Thesis

The United States is in the midst of an extreme housing shortage that is not going away anytime soon. A 2021 study estimated that the US was facing an undersupply of 5.5 million homes, and the number of active house listings in the US dramatically decreased from roughly 1.5 million in October 2016 to less than 500K in October 2021. Coupled with continued strong demand for housing, this undersupply is driving up median home prices across the nation, peaking with a 25% increase in median home prices between 2019 and 2021. Meanwhile, US cities of all sizes are building at too slow of a pace to keep up with demand.

In 2022, it was believed that rising mortgage rates would slow demand for housing and effectively decrease home prices by increasing the cost of borrowing for consumers. This belief gained steam as homebuilder confidence and single-family home sales began to plummet in the first quarter of 2022. However, despite mortgage rates being at their highest level since 2008, median prices for single-family homes across the nation continued to increase. As a result, housing affordability dropped to its lowest level in 10 years in 2022. Lack of housing affordability likely has negative consequences that impact many different facets of the economy.

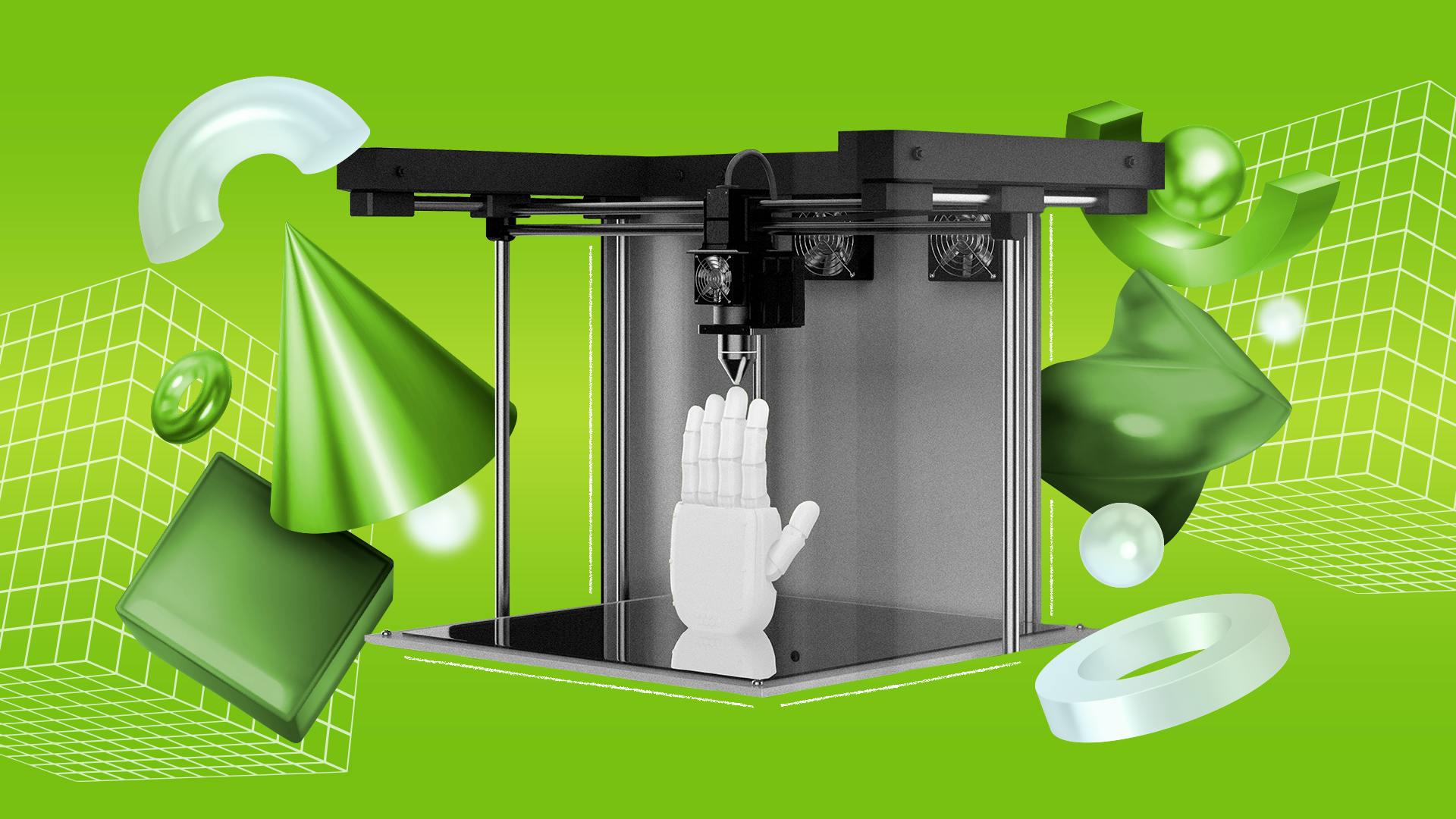

ICON is a construction technology company that uses 3D robotics, software, and advanced materials to advance homebuilding capacity. It wants to make houses and other structures that are not only considerably cheaper than conventional methods but also faster to build, more sustainable, more resilient and energy efficient, and built with more design freedom. The company thinks it will be able to achieve these objectives by reducing the high labor and material costs associated with traditional building methods with the use of its efficient, low-waste 3D printers and other technologies.

Founding Story

ICON was founded in late 2017 by Jason Ballard (CEO), Evan Loomis, and Alexander Le Roux (CTO). After originally meeting at Texas A&M, Ballard and Loomis founded TreeHouse together in 2008. Treehouse was a home upgrade company focused on sustainability, design, and home resiliency. Their early exposure to the construction industry led the pair to become convinced that there must be a better way to build more affordable, sustainable houses. They studied several methods to accomplish this goal and eventually decided that 3D printing was the best alternative, although they lacked the technical prowess to make it a reality.

Nevertheless, they saw 3D printing as a logical solution to the inefficiencies they witnessed in the construction industry, believing it would be cheaper, faster, and more resilient in extreme weather. Ballard had read extensively about the potential for 3D printing houses and knew nobody had yet cracked that opportunity.

In 2017, he and Loomis joined forces with Le Roux, who was experimenting with the technology in Houston. As the cofounders had their first conversations with potential investors, they kept hearing that ICON was exciting, but it still seemed like science fiction. They needed a prototype printer that could print something that looked like a home and was a livable house. When no funding materialized, they maxed out several personal credit cards to build Vulcan I.

ICON officially launched at SXSW in 2018, building the first permitted 3D-printed home in the US. The home, which took 48 hours to build and helped ICON win the Social & Culture category at the SXSW pitch competition, represented a massive development for the nascent 3D construction industry and propelled ICON into the spotlight.

Product

ICON builds entire or partial 3D-printed concrete homes and buildings using its proprietary Vulcan Construction System, which consists of hardware, software, and construction materials.

Source: ICON

Vulcan

The Vulcan is ICON’s third-generation 3D printer that can print buildings up to 3K square feet without relocation more efficiently than other building methods. The company produces and operates these 3D printers on construction sites to ensure that the printer runs smoothly and functions with the other parts of the company’s construction system. Although the Vulcan is massive, measuring 15’6” x 46’6”, it was designed to be moved rapidly from one site to the next to increase the printer’s productivity.

Source: ICON

Magma

Magma is a portable factory that mixes ICON’s proprietary Lavacrete mixture with additives and water before supplying the material to the Vulcan 3D printer to print. Magma ingests dry Lavacrete, hydrates, and then adjusts the formula in real time based on the conditions at the building site itself. Once the material is mixed, Magma pumps the Lavacrete to Vulcan for printing. The Magma system accounts for differences in current weather conditions at the printing site and adjusts the Lavacrete formula to produce the best building material.

Source: ICON

Lavacrete

Lavacrete is a cement-based mixture created by ICON for use in its printers. It is a proprietary material ICON created to be highly printable and strong. Lavacrete has gone through rigorous testing and development, yielding a durable building material. The material was created with two ends in mind: 1) to allow ICON to print at high speeds while retaining its form and 2) to be stronger and more resilient than other concretes.

Source: 3D Printing Industry

Build OS

BuildOS maintains the digital architecture, and helps control the robots that turn designs into physical buildings. It is ICON’s digital operating system that the company uses to control every part of the printing process, helping projects move from floor plans to 3D-printed structures. The operating system utilizes real-time data to direct the Vulcan 3D printer and Magma mixer onsite to ensure that ICON is producing high-quality structures, regardless of external conditions.

Market

Customer

Developers and Homebuilders: While 3D-printing technology is still a recent innovation in the construction industry, developers and homebuilders are beginning to incorporate it into their work processes due to the promise of productivity gains. While historically fragmented, the home-building industry is undergoing a seismic shift towards more concentration with the top 100 builders constituting almost half of all new single-family home sales in 2020.

This increasing concentration is largely driven by the top two US homebuilders, D.R. Horton and Lennar. These were responsible for the majority of homes built by the top 10 builders as a whole between 2018 and 2020. Both companies are investors in ICON, and Lennar is already partnering with the company to build a 100-home community in Austin, Texas. It began construction in 2022.

Government & Defense: ICON works with governmental agencies, from NASA to the Department of Defense, to build cheaper and more efficient structures, including military barracks and rocket launch pads. The company’s partnership with NASA to build structures on the Moon and Mars is an example of the demand for ICON’s technology from the public sector.

Non-Profits: ICON partners with nonprofit organizations to quickly build houses cheaper than conventional methods. For example, ICON partnered with the nonprofit New Story in 2021 to provide 3D-printed homes to families in Nacajuca, Mexico, who had previously suffered from flooding and overcrowding in their homes.

Market Size

The US construction market is a massive, low-growth industry with a projected 2023 market sized at $2.6 trillion. For comparison, the total GDP of the United States in 2022 was $25.4 trillion.

Globally, the 3D printing construction market was valued at $18.1 million in 2022, and only approximately 10 of the 912K single-family houses built in 2021 were 3D-printed. However, proponents suggest that the productivity gains from the technology will lead to rapid adoption by homebuilders and consumers.

Competition

3D Printing Construction Companies (Direct Competitors)

Mighty Buildings: Mighty Buildings is a modular construction company working on disrupting the residential housing market with 3D printing technology, robotics, and composite materials. It 3D prints ready-to-install panels in a factory and assembles them onsite. The company was founded in 2017 and has raised $101.8 million. The company raised a $22 million Series B extension in 2021 after raising $40 million in its Series B raise.

COBOD: COBOD is a Denmark-based 3D printing construction company founded in 2017. Like ICON, the company manufactures and operates 3D printers capable of building homes and other structures directly onsite. COBOD has a global footprint and received an undisclosed amount of investment from strategic partners like CEMEX, a global construction materials company.

Alquist 3D: Alquist uses 3D printing technology to create designs while lowering the cost of housing and infrastructure. It operates a model similar to ICON and COBOD, producing and operating construction-scale 3D printers to print concrete houses. The company was founded in 2020 and raised a $1 million round in 2020.

Diamond Age: Diamond Age offers robotic construction technology intended to address construction labor shortages. It was founded in 2018 and has raised $58 million in funding. It claims its automation and suite of robotic tools offset 55% of the manual labor required to build a conventional home.

Tech-Enabled Construction Startups (Adjacent Competitors)

Homebound: Homebound aims to simplify the homebuilding process by infusing technology that lets homebuyers design their house and receive financing without having to worry about regulatory or construction problems. While Homebound competes with ICON in the sense that both companies aim to make the homebuilding process easier, it does not build 3D-printed homes. The company has raised $128.4 million in funding and raised a $75 million Series C in February 2022.

Traditional Homebuilders

D.R. Horton: D.R. Horton is one of the largest traditional homebuilders in the US, achieving revenue of $33.5 billion in its 2022 fiscal year. The company builds houses using conventional methods. D.R. Horton is an early investor in ICON.

Lennar: Lennar is a major homebuilder in the US, with a 2022 revenue of $33.7 billion. Similar to D.R. Horton, Lennar invested in ICON’s 2021 Series B round and is already partnering with the 3D printing company to build homes in Austin, Texas.

Business Model

ICON’s business model is similar to that of a normal construction company. The startup works with several stakeholders, including developers and architects, to construct houses or other buildings using its 3D printing technology. ICON earns revenue from these project contracts, whether helping to build part of a house for a private developer or building a shelter for the US military.

Depending on the house's design, ICON can build it much cheaper than traditional construction methods, with co-founder Jason Ballard noting that price savings can range from 10-30%. This is partially due to ICON’s ability to cut out labor expenses and reduce material waste from construction costs. Additionally, 3D-printing construction is an asset-heavy business, as companies manufacture and operate their own 3D printers, meaning that ICON’s business model's scalability may be dependent on their ability to access capital to fabricate its 3D printers continuously.

Traction

As of August 2021, ICON had built more than two dozen 3D-printed homes and other buildings across the US and Mexico, including its work with nonprofits. This figure also included its 4-home partnership with developer 3Strands' East 17th Street Residences, that ICON claims were the first 3D-printed homes for sale in the US.

Source: ICON

Other promising signals of ICON’s early traction are the projects the company has completed for the US government. One example of these projects is the military barracks that ICON printed at Camp Swift in 2021 as part of a partnership with the Texas Military Department, the largest 3D-printed structure in North America.

Source: ICON

At the time of its Series B in August 2021, ICON announced that it had experienced 400% annual revenue growth nearly every year since it was founded in 2017, had more than 100 employees, and was expected to double in size within one year.

Valuation

ICON raised a $207 million Series B in August 2021 led by Norwest Venture Partners with participation from 8VC, LenX (Lennar’s venture arm), and Fifth Wall. Shortly after, ICON raised a $185 million Series B extension in February 2022 led by Tiger Global Management with participation from existing investors. Although the company has never publicly disclosed its valuation, sources close to it suggested that it was nearing $2 billion at the time of its Series B extension. These latest rounds put ICON’s total funding amount at $451.5 million, including capital from other investors such as Oakhouse Partners, Moderne Ventures, and Bond.

Key Opportunities

Partnerships with Established Homebuilders

ICON’s relationships with Lennar and D.R. Horton, the two largest homebuilders in the United States, present an opportunity and represent a significant step towards the widespread adoption of 3D printing technology in the construction industry. One example of these relationships is ICON’s joint project with Lennar to build a 100-home community in Austin. The two companies owned the largest 3D-printed home community and began construction in 2022. When asked about Lennar’s long-term plans with ICON, Lennar’s executive chairman Stuart Miller said that “we expect to take this all the way through. This is the first 100 homes, but we expect to be able to bring this to scale and at scale, we can bring cycle times down and also bring costs down.”

Additionally, while no official partnerships with D.R. Horton have been announced, the homebuilder invested in ICON’s seed round in 2018. Given the size of Lennar and D.R. Horton, the company could place itself in an advantageous position over its competitors with these partnerships.

Space Exploration

Funding for space activity has steadily increased in both the public and private sectors over the past twenty years. The market size of commercial space activity more than tripled between 2005 and 2020, rising from $110 billion to $357 billion during the time period. Over the next twenty years, this promising trend is expected to continue, with Morgan Stanley estimating that it will become a $1 trillion market by 2040. NASA’s budget is also at its highest point since the early 90s, reaching roughly $24 billion in 2022.

This increasing interest in space exploration bodes well for ICON due to the company’s existing partnerships with NASA, including not only developing technology that could be used to 3D print buildings on the Moon and Mars in the future but also its completed projects like a 3D-printed rocket pad and Mars habitat simulator.

Key Risks

Local Regulations

Regulatory differences at the local level could slow down ICON’s ability to scale up its residential building segment. Experts in the industry note that local building codes across the United States differ significantly, unlike European countries that standardize building rules at the national level. As of March 2023, apart from one project in Mexico, ICON has only built houses in and around Austin, Texas, prompting questions about how local building codes could hamper the company’s ability to deploy its technology in municipalities across the nation successfully.

Demand for Concrete-Framed Homes

While 3D-printing technology could potentially revolutionize the construction industry, some industry experts are less sure of the technology’s growth potential due to the use of materials, such as concrete, that are not commonly popular among consumers. Robert Dietz, the chief economist of the National Association of Home Builders (NAHB), talked about this technology and the NAHB’s belief in its limited market potential in 2022:

“We tend to think of 3D-printed homes as a subset of concrete-framed homes, which are just 10% of single-family homes. So it’s a small share of an already small share.”

Although co-founder Jason Ballard observed a stark increase in demand for 3D-printed houses and structures between the company’s 2020 Series A and 2021 Series B, the true market for these houses could be smaller than many think due to limited consumer demand for concrete-framed homes.

Source: Eye on Housing

Summary

The undersupply of residential housing and consequent worsening housing affordability in the United States is not being solved by traditional building methods, as homebuilders struggle to keep up with high demand for housing. ICON has the opportunity to become a key player in addressing the US housing shortage by providing 3D printing technology. By reducing costs and improving construction productivity, the company may be able to build houses faster and cheaper than the status quo, giving ICON the potential to offer a meaningful solution. While the adoption of the technology and acceptance of 3D-printed concrete homes remains a concern, the company’s partnerships with Lennar and several government agencies indicate that there is an appetite for ICON’s solutions. In the future, the key question will be just how big that appetite is.