Thesis

In recent years, customer preferences began to shift towards digital communications. 94% of respondents in a McKinsey survey of global B2B leaders view today’s omni-channel reality—in which customers buy face-to-face, remotely, and online — as effective or more effective than before the COVID-19 pandemic. B2B customers regularly use ten or more channels to interact with sellers. Buyers are more willing than ever to spend big through online sales channels. Ensuring visibility across points of engagement in the sales cycle is crucial to managing demand, closing deals, and forecasting sales. By 2025, 80% of B2B sales interactions between suppliers and buyers will happen digitally.

Digitization of sales creates an opportunity for software to analyze customer conversations for insights to optimize sales conversations and improve sales teams' performance. The traditional sales process is predicated on manual data entry into CRM systems and subjective assessment of sales information to optimize sales processes and conversations. By 2025, 60% of B2B sales organizations will transition from intuition-based selling to data-driven selling, merging their sales process, applications, data, and analytics into a single operational practice. As a result, the global sales intelligence market size is projected to reach $3.4 billion by 2024.

Gong is a revenue intelligence platform that is driving digital transformation of B2B sales, providing revenue teams with data-driven insights that increase revenue, reduce churn, and drive productivity. It captures and analyzes a company’s customer interactions across emails and calls and generates insights about markets, deals, and employee skills, and then recommends next steps to move deals forward and ensure customer success. This enables customer-facing workers to make decisions informed by business reality instead of subjective judgment. As CRMs defined the system of record for executives to view aggregate metrics at a glance, Gong positions itself as a platform for revenue intelligence, bridging transparency to actionable insight based on what is recorded from customer interactions.

Founding Story

Amit Bendov, the CEO and co-founder of Gong, was one of the founding team of the workforce management software company ClickSoftware that Salesforce acquired for $1.3 billion. After spending over a decade at ClickSoftware, he became the CMO at Panaya in the ERP space. Between 2012 and 2015, he was the CEO of the business intelligence software company Sisense. He co-founded Gong in 2015 with the Chief Product Officer Eilon Reshef, who previously cofounded the SaaS company WebCollege in 1999. Both Bendov and Reshef rose to prominence in the Israeli tech scene.

The inspiration for Gong came from Bendov’s experience trying to figure out why sales had taken a nosedive after consecutive quarters of growth. He and his team analyzed the information in the CRM, scrutinized the sales pipeline, and looked at lead generation, conversation rates, and more. He then spoke to his sales team, who all painted a different picture of the reasons behind the headwinds. Bendov quickly realized that the reasons behind slowing sales would change based on the stakeholder he spoke to. He started asking his sales reps to record calls looking for insights from those conversations. Through this experience navigating a choppier-than-expected sales cycle, Bendov realized that he needed a single source of truth marrying qualitative and quantitative data to surface actionable insights that didn’t rely on subjective opinions. The company’s CRM, the de facto system of record, was great at recording what happened, but not why it happened.

Bendov then connected with former Tel Aviv University colleague and to-be cofounder Eilon Reshef, and they started with scoping out the problem and interviewed 50 buyers across different sales personas. Around the same time in 2015, according to Bendov, natural language processing had reached an inflection point with recurrent networks that could extract keywords from sales conversations and glean insights. Gong was born in 2015. The team realized that companies don’t understand why their sales teams aren’t meeting their targets. The company’s technology therefore records sales calls, transcribes them, and then uses machine learning to run an analysis to provide insights to salespeople and sales leaders so that they can improve their performance and win more deals.

Product

Previously, sales teams had to collect customer data and manually record it down into their CRM tools, analyze it, discuss it, and then think about ways to implement it to boost their revenue. With Gong, all of that can be automated at scale.

The Gong Reality Platform

Source: Gong

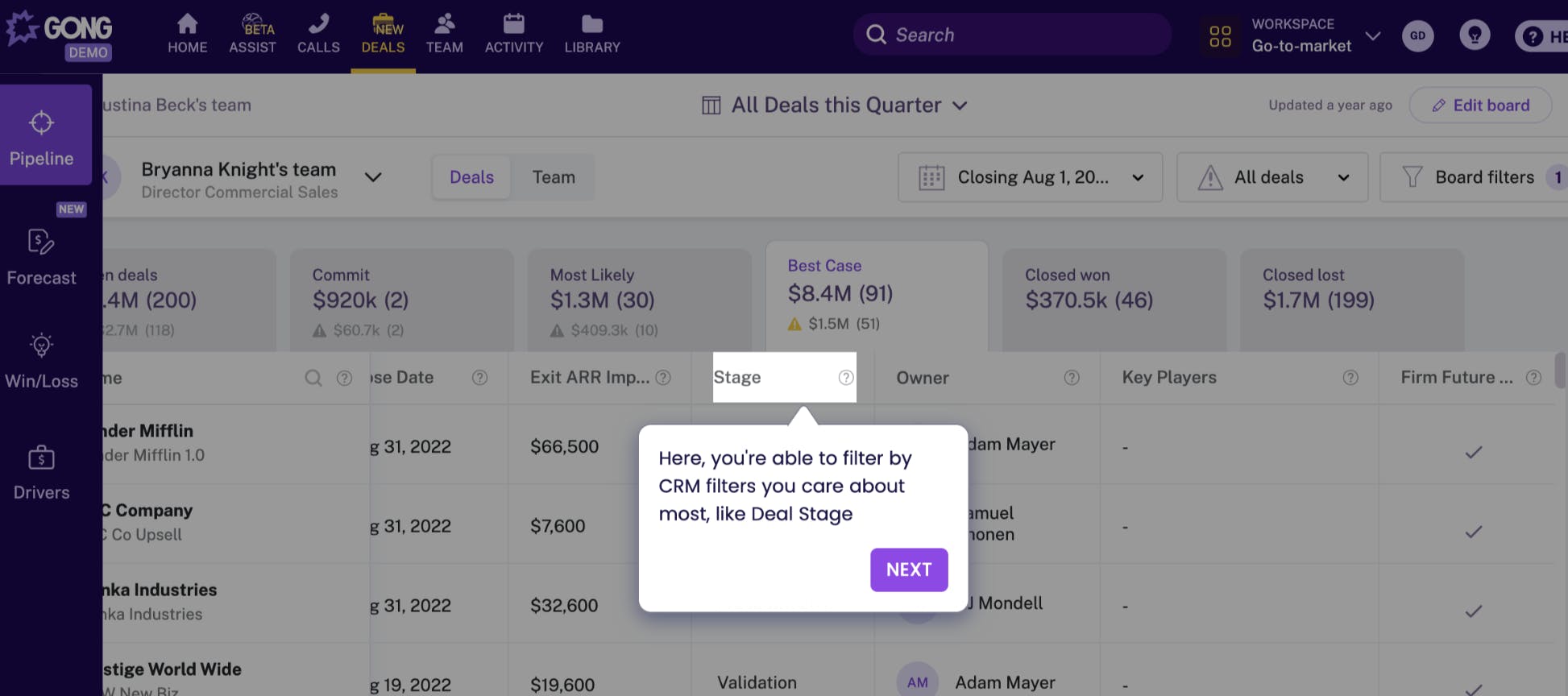

Gong captures conversations from video calls to phone calls, emails, and more — anywhere salespeople interact with customers or prospects. It allows users to toggle between multiple views of the company sales pipeline. This data originates from CRMs like Salesforce or Hubspot and is brought into Gong’s platform with partner integration.

Depending on the persona (HQ or field rep), users can better understand the state of the sales pipeline, with the ability to segment on variables like the deal stage, team, account, and close date. Users can also see an abstracted timeline of customer interactions related to a given deal over time, with the ability to double-click into a consolidated view of customer communications for the opportunity. It also has AI-enabled notifications that can trigger warnings for low engagement and other indicators that may signal a deal at risk. Gong also generates deal insights on why deals are won or lost based on the number of contacts engaged, deal duration, deal size, number of calls, competitor mentions it parsed from communications, etc. It can also produce basic analytics of what strategic initiatives may have impacted closed-won and lost deals.

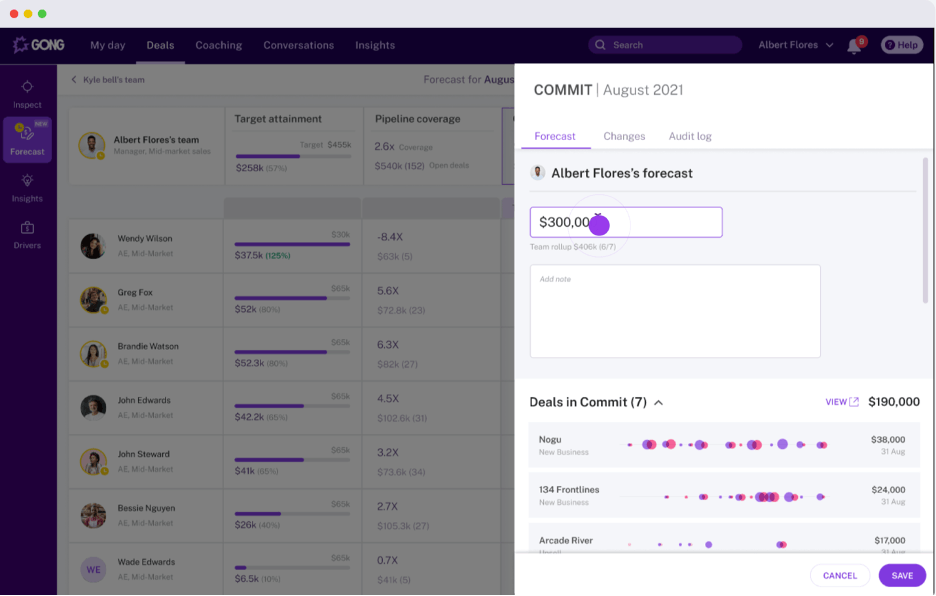

Gong Forecast

Source: Gong

Forecasting gives teams visibility into their pipeline in order to deliver revenue predictability. It enables sales leadership to track deals for each team member, with an interface for users to update forecasts in real time based on sentiment tracked through the company’s NLP tech.

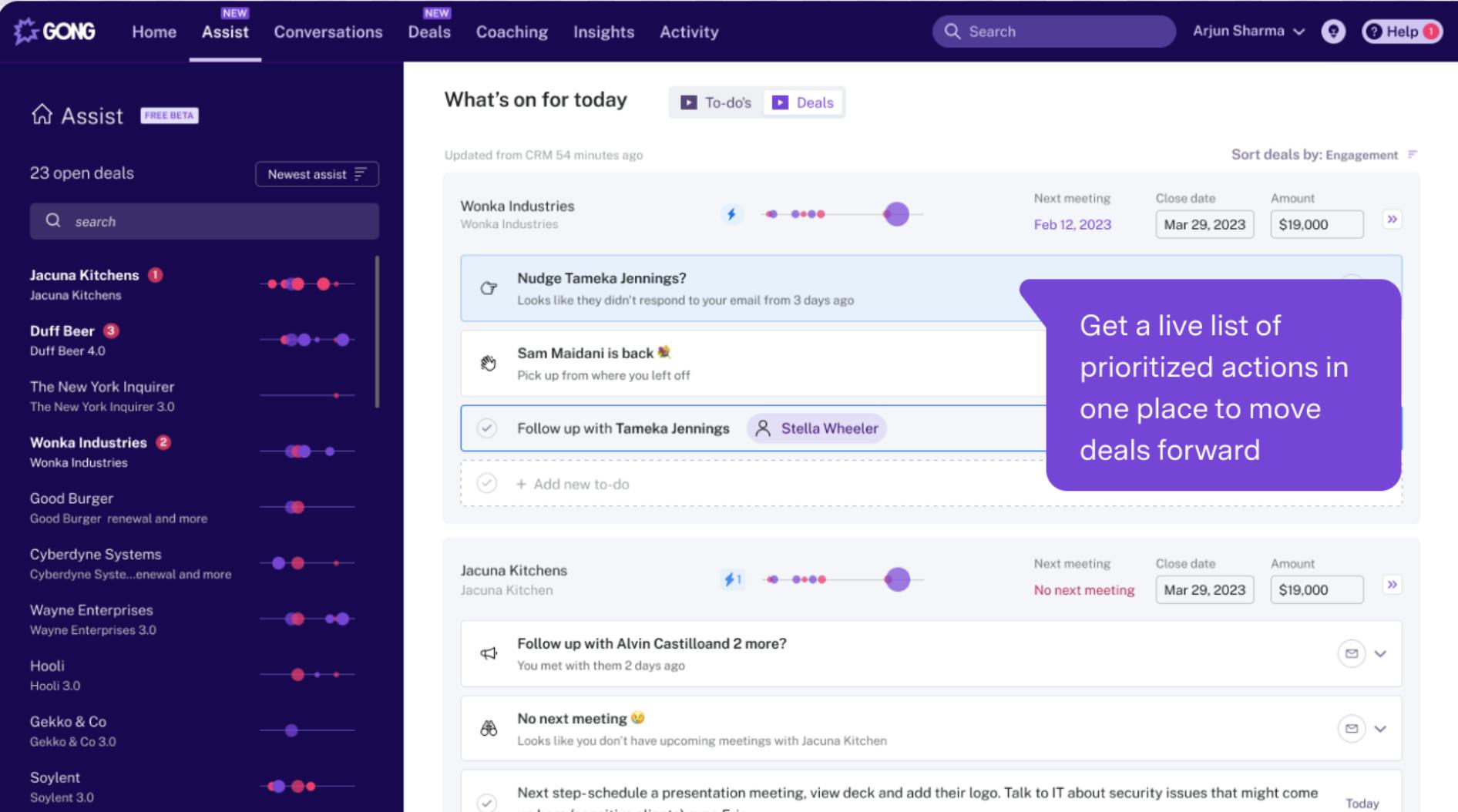

Gong Assist

Source: Gong

Launched in November 2022, Gong Assist is an AI-powered system that automates tasks, monitors opportunities, and recommends the next steps at the right time to help salespeople win more deals. It provides email templates based on topics discussed in prior interactions, the ability to update the CRM straight from Gong without needing to click out, and shareable workflows with teammates to ensure customer success and end-to-end visibility.

Integrations

With integrations into CRMs, email applications, calendars, business intelligence tools and more, Gong’s platform provides a seamless experience bridging the commercial org including revenue operations, sales enablement, sales, and customer success. By bridging all the channels of seller-buyer interactions, and seller-stakeholder engagement, Gong captures a flywheel of information and recommends the next best actions in a way that can be integrated across an organization.

Gong for Market Insights

Market intelligence provides a view of competitor penetration at accounts; deals lost to competitors, customer feedback on products, as well as pricing perceptions. It also helps identify business risks early on, replicate best practices, and get ahead of emerging market needs.

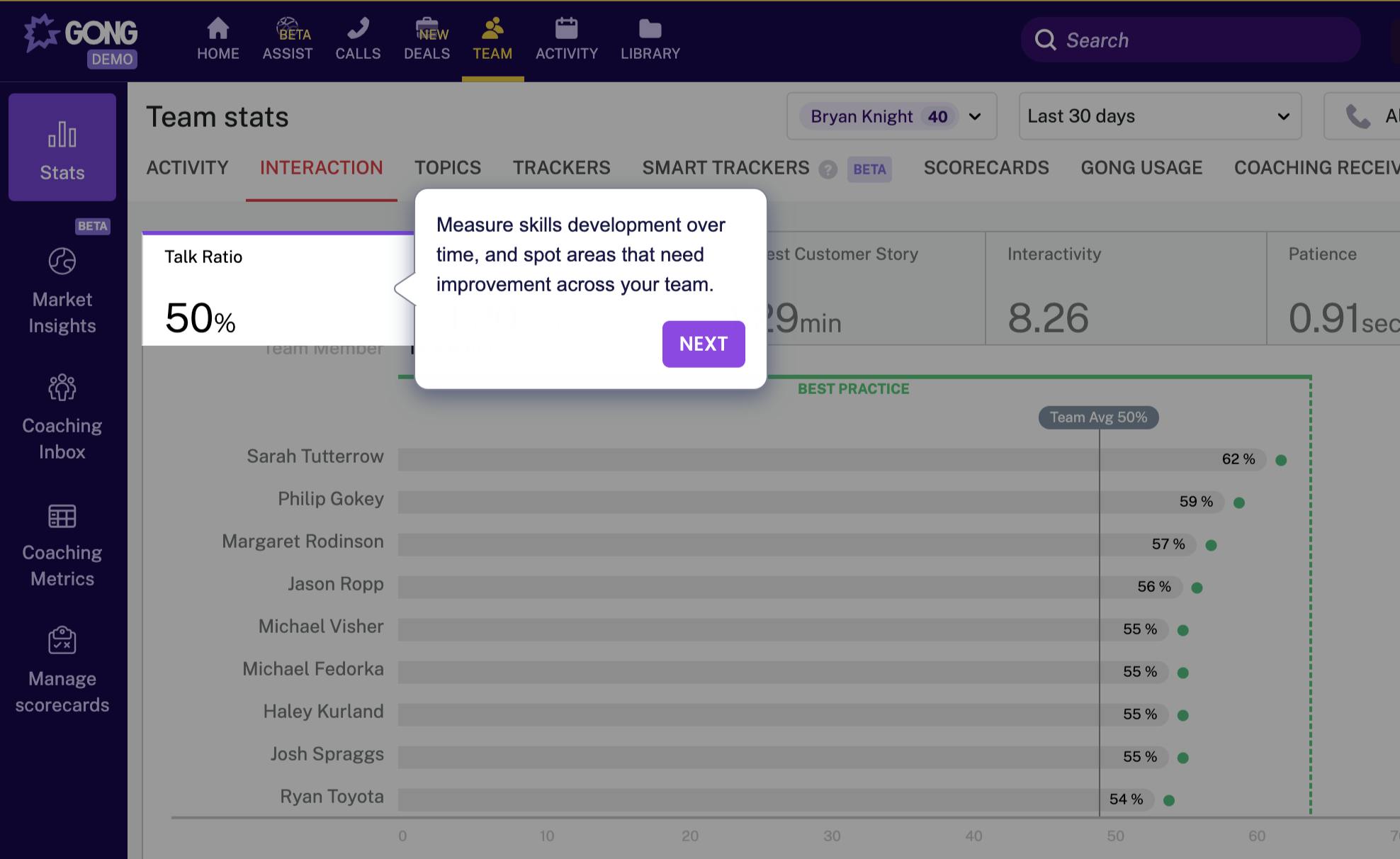

Gong for Coaching

Source: Gong

After ingesting calls and emails, Gong is able to measure and help sales teams optimize how they sell and parse spoken and written keywords to enable salespeople to quantify points of interest such as questions, keywords, and smart trackers. Teams can listen to each others’ recorded calls and annotate calls, enabling sales reps to have performance feedback integrated into a single place for current and future customer touchpoints. Users are given metrics such as talk time and monologue time to reference, and leadership is then able to track feedback across their teams.

Market

Customer

Gong’s core customer personas include small, mid-market, and enterprise pre-sales, sales, and post-sales teams across a variety of industries, including financial services, media, staffing, technology, hospitality, and real estate.

The company has over 3.5K customers. Some notable customers include Twilio, Pinterest, Webflow, ServiceTitan, Zillow, Linkedin, Hubspot, and Shopify.

Additionally, post-sales and customer success teams can track effective onboarding tactics and customer sentiment across a contract life-cycle. The marketing team is able to use it to evaluate how effective messaging and positioning may be with customer segments by seeing how customers respond. Finance teams use Gong for revenue projections. Product teams use Gong as an intake tool for customer feedback to inform road mapping.

Market Size

The global sales intelligence market size was valued at $2.8 billion in 2020 and is projected to reach $7.4 billion by 2030, growing at a CAGR of 10.6% from 2021 to 2030.

This growth can be attributed to the increasing demand for real-time customer insights and predictive analytics and the growing need for effective sales and marketing strategies. The pandemic has accelerated the adoption of revenue intelligence solutions as companies look to understand their customers better and adapt to the changing market conditions. The surge in demand for content optimization and data enrichment tools is expected to further drive the growth of the sale intelligence market.

Competition

Clari - Clari is a revenue operations company that provides end-to-end sales analytics and a forecasting platform. Its core strength is the support of revenue management, including pipeline management, forecasting, and deal review. Unlike Gong, its strategy integrates rather than replicates related sales technology categories such as conversation intelligence, sales engagement, and enablement. It was founded in 2013 and has raised almost $500 million in funding.

Outreach - Outreach is a sales engagement platform that accelerates revenue growth by optimizing email, voice, and social interactions throughout the customer lifecycle. It wants to offer sales engagement, revenue intelligence, and revenue operations in a unified platform. It was founded in 2014 and has raised $490 million.

Salesloft - Salesloft is a sales engagement platform that helps salespeople sell better to clients, which includes real-time monitoring of interactions to provide coaching, suggestions for supplementary content to enhance the pitch, and workflows to manage records and communications. It was founded in 2011 and has raised $245 million in funding.

Aviso - Aviso is a sales forecasting and pipeline management company. It was founded in 2012 and has raised $60 million in funding.

Chorus.ai - Chorus is a conversation intelligence platform for sales teams that can transform conversations into data and insights. It was founded in 2015 and raised $100 million in funding. ZoomInfo acquired it in 2021 for $575 million.

InsightSquared - InsightSquared is another revenue intelligence platform that provides sales intelligence for forecasting, accuracy, and decision-making. It was founded in 2010 and has raised $50 million in funding. Mediafly acquired it in 2021.

People.ai - People.ai helps sales, marketing, and customer success teams uncover revenue opportunities by capturing all customer contacts, activity, and engagement to drive actionable insights across all revenue teams. It was founded in 2016 and has raised $200 million in funding.

Business Model

Gong operates on a subscription model. All licenses offered by Gong are priced per recorded user. There is also a platform fee based on the number of users supported. How much it costs per user depends on the license type. They do not charge extra for any integrations. It does not disclose any standard pricing on its website.

Per a third-party report, for a team of 100 users, Gong’s cost could be $149K for an annual subscription. The platform subscription is $5K, and the per-user cost is $1,440.

Traction

Gong has over 3.5K customers, including Twilio, Zillow, LinkedIn, Hubspot, and Shopify. It has 1.2K employees and offices in San Francisco, Tel Aviv, and Dublin.

In 2023, Gong's revenue run rate hit $178 million. The company disclosed that ARR grew 2.3x from Q1 2020 to Q1 2021, while net dollar retention reportedly reached 140%, in June 2021.

An analysis by SaaS buying and management platform Vendr showed Gong moved into the top 10 software sellers by share of wallet at 1.38% in 2022.

Valuation

In June 2021, Gong raised $250 million at a $7.3 billion valuation led by Franklin Templeton, with participation from existing investors Coatue, Salesforce, Ventures, Sequoia, Thrive Capital, and Tiger Global. This Series E round brought the company’s total funding to $584 million.

The company said in June 2021 that it had increased ARR 2.3x between Q1 of 2020 and Q1 of 2021 and reached 2,000+ customers.

In 2023, Gong's revenue run rate hit $178 million. For comparison, competitor Chorus.ai was acquired by public lead generation database company ZoomInfo for $575 million in July 2021. As of February 2023, ZoomInfo trades at an enterprise value of $13 billion with $1.2 billion annualized revenue for FY22 for a ~12x EV to revenue ratio.

Key Opportunities

Learning and Development

Gong’s platform already enables sales leadership to listen in on conversations and see which led to deals won or lost. Further optimizing its AI technology to automate and customize feedback in real-time during sales calls opens up opportunities in the adjacent learning and development category, where sales can adjust pitches as customers respond. This could help make its people intelligence tooling better and go deeper in performance management and improvement.

Revenue Operations

Given how integral its product is in the process and workflows of salespeople and sales leadership, Gong has the opportunity to expand into tech stacks of revenue organizations and start capturing workflows and align processes across marketing, account management, and customer support to become a more holistic platform covering the entire lifecycle of prospects and customers.

Virtual Assistance

While Gong primarily ingests data and derives insights for sales teams to act on, automating the action itself for use cases like follow-up emails and contracting may now be possible with recent developments in AI-generated text. Becoming an assistant that can take contextual actions would help make salespeople more productive and increase the value proposition of Gong to companies. It has already taken steps to leverage the recent developments in generative AI. It recently announced Gong Smart Trackers, a user-trainable system that goes beyond keyword recognition to understand the context of all customer conversations.

Vertical Focus

Training the platform’s models on industry-specific jargon as the company expands its reach can help Gong saturate its target segments in certain verticals faster. The company has already shown a desire to go deep vertically for sales conversation optimization by developing in-house transcription models for 70+ languages.

Key Risks

Product Momentum

Competitors Chorus and Wingman have been acquired by public company ZoomInfo and private company Clari, respectively, and now have cross-selling and distribution advantages. Smaller players are rising with more focused and specialized products. Firms like Clari are looking to integrate better beyond the sales organization to create a full-service tracking tool. Avisio is taking a similar approach as Gong, raising the prospect of a price war. Microsoft and Salesforce are trying to replicate Gong’s success within their platforms. Gong is going to need to not only maintain momentum in its go-to-market across market segments and industries but also continue to accelerate product growth and expansion to take over more layers of the tech stack and workflows of sales teams.

Platform Risk

Gong relies on CRM systems like Salesforce and communication recording tools for importing sales conversations and activity into its platform for running the analysis. It sits downstream of those platforms to offer value to its customers. There’s a risk that native offerings of entrenched systems of records could reduce the need or competitiveness of Gong’s offering.

Privacy

Gong takes conversations, analyzes them, and gives feedback. This feedback goes to individuals, across teams and organizations, in an effort to share learnings. Many sales processes are highly confidential, and sellers and buyers deal with confidential information in some industries. A lot of customer discovery involves understanding pain points, which requires sensitive information-sharing from potential customers. This creates privacy concerns.

Summary

Gong is changing traditional sales with a revenue intelligence platform, leveraging AI to derive qualitative insights across voice and text sales channels. By complementing how legacy CRMs act as systems of record dependent on active user input, Gong optimizes for an autonomous end-user experience where reps and leadership alike can have a 360-view of the sales journey without needing to spend time on administration. The platform’s ability to service use cases across the revenue center and continued expansion of functionality for sales, customer success, marketing, product, and finance reflect Gong’s stickiness and successful GTM strategy. For a business that began as a vertical SaaS wedge, Gong’s growing horizontal sprawl indicates a successful, scalable integration of AI into everyday workflows. Gong’s growth and dependence on Salesforce is one to watch as it confronts a macroeconomic environment favoring consolidation.