Thesis

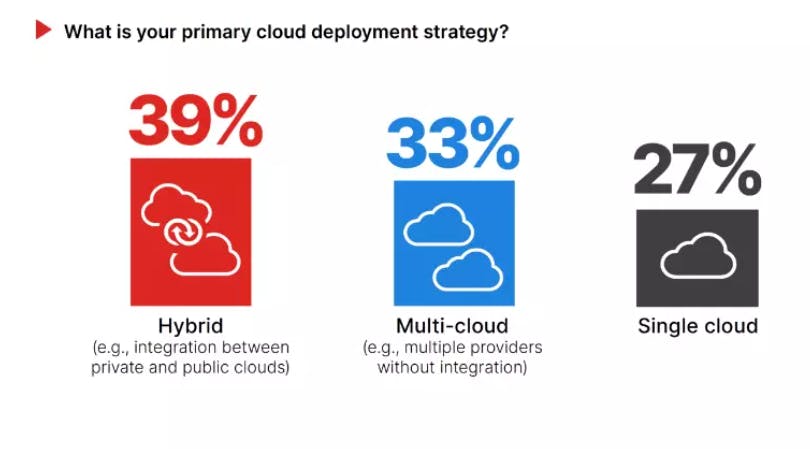

The shift towards multi-cloud and hybrid cloud infrastructures has significantly changed the way enterprises manage their data environments. As organizations increasingly adopt these complex infrastructures, managing the vast amounts of machine-generated data—necessary for monitoring, security, and real-time operations—has become a major challenge. As of July 2024, 72% of organizations now deploy either hybrid cloud (39%) or multi-cloud (33%) strategies, a trend that continues to grow. Hybrid cloud implementation also rose from 36% in 2023 to 39% in 2024.

Another survey revealed that 80% of organizations use multiple public cloud providers. This complexity, coupled with rising cloud costs, has driven companies to seek more efficient ways to handle their data. In 2022, cloud waste alone accounted for 32% of companies’ cloud budgets, with total cloud spend estimated at $500 billion, highlighting inefficiencies in how organizations manage their data flows. This growing problem emphasizes the need for solutions that can streamline and optimize data processing while maintaining flexibility and control.

One of the biggest trends driving this need is the explosion of observability and machine-generated data. Multi-cloud and hybrid environments, with their distributed systems and proliferation of services, generate more data points to monitor for performance, security, and regulatory compliance. Gartner estimates that 70% of workloads will run in a cloud environment by 2028, further contributing to the surge in machine-generated data. With this rapid growth, organizations are looking for tools that can help them manage data efficiently while minimizing the cost and operational burden associated with traditional observability platforms.

Cribl is focused on addressing these challenges by providing a more flexible, vendor-neutral platform that enables companies to filter, route, and transform observability data before it enters downstream platforms like Splunk or Datadog. Cribl's ability to reduce data volumes by more than 25% directly addresses the problem of cloud waste, offering measurable ROI through reductions in licensing fees, infrastructure costs, and SaaS charges. By integrating seamlessly into existing infrastructures, Cribl allows enterprises to scale efficiently without overhauling their data systems. As cloud adoption and the demand for more sophisticated data management continue to grow, Cribl’s platform offers a solution that helps companies manage the rising complexity and cost of observability data, positioning it to benefit from the ongoing modernization of enterprise data management.

Founding Story

Cribl was founded in 2018 by Clint Sharp (CEO), Dritan Bitincka (CPO), and Ledion Bitincka (CTO). All three founders previously worked at Splunk, where Sharp was head of product for Splunk Cloud, Dritan was a principal architect, and Ledion was the advanced development architect. Their shared experience at Splunk exposed them to the challenges of managing the growing volume of machine data in enterprises, which led them to create Cribl with the goal of building a scalable data processing platform.

Source: IT Supply Chain

Before finding success with Cribl’s current focus, the team spent 18 months experimenting with various ideas and burning through personal funds before pivoting to the platform that would become Cribl. Sharp later reflected on the company’s early hiring decisions, noting that he might have moved too quickly with the first 10 to 12 hires and wished he had taken a more reserved approach to make key hires earlier.

Sharp’s IT background and focus on customer empathy shaped Cribl’s core approach to solving enterprise data challenges. Dritan and Ledion brought technical expertise, having designed distributed systems and led the development of products like Hunk and SmartStore at Splunk. In February 2019, their vision was validated with seed funding from CRV, allowing them to expand the Cribl platform.

As Cribl grew, the company discovered broader use cases for its products, including cybersecurity and log management. The company attracted senior talent like Zachary Johnson, who joined as CFO in 2020 after previously working at Splunk as well. The team’s shared technical expertise and customer-focused approach have remained central to Cribl’s development, helping it address key data management challenges for enterprises.

Product

Cribl offers a suite of data observability and management solutions designed to help organizations handle large volumes of event and telemetry data efficiently.

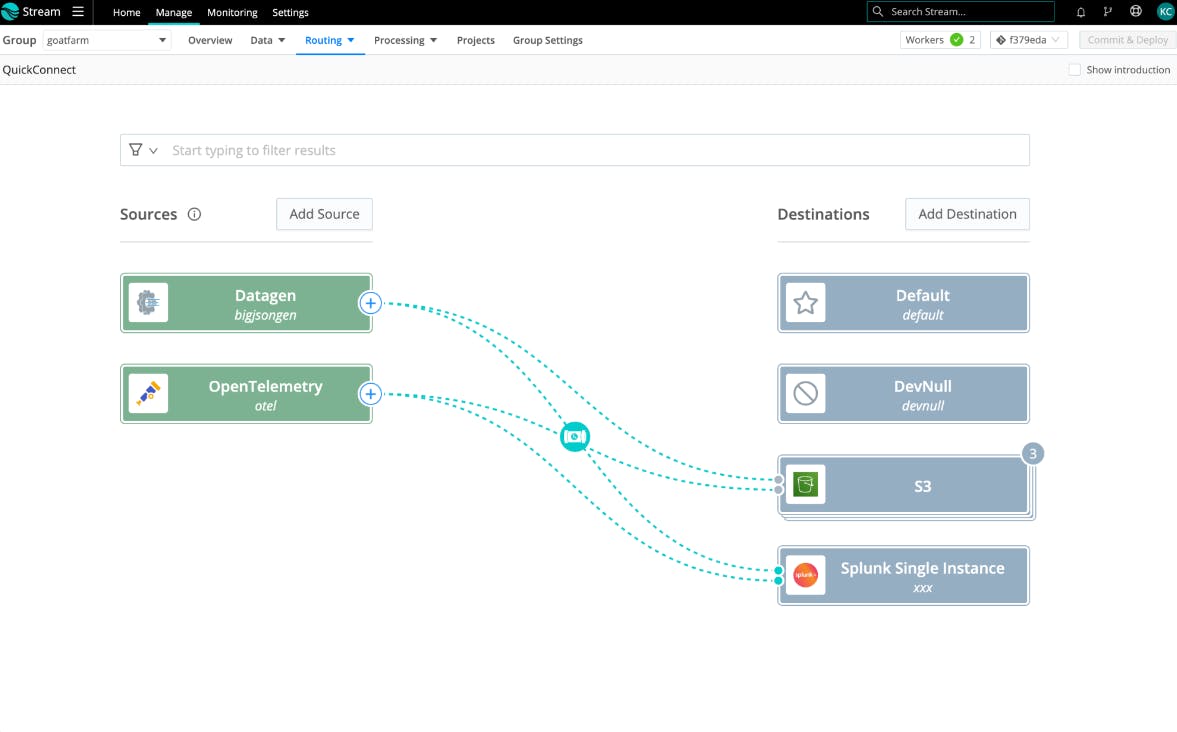

Cribl Stream

Cribl Stream is a data stream engine focused on centralized data parsing and processing. It allows users to take any data source, and route, reduce, reformat, or enrich the data before sending it to the desired destination. Stream’s visual rapid-development UI, with drag-and-drop functionality, makes it easy for users to get data flowing without extensive configuration.

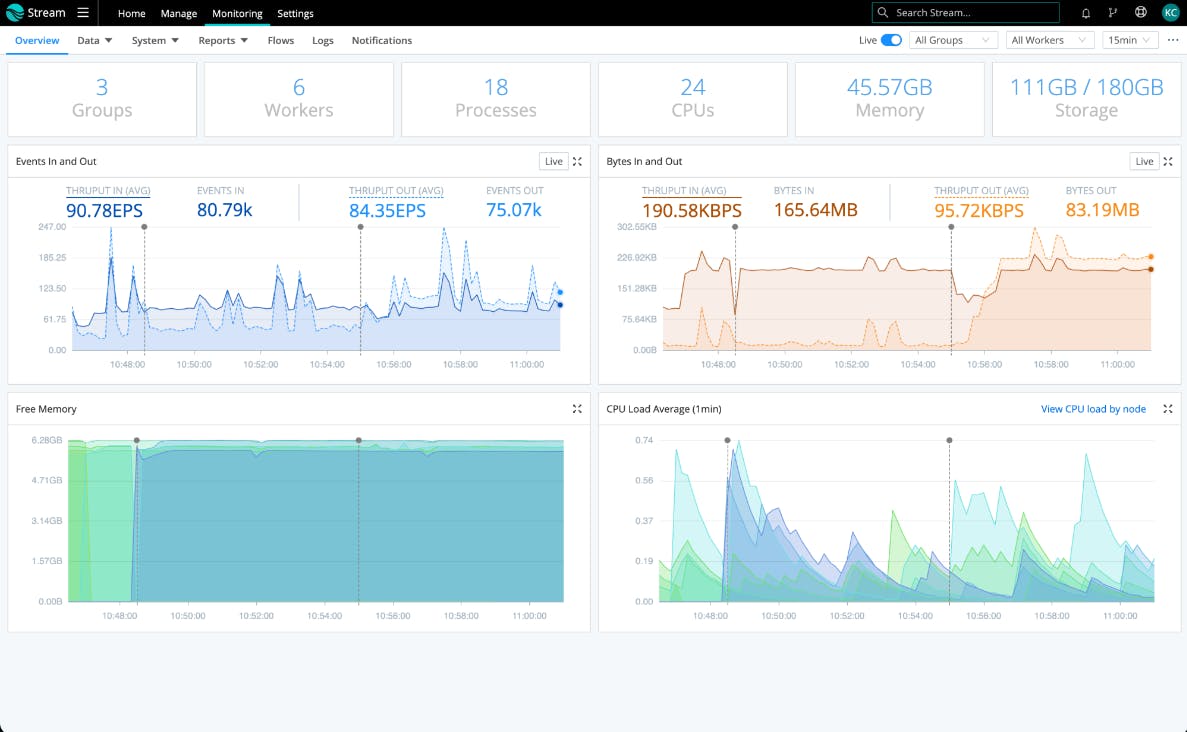

Source: Cribl

Additionally, it offers different deployment options, allowing customers to deploy on-premise, in the cloud, or in a hybrid model that best fits their needs. Users can also take advantage of a centralized monitoring dashboard to gain real-time insights into their data flow and system metrics, ensuring efficient data management.

Source: Cribl

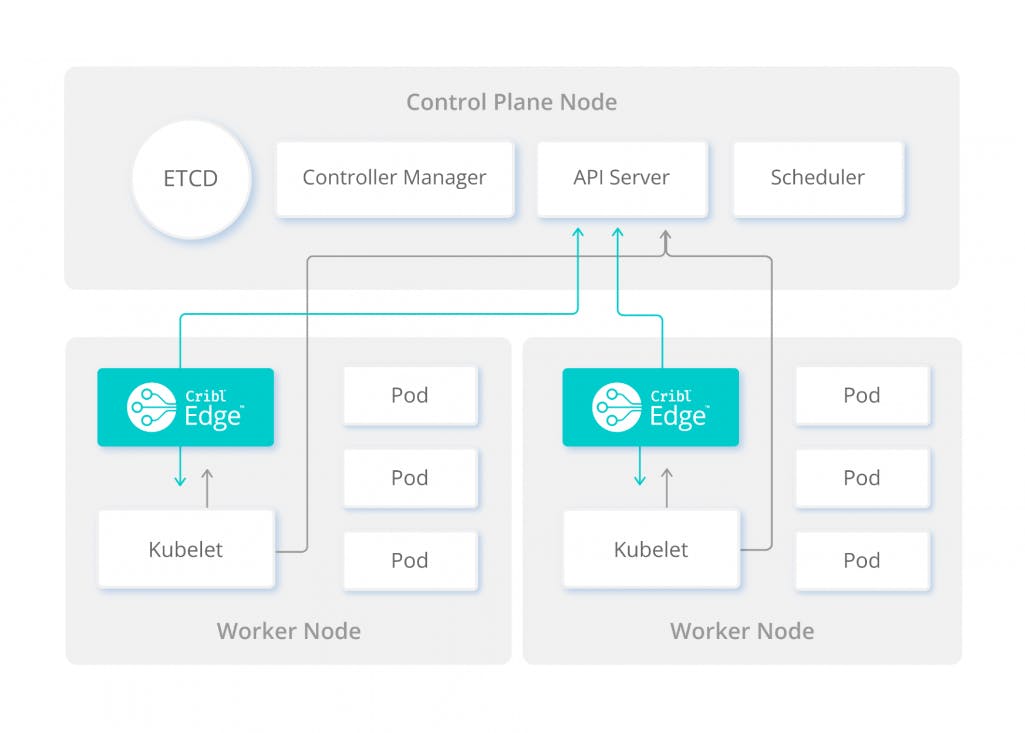

Cribl Edge

Cribl Edge is designed for large-scale data collection at the edge, capable of managing thousands of nodes. Edge allows for centralized fleet management, auto-detects valuable portions of telemetry, and lets users determine whether to forward data to Stream or other destinations. With features like Kubernetes observability and real-time configuration management, Edge is particularly valuable for customers managing distributed environments or complex infrastructures. Edge’s vendor-agnostic design helps users avoid vendor lock-in, providing more flexibility in how data is collected and managed.

Source: Cribl

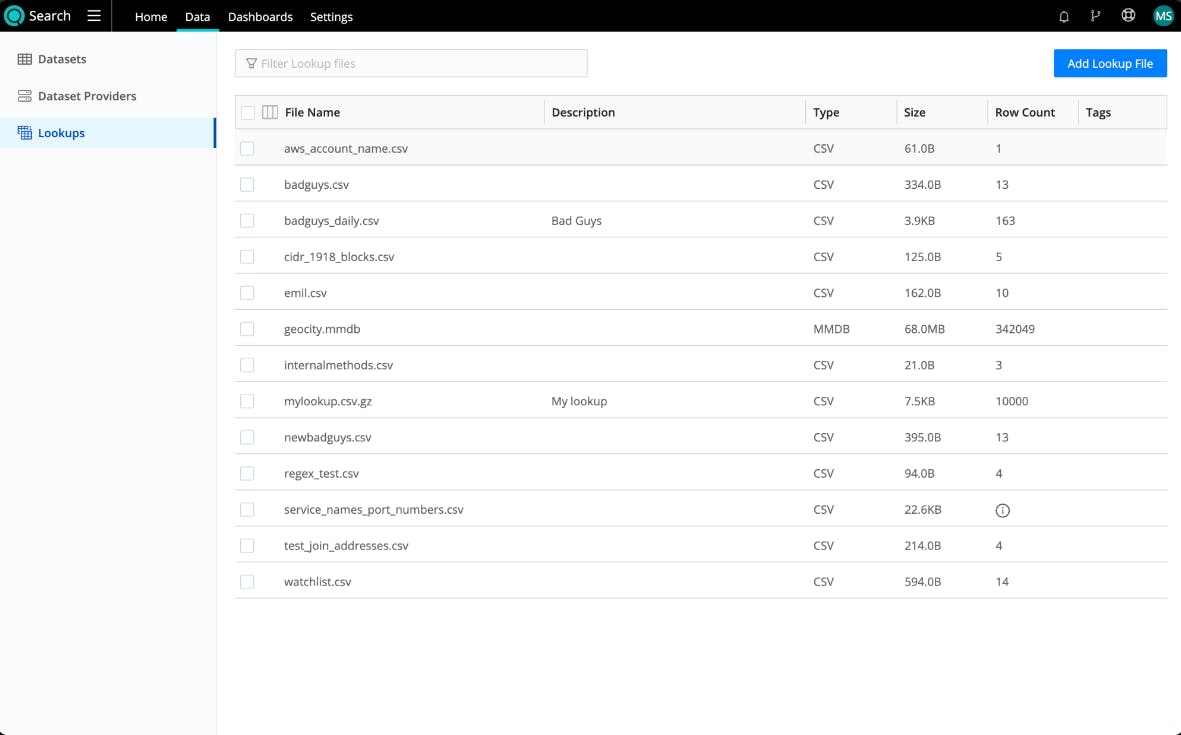

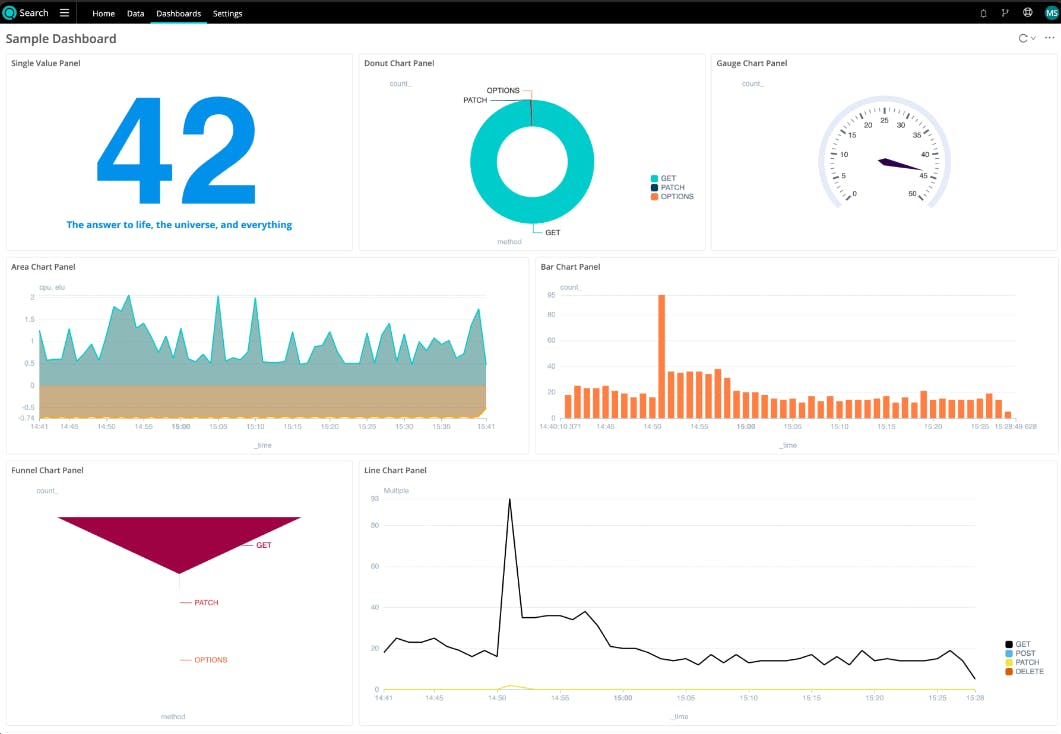

Cribl Search

Source: Cribl

Cribl Search is a search tool that enables users to explore and analyze data directly at its source. This federated search solution allows users to search across multiple cloud environments and APIs, providing seamless access to data in object stores like AWS S3, Azure Blob, and Google Cloud Storage. Cribl Search’s approach to separating the query engine from the storage medium allows for efficient data analysis without the need for costly storage solutions.

Source: Cribl

With customizable dashboards, live data integration, and advanced search capabilities, Search helps organizations streamline their analysis processes and gain deeper insights into their data. Customers can also route query results to other destinations for analysis, as well as schedule and automate searches and results processing.

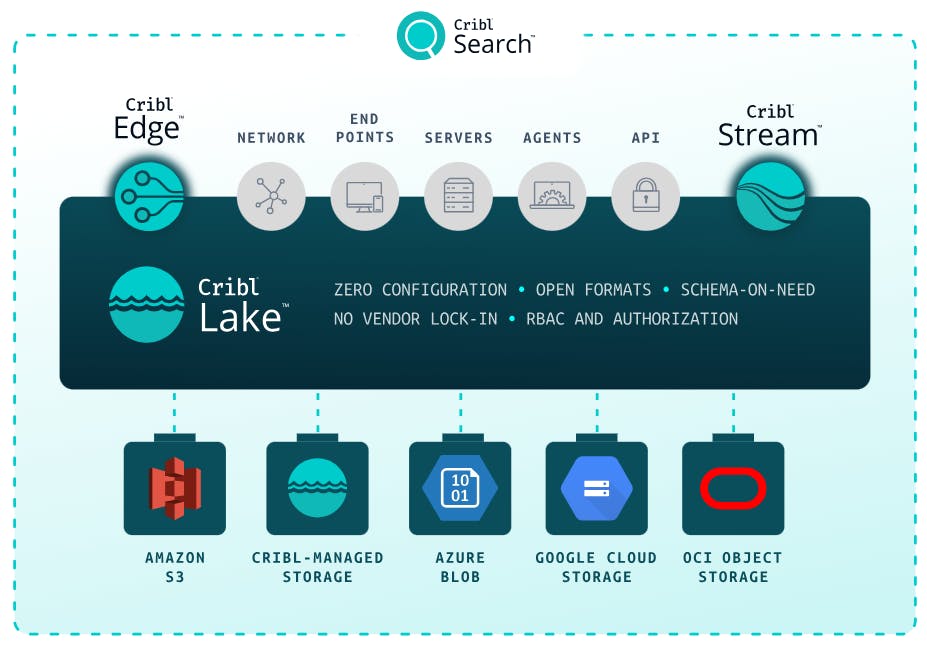

Cribl Lake

Source: Cribl

Cribl Lake offers a data lake solution that allows customers to store and replay data without needing pre-defined schemas. Leveraging open formats, Cribl Lake eliminates vendor lock-in, making it possible to use a wide range of tools for data analysis. It enables affordable and flexible storage options, ensuring that organizations can manage their data efficiently while retaining the ability to analyze it across different platforms.

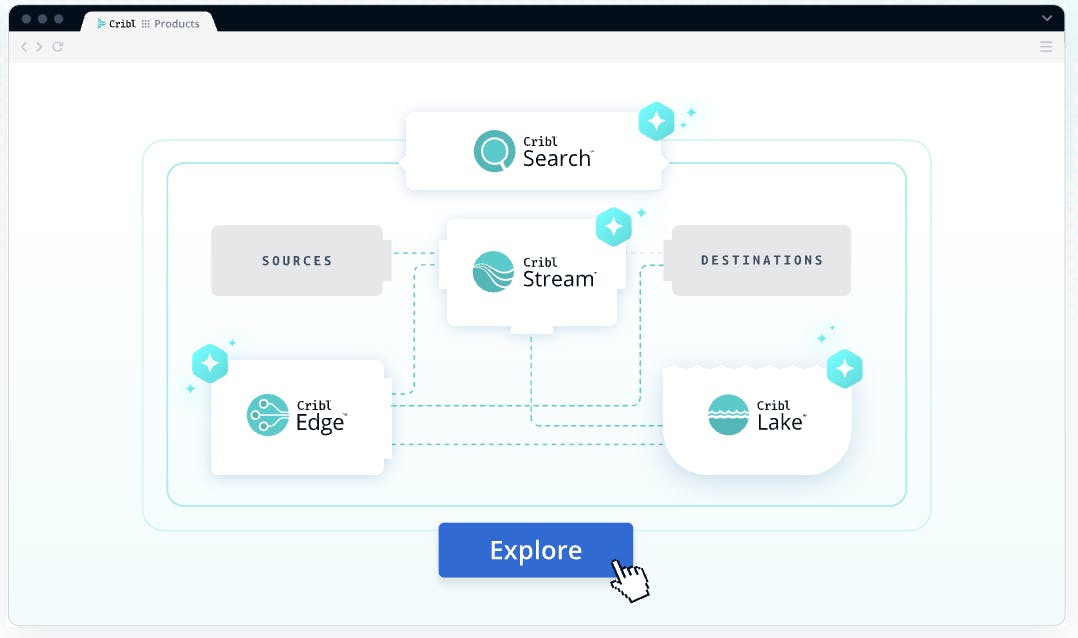

Cribl.Cloud

Source: Cribl

Cribl.Cloud is a platform built to enable access to a variety of Cribl services that can be configured and managed, such as Stream, Edge, Search, and Lake. The goal of the platform is to remove the burden of setting up infrastructure in a scalable and secure way. Users can create separate workspaces to determine how best to provision Cribl. In addition, Crible.Cloud enables users to manage authentication and authorization of different Cribl services.

Cribl.Cloud is listed on the AWS marketplace, which allows users to leverage existing AWS credits to “try, buy, and consume Crible products… [while] easily tracking billing and usage directly on AWS marketplace.” Cribl.Cloud differs from self-managed deployments in that these are “fully managed, cloud-based environments” which remove the need for users to manage infrastructure setup and scaling.

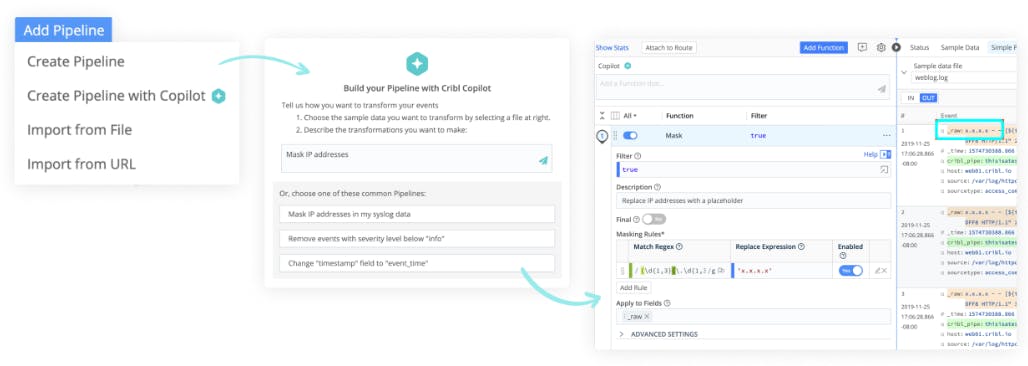

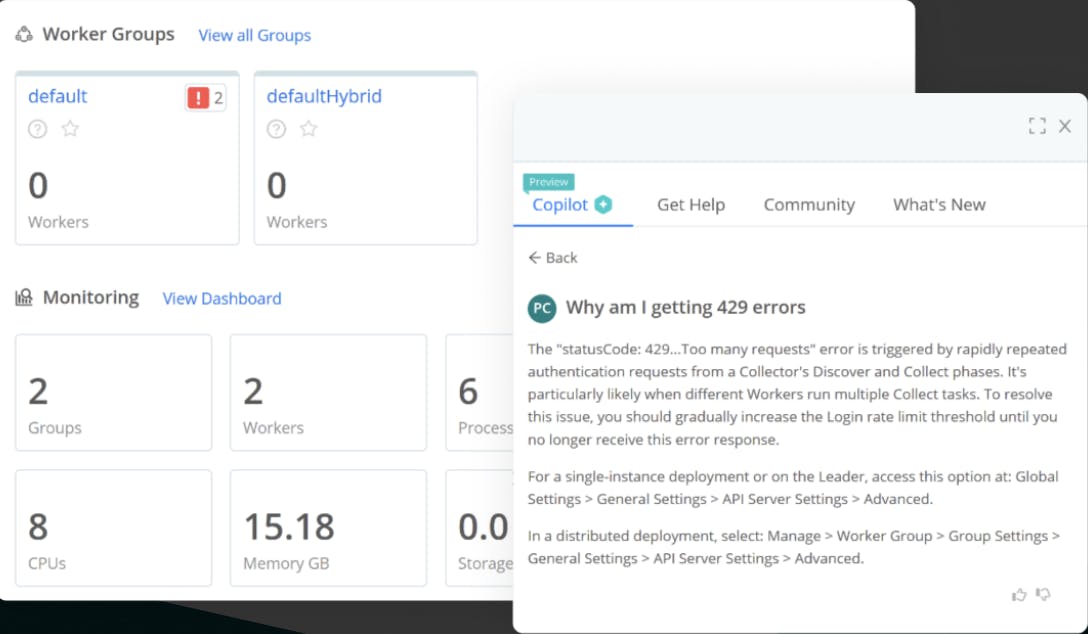

Cribl Copilot

Source: Cribl

Cribl’s AI-powered Copilot tool helps streamline the deployment and customization of the entire Cribl system. Copilot integrates with Cribl’s other products to accelerate setup and operations, reducing the time it takes to get systems running smoothly.

Source: Cribl

The tool also offers troubleshooting capabilities, using natural language processing to resolve configuration errors and automate various tasks, such as setting up pipelines or regex configurations.

Furthermore, all of Cribl’s products integrate with over 90 sources and destinations, allowing users to route data to and from platforms such as AWS Lambda, Google Cloud Storage, Kafka, and Snowflake. This interoperability provides flexibility and ensures that organizations can manage their data flow in a way that best suits their unique operational needs.

Cribl AppScope

Source: Cribl

Cribl AppScope is a tool built for operations and security teams, rather than development. teams. The goal is to enable operations and security teams to avoid using developer hours to “re-instrument code, append side cars, or log shippers.” Instead, attaching Cribl AppScope to any Linux binary will enable users to view telemetry data and drill into log and metric tools.

As Cribl explains, “AppScope is a universal instrumentation agent that provides full application visibility, including rate, error, and duration of HTTP requests, filesystem accesses, network flows, and performance metrics, from any Linux executable regardless of the runtime.” As developer resources become increasingly scarce, this tool enables non-technical users to leverage the same types of data for alerting, reporting, or troubleshooting.

Market

Customer

Source: CloudZero

Cribl’s ideal customer profile is enterprises operating in complex IT environments, such as those with multi-cloud or hybrid cloud architectures. Operating across various industries like financial services, healthcare, retail, and telecommunications, these companies typically generate vast amounts of observability data from their applications, infrastructure, and network systems. Therefore they often have large-scale logging and monitoring needs and rely on platforms like Splunk, Datadog, AWS, or Elastic.

Cribl operates with a vendor-agnostic approach that makes its platform appealing to any organization managing large-scale data pipelines. The platform’s flexibility allows it to integrate seamlessly into existing infrastructures, including the aforementioned platforms, which broadens its appeal across sectors. Cribl’s ability to manage data at scale, offering customers control over how observability data is routed and processed, is a key factor in its appeal to companies dealing with high data volumes and complex environments.

For example, Accenture Federal Services (AFS) uses Cribl Stream to manage data aggregation from across 90 different sites, handling around 5 TB of daily traffic. AFS leverages Cribl to ensure that the data coming in is clean and properly formatted to meet their client’s specific needs. Similarly, Sally Beauty sought a solution to better control its data flows into Elastic Cloud from Endgame endpoint detection and response (EDR). Using Cribl, Sally Beauty was able to gain better control over what data was sent, dropped, or enhanced, and where it was routed for further action, reducing their daily EDR by 41%. These use cases demonstrate how Cribl is being applied in real-world environments to solve complex data management challenges.

Market Size

Cribl operates within two primary markets: the observability tools market and the data pipeline tools market. These markets focus on helping enterprises manage, monitor, and optimize machine-generated data, including logs, metrics, traces, and security data from applications, infrastructure, and network environments. The observability tools market, valued at $2.4 billion in 2023, is expected to grow to $4.1 billion by 2028 at an 11.7% CAGR. This growth is driven by the increasing complexity of IT environments, which require real-time monitoring and data analysis to ensure efficient and secure operations.

In addition to observability tools, Cribl competes in the data pipeline tools market, which plays a critical role in moving and transforming data for analysis. In 2021, the global data pipeline tools market was valued at $6.8 billion, and it is projected to grow significantly, reaching $35.6 billion by 2031 with a CAGR of 18.2%. This market expansion is fueled by the increasing volume of data being generated across enterprises and the need for scalable solutions to manage and process this data efficiently.

Cribl’s positioning in both of these markets allows it to address key enterprise challenges related to data flow, monitoring, and optimization. With both markets experiencing strong growth, Cribl is positioning itself to capture a share of the rapidly expanding demand for observability and data pipeline tools.

Competition

Competitive Landscape

The observability market is highly competitive, with several established players and emerging companies vying for dominance. The biggest competitors for Cribl include incumbents like Splunk, Datadog, and Grafana Labs, which are well-established in the space and have deeply integrated their solutions into enterprise workflows. These companies have broad product offerings that span the full spectrum of observability, including infrastructure monitoring, log aggregation, and data analytics. Cribl, however, positions itself as a more specialized player focused on optimizing data routing and management across observability tools, distinguishing it from these larger platforms.

While incumbents like Splunk and Datadog hold a large share of the market due to their comprehensive full-stack solutions, newer entrants like Cribl are gaining traction by offering more niche, flexible solutions that address specific pain points in data management and pipeline optimization. This suggests a market that is both fragmented (with numerous players competing for specific use cases), and increasingly concentrated among the largest, full-stack platforms.

Cribl’s differentiation lies in its focus on flexibility and integration. Unlike competitors like Datadog and Splunk, which offer end-to-end platforms, Cribl’s core strength is in managing data pipelines, allowing businesses to filter, route, and optimize data flows between different observability tools. This positions Cribl as an infrastructure solution provider rather than a direct platform competitor, potentially giving it a competitive moat in helping enterprises streamline data management across multiple environments. This flexibility could act as a competitive advantage, particularly as enterprises seek ways to handle the growing complexity and costs associated with data observability.

Competitors

Grafana Labs: Founded in 2014, Grafana Labs offers open-source observability and data visualization tools, enabling organizations to visualize, query, and set alerts on data from multiple sources in real time. Its platform includes popular products like Grafana for dashboards, Loki for log aggregation, and Tempo for tracing. In August 2024, Grafana Labs raised $270 million in a Series D funding round led by Lightspeed Venture Partners, which valued the company at $6 billion. As of February 2025, Grafana Labs had raised a total of $805.2 million in funding from investors such as Sequoia Capital, GIC, Coatue, and Lead Edge Capital. Both Grafana Labs and Cribl operate in the observability space, but their focus differs. Grafana Labs provides an end-to-end platform with integrated data visualization, logs, and tracing. On the other hand, Cribl focuses more on optimizing data collection and routing, helping organizations manage observability data across multiple tools, including Grafana itself.

Chronosphere: Founded in 2019, Chronosphere is an observability platform designed to help organizations manage and optimize cloud-native environments by scaling observability data and providing insights into system performance. In January 2023, the company raised $115 million in a Series C funding round led by General Atlantic, which valued the company at $1.6 billion. As of February 2025, Chronosphere had raised a total of $342.5 million from investors like Lux Capital, Greylock, Spark Capital, and Glynn Capital. While both Chronosphere and Cribl target observability in cloud-native environments, Chronosphere focuses on providing a full observability platform, whereas Cribl specializes in managing and optimizing the flow of data between observability tools, positioning it more as an infrastructure solution.

Splunk: Founded in 2003, Splunk is a leader in data analytics and monitoring, providing a platform that enables businesses to search, monitor, and analyze machine-generated big data. In March 2024, Splunk was acquired by Cisco for $28 billion, positioning it to further expand its reach within enterprise observability and data analytics ecosystems. Both Splunk and Cribl offer solutions that allow data to be transformed, routed, and filtered. However, a key difference lies in their product architecture. Cribl's Stream product is designed with flexibility in mind, integrating seamlessly with multiple platforms and storage solutions beyond Splunk environments. In contrast, Splunk's data processors are highly optimized specifically for use within Splunk's ecosystem.

Datadog: Founded in 2010, Datadog is a cloud-native monitoring and observability platform that integrates and monitors infrastructure, applications, logs, and security data across cloud environments. The company went public through an initial public offering (IPO) in September 2019. As of February 2025, Datadog had a market cap of $41.3 billion. Both Datadog and Cribl are key players in the observability space, but their focus areas differ. Datadog provides an end-to-end monitoring platform that spans applications, infrastructure, and logs. In contrast, Cribl focuses on optimizing observability data pipelines, enabling companies to manage the flow and storage of data more efficiently.

Business Model

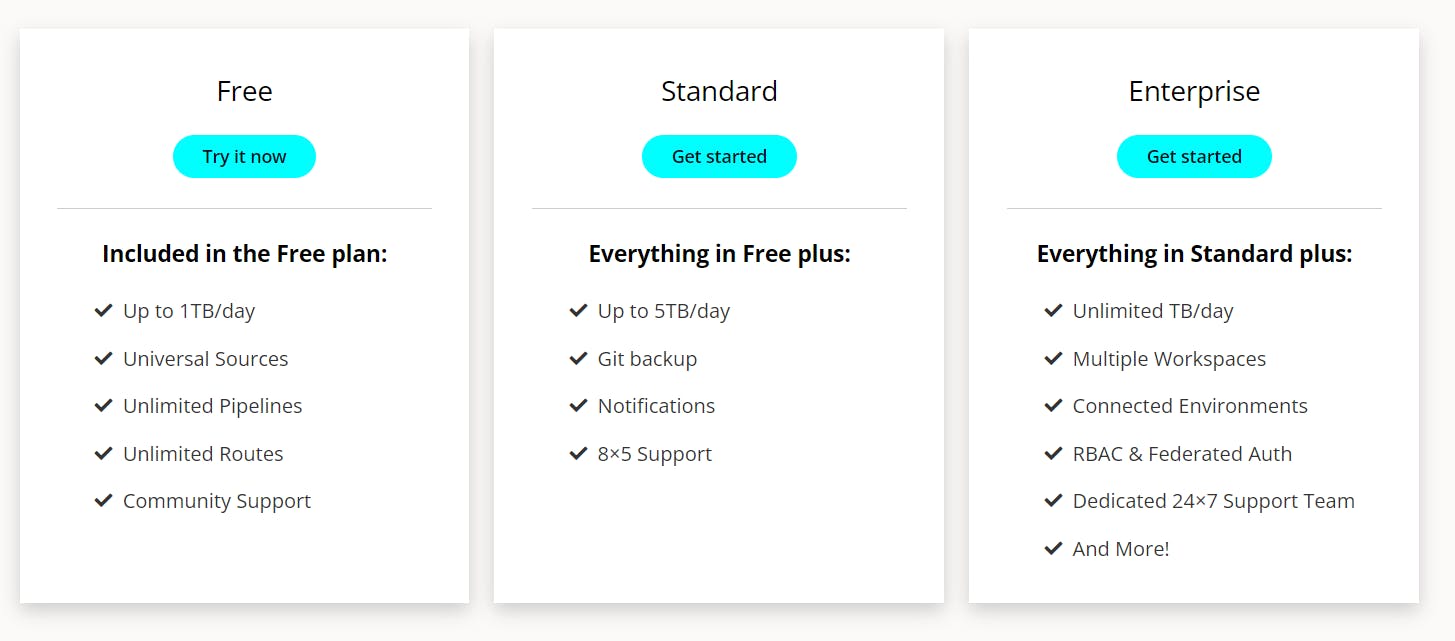

Source: Cribl

Cribl operates on a freemium model with three different pricing tiers: Free, Standard, and Enterprise.

The free plan is intended for users who just want to try the service out or process data under 1 TB per day. This also comes with benefits such as universal sources, unlimited pipelines and routes as well as community support.

The standard plan is intended for users who want more robust support, higher data capacity of up to 5 TB per day, and additional features such as Git backup, key management services, and persistent queueing.

The enterprise plan goes beyond that with no data limits, multiple workspaces, and a dedicated support team available 24/7.

Definitive pricing is dependent upon which modules and services customers add to their tier packages.

Traction

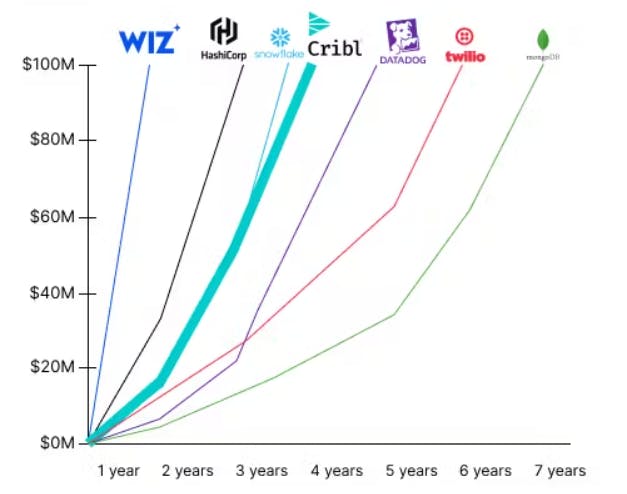

Source: Sacra

In October 2023, the company announced it had surpassed $100 million in annual recurring revenue (ARR), growing from $1 million to over $100 million in less than four years. In January 2025, Cribl announced the company had reached $200 million in ARR, growing 70% year-over-year.

Key customers include Accenture, Bayer, Finra, Sally Beauty, SAP, and Vodafone, indicating broad industry adoption. In January 2025, Cribl’s customers included “43 members of the Fortune 100, as well as 130 members of the Fortune 500.” Additionally, Cribl has formed partnerships with major players such as CrowdStrike, AWS, and Deloitte to provide data solutions, thereby expanding its reach and distribution. In a Gartner survey in January 2025, Cribl customers reported a 92% “willingness to recommend” score.

Valuation

In August 2024, Cribl raised a Series E funding round of $319 million, led by Google Ventures. This resulted in the company being valued at $3.5 billion, up 40% from its Series D valuation in August 2022. Other notable investors include Sequoia Capital, Greylock, Redpoint, and GIC. In total, the company has raised $721.2 million in funding as of September 2024.

As of January 2025, Cribl’s CEO, Clint Sharp, said “We will eventually be a public company… I think there’s no destination other than the public markets. At minimum, I’d say it’s two years away.” Based on Cribl’s $3.5 billion valuation, at $200 million ARR, that represents a 17.5x multiple. Publicly traded comparable, Datadog, trades at a similar multiple of 18.3x, though at a scale of $2.6 billion of revenue, growing 26%.

Key Opportunities

Managing Increasingly Complex Data

The cost and complexity of handling observability data are rapidly increasing, making it harder for organizations to efficiently manage and optimize their data pipelines. One 2023 report found that 98% of respondents experienced unexpected cost increases related to observability, with many pointing to the sheer volume of data as a primary challenge. This highlights the growing burden on organizations as they attempt to handle larger and more complex data flows. Additionally, Grafana Labs' "Observability Survey" revealed that 56% of respondents identified cost as their biggest concern, while complexity followed closely behind, cited by 50% of participants.

Cribl is positioned to capitalize on this challenge. As the volume and complexity of data continue to grow, Cribl’s products can provide scalable solutions that help organizations manage and optimize their observability data pipelines more efficiently, mitigating the cost and complexity issues many are facing.

Regulations & Compliance

The increasing pressure from data governance and privacy regulations is compelling companies to manage their data more effectively, particularly observability data, which often includes sensitive information. One 2024 privacy study highlights that 73% of consumers are now more concerned about their data privacy than in previous years and, by the end of 2024, 75% of the global population was expected to have their personal data protected under modern privacy regulations like GDPR. As regulatory oversight grows, organizations are being forced to implement more stringent data management practices to ensure compliance.

Cribl is positioning itself to help companies navigate these challenges by providing tools that offer better control over data pipelines. With features that allow businesses to filter, redact, and manage sensitive information before it reaches downstream destinations, Cribl can play a key role in helping organizations meet their regulatory obligations while optimizing their data-handling processes.

Cost Optimization

As monitoring and log storage costs rise with increasing data volumes, companies are searching for ways to reduce expenses without sacrificing the quality of their observability systems. According to a 2024 report on observability, 91% of organizations are actively working to reduce their observability costs. Among the strategies being implemented, 52% of organizations are trying to gain better visibility into their monitoring costs, 38% are adopting data management practices, and 32% are working to reduce the volume of monitoring data collected. Additionally, 37% of respondents specifically mentioned optimizing the volume of monitoring data as a key method to control costs.

Cribl can take advantage of this opportunity by helping companies cut costs through its features like data routing, filtering, and reduction. By enabling businesses to filter out unnecessary or irrelevant data before it reaches downstream systems, Cribl reduces storage and processing costs, allowing organizations to maintain high-quality observability without the financial burden of handling excessive data.

Key Risks

Scaling Issues

As more enterprises adopt increasingly complex observability infrastructures, Cribl may face significant challenges in scaling its solutions to meet growing data demands. The risk lies in the company's ability to manage the rising volume and complexity of observability data, which, if mishandled, could lead to bottlenecks and a loss of credibility. According to a 2024 report by Dynatrace, 88% of technology leaders noted that the complexity of their tech stacks has significantly increased in the past year, making it more difficult to manage data efficiently. Similarly, the 2024 State of Observability report highlights that 84% of companies are struggling with the same issues as they adopt more advanced observability tools. These complexities could place considerable strain on Cribl's infrastructure, risking performance slowdowns and operational inefficiencies if not properly addressed.

Competitive Pressure

Cribl faces significant pressure from established competitors like Splunk and Datadog, both of which are deeply integrated into enterprise workflows and offer full-stack observability solutions. Splunk, for instance, was acquired by Cisco in 2023 as part of Cisco’s strategy to accelerate full-stack observability across enterprise systems, potentially expanding Splunk's feature set and reducing the need for specialized solutions like Cribl. Similarly, Datadog continues to expand its feature set, providing highly integrated monitoring and analytics tools that make it a strong competitor in the observability space. While Cribl offers a specialized and flexible approach to data routing, the risk remains that incumbents like Splunk and Datadog could further develop or acquire similar capabilities within their own environments, diminishing the differentiation Cribl currently enjoys.

Summary

Positioned within the observability tools market, Cribl focuses on optimizing the flow and management of observability data across multi-cloud and hybrid environments. The company offers flexible, vendor-neutral solutions that help enterprises reduce complexity and costs, particularly as organizations struggle with the rising volume of observability data and regulatory pressures on data governance.

Cribl's core strength lies in its ability to manage observability data pipelines, providing a scalable and efficient way to route, filter, and transform data. This differentiates it from competitors that offer full-stack observability solutions. However, despite its niche, Cribl faces the challenge of scaling its infrastructure to meet the demands of increasingly complex enterprise environments. Additionally, competitive pressure from larger incumbents—who may expand their feature sets to diminish Cribl's market differentiation—remains a key concern.

The main questions moving forward involve Cribl's ability to maintain its competitive edge through continued innovation in data routing and observability management, while also handling the increasing technical demands posed by larger, more complex data environments. How effectively Cribl scales its solutions and fends off competitive pressures from established players will determine its long-term positioning in the market.