Thesis

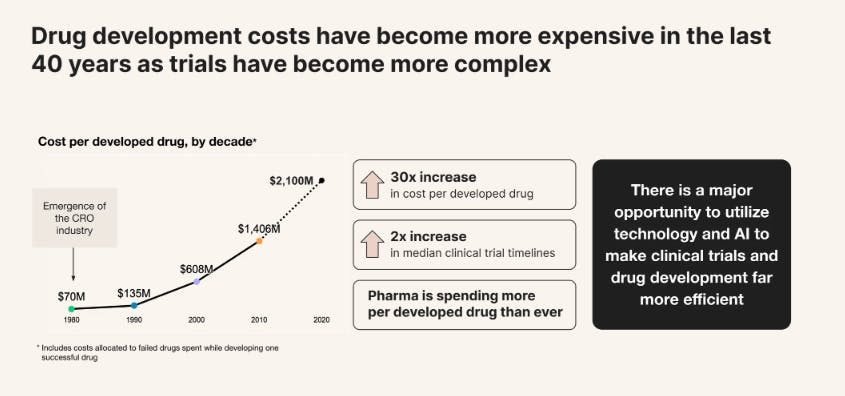

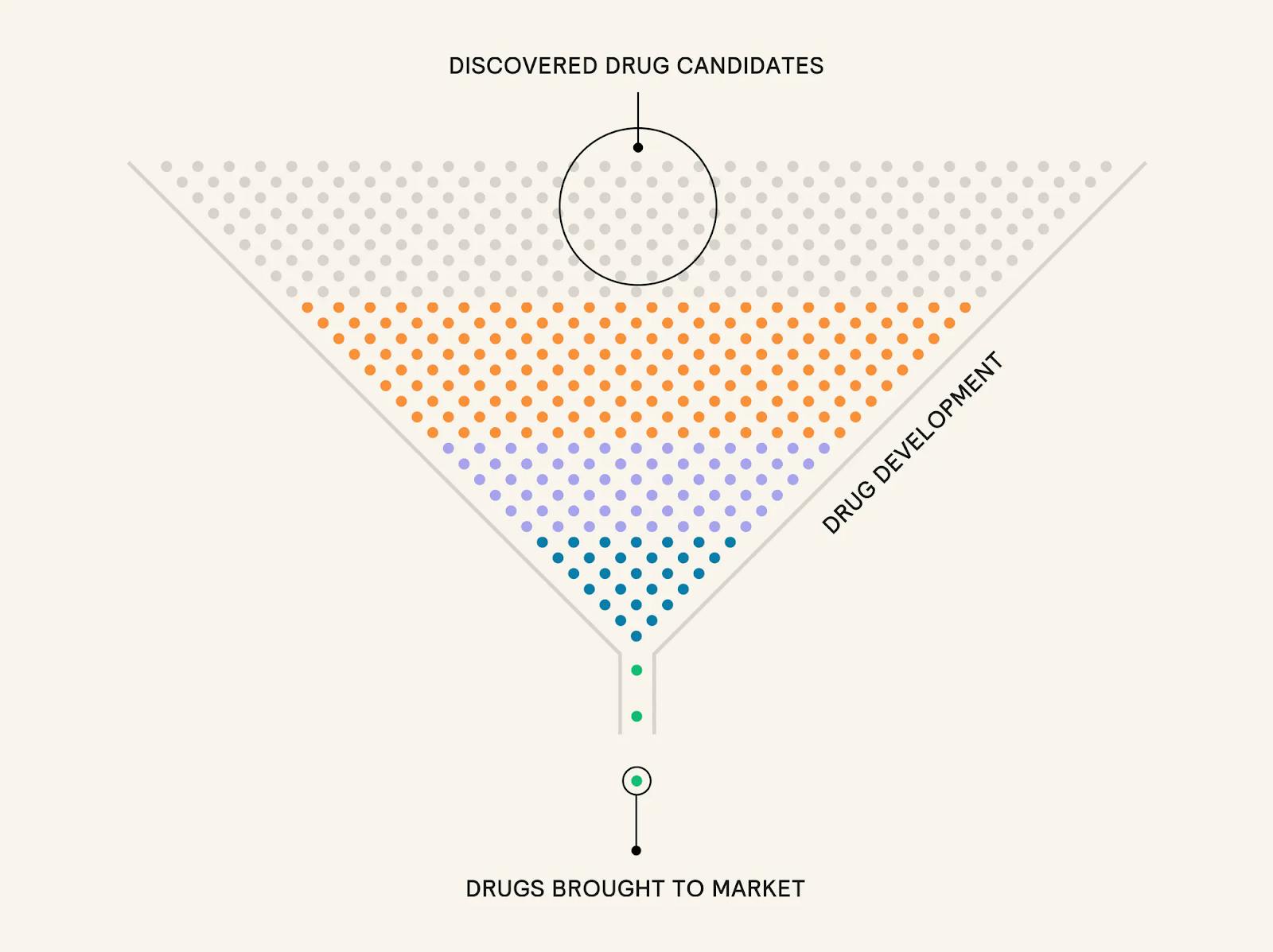

The pharmaceutical industry remains one of the largest global sectors, with the top ten companies collectively valued at $3.2 trillion as of December 2025. Yet despite this scale, the cost of developing a single drug has increased dramatically in recent decades, with R&D expenses growing at an average annual rate of 8.5% from 2012 to 2024. As of 2024, estimates place the full cost of bringing a drug to market between $800 million and $2.3 billion, depending on methodology and drug type. Importantly, these figures incorporate not just successful products but also the substantial cost burden of failed candidates, which make up the majority. As of 2022, only about 10% of drug candidates entering the development pipeline ultimately received FDA approval.

Source: Formation Bio

The clinical development stage is a major contributor to these costs. Phase 2 and 3 trials, in particular, are resource-intensive and prone to failure. As of 2025, ~47–60% of drugs advanced from Phase 2 to Phase 3, and only ~50–70% of those drugs successfully passed Phase 3. As a result, nearly 60% of R&D costs are sunk into drugs that never reach the market. As of 2024, clinical trials alone accounted for an estimated 40.2% of total development costs when failure and capital expenses were included. As of 2025, Phase 3 studies cost over $100 million per program, underscoring the financial risk borne by companies advancing assets at this stage.

These rising costs have coincided with a structural shift in the industry: larger pharmaceutical companies face increasing constraints on internal R&D budgets and cannot develop the growing volume of drug candidates emerging from improved discovery methods, including AI-driven platforms. Many are limited by investor pressure to cap R&D spend at 20–25% of sales as of 2024. Meanwhile, smaller and mid-sized companies responsible for 72% of new drug approvals in 2025 face even tighter resource constraints, often unable to fund development past early-stage trials. This bottleneck has created strong incentives to explore alternative development models that can accelerate progress through the clinical stages more efficiently.

Formation Bio is a tech-enabled drug development company. It addresses the clinical trials bottleneck in the drug development process by acquiring or in-licensing clinical-stage assets from pharmaceutical and biotechnology companies and conducting clinical trials more cost-effectively and faster. As of 2025, the company had supported hundreds of studies across the clinical trial timeline in roles ranging from recruitment vendor and tech partner to trial site manager and CRO. Its team and advisors have been involved in over 75 regulatory submissions as of May 2024, with over 45 drugs approved as of April 2025.

Founding Story

Formation Bio, originally named TrialSpark, was founded by Benjamine Liu (CEO), Linhao Zhang (former CTO), and Kit Dobyns in 2016 to address a structural inefficiency in the pharmaceutical industry: the clinical trial bottleneck. While drug discovery had become faster and more efficient, the infrastructure for testing and developing those therapies had not kept pace. They believed that the limiting factor was no longer scientific innovation, but the cost, speed, and scalability of clinical trials.

Benjamine Liu received his bachelor’s degree in biology from Yale University in 2012, before completing a Master of Philosophy degree in computational biology at the University of Cambridge as a Paul Mellon Scholar. He then pursued a Doctor of Philosophy degree at the University of Oxford as a Rhodes Scholar. During his graduate research, Liu identified several promising drug candidates for Parkinson’s disease and sought to bring them into development. However, pharmaceutical companies repeatedly turned him away, not due to scientific concerns, but because they lacked the bandwidth and resources to conduct additional clinical trials. This experience made clear to Liu that the bottleneck in drug development had shifted from discovery to clinical execution.

Source: Endpoints News

In 2016, while still completing his doctorate, Liu co-founded TrialSpark to address this problem directly. He partnered with Zhang and Dobyns. Dobyns completed his undergraduate studies at Cornell University and was also a Rhodes Scholar at the University of Oxford. Liu and Dobyns were assigned as roommates during the Rhodes Scholar pre-orientation program at Oxford. Zhang is a computer science graduate from the University of Texas at Austin and a former engineer at Salesforce and Oscar Health. Dobyns and Zhang first met as roommates during an internship at Salesforce. Liu stated, “Having that familiarity and really first being friends that you enjoyed debating issues with created a great foundation… we felt like we were going to be good co-founders together.”

Source: Formation Bio

TrialSpark began as a software platform that integrated the front-end of clinical trials, such as patient recruitment and electronic consent, with back-end operations including data management, monitoring, and biostatistics. The goal was to accelerate trial timelines and increase the diversity and representativeness of study populations. Initially serving as a vendor to pharmaceutical companies, TrialSpark later expanded into a full-service CRO, running end-to-end trials on its proprietary platform.

In 2022, Formation Bio expanded into acquiring and developing its own drug assets using its AI-enabled infrastructure. As the company moved beyond CRO services, it began recruiting leading physicians to conduct trials and pairing them with clinical-stage drug candidates. When fundraising, Sequoia recognized TrialSpark’s outsider, technology-driven approach as a potentially transformative model for drug development. In December 2023, TrialSpark rebranded to Formation Bio to reflect its evolution from streamlining clinical trials to building a fully integrated drug development platform.

As of January 2026, Liu remained on Formation Bio’s executive team as CEO. Zhang remained at the company as a co-founder, but left the position of CTO in August 2025, and in September 2025, Dan Neil was brought on as the new CTO. Dobyns left the company in 2019 to found Cayaba Care, a provider of maternity services. Since then, Formation Bio’s leadership team has grown.

In 2021, Gavin Corcoran joined as Chief Development Officer. A board-certified infectious disease physician, Corcoran leads the development organization, overseeing medical and scientific input across all areas of drug development. He previously served as Chief Medical Officer at Allergan and Stiefel. In 2024, David Steinberg was appointed Chief Business Officer. Before joining Formation Bio, he founded and led Pyxis Oncology and Vor Biopharma, and played key roles in several venture-backed biotechs, including Glyph Biosciences, Vedanta Bioscience, Photys Therapeutics, and Be Biopharma.

Mikael Dolsten, former Chief Scientific Officer and President of Pfizer R&D, joined Formation Bio in April 2025 as Chair of the Drug Picking Committee, Co-Chair of the Investment Advisory Committee, and Chair of the Science, Technology, and Product Planning Committee.

In September 2025, Formation Bio further expanded its leadership team with several senior hires. Louis (Lou) Brenner, MD, joined as Chief Medical Officer, having previously led Allena Pharmaceuticals from a private early-stage company to a public biotech with multiple Phase 2 and Phase 3 programs; he had also overseen drug approvals and commercial launches at Genzyme, AMAG, Radius, and Idera. As mentioned above, Daniel Neil, PhD, was appointed Chief Technology Officer after serving as Chief Data Officer at Tessera Therapeutics, where he built AI/ML systems supporting gene editing programs, and as CTO at BenevolentAI, where he led product, AI research, and data infrastructure through rapid scale and a public listing.

Frank D’Amelio joined as Strategic Advisor and Co-Chair of the Investment Advisory Committee, following nearly 15 years as CFO at Pfizer. Dashyant Dhanak, PhD, also joined as Strategic Advisor and Investment Advisory Committee member, bringing over 30 years of drug discovery leadership from roles at Deciphera Pharmaceuticals, Incyte, Janssen, and GlaxoSmithKline.

In June 2025, the company launched its first Entrepreneurs in Residence (EIR) program to accelerate pipeline growth and strategic partnerships. The program brings in biotech dealmakers to identify, acquire, and develop high-potential drug assets alongside the company’s Chief Business Officer. The inaugural class includes Kia Motesharei, Ph.D. (focusing on NASH/MASH), Minji Kim, Ph.D., MBA (Korea/APAC and cross-border transactions), John Taylor, M.S. (rare diseases), and Anthony S. Walsh, D.Phil (immunology & inflammation, bispecifics).

Source: PR Newswire

Product

Formation Bio aims to improve the efficiency of the traditional drug development process using technology and AI. Traditionally, the process starts with discovery, followed by preclinical research to assess toxicity through in vitro and in vivo testing. Only a few compounds progress beyond this stage, which accounted for about 6.8% of total development costs, ranging from 5.3% in gastrointestinal to 12.5% in ophthalmology as of 2024.

Drugs that pass preclinical testing enter human clinical trials, which unfold in four phases. Phase 1 tests safety and dosage in small groups, with about 63% of drugs advancing as of 2024. Phase 2 evaluates efficacy and side effects in several hundred participants, but only 31% of drugs moved forward as of 2024. Phase 3, the most costly and time-consuming, involves hundreds to thousands of patients and lasts up to four years, with a success rate of 58% as of 2024. Phase 4 occurs post-approval and monitors long-term outcomes in large populations. Clinical trials face operational challenges ranging from slow patient recruitment and inconsistent site performance to complex regulations and fragmented data. These factors drive high costs, frequent delays, and a high risk of trial failure.

Formation Bio helps pharmaceutical companies offload clinical drug development using its proprietary, tech-enabled platform designed to improve efficiency, speed, and sustainability across the pipeline. Its platform is comprised of three integrated components: AI-Driven Drug Development, a Clinical Trial Engine, and a Universal Data Platform.

Source: Formation Bio

This technology stack automates a wide range of tasks, including medical writing, protocol development, regulatory submissions, biostatistics, and data management. Specific applications include automated generation of pre-screening questionnaires and adverse event reports, AI-powered patient recruitment channels, and optimization of study designs to align with target populations, cost constraints, and evidence requirements. These capabilities are enabled through the integration of large language models (LLMs) and AI agents into Formation Bio’s workflows.

Formation Bio partners with pharmaceutical companies, biotech firms, and academic institutions, leveraging a network that has contributed to more than 45 approved drugs as of April 2025.

Technology-Driven Drug Development Platform

Formation Bio has built an integrated technology platform designed to streamline drug development. At its core is the Universal Data Platform, which consolidates clinical, scientific, regulatory, and external datasets into a centralized knowledge base. Layered on top is an app ecosystem powered by pharmaceutical-specific AI models and agents. These tools are embedded directly into the workflows of development teams, enabling real-time interaction and continuous refinement of both data and models. As experts use the platform, their inputs improve model performance, creating a feedback loop that evolves alongside the company’s operations. This structure breaks down traditional data silos and provides a unified environment for building and iterating development applications.

The company’s AI integration follows a phased, three-tiered approach. In the short term, AI automates routine processes — for example, reducing the time required to generate FDA-required adverse event reports from ten hours to just one. In the medium term, AI agents act as copilots, supporting strategic decisions such as recruitment planning or trial design. The long-term goal is to enable autonomous systems capable of making complex decisions independently, such as predicting a drug’s toxicity, tolerability, or efficacy.

Drug Selection and Development Design Mechanism

Formation Bio’s Universal Data Platform serves as the backbone of its development model. It integrates structured and unstructured data, including clinical protocols, regulatory guidance, EHRs, claims data, scientific publications, and partner datasets into a unified system. This eliminates many fragmented, manual processes that slow traditional R&D. By consolidating all relevant data into one platform, teams can access a full spectrum of information needed to inform trial and program design without time-consuming data wrangling.

Drug selection is guided by a combination of internal research, literature synthesis, and insights generated by the platform. Formation Bio focuses on acquiring or in-licensing early- to mid-stage drug assets, typically for chronic diseases treated outside of hospital settings, from pharmaceutical companies, biotechs, and academic institutions. Instead of emphasizing early-stage discovery, the company concentrates on accelerating development beyond proof of concept.

Successful drug development relies not only on the molecule itself but also on the design of the development program, which often requires synthesizing vast, disparate datasets to answer regulatory, clinical, and commercial questions. Formation Bio’s platform reduces this burden by providing clean, standardized access to relevant information, supporting faster and more informed decision-making. The company continues to refine its AI systems to further assist in predicting outcomes and optimizing program design.

AI-Enabled Clinical Trial Execution

Formation Bio applies AI across the entire clinical trial lifecycle to address persistent inefficiencies in recruitment, data oversight, and operational execution — problems delaying approximately 80% of clinical trials industry-wide as of December 2024. Its Clinical Trial Engine reduces the time involved in critical processes, including study startup, participant recruitment, and data management. Tools like real-time anomaly detection, centralized monitoring, and automated data cleaning enable faster issue resolution and more accurate oversight.

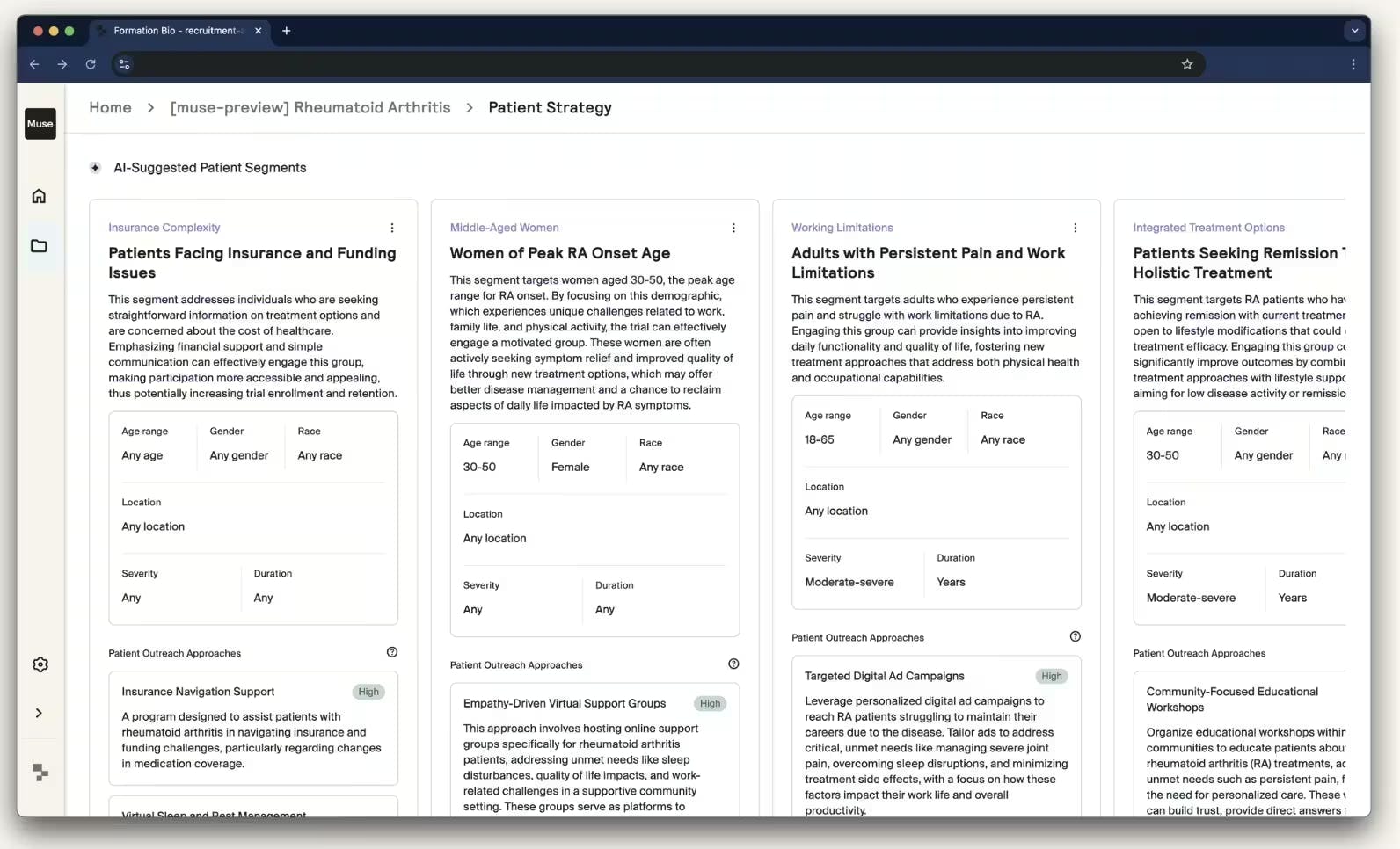

A key component of this system is Muse, Formation Bio’s generative AI tool for patient recruitment that was launched in November 2024 in collaboration with Sanofi and OpenAI. As of 2024, it is estimated that fewer than 10% of patients participate in clinical trials, often because they are never informed of or invited to enroll. Muse aims to address this bottleneck by accelerating patient recruitment strategy. Specifically, it transforms a small set of trial documents into tailored materials, including pre-screening questionnaires, digital ads, and outreach content, in under ~15 minutes. It synthesizes scientific literature, real-world data, and competitive insights to identify ideal patient populations and recommend recruitment strategies.

Muse supports real-time editing through conversational interfaces and automates compliance checks, enabling teams to quickly tailor content across demographics, languages, and outreach channels. It also integrates Institutional Review Board (IRB) and regulatory guideline checks into content generation to reduce regulatory setbacks and improve compliance. Muse’s architecture uses OpenAI’s Assistants API and vector databases. By automating what previously required large expert teams and extensive manual review, Muse accelerates and sharpens recruitment efforts.

More broadly, the Clinical Trial Engine streamlines data ingestion, reconciliation, and analysis, helping eliminate readout delays and facilitate faster program decisions. Its modular architecture allows the system to scale across therapeutic areas and trial types.

Source: Formation Bio

In addition to its in-house facilities and tools, Formation Bio collaborates with investigators and physicians to expand trial access and improve execution. Investigators benefit from expedited site qualification, digital onboarding, and automated data capture, while physicians gain more treatment options for their patients. As of June 2024, the company had supported over 300 trials across 10+ therapeutic areas. With its AI-driven platform, Formation Bio is focused not only on accelerating timelines but on improving trial quality, ultimately bringing new therapies to patients faster than traditional pharmaceutical models allow.

Market

Customer

Formation Bio partners with pharmaceutical and biotechnology companies that have promising drug candidates but lack the resources to advance them through clinical development. Formation Bio typically acquires or in-licenses assets before Phase 2 and progresses them through later stages, where the perceived value of a drug candidate can increase significantly. Its tech-enabled platform is designed to reduce the cost and duration of clinical trials, which can improve the likelihood of a successful outcome for both Formation Bio and its partners.

This model offers flexibility in how assets are developed and exited. Exits can occur through partnerships, asset sales to larger pharmaceutical firms, or continued internal development. Assets are often held for relatively short periods, consistent with an approach seen in transactions such as Roche’s 2023 acquisition of Telavant, where a drug was developed and sold within a few years.

For pharmaceutical and biotech companies, Formation Bio provides an off–balance sheet development pathway, allowing them to pursue more discovery programs without taking on additional internal costs or risks. As of June 2024, the company reported growing interest from large pharmaceutical and biotechnology companies seeking to advance drug candidates that couldn’t be supported internally.

Before acquiring its own assets, Formation Bio operated as a tech-enabled contract research organization (CRO). Early CRO clients included Novartis (2018 partnership for trial sites), Pfizer (2019 for site/patient optimization), Sanofi (multi-asset deal in 2022, plus 2024 AI collaboration with OpenAI), Versanis Bio, and Aditum Bio.

Beyond corporate partners, Formation Bio also partners with physicians to help their patients gain access to investigational products by connecting them with nearby clinical trial sites. Physicians identify and refer eligible patients to Formation Bio’s enrollment specialists. They are compensated for their time and can provide patients access to investigational products without taking on full research responsibilities. Investigators can also join Formation Bio’s Research Network to gain early access to upcoming studies, fast site qualification (often within 1–2 weeks), and in-house research nurses for patient enrollment screening.

Market Size

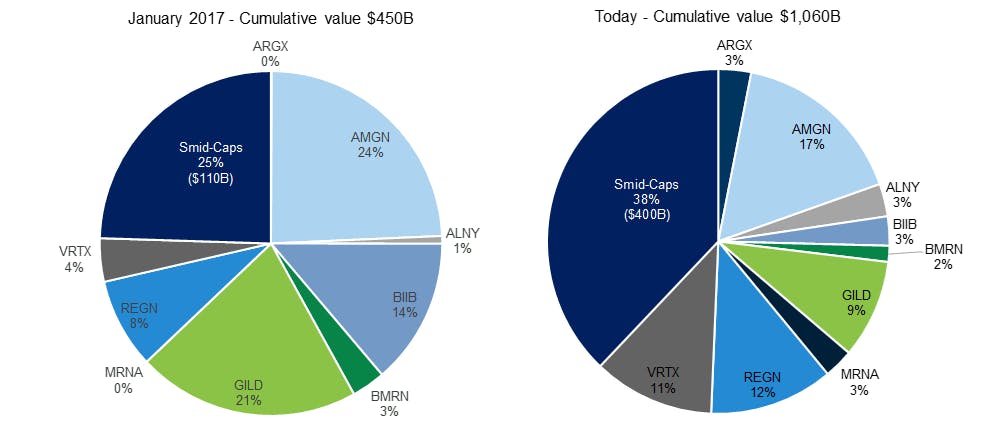

As of 2025, the pharmaceutical industry was one of the largest global sectors. As of December 2025, the 10 biggest pharmaceutical companies had a combined market cap of approximately $3.2 trillion. US spending on pharmaceuticals and prescription drugs reached $805.9 billion in 2024, up 10.2% from the prior year, largely driven by demand for GLP-1 drugs and oncology therapies. Projections indicate a further 9-11% increase in 2025, potentially exceeding $880 billion. Small and mid-cap pharmaceutical companies like Formation Bio have also been steadily increasing their market share in the years leading up to 2024.

Source: Goldman Sachs

The global biotechnology market was valued at $1.55 trillion in 2023 and was projected to grow at a 14.0% CAGR from 2024 to 2030, driven by government efforts to modernize regulatory frameworks, streamline approvals, and standardize clinical studies. As of 2024, personalized medicine and orphan drugs continued to expand the market and attract emerging biotech players.

As of 2023, the global market for preclinical drug assets was valued at $4.8 billion in 2022 and was projected to reach $7.6 billion by 2027, growing at a CAGR of 9.4% from 2023 to 2027. This growth is primarily driven by increased drug discovery activity, including the use of AI in early-stage research. Formation Bio’s model involves acquiring preclinical drug candidates and advancing them through clinical development. Growth in this sector increases the pool of drugs that Formation Bio can acquire and develop.

Competition

Competitive Landscape

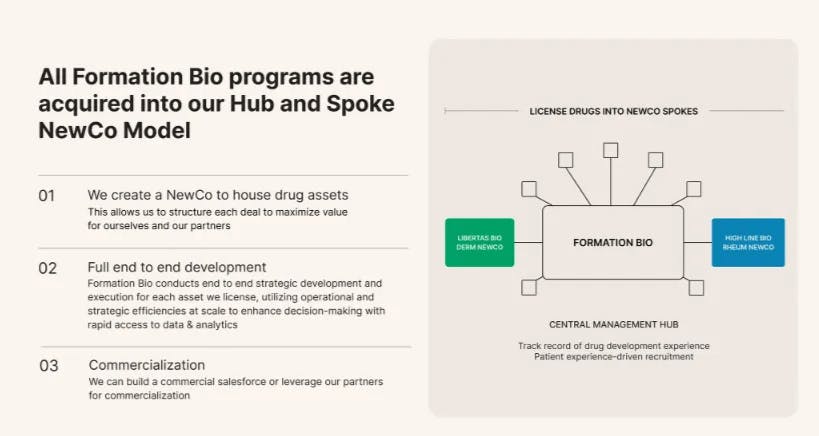

Formation Bio acquires or licenses drug candidates and uses technology to streamline clinical development. Rather than discovering drugs in-house, it focuses on improving the speed and efficiency of trials through software, data infrastructure, and operational expertise. When it acquires a drug, it often places it in a subsidiary company designed to support development and eventual exit.

Competitors generally fall into two groups: modern contract research organizations that may expand into drug development, and traditional biopharma companies with internal pipelines. Compared to larger developers like BridgeBio or Roivant, Formation Bio’s advantage lies in its clinical data systems and network. Its use of tools like electronic health records helps speed up processes such as patient recruitment, which can significantly reduce development timelines across multiple programs.

Drug Development Competitors

Roivant Sciences: Roivant Sciences, founded in 2014, is a publicly traded pharmaceutical company with a market cap of $16 billion as of January 2026. This is up from $7.4 billion in April 2025. Roivant’s market cap nearly doubled over 2025, largely due to a series of positive late‑stage clinical results, especially for brepocitinib in dermatomyositis, and accelerated timelines for key autoimmune candidates like IMVT‑1402. The company operates under a decentralized "hub-and-spoke" model, building and incubating independent biotech and healthcare technology companies that focus on specific therapeutic areas or technologies. Roivant often acquires or licenses underutilized drug candidates from larger pharmaceutical companies and accelerates their development and commercialization through its portfolio of subsidiaries.

As of December 2025, Roivant had 11 distinct drugs in its pipeline across subsidiaries, with eight in the registrational phase (primarily brepocitinib and IMVT-1402 programs) and three in proof-of-concept (including clinical trial) stages. Its track record now includes 12 positive Phase 3 trials since 2019 across immunology, dermatology, and other areas. Notably, in October 2024, Organon acquired Dermavant, one of Roivant’s subsidiaries focused on immuno-dermatology.

Formation Bio appears to be adopting a hub-and-spoke structure similar to Roivant’s, using a subsidiary company model to develop individual drug programs. Both companies aim to accelerate drug development by combining focused teams with centralized technological infrastructure to improve speed and efficiency across their pipelines.

Arctic Therapeutics: Arctic Therapeutics is an Icelandic pharmaceutical company founded in 2015 as a spin-off from the Center for Applied Genomics (CAG) at the Children’s Hospital of Philadelphia. The company combines bioinformatics and AI to de-risk and accelerate drug discovery and development. In January 2025, it raised €26.5 million in Series A funding to support clinical trials for its pipeline drugs. Unlike Formation Bio, which acquires or licenses preclinical assets for development, Arctic Therapeutics focuses on end-to-end drug discovery and development.

Arctic Therapeutics uses genetic sequencing along with access to national biobanks and genealogy datasets, supported by medical partnerships, to uncover the genetic causes of disease and develop more targeted therapies. As of December 2025, the company had five drugs in its pipeline — three in Phase 2, one in Phase 1, and one in preclinical development — focused on dementia, autoimmune conditions, dermatoinflammatory diseases, rhinovirus, and rare autoinflammatory disorders. Arctic Therapeutics aims to bring its drugs into clinical trials before licensing them to pharmaceutical partners.

Insilico Medicine: Insilico Medicine, founded in 2014, is an AI-driven drug discovery platform. Its core product is Pharma.ai, a generative AI software designed to improve the quality of pharmaceutical research. It has launched 31 programs, including 22 preclinical candidates nominated since 2021, and has ten drugs with authorization to conduct clinical trials as of April 2025.

In March 2025, Insilico raised $110 million in Series E financing to refine its AI models, expand its automated lab capabilities, and advance clinical validation of its lead programs. As of March 2025, its AI-first approach reduced preclinical candidate nomination timelines from 2.5–4 years to 12–18 months, while minimizing the number of compounds synthesized per program.

Primarily focused on discovery, Insilico has secured over $2.1 billion in out-licensing deals and $1.4 billion in partnerships with companies like Sanofi and Saudi Aramco as of March 2025. In November 2025, Insilico entered a research and licensing collaboration with Eli Lilly that uses Pharma.ai for drug discovery and includes over $100 million in potential milestone payments.

It has expanded into clinical development through tools like inClinico, which predicts trial success, identifies design risks, and generates performance reports. As its platform evolves, it may further expand its AI capabilities into clinical trials to improve development efficiency, similar to Formation Bio’s approach. Insilico has also filed for an IPO on the Hong Kong Securities Exchange, aiming to raise $292 million to fund its clinical pipeline and AI/automation platform expansion

Relation Therapeutics: Relation Therapeutics, founded in 2020, is a biotech company focused on applying machine learning, resolution biology, and clinical insights to drug discovery and development. As of January 2026, its pipeline targeted osteoporosis, with broader efforts underway in fibrotic diseases and osteoarthritis through partnerships. Relation Therapeutics combines lab experiments with machine learning to identify promising drug targets and confirm their potential before moving them toward development, helping reduce the risk of failure later on. It uses advanced computing resources, including access to NVIDIA’s Cambridge-1 supercomputer, to power its research. As of January 2026, the company had raised a total of $95 million over three rounds of funding and had formed a strategic partnership with GSK, which includes $45 million in upfront and equity funding, plus additional milestone payments.

Unlike Formation Bio, which acquires clinical-stage drugs and focuses on speeding up and reducing the cost of trials using AI, Relation works earlier in the drug development process. It focuses on finding new drug targets and preparing them for development, often in partnership with pharma companies.

Verdiva Bio: Verdiva Bio, founded in July 2024, is a clinical-stage biopharmaceutical company focused on obesity and cardiometabolic disorders. It launched with $411 million in funding, led by Forbion and General Atlantic. Rather than developing its own pipeline, Verdiva licensed a portfolio of three drug candidates from the Chinese firm Sciwind Biosciences.

Verdiva Bio’s pipeline includes a once-weekly oral GLP-1 therapy set to enter Phase 2 trials, as well as oral and injectable candidates targeting amylin. Like Formation Bio, Verdiva is centered on clinical development and asset licensing, but it does not appear to use AI in its model and focuses on a narrower therapeutic area.

Modern Contract Research Organizations

Lindus Health: Lindus Health, founded in London in 2021, is a clinical research organization that describes itself as an “anti-CRO,” aiming to address inefficiencies in the traditional clinical trial process. In January 2025, the company raised $55 million in Series B funding led by Balderton Capital to further develop its AI tools and its eClinical platform, Citrus.

Lindus Health offers fully integrated trial services, including study startup, patient recruitment, study and data management, and site operations, alongside software for data capture, eConsent, and pre-screening via its Citrus eClinical platform, which powers over 42 trials enrolling over 36K patients as of December 2025. The company operates across multiple therapeutic areas such as psychiatry, dermatology, women’s health, respiratory, and diagnostics. As of December 2025, Lindus Health continued to follow a model where trial sponsors retained ownership of their assets while outsourcing trial execution. This distinguishes it from Formation Bio, which has moved toward internal asset development alongside its technology platform.

Tempus: Tempus (TEM) is a health technology company founded in 2015 that went public in June 2024 with a valuation of over $6 billion. It reported $693 million in revenue in 2024, a 30.4% year-over-year increase. It has a market cap of $12.1 billion as of January 2026. Tempus runs a data platform with 450 connections across 2K healthcare institutions, used by over 7K physicians as of June 2024. It integrates clinical and molecular data to enable real-time, personalized treatment decisions. It has signed partnerships with AstraZeneca and Pathos to develop a $200 million multimodal oncology model.

In addition to its diagnostics and data services, Tempus is active in clinical development. While it engages external CROs for trial operations, it manages key parts of the clinical trial process in-house. This includes trial design, biomarker strategy, site activation, patient identification and enrollment, and oversight of data protocols. This hybrid approach (centralized management with outsourced execution) distinguishes Tempus from traditional CROs and from companies like Formation Bio, which focuses more on internalized, tech-driven trial execution.

Biorce: Biorce is a Barcelona-based AI medical technology company founded in 2024 that develops tools to support clinical trial operations. In November 2024, it raised €3.5 million in funding, followed by an additional €5 million from Norrsken VC in July 2025 to fuel US expansion, a new product launch, and team growth amid seven-figure ARR and 600+ monthly users.

Its primary product, Jarvis (now part of the Aika platform), is a "Clinical AI Assistant" designed to simplify trials by addressing issues such as human error, inefficient site selection, and inconsistent communication, claiming >50% cost reductions and 40% faster timelines. Jarvis uses clinical data and research literature (>500K studies) to assist patients and healthcare providers with features like text-based question answering, protocol development support, and site selection recommendations with probability scoring. As of January 2026, Biorce’s partners included Google and Nvidia. Unlike Formation Bio, Biorce does not develop or license drug candidates. Its focus is solely on optimizing the clinical trial process. This is similar to how Formation Bio’s Muse tool supports trial recruitment.

Business Model

Revenue

Formation Bio operates as a fully integrated pharmaceutical company with a business model focused on acquiring or licensing promising drug candidates from pharmaceutical companies, biotechnology firms, and academic institutions that lack the resources to advance them through clinical trials. The company specifically targets pre-Phase 2 assets, where it can apply its proprietary technology platform to accelerate development and create more value.

Formation Bio's competitive advantage lies in its vertically integrated clinical trial platform that runs clinical trial execution, replacing the traditional contract research organization (CRO) model. By integrating patient recruitment, site management, study monitoring, and data analysis into a unified system supported by technological tools for patient intelligence and real-time data surveillance, Formation Bio conducts clinical trials faster and at lower cost than conventional approaches.

The company monetizes its assets through the following value creation cycle: it acquires promising drug candidates, efficiently advances them through clinical development, likely over a two-to-three-year period, and then exits either by licensing or selling the de-risked assets to larger pharmaceutical companies during or after Phase 3 trials.

This approach allows Formation Bio to capture substantial value appreciation while partners benefit from access to de-risked assets without bearing the full development burden or P&L risk, which a former executive described as an "off-balance-sheet" pathway for larger pharmaceutical companies. For each asset, Formation Bio typically uses a NewCo model, like a subsidiary, that allows shared ownership with partners and covers all funding and resources needed for clinical development.

The company's ability to detect efficacy biomarkers earlier than traditional methods further enhances value creation. Early efficacy biomarker detection helps prove a drug works sooner, cutting costs, reducing risk, and making it more attractive to investors or partners. This is useful, particularly in complex therapeutic areas where legacy players may have lower risk tolerance.

Source: Formation Bio

Costs

As of 2024, the mean cost of advancing a drug candidate through the clinical phase was estimated at $117.4 million, with Phases 1, 2, and 3 together accounting for approximately 68% of total development costs. When factoring in the cost of capital and the high rate of trial failure, that figure rises substantially to $893.7 million. Among clinical stages, Phase 3 is typically the most expensive due to its longer duration and the need to enroll larger patient populations. However, methods such as decentralized trials, in-home testing, and the use of lower-cost facilities have shown potential to reduce per-trial costs.

Formation Bio’s cost structure likely reflects both these macro-level dynamics and company-specific operational needs. By focusing on acquiring or in-licensing pre-phase 2 assets, Formation Bio bears the financial burden associated with late-stage clinical failure. The company likely spends on R&D to improve its AI, and may also incur costs for drug evaluation, licensing, running trials, hiring experts, and maintaining its tech platform.

While these costs appear significant, Formation Bio’s model is designed to mitigate them through operational efficiency. The company uses AI to streamline workflows such as medical writing, protocol generation, and trial monitoring, reducing reliance on manual labor. It also applies predictive models to optimize patient recruitment and site selection, which helps shorten timelines and reduce trial delays. Innovations like trials conducted in local physicians’ offices further lower costs and increase patient access. These efficiencies, combined with strategic asset selection, aim to improve the likelihood of increasing the drug’s value while maintaining a leaner development footprint than traditional pharmaceutical players.

Traction

Liu has described Formation Bio’s growth strategy as “building enough at each stage to unlock the next level.” The company followed a methodical progression. It began by developing patient recruitment tools and selling them as a standalone product. It then added clinical trial site management and technical support, which were also offered as independent services. These capabilities laid the groundwork for Formation Bio to evolve into a full-service, tech-enabled contract research organization (CRO) and later, an end-to-end drug development platform.

In December 2018, Formation Bio launched its first clinical trial sites through a partnership with Novartis, enabling patients to participate in trials through their local physicians. In October 2019, it partnered with digital therapeutics company Limbix to support a trial for adolescent depression using the same decentralized recruitment model. That same year, in September, Formation Bio entered a partnership with Pfizer to improve clinical trial speed and access by using data to optimize site and patient selection. Pfizer’s then-Chief Development Officer highlighted the partnership as a way to expand access to patients who might not otherwise participate in trials.

By 2021, Formation Bio had established internal capabilities across the entire clinical trial lifecycle, including patient recruitment, trial startup, site management, data readout, and regulatory compliance. These integrated processes allowed the company to run trials 30–50% faster than industry benchmarks and accelerate trial startup and closeout timelines by 2–3x as of December 2024. Patient recruitment, typically a delaying factor in over 80% of trials, was completed 2.5x faster than the industry standard as of December 2024. The company’s operational efficiency enabled early revenue generation, supported successive funding rounds, and facilitated its transition from a CRO to an integrated drug developer.

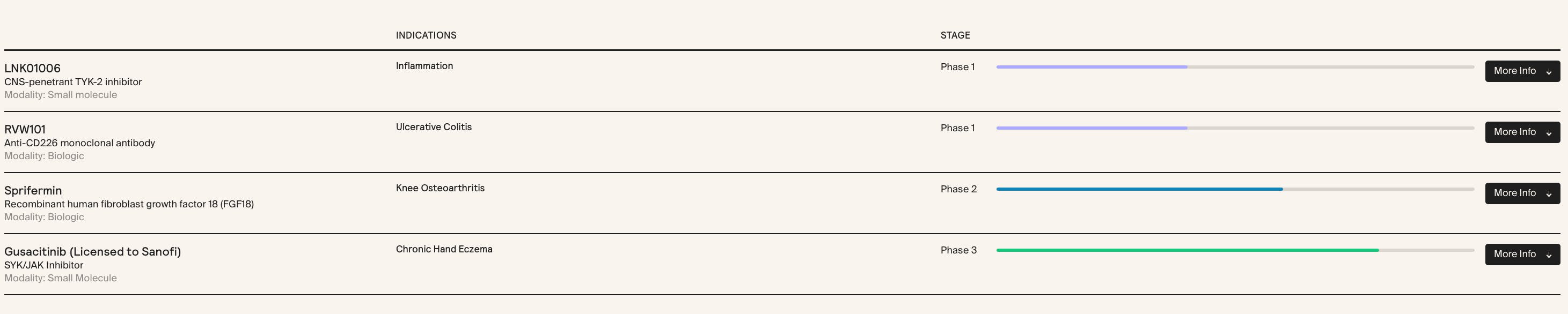

After raising $156 million in Series C funding in September 2021, the company began acquiring clinical-stage drug assets and conducting trials in-house. In January 2022, it licensed global rights to Sprifermin, a Phase 2 recombinant FGF18 therapy for osteoarthritis, from Merck KGaA. Later that year, in November, it acquired Libertas Bio, gaining three additional immunodermatology assets: Gusacitinib, a Phase 3-ready SYK/JAK inhibitor for chronic hand eczema; ASN008, a Phase 2 topical sodium channel blocker for pruritus associated with atopic dermatitis; and ASN011, a preclinical SYK/JAK inhibitor. That same year, Formation Bio partnered with Sanofi on a multi-asset deal focused on licensing and developing Phase 2 and 3 candidates, with plans for six transactions over three years.

In May 2024, Formation Bio announced a collaboration with OpenAI and Sanofi to jointly develop AI models for drug development. OpenAI contributes advanced AI capabilities, Sanofi provides proprietary datasets, and Formation Bio integrates these into its development platform. As of 2024, the company had supported hundreds of studies across the clinical trial timeline in roles ranging from recruitment vendor and tech partner to trial site manager and CRO. Its team and advisors have been involved in over 75 regulatory submissions as of May 2024, with 45 drugs approved as of April 2025.

In June 2025, Formation Bio’s subsidiary Libertas Bio licensed gusacitinib, a dual JAK/SYK inhibitor, to Sanofi for development in a new indication, with the deal potentially worth up to €545 million including milestones and royalties.

In July 2025, Formation Bio licensed worldwide rights to IMIDomics’ anti-CD226 monoclonal antibody, an IND-cleared, Phase 1–ready program that will initially be developed for ulcerative colitis. Under the deal, IMIDomics receives an upfront payment, milestone payments, royalties, and equity in Riverview Bio, a Formation Bio subsidiary created to develop the program.

In December 2025, Formation Bio acquired worldwide rights outside Greater China to LNK01006, a CNS-penetrant, allosteric TYK2 inhibitor from Lynk Pharmaceuticals, and will develop the asset within its new subsidiary, Bleecker Bio. The program recently received FDA IND clearance for Phase 1. LNK01006 is designed to selectively inhibit TYK2 while penetrating the central nervous system, allowing it to modulate immune signaling in autoimmune and inflammatory diseases where immune activity within the CNS or other compartmentalized tissues plays a role. Under the agreement, Lynk Pharmaceuticals will receive an upfront payment, a minority equity stake in Bleecker Bio, up to $605 million in development, regulatory, and commercial milestones, and tiered royalties, with Pacific Bridge NY participating as a minority co-investor.

As of December 2025, Formation Bio’s internal pipeline included four active programs: LNK01006, in Phase 1 for inflammation; RVW101, in Phase 1 Ulcerative Colitis; Sprifermin, in Phase 2 for Knee Osteoarthritis; and Gusacitinib (Licensed to Sanofi), for Chronic Hand Eczema.

Source: Formation Bio

Valuation

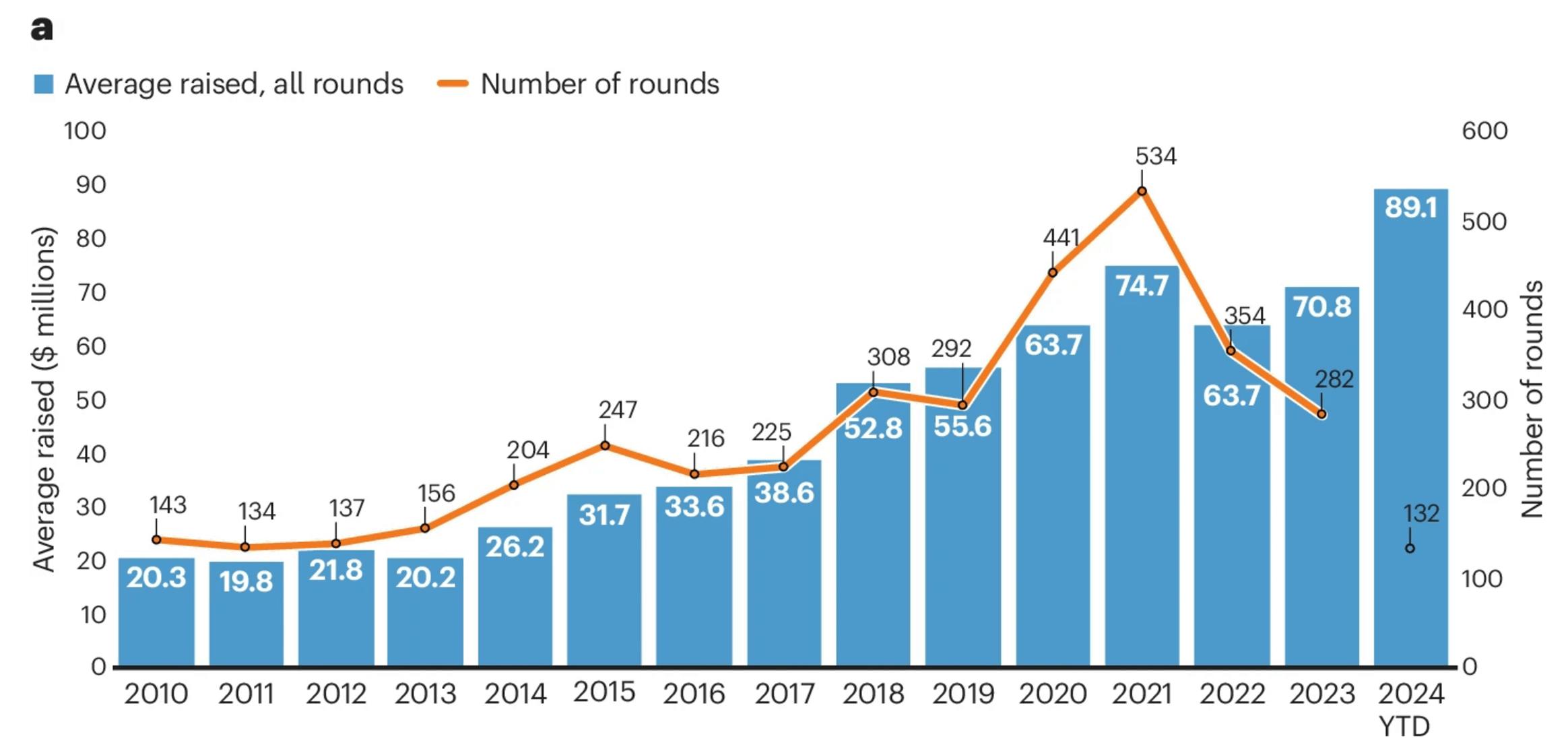

In June of 2024, Formation Bio closed a $372 million Series D funding round led by Andreessen Horowitz and participation from Sanoi, Sequoia, Thrive, Emerson Collective, Lachy Groom, SV Angel Growth, FPV Ventures, and others. In June 2024, Formation Bio stated that the capital would be used primarily to acquire and in-license candidate drugs and expand its AI capabilities. While the company did not disclose the valuation of this round, it described the valuation as a "material step up” from that of Formation Bio’s previous Series C round in September 2021, wherein it was valued at $1 billion. The raise put Formation Bio’s total funding at $528 million over four rounds as of April 2025. As of April 2025, the company has had 19 investors.

In 2024, biotech funding rounds have become less frequent but substantially larger in size, with over 50 companies raising rounds exceeding $100 million. The average post-seed financing round in 2024 was $89.1 million — approximately $18 million higher than in 2023 — a trend that reflects the scale and positioning of Formation Bio’s Series D financing round. From 2024 to 2025, average round size remained effectively flat.

Source: Nature

Key Opportunities

Partnership with OpenAI

Formation Bio took an AI-first approach to drug development before large language models (LLMs) were widely accepted or adopted in the biotech industry. These models, along with AI-driven workflows that can act semi-independently ("agentic" systems), have rapidly improved in capability, reliability, and access to funding. Because Formation Bio does not focus on creating its own proprietary AI models, like those used for tasks such as protein structure prediction, it is likely to benefit as AI technology advances broadly across the industry. In other words, rather than being disrupted by the release of more powerful models from outside developers, the company can quickly adopt and integrate those tools into its operations, gaining efficiency without having to build the core technology itself.

This strategy was further reinforced in May 2024, when Formation Bio announced a partnership with Sanofi and OpenAI. The partnership was designed to enhance Formation’s internal software systems, particularly in areas related to data handling and the use of fine-tuned AI models. Such a collaboration has been uncommon in the pharmaceutical sector as of April 2025. According to Formation Bio’s CEO, the partnership is expected to significantly increase operational productivity and accelerate the process of bringing new treatments to market.

Vertical Integration Into Preclinical Research Trials

As of April 2025, Formation Bio was focused on acquiring or in-licensing pre-phase 2 assets, but its goal of building an end-to-end drug development platform implies potential expansion into earlier stages, including preclinical development. This phase involves in vitro and in vivo testing to evaluate safety, pharmacology, and efficacy before human trials begin. It is a critical and highly specialized part of the R&D process that can be outsourced to preclinical contract research organizations (CROs).

The global preclinical CRO market was valued at $6.8 billion in 2025 and was projected to grow to $14.3 billion by 2034, driven by increased demand for biologics, pressure to reduce R&D costs, and a greater reliance on outsourced services. AI and machine learning are increasingly used in this space to improve chemical screening, toxicity prediction, biomarker discovery, and data management. These tools may reduce costs, speed up timelines, and improve success rates during early development.

Formation Bio has an existing data and AI infrastructure that could be applied to areas such as toxicology modeling, compound screening, and early target selection. If the company begins acquiring earlier-stage assets, it may take on more control of preclinical activities directly, rather than relying on external partners. This would allow it to influence key development decisions earlier in the pipeline and potentially expand the scope of its platform beyond clinical execution.

Such a move would shift Formation Bio closer to a vertically integrated model, covering a wider portion of the drug development value chain and potentially capturing value from earlier risk inflection points.

Asset Acquisitions

Formation Bio is structured to benefit not just from previous acquisitions, such as those from Merck KGaA and Libertas Bio, but from similar transactions as a core part of its long-term business model. The company’s approach is built around acquiring and integrating assets from smaller firms to improve efficiency in areas like research, administration, finance, and asset management.

While such consolidation could raise competition concerns when driven by larger industry players, acquisitions involving smaller companies are more often associated with improved productivity and better use of resources. Because Formation Bio’s model is explicitly focused on using technology to unlock these kinds of operational gains, continuing to acquire assets in this way aligns closely with its strategy and is likely to remain a source of advantage over the next decade.

Investment in high multiple drug categories

Formation Bio has the opportunity to pursue higher-margin opportunities by accelerating development and reducing costs for particularly lucrative drug categories. Certain therapeutic areas have consistently delivered strong returns on investment despite the high cost and risk of drug development. As of 2022, orphan drugs yielded a 7.2x return on investment, oncology drugs 4.3x, small molecule drugs 3.6x, and multi-indication drugs 2.9x.

These categories can face fewer competitors, benefit from expedited regulatory pathways, and command premium pricing, especially for orphan and oncology drugs. However, they also tend to require complex trial designs, extended timelines, and high patient engagement, all of which contribute to inflated development costs and failure risk.

Formation Bio’s AI-enabled clinical trial engine — designed to streamline trial execution, automate compliance-heavy workflows, and accelerate patient recruitment — offers a compelling value proposition in these high-stakes categories. By reducing the time and cost to reach key clinical milestones, Formation Bio can help partners unlock value inflection points faster, creating the potential for even more attractive margins on successful assets.

Increased cost of development for certain drugs

The cost of bringing a drug to market has risen, with R&D expenses increasing at an average rate of 8.5% annually over the last decade. As of 2024, the cost per approved drug ranged from $800 million to $2.3 billion, with roughly 60% spent on candidates that ultimately fail. Success rates remain low, particularly in the transition from Phase 2 to Phase 3, which had just a 31% success rate as of 2024.

This escalating cost environment creates an opportunity for Formation Bio. By offering a tech-enabled, AI-driven development platform, the company provides pharma and biotech firms a path to advance drugs faster and at lower cost. Formation Bio’s platform reduces operational inefficiencies across trial design, patient recruitment, and data processing, directly addressing the pain points that inflate traditional R&D timelines and budgets.

Regulatory support

The COVID-19 response illustrated how government support can accelerate drug development by offsetting R&D costs or guaranteeing future purchases. In 2020, Operation Warp Speed committed over $19 billion to fast-track vaccine development, enabling pharmaceutical companies to parallelize trials and bring candidates to market in record time. This model shows that when tackling high-risk or high-impact drugs, public funding can reduce financial barriers and encourage innovation.

As Formation Bio expands its pipeline and takes on higher-stakes assets, similar government partnerships or policy frameworks could provide financial upside or downside protection, especially for programs with broad public health relevance.

Key Risks

Pipeline Risk

Formation Bio's primary risks are tied to its drug pipeline, particularly the potential underperformance of its four drugs in future clinical trials. Even with successful outcomes, unforeseen delays could disrupt the company’s financial timeline and hinder its ability to monetize these assets as planned. Given the small number of assets, even a single setback could have significant consequences, with multiple issues potentially affecting the company's ability to raise additional capital.

Additionally, there is a risk that the company's scientific leadership may lack the specialized expertise required to effectively select and develop the drugs in its portfolio. By acquiring assets in areas such as dermatitis, parasthetica, eczema, and osteoarthritis, Formation Bio is betting on its ability to outperform the broader market in understanding how these drugs are valued and how they can be optimally developed.

Misplaced AI Bets

As an AI-native company, Formation Bio introduces incremental technological risks into its operations pipeline. While the likelihood of errors, such as hallucinations or misinterpretations, is low in individual LLM use cases and will decrease over time with model improvements, the extended timelines of drug development mean that such errors could accumulate and lead to significant, potentially harmful consequences.

Furthermore, by partnering with OpenAI, Formation Bio is betting that OpenAI will maintain its leadership in AI technology. However, with evidence from July 2024 suggesting that competitors like Anthropic are rapidly advancing and even surpassing OpenAI in certain use cases, Formation Bio faces the risk of falling behind technologically.

Exclusivity Risk

The use of exclusive agreements between clinical development platforms, such as Lindus Health, and large pharmaceutical companies can pose a risk for Formation Bio. These contracts may limit access to certain targets, technologies, or therapeutic modalities, reducing opportunities for companies like Formation Bio to engage with those assets. While the broader pipeline of preclinical assets remains strong, exclusivity can constrain strategic flexibility, intensify competition for non-exclusive assets, and drive up licensing costs.

Summary

Formation Bio is a tech-driven drug development company that speeds up clinical trials by using AI and acquiring or licensing clinical-stage drugs. Its AI helps improve tasks like medical writing, finding patients, and setting up trial sites. In June 2024, it raised $372 million in Series D funding to grow its drug portfolio and AI tools. As of December 2025, the company had four drugs in development, focused on inflammatory/immune-mediated diseases and musculoskeletal conditions. Growth opportunities include expanding AI through partnerships with OpenAI and Sanofi, and taking advantage of rising drug development costs. Key risks include challenges in using AI effectively, the strength of its drug pipeline, and the limits of its exclusivity deals.