Thesis

As of 2021, 4.3% of children in the US under 17 had lost at least one parent. A 2020 study found that 44% of households believed they would face financial hardship within six months if they lost their primary breadwinner. Life insurance provides a crucial financial buffer for such families, protecting them from potential hardship in the event of an untimely death. As of 2022, 90 million American families depended on life insurance products for their financial security.

Life insurance first appeared in ancient Rome, where military leader Caius Marius established "burial clubs" in 100 B.C. to cover funeral expenses for troops. Burial clubs then reemerged in 18th-century Europe and America. By the twentieth century, conventional life insurance products had become mainstream. Post-World War II economic growth spurred widespread adoption, with nearly 90% of married households owning life insurance policies by the mid-1970s. However, despite more cost-effective options, life insurance ownership rates among parents had declined to 59% in 2023.

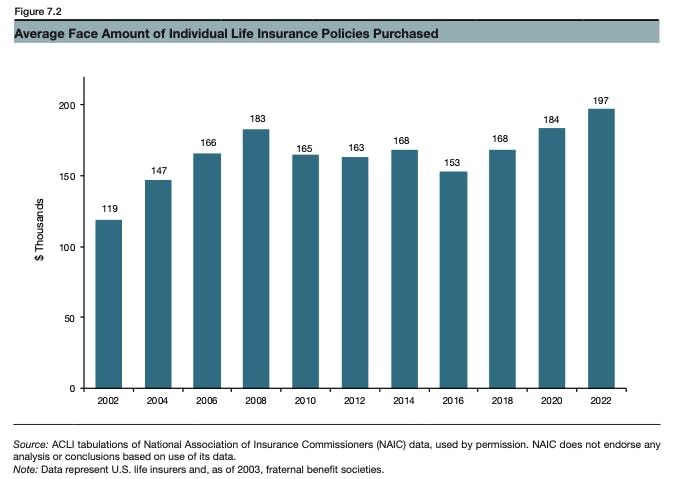

Even with this relative decline from its peak, life insurance remained a large market in the early 2020s. Individual life insurance, representing approximately 64% of all life insurance, had a face amount of $14 trillion in 2022, having grown 2.3% annually since 2012. The average size of an individual life policy grew at a 4.7% CAGR from $119K in 2002 to $297K in 2022.

Source: ACLI

Life insurance, however, has a mixed reputation with consumers; life insurance had average NPS scores ranging from 4.5% in 2018 according to one report to 39% in 2021 according to another, with issues stemming from common sales and application processes in life insurance. Unlike other forms of insurance like auto insurance, life insurance is primarily sold face-to-face through an insurance agent. Insurance agents face perverse incentives, where they are pushed to sell high-commission policies that may be excessive for the consumer’s needs. Moreover, the application process takes between four to eight weeks and often includes blood and urine tests.

These frictions can create a negative feedback loop: as customers become disenchanted from negative interactions with agents and carriers, they develop a pessimistic, often inaccurate, perception of life insurance products. As a result, 82% of Americans overestimated the cost of life insurance as of September 2023, adding to the challenges that the life insurance industry faces.

These challenges hint at the potential changes that might re-invigorate the industry. In 2020, it was found that 50% of life insurance seekers prioritize convenience, speed, and simplicity in underwriting above all other factors. 2023 was the first year in which consumers expressed a preference for buying life insurance online rather than in person. Both of these statistics favor digitally-native platforms that can issue policies and bypass face-to-face interaction. Additionally, it was estimated that 30% of consumers expressed intent to purchase life insurance in 2024.

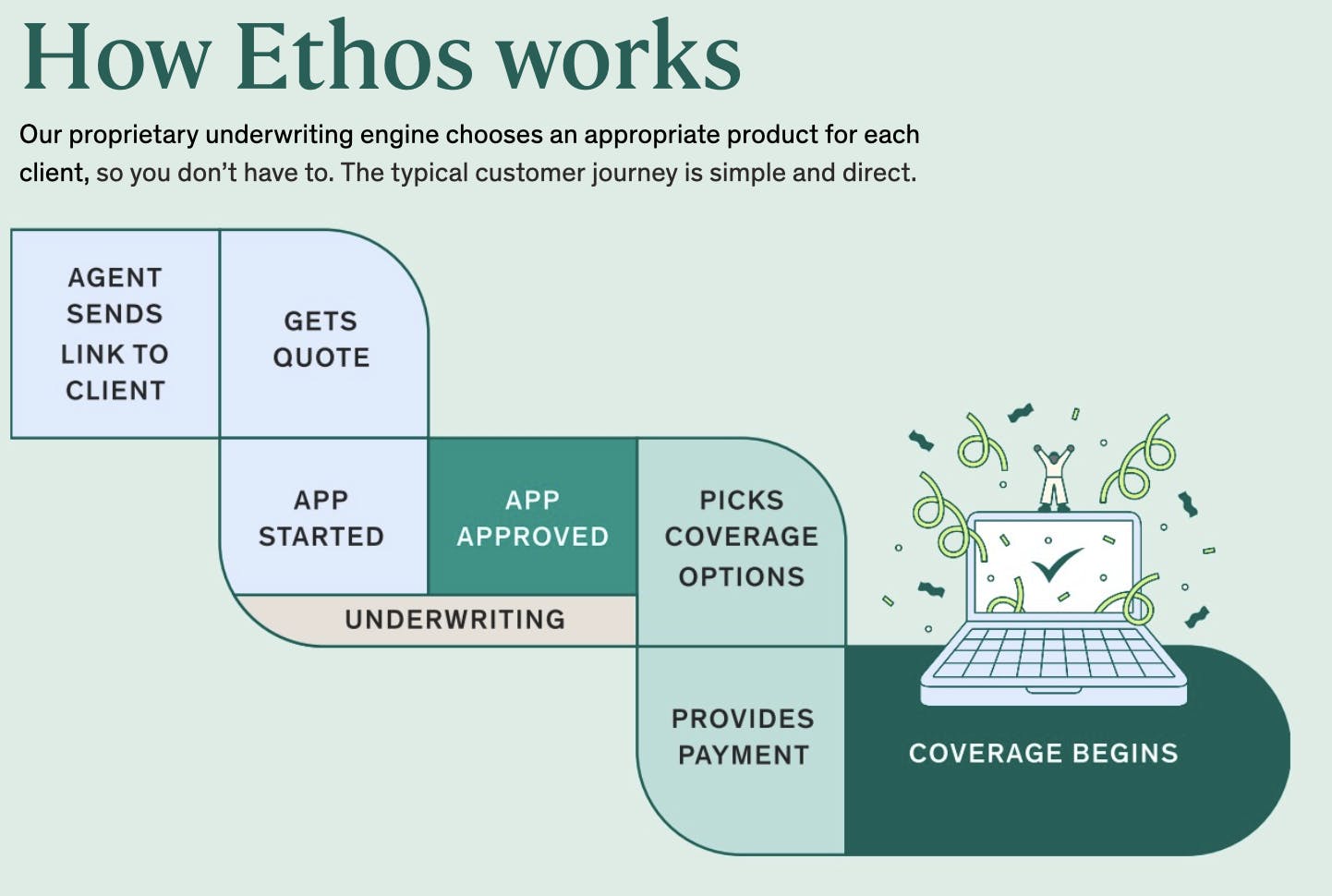

Ethos is a life insurance company that offers an online application process that prioritizes speed and ease of application. Its mission is “to protect the next million families”, and it describes itself as a “no-medical-exam, instant life insurance provider” that provides "life insurance in five minutes”. For consumers, the company provides life insurance policies designed to be accessible and affordable, leveraging data analytics to assess risk and expedite approvals through digitally-native underwriting. It also has an agent sales portal intended to serve as a turnkey solution for agents.

Founding Story

Ethos was founded in 2016 by Peter Colis (CEO) and Lingke Wang (former CTO).

While roommates at Stanford Business School, Wang shared his costly experience with life insurance with Colis. At age 20, Wang had been persuaded to buy a permanent life policy, framed as a good investment despite his having no spouse or children. As the monthly expenses mounted, Wang realized his mistake and lost most of his investment. With this, Wang experienced the misaligned incentives of traditional insurance sales first-hand. Recognizing these flaws, the pair “became set on fixing the industry — starting with Ovid and then Ethos.”

Wang and Colis founded Ovid, their first life insurance company, in the summer of 2015. Ovid connects policyholders and investors for life settlement transactions. The company acts as a marketplace to help policyholders realize the equity value of their policy through a competitive bidding process. In 2019, Ovid was acquired by an undisclosed buyer for an undisclosed amount, and as of 2024, continues to operate.

In an interview, Wang described starting Ovid as a “foot in the door” to the life insurance industry, providing a strong foundation to tackle deeper issues. When running Ovid, Colis and Wang realized that in order to drive meaningful changes to the industry, they had to get to the root of the problem by, as Wang put it in a 2019 interview, offering “a product that ensures families are appropriately protected considering their financial means.”

In the summer of 2016, Colis and Wang first conceptualized Ethos and built an early version of the company with “forward-thinking” insurance companies. Starting in late 2017, Ethos quietly launched in select markets. At this time, Colis and Wang focused on refining their product through rapid iteration driven by user insights, often releasing code throughout the day. In parallel, they worked on automating workflow processes for their 100-year-old insurance carrier partner. In the same year, Ethos also secured a seed financing round from Sequoia Capital, but they were only able to secure this funding round after Colis and Wang had been rejected by 39 other investors. In June 2018, Ethos officially launched out of stealth with a $11.5 million financing round led by Sequoia Capital.

Product

Online Application Platform

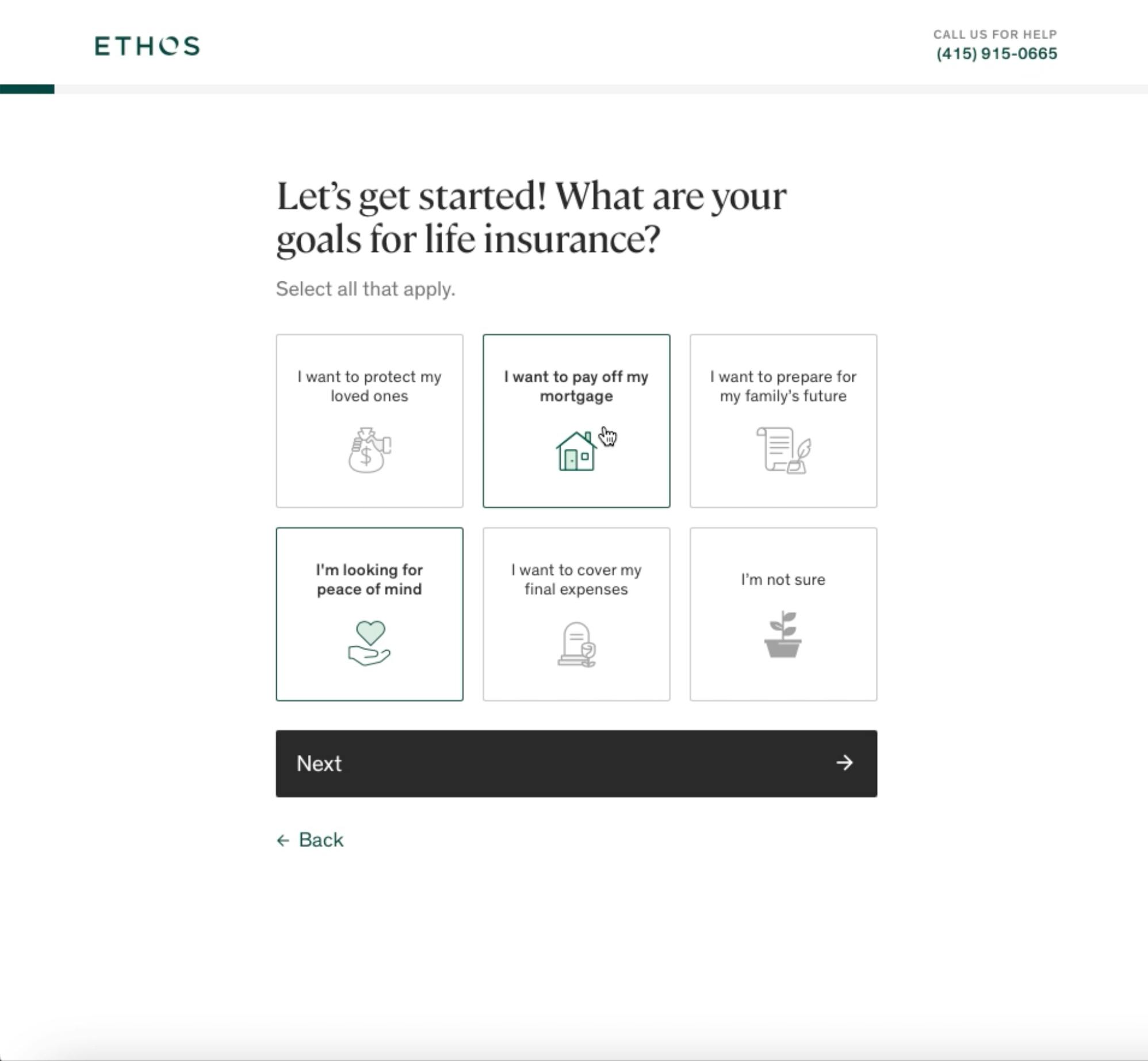

Ethos’s application platform offers a streamlined way to buy life insurance. Users can start a term life insurance application directly from the homepage. Through an interface and flow similar to TurboTax, users answer questions about their financial dependents, health, smoking status, and desired coverage timeline. To assist in determining the user’s life insurance needs, the application may also ask about estate plans, wills, and outstanding debts.

Source: Ethos

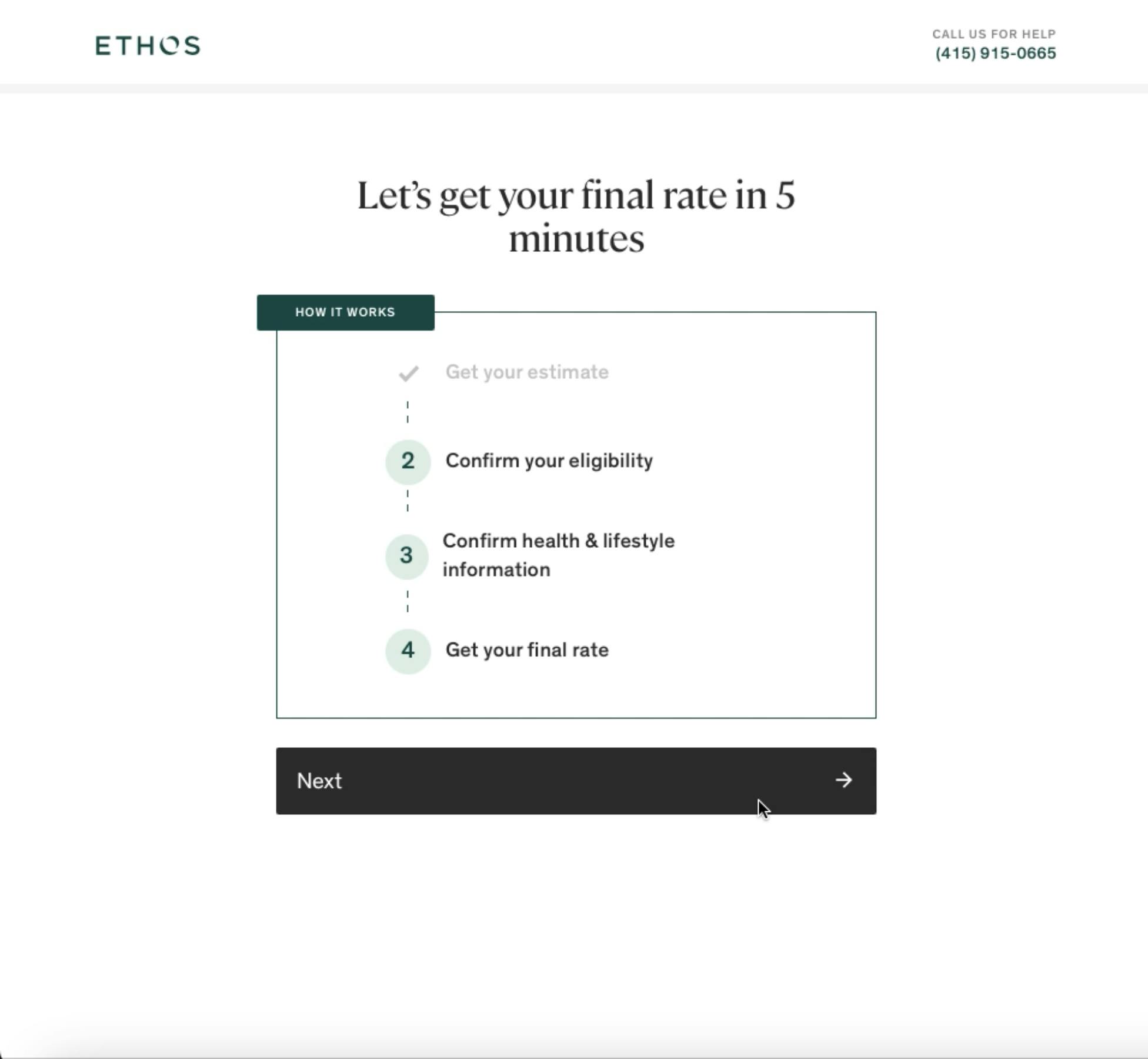

Based on the user’s responses, Ethos suggests an appropriate policy duration and coverage amount. Eligible applicants may receive policy approval on the same day.

Source: Ethos

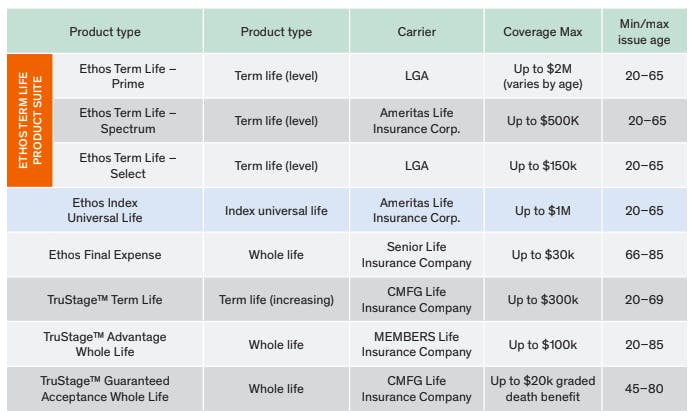

Policies Offered: Ethos’s main policy offering is term life insurance. Term life insurance policies provide coverage for a specified period. Upon the expiration of a term life policy, the coverage will lapse and no payment will be made to the beneficiary in the event of death. This is unlike permanent life policies, also known as whole life policies, which provide protection for as long as the insured lives. Ethos promotes term life insurance policies as more affordable, flexible, and simple than whole-life policies.

Ethos offers term life policies for individuals aged 20 to 65 across all US states except New York, with coverage ranging from $20K to $2 million and policy durations ranging from 10 to 30 years. These policies are issued by Legal & General America, Ameritas Life Insurance Corp., and TruStage. Additionally, Ethos provides whole life insurance for individuals ages 66 to 85, offering instant approval regardless of health history. These policies range in coverage from $1K to $30K. Ethos’s whole life policies are issued through TruStage in all US states except New York.

Source: Ethos

Will & Estate Planning Tools: All Ethos products within the “Ethos Term Life Product Suite” include free will and estate planning tools. These tools allow customers to create a will, trust, and power of attorney. Obtaining these additional products also takes under an hour and is fully online. Non-Ethos policy-holders can purchase these services separately for $149 for the will services, and $449 for the will and estate planning bundle, respectively.

After completing the online application flow (which Ethos claims takes about five minutes), Ethos will process the application and provide the user eligibility status and rates. The processing time will vary based on the user’s application answers.

Underwriting Engine: One core selling point for Ethos is that its application does not require a medical exam. Instead, it uses health questions and third-party data to inform its risk assessment. As described by Colis in an interview, Ethos “utilizes 300K data points and 30K algorithmic rules in real-time to evaluate each applicant and get them the right policy at the right price.” This underwriting process is unlike traditional underwriting processes and involves “several orders-of-magnitude more data than a traditional underwriter can absorb.”

Honesty Tactics: Like any life insurance application, ensuring the honesty of the applicant is an obstacle. Ethos has leveraged ideas in behavioral economics to increase the likelihood of an honest application. This includes “priming” the applicant with an honesty pledge before entering any personal information.

Agent-to-consumer

Source: Ethos

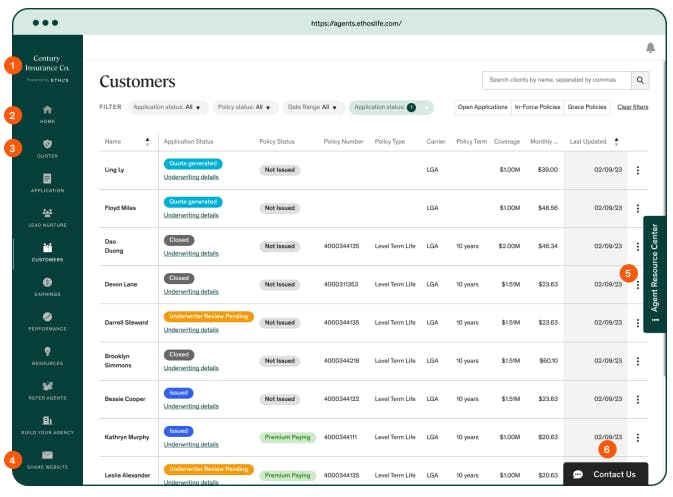

In addition to its online application for individuals and families, Ethos also provides tools for agents that accelerate their life insurance policy sales. These tools are wrapped under the Ethos sales portal, which operates as an all-in-one CRM for the agent. Agents can quickly send a client links (personalized with the agent’s company name) to apply and obtain quotes instantly. Agents can see the status of each policy, its underwriting details, and any relevant updates to the policy.

Source: Ethos

Ethos also provides a suite of training content for agents that covers the basics of life insurance, agent FAQs, and resources to use with clients.

Market

Customer

Ethos has three key stakeholders: insurance buyers, insurance agents, and insurance carriers.

Insurance buyers: Ethos serves families and individuals through its life insurance offerings. The average Ethos customer looks different than the typical life insurance purchaser. The first way they differ is income. In 2021, 40% of Ethos’s new policyholders had incomes of $60K or less; the median income of all life insurance holders, in general, was $88K as of March 2024. The second way they differ is a preference towards a digital, low-touch sales process: one insurance agent shared that he positioned Ethos as the “low-pressure” option: “I like sharing the link because it’s not sales-y and it’s not pushy. I don’t have to look like an insurance agent”.

Insurance agents: Ethos serves agents by providing them with a turn-key solution to sell and manage life insurance policies. Ethos’ sales portal caters to three types of insurance agents: new agents, property and casualty (P&C) agents that want to cross-sell life insurance to their book of clients, and experienced agents that accelerate sales by eliminating administrative burden. Ethos has begun partnerships with large agencies such as Goosehead and FFL to kickstart this strategy and expand its reach within the agent industry.

Insurance carriers: Ethos serves two functions for its carrier partners: distribution and underwriting. Ethos ultimately does not sell its own policies— it sells policies issued by a third-party carrier. Unlike a traditional agency that is entirely focused on selling policies for its carriers, Ethos is licensed as both a distributor and a third-party administrator (TPA). TPAs are allowed to share in some of the business activities of the carrier. Ethos leverages this ability by performing underwriting services for carriers, which is seen in its online application platform.

Market Size

In 2022, 9.4 million individual life insurance policies were purchased in the US, with 39% being term life, Ethos’s core product offering, and 61% being whole life. Term life, however, accounted for 71% of the $1.8 trillion of the total face amount sold in 2022. The reason for this disparity lies in the nature of these products: term life offers substantial temporary protection with higher coverage amounts at lower costs, while whole life, designed for lifelong coverage and cash value accumulation, typically results in more policies but smaller face amounts.

Term life insurance has seen consistent growth, with premiums up 5% from 2022 to 2023, outpacing whole life at 1%. Term life, however, is noted to be more sensitive to inflation and unemployment, since it targets less affluent families. Term life insurance was valued at $1.1 trillion in 2024 and is expected to reach a value of $1.9 trillion by 2030.

Competition

Ladder: Similar to Ethos, Ladder offers a fully online life insurance application that offers up to $3 million in coverage (and up to $8 million with an in-person component). This exceeds Ethos’s $2 million coverage maximum. Ladder also offers tech-enabled sales tools for agents, advisors, and affiliates. One of Ladder’s unique features is that it allows customers to adjust coverage at any point in the policy’s life.

Founded one year before Ethos in 2015, Ladder has raised $194 million in total funding as of August 2024 from investors such as 8VC, Lightspeed Venture Partners, and Canaan Partners, and was valued at $900 million in October 2021. While its revenue and cost numbers haven't been disclosed, it was reported that the company issued $42 billion in coverage in 2022.

Bestow: Founded in 2016, Bestow is similar to both Ladder and Ethos in that it provides an online life insurance application. Unlike Ethos, however, Bestow was the first insuretech company to become an insurance carrier in 2020. This gave the company a more favorable cost structure when pricing policies, as well as allowing the company to foster unique relationships with insurance platforms and digital agencies.

In addition to its agency partnerships, Bestow has also expanded into providing data solutions. In May 2024, Bestow sold its life insurance company to Sammons Financial Group and has since shifted all of its focus towards its enterprise SaaS product, with the goal of becoming the leading technology platform for the insurance industry. Bestow has raised $137.5 million as of August 2024 from investors including 8VC, New Enterprise Associates, and Valar Ventures.

PolicyGenius: Founded in 2013, PolicyGenius is an independent, digitally-native insurance broker that enables users to research and compare quotes for four unique types of insurance: life, home, auto, and disability. PolicyGenius is a licensed broker, not an agent like Ethos. PolicyGenius was acquired by Zinnia, a life insurance and annuity administration platform and portfolio company of private equity firm Eldridge, in 2023 for an undisclosed amount.

Business Model

Ethos is a licensed insurance agency that provides producer, underwriting, and TPA services. Unlike a traditional life insurance company, Ethos operates as a technology-driven insurance distributor for its third-party insurance carriers, which include Legal & General America, TruStage, and Ameritas. While Ethos provides underwriting services for its carriers, it does not take any financial risk in terms of policy payouts or premium collection.

Ethos generates revenue by generating sales for its carriers. These sales are realized through a two-pronged distribution strategy: direct-to-consumer, facilitated through its online application, and agent-to-consumer, facilitated through a network of “thousands of independent insurance agents” that sell policies through the Ethos Agent platform. Upon selling a policy, carriers pay Ethos commissions directly. Depending on whether the sale was assisted by an agent, Ethos will pay a portion of the commission to the agent as a referral fee.

The primary cost for Ethos is incurred when underwriting an application, which involves expenses relating to assessing an applicant’s health and eligibility. More specifically, Ethos pays data providers like MIB Group to obtain user-specific information. This data may include medical records, prescription histories, and other relevant data points. Ethos’s underwriting costs are incurred regardless of whether the application will result in a sale — it’s a prerequisite to accurately price the policy. In this way, the cost of underwriting can be framed as the cost of customer acquisition because Ethos cannot acquire or approve a policy without underwriting the customer.

Traction

While Ethos does not share its revenue numbers publicly, at the time of a 2021 Series D funding round, the company reported that both revenues and user numbers grew 500% compared to 2020. In 2021, Ethos was noted to be on track to issue $20 billion in life insurance policies and to approach $100 million in annualized growth profit. During that same time, Colis mentioned that the company was not yet profitable. Ethos reports to have an NPS of 78 as of 2024 and is rated 4.8/5 on Trustpilot as of 2024.

In January 2022, Ethos acquired will and trust creation software Tomorrow Ideas for an undisclosed amount. This acquisition enabled Ethos to offer its users free will and estate planning tools for its life insurance policies later that year. Founded in 2016, Tomorrow Ideas grew to over 600K users and raised $17 million from investors including IA Capital, Allianz, Aflac, and Sinai Ventures before being acquired.

In June 2022, Ethos conducted a round of layoffs affecting 12% of its staff, or 40 employees. The company cited market conditions as the reason for the layoffs, saying it reduced its cost structure “in a manner that allows us to responsibly and sustainably expand”. However, it emphasized that its business was growing, claiming that it was the “first insurtech to have grown gross profits above 9 figures” and saying that in the preceding year and a half, it had tripled revenue and gross profit.

In February 2023, the company conducted an additional layoff impacting approximately 50 employees. Unlike with the previous round of layoffs, the company did not comment publicly.

Valuation

Ethos raised a $100 million Series D-1 in July 2021 at a $2.7 billion valuation, with SoftBank Investment Advisers leading the round. Over seven funding rounds, Ethos has raised a total of $414 million in funding as of August 2024 from investors such as Sequoia Capital, Accel, and Google Ventures. It has also secured funding from notable celebrities including Jay-Z, Will Smith, Kevin Durant, and Robert Downey, Jr.

Key Opportunities

Market Expansion

Ethos's online application platform enables partnerships that were previously infeasible for traditional insurance distributors. In 2019, Sequoia investor and Ethos board member Roelof Botha envisioned Ethos building a partnership with companies like 23AndMe, offering life insurance to their customer bases as part of a bundle. This is a strategy the company could still employ.

The benefit of this strategy would be to tap into audiences who may not have considered life insurance before, while also accessing a potentially favorable risk pool. Such partnerships could also help Ethos overcome the adverse selection problem that plagues the entire industry, where typically riskier individuals seek out insurance and drive up prices. By reaching a healthier demographic through these partnerships, Ethos could simultaneously expand its market share and improve its risk profile.

Establishing a Data Moat

Ethos has the potential to significantly improve its underwriting process through economies of scale and data aggregation. As the company accumulates more policyholder data over time, it can refine its risk assessment models, potentially leading to more accurate and cost-effective underwriting decisions. By analyzing cohorts of similar applicants, Ethos could optimize its underwriting criteria and selectively gather data. When these efficiencies compound, Ethos could potentially lower underwriting costs by orders of magnitude, improving both its profitability and its ability to serve a broader range of customers.

Key Risks

Underwriting Costs

A significant challenge for Ethos is the high cost of data acquisition for underwriting purposes. Traditional methods like collecting blood and urine samples can be cheaper than acquiring the necessary digital data for algorithmic underwriting. These high data-acquisition costs impact customer acquisition costs and could make it difficult to achieve favorable unit economics.

According to a former executive at Ethos, in 2022 the company was working to optimize this process by being more selective about what data it collects and when in the application process it acquires data. A former Ethos employee claims that in order for companies like Ethos to succeed, digital underwriting must reach a “tipping point”, at which the increase in the cost of underwriting can be justified by increased application conversion rates.

Beating Incumbents To Term

A similar risk for Ethos is that it may need to beat incumbents in selling term policies. As mentioned before, the core revenue driver for life insurance incumbents is selling whole life policies. But one route to selling whole life policies is by upselling an existing term policy. Ethos has positioned itself as a term life provider, and it only provides whole life policies for those above age 65.

This means Ethos may ultimately need to compete with incumbents when selling term policies. A previous Ethos employee says that incumbents “can operate their term policy business as a loss leader”, where they are effectively acquiring term life customers only to upsell them to a whole life policy through a traditional agent. This is another example in which Ethos’s unit economics are challenged — its CAC is made higher by incumbents that can pay high acquisition costs justified through potential future upselling.

Conservative Industry Partners

Ethos faces challenges in implementing its new digitally-native underwriting standards due to the conservative nature of carriers and reinsurance companies. These industry partners are cautious about adopting new technologies and methods, preferring to "dip their toes" rather than fully commit. The long-term nature of life insurance risk also implies that it could take years for these partners to fully trust and adopt Ethos's innovative approaches.

Limited Addressable Market

While Ethos and other insurtechs often cite the large number of individuals who are uninsured or underinsured as a growth opportunity, this may be overstated. A significant portion of this uninsured population may be uninsurable due to health factors such as increasing obesity rates. For those who are insurable but high-risk, the resulting high premiums may make policies unaffordable or unattractive. If demand for life insurance is in fact elastic, the addressable market for Ethos may be smaller than initially perceived, potentially limiting growth prospects.

Summary

Ethos is a life insurance platform founded to streamline the inefficiencies of the life insurance industry. It offers a fast online application process without any in-person interaction, as well as a sales platform that enables agents to onboard quickly, accelerate sales, and automate case management. While Ethos has the potential to unlock new markets, it faces challenges in unit economics and relationships with industry incumbents. Nonetheless, Ethos is well-positioned to capitalize on changing demographics and consumer sentiment in the life insurance sector.