Thesis

Since the mid-2000s, which saw the inception of video streaming platform YouTube in 2005 and the launch of on-demand video from Netflix in 2007, video streaming has become a mainstay in consumer media consumption. In April 2025, streaming accounted for 36% of all TV usage. Netflix, the largest streaming service globally as of January 2025, had 282.7 million paid memberships in Q3 2024, up 1.8% from Q2 2024 and representing 8.3% YoY growth.

The 2010s brought a wave of social media platforms, and with them, the emergence of short-form video. Founded in 2010, by May 2025, Instagram had grown to be the world’s third-largest social media platform, with 2 billion MAUs. Instagram introduced its short-form video feature, Reels, in 2020. As of the Q1 2024 earnings call of Meta, Instagram’s parent company, Reels comprised 50% of time spent on Instagram, and video comprised 60% of time spent across Instagram and Facebook. In February 2025, it was reported that Instagram was considering spinning off Reels into a standalone app, which could suggest Meta plans to increase investment in short-form video to the degree that it constitutes an independent app.

Across the social media landscape, short-form video continues to grow. In 2020, YouTube launched Shorts, its short-form video product, in addition to its core offerings of on-demand and live videos. YouTube’s bet on short-form video had paid off by 2024, when 26% of user time spent on YouTube was spent watching Shorts.

TikTok, a social media platform with 1.6 billion MAUs as of February 2025, has become nearly synonymous with short-term video, with over half of user time spent on the app dedicated to watching short-form video. In 2024, TikTok had 1.6 billion MAUs, up 6.1% YoY. Since TikTok is an app for creating, sharing, and consuming short-form video, all of its revenue is inherently linked to short-form video. Its 2024 revenue was $23 billion, of which about 80% came from ads and 20% came from TikTok Shop and in-app purchases.

The growth of online video has created a lucrative video advertising space. In 2023, the global digital video advertising market size was valued at $187.5 billion, which is expected to grow to $659.2 billion by 2030. One example of ad revenue growth is YouTube, which had 2.7 billion MAUs in 2024 and ended Q4 2024 with $10.5 million in ad revenue, up nearly 14% from $9.2 million in Q4 2023. The same trend can be seen across other social media platforms. In 2024, social media ad spend in the United States alone was $76.4 billion, and it is projected to reach $88.1 billion by 2028. Because short-form video is increasingly leading social media revenue and company investment, this suggests that a significant portion of future social media ad spend will be driven by video.

If the expansion of the video ad category had not already driven more video ad spend from advertisers, consumer sentiment would have. In 2025, 78% of consumers indicated that they wanted brands to use more video, especially personalized video. In particular, 93% of Gen Z expressed a desire for personalized video content. Gen Z has become the leading consumer of video content; in 2024, over half of TikTok MAUs were between the ages of 18–34, and 30.2% were between the ages of 18–24. Between 2024 and 2030, Gen Z global spending is expected to grow over 460%, to $12.6 trillion from $2.7 trillion. This might suggest that advertisers and retailers will continue to invest in video. Irrespective of age demographic, personalized video is three times more likely to make customers recommend a brand, indicating continued upside for the video advertising space.

Mux is a B2B video infrastructure platform that offers live and on-demand video hosting, storage, delivery, and analytics. It provides developer-oriented software and tooling that handle the costly infrastructure of video delivery, such as encoding and dynamically streaming videos to ensure a delightful end-user experience, so that apps can embed and serve videos to meet growing consumer demands.

Founding Story

Mux was founded in 2015 by Jon Dahl (CEO), Adam Brown (CTO), Matthew McClure, and Steve Heffernan. All four cofounders were experienced in video technology and infrastructure before founding Mux.

Dahl and Heffernan founded Zencoder with Brandon Arbini in the W10 Y Combinator batch. Before Mux and Zencoder, Heffernan also created Video.js, the first open-source HTML5 video player, in 2010. At Zencoder, Dahl served as CEO, and Heffernan served as head of Product Design and Marketing. Zencoder offered a cloud-based video encoding service with which customers could interface directly via API, at a time when encoding was typically done on-premises (and therefore required companies to make costly hardware investments). Zencoder raised a $2 million series A in April 2011 and was acquired by video delivery platform Brightcove for $30 million in July 2012. Both Dahl and Heffernan remained at Brightcove until 2015 — Dahl as a VP of Technology, and Heffernan as a director.

Brown, meanwhile, spent years as a software engineer at streaming and media companies before founding Mux; from 2012–2013, he was a developer at TSAV, where he built apps for audio and video streaming. From 2013–2014, Brown was a software engineer at Brightcove, part of which was spent on the Zencoder team. In the year before founding Mux, he was a software engineer at Otoy, Inc., developing cloud rendering for VR apps.

McClure was also a media and streaming entrepreneur and engineer prior to Mux. From 2011–2013, he was the cofounder of a company called TuneWolf, which provided a “virtual jukebox” for bar patrons to play music at food/drink establishments. During that time, like Brown, he was also a developer at TSAV. From 2012–2015, he was a developer advocate and software engineer at Brightcove.

All four cofounders began brainstorming the idea for what would become Mux in late 2015. The founding team created another company in the video space because Zencoder’s rapid launch and acquisition left the team with “unfinished business,” including parallelizing video encoding. According to Dahl:

“[W]e started Mux with an ambitious goal: let's build the absolute best video technology in the world, and let's package it up as a simple cloud API for anyone to use.”

Heffernan likewise stated:

“We started Mux because we saw what our friends at the most advanced video companies had built to monitor their viewer experience, and we wanted it, and we wanted to bring it to everyone.”

In early 2016, the cofounders joined the W16 Y Combinator batch, at the end of which they’d hired their first employees and raised a $120K pre-seed. Mux’s first product was a video analytics product called Mux Data, which launched in 2016. While the cofounders had always had their sights set on creating a video product, Brown noted that they shipped a data product first because there were already established video API competitors with large engineering capacity at the time, and they saw an opportunity to find initial product-market fit with a data product.

Product

Mux is an API-first video infrastructure platform that lets developers embed live or on-demand streaming in their apps with just a few lines of code, while Mux handles the heavy lifting of encoding, storage, and global delivery. It pairs those streaming APIs with real-time Quality-of-Experience analytics — tracking startup time, rebuffering, playback errors, and more — so teams can quickly detect issues and optimize viewer performance at scale.

Mux has three core product offerings: (1) Mux Video, (2) Mux Data, and (3) Mux Player.

Mux Video

The Mux Video API allows apps to host, encode, store, and stream user videos. Developers can expose the Mux Video API within an app, which allows it to ingest user-uploaded videos.

From there, Mux Video creates a video asset and streams it via adaptive bitrate streaming (ABS). ABS works by encoding a video at multiple bitrates — a bitrate is the number of video bits that can be processed per unit time — and automatically adjusts video stream quality to the most optimal bitrate given a device's current CPU and bandwidth. Via ABS, the player client dynamically switches to the most performant encoding at any given time, allowing it to serve low-buffer, fast-start streaming at any level of connection quality

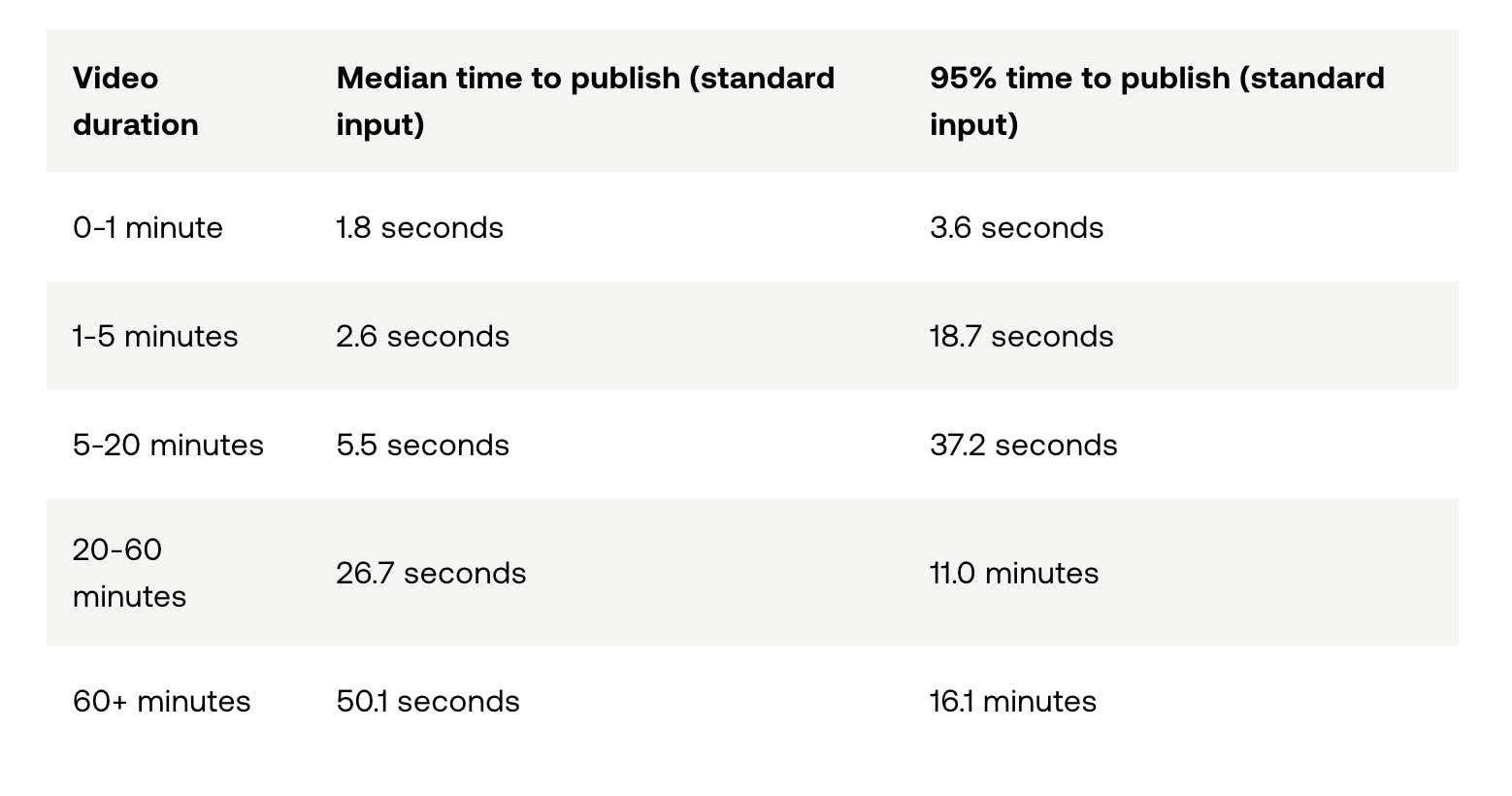

Mux Video furthermore encodes video using its just-in-time transcoding technology, which allows videos to be encoded as they are watched for the first time. Just-in-time transcoding has two main components: (1) It breaks videos into smaller chunks and parallelizes processing of those chunks, and (2) it streams video through a transcoder so that each video “chunk” can be watched as soon as it is transcoded, effectively allowing for video playback to begin before the entire video has finished transcoding. Just-in-time transcoding enables the publication of videos within seconds; as of 2023, the median time to publish a video under one minute with Mux Video was less than two seconds.

Source: Mux

Rapid video publication allows the Mux API to afford app developers instant features from uploaded videos, such as thumbnail selection, GIF generation, and live clip extraction. For end users, faster time-to-publish provides an available, performant user experience; for customers, the resulting performant experience reduces the potential of end-user churn in apps with user-generated video.

Once a video is uploaded, Mux Video promises users that, for the lifespan of a video, it will automatically update the video’s encoders, decoders, and renditions (which convert video files from one format to another) to newer technologies at no additional cost to the user. Customers can update, manage, and delete videos via the Mux Video API, and they can also add video to their applications using a headless CMS. Additional features include AI workflows to generate video chapters and translate, dub, summarize, or tag videos. Finally, customers who also pay for Mux Data can view analytics of uploaded videos with Mux Data.

As Mux cofounder and CTO Adam Brown put it:

“The video product is the full end-to-end solution. You give us a video source file—whether it be live or a video on demand, like a recording—and we handle all of the hard bits in between: the transcoding, the storage, and the delivery, including that last-mile delivery—that CDN to ISP delivery—as well. At the simplest, you give us a file and we give you a URL to drop into the video player, and it's going to work everywhere.”

Mux Data

Mux Data allows customers to track their videos’ performance and engagement, even for videos that are not hosted on Mux Video. Mux Data metrics are segmentable across various fields, including device, OS, browser, and geography.

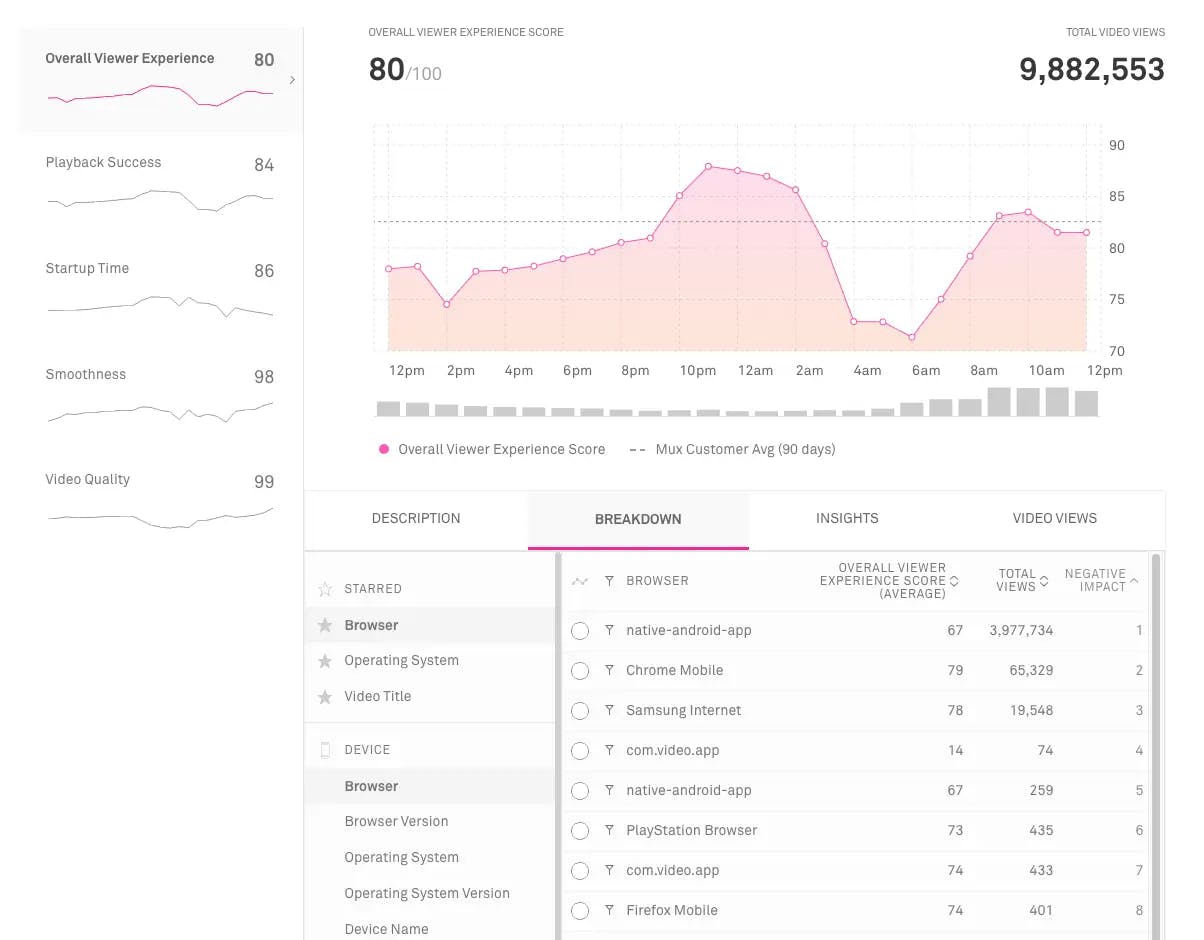

Source: Mux

Mux Data includes the following metrics, which are segmentable across various fields, including device, OS, browser, and geography:

Monitoring: Monitoring metrics include current concurrent viewers (CCV) and video failure rates.

Viewer Experience: Viewer experience metrics, such as video startup or playback failures, rate of viewers abandoning videos, rebuffering rate, and startup time.

Telemetry: Telemetry, such as aggregate views, unique viewers, and video playing time.

Ads: Ads information: ad attempts, breaks, and impressions.

Video Quality: Video quality score, a ratio of video resolution to player dimension weighted by the percentage of upscaling, or the process of increasing a video’s resolution.

Quality of Experience: Viewer Quality of Experience (QoE), an aggregate metric for end-to-end user experience of watching a video, calculated based on playback success, startup time, playback smoothness, and video quality.

Source: Mux

Customers can integrate Mux Data into their Android, iOS, TV, or web clients via an SDK to start collecting data. They can also leverage Mux’s Exports API to extract data to their applications, stream directly to AWS or Google Cloud, or build custom integrations with the Mux Data SDK. The Mux Data SDK supports custom JavaScript, Java, and Objective-C integrations.

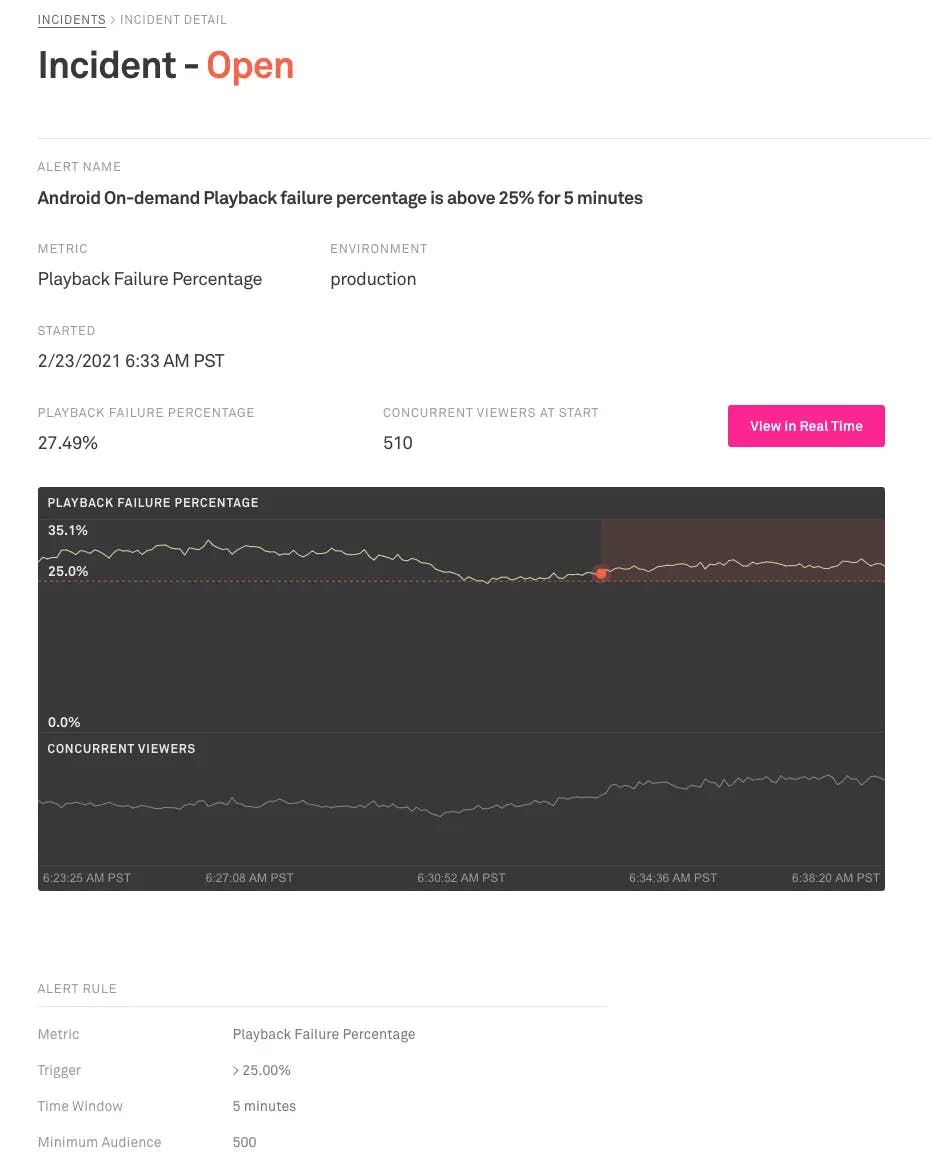

Mux Data also offers alerts to indicate thresholds of concern and track incidents, which customers can monitor within the Mux Data Monitoring dashboard or via its PagerDuty integration.

Source: Mux

Since decreased video performance can lead to decreased end-user outcomes, such metrics impact the business metrics of Mux customers’ apps. For example, increases in the time it takes to render video and the percentage of a video spent buffering are both negatively correlated with the number of views and the amount of time a video is watched.

Video delay, in particular, has been found to cause viewers to abandon videos; every second of video delay increases user abandonment rates by 5.8%. When video playback delay due to rebuffering is greater than or equal to one percent of a video’s duration, viewers play 5% less of the video than viewers who didn’t experience any rebuffering. Additionally, viewers who experience video playback failure are less likely to return to the site on which they saw that video; one video failure decreases the chance that a viewer will return to the content provider in the next week by 2.3%.

According to CTO Adam Brown, Mux Data’s value proposition is enabling developers to understand the performance of different video players or delivery stacks. They can then use this monitoring to make decisions, often in real-time, on the optimal video stack.

Mux Player

Source: Mux

Mux Player is a web component that allows developers to embed and play content hosted on Mux Video in their apps. Customers can implement Mux Player with popular web frameworks, including React, Preact, Angular, Vue, Svelte, HTML, and HTML embeddings. Mux Player also supports AirPlay and Chromecast.

Mux Player affords end users the ability to interact with videos, like previewing thumbnails in a video timeline and navigating the video with keyboard controls. Mux Player also supports adaptive bitrate streaming, video poster-configurable images, and video analytics with Mux Data out of the box (if customers also pay for Mux Data).

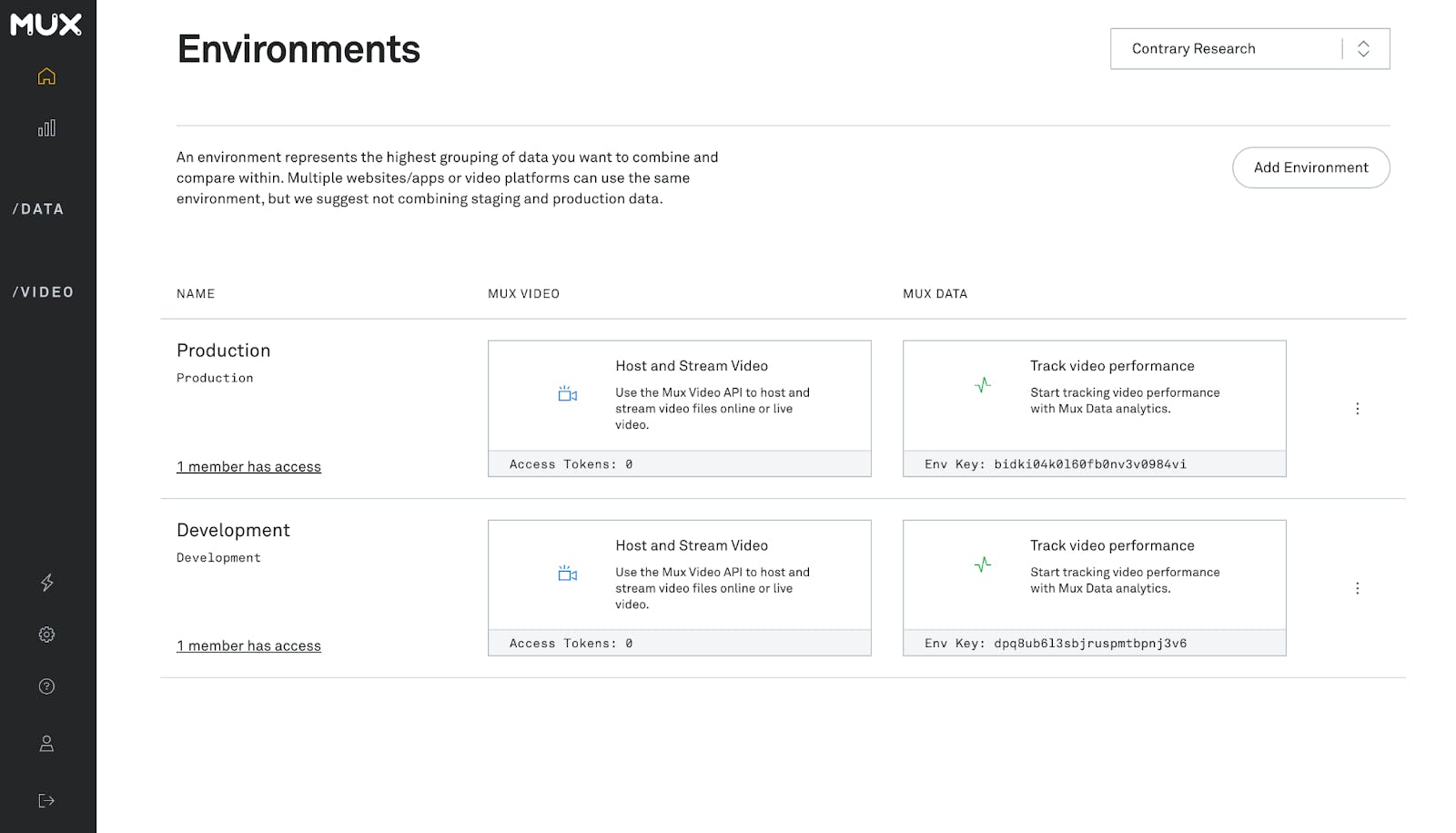

Mux Dashboard

Source: Mux

Customers can access Mux features after signing up through the Mux Dashboard, including Mux Data dashboards and incidents. Additionally, they can create and manage production and staging environments, see API events and logs, and see their inventory of Mux Video assets and live streams.

Market

Customer

Mux’s ideal customers include companies with a business case to host and stream performant video. According to one unverified source, Mux is most commonly used in companies with 1–10 employees doing $1–10 million in revenue.

Large tech companies participating in the video production and publishing space, like Meta, Netflix, and Google, are unlikely to be Mux customers and pay for video infrastructure frameworks and storage, often because they have already developed it in-house and have entire engineering teams dedicated to maintaining and upgrading it. Conversely, Mux offers performant video features, such as adaptive bitrate streaming, to organizations without such R&D capital, research prowess, and ability to operate end-to-end video at scale.

Source: Mux

Notable customers of Mux as of June 2025 include Paramount, Patreon, Substack, Vimeo, Vercel, Hubspot, Shopify, Dropbox, Glassdoor, Fox, Yelp, PBS, Soundcloud, and Synthesia.

Market Size

While not the core job-to-be-done of Mux’s product, video production is the input on which Mux’s business model depends, and it is a market that is likely to expand as the demand for consumer video in streaming, social media, and advertising increases. The global video production market size was estimated to be $70.4 billion in 2022, and it was expected to grow at a 33.5% CAGR from 2023–2030.

Emerging generative AI models have the potential to accelerate this growth by making video production much faster and less labor-intensive. For example, in May 2025, a research group from MIT CSAIL and Adobe Research created a hybrid AI model that generated videos up to 100 times faster than leading AI models from OpenAI and Google. Such advancements in video production technology will likely allow more companies to establish and grow in this space.

Because Mux affords customers the ability to host and embed video content, it operates in the video streaming category. In 2024, the global video streaming market was valued at $674.3 billion, and it is projected to reach $811.4 billion in 2025 and grow at a CAGR of 18.5% to $2.7 trillion by 2032. As the demand for streaming grows, so too will the need for performant streaming infrastructure (especially by companies and platforms without the resources to build video infrastructure internally) like Mux provides.

The growth of the video streaming space has been accelerated by the proliferation of mobile devices and smartphones, which allow people to stream videos practically anywhere. In the US alone, 91% of Americans owned a smartphone in November 2024. By February 2025, 68% of households in the US reported using phones to watch videos. The popularity of using mobile devices to watch video content suggests that users are increasingly streaming video on cellular networks, highlighting a demand for the video infrastructure that Mux provides, which can deliver across fluctuating bandwidth and optimize data usage.

Competition

Enterprise

Vimeo Enterprise: Vimeo Enterprise was founded in 2019 and offers B2B video sharing, management, and analytics. It is a product line of Vimeo, a video sharing and hosting platform on which users can upload, edit, and publish videos. Vimeo was founded in 2004 and went public in May 2021. As of June 2025, Vimeo had a market cap of $691.2 million.

Vimeo Enterprise competes directly with Mux Player with its Video Player product, with Mux Video with its Video Hosting and Live Streaming products, and with Mux Data with its Analytics product. It also offers end-to-end video features that Mux does not, which might make it a more attractive option for customers looking for more functionality in one place. These include video editing features, video monetization, and various B2B integrations, including GoDaddy, Dropbox, and HubSpot.

BytePlus: BytePlus was founded in 2021. BytePlus is a subsidiary of TikTok's parent company, ByteDance, which was founded in 2012 and was valued at around $315 billion in March 2025. In particular, BytePlus was born out of ByteDance's research and engineering efforts and provides solutions, particularly machine learning and cloud infrastructure, to customers.

BytePlus’s portfolio of product offerings includes AI and personalization, live streaming and video infrastructure, and cloud solutions such as data stores and containers, and several of its products are direct competitors of those of Mux. For example, its MediaLive product provides less than one-second video playback and adaptive bitrate streaming optimization, similar to Mux Video. Its Video on Demand product also affords video upload, dynamic encoding/decoding, and distribution, like Mux Video, and video quality analytics, like Mux Data. Unlike Mux, BytePlus also offers additional cloud and AI personalization features, which may make it a more attractive choice for companies looking for a more one-stop shop vendor.

Open Source

Alliance for Open Media: The Alliance for Open Media (AOMedia) is a consortium hosted under the Joint Development Foundation, the open-source arm of the Linux Foundation. Established in 2015, its founding members include cloud, consumer, and streaming tech giants Amazon, Apple, Arm, Cisco, Facebook, Google, Intel, Microsoft, Mozilla, Netflix, NVIDIA, Samsung Electronics, and Tencent.

AOMedia aims to “develop royalty-free standards and software for frictionless audio-visual experiences.” Its first project was AV1, an open and royalty-free codec that increases video compression efficiency. Launched in 2018, AV1 has most notably been adopted by streaming heavyweights Meta, Microsoft Teams, Netflix, and Meta. In fact, in February 2023, Meta committed to continuing to implement and contribute to AV1 in Facebook and Instagram Reels.

Notably, AOMedia is not a for-profit corporation, and it is therefore unlikely to compete actively with Mux for customers or market share. However, its open-source model allows companies with enough capital and expertise to build video infrastructure on top of it for free, when they might have otherwise been customers of a video infrastructure SaaS company like Mux.

As of May 2025, Mux claims that AV1 is too computationally expensive to support live video encoding and that it is only viable for videos with viewership high enough to offset the encoding costs. If AV1 becomes more computationally economical in the future, however, it may pose a risk to Mux Video due to its accessibility/cost effectiveness and the research moat it has built with high-profile contributors such as Meta

Business Model

Pricing

Mux provides video infrastructure and software-as-a-service, largely targeting developers via API and web console interfaces. As cofounder Adam Brown remarked:

“... we look a lot at Stripe and Twilio and folks like that who have done similar things in the space: targeting developers first and building products around the developer as the go-to-market strategy.”

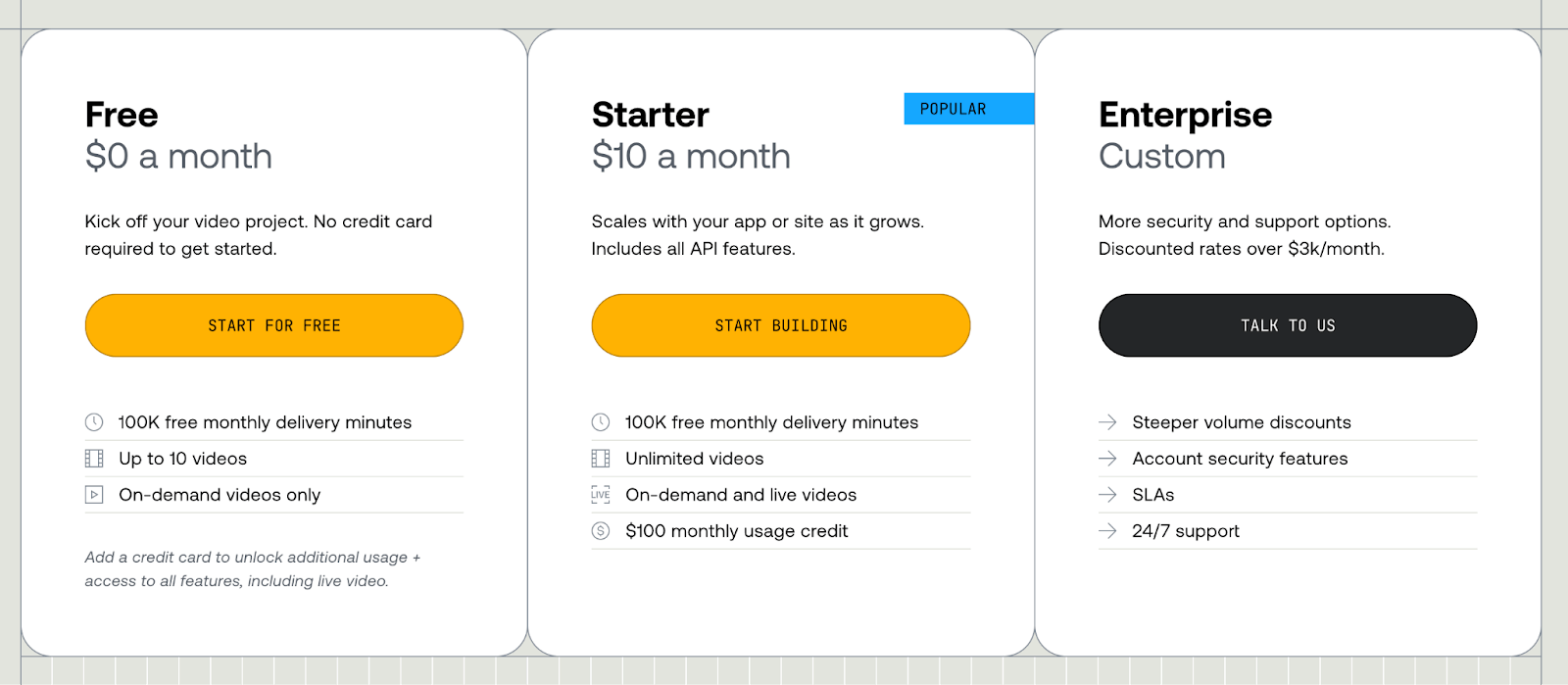

As of June 2025, Mux operates on a freemium subscription-based billing model with three tiers:

Free: Costs $0/month but has limited quality and quantity thresholds.

Starter: Costs $10/month, offers unlimited on-demand and live videos, and includes all API features.

Enterprise: Custom billing depending on the customer’s level of usage and support, and offers discounts for accounts over $3K/month.

Source: Mux

As of May 2025, the pricing of each tier varies across three components of video infrastructure: (1) Encoding, (2) Storage, and (3) Delivery, each of which is charged per minute of usage. The only exception is storage, which is prorated by the percentage stored. For example, a customer who stores a 10-minute asset for half a month will incur a five-minute charge that month.

Within each component, Mux offers three quality levels: Basic, Plus, and Premium; price per minute increases as quality/level increases.

Traction

In 2016, Mux had 10 employees, and its customers included PBS and Funny or Die, a comedy video site whose founders include actor Will Ferrell. By 2018, Mux had 30 paying Mux Data customers and had launched Mux Video. In 2020, Mux did $8 million in revenue. Notably, in 2021, Mux had jumped to $32.1 million in revenue (up 400% YoY), and grew on-demand streaming by 300% and live streaming by 37x. In August 2023, Mux Data monitored the largest livestream up until that point, which had a high of 30 million concurrent viewers. That same year, it generated $30.8 million in revenue.

As of April 2025, Mux had over 4.5K customers, and its customer base spans streaming apps and social media, to CRM tools. Notable customers include:

Video-first consumer platforms: Fox, Paramount, Patreon, and Viacom CBS.

Consumer and social apps that support video media: Citizen, Shopify, Strava, Substack, and Yelp.

Other noteworthy brands: Dropbox, Equinox, HubSpot, Typeform, and Vercel.

Valuation

As of June 2025, Mux had raised $173.9 million in total funding. It raised a $105 million Series D at a valuation of more than $1 billion, led by Coatue, in May 2021. Other notable investors in the round included participants from previous rounds, such as Accel, Andreessen Horowitz, which led its July 2020 Series C, and Cobalt. New investors in the round included Dragoneer and HubSpot Ventures.

Key Opportunities

Ecommerce

Video demand and growth are significant drivers of advertising. For example, personalized video is three times more likely to make customers recommend a brand, and in 2022, video ads achieved 25% more impressions than static ads. A key player in digital advertising is the e-commerce space, which itself is also growing: in 2024, ecommerce sales were estimated to be $1.2 trillion, growing at 8.1% YoY

As such, there exists an opportunity for Mux to capture and build more functionality for ecommerce apps, which are increasingly leaning into video. In 2022, Instacart, the leading grocery delivery company in the US, released shoppable in-app video ads. Likewise, eBay, the fourth most-downloaded shopping app as of May 2025, allows sellers to upload videos to listings.

Ecommerce platforms are ideal customers for video infrastructure services, as they are unlikely to invest heavily in building video infrastructure from scratch since their core product is in transactions and not media. Therefore, Mux’s API-forward products would allow ecommerce customers to integrate with relative ease. Mux is better positioned to cater to the ecommerce space than some of its competitors, since ecommerce platforms largely do not create their own ads and instead serve the ads of their vendors. As such, they are unlikely to need the additional features, such as video editing and AI video generation, of key Mux competitors.

International Expansion

The global rollout of 5G networks will only make video streaming more accessible. 5G network coverage is predicted to reach 85% of the world population outside of mainland China (where it was 95% in 2024) by the end of 2030. Increasing demand for video to be served globally, and the promulgation of technologies that afford it, both point to the need for video infrastructure at scale in non-English speaking locales, presenting an opportunity for Mux to localize and expand to geographies outside of the US and capture these growing markets.

Key Risks

Cloud Costs

Not unlike many other B2B SaaS companies, Mux provides customers with software built atop cloud infrastructure, the costs of which are rising. Global public cloud spend was projected to hit $723.4 billion in 2025, up from $595.7 billion in 2024, and company budgets are feeling the strain. In a 2025 survey, 87% of software enterprises reported that managing cloud spend was their foremost cloud challenge.

Notably, one of Mux’s core offerings is video storage; this means that Mux charges a fixed rate (per its pricing model) for storage, the costs of which it does not control. Such costs are determined by the vendor, which could theoretically increase its storage costs at any time. In 2023, 54% of IT enterprises reported that their cloud storage costs grew faster than overall cloud costs.

The trend of increasing cloud storage costs has persisted; in 2025, 62% of surveyed cloud organizations reported exceeding their budgeted cloud storage spend, up from 53% in 2024. Storage cost increases are at least in part due to supply chain issues, which decrease the availability of hardware inputs and therefore increase vendor storage costs. In 2023, 65% of IT enterprises optimized and extended the use of their storage resources due to being unable to procure newer storage.

If cloud storage costs were to increase dramatically, it would put immediate strain on Mux’s profit margins; unlike compute, of which companies can reduce costs by load-shedding or de-resourcing (possibly at the expense of performance), there are fewer immediate ways to reduce storage costs for a storage product. A possible mitigation under this scenario would be to temporarily (or indefinitely) increase prices, which could lead to customer churn.

Narrow Product Range

Mux offers comparatively fewer products than some of its key competitors; Vimeo Enterprise, for example, offers video creation and monetization tools and specialized e-commerce and CRM integrations, in addition to competitors to Mux’s video infrastructure and analytics products. Similarly, BytePlus offers cloud computing and storage solutions and AI personalization, in addition to video infrastructure and analytics like Mux.

Having larger product portfolios can make Mux’s competitors more attractive to customers by offering more functionality in one place, which can reduce integration and financial complexity for customers. Additionally, Mux’s competitors’ broader product ranges can generate greater net revenue and afford them the ability to invest in R&D at a scale Mux cannot, or offset initial costs of new products pre-product market fit. Mux’s narrow product range might cause it to lose customers to competitors that cover more ground.

Summary

Mux is a B2B SaaS company that provides video infrastructure to customers: Mux Video allows customers to stream live or on-demand video via API, Mux Data provides monitoring for video telemetry and engagement, and Mux Player allows apps to embed videos and afford intuitive user interactions. Mux offers customers developer-driven features to serve and manage performant video as global demand grows, both for short-form video and longer streaming content. Its reliance on costly cloud infrastructure and relatively narrow product range could pose future obstacles to its product differentiation.