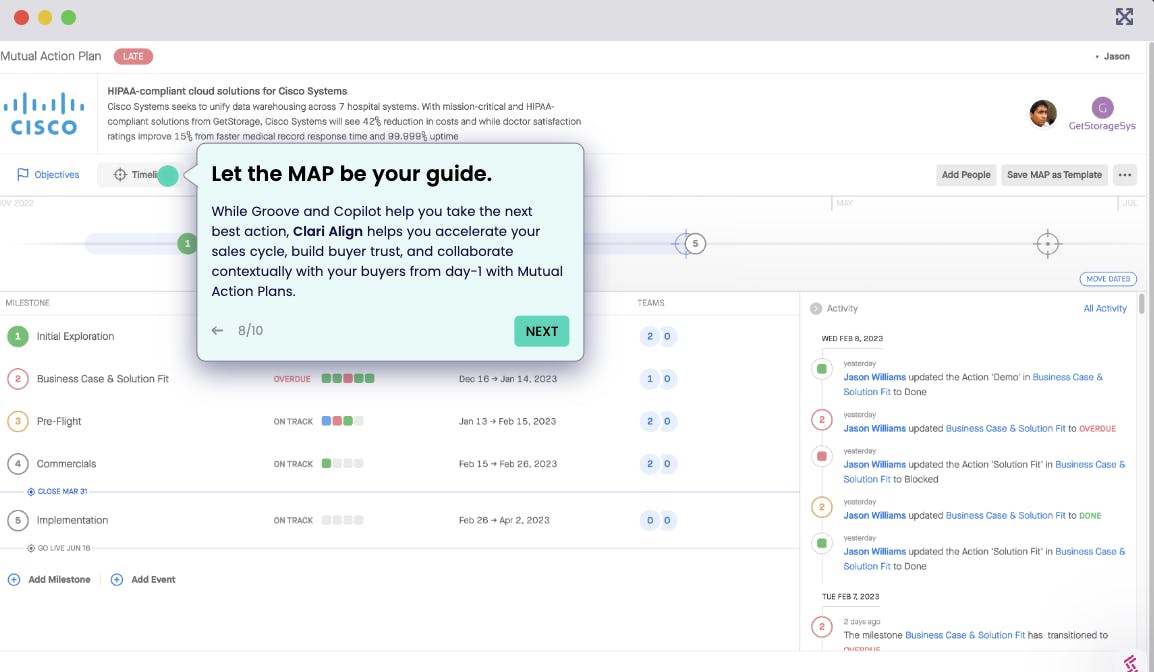

Align

Source: Clari

Clari Align helps share plans in a unified space, align business objectives, manage stakeholders, de-risk the buyer, and improve conversion rates.

Align Home is a shared collaborative microsite and serves as a simpler alternative to building out a mutual action plan. It captures business objectives, surfaces deal artifacts, and enables actions to be assigned to Buyers in a unified buying experience, as opposed to sending several emails and PDFs that could get lost.

Timeline, a feature within Clari’s Align product, helps detail milestones and next steps. Internal and external stakeholders can be invited, private milestones can be implemented for internal discussion, and milestones can be tracked by team member to determine which key stakeholders/actions are missing. Mutual Action Plan templates provide a blueprint for how to go about deals and are completely customizable, and all files can be shared in one place within the Align workspace. This allows for continuity within sales cycles and also helps track buyer engagement — one of Align’s key deal health indicators.

Source: Clari

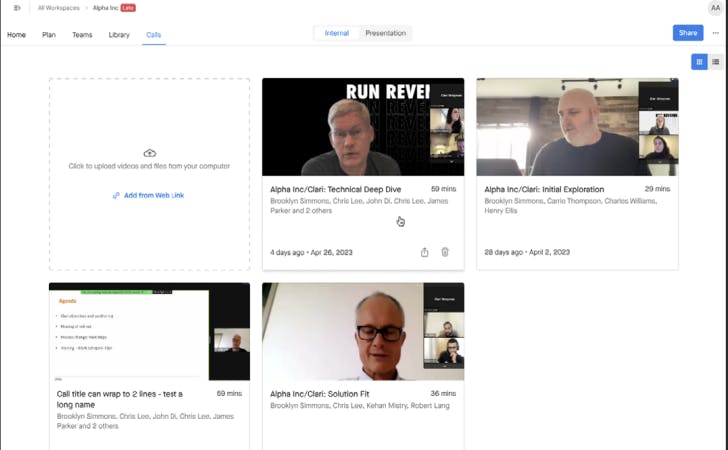

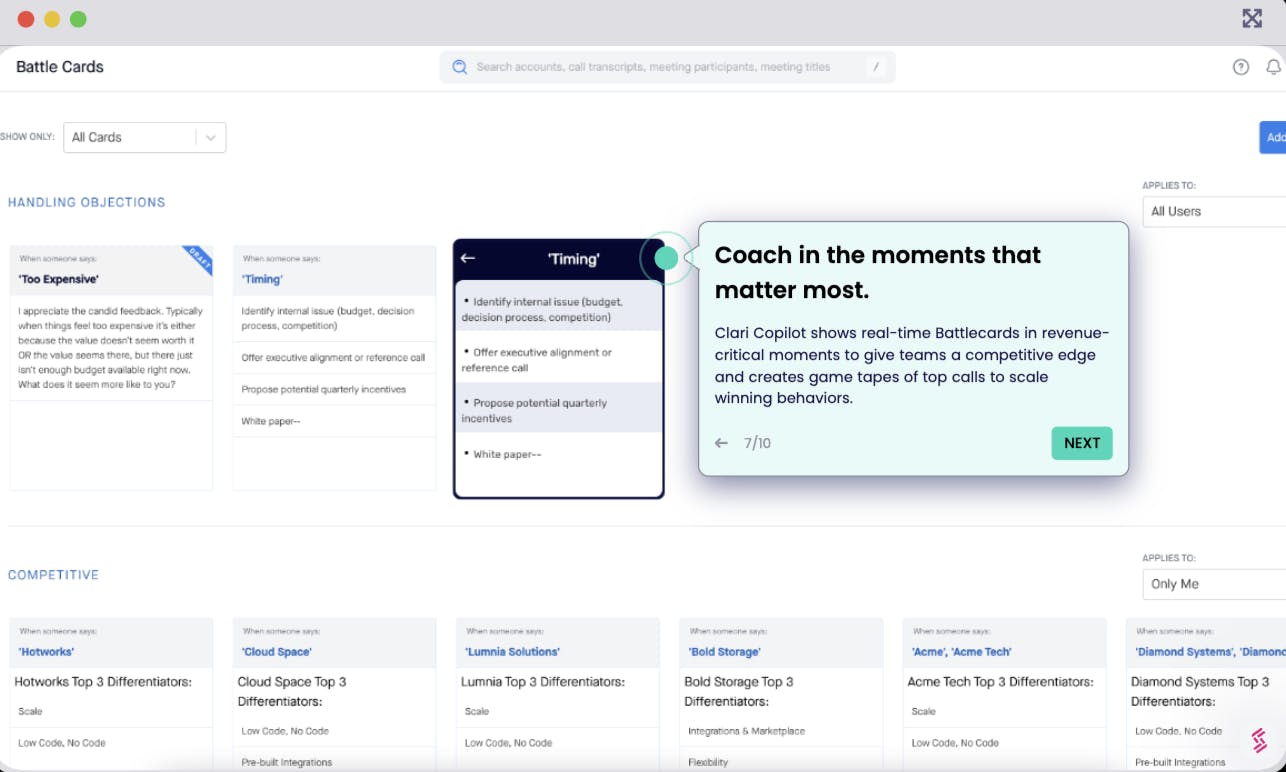

Copilot

Source: Clari

Clari Copilot’s conversation intelligence platform records calls and provides actionable insights in real time to help close deals and improve conversion rates. Key features of the module include actionable alerts, which are real-time “Battlecards” and monologue alerts which help reps with objection handling during client meetings. Recorded “game tapes” allow reps to playback successful meetings and learn from winning behavior. According to Clari, Battlecards have a 10% higher win rate.

Additionally, RevAI in Copilot helps deliver formatted call summaries, next steps, and suggested actions within Slack or Microsoft Teams based on gathered data from meetings. Copilot also records calls; all recorded conversations are centralized in one location and have search and filter features to help locate specific call recordings or transcript matches.

Forecast

Source: Clari

Clari Forecast provides a complete and accurate view of future revenue with tactical insights and, using RevDB, the next steps to help businesses get there. Forecast allows businesses to set realistic revenue targets, backed by historical performance and future needs, with customers reporting an average of an 11% increase in win rates. Clari also supports multiple business models and complex and custom hierarchies, including subscription revenue models. Clair claims that RevOps professionals see a 90% reduction in time spent on forecasting and related activities after the implementation of Clari Forecast.

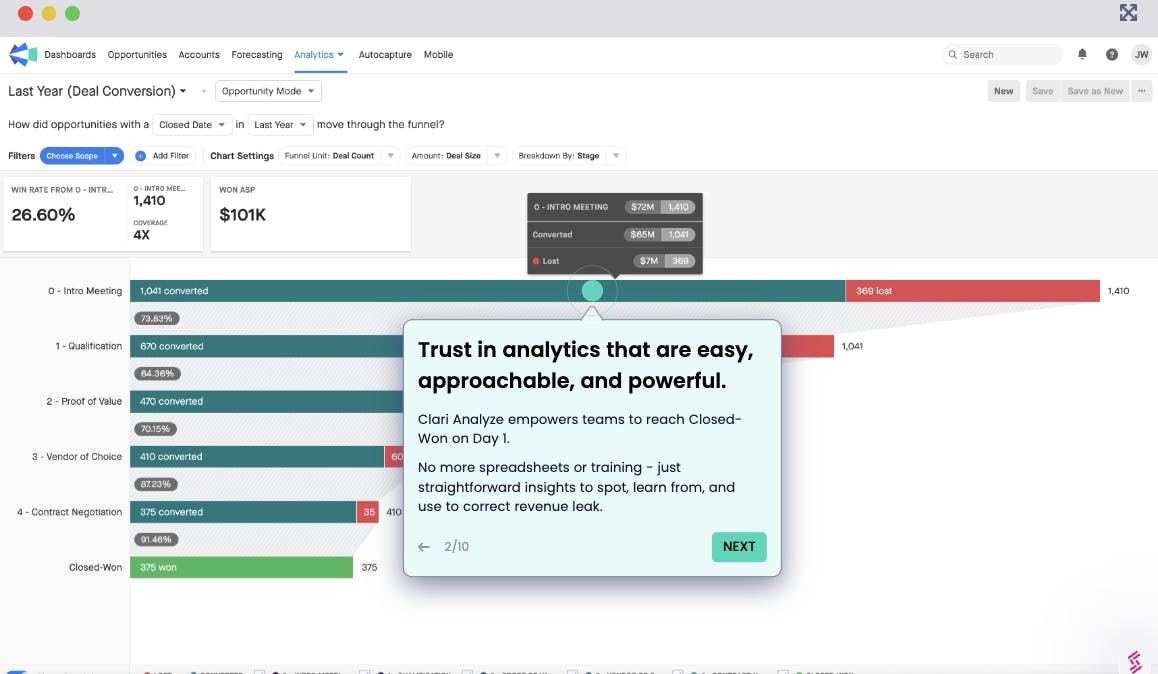

Analyze

Source: Clari

Clari Analyze provides visibility into various aspects of a business. Practical analytics, visuals, and straightforward insights help customers to spot, learn from, and implement in order to correct revenue leak. Clari emphasizes approachability and ease-of-access, which is why all reports and analytics are on one centralized dashboard and can be filtered by various metrics.

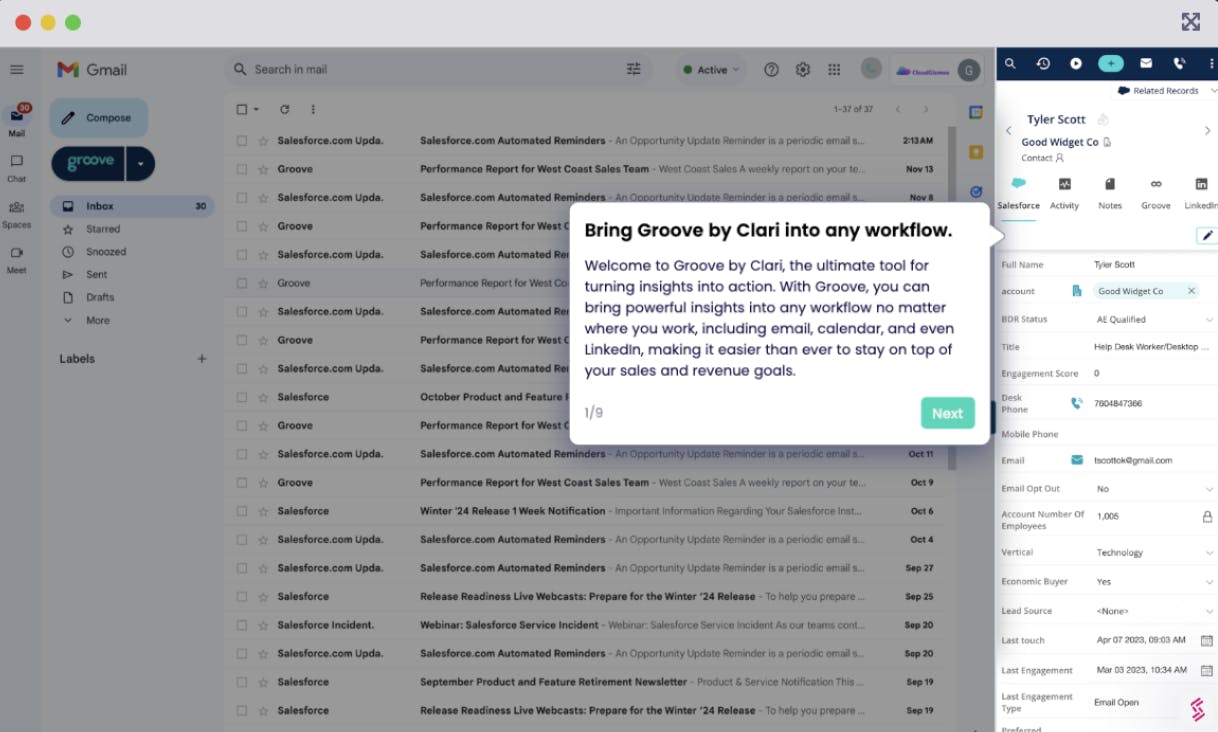

Groove

Source: Clari

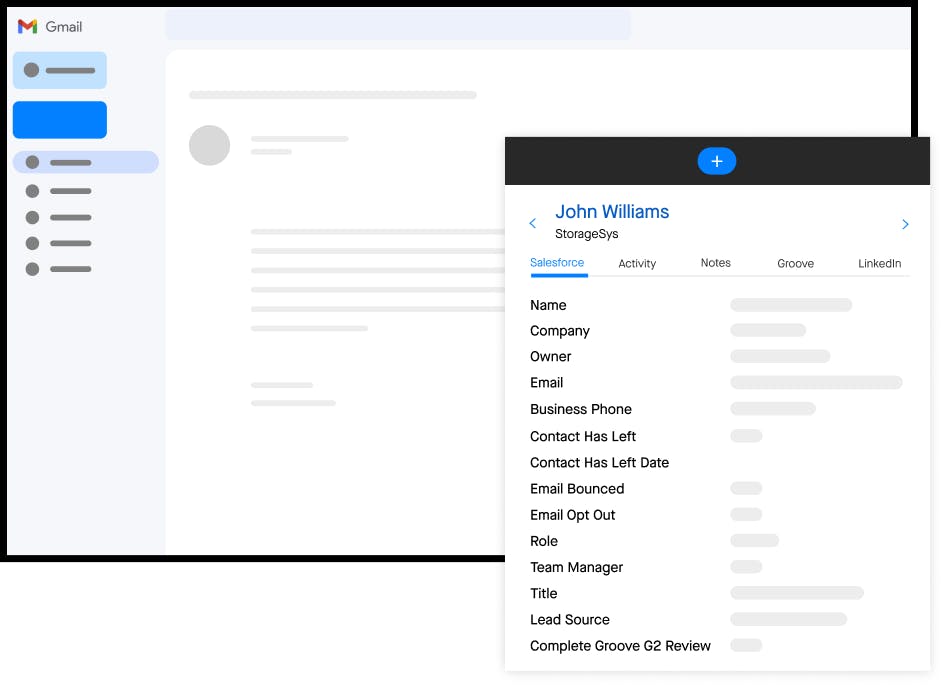

Groove by Clari allows customers to bring insights into any workflow from tools including email, calendar, and LinkedIn. It also updates Salesforce in real-time, surfacing relevant engagement history and providing alerts regarding revenue-critical actions and tasks.

Key features of the module include:

Groove Dialer: Dialer provides the ability to instantly initiate calls and texts from any tab in your browser. It also enables sellers to manage email templates by consolidating them into a single location, ensuring emails are effective, standardized, and on-brand.

Groove Scheduler: Scheduler allows for sellers to share a link with customers to enable them to easily access their team’s availability and schedule meetings instantaneously.

Groove Spaces: Spaces helps manage sales pipelines and opportunities on a centralized dashboard; it allows for visibility into every account’s progress and the ability to track effort versus engagement, assign tasks to team members, and collaborate with your team.

Groove Plays: Plays create revenue-critical actions for sellers to follow up on based on meetings, emails, and deal information from other sources, which minimizes opportunity loss and emphasizes revenue moments.

RevDB

Source: Clari

RevDB ensures revenue data is complete, actionable, and easy to use, with the ultimate goal of converting revenue leak into revenue precision. Currently, RevDB serves as the only database purpose-built to support revenue workflows. It helps format data, tailoring it to the respective organization so revenue teams can run custom analytics and act upon derived insights.

According to Clari, customers see up to a 95% increase in forecast accuracy with RevDB, and a 10% reduction in slipped deals. Clari also claims that RevDB is the industry’s largest revenue database, which means Clari’s ML and AI should have expansive revenue data to train models and predict outcomes.

Differentiation

Clari’s growing set of public APIs and data ingestion capabilities within the platform allows businesses to connect their own databases and custom-build platforms to suit their needs, along with providing real-time data and predictive insights. Integrations, another feature, enables businesses to implement their own data and tools into Clari’s revenue platform, allowing for a more streamlined process, similar to Clari’s APIs. Clari provides pre-built integrations, a database of compiled software, and also includes customer-specific customization.

The platform also includes Clari Insights Lab: Insights Lab analyzes data across Clari’s customer base to provide benchmarks, metrics, and assessments to help businesses boost performance and tailor KPIs.

Market

Customer

Clari’s customer profile is typically a medium to large-sized business operating in B2B SaaS. That said, Clari also supports other verticals including cloud security and cybersecurity. Because revenue leakage and wins are very easily quantifiable, Clari can estimate ROI and win rates and pitch itself to potential customers.

Clari leverages a mix-and-match, scalable market strategy. With no platform fee, customers can start with any of the offered modules and then stack them as needed. As of May 2024, Clari has 220K+ users across 170 countries — spanning both large public corporations as well as smaller private tech companies.

Zoom is a notable customer that was initially drawn to Clari’s UI because it allowed sales representatives to seamlessly update pipelines, insert forecasts to share internally, and overall save valuable time.

Databricks uses Clari’s forecasting solution to track and plan growth, win revenue moments, and mitigate revenue leak. Databricks’ VP of Sales, Jules Gsell, explains it this way:

“We use Clari to have more intelligent forecast conversations, especially when we look further out. By looking at historical trends, we can extrapolate where we’ll be going forward.”

Another customer, Tipalti, is an accounting software company that uses Clari to optimize sales rep performance and streamline team operations. As a growing business, Tipalti values being able to use meeting minutes to develop a strategy based on real-time data rather than going over the news.

At most companies, workflows are run using some combination of spreadsheets, business intelligence tools, and legacy CRMs. These solutions are not purpose-built to run revenue, resulting in them being ineffective. Clari’s end-to-end platform improves upon traditionally used software. In May 2024, customers were provided access to Clari Circle — a collaborative forum for revenue professionals to learn about Clari’s solutions, accelerate their own careers, and connect with others in the space. Clari Circle includes Clari Community, Clari University, and Knowledge Base — all of which serve as interactive tools to provide customer support and connection.

Market Size

The revenue management market was valued at $19.3 billion in 2022 and is expected to grow to $48.4 billion by 2032, representing a 9.7% CAGR. As the revenue management market grows, the opportunity for Clari to expand its customer base grows as well. Revenue management is becoming necessary for businesses to maintain competitiveness. One 2021 study found that implementation of revenue management platforms within SaaS businesses is expected to increase from 30% in 2021 to 93% by the end of 2024.

From a bottom-up perspective, the RevOps market was valued at $219 million in 2022 and is expected to reach $698 million in 2028, representing a 26% CAGR. It is important to note the distinction between revenue management and RevOps. While both markets are positively correlated, RevOps is an emerging movement within revenue management that focuses on unifying sales, marketing, and customer success through implementing new technology within legacy CRMs. Clari, while specifically classified as a RevOps technology, also falls under the larger, rapidly growing revenue management market.

Key drivers of growth include (1) an increase in adoption of revenue management platforms across companies, especially B2B SaaS businesses, (2) a growing need for increasing revenue management efficiency, and (3) a rising demand for modernizing legacy systems through AI integration.

Competition

The market for revenue management and AI-integrated revenue operation solutions is competitive, given the rapid expansion. In 2023, Clari acquired one of its competitors, Groove. However, the company still faces competition from other platforms, including emerging startups alongside well-established companies. Notable competitors include Gong, Salesloft, IBM’s Cloud Pak, and Salesforce’s Sales Cloud.

Salesloft: Salesloft’s patent-pending AI engine, Conductor AI, helps power its workflow automation product Rhythm. Founded in 2011, the company has raised $245 million as of February 2024. Salesloft raised $100 million at a $1.1 billion valuation in its Series E in January 2021, led by investor Owl Rock Capital. Rhythm synthesizes buyer behavior and turns its analysis into actionable recommendations, which are organized by impact on sellers’ workflow. The product’s key differentiation lies in this ability to prioritize and organize sellers’ processes by providing seller-specific insight and personalization, businesses can tailor Salesloft to their needs.

Gong: Gong was founded in 2015 as a tool to help record, transcribe, and analyze sales calls to improve employee performance and increase close rates. The company had over 4K customers as of February 2024; in its Series E round, led by Franklin Templeton, Gong raised $250 million. Gong has received $583 million in total funding, with backing from firms like Coatue and Sequoia. Its product is similar to Clari’s Co-pilot product, as it features conversation intelligence capabilities for sales reps.

IBM: IBM launched Cloud Pak for Data launched in January 2023 and offers a streamlined solution for data management. It is available for self-hosting or deployment on IBM Cloud. However, the software focuses more on organization rather than prescriptive analysis and forecasting — both of which Clari’s platform offers. IBM’s Cloud Pak platform, which includes six products or “Paks,” focuses on digital transformation and integrated AI analysis. Also, by verticalizing the software delivery process on its Red Hat OpenShift platform, IBM is able to offer its products to its customers.

Salesforce: Salesforce competes in the revenue management space with its Sales Cloud product. In November 2023, Salesforce launched new AI products within Sales Cloud, similar to an AI assistant Copilot. Like Clari, the software fits into a user’s CRM to improve seller productivity and help close deals faster. Salesforce can likely continue developing its product line and create a solution for sellers to optimize revenue performance.

Business Model

Source: Clari

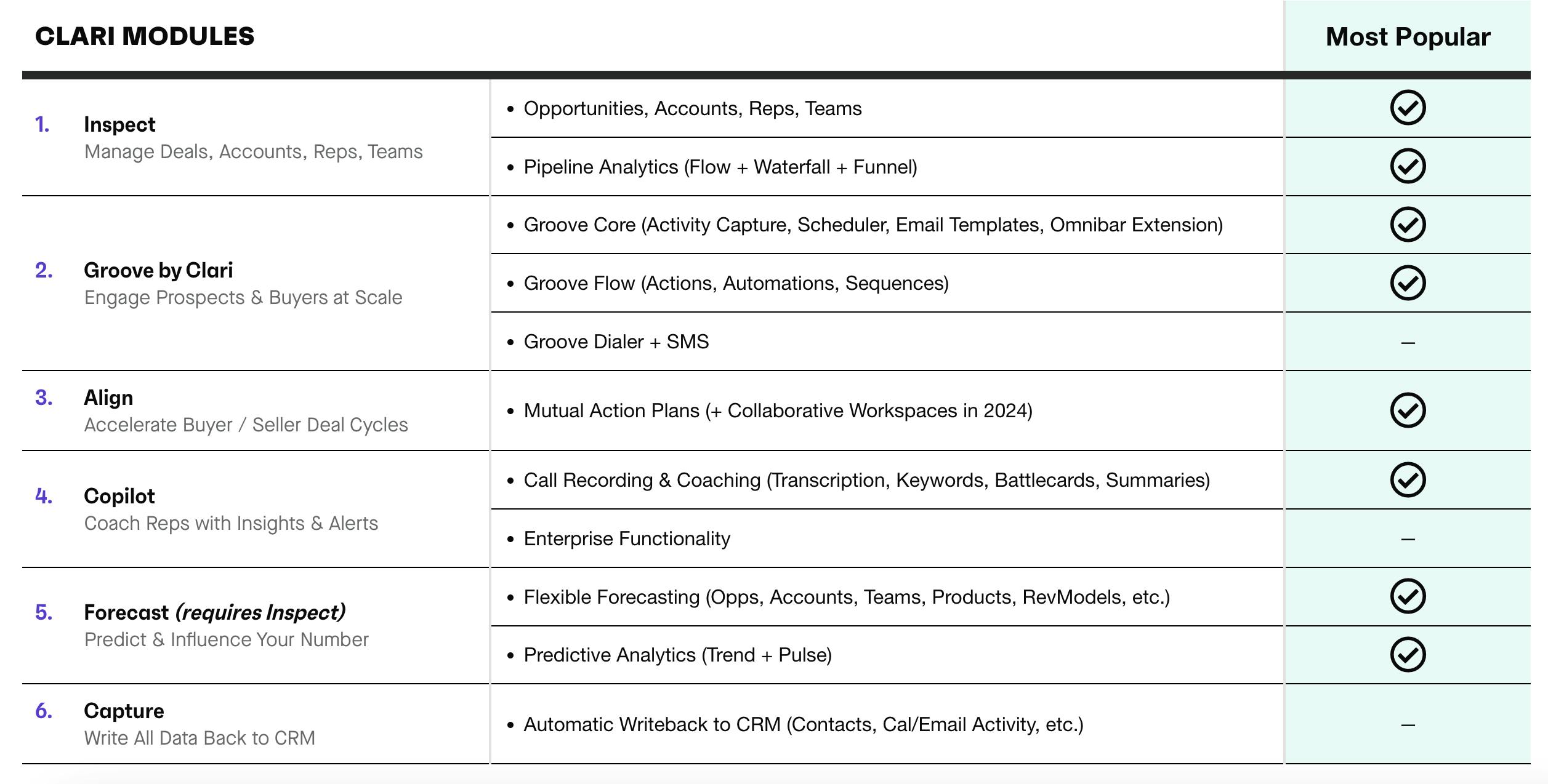

Clari operates on a SaaS business model and offers eight products in its suite and six stackable modules for its platform. In addition to the variety of modules, Clari’s platform includes RevDB and enterprise support with no platform fee. Its foundation model, called Clari Foundation, comes with all products. It includes an “Out of the Box” service which provides easy setup on the Clari platform through self-serve administration. Products scale by user, and customers have the option to upgrade anytime.

Clari does not openly disclose pricing for any of its products; because of a lack of a one-size-fits-all model, Clari provides customized quotes for companies. Companies can also access platform demos of all products through Clari’s website.

Traction

Source: Clari

As of May 2024, Clari served over 220K+ users across 170 countries and claims to have helped reduce collective revenue leak by $9.6 billion. More than 1.5K businesses use Clari’s Revenue Platform, with most being based in the U.S. and Europe. Following the acquisition of Groove however, Clari saw an increase in customers in Europe, the Middle East, and Africa.

One unverified source estimated Clari’s 2023 revenue at $97.5 million, the bulk of which comes from B2B companies within the U.S. In November 2023, the company was named on the 2023 Deloitte Technology Fast 500 with a growth rate of 264% from 2019 to 2022 and also named a leader in the Forrester Wave for Revenue Operations and Intelligence. Towards the end of 2022, Clari’s CFO Kelly Battles commented on the future of Clari’s growth: “Clari’s market opportunity is particularly exciting to me as it is large, growing, and important” — a claim supported by the fact that adoption of RevOps technology is expected to spike to 93% in 2024, up from a previous 30% in 2021. Clari’s number of users has doubled from 2021 to 2023 and customers are spending, on average, 50% more time running revenue within Clari’s platform.

Valuation

In January 2022, Clari raised $225 million in its Series F at a $2.6 billion valuation, quadrupling the company’s valuation in two years. The round was lead by Blackstone Group, along with existing investors, including Sequoia, Bain, and Silver Lake. The company has raised roughly $496 million over 8 funding rounds. Clari’s revenue was estimated by one unverified source to be at $97.5 million in 2023. Based on the company’s early 2022 valuation of $2.6 billion, that would represent a 26.7x multiple on 2023 revenue.

Key Opportunities

Advancements in Generative AI

Advancements in generative AI drive demand for a more efficient and accurate revenue management solution. As access to revenue management tools and insights increase, Clari is presented with a growing market for its products. Clari has the opportunity to address this demand by enhancing its platform to meet customer needs through advancement in product innovation, user experience, and customer support. In March 2024, Clari announced several advancements to its RevAI platform, furthering its generative AI capabilities to better track revenue lifecycle and help close sales pipelines faster.

Expanding Clari’s Global Footprint

In early September 2023, soon after appointing Rohit Shrivastava as EVP and Chief Product Office, Clari announced the opening of a new engineering, product, and support center in Krakow, Poland, complementing its Bangalore, India, and US operations. Clari’s customer base is primarily comprised of US-based companies and saw growth in its Middle East and Africa customer base after the acquisition of Groove. That said, Clari’s expansion in Europe seems like a logical step towards customer growth as outward expansion could serve as a geographic competitive moat and enable Clari to tap into new customer bases.

Key Risks

Siloed Tech Stacks

Most GTM teams have siloed tech stacks. In fact, one report revealed that approximately 89% of IT teams still struggle with data silos. Silos often originate from isolated teams or resources. Because certain functions can be viewed as distinct verticals within IT departments, each is expected to have its own focus and specialization. This subsequently hampers the creation of end-to-end processes like Clari’s by segregating data and slowing down cross-functional cooperation within IT teams. Siloed tech stacks could prevent the effective implementation of RevOps technology like Clari, which aims to connect sales, marketing, and customer-facing teams.

Crowded Market

Clari operates in a highly competitive market, and competition from established players as well as startups could hinder its ability to maintain its position in the revenue management industry. With advancements in technology companies are able to mature more quickly. Referred to as “RGM democratization” by Microsoft, companies entering the revenue management market are able to leap from current levels to higher levels of maturity. This, in turn, creates stronger competition for Clari and makes it harder for the company to defend against competitors entering its target market.

Summary

The Revenue Operations space is beginning to expand due to advancements in predictive and generative AI. Implementing revenue management technologies is becoming table stakes as markets become increasingly competitive, and the need for a centralized tool to unify the revenue management lifecycle cannot be understated. Clari’s AI-integration platform provides a simplified, end-to-end solution for customers by providing a range of AI-driven solutions and optimizing revenue processes across teams. Clari has served both early startups and larger enterprises; however, the company also faces several key risks including RGM democratization and tech silos. To stay competitive, Clari will need to continuously innovate and better its product platform while expanding its global customer base.