Thesis

Grafana Labs is an observability platform commercializing open-source IT systems monitoring. The company is leading with an open-source business model to compete against proprietary technology like Datadog, Dynatrace, Splunk, and New Relic.

Every company is a data company and every company is unique, which means that observability can be a complex matter for each individual user. Observability adoption among companies with distributed systems is expected to grow from 10% in 2020 to 30% in 2024, and companies that use it can expect game-changing outcomes: they are 64% more likely to measure the impact of performance issues. While the value of observability is clear, the complexity of implementation is a barrier.

Open-source cloud-native solutions are gaining popularity with developers and IT workers. According to CNCF, the most commonly adopted and recommended observability tools are open-source. Grafana Labs is leading the charge in that open-source trend. The company initially found success after building a visualization tool for time series data and then began building products to serve other aspects of observability.

Grafana Labs’ observability platform is based on its open-source project, Grafana OSS, which was built by one of the company’s co-founders. It defines its company's mission as follows:

“We believe in breaking traditional data boundaries, making metric visualization tools that are more accessible and easy to use across the entire organization. And most importantly, open source.”

Grafana Labs’ vision of leveraging open-source technology to increase accessibility and ease of use is a significant value proposition for users who want more flexibility from their observability tool. As the adoption of observability only increases, Grafana Labs is positioned to become the ideal solution for customers who want more control of their data tools.

Founding Story

Grafana, an open-source software project released in early 2014, started as a hobby project for Torkel Ödegaard. One year after releasing Grafana, Ödegaard met Raj Dutt and Anthony Woods in New York. Together, they founded a company making commercially licensed software built around Grafana OSS called Raintack. After launching the company, Dutt became the CEO, Ödegaard became the company’s CGO, and Woods became its CTO. In 2017, Raintack’s founders decided to rebrand the company as Grafana Labs.

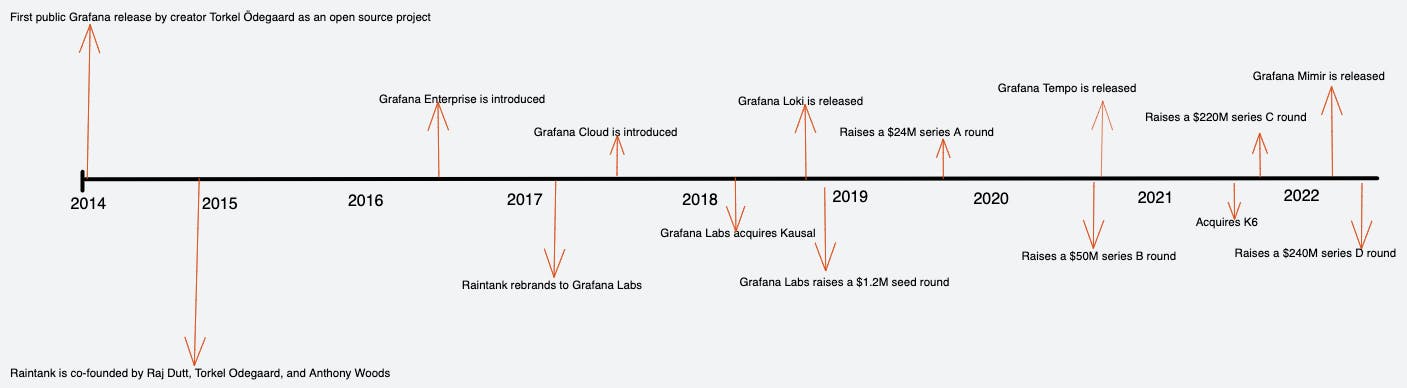

Here is a timeline of some of Grafana Labs’ key milestones in the years leading up until 2022:

Source: Contrary Research, Grafana Labs

Before founding Grafana Labs, Raj Dutt founded Voxel, an infrastructure hosting company, in 1999 while he was attending school. He scaled the company to over 1,000 customers and sold it to Internap for ~$30 million in 2012. While running Voxel, Dutt met Grafana co-founder Anthony Woods. Woods ended up leading Voxel’s operations in Singapore.

Torkel Ödegaard is given credit for the creation of Grafana Labs. He used a time-series database and monitoring tool known as Graphite while working as a developer for eBay. Ödegaard was determined to improve Graphite’s poor user interface. He began creating a user-friendly dashboarding tool for time-series metrics. His dashboarding project would later become Grafana OSS. From the very beginning, the ethos of accessibility and ease of use was evident at the foundation of Grafana Labs.

Product

Grafana Labs is an observability platform using open-source components. Observability tools provide visibility into the performance of IT systems and application infrastructure. When problems arise, developers use observability tools to pinpoint and debug issues quickly.

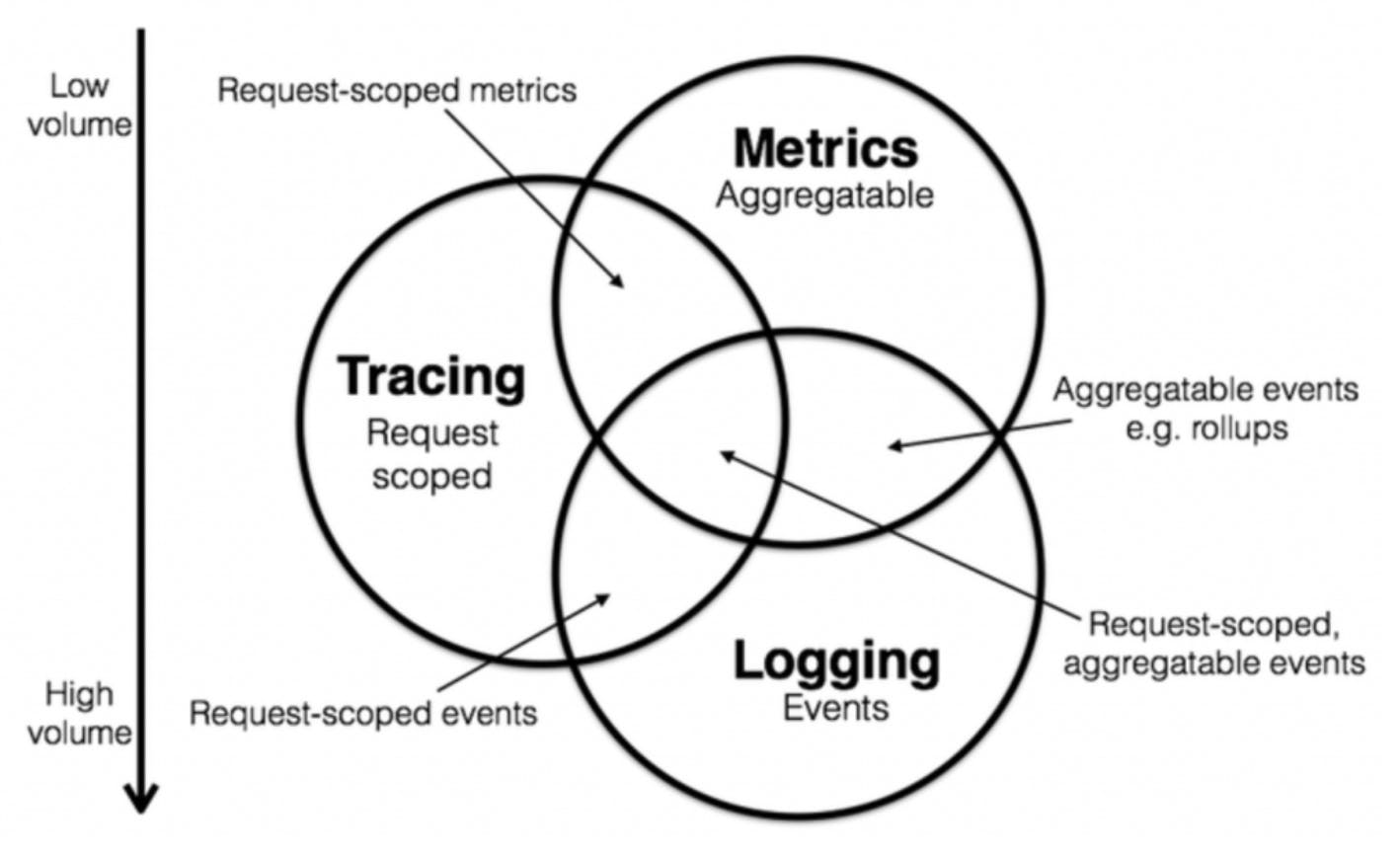

There are three main pillars of observability:

Logs: A log is a time-stamped record of an event happening at a particular time.

Metrics: A metric is a numeric representation of data measured over time intervals.

Traces: A trace represents the end-to-end journey of a request through a distributed system.

Altogether, the three pillars of observability provide maximum visibility into the behavior and performances of distributed infrastructure systems.

Source: Crowdstrike

In its early days, Grafana Labs built a dashboarding and visualization solution based on Grafana OSS for time-series data. Since then, it has developed three other main products: Grafana Loki, Grafana Temp, and Grafana Mimir.

Grafana Loki

Grafana Loki is an open-source log aggregation tool. Before any observability can take place, log data needs to be aggregated from applications and infrastructure. Grafana Loki makes it easier to tag specific log streams in a way that still allows for observability but doesn’t require as much time or storage. According to the company, Grafana Loki is easier to operate, more cost-effective, and requires less storage than other solutions. Grafana Loki was released in 2018 and has over 66K active users and more than 400 contributors as of April 2023.

Grafana Tempo

Grafana Tempo is an open-source distributed tracing tool released in 2021. When attempting to trace requests through different systems, traditional tracing tools will index entire parent-child relationships through a system that requires more complex and expensive databases to manage like Elasticsearch or Cassandra. Grafana Tempo doesn't index traces, making it much easier to engage with the underlying observability data. As of April 2023, it has more than 2K active users and 70+ open-source contributors.

Grafana Mimir

Grafana Mimir is an open-source time-series database for metrics released in March 2022. Developers can use Mimir to scale, store, and query up to 1 billion active time series metrics. Users can also set up alerts around specific metrics triggers. The product is a fork of another open-source tool called Cortex. Grafana Labs claims Mimir is 40x faster than Cortex.

Grafana Cloud & Grafana Enterprise

Grafana Labs offers Grafana Cloud for its users to access all its products as a managed service. The company also offers Grafana Enterprise for self-managing Grafana Labs products on-premise. It is free to use but with access to a limited amount of features.

Grafana Phlare

In November 2022, Grafana unveiled the fourth product in its observability suite, Phlare, which focuses on continuous profiling. Continuous profiling allows users to regularly assess resource usage levels to improve performance and decrease cost across an organization. Richard Hartmann, the director of community at Grafana Labs, described the importance of continuous profiling and the unveiling of this new product shortly after its launch:

“Profiling is the fourth pillar of observability. No other pillars give you continuous software profiles with direct insight allowing you to optimize your software and infrastructure.”

In March 2023, Grafana acquired Pyroscope, a continuous profiling startup that Grafana merged with Phlare to improve its open-source continuous profiling offering.

Market

Customer

The typical Grafana Labs customer begins their journey with the open-source version of Grafana. Eventually, they scale their way into paid subscriptions for access to proprietary features, premium plugins, integrations to other commercial services, and professional support.

The company has more than 3K customers as of April 2023, including notable companies such as PayPal, Salesforce, Booking.com, Bloomberg, Unity, Olo, eBay, Wix, and J.P. Morgan. For comparison, Grafana Labs competitors such as Datadog have over 23K paying customers as of February 2023.

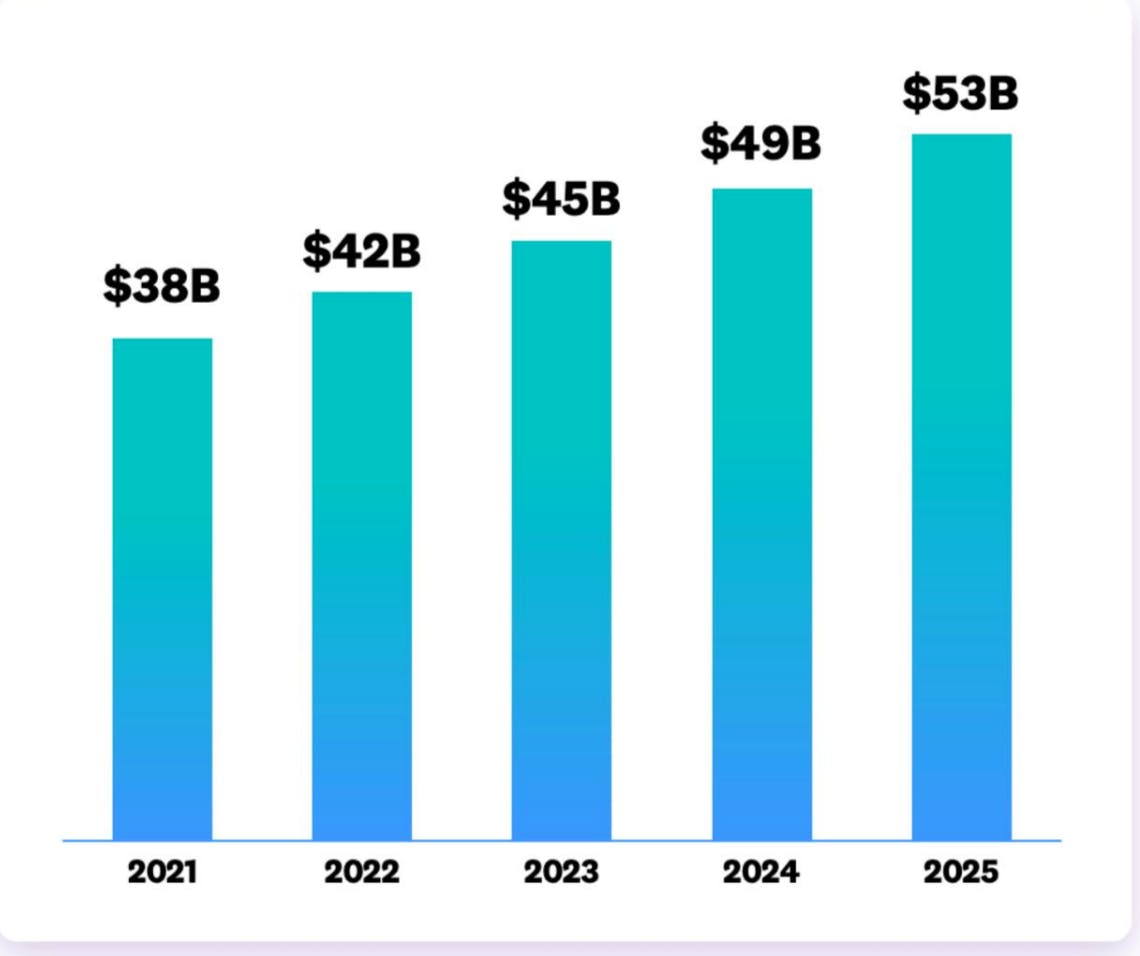

Market Size

The observability market is a beneficiary of digital transformation, increases in IT spending, and the rise of the Internet of Things (IoT) industry over the past decade. The observability space is projected to grow at a CAGR of 9% from $38 billion in 2021 to $53 billion by 2025.

Source: Datadog

Competition

Despite high growth, the observability market is highly competitive. Grafana Labs faces competition from companies offering a full stack of observability tools. Notable competitors include Datadog, New Relic, and Dynatrace. Datadog pioneered an all-in-one, unified observability platform combined with a set of security products. Conversely, Crowdstrike (known for its market-leading endpoint security solutions) entered the observability market by acquiring Humio, a log management tool.

Observability spans the gap between IT ops and security. Managing log data can reveal not only performance issues but also potential security threats. As a result, there are players in the space coming from both sides of that equation. While Grafana Labs has been leveraged to create some security monitoring stacks, it is still much less sophisticated on the security side compared to Datadog's security monitoring solution. Cybersecurity vendors such as SentinelOne and Palo Alto Networks will also likely intensify competition in the observability market given their existing install bases.

In terms of individual products, Grafana Loki competes with Splunk’s log observer and Sumo Logic’s log monitoring tool. HoneyComb and Lightstep challenge Grafana Tempo for distributed tracing. Moreover, the company competes with other commercialized open-source projects such as Logz, a product built on Grafana Labs and ELK. Grafana Labs’ edge over its competition is its open-source standards combined with a thriving community.

Grafana Labs has taken a very explicit “Switzerland” approach to its competition in the spirit of maintaining an open ecosystem. According to Raj Dutt, the CEO of Grafana Labs, this is the company's first priority:

“We have this big-tent philosophy. It’s all about interoperability. We don’t view Elastic as a competitor. We view them as a really good database that some of our customers want to use. The same goes for Splunk, [it’s] a great tool for collecting and visualizing log data. People want to do logs in Splunk, maybe do metrics in Prometheus, and traces in Jaeger. So [Grafana] gives customer choice, and it’s quite a unique approach. Most vendors want to lock their customer into the platform. I’m biased when I say this, but we think Grafana is the best virtualization software, and that’s why people use it.”

Business Model

Grafana Labs employs an open-core business model. Some platform features are free, and others are only for paying customers. In Grafana Labs’ case, the core software is open source and then customers pay for the extensions, plugins, and support.

For any open-source company, there can be tension in terms of what is open-source and what is paid. As the company grows to expand its product stack, many new features will be proprietary. But Grafana Labs is uniquely focused on enabling its open-source community as best as it can. As CEO Raj Dutt puts it:

“90% of our users will never pay us, and that’s by design. It’s really important for us to have a healthy open source community. That’s mission number one.”

Traction

Grafana Labs had over 10 million users and 900K active product installations globally as of April 2022. The company further claims Grafana OSS adoption increased 25X between 2017 and 2022. Grafana Labs also has partnerships with public cloud providers. Notable partnerships include AWS, Microsoft Azure, Google Cloud, Alibaba Cloud, and Tencent Cloud.

Valuation

Grafana Labs raised a $240 million Series D round in April 2022, bringing its total funding to $535.2 million. Its Series D was led by GIC Fund and while the round’s ultimate valuation was not disclosed, the company was reportedly seeking funds at a valuation of at least $5 billion. CEO Raj Dutt made the following comments after the round:

"Our plans are simple: aggressively deliver on our product roadmap and our commitment to embracing the big tent — enabling our users to compose and visualize data from any source — while continuing to build out modern observability capabilities across metrics, logs, tracing, and more […] We are committed to the continual release of impactful open-source software, bringing many new capabilities to market, and constantly listening to the community and our customers to drive innovation."

Notable investors in Grafana Labs include Sequoia Capital, Coatue, GIC (Singapore’s sovereign fund), Lightspeed Venture Partners, Lead Edge Capital, and J.P. Morgan.

Key Opportunities

Open Source Data Reliability

Where IT observability is the management of applications and infrastructure, there is an entire ecosystem that revolves around a company’s data. This is becoming increasingly complex as the volume of datasets and data tools grows. Data visibility and monitoring for anomalies are becoming more critical for data engineers. Companies like Monte Carlo offer popular proprietary data observability solutions. Given its position with a customer’s infrastructure, Grafana Labs could extend its platform to build an open-source alternative to Monte Carlo.

Security Monitoring

Grafana Labs could also follow the lead of Datadog in offering more robust security solutions. The core building blocks of security information and event management (SIEM) revolve around log data management which Grafana is already plugged into. There is an opportunity for Grafana Labs to build real-time threat detection features into Grafana Loki. The company could also expand to offer cloud workload security and application security monitoring product. As seen from other players in the space, there is significant overlap across IT ops and security.

Key Risks

Maintaining The Open Source Community

Given how much of Grafana’s competitive advantage comes from the quality of its open-source community, there is a constant need to maintain the relationship that the company has with the community. Every open-source company has to find this same balance between building proprietary functionality while still maintaining the flexibility inherent in their open-source model.

Strip Mining

Strip mining involves a public cloud vendor offering open-source software as a service on its platform. The most prominent case was when Amazon AWS (using Elastic’s open-source software, OpenSearch) released a data search tool directly competing with Elastic. In response, Elastic announced plans to change its software license to prevent AWS from using its software. Amazon responded by announcing plans to fork Elastic and maintain the software as a ‘truly open-source option.' All open-source software platforms face the risk of strip mining. Grafana Labs’ open-source offerings are no exception. For monitoring, this threat is lessened because the public cloud vendors have their existing solutions and it's a question of competitiveness vs. replication.

Intense Competition

Grafana Labs faces intense competition from established and emerging observability vendors. Datadog and Dynatrace have excellent reputations in the enterprise market and their products offer well-respected developer experience. They both offer unified observability platforms with robust go-to-market strategies. Grafana also faces notable emerging competitors like Honeycomb or WhyLabs, a startup building an observability platform tailored to AI and the underlying data pipelines. Competitors like WhyLabs, and new future competitors, could build niche observability software superior to Grafana Labs’ product offerings.

Summary

The advantage of building a commercial entity around an open-source project, such as Grafana, comes from the passionate community of users who validate the value of the underlying technology. The disadvantage, however, is the challenge of converting open-source users to paying customers. Companies like Grafana Labs must consistently build more proprietary tools to appeal to enterprise customers. Grafana Labs is well-positioned to emerge as a challenger in the observability market dominated by closed, proprietary vendors by leveraging a robust open-source offering and community.