Thesis

Lack of adequate housing supply has been an increasing issue in the US. A housing construction slowdown over the 2010s paired with a surge in home buying due to the low interest rates in the early 2020s has impacted the available housing supply. It has been estimated that the US had a shortage of 6.5 million single-family homes as of March 2023. New home builds continued to fall despite this, with new-build sales having fallen 9% year over year in August 2023. This only exacerbates the mismatch between supply and demand in housing.

Compounding this is the labor shortage within the construction industry; there was an estimated shortfall of 501K workers in construction as of January 2024. Construction also suffers from inefficiencies impacting time to build, costs, and pollution. The average home took 7.6 months to build as of 2022, not taking into account the lengthy pre-construction process which includes finding and purchasing land, designing the home, and the initial construction permitting processes. Once constructed, the operations of buildings account for 30% of global final energy consumption and 26% of global energy-related emissions. Additionally, the average cost to build a new single-family home (including the cost of land) was $644K as of February 2024.

Cover is a modular home builder that designs, manufactures, and installs backyard homes in Los Angeles. It manufactures panels in its factory, then transports them on a standard truck and assembles them on site. Its process is designed to make the construction process quicker, more environmentally friendly, and scalable. Cover uses software and manufacturing technology to help its home-building process become more efficient. Its vision is to build high-end panelized homes that can be fabricated and assembled in a factory; to do for homebuilding what Henry Ford did for automobile production.

Founding Story

Cover Technologies was founded in 2014 by Jemuel Joseph (President) and Alexis Rivas (CEO). The pair met while studying architecture at the Cooper Union, where they built a computer numerical control (CNC) machine together to run faster architectural models while at school before starting Cover.

Source: Archinect

Rivas worked on several residential projects at various firms in the US, Canada, and Europe. He began to notice that the project delivery process had inefficiencies, in particular, that the majority of construction cost inefficiencies stemmed from coordinating between the different people needed to build a home including the architects, engineers, general contractors, subcontractors, and others.

This eventually led him to a job in prefab construction. The key learning Rivas took away from his experience in that industry was that although prefab builders were building homes in a factory, they were still utilizing what was essentially a fundamentally conventional process to do so. As Rivas put it in an interview:

“I learned that the approach they had didn't work. They were building homes in a factory, but they were building homes the same way as conventional construction. They were still using 2x4s, hammers and nails, and drywall. The result was a marginally better process and product, but the gains were outweighed by the cost of transporting the large room-size blocks on oversized trucks and by the overhead of a factory. To make a product in a factory efficiently and realize a meaningful improvement to the product you have to redesign the product from the ground up to be geared towards manufacturability from the start.”

This line of thinking led him to realize that there was an opportunity for a better way of doing things. He then approached Joseph about starting a new company to implement his idea.

Joseph, like Rivas, studied architecture at Cooper Union but had always approached the field with a technological lens. Joseph built his first website when he was seven and had a deep interest in software and computers while growing up. These early influences would lead him to develop an interest in geospatial mapping and computational design, and he was on the verge of leaving architecture to become a software engineer when Rivas approached him with the idea for what would become Cover.

Although the duo had both architectural and technical software backgrounds, they lacked mechanical or manufacturing engineering expertise. They knew that they wanted to build homes on production lines, so they recruited a team of engineers from companies, including Tesla, SpaceX, and Apple to kickstart the process.

Product

Cover creates backyard homes, also known as accessory dwelling units (ADUs). As of March 2024, it limits its operations to the Los Angeles market. Cover manages the process of producing these units end-to-end including design, permitting, manufacturing, and installation. Cover offers two standard models that come pre-designed, the S1 and S2, along with custom builds.

Cover S

Source: Cover

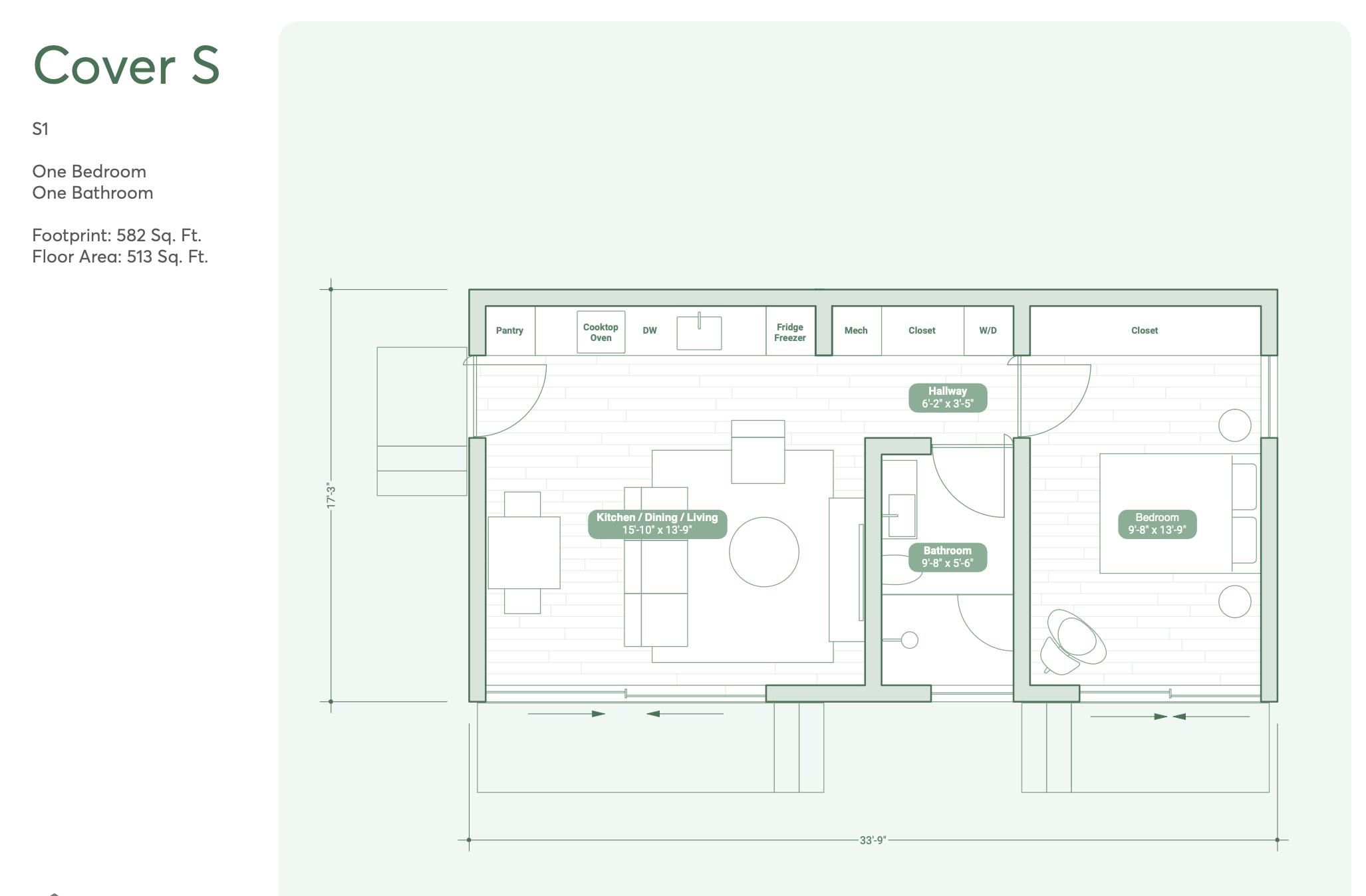

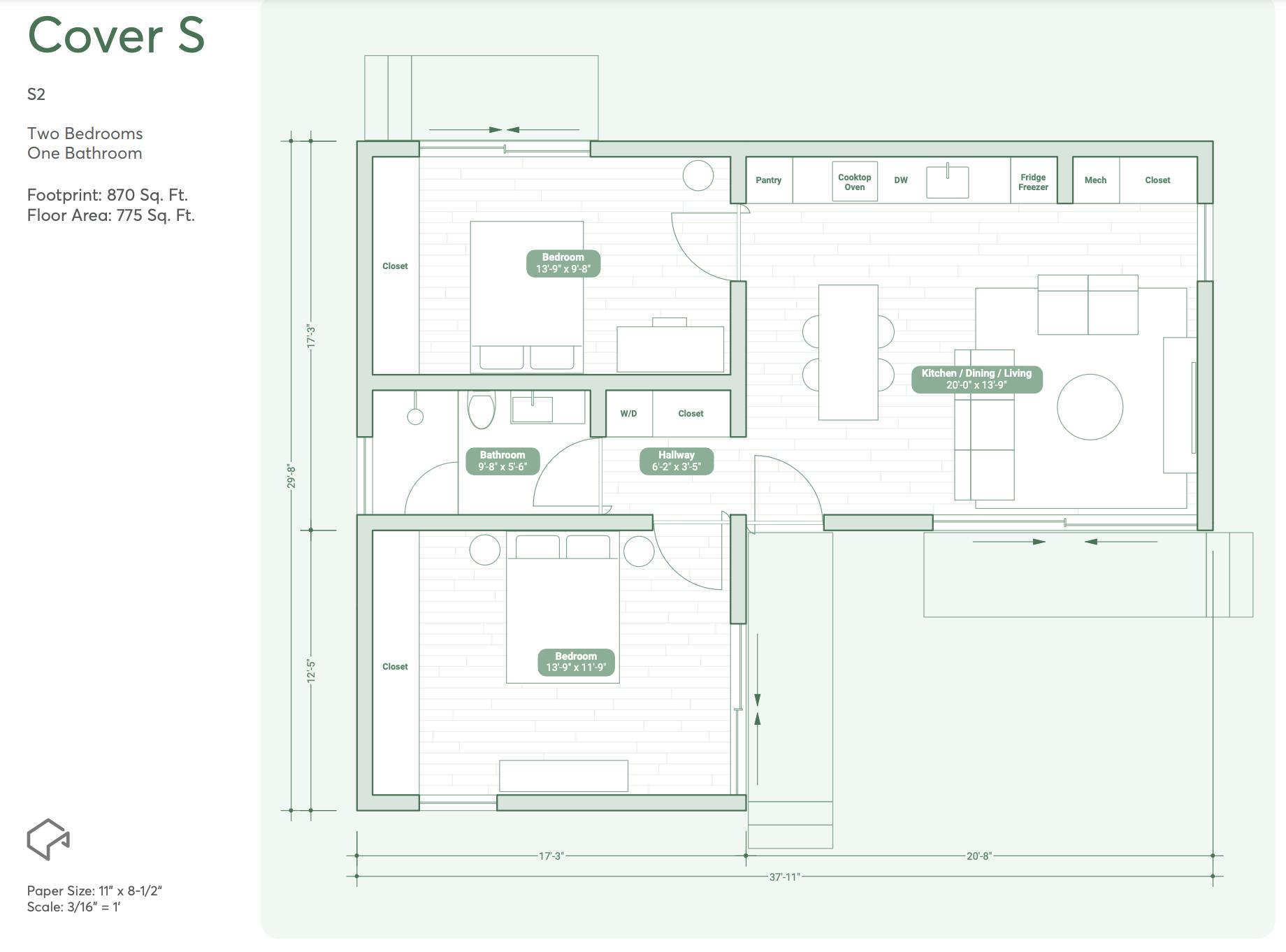

The Cover S is Cover’s background home unit that the company describes as a “culmination” of the experience of having designed over 1K custom builds, specifically tailored for LA. It has two variants, the S1 and the S2. Cover S units are pre-engineered which the company claims “eliminates” the majority of engineering, design, and permit preparation costs for its customers.

They are designed to fit “most LA properties”, and the company offers $250 site visits to prospective customers who are interested in seeing if their backyards are viable sites for a Cover unit. The company also says that it can deliver its Cover S product “in as little as six months”.

Both the S1 and S2 come equipped with 9’ ceilings, floor-to-ceiling windows, and 12’ wide sliding glass doors. The company also says that they are equipped with “premium” appliances, built-in storage, and integrated lighting. They can also be built with black, white, or wood finishes. Both the Cover S models can be completed within three to six months. A virtual tour of a Cover unit can be found here.

Cover S1

Source: Cover

The Cover S1 is Cover’s one-bedroom unit that is designed to fit in 45’+ wide lots. It is 580 square feet in size. Its total price starts at $354K, which includes the cost of the unit, site work, permitting fees, and design and engineering fees.

Cover S2

Source: Cover

The S2 is Cover’s pre-designed two-bedroom unit. It is 870 square feet in size and is designed to fit lots that are 50’ wide or larger. Its total price starts at $487K.

Custom Build

Source: Cover

Cover tailors homes to meet the unique preferences and characteristics of both the homeowner and the property. Utilizing a component-based, panelized system, Cover enables a wide array of design possibilities that can be built out using Cover’s pre-engineered building system.

Pricing for custom builds is calculated “based on the type and number of components” in the custom design, as opposed to a general per-foot cost. The company says that this is intended to provide its customers with accurate pricing upfront at the beginning of a project. Cover offers custom builds with a fixed $40K design and engineering fee within a 9-14 month timeline.

Market

Customer

Cover primarily caters to Los Angeles homeowners who have outgrown their current residences and are looking for additional space. The majority of the company's customers opt for Accessory Dwelling Units (ADUs), which serve a variety of purposes such as accommodating family members, creating separate home offices, or generating rental income.

Cover's customer base is geographically concentrated in Los Angeles, which is the only market in which it operates as of March 2024. Selling to these customers varies in complexity, depending on individual needs and circumstances. One notable customer example was a backyard home Cover built in Brentwood, CA, to bring a family closer together during the COVID-19 pandemic.

“Claudia Buchanan and her family sought a living arrangement that would provide both togetherness and independence for her mother, Alice. Opting for our prefabricated accessory dwelling unit, the family was drawn to our emphasis on flexible, speedy, and sustainable design.”

Market Size

Globally, the modular and prefabricated construction market surpassed $147 billion in 2022 and is expected to grow at 6.5% CAGR to reach $285 billion by 2032. Trends such as a slowdown in housing construction during the 2010s paired with a surge in home buying due to the low interest rates in the early 2020s during the COVID pandemic have led to a shortage of housing, which has helped drive demand for non-traditional methods of construction.

Compounding this is the labor shortage within the construction industry where there was an estimated shortfall of 501K workers in construction as of January 2024. Construction also suffers from inefficiencies impacting time to build, costs, and pollution. The average home took 7.6 months to build as of 2022, not taking into account the lengthy pre-construction process which includes finding and purchasing land, designing the home, and the initial construction permitting processes. Once constructed, the operations of buildings account for 30% of global final energy consumption and 26% of global energy-related emissions. Additionally, the average cost to build a new single-family home (including the cost of land) was $644K as of February 2024.

Modular and prefabricated construction addresses these issues by lowering costs, time-to-construction, and environmental impact of construction. Prefabricated construction still has low market penetration in the US; in 2023, less than 4% of US housing stock was built using modular techniques. Despite this low adoption rate in the US, other countries have proven that there is room for this market share to grow significantly; 15% of homes in Japan, and 45% of homes in Finland, Norway, and Sweden were built using modular techniques as of May 2023.

Competition

Mighty Buildings: Mighty Buildings was founded in 2017 and is a construction technology company that builds homes using a process that combines 3D printing and advanced material science with off-site prefabrication and robotics. Mighty Buildings raised a $40 million Series B in February 2021, led by Khosla Ventures and Zeno Ventures. It has raised a total of $153.8 million as of March 2024. It says that its homes take four days to assemble. It offers an ADU model that is 636 square feet, along with full units that range from a 1.9K square feet townhome to a 3.2K square feet two-story home, along with custom models. The company operates in California.

Abodu: Abodu is a prefab home builder that builds ADUs by constructing them offsite and installing them in homeowner backyards. Abodu was founded in 2018 and has raised $23.5 million in funding as of March 2024. It raised a $20 million Series A in July 2021 led by Norwest Venture Partners. Other notable investors include Initialized Capital and Redfin CEO Glenn Kelman. Unlike Cover which serves only Los Angeles, Abodu is based in Redwood City and serves the entire state of California. It offers several models, including a studio unit, a one-bedroom unit, a two-bedroom unit, and a house. Its unit sizes range from 340 square feet to 800 square feet, and prices range from $228K to $439K, and it delivers its units “in as little as six months”.

Blokable: Blokable is a modular home builder for multi-family properties. Blokable was founded in 2016 and has raised $35.9 million in total funding as of March 2024. It raised a $23 million Series A in August 2019 led by Vulcan Capital, with other notable investors including Building Ventures, Jason Calcanis, Kapor Capital, and Marc Benioff. Unlike Cover which is focused on modular building ADUs, Blockable specializes in modular construction for multifamily homes.

Connect Homes: Connect Homes was founded in 2011 and is a modular home builder that designs, manufactures, delivers, and installs single-family homes and other housing solutions across the US. It provides both a “Pro Series” of standardized prefab design options (comparable to the Cover S) and a semi-custom “Design Series” of premium models. The company has raised $19.8 million in funding as of March 2024, with a $10.8 million Series A in May 2019 led by Brick & Mortar Ventures and Virgo Investment Group.

Business Model

The company's pricing strategy is unique in that it calculates costs based on the type and number of components in a design, rather than a general per-foot cost. This approach is intended to allow for fixed, up-front, and accurate pricing tailored to each project. Before entering into a contract with a client, Cover locks in the pricing, which includes permitting fees, city fees, foundation fees, and the cost of the home itself.

The major costs associated with Cover's business model include materials, machinery, labor, and the operation of its warehouse. Cover is asset-heavy, as it requires materials, warehouse space, and machinery all of which power the core function of its business to run. Additionally, there are long-term structural costs associated with maintaining and improving its manufacturing and assembly processes, with depreciation of machinery to consider.

Over time, Cover has streamlined its manufacturing process, reducing the time and labor required for installation. For instance, the installation of a modular unit, which initially took 120 days and about a dozen people, only takes 30 days and six people as of June 2023. As of March 2024, the S1 unit costs $354K and the S2 costs $487K.

Traction

By October 2021, Cover had built 20 backyard homes. By June 2023, CEO Alexis Rivas stated that the company had finished just a “few dozen” homes, and the company was not disclosing revenue. Assuming an average revenue per project of $420.5K (the midpoint between an S1 and S2 starting cost), and between 24 to 56 total completed projects as of June 2023, the company’s total revenue in its first nine years would have been between $10 million to $23 million. On the regulatory front, as of August 2023, Cover was in the process of getting pre-approved pre-permitted plans in Los Angeles. This would allow for quicker permit process time, smaller permitting fees, and less variability of approvals.

Valuation

Cover raised a $60 million Series B in October 2021 at an undisclosed valuation. The round was led by Gigafund, with participation from other notable investors including Founders Fund, Valor Equity Partners, Lennar Corporation, General Catalyst, and Naval Ravikant. As of March 2024, the company has raised a total of $73.3 million in funding.

Key Opportunities

Expanding from ADUs

Cover’s strategy was initially to build backyard homes “to prove on a small scale that our core software and panel building technology works”. CEO Alex Rivas stated that the company’s next step is to expand “to primary homes, communities, and multi-family and mixed-use”. According to Rivas, the company’s initial technology build-out will allow it to expand quickly to other building types; as he put it in a February 2021 interview:

“What we’re really building is a finite set of lego-like building panels that can be combined to create all kinds of different structures and software that streamlines the entire process.”

This modularity is intended to allow for a versatility of product offerings that the company can expand to provide in the near future. This would increase the company’s total addressable market.

Geographic Expansion

As of March 2024, Cover only serves the Los Angeles area, whereas competitors like Abodu serve the entire state of California. While regulatory complexity is an obstacle in each new market, as are different preferences and homeowner needs, the company can expand its pool of potential customers by entering new markets.

Key Risks

Demand Variability

Production lines work best when demand is steady, and utilization is high. Given the peaks and troughs of the construction industry, there is a lot of variability in demand which creates challenges from a manufacturing perspective. This variability of demand creates headaches for modular companies. Oftentimes, in order to fill idle production capacity, companies enter low-value contracts in order to increase utilization rates, despite margins being consumed by high logistics and on-site labor costs — effectively operating projects at or close to breakeven.

Capital Intensive Business Model

Home building generally is a capital-intensive industry, however, modular construction is an especially capital-intensive approach to building with high up-front costs. The cost to build and maintain the factories paired with the resources needed to own and maintain transportation infrastructure is likewise costly. At times, with no long track record of success, modular firms can be asked to provide additional working capital for performance bonds as a way to protect the building owner from downside risk. Modular home building can therefore be seen as high-risk compared to traditional construction methods.

Regionality Constraints

Cover has focused its initial launch and implementation in Los Angeles, which is a particularly warm region with limited precipitation and weather variability. The proof of concept designs that were successful in LA may have difficulty translating to the variability of climate in other parts of the US Weather conditions impact the design of modular structures and may make it difficult for Cover to scale its product nationally Additionally, zoning, licensing, and regulations differ locally. Market expansion is therefore much more complex than, for example, a software business.

Summary

With an increasing shortage of housing supply in the US, Cover uses technology to design, manufacture, and install backyard homes (ADUs) in Los Angeles. Its approach involves factory manufacturing of panels, which are then transported and assembled on-site, with the goal of creating a quicker, more eco-friendly, and scalable construction process. Cover's focus is on creating functional, high-quality homes with features like floor-to-ceiling windows and efficient energy systems, reducing energy usage by 75%. While currently serving Los Angeles homeowners, Cover plans to expand its market, potentially tapping into primary homes and multifamily buildings, but faces challenges related to variable demand in the construction industry, capital intensity, and region-specific constraints.