Thesis

The emergence of blockchain technology and increased mainstream awareness of the crypto universe have led to the growth of non-fungible tokens (NFTs), which aim to reimagine digital ownership. NFTs allow creators and collectors to create, buy, and sell digital assets of verifiable origin. They serve as one of the central parts of the Web3 ecosystem, which seeks to replace the power of large technology companies over the internet with new web-based decentralized systems and user control of their data and digital assets. Advocates believe NFTs will play a key function in the online economy of the future, powering everything from identity verification and cultural production to new forms of corporate and civil governance.

Though many of these applications are still nascent, speculation has driven an explosion in NFT trading volume and valuations. Marketplaces already play a strong role in the digital economy, allowing creators and collectors to showcase, discover, purchase, and trade NFTs. NFT trading surged between 2020 and 2021, with overall sales volume increasing from $95 million to $25 billion, with some projections suggesting it will reach $212 billion by 2030. However, the sector is still relatively new and faces significant challenges, including fragmented ecosystems, high transaction fees, and technical issues, which create barriers to entry and limit market growth.

Magic Eden is an NFT marketplace initially focused on the Solana blockchain and aims to address the common challenges in the NFTs space by leveraging the Solana blockchain’s high throughput, low latency, and low-cost transactions. In doing so, it offers creators and collectors a fast and affordable NFT trading experience, helping minimize the friction experienced by early adopters.

Founding Story

Source: The Information

Magic Eden was founded in 2021 by CEO Jack Lu, CTO Sidney Zhang, COO Zhuoxun Yin, and chief engineer Zhoujie Zhou. Lu and Zhang had known each other since high school when they both attended the same tutoring classes. Zhang got involved in startups after graduating from university, later moving to the US and raising capital for a Bitcoin startup. Lu was a consultant for Boston Consulting Group before joining Google as a Product Manager. Yin worked for Bain & Company, where he worked primarily with healthcare startups but also became interested in cryptocurrencies. He later joined dYdX, a decentralized crypto exchange, before working for Coinbase. Zhou worked as an engineer at Facebook and Checkr.

Intrigued by the potential of NFTs to redefine value and ownership in the digital era, the founders started Magic Eden as a platform to allow users to access, trade, and interact with NFTs easily. Launched in September 2021, Magic Eden saw $50K in trades on its first day. By November, it became the leading Solana NFT marketplace, and by December, it listed over 1.5K NFT collections. In nine months, Magic Eden had become the second-largest NFT marketplace, surpassed only by market leader OpenSea.

Product

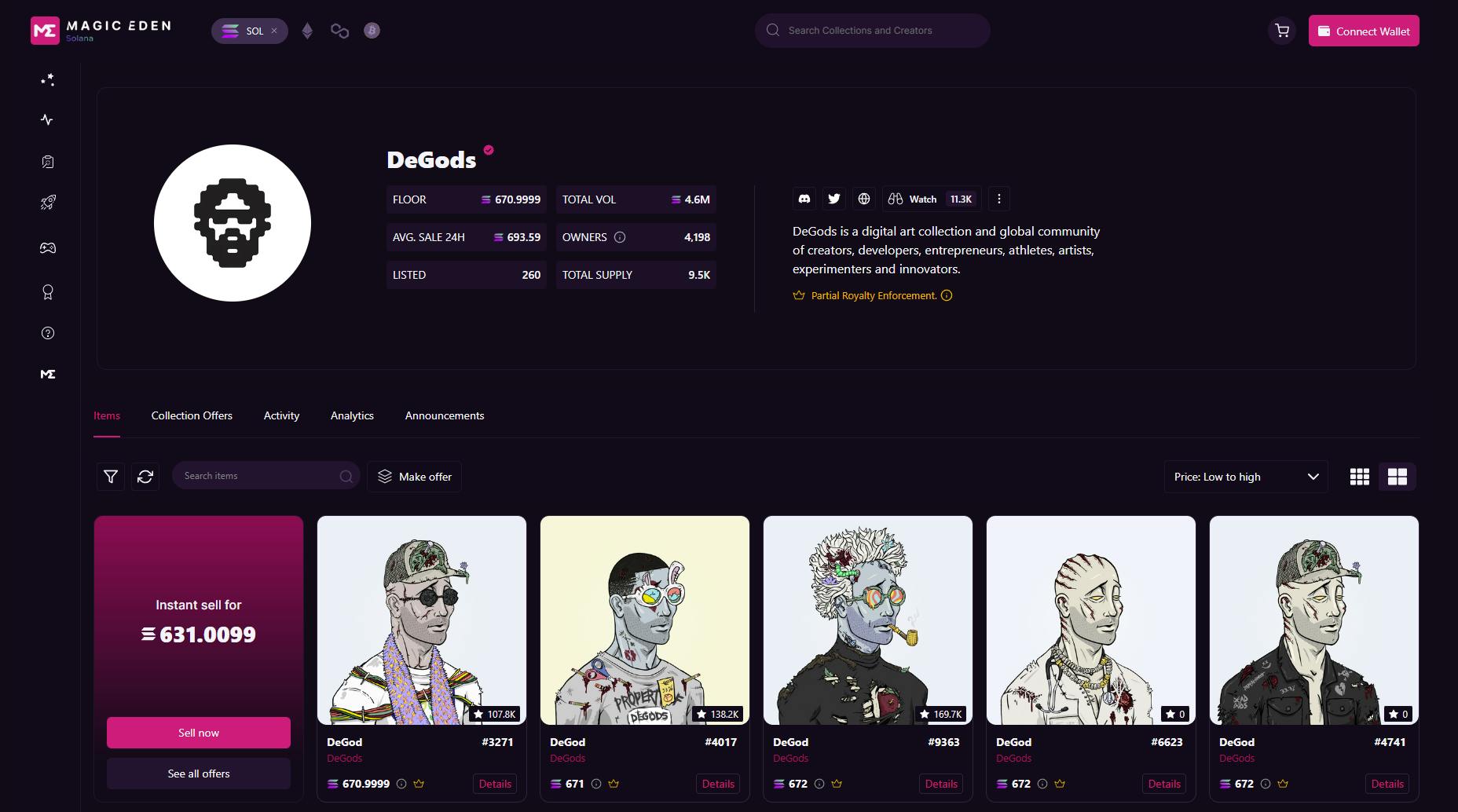

Marketplace

The Magic Eden marketplace supports various NFT categories, including art, collectibles, gaming items, and more. Users can browse curated collections, participate in auctions, and mint new NFTs directly on the Magic Eden platform. Benefiting from Solana's high-speed, low-cost blockchain, users can transact NFTs with reduced fees and waiting times compared to marketplaces using other blockchains. In addition to Solana, Magic Eden also supports NFT transactions on the Ethereum, Polygon, and Bitcoin blockchains, and is set to launch a full ETH marketplace in April 2023.

Source: Magic Eden

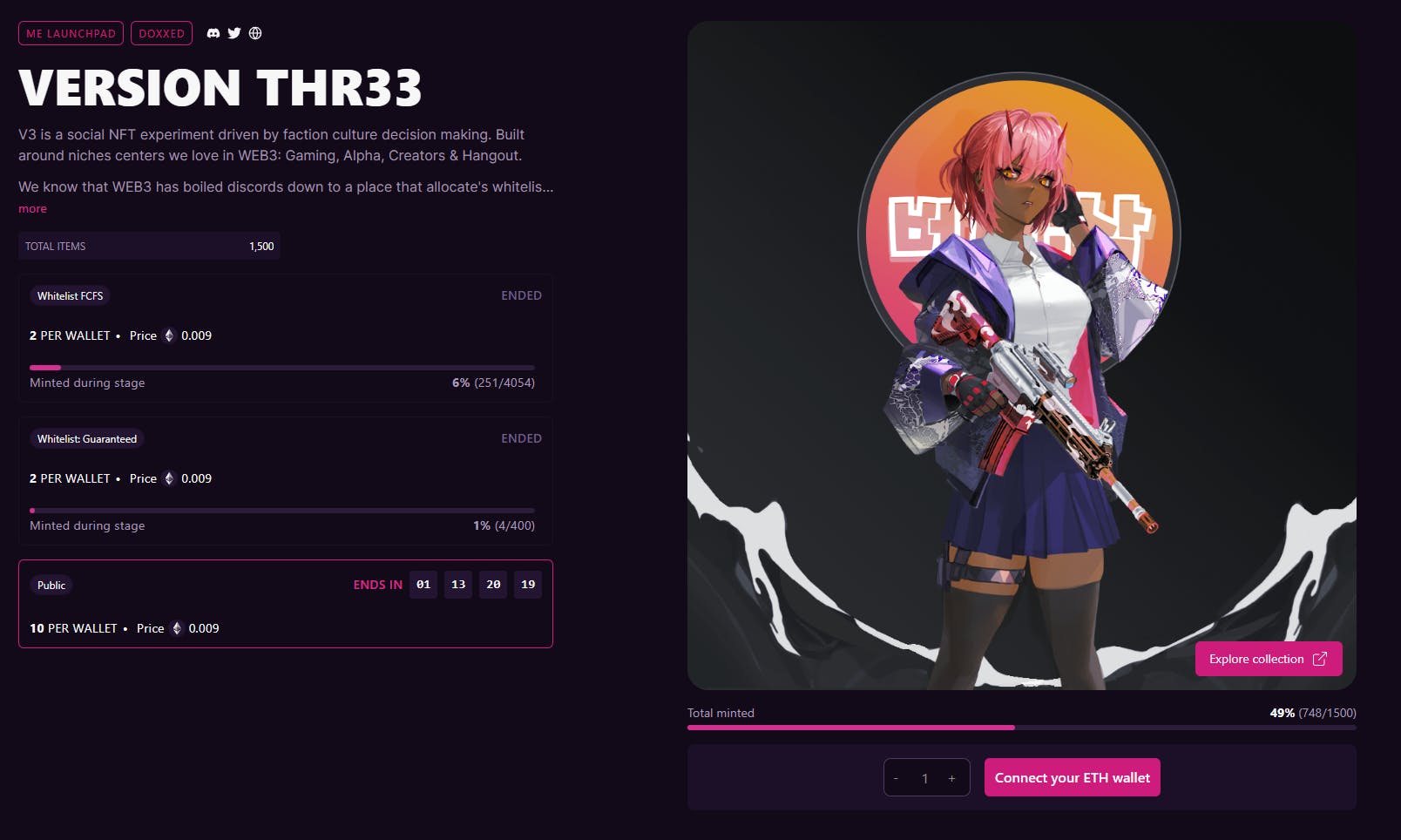

Launchpad

Magic Eden Launchpad is a white glove minting and marketing service offered to NFT creators. NFT projects accepted into Launchpad receive four primary services:

Support for minting NFTs: Magic Eden staff provide technical support and expertise to NFT creators to ensure a seamless minting process.

Community support: Creators are invited to an exclusive Discord community where Launchpad alumni can learn from and support one another.

Automatic distribution: Magic Eden distributes the collection on the marketplace for a project launch without delays or issues. Creators enjoy a 0% listing fee. All users are charged a 2% transaction fee.

Marketing support: Magic Eden shares project launch announcements on its social media channels to build hype and awareness for the advertised project.

Source: Magic Eden

With an acceptance rate of below 5%, collections that appear on Launchpad communicate exclusivity and trust to potential buyers. By offering a streamlined process for minting, marketing, and distributing NFTs, Launchpad serves as a comprehensive solution for creators to gain exposure, build communities, and drive demand for their NFT collections.

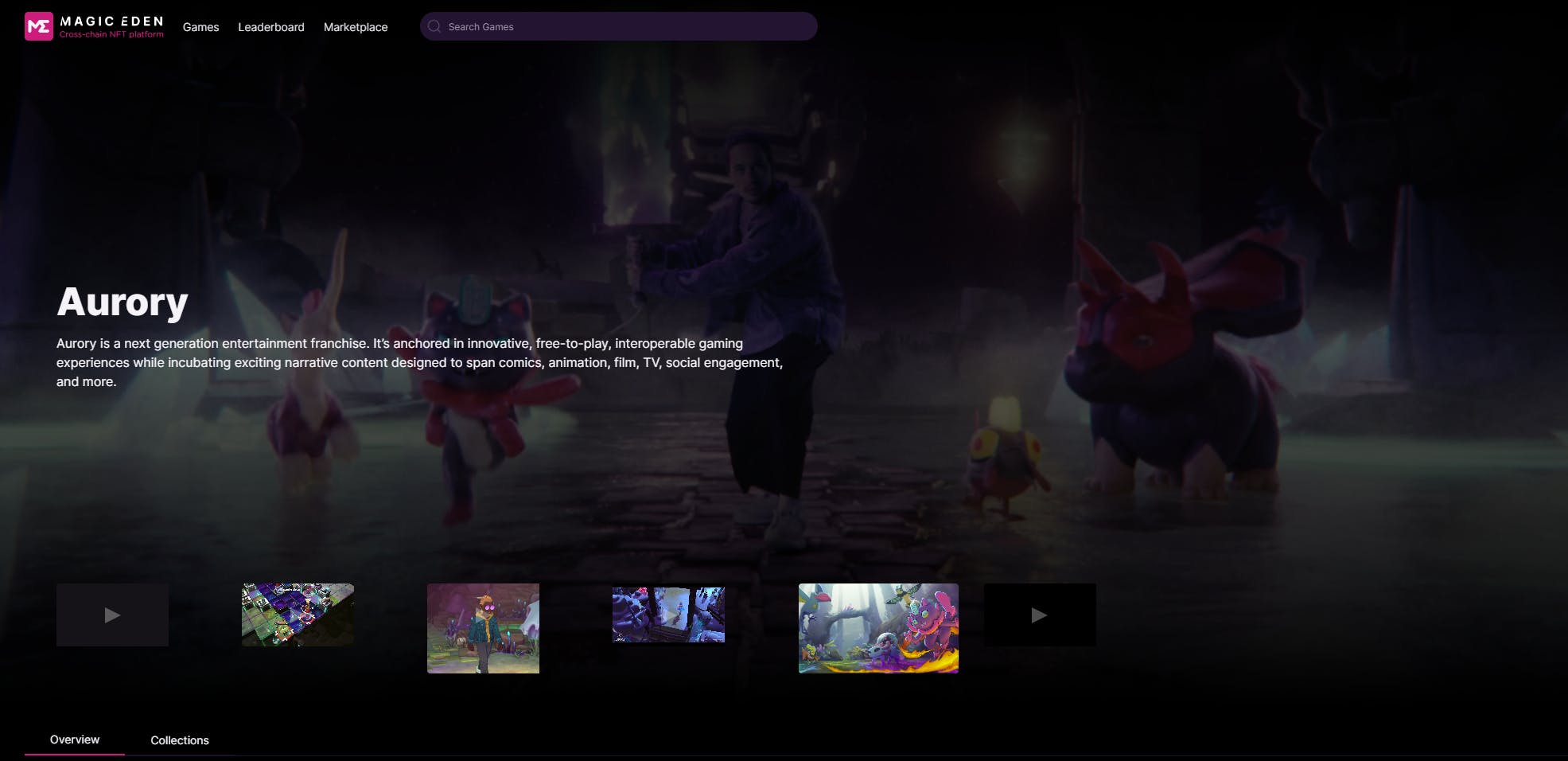

Eden Games

Launched in 2022, Eden Games is a content platform for gaming NFTs. By leveraging its user base and visibility as one of the largest NFT marketplaces, Eden Games provides the following services:

Listing Pages: Eden Games provides Web3 games with dedicated listing pages which display a trailer, description, and collection information.

Content Hub: Magic Eden partners with its community and influencers to review and showcase games. Game developers are provided with a centralized hub to post content and updates easily discoverable by their communities.

Activities, Competitions, and Tournaments: Magic Eden hosts gaming activities and events on its platform and Discord. With Magic Eden claiming 1.5 million daily platform visitors, these events provide visibility and marketing for partner games.

Source: Magic Eden

Market

Customer

Magic Eden's ideal customer includes cryptocurrency enthusiasts interested in NFTs, digital art, and collectibles. During the peak of NFT popularity, Ethereum gas fees for purchasing and transacting with NFTs could reach between $50 and $450, posing a substantial barrier to entry. By initially concentrating on supporting NFTs on the Solana blockchain – a chain known for its transaction speed and low fees – Magic Eden provided a way for customers to buy and sell NFTs while avoiding fees. The company also serves NFT creators and collectives looking to list their collections on a platform with a broad user base.

Market Size

The global NFT market size rose to an estimated $3 billion in 2022, with a CAGR of 35% leading to projections of a $13 billion market in 2027. However, the crypto market saw a significant slowdown in the latter half of 2022 amid a changing macroeconomic climate, which continued through the first three months of 2023. Key potential drivers for future growth include continuing mainstream adoption of NFTs, advances in blockchain technology, and a development community working on improving utility and real-world application for NFTs.

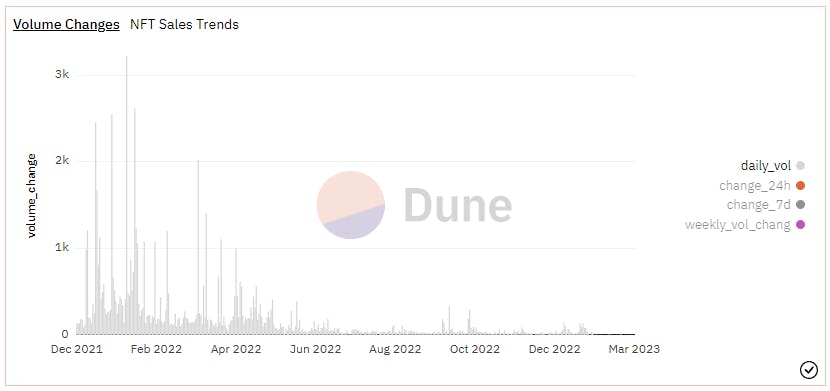

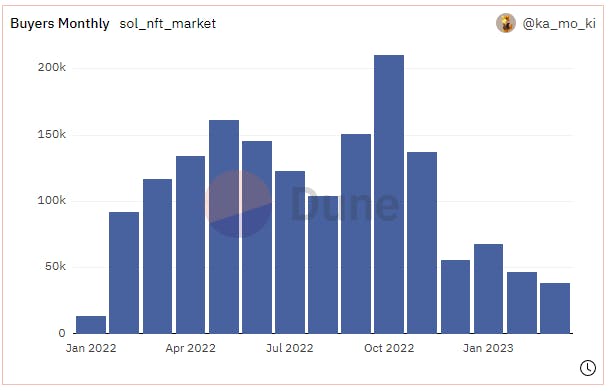

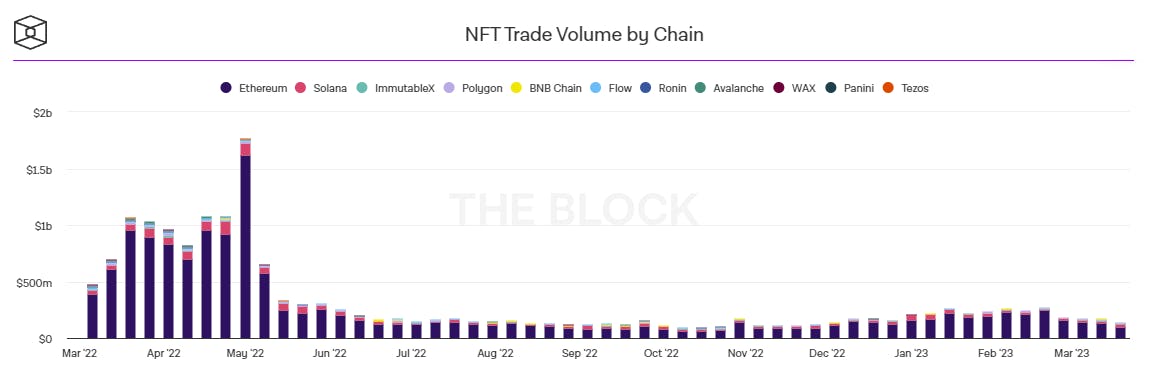

The crypto downturn has in the shorter term led to a significant contraction of Magic Eden’s market size. Magic Eden generates revenue from the transaction volume of NFTs and digital collectibles in its marketplace. Transaction volume across the whole sector is volatile, typically increasing significantly during crypto bull markets and collapsing during bear markets. As an example, NFT daily trading volume fell from a peak of $17 billion in January 2022 to $500 million in September 2022.

Source: Dune Analytics

Competition

Magic Eden’s competitors are other NFT marketplaces, as well as cryptocurrency exchanges that offer NFT trading functionality.

OpenSea: Founded in 2017 and valued at $13.3 billion in January 2022, OpenSea is the world’s largest NFT marketplace. It has one of the highest trading volumes of any NFT marketplace and is home to notable NFT collections like Cryptopunks, Azuki, and Moonbirds. While Magic Eden has held its position as the market leader for Solana NFTs, OpenSea maintains mindshare as the flagship NFT marketplace, with over 23 million website visits in February 2023 and significantly higher trading volume than Magic Eden on Polygon and Ethereum blockchains. Coatue and Paradigm led OpenSea’s $300 million Series C round in 2022.

Coinbase: Going public via direct NASDAQ listing in April 2021, Coinbase is the largest cryptocurrency exchange in the United States. With a market cap of over $16.1 billion as of April 2023 and 110 million verified users, Coinbase has diverse product offerings in cryptocurrency trading, wallets, NFTs, lending, and more. Coinbase launched its NFT marketplace offering in April 2022. While Coinbase’s NFT marketplace is widely considered unsuccessful to date, with less than 50 sales and 3 ETH in volume reported one week in February 2023, the company has signaled continued investment in the product.

Dapper Labs: Dapper Labs is a blockchain technology company founded in 2018 by the cofounders of the popular blockchain game CryptoKitties. In addition to developing Flow, a blockchain optimized for applications and games, Dapper Labs operates marketplaces for three highly visible branded NFT collections: NBA Top Shot, NFL All Day, and UFC Strike. While declining interest in NFTs reduced sales on the Flow blockchain by 60% in 2022, the NFT collections associated with Dapper Labs are connected to massively popular sports franchises. Dapper Labs’ potential to attract sports fans who might otherwise be uninterested in NFTs is a competitive advantage over other NFT marketplaces like Magic Eden, which primarily cater to crypto enthusiasts. Dapper Labs raised a $250 million Series D in September 2021 led by Coatue, with participation by Andreessen Horowitz and Google Ventures.

Blur: Founded in 2022, Blur is an NFT marketplace that caters to professional traders. In February 2023, Blur overtook OpenSea in trading volume as OpenSea struggled to handle the issue of creator royalties, which Blur capitalized on. Blur’s high trading volume is attributed to several wallets trading high-profile NFTs from collections like Bored Ape Yacht Club, Pudgy Penguins, and Doodles. Blur developed a loyalty program where creators who list exclusively on Blur are rewarded with loyalty points, which grant users future airdrops of the $BLUR token. While Blur does not support Solana NFTs today, its challenge to the incumbent OpenSea with zero trading fees, easy creator royalty policies, and a loyalty program could threaten Magic Eden if Blur expands to the Solana blockchain. Blur raised $11 million in a seed round led by Paradigm in March 2022.

Business Model

Magic Eden charges a transaction fee for every purchase made on the platform, with a take rate of 2%. This fee is applied to the total value of the transaction, and users cover any cryptocurrency transaction fees. Magic Eden’s recent push into gaming, including the launch of a gaming hub to help web3 game developers grow their player bases, also allows Magic Eden to charge transaction fees on any NFTs purchased by players.

Traction

Magic Eden has experienced rapid growth since its launch in September 2021. Within nine months, the platform became the second-largest NFT marketplace behind OpenSea, with over 10K NFT collections and over $2 billion in sales.

In November 2022, Magic Eden said gaming developers like BORA, IntellaX, nWay, Block Games, Boomland, Planet Mojo, and Taunt Battleworld had committed to the company’s Launchpad with Polygon. It also said it had helped bring over 100 games to market across the layer-1 blockchains Solana and Ethereum. However, the industry-wide slowdown has impacted Magic Eden. The company laid off 22 workers as part of a restructure in 2023.

Source: Dune Analytics

Valuation

In June 2022, Magic Eden raised $130 million in a Series B led by Greylock Partners and Electric Capital, which valued the NFT platform at $1.6 billion. Key investors also included Sequoia Capital, Lightspeed Venture Partners, and Paradigm. Magic Eden has raised $170 million in total financing.

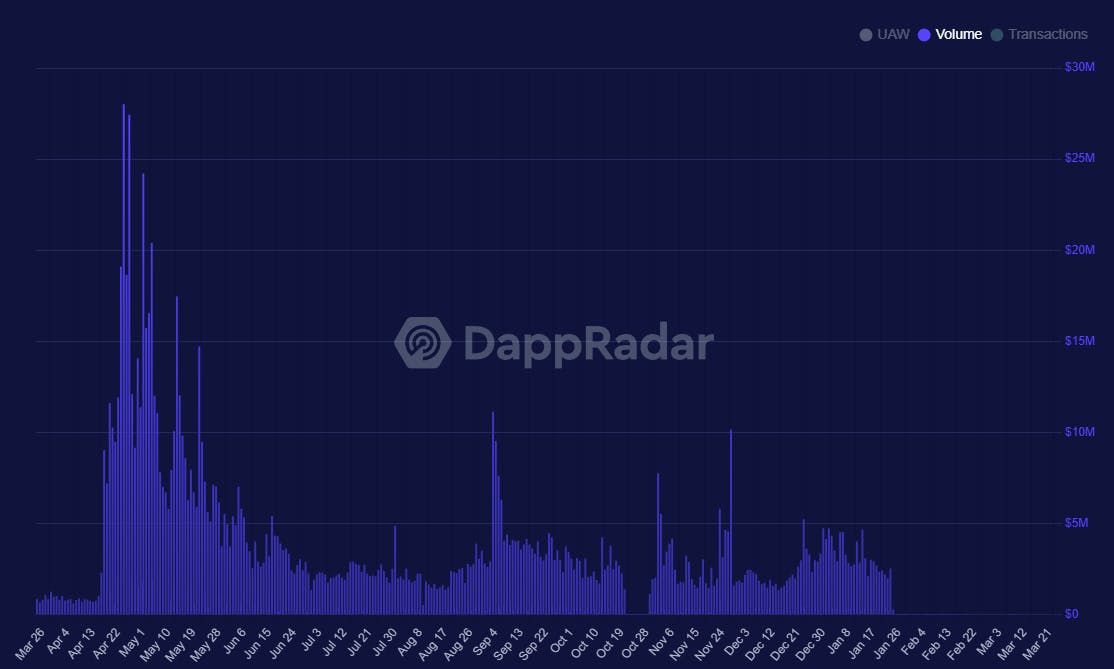

Magic Eden’s transaction volume over the past year is estimated at $1.3 billion. Applying Magic Eden’s 2% take fee to this sum, the company’s revenue over the past year is estimated at $26 million. At a $1.6 billion valuation, Magic Eden is valued at a 60x multiple. This estimation does not account for revenue from other blockchains Magic Eden now supports — including Ethereum, Bitcoin, and Polygon — which are a smaller part of its business.

Source: DappRadar

Key Opportunities

Blockchain Gaming

The global blockchain gaming market is predicted to grow to $65 billion by 2027, which is attributed to the adoption of play-to-earn (P2E) models and significant player growth in the Asia-Pacific region. In Web3 games, players earn and transact digital goods through NFTs. By partnering with Web3 gaming companies, Magic Eden aims to make its marketplace a primary platform for web3 gamers to transact with their in-game NFTs. Assuming that Magic Eden applies its standard take fee of 2%, Web3 gaming represents a potential new vertical for Magic Eden to tap into for growth.

Cross-Chain Growth

While Magic Eden has established itself as the market leader for Solana NFTs, the platform has yet to find significant adoption cross-chain for Ethereum, Polygon, or Bitcoin NFTs. The top NFT collections by trading volume and market cap are on the Ethereum blockchain, with the top Solana NFT collections representing a minority of the overall NFT market. Despite now supporting NFTs on the Ethereum network, Magic Eden has yet to find significant adoption outside the Solana ecosystem. Growing market share and adoption cross-chain for NFTs outside of Solana represents an opportunity for Magic Eden to be the marketplace where lucrative, high-value NFTs are traded, driving additional revenue and awareness of the platform.

Key Risks

Crypto Winter

The crypto market is notoriously volatile, and there is a risk of significant price declines and lowered transaction volume during “crypto winters”. These downturns can lead to significant reduction in user demand and interest in NFTs — Magic Eden's core product — and negatively impact the company's revenue. In September 2022, NFT trading volumes had collapsed 97% from a January 2022 peak. This collapse in demand also translates to lower NFT prices on average.

Crypto winters are also associated with lower investor interest and a slowdown in fundraising, making it challenging for Magic Eden to raise the capital necessary to continue operating and expanding. In February 2023, CEO Jack Lu announced 22 employees would be let go, reflecting the ongoing impact of the crypto slowdown.

Source: The Block

FTX Insolvency

The collapse of FTX in November 2022, following a report highlighting solvency concerns, presents a significant risk to Magic Eden. FTX and Alameda Research had invested in Magic Eden during its early rounds. The collapse of FTX also set off the so-called “crypto contagion” that saw major crypto entities like BlockFi and Digital Currency Group go bankrupt or face insolvency.

Because of FTX’s significant role in the crypto ecosystem, both as an investor and a public face of crypto, its collapse set back development and investment in the crypto space, presenting a headwind for Magic Eden. The FTX collapse also resulted in a loss of confidence in Solana, which could dissuade founders and creators from building new applications and NFT collections on the Solana blockchain, arresting the growth of the primary ecosystem Magic Eden relies on.

Marketplace Competitors

Despite Magic Eden’s growth in 2022, new entrants into the NFT marketplace space have lowered its market share of Solana NFTs. Magic Eden’s contentious decision to enforce NFT royalties saw traders adopt competitor marketplaces like Hadeswap and Yawww, which promised low to no royalty fees. Rapid market share erosion forced Magic Eden to reverse its early decision, allowing users to opt out of paying royalty fees to artists and creators. Although quick action prevented the further loss in market share, Magic Eden’s leading position in the Solana NFT space can be threatened by upstarts that offer unique value propositions to NFT creators and collectors.

Summary

As the NFT market grows, marketplace platforms are emerging to help users create, trade, and discover unique digital assets. Magic Eden has positioned itself as one of the leading marketplaces for Solana-based NFTs and expanded cross-chain support for other cryptocurrencies. With focus areas on royalties, gaming, and community collaboration, Magic Eden aims to differentiate itself within the competitive NFT marketplace landscape. However, the company faces several challenges, including navigating an evolving regulatory environment, maintaining user trust in the face of potential security risks, and establishing a defensible market position against existing and emerging competitors. Magic Eden will need continued innovation and community engagement to maintain its foothold in the NFT market through broad volatility and solidify its position as a leading Web3 art, collectibles, and gaming platform.