Thesis

The brain allocates more matter to processing olfactory signals than to any sense other than vision, and unlike the other four senses, vision, hearing, touch and taste, which first pass through the thalamus, olfactory signals are routed directly to the limbic system, namely the amygdala and hippocampus, the brain’s emotional and memory centres. This absence of thalamic intermediation explains why odors are such powerful emotive triggers, instantly bringing back memories of loved ones, past homes, or familiar meals. Yet, in terms of digitisation, it lags far behind other senses; modern devices have cameras (digital eyes) and microphones (digital ears), but no aroma equivalent.

Source: Osmo

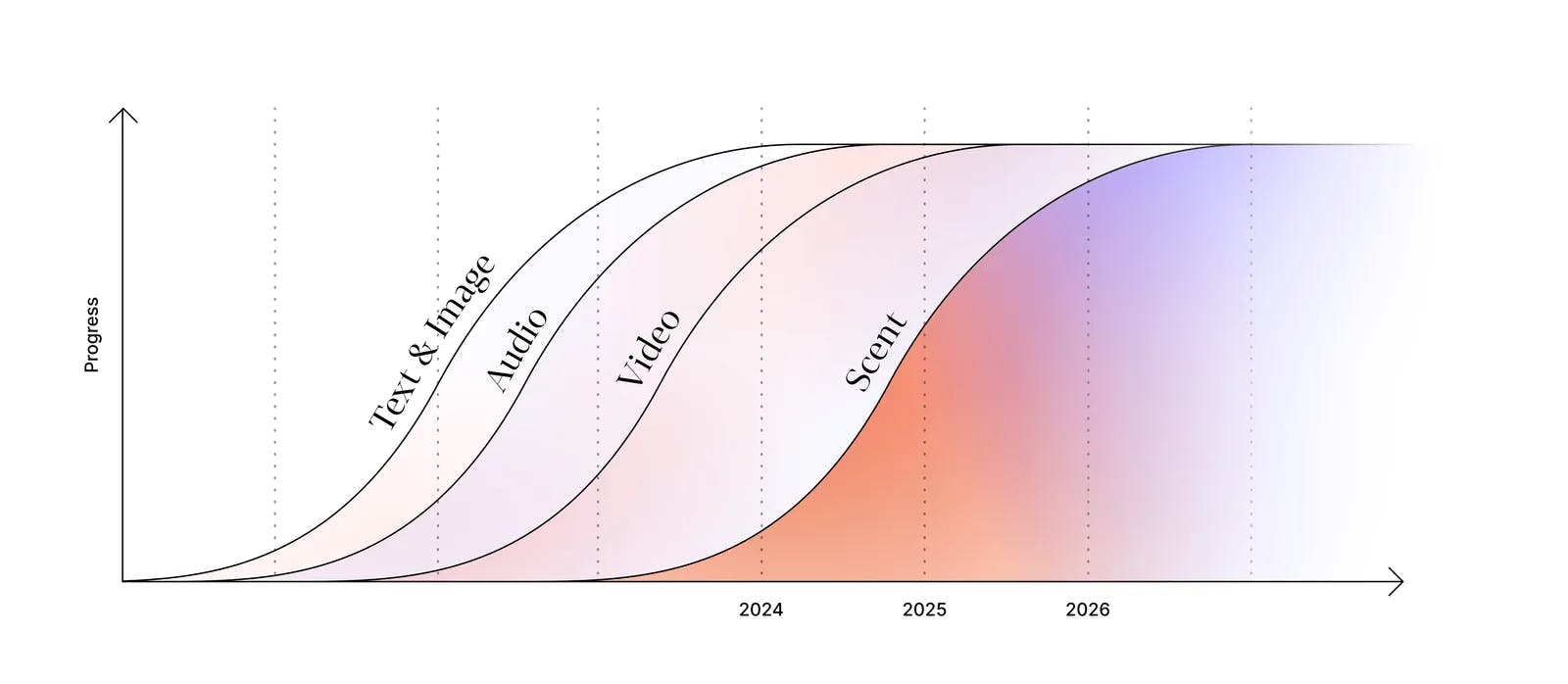

When it comes to digitizing vision, photoreceptors were first observed in 1851, leading to the discovery of the RGB (red, green, blue) color map, which was later commercialized in 1981 with the Sony Mavica. This technology has gone on to be used in photography, filmmaking, facial recognition, and scientific imaging. Audio advancements were driven by the Fourier Basis, the theorem that any complex signal can be decomposed into a sum of sine and cosine waves. Using the Fourier Transform enabled researchers to map complex sounds to frequency components. Applications have led to music streaming (MP3 compression), real-time voice processing, and hearing aids.

With vision, we understood the visual cortex and therefore biology before making any inspired technology. However, with audio, we developed mathematical models prior to understanding the biological elements. The method of digitizing scent is parallel to that of audio, in which it is developing AI models to replicate olfaction, with a tech-first, biology-second approach. This approach has been a necessity since it is still not understood fundamentally the interaction/binding between the molecules and the 400 unique receptors, the shape of the receptors, or the encoding of these complex signals to the brain.

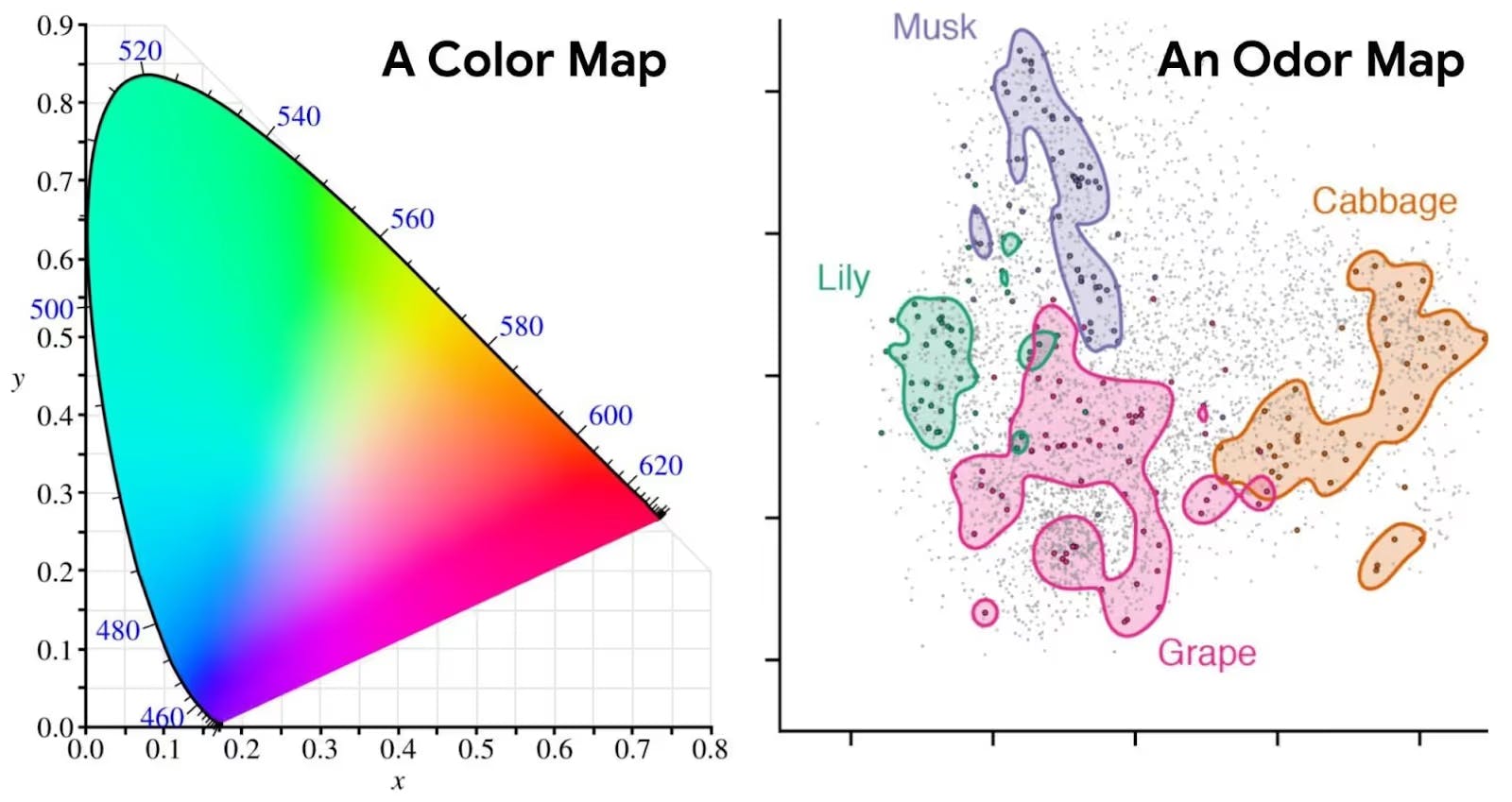

The key to digitizing these senses was finding a sensory map similar to the translation process between the receptors and the brain. For vision, it was RGB (three dimensions), for audio, it was frequency and amplitude (two dimensions), for scent, the true dimensionality is unknown but assumed to be significantly more complex given the 400 unique receptors. This unstructured nature of smells, the difficulty in finding a mapping, the lack of industry-academic collaboration due to concerns over IP leakage, and the multidisciplinary nature of the problem requiring both computer science and molecular biology expertise have meant the study of olfaction has been somewhat neglected.

The human olfactory system, although less receptor-dense than species such as rats or dogs, demonstrates remarkable sensitivity. It can detect changes in concentration at magnitudes below one part per billion, comparable to identifying a few drops of a volatile compound dispersed in an Olympic-sized swimming pool. Beyond sensitivity, its discriminative capacity is exemplified by a study finding that humans can distinguish up to 1 trillion odors.

Despite this biological sophistication, the process of scent creation remains largely artisanal and labour-intensive. Master Perfumers, referred to as “noses” in the industry, require over a decade of training and are in short supply in an industry heavily reliant on their expertise for fragrance formulation. Compounding this challenge are rising pressures to conform to regulatory and environmental constraints. Fragrance and Flavor (F&F) houses must increasingly ensure their formulas are biodegradable, non-irritant, allergen-free, and compliant with tightening global regulations. These requirements reduce the palette of available ingredients; examples include the blacklisting of oakmoss and the restriction on synthetic compounds lilial and llyral. Consequently, formulation efforts are diverted away from innovation and creativity towards reformulation and regulatory substitution.

While a theoretical solution lies in designing entirely new odorant molecules, this route is burdened by high costs and significant commercial risk. The process generally begins with a known base molecule, followed by chemical modifications and subsequent rounds of testing, which can cycle over years.

Omso AI’s objective is to digitize the human sense of smell. For computers to interact with the world via the same modalities as humans, Osmo has sought to construct an odor map and use this to replicate and compose new scents with exact precision. Josh Wolfe, a lead investor, spoke in 2024 of the company’s vision to build a “Shazam for scent”, a platform capable of capturing, storing, and transmitting olfactory experiences.

Founding Story

Alex Wiltschko, CEO, founded Osmo in 2023 as the synthesis of his two lifelong pursuits: computers and perfumery, defining himself as “not interested in a lot of things, but obsessed with some things”. The origins of which trace back to his childhood in Texas, where his early exposure to computing came from his father, who worked as a mainframe operator. Parallel to this was the emergence of a fascination with fragrance at age 11 during a summer camp. Observing that the cool children wore distinctive fragrances, he viewed scent as a marker of individuality. Through designing websites and logos, Wiltschko saved enough at 12 to buy a bottle of Bulgari Black. Through fragrance literature, Perfumes: The Guide by Luca Turin and Tania Sanchez, Wiltschko was captivated by the ability of the fragrances to evoke such emotive, subjective experiences.

As Wiltschko described an interaction with his first bottle of Bulgari Black:

“A spritz from the hockey-puck shaped bottle unleashes a drama in three acts. It first smells like a screeching rubber tire, which soon gives way to the aroma of leather and vanilla, and finally evens out to the smell of tobacco smeared out on an old armchair.”

Given a family background in academia, his mother in public health, and father in geology, Wiltschko chose not to pursue perfumery but instead studied neuroscience at the University of Michigan. Unable to fully understand how the brain turned molecules into emotions and perceptions, he entered a PhD program at Harvard, drawn by its density of olfactory neuroscience professors. There, he studied under Sandeep Datta, a neurobiologist trained by Nobel Laureate Richard Axel, who, with Linda Buck, is credited for discovering the specific gene family of the olfactory receptors and proposing the one-neuron, one-receptor rule.

Wiltschko’s doctoral thesis, The Structure of Mouse Behaviour, inspired by the phenomenon of mice smelling fear, sought to identify repeated patterns of mice referred to as behavioural syllables to understand how the brain structures behaviour. The methodology and tools developed during this research formed the basis for Syllabe Life Sciences, Wiltschko’s first entrepreneurial venture, a spinout later acquired by Neumora Therapeutics for use in neurological drug development pipelines. This research was ultimately tangential to Wiltshcko’s core interests, and the key takeaway from this period was the importance of making solutions narratively driven. Wiltschko described the core lesson from his time in academia by saying that “the **only way people can consistently absorb information is through storytelling."

Next, he co-founded Whetlab in 2013, an MLaaS company, automating the model hyperparameter tuning process. Whetlab was acquired by Twitter in 2015. At Twitter, Wiltschko worked within the Advanced Technology Group, where he contributed to the development of torch.autograd, the engine of PyTorch’s backpropagation. His co-founder, Ryan Adams, credited as a key mentor, studied under Geoffrey Hinton, the Godfather of Deep Learning, who now sits on Osmo’s Scientific Advisory Board (SAB).

During his PhD, Wiltschko faced the personal loss of his father due to an undiagnosed tumour. Discovering the potential of biomarkers in detecting such diseases, Wiltschko realized the potential of smell to save lives beyond its commercial applications. Additionally, architectural and hardware advances for deep learning transformed the capabilities of ML beyond structured datasets, creating the opportune moment for Wiltschko.

Following the completion of his PhD, Wiltschko joined Google Research’s Brain Team (now Google DeepMind), establishing and leading the first olfaction team, addressing one of olfaction’s central challenges: mapping molecular structure to perceptual experiences. One foundational influence was the 2015 DREAM Olfaction Prediction Challenge, initiated by IBM researcher Pablo Meyer, tasking teams to build models capable of predicting molecule aromas based on chemical structure. At Google Brain, Wiltschko’s team moved beyond the structural approach to propose a new variable influencing scent: metabolic similarity. Wiltschko hypothesized that chemicals would smell similar not just due to chemical similarities, but also biological similarities, inspired by the view of the sun being the evolutionary driver, “prior”, for light and the belief that the olfactory equivalent was the atmosphere formed through millions of years of metabolic processes releasing volatile organic compounds (VOCs).

The team constructed a database of metabolic relationships, defined by enzymatic pathways transforming one molecule into another, quantifying the metabolic distance between molecules by calculating the minimal number of enzymatic steps required for conversion and using this as a proxy for metabolic similarity. Empirical findings confirmed an almost linear relationship, addressing a longstanding limitation in structural models.

As Wiltschko explained, his sentiment following the discovery of this metabolic-olfactory connection:

“[When you experience a smell,] you are perceiving parts of another living thing, I just think that’s really beautiful. I feel more connected to life that way.”

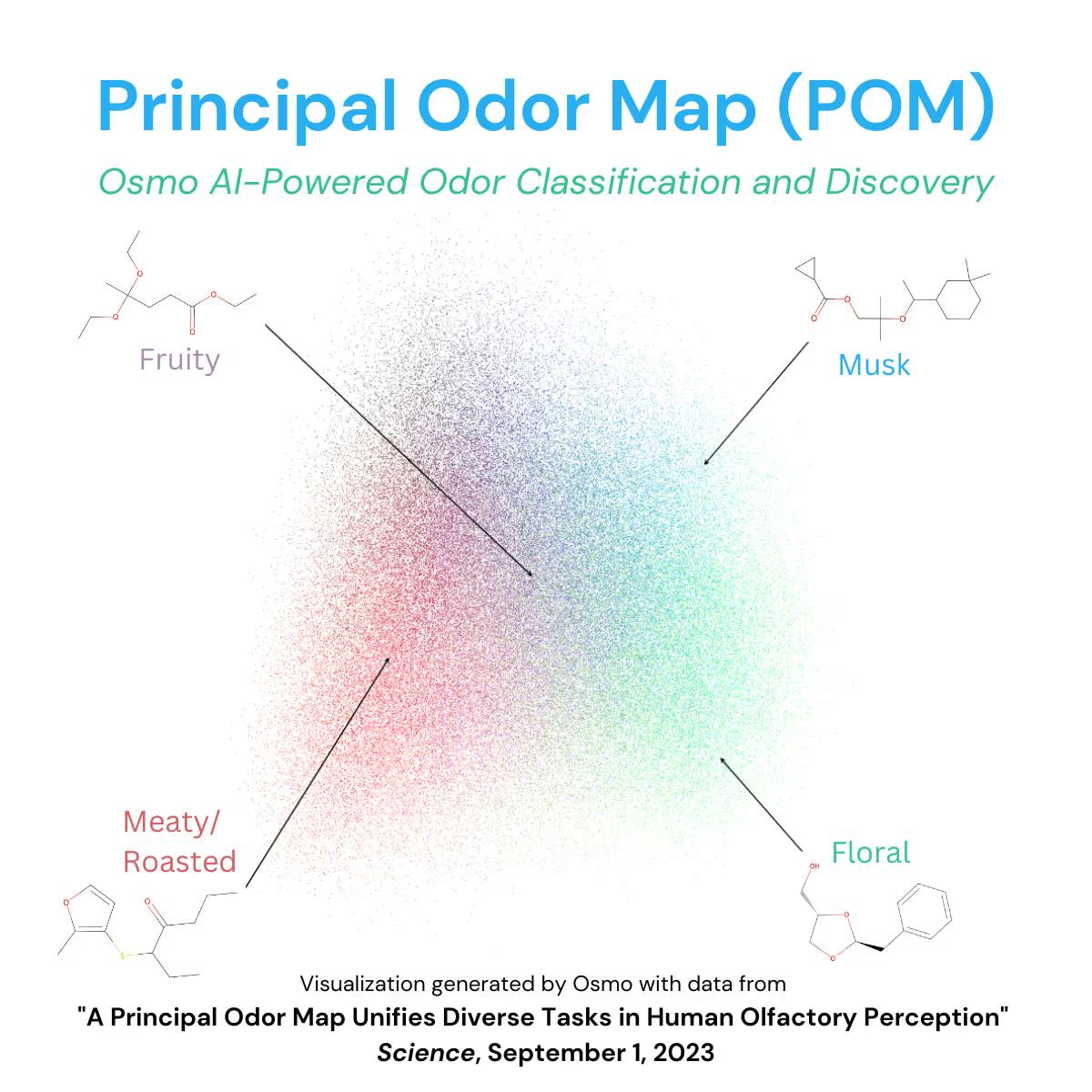

Source: Osmo

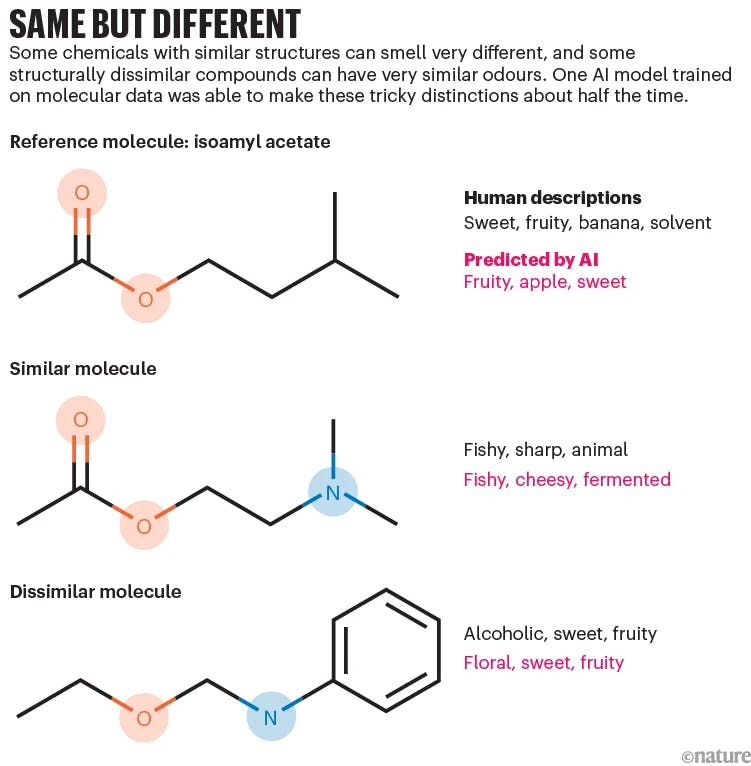

Building on this breakthrough, the team started work on a Principal Odor Map (POM). A term to describe the embedding of their deep learning model, a high-dimensional representation linking molecular structure to perceived smell. This model was trained on over 5K molecules with 256 dimensions and then tested on 320 unique compounds. A panel of 15 individuals, exposed to a controlled lexicon from a proprietary 138-word fragrance wheel with 55 odors over five one-hour training sessions, provided the perceptual benchmarks. The model was able to predict odor profiles more accurately than the average trained human in 53% of cases, surpassing the baseline Morgan Fingerprint approach, previously the default technique representing molecular structures as binary vectors.

Mainland described the rationale for training the panellists and the difficulty in producing a map, saying that:

“For one smell, panellists chose the words ‘sharp, sweet, roasted, buttery’. A master perfumer, asked to describe the same smell, noted ‘ski lodge, fireplace without a fire’. That shows you the gap … Our lexicon is not good enough.”

Several limitations of the POM model were identified. First, deep learning remains a black box approach. The lack of interpretability means that, as of May 2025, there was still no consensus on fundamental biological processes. Secondly, the model struggled with enantiomers, molecules with identical formulas but different 3D configurations, leading to different smells (e.g., (R)-limonene smells like orange, while (S)-limonene smells like lemon). Thirdly, the model was trained exclusively on single molecules, whereas real-world scents are composed of hundreds of volatiles, 800 for coffee, of which only 30 are responsible for the aroma known as the Key Food Odorants (KFOs). Finally, non-linearities such as scent intensity, where a compound like MMB can smell roasty at low concentrations but of urine at high ones, are not reliably captured.

Source: Nature

Despite these constraints, the release of the POM offered proof of concept that olfaction could be digitized. This milestone marked the team passing the Odor Turing Test to transition to Google Ventures and begin formalizing the vision for Osmo. Given the preliminary paper, the team believes that the embedding cluster of molecules is biologically grounded and could therefore potentially reflect metabolic similarity, although no conclusion has been drawn as of early 2025.

Wiltschko founded Osmo in Cambridge, Massachusetts, under MIT’s The Engine accelerator. Internally, the team is described as an amalgamation of “atoms and bits people”, fusing a group of chemists, perfumers, neuroscientists, and ML researchers. Several key figures from Wiltschko’s team include Rick Gerkin, who contributed to the winning entry in the 2015 DREAM challenge, using molecule size and compactness as predictors. He was also a co-author of the POM study following Wiltschko from the Google Brain team. Joel Mainland, part of the Monell Chemical Senses Centre, who assisted in the panellist training in the POM research and is credited with creating neural nets to map molecular structure to odor, is on the SAB.

In late 2024, Geoffrey Hinton joined the SAB, describing olfaction during his endorsement speech as “the new frontier for AI” with Osmo being the definitive leader. A major recruitment for Osmo’s industry reputation was Christophe Laudamiel, a Master Perfumer, known for his iconic compositions such as Fierce and Polo Blue, scents which Wiltschko recalled from his initial spark at that summer camp. Laudamiel brings extensive commercial and creative experience, having worked with leading houses such as Firmenich, IFF, and Mane and clients ranging from Procter & Gamble to Tom Ford.

The convergence of computational biology and olfactory creativity under one organization illustrates the multidisciplinary approach Osmo is taking to map, replicate, and design scents with precision. Wiltschko has jokingly remarked that his ultimate goal would be a real-world Star Trek tricorder, a handheld device capable of chemically analyzing a sample and producing a complete molecular profile. While still aspirational, the tech stack being built by Osmo represents the first credible platform toward such a possibility.

Product

Source: Dmytro Rak

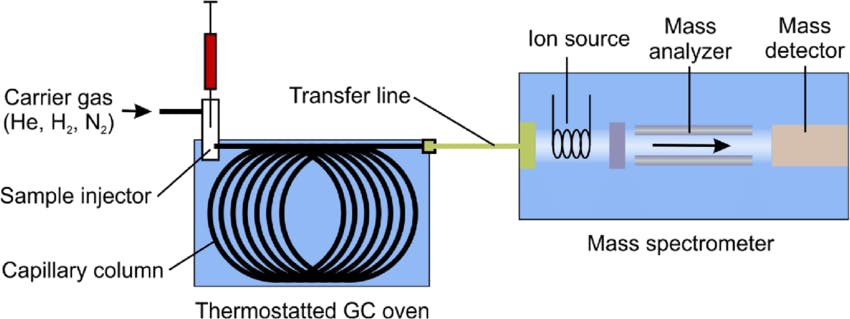

Osmo’s core technology operationalizes the transition of VOCs into structured digital representations. The process begins with the collection of VOCs using a Gas Chromatography-Mass Spectrometer (GC-MS). Osmo employs headspace sampling, a technique that captures airborne molecules emitted from a source, avoiding omission or alteration of any critical odorants. Laurianne Paravisini, Osmo’s Director of Analytical Chemistry, has highlighted this step, specifically the representativeness of the sampled headspace, as a key area for ongoing innovation.

Source: Anthias Consulting

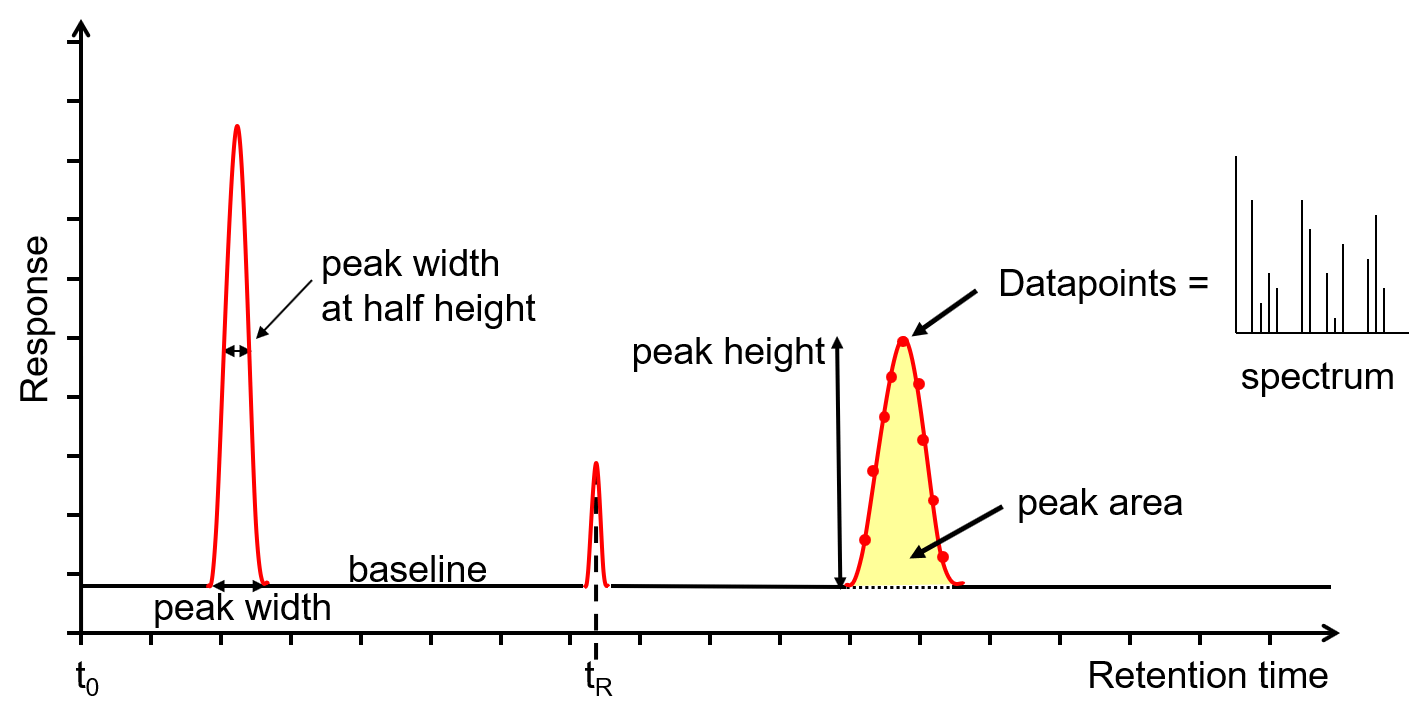

In the gas chromatography (molecule separation) stage, the mixture is vaporised and combined with an inert carrier gas, typically helium, referred to as the mobile phase, which passes through a coiled column lined with an absorbent liquid, referred to as the stationary phase. Each compound travels through the column at a rate determined by its boiling point, molecular weight, and affinity for the stationary phase, resulting in the separation of the mixture’s constituents. The output is a chromatograph with distinct peaks, each representing an isolated molecule.

These are then routed to the mass spectrometer (molecule identification) stage. Molecules are first ionized via an electron beam, a process that fragments the molecules into smaller ions, which are analyzed based on their unique mass-to-charge ratios. The resulting mass spectra, a distribution of the ratios referred to as a fingerprint, are matched against existing databases to identify each compound. Some machines are equipped with a complementary instrument, the Gas Chromatograph Olfactometer (GC-O), which apportions the molecule samples, separated in the GC-MS, to a sniffing port and the mass spectrometer, giving team members a chance to smell the mixture molecule by molecule, ensuring validation of scent replication and accurate description of test samples.

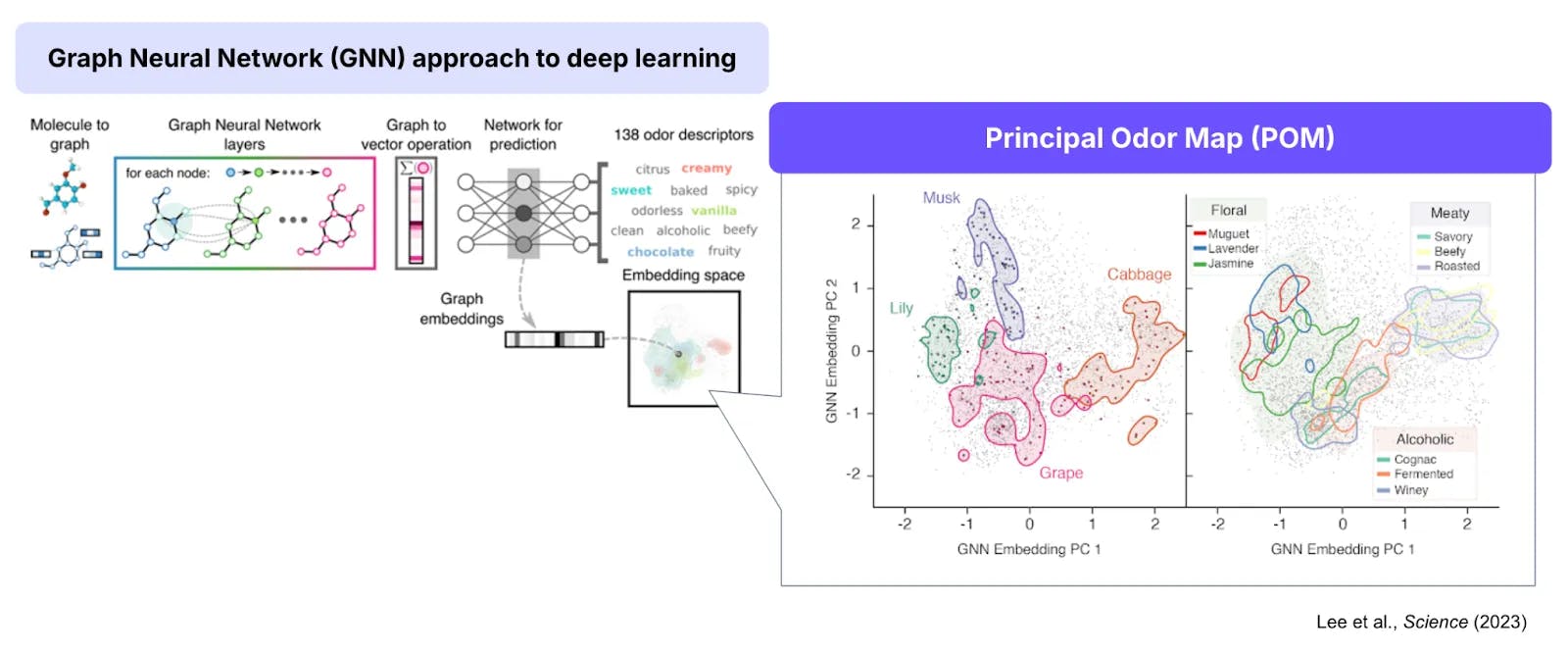

Osmo has automated the downstream interpretation of GC-MS outputs, converting each identified molecule into machine-readable inputs: graphs with atoms as nodes and bonds as edges, which are transformed into numerical vectors via one-hot encoding. The model Osmo uses is a Graph Neural Network (GNN). GNNs have a unique repeated step, message passing, which enables information pooling, allowing each node to “talk” to its neighbourhood and develop an embedded context on the surrounding chemical environment.

The success of GNNs in modelling chemical relations when compared to other deep learning methods is attributable to this encoding stage. The graph is then aggregated via a summation or average operator to all nodal vectors into a single learned embedding forming the POM, offering semantic generalisation for Osmo to project even unseen molecules into the space and predict the olfactory profiles. Additionally, user feedback, such as “too citrusy” or “not woody enough”, has been helping model tuning, equivalent to RLHF.

Source: Osmo

Standard GNNs, however, operate on 2D molecular representations and therefore struggle with chirality, the enantiomer problem referenced previously, where molecules have different scents depending on handedness. Architectural advancements, such as POI-3DGCN, allow 3D inputs for the incorporation of sterochemical information, offering promise to resolve chirality and intensity prediction problems. While it is not publicly confirmed as of May 2025 whether Osmo has implemented this exact framework, such functionality would be expected to be integrated to provide the precision mapping required.

Source: Osmo

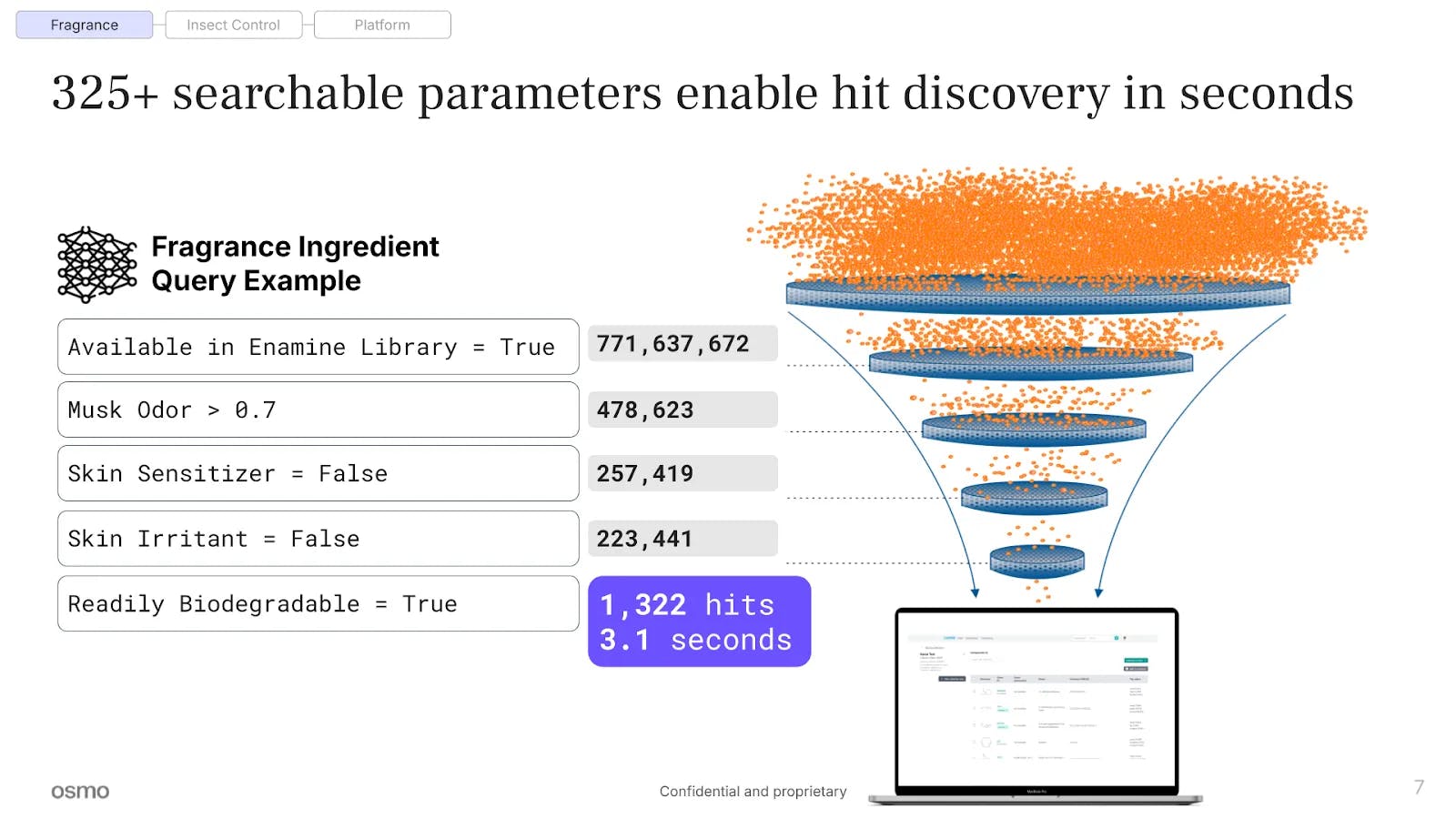

These capabilities are supported by Osmo’s expanding virtual molecule library, containing over 1 billion small molecules. This database enables rapid querying of potential ingredients for scent design, allowing users to identify candidate compounds that meet safety, regulatory, and perceptual criteria before physical synthesis or testing. This interface bridges the molecular analytics with creative formulation.

Source: Osmo

To fully realize a transmissible scent system and bring about the “Shazam of scent”, a tech stack of three core components is required:

Sensor: Captures and digitizes scent input from the physical environment

Map: Translates molecular structure into a perceptual profile via the POM

Printer: Reconstructs and emits the corresponding scent by releasing a precise molecule mixture

Osmo has developed working versions of all three devices and is currently focused on miniaturisation and hardware refinement to make these components commercially deployable.

Scent Teleportation

In 2024, Osmo achieved a key milestone: scent teleportation. This process involved capturing the molecular composition of a real-world smell and translating it into a digital format to be projected onto the map. This abstraction can be used to formulate a recipe with ingredients and concentrations to be interpreted and followed by the scent printer. Overcoming the challenge of getting computers to understand the data received from the chemical sensors and emulating the translation of scent molecules into neural signals as part of olfactory transduction, established a machine replication of the olfactory system for the first time. The first reported scent to undergo this process was that of a plum. This achievement validated Osmo’s ability to perform semantic mapping; they have since performed thousands of similar trials.

Since the reconstructed scent is derived from a reduced set of essential odorants rather than a full molecule replication, the output is perceptually equivalent but potentially structurally simplified, offering possibilities for parsimonious modifications of existing fragrance house formulas. This step validated Osmo’s three core technologies, which it has termed Olfactory Intelligence (OI). Through OI, Osmo not only digitizes scent but establishes a full infrastructure for reading, interpreting, and generating scents.

Forge

Forge is Osmo’s in-house molecule discovery engine, designed to overcome one of the fragrance industry’s core bottlenecks, the inability to rapidly invent, validate, and scale new odorant molecules for commercial use. Traditionally, the development of proprietary compounds, referred to as captives, is a time- and resource-consuming process, taking up to a decade, making projects with such uncertainties uneconomical. Forge compresses this development cycle by 4x, enabling new molecule creation within 1.75-2.5 years, and with the capacity to develop multiple candidates in parallel.

Using its OI, Osmo’s POM offers computational iteration on scents without requiring full synthesis at each step, hence the reduction in time-to-market. This technology enables Osmo to act as both a discovery platform and an ingredient supplier. Initial disclosed new compounds have included Compound 533, described as “the boundary where the red flesh transitions into white rind.”, Glossine, Fractaline, and Quasarine, the latter three each offering a unique spin on a floral base. Beyond their sensory profiles, molecules like Fractaline have been engineered to offer functional benefits, such as acting as scent amplifiers in low concentrations. The more captives designed through Forge, the greater the value proposition Osmo offers to clients as it seeks to establish its industry presence.

Generation: AI-Powered Fragrance House

Generation is Osmo’s primary commercial venture, launched in March 2025, following the private beta of “Fragrance 2o” initiated in September 2024. Generation is positioned as the world’s first AI-powered fragrance house, targeting B2B clients with a platform that integrates creative input, molecular generation, and physical sampling.

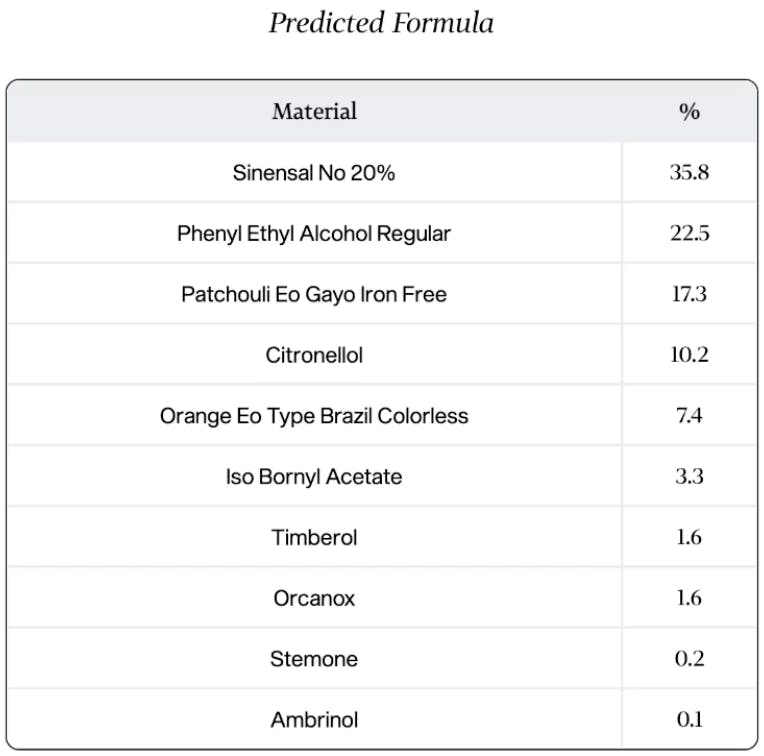

For clients, the process begins with a creative brief, via text, image, or audio, describing the intended narrative or emotional arc of the fragrance. Osmo’s OI system parses this input, interprets the semantics, and generates an initial fragrance formulation. This is then refined through additional suggestions/alterations from the client with the assistance of master perfumer, Laudamiel, followed by the synthesis and delivery of a physical sample. The iterative process is therefore cut down from ~3 months to only days/weeks.

The shortened timescale is enabled by two key features; firstly, the automated regulatory compliance, by which Generation integrates customisable regulatory filters at the formulation stage, removing any compounds flagged for allergenicity, toxicity, or sustainability concerns, eliminating the manual screening stage. Second, Osmo offers a dynamic ingredient list including natural ingredients, synthetics, and at least five captives.

Generation is particularly targeting under-served mid-market clients, companies with <$100 million in revenue, who historically lacked the volume or budget to justify bespoke formulations from legacy F&F houses. This segment has traditionally defaulted to off-the-shelf scents due to cost and minimum order constraints, if served at all. Generation lowers these barriers by altering the cost structure to be less labour-intensive.

Osmo’s early commercial engagements have included a collaboration with Travertine Spa, a luxury fragrance house. Osmo was able to develop a fragrance within weeks relative to the company’s experience of over 1 year, and the scent is set for release in Spring 2025. Other clients include Alice Panikian, who is both a customer and a member of Osmo’s Creators & Partnerships team, and The Museum of Pop Culture (MOPOP), for which Osmo is designing a bespoke institutional scent.

To support platform scaling, Osmo has expanded its operational infrastructure, hiring Andrew Kim as plant manager and Florence Bagneris as VP of Sales to accelerate the go-to-market (GTM) strategy. As the company moves towards larger-scale production and licensing of its fragrance ingredients, Generation serves as the client interface, enabling the creation of a fragrance-as-a-service model.

Inspire

Source: Osmo

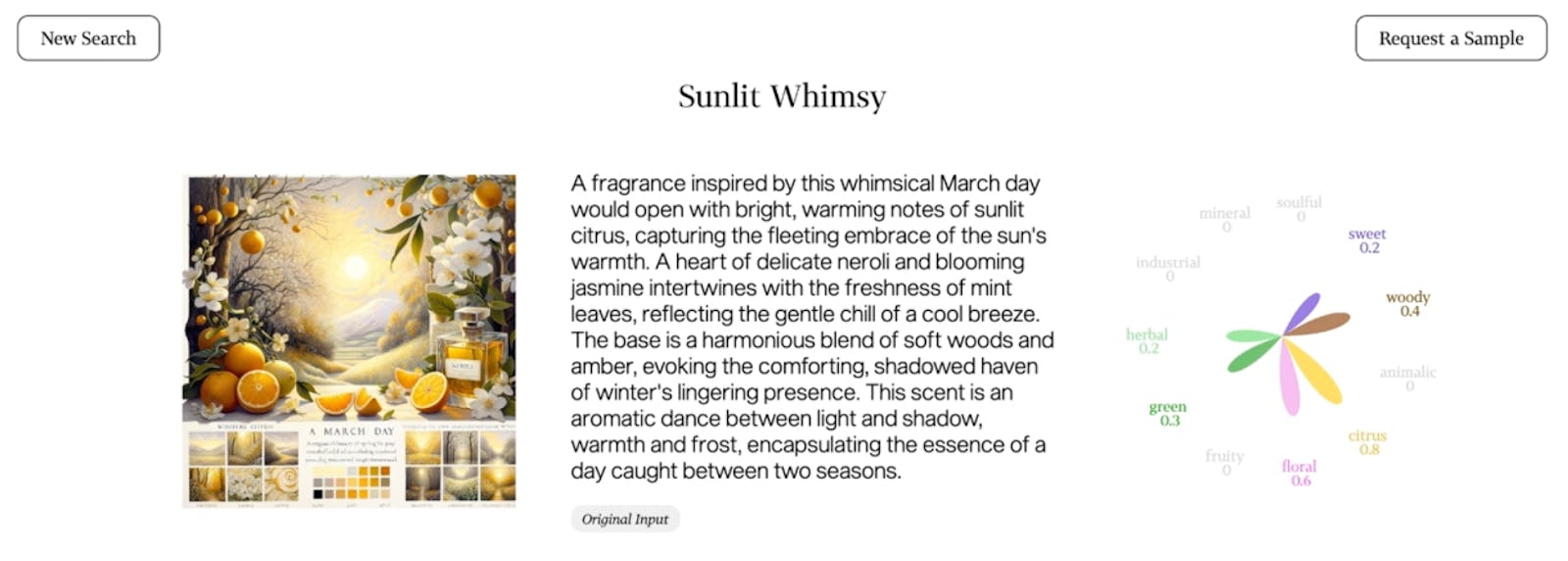

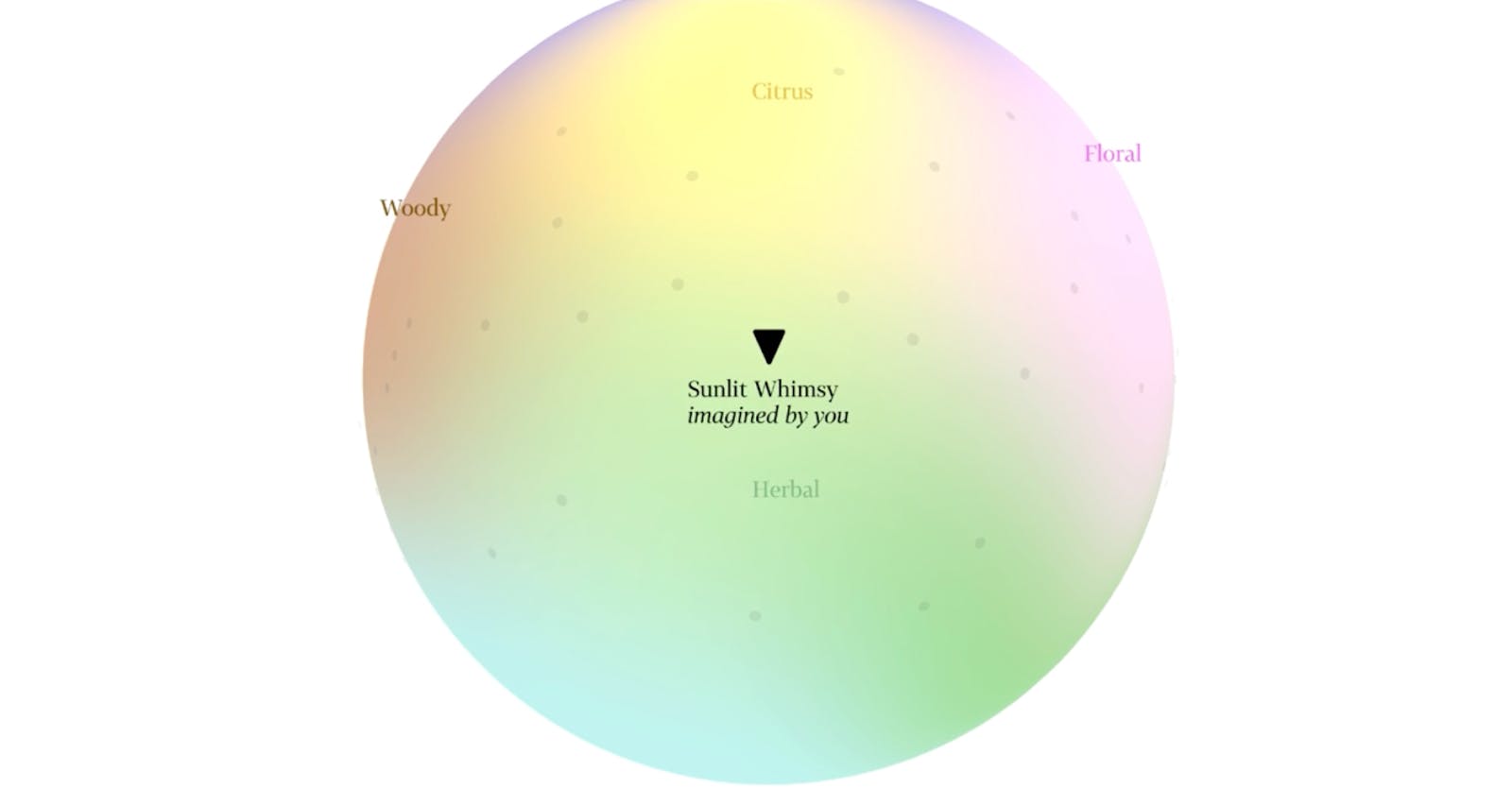

Inspire is Osmo’s “GPT for perfume”, offering a client interface layer on the company’s OI stack, with a prompt-based tool for scent design. While still in internal use and closed beta as of May 2025, Inspire provides a direct channel through which individuals can engage with Osmo’s scent-generation engine, co-creating personalized fragrances without requiring technical expertise.

Source: Osmo

Inspire functions by taking a prompt, textual or visual, and generating a proposed scent name, descriptive narrative, and molecular formula aligned with the scene or concept provided. The system maps the resulting formulation onto Osmo’s 3D visualisation of the POM, conceptualized as a globe. The placement of the generated scent on the globe offers an interpretable reference point, contextualized based on proximity to other well-known fragrances given by interactive nodes displaying relevant comparative information.

Source: Osmo

Source: Osmo

Functionally, Inspire serves three purposes: user calibration, helping reduce the constraint of industry jargon so customers can ensure their scent aligns with their brief objectives, a model interface, offering an intuitive front-end to Osmo’s OI infrastructure, and fragrance prototyping, granting users a faster iteration cycle of exploring and refining samples.

Though Inspire is not yet publicly available, its design aligns with Osmo’s long-term objectives of decentralizing fragrance creation. It lowers the barrier to entry for individuals, creators, and small businesses to explore scent design without significant capital or institutional branding. It also serves as a feeder into Generation, Osmo’s B2B F&F house, allowing users to develop prototypes in Inspire before committing to a commercial-scale roll-out. Planned future enhancements include editable scent profiles allowing real-time modification of notes for fine-tuning, regulatory pre-screening to automate compliance checks with major regulatory bodies (e.g., IFRA, EPA, EU) using “one-click reformulation” and cost estimation tools to offer the customer a price estimate prior to entering production.

Market

Customer

While the origins of perfumery can be traced back to Mesopotamia, modern perfumery was formalized in Grasse, France. The industry evolved from practical roots; originally tasked with masking the odors of tanned leather gloves, into a high-barrier trade dominated by exclusivity and artisanal knowledge. Regulations emerged in the 18th-century French regulation mandating that all medicinal goods list their ingredients, causing a delineation between pharmaceutical and fragrance industries, with perfumery preserving a culture of opacity. This trend was further entrenched by modern legislation in 1973, the “fragrance loophole”, issued by the Federal Fair Packaging and Labelling Act. This act allows companies to label multiple ingredients under the umbrella term “Fragrance”, potentially concealing sensitizing of allergenic compounds under the guise of trade secrecy.

Wiltschko believes this opacity has constrained innovation and safety transparency, where even brand owners are unaware of their own fragrance formulations, with examples such as Frito-Lay being contractually denied the composition of its Cool Ranch flavoring. Osmo’s goal is to bring accessibility and transparency to a system that has historically relied on proprietary bottlenecks. Rather than replacing Master Perfumers, Osmo is expanding its creative toolkit, preserving human-driven development while automating the laborious compliance layers and initial translation of inspiration into ingredients. As of May 2025, the company has only announced Travertine Spa Atelier and MOPOP as corporate partners. However, Osmo will likely seek to develop commercial relations with the incumbent F&F houses to offer AI tools and directly sell to smaller corporate clients the ability to develop custom fragrances for their brands.

Market Size

The F&F industry is currently oligopolistic, with a handful of dominant firms, namely IFF, Givaudan, Firmenich, Symrise, and Mane, controlling the bulk of the formulation and ingredient supply. There are fewer than 600 trained perfumers globally, a talent pool smaller than the number of astronauts or chess grandmasters. Of these, IFF alone employs an estimated 10%, making perfumer recruitment highly competitive and structurally inefficient.

Wiltschko estimates that the top 50 F&F houses serve ~60K brands. Osmo’s ambition is to scale this end market number by 100x, offering AI-enhanced formulation services to clients previously excluded due to volume thresholds and formulation costs. SMEs in particular are underserved; most do not generate enough demand to justify the development of bespoke scents. Osmo’s platform infrastructure, through tools like Generation and Inspire, lowers both cost and minimum order requirements, unlocking a new segment of B2B and creator clients.

The traditional perfumery workflow is manual and protracted. Brands submit creative briefs, which F&F houses triage based on volume and commercial viability. Even accepted briefs often result in minor adjustments of existing formulations rather than genuine brand-tailored innovations, due to the cost and time required to achieve client satisfaction through functional integration with the base product and regulatory approval. Osmo’s systems compress this cycle to days from weeks by automating compliance checks, ingredient filtering, and formula validation.

The global fragrance market is mature, but significant in absolute terms. The global perfume market is estimated to be worth $66.1 billion in 2025, growing to $73.1 billion by 2030, implying a CAGR of 5.5%. Given this maturity, margins have come under pressure over the past decade from inflationary impacts, supply chain challenges, and declining volumes. Using the pharmaceutical industry as a proxy, new molecule development can cost millions; therefore, F&F houses are increasingly seeking innovation to restore certainty and operating leverage to the process.

Fragrance also acts as a vertical within the broader $557.2 billion Beauty and Personal Care market, where it is the primary purchase driver for consumers. Osmo’s core capabilities extend beyond perfumes into any product requiring scent; shampoos, lotions, air fresheners, etc., providing significant expansion potential. Additional adjacent markets include: the $1.1 trillion global counterfeit trade, the $10.7 billion insect repellent industry, amongst opportunities within healthcare for biomarker detection diagnostic devices.

Competition

Legacy Fragrance Houses

Givaudan: Founded in 1985 and based in Switzerland, Givaudan is the world’s largest F&F manufacturer by market capitalization, valued at $43 billion as of May 2025. In FY24, it reported revenues of $8.2 billion, divided across two main segments: Fragrance & Beauty and Taste & Wellbeing. Givaudan has actively pursued AI integration, acquiring Myrissi in 2021 to explore relationships between scent and colour, and launching Carto in 2019, an internal AI tool that enables scent formulation by accessing a database of 5K ingredients. Carto has since evolved into a generative interface likened to a “ChatGPT for fragrance,” assisting perfumers with sample creation and combination exploration.

However, while Givaudan automates sample generation and possesses greater ingredient and captive accessibility, formulation remains manual. Osmo’s value proposition, automating formulation, compliance filtering, and synthesis prediction, positions Osmo as a modular complement rather than a direct substitute, capable of augmenting Givaudan’s existing infrastructure.

DSM-Firmenich: DSM-Firmenich emerged from the 2023 merger of Firmenich, an F&F house, and DSM, a pharmaceutical and nutrition conglomerate, combining fragrance, nutrition, and materials science capabilities under one entity with a market capitalisation of $27.9 billion. Firmenich first announced its AI-created flavor with Microsoft in 2020, and subsequently launched Scentmate in 2021. Scentmate is a tool streamlining the client brief process; however, DSM-Firmenich’s AI initiatives remain largely customer-facing and interface-focused. Osmo’s focus on accelerating molecule discovery and molecular-level mapping places it outside the scope of Firmenich’s tooling. Notably, Florence Bagneris, Osmo’s VP of Sales as of June 2025, was hired from Firmenich, likely providing domain insight.

International Flavors & Fragrances (IFF): IFF, founded in 1833 and based in the US, is a diversified F&F supplier with a market cap of $19.6 billion. Following its 2021 merger with DuPont’s Nutrition & Biosciences, IFF’s product scope extends beyond fragrances into enzymes, nutrition, and pharma. In early 2025, IFF introduced ScentChat, which aggregates customer feedback using natural language processing (NLP) to guide perfumers during brief development. In April 2025, IFF also launched the Science of Performance program, unveiling two proprietary tools: IFF SCENT+, for tuning fragrance intensity, and IFF CTRL+D, for neutralizing malodors. While these tools provide performance enhancement in applied fragrance contexts, they do not address the formulation bottlenecks and workflows.

Symrise: Founded in 1974 and valued at $15.5 billion, Symrise operates across nutrition, cosmetics, and fragrance. Its AI platform, Philyra, developed in partnership with IBM, uses a database of 1.7 million in-house formulations to predict scents suited for specific demographics. Initial commercial validation included the co-development of Egeo On Me and Egeo On You for Brazilian brand O Boticáricio in 2019. Philyra 2.0, launched in 2022, expanded its focus to include sustainability, guiding perfumers towards environmentally preferable ingredients.

Philyra’s competitive strength lies in its massive dataset and IBM’s expertise. However, the platform remains internal and proprietary, with no indication of commercialisation. Osmo, by contrast, is developing modular tools with potential cross-industry applications, taking a more liberal approach to distribution and co-creation.

MANE: Established in 1871, MANE generates $2.1 billion in annual sales across flavors, fragrances, and ingredients. Its AI capabilities include WELLMOTION, which links scent to emotion via consumer psychometric studies; GREEN MOTION, an environmental compliance scoring tool for fragrances; and Motion Lab, its internal AI deployment unit. However, as of May 2025, these tools primarily serve analytical or evaluative functions, not yet integrated into the formulation pipeline.

AI Fragrance Startups

Koniku: Founded in 2015, Koniku uses synthetic biology to create devices that can detect smells. Its primary product, the Koniku-Kore, is a bio-electric sensor constructed using genetically modified neurons integrated with silicon. The sensor is designed to detect and analyze VOCs, drawing from neural signaling rather than purely ML processing. In December 2022, Koniku raised $37 million in a Series A round, with backing from Platform Capital, IDO Investments, and SoftBank. The company’s applications are in the defense, healthcare, and agriculture industries, materially different from Osmo’s. While Koniku pursues a fundamental reinvention of sensing hardware, Osmo leverages existing GC-MS systems and instead innovates at the software, representation, and model-inference layers. This reduces R&D cycles and capital intensity, enabling faster deployment.

Perfume: Perfume was founded in 2021 and operates in the consumer IoT segment. It's a smart home diffuser that uses mood-sensing AI to select and emit fragrances based on the user's heart rate, email activity, and social media usage. In January 2024, $1 million in seed funding from TF Capital. Innovation is primarily concentrated in the mood-detection architecture and the behavioural learning system; the scent delivery mechanism itself draws from a fixed catalogue of 60 pre-mixed fragrances and 3 base ingredient pools to recreate them. Perfume is therefore not a full-stack scent platform, instead focusing on D2C applications, not engaging in molecule discovery or structural prediction.

Noze: Founded in 2015, Noze uses modified NASA sensor technology to analyze human breath for medical diagnostics. Its DiagNoze device aims to detect disease biomarkers, such as those for epilepsy, diabetes, and breast cancer, via VOC analysis. The company raised $5 million in a Gates Foundation-backed round in July 2024. Noze is pre-commercial pending FDA and international regulatory approvals. Its development pathway is aligned with clinical diagnostics rather than consumer or creative olfaction, distinguishing itself from Osmo’s core model.

Cyrano Therapeutics: Cyrano is a company, established in 2014, focused on restoring olfactory function in patients suffering from anosmia. Its lead candidate, CYR-064, is currently in clinical trials, following earlier pilot success, in which 8 of 10 patients reported improved smell and taste. Cyrano raised $9 million in a Series B in January 2024, led by DeepWork Capital. The company is entirely oriented toward medical intervention rather than olfactory modelling or digitization, only potentially acting as a direct competitor to Osmo’s future endeavors in healthcare devices.

Aromyx: Aromyx, after its founding in 2013, is building a platform for capturing and digitally encoding scent and taste. To date, in May 2025, Aroymx has raised $18.8 million; their most recent funding round, Series A, occurred in July 2021 for $10 million. Aromyx initially positioned itself as a tool provider for F&F firms and corporate clients. Subsequent public updates have been sparse, and the current status of their technology and business model remains unclear. While early goals aligned with Osmo’s objectives, the absence of confirmed commercial traction or end-to-end synthesis indicates a divergence in progress and maturity.

Moodify: Established in 2017, Moodify develops Scent AI for digitised fragrance reformulation and malodor neutralisation. With $10.6 million raised from Changer Club in May 2022, it launched (Re)Formulation, a platform automating adjustments to scent compositions for product applications such as pet care and sanitary goods. While Moodify’s focus overlaps with parts of Osmo’s workflow, its primary objective is product-specific optimization rather than foundational digitisation of smell; therefore, the two companies ultimately differ in scope and array of potential applications.

Canaery: Founded in 2020, Canaery focuses on scent detection for security and hazard identification. It has raised $4 million in seed funding and remains pre-commercial. While the company may eventually require similar scent-mapping infrastructure to model VOCs and classify safe versus dangerous compounds, it is still in early development. Its specialisation in security diverges from Osmo’s primary vertical, and Osmo’s POM offers a first-mover advantage.

Synthetic Biology and Bioengineering

Debut: Debut was founded in 2019 as a synthetic biotech company focused on sustainable molecule production for the beauty and fragrance industries. In June 2023, it secured $40 million in a Series B round led by L’Oréal’s investment department. Debut uses proprietary biomanufacturing to produce bio-identical scen ingredients, with purities up to 95%, a feat not possible with current chemical synthesis or fermentation processes. Unlike Osmo, Debut’s innovation lies in raw material production. While it addresses supply chain, sustainability, material safety issues, and optimal ingredient sourcing rather than formula generation, there may be more direct competition between Osmo and Debut for customers seeking substitute ingredient alternatives.

EvodiaBio: EvodiaBio, founded in 2021, specializes in precision yeast fermentation to replicate aromatic compounds at reduced cost and environmental impact. The company completed a $14 million Series A in June 2024. Its primary customers are in the beverage and nutrition industries, using its fermentation platform to create sustainable aroma molecules for flavor enhancement. In January 2023, Symrise acquired a minority stake in EvodiaBio to support the development of sustainable olfactory ingredients. While their technical objective, sustainability through bioengineering, overlaps with Osmo’s long-term roadmap, EvodiaBio’s application domain is unique and unlikely to intersect with Osmo’s near-term GTM strategy.

Ginkgo Bioworks: Founded in 2008, Ginkgo Bioworks is the most mature of the selected synthetic biology players, with over $1 billion invested in its platform. Gingko engineers custom microbes to produce targeted molecules at scale and licenses this infrastructure across industries, including agriculture, pharmaceuticals, food, and industrial manufacturing. While it did collaborate with a F&F house in 2015, Ginkgo’s customer diversification makes it unlikely to specialize in fragrance and compete directly with Osmo. Instead, Gingko may serve as a source of next-generation ingredients complementing Osmo’s platform for reformulations.

Business Model

Osmo operates as a B2B technology provider, focusing on enabling fragrance creation for brands, influencers, and independent perfume houses. Its principal business line centres on supporting the development of new formulations or optimizing existing ones through its Generation platform. Clients submit creative briefs, either for product launches or brand extensions, and Osmo facilitates a faster, more transparent, and cost-effective route from concept to physical fragrance. This model utilises Osmo’s full-stack infrastructure, encompassing molecular prediction, regulatory compliance, and synthesis optimisation to lower the barriers traditionally associated with bespoke scent creation.

Beyond its core offerings, Osmo has engaged in exploratory partnerships, such as its collaboration with StockX, signalling optionality to expand into new verticals. Potential future applications include air quality monitoring, security screening, and health diagnostics, areas reliant on the same underlying capability to detect, interpret, and act on the classification of VOCs. These initiatives are currently peripheral but reflect the extensibility of Osmo’s platform across domains. In the long term, Wiltschko has indicated an ambition to enter the D2C space, enabling customers to design their scents and improve platform visibility.

Through Generation, Osmo has created a hybrid model combining elements of a traditional F&F house and an ingredient supplier. By licensing its proprietary molecules, Osmo captures recurring revenue from intellectual property contracts and in addition to project-based design fees. This dual structure transforms the traditional F&F manufacturer economics, from high fixed costs and long iteration cycles to a software-driven, modular, capital efficiency process. As a result, Osmo can serve smaller, lower volume clients typically ignored by the top F&F houses, bypassing the former impossible requirement to capture clients locked in decade-long contracts by creating a new market.

Alternative monetization paths remain contingent on execution. Osmo could evolve into a dedicated ingredients company specializing in novel captives or position itself as a scent-as-a-service provider for industries like healthcare and consumer goods. While technically feasible, these models require further hardware miniaturisation and regulatory approvals. The company remains focused on scaling its core B2B fragrance offerings via the Generation platform, building the infrastructure necessary to unlock these possible alternatives.

Traction

Osmo’s trajectory has been characterized by intensive R&D, rapid team expansion, and increasing product validation. By the end of 2023, the company operated with a team of 25 employees, and by 2025, this figure had grown to 70, reflecting an accelerated ramp in technical and GTM capacity. During this period, Osmo secured several initial customers through its private beta, including corporate clients and influencers, establishing the world’s largest collection of AI-generated fragrance mixtures.

Since its inception up to 2025, Osmo’s strategic focus remained primarily on proving its underlying thesis: that scent could be digitized, semantically mapped, and physically reproduced with high precision. The company achieved functional integration of its hardware components required for this process, VOC headspace capture, molecular interpretation, and scent reconstruction, marking a complete proof of concept. The launch of Generation in early 2025 signals the pivot towards productisation and commercialisation, with the company now engaging with more clients, shipping physical fragrance outputs, and expanding its sales and production capabilities. In parallel, key GTM hires have been made to drive this next phase. Recognition of Osmo’s leadership in olfactory intelligence came in March 2025, when it was named one of Fast Company’s most innovative companies in applied AI.

In May 2025, Modal announced that Twirl, a data pipeline orchestration startup, would be joining the company. The move brings Twirl’s leadership into Modal’s team and expands its presence in Stockholm. It also signals Modal’s push beyond AI inference into broader data and ML infrastructure.

Valuation

Osmo has raised substantial backing from a mix of institutional and strategic investors. Its $60 million Series A round, completed in January 2023, was led by Lux Capital and Google Ventures. The round included participation from Arena Holdings, Moore Strategic Ventures, Two Sigma Ventures, Amazon’s Alexa Fund, Exor Ventures, and the Bill & Melinda Gates Foundation. High-conviction individuals such as Henry Kravis (KKR) and Jeff Dean (Google DeepMind) also invested.

In November 2023, the Gates Foundation extended its support via a $3.5 million grant, bringing the total raised to $63.5 million, aimed at developing DEET alternatives, highlighting Osmo’s potential for expanding its relevance beyond fragrance. As of May 2025, Osmo is positioned with the capacity to extend into diagnostics, environmental sensing, and counterfeit detection.

Key Opportunities

Fragrance Industry

Osmo’s platform architecture and olfactory modelling open several opportunities across the fragrance industry. One of the most immediate lies in accelerating molecule discovery and identification. Current industry knowledge only captures a fraction of the true possible mixtures, with a lower bound estimate of 40 billion potential odor compounds in existence, the fragrance industry is aware of 100 million. With >99% yet to discover, Osmo’s OI through its GNN infrastructure via Forge enables scalable exploration. According to internal performance metrics, Osmo claims its model performs 3x better than existing discovery methods used by major F&F houses. By automating this process, Osmo offers a pathway to expand the global scent library and reform the incentive structure to become less capital-intensive.

Simultaneously, Osmo is positioned to assist in alleviating increasing pressure on raw material sourcing through synthetic ingredient development. The fragrance supply chain is being strained by several factors: climate change, geopolitical instability, environmental degradation, and protectionist trade policies. Natural ingredient availability, particularly floral and citrus inputs, is in decline. Sandalwood trees are endangered due to overharvesting, and sources, like rose petals, require unsustainable input volumes; 10K petals per pound of oil. Ingredient availability is further complicated through multinational sourcing: perfume houses rely on palettes of 1K to 4K ingredients sourced from up to 50 countries. Tariff regimes, especially between the US and China, home to critical oils like geranium, eucalyptus, and peppermint, are introducing volatility to pricing and availability.

In response, the industry is pivoting towards synthetic material substitutes that offer durability, cost-efficiency, and regulatory compliance without sacrificing the olfactory profile. Osmo’s Generation and Forge support this shift by automating the reformulation and optimization process. A typical formula may include 80 to 100 raw materials; Osmo’s tools can analyze such formulas via GC-MS, identify the key odorants, and propose replacements that maintain scent parity while improving cost or sustainability. A process previously requiring weeks of analyst review and multiple substitute iterations has been reduced to an automated output requiring only perfumer validation. This supports reactive reformulations to ensure product continuity as well as proactive reformulations, with long-term sustainability efforts prevalent in cosmetics, personal care, and sanitation products.

In the longer term, Osmo has identified direct-to-consumer personalisation as a strategic frontier. The current bespoke fragrance experience is exclusive and cost-prohibitive, priced at thousands for several samples. Osmo’s platform, particularly via its Inspire interface, provides the foundation for decentralizing scent creation, allowing consumers to design fragrances aligned with personality traits or particular emotive expressions. However, such a service model, logistically demanding, will require the establishment of the B2B operation first. Only through the development of supply chains and fulfilment systems can Osmo extend these tools to the broader consumer base.

Mosquito Repellent

Another of Osmo’s non-fragrance applications lies in the development of next-generation mosquito repellents. Vector-borne diseases such as malaria, dengue, and Zika collectively cause approximately 700K deaths per year. Mosquitoes and other disease vectors rely heavily on olfaction to locate hosts, rendering their behaviour manipulable by reverse-engineering that process, through compounds referred to as semiochemicals that interfere with or redirect scent-based host-seeking.

While at Google Brain, Wiltschko and his team published a preprint demonstrating that, within a 317-compound test set, their model successfully identified 10 molecules with equal or greater repellent efficacy than DEET, the current industry standard. DEET was originally discovered in a 1942 US Department of Agriculture study aimed at protecting soldiers from tropical diseases, using a dataset comprising 30 compounds. Despite its effectiveness, however, DEET has several drawbacks, including skin irritation, which Osmo hopes to rectify.

Unlike traditional molecule research, historically reliant on empirical testing and trial-and-error formulation, Osmo’s approach digitises the identification and evaluation process. By projecting candidate molecules into its POM and training the GNN on the evaluations in the 1942 dataset, Osmo was able to predict both functional performance and adverse reactions to refine the viable candidate list without immediate in-person testing.

In partnership with the Gates Foundation and Dutch biotech firm Trop IQ, Osmo has refined its list of candidate molecules to 8 compounds, demonstrating superior potency and safety profiles relative to DEET. If these molecules were to clear the EPA approval process, Osmo is positioned to license them and collect associated royalties.

Healthcare: Digital Nose Diagnostics

Olfaction has a long history in medicine, with recorded use in diagnostics dating back to 400 BC, when clinicians relied on breath odors to assess health conditions. Although modern medicine moved toward empirical lab testing, Osmo could explore opportunities in this area where its ability to objectively interpret VOC profiles offers a pathway to produce non-invasive screening tools.

Multiple studies have documented the biological plausibility of scent-based disease detection. Parkinson’s disease has been associated with changes in sebum VOC composition, and Alzheimer’s, Covid-19, and metabolic disorders like diabetes also produce distinct olfactory markers. Prediabetic and insulin-deficient individuals are known to emit a mild alcoholic odor due to metabolic byproducts. In oncology, dogs have demonstrated the ability to detect melanomas and lung cancer, suggesting the presence of a common biomarker across tumour types. More recently, dogs and invertebrates have been trained to detect infectious diseases such as tuberculosis, MRSA, malaria, UTIs, COVID-19, and Helicobacter pylori. These are examples that have reinforced the hypothesis that many diseases share a VOC-based olfactory signature.

Despite these findings, the space remains nascent. No definitive link has yet been established between specific diseases and reproducible olfactory biomarkers, due to challenges in replicability and generality. By digitizing the technology required to conduct objective, large-scale clinical trials, Osmo could partner with clinical institutions or develop a diagnostic device directly to enter the space.

Counterfeit Verification

Counterfeit goods are a pervasive problem for brands and third-party sellers, with an estimated economic damage exceeding $500 billion annually. Traditional verification methods, such as visual inspection, RFID tags, or serial tracking, are being increasingly circumvented or cloned. In a recent collaboration with StockX, Osmo deployed its technology to identify counterfeit products based on scent profiles. Counterfeit sneakers, often manufactured with cheaper adhesives, synthetic leathers, or glues, emit a different VOC signature than their authentic counterparts. Historically, StockX relied on sniff tests and visual cues to determine the fakes, labour-intensive methods which introduced subjectivity. Osmo offered a portable GC-MS capable of distinguishing genuine from counterfeit products with 95% accuracy in under 20 seconds. Team members suggested the accuracy would likely have been higher if not for the presence of mislabelled samples in the test dataset.

However, the scope of this opportunity is constrained by the requirement that target items possess a consistent and unique olfactory signature, applicable to leather goods, sneakers, or perfumes but excluding clothes. Additionally, competing authentication technologies, RFID tags, and DNA tags, such as those developed by LVMH in partnership with The ORDRE Group, are already embedded in brand ecosystems. For Osmo’s hardware to achieve wide adoption, it must either outperform these existing alternatives, operate at a lower cost, or provide supplementary security features. The operational challenge is that the system must be retrained regularly for new product launches, requiring both authentic and counterfeit test sets.

To address these constraints, Wiltschko has proposed embedding odorless molecular tags into authentic products as a unique identifier. The idea gains traction given emerging evidence that RFID tags are themselves being cloned by increasingly sophisticated means.

Unexplored Applications

Lead investor, Wolfe, has noted defense applications with the potential for odorless molecular fingerprints to be used for tracking individuals or verifying identities, analogous in function to the scent-based digital signatures for authentication. A related application is in explosive and narcotics detection, for which dogs are currently the standard for airport security, achieving a true positive rate of 87.7% with 5.3% false positives. Osmo’s technology, if brought to parity with canine benchmarks, could provide a portable and standardized alternative with a superior cost structure, requiring a one-off investment rather than personnel training and related costs and potentially less variance across performance.

Another area with potential is indoor air quality monitoring. Current home detectors typically measure only carbon monoxide or particulate matter, leaving a wide array of harmful VOCs untracked. Osmo’s OI systems could be adapted to detect a much broader spectrum of airborne compounds, ranging from volatile solvents to toxic gases. This functionality would appeal to households, office buildings, and enclosed spaces, but adoption would be subject to construction regulations.

Commercial spaces are also beginning to explore the use of ambient scenting as part of the consumer experience. High-end hotels, spas, and retail stores already use ambient olfaction to create memorability and maintain high customer retention. Osmo could enable a new generation of brand environments, where ambient scent is no longer manually selected but tailor-made to reflect the brand identity. Use cases could extend from aviation to reduce passenger anxiety, to fine dining to enhance gastronomic experiences.

In the food technology sector, Osmo could address one of the biggest challenges of plant-based and lab-grown meat: replicating authentic aroma. Matching the olfactory profile of meat across raw, cooking, and cooked states remains a core technical hurdle for flavour engineers. Given that scent constitutes the majority of taste perception, Osmo’s ability to deconstruct and replicate these transitions presents a novel tool for food companies seeking full sensory parity.

Finally, over a longer horizon, Osmo intends to develop consumer devices incorporating its technology, bringing fragrance reading and writing to household products. While these applications remain several years away, the feasibility is reinforced by the platform’s modularity, model generalisability, and early demonstration of high-performance “teleportation” capabilities, with the pace of innovation ultimately being determined by the ability of Osmo to feed the model high-quality data.

Key Risks

Execution Risk and Technical Feasibility

Inherent to Osmo’s operations at the intersection of olfactory chemistry and machine learning, significant execution and scaling risks are present. While the company has made considerable progress in constructing an operational fragrance formulation pipeline, the technical feasibility of fully modelling human scent perception remains an open challenge. Osmo’s current model successfully bypasses a requisite understanding of the neurobiology of olfaction, relying instead on molecular structure as the input variable. However, scent perception is influenced by unexplained variables, such as receptor expression variation, concentration non-linearities, and chemical interactions not fully encoded in current datasets. These factors may persist until more comprehensive biological understanding becomes available.

Model refinement will require continual expansion of Osmo’s dataset; the accumulation of high-quality standardized inputs. As of May 2025, the company maintains a manually curated training set of 5K+ molecules with 138 standardized descriptors, far from representative of the 40 billion odorous compounds in existence. Scaling laws in AI suggest that model performance can be improved through dataset size, model parameters, and compute power. While Osmo believes its current parameterisation (256-dimensional POM embedding) aligns with the number of olfactory receptors, growth in dataset volume and compute will require both time and additional capital. The applicability of scaling laws beyond text and image tasks remains speculative; therefore, Osmo’s ability to progress the model's abilities is not guaranteed.

There are also unresolved issues in model validation. Since no machines exist to verify scent output, the evaluation of printed fragrances still relies on trained individuals. This introduces potential bottlenecks and bias, particularly if generalisation is required across global populations with differing olfactory genetics, preferences, and cultural scent norms. Moreover, compacting the hardware is a necessary next step, but even with successful miniaturisation, consumer adoption will depend on execution through usability, price sensitivity, and willingness to more actively integrate scent into daily routines.

Nascent Business Model

Osmo’s business model is in a formative stage. It's a B2B platform, Generation, launched only in March 2025, and has yet to establish predictable revenue streams. While early partnerships have validated industry curiosity and securing small- to mid-sized clients could allow for lower-stakes experimentation, more evidence of successful onboardings, scalability, and customer retention is needed. Given its likely large fragrance houses have tens or hundreds of captives, producing compelling case studies and new molecules is required to demonstrate value beyond laboratory settings. The presence of Laudamiel lends industry credibility, but user experience, unit economics, and financial feasibility will become critical as the company evolves.

Regulatory Friction

Regulations present an additional structural risk. For Osmo’s novel molecules to be approved for commercial use in products, they must pass through the Environmental Protection Agency’s (EPA) evaluation process under the Toxic Substances Control Act (TSCA), requiring submission of premanufacture notices (PMNs). Although the nominal review period is 90 days, the lack of sufficient health and environmental data in many applications frequently leads to extensions, delaying time to market. Even under Osmo’s accelerated development timeline, regulatory approval stretches the new molecule deployment time to two years. This poses a sufficient lag to introduce uncertainties in capital allocation and revenue planning decisions.

Summary

Osmo is an olfactory intelligence company developing the first scalable system for reading, mapping, and reproducing scent, with the company claiming the first successful digital capture and re-synthesis of a naturally occurring smell. Osmo operates under a vision to democratize scent and provides a platform combining AI-driven molecule discovery (Forge), formulation automation (Generation), and exploratory applications in security, product authentication, and public health. Backed by a $60 million Series A from Lux Capital, GV, and others, and staffed with a team spanning AI, chemistry, and perfumery, Osmo has demonstrated early validation through successful collaborations with StockX and Travertine Spa, and secured a Gates Foundation grant for DEET alternatives.

The growing demand for sustainable fragrance ingredients, personalized consumer products, and high-resolution chemical sensing positions Osmo at the forefront of the olfactory frontier. The company faces challenges in miniaturizing its hardware, scaling data infrastructure for generalizability across the billions of odorous molecules, demonstrating performance parity on volatile mixtures, and proving monetization potential. In tackling these, Osmo will look to translate its scientific advances into commercial viability across new molecule discovery and engineering, as well as scent formulation for clients. As of May 2025, it is positioning itself not for acquisition but to define the architecture for programmable scent, offering a future where olfaction, like vision and sound, becomes a digitized, accessible, distributable medium.