Thesis

Transportation is one of the industries that produces the highest amount of emissions. As of 2024, it is responsible for 28% of all CO2 emissions in the US, the largest single contributor. Achieving climate goals set out in the Paris Agreement will require a 25% decrease in emissions associated with transport by 2030. Technological advances such as faster computing, sensors, better batteries, and scalable manufacturing have enabled a rapid electrification of land-based transportation. Between 2019 and 2022, emissions from new passenger cars in the EU decreased by 27%, driven by a surge in EV demand.

The maritime sector, responsible for around 10% of total transportation emissions, meanwhile, has failed to adopt these innovations. In 2022 alone, global maritime emissions grew by 5%. The operation of ships and boats remains very energy inefficient. Even a small vessel uses between 6 to 8 gallons of fuel per hour of operation, with large vessels burning through up to 30 gallons per hour. An average gas-powered car, meanwhile, can achieve around 2 gallons per hour.

That inefficiency creates pressure to electrify and decarbonize the maritime sector. This is especially true for short-haul routes. California was among the first US states to impose a 2025 zero-emissions deadline on short-run ferries. Battery technology, charging, advanced composites, and autonomous piloting could create an opportunity to build more energy- and cost-effective vessels.

At the same time, coastal cities worldwide face worsening urbanization pressures. Around 40% of the US population lives in coastal areas, with similar numbers globally. Congestion in dense urban centers around the world is getting increasingly worse. However, coastal cities can leverage an unused piece of transport infrastructure: waterways. The global economy used to rely on water-based transport. However, since the introduction of gas engines, cars, and trucks replaced most boats. Due to the inefficiency of traditional boats, cars became 15x cheaper to use. As a result, water transport has become less and less popular, and boats are now primarily seen as "a wealthy person's toy”, not a practical vehicle.

That’s where Navier* comes in. Navier aims to become the maritime company of the future. It builds electric passenger hydrofoils. Its first “flying boat” vessel produces no emissions and cuts operational costs by a factor of 10. The company aims to spark the electrification of the maritime industry by pioneering a hydrofoiling technology platform. Similar to the early days of automobiles, Navier wants to transform boats from a toy into a mass-transit vehicle. The company's mission is to open waterways as a new way of mass transport and “make our waterways as accessible as our highways”.

Founding Story

Navier, as a company, was founded in 2019 by MIT graduate Sampriti Bhattacharyya (CEO).

Bhattacharyya has been fascinated by space since stargazing in her childhood. However, Bhattacharyya didn’t get access to a computer with internet at age 20. At that point, she landed an internship at Fermilab in Chicago. During her work there, she fell in love with physics. In a July 2024 interview with Contrary Research, Bhattacharyya spoke of her time this way:

“It was my first exposure to working on complex real “hardware”, like particle accelerators. I wanted to understand why the universe exists and build machines based on what I learned.”

Bhattacharyya later went on to join NASA’s Ames Research Center where she worked on intelligent flight control systems. She also studied aerospace engineering at Ohio State where she worked on nuclear reactors with funding from the Department of Energy and Fermilab. Her research gained attention in the scientific community and, in 2012, she was accepted into a PhD program in mechanical engineering at MIT.

During her PhD, she became focused on learning more about the oceans. The crash of flight MH370 in 2014 was a pivotal moment. She realized that as an aerospace engineer, she was working on exploring the universe beyond our planet, even though the technology didn’t exist to find a large airliner crashed into an ocean here on Earth. That was when the idea of starting a next-generation maritime company was born. Bhattacharyya started work on marine robotics. She focused on underwater drones for monitoring energy systems, which was related to her previous research in nuclear engineering, focusing on submerged energy systems, like boiling water reactors. During that work, she found that hydrofoils are much more efficient than traditional vessels.

Bhattacharyya tried to commercialize some of her research during her PhD when she launched her first company, Hydroswarm. She aimed to build autonomous, jet-powered underwater drones for mapping the ocean floor, as well as inspecting underwater infrastructure and ship hulls. While the technology was promising, the timing wasn't right. She faced visa and IP issues, as well as a slowdown in the drone market, and the project failed.

However, Bhattacharyya remained certain that she wanted to build a fleet of efficient, autonomous watercraft. In a July 2024 interview with Contrary Research, Bhattacharyya described her long-term goal for the company:

“My mission was always to build an ecosystem of autonomous marine vessels run by a standardized OS and communications network, eventually leading to overwater and underwater vessels that can communicate and work together.”

After her graduation, she moved to San Francisco to continue working on the idea for a maritime company based on efficient vessel design and advanced software.

The original idea for Navier wasn't building hydrofoils. It was closer to Bhattacharyya’s earlier work on autonomous vessels. For the first year, Navier focused on building autonomous piloting software. The team was planning to retrofit existing boats with a new OS to assemble autonomous fleets. But in 2020, with the COVID-19 pandemic, it proved impossible to gain access to vessels and the team changed direction. As Bhattacharyya told Contrary Research in a July 2024 interview:

"It became clear retrofitting existing vessels is a non-scalable business. We realized that to build a next-gen maritime company, we would have to build the vessels ground up, including an appropriate vessel platform that is meant for efficient, scalable, autonomous operations. The very first problem to address was that boats were inherently inefficient and there had been very little innovation in the industry optimizing vessel design and architecture.”

Bhattacharyya recognized an opportunity in the increasing reliability and falling cost curves of technologies like batteries, advanced materials, and sensing. Then it became clear that Navier could build a next-generation, hyper-efficient, autonomous watercraft built from scratch.

In addition to technological unlocks, Bhattacharyya saw a significant change in how maritime production would occur going forward. Historically, maritime production has been heavily labor intensive, both to manufacture and to operate. As a result, the US has ramped down much of its shipbuilding, falling to #11 globally for shipbuilding capacity, far behind countries like China. But going forward, the future of maritime is increasingly at the crossroads between hardware and software. That shift creates an opportunity to build “America's next-generation maritime company with a focus on the global market,” as Bhattacharyya describes it to Contrary Research.

Building on Bhattacharyya’s previous work, she settled on foiling as the most efficient way to propel a vessel on water. Bhattacharyya then tapped Paul Bieker, an expert in hydrofoil technology and principal designer engineer for Oracle Team USA at the 35th America’s Cup. He led the architecture for Navier’s first prototype, the Navier 27.

Navier has recruited several other key team members. Kenneth Jensen, who led vertical take-off and landing (VTOL) control systems development at Kitty Hawk and truck control system engineering at Uber, joined Navier in early 2022 to develop controls software. Jensen, driven to reduce road congestion, was convinced that time-to-market for flying boats would be significantly faster than for flying cars which he worked on at Kitty Hawk. Reo Baird, who previously joined as Navier’s CTO in 2019, left the company in 2022 to join another hydrofoil company, Valo. At Baird’s departure, Jensen became Navier’s CTO.

Product

While Navier’s first commercial product is the N30, the product vision for Navier as a company is to build a next-generation end-to-end maritime operating platform. In a July 2024 interview with Contrary Research, Bhattacharyya explained it this way:

“Just like Tesla has a broad tech stack, Navier is building the vessel, the automation platform, the diagnostic system, the power train, and on and on. And each of these is scalable and licensable, which makes up our real product.”

N30

Navier’s flagship product is the Navier 30. It’s a 30-foot electric hydrofoiling boat that seats six passengers. It has a cruising speed of 20 knots (KT) and a range of 75 nautical miles (NM), the longest of any electric boat on the market. Navier is planning to increase the range further to 100 NM (115 miles) by the end of 2024. That’s a range that would be sufficient to connect cities like San Francisco and San Jose, Los Angeles and San Diego, New York and Philadelphia, or Seattle and Vancouver.

The N30 is powered by two 90KW electric motors and, according to a July 2024 interview with Contrary Research, the company shared the N30 can reach a maximum speed of 35KT. The takeoff speed for foiling is 16KT. It’s available in three variants: covered cabin, hardtop, and open-top, and can be equipped with amenities like tables and Wi-Fi.

The N30 requires no extra infrastructure and instead can use existing marinas. The company shared in an interview with Contrary Research that all production boats have fast charging capabilities. The batteries are charged using shore power (240V) outlets that exist at most marinas. Currently, overnight charging is the best option but Navier plans to install fast charging infrastructure in marinas to reduce turnaround times. The beam is 8’6”, allowing the N30 to operate in a traditional marina. With retractable foils, it can navigate shallow water without scraping the bottom, minimizing impact on marine life and infrastructure.

According to Navier, the operational cost for the N30 is 38 cents per mile, 10 times lower than for traditional gas-powered boats. Increasing autonomy could further streamline costs in commercial applications since the biggest cost for water taxis and commercial ferries is trained personnel.

Source: Powerboat & Rib

Navier points to two unlocking innovations for its boats that meaningfully impact efficiency: hydrofoiling and electric power. In a July 2024 interview with Contrary Research, Bhattacharyya explained both unlocks this way:

“For the product direction, we started from first principles: boats were going electric, but the biggest challenge to mainstream adoption of electric boats was range. You are using a lot of energy to push water. The second key issue for commercial operators is reliability. That’s why hydrofoiling hadn’t gone mainstream before. So range and reliability became the biggest focuses for us. Navier isn’t sustainable just for the sake of being sustainable. The combination of electric power and hydrofoiling enables 10X more operational efficiency.”

Hydrofoiling Technology

The key feature of Navier’s vessels is its foiling technology, which reduces drag, wake, and turbulence. Since Navier's hydrofoiling technology is electric-powered, it also reduces pollution. The concept of foiling has been around since the 19th century. But in recent years the technology was mainly used in high-end racing boats, in competitions like the America’s Cup. Thanks to advances in technologies like advanced composites, avionics software, and battery technology, it’s now possible to build a cost-effective electric hydrofoil at scale.

Source: Sail Magazine

Hydrofoils operate more like aircraft than boats. Vessels of this type have propellers mounted underneath a set of wings, which extend beneath the body of the watercraft. Once the vessel reaches a certain speed, the foils lift the boat above the water. They use elevators and ailerons to navigate. Making a stable hydrofoil that can fly over choppy conditions requires a lot of advanced software. To respond to those obstacles, Navier has borrowed heavily from aerospace engineering practices. The vessel’s sensors feed information into an avionics software suite that adjusts the foil configuration.

The hydrofoil concept allows Navier to reduce the drag and make efficient electric boats. Due to drag in water, foiling is necessary to make an electric boat that can achieve a practical range. Apart from efficiency, another advantage of hydrofoils is passenger comfort. Hydrofoil boats glide over waves, resulting in a stable ride even in choppy water conditions. The N30 can glide over waves up to 4.5 feet with no impact on stability. With an electric motor, the N30 is also quiet. Since hydrofoils don’t generate a wake, they also have less impact on marine life or the coast.

In a July 2024 interview with Contrary Research, Bhattacharyya explained the limited impact the N30 has across the maritime ecosystem:

“Fully retracted, we are less than 2 feet, so the boat can also go into shallow waters. The foils can be entirely retracted and stowed with a lift / tilt mechanism, so they stay out of the water, and you can both trailer or beach the N30. That means you are not constrained by dock space availability.”

Software Platform

The main technology platform behind Navier’s N30 is its controls software. Its key innovation is a hydrofoiling technology platform that can be used for multiple vessel types. Bhattacharyya describes the N30 as primarily software-driven:

“The control system software is what stabilizes and flies [N30] using sensor information and then driving the actuators. The user operates at a higher level (or outer loop), and drives it like a normal boat.”

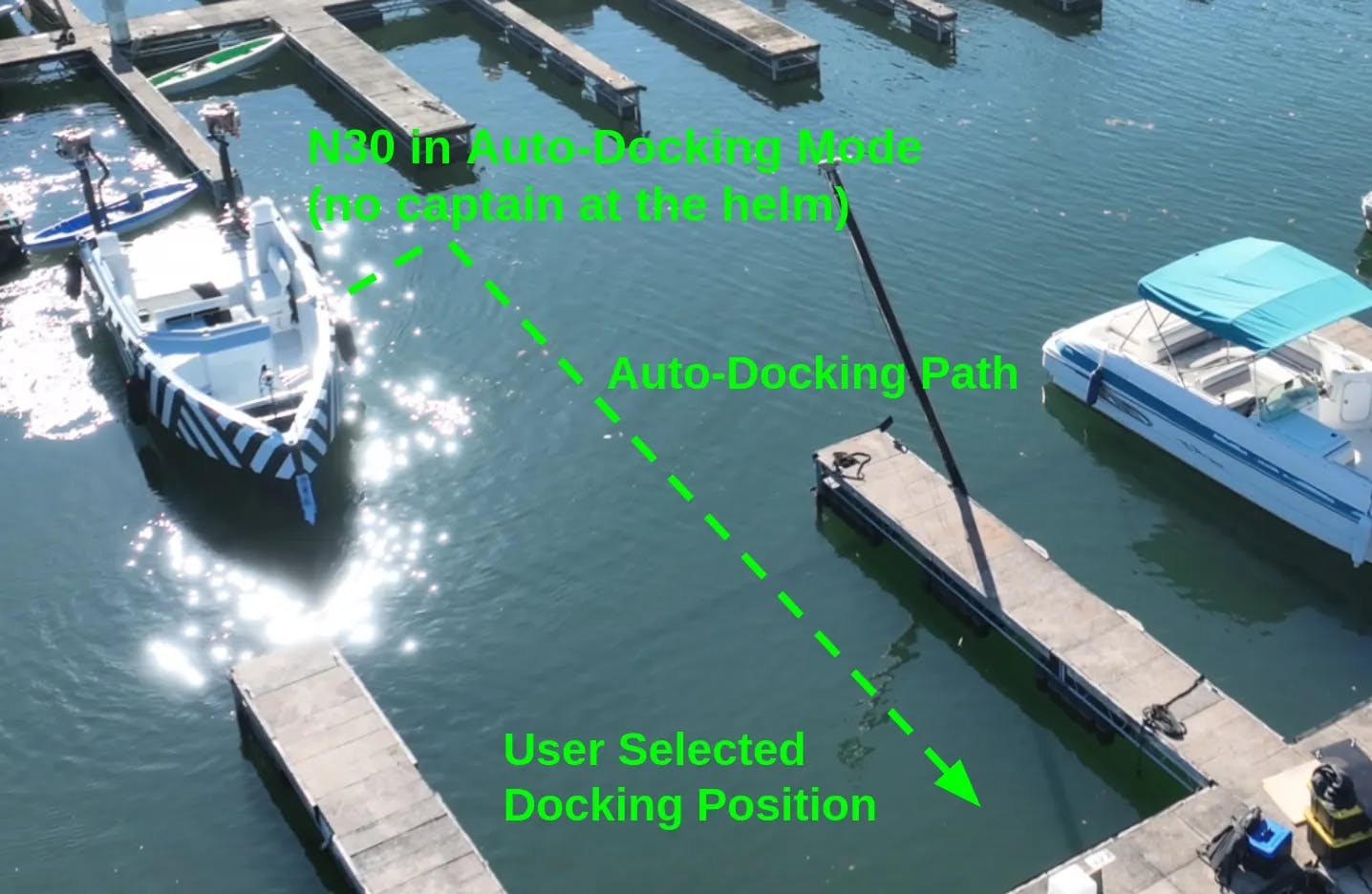

Navier is working on incorporating more high-level control features, ultimately working towards a full self-driving mode. However, according to Bhattacharyya, even partial autonomy will bring significant value to customers. Listening to customer feedback, Navier is developing a self-docking capability for the N30, allowing it to park itself in a marina. Most customers enjoy driving boats recreationally, but auto-docking has been highly requested. It will be launched to customers by the end of 2024. Similar to other technology platform companies like Tesla, Navier can release software updates adding more autonomy in the future.

Source: Techcrunch

Commercialization

The first prototype of the N30 vessel was built in a year during 2022. However, the N30 is just Navier’s first intended product. The N30 is a prototype of Navier’s technology platform: foiling, electric drive, control software, and autonomy. Building on these components will allow Navier to launch bigger vessels.

Navier’s strategy is similar to Tesla's. It's starting with a premium, niche product to prove its technology and then moving into more scalable versions. In the maritime industry, more scalable products would be bigger vessels that can be used by commercial operators.

Navier sees its next step as building a 30-passenger vessel. A vessel at that scale could provide much lower carbon emissions and operational efficiency. According to the company, each 30-passenger boat would take 120 cars a day off the road. This is also where Navier will be able to expand into a scalable water transit business.

Market

Customer

Private Customers

Navier’s first target customer base with the N30 is the recreational, private boat owners' segment. It sells the N30 as a private pleasure craft. Compared to traditional boats, the N30 is designed to be 10x cheaper to operate. As it glides above the waves, it’s more pleasant to drive and easier to navigate. It’s also built to be stable on the water, ideally making the ride more comfortable for passengers. Combined with increasing self-driving capabilities, the N30 should offer a superior user experience compared to traditional boats.

Institutional Customers

In the medium term, institutional customers will become Navier's main customer segment. Ferry services, water taxis, and water tour companies are increasingly focusing on decarbonizing their fleets. At 38 cents a mile, the N30 already provides 10x decreases in operational costs. A larger vessel, like the 30-passenger hydrofoil that Navier is working on, would provide large operational savings for these types of operators. Seamus Murphy, the executive director of the Water Emergency Transportation Authority, the regional body that oversees ferry service on San Francisco Bay, said:

“We’re a commuter ferry system, so a vessel that carries six people doesn’t do a lot for us. Once they get up to 150 people, that starts to be a vessel that’s usable for us.”

Water Mobility

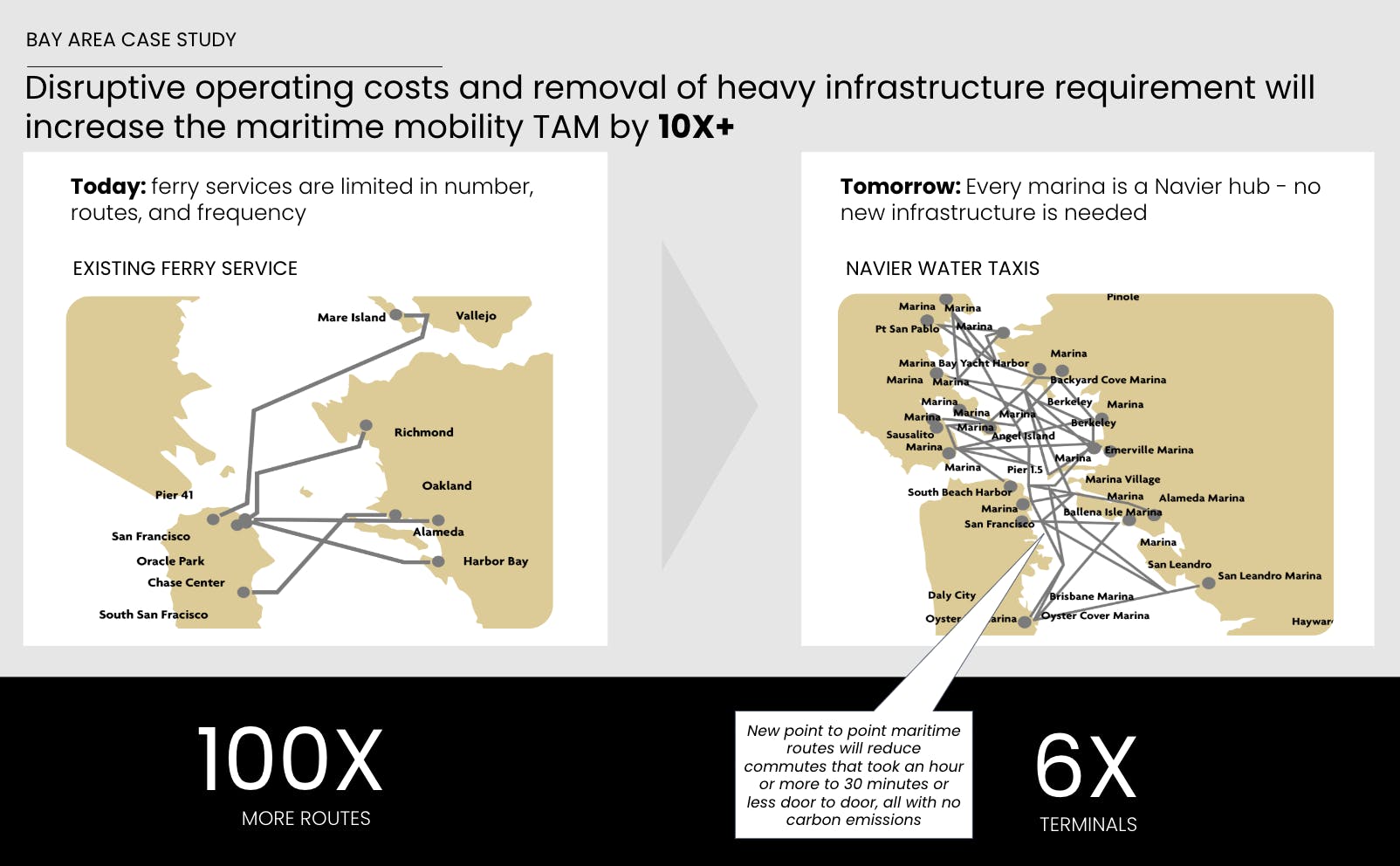

Source: Navier

In the long term, the N30 is designed to serve as the foundation of Navier’s water mobility concept. Navier aims to open a new transportation channel by providing water transit services either directly to consumers or through partnerships. Bhattacharyya explains that Navier’s water taxis will eventually operate on demand:

“For instance, they can run early in the morning, during off-hours, or late at night along already established ferry routes, or during weekend events such as baseball or basketball games.”

On some routes, like the East San Francisco Bay to San Francisco Airport, a water service could cut the travel time in half. The water taxi would allow customers to bypass traffic and travel more comfortably. With no fuel costs and increasingly autonomous operations, Navier could offer more affordable rides and shuttle commuters across bays or lakes, or for tours.

More broadly, Bhattacharyya laid out a vision for Navier in a July 2024 interview with Contrary Research. The company’s goal is to “fundamentally change the way coastal cities are built and operate.” If you think about the impact train stations had on the towns they were placed in, the impact will be similar if marinas can become nodes for high-speed transportation. Bhattacharyya explains it this way:

“Any marina can become a node for high-speed transportation and as a result more infrastructure develops. Offices, stores, all of it gets built up. You can reduce a 2 hour commute to 40 minutes. It changes the economics of how far away from a city you can live and impacts the economy in those areas impacted by the transportation. It's not just about building a maritime company, but also unlocking the secondary effects on the economy. The development around every marina could be huge, from investment to land values.”

Cargo Transport

In the long term, Navier also intends to target cargo shipping, focusing on short-sea shipping routes. Starting with coastal routes, then expanding to coast-to-island, and eventually trans-oceanic routes. Retrofitting large cargo ships with battery packs is not efficient and a solution to decarbonize oceanic shipping is yet to emerge.

Navier is aiming to build a fleet of autonomous, hyper-efficient smaller boats, like single-container barges for short sea shipping, that will operate more frequent and point-to-point trips. The reason shipping is done with huge vessels is because ships are expensive to build and large vessels can achieve economies of scale. However, a smaller, cost-efficient, and faster vessel could disrupt that model.

In terms of unlocking American ship building capacity, Bhattacharyya makes the point that ship building capacity doesn’t just come from building recreational boats or even ferries. A critical part of the equation is reclaiming commercial and cargo ship building. Bhattacharyya explains it this way:

“When you look at Tesla, they couldn't have started with semi-trucks. When you're building this kind of marine vessels your infrastructure starts on the coast, with things like charging stations. The bigger bets on trans-oceanic will be the possibility of moving to smaller and more frequent vessels. Enabling more frequent trans-oceanic trips could decrease the average length for goods delivery from 30 days down to 7 days.”

Market Size

Private Customers

As of 2023, the global recreational boat market is estimated at a size of around $19 billion. In 2023, an estimated 258K new powered boats were sold to private buyers.

Institutional Customers

In 2020, the US had 839 ferry vessels in service, operating on 1.1K routes. On average, larger ships are replaced every 20 to 30 years. Ferries in the US carried 132 million passengers in 2020, with 67% of that traffic being commuter journeys. Globally, the ferry fleet is estimated at 15.4K vessels, carrying 4.3 billion passengers per year.

Water Mobility

Navier’s long-term ambitions go beyond decarbonizing existing ferry and private boat fleets. The company believes that water taxis will become a new method of mass transportation. Navier claims that just in the San Francisco Bay Area, the number of ferry routes could be increased from just five routes to around 2K routes. This would shorten trips like those from Richmond in the East Bay to San Francisco from one hour to only 15 minutes.

As of 2011, Americans were collectively taking about 2.6 billion long-distance car trips of more than 50 miles per year. Navier hopes it can replace a significant portion of such car journeys with boat trips. Around 40% of the US population lives in coastal areas. Assuming an even distribution of trips across the country and that 10% of car trips in coastal areas could be replaced by boats, that would imply an additional market of at least 90 million passengers that Navier can address.

Cargo Services

The global freight shipping market is estimated at $134 billion as of 2024 with demand growing at least 3% per year. Short sea shipping in the EU alone included 1.3 billion trips per year.

Competition

Direct Competitors

Candela: Candela was founded in 2014. As of July 2024, the company had raised a total of $48 million. Candela developed the C-7 and C-8, recreational boats slightly smaller than the N30. The company has already manufactured at least 60 units. Candela has also successfully tested the P-12 vessel, which can carry up to 20 passengers. The P-12 costs around $400K with a range of 60NM. Candela has launched a ferry pilot in Stockholm and deployed the P-12 in a commercial ferry service in New Zealand.

Source: Candela

Electric Conversion

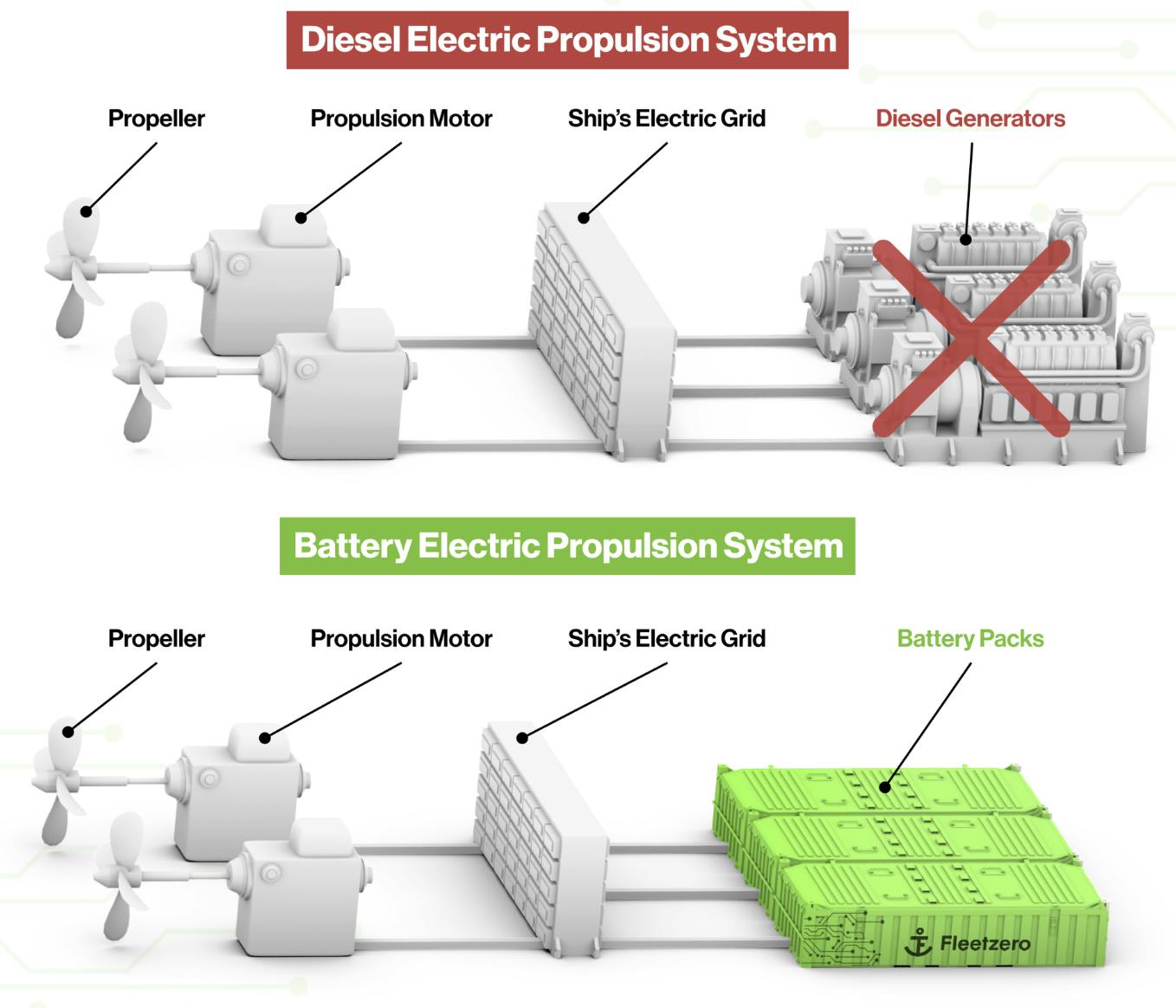

Providers of electric conversions for existing boats might become an alternative to purchasing new electric boats from Navier, particularly for larger ships.

Fleetzero: Fleetzero was founded in 2021. As of July 2024, the company had raised a total of $15.5 million from investors, including Founders Fund. Fleetzero aims to electrify large vessels with advanced marine energy storage systems. In 2023, Fleetzero retrofitted its first ship, the Pacific Jule. In March 2024, the Japanese shipping conglomerate MOL also invested in the company with the aim to install the systems on MOL ships.

Source: Techcrunch

Evoy: Evoy was founded in 2018. As of July 2024, the company had raised a total of $11.9 million in investment and grants. Evoy develops a number of electric propulsion systems to custom-fit a particular boat. It offers both inboard and outboard engines with power outputs up to 300 horsepower. Its propulsion systems can achieve a range of up to 60 NM, at 5 knots.

Source: Evoy

Pure Watercraft: Pure Watercraft was founded in 2011. As of July 2024, the company had raised a total of $204 million in funding. It develops outboard electric propulsion systems, which can be used as a drop-in replacement for vessels. It also offers small pontoon boats, starting at $30K. The company has partnered with GM to develop its EV technology.

Traditional Electric Boats

Arc: Arc was founded in 2021. As of July 2024, the company had raised a total of $100 million from investors including a16z and Lowercarbon. Arc is developing electric watercraft with purpose-built hulls and battery packs. As of September 2023, the company had delivered 20 Arc One boats to customers. The Arc One is a 24-foot boat with 500 horsepower and a range of three to five hours. As of July 2024, Arc was developing the Arc Sport, a high-performance wake boat.

It’s important to note that because is not a hydrofoiling boat it would be very difficult for them to address transportation use cases. The fact that Arc’s boats have to ride wakes and jump waves makes the trips much more choppy, which is typically only acceptable to recreational vehicle users rather than things like passenger commuting.

Source: TechCrunch

X-Shore: X-Shore was founded in 1996. As of July 2024, the company had raised a total of $104 million in funding. It designs and manufactures some of the most affordable electric boats on the market, with prices starting under $100K. With the Eelex 8000 model, X-Shore has achieved a range of 100 NM and a top speed of over 30 knots with a price point of around $250K.

Source: BoatTEST

Alternative Propulsion

Yara Birkeland: Yara is a large international chemical conglomerate founded in Norway in 1905. In 2020, Yara launched the Yara Birkeland, a fully electric, autonomous container ship. The ship has been developed in collaboration with KONGSBERG. It's capable of carrying 120 containers, replacing 40K diesel truck journeys per year. It entered commercial operation in 2022.

Source: Yara International

Oceanbird: Oceanbird is a Swedish joint venture between Alfa Laval and Wallenius founded in 2021. The company is developing wind propulsion systems for both new and existing vessels. Its wings fold when ships enter ports and spread out on open waters to provide wind power to the ship. The first wing was estimated to be installed on a vessel in 2024.

Source: Oceanbird

Business Model

Navier sells the N30 directly to customers. Navier informed Contrary Research in December 2025 that the N30 starts at $850K, compared to gas-powered boats of a similar size and alternative products like Arc One ($300K) and Candela ($390K). Navier collects $1K deposits on order. Configuration and financing options are available once the boat enters manufacturing.

In addition to direct sales, the company is expanding into water taxi services. Currently, Navier is working with strategic partners to provide commuter services in the San Francisco Bay. In the long term, it's aiming to offer a ride-hailing model similar to Uber.

Traction

Direct Sales

In a July 2024 interview with Contrary Research, Navier shared that it was on track to sell 10 N30s in 2024, and are scaling to sell 40+ in 2025. In addition, the company is laying the ground work to be able to scale to 200+ vessels from 2026 and on. In 2025, the company plans to set up a larger production facility for future vessels, though the expensive varient of the N30 will “always stay a limited edition.” The company claims that production slots are sold out, and it has secured a significant waitlist for the following years. Navier partnered with Lyman-Morse to fulfill the first year of production for the N30 and manufacture the hulls in Maine.

Partnerships

Stripe

In January 2024 Navier announced a pilot mobility programme with Stripe. Starting in March 2024, Navier Mobility will provide a water taxi service to Stripe employees on a route from Larkspur to Oyster Point. The project starts with a single vessel and one round trip per day. The service will reduce the commute time for employees from 90 minutes to about 45 minutes.

The whole program is paid for by Stripe at no cost to the employees. Navier plans to add an additional five to seven boats as the program advances, with future vessels seating up to 30 passengers. Navier sees the Stripe pilot as a learning opportunity, as Bhattacharyya describes it:

“Over the next few months, our goal is to identify the most critical commuting routes from Oyster Point and gain insights into commuter behaviors. This will help us fine-tune our services to alleviate traffic congestion in coastal cities while addressing issues like pollution and lost work hours. Furthermore, our pilot program will be instrumental in refining our onboard systems, including automated collision detection and autonomous navigation technologies.”

Mobility Services

In January 2024, Navier announced it had secured landing rights in the Coyote Point Recreation Area, near San Francisco International Airport. The company is planning to launch a transit service from Marin County and the East Bay to SFO. This is planned to be Navier’s second pilot program, as described by Bhattacharyya:

“We’ll learn what fails and what works. This will drive the data for building reliable systems and diagnostic infrastructure for a larger fleet.”

Other areas have also expressed interest in mobility pilots. The city of Sausalito wants to launch another pilot project with Navier to complement the existing ferry system connecting Sausalito to the East Bay. As described by Janelle Kellman, Sausalito, City Council Member:

“We are actively looking for the right dock to locate an electric water taxi service; we’re engaging with the Navier team, we’ve tested their vessel, and when the idea for a pilot came up, we said, we want to be first!”

In April 2024, Bhattacharyya noted that Navier is in the process of signing a number of other partners for its mobility business.

Defense

Navier is also developing relationships with the US Department of Defense for potential military uses of the N30 and future vessels.

Valuation

In 2022, Navier announced a $7.2 million seed round led by Global Founders Capital and Treble at an undisclosed valuation. As of July 2024, Navier shared with Contrary Research that the company’s total funding was reportedly $15 million, with backing from angels like Google co-founder Sergey Brin and Android co-founder Rich Miner.

Key Opportunities

Last Mile Transportation

As Navier builds its fleet capabilities one key opportunity is to enable last mile transportation, particularly to and from airports and hotels. Navier is already working to help transport people to and from the San Francisco airport. The same could be done for water front hotels, island amenities, and other harder-to-access locations. Many of these locations today are reliant on ferries which offer slower and less reliable services. Navier could provide a higher quality options for these water-surrounded offerings.

Diversifying Vessel Types

Navier can leverage its technology platform to develop a line of vessels beyond small private boats. In 2023, Navier announced its defense program to develop vessels targeted at the needs of the military like safeguarding coastal borders. Navier shared that its defense arm is currently working on several vital projects in the defense sector, but did not share any details. With reliance on autonomous military drones surging globally, Navier’s vision of autonomous foiling watercraft could become attractive for the military.

Bhattacharyya sees similarly large opportunities for Navier in areas like on-demand ferries, and smaller cargo vessels. This evolution could be similar to how Tesla expanded from passenger cars to heavier vehicles, including semi-trucks. Navier has the opportunity to electrify a large part of the maritime industry by expanding its foiling to multiple vessel types. As explained by Bhattacharyya, the vision of Navier is not a boat manufacturing company but a scalable technology platform for autonomous water transportation. The size, type, and shape of the boat hull itself should play a diminishing role in the future.

Public Sector Support

Local governments and waterfront communities are increasingly driving a push towards cleaner and quieter waterways. Restrictions on or outright bans of gas-powered vessels are becoming increasingly common. Governments are aiming to reduce disturbance caused by wake, noise pollution, and damage to the biosphere. Similar to restrictions on the sale of gas-powered cars, more and more governments are imposing limits on the sale of gas-powered vessels.

The state of California has imposed a zero-emissions deadline on all commercial ferries by the end of 2025. In 2023, the US Senate also introduced the Clean Shipping Act to curb emissions of ocean-going vessels, and both the EU and the UK are introducing similar measures. Local governments are also increasingly investing in decarbonizing water transport. In 2023, the San Francisco Bay Area Water Emergency Transportation Authority (WETA) was awarded a $13.8 million grant to electrify its fleet.

With a multi-purpose electric vessel, Navier is positioned to take advantage of both legislation and public investment in water transport. Public sector support may allow the company to scale and develop larger vessels at a faster rate.

Key Risks

Scaleability

A key value proposition for Navier's product, particularly with larger vessel types, is better operating costs. However, demonstrating those superior unit economics requires time and scale, particularly for Navier’s manufacturing operation. Bhattacharyya admits that scaling the manufacturing of the N30 to deliver is the main challenge for the company.

In a legacy market like the maritime industry, Navier's vessels will have to be an order of magnitude more efficient than existing alternatives. However, simplifying the designs of the hull and boat architecture to make scaling as easy as possible is Navier's main focus. According to Bhattacharyya, the company is already achieving positive margins on each unit sold.

Maritime Market Dynamics

The lifecycle dynamics of commercial vessels could potentially be a risk to Navier’s long-term business model for more commercial operations. Unlike cars, boats are vehicles purchased for many years and often retrofitted and modernized many times before replacement. On average, larger ships are replaced every 20 to 30 years. Out of the roughly 50K ocean-going vessels in service globally, only around 2% reach the end of service each year.

Consequently, retrofitting existing vessels with electrical propulsion mechanisms might be the preferred approach to decarbonization, particularly for larger vessel types. The 10x efficiency gains of using a hydrofoil might be enough of a selling point for opening some new markets, but replacing existing fleets with Navier vessels might prove more difficult.

Summary

Navier builds electric hydrofoiling boats. Founded in 2019 by MIT graduate Sampriti Bhattacharyya, the company’s aim is to make water infrastructure more accessible. The flagship product, the N30, combines advanced hydrofoiling technology and sophisticated control software, offering significant operational cost savings, environmental benefits, and better passenger comfort.

The N30 targets recreational owners and institutional customers like ferry services and water taxi companies. In addition to delivering over 20 N30s to private customers, Navier has established partnerships for water mobility services with companies like Stripe and is aiming to further expand into defense applications.

*Contrary is an investor in Navier through one or more affiliates.