Thesis

For decades, technology has lowered the barriers to entrepreneurship across industries. Amazon democratized retail, allowing anyone to become a seller without owning a storefront. Uber turned underutilized cars into an on-demand transportation network, unlocking new income streams for millions. Replit* and modern developer platforms have made software creation more accessible, allowing anyone to build and deploy applications with minimal friction. While more entrepreneurial restaurants are turning to technology for similar enablement, they’ve struggled to achieve the same success.

It’s estimated that up to 60% of consumers in the US order delivery or takeout at least once a week. The COVID-19 pandemic accelerated this trend, driving mass adoption of food delivery apps like Uber Eats, DoorDash*, and Grubhub. As demand for off-premise dining skyrocketed, restaurants became increasingly dependent on digital orders, responsible for an average of 41% of their revenues. However, traditional restaurant infrastructure wasn’t designed for this shift. Full-service restaurants were optimized for dine-in, leaving them inefficient, costly, and logistically constrained when it came to delivery fulfillment. While food delivery platforms solved distribution, the missing piece was food preparation itself - making high-quality food at scale, efficiently and affordably.

Food is fundamental to human life, yet the way it is prepared and delivered is riddled with inefficiencies. Unlike Uber, which leveraged an existing supply of idle cars, food preparation lacked the same existing infrastructure. Restaurants face high rents, labor shortages, and operational complexity, which makes scaling for delivery unsustainable. CloudKitchens CEO Travis Kalanick sees automation as the key to disrupting the restaurant industry, addressing two of its biggest cost drivers: food logistics and food production. CloudKitchens is working toward a fully autonomous, hyper-efficient food ecosystem, positioning itself as the AWS of food infrastructure - a backend system that powers digital-first restaurant brands worldwide.

Kalanick describes CloudKitchens as a digital operating system for the physical world, drawing parallels between computing architecture and food logistics. In computing, three core components define how information flows:

Processing (CPU): Executes operations on data

Storage (Memory): Retains and organizes data

Networking (Connectivity): Moves data between systems

Kalanick sees CloudKitchens as applying an analogous model to food infrastructure:

Processing → Automated food preparation: Robotics and AI-driven kitchens handle cooking and assembly at scale.

Storage → Real estate & kitchen capacity: Ghost kitchens function as storage hubs for food production, optimized for delivery demand.

Networking → Logistics & dispatching: AI-powered routing ensures food moves efficiently from kitchen to consumer.

By integrating these three layers, CloudKitchens aims to make food preparation as frictionless, scalable, and cost-effective as cloud computing. If successful, it could fundamentally reshape the restaurant industry by transforming dining from a costly, labor-intensive business into a scalable, automated system that enables more entrepreneurs to succeed with lower risk and higher efficiency.

Founding Story

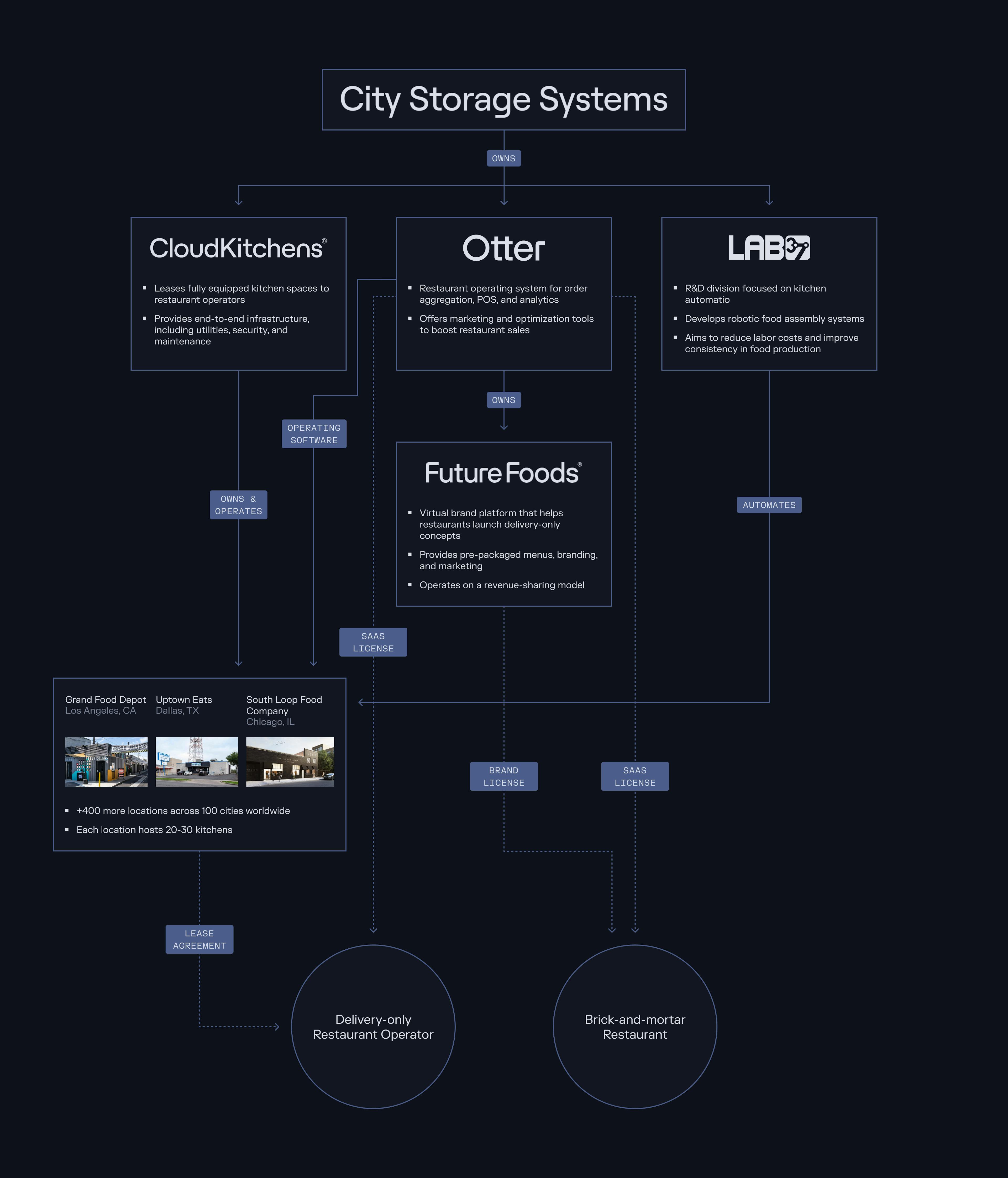

CloudKitchens is part of City Storage Systems (CSS), a real estate and technology holding company focused on repurposing distressed real estate assets into modern food delivery infrastructure. CSS owns and operates CloudKitchens, which provides kitchen spaces for delivery-only restaurants, Otter, a restaurant software and order management platform, and Lab37, a robotics and automation division aimed at optimizing food production.

Source: Contrary Research

CloudKitchens (originally Urban Kitchens) was founded in 2016 by Diego Berdakin, Sky Dayton, and Barak Diskin in Los Angeles. At the time, food delivery apps were in their infancy. DoorDash, UberEats, and Grubhub had just launched, and restaurant infrastructure was not built for a delivery-first world. Traditional restaurants had high fixed costs, limited space, and inefficient kitchen layouts, making it difficult to meet the growing demand for online orders.

Prior to founding CloudKitchens, Dayton founded EarthLink, eCompanies, and Boingo. Berdakin, meanwhile, had previously founded BeachMint and sold it to Conde Nast in 2014. Diskin came from a real estate background, having started his career at LA-based multifamily developer Decron. Together, the three co-founders bought two warehouses at 1840 W Washington Blvd near Los Angeles and combined them to form the company’s first 27-kitchen facility.

Source: LoopNet

The core business of CSS has been buying out distressed parking and industrial assets, repurposing them into food delivery hubs, and leasing them to operators. In early job listings, the company called itself “the ‘Amazon’ of the food delivery world… providing infrastructure and software that enables food operators to open delivery-only locations with minimal capital expenditure and time.” Alongside CloudKitchens, the team also launched CloudRetail, to help consumer brands sell CPG products via food delivery platforms.

In 2017, CloudKitchens raised a Series A led by Craft Ventures and Social Capital. Just two years later, Uber’s founder and former CEO Travis Kalanick bought a controlling interest in CSS for $150 million and became the company’s CEO. Several months before the buyout, Kalanick resigned from Uber and sold 90% of his shares for a profit of $2.5 billion.

Source: X

Under Kalanick, CSS expanded beyond real estate and launched multiple new business lines. In 2020, it introduced Otter, a restaurant SaaS platform that provides order management, POS solutions, marketing tools, and virtual restaurant brands under the Future Foods umbrella. That same year, it briefly launched Internet Food Court, a consumer-facing marketplace that allowed customers to order directly from CloudKitchens locations, which was shortly discontinued without any comment from the company. In 2023, CSS unveiled Lab37, an in-house R&D lab developing automation and robotics for food preparation and order conveyance.

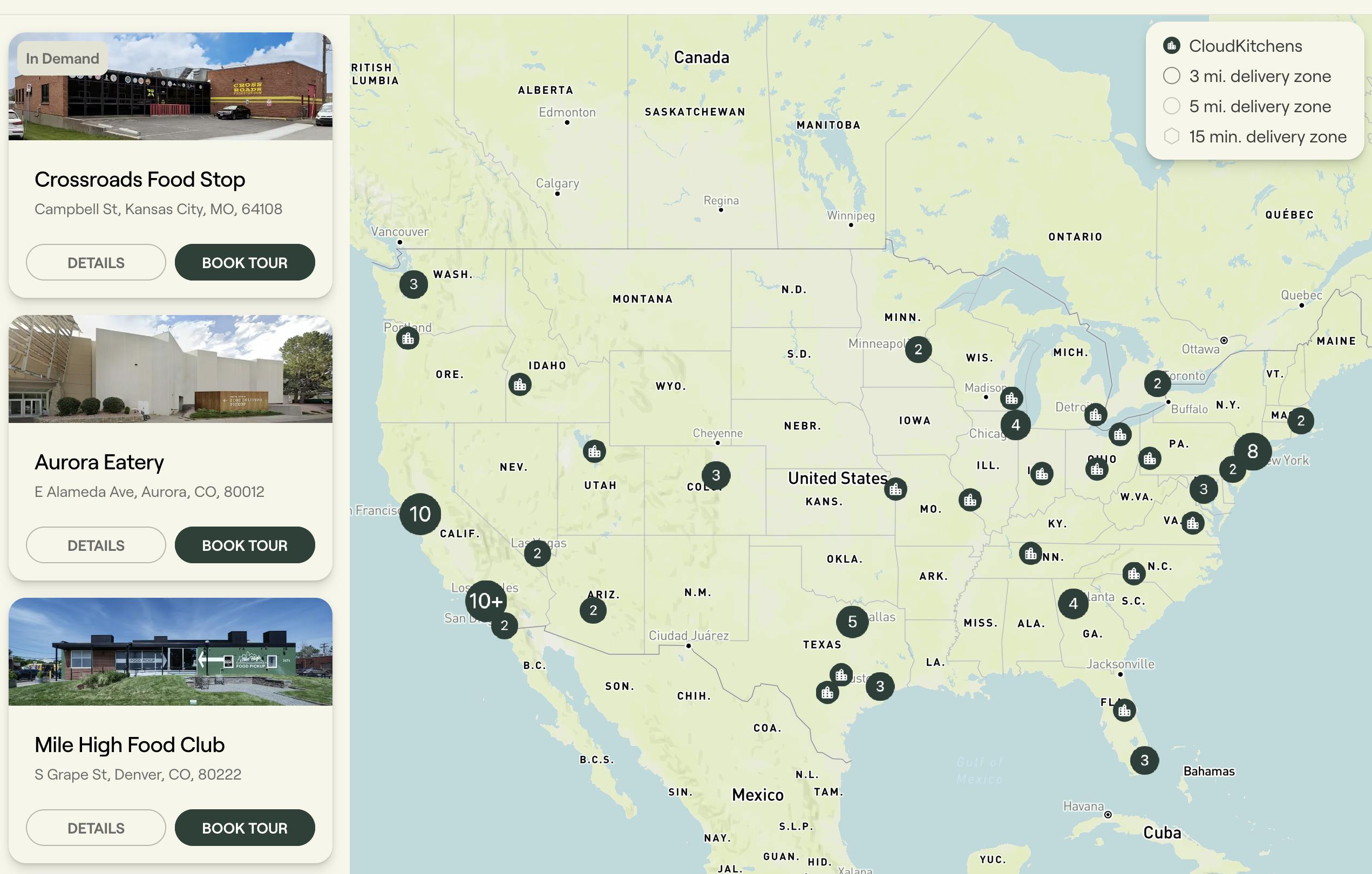

CloudKitchens has expanded its real estate footprint globally, building properties across 30 countries and over 100 cities. The company has remained highly secretive, limiting public interviews and restricting employees from listing their affiliation online.

Product

CloudKitchens

Source: YouTube

At the core of CloudKitchens’ operations is a network of delivery-first kitchen facilities, strategically positioned in high-demand urban areas to optimize food preparation and fulfillment. These facilities are designed to be low-cost, high-efficiency alternatives to traditional restaurant spaces, allowing food entrepreneurs and established brands to launch or expand their operations with minimal overhead. CloudKitchens has scaled its presence across over 110 cities in over 30 countries, operating over 400 locations, each housing around 30 individual 200 square foot kitchens.

Source: CloudKitchens

Unlike traditional brick-and-mortar setups, these kitchens eliminate the need for dining areas, instead optimizing for rapid food preparation and order dispatch. Some locations also accommodate walk-in and takeaway customers, enabling a hybrid model where brands can serve both online and in-person demand. CloudKitchens provides comprehensive infrastructure and operational support, allowing restaurant operators to focus on cooking rather than managing logistics. On-site staff and autonomous robots facilitate kitchen-to-driver handoff, ensuring that food moves seamlessly from preparation to pickup. Additionally, CloudKitchens handles property management, security, maintenance, and cleaning.

Source: City Storage Systems

Each kitchen is equipped with cooking appliances, ventilation systems, and prep stations, enabling operators to set up and start cooking within weeks rather than months. The facilities also include utilities such as electricity, water, high-speed internet, and HVAC systems, all bundled into a single cost structure. CloudKitchens advertises a setup investment starting at $30K, lowering the capital expenditure required to launch a food business compared to traditional restaurants. This plug-and-play model minimizes risk, making it easier for food brands to scale across multiple locations.

Otter

Source: YouTube

Otter offers a suite of solutions that power CloudKitchens’ facilities while also serving standalone restaurants. It has expanded into a broad restaurant operating system, including:

Ordering channels: POS, Kiosk, QR Ordering, Online Ordering

Order management: Secure Payments, Order Manager, Kitchen Display, Order Handoffs

Unified operations: Menus and 86ing

Guest engagement and growth: Loyalty, Marketing, Virtual Brands

Intelligence and reporting: Live Alerts, Financials, Disputes & Refunds, Analytics

Source: Otter

Otter’s software integrates with third-party platforms while also supporting direct ordering, allowing restaurants to manage both marketplace and in-house sales from a single dashboard. Beyond order management, Otter now functions as “mission control” for restaurants. Its AI-powered marketing engine helps restaurants determine the best promotions to run by analyzing historical data, customer behavior, and real-time demand trends. Otter dynamically adjusts spending across multiple locations and platforms, leveraging advanced mathematical optimization (OR-Tools) to maximize efficiency. One controlled experiment demonstrated that Otter’s global budget optimization approach increased total order volume by 7% compared to traditional marketing methods.

Beyond software, Otter’s expansion into POS systems gives CloudKitchens direct access to in-store sales data. By integrating both online and offline transactions, CloudKitchens can make more informed decisions about tenant mix within its facilities and identify opportunities for new brands. The POS product, already deployed in over 100K restaurants globally as of March 2025, is being bundled with Otter at $69 per month, offering an all-in-one solution without the need for separate integrations - undercutting competitors like Toast and Square on payment processing fees by 0.2-0.3%.

Lab37

Source: YouTube

Lab37 is CloudKitchens’ research and development arm, advancing kitchen automation and logistics. With the goal of eliminating inefficiencies in food preparation and order fulfillment, Lab37 is building robotic systems that streamline kitchen operations, reducing labor dependency and increasing throughput. The division is reportedly headed by Eric Meyhofer, who previously led Uber’s Advanced Technologies Group, working on self-driving car technologies.

Lab37’s first machine is the Bowl Builder, a robotic meal assembly system. Operators prepare ingredients in the morning, and throughout the day, the machine takes over the portioning, assembly, and packaging of meals based on incoming orders.

Source: YouTube

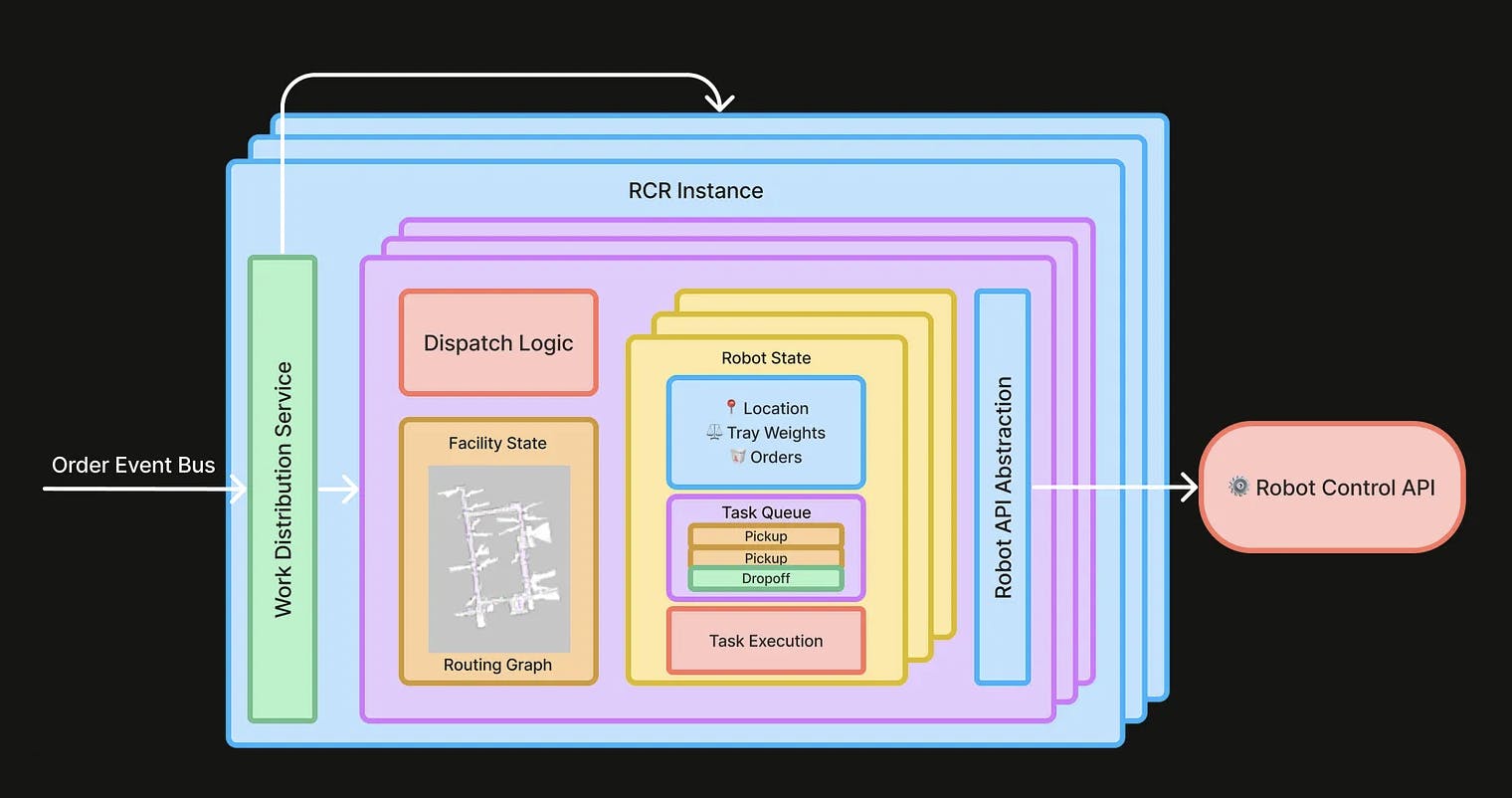

Beyond food assembly, Lab37 has also developed a robotic conveyance system to optimize the movement of food within its facilities. The Robotic Conveyance Routing (RCR) system controls robots manufactured by Bear Robotics to transport orders from individual kitchens to designated pickup areas, ensuring a seamless handoff to couriers. The system leverages multi-order trips, where a single robot picks up multiple orders before heading to the pickup station, as well as predictive dispatch, where robots are sent to kitchens before orders are even completed based on real-time demand forecasting.

Source: City Storage Systems

Future Foods

Source: Future Foods

Future Foods helps traditional brick-and-mortar restaurants boost sales by adding delivery-only brands to their existing kitchens. Instead of creating new concepts, restaurants can license pre-developed virtual brands with ready-made menus, marketing, and platform integration. CloudKitchens handles the setup, with the goal to maximize kitchen output using existing inventory and staff, creating new revenue streams without additional real estate or major capital investment.

The model is designed for quick scalability, with brands like “Thick Chick” (fried chicken), “Dolce & GaPasta” (Italian), and “Grannies Pannies” (breakfast classics). Participating restaurants reportedly earn $1.5–$3K per week in extra revenue, running these brands alongside their main business. Some, like Home Sweet Harlem in NYC, operate multiple Future Foods concepts at once. Charlie Mae’s, a Southern restaurant in Phoenix, AZ, has reported that one of Future Foods’ virtual brands is responsible for up to 15% of their revenue.

Beyond helping restaurants, Future Foods also serves CloudKitchens’ broader real estate strategy. In some cases, the company has targeted restaurants near its upcoming kitchen facilities, using data from virtual brand performance to identify successful operators who might later move into its ghost kitchens. This gives CloudKitchens insights into market demand, menu viability, and tenant selection, helping de-risk its facilities before they open.

Cloud Retail

Source: hngry.tv

Through CloudRetail, the company attempted to expand into the retail sector, offering CPG brands last-mile storage and fulfillment for on-demand delivery via aggregator platforms. The model functions like Fulfillment by Amazon, allowing brands to store cold and dry goods in CloudKitchens facilities and sell them through virtual storefronts. CloudRetail targets snacks, beverages, consumers goods and alcohol. As of March 2025, CloudRetail appears to have been discontinued.

Market

Customer

Emerging Restaurants

CloudKitchens primarily serves independent chefs, small restaurant owners, and food entrepreneurs looking to expand their delivery operations without the high costs and risks of traditional brick-and-mortar locations. These operators often face challenges like rising rent, labor shortages, and the logistical complexities of running a dine-in establishment. CloudKitchens offers a turnkey solution: fully equipped kitchen spaces, order aggregation software, and delivery logistics support. By eliminating front-of-house expenses and simplifying operations, CloudKitchens enables restaurants to focus entirely on food preparation while rapidly scaling their business across multiple locations.

For SMBs, the appeal lies in lower capital expenditure - operators can launch a new location for as little as $30K, compared to the six-figure investment required for a traditional restaurant. Additionally, by leveraging CloudKitchens’ order insights and marketing tools, these restaurants can optimize menu pricing, track sales performance across platforms, and experiment with new concepts to drive additional revenue.

Enterprise Restaurants

For enterprise customers, CloudKitchens provides a cost-efficient, rapid expansion model tailored for the delivery era, as a way to enter new geographies without committing to full build-out.

Fast-casual and QSR (quick-service restaurant) brands integrate CloudKitchens into their hub-and-spoke model, where traditional locations serve as flagship stores while ghost kitchens function as fulfillment centers for online orders. This model allows large brands to increase their delivery radius, reduce strain on in-store staff, and improve order efficiency, especially in high-density urban areas.

This model has delivered notable results, with enterprise brands in CloudKitchens facilities achieving average unit volumes (AUVs) of $1.2 million, with top locations exceeding $2.5 million per year. Leading franchises such as Chick-fil-A, Wendy’s, Little Caesars, and Taco Bell have leveraged CloudKitchens to grow their delivery footprint. In addition, Otter has been adopted by customers including Denny’s, Ben & Jerry’s, and Hardee’s.

Consumers

CloudKitchens operates behind the scenes, powering the infrastructure that enables faster, fresher, and more reliable food delivery. While consumers may never see a CloudKitchens facility, its impact is felt in every order - by reducing delivery times, improving food consistency, and ensuring restaurants can operate efficiently at scale. Many of CloudKitchens’ end users are students and young professionals, as locations are strategically positioned next to college campuses and office centers. Many of the company’s property listings provide details on surrounding demographics, such as total food and drink spending in a 1-5 mile radius.

Additionally, Otter allows restaurants to bypass third-party delivery aggregators by creating custom digital storefronts, enabling brands to engage directly with their end customers. This gives restaurants greater control over pricing, promotions, and customer relationships, which could result in lower fees and better deals for customers, offering an alternative to major marketplaces like Uber Eats and DoorDash.

Beyond delivery, select CloudKitchens locations cater to walk-in and takeaway customers, creating a hybrid model that blends the speed of ghost kitchens with the accessibility of traditional restaurants. These locations allow customers to pick up their meals directly, avoiding delivery fees and wait times.

Market Size

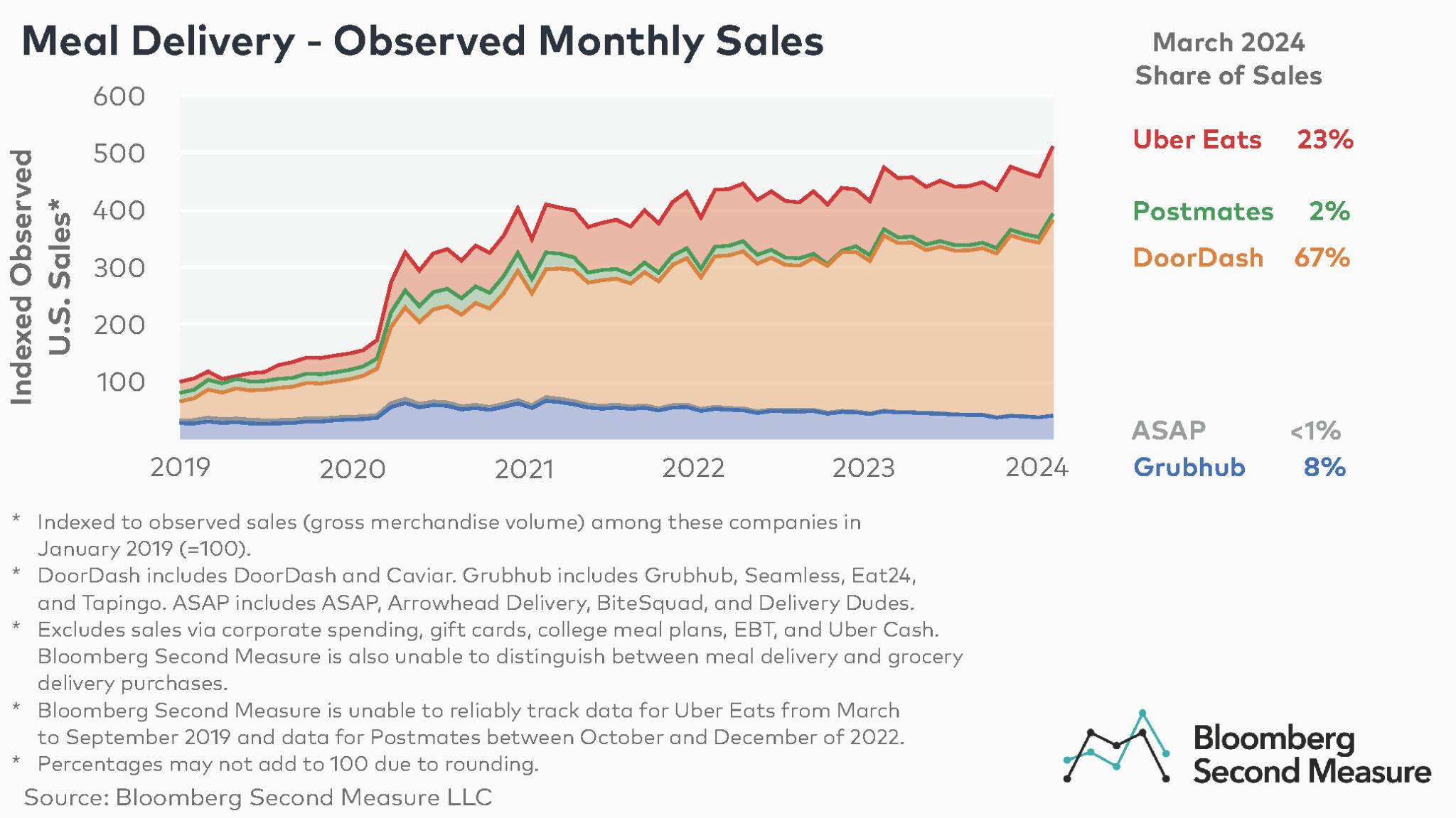

While CloudKitchens, Otter, and Lab37 are all part of the same company, they operate in distinct but interconnected markets. CloudKitchens is fundamentally a real estate and logistics business, focused on the ghost kitchen sector; Otter operates in the restaurant management software space; and Lab37 is tackling kitchen automation, addressing labor efficiency in the food service industry. Together, these divisions form a vertically integrated ecosystem in the food delivery market that has, historically, been dominated by on-demand delivery platforms like DoorDash, Uber Eats, and Grubhub.

Source: Second Measure

The food delivery industry has seen rapid growth over the last decade, driven by rising consumer demand for convenience and advancements in delivery logistics. In 2025, revenue in the global food delivery market is expected to reach $1.4 trillion and is projected to surpass $1.9 trillion by 2029, growing at a CAGR of 7.8%. As consumer behavior shifts toward digital ordering and off-premise dining, the demand for efficient, delivery-optimized restaurant operations continues to grow.

In the US, 60% of consumers ordered delivery or takeout at least once a week as of 2022, and the number of ghost kitchen units had reportedly surpassed 7.5K as of May 2024. CloudKitchens operates over 2K in North America as of March 2025.

As restaurants become more reliant on third-party delivery platforms, demand for multi-channel order management, analytics, and automation tools has surged. The global restaurant software market was valued at $15.3 billion in 2023 and is expected to grow at a CAGR of 13.6% through 2030.

Labor shortages and rising wages have made automation an interesting avenue for restaurant operators. The US restaurant industry employs over 13 million workers, but wages have risen 25% from 2019 to 2023, creating significant cost pressures. The kitchen automation market is estimated at $3.5 billion in 2025, fueled by advancements in robotic food preparation.

Competition

Ghost Kitchen Brands & Operators

The ghost kitchen industry has seen major shakeups over the past few years, with several well-funded players like Reef, Kitchen United, and Growth Kitchen, either pivoting away from or shutting down their operations. The struggles stem from a fundamental challenge - restaurants are low-margin businesses (5-10%), making it difficult for landlords to succeed unless their tenants are experienced QSR operators with predictable, high-volume orders. As a result, high turnover, low occupancy rates, and operational inefficiencies are not just symptoms of poor execution, but structural issues inherent to the model. Ghost kitchens remain an unproven concept, and their popularity has declined since the end of COVID-19, as consumer dining habits shifted back toward in-person experiences.

Health and regulatory concerns have also plagued the industry, and CloudKitchens has faced similar scrutiny. However, Travis Kalanick has a track record of navigating regulatory gray areas, as seen with Uber, which received a cease-and-desist order in 2010 from the San Francisco Municipal Transportation Authority yet still became a global giant despite resistance from taxi commissions.

Whether CloudKitchens follows the same trajectory as its failed competitors will depend on its ability to attract the right tenant mix and maintain occupancy at scale. It has a key advantage with Otter, which processes 18% of all delivery orders in the US, giving CloudKitchens deeper insights into demand patterns and a built-in ecosystem that other ghost kitchen operators lacked.

Reef: Founded in 2013, Reef was initially a parking lot operator that pivoted to ghost kitchens, deploying modular kitchen units through food trailers in high-traffic urban areas. Reef partnered with major restaurant brands like Wendy’s and TGI Fridays. However, its expansion led to quality control issues, health code violations, and permitting disputes, as many of its food trailers operated in a grey area of food safety regulations. Struggles with tenant retention and profitability further strained the business. As of March 2025, it had raised over $1.5 billion from Softbank and Mubadala. In August 2024, Reef announced it would close all food prep locations and pivot to grocery delivery.

Kitchen United: Founded in 2017, Kitchen United was one of the first entrants into the ghost kitchen market, offering shared commercial kitchen spaces for restaurant brands to fulfill delivery and takeout orders. Unlike CloudKitchens, which owns and operates its facilities, Kitchen United partnered with third-party real estate owners, including major grocery chains like Kroger, to embed ghost kitchens within retail locations. The company raised over $150 million in funding from firms like Google Ventures, Fidelity, and Kroger. In November 2023, Kitchen United announced it would close all kitchen facilities and pivot to software. The company’s remaining assets had been bought by Nimbus Kitchens, ChefSuite and C3.

Virtual Dining Concepts: Founded in 2020, Virtual Dining Concepts (VDC) has launched a mix of independent concepts and celebrity-backed brands, including MrBeast Burger, Pardon My Cheesesteak, Mariah’s Cookies, and Buddy V’s Cake Slice. Like FutureFoods, the company specializes in virtual restaurant brands, partnering with existing restaurants to expand their delivery offerings. The company operates across more than 2K locations and collaborates with over 30 restaurant chains. As of March 2024, VDC had raised $20 million in total funding.

Nextbite: Founded in 2017, Nextbite doesn’t own physical infrastructure but instead creates virtual restaurant brands for existing brick-and-mortar restaurants to operate out of their kitchens. While this approach is more of a licensing model, it still competes in the digital restaurant space against FutureFoods. Nextbite had raised $150 million in total funding, before being acquired by Sam Nazarian’s C3 hospitality group in June 2023.

Growth Kitchen: Founded in 2020, Growth Kitchen began as a competitor to CloudKitchens in the UK, acquiring and managing ghost kitchen facilities. The company faced similar challenges to other ghost kitchen operators, including high real estate costs, occupancy struggles, and operational inefficiencies. By 2024, Growth Kitchen sold off its kitchen assets and pivoted to leveraging existing commercial kitchen infrastructure to bring virtual brands online. As of March 2025, Growth Kitchen had raised £3 million.

Restaurant Software

Toast: Founded in 2011, Toast is one of the most widely used restaurant software platforms, providing a cloud-based POS, kitchen display systems, payment processing, and online ordering. While it primarily serves full-service restaurants, it has expanded into fast-casual and delivery-first operations. Toast has over 134K restaurants using its software, which is a close match to Otter’s 100K. Toast went public in 2022 and generated $4.9 billion in revenue in 2024. As of March 2025, Toast had a market cap of $20 billion.

Square (Block): Founded in 2009, Square provides an integrated POS, online ordering, and payment system with a strong presence among independent restaurants and small chains. It also enables direct-to-consumer digital ordering, reducing reliance on third-party platforms. Square went public in 2015 and generated $6.6 billion in revenue in 2024. As of March 2025, Block had a market cap of $53.89 billion.

Slice: Founded in 2015, Slice helps independent pizzerias grow their businesses by increasing order values, improving customer retention, and optimizing operations. With nearly 20K pizzerias on its platform, Slice has positioned itself as an essential operating system for local pizza shops. It has expanded beyond ordering to include a branded consumer app with over 9 million active users. As of March 2025, Slice had raised $125 million.

Kitchen Automation

Miso Robotics: Founded in 2016, Miso is known for developing Flippy, a robotic arm that automates fry stations in fast-food restaurants. Miso has partnered with brands like White Castle and Jack in the Box to reduce labor dependency in high-volume kitchen tasks. As of March 2025, Miso had raised $96.9 million.

Picnic: Founded in 2016, Picnic specializes in automated food assembly, particularly for pizza-making, where it uses robotics to prepare pizzas in a fraction of the time it takes human staff. It has found popularity amongst university canteens, with clients such as Penn State, UT Austin, and the University of Mississippi. As of March 2025, Picnic had raised $57 million.

Spyce: Founded in 2015, Spyce developed an automated kitchen system for assembling grain bowls and salads, similar to Lab37’s “Bowl Builder” machine. After the company raised over $25 million, Sweetgreen acquired Spyce in 2021.

Business Model

CloudKitchens

CloudKitchens operates a vertically integrated business model, balancing an asset-heavy real estate model with an asset-light software-driven expansion. CloudKitchens monetizes its ecosystem by providing kitchen space, operational support, software, and logistics solutions for delivery-first food businesses.

The company specializes in acquiring distressed or underutilized real estate and converting it into high-density, delivery-only kitchen facilities. The value of CloudKitchens’ real estate portfolio highly depends on the NOI, occupancy and turnover rates of its facilities. Depending on the location, a 200 square foot unit from CloudKitchens in the US is available for rent from $3.5-6K per month. The company also generates revenue from additional infrastructure services, such as cold storage, utilities, and property management, bundled into the lease.

By controlling both the physical infrastructure and digital tools powering food delivery, CloudKitchens captures value across multiple touch points, positioning itself as a key player in the evolving restaurant industry. That’s where the company’s other products, like Otter and Future Foods, come in.

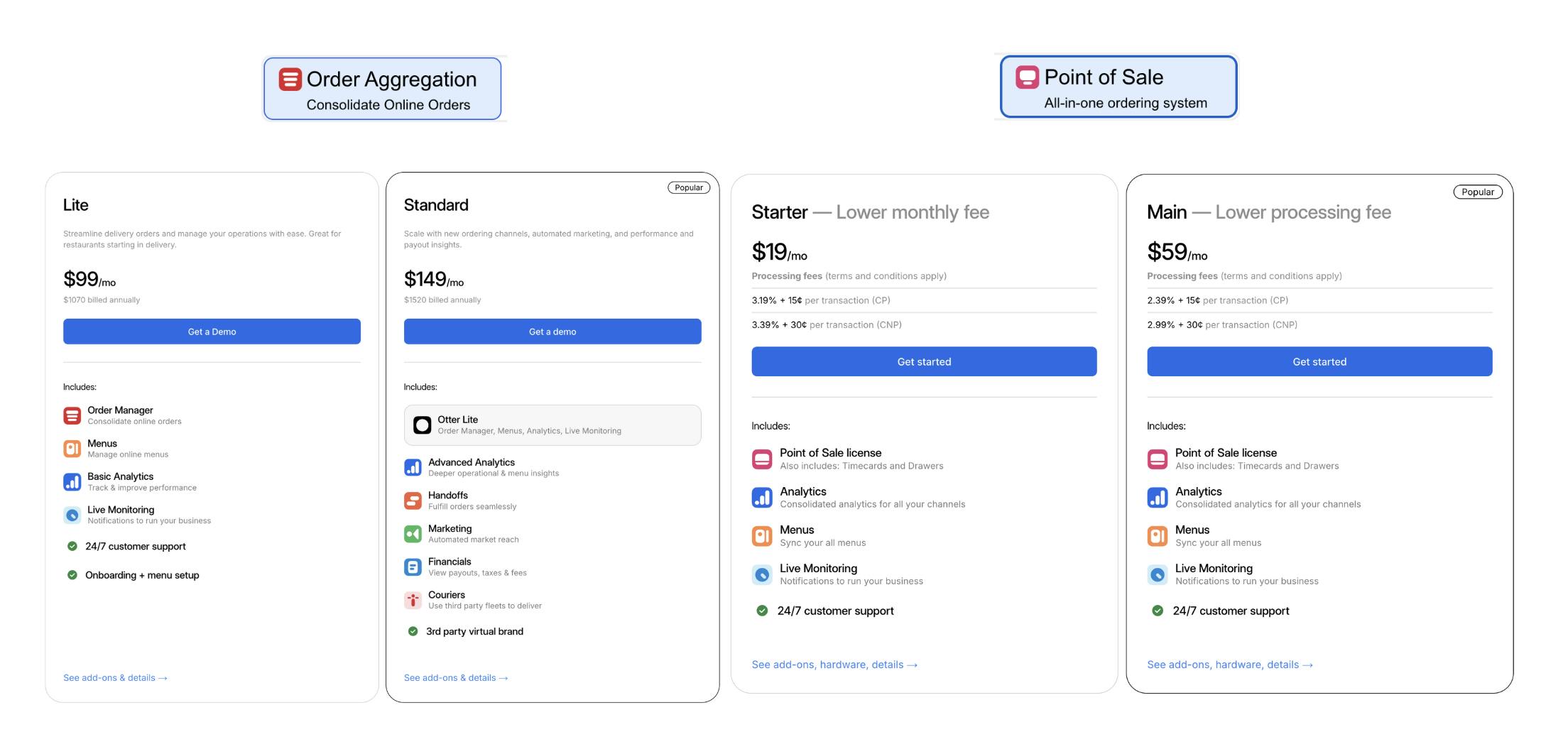

Otter

Source: Otter

Otter operates as a standalone SaaS business. It offers order aggregation, point-of-sale (POS) functionality, and marketing tools to restaurant operators, generating revenue through subscription fees. Restaurants using Otter can manage their delivery presence across multiple platforms, with some opting for an all-in-one package that includes hardware and payment processing for a monthly fee. Otter charges on a per-location basis, with two tiers for its POS solution ($19 per month or $59 per month + processing fees, hardware and add-ons), and two tiers for Order Aggregation ($99 per month or $149 per month + add-ons).

Future Foods

Future Foods, CloudKitchens’ virtual brand division, allows existing restaurants to operate additional delivery-only brands. Participating restaurants receive pre-designed menus, marketing assets, and demand generation support in exchange for a revenue share model, typically around 10% of sales.

Traction

CloudKitchens has expanded its global footprint, with over 400 locations across 110 cities in 30 countries, each housing 20-30 kitchen units. CloudKitchens has attracted enterprise brands like Chick-fil-A, Wendy’s, Taco Bell, and Little Caesars, which have leveraged its facilities to expand into new markets. Operators using CloudKitchens’ infrastructure are seeing an average unit volume of $1.2 million per location, demonstrating the profitability of the model.

Otter has established itself as a notable player in restaurant technology, facilitating order aggregation and operational management for over 100K restaurants. By 2024, 18% of all online food delivery orders in the U.S. were processed through Otter’s software. With Otter, CloudKitchens has extended its influence beyond its own properties, embedding itself in the broader restaurant ecosystem.

Historically, CloudKitchens has been very secretive, not granting interviews to press or allowing employees to list affiliations on LinkedIn. One unverified estimate indicated that CloudKitchen’s 2024 revenue may have been ~$1.1 billion.

CloudKitchens faces high tenant turnover, with 2022 reports showing an average 65% churn within a year for 20 of its locations nationwide. Many operators struggle to cover rent and delivery fees, citing poor maintenance, lack of marketing support, and slow service.

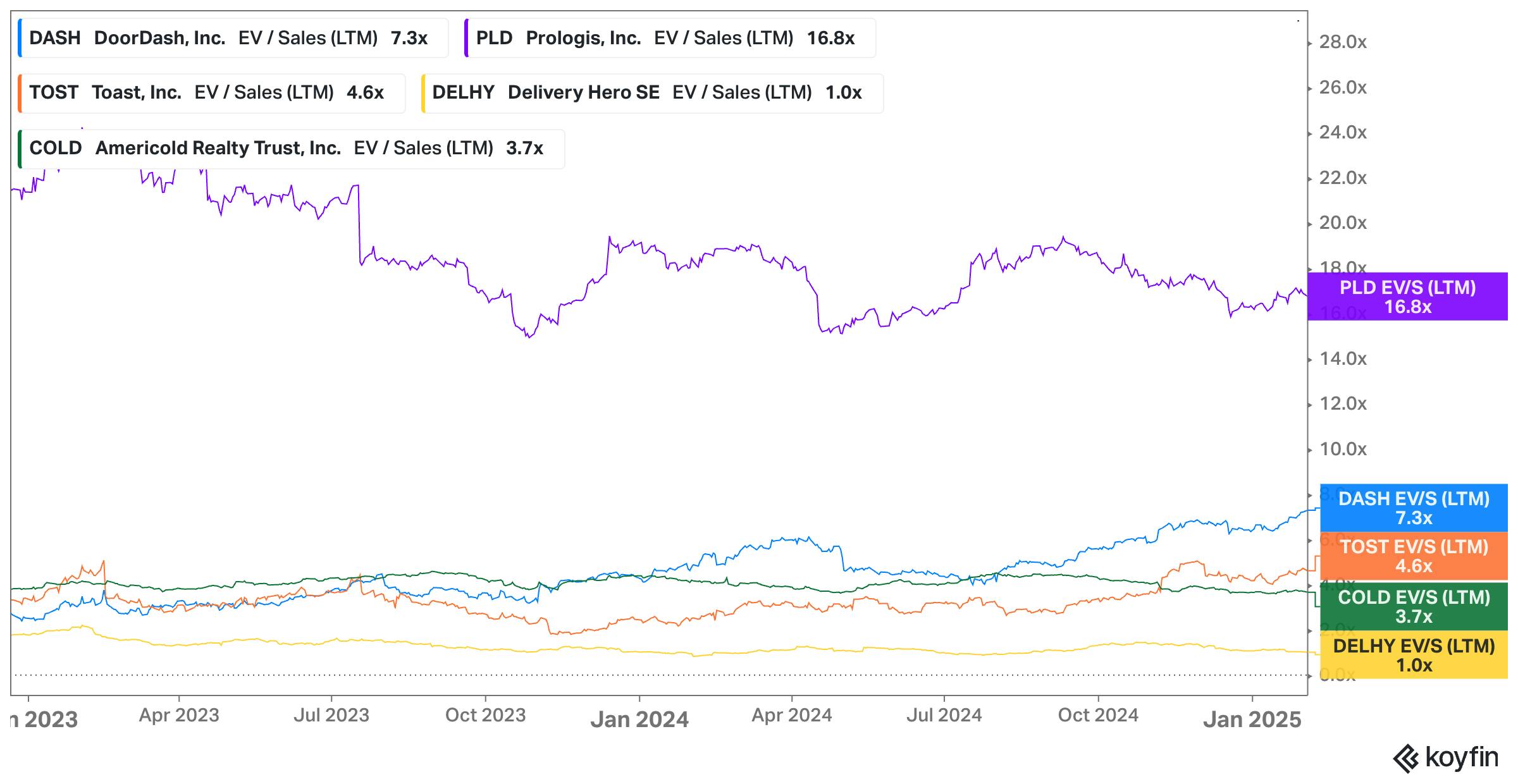

Valuation

As of March 2025, CloudKitchens had raised $1.3 billion across multiple funding rounds, with major investors including Saudi Arabia’s Public Investment Fund (PIF), Microsoft, Craft Ventures, and King Street Capital Management. In November 2021, the company raised $850 million in a mix of debt and equity at a $15 billion valuation.

Based on the one unverified estimate of CloudKitchen’s revenue at $1.1 billion, the company’s 2021 valuation of $15 billion represents a 13.6x LTM revenue multiple. CloudKitchen’s broader business is complex and involves a number of operating components: (1) real estate and restaurant operations, (2) POS and software, and (3) marketing services. Real estate companies like Prologis and Americold Realty Trust trade at the opposite ends of the spectrum, from 16.8x LTM revenue to 3.7x LTM revenue respectively. Meanwhile, food delivery companies like DoorDash and Delivery Hero can also trade at a broad range, from 7.3x LTM revenue to 1.0x LTM revenue respectively.

Given the complexity of CloudKitchen’s business, it's difficult to determine how it would trade in public markets. There is added complexity, given the corporate entity structure of the business. While it's not publicly disclosed, it's likely that City Storage Systems continues to operate as the parent company of the various products associated with CloudKitchens, from Otter to Lab37 and Future Foods. It’s unclear how this structure would be regarded in the public markets, especially with Kalanick in the role of CEO, given his mixed experience with shareholders in the past.

Source: Koyfin

Key Opportunities

Going Public via REIT

One key opportunity for CloudKitchens lies in institutionalizing ghost kitchens as a real estate asset class and eventually taking the business public through a REIT (Real Estate Investment Trust) structure. By packaging its properties into a REIT, the company could attract institutional investors, lower its cost of capital, and scale more efficiently. This model mirrors the trajectory of data center and logistics REITs, such as Digital Realty and Prologis, which have gained significant market traction as new infrastructure categories. Going public through a REIT would also provide CloudKitchens with a liquidity event that allows for further expansion.

One obstacle in doing so is associated with the business model’s novelty and the challenging nature of doing business with first-time restaurant operators. Four Corners Property Trust, a comparable REIT focusing on operating properties leased to traditional QSR restaurants, advertises a 99.6% occupancy rate across its portfolio. If CloudKitchens is able to reduce its turnover rate and demonstrate that it could attract stable tenants, it could consider this as an avenue for expansion.

Expanding Walk-In Food Halls

CloudKitchens has the opportunity to expand its walk-in food hall concept. While CloudKitchens was built primarily for delivery-first operations, many locations already accommodate takeaway customers. Developing food halls in high-foot-traffic urban areas, like Time Out Market or Urbanspace, could create a new revenue stream while increasing brand visibility. This shift would allow CloudKitchens to tap into both digital and physical restaurant demand, providing a hybrid model that combines ghost kitchen efficiency with in-person customer engagement.

Launching a Delivery Marketplace

Today, CloudKitchens operators depend on third-party platforms like Uber Eats, DoorDash, and Grubhub to drive orders, paying commissions as high as 30%. With Otter’s infrastructure, CloudKitchens could enable its restaurant partners to process orders directly, creating a first-party delivery network. This would not only allow operators to bypass aggregator fees but also give CloudKitchens full control over customer data, pricing strategies, and order fulfillment.

Key Risks

High CapEx & Real Estate Risk

CloudKitchens’ business model is capital-intensive, requiring significant upfront investment to acquire and repurpose real estate into ghost kitchen facilities. Rising property costs, interest rate hikes, and economic downturns could impact CloudKitchens’ ability to acquire new locations at favorable terms. Additionally, its reliance on distressed real estate means navigating zoning laws and local opposition, which can slow expansion and increase regulatory hurdles.

Vacancy Rates

Since COVID-19 has come to an end, many ghost kitchen operators have struggled to keep their units occupied, leading to the fall of Kitchen United and Reef. CloudKitchens has also resorted to laying off staff and closing down select locations.

Tenant churn poses another risk, as many CloudKitchens tenants are small restaurant operators with tight margins and limited capital reserves. While the model promises lower overhead compared to traditional brick-and-mortar restaurants, competition in the food delivery space remains fierce, and operators frequently struggle with profitability.

Traditional Restaurant Competition

Major QSR brands are investing in their own delivery infrastructure, reducing their need for third-party ghost kitchens. Additionally, independent restaurants are increasingly optimizing for takeout and delivery from their existing locations, eroding CloudKitchens’ value proposition. The rise of restaurant-owned virtual brands and in-house fulfillment strategies could further intensify competition, limiting CloudKitchens’ ability to capture market share.

Legal Disputes

CloudKitchens has faced legal challenges, including allegations of workplace discrimination, wrongful termination, and unfair labor practices. One 2024 lawsuit by former top salesperson Isabella Vincenza claims the company retaliated against her for taking maternity leave. CloudKitchens denies the allegations, but the case brings back past controversies surrounding CEO Travis Kalanick. Beyond workplace disputes, the company has faced lawsuits over unpaid overtime and labor violations, some of which have been settled or moved to arbitration.

Summary

CloudKitchens has built a vertically integrated food delivery infrastructure powerhouse, combining real estate, software, and automation across 400+ locations in 110 cities. Its model has attracted enterprise brands like Chick-fil-A, Wendy’s, and Taco Bell, enabling rapid expansion with lower costs and faster go-to-market. Despite its scale, CloudKitchens faces challenges, including high capital expenditure, tenant churn, and growing competition from traditional restaurants. To sustain growth, the company could institutionalize ghost kitchens as a real estate asset class, expand walk-in food halls, and launch its own delivery marketplace. Whether it becomes the dominant force in food delivery or struggles under its aggressive expansion will depend on its ability to maintain occupancy, optimize operations, and navigate regulatory hurdles.

*Contrary is an investor in Replit and DoorDash through one or more affiliates.