Thesis

Artificial intelligence is uniquely suited for industries that rely heavily on information, precision, and repeatable workflows. Legal services as an industry, meanwhile, is built around language, logic, rules, and the interpretation of structured and unstructured data, making it a perfect fit for AI, especially considering the legal fields’ reliance on both a high volume of complex texts and high-cost labor.

The average attorney billable rate in 2024 hit $313 per hour, with some attorneys billing as high as $3K per hour. The introduction of AI is driving a fundamental reevaluation of the legal staffing model. As one law school Dean put it in 2023, AI could represent an “even more momentous shift than the advent of the internet” for legal services. One 2023 report predicted that 44% of legal industry employment is exposed to automation, second only to office and administrative work. Another 2024 report estimated that ~75% “of a law firm’s hourly billable tasks are potentially exposed to automation by AI.” Information-heavy tasks are not only the most exposed to automation, but also account for 66% of average hourly billable work.

The utilization of AI in legal services is being accelerated to address serious breaking points as the US judicial system is facing a backlog crisis. As of 2022, some states had seen the number of pending cases double, with some cases being postponed 20 times. The US ranked 107th out of 142 countries for civil justice accessibility in 2024. Increasingly, countries have started turning to AI to accelerate their judicial processes. Germany has started using AI to address overwhelming caseloads, Brazil hired OpenAI in 2024 to address 78 million undecided cases, and China has introduced an AI-assisted trial mechanism to reduce the time required for document preparation. Following suit, the US federal court system is actively exploring AI use cases to promote access to justice and achieve cost efficiencies, such as chatbots to provide public access to information after hours.

In addition to clerical backlogs, the legal industry is breaking under the weight of an antiquated labor system. While consulting firms like McKinsey have shifted their pricing strategies to packaged deals and fixed-fee structures in place of traditional hourly models, law firms continue to leverage billable hours. But this model is increasingly coming under scrutiny. One 2025 report found 71% of clients prefer flat fees, and firms in 2025 reportedly recorded 34% more flat-fee billables than in 2016. As the legal profession continues to wrestle with its increasingly inefficient labor model and a massive backlog in efficiency, firms look to leverage AI more effectively. Rather than getting every lawyer a ChatGPT subscription, companies have emerged to offer a purpose-built system for leveraging AI in legal services.

That’s where Harvey comes in. Harvey is an application-layer AI trained on domain-specific data and built by legal practitioners. The product is designed to bridge the gap between general-purpose language models and the highly specialized demands of legal practice. Rather than offering a one-size-fits-all chatbot, Harvey delivers tailored tools that support tasks like contract analysis, legal research, and drafting, while embedding an awareness of legal standards and professional responsibility.

Founding Story

Source: Harvey

Headquartered in San Francisco, Harvey was founded in 2022 by Winston Weinberg (CEO) and Gabriel Pereyra (President). After obtaining a JD from USC, Weinberg worked briefly as a securities and antitrust litigator at the firm O’Melveny & Myers, and Pereyra was previously a research scientist at DeepMind, Google Brain, and Meta AI.

The founding story of Harvey began when Pereyra and Weinberg reconnected a couple of years after first meeting. Pereyra showed Weinberg GPT-3, which had just become publicly available. Weinberg said he was “stunned”: not only by the capabilities of the model, but by the fact that no one seemed to be talking about it or applying it to real-world problems. He shared some of his legal workflows with Pereyra, and together they began to experiment.

Their first “aha” moment came when they pulled one hundred landlord-tenant questions from the r/legaladvice subreddit and designed early chain-of-thought prompts, even before that technique had a name. They ran the answers through GPT-3 and gave the results to three landlord-tenant attorneys without mentioning that AI was involved. The attorneys were simply asked whether they would feel comfortable sending each answer to a client without edits. The result: 86 out of 100 were approved.

The team then cold-emailed OpenAI’s general counsel in 2022 with their findings, which led to a pivotal meeting with OpenAI’s leadership in July 2022. Soon after, Harvey became one of the first recipients of investment from the OpenAI Startup Fund.

In May 2025, Harvey brought on John Haddock as Chief Business Officer, after having spent a decade scaling Stripe.

Product

Harvey is focused on making legal workflows easier and repeatable. Its approach centers on converting professional legal processes into modular, automated systems that are “chained” together to accomplish specific tasks. For example, one model might accomplish clause extraction, and another handles risk scoring. Weinberg has described how Harvey’s system operates much like a traditional law firm workflow: a client request is broken down into smaller, specialized tasks, each handled by a different associate (model) before being recombined into a coherent final output.

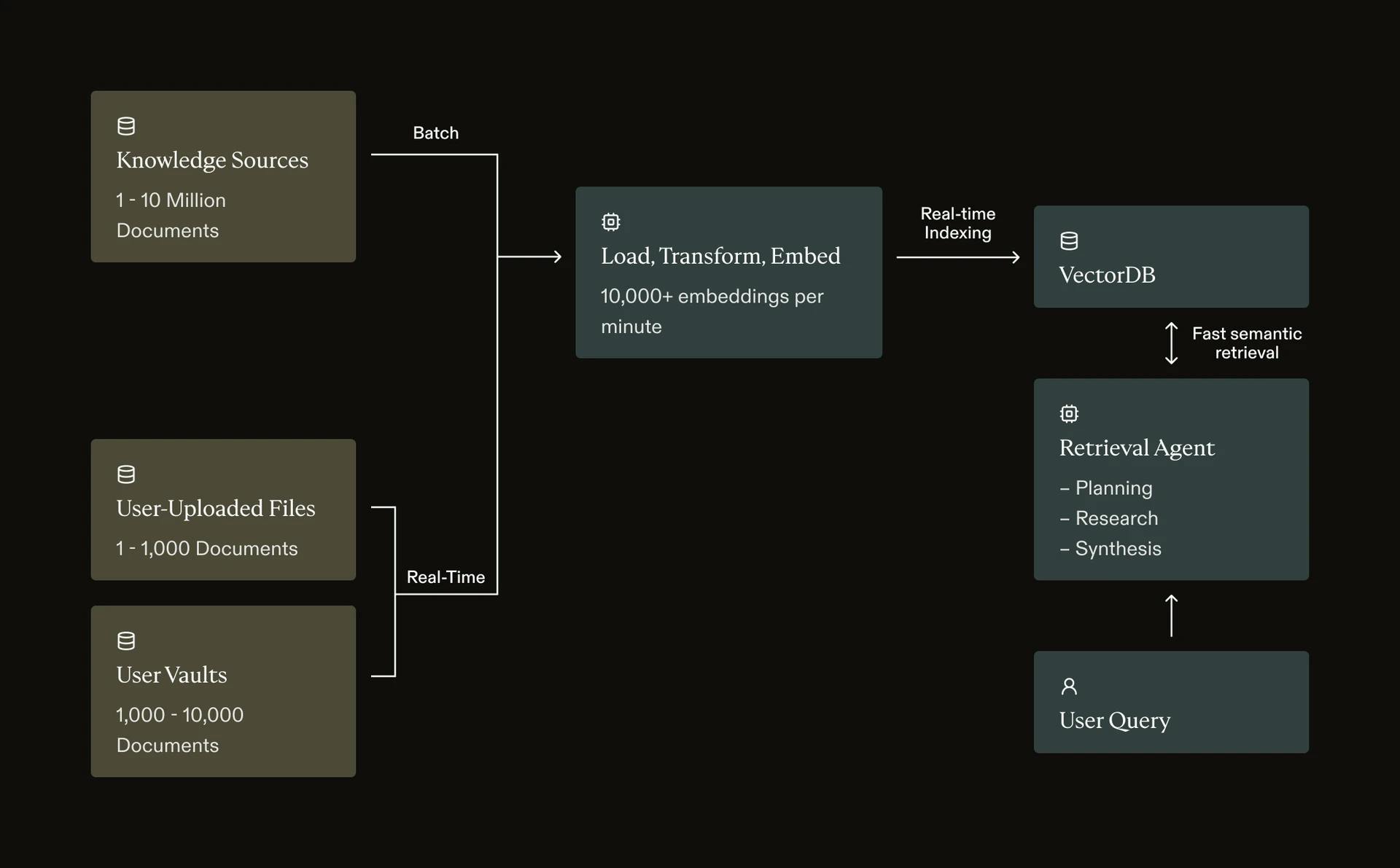

This modular workflow leverages an architecture designed to support specialized reasoning at each step. Each user query is processed through a layered architecture: a cascade of LLMs fine-tuned for legal synthesis; retrieval-augmented generation (RAG) systems that draw on both public legal databases and private user inputs; and orchestration engines like the o1 model that manage task decomposition and reasoning. This technical stack allows Harvey to deliver a work product that is intended to align closely with the standards of professional legal practice.

Harvey’s product suite is broken down into four offerings: Assistant, Vault, Knowledge, and Workflows.

Assistant

Source: Harvey

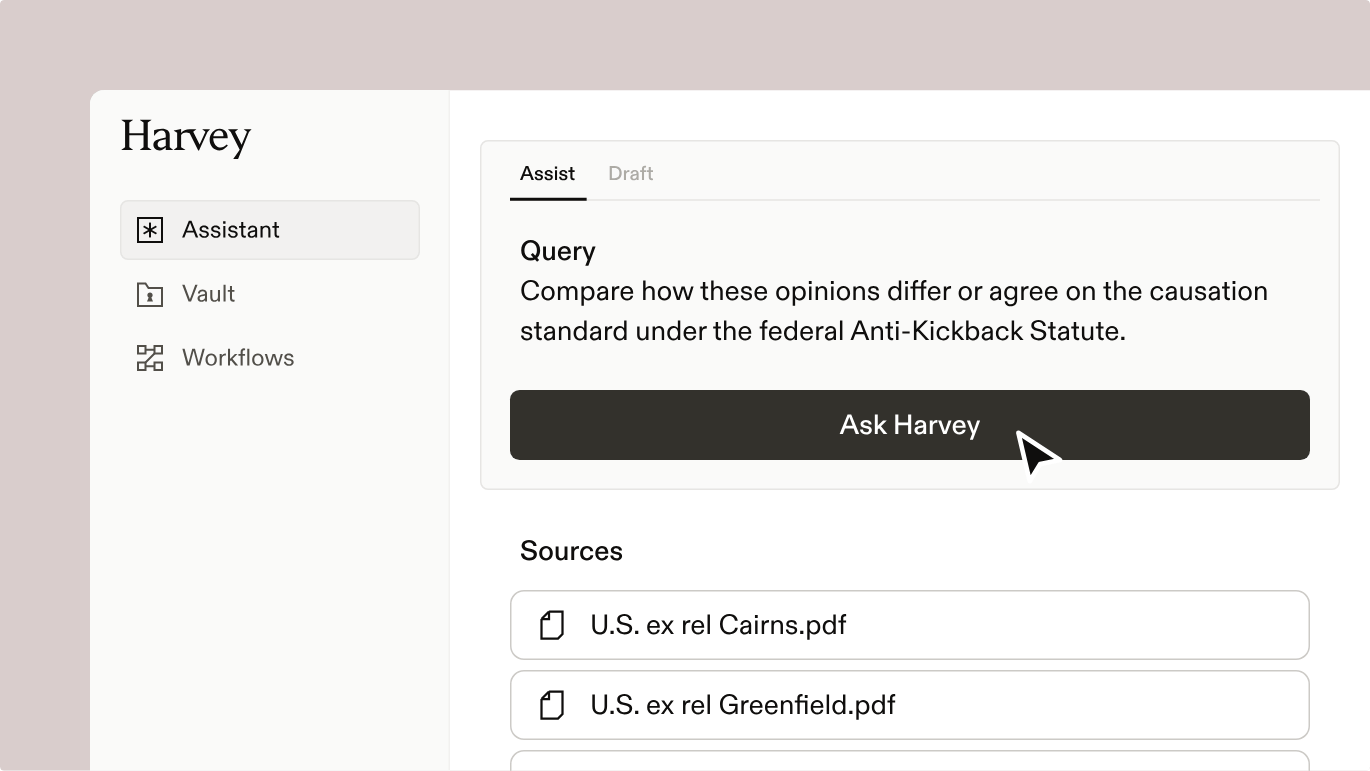

Assistant tries to shrink the distance between natural language prompts and deep domain expertise. It supports over 50 languages, countries, and legal systems, making it “universally fluent” in an attempt to make the product accessible for global use. Users can ask sophisticated questions across up to 50 documents at once, extracting insights from their organization’s internal knowledge base. Each answer includes cited materials to bridge the gap from model output to existing trusted sources.

Harvey also enables agentic workflows that leverage domain-specific agents to tackle complex tasks like contract drafting, legal research, and analysis. Assistant can also operate directly in Microsoft Word via an add-in.

In 2024, Assistant was updated to function in two main modes: Assist and Draft. Assist Mode is tailored for quick insights that are ideal for summarizing, analyzing, and searching through complex material. For example, it could be used to identify inconsistencies across multiple depositions and present them in a table. Draft Mode, on the other hand, is designed for creating and refining long-form substantive legal documents such as briefs, contracts, and provisions.

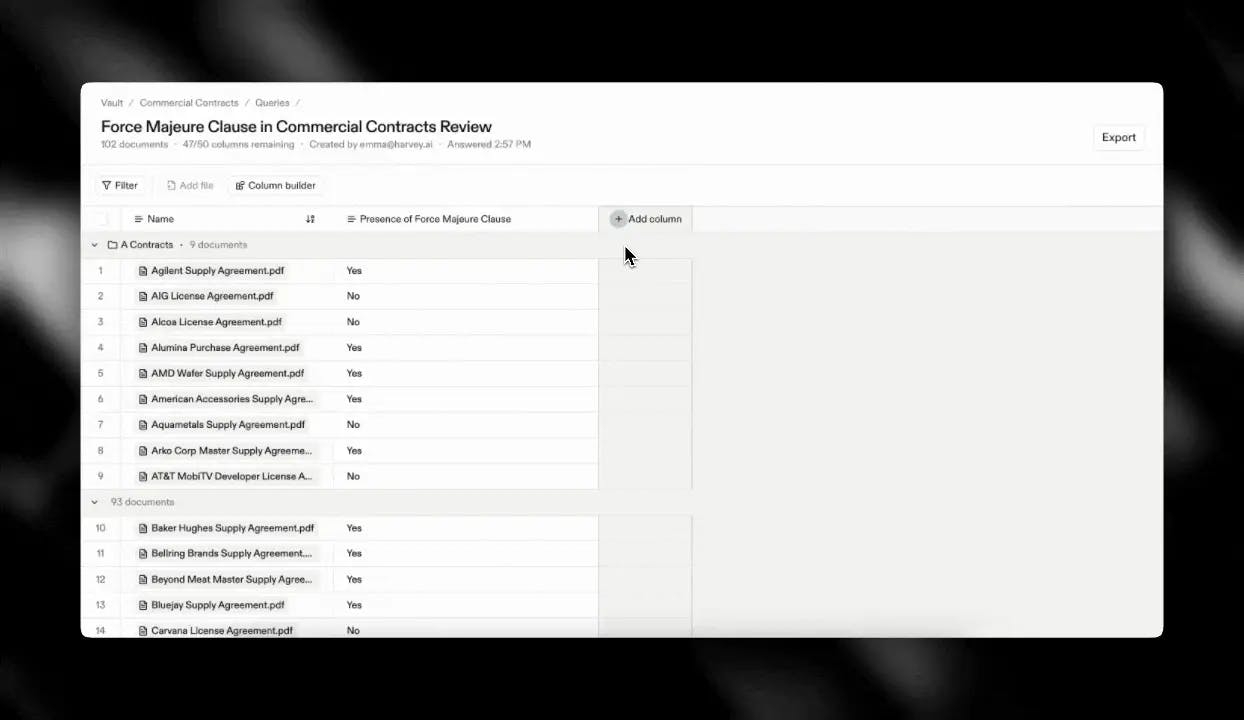

Vault

Source: Harvey

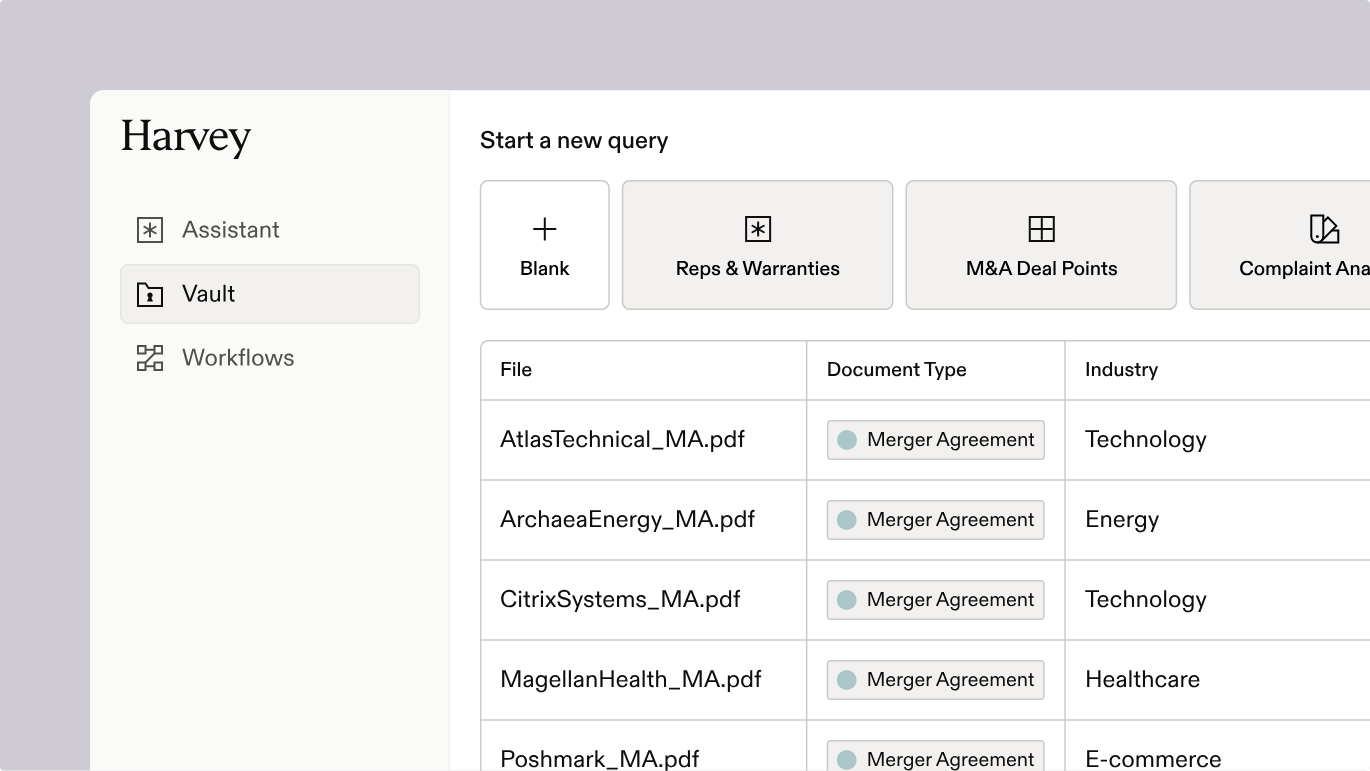

Vault is a secure, AI-powered workspace designed to help legal, finance, and tax professionals manage and analyze large volumes of documents with speed and precision in order to handle complex, document-heavy matters. According to the company, the product is meant to manage these workflows in minutes rather than hours or days. Vault enables users to upload and store up to 10K documents per project, delivering key term extraction that can identify up to 97% of key terms across over 50 fields per document.

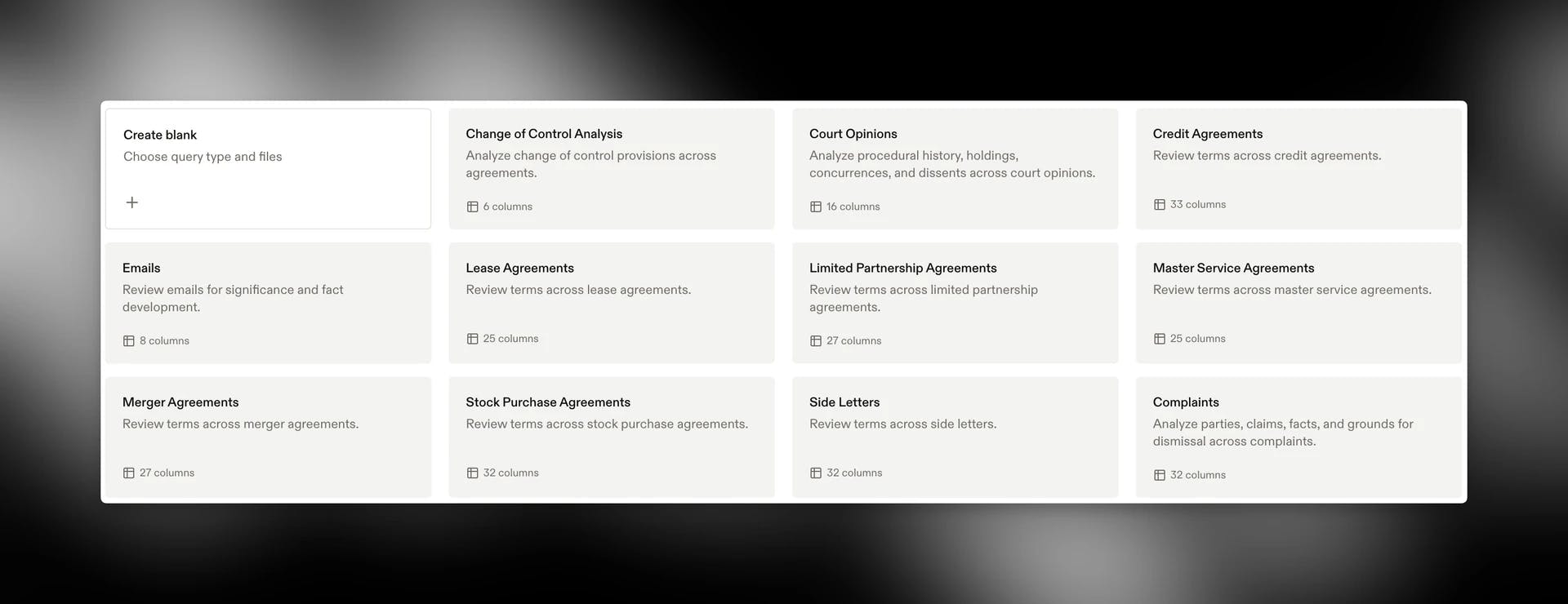

With the introduction of one-click workflows for standard document types, Vault sought to eliminate the need for complex prompt engineering. This allows legal teams to quickly extract key insights and focus on high-level decision-making, while Vault manages the underlying technical execution.

These workflows, developed by a team of former large law firm attorneys and AI researchers, cover a range of documents such as merger agreements, stock purchase agreements, leases, limited partnership agreements, and court opinions. The product has demonstrated high recall scores, ensuring comprehensive data extraction.

Source: Harvey

Vault also streamlines access to internal knowledge without the need for manual searching, and its collaborative features allow teams to share projects while controlling permissions. It also integrates with platforms like SharePoint, making it easy to sync files from existing systems.

Another key feature of Vault is the Review Table, an interactive spreadsheet that organizes key data extracted from large sets of documents. When thousands of contracts, leases, or court opinions are uploaded, Harvey’s AI identifies and extracts critical details such as dates, parties, clauses, and dollar amounts. The extracted information is then displayed in the Review Table, with each row corresponding to a document and each column representing a specific data point (e.g., “Effective Date,” “Jurisdiction,” “Termination Clause”). This structured format enables sorting, filtering, comparison, and analysis without the need to open each document individually.

Source: Harvey

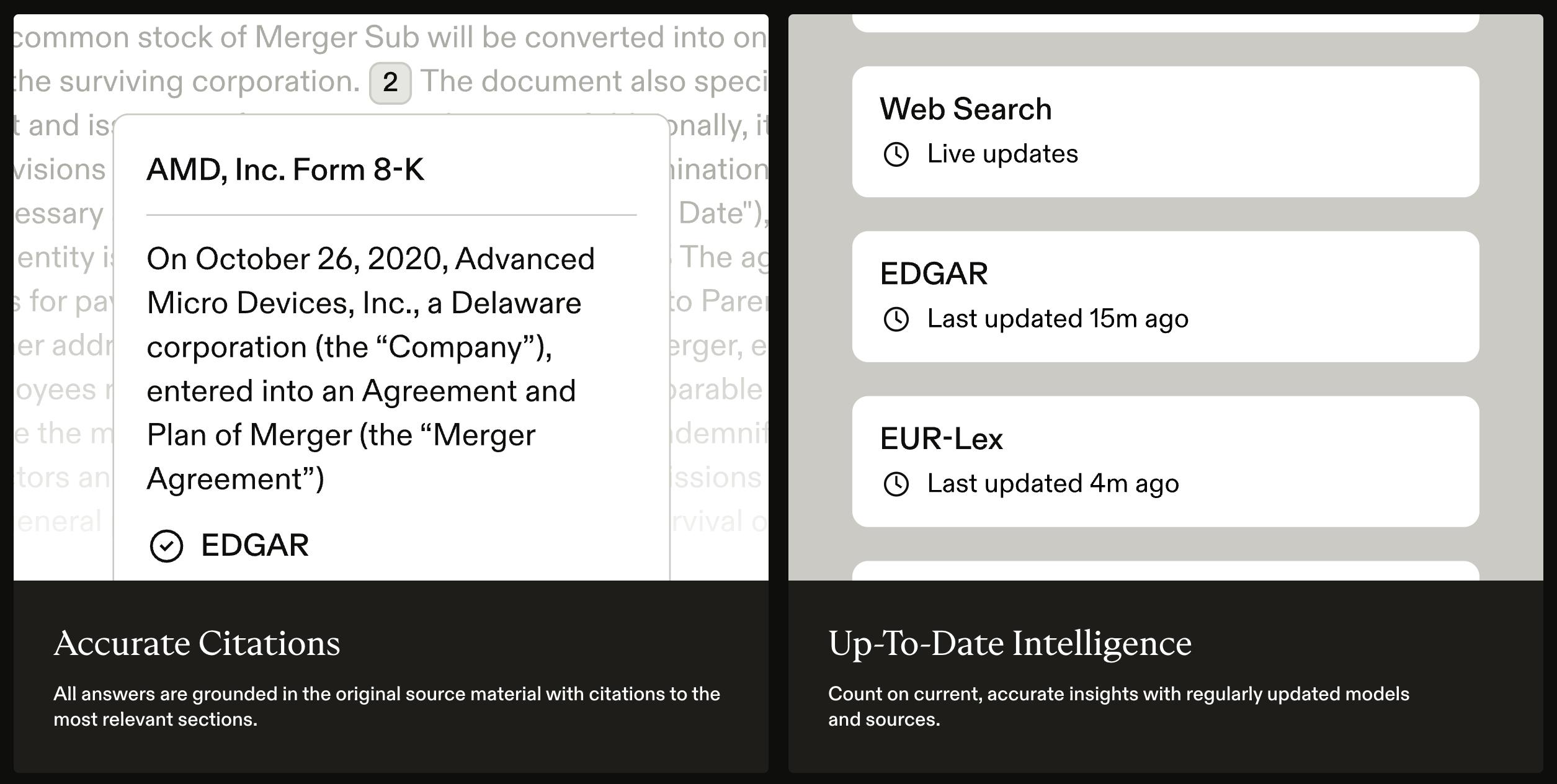

Knowledge

Source: Harvey

Knowledge is an AI-powered research platform tailored for legal, regulatory, and tax professionals. The results of search queries enable users to identify the underlying sources for specific claims and positions. The product leverages industry-trained models to deliver responses grounded in original source materials, complete with citations to the most relevant sections. The platform ensures up-to-date intelligence by regularly updating its models and sources.

Harvey Knowledge provides access to a wide range of global resources, including EDGAR for public company disclosures, EUR-Lex for European Union case law, and a broad database of law firm memos. As of July 2025, Harvey intended to expand coverage to include US federal and state case law, as well as French case law from key judicial bodies. By integrating these resources, Harvey Knowledge enables professionals to conduct rapid research while being able to trace the product’s outputs back to trusted sources.

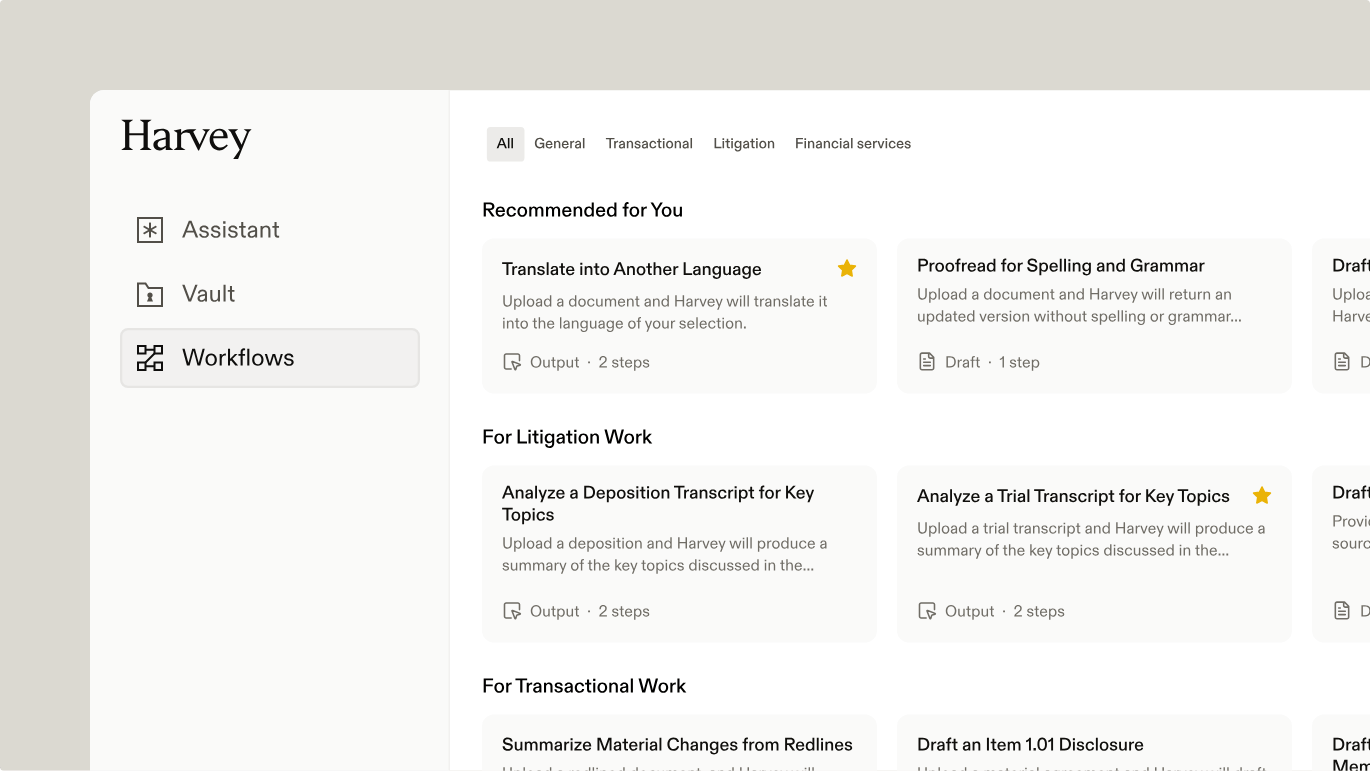

Workflows

Source: Harvey

Workflows is a no-code, AI-driven solution designed to help legal firms automate and scale routine legal tasks. Users can either deploy pre-built workflows or create their own custom sequences that integrate multiple AI models into a single, firm-specific process. With a visual Workflow Builder, the platform enables users to configure step‑by‑step inputs, contextual filters, and logic tailored to real-world legal procedures.

One key feature of Workflows is its transparency and quality control: each stage of the process exposes the AI’s reasoning so teams can trace, validate, and refine outputs as needed. The platform emphasizes consistency in high-quality legal work by combining domain-specific models with an organization’s own expertise in order to deliver “expert quality” results.

Partner Development

Harvey is also actively engaging in bespoke product development with law firm partners to productize certain legal work products. Traditionally, legal work, particularly in large firms, has operated under the billable hour model, which disincentivizes efficiency gains. Selling software that automates or accelerates work often clashes with this model, since fewer billable hours can mean lower revenue. One way to sidestep this dilemma is by targeting workflows that firms already perform at low margins or even at a loss, helping turn those into scalable, tech-enabled offerings.

One example comes from the private equity industry. Law firms often take on lower-margin tasks like side-letter compliance or fund formation support in order to win future high-value work such as leveraged buyouts or M&A transactions. Harvey collaborates with firms to productize these entry-point services in order to build software tools that let firms handle them more efficiently, deliver them at flat rates, and expand market share in previously unprofitable segments. This model aligns the incentives of legal tech and law firm economics not by threatening to replace billable work, but by upgrading marginal work into revenue-generating products.

Deep customization and collaboration do not just occur for low-margin work. For example, Harvey has partnered with A&O Shearman to develop a “merger control tool” that “taps the firm’s global antitrust bench.” In June 2025, Harvey announced a partnership with the law firm Paul, Weiss, which was the first law firm to launch custom workflows using “Workflow Builder.” In June 2025, Harvey announced a LexisNexis partnership that referenced a “Motion to Dismiss Workflow” and a “Motion for Summary Judgment Workflow.” Given the complexity of these procedural tasks, developing functional, end-to-end workflows for them would represent a significant technical and professional advancement in legal automation.

As client demand increases, opportunities for this kind of workflow partnership may prove plentiful as firms seek to market themselves as AI-forward.

Market

Customer

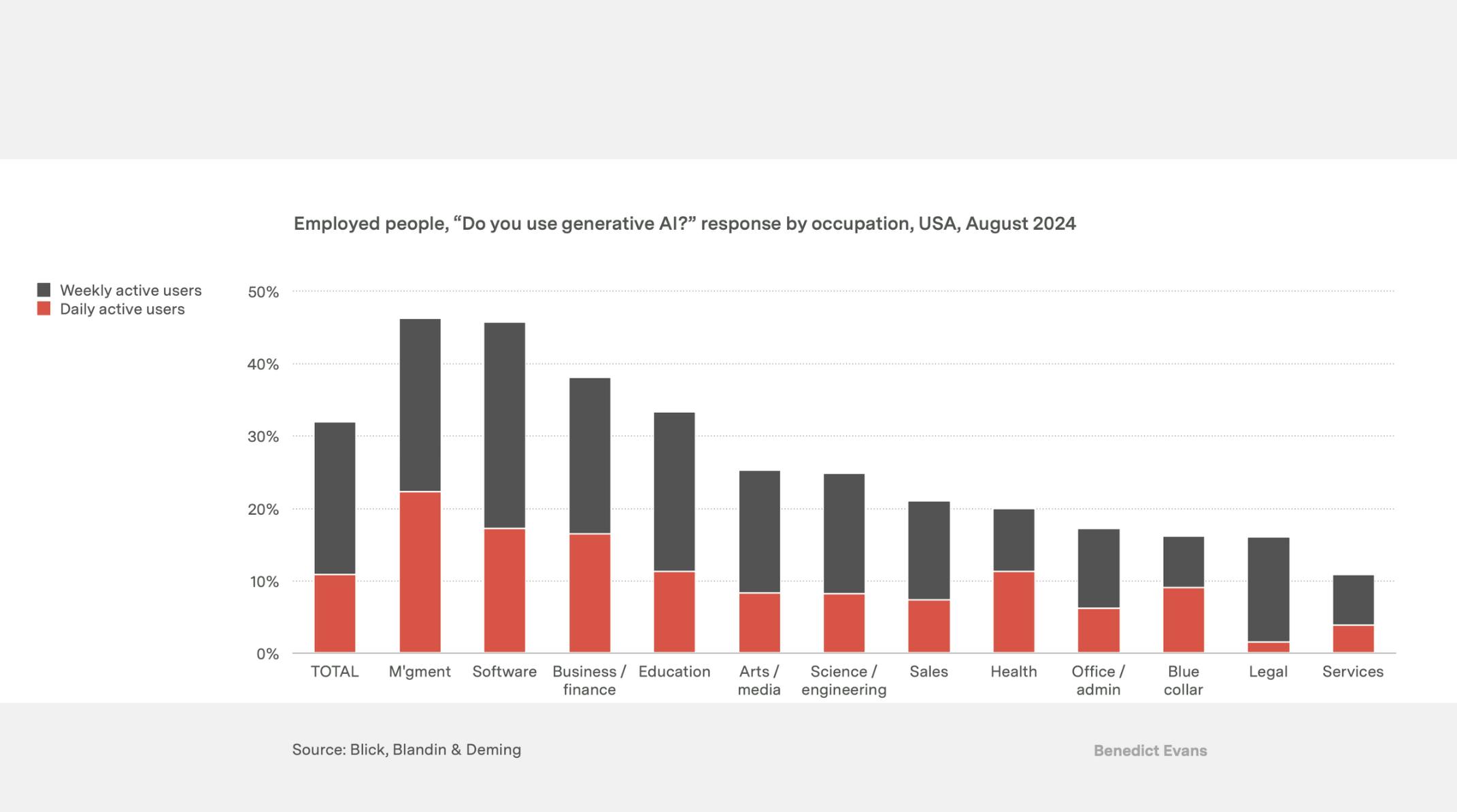

As an industry overall, legal professionals have been slow to adopt AI. One September 2024 report showed that legal professionals used AI less than even blue-collar workers.

Source: Benedict Evans

However, the use of generative AI is increasing in demand, including pressure from clients to use it. One 2024 study reported that 58% of corporate legal departments expect their outside counsel to use AI. Another report noted that 70% of clients either want their lawyers to use AI or are amenable. As this figure increases, law firms will have to meet that demand through enterprise tools. In particular, as 53% of law firms face attrition challenges with two out of five expecting to lose 40% of their support staff to retirement by 2028, AI solutions like Harvey become even more critical.

Harvey’s customers include law firms, corporate legal departments, and professional services organizations such as A&O Shearman, Macfarlanes, Bridgewater Associates, PwC UK, The Adecco Group, Carrefour Spain, and Mori Hamada & Matsumoto. By 2024, Harvey's clientele included 28% of the Am Law 100, with its reach extending to 235 clients across 42 countries. As of May 2025, lawyers at 8 of the 10 highest-grossing law firms in the US were using Harvey.

Market Size

The global legal services sector had a market size of $1 trillion as of 2024. Within that market, the market size for legal technology was estimated at $33.3 billion in 2025 and is expected to register a CAGR of 10.2%, growing to $46.8 billion by 2030. North America, Harvey’s main target market, accounts for 47% of the global legal tech market.

Within the global legal technology market, 43% of the market is accounted for by eDiscovery solutions, including products like Harvey Knowledge, which was estimated at $15 billion in 2023. eDiscovery refers to the process of identifying, collecting, preserving, processing, reviewing, and exchanging electronically stored information (ESI) for use as evidence in legal proceedings like litigation, government investigations, or regulatory requests. The increasing volume and complexity of digital data make eDiscovery a critical and often intricate process for legal teams, necessitating specialized software and expertise to manage and extract relevant information in a legally defensible manner.

Competition

Competitive Landscape

In April 2023, OpenAI made headlines with the claim that GPT-4 had passed the Uniform Bar Exam (UBE), scoring in the 90th percentile. As AI has increasingly demonstrated competence in legal services, it has led to intensified competition as new startups and established players have rushed to capitalize on the opportunity. In terms of differentiation, Weinberg has emphasized his belief that Harvey’s edge is “top-tier talent and a product strategy built on deep collaboration with its customers.”

One key component of differentiation in this market is the utilization of either proprietary AI models or third-party tools from companies like OpenAI and Anthropic. Previously, Harvey was unique in the space for its focus on only providing access to OpenAI’s GPT models in its product. However, in May 2025, Harvey announced plans to move away from relying solely on OpenAI, opting instead for a multi-model approach starting with access to Anthropic’s Claude models and Google’s Gemini models. Other companies, like EvenUp, have built in-house proprietary models like Piai with a focus on the company's particular legal focus (personal injury law).

Overall, it seems likely that general-purpose LLMs could end up outperforming domain-specific models even within specialized domains. For example, in a 2023 study, several general LLMs were pitted against BloombergGPT, a model “purpose-built from scratch for finance” across a set of finance-specific NLP benchmarks. Despite lacking explicit financial specialization, some general models matched or even exceeded BloombergGPT’s performance. For legal tech players like Harvey, the opportunity is not just in outperforming legacy systems, but leveraging generalist models that “are becoming increasingly capable and are starting to penetrate deep into the application layer.”

Beyond broad legal use cases for AI, there has also been a notable increase in startups taking aim at various niches in the legal services market that could meaningfully erode Harvey’s overall value proposition. Some examples include Legora, Spellbook, Kira, Version Story, Robin AI, and more. In addition, there are also general AI companies that have built out legal verticals, such as Hebbia and others.

Filevine

Founded in 2014, Filevine positions itself as a comprehensive, AI-enhanced alternative to tools like Harvey by offering a full legal operating system centered around the case file. Evolving from a task management tool into an all-in-one platform, Filevine now spans case and document management, lead intake, contract lifecycle management, billing, e-signatures, and analytics. Each component is built to be integrated across workflows. Its standout features include bi-directional sync that automates drafting with real-time case data, and a suite of AI tools like DemandsAI and AIFields that accelerate document creation, data extraction, and legal analysis. By streamlining core legal workflows, Filevine aims to eliminate rote tasks and make legal teams faster and more efficient.

As of July 2025, Filevine had raised a total of $226.1 million, including a Series D in 2022 led by StepStone Group, raising $108 million at an estimated $842 million valuation.

CoCounsel

CoCounsel, started by Casetext in 2023 and then acquired by the legal industry giant Thomson Reuters, is a generative AI assistant designed to enhance legal workflows by integrating directly with widely used platforms like Westlaw, Practical Law, and Microsoft 365. Rather than operating as a standalone tool, CoCounsel is bundled with existing Thomson Reuters subscriptions, making it a more attractive option for firms already embedded in that ecosystem. Its features, such as legal research, document summarization, and contract analysis, are grounded in Thomson Reuters’s authoritative legal content, offering reliability and familiarity.

For many legal teams, especially those already paying for Westlaw or Practical Law, opting into CoCounsel is a matter of convenience and continuity, making it a natural choice over competitors like Harvey that may require separate onboarding, training, or subscriptions.

Clio

Founded in 2008, Clio was a first mover in the field and remains a large provider of cloud-based legal technology designed to streamline law firm operations. Clio Manage serves as its core law practice management system, providing tools for case management, time tracking, billing, and secure document storage. Clio Grow focuses on client intake and CRM, streamlining lead management, intake workflows, and client communications. For document automation, Clio Draft enables firms to efficiently generate legal documents. Clio Accounting offers legal-specific accounting tools to ensure compliance and financial management. Additionally, Clio supports over 250 third-party integrations, allowing firms to customize their workflows with apps for e-signatures, accounting, and automation.

In June 2025, Clio launched Clio Duo, its AI-powered assistant. In June 2025, it acquired the legal research and AI company vLex for $1 billion, indicating that this move is in full swing. As of July 2025, Clio had raised $1.3 billion in funding, including a $900 million Series F at a $3 billion valuation in July 2024, led by New Enterprise Associates.

Covenant

Covenant was founded in 2021 by former WilmerHale partner Jen Berrent. While Harvey targets a broad swath of legal workflows, Covenant is taking a narrower approach by automating one of the most expensive yet repetitive tasks in private equity: verifying that subscription agreements match the bespoke terms negotiated in LP side letters. For large institutional investors, this review process can quietly rack up six-figure legal bills per year. Aggregated across US institutions, that adds up to an estimated $5 billion in 2024.

Covenant replaces manual review with a verticalized AI workflow: it ingests LP documents, applies a fine-tuned model to flag mismatches, and outputs a signature-ready closing binder. According to the company, the result is faster, more consistent, and cheaper than the traditional approach. While the market is narrower than Harvey’s, it’s sticky and lucrative. LPs rarely switch mid-fund, and even modest market share implies meaningful recurring revenue. Covenant’s valuation is undisclosed in 2025, and Flybridge Capital Partners is an investor.

Business Model

Harvey’s pricing model is not disclosed on its website, but one source indicates that it operates with a standard pay-per-seat model with custom pricing. Another unverified source indicates that Harvey prices access to its product at $1K per user per month. Its other line of bespoke products described above would also generate revenue, but the business model remains undisclosed.

Traction

Harvey’s first large customer came in early 2023 when Allen & Overy, one of the world’s largest law firms, announced it was rolling out the tool to its 3.5K attorneys. Until then, AI adoption in major law firms had been slow, with many viewing these tools as either too risky or too simplistic for complex legal work. Following Allen & Overy’s adoption, Harvey’s momentum accelerated. As of April 2025, Harvey was used by 337 legal clients in 53 countries, and its ARR had crossed $75 million.

Harvey’s global traction is underscored by its 2023 collaboration with the Singapore judiciary, where a system based on Harvey’s platform has been deployed in the Small Claims Tribunals. This system is intended to assist common people in navigating the legal system by digitally holding their hand through the process. Singapore’s adoption, alongside AI-powered translation services into official languages, highlights both Harvey’s international applicability and its growing role in public-sector legal innovation.

Valuation

As of July 2025, Harvey had completed six funding rounds totaling $806 million. The company raised $5 million in a seed round in November 2022, led by the OpenAI Startup Fund. This was followed by a $21 million Series A in April 2023, led by Sequoia Capital. In December 2023, Harvey closed an $80 million Series B round with lead investors Elad Gil and Kleiner Perkins. A $100 million Series C round followed in July 2024, led by Google Ventures. In February 2025, Harvey raised $300 million in its Series D round, led by Sequoia Capital, valuing the company at $3 billion. Then, in a May 2025 Series E led by Kleiner Perkins and Coatue, Harvey raised $300 million at a $5 billion valuation. As of May 2025, Harvey had the highest valuation of any legal AI startup, compared to adjacent players like Ironclad at $3.2 billion and Clio at $3 billion.

Key Opportunities

Reducing Legal Research Hallucinations

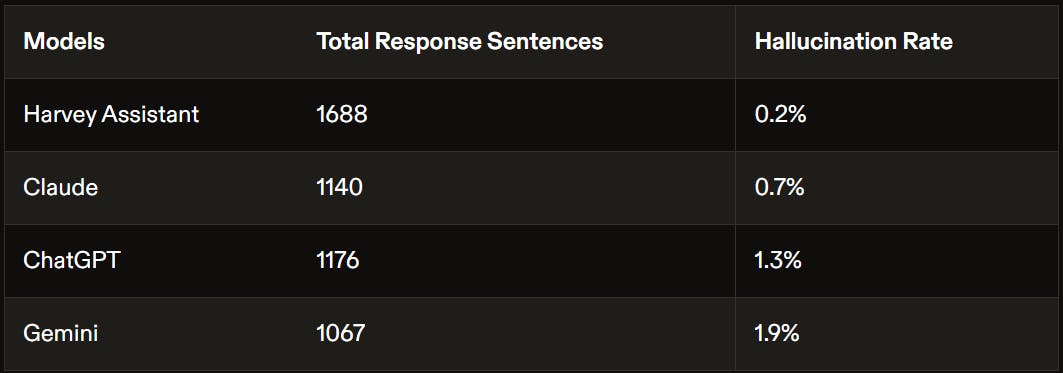

One opportunity for Harvey lies in becoming the industry standard for reducing legal research hallucinations, which represents an existential challenge for applying generative AI in high-stakes legal contexts. In contrast to other domains where occasional inaccuracy may be tolerable, the legal profession demands near-perfect reliability: even a single fabricated case citation can compromise a brief, harm a client, or sanction an attorney.

As the US Supreme Court Chief Justice Roberts emphasized in his 2023 Year-End Report, the legal system relies on trust, and courts are now wrestling with the implications of AI-generated filings that include fictitious or misstated authorities. Stanford’s HAI study further underscores the severity of this issue, revealing that LLMs frequently invent or misattribute legal precedents, even when prompted with structured queries. One 2024 study found that even specialized legal LLMs that tout themselves as hallucination-free actually hallucinate 17-33% of the time. In 2025, the Supreme Court of Texas is considering banning the use of AI in its state’s legal proceedings because of the mayhem that bogus legal research can cause.

Harvey’s approach positions it to gain trust. Rather than relying solely on static prompt tuning or generic citation links, Harvey is developing advanced agentic workflows that aim to catch and proactively correct hallucinations in real time. These systems enable agents to self-review, perform deeper research, and escalate ambiguities to human experts instead of bluffing through knowledge gaps. Though this correction layer currently takes longer than typical copilot-style interactions, its value scales exponentially as tasks grow more complex.

In parallel, Harvey has implemented robust safeguards against misinformation at the system level: its legal research tool surfaces citations alongside direct links to primary sources, allowing attorneys to verify case law in its original context. It further limits outputs to jurisdiction-specific databases and applies retrieval-augmented generation (RAG), grounding responses in authentic, accessible authority and sharply reducing the model’s freedom to fabricate. Harvey’s June 2025 partnership with LexisNexis is also a major step in building trust with clients who have long looked to LexisNexis as an authoritative source.

Harvey is also investing in transparency, building tools to trace model reasoning and distinguish clearly between retrieved materials and AI-generated analysis. This commitment to explainability, grounded reasoning, and proactive error correction positions Harvey to become a trusted platform for AI in high-stakes legal work.

Source: Harvey

Owning Legal RAG

Harvey’s enterprise-grade RAG system presents a compelling opportunity to establish a dominant position in the legal tech space. While generic RAG systems are increasingly commoditized, Harvey’s tailored approach to handling the complexities of legal data offers a clear competitive edge. Legal workflows involve nuanced, context-dependent data that cannot simply be processed by generic systems. In particular, Harvey’s ability to refine RAG models through close collaboration with domain experts, such as PwC’s tax professionals for their Tax AI Assistant, ensures that its outputs are both highly accurate and more reliable than off-the-shelf alternatives.

The technical sophistication required to build such a system, combined with the ability to integrate complex legal reasoning into a user-friendly platform, represents a significant opportunity for Harvey to capture market share and solidify its position as a leader in the legal tech startup ecosystem. Competitors may struggle to replicate this level of domain-specific expertise and enterprise-grade capabilities, giving Harvey a powerful advantage in the race to dominate the legal AI landscape.

Source: Harvey

Becoming A Recruiting Asset

Another key opportunity for Harvey lies in its potential to reshape junior associate workflows and, by extension, law firm recruiting dynamics. As Harvey automates repetitive, low-value tasks like first-pass research, document summarization, and contract markup, it frees up junior attorneys to engage more directly with higher-order legal analysis and strategic thinking much earlier in their careers. This shift appeals to a rising generation of law graduates who are less interested in grinding through boilerplate work and more eager to gain substantive experience.

Big Law firms are known for high churn and burnout rates among associates, often due to long hours spent on rote, mechanical tasks. By reducing the volume of such work, Harvey enables firms to offer a more sustainable and rewarding early-career experience. As a result, firms that integrate Harvey effectively may gain a competitive edge in attracting and retaining top junior talent by offering a more intellectually engaging, AI-augmented practice environment.

Key Risks

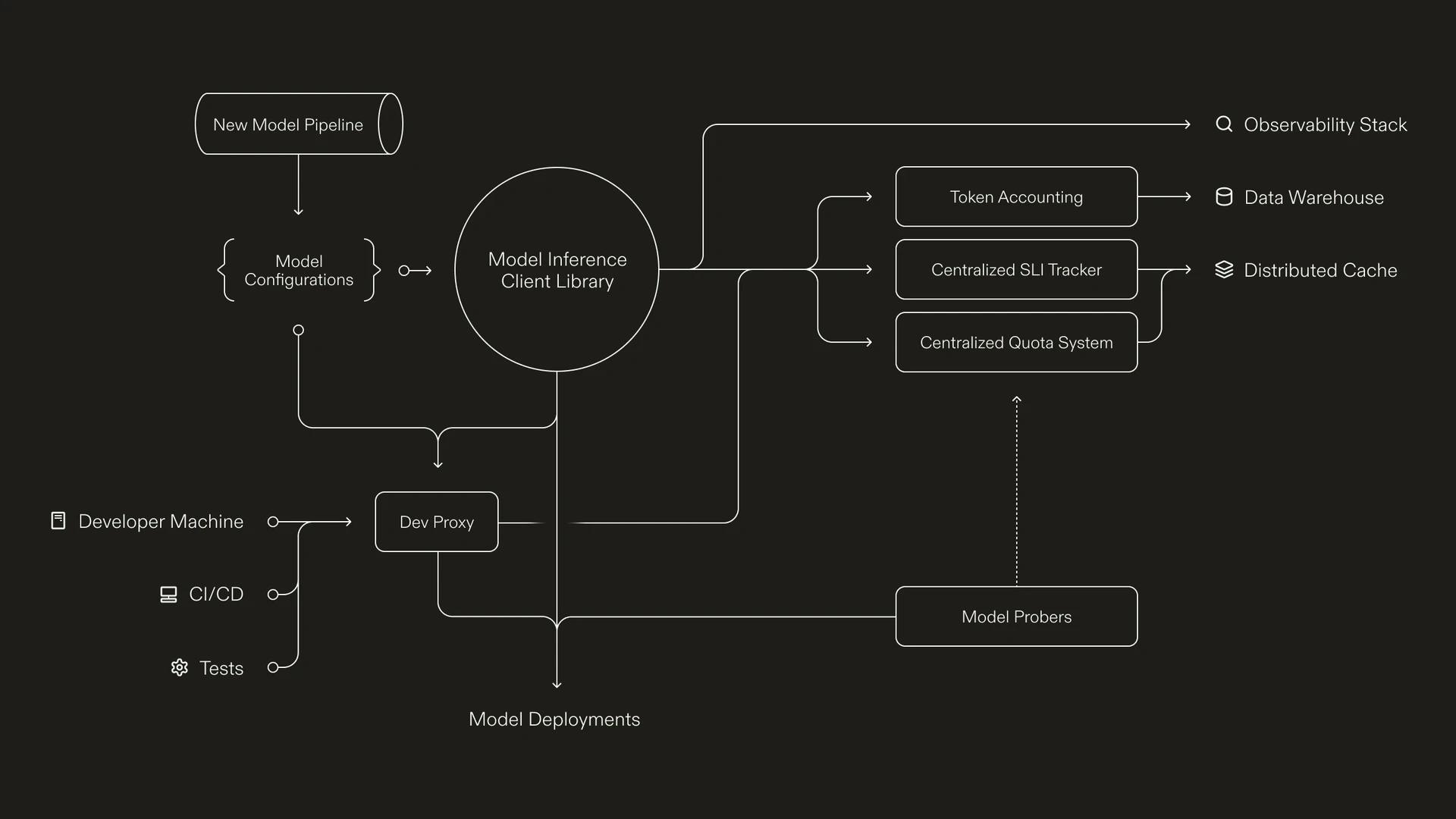

Managing Computational Load & AI Infrastructure

A critical operational risk for Harvey AI lies in the management of computational load across its LLM deployments. Each model deployment operates within finite resource constraints, and when demand surges, whether due to traffic spikes, onboarding of new enterprise clients, or usage clustering across jurisdictions, those deployments risk hitting resource ceilings. If not properly managed, such scenarios can lead to degraded performance, increased latency, request timeouts, or full-scale service outages.

Source: Harvey

For a company like Harvey, which markets itself as a dependable AI co-counsel for high-stakes legal work, even short-lived performance disruptions could severely undermine user trust. Legal professionals, especially in Big Law and in-house counsel environments, require tools that are not only intelligent but also predictably reliable. In legal work, missing certain deadlines can result in a loss of a lawsuit, which in the corporate world is often worth billions. An outage during critical legal workflows, such as court filings, contract negotiations, or trial prep, could tarnish Harvey’s reputation and expose it to customer churn, liability claims, or reputational damage.

Moreover, this technical risk has downstream implications for business development. Harvey’s continued expansion depends heavily on securing large enterprise accounts, including Am Law 100 firms, global in-house legal teams, and public sector entities. These clients conduct rigorous due diligence before committing to third-party software. Any indication that Harvey’s infrastructure may buckle under high load could slow adoption, elongate sales cycles, or even preclude consideration in competitive procurement processes.

In an increasingly competitive legal AI landscape, where stability and scale are just as critical as accuracy, Harvey’s ability to maintain resilient and performant infrastructure under pressure will be a key determinant of its long-term commercial viability. While the company has outlined safeguards such as load balancing, real-time monitoring, and model failover strategies, those measures must continually evolve to keep pace with client growth, regulatory expectations, and the unpredictable demands of AI inference at scale. Failure to do so would not just be a technical setback, but a material business risk.

Data Privacy

Another key risk for Harvey’s business lies in data privacy and the handling of sensitive legal information. Since Harvey operates in the legal domain where confidentiality is paramount, the company must navigate complex privacy regulations, attorney-client privilege concerns, and divergent data protection laws across jurisdictions. Law firms and corporate legal departments are justifiably cautious about where their data goes, how it’s processed, and who has access to it. Any perceived or actual lapse in data security could erode trust and pose serious legal or reputational consequences.

To mitigate these risks, Harvey implements a multi-layered security framework to protect sensitive legal data and maintain client trust. The company maintains an in-house security team responsible for the secure development and operation of its products and infrastructure. To validate the robustness of its defenses, Harvey partners with industry leaders such as NCC Group and BishopFox for independent assessments of its web and network security. A dedicated Security Advisory Board comprising experts from leading financial institutions and cloud providers guides the company’s privacy and security strategy.

In addition to technical safeguards, Harvey provides contractual security guarantees through its Security Addendum and offers strict data residency controls, giving clients full control over where their data is stored. Enterprise-grade features such as SAML SSO, audit logging, IP allow-listing, and lifecycle management further strengthen its platform. These measures are designed not only to meet but to anticipate the stringent requirements of law firms and corporate legal departments.

Still, the company must remain vigilant. As AI models evolve and handle more complex tasks, Harvey will need to continuously demonstrate that its security posture is not just compliant but proactive, particularly as its footprint expands across global legal markets.

Overreliance

In April 2023, OpenAI made headlines with the claim that GPT-4 had passed the Uniform Bar Exam (UBE), scoring in the 90th percentile. However, further study in May 2024 indicated that this performance was overstated. In fact, GPT-4 had performed well against test-takers who had already failed the test once before; “a much lower-scoring group than those who generally take the test.” In reality, GPT-4’s performance was “in the 69th percentile of all test takers and in the 48th percentile of those taking the test for the first time.”

The adoption of AI in the legal services industry indicates that practitioners are both willing to experiment with these tools and, potentially, are already starting to see value from their use. However, if the legal profession becomes overly dependent on these tools, it could meaningfully erode trust in the industry. That could result in further user distrust of the tool and ultimately dampen the willingness to adopt AI in the field, adversely impacting companies like Harvey.

Summary

Despite rapid advancements in legal AI, adoption is still uneven and often slowed by entrenched business models and risk-averse cultures. Billable hour structures disincentivize efficiency gains, junior attorneys are trained on repetitive tasks that AI can now automate, and senior partners are starting to look for ways to build technology-enabled efficiency into their business. As backlog crises mount, client expectations shift, and support staff retire en masse, the pressure to integrate intelligent systems is rising. Harvey’s value proposition is built not on replacing lawyers but on absorbing routine work, preserving institutional knowledge, and enabling firms to scale without compromising quality. AI is beginning to outperform human lawyers on certain tasks, and that trend is only accelerating. As Andrew Perlman put it, “AI will not eliminate the need for lawyers, but it does portend the end of lawyering as we know it.”

Harvey's long-term success will hinge on its ability to navigate enterprise demands, including data security, uptime, and explainability, all while sustaining its lead in legal-specific RAG and agentic workflows. With 28% of the Am Law 100 as customers and partnerships across private equity, litigation, and corporate counsel, Harvey has built a notable distribution beachhead. But its advantage is not guaranteed. Incumbents like Clio and Thomson Reuters are bundling AI into full-stack offerings, and a wave of verticalized startups is attacking specific legal niches. Harvey’s bet is that winning the application layer with best-in-class tooling and tight customer collaboration will prove more defensible than building yet another LLM.