Thesis

In 2015, New York City alone collected $565 million from parking ticket fines, with the average parking ticket costing drivers between $45-$125.. In most cases, attorney fees cost more than the fines themselves. As a result, these parking tickets often go uncontested. In 2019, the top 16 US cities generated over $1.4 billion from parking tickets. The average person lacks the resources to dispute a parking ticket in court due to limited time and funding, especially because the odds of winning and overturning the fine are low. A 2022 report found that out of 1.9 million civil legal problems for which low-income Americans sought legal aid, 63%-70% did not receive any or enough legal assistance.

Corporations are also known to take advantage of citizens in similar ways. Disputing claims with corporations can be a complicated and intimidating process. For example, Comcast has been accused of charging consumers hidden fees without their knowledge. Whether disputing concert ticket scams or fighting overcharged bank fees, the price of obtaining legal support rarely warrants the financial benefit of winning the disputes for consumers. More than 80% of individuals below the poverty line, and a substantial number of middle-income Americans, do not receive substantial support when confronted with civil legal matters, including child custody, debt collection, eviction, and foreclosure.

DoNotPay describes itself as “the world’s first robot lawyer”. Founder Joshua Browder, by contrast, states in his Twitter bio that the company is “building products to save people time and money with A.I.”. DoNotPay helps consumers file disputes and expands access to legal assistance across various issues, from overturning parking tickets to appealing bank fees. It is also applicable to a wide range of use cases including a fake phone verification tool to help users take advantage of free trials and a credit card that allows users to sign up for free trials but closes before the trial period expires and payment is incurred. DoNotPay is accessible to consumers through its website and app.

Founding Story

Source: Aspen Institute

DoNotPay was founded in 2015 by Joshua Browder (CEO). Browder grew up in England and taught himself to code when he was 12. The inspiration for DoNotPay emerged during Joshua’s freshman year at Stanford University when he had over 30 parking tickets between the ages of 18 and 20, but he couldn't afford to pay for them and learned that “if you know the right things to say, you can save a lot of money.”

He built a reputation amongst friends and family for being able to help with parking tickets. People started reaching out to him about their legal troubles with tickets. He decided to automate his solution, creating a website in August 2015 to help people contest parking tickets. The website generated appeal letters for parking tickets using historically successful defenses as templates. Browder said in 2015 that:

“I created the service after scanning thousands of pages of documents released under the Freedom of Information Act and consulting a leading traffic lawyer".

The website quickly gained media traction. That same year, he studied computer science and economics at Stanford. He later dropped out and joined the Thiel Fellowship.

Since DoNotPay’s early success in 2015, it has gradually evolved from a simple parking ticket avoidance app to a multi-purpose legal aid for consumer rights. In 2017, DoNotPay expanded its services to the UK and all 50 states in the US. In 2020, it also began testing its services in Australia and Canada. In early 2023, the company gained mainstream attention as it announced its plans to use an AI robot lawyer in a US courtroom. The announcement generated much discussion regarding AI's role in law, and DoNotPay eventually decided not to pursue the experiment following legal pushback.

Product

DoNotPay helps consumers skip time-consuming but simple processes like canceling subscriptions, disputing parking tickets, and fighting email spam. DoNotPay describes itself as focused on consumer rights, and the company aims to build products that help consumers where lawyers won’t, such as disputing a $40 parking ticket. Joshua Browder has previously stated that “there isn't a lawyer that will get out of bed to help you with a $400 refund,” and DoNotPay is focused on solving this specific challenge.

DoNotPay’s Website

The website provides 200 use cases, with its most popular offering being a fake phone verification tool that lets users take advantage of free trials. While the specific user experience differs across offerings, users provide basic information about themselves and the case for legal-related matters. Then DoNotPay automates drafting and mailing the necessary letters to the relevant authorities. Depending on the use case, generating a personalized legal letter can range from a few seconds to multiple hours.

As of May 2023, the bot powering most of DoNotPay’s services was built using OpenAI’s GPT-3 API. When the bot is unaware of how to solve a legal question, Joshua Browder says it “will just stop in its tracks and ask the user for help” instead of providing a potentially inaccurate response.

In addition to DoNotPay’s bot tool, its website also hosts legal resources to help consumers with legal issues. Each article provides users with various resources and legal information and explains how users can use DoNotPay to solve that specific case.

Source: DoNotPay

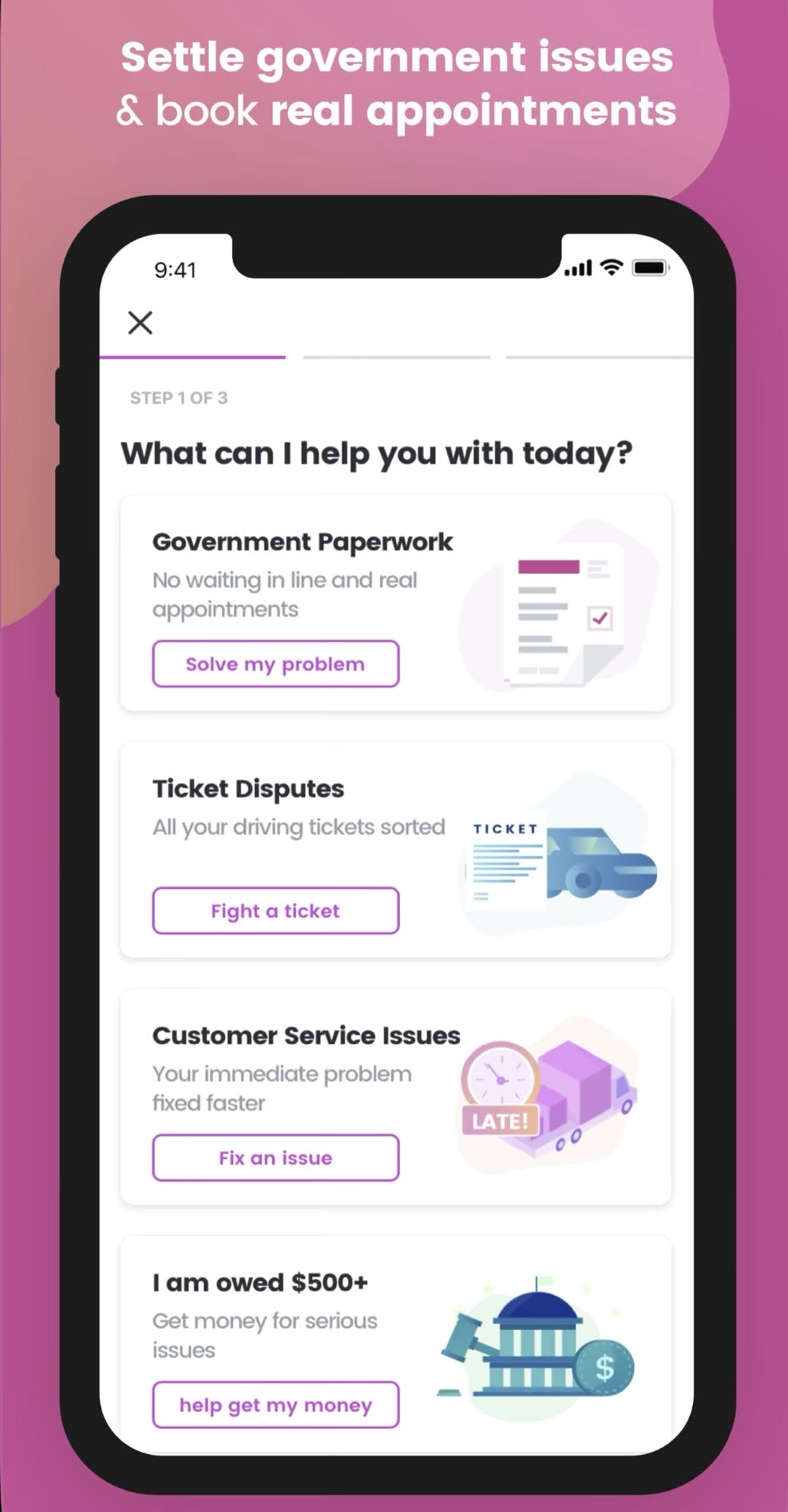

DoNotPay’s App

DoNotPay’s app launched on the App Store in 2018. Like DoNotPay’s website, the app requires users to pay $36 every two months before accessing any of the app’s features. This strategy positions the app as a complementary product to DoNotPay’s website instead of a standalone app that can attract new users to the product. In 2020, Joshua Browder tweeted that less than 10% of subscribers to DoNotPay are from its app.

In the app, all of DoNotPay’s offerings are listed on the homepage, and users can scroll through to find the use case that solves their specific needs. Alternatively, users can chat with a customer support representative to walk through the necessary processes to file a dispute or claim through DoNotPay.

In 2020, Apple temporarily removed DoNotPay’s app from the App Store as it was “too App Store-like”. Apple stated that DoNotPay needed to build a separate app for each of its products. Joshua Browder suggested these actions were an attempt by Apple to earn more money by taking a 30% cut on multiple applications instead of just one. Following a Twitter thread from Joshua, the app was restored by Apple.

Source: App Store

Joshua Browder also announced in April 2023 that DoNotPay services would soon be available via iMessage, allowing users to text a phone number and receive instant help simply. This announcement followed multiple tweets showcasing DoNotPay products built with GPT-4.

Source: Twitter

Alongside its consumer rights tools, in January 2023, DoNotPay also announced that it had created an AI lawyer to represent someone in a US courtroom. The idea was to have an AI lawyer send responses to a human sitting in the courtroom in real-time using AirPods. However, following legal pushback and “threats from state bar prosecutors”, DoNotPay decided to retire its AI courtroom product concept and focus solely on consumer-rights products moving forward.

Market

Customer

DoNotPay’s products are designed to make legal information and self-help accessible to everyone, no matter their financial situation. So far, the company has focused on developing products that help consumers fight legal battles in situations where they can’t afford legal help and in situations that are too small for lawyers to get involved, such as disputing a parking ticket. Given this, DoNotPay naturally lends itself to lower-income consumers who may have a greater need to avoid unnecessary legal costs, which includes the 40% of the US population who are reportedly struggling to pay their bills as of July 2022. The services offered by DoNotPay are available in the US and the UK and are being tested in Australia and Canada.

Market Size

The legal AI software market was valued at $548 million in 2022 and is projected to grow at a CAGR of 29.2% between 2022-2027. Yet, unlike DoNotPay, most AI software in the legal industry is designed to optimize processes for lawyers. DoNotPay is instead focused on using AI to directly provide legal support to consumers, bypassing the entire legal industry.

As a result, DoNotPay also competes in the broader industry of legal advice and services, valued at $901 billion in 2021 and growing at a CAGR of 3.0% between 2022-2030. However, it is important to note that as of 2023 only licensed attorneys have the right to provide legal services and advice to clients. Therefore it remains unclear whether DoNotPay will be able to fully tap into the legal advisory market through its AI-powered software.

Competition

Lithic: Privacy.com, which rebranded to Lithic in 2021, offers a card product that enables users to pay for services with an automatically generated, unique 16-digit virtual card number. The product masks users’ payment information and lets users cancel their subscriptions easily by simply closing the card. Unlike DoNotPay, these cards allow users to make actual purchases if desired. In contrast, DoNotPay’s equivalent product is a virtual card that solely helps users sign up for free trials. Then when a vendor attempts to charge them, the card automatically declines the transaction so that the user loses no money. DoNotPay also generates fake email addresses alongside the cards that help users conceal their identities. While DoNotPay charges $36 on a bimonthly basis to access any of its products, Lithic offers a free version where users can generate up to 12 virtual cards per month. Lithic has raised a total of $115.4 million in funding. Its latest round as of 2023 was its $60 million Series C in 2021.

Burner App: The Burner App lets users generate disposable phone numbers that bypass authentication processes, calls, and texts, without having to disclose their real phone numbers. The app also allows users to call and text on a temporary phone number, masking their real phone for privacy reasons. The cheapest available plan on the Burner App is $4.99 a month. Unlike DoNotPay, the Burner App connects to users’ real phones. However, the company states that its burner phones cannot be tracked. Also, while DoNotPay’s phone provides services for 10 minutes, the burner phone created via the Burner App can last for months. The Burner App has raised $2 million to date, with its most recent round as of 2023 having been its $2 million seed round led by Founder Collective and Venrock.

AI Lawyer: AI Lawyer is a chatbot that lets users ask questions and provides them with useful resources and articles in response. The product also allows users to upload agreements and receive an analysis of the terms, and it enables lawyers to connect the chatbot to their websites to drive revenue. As DoNotPay begins to roll out its iMessage bot, it will compete with AI services like AI Lawyer. Further, AI Lawyer offers users an alternative solution to scrolling through DoNotPay’s legal resources and articles. AI Lawyer charges $19.99 per month but offers users a free trial for its services, unlike DoNotPay.

Business Model

DoNotPay charges users $36 every two months to use its 200+ products. Previously, the service cost $3 per month to use, and its current price as of 2023 represents a 6x increase in the cost of its services over the previous two years.

Traction

In 2021, Browder reported that DoNotPay had 250K subscribers; in May 2023, Browder said that DoNotPay had “well over 200,000 subscribers”.

To date, DoNotPay has resolved over 2 million cases and offers over 200 use cases on its website. Though DoNotPay has not disclosed its revenue, it charges $36 every two months. Given this, it can be estimated that DoNotPay is generating $54 million in annual revenue, assuming that all 250K users subscribe for 1 year.

Valuation

DoNotPay has raised a total of $27.7 million in funding. In 2021, DoNotPay raised a $10 million Series B round from Andreessen Horowitz and Lux Capital, alongside investors including Sam Bankman-Fried. Following the collapse of FTX, founder Joshua Browder tweeted "At @donotpay, we feel deep shame in letting FTX/Alameda Research become a small investor in our company a year ago.” The valuation in its Series B round was $210 million and DoNotPay was profitable at the time of funding.

Key Opportunities

Chat Interface

As DoNotPay seeks to become the general counsel for consumer rights cases, it must optimize its user experience to provide users with instant legal information through an easy-to-use interface. One such opportunity lies in creating a GPT-powered chat interface that enables users to talk to the AI powering DoNotPay. The interface could let users receive instant, personalized responses from an AI lawyer. It could enable users to bypass the complex legal process by working directly with the chatbot for their needs.

Financial Optimization

Given that DoNotPay’s AI specializes in negotiating discounts and fighting unclaimed bills, DoNotPay is well-positioned to help consumers optimize their financial profiles. As Joshua’s Twitter experiment has shown, DoNotPay is able to find unique opportunities for consumers to save money. By building out a comprehensive financial integration tool, DoNotPay could assist users with saving money, avoiding overpriced purchases, and flagging subscriptions that are no longer in use. This use case aligns well with DoNotPay’s existing customer profile. It could present some interesting product integrations for DoNotPay in the financial services industry, such as leveraging DoNotPay’s virtual cards to increase savings.

Key Risks

Legal Repercussions

There is no formal regulation in the US centered around the use of AI in the courtroom and the use of electronic devices is banned in most courtrooms. This poses a legal challenge for DoNotPay should they wish to use their AI bots to represent people in court. The company came under scrutiny at the beginning of 2023 after Joshua Browder announced DoNotPay’s experiment to pay an individual $1 million to represent them in court using AI by using hearing accessibility tools such as AirPods and smart glasses. Lawyers believed that Joshua’s approach was likely to create enmity and that it was a direct breach of law. After facing threats from state bar prosecutors to be imprisoned for six months, Joshua decided to abandon the experiment and instead re-focus on DoNotPay’s core mission of building tools for consumer rights. This failed experiment shows the difficulty of replacing lawyers with AI and how it remains difficult to tap into the legal services and advisory market without the required licenses.

Pending Lawsuits

In March 2023 a prominent plaintiffs’ law firm, Edelson, filed a class action lawsuit against DoNotPay. The lawsuit, filed on behalf of a Californian resident, states that DoNotPay is practicing law without the required licenses and that its services are “substandard and poorly done”. The lawsuit additionally states:

“Unfortunately for its customers, DoNotPay is not actually a robot, a lawyer, nor a law firm. DoNotPay does not have a law degree, is not barred in any jurisdiction, and is not supervised by any lawyer”.

Alongside stating that DoNotPay is providing legal advice when it is unauthorized to do so, the lawsuit also argues:

“DoNotPay is merely a website with a repository of—unfortunately, substandard—legal documents that at best fills in a legal adlib based on information input by customers”.

This is not the only lawsuit that DoNotPay is facing. In February of 2023, a lawsuit was filed to the New York State Supreme Court comparing DoNotPay to Theranos and it stated that DoNotPay “does not actually have any AI or “robot” undergirding its systems”. Joshua Browder has not commented on the latter lawsuit but responded to the lawsuit filed by Edelson on Twitter, saying that “DoNotPay is not going to be bullied by America’s richest class action lawyer” and that DoNotPay is “fighting back” and may even use its robot lawyer for the case.

Negative PR

DoNotPay has also recently come under scrutiny among users due to a substandard user experience, with many users repeatedly discussing the difficulty of canceling a subscription on the website. On Trustpilot, 71% of the 360 reviews have given DoNotPay a 1-star, with many referring to the product as a “scam”. Further, the Better Business Bureau website has also given DoNotPay a score of 1.74/5, with customer reviews citing similar concerns about the functionality of its product.

Alongside these negative reviews, press coverage raises significant questions about the company and its founder. Certain Twitter threads have also questioned whether there is any AI behind the product in the first place, while other articles suggest that founder Joshua Browder previously photoshopped donation receipts after failing to donate money that he pledged to, raising ethical concerns. Given the above, as DoNotPay seeks to expand its product offerings and enter new markets, it is imperative that these customer reviews improve and that DoNotPay streamlines the cancellation process on its website.

Summary

As DoNotPay faces increasing public scrutiny alongside two lawsuits, 2023 is shaping up to be a critical year for the company. If DoNotPay is able to overcome the significant challenges it faces, it may be able to leverage AI to build something like a general counsel for consumers that is reachable 24/7 via a simple text message. Overall, the company’s initial bet that the market for consumer rights is underserved was mostly successful, drawing significant media and user attention over the past few years. As DoNotPay seeks to build on its user base of 250K subscribers, its biggest challenge will be expanding from an online service that solves specific use cases to a service that automates the entire consumer rights legal process, from creating documents to filing claims.