Thesis

The world is transitioning to the cloud. According to Datadog and Gartner, cloud spend grew from $50 billion in 2010 to $500 billion in 2022, and is forecasted to reach $1 trillion in 2026. With that ongoing transition comes a need for businesses to integrate and synchronize their data across multiple applications. As they adopt a growing number of SaaS applications and data storage solutions, and the overall ecosystem becomes more complex, the challenge of maintaining accurate and accessible data across platforms becomes increasingly critical.

The scale of the problem is exacerbated by the fact every business team — be they sales, marketing, support or success — needs relevant and accurate data to support informed decision-making. These teams often lack the technical expertise to interface with singular sources of truth like data warehouses. Instead, they expect unified, real-time data in their existing workflows and software they use to talk to customers, like email, CRM and support platforms.

With a user-friendly, no-code interface and data connectors to a wide array of applications, Hightouch offers a simple way to sync data back and forth between a data warehouse and the software tools a business uses every day — without the need to rely on engineering or technical worker. In doing so, it aims to make it easier to operationalize a company’s data resources, streamline their data management, and break down data silos.

Founding Story

Hightouch was co-founded in San Francisco in 2018 by Kashish Gupta (co-CEO), Josh Curl (CTO), and Tejas Manohar (co-CEO). Gupta, a Wharton School graduate, founded an app for students to buy and sell home-cooked meals, and later worked at the venture firm Bessemer Partners. Curl, a graduate of Michigan State University with a bachelor’s degree in computer science, previously co-founded Deviceplane, a platform for accessing and managing remote IoT fleets, and spent 2 years as a software engineer at Segment. Manohar was a KPCB Engineering Fellow, and has worked at a number of software companies, including Segment.

During their time at Segment, Curl and Manohar saw first-hand the rise of data warehousing solutions like Snowflake, Google’s BigQuery, and Amazon Redshift. Together with Gupta, the team decided to see how they could help businesses activate these increasingly centralized stores of valuable data. They participated in Y Combinator’s summer 2019 batch.

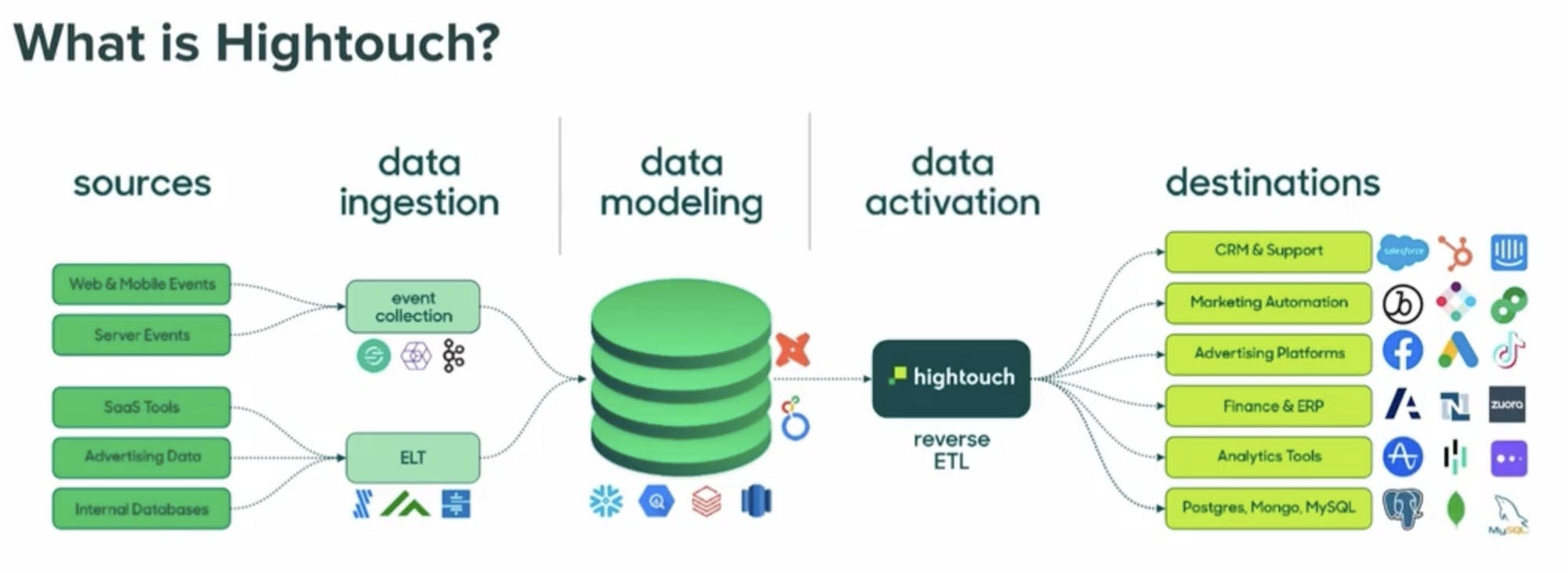

The Hightouch team started to build data pipelines which could extract data from a warehouse and push it into the SaaS tools business teams use. On starting the company, their product was dubbed “Reverse ETL”, as it was reminiscent of the ETL (Extract, Transform, Load) process — which turns source data into a format suitable for warehousing and analysis — only in reverse. Over time, their customers found new use cases for the Hightouch product, and the team executed on those needs.

Product

Hightouch is a data activation platform, which takes the data sitting in a warehouse and pushes it to 140+ business applications. With reverse ETL, data analysts and engineers can extract the data from the warehouse using SQL, map it to a business tool, and load it at a predefined frequency. Business users can then use a no-code user interface to access and activate the data from the warehouse, without depending on their data team.

Source: Hightouch

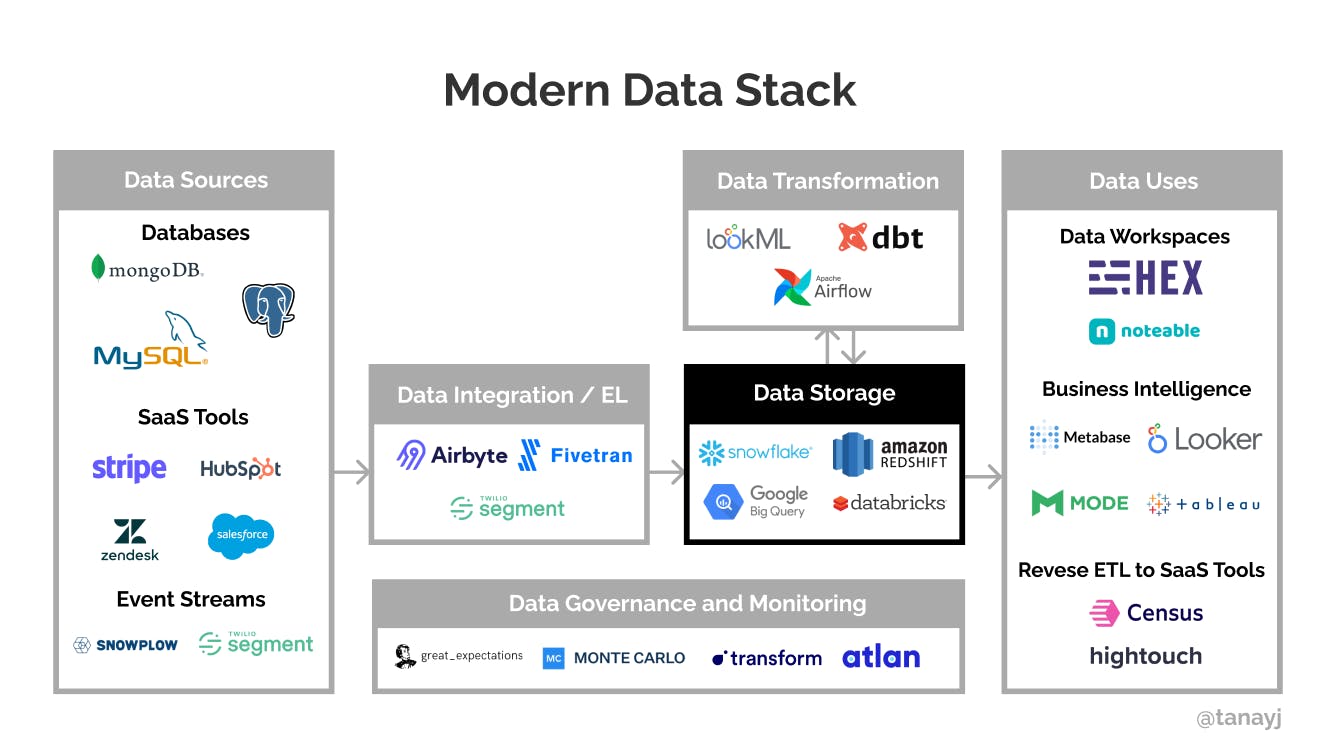

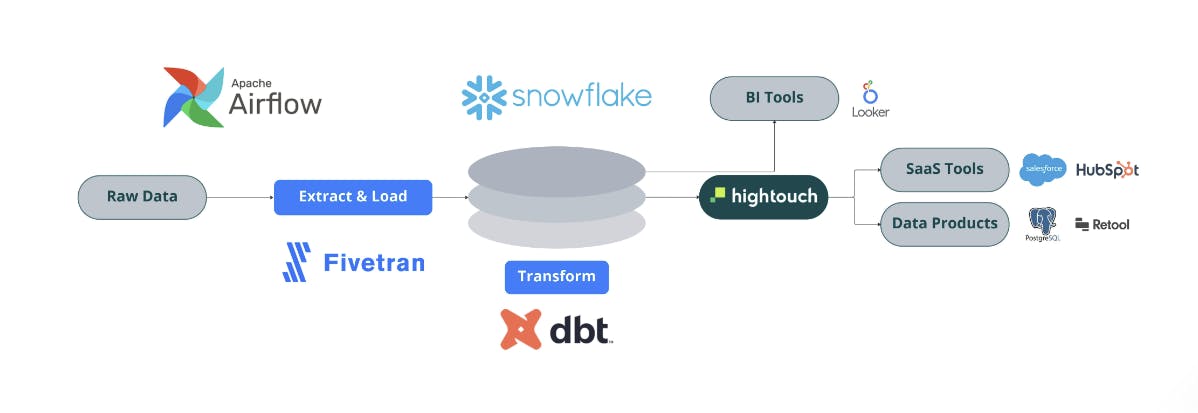

Justin Gage of Technically defines the modern data stack as a “set of tools that data teams are using to collect, transform, explore, and make use of their company’s data”. It replaces a previous generation of platforms like Oracle, Teradata or Hadoop — which were mostly on-premise, open-source and highly complex — with a stack which is cloud-based and easier to operate.

The modern data stack has 4 main pillars:

Data storage, which includes cloud-based data warehouse solutions like Snowflake, Redshift or BigQuery, to store data.

Data transformation solutions like dbt or Airflow to transform and organize data in the data-warehouse.

Data usage solutions to leverage the data from the data-warehouse for the different teams in an organization. This can be split between data visualization with tools like Looker and Tableau, and data activation with tools like Census and Hightouch.

Source: Tanay Jaipuria

Hightouch offers 4 primary products: (1) a reverse ETL, (2) a customer studio, (3) a personalisation API and (4) a business notifications platform.

Reverse ETL

The reverse ETL helps data teams to synchronize data from a data warehouse to third-party applications (e.g. CRM, marketing automation, ad and analytics platforms). First, data teams connect Hightouch to their data warehouse (e.g. Snowflake) and the destinations they want to serve (e.g. Salesforce). Hightouch supports 15+ data sources and 140+ data destinations. Second, they query the data from the data warehouse using SQL or an existing data model like dbt or Looker. Third, they map the data model to the destination data fields and decide on a synchronization schedule.

Hightouch’s reverse ETL replaces in-house connections — which are hard to build and maintain — and the CSV extracts a data team performs for business teams.

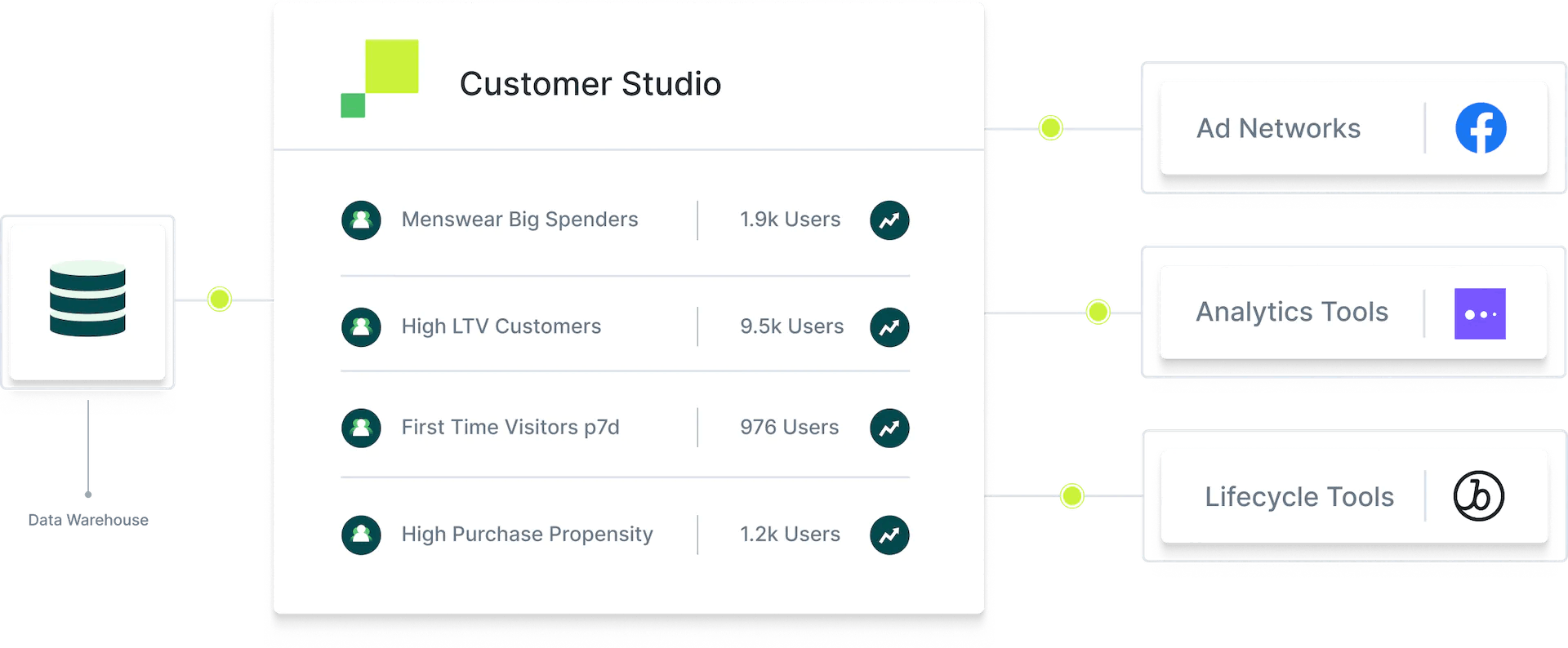

Customer Studio

The Customer Studio helps marketing teams activate the customer data sitting in their warehouse. A marketing team doesn’t need to rely on the data team or to know how to use SQL to use Hightouch’s Customer Studio.

Hightouch markets its Customer Studio as the future of customer data platforms (CDPs). With Hightouch, the data warehouse remains the source of truth of a business and companies don’t have to duplicate and store customer data in traditional CDPs which present a risk for data siloing.

The Customer Studio offers a number of features. Marketing teams can:

Synchronize customer data to the marketing tools they use across different functions like advertising (Google Ads, Facebook Ads, Amazon Ads, Linkedin Ads, Snapchat, TikTok, Twitter), SMS & push notifications (Braze, Attentive, Customer.io, Klaviyo), CRMs (Salesforce, Kustomer) or email (Mailchimp, Marketo, Salesforce Marketing Cloud).

Enrich customer data with new computed fields named Traits in order to enable more precise segmentation. Examples of Traits include most frequent category purchased, total lifetime purchases, and last product viewed.

Run A/B tests and multivariate testing directly from Hightouch.

Break down their customers by characteristics, in order to develop a good understanding of the audiences they want to target.

Analyze their audiences to identify potential overlaps and avoid targeting the same customer with multiple campaigns.

Source: Hightouch

Personalization API

Hightouch offers a ‘personalization API’, which allows product and marketing teams to leverage data warehouses to deliver data-rich experiences for customers, without the need for software teams to develop dedicated application databases. It can be used to personalize marketing campaigns, run product experiments in real-time, or to dynamically target product experiences on the go.

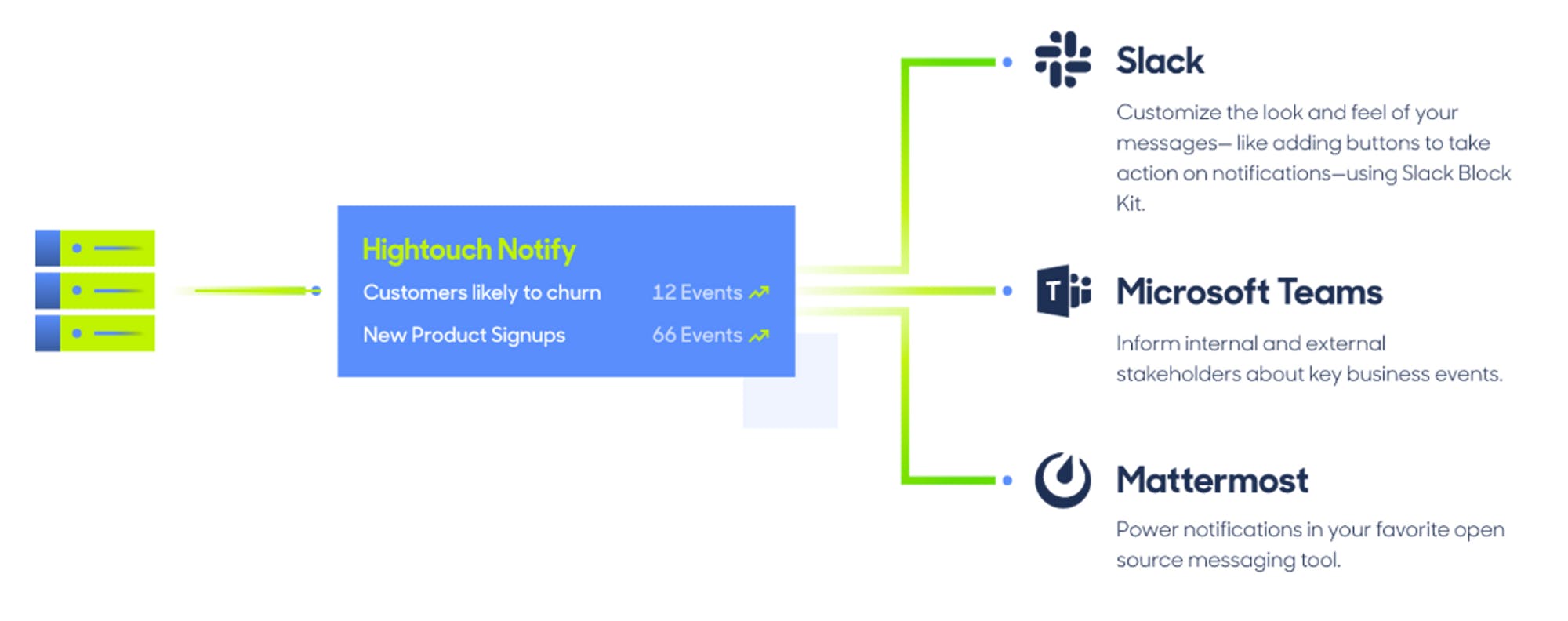

Notify

The business notifications platform is used by operation teams to push business events — such as an upsell opportunity, or a customer likely to churn — into messaging platforms like Slack and Teams. Operations teams can build these workflows autonomously from both tech and data teams. This allows business teams to receive critical, data-driven notifications without leaving the communications apps they use on a daily basis.

Source: Hightouch

Market

Customer

Hightouch is a horizontal platform used across many departments (marketing, sales, finance, support) and industries (healthcare, ecommerce, SaaS). When selling the product, Hightouch’s main internal champion is usually an advanced data analyst or a data engineer. Business-side employees from sales, marketing, operations, or customer success teams can also participate in the co-design of the first activation workflows powered by Hightouch.

Below are 3 examples of how customers are using Hightouch:

Gorgias is a customer support platform for e-commerce companies. To enable a unique system of records of their customers, Gorgias implemented a modern data stack including BigQuery as a data warehouse and Hightouch as reverse ETL. Hightouch is used to improve advertising targeting by pushing the data from BigQuery to ad platforms and to score leads, improving productivity for the outbound sales team.

Ramp* is a modern spend management platform. Ramp needed to implement a modern data stack to streamline its operations and make data more accessible to its various teams. This new data stack uses Hightouch to activate data for sales and marketing use. More specifically, Hightouch was used to create an outbound sales channel that now drives 25% of Ramp’s* sales pipeline.

Imperfect Foods is an online grocer working with farmers and manufacturers to combat food waste. It has built a modern data stack with Fivetran as ETL, Snowflake as a data warehouse, and Hightouch as reverse ETL. Hightouch is used to improve advertising targeting by leveraging first-party customer data to feed advertising platforms. It helped to decrease the CAC by 15% and to increase reactivations by over 50%.

Source: Hightouch

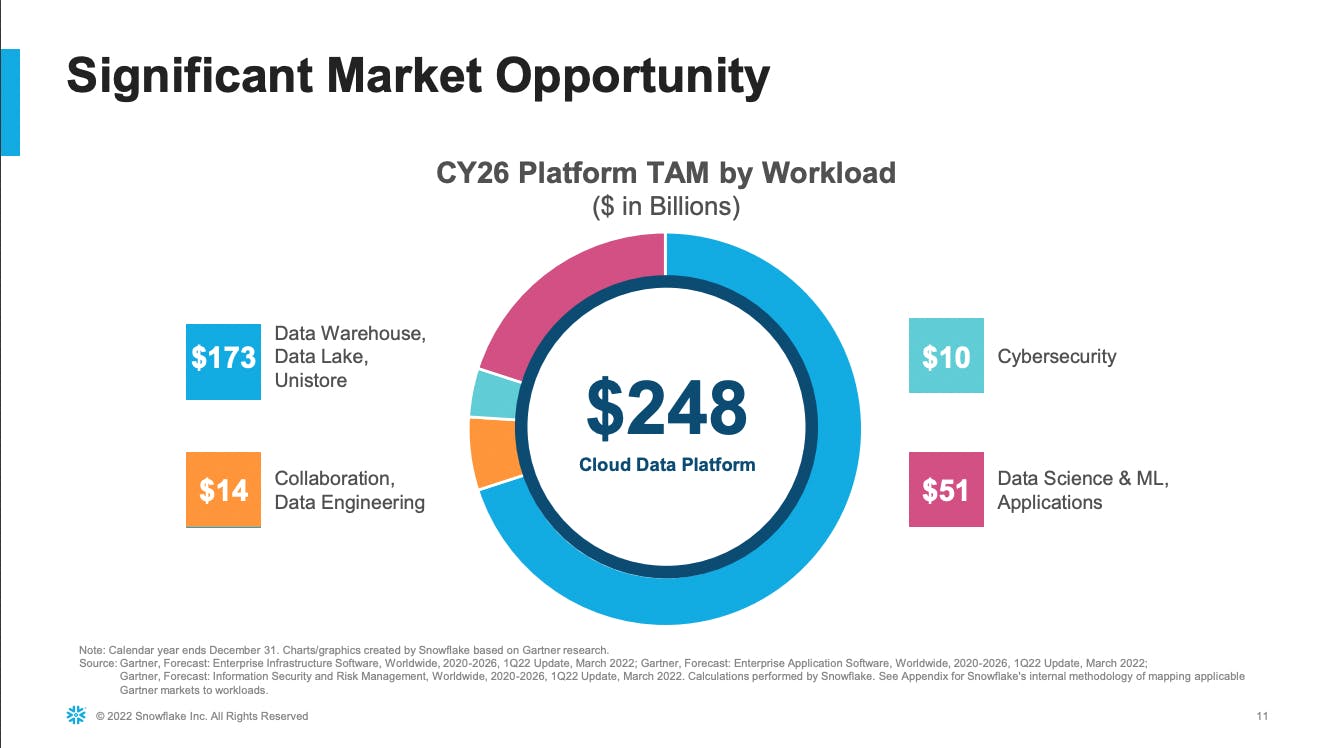

Market Size

Hightouch is a horizontal platform. In theory, it could be used (1) by any company in the world as long as they have a data warehouse, and (2) across multiple business functions, even if marketing data activation is its current primary use case.

This means that Hightouch is going after a segment of the cloud data platform market estimated to reach $248 billion by 2026 according to Snowflake. The global business intelligence market was valued at $27 billion in 2022. The market is projected to grow from $29 billion in 2023 to $54 billion by 2030. It’s fair to assume that the reverse ETL market could be at least as large as the business intelligence market in the long term, as activating data has a stronger ROI than visualizing data.

Source: Snowflake

Another way to evaluate Hightouch’s market is to look at the CDP sector, as marketing remains Hightouch’s main use case. In 2020, IDC estimated that CDP companies were generating $1.3 billion in revenues, and Twilio which acquired Segment estimates that the customer engagement segment will reach $43 billion by 2025.

Competition

Hightouch faces competition both from companies that operate directly in the same part of the modern data pipeline, as well as legacy data platforms looking to extend their offering for new customers and markets.

Direct competitors

Census: Founded in 2018, Census is Hightouch’s most direct competitor. Like Hightouch, Census delivers data and analytics from a warehouse into all operational tools. Both companies boast similar features, like a no-code builder for marketing teams and a notification product for operations teams. Census raised a $4.3 million seed round in May 2020 led by a16z, a $16 million series A in February 2021 led by Sequoia, and a $60 million Series B in Februrary 2022 led by Insight and Tiger. Census Reverse ETL is how companies like Figma, Notion, Canva, and Loom build better business operations.

Rudderstack: RudderStack is an open-source, enterprise-ready platform for collecting, storing, and routing customer event data to a data warehouse and dozens of other tools. It was founded in 2019 and has raised $82 million in funding.

Grouparoo: Grouparoo is an open-source customer data framework built to easily sync data from the data warehouse to 3rd party tools. It was founded in 2019. In April 2022, it was acquired by data integration platform Airbyte.

Legacy competitors

There is much scope for companies in the data orchestration space to move onto Hightrain’s turf. Companies like Fivetran and Airbyte have built data pipelines to pull data from different sources to push it into a data warehouse. It’s a logical next step for them to pull the data from the data warehouse to activate them into different applications that often are the sources used in their ETL product. At this stage, Fivetran has decided to build a strong partnership with Hightouch instead of competing with them. Airbyte, meanwhile, has adopted a more aggressive approach via the Grouparoo acquisition.

Data warehouses such as Snowflake, Databricks, or BigQuery are at the center of modern data infrastructure. They could expand the modern data stack downstream by building a pipeline to push data from a warehouse to other applications. Reverse ETLs are thriving because customers are churning away from data infrastructure platforms like Segment, towards a more modern data stack. In reaction to this, Segment released a reverse ETL product in which it no longer stores customer data, and instead streams customer data in and out of the data warehouse into third-party applications and into its customers' products, enabling personalized experiences.

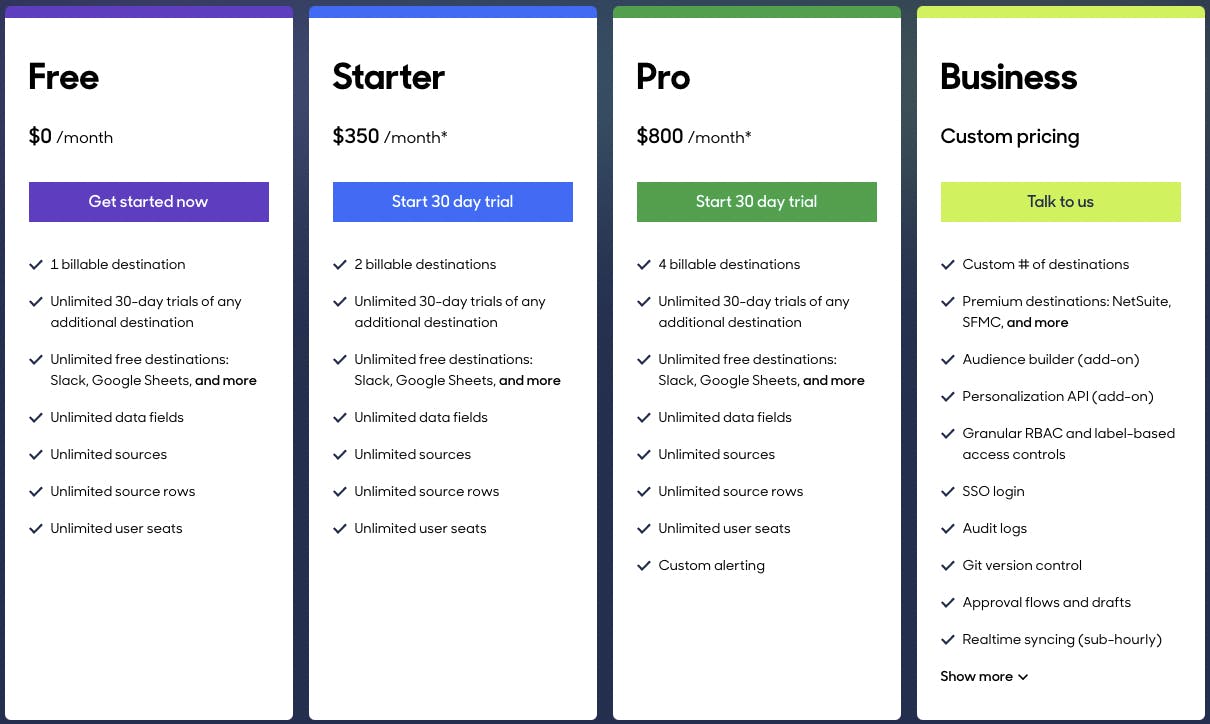

Business Model

Hightouch is a SaaS product with a usage-based pricing model based on the number of destinations. It can be purchased as a self-service offering, but Hightouch also offers a sales team which works with large organizations which require deeper usage and integration. It offers tiered subscriptions including a free subscription, starter subscription ($350/month), pro subscription ($800/ month), and business subscription with custom pricing.

Source: Hightouch

Traction

In August 2022, Hightouch announced it had tripled its revenues in the first half of 2022, and that it was working with 1K+ customers. In 2022, Hightouch was predicted to pass the $10 million ARR threshold. Its customer base includes Warner Music Group, Soundcloud, Plaid, Zapier, Ramp*, and Retool.

Valuation

In December 2020, Hightouch raised a $2.1 million seed round led by Afore Capital and Slack Fund. In July 2021, Hightouch raised a $12.1 million series A led by Amplify with participation from Bain, YC, and Afore. In November 2021, Hightouch raised a $40 million series B at a $450 million valuation, led by Iconiq.

In November 2021, Hightouch raised at $450 million valuation implying a 45x EV/ARR multiple based on the $10 million ARR the company was predicted to reach in 2022. It implies that Hightouch is trading at a large premium compared to publicly listed peers such as Snowflake (trading at 15.9x EV/NTM Sales) or Twilio (trading at 2.1x EV/NTM Sales).

Key Opportunities

Expanding User Personas

Hightouch started as a technical product sold and used by data teams. To use the core Hightouch product requires an understanding of SQL in order to make queries. Hightouch has, however, initiated an effort to expand accessibility, particularly for marketing teams. It released a no-code interface to build audiences before pushing them to the advertising platform. In February 2023, it released Customer Studio, a product accessible for non-technical marketing staff to explore and activate customer data in a warehouse. Further reducing technical barriers to usage should increase its usage within organizations and make business teams more independent at leveraging the data from the warehouse..

Expanding Use Cases

In its early days, Hightouch’s main use case was to enable marketing teams to activate customer data from the warehouse and personalize marketing campaigns across channels. But the reverse ETL technology is horizontal and has applications beyond marketing.

Hightouch has started to serve other business functions — like sales to score potential leads, customer success to identify churn risk, finance for billing, and product to craft personalized experiences. In the coming years, Hightouch has the potential to extend its reach into further business functions and teams, without much retooling of its core product.

Downstream Vertical Integration

Hightouch wants to become a data activation platform which goes beyond serving as the plumbing between the warehouse and third-party applications. In pursuit of this goal, it has already built interfaces accessible for business teams to make them more productive.

For example, marketing teams can build customer segments in Hightouch before pushing them into advertising platforms and campaign management tools. At some point, it could make sense for Hightouch to expand downstream and replace the function of some of the various applications and platforms it currently connects to.

Key Risks

Consolidation

In a tech downmarket and an economy that could enter a recession, customers may try to consolidate their data stack by reducing the number of tools they use and the number of vendors they pay. In the mid-term, certain players in the modern data stack, starting with data warehouses, will try to own as much of the value chain as possible. In this scenario, the Reverse ETL feature could become commoditized.

Finding the Right Balance

Hightouch’s potential stems from the horizontal use cases of its reverse ETL technology and the fact that Hightouch is positioned to build functional apps for business teams that want to activate and operationalize data sitting in their warehouse. However, Hightouch must manage this tension between widening its breadth to increase its addressable market and the depth of its product. If it fails to correctly manage this balance, the platform’s stickiness could be reduced.

Summary

With rising cloud adoption, companies are increasingly relying on a modern data stack to streamline data management. As part of this journey, they inevitably look at ways to better leverage the data in their warehouses. Alongside data visualization, data activation based on reverse ETL pipelines is emerging as an effective means to achieve this.

Hightouch aims to become the most valuable part of the modern data stack by offering companies returns on their data investment and being the main place business users spend their day. The key question remains the long-term viability of this category as a standalone product, as opposed to a feature set in a full stack data platform.

*Contrary is an investor in Ramp through one or more affiliates.