Thesis

There were 1 billion office visits to US healthcare providers in 2019, 6.7 billion drug prescriptions written in 2022 (up from 6.1 billion in 2018), and 15 billion medical claims transactions in 2023. Accurate healthcare provider data is essential for coordinating care, ensuring accurate medication prescribing, and facilitating correct billing in healthcare, directly affecting patient outcomes. The large and growing volume of such interactions underscores the need for precise information about healthcare providers.

However, a Medicare review of healthcare-provider directories in 2016-2017 found that 52.2% of locations listed had at least one inaccuracy. A 2018 Medicare review found inaccuracies ranging from 5% to 94% of all listings. 81% of entries in the provider directories of five of the largest insurers in the US were inaccurate, according to a March 2023 report. Moreover, a 2021 report found that 30% of provider information churns every year. This reliance on flawed data with missing or multiple sources of truth can lead to inefficiencies, patient dissatisfaction, inaccurate or delayed claims, and high out-of-network costs and care.

Ribbon (also called Ribbon Health) manages actionable provider information for healthcare enterprises. It partners with health plans, care navigators, and primary care companies to solve the problem of fragmented and inaccurate provider data. The company’s Provider Data Platform integrates into the workflows of healthcare providers to capture, clean, and aggregate data on providers, insurance plans, costs, and quality of care while continuously improving the data’s accuracy. As of March 2024, Ribbon claimed its directory included information for 99.9% of US providers and practice facilities. Users were able to improve data accuracy by as much as 90% as of March 2024, and reduced team time spent on tasks like data intake, data standardization, and QA checking by up to 95%.

Founding Story

Ribbon was founded by Nate Maslak (CEO) and Nate Fox (CTO) in 2016. Maslak was a healthcare consultant at McKinsey who later led a business unit at data collection platform Datalogix, which Oracle acquired in 2014. Fox had been a product marketing manager at Microsoft and an analytics engineer at social advertising startup Unified.

The pair met as students at Harvard Business School in 2015 where they discovered they shared a common interest in the healthcare industry, having had serious problems with it in the past. Fox was born with severe hearing impairment but obtained full hearing due to successful intervention from finding the right specialists early in his childhood. Maslak’s mother, an immigrant from Russia, had spent thousands of dollars searching for the right specialist to solve her joint pain problems; not only did this process place her in deep medical debt, but it took many specialists and years before her condition was finally resolved.

Maslak and Fox realized the necessity for better healthcare navigators and decided to start a company. In 2016, they built a tool called HealthWiz which helped patients find doctors. It was unsuccessful due to inaccurate information online; customers complained that recommended providers no longer accepted their insurance, phone numbers were out of date, and addresses of doctors’ offices were inaccurate. That helped the team recognize that even the best care navigators could only be as good as the underlying provider data. They started building datasets and workflows to gather and clean the data. Soon, healthcare organizations wanted to buy their dataset.

The company pivoted and rebranded to Ribbon Health in 2018 to target this problem specifically from the data infrastructure layer. In a November 2021 interview, Maslak described Ribbon this way:

“Ribbon collects data from over a thousand different data sources at any given time, and then we try to figure out what's right and what's wrong. We may see 50 phone numbers per provider, then there are addresses, specialties, cost and quality information that add to the mess of data. That’s what healthcare consumers struggle with on a daily basis, and that’s why we exist to solve that problem and make it go away.”

Product

Provider Data Platform

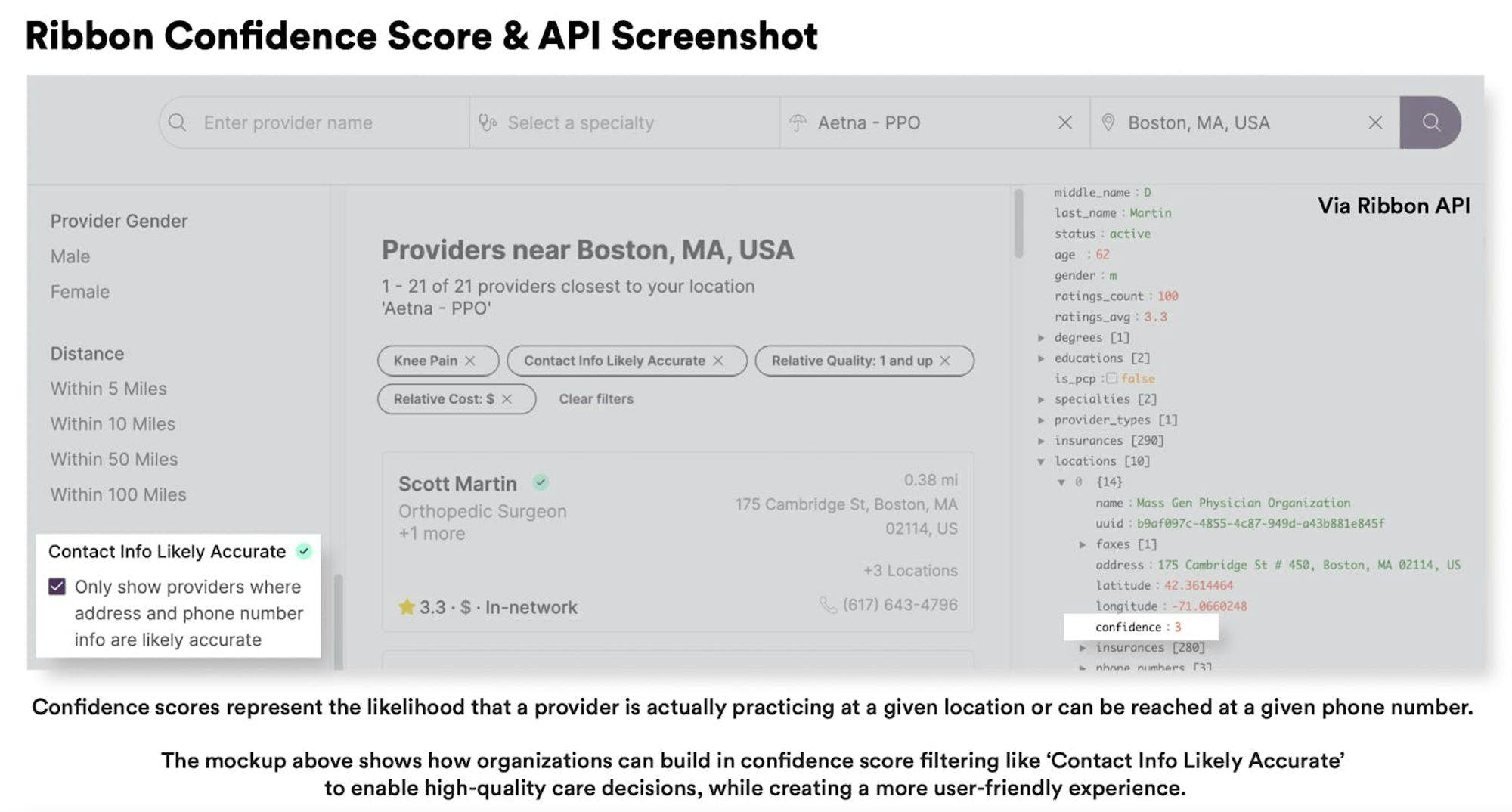

The core of Ribbon's offerings is its Provider Data Platform. This platform is designed to turn provider data “from an operational headache to a source of business efficiency and value.” It sources data from the Ribbon Directory, a data set on healthcare providers and facilities, as well as data from industry partners such as CareJourney. The platform then acts on the data through four capabilities:

Data Integration: Ribbon integrates and standardizes multiple provider data sources into a single database.

Accuracy Scoring: The company’s AI models assess provider data accuracy from 0% to 100%.

Master Data Management: Ribbon provides a central database to store, maintain, manipulate, and trace data changes over time.

Data View: Through the Provider Data Platform, users can configure data into multiple views and subsets for different use cases such as directories or claims.

As of March 2024, Ribbon asserted that its platform included data on 99.9% of U.S. providers and practice facilities. Ribbon aims to make it easy for healthcare organizations to integrate this information with their workflows. Its API contains endpoints to access key information such as providers, locations, insurance, and cost estimates.

Source: Out of Pocket Health

The company’s Provider Data Platform has two main use cases: Care Navigation and Referrals, and Provider Data Management.

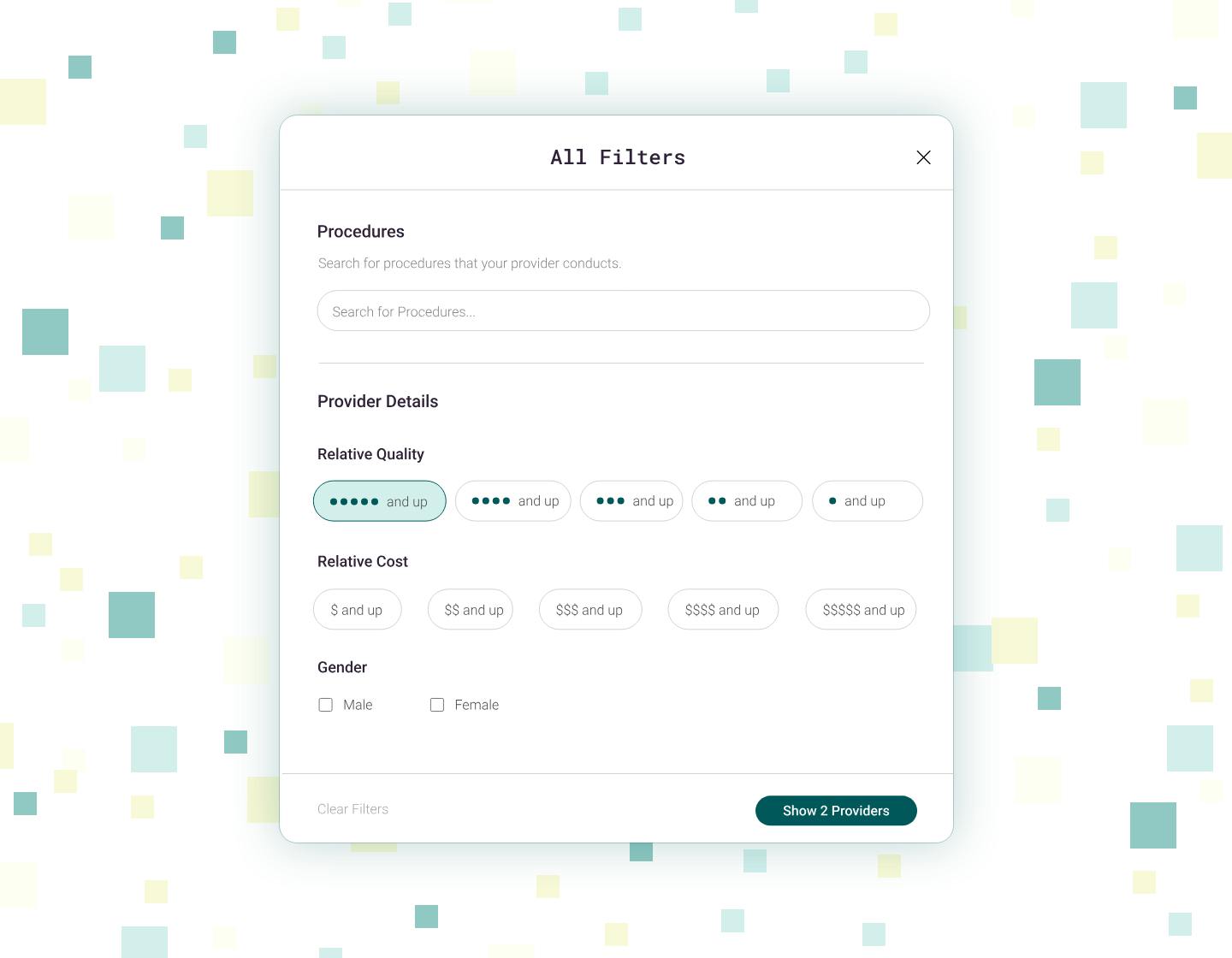

Care Navigation and Referrals: Ribbon's platform allows users to find doctors through provider search, gives cost estimates based on insurance, and contains information on doctors’ specialties, conditions they treat, and procedures they perform. One primary care customer saw 40 minutes saved per referral using Ribbon’s platform and a 250% increase in referrals per day according to the company.

Provider Data Management: Ribbon reduces time spent on data entry and data sources management. It automates roster processing and consolidates provider data into one source while offering data accuracy checks. The platform also provides a unified dashboard for monitoring data workflows. Additionally, Ribbon integrates custom insurance information. Ribbon highlights a case where one of its health plan customers saw a 58% decrease in support tickets by utilizing the platform.

Ribbon for Startups

Source: Ribbon

Ribbon's startup program offers startups a data platform to guide employees to better care. With this solution, startups can search through provider information and make referrals, verify insurances accepted for providers and facilities across a variety of plan types, and evaluate cost and experience for both providers and procedures.

As of March 2024, Ribbon for Startups features discounted pricing, national coverage on 99.9% of providers and facilities, API-driven integration, and access to all data within the Ribbon Foundation, including provider information, insurance accepted, cost, experience, and more. Ribbon for Startups is open for companies with fewer than 50 employees or less than $10 million in funding as of March 2024.

Ribbon for Health Plans

Ribbon for Health Plans transforms provider data infrastructure to improve business efficiency and enhance health plan member experiences. Its features include automating the ingestion and standardization of diverse data sources to create a unified source of truth, custom processing for efficient data management at scale, and continuous quality assurance checks. Additionally, Ribbon offers data enrichment to build comprehensive databases, distinguishing between high and low-quality data, and generating actionable insights through machine learning models and custom reporting dashboards.

According to Ribbon, one of its customers saw a 95% reduction in time spent on data management with Ribbon’s offering. Another of its customers saw a 26% decrease in support tickets YoY, while a national payer-provider customer achieved a 99% post-visit CSAT score.

Market

Customer

As of March 2024, Ribbon’s customer base included health plans, care navigation teams, primary and specialty care groups, and healthcare technology companies. Notable customers included Rightway, CareJourney, Health Advocate, and Carbon Health.

Source: Ribbon

Ribbon’s customers included over 30 healthcare organizations as of November 2021. At that time, a VP of product strategy at Ribbon customer Health Advocate, described Ribbon’s value as follows:

“Ribbon helps us connect members with high-quality providers and ensure patients are making knowledgeable decisions on their care, leading to improved outcomes, reduced costs and peace of mind.”

As of March 2024, Ribbon also partnered with several companies to “power the best data and get it in the hands of healthcare innovators.” These partners included CareJourney, Turquoise Health, HTD, and the AWS Marketplace.

Market Size

Healthcare analytics, the industry within which Ribbon operates, was valued at $43.1 billion in 2023 and was expected to expand at a CAGR of 21.1% from 2024 to 2030. This growth is being driven by increasing costs of treatment, and decreasing patient retention and engagement.

Within the healthcare analytics industry, Ribbon helps curb healthcare spending waste by reducing inaccuracies and churn in provider data. In 2022, US healthcare spending reached $4.5 trillion or $13.5K per person. This accounted for 17.3% of the nation’s GDP. However, a 2019 analysis found that the US saw an estimated $760-935 billion of healthcare waste annually, of which inaccurate provider directories cost provider groups $2.8 billion in annual costs.

Competition

Garner: Garner is a data-driven doctor quality analytics platform. It was founded in 2019. The company raised a $45 million Series B round in December 2021, led by Redpoint Ventures. It had raised $61.3 million in total funding as of March 2024. As of March 2024, Garner claimed to have compiled the “largest claims database” in the US, with over 60 billion medical records from 320 million patients. Garner’s DataPro solution competes directly with Ribbon’s Provider Data Platform. Like Ribbon, Garner utilizes its data service to guide employers in reducing health plan costs. Unlike Ribbon, however, Garner also targets individuals through an app and concierge team for patients to find better healthcare providers in their network.

Abacus Insights: Abacus Insights is a healthcare data management and analytics platform. It was founded in 2017. The company raised a $28 million Series C round in June 2022 and had raised $81.6 million in total funding as of March 2024. The Abacus Insights Platform competes directly with Ribbon’s Provider Data Platform, offering solutions across risk adjustment, CMS interoperability, and cost-of-care management among others. As of March 2024, Abacus Insights had over 21 million members.

Embold Health: Embold Health is a healthcare analytics company offering solutions for employers, as well as health plans and other partners. It was founded in 2017. The company raised a $23 million Series B round in March 2022, led by Echo Health Ventures. It had raised $49.9 million in total funding as of March 2024. As of March 2024, the company’s goal was to bring together the “largest dataset in healthcare, clinically validated analytics, and the expertise of leading physicians and data scientists” to empower “employers, health plans, and physicians to make better choices.”

Definitive Healthcare: Definitive Healthcare offers commercial intelligence to healthcare organizations. It was founded in 2011. As of March 2024, Definitive Healthcare was a publicly traded company (NASDAQ: DH) with a market capitalization of $920.6 million. Like Ribbon, Definitive Healthcare focuses on improving healthcare data quality and resolving data silos to enable centralized insights. It dubs this “healthcare commercial intelligence.” Unlike Ribbon, as of March 2024, Definitive Healthcare offered an extensive product suite instead of a single platform. This included products such as HospitalView, PhysicianView, and ClinicView, as well as the Monocl Expert product suite, the Populi suite, latitude analytics, and passport analytics. As of March 2024, Definitive Healthcare serviced 9.3K+ hospitals & IDN profiles across the US and over 2.6 million doctors and health professional profiles.

Business Model

As of December 2021, Ribbon was operating on a subscription-based model, charging a recurring fee for tiered access to data modules (e.g., directory only, directory, and network). In 2021, the company reportedly saw an even one-third revenue split across health plans, providers, and patient-facing use cases. As of March 2024, Ribbon did not have a standard list price for its offerings. Instead, the company prompted prospects to “get in touch” and answer the question “How can we be most helpful?” For its Ribbon for Startups solution, the company offered discounted a platform fee, plus a variable fee as of March 2024.

As of March 2024, customers could choose from either (1) the Ribbon Foundation, which gives customers access to the company’s data assets; (2) the Ribbon Data Toolkit, which provides access to the company’s provider data assets, plus “the flexibility to reflect additional data sources”; or (3) the full Ribbon Provider Data platform.

Traction

In November 2021, Ribbon reported 2.4X growth in annual recurring revenue (ARR) and 150% net revenue retention. It had acquired around 30 healthcare organizations as customers as of November 2021, including insurers like PacificSource, providers like Oak Street Health, and employer care navigators like Health Advocate. In 2022, Ribbon grew its customer base by 65%, including the acquisition of new partners like Turquoise Health and Elation Health along with multiple health plans, care navigation, and primary care organizations. As of November 2022, Ribbon had increased revenue by 88% over 2021.

Valuation

As of March 2024, Ribbon had raised $53.8 million in total funding over five funding rounds from investors including Core Innovation Capital, General Catalyst, and Y Combinator. In February 2020, Ribbon raised a $10.3 million Series A round led by a16z. In November 2021, the company raised a $43.5 million Series B round led by General Catalyst at an undisclosed valuation.

Key Opportunities

Value-Based Care

One area of opportunity for Ribbon lies in the growing trend toward value-based care (VBC), a model where healthcare providers are paid based on the quality of care rather than the volume of services provided. The Centers for Medicare and Medicaid Services aims to have all Medicare beneficiaries and most Medicaid beneficiaries enrolled in VBC programs by 2030. VBC was projected to grow from $500 billion in 2023 to over $1 trillion.

As of March 2024, Ribbon’s website stated that its mission was “to power every care decision to be accessible, affordable, and high quality.” This statement is in line with the principle behind value-based care of correcting the misaligned incentives of the US fee-for-service system driving its poor results compared to other countries. Ribbon can help healthcare providers track and manage patient data accurately, which would be key for success under a value-based care model. General Catalyst’s Holly Maloney, who led Ribbon’s Series B round, stressed the need to enable the societal shift toward value-based care. She decided to invest in Ribbon “because they ensure that patients receive the best care from a provider that has the right combination of quality and cost.”

Healthcare Digitization

The digitalization of healthcare in the US has experienced significant growth, driven in part by patient demands for better and more personalized care, and the increasing penetration of the internet and mobile devices. The digital health market in the US was valued at $77 billion in 2022 and was projected to grow at a CAGR of 17.1% from 2023 to 2030. In November 2021, Ribbon CEO Nate Maslak stated that the company’s growth was in part due to this trend as Ribbon was “at the right place and time with the right solution.” Maslak added that insurance executives would routinely “grill” him on things like API latency and uptime, which he saw as unlikely a few years prior. Ribbon can continue taking advantage of this trend, with healthcare organizations increasingly requiring resolution for issues at the data level.

Potential for Data Network Effects

As of March 2024, the American healthcare system lacks one single source of truth for provider data. Unlike how people can use Yelp to find restaurant recommendations or Google Maps to search for the most efficient commute route, there is currently no market-winning solution to find the right doctor for one’s urgent medical needs.

Data products have the advantage of potentially benefiting from network effects. Every day a healthcare organization uses Ribbon, the data grows in quantity and quality (i.e., when customers correct or confirm data). With enough scale, this could enable Ribbon to be the single source of truth for provider data at a national scale. Two of Ribbon’s investors saw this opportunity and quoted it as one of the reasons why they invested in the company. In a November 2021 article, Julie Yoo, General Partner at a16z stated “One of the reasons that Ribbon stood out to us was its ability to create network effects”, while Holly Maloney from General Catalyst said:

“I spend a lot of time on platforms, thinking about the opportunities that platforms create, especially those that drive network effects. We see critical components in the healthcare ecosystem that could benefit from the data layer that Ribbon is building. There are a lot of unique opportunities to build different applications on top of a really powerful API-driven data platform. What I love about Ribbon is your imagination can take off pretty quickly as you think about the possibilities and opportunities.”

Key Risks

Regulatory Hurdles

Healthcare is a heavily regulated field in the US. With standards growing more stringent and new laws being enacted (e.g., HIPAA, GDPR, CCPA, HITECH Act), healthcare organizations frequently see compliance penalties. Since April 2003, the US Office for Civil Rights (OCR) has received over 353.8K HIPAA complaints and has initiated over 1.2K compliance reviews as of February 2024. When hackers breached a database owned by Anthem in 2014, Anthem had to pay a $16 million fine for violating HIPAA. As of February 2024, OCR settled or imposed a monetary penalty in 143 cases resulting in a total of $142.5 million in fines.

Ribbon must be careful with following compliance requirements as it continues to scale; any breach or non-compliance could result in legal penalties, damage to reputation, and loss of trust among partners and customers.

Data Accuracy

A healthcare blog observed in December 2021 that “most providers don’t care about the part of the patient experience that involves navigating to them, so they’re never going to be proactively making sure their data is up to date.” Notably, 81% of entries in the provider directories of five of the largest insurers in the US were inaccurate, according to a March 2023 report. Similarly, there have been instances in which providers have engaged in creating “ghost networks”, i. e. provider directories that list out-of-network physicians as in-network.

For example, in December 2021 the city of San Diego sued three major insurers over false advertising and misleading consumers; according to the lawsuit, HealthNet, Kaiser, and Molina’s directories had error rates of 18%, 19%, and 58% respectively in 2019. If this continues to hold, Ribbon will likely never have full incentive alignment in reaching 100% accuracy in provider directory data, which may influence its ability to deliver on the promise of “creating a world where navigating healthcare is simple.”

Summary

There is a lack of precise and trustworthy information about healthcare providers in the US. Ribbon’s Provider Data Platform helps centralize, improve, and manage provider information for healthcare enterprises. The company partners with health plans, primary care companies, care navigators, and other organizations to solve the problem of fragmented and inaccurate provider data. With the growing trends towards value-based care and digitized healthcare, Ribbon has the potential to become the market leader and single source of truth in US healthcare data infrastructure. However, growing regulatory hurdles and the general lack of data accuracy across insurers and providers could pose challenges as the company continues to scale.