Thesis

The enterprise security landscape has evolved as traditional analog systems give way to cloud-based digital solutions. This change has been fueled by technological advancements as well as the growing need for real-time monitoring, data analytics, and remote access. Global security and risk management spending was $150.4 billion in 2021. This figure grew to $188.1 billion in 2023 and is projected to reach $215 billion in 2024, with growth driven by societal changes like fewer in-person security guards and growing enterprise concern about crime.

Concurrently, the Internet of Things (IoT) has accelerated the adoption of smart devices, with enterprise IoT spending growing from $128.9 billion in 2020 to $201 billion in 2022. The proliferation of smart devices has created an extensive ecosystem of interconnected sensors, cameras, and other devices that can be centrally managed and analyzed to bolster security measures and streamline operations.

The growing need for enterprise security and advancements in physical security technology have together led to an increased demand for integrated security solutions. The global physical security market, which includes video surveillance, access control, and intrusion detection, was valued at $127 billion in 2022 with an expected CAGR of 6.8%. In addition, the growing prevalence of cyber threats and physical security threats have contributed to the expansion of the enterprise security market. This combination of factors presents an opportunity for businesses seeking to provide solutions for securing organizations and enterprises against potential threats.

This is where Verkada comes in. Verkada is a technology company that offers enterprise security systems that combine modern hardware with intelligent, cloud-based software. Verkada is positioning itself to address the increasing demand for modern enterprise security solutions. Verkada’s hardware and software offerings combine into a fully integrated subscription-based product for video security, access control, and physical security. The company seeks to distinguish itself from market incumbents by offering a broad suite of direct-to-cloud products.

Founding Story

Verkada was founded in 2016 by Filip Kaliszan (CEO), Benjamin Bercovitz, James Ren (Software Architect), and Hans Robertson (Executive Chairman). Kaliszan, Bercovitz, and Ren previously worked together on CourseRank, a class data aggregation platform. They started CourseRank when they were still students at Stanford and sold the company to Chegg in 2010.

Robertson, meanwhile, had co-founded Meraki before founding Verkada. Meraki was a networking business that was acquired by Cisco for $1.2 billion in 2012, which gave him experience in creating hybrid hardware and cloud software products for enterprise customers.

Both Kaliszan and Robertson experienced issues with existing enterprise video security products, which motivated them to build a better solution. In 2012, Robertson faced a break-in at Meraki. When he consulted the company’s security system to find footage of the theft of the 50 iPads that had been stolen, it turned out that the video wasn’t working and it had not been operational for months. This led him to look for other products in the market, but he could find nothing effective.

Meanwhile, also in 2012, Kaliszan sold his first company and bought a house in which he wanted to install a security system. He assumed that the best product would be an enterprise-grade system, but he found to his disappointment that despite their costliness, the enterprise video security products were not very good. This remained true when the founding team began searching for a new business idea years later, which led to the founding of Verkada with the intent of developing a modern, secure, and user-friendly video security system for enterprises.

Product

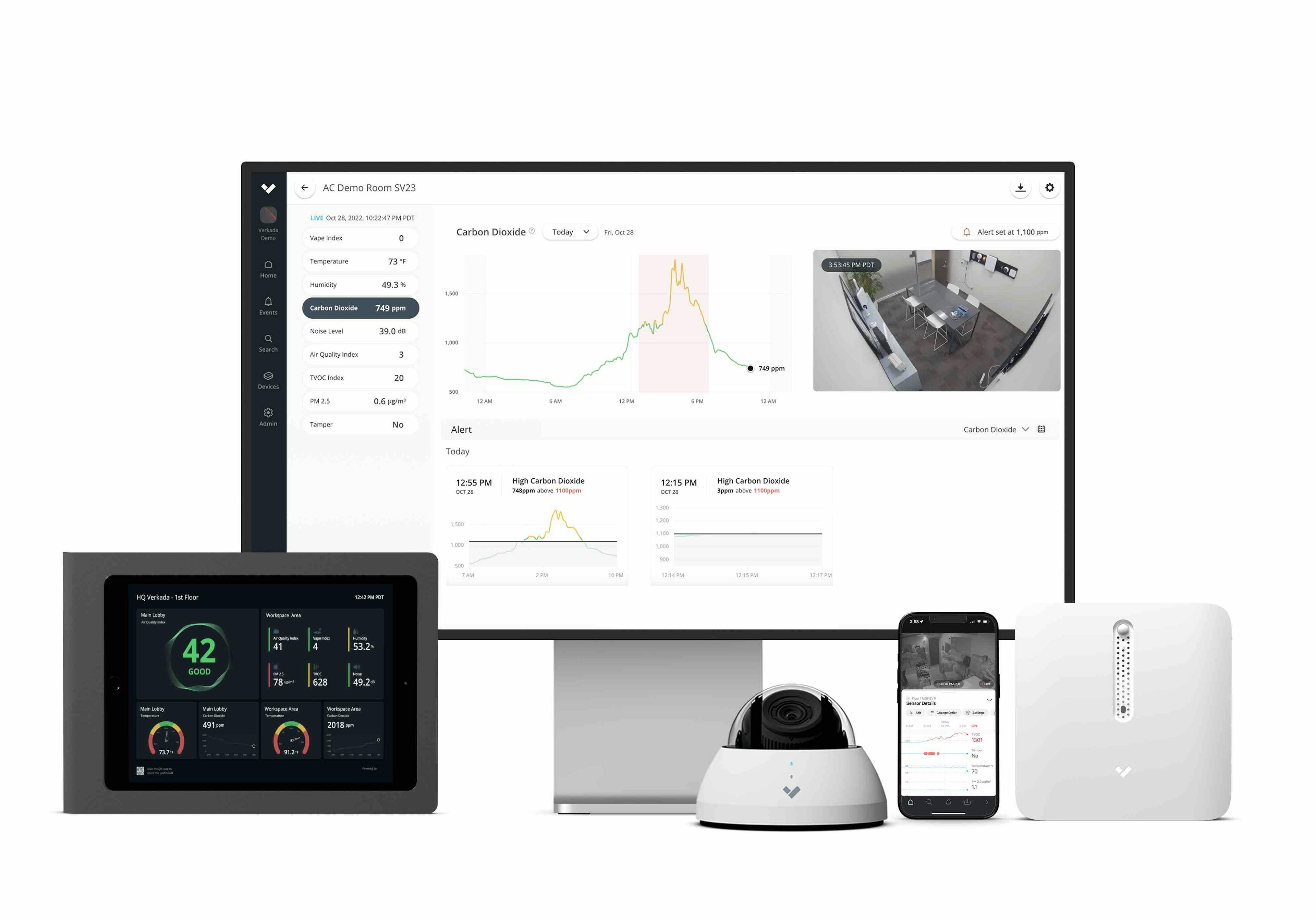

Verkada offers a suite of cloud-based surveillance and access control products designed to simplify security management. Verkada products include high-resolution security cameras, door access controllers, environmental sensors, and a centralized software platform. Its hardware product offerings are managed by the Verkada Command software platform.

Platform

Source: Verkada

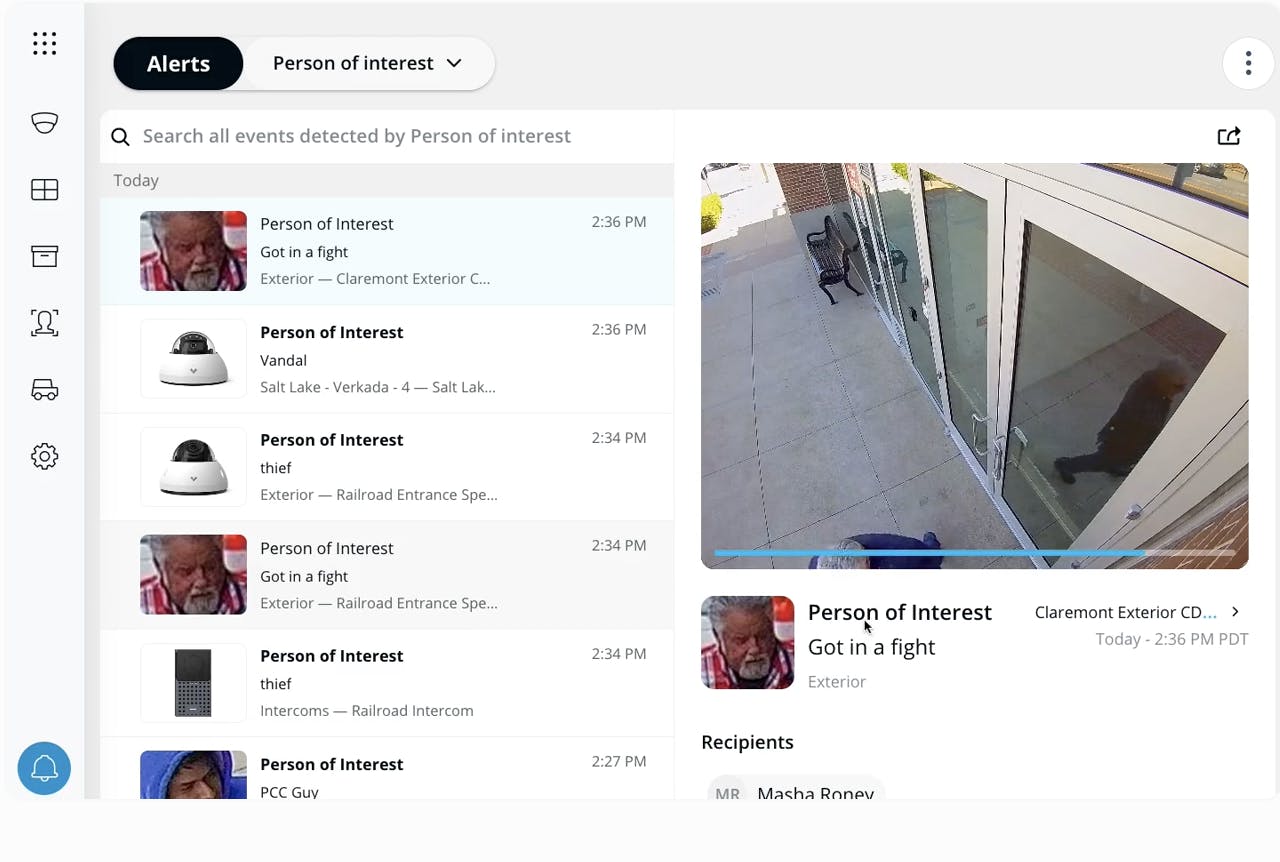

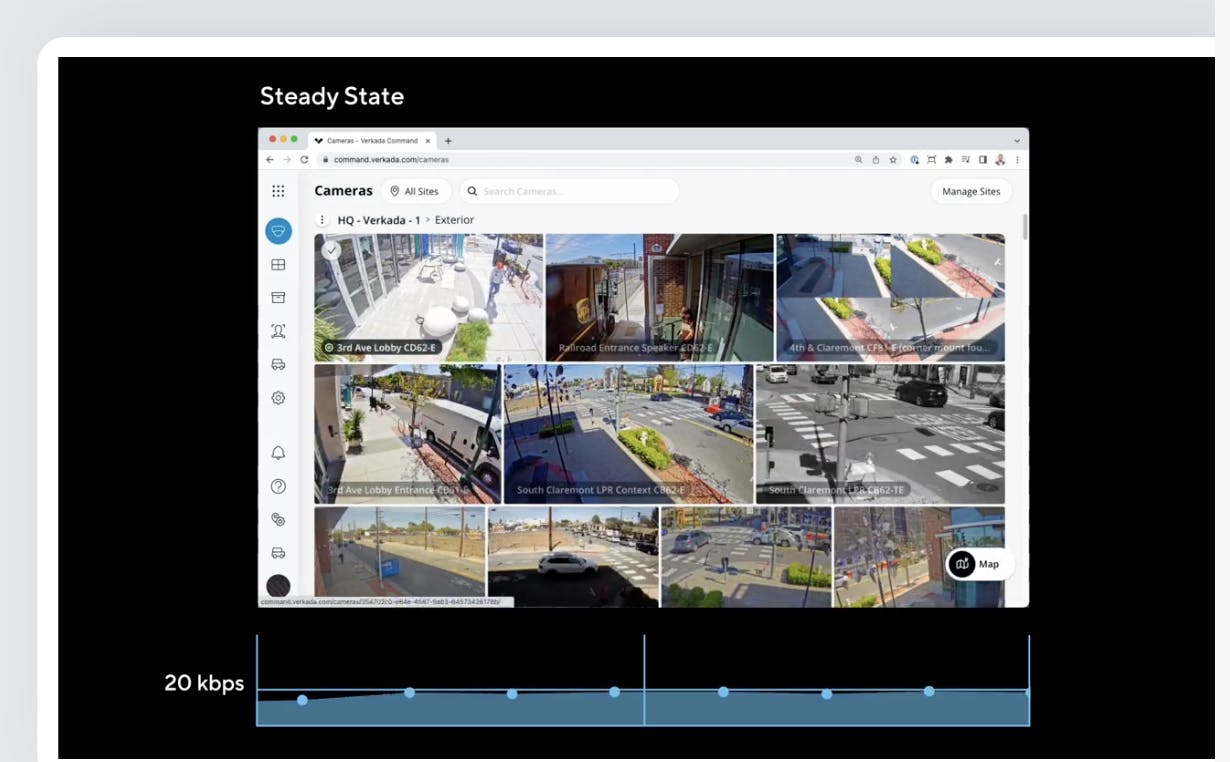

Verkada Command is a cloud-based software platform that centralizes the management and monitoring of Verkada's suite of security products, including surveillance cameras and access control systems. Accessible via a web browser or mobile app, Command allows users to view live and recorded video footage, manage user access permissions, and configure device settings from a single user interface.

Video Security

Source: Verkada

Verkada offers a suite of security camera products that integrate natively with the company’s Command platform. The integration of Verkada’s security cameras with its Command platform is meant to enable a quicker, easier setup relative to competitors.

Verkada’s video security cameras provide live and recorded video feeds and enable the Command platform to send alerts to users based on predefined parameters like motion detection, object recognition, or even facial recognition in most states. As of February 2024, Verkada offers six camera models: the Dome Series, the Bullet Series, the Mini Series, the Fisheye Series, the Multisensor Series, and the Pan-Tilt-Zoom (PTZ) Series.

Access Control

Source: Verkada

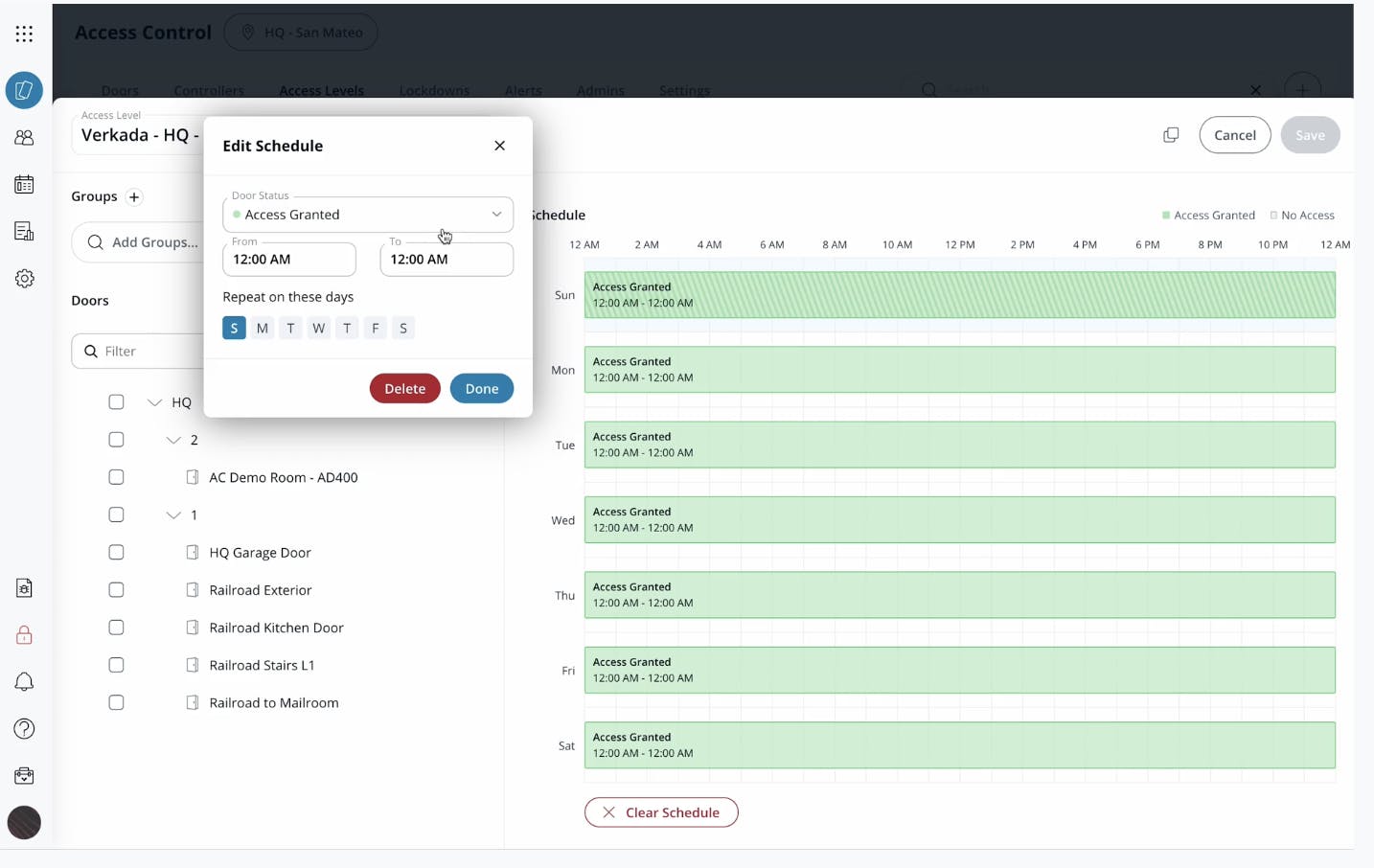

Verkada’s Access Control is a suite of products that enables organizations to manage physical entry points at multiple locations, such as doors and gates, through its Command platform. The access control hardware, comprised of electronic door controllers and card readers, integrates natively with Verkada’s Command software.

Users can grant or revoke access permissions for individuals or groups based on factors such as time, location, and security clearance. The Access Control product complements Verkada’s video security offerings, allowing for video footage to be correlated with access events in the Command platform.

Intercom

Source: Verkada

Verkada’s Intercom product is a cloud-based communication system that facilitates secure entry management. The Intercom consists of a video receiver that can communicate with Verkada’s Command app on a web browser, the Verkada Pass app on mobile, or directly to a phone number. The Intercom system supports two-way audio communication and video verification, allowing authorized personnel to remotely grant or deny access to visitors.

Air Quality

Source: Verkada

Verkada's Air Quality product is an IoT-enabled environmental sensor designed to monitor and analyze indoor air quality in real time. The sensor integrates with Verkada's existing products and Command platform, offering a unified platform for facility management. Data collected by the air quality sensors is stored and analyzed in the cloud, allowing administrators to access historical trends, receive alerts on potential issues, and remotely manage the devices from any internet-connected device.

Workplace

Source: Verkada

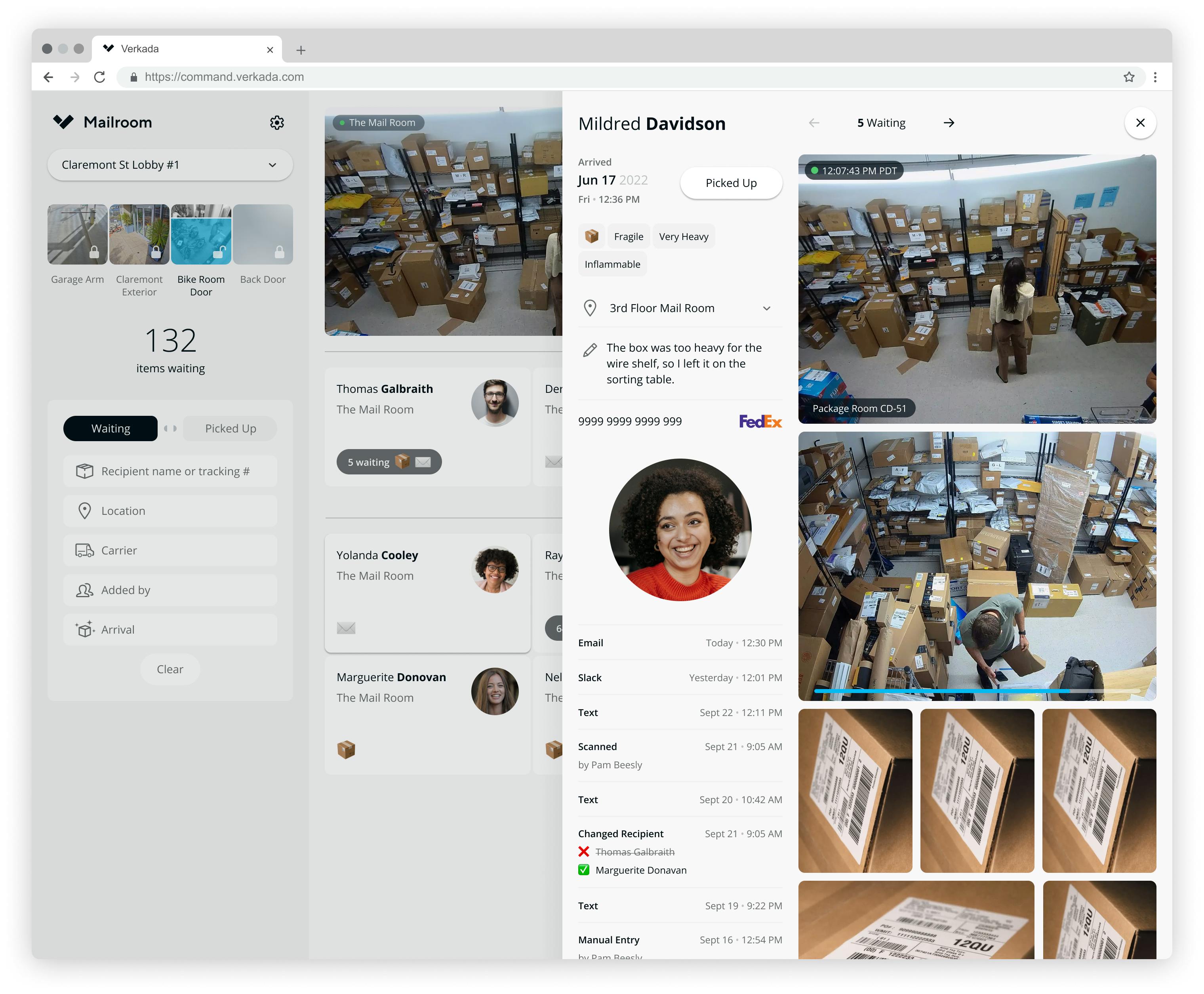

Verkada’s Workplace product is a set of services that streamline workplace operations like checking in guests and receiving mailroom deliveries. Verkada Guest is a visitor management system that streamlines the guest check-in process and works with Verkada’s video security and access control offerings.

Verkada Mailroom is a package tracking and delivery management solution that helps organizations handle incoming packages and mail. After scanning a package label with the Verkada Mailroom app, the app sends notifications to the intended recipients and secures the package until pickup by working with Verkada’s video security products.

Alarms

Source: Verkada

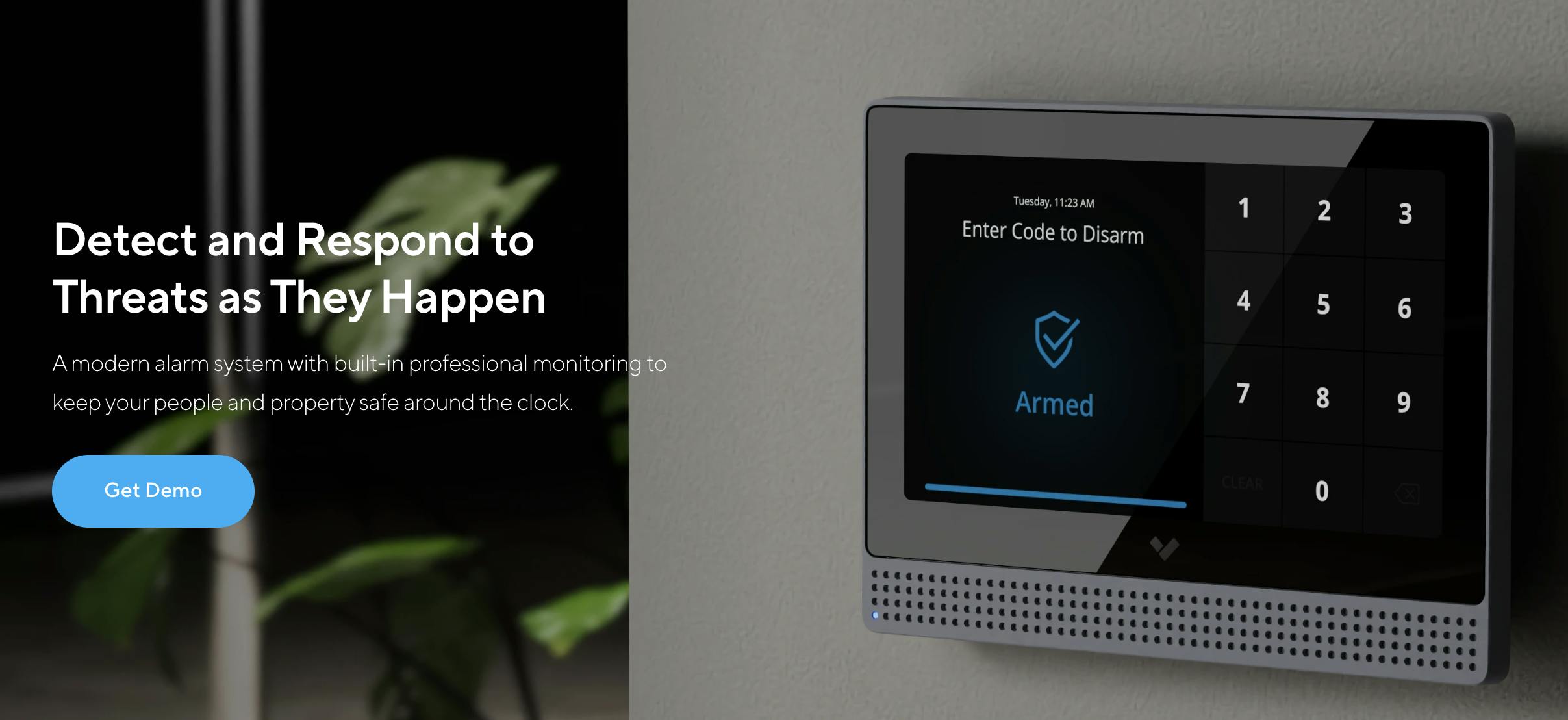

Alarms is Verkada’s integrated security solution for intrusion detection, deterrence, and response. The Alarms product offering consists of several services and offerings:

Monitoring: Verkada offers a monitoring service with operators evaluating live footage where customers can determine the areas to cover, arm/disarm schedule, and how operators should respond to potential threats.

Intrusion Detection: Wireless intrusion sensors and alarm panels allow customers to detect potential intrusions.

Intrusion Deterrence: Speakers and alarm consoles also enable customers to deter threats by playing sound or speaking to would-be intruders.

Panic Buttons: Customizable panic buttons allow users to call for help. Panic Buttons integrate with with Verkada’s video security products to provide video footage of where and when a panic button was pressed.

Market

Customer

Verkada's ideal customer profile includes any enterprise or organization with physical facilities that need to be secured. This includes businesses of all sizes, ranging from small and medium-sized enterprises to large corporations, as well as public institutions such as schools, hospitals, and government agencies.

Because Verkada’s products are cloud-based and don’t require on-premise servers, the company targets customers who have difficulty with or a limited appetite for maintaining an in-house IT team that would normally manage an on-premise security system. Verkada’s offerings with environmental sensors also broaden the company’s reach to customers in industries with specific environmental requirements, such as manufacturing, data centers, and pharmaceuticals.

Source: Verkada

As of February 2024, Verkada had over 20K customers across a variety of industries. Notable customers representative of the various industries that Verkada serves include Cloudflare, Goodwill, the YMCA, Joe & the Juice, Equinox, Virgin Hyperloop, People’s National Bank, and Pasadena City College.

Market Size

Verkada serves the enterprise physical security market, which includes video surveillance and access control segments. The global video surveillance market was valued at $42.9 billion in 2019 and is expected to grow at a CAGR of 14.6% to reach $144.9 billion by 2027, whereas the access control market was valued at $10.3 billion in 2019 and is projected to expand at an 8.7% CAGR to reach $20 billion by 2027.

Key drivers for growth in these markets include increasing security concerns, rapid technological advancements, and the rising adoption of cloud-based services and IoT devices. Security system integrators see a promising future, with 65% of respondents in a survey rating the current state of the video surveillance market as “Excellent / Very Good.” Verkada's integrated security solutions position the company to capitalize on the growing demand for comprehensive security systems.

Competition

Axis Communications: Axis Communications is a Swedish manufacturer of video cameras, access control hardware, and other physical security devices. Operating as an independent subsidiary of Canon since its acquisition in 2015, Axis has been manufacturing security devices for 40 years since its founding in 1984. In an industry group survey from January 2022, Axis was rated the favorite camera manufacturer of video security integrators and considered a market leader in the video surveillance market. With $1.6 billion in revenue in 2022, Axis competes against Verkada with its security camera and access control hardware offerings.

Hanhwa Vision: Hanhwa Vision is a video security company that manufactures video camera hardware. Founded in 1977, Hanwha Vision operates as a subsidiary of the South Korean business conglomerate, Hanwha Group. Hanhwa has grown considerably since acquiring Samsung’s video surveillance business in 2014 and has benefitted from market leader Axis experiencing supply shortages in the immediate aftermath of the COVID-19 pandemic.

Hanwha Vision, having surpassed one trillion won in revenue (~$750 million) in 2022, has grown its market position considerably and competes with Verkada in the security camera hardware and video management software (VMS) segments. Hanwha’s VMS offering was the highest-ranked VMS when surveyed by security system integrators in 2023.

Avigilon: Avigilon is a Canadian subsidiary of Motorola that specializes in surveillance cameras, access control products, and video management software. Founded in 2004, Avigilon went public in 2011 and was acquired by Motorola in 2018 for $1 billion. Security system integrators rated Avigilon as their #3 favorite camera manufacturer and their #1 VMS product in 2020.

With existing product offerings in video security, Avigilon’s parent company Motorola is making significant investments in related areas. For example, in 2021, Motorola acquired Openpath, a cloud-based access control provider. Also in 2021, Motorola acquired Envysion, an enterprise video security company that provided video security solutions as a subscription service. Then, in 2022, Motorola acquired Ava, a cloud-based video security analytics provider. These acquisitions, particularly in the access control space and the shift to cloud-based providers, offer direct competition to several segments of Verkada’s product portfolio.

Spot AI: Founded in 2018, Spot AI is a video security and analytics company that positions itself as a competitor to Verkada in the video surveillance industry. Spot AI's software platform leverages AI algorithms and machine learning to enable real-time video analytics, object detection, and event recognition in both cloud and on-premise deployments. Spot AI has gained traction with enterprise clients across various sectors, including retail, healthcare, and manufacturing. In November 2022, Spot AI closed a $40 million Series B funding round led by Scale Venture Partners, bringing its total funding to $62 million. Spot AI's software technology has positioned the company as a competitor to Verkada’s Command platform.

Business Model

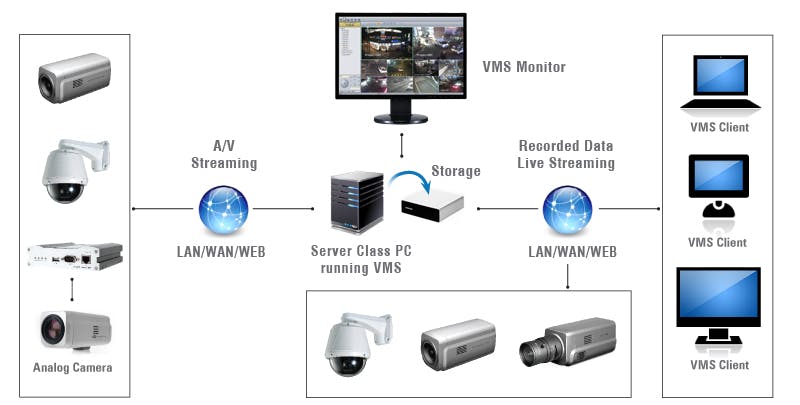

Verkada operates a subscription-based business model that combines integrated hardware and software in a direct-to-cloud security solution. The company has a VSaaS (video surveillance as a service) model, meant to disrupt the traditional enterprise security model. This traditional model typically involves the following components:

(Analog) Camera: Verkada offers video cameras that capture footage and stream the video to an on-prem server or storage. The customer generally pays a one-time fee for the purchase and installation of the cameras. Verkada cameras typically adhere to a number of industry standards and the customer has the freedom to purchase and use cameras from any company.

Server Hardware: Verkada offers on-prem computing hardware responsible for the decoding, storage, and streaming of video data. The customer pays a one-time fee for the purchase and installation of server hardware. Similar to cameras, server hardware is a commodity with no vendor lock-in.

Video Management System (VMS): Verkada also offers a software application that receives video data from the server hardware and renders it in a user interface that customers can interact with on a computer or mobile device. VMS applications typically support a broad range of cameras and the customer has the freedom to choose the application that best fits their needs. A VMS requires a one-time license fee or ongoing subscription cost.

Source: Marshall

In contrast to this, Verkada's VSaaS business model involves vertically integrating all of the components of traditional enterprise security solutions into a single subscription. Customers do not purchase their own cameras, buy their own server hardware, and select a specific VMS. Instead, with a subscription, Verkada supplies everything required. A Verkada subscription includes:

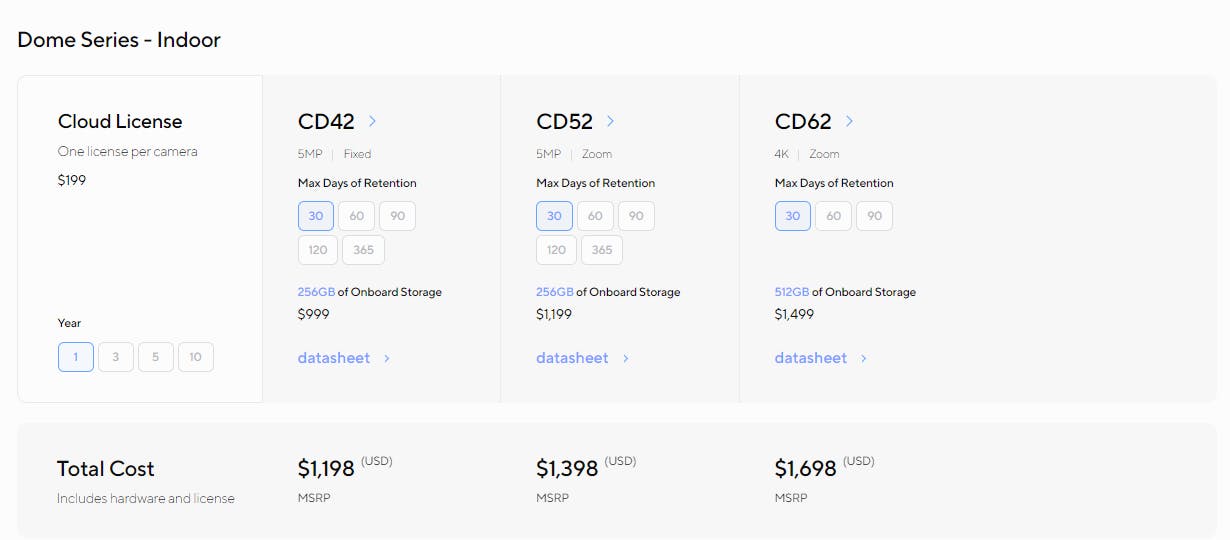

Hardware: Customers select the types of sensors (cameras, access control devices, alarms, etc) based on their needs. The price of the subscription includes the cost of the sensors. Verkada sensors are only compatible with Verkada’s software platform, meaning customers cannot purchase or use sensors from other companies.

Storage: Video and sensor data captured is streamed and stored in a cloud managed by Verkada. Customers can customize the amount of on-device storage which affects the subscription price.

Software Platform: Verkada’s Command software platform is natively integrated with all of Verkada’s sensors and cloud storage. Customers configure, view, and interact with their sensors and data through the software platform. The software platform only supports Verkada’s hardware.

Source: Verkada

Verkada offers estimates of the total cost of a subscription that varies according to the product selected.

Traction

Verkada has experienced growth in its customer base and established strategic partnerships within the enterprise security sector. In 2020, the company said it had 2.5K clients, including 25 Fortune 500 companies. Over the next two years, Verkada would experience significant growth with its customer count more than quadrupling to over 13K by 2022.

As of 2023, the company stated that over 15.7K enterprise organizations were using Verkada’s security solutions. In January 2024, the company stated that it had grown its marketing team by 69% in the preceding two years amidst the launch of new initiatives and programs. As of February 2024, the company reported that it had amassed over 20K customers, achieved a 9.5/10 ease-of-use rating, and had 6K resellers.

Valuation

In October 2023, 13 months after initially announcing its Series D, Verkada received another $100 million in a Series D funding round at an undisclosed valuation led by Alkeon Capital with participation from Lightspeed Venture Partners and others. This brought Verkada’s total Series D funding amount to $305 million. Before this, in September 2022, Verkada had raised $205 million in its initial Series D led by Linse Capital, which valued the enterprise security company at $3.2 billion. Key investors also included Sequoia Capital, First Round Capital, Felicis Ventures, and Next47.

As of February 2024, Verkada has raised $444.3 million in total financing. In 2021, security industry research group IPVM released a report estimating Verkada’s 2021 revenue at $130 million. At a $3.2 billion valuation, Verkada would be valued at a 25x multiple. This estimation does not account for revenue growth from 2021 to 2022 when the company received its $3.2 billion valuation.

Key Opportunities

Smart Building Management

One opportunity for Verkada is to develop new products that integrate with smart building technologies, such as energy management systems, HVAC controls, and lighting systems. Verkada’s existing product portfolio focuses on physical security. However, the company has started inroads into the facility management market with the release of its air quality sensor products in 2022.

By combining its established physical security offerings with new facility management products, Verkada could offer customers an all-in-one smart building solution. The global smart building market size is projected to reach $201 billion by 2031, representing a CAGR of 11.3% from 2022 to 2031. Verkada’s focus on cloud-based technology and user-friendly interfaces could give it a competitive edge in attracting new customers and expanding its addressable market.

Predictive Surveillance

Advancements in artificial intelligence and machine learning present an opportunity for Verkada to enhance its security offerings. Predictive surveillance utilizes AI and machine learning to proactively anticipate potential security threats before they occur. In contrast, traditional reactive surveillance relies on human monitoring and manual intervention, responding to security events only after they have taken place, which can be slower and less efficient.

Over 78% of business leaders stated that the digital transformation of physical security will generate a significant ROI. The adoption of AI technologies coupled with video surveillance is seeing mainstream adoption, with the city of Paris planning on using AI video surveillance for the 2024 Paris Olympics. Verkada's focus on software-enabled products represents an opportunity for embracing AI-enabled surveillance capabilities as a natural extension of their product lineup.

Key Risks

Company Culture

In October 2020, Verkada employees reported an incident where a Verkada sales director used access to the company’s security system to take photos of a female employee and post them in a Slack channel with sexually graphic content. A group of men in leadership positions on the sales team who were part of the Slack channel reportedly contributed to a culture of sexism at the company, where former employees described the company as tolerant of the harassment of women and emblematic of “bro culture.”

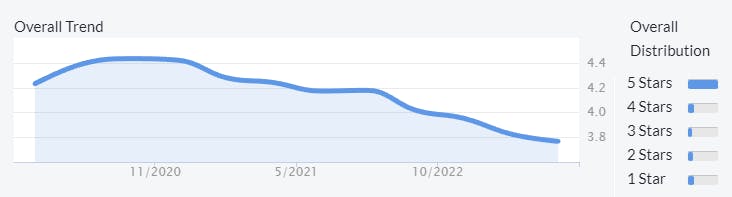

Source: Glassdoor

Employees found Verkada leadership’s initial response, which gave the offending employees the option of leaving the company or having their share of stock reduced, to be inadequate. Verkada later terminated the employees after negative employee feedback and media coverage.

In a later incident in early 2021, Verkada terminated a sales manager for exposing himself to a female colleague at an out-of-office gathering. Sexism and discrimination incidents at Verkada pose risks by damaging the company’s reputation and employee morale. A poor company culture could adversely affect Verkada’s ability to hire and retain top talent. Verkada’s rating on Glassdoor was 3.4 as of February 2024.

Cybersecurity Breaches

In March 2021, a group of hackers breached Verkada and obtained access to the live feeds of 150K surveillance cameras. The hackers were able to view video footage from Verkada customers including Tesla, Cloudflare, and other privacy-conscious organizations like women’s health clinics, police stations, and hospitals.

Source: Bloomberg

The hackers were relatively unsophisticated and gained access to Verkada through a “Super Admin” account by finding a username and password for an administrator account publicly exposed on the internet. According to a member of the hacker group that breached the system, the hack was intended to show how easily Verkada’s system could be hacked.

This breach directly undermined Verkada’s core mission of providing secure surveillance solutions for customers. The incident may have shaken customer trust, and further incidents could place the company at a disadvantage in an industry where robust security is of paramount importance.

Vendor Lock-In

Verkada’s innovation in combining the enterprise security stack into a single subscription-based offering means that Verkada customers are locked in. Unlike traditional competitors, where a customer might choose security cameras from Axis, access control devices from Hanwha, and a VMS software platform from Avigilon, Verkada’s products form a closed, proprietary ecosystem.

Enterprise security industry group IPVM tested and concluded that Verkada’s cameras and other hardware products could not be effectively used if a customer did not have an active, paid subscription. The incumbent enterprise security industry highlights this means that customers can purchase and be locked out from using hardware they have paid for, framing the subscription-based lock-in as “hostage as a service.”

Source: IPVM

A 2021 survey of over 200 security system integrators, who are specialized professionals with domain expertise in designing, installing, and maintaining security solutions for clients, found these respondents had an overwhelmingly negative opinion of Verkada. As companies become more aware of the potential downsides of vendor lock-in, they may increasingly seek solutions that offer greater flexibility and avoid over-reliance on a single provider. Customers who are concerned about vendor lock-in may be hesitant to commit to Verkada's platform, fearing that they will be unable to easily switch to alternative solutions if their needs change or if they become dissatisfied with Verkada's offerings.

Summary

Security concerns and rapid technological advancements are driving growth in the enterprise physical security market, particularly in the video surveillance and access control segments. Verkada is well-positioned to capitalize on this trend with its integrated security solutions, having shown significant traction with organizations of various types and sizes. By providing a comprehensive security product that combines video surveillance, access control, and alarms, Verkada aims to address the growing demand for advanced security technology. However, the fallout from Verkada’s internal conflicts and 2021 data breach present reputational and customer trust challenges. To succeed, Verkada needs to continue delivering innovative enterprise management products and develop a long-term track record of success to ensure it remains a top choice for organizations seeking enterprise security solutions.