Thesis

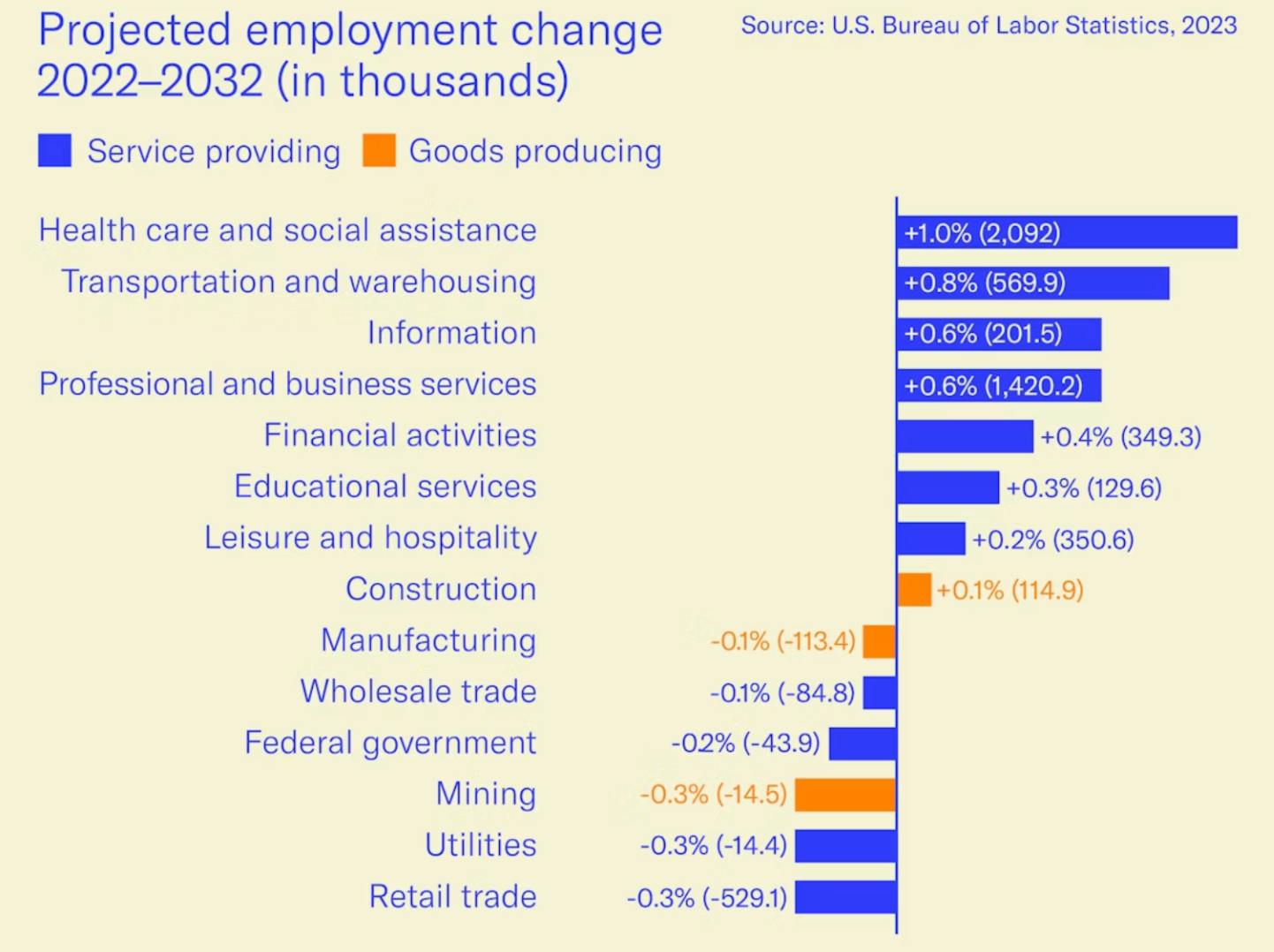

Labor shortages have become a widespread issue across the US, with 1.2 million more job openings than available workers as of March 2025. The manufacturing sector is projected to face a deficit of 3.8 million workers through 2034. Meanwhile, 76% of supply chain and logistics operations report experiencing labor shortages, and retailers anticipate more than 1 million unfulfilled jobs in customer-facing positions in 2025. Labor market growth is expected to be weak, with only a projected increase of 1.8 million (1.1%) people by 2031, placing strain across industries. This stems from a deeper misalignment between the realities of the work and the expectations of the modern workforce. Repetitive, physically demanding tasks, stagnant wages, and low job prestige have made these roles increasingly unattractive — especially to younger generations who prioritize flexibility, purpose, and autonomy.

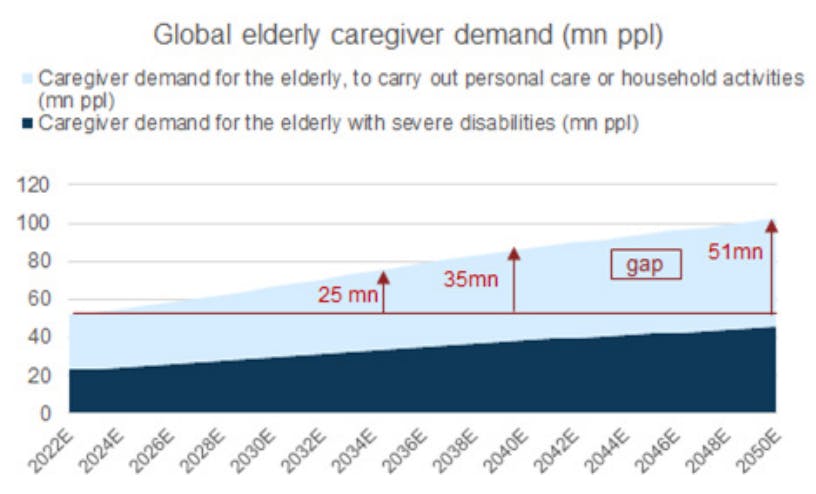

Meanwhile, another labor-intensive industry is facing shortages as the demand for in-home care is increasing. Globally, over 700 million adults aged 65 and older require some form of assistance, a figure that is expected to rise as populations continue to age. In the US alone, the over-65 demographic is projected to grow to 82 million (47% increase) by 2050. This age group’s share of the total population is also anticipated to rise from 17% to 23% by 2050. The growth in the elderly population is driving a greater demand for in-home care services, further intensifying existing labor shortages.

In 1977, as part of Robot Visions, Isaac Asimov wrote an essay predicting the effect of technological advances in automation on human labor:

“I can't help but think, however, that the advance of computerization and automation is going to wipe out the subwork of humanity—the dull pushing and shoving and punching and clicking and filing and all the other simple and repetitive motions, both physical and mental, that can be done perfectly easily—and better—by machines no more complicated than those we can already build. In a properly automated and educated world, then, machines may prove to be the true humanizing influence. It may be that machines will do the work that makes life possible and that human beings will do all the other things that make life pleasant and worthwhile.”

Much like ChatGPT marked a turning point for artificial intelligence, a similar inflection point in robotics is underway. Advances in multimodal AI, embodied control, and large-scale training are beginning to unlock general-purpose utility in the physical world, not just for structured factory tasks, but for unstructured real-world environments. For the first time, robots are showing signs of broad, human-like adaptability.

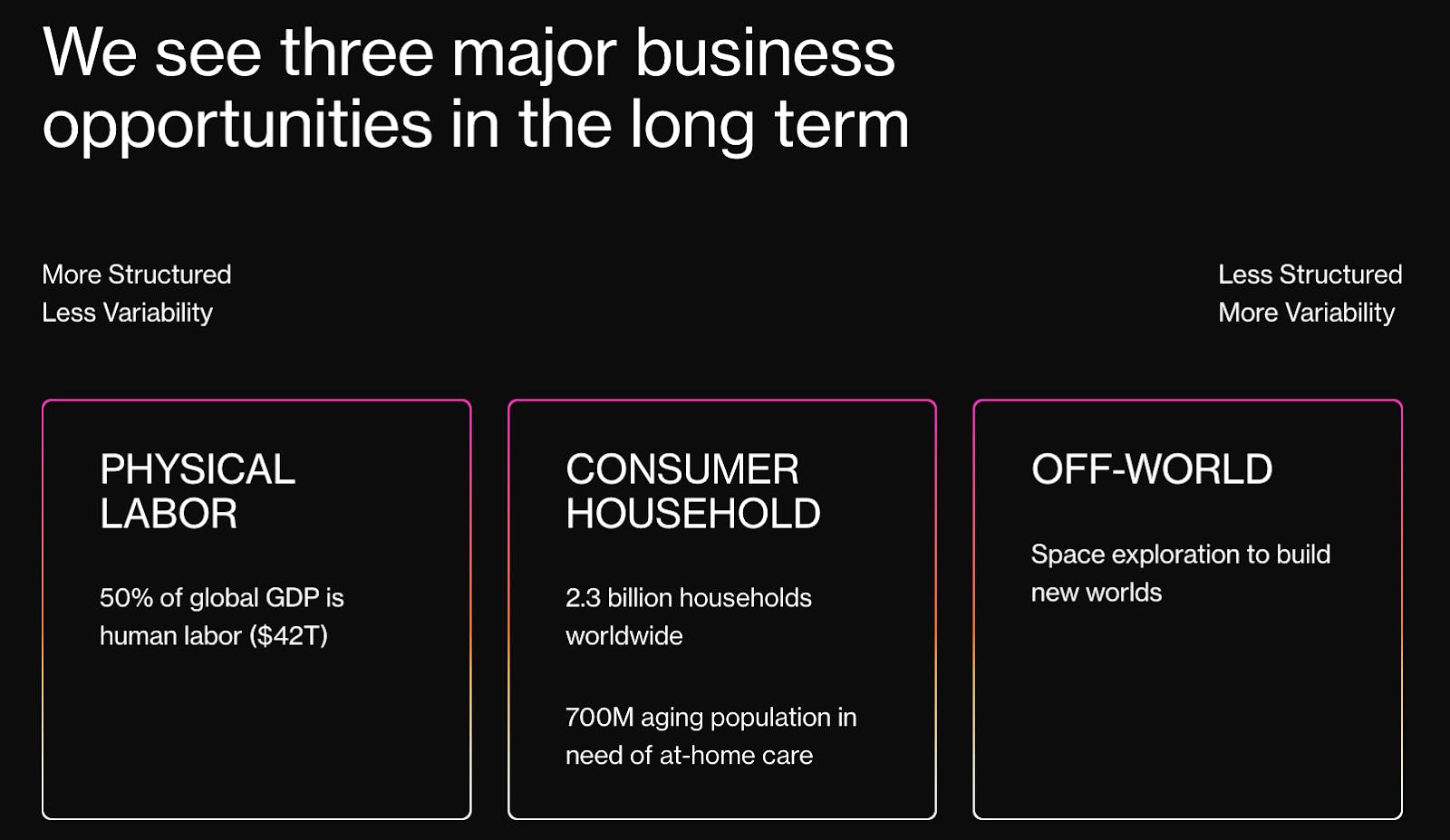

Figure’s long-term vision is to make labor optional by providing every human on the planet with a personal humanoid robot. The company plans to enter commercial labor markets before serving consumer household markets. Through partnerships with Microsoft, NVIDIA, and BMW, Figure aims to develop general-purpose humanoids that make a positive impact on humanity and create a better life for future generations.

Founding Story

Figure was founded by Brett Adcock (CEO) in 2022 in Sunnyvale, California.

Raised in rural Moweaqua, Illinois on a third-generation farm, Adcock credits his family’s work ethic with inspiring an interest in building companies. While pursuing electrical engineering and business administration degrees at the University of Florida in 2004, Adcock built his first venture, Street of Walls, a website aimed at helping undergraduates recruit for jobs in finance. By 2023, the platform had garnered 30 million unique views.

After building Street of Walls and working as an analyst at two hedge funds covering the staffing and headhunting industry since graduating in 2008, Adcock identified a major gap: traditional recruiters lacked the advanced technology needed to effectively source top-tier talent. In 2013, Adcock co-founded Vettery with Adam Goldstein, a managing partner at one of the hedge funds Adcock used to work for. Vettery, an AI-powered online marketplace matching human capital to job opportunities, was acquired in 2018 for $100 million by The Adecco Group, a Switzerland-based global HR services firm.

After the successful acquisition, Adcock found himself exploring aviation and hardware due to his passion for solving traffic and building sustainable transportation. In 2018, he co-founded another company with Goldstein called Archer Aviation. He funded the company with his own money and personally built the engineering lab for it at the University of Florida, his alma mater. Aiming to solve the dual problems of urban mobility and sustainable transportation, Archer builds electric vertical takeoff and landing (VTOL) aircraft. They raised a total of $1.5 billion and took the company public through a SPAC deal in 2021 at a valuation of $2.7 billion.

Source: Archer Aviation

After four years, Adcock was ready to move on. He’s still a majority shareholder in Archer, but he “felt like there was a misalignment between [him] and the board.” He also wanted to get focused on “this new AI/robotics revolution.” Stepping away from Archer, Adcock founded Figure in 2022 with $100 million of his own money. Figure’s end goal is to create general-purpose humanoids, or human-size robots, that will replace humans in manual labor roles. To do so, Adcock assembled a team of engineers from world-class robotics and technology companies like Boston Dynamics, Agility Robotics, Tesla, Rivian, Apple, and Google. He also brought over Dana Berlin (VP of Commercialization & Capital), Lee Randaccio (VP of Growth), and Logan Berkowitz (VP of Business Operations) from Archer and Vettery, and added David McCall (Principal Industrial Designer), Mathew DeDonato (Director of Robotic Systems), Michael Rose (former Director of Robot Controls), and Damien Bardon (Director of Humanoid Management System) during the early days of the company.

Given the overlap between robotics research and autonomous vehicles, particularly in areas like battery design and Simultaneous Localization and Mapping (SLAM) development, many members of the Figure team bring rich experiences from autonomous and electric vehicle design. For example, McCall was previously Senior Automotive Designer at Rivian, Senior Automotive Designer at Audi, Automotive Designer at Faraday Future, and Automotive Designer at Ford. DeDonato was previously Senior Manager of Vehicle Hardware Platforms at both Woven Planet Holdings and the Toyota Research Institute. Bardon was previously Head of Avionics at Archer, Head of Avionics at Airbus, and Technical Engineering Manager at VT iDirect. Past team members include Figure’s founding CTO Jerry Pratt, who served as a senior research scientist at IHMC for 20 years and received a PhD from MIT in computer science. He left Figure to start his own humanoid robotics company, Persona.

Product

Figure’s goal is to produce general-purpose humanoid robots designed to perform a wide range of tasks in a world optimized for the human form. To achieve this goal, Figure is advancing its current and future products in five areas of advancement: system hardware, unit cost, safety, volume manufacturing, and artificial intelligence. As of March 2025, there are two robot models in the company’s product line, Figure 01 and Figure 02, powered by Helix, Figure’s in-house AI, and manufactured by its BotQ facility.

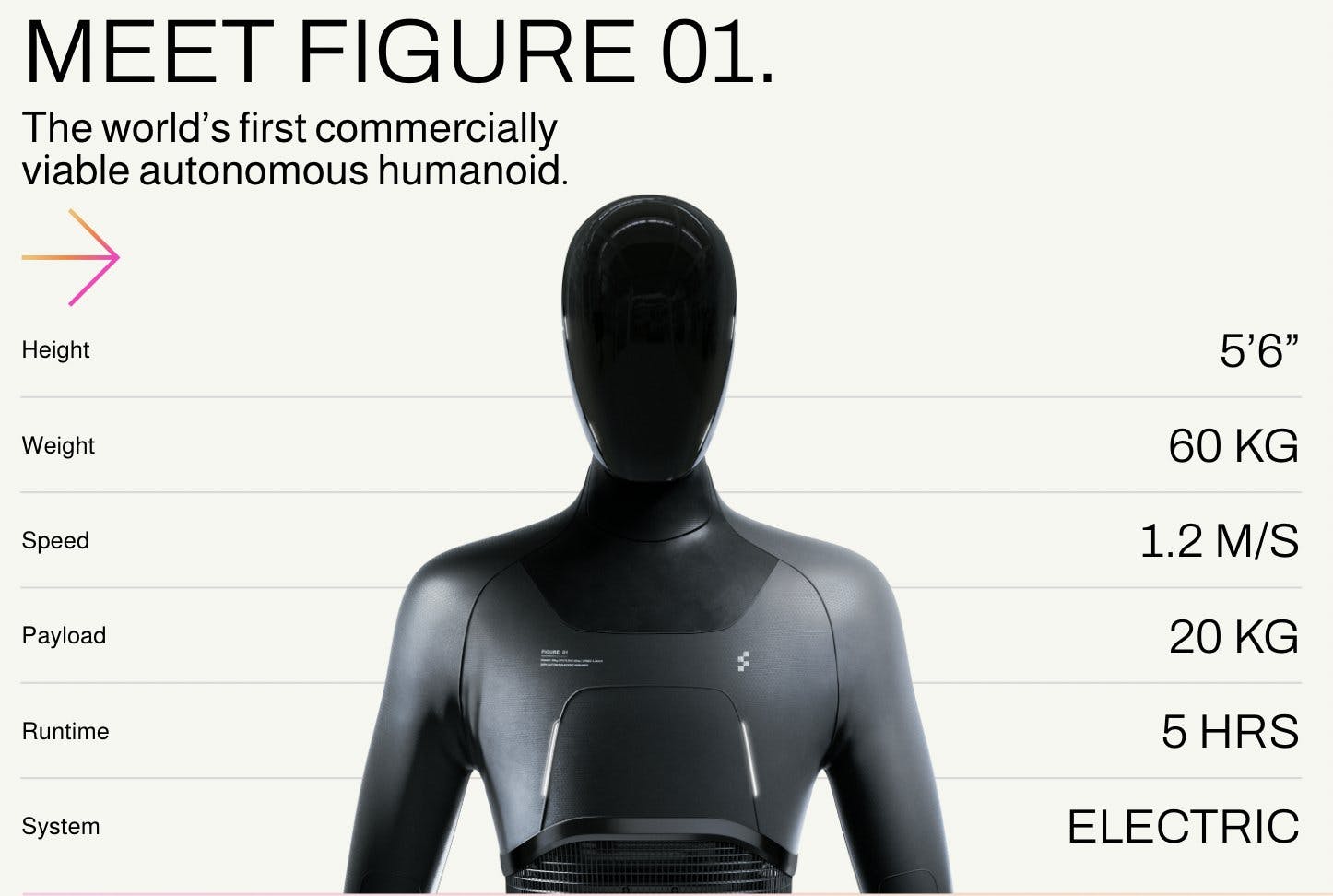

Figure 01

Designed to closely match the global human average weight (62 kg) and height (5 ft 7.5 in for men & 5 ft 3 in for women), Figure 01 stands at 5 ft 6 in and weighs 60 kg. Core specifications include a 20 kg payload, five-hour runtime, 1.2 m/s speed, and an electric power system. Using a vision language model (VLM) trained by Open-AI, Figure 01’s neural network takes in images at 10 hz through onboard cameras and outputs 24 degrees of freedom actions at 200 Hz. Figure 01 is designed to operate in complex, unstructured real-world environments both autonomously and in response to verbal commands.

Source: Brett Adcock

Figure 01 Progress Updates

Figure 01 was introduced in March 2023 when the company emerged from stealth, releasing a video titled Introducing Figure. The video features a computer-generated image (CGI) render of the humanoid robot. In October 2023, the company released additional videos titled Figure 01 Dynamic Walking and Dynamic Walking, both showcasing the bipedal capabilities of Figure 01.

Source: Figure

In January and February of 2024, Figure released two more videos, AI Trained Coffee Demo and Real World Task, showcasing Figure 01’s abilities to complete tasks in both household and corporate settings. The first video demonstrated the robot’s capacity to follow verbal commands to complete a household task (making coffee) after 10 hours of training. The second video highlights its ability in a labor setting, where it autonomously moved boxes at 16.7% of human speed.

Source: Figure

Figure released the company’s partnerships with OpenAI and BMW in 2024.

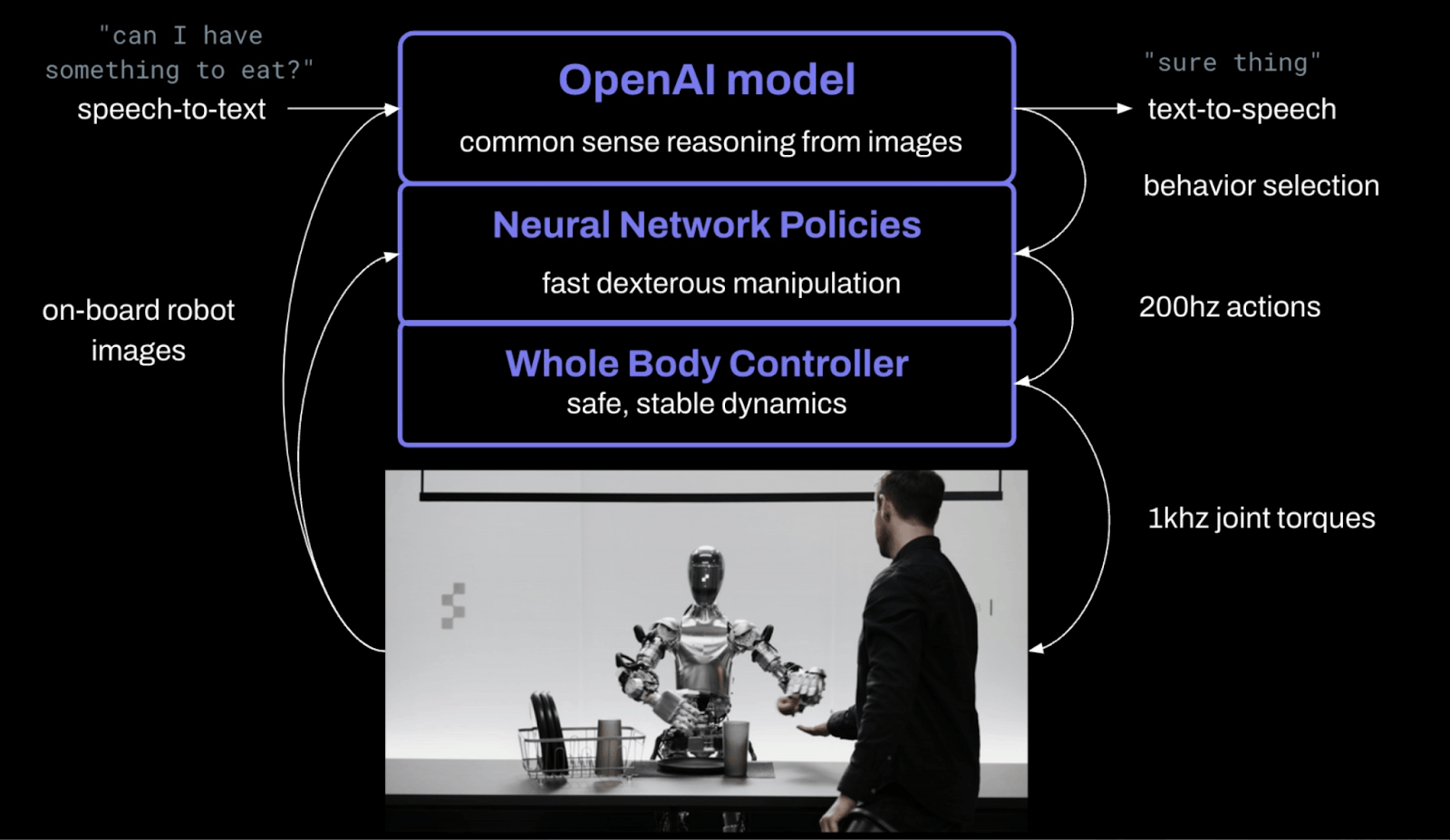

In OpenAI Speech-to-Speech Reasoning, Figure 01 showcases improved logic and dexterity compared to the earlier coffee-making demonstration. The robot can process verbal commands like “can I have something to eat?”, understand the context (recognize that there is an apple on the table and know it’s food), and perform the action (grabbing the apple to hand to the human who is asking for something to eat). According to Corey Lynch, a Senior AI Engineer at Figure, the integration of OpenAI’s internet-trained AI model gives Figure 01 more advanced reasoning and contextual capabilities.

“We feed images from the robot's cameras and transcribed text from speech captured by onboard microphones to a large multimodal model trained by OpenAI that understands both images and text. The model processes the entire history of the conversation, including past images, to come up with language responses, which are spoken back to the human via text-to-speech. The same model is responsible for deciding which learned, closed-loop behavior to run on the robot to fulfill a given command, loading particular neural network weights onto the GPU and executing a policy.”

Source: Corey Lynch

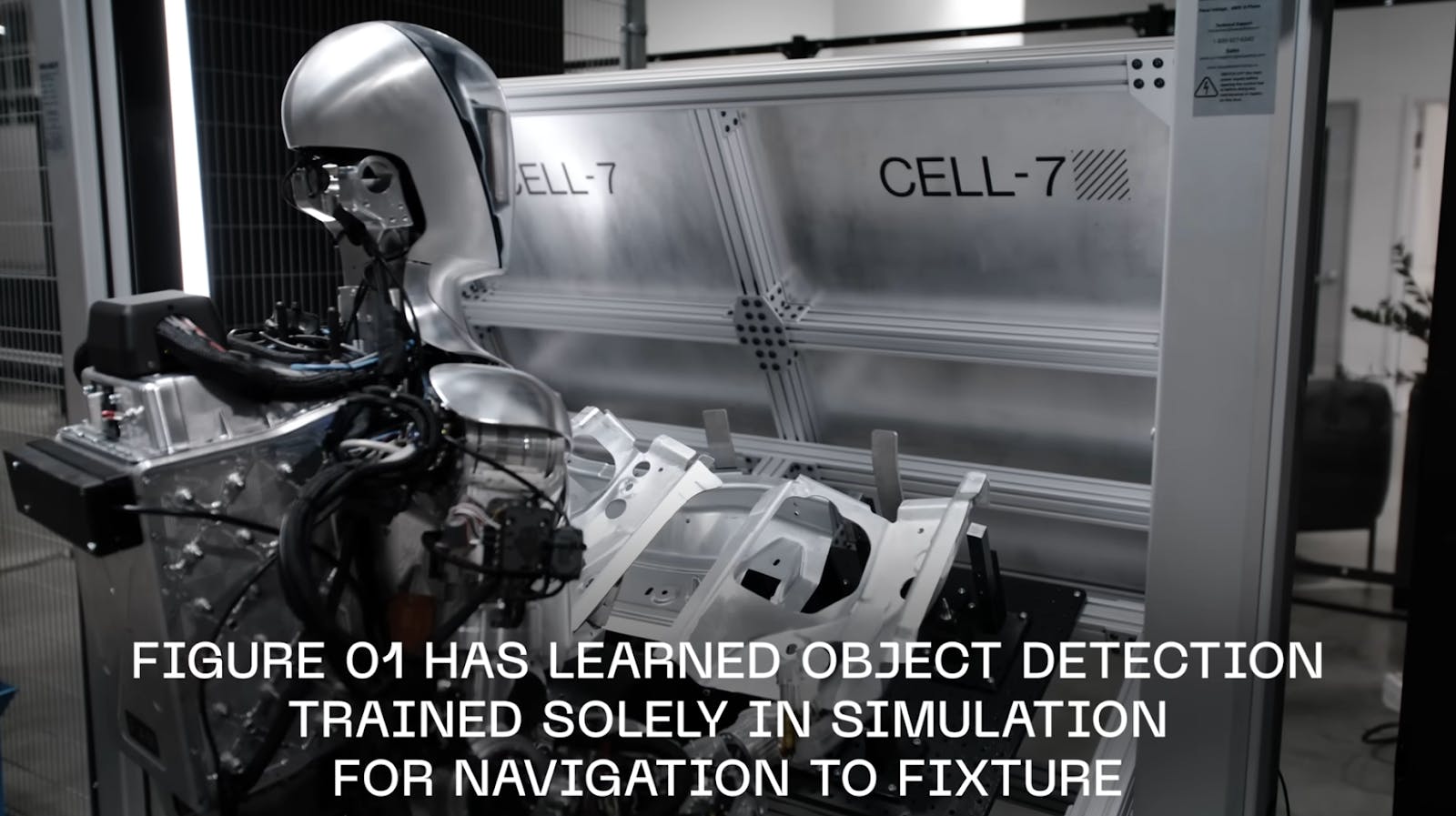

In BMW Full Use Case, Figure 01’s fully autonomous and AI-driven physical manipulation is showcased at Plant Spartanburg, BMW’s largest automotive exporter in the US with more than 6.3 million BMWs assembled over the past 30 years. In the video, Figure 01 can autonomously place, pick, detect, navigate, and insert car parts into the correct positions while self-correcting through any errors in the process.

Source: Figure

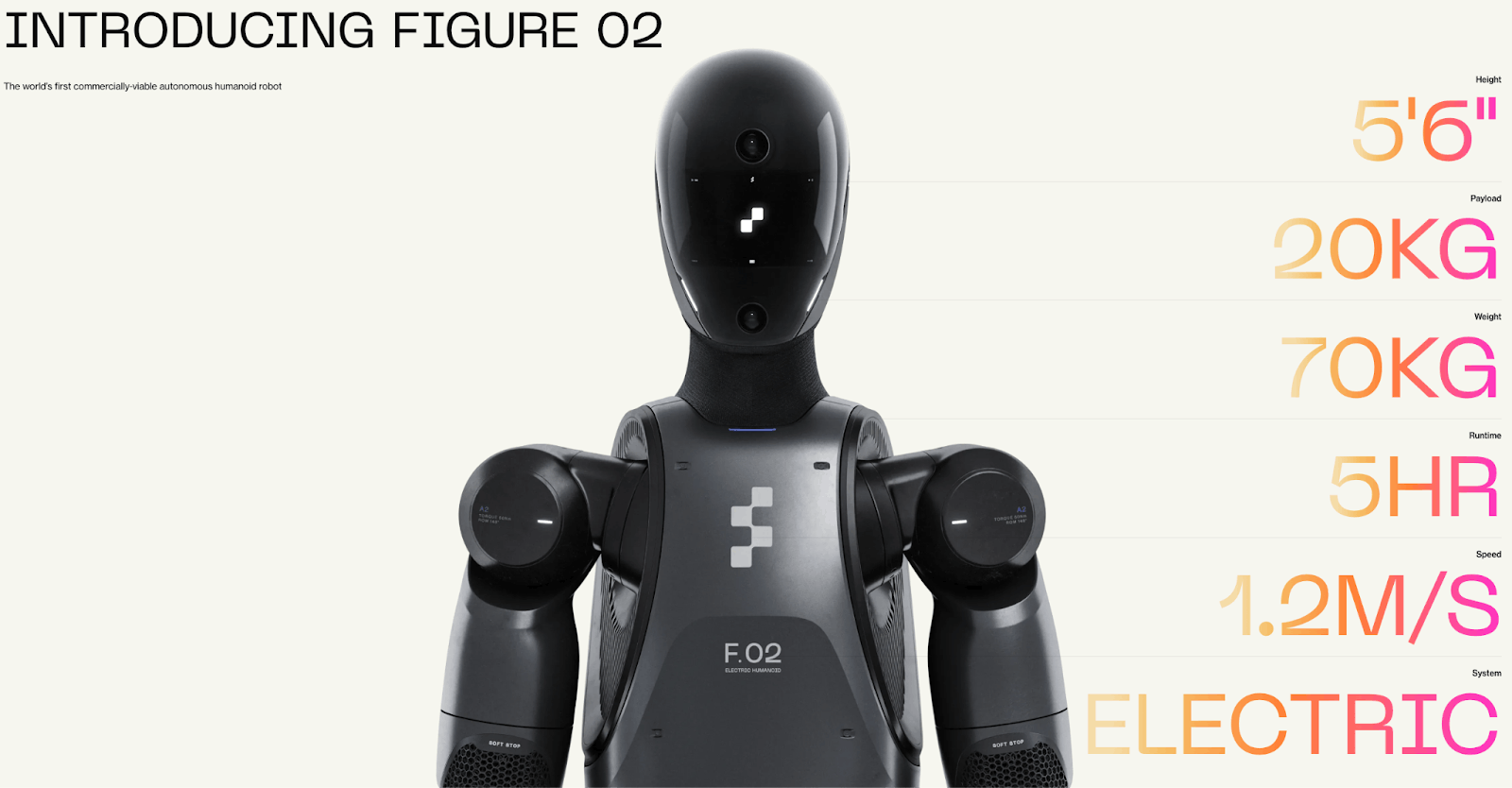

Figure 02

Figure 02 was engineered with several advancements over Figure 01, designed to handle up to 20 hours of autonomous work daily. Its exoskeleton structure offers crash protection, while custom-designed appendages and a six-camera vision system enhance physical capabilities. The robot is powered by onboard CPU and GPU processors, with fully integrated wiring and a custom battery pack to ensure seamless operation. Additionally, Figure 02 features enhanced logical reasoning and failure protections. A key upgrade was its fully integrated speech-to-speech conversational ability, with speech set to become the primary interface for all future Figure models.

Source: Figure

Figure 02 Progress Updates

After 18 months of development, Figure 02 was unveiled in August 2024. Unlike Figure 01’s computer-generated reveal, the new robot’s reveal featured a live-action demonstration of its capabilities. Notably, it boasts a fourth-generation hand design with 16 degrees of freedom, enhanced AI inference and computation (three times that of Figure 01), and a 2.25 KWh battery, offering 50% more runtime over Figure 01. Apart from physical and technical specifications, Figure 02 has completed a viability trial run at BMW’s Plant Spartanburg, focusing on testing autonomous operations, neural network-assisted manipulation, and self-correcting behavior.

Source: Figure

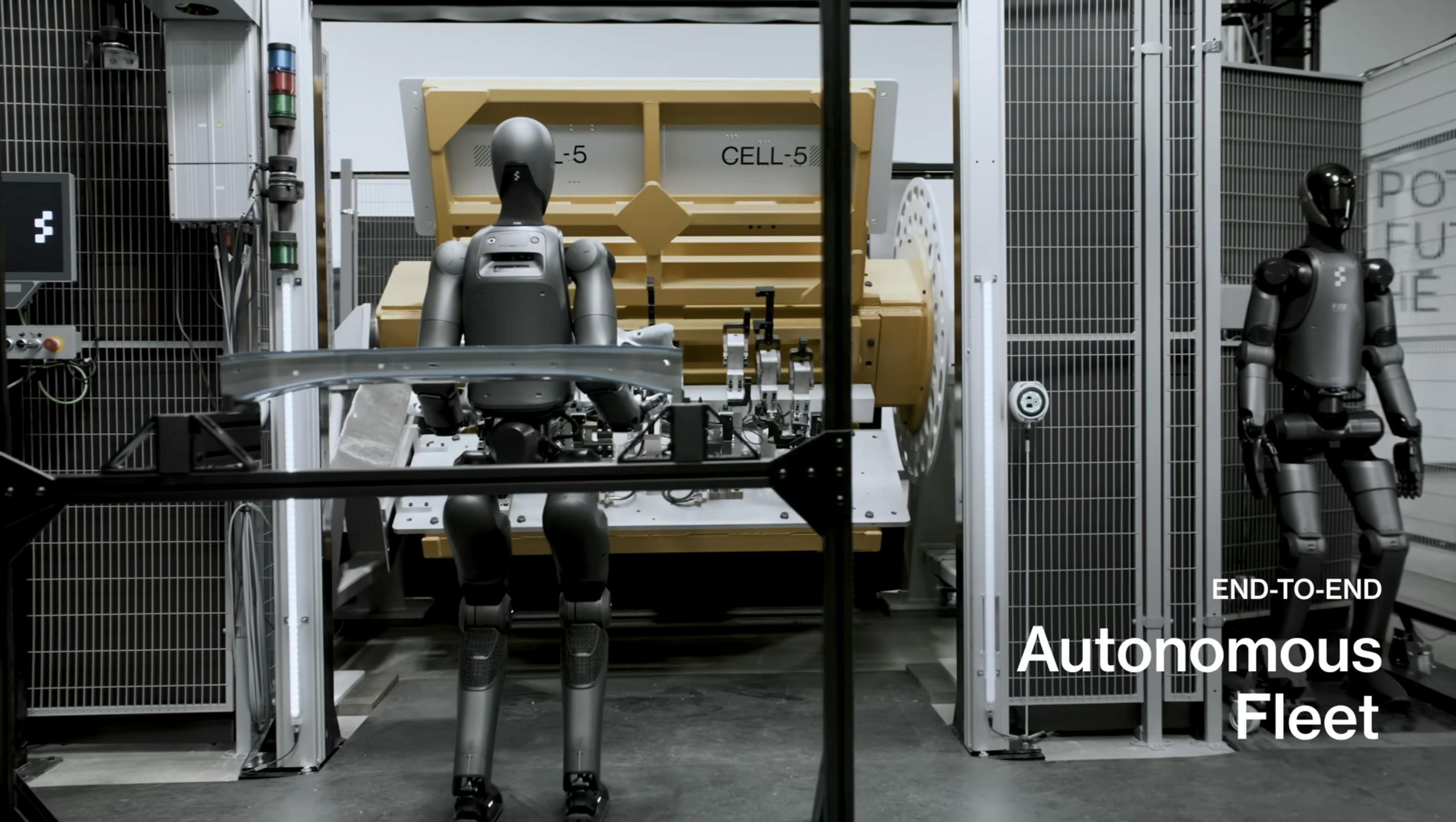

In a November 2024 status update, the company claimed that Figure 02 robots at BMW’s Spartanburg factory had dramatically ramped productivity and technical reliability since the initial viability trial run in August 2024. The video showed Figure 02 robots running 1K placements per day and operating completely autonomously with boosted reliability and speed.

Source: Figure

In February 2025, Figure introduced a new commercial application — logistics package handling and triaging, showing Figure 02’s ability to manipulate moving objects in dynamic environments with human-like speed and dexterity. Powered by Helix, Figure’s proprietary Vision-Language-Action (VLA) model, the robot can identify, grasp, and reorient diverse package types, from rigid boxes to deformable bags, ensuring correct label orientation for downstream scanning. The task requires continuous visual assessment and real-time corrections, especially as packages vary in size, weight, and material.

Source: Figure

Simultaneously, Figure has accelerated development toward home deployment, starting alpha testing in 2025. Helix enables Figure 02 to handle household tasks through natural language instructions, marking a major leap toward general-purpose robotics in unstructured environments.

Unlike factories or warehouses, homes are unpredictable ecosystems filled with objects of varied size, shape, and fragility. Helix overcomes this complexity by combining real-time visual understanding with semantic reasoning, allowing the robot to pick up thousands of novel items and execute multi-step tasks without prior training. In recent demonstrations, Figure 02 robots equipped with Helix coordinated to put away groceries, follow voice commands like “hand the bag of cookies to the robot on your right,” and interact intelligently with previously unseen items. According to Figure, this generalist control stack is the foundation for bringing humanoid robots into everyday homes.

Source: Figure

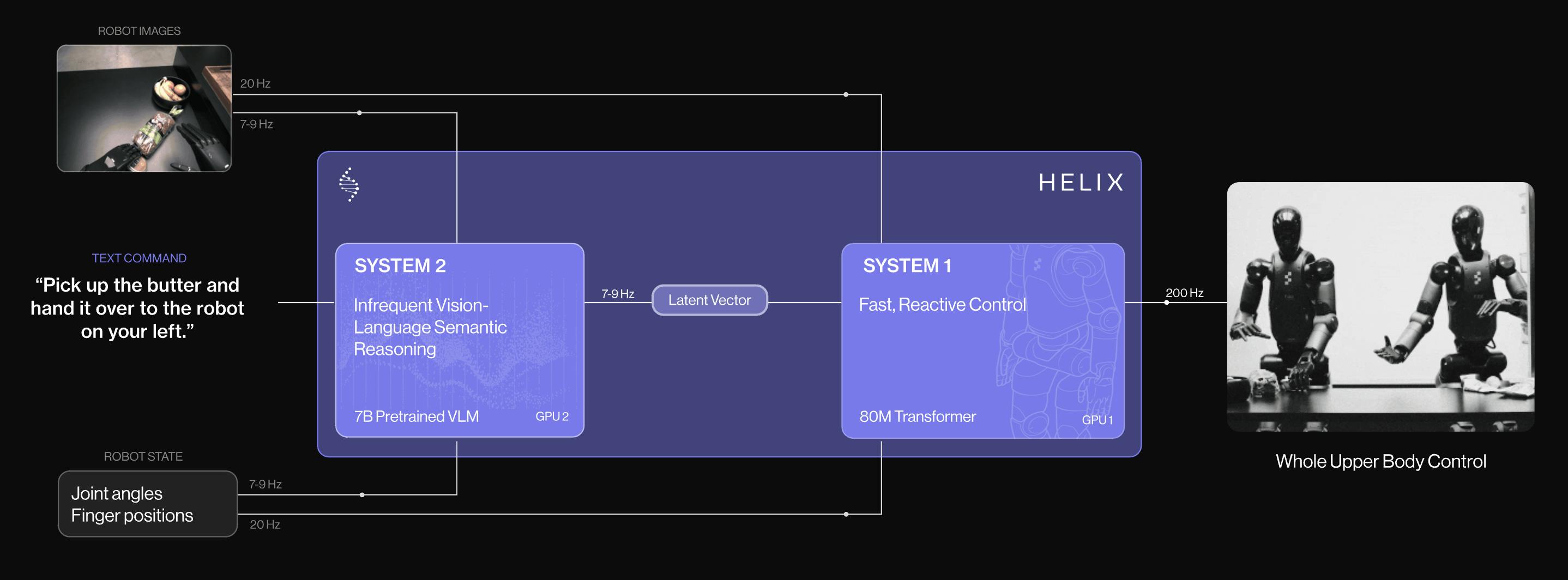

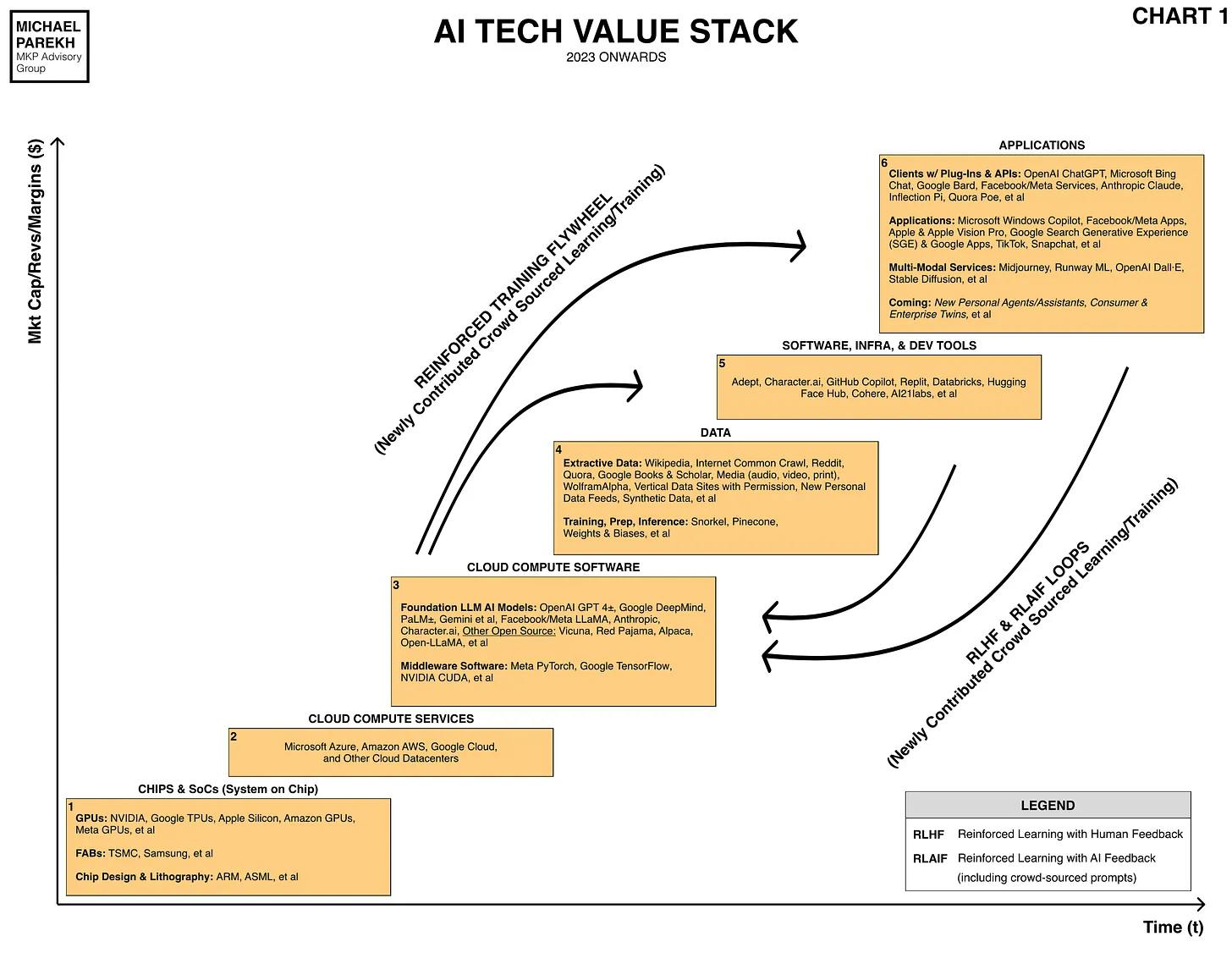

Helix

Figure’s long-term success hinges not just on advanced hardware but on its ability to scale intelligence across robots. In February 2024, Figure announced its partnership with OpenAI to develop AI models for its robots. But in February 2025, the company publicly stepped away from this collaboration and unveiled its own AI system, Helix, a proprietary Vision-Language-Action (VLA) model built entirely in-house. Designed to unify perception, language understanding, and learned control, Helix marks a shift in how robots are trained and deployed.

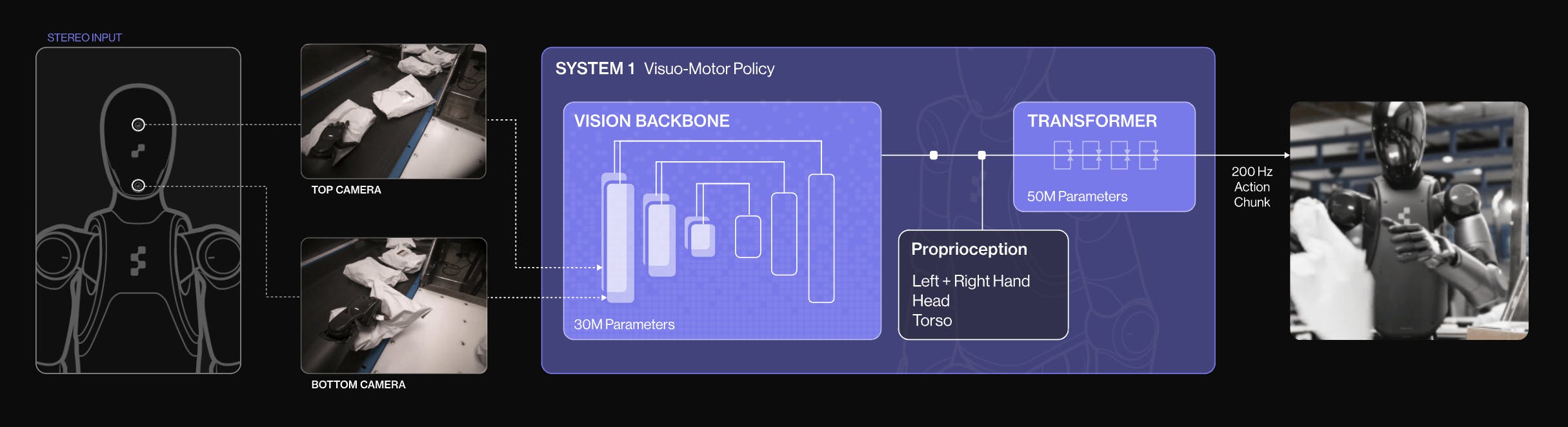

Helix introduces a “System 1 / System 2” architecture. System 2 is a slower, internet-pretrained VLM that interprets high-level language and visual context, operating at 7–9Hz. System 1, by contrast, is a fast visuo-motor control policy running at 200Hz, capable of precise continuous action in real time. This structure allows robots to “think slow” about goals and “act fast” on execution — a reference to Daniel Kahneman’s book Thinking, Fast and Slow, which proposed that the human was similarly composed of a System 1 and System 2.

Source: Figure

This architecture powers Helix’s ability to generalize. In home environments, Helix-enabled robots can reportedly pick up thousands of previously unseen objects based on simple voice commands, such as “place the bag of cookies in the drawer,” even when working alongside another robot. In logistics settings, according to Figure, Helix achieves faster-than-demonstrator package manipulation, identifying deformable bags, reorienting labels, and self-correcting in real-time — tasks that previously required hand-coded heuristics or massive volumes of training data.

Source: Figure

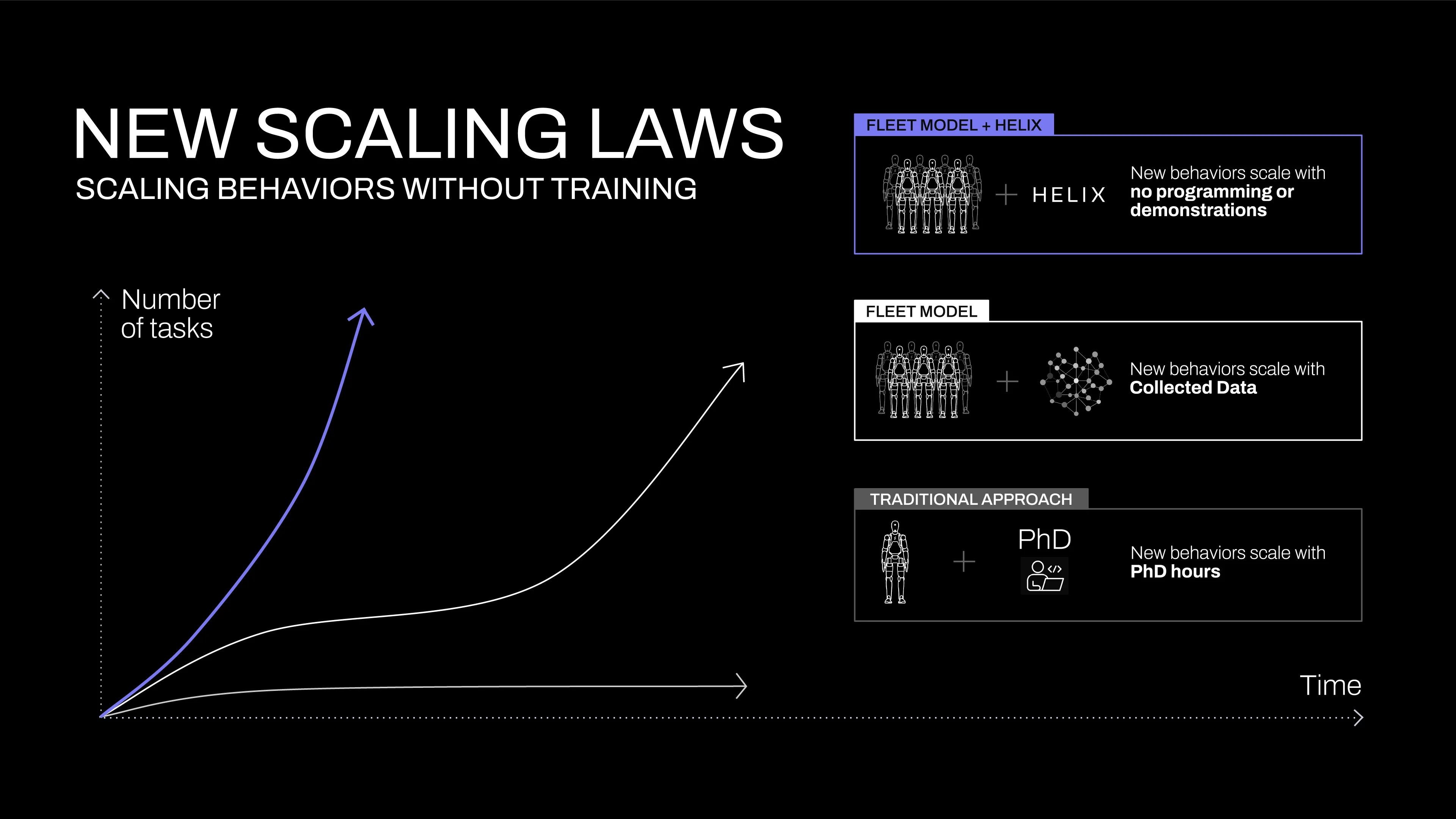

Helix is also intended to redefine scalability in robotics. Traditional robot learning has been bottlenecked by the need for manual scripting or thousands of demonstrations per new skill. Helix is designed to allow new skills to be deployed instantly via language, translating the semantic knowledge of VLMs directly into robot control. As Adcock explained:

"The training set we collected for the initial Helix unveil was ~20TB. This is ~2x the size of a LLM training set assuming 1x10¹³ tokens. There is so much data in the real world—we haven’t even scratched the surface."

Source: Figure

As supply chains mature and hardware becomes commoditized, Figure's success will rely on its ability to integrate VLMs, hardware, and AI to deliver customized robotic solutions. This makes Figure’s final design principle crucial:

“Artificial Intelligence: Building an AI system that enables our humanoids to perform everyday tasks autonomously is arguably one of the hardest problems we face long-term. We are tackling this by building intelligent embodied agents that can interact with complex and unstructured real-world environments.”

To support Helix’s development and deployment at scale, Figure has partnered with leading AI infrastructure providers. Microsoft powers large-scale training of Helix and related models through its ND H100 GPU clusters, enabling Figure to process massive real-world datasets like the initial 20TB Helix training set. NVIDIA, meanwhile, supports Figure with full-stack acceleration, spanning simulation, training, and inference, through its libraries, robotics systems, and the GR00T foundation model for general-purpose humanoid control.

BotQ

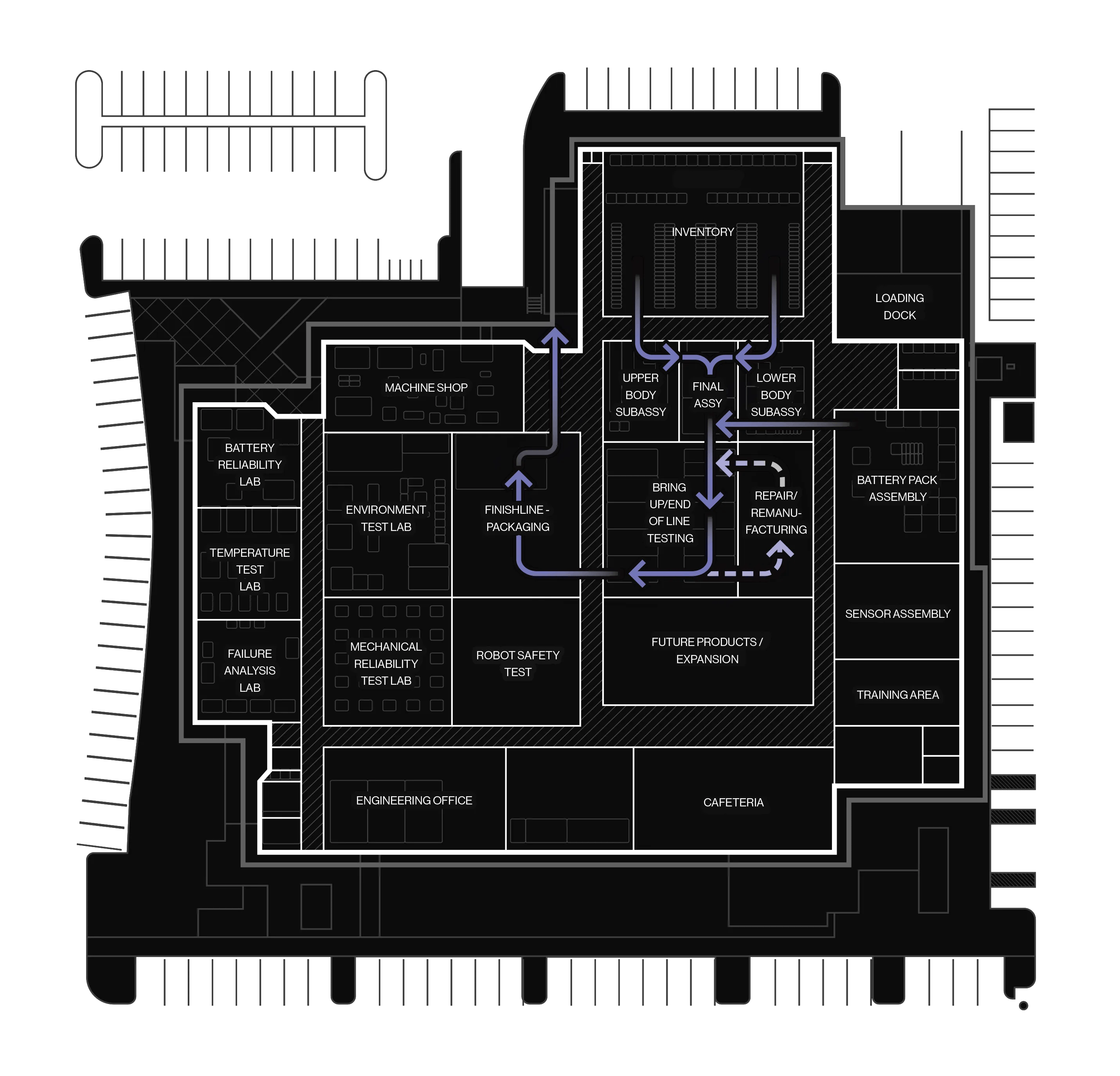

In March 2025, Figure unveiled BotQ, its first high-volume manufacturing facility dedicated to building humanoid robots at industrial scale. The initial production line is capable of producing up to 12K units annually, with expansion already underway. To enable manufacturing at scale, Figure rearchitected its humanoid platform - cutting production time from days to seconds.

Source: Figure

Meanwhile, a dedicated reliability team at BotQ conducts accelerated lifecycle testing to identify failure points early and inform continuous hardware improvements. The facility runs on a custom-built Manufacturing Execution System (MES), integrating supply chain, inventory, and quality control into a unified software layer. Connected IoT systems track every component in real time, forming a digital twin of each robot as it moves through the line. A core innovation is the use of Figure robots to assist in their own assembly. These robots perform repetitive tasks such as material handling and battery testing, enabling a hybrid workforce that increases throughput without rigid conveyors or costly retooling.

Source: Figure

BotQ reflects Figure’s broader philosophy: performance comes from tight integration between hardware and AI. As Adcock put it in a February 2025 tweet, “We can’t outsource AI for the same reason we don’t outsource actuators, batteries, or electronics—it’s too critical to performance". While LLMs are becoming more commoditized, Figure’s focus is on the harder problem: building real-time AI systems for physical robots operating in dynamic environments. Adcock's tweet went on to say that LLMs have quickly become the smallest piece of the puzzle, and that Figure’s AI models are built entirely in-house, making external AI partnerships not just cumbersome but ultimately irrelevant to Figure’s success.

Humanoid Forms

The two primary schools of thought in robotic design are biomimetic and functional. Biomimetic designs seek to translate natural systems (biological forms) into engineering principles. Notable examples include Boston Dynamics’ Spot, the Wyss Institute at Harvard’s RoboBees, and Festo’s BionicKangaroo. On the other hand, functional designs focus on identifying specific hardware requirements and high-level functionalities, analyzing, and integrating unit interactions to address particular scenarios or problems. Prominent examples include iRobot’s Roomba, Kuka’s KR QUANTEC series, and ABB’s YuMi. These design philosophies are not mutually exclusive and robotic design often draws on both approaches to construct viable robots.

Humanoid robots are considered a subset of biomimetic design that focuses on replicating and enhancing the human form. Though researchers differ on whether the humanoid form is most efficient for robotic designs and use cases, Figure believes that multi-functional humanoid robots are best suited for a world where most tasks are already designed for human interactions. Prominent tech figures including Tesla CEO Elon Musk and NVIDIA CEO Jensen Huang have voiced support for this view. In March 2024, Musk, whose company is developing the Optimus humanoid robot, stated that “Earth is already tailor-made for generalized humanoid robots.” Huang agreed with Musk’s sentiment at Computex, the foremost computer hardware conference in Taiwan, in June 2024, noting that “the easiest robots to adapt into the world are humanoid robots because we built the world for us. We also have the most amount of data to train these robots than other types of robots because we have the same physique.” According to Figure, the development of future Figure robot models will proceed under the following guidelines:

“Our team is designing a fully electromechanical humanoid, including hands. The goal is to develop hardware with the physical capabilities of a non-expert human. We are measuring this in terms of range of motion, payload, torque, cost of transport and speed, and will continue to improve through rapid cycles of development, each cycle as part of a continuum.”

Robotics and Human Safety

Asimov’s Three Laws of Robotics have been a common framework for robotic operating principles since they were introduced in his 1942 short story, Runaround. The moral quandaries Asimov explored have challenged, motivated, and most of all, inspired generations to push the boundaries of the future. Entrepreneurs like Adcock, Musk, and Bezos claim Asimov as an important influence on their philosophies and work. Given the First Law stating that “a robot may not injure a human being or, through inaction, allow a human being to come to harm,” Figure prioritizes human safety as a core tenet of its operating philosophy:

“Safety: It’s essential that our humanoids will be able to interact with humans in the workplace safely. We will design them to be able to adhere to industry standards and corporate requirements.”

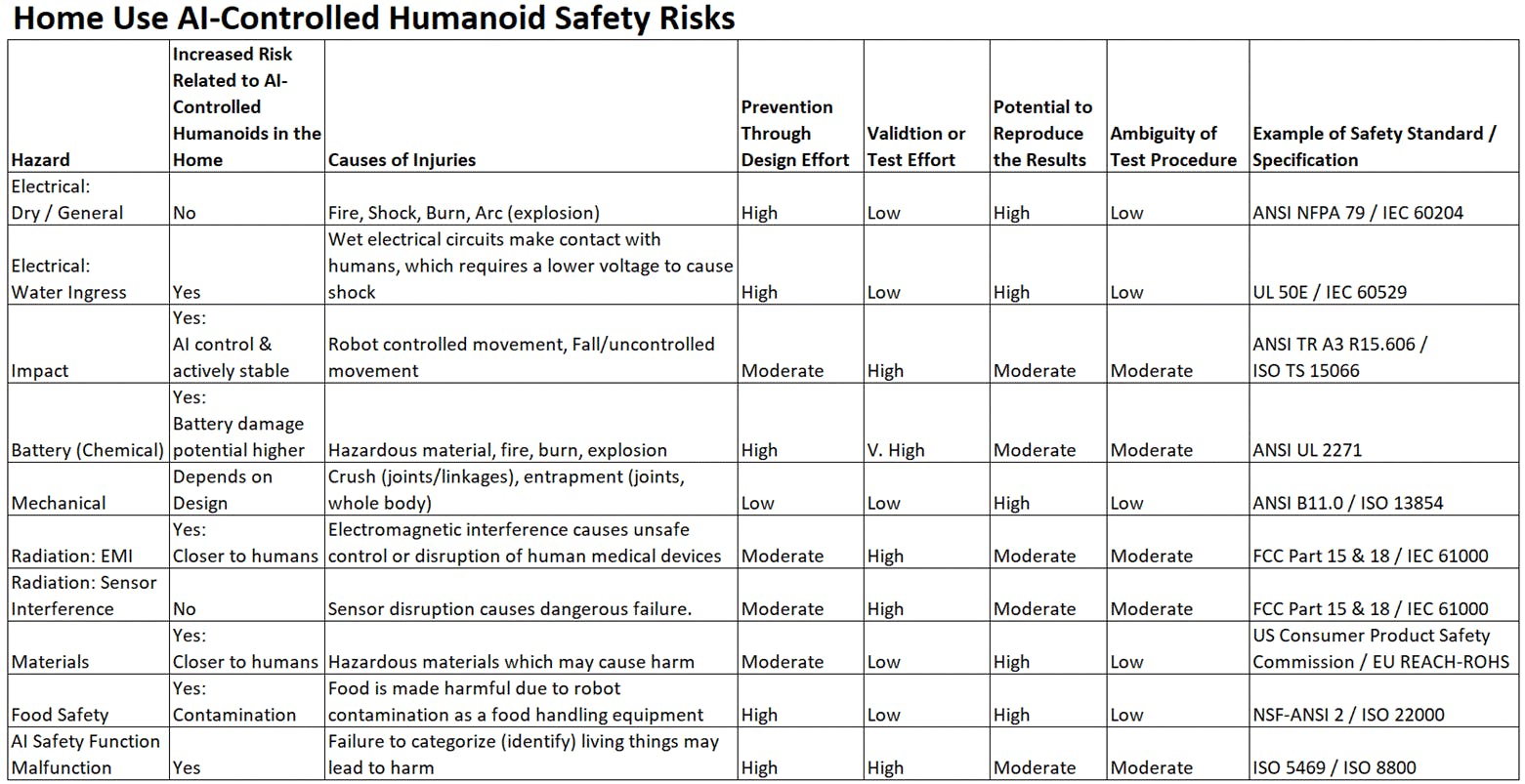

Unlike traditional industrial robots, which operate in structured environments with clear guardrails, humanoids pose unique safety challenges. Their mobile, actively balanced design introduces new risks that lack well-defined standards today. Rob Gruendel, who leads robotics safety at Figure and sits on ANSI and ISO standards committees, has outlined how the company is developing safety systems that go far beyond compliance. Figure’s safety strategy includes redundant torque sensors, active fall mitigation, self-calibrating proprioception, and certified override systems to prevent harm to living beings, especially in unstructured home environments.

Source: Figure Principal Engineer Rob Gruendel via Linkedin

Adcock has gone on record to say that a “high safety track record will be needed before building trust of the robot in your home.” In line with the initial business plan to pursue enterprise opportunities and increase capital efficiency early on, Figure has opted to initially enter corporate labor industries where training could be more generalized in a structured warehouse or shipping environment as opposed to the highly unstructured environment of households.

Market

Customer

Figure’s long-term target customers are large enterprises across every industry (except military or defense applications) in need of large-scale labor, and retail consumers in need of at-home care. Figure aims to have an initial impact on industries where labor shortages are most severe, such as manufacturing, warehousing, logistics, and retail.

Source: US Chamber of Commerce

Adcock envisions that by 2030, Figure will expand its reach to retail consumers, targeting 2.3 billion households globally, while also addressing the needs of the 700 million elderly individuals requiring at-home care. In the longer run, Figure expects use cases to emerge in off-world applications.

Source: Figure

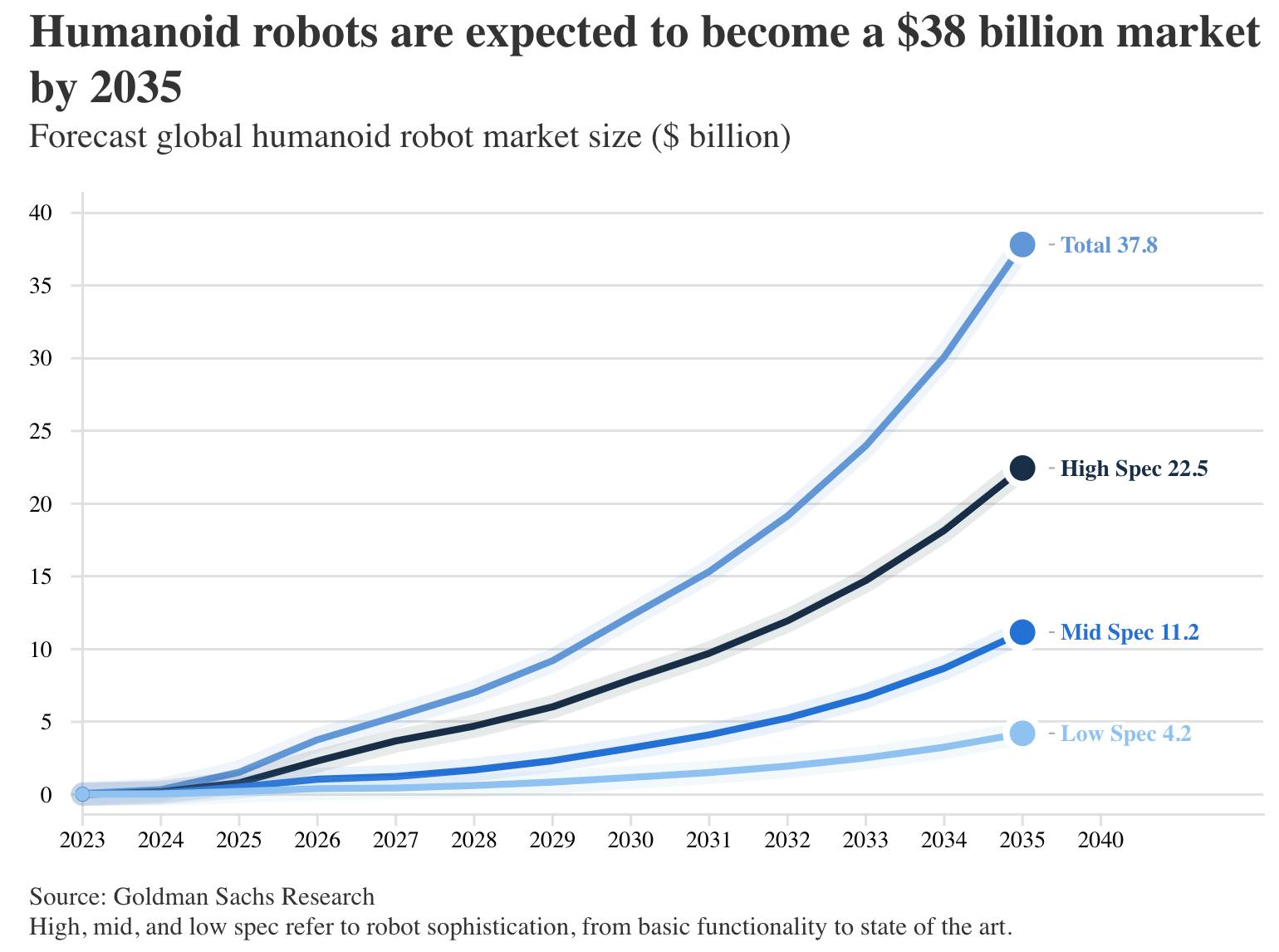

Market Size

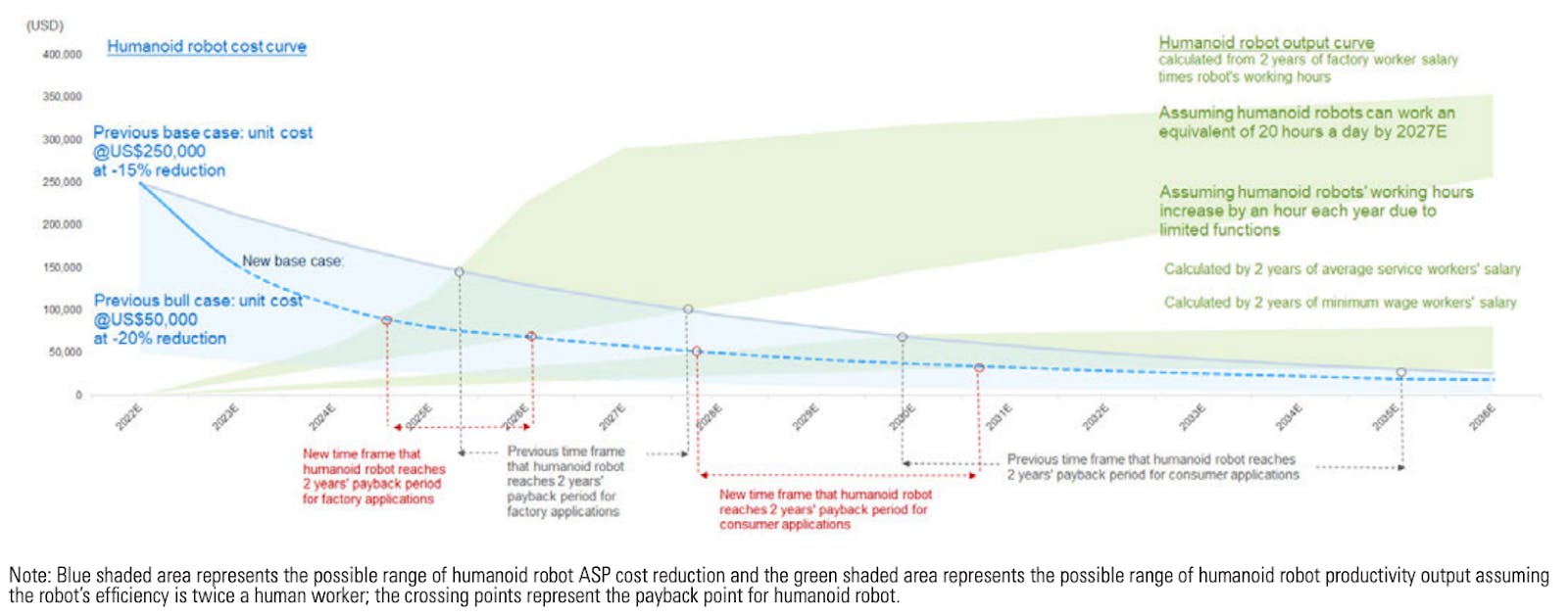

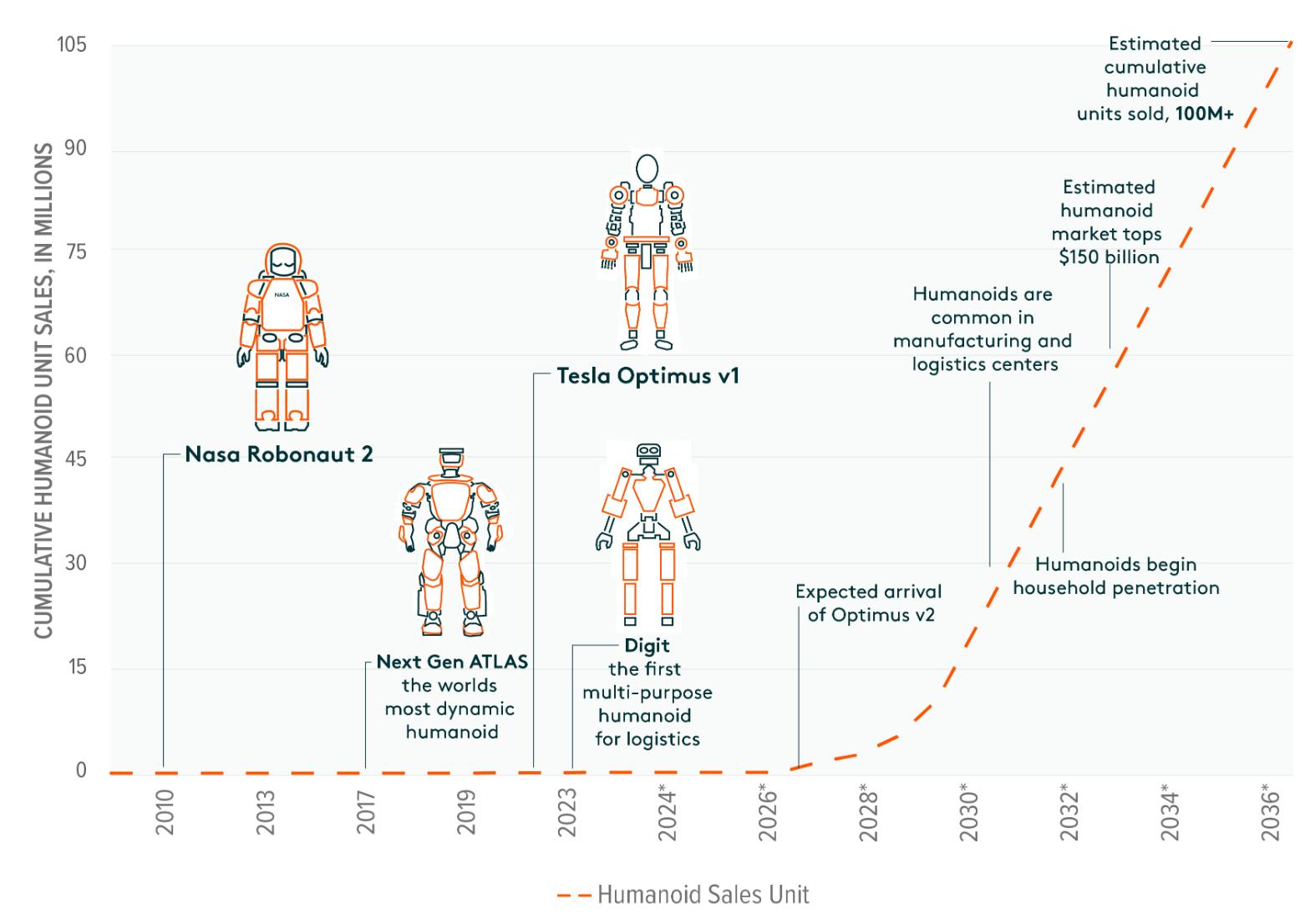

The AI hardware market is predicted to reach $128.7 billion by 2033, growing at a CAGR of 23.9% from 2024 to 2033. Figure operates specifically within the humanoid robotics segment, which is expected to reach $38 billion by 2035. Between 2024 and 2035, robot shipments are expected to increase fourfold to 1.4 million units, driven by a significant 40% reduction in material costs, leading to a faster path to profitability.

Humanoid robots are particularly suited for tasks that are “dangerous, dirty, and dull.” Labor shortages often arise in jobs that pose health hazards, are necessary but unpleasant, or involve repetitive, tedious work. By 2035, the global demand for humanoid robots could reach between 1.1 million and 3.5 million units, assuming a labor substitution rate of up to 15% in industries such as car manufacturing and high-risk sectors like disaster rescue and nuclear reactor maintenance.

Source: Goldman Sachs

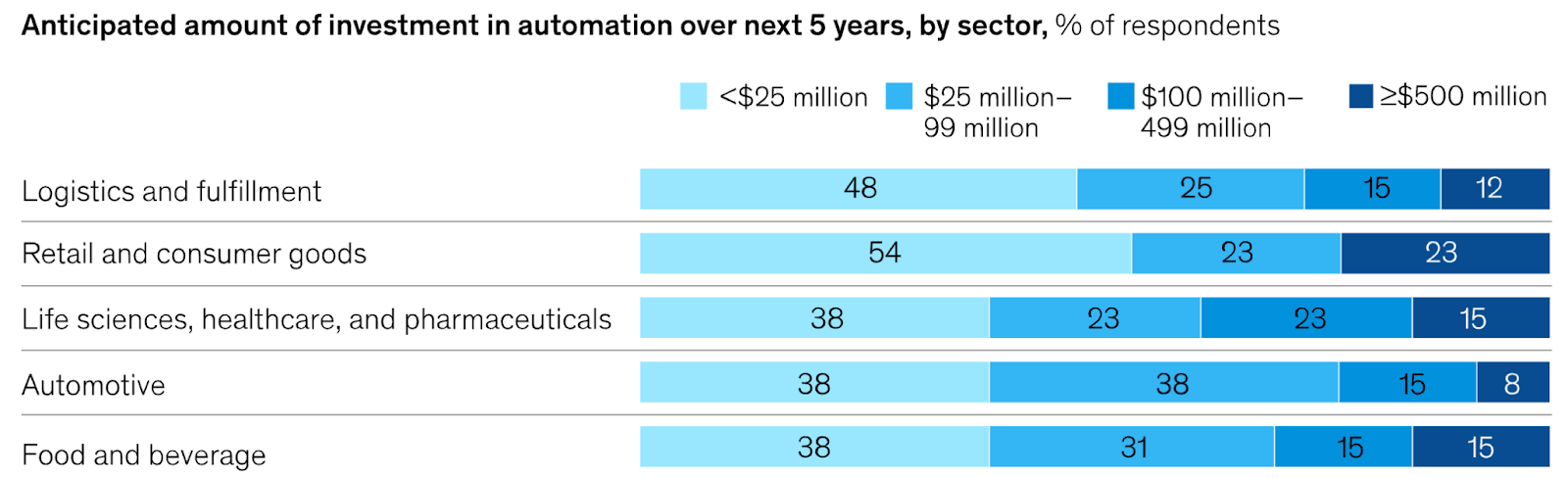

Automated systems will account for up to 25% of industrial companies’ capital spending over 2023-2028. Retail and consumer goods emerge as the largest spenders, with 23% of respondents from that sector planning to invest over $500 million. Logistics and fulfillment are projected to allocate the highest shares of their budgets to automation, with these sectors anticipating that automation will comprise 30% or more of their capital expenditures in the coming five years.

Source: McKinsey

Competition

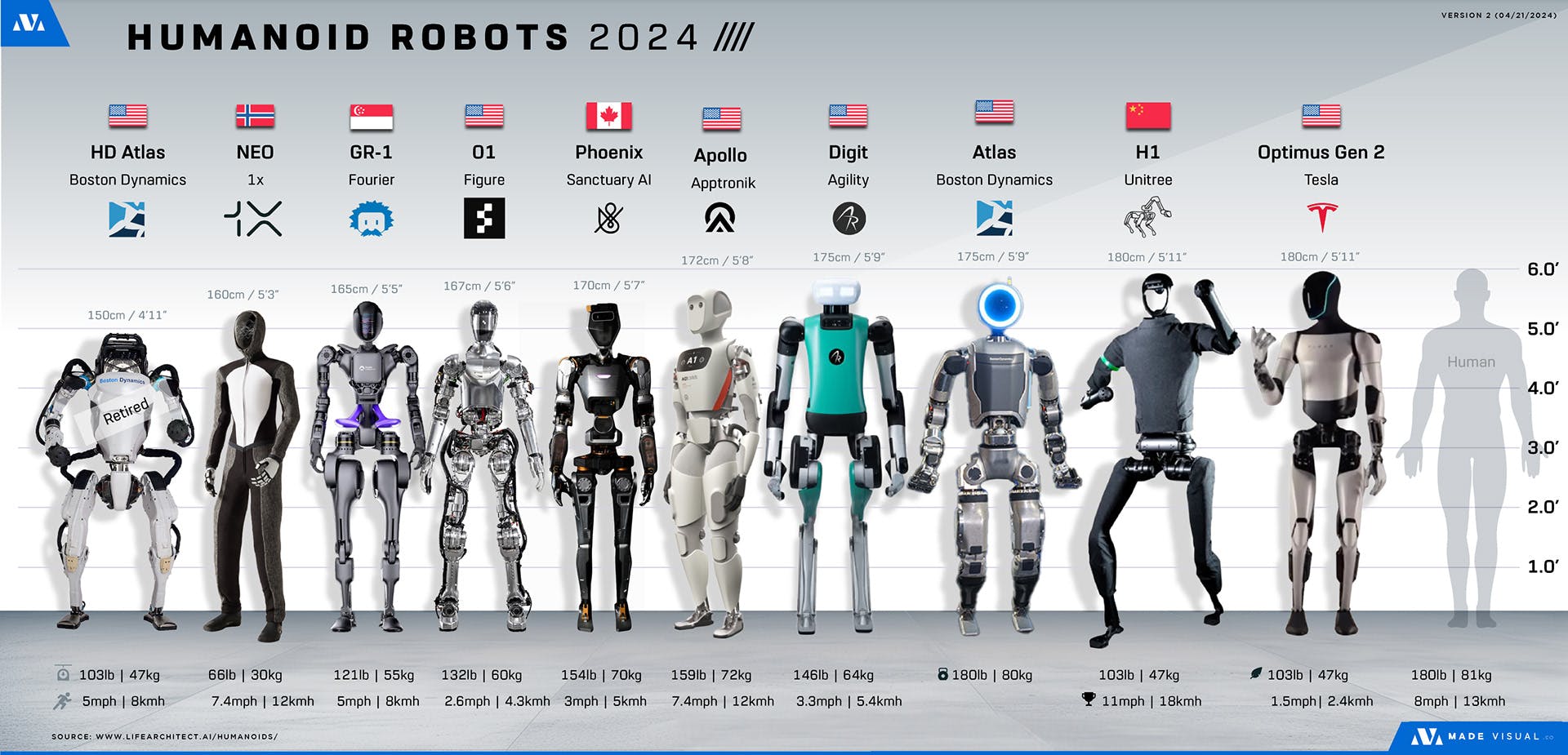

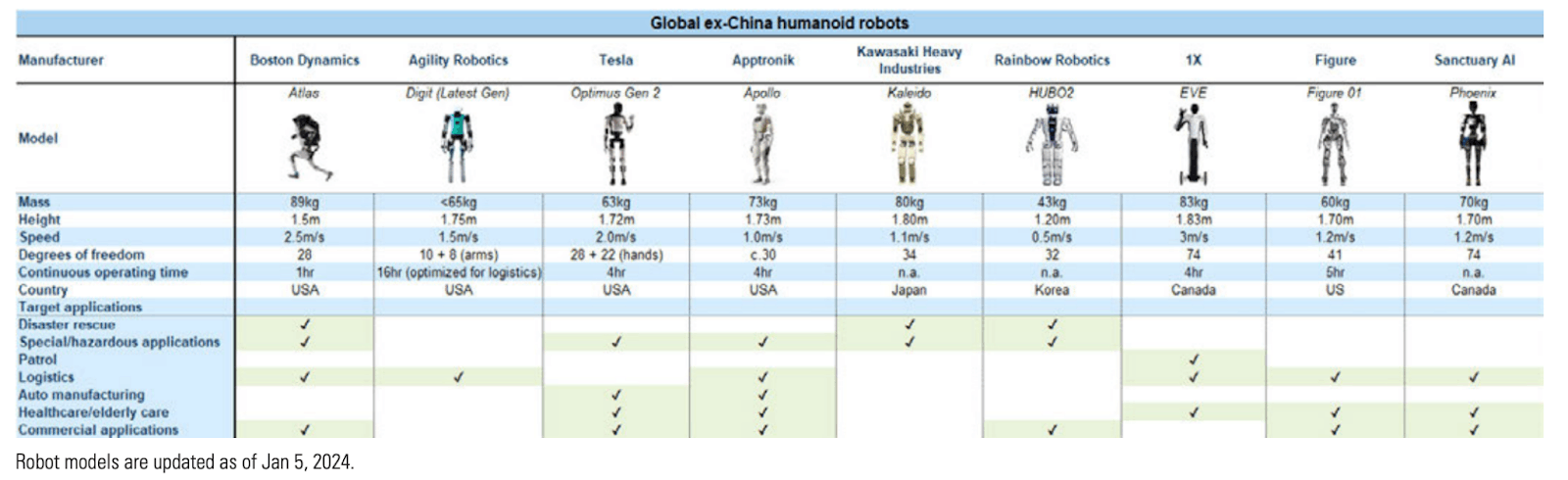

Figure faces competition from numerous humanoid robot startups and established companies, both domestically and globally.

Source: Harrison Schell

Startups

Agility Robotics: Founded in 2015 and based in Pittsburgh, Pennsylvania, Agility Robotics is developing humanoid robots to address labor shortages in the distribution, retail, manufacturing, and logistics industries. Originally a spin-off from Oregon State University, the company created Cassie, a bipedal robot lacking a torso and perception systems. Cassie set the Guinness world record for the fastest 100-meter run by a bipedal robot in December 2022. Agility’s flagship humanoid robot, Digit, features a unique “backward” leg design that enhances maneuverability in factory and manufacturing settings.

Digit is sold alongside Agility Arc, a cloud automation platform that monitors fleets of Digit robots and integrates with existing client workflows, as well as Arc Accessories, a suite of charging docks, work cells, and control pendants. In October 2023, Agility signed a collaboration agreement with Amazon to test Digit in Amazon warehouses. In June 2024, Agility signed a multi-year RaaS to begin deploying Digit in GXO’s logistics operations in what Agility claims is the robotic industry’s first commercial deployment of humanoid robots. While both Agility and Figure are focused on humanoid robots for automation and labor replacement, Agility Robotics is more specialized in industrial settings like warehouses and logistics, whereas Figure AI has a broader vision of developing general-purpose humanoid robots for both commercial and household applications. As of March 2025, Agility Robotics had raised a total of $178 million at a valuation of $550 million, with key investors including the Amazon Industrial Innovation Fund, Sony Innovation Fund, Playground Global, and DARPA.

1X: Founded in 2014 and based in Sunnyvale, California, 1X is developing safety-focused AI-powered humanoid robots. 1X’s first commercially available robot, EVE, was designed with a rolling base and a humanoid upper body. This was followed by NEO Beta, released in August 2024, designed to mimic the human form more closely, with bipedal locomotion and biomimetic musculature. NEO can be operated remotely and autonomously. 1X is training NEO through its “1X World Model,” built upon AI video generation and autonomous vehicle world generation models combined with real-world human-robot interaction data. Its model NEO Gamma was released in February 2025 and will be tested in “a few hundred to a few thousand” homes before the end of the year, as reported by 1X’s CEO Bernt Børnich.

As of March 2025, 1X intends to use EVE in industrial settings to address labor shortages, while NEO will be focused on home applications. 1X has raised a total of $140 million at an estimated valuation between $400 million to $600 million. Key investors include OpenAI, Tiger Global, EQT Ventures, Samsung NEXT Ventures, and ADT Security Services.

Apptronik: Founded in 2016 and based in Austin, Texas, Apptronik is developing general-purpose humanoid robots. Apptronik was originally funded by NASA to develop space-intended humanoid robots Valkyrie 1 and Valkyrie 2. Over time, this work transformed into Apollo, Apptronik’s most recent model. Apollo is built modularly and can be mounted on any base platform (stationary or mobile). It intends to operate in the warehouse and manufacturing industries before aiming to extend into consumer household markets, similar to Figure’s model. Apptronik signed a collaboration agreement with car manufacturer Mercedes-Benz in March 2024 to test Apollo at its manufacturing facilities and a partnership agreement with Google DeepMind in December 2024 to bring AI capabilities to Apollo. Apptronik bootstrapped until its Seed round and has raised a total of $431 million at an undisclosed valuation. Key investors include Capital Factory, Perot Jain, WorldQuant Ventures, NASA, NSF, and the US DoD.

Incumbents

Tesla: Founded in 2003 and based in Austin, Texas, Tesla is a vertically integrated electric vehicle manufacturer and autonomous software developer. Under founder Elon Musk’s direction, the company began developing Optimus, a general-purpose humanoid robot. The robot was revealed at Tesla’s AI Day in August 2021, and prototypes were displayed at Tesla’s second AI Day in September 2022. The latest robot iteration, Optimus Generation 2, was unveiled in December 2023. In May 2024, Tesla showed Optimus performing tasks in a Tesla electric vehicle manufacturing plant. Musk claims that Optimus will be controlled by the same AI system Tesla is developing for the advanced driver-assistance system used in its cars. In June 2024, Musk projected Optimus to enter limited production in 2025 where the company will have over 1K Optimus robots working at Tesla.

Musk further projects Optimus to begin sales in 2026 and predicts that Optimus could potentially bring Tesla’s market cap to $25 trillion. In March 2025, Musk estimated that Tesla would manufacture around 5K robots before the end of the year, targeting a price tag below $20K.

Boston Dynamics: Founded in 1992 and based in Boston, Massachusetts, Boston Dynamics is a robotics company developing both highly mobile practical humanoid and non-humanoid robots in the manufacturing, construction, energy, defense, education, and logistics industries. Boston Dynamics’ humanoid robot products include the Atlas line. The first version of Atlas was produced under the direction of DARPA and constructed by Boston Dynamics.

The most recent version of Atlas was unveiled in April 2024, is designed to improve on human capabilities, and is intended to address labor shortages in 3D industries. Boston Dynamics has signed a collaboration agreement with car manufacturer and investor Hyundai in April 2024 to test Atlas at manufacturing facilities. Boston Dynamics was originally spun out of MIT and CMU and operated independently until it was acquired by Google in 2013. The company was thereafter acquired by SoftBank in 2017 until Hyundai acquired a controlling stake in the company from SoftBank for $880 million in 2020.

Ubtech: Founded in 2012 and based in Shenzhen, China, Ubtech Robotics is a robotics company developing both humanoid and non-humanoid robots in the commercial and healthcare industries. Ubtech’s humanoid line includes the Walker S, Walker X, Walker, and Panda Robot. The Walker S is Ubtech’s latest humanoid robot, with integrated VLMs, 3D semantic navigation, integrated LLM reasoning, and object detection to manipulation capabilities.

Ubtech is using Walker S for manufacturing use cases and plans to eventually use the robot model for consumer household use cases, which is Figure’s goal as well. Ubtech signed a collaboration agreement with car manufacturer Dongfeng Liuzhou Motor in June 2024 to test Walker S at manufacturing facilities. Ubtech‘s IPO raised $130 million in December 2023 and the company's market cap was $36.5 billion as of March 2025. Ubtech was formerly backed by key investors Tencent, ICBC, CITIC Securities, Minsheng Bank, and Jinyuang Group.

Source: Goldman Sachs

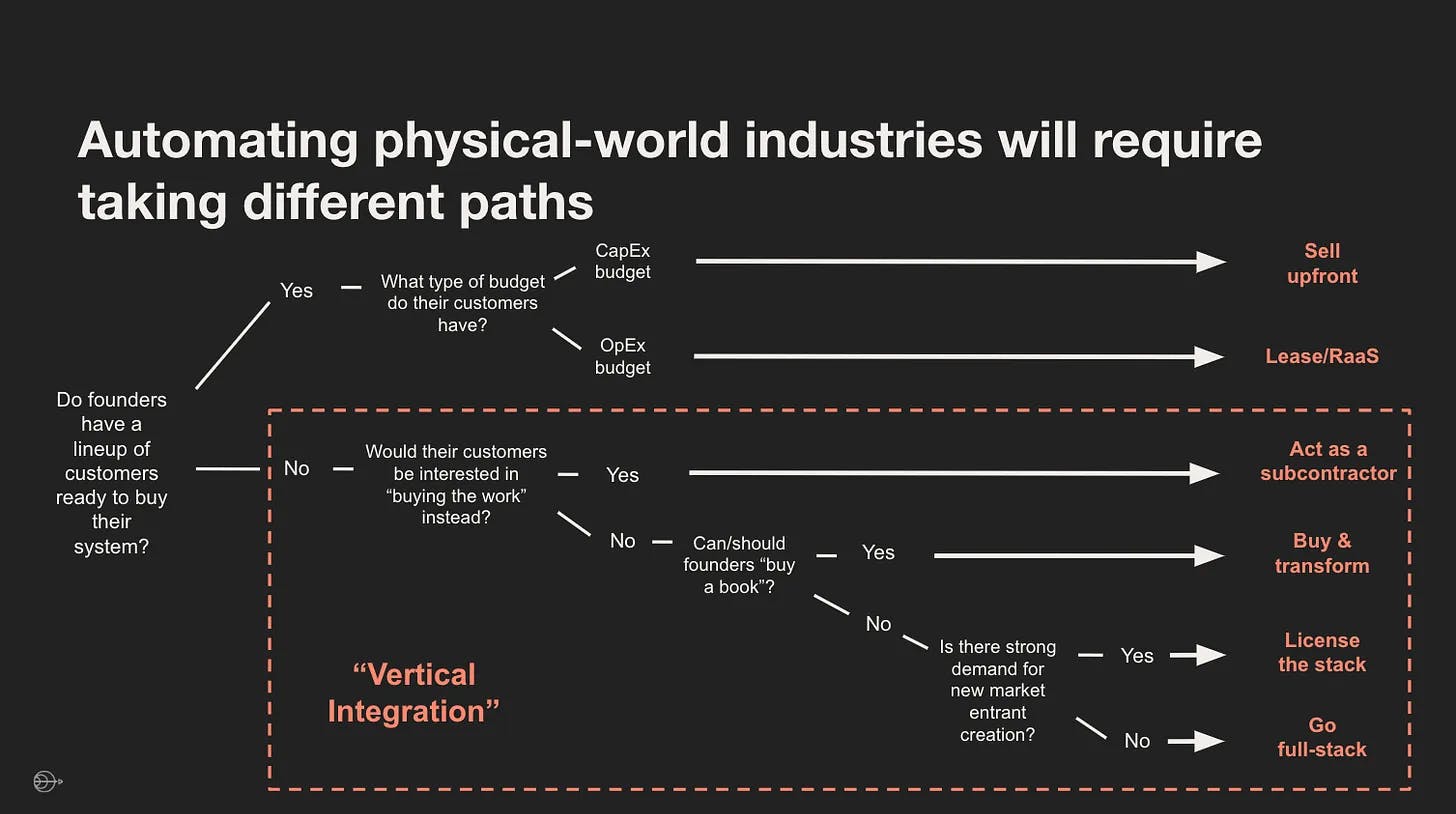

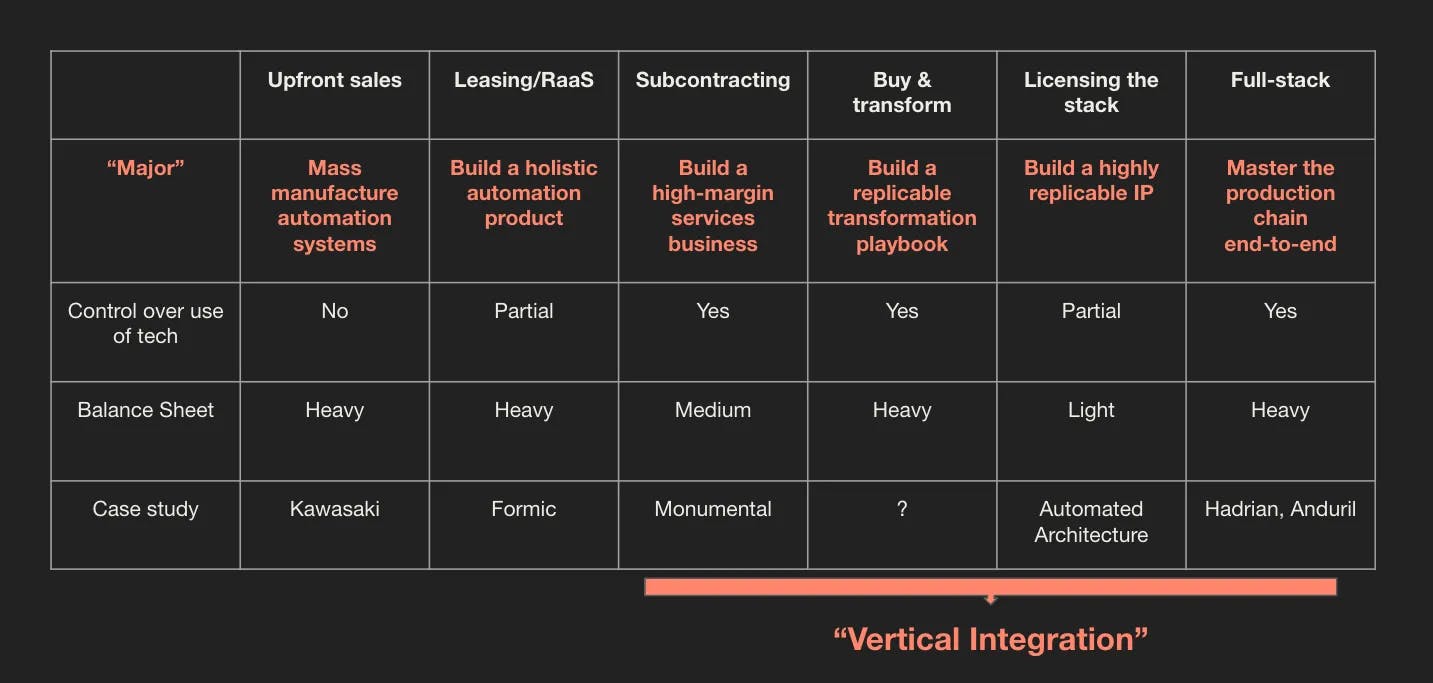

Business Model

As venture capital dollars flow into deep tech, investors remain wary of high capital expenditure requirements, supply chain immaturity, lower ROI, high-risk profiles, increasing valuations from investor crowding, and long roads to commercialization — let alone profitability. As a humanoid robotics company primarily funded through venture capital, Figure recognizes the necessity of building out protections against the aforementioned risks. Adcock understands the need to balance technical viability with fundraising. Building a viable robot is not enough; reaching venture capital milestones requires a clear path to profitability, scalability, and efficient use of capital.

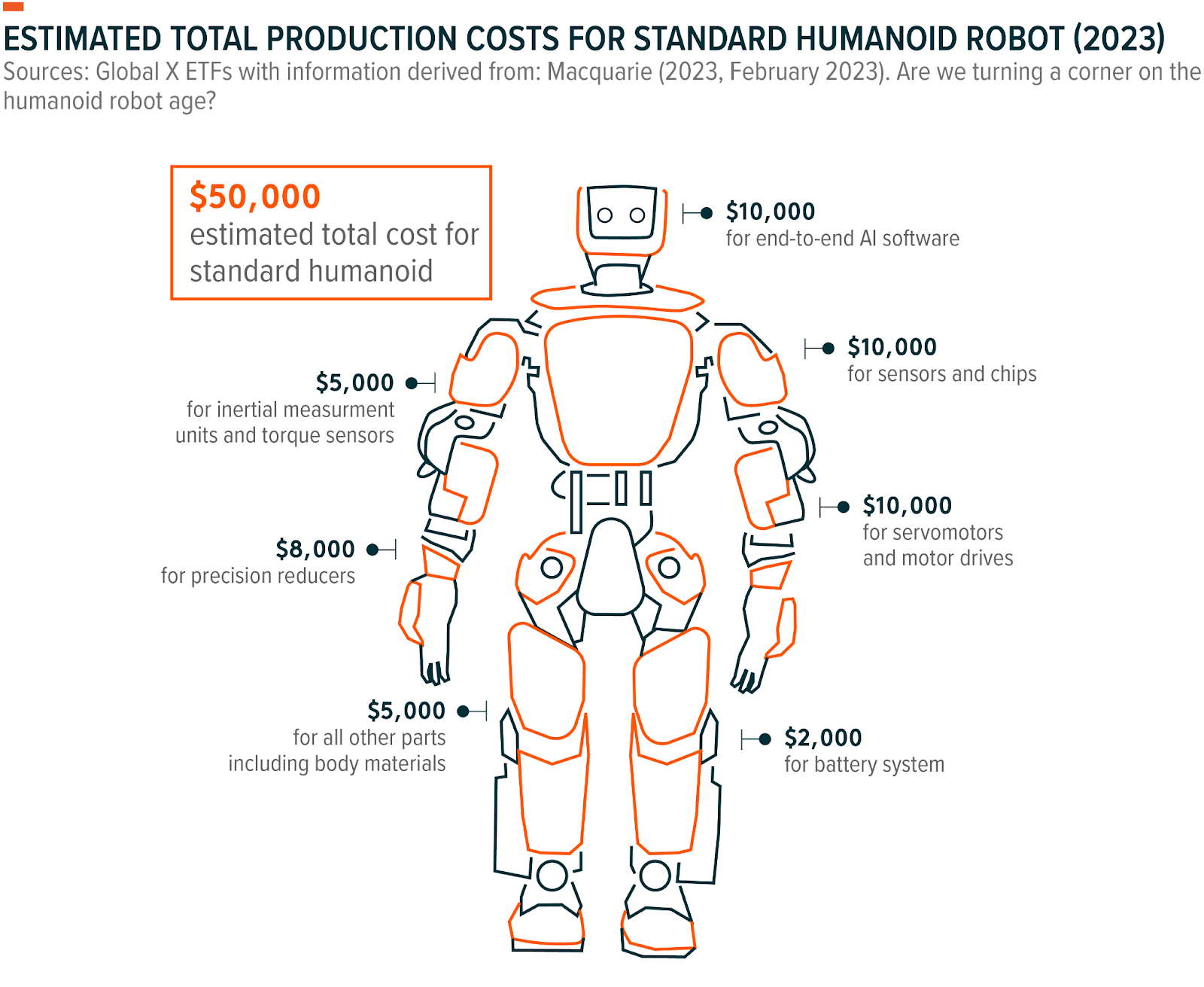

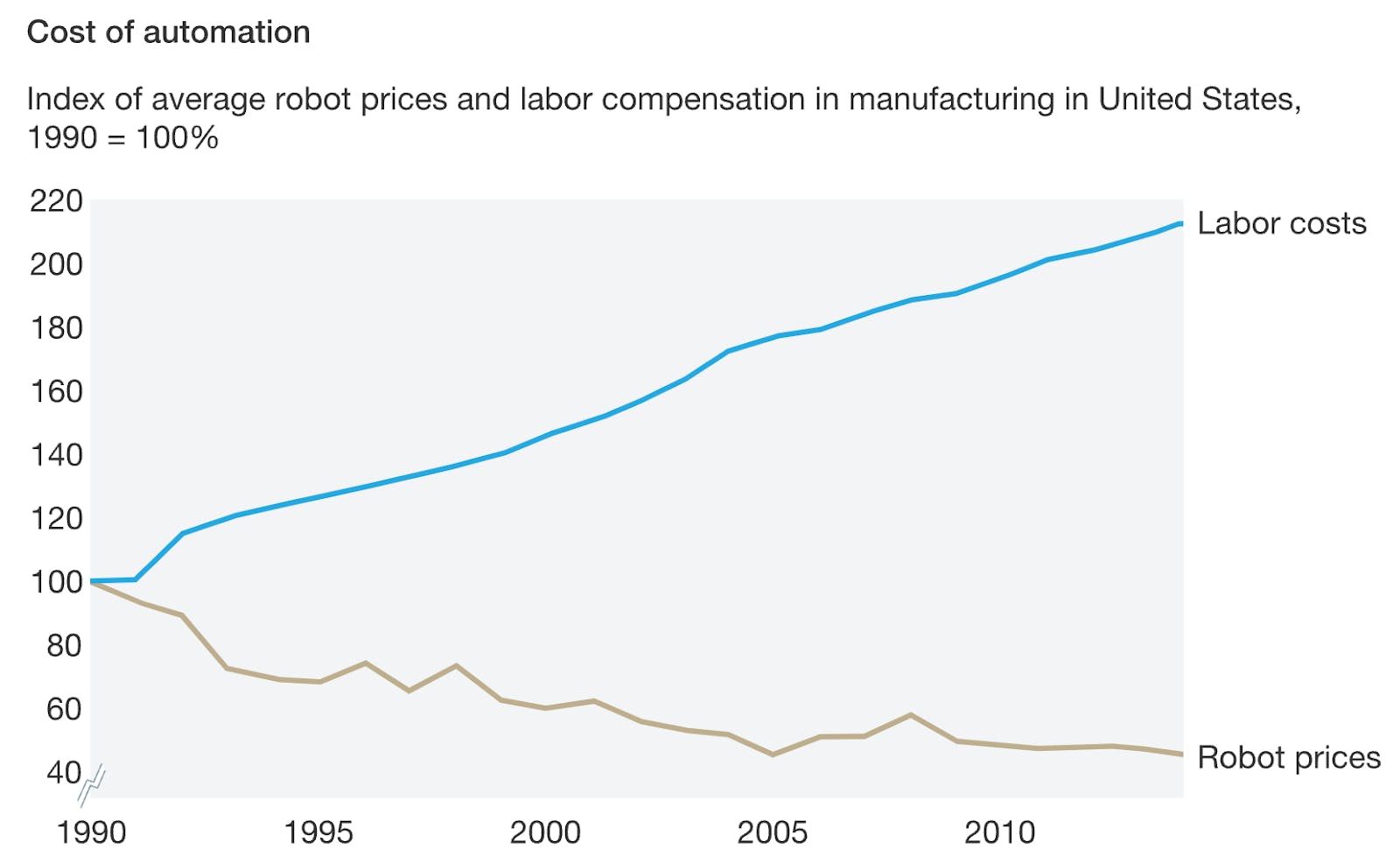

For the industries targeted by Figure and other humanoid robotics companies, the key measure of ROI is how the robot’s lifetime cost compares to human labor costs and performance. If a robot's total cost exceeds that of human labor, particularly with lower labor quality, it becomes unviable for adoption. The current target price for viable humanoid robots is around $50,000, aligning with the annual wage for a single shift of labor at just over $18 per hour. Ultimately, clients don’t care how the technology works; they only care that it delivers the desired solution at the right cost. As Steve Jobs opined, “You‘ve got to start with the customer experience and work back toward the technology - not the other way around.”

Source: Global X ETFs

This manifests in two areas of advancement for Figure: maintaining high-quality standards through simultaneous prototyping and reducing robot unit costs via volume manufacturing. Figure’s robot manufacturing and prototyping will have the following two mandates:

“Unit Cost: We’re aiming to reduce individual humanoid unit costs through high-rate volume manufacturing, working towards a sustainable economy of scale. We are measuring our costs through the fully burdened operating cost/hour. At high rates of volume manufacturing, I am optimistic unit cost will come down to affordable levels.

Volume Manufacturing: We foresee not only needing to deliver a high quality product, but also needing to deliver it at an exceptionally high volume. We anticipate a steep learning curve as we exit prototyping and enter volume manufacturing. We are preparing for this by being thoughtful about design for manufacturing, system safety, reliability, quality, and other production planning.”

To implement these mandates, Adcock has repeatedly emphasized the importance of rapid design iterations, prototyping, and testing as Figure’s key differentiators, so much so that it has become a hiring requirement and the company’s primary value. Hardware design is notoriously much slower than software, but Adcock believes that the teams that build, test, and ship faster will lead in the space. Figure aims to release new hardware and software versions every six months, striving to be first to market. Speed and cost reductions are also the reasoning behind Figure’s vertical integration. While Adcock would rather “buy [parts] than build” to expedite development and market entry, the required technical expertise and supply chain immaturity make vertically integrating hardware stacks essential for complex robotics projects.

Source: Angèle Sahraoui

While Figure has not explicitly outlined its commercialization plans, its business model can be inferred from Adcock’s remarks about making humanoid robotics accessible to both enterprise and consumer clients, along with comparisons to contemporaries like Apple and Tesla. Adcock has emphasized that Figure's strategy prioritizes near-term revenues to facilitate capital raising, with initial use cases targeting the manufacturing, warehousing, logistics, and retail sectors.

At the enterprise level, Figure is likely to adopt established hardware contracts, with multi-year Hardware as a Service (HaaS) or Robotics as a Service (RaaS). This approach will serve as the primary revenue stream from enterprise clients seeking large-scale labor solutions over the viable lifetimes of their robots.

As a vertically integrated hardware manufacturer and software developer, Figure’s most fitting consumer comparison is Tesla. The consumer business model may mirror Tesla’s approach, combining one-time hardware sales with monthly or annual subscriptions for accompanying software sold directly to consumers.

Source: Angèle Sahraoui

Traction

As of March 2025, Figure has not disclosed revenue numbers, pricing, or total robots produced, and the company generated its first revenue in December 2024. Figure’s first commercial agreement with BMW was announced in January 2024. In August 2024, both Figure 01 and Figure 02 completed a trial run at BMW’s Plant Spartanburg, which operated on a milestone-based approach. The trial identified specific automotive manufacturing tasks the robots could handle, with plans for staged deployments of additional robot models to follow.

If Figure can demonstrate the clear value of its robots for BMW and replicate this success with other clients, it may be well-positioned to become a provider of robotic solutions to alleviate human labor shortages. In November 2024, Adcock announced that a fleet of Figure 02 robots were completing over 1000 placements of sheet metal on car fixtures per day, in a faster, more accurate, and more reliable manner than earlier trial runs. Figure’s second paying customer was announced in February 2025 — Adcock left the company’s name undisclosed, but mentioned that it was one of the biggest companies in the US: “Between both customers, we believe there is a path to 100K robots over the next four years”.

Figure has also established partnerships with two leading technology companies, Microsoft and NVIDIA, both of which invested in the company’s Series B round in February 2024. Microsoft powers large-scale training of Helix and related models through its ND H100 GPU clusters, enabling Figure to process massive real-world datasets like the initial 20TB Helix training set.

NVIDIA, meanwhile, supports Figure with full-stack acceleration, spanning simulation, training, and inference, through its libraries, robotics systems, and the GR00T foundation model for general-purpose humanoid control. Figure has previously partnered with OpenAI, which also participated in the company’s Series B round in February 2024, to develop Figure’s natural language capabilities. The partnership was denounced in February 2025, shortly before Figure announced its in-house AI model Helix.

In January 2025, Adcock announced Figure was producing robots at a rate of one per week. Adcock projects high-rate manufacturing of robots to begin in 2025 at Figure’s BotQ facility in California, with an initial production capacity of 12K units per year. He believes building robots and ramping production is not difficult; instead, he emphasizes reliability and cost as the key metrics that Figure is indexing on. With that in mind, he also believes Figure robots will be sold under $20K per unit.

Figure plans to begin manufacturing Figure 03 as the successor to Figure 01 and Figure 02. Adcock sees Figure 01 as the prototype that solidified the humanoid form and hardware choices for future robotic models, Figure 02 as an improvement on Figure 01’s hardware with feature-complete software/hardware integration, and Figure 03 as the model that improves on reliability, cost, and enables high-rate manufacturing. In March 2025, Adcock described Figure 03 as the proudest moment he had in engineering - compared to Figure 02, Figure 03 is smaller, lighter, has better sensors, and all of its body parts are designed specifically for neural nets.

The company has also gained significant traction across social media where Figure releases its product demonstrations. As of March 2025, Figure had 119K followers on Twitter, 131K subscribers on YouTube, 2.8 million views on its most-watched YouTube video, and 35K followers on Instagram. The company had 200 total employees as of March 2025 and was hiring for hundreds of roles.

Valuation

In February 2024, Figure raised a $675 million Series B round at a valuation of $2.6 billion. The round brought the company’s total funding amount to $845 million. Key investors included Microsoft, OpenAI, NVIDIA, Bezos Expeditions, and Intel Capital.

Source: Figure

The Series B round followed a $70 million Series A round from 2023. That round was led by Parkway Venture Capital and joined by participating investments from Adcock, Aliya Capital, Bold Capital Partners, Tamarack Global, FJ Labs, and Till Reuter.

Adcock fully self-funded Figure’s $100 million seed round, highlighting the challenges of securing venture capital for deep tech startups. He noted that many VCs are hesitant to invest in this sector due to the constraints imposed by existing LP mandates, the heavy capital requirements for hardware, longer timelines, and the complexity of deep tech innovation.

In February 2025, Figure was in talks to raise $1.5 billion at a $39.5 billion valuation, in a round led by Align Ventures and Parkway Venture Capital. Setter Capital has indicated that Figure is the 6th most sought-after company in the secondary market as of February 2025.

Source: Setter Capital

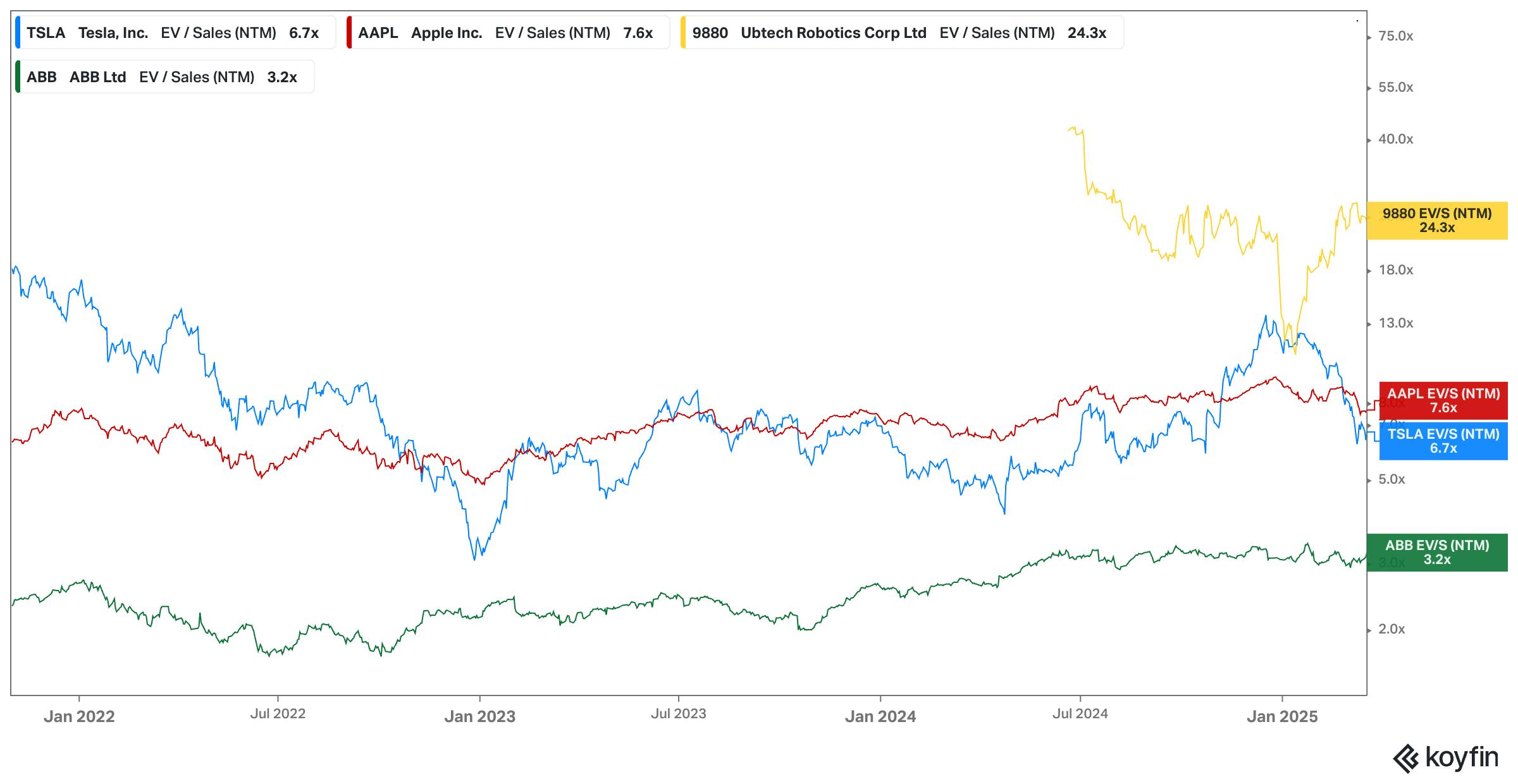

Figure began generating revenue, according to its CEO, as of December 2024 but there are no publicly available revenue numbers. As a proxy, Apple, Tesla, ABB Ltd, and UBTECH are comparable companies that are publicly traded.

Source: Koyfin

Using these companies as a benchmark, NTM revenue multiples range from Apple at 7.6x, Tesla at 6.7x, and ABB at 3.2x, to UBTECH at 24.3x. As an early-stage humanoid robotics company with high capital expenditure requirements before achieving sustainable commercialization, implied revenue multiples should not be taken as a strict roadmap, but instead as a guideline for Figure’s future growth prospects. As Figure releases better models with integrated AI-powered capabilities, its valuation will be influenced by its ability to capture market share and the viability of humanoid robots in labor markets.

Key Opportunities

Robots for Households and Aging Populations

Automation of everyday household tasks and care for aging populations serves as a tailwind for humanoid robotics development. Current estimates suggest that retail consumers represent 2.3 billion households globally, while over 700 million people make up the aging population in need of at-home care.

Source: Goldman Sachs

However, households pose a greater technical challenge than most corporate labor sectors. Homes are unstructured environments with high human density, requiring robots to maintain reliability and safety standards while performing far more advanced tasks. This challenge is reflected in Moravec’s paradox, where relatively simple tasks for humans (laundry, cooking, cleaning) become monumental training hurdles for any household robot.

As a result, Figure plans to enter the consumer household market in the medium term, following successful commercialization in corporate labor sectors. In October 2023, Adcock projected humanoid robots would likely enter households by 2030, after “millions of robots” have been deployed in commercial labor markets. Previews of how Figure robots might integrate into homes can be seen in various showcase videos, including OpenAI Speech-to-Speech Reasoning, Real World Task, and AI Trained Coffee Demo.

Vertical Integration

Peter Thiel has argued that vertically integrated, complex monopolies are an “under-explored modality of technological progress.” Historically, companies that were able to accomplish monopolistic vertical integration were capital-intensive hardware companies. Prominent examples include Standard Oil, Ford, Intel, Tesla, and SpaceX. Thiel continues:

“[Vertical integration is] typically fairly capital intensive [and] we live in a culture where it's very hard to get people to buy into anything that's super complicated and takes very long to build. I think the key to [Tesla and SpaceX] was the complex vertically integrated monopoly structure they had. If you look at Tesla or SpaceX…there was no sort of single massive breakthrough. But what was really impressive was integrating all these pieces together and doing it in a way that was more vertically integrated than most other competitors.”

Figure emulates the vertical integration model to create a sustainable competitive advantage in the robotics industry. Though Figure began with a buy-over-build model to prioritize go-to-market speed, the lack of existing manufacturing expertise and supply chain immaturity forced Figure to vertically integrate every step of the robot production process. According to Adcock, Figure “is vertically integrated and design[s] everything in house: motors, sensors, actuators, structures, battery systems, embedded SW, firmware, controls, AI systems, etc.”

For Figure, vertical integration solves for both cost and speed. By taking control of its design, supply chain, and manufacturing processes, Figure can “reduce individual humanoid unit costs through high-rate volume manufacturing” and prevent go-to-market delays caused by third-party suppliers or manufacturers. As of August 2024, with full vertical integration in place, Adcock plans to drive low-cost, high-volume production in 2025. In an industry where cost efficiency and rapid innovations are critical, vertical integration enables Figure to scale effectively.

Figure’s vertical integration is further supported by trends in manufacturing on-shoring and favorable federal policies, particularly in technology-focused sectors like electric and factory manufacturing. Legislation such as the Infrastructure Investment and Jobs Act ($1.2 trillion in direct spending and incentives), the Inflation Reduction Act ($370 billion in tax incentives), and the CHIPS Act ($50 billion in direct spending) have made domestic manufacturing increasingly attractive amid rising geopolitical risks. By establishing local manufacturing in the US, Figure can take advantage of government incentives, subsidies, and partnerships aimed at bolstering domestic industrial capacity, enhancing its vertical integration efforts.

Key Risks

Graveyard of Attempts

As of 2025, no company has achieved the holy grail, which is to create humanoid robots with integrated AI capabilities for a $50,000 price tag. Figure candidly acknowledges that the path to viable humanoids will be difficult and cautions that the “journey will take decades” along with “billions of dollars invested,” all while facing “high risk and extremely low chances of success.”

Source: McKinsey

Hardware Capabilities

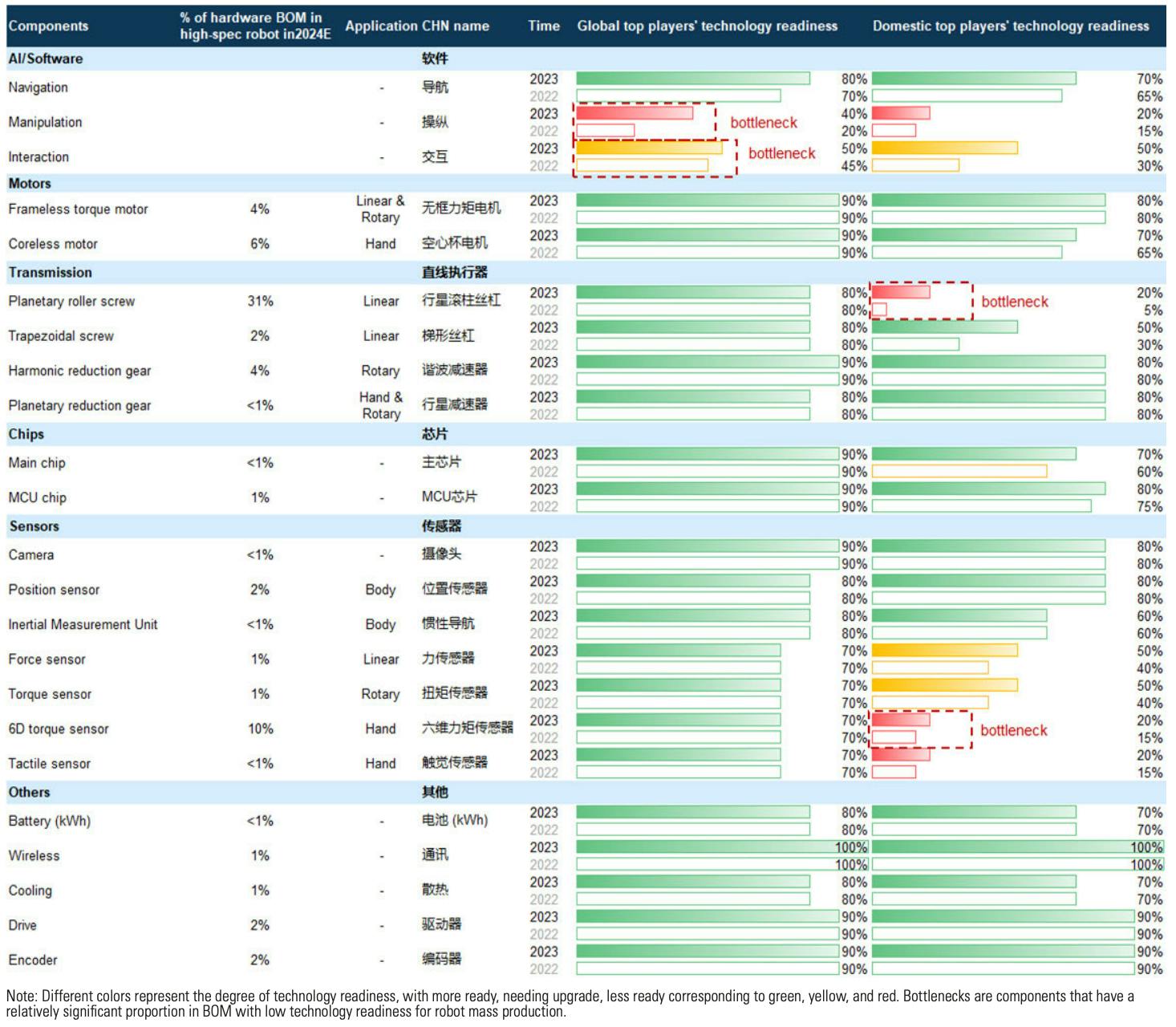

Historically, one of the main obstacles to creating commercially viable humanoid robots has been the lack of sufficiently advanced hardware that can match or exceed human capabilities. Compounding this challenge is the high cost of developing such advanced hardware. For instance, in September 2010, a leading humanoid robot, ASIT’s HRP-4, was priced at $300K. By 2024, the price range for humanoid robots varied significantly, with lower-end models estimated at around $30K and state-of-the-art versions reaching up to $150K per unit.

Source: Goldman Sachs

Despite significant reductions in costs, finding the right balance of power efficiency, mobility, dexterity, and durability in humanoid robots continues to be a persistent challenge, especially due to the immature supply chain for robotic components. Bottlenecks in sourcing and integrating high-quality parts, such as actuators and sensors, into a cohesive system that can reliably perform human tasks across various environments hinder testing speed and machine capabilities. If Figure does not effectively tackle these hardware challenges, it risks producing robots that are either too expensive or unsuitable for practical consumer applications.

Source: Goldman Sachs

Scaling Volume Manufacturing and Cutting Unit Costs

While Figure seeks to reduce unit costs through volume manufacturing, the shift from prototyping to mass production presents significant challenges. Currently, Figure operates with vertical integration due to the absence of third-party manufacturing capabilities and mature supply chains. Scaling up to mass production will necessitate substantial capital investment in building factories and establishing supply chains, further complicated by the lack of existing infrastructure for humanoid robots.

Unlike Tesla, which could leverage existing automotive manufacturing facilities to transition to humanoid robot production, Figure faces the challenge of developing entirely new manufacturing processes and facilities specifically designed for humanoid robots. This entails not only constructing factories but also creating specialized equipment, training a skilled workforce (until the robots are capable of building themselves), and establishing a reliable supply chain for high-precision components that meet the rigorous demands of humanoid robotics. Avoiding volume manufacturing is not an option. Adcock has consistently emphasized that “the only way out is through.” Lowering unit costs and scaling production for commercialization will require Figure to carefully manage its current capital while seeking additional funding to ensure it can grow without compromising go-to-market speed, product quality, or financial stability.

AI/Software Capabilities

The reasoning engine that drives humanoid robots is as crucial as the hardware itself. Without AI models that train robots to execute a range of specialized tasks tailored to specific labor market needs, humanoid robots cannot deliver the quality of work necessary at a reasonable cost to effectively replace humans or non-humanoid robotic models. There are two significant risks involved: first, AI research may struggle to keep up with the demands of humanoid robotics due to a shortage of high-quality training data and second, the integration of AI software with robotic hardware presents substantial challenges.

Though AI models have developed at breakneck speed since the “ChatGPT” moment in 2022, AI progress has since slowed due to diminishing data availability. As companies like OpenAI, Anthropic, Google, and Meta compete to create better models, the amount of data needed increases. Estimates project as many as 60 trillion to 100 trillion tokens of data needed for GPT-5 (GPT-4 was estimated at 12 trillion). According to Paul Villalobos, an AI researcher at Epoch AI, “harnessing all the high-quality language and image data available could still leave a shortfall of 10 trillion to 20 trillion tokens or more.” Even synthetically generated AI data may not serve as a long-term solution, with worries that “increasing synthetic data intake” will “pollute LLM AI models.”

Source: Substack

Figure believes that AI software integration will be the key differentiator among humanoid robotics companies. Recognized as one of the most challenging technical tasks in robotics, successful integration requires seamless communication between software and hardware. This ensures that robots can autonomously interpret sensory data, make decisions, and execute physical actions in real time. Achieving this requires not only highly optimized algorithms that function within the robot's processing power, energy limitations, and physical manipulation capabilities, but also the flexibility to adapt to changing environments.

Integrated AI models must precisely control the robot's movements, coordinating multiple actuators and sensors to replicate human actions accurately. Any discrepancies between software commands and hardware execution can result in compromised labor quality and raise safety concerns. Furthermore, the necessity for ongoing updates, with Figure aiming to implement updates every six months, adds another layer of complexity, as changes in software often require corresponding adjustments in hardware, and vice versa. This creates a resource-intensive cycle of continuous iteration. Without effective integration, Figure will struggle to unlock the full potential of humanoid robots, hindering adoption and limiting their positive impact on industries and society.

Crowded Market

The market for humanoid robots is growing increasingly competitive. From incumbents like Boston Dynamics and the Toyota Research Institute to newcomers like Tesla and Agility Robotics, over 30 established companies are racing to market. Despite this, Adcock and former Figure CTO Pratt remain unconcerned about competition. Pratt remarked “I think it’s just a question of getting there... there’s room for several companies, and I think we can be one of them.”

Source: LinkedIn

Differentiation among robotic models will hinge on the speed of iteration and time to market. However, as hardware becomes commoditized, the strength of software integrations with that hardware will take on greater significance. To sustain its development and market share after commercialization, Figure must carefully manage its speed to market while continually innovating its humanoid robot products to effectively capture market share from competitors.

Source: Global X ETFs

Brett Adcock’s Track Record

Brett Adcock has had professional success in the past, such as building Street of Walls to 30 million unique views and selling Vettery to The Adecco Group for $100 million. However, one potentially concerning sign for the future of Figure is Adcock’s experience building Archer Aviation. While the company went public via SPAC in September 2021 at a market cap of ~$2.3 billion, a figure that has since grown to $4.8 billion by January 2025, the company faces continued skepticism. In addition, despite an indicative order book of $6 billion in December 2024, the company has yet to generate any revenue as of March 2025.

Some research reports have pointed to Archer Aviation’s limited flight activity, recycled video marketing materials, misleading DoD contracts, and partner agreements that were “bought with cheap warrants” as indicators that despite the company’s significant promises, there was limited substance to back them up. In particular, Adcock’s separation agreement from Archer Aviation in April 2022 included accelerated vesting for his shares in, what one August 2023 report called, a “stealthy divorce… [including] accelerated vesting of a huge chunk of insider stock to permit selling sooner (which has commenced), while the circumstances of that breakup have never been fully disclosed for investors to evaluate its materiality.”

In addition, there are questions about the quality of the team that Adcock has assembled at Figure. Despite only having reportedly begun to generate revenue in December 2024, , the company had already filled executive positions like VP of Growth and VP of Commercialization and Capital, many of which were filled by executives who have been with Adcock through Archer, and even Vettery. And while Figure does have director-level positions over more technical operational areas such as humanoid management systems, many of these technical executives previously held roles at Archer over significantly different areas, like vehicle management systems.

In particular, the company’s technical bench in AI seems somewhat limited. The majority of AI engineers joined the company in 2024, and most are relatively junior. Founded in 2022, the company is expected to rapidly grow its technical talent over time. However, a persistent lack of interest from established AI engineers in joining Figure could suggest that its AI potential is overstated.

In a September 2024 interview with Contrary Research, one AI and robotics investor indicated that conversations they had previously had with either former employees or AI researchers familiar with the team led them to believe “the intelligence in the [Figure] robot is near zero.”

If Archer Aviation is a cautionary tale for the potential future of Figure, it causes concerns for the company’s ability to actually commercialize its products and achieve meaningful success. Instead, the downside case could be that Figure is able to attract meaningful hype and attention but could fail to deliver any meaningful results.

Summary

Figure was founded by Brett Adcock in 2022 to liberate humans from manual labor and enhance global productivity. The company’s core product is the Figure humanoid robot series. As of March 2025, the Figure line includes two model iterations, Figure 01 and Figure 02, which feature speech-to-speech user interfaces, onboard VLMs, and advanced manipulation hardware to perform AI-powered autonomous work. At the heart of this system is Helix, Figure’s in-house AI model that enables high-frequency, generalizable robot control - a foundational leap beyond conventional LLMs. Unlike most robotics companies, Figure is vertically integrated across both hardware and AI, designing its own actuators, batteries, and neural control systems from scratch.

By the end of 2025, Figure aims to achieve low-cost, high-volume production of its next-generation model Figure 03 in its BotQ manufacturing facility, focusing on commercial labor opportunities and expanding into consumer household markets by 2030. The company’s success depends on its ability to maintain rapid technology iteration, software-hardware integration, and cost-effective manufacturing scaling. If it succeeds, Figure could become the defining company of a new technological era, bringing embodied AI into the workforce and eventually into everyday life.