Thesis

According to recent data from the FBI, only 50% of homicides in 2020 were resolved by police — down from more than 90% in the 1960s. The clearance rate for other types of violent crime, including manslaughter, and assault, have also seen notable decades-long declines since the 1980s, and everyone from law enforcement agencies to homeowners associations are looking for more efficient ways to prevent and solve crimes.

A significant point of leverage in increasing crime clearance rates is improving video surveillance, particularly with the use of ALPR (automatic license plate reader) cameras, as more than 70% of crimes involve the use of a vehicle by the criminal which allows for identification via license plate number, car type, and car color. In 2021, the ALPR industry was estimated to be a $2.6 billion market, but incumbent products are often expensive and only accessible for well-funded police departments and wealthy neighborhoods. There is significant room for growth.

This is where Flock Safety comes in. By employing cloud-based video analytics, and AI-powered computer vision, Flock Safety’s ALPR and other surveillance products cost significantly less than leading incumbents, allowing for customers to cover a greater area with the same amount of funding compared to legacy products. As of late 2022, Flock Safety was reported to be helping solve 5% of all reported crimes across the US.

Founding Story

Flock Safety was founded in 2017 by CEO Garrett Langley after he was the victim of a property crime in Atlanta. Police were unable to help him track down the suspects because of a lack of evidence. In the process he spoke to a sergeant who recommended that Langley file an insurance claim, and he also learned that getting a criminal’s license plate number was typically critical in helping detectives solve a case, but that legacy license plate readers were too expensive to roll out across a whole county.

He saw an opportunity for a company to help make law enforcement cheaper and more efficient. He then brought on co-founder and CTO Matt Feury along with early employees Paige Todd and Bailey Quintrell prior to publicly launching Flock Safety in March 2017.

Product

Flock Safety describes itself as a “public safety operating system for cities that helps communities and law enforcement eliminate crime, protect privacy, and mitigate bias.” Its surveillance products include relatively low cost ALPR cameras, a gun-shot audio detector, and a location-flexible license-plate reader for quick deployment. These devices feed into a centralized database called “Flock OS” that allows customers to use a local and national search network to find a suspect vehicle across state lines, including “up to 1 billion monthly plate reads” of data.

The value proposition of Flock Safety is the cost-efficiency of its products vs. legacy solutions. Compared to leading competitors, the company claims a city can deploy 20x more ALPR devices at the same cost. Communities that use Flock Safety have reported a 90% decline in package and mail theft, and cities like San Marino, California reported a 70% reduction in crime using Flock Safety. Another district with 1 million annual visitors reported a 46% decline in car break-ins and a 25% decline in vehicle thefts. The company also claims that neighborhoods using Flock Safety see $40K in annual savings compared to installing a physical gate.

Flock Cameras: Falcon & Sparrow

Source: Flock Safety

Flock Safety’s flagship product is its Automatic License Plate Reader (ALPR) cameras including the Flock Safety Sparrow and the Falcon Flex. ALPR cameras take pictures of license plates that are on the back of cars using infrastructure light. Once all permits and regulations are met, the company installs a pole with a solar panel, and mounts the camera on it.

Flock Safety cameras use solar power and LTE connectivity, reducing power costs and increasing speed to deployment. The company’s “Vehicle Fingerprint” technology capture information beyond license plates including vehicle type, make, color, license plate state, missing / covered plates, bumper stickers, decals, and roof racks. The cameras can capture license plates up to 100 feet away and up to two lanes of traffic per camera, and the company claims that its ALPR cameras have a 97% capture rate. Once the ALPR camera captures the image, it feeds the image and the encompassing metadata that it gathers with its Vehicle Fingerprint technology into Flock Safety’s database (Flock OS).

Flock Safety stores camera footage for 30 days before permanently deleting the footage to preserve privacy and security, and has two different types of ALPR Cameras designed for different customers and use cases.

Flock Safety Falcon & Falcon Flex: The Falcon Camera is the main ALPR system that captures evidence and notifies police. The Falcon Flex is similar to the Falcon but also contains a portable mount so that the customer can easily move the camera to different locations as needed. So, if a town was to host a marathon, for example, in a place where cameras weren’t covering the main areas, the town would be able to move the cameras.

Flock Safety Sparrow: The second ALPR Camera is the Flock Safety Sparrow designed only for private communities and not law enforcement. This camera is a less expensive product that captures additional evidence and footage but uploads slower and doesn’t have all of the same software capabilities, such as real-time alerts to police.

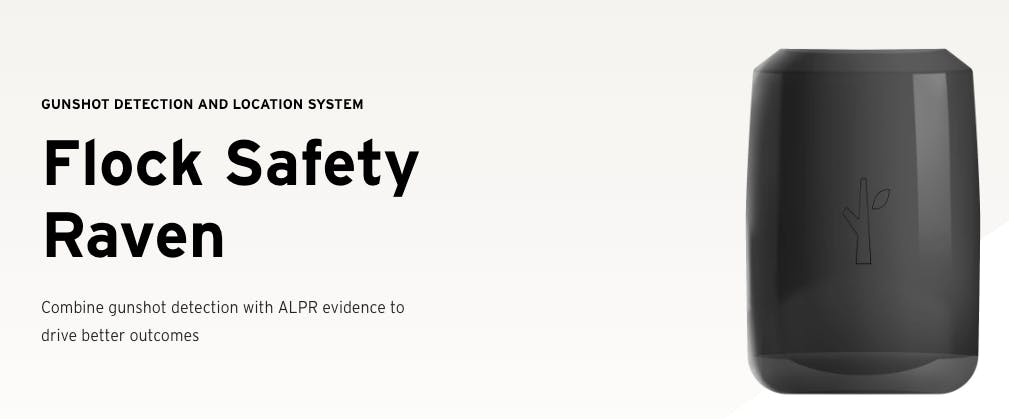

Flock Safety Gun-Shot Audio Detector: Raven

Source: Flock Safety

Flock Safety’s growth strategy includes building adjacent hardware products that interact with the ALPR to reduce crime. The Flock Safety Raven is an audio detection device that detects gunshots, logs the location, and notifies police of the situation. Simultaneously, the ALPR camera captures nearby vehicle details. The company claims that the Raven contains 90% detection accuracy, under 60 seconds to dispatch police, and 90 feet gunshot location accuracy.

Market

Customer

There are two main use cases for Flock Safety’s customers. First, the cameras notify police if a wanted license plate is captured by one of the cameras, allowing police to respond in real-time to hot list alerts. Second, using the Flock OS database the customer can filter through all of the metadata to find a license plate of a crime that was already committed and gather leads.

For example, let’s say someone with a red Ford Mustang just committed a crime, and the only lead from witnesses was a description of the suspect’s car. Through Flock Safety’s searchable repository, instead of having to analyze all camera footage, the customer can filter footage for “Coupe”, “Ford”, “Red”, and the repository will show all the photographs of that description recorded by the Flock Safety camera. This saves the customer time since with other ALPRs they would likely need to go through thousands of reads before finding the red Ford Mustang.

Flock Safety currently has two core customer segments including HOAs and law enforcement agencies such as local police departments, with plans to expand to more effectively serve local businesses

Homeowners Associations (HOAs) and Neighborhoods: HOA’s are private organizations that oversee the management of some residential communities. Flock Safety targeted HOA’s first in its go-to-market motion and HOA’s still represent over 40% of the business as of 2021. Part of the HOA’s role is to ensure an improvement in neighborhood security and protect home values.

Law Enforcement: Includes both small-town and big city police departments. Flock Safety’s ALPR cameras helps law enforcement automate investigative leads so that they can get the first lead faster to solve crimes. In addition to local police departments, Flock Safety also said that they have a partnership with the FBI that allows them to monitor cameras for a quarter of a million wanted vehicles from the FBI’s database.

Businesses: Besides HOAs and law enforcement, the company is looking to expand by providing its solution to businesses, residential real estate, improvement districts, schools, and builders who are looking to reduce organized retail crime, vehicle break-ins, banned guests, property crimes, and parking lot crimes.

Market Size

There are about 18K state and local law enforcements in the USA, 12.5K of which are local police departments, and there are over 370K homeowner associations in the United States, representing over 40 million households. The ALPR industry was estimated to be valued at a $2.6 billion market size as of 2021 and projected to be worth $5.8 billion by 2030, a 10% CAGR.

Competition

Motorola

Source: Motorola

Prior to Flock Safety’s arrival, Motorola’s expensive ALPRs were one of the few product options available to most police departments, but Motorola has seen quick encroachment on its market position by Flock Safety ever since it launched due to Flock Safety’s cost-efficiency and technology advantages.

In early 2021, in a bid to keep up with the challenge posed by Flock Safety, Motorola acquired VaaS International Holdings, which focuses on AI-driven image capture and analysis, for $445 million. One of its subsidiaries was Vigilant Solutions, which focused on ALPR for law enforcement. VaaS’s revenue was expected to be $100 million in 2019.

Motorola entered direct competition with Flock Safety by launching the L6Q LPR Camera System, a similar system to Flock Safety’s Falcon hardware. Motorola claims that the scan collects make, model, color, and speed. One advantage to Motorola is that it also sells fixed video systems, in-car systems, and body-worn camera, making the company an all-in-one bundle provider to a law enforcement agency.

In one interview in August 2021 with a Former executive at Flock Safety, they noted that Motorola’s Vigilant Solutions had become Flock Safety’s biggest competitor and the two companies compete head-to-head mostly in law enforcement deals, and not HOA deals.

At the time of this interview, Motorola’s Vigilant operated with an ownership business model so police had to spend more upfront in order to buy the camera, compared to Flock Safety’s leasing business model. The employee also noted that Flock Safety would win deals over Vigilant due to its search experience and database advantage. On the other hand, Vigilant would occasionally win deals over Flock Safety in the north due to issues getting sunlight to the solar panels and the Vigilant camera outperforming Flock Safety’s in nighttime pictures.

Rekor

Rekor utilizes AI and machine learning to recognize license plates, does advanced searches of footage based on license plate number and vehicle descriptions, and contains a fully automated compliance system. Rekor’s model is different from Flock Safety’s. The company doesn’t have its own hardware. It’s a cloud only model that takes data from third party hardware and integrates the data to create a searchable repository similar to what Flock Safety has.

Verkada

Verkada is another competitor to Flock Safety and it takes a different hardware approach to ALPRs. The company uses a dual-camera system, one that captures the license plate, and a context camera that provides video evidence for each read. Verkada’s LPR product is one of many in its security and surveillance offerings, so it focuses on much more than LPR use cases. The company currently has over 15K customers.

Business Model

Flock Safety refers to its business model as a “public safety-as-a-service”, meaning that the company offers its products under a leasing model through an annual subscription rather than directly for purchase. Flock Safety’s ALPR cameras minimum of $2,400 annually with a one-time installation cost of $350. Maintenance, footage hosting, cell service, and software upgrades are included in the subscription price.

The advantage to this model is that the customer can take a more hands-off approach to handling the ALPR cameras. This model also better aligns incentives between Flock Safety and the customer; whenever Flock Safety comes out with an updated camera, they replace the legacy camera with the new camera for free so that customers aren’t stuck with legacy technology. Additionally, the subscription is less of an upfront cost for the customer, so Flock Safety must prove out its value proposition early in order to ensure that the customer renews. This approach is not without precedent in the policing industry; for example, Axon (formerly known as Taser) also previously transitioned from selling hardware to a subscription-based business.

Flock Safety’s Network Effect

As Flock Safety’s user base grows, their product performance improves. There are two components to this. First, HOAs opt to share the data from their Flock Safety Cameras with local law enforcement. That gives local law enforcement the ability to analyze more cameras in their city than what they bought for just their department. Second, Flock Safety’s TALON network lets police departments opt-in to share ALPR data (that the department personally purchased, not the HOA cameras) with other departments, providing real-time information sharing across jurisdictions in over 700 cities at zero additional costs.

For example, an interview with the Head of Technology at one Utah police department paid for 52 cameras through Flock Safety, yet has access to 141 different cameras from HOAs in the area and this police department has access to 988 cameras by sharing data feeds with neighboring police departments in other jurisdictions. This interconnected system creates a network effect, since as more Flock Safety devices gets deployed within a locale, there is then more evidence to share and solve crimes.

Traction

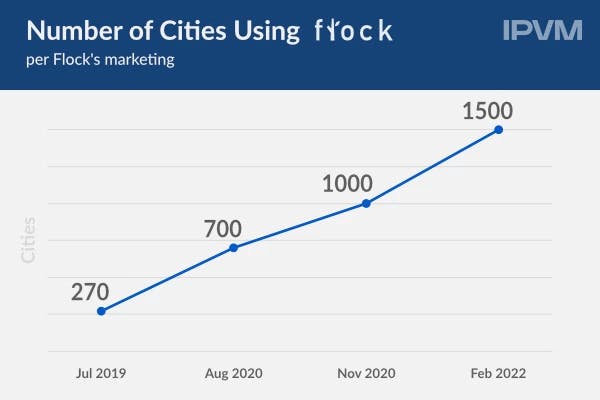

Flock Safety has sold its product to over 2.5K communities as of early 2023, including 2K law enforcement agencies, which demonstrates Flock Safety’s success in expanding its go to market motion outside of just HOAs. Flock Safety also now operates in over 42 states. The company has not publicly disclosed revenue figures; however, most cities using ALPRs are purchasing ~10-20 cameras. If the average Flock Safety customers purchased 10-20 cameras at the annual subscription price point of $2.4K, the company would be generating $48-96 million in ARR. This excludes installation fees, and any additional products sold such as the Raven Gun Shot Detector.

Source: IPVM

Through the ALPR cameras, Flock Safety captures over 1 billion vehicle license plates per month, and customers’ communities have reported up to a 70% reduction in crime. The company notes that it believes the most important statistic about the company is that its technology is being used to solve about 5% of all reported crimes in the US as of November 2022.

Valuation

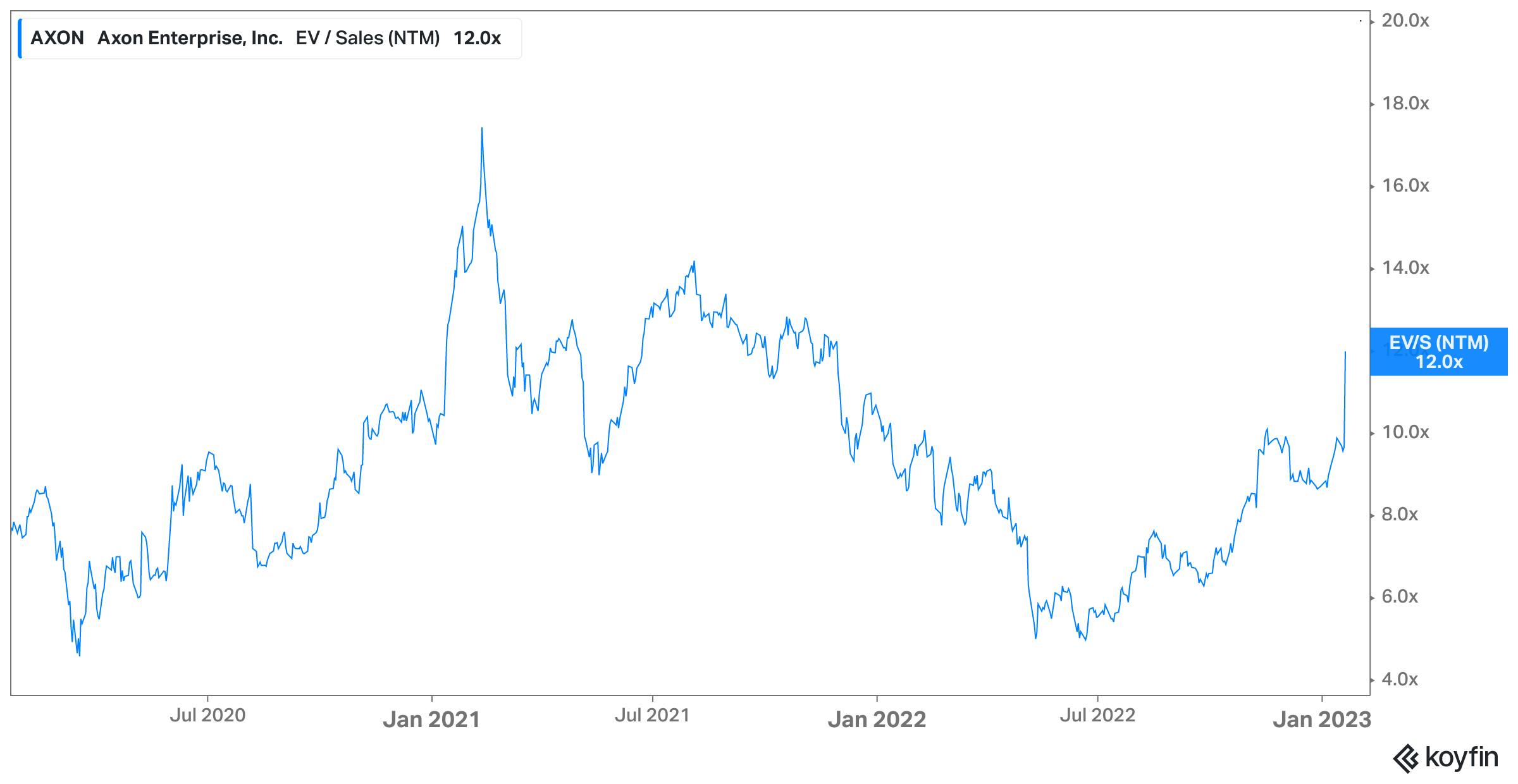

In February 2022, Flock Safety raised a $150 million Series E led by Tiger Global at a $3.5 billion valuation. Based on our estimates of the companies revenue at ~48-96 million ARR as of early 2023, that $3.5 billion valuation would represent a range of 36-73x ARR multiple for Flock Safety. Axon Enterprise is a similar company to Flock Safety, focusing on public safety, selling to police departments, and containing a similar subscription business model. As of January 2023, Axon is trading at ~12x NTM revenue after dropping from an early 2021 peak of ~18x NTM revenue.

Source: Koyfin

Key Opportunities

Adding Additional Customers

Given that Flock Safety is only working with over 2K police departments, there is plenty of runway to land more of the almost 18K law enforcement agencies and 370K HOAs across the US. Additionally, Flock Safety has the potential to win customers in other verticals such as schools, hospitals, businesses, and apartment complex. For example, a Chief of Police at one police department noted in one interview that a liberal arts college, business owners, and residents were all funding Flock Safety cameras and sharing the data with the police department.

Existing Customer Expansion

Flock Safety can expand within its current customer base in two main ways. First, lease more cameras to them. If the customer leases a select number of cameras and determines that there is a clear value proposition for the product, they may be interested in adding more cameras to their fleet to secure more locations. Second, the company can cross-sell to these customers with additional hardware products. These products shouldn’t be viewed as totally separate from the core ALPR hardware, rather they are additional use cases that work well in tandem with the ALPR system. The company has started to do this with its gun-shot detector product, Raven. The company has also indicated that it intends to build hardware around combatting illegal street racing.

Hardware and Software Updates

What separates Flock Safety from some of its competition is the leasing business model that gives Flock Safety the ability to replace hardware and ship software at no additional cost to the customer. Flock Safety has the opportunity to pull away from the competition by improving its cameras, search capabilities, and layering additional integrations like traditional surveillance to make Flock Safety a one-stop solution.

Key Risks

Privacy Issues

There are concerns about whether Flock Safety is building an AI driven mass-surveillance system. The ACLU published a 13-page paper outlining concerns about the company and the industry as a whole. Having ALPR cameras deployed across the country can raise privacy concerns for the neighborhoods being surveilled. Flock Safety needs to be thoughtful of whether ALPRs violate a citizen's right to privacy. Even if the products don’t technically violate privacy, having enough people who are skeptical of surveillance systems would lead to long term damage to the brand.

Flock Safety has taken steps to address these issues. The company doesn’t do any facial recognition. Data is owned by the customer and not sent to 3rd parties. Camera footage is deleted after 30 days. Additionally, the company creates an audit trail for every search in the database, and every search for footage requires a specific reason for why the search is occurring.

Displacing Crime

Flock Safety has demonstrated success by reducing crime, but criminals could easily determine where cameras are located and, instead, commit crime away from where the devices are installed. This is a risk to Flock Safety in the sense that it may not fulfill its mission of solving crime if the product is just moving crime elsewhere instead of being deterred overall. However, it may also be an opportunity, as cities might feel that they are at more risk of criminal activity if neighboring cities have ALPR cameras and they don't. The result of this could be a domino effect where cities that don’t have ALPR cameras now need them more, leading to more purchases for Flock Safety.

Difficulty Securing New Contracts

Working with local agencies and HOAs may be difficult because each has its own rules and regulations that Flock Safety needs to comply with. Some examples may include where poles can be placed on the ground, where the cameras can be located, and whether police departments can procure through leasing hardware or do they have to actually purchase the equipment. The impact of working locally is that it could lengthen sales cycles and delay speed to deployment.

Summary

Flock Safety sells ALPR cameras as a leasing model at an attractive price given its value proposition to aid law enforcement in preventing and solving crime by providing objective evidence. The company first started selling to HOAs, moved to selling to law enforcement, and is now expanding to more customers and use cases. Since HOA’s share camera feeds with local law enforcement, and law enforcement shares with each other through Talon, there is a network effect where more devices deployed leads to more evidence to solve crimes. Flock Safety has the opportunity to expand to more cities. However, citizens may feel uncomfortable with the network that Flock Safety is creating. It will be important to monitor the brand perception of the company moving forward.