Thesis

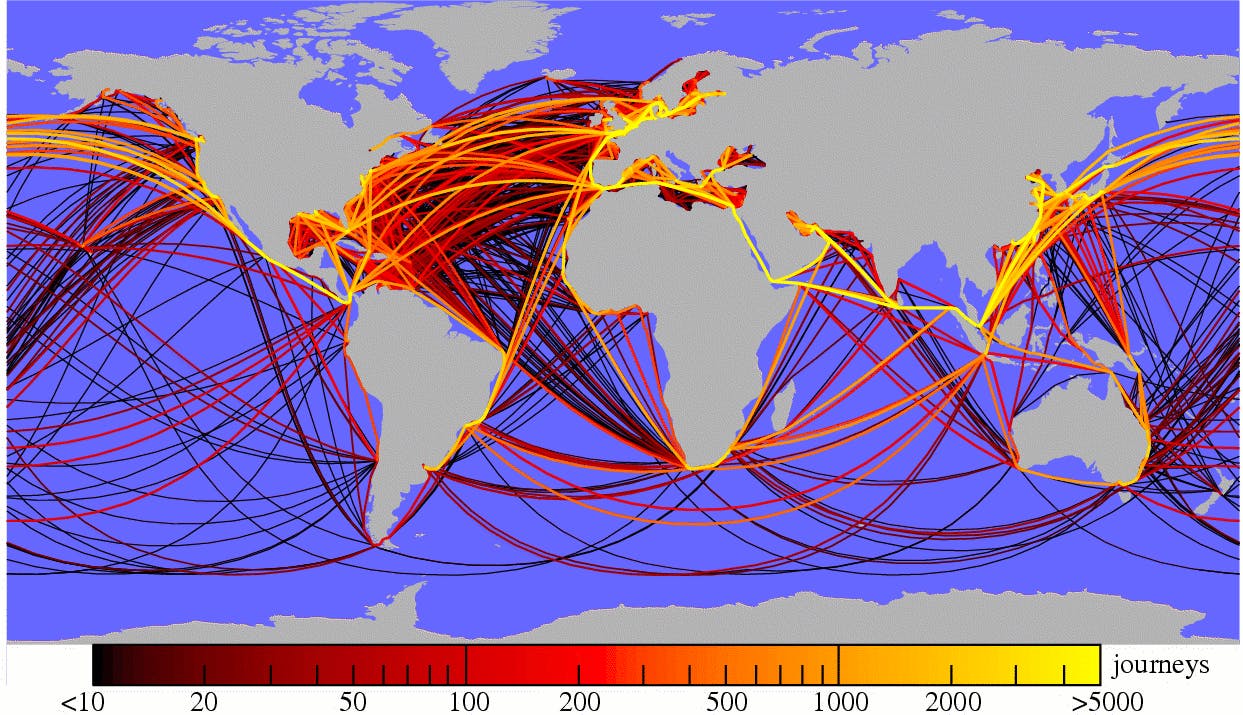

The modern world is built on the movement of goods. As of 2025, roughly 90% of global trade moved by ocean, and the surrounding infrastructure, such as shipping lines, ports, trucking networks, warehousing, customs, and digital brokers, formed a $10 trillion global industry. This network is responsible for enabling the flow of nearly every category of goods across supply chains worldwide. A handful of shipping conglomerates and freight forwarders control large swaths of these flows, operating globally interconnected networks that determine how everything from electronics to pharmaceuticals reaches consumers.

Source: WIRED

Legacy players in the supply chain and logistics industry traditionally rely on faxes, phone calls, emails, and PDFs, leading to loss-heavy, slow communication and difficulty in sharing data. In some cases, logistics companies use software but don’t want to share data, or lack interoperability with other software. This leads to incomplete data and a lack of visibility, which reduces the accuracy of supply chain teams’ forecasting. Some consider this data inaccessibility to be one of the biggest obstacles in global supply chains.

Effective digitization can boost supply chain productivity. One study found that supply chain digitization boosts companies’ operating earnings by 3.2%, more than any other operational improvement. During the COVID-19 era, o ver 75% of supply chain executives listed supply chain visibility as a top priority in 2021, while 94% lacked visibility into their supply chain.

The urgency to digitize intensified in 2025, a year defined by tariff shocks, port disruptions, and geopolitical instability. The US-China trade war escalated into one of the most volatile periods for importers in a decade, leaving many businesses scrambling to recalculate landed costs, reroute supply chains, and avoid sudden duty exposure. As instability became the norm, Flexport CEO Ryan Petersen argued that “technology is the cure to volatility”.

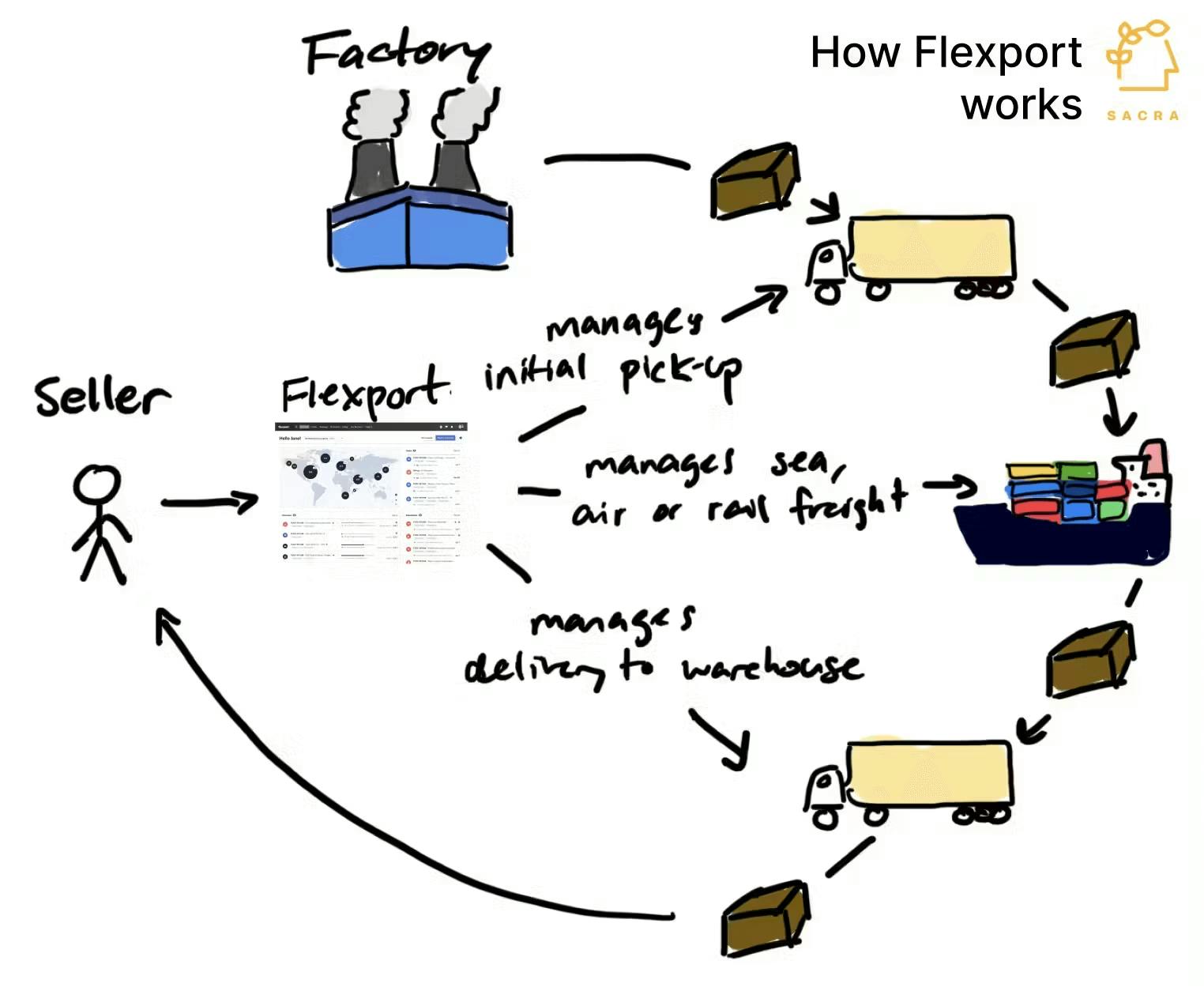

Flexport is a freight forwarder helping companies digitize their supply chains. Like other freight forwarders, Flexport’s main job is to coordinate with as many as 20 different companies to move freight internationally, but the company’s vision extends much further. Through technology and operational excellence, Flexport aims to manage customs more intelligently, enhance visibility across shipments and inventory, reduce real costs through automation and optimization, and unlock growth by making logistics an enabler rather than a bottleneck.

Long-term, Flexport is building toward a world where global logistics works like a utility, “as easy as flipping a light switch,” in Petersen’s words. In this vision, companies spend their time on product quality, manufacturing, and brand building, while the end-to-end transportation of goods becomes reliable, automated, and inexpensive. The vision would be for everything between factory floor and customer door to become as dependable as the electric grid: invisible, stable, and always on.

Founding Story

Flexport was founded in 2013 by Ryan Petersen (CEO).

In the early 2000s, after graduating from college, Petersen was importing and reselling scooters and motorcycles from China along with his brother and a friend. Petersen moved to China to source the products, and that’s where he first dealt with the difficulty and disorganization of logistics.

To address this problem, the trio created ImportGenius.com in 2006 at the same time as Petersen was heading off to business school. The company digitized shipping information to help companies understand competitors’ supply chains and search for suppliers, in exchange for a subscription fee. In hindsight, speaking in 2019, Petersen believed the company was not defensible, due to its reliance on sourcing public government data. Nonetheless, ImportGenius was still a multi-million-dollar business as of February 2022.

While running ImportGenius, Petersen began working on the idea of a “TurboTax for customer paperwork” in 2010. To validate the idea, he launched a simple landing page to collect emails of customers interested in the service. Within the first year, the site attracted over 300 companies, including Foxconn, Cargill, and Saudi Aramco. Petersen spent the next three years learning more about customs and getting approved as a customs broker. In 2013, Petersen was approved as a broker and pitched Flexport to Y Combinator that spring. The company participated in the 2014 YC batch under Paul Graham’s mentorship.

Source: Bloomberg

An early challenge for Flexport was overcoming the chicken-and-egg problem inherent in its business model. As a freight forwarder, Flexport needed both shippers and carriers, but faced resistance from both sides. Petersen's solution was to leverage Flexport's software as a unique selling point. He approached potential customers with the platform, securing conditional commitments: “If this software works, and if you hit this price, then I will buy.” Armed with these commitments, Petersen negotiated with carriers, offering them business from major shippers in exchange for competitive rates. This strategy allowed Flexport to build both sides of its marketplace simultaneously.

Beyond solving the initial marketplace problem, the company recognized the imperative to create differentiated value for all of its stakeholders. For shippers, this meant co-developing software features like custom dashboards. For carriers, it involved creating premium services to help them differentiate and increase margins. This approach of ensuring "everybody wins" became a core principle in Flexport's platform development.

Despite its software-centric pitch, Flexport's early operations were highly labor-intensive. The company prioritized customer acquisition and service delivery and relied heavily on manual processes. Only after identifying specific inefficiencies in their workflows did the company begin developing technological solutions, gradually automating its operations. Petersen likened this early experience to "building a rocket ship while it's in flight."

Petersen led Flexport as its sole CEO until September 2022. From then until March 2023, Petersen and Dave Clark, formerly an Amazon executive, were co-CEOs. At Amazon, Clark had been the CEO of Worldwide Consumer and helped scale its fulfillment and delivery networks. In March 2023, Clark became the sole CEO, with Petersen transitioning to executive chairman.

In July 2023, Petersen became a partner at Founders Fund while maintaining board-level visibility at Flexport. Several Flexport employees reached out to Petersen with concerns over the company’s performance. In September 2023, Clark resigned, and Petersen returned as CEO. Clark's tenure faced challenges, primarily due to difficulties adapting to Flexport's high-touch business model and concerns over financial management. Petersen's return aimed to address these issues, focusing on driving growth and profitability.

Product

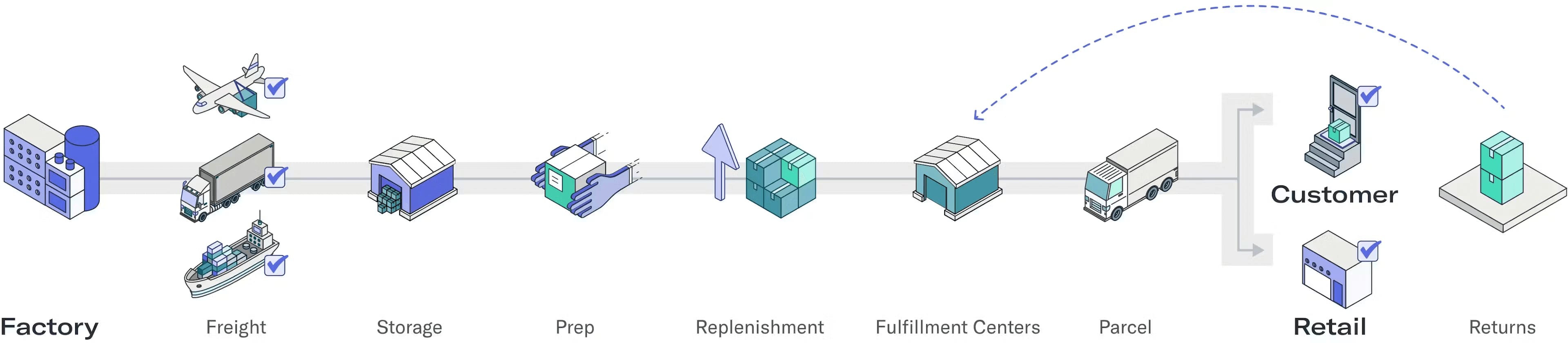

As a digital freight forwarder, Flexport helps customers move shipments while using software to operate more efficiently and effectively. It stitches together data from all of the parties involved with shipments so they can all manage and track those shipments from Flexport’s cloud-based platform. The company layers supplementary products, including cargo insurance and financing, on top of its core business.

Source: Flexport

Each step of a shipment can be thought of as a “link” in the supply chain. The dependencies mean that if one link is delayed, all the following links become delayed as well. Data bottlenecks occur as well because each company typically has its own IT system, resulting in poor visibility into shipments’ location and status. The antiquated industry often relies on phone calls, emails, paper documents, and faxes to keep track of shipments. Flexport’s product is digital-first in an attempt to solve these inefficiencies.

Flexport’s software connects data across several different companies involved in each shipment into the Flexport platform, progressing toward a real-time digital clone of the physical supply chain. One survey found that compared to other freight forwarders, Flexport’s digital approach saves customers an average of four hours weekly.

Source: Flexport

Flexport’s solutions can be grouped into (1) freight forwarding, (2) logistics fulfillment, (3) supply chain management, and (4) add-on services.

Freight Forwarding

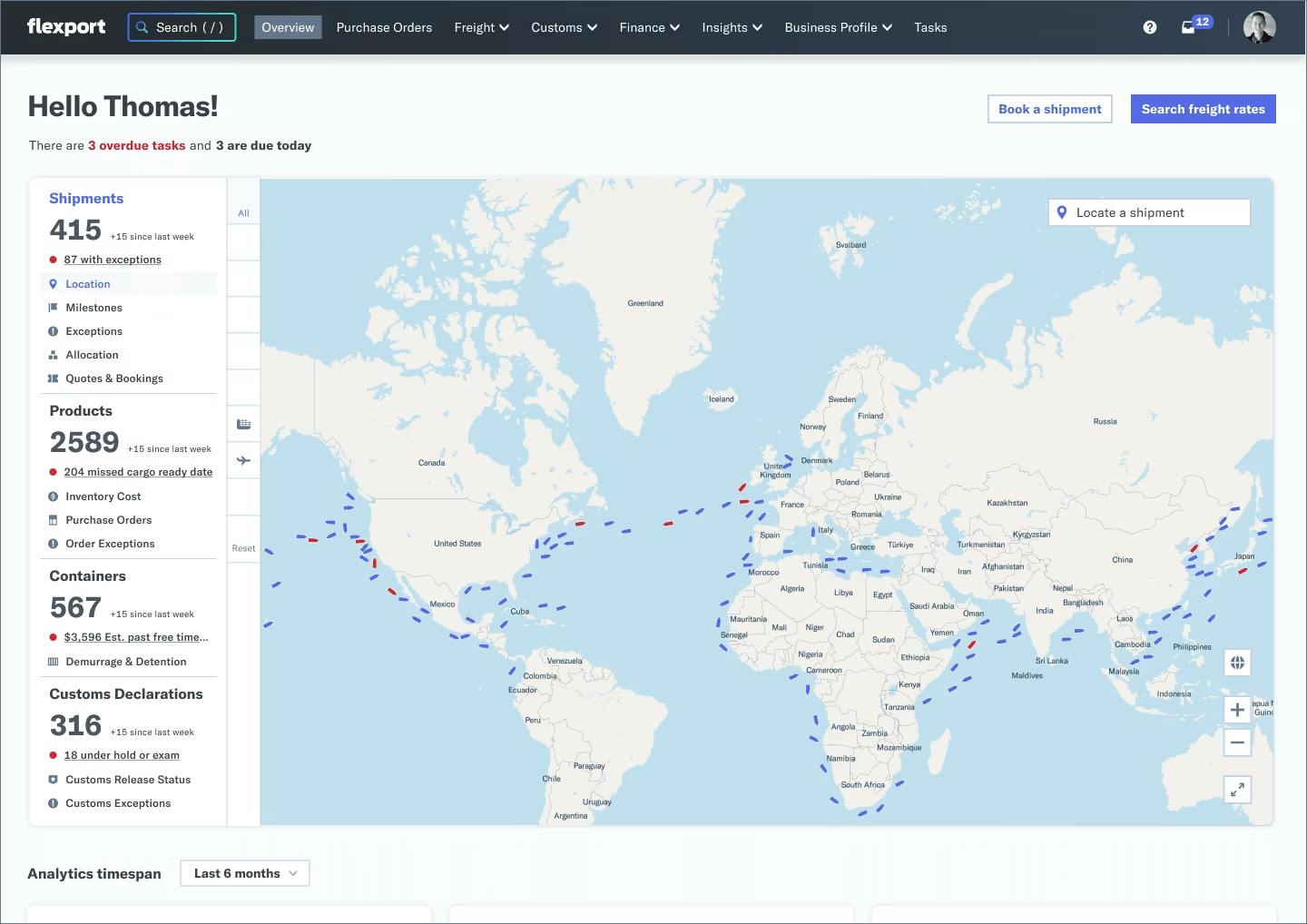

Flexport's core product is its freight forwarding offering, accessed through the Flexport Platform — an end-to-end supply chain management platform that streamlines logistics through five stages: order, book, track, clear, and deliver.

Source: Flexport

End users primarily interact with the Flexport Platform through a dashboard. The dashboard comes with pre-configured options geared toward various user personas and can be further customized based on user preferences. It is currently accessible via web browser, and the company is working on a mobile app. Customers can also access data through the Flexport API and directly in Shopify. The API is also used to ingest and integrate data from companies involved in the shipping process.

Because of this integrated data, customers can dive into the status of any particular shipment, whether it’s on a truck, container ship, plane or train or in a warehouse. With machine learning and satellites, Flexport narrows arrival estimates, in some cases from multiple weeks to a single day. These tighter windows increase business efficiency and certainty. Flexport also flags shipments’ changes and potential issues so customers can quickly view and address them if necessary.

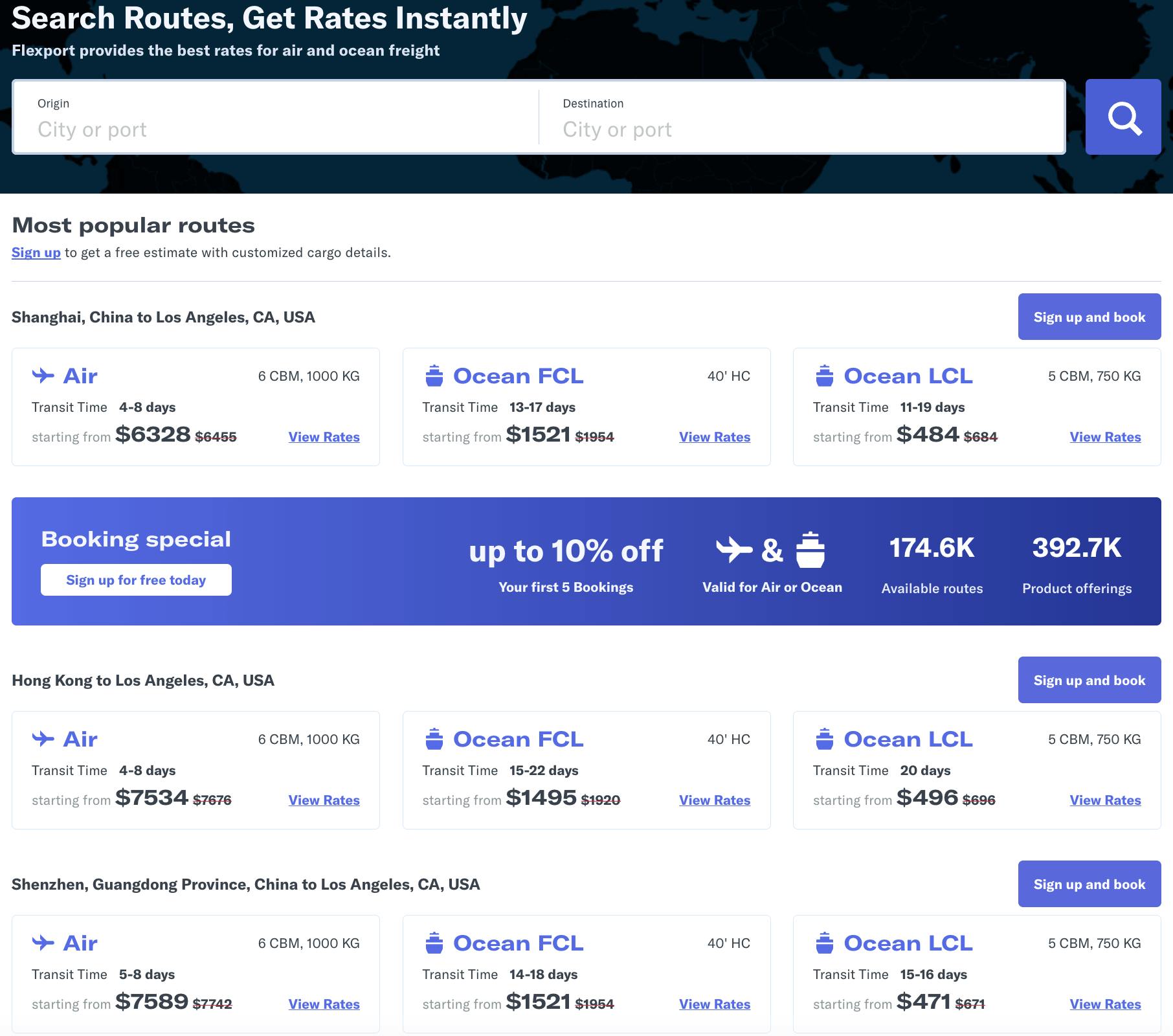

Flexport offers comprehensive freight forwarding services across multiple modes of transportation, including ocean, air, less-than-container load (LCL), and trucking. Their platform uses machine learning for reliable transit times and increased speed on pricing and Shipping Order (SO) releases. Flexport provides flexible service levels, including guaranteed services, and maintains an extensive carrier network (including Maersk, Evergreen, OOCL, ONE, Hapag-Lloyd). For air freight, they offer dedicated capacity from Asia, including two leased Boeing 747s as of August 2024. Flexport Air Freight also provides enhanced security measures such as shipment-level GPS tracking, in-person escorts, and geofencing for high-value cargo.

Source: Flexport

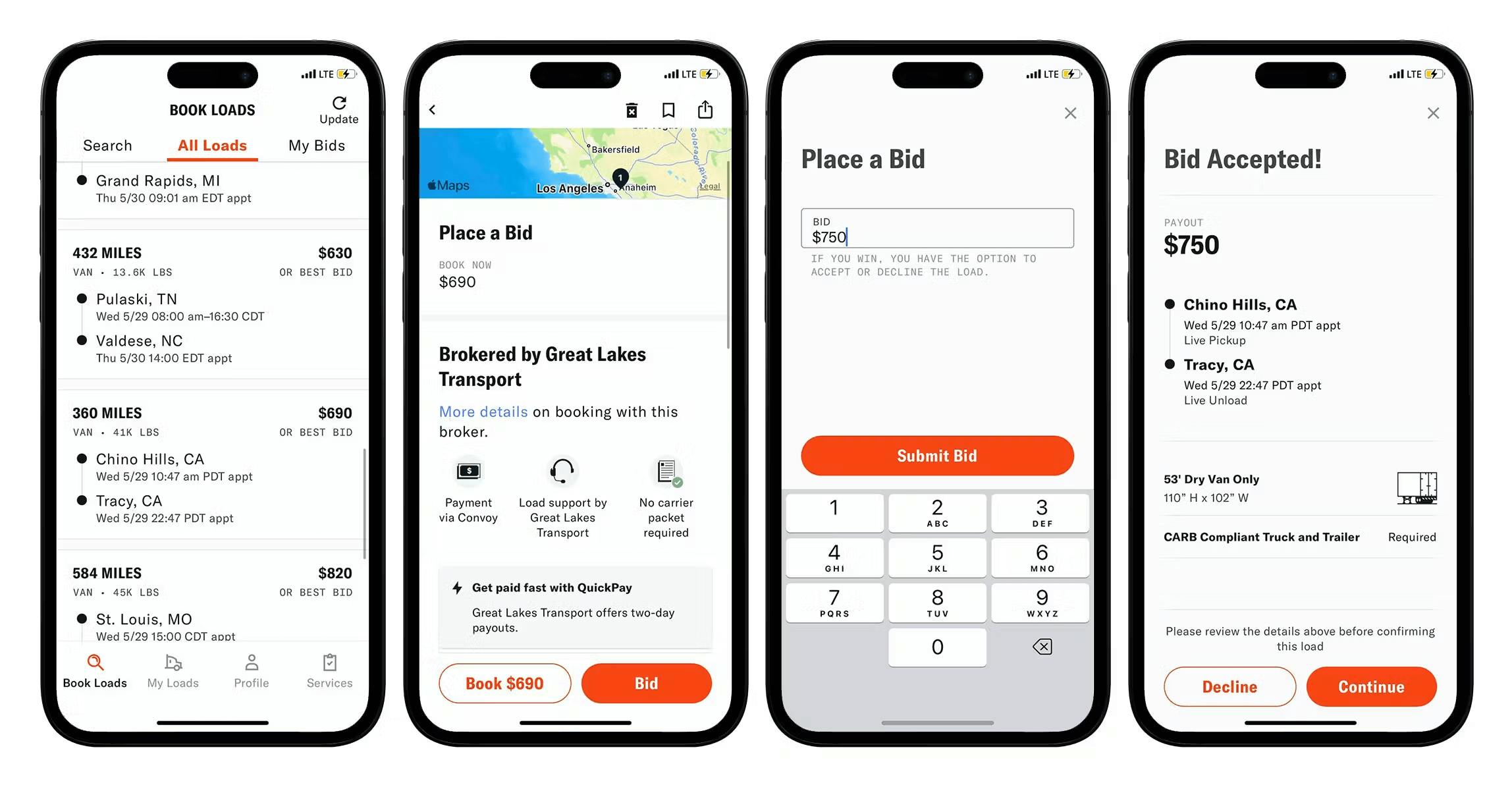

Following its acquisition of Convoy in November 2023, in February 2024, Flexport launched the Convoy Platform. The platform is an AI-powered marketplace that connects shippers and brokers with a network of small carriers and owner-operators across the US. It offers near real-time visibility, on-time performance, and competitive rates for capacity management in the trucking industry.

Expanding on this initial launch, Flexport announced in June 2024 an expansion of these capabilities focused on freight execution and lowering operating costs for brokers and carriers. The platform now provides brokers with access to a unique pool of flexible carrier capacity, operating 24/7 with high visibility. It automates manual tasks such as carrier negotiation, document management, and payment, potentially reducing carrier procurement and load management costs by up to 90%. The platform utilizes ML models based on proprietary data to help brokers monitor carrier risk and reduce fraud.

Source: PR Newswire

Flexport ultimately sold the Convoy Platform to DAT Freight & Analytics in July 2025. The transaction delivered a strong financial outcome for Flexport, and allowed the company to concentrate on its core international freight forwarding and fulfillment businesses.

In October 2025, Flexport introduced the Rate Explorer module, a new quoting and booking experience that brings airline-style price discovery to freight. The tool sits natively inside the platform and lets shippers obtain instant quotes for both air and ocean freight, eliminating the industry’s standard multi-hour quoting cycle. Flexport positions Rate Explorer as a way to keep forwarders accountable and to compete directly on rate transparency, leveraging its underlying carrier network to surface competitive spot prices.

Source: Flexport

Logistics Fulfillment

Through its fulfillment offerings, Flexport operates as a third-party logistics (3PL) provider, allowing businesses to outsource their entire logistics operations. Customers can ship inventory directly from the manufacturer to Flexport-operated warehouses in the US, and then deliver domestic orders with two-day shipping, unifying freight forwarding and final-mile fulfillment under one roof. In October 2025, Flexport shared that through 2025, it maintained 98% on-time delivery and 99% same-day shipping for orders received by 2:00 PM.

With the help of the company’s acquisition of Shopify Logistics in May 2023, in September 2023, Flexport released e-commerce fulfillment services tailored for small- and medium-sized ecommerce businesses. It provides customizable solutions with open APIs, affordable, fast delivery options including Shop Promise and Fast Tags, and access to a network of five distribution centers throughout the US, totaling over 5 million square feet. The service integrates with platforms like Shopify, Walmart, eBay, and SHEIN. Flexport also offers wholesale fulfillment services for businesses selling to retailers. The service offers routing guides, compliance, and EDI integration with large retailers like Target, Walmart, and Costco.

The backbone of this service is the Omnichannel Seller Portal, a centralized interface that connects directly to platforms like Shopify. Through the portal, merchants can track inbound freight, manage inventory across Flexport’s warehouse network, and fulfill orders across direct-to-consumer, retail, and B2B channels. It also supports automated order routing, replenishment workflows, and real-time inventory visibility, giving brands a single system to coordinate their logistics operations end-to-end. In October 2025, Flexport expanded these capabilities by allowing merchants to accept backorders and pre-sales for SKUs still in transit, directly addressing the $1-2 trillion in annual revenue lost to stockouts.

Flexport operates a nationwide warehouse network with five fulfillment centers located near major US ports and population hubs, with over 5 million square feet of warehouse space. As of November 2025, Flexport operates warehouses in Los Angeles, New Jersey, Dallas, Atlanta, and Chicago. These facilities offer cross-docking, long-term bulk storage, and value-added services such as kitting, labeling, and returns processing. The network is optimized for nationwide two-day ground shipping in the US.

Source: Flexport

Supply Chain Management

Flexport offers a suite of supply chain management tools built to give brands greater visibility, control, and predictability across global operations. These tools are especially useful for larger shippers coordinating dozens of suppliers and hundreds of SKUs across multiple transportation modes, even for shipments not managed by Flexport.

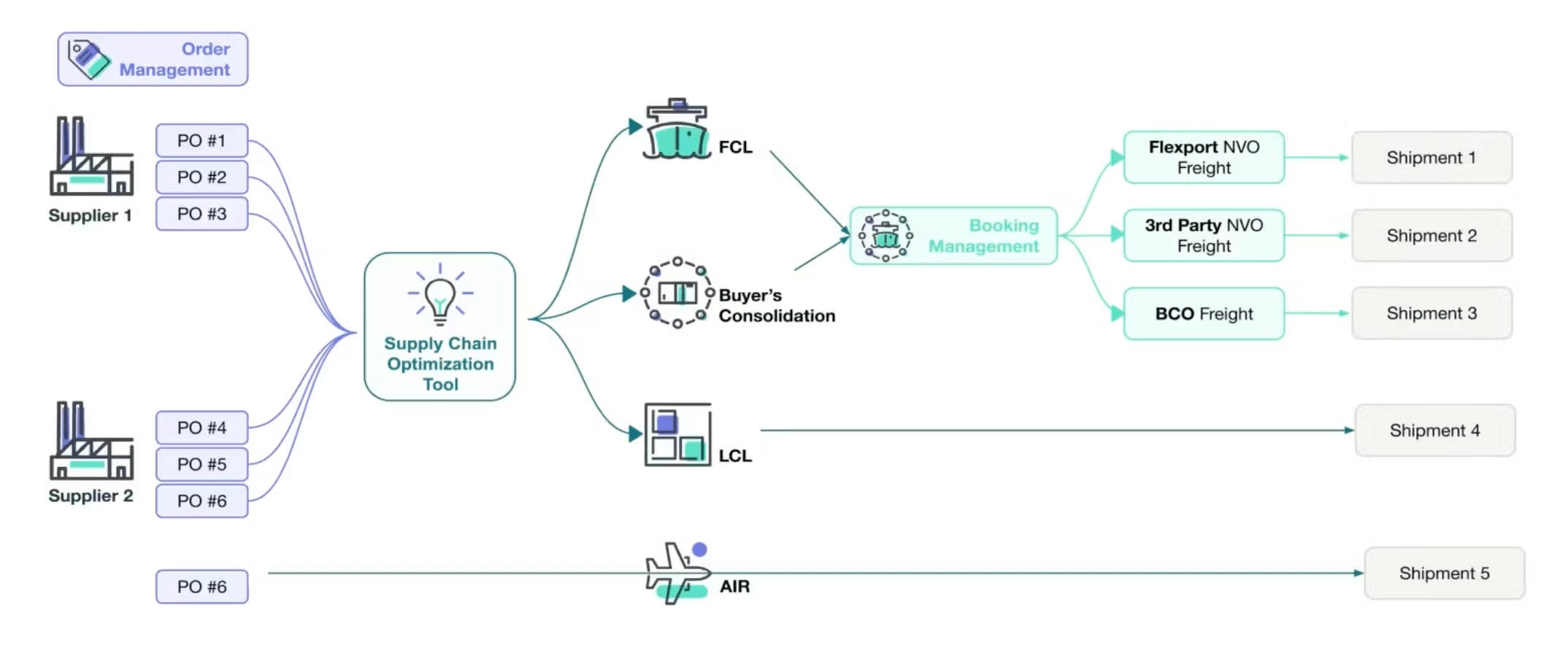

Source: Flexport

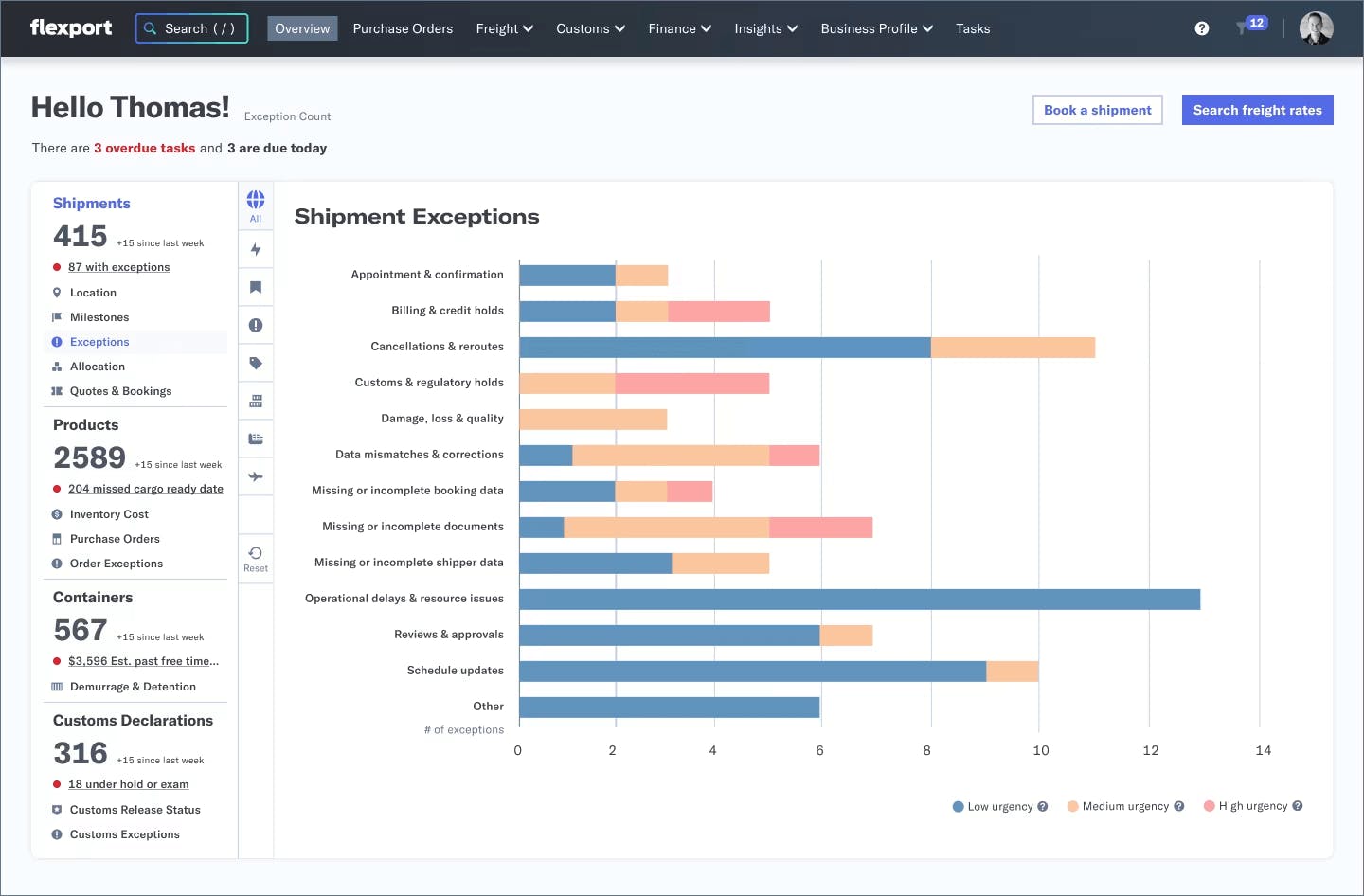

At the core is Flexport’s Control Tower, launched in January 2025. Control Tower a real-time dashboard that tracks shipments in progress, monitors supplier performance, and flags exceptions before they escalate. It provides granular analytics on transit times, on-time rates, and bottlenecks — helping operators proactively manage risks and improve SLA compliance. In October 2025, Flexport expanded this capability with a new exception management system that classifies more than 600 exception types and assigns priority scoring, allowing operators to understand where attention is most urgently needed across a complex network.

Source: Flexport

Flexport’s Order Management system enables purchase order-level collaboration between buyers, suppliers, and logistics teams. Users can set service-level agreements, monitor SKU-level readiness, and forecast shipping needs based on production timelines and demand trends.

Booking Management tools streamline freight allocation and contract utilization. Shippers can prioritize bookings based on cost, carrier performance, or urgency, while improving forecasting accuracy through demand-based planning and historical trends.

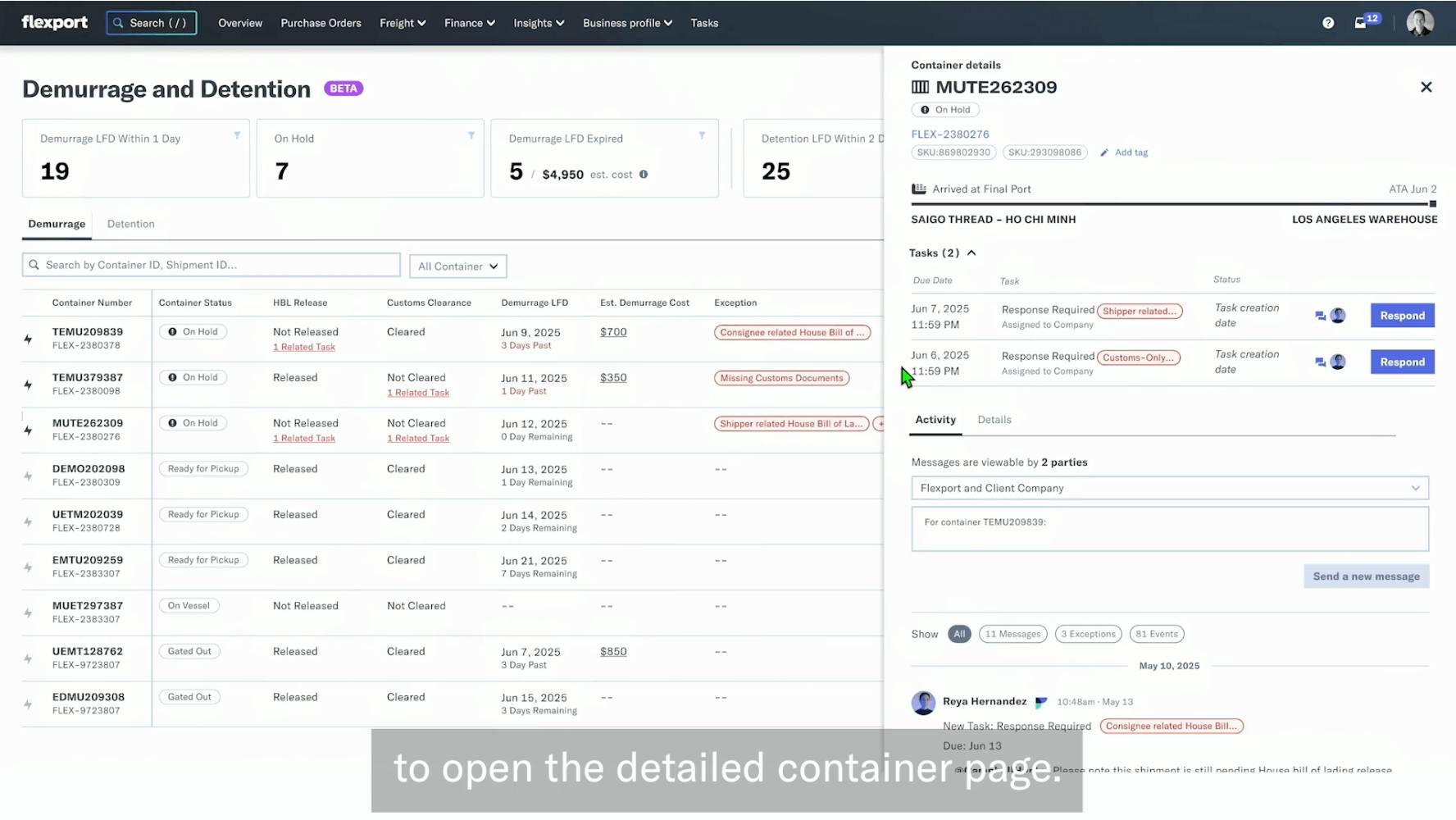

To address bottlenecks at ports and warehouses, Flexport introduced two operational workflow modules in October 2025. The first is the Detention & Demurrage Defender, which gives teams a centralized view of inbound containers, deadlines, and fee exposure, enabling them to reduce or avoid charges associated with slow pickup or return of equipment. The second is a Warehouse Appointment & Dock Planning module, designed to solve the inability to secure timely delivery appointments, one of the leading sources of demurrage. The tool provides scheduling and dock assignment features that align inbound transportation with warehouse capacity.

Source: Flexport

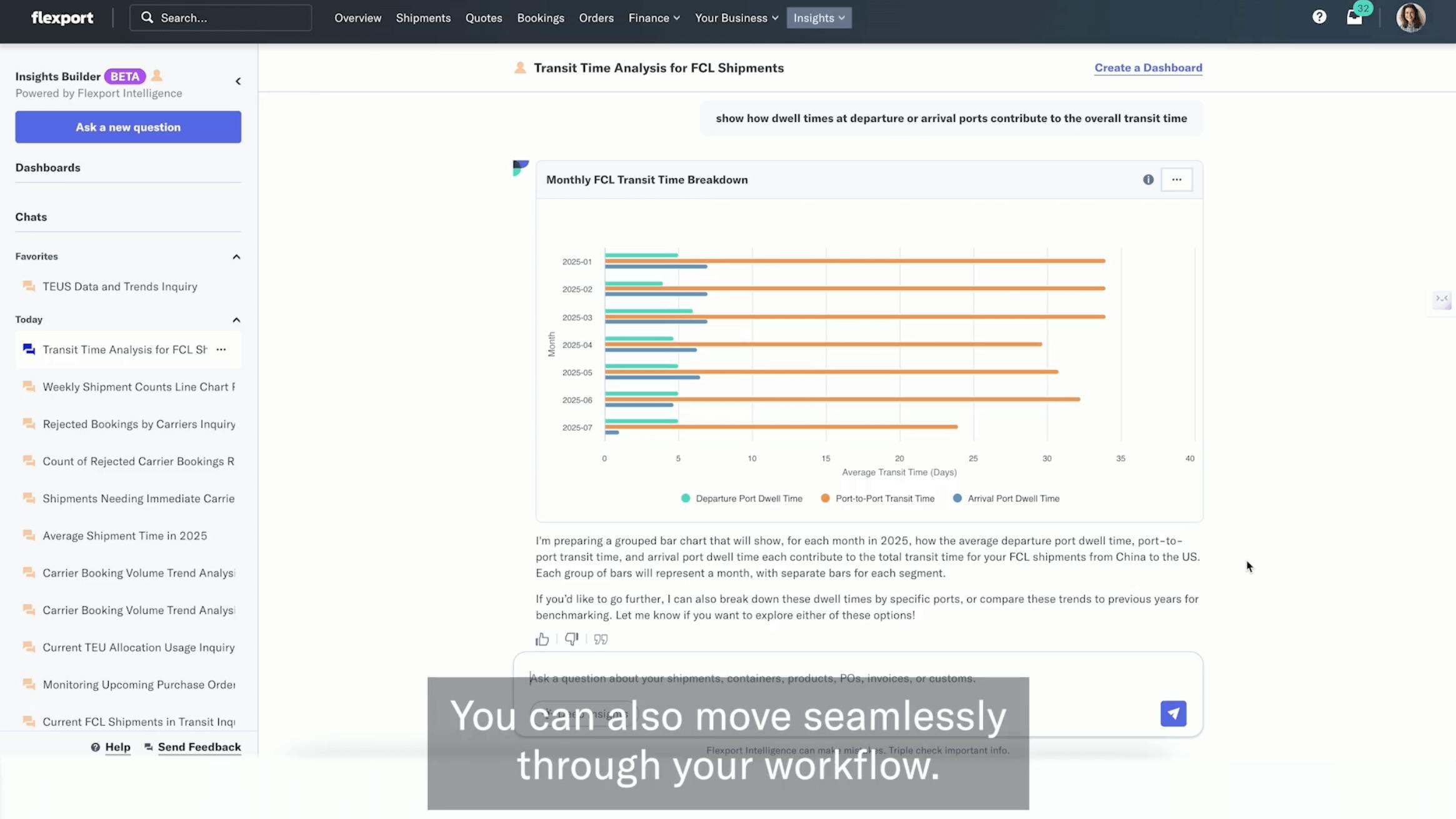

In October 2025, Flexport expanded its analytics layer with the Insights Builder, an AI-powered reporting tool that lets users query shipment, customs, booking, and fulfillment data in natural language. Insights Builder automatically generates dashboards, tables, and visualizations across all connected data sources, reducing dependence on analysts and speeding up decision cycles.

Add-On Services

Flexport layers financial, compliance, and analytics tools on top of its core logistics offering, turning them into embedded services that drive efficiency and margin improvement.

Flexport’s AI tools are designed to make complex logistics workflows more accessible and scalable. With the launch of Flexport Intelligence in January 2025, users can query shipment data using natural language prompts to generate custom reports and visualizations instantly —capabilities that previously required a Flexport employee. These tools now allow customers to interact directly with their supply chain data, including freight not managed by Flexport, while still retaining the option to connect with human support when needed.

Source: Flexport

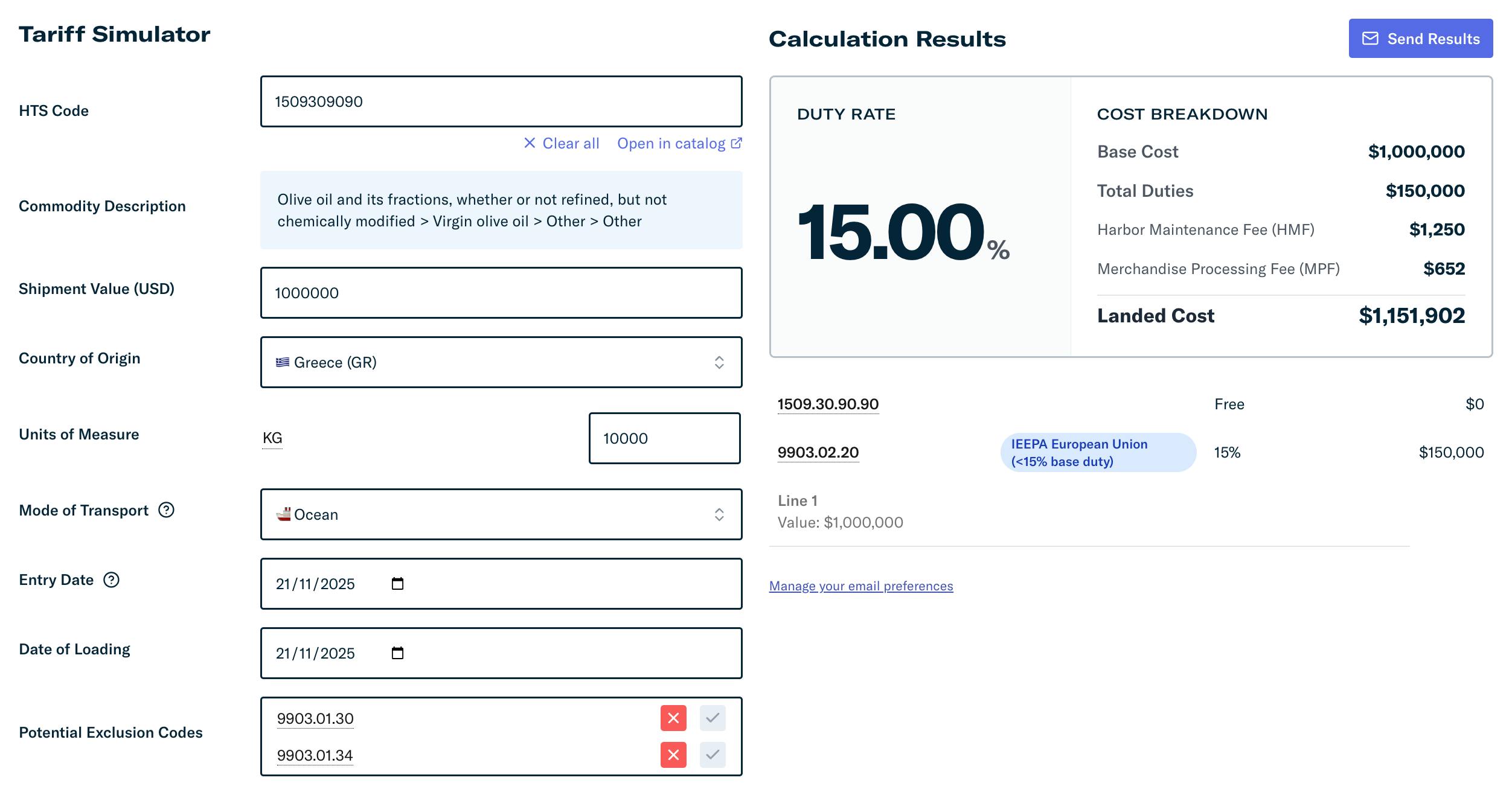

Flexport Customs LLC is Flexport’s customs broker. Available as a standalone product or integrated, the company’s broker aids in calculating landed costs, improves exception management, and offers trade advisory services. The platform includes features like Quick Search for efficient document retrieval, a Product Library for streamlined customs data management, and landed cost calculation for accurate inventory cost assessment. It helps find patterns to improve import strategy and increase duty avoidance. Clients can reclaim overpaid duties through Duty Drawback, a full-service platform that automates refund claims, audit trails, and compliance.

In October 2025, Flexport unified its customs products into a single Customs Technology Suite. The suite includes Tariff Simulator Pro, which lets importers bulk-upload HS/HTS codes, receive real-time duty alerts, and view partner-agency requirements; Customs Analysis, which pulls up to five years of data directly from CBP and prior brokers to create a complete, audit-ready import history; and an AI Compliance Audit that reviews 100% of entries before filing, catching misclassifications, incorrect country codes, valuation errors, and other issues that traditionally result in holds or penalties.

In January 2026, Flexport also launched a Tariff Refund Calculator ahead of a potential Supreme Court ruling in 2026 which could overturn the legality of the Trump administration’s 2025 tariffs. The tool is intended to quantify how much money they might get back in the case that tariffs are overturned. Ryan Petersen said that Flexport built the tool to help customers scenario plan, commenting that “We can’t predict the Court’s decision, but we can give businesses clearer insight so they’re prepared for whatever comes next.”

Source: Flexport

On the financial side, Flexport Capital offers 60–120 day non-dilutive loans for inventory and logistics spend, helping customers smooth cash flow and bridge working capital gaps. Since its inception in 2017, Flexport Capital has provided over $2 billion in financing to its customers. In August 2025, BlackRock partnered with Flexport to expand its financing base by $250 million.

Cargo Insurance options span marine, parcel, and motor truck policies, with digitized claims workflows for faster reimbursement. Flexport also provides Trade Advisory services — consultants who leverage ACE data, HS code analysis, and tariff modeling to reduce landed costs and ensure regulatory compliance.

Flexport is also testing AI-powered voice agents for internal coordination with truckers and warehouses, though CEO Ryan Petersen emphasized a high bar for quality before deploying them more broadly. Rather than replacing employees, Flexport sees these tools as a way to scale faster, unlocking growth and freeing up its team for higher-impact work.

Flexport.org & Flexport Ventures

Flexport.org is Flexport’s social good wing with a mission to “Make Logistics a Positive Force for Social and Environmental Impact.” To start, nonprofits receive free access to the Flexport platform. They can use the platform along with pro bono advice and discounted shipping rates to manage logistics cost-effectively. With the Flexport.org Fund, Flexport directly pays for the transportation costs of nonprofits. Flexport.org also helps provide the Climate product for offsetting carbon emissions and donating unsold goods.

Flexport Ventures is the company’s investment wing. It has made 80 investments and acquisitions as of January 2026. Most of the investments were in startups at the Series B stage or earlier, in or adjacent to the supply chain and logistics industry.

Market

Customer

Flexport serves customers with international supply chains of varying sizes, ranging from small businesses (independent Shopify stores) to modern companies (Sonos, Peloton, Warby Parker) to established brands (Bridgestone, Georgia-Pacific, and Gerber). Its less-than-container offering is especially important for SMBs. Dave Clark, Flexport’s former CEO, explained Flexport’s value proposition for companies other than the very largest:

“Most companies aren’t able to invest in the technology they need to run the kind of global supply chain that large enterprises can, whether it be Amazon or General Motors or Walmart, you name it. They lack the ability to achieve delivery speeds, costs and quality that the big players can provide. Our technology is a way to enable them and their growth for the future. We think being able to unlock capacity for entrepreneurs and help the environment in the process is a big opportunity for the business and for our customers.”

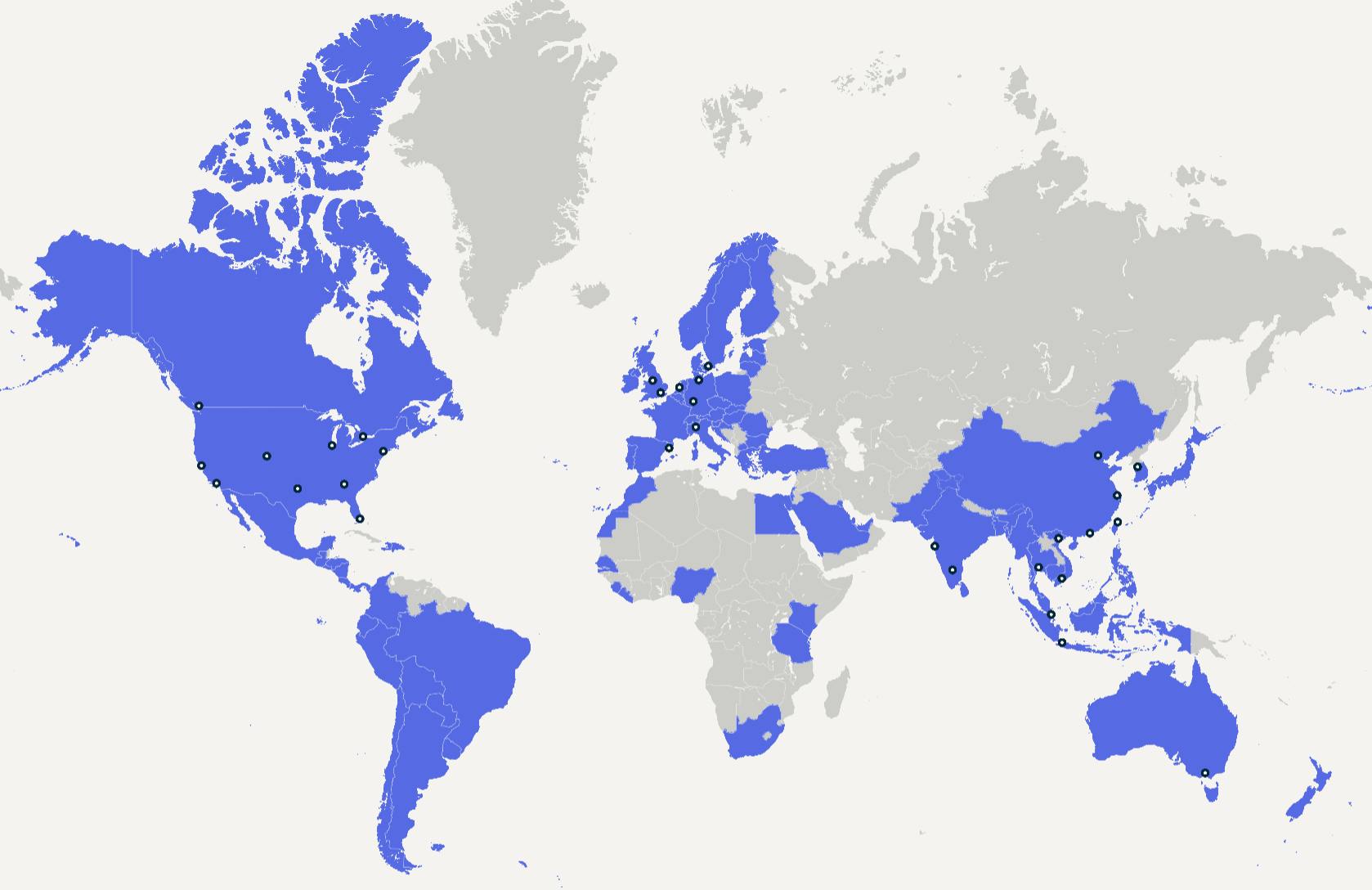

As of January 2026, Flexport had five first-party operated fulfillment centers in New Jersey, LA, Dallas, Atlanta, and Chicago. It also had offices across countries in Asia and Europe in addition to the US and Canada, with coverage spanning a number of countries in North America, South America, Europe, Asia, Africa, and Australia.

Source: Flexport

About 75% of Flexport’s revenue came from mid-market or larger companies as of March 2020. Its largest customer spent over $100 million with the company in 2024, and for many customers, logistics is the second-largest line item after cost of goods sold. But Flexport is unlikely to ever be used by giants like Apple, Nike, and P&G. At a certain scale, it can make sense for large enterprises, such as Apple and Nike, to ship directly with carriers rather than rely on freight forwarders.

In April 2024, Shein named Flexport its preferred logistics partner for smaller merchants on Shein's US marketplace. Flexport continues to offer similar services for merchants on Shopify, Walmart, and eBay platforms, indicating a diverse fulfillment customer base across different ecommerce channels.

Market Size

Global trade reached $33 trillion in 2024. Logistics powers this trade and represents an estimated $9.6 trillion market, worth ~12% of global GDP. In the US alone, $2.3 trillion was spent in 2024 on business logistics costs, representing 8.7% of national GDP. While only 0.18% of logistics spending goes toward logistics technology, a 2023 McKinsey report found that 93% of logistics providers plan to maintain or increase their spending on digital logistics.

Freight forwarding reveals a $208.3 billion market with a ~3.3% CAGR. While analysts list the market as growing, freight forwarding experienced a contraction from 2021-2023. One 2024 report noted that all of the top 20 freight forwarders saw revenues decline in 2023.

The global 3PL market was sized at $1.2 trillion in 2024. Similar to freight forwarding, this market has also contracted — in the US, 2023 net revenues in 3PL were $129 billion, down 12.8% from 2023. Other components of Flexport’s market include cargo insurance, which is sized at $71.4 billion. More than 60% of freight is under- or uninsured, indicating a strong growth opportunity in the space.

Competition

The freight forwarding market is highly fragmented. The two largest players, DHL and Kuehne + Nagel, accounted for only 6% market share combined in 2023, and the top 20 accounted for only 30-40% of the market. With higher volumes, larger freight forwarders can negotiate lower prices from carriers, resulting in better margins. Smaller forwarders account for the remaining two-thirds — one reason they may remain in business despite lower margins is their local expertise.

Freight forwarders typically have net promoter scores in the teens versus in the 70s for Flexport, but there is disagreement as to whether incumbents are just unwilling or unable to use modern technology, or whether they simply do not brand themselves as “digital.” Not only can freight forwarders build tech in-house, but they can also buy off-the-shelf software from companies like WiseTech, as DHL does.

While the 3PL market is similarly fragmented, it has undergone some consolidation beginning in 2021 and has received interest from private equity firms. Amazon is a clear market leader in the 3PL space, earning 2024 revenues over $156 billion from third-party seller services and operating ~255 million square feet of warehousing space.

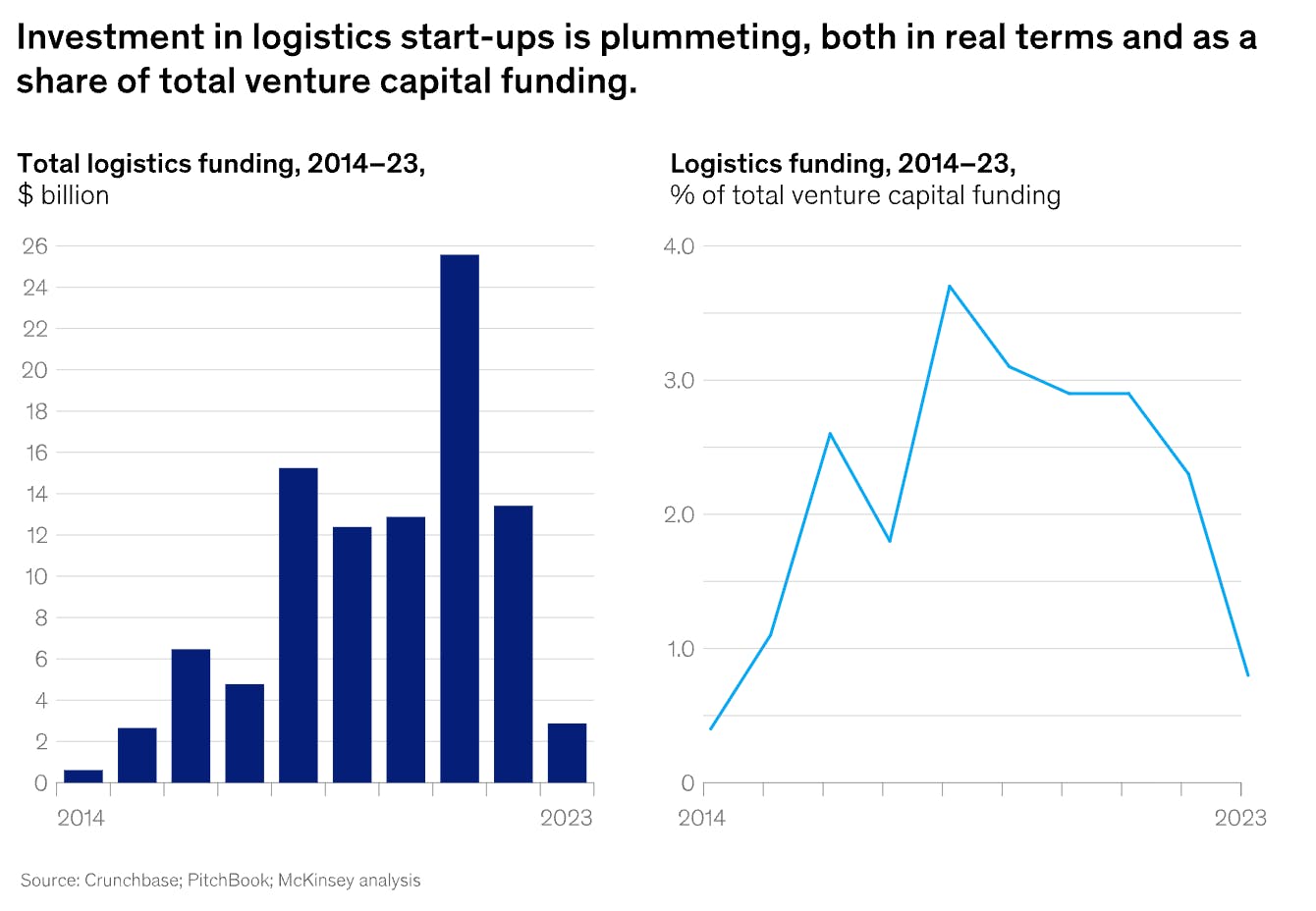

While VC investment in the logistics reached a record $25.6 billion in 2021, it fell nearly 90% to $2.9 billion in 2023. This has been driven primarily from a rise in interest rates and slowdown in e-commerce spending. 2023 innovations in AI and large language models (LLMs) may revive VC interest.

Source: McKinsey

Incumbents

Kuehne+Nagel: Founded in 1890, Kuehne+Nagel has grown to become the largest freight forwarder globally with a market cap of $28.6 billion as of January 2026 and 2024 revenues of $29.9 billion. The company serves 400K customers across 1.3K locations as of November 2025, and is headquartered in Schindellegi, Switzerland. In 2018, Kuehne+Nagel introduced its digital platform myKN.

DSV: Founded in 1976, DSV has pursued aggressive growth through acquisitions. In September 2024, the company acquired DB Schenker for $12.14 billion. This acquisition is expected to make DSV the market leader with 6-7% market share, overtaking both Kuehne+Nagel and DHL. The company offers myDSV, a platform specifically catered to SMBs. DSV has a market cap of $50 billion as of November 2025, and generated $25 billion in revenue in 2024. It is based in Hedehusene, Denmark.

DHL Supply Chain & Global Forwarding: Founded in 1969, DHL has established itself as one of the largest players in the industry, ranked as the second-largest freight forwarder globally with a market cap of $68.8 billion as of January 2026. The company served 167K customers as of January 2026 and launched myDHLi in March 2020 as its fully integrated online platform. It is headquartered in Bonn, Germany.

Startups

E2Open: Founded in 2000, E2Open provides end-to-end cloud-based supply chain management software, serving over 6K customers across 180 countries with a 95% gross retention rate as of October 2024. While E2Open is not a digital freight forwarder like Flexport, the company was noted as a strong competitor to Flexport in industry interviews. E2Open serves larger enterprises than Flexport and lists demand planning, global trade management, logistics execution, and channel performance optimization as its core services. The company has gone public twice (2012 and 2021) with a private equity phase in between, and was acquired by WiseTech Global for $2.1 billion in May 2025.

Freightos: Founded in 2012 and based in Barcelona, Spain, Freightos operates a global digital booking platform for international freight, facilitating instant quoting, booking, and shipment management across ocean, air, and land transportation. Unlike Flexport, Freightos does not operate as a freight forwarder but instead serves as a neutral marketplace connecting importers with logistics providers. The company’s platform supports over 10K importers and thousands of forwarders and carriers, including airlines like Lufthansa and carriers like MSC. Freightos went public via SPAC in 2023 and had a market cap of approximately $100 million as of November 2025.

Forto: Founded in 2016 as FreightHub, Forto is a German digital freight forwarder has raised significant capital, including a $250 million Series D round in March 2022. Forto was ranked as a top 20 freight forwarder on the Asia to Europe trade lane in 2022. Compare to Flexport, Forto offers a smaller product line, focusing on pre and on-carriage, customs clearance, insurance, and buyers consolidation in addition to freight forwarding. As of January 2026, Forto had raised a total of $593.4 million in funding.

Nowports: Known as the "Flexport for LatAm," Nowports was founded in 2018 and raised a $150 million Series C round led by SoftBank in May 2022, which brought its total funding to $242.6 million. The company offers a more focused product line than Flexport, specializing in freight forwarding and storage/warehousing solutions specifically for Latin American trade routes.

Sennder: Founded in 2015, Sennder is a digital freight forwarder based in has grown through acquisitions. In July 2024, Sennder acquired C.H. Robinson's European Surface Transportation operations, doubling its revenue to $1.5 billion. Sennder was ranked as the largest FTL player in Italy in 2022. One limitation of Sennder’s product offering is that it is limited to truck freight forwarding only. As of January 2026, Sennder has raised a total of $340 million in funding.

Business Model

Flexport monetizes across three primary layers: freight forwarding (its core logistics brokerage business), fulfillment (warehousing and last-mile services), and complementary services (customs, finance, insurance, and advisory). Its pricing model reflects high operational complexity and a growing emphasis on software-enabled services. The company also operates a strategic investment arm to accelerate ecosystem development.

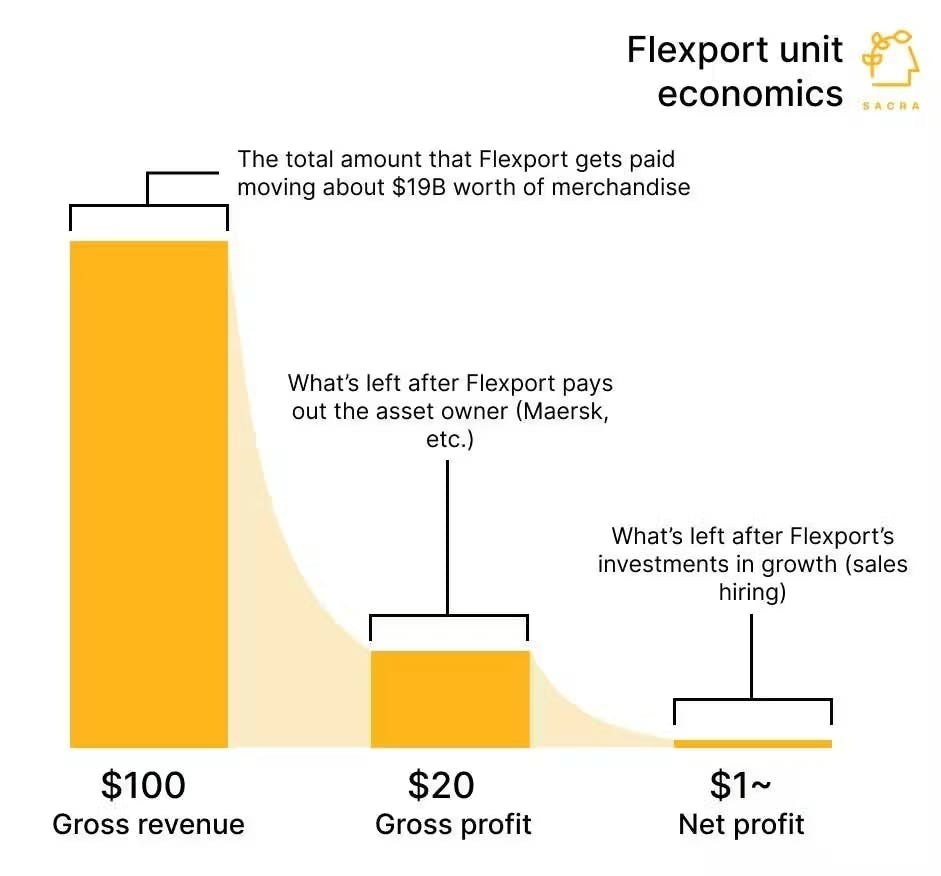

Source: Sacra

Freight Forwarding

Ryan Petersen provides a simple method of distinguishing between parcels (smaller packages) and freight: “Is the product too heavy for the driver to lift up and put in the truck? The moment it is, now it’s freight.” Moving freight requires larger, more robust physical equipment to store and move. This makes it infeasible for a single company to possess all of the physical infrastructure necessary to handle the full supply chain flow (e.g, workers at every port in the world). Contrast this with parcel shippers like FedEx and UPS, which control their whole delivery network in the US, including a single IT system, trucks, and planes. Their end-to-end ownership enables robust visibility and tracking of shipments along all possible routes.

The fragmentation of the cargo network means that companies often rely on freight forwarders to handle their international supply chain and logistics. Instead of operating their own fleets of physical assets like ships and planes, freight forwarders act as brokers. They coordinate with 5 to 20 other companies to move a single shipment from its origin through customs to its destination. A former Flexport manager described the many involved parties for a hypothetical shipment:

“You're going to have the origin warehouse. You're going to have the origin truck provider. You're going to have the origin customs agent based on the country. You're going to have the ocean shipping line. You're going to have the destination customs agent, the destination trucking company, the destination warehousing company. You're going to have insurance providers, trade finance providers, so on and so forth.”

Flexport is paid by customers to move freight. Pricing is lower for higher shipping volumes. As of March 2025, customers spent between $200K and $100 million annually on Flexport. Flexport grew to $200 million in annual revenue by 2016, despite the lack of any sales or marketing efforts. This changed by March 2020, by which time about 90% of revenue was attained through cold outreach.

Each Flexport customer is paired 1:1 with a “squad” that includes an operational account manager, operations associates, a customs broker, and an engineer. The squad model is intended to ensure a top-notch customer service experience. Flexport’s customers spend millions on the product annually, and as Ben Braverman, Flexport’s former CRO, put it, “if they don’t get what they’re expecting, they fire us immediately.”

Source: Sacra

This dynamic creates a race-to-the-bottom for pricing among forwarders, resulting in low margins. Flexport is no exception: in 2021, it had a ~1% profit margin. Despite low margins, return on capital can be high given the fact that freight-forwarding is asset-light.

Given that freight forwarders receive better wholesale pricing from carriers for higher volumes of shipments, the industry experiences economies of scale. Flexport can benefit from this as it grows. Larger competitors like Kuehne + Nagel and Expeditors see gross margins around 30% compared to 20% for Flexport. Flexport began with a focus on the transpacific trade lane. It grew to become a top-five forwarder on that lane for both air and ocean freight. As that market softens, the company is focusing more on other trade lanes.

Fulfillment

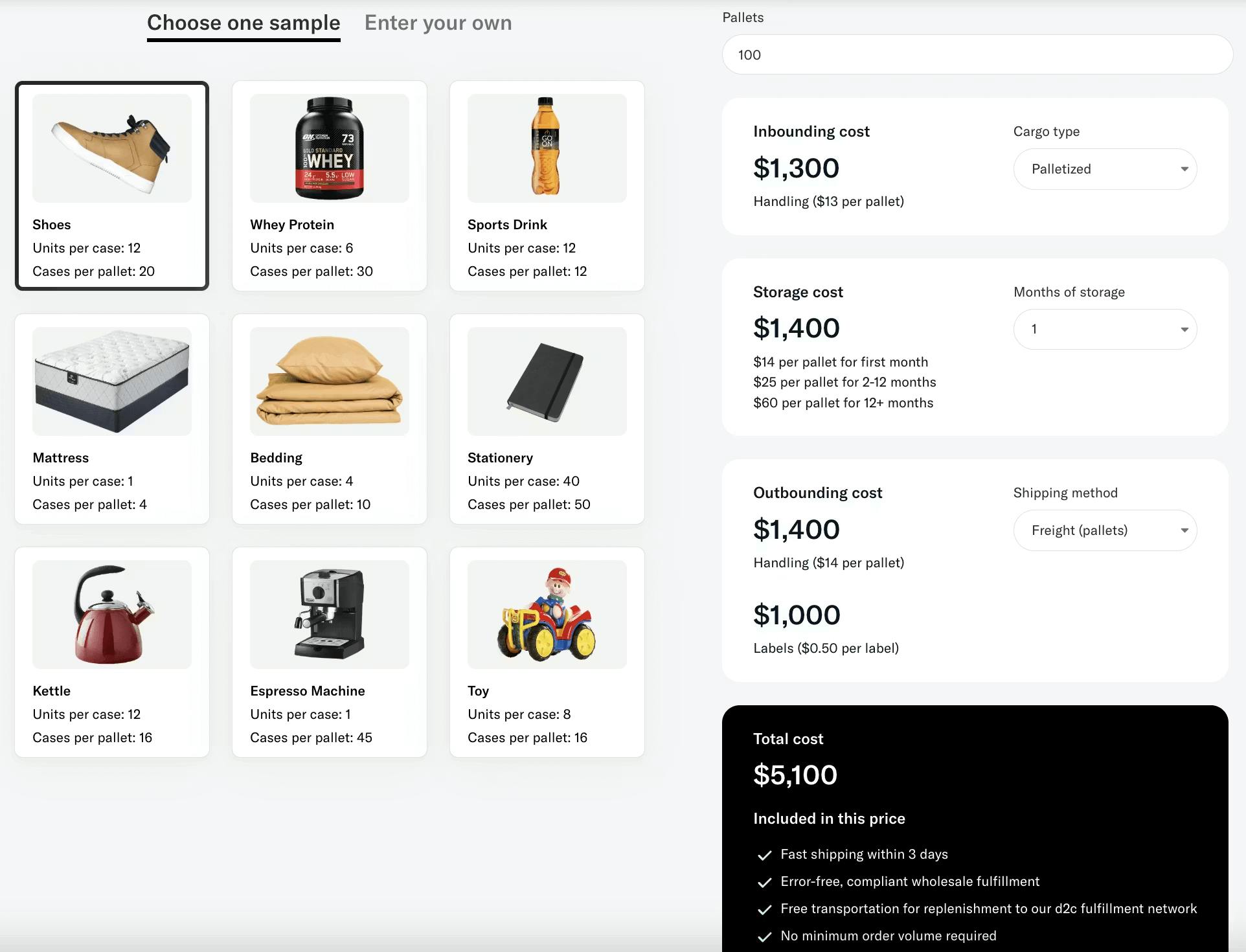

Flexport’s fulfillment business supports both wholesale replenishment and D2C ecommerce orders, with pricing structured on a pay-as-you-go model. Customers are charged for inbound container handling, pallet storage, and outbound processing, with no minimum order volume.

The fulfillment business was built on the back of Flexport’s 2023 acquisition of Deliverr. At the time of Shopify’s 2022 acquisition, Deliverr was reportedly losing $4–5 per order. By October 2024, Flexport announced plans to shift toward an asset-light fulfillment model by 2027, offloading excess warehouse space and partnering with 3PLs to reduce fixed costs. As of May 2025, Flexport operates a ~5 million square foot fulfillment network and integrates with Shopify to support merchants across channels.

Through its Fulfillment Calculator, customers can estimate costs by SKU type based on real-world units-per-case and pallets-per-case assumptions. This pricing transparency, combined with Flexport’s promise of 3-day shipping and error-free fulfillment, aims to attract growing SMBs that want Amazon-like logistics without fixed infrastructure.

Source: Flexport

Complementary Products

Flexport layers high-margin financial, compliance, and analytics products on top of its core freight and fulfillment businesses. These offerings serve two purposes: increasing customer stickiness by embedding into broader workflows, and monetizing additional parts of the shipment lifecycle. Once the Flexport platform handles their freight, customers can pay for high-margin, related products like cargo insurance, financing, and customs assistance. Some products, like insurance and customs brokers, are offered as standalone products to non-customers, too. A former employee of the company claimed these ancillary products return 50-90% in gross margin.

Smaller, regional freight forwarders lack the resources to build similar software to Flexport, so they pay to use Flexport’s platform to improve their operational efficiency. These forwarders, referred to by Flexport as Certified Partners, also benefit from greater volumes, which can help them negotiate lower shipping rates with carriers. Flexport benefits not only from earning a ~1% cut of these partners’ revenue, but also from adding to its dataset and being able to offer shipping in more areas without having to build out its own staffing there.

Investments

Flexport believes it can’t single-handedly drive the digitization of logistics, so it has become a prolific investor in early-stage logistics startups. It also partners with On Deck to offer an incubator for logistics startups.

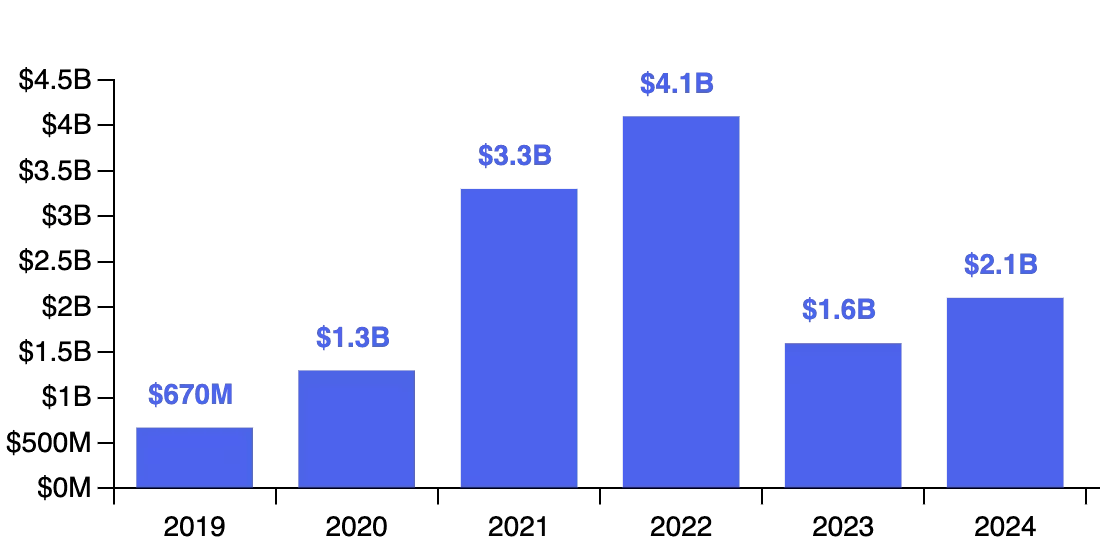

Traction

As of November 2025, Flexport serves over 10K customers and suppliers across 112 countries. In 2021, the company moved $19 billion in gross merchandise value, amounting to nearly 700K shipped containers. Following pandemic-era highs, the company’s revenue peaked at approximately $5 billion in 2022 before declining to $1.6 billion in 2023 amid falling freight rates and softening demand. Sacra estimates revenue rebounded to $2.1 billion in 2024, up 31% year-over-year, and Flexport projects it will exit 2025 with approximately $100 million in EBITDA.

Source: Sacra

This turnaround followed a turbulent period of leadership transition. After bringing in Dave Clark as co-CEO in 2022, Flexport suffered a decline in operational discipline and NPS fell to 17. Founder Ryan Petersen returned in September 2023 as CEO, quickly restoring NPS to 72 and driving renewed customer-centric execution.

Flexport’s fulfillment business has seen rapid growth, doubling revenue in the first 60 days of 2025. Warehouse utilization improved from below 50% to 75% by Q2 2025 following the imposition of 15–35% apparel tariffs in Mexico, which prompted many ecommerce sellers to relocate fulfillment operations to the US.

Flexport remains exposed to global macro disruptions, which cut both ways. Its 2022 revenue surge was driven by COVID-era freight shortages. In 2024, Houthi attacks in the Red Sea contributed to a threefold increase in Asia-Europe container rates — reigniting Flexport’s growth trajectory. Petersen noted the company had demand for double the shipping volume in 2024 than it could service.

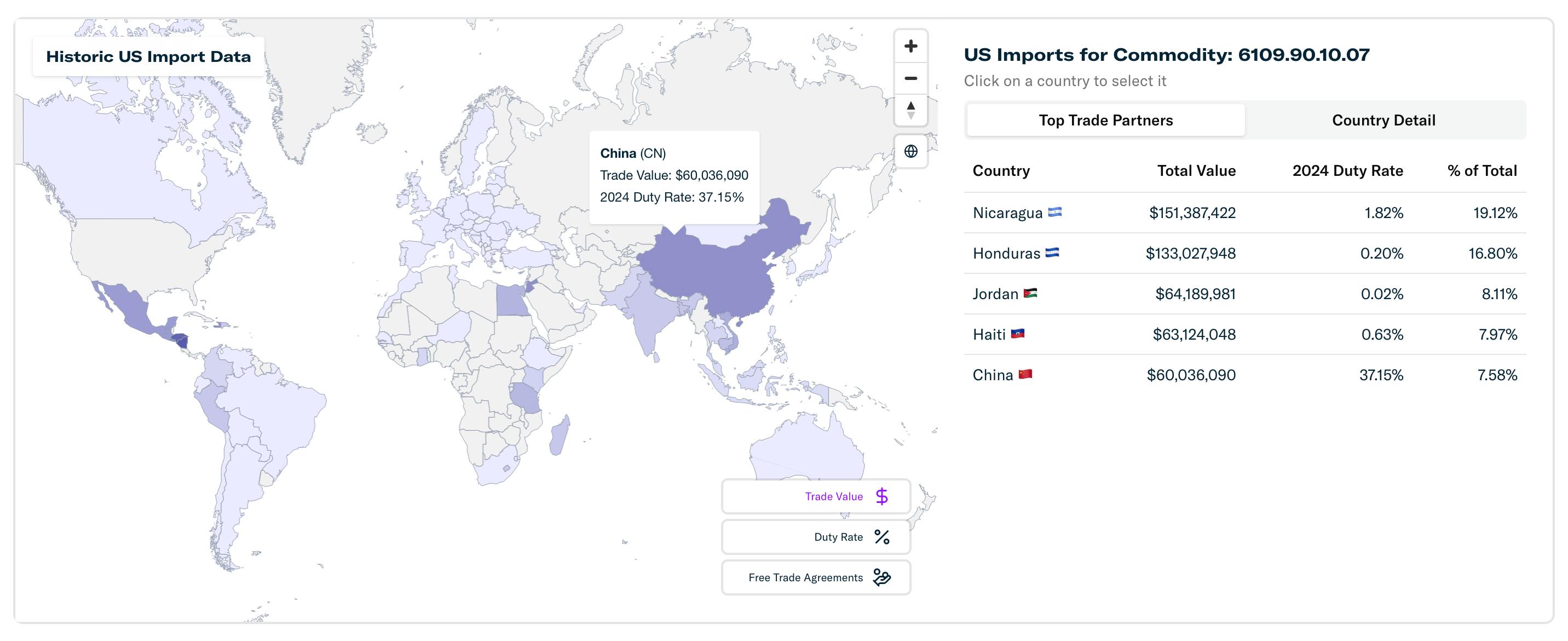

Following President Trump’s April 2025 announcement of reciprocal tariffs on imports to the US, Petersen has held over 100 customer calls and cited widespread concern over the impact on importers, estimating that 80% of brands importing exclusively from China are at risk of bankruptcy if the tariff environment doesn’t change. In May 2025, Flexport launched Tariff Simulator Pro to help shippers assess the rapidly changing tariff environment, and adjust their supply chain strategies accordingly.

Source: Flexport

Flexport has secured notable partnerships, including an agreement with global fashion retailer Shein in April 2024 to serve as their US logistics partner. The company also maintains a partnership with Apple, though this relationship has reportedly been financially challenging, resulting in monthly losses of $2 million as of February 2024. In a 2023 interview, Petersen mentioned that Flexport has established integrations with the 15 “most important” big-box retailers in the US.

In May 2023, Flexport acquired Shopify’s Logistics arm for an undisclosed amount. The acquisition included Deliverr, which Shopify had purchased for $2.1 billion the previous year. Strategically, this acquisition extended Flexport's capabilities "all the way to the door". As part of the deal, Shopify received a 13% equity stake in Flexport and a seat on the board.

In November 2023, Flexport acquired key assets from Convoy, a trucking technology company most recently valued at $3.8 billion in April 2022. While the purchase price was undisclosed, Petersen described it as "modest" relative to the value acquired. The acquisition primarily focused on Convoy's technology, coined as “Uber for trucking”, as well as a core group of about 50 top engineers. This move gave Flexport access to truck brokerage technology for full truckload domestic shipping within the United States, along with a network of 400K drivers accessible via a mobile app. In July 2025, Flexport sold the Convoy Platform to DAT Freight & Analytics. The transaction delivered a strong financial outcome for Flexport, and allowed the company to concentrate on its core international freight forwarding and fulfillment businesses.

Flexport maintains a strong engineering culture, with biannual technology releases and regular internal hackathons, where developers scope LLM-based projects, some of which are promoted into production features. In November 2025, CEO Ryan Petersen mentioned that Flexport’s ML-driven planning engine has reduced the company’s ocean freight spend by roughly 2%, while simultaneously improving average transit times by around 20%. Company-wide automation has increased from roughly 20% of operational work at the start of 2025 to about 50% by the end of the year, with an internal goal of automating up to 95% of repeatable workflows over the next few years.

In August 2025, BlackRock partnered with Flexport Capital to expand its financing base by $250 million. Since its inception in 2017, Flexport Capital has provided over $2 billion in financing to its customers.

Flexport has undergone several rounds of job cuts, reducing its workforce by 20% in January 2023, 20% in October 2023, 15-20% (approximately 400 roles) in January 2024, and 2% in October 2024. Reasons cited for these job cuts include slumps in shipping demand, improved efficiencies, and a renewed focus on profitability.

Valuation

In January 2024 Flexport raised a $260 million uncapped convertible note from Shopify. Petersen cited ensuring profitability, strengthening the balance sheet, and building customer confidence as the main motivations for this financing round. Over 19 funding rounds, Flexport has raised a total of $2.7 billion as of November 2025 from investors such as Founders Fund, Shopify, and Andreesen Horowitz.

While Flexport reached an $8 billion post-money valuation in its $935 million Series E in February 2022, according to Caplight, the company is trading at a valuation of $2.5 billion in secondary markets as of May 2025. The reason for this sharp discount is likely due to the volatility in container pricing, which underpin Flexport’s freight forwarding revenue. Container prices spiked in 2021 and 2022 to unprecedented levels (upwards of $10K a container), contributing to record revenues for the company. In 2023, container prices regressed to its previous levels hovering around $1.5K. Assuming container prices remain at this level, the company will need to grow container volume dramatically in order to meet its peak valuation.

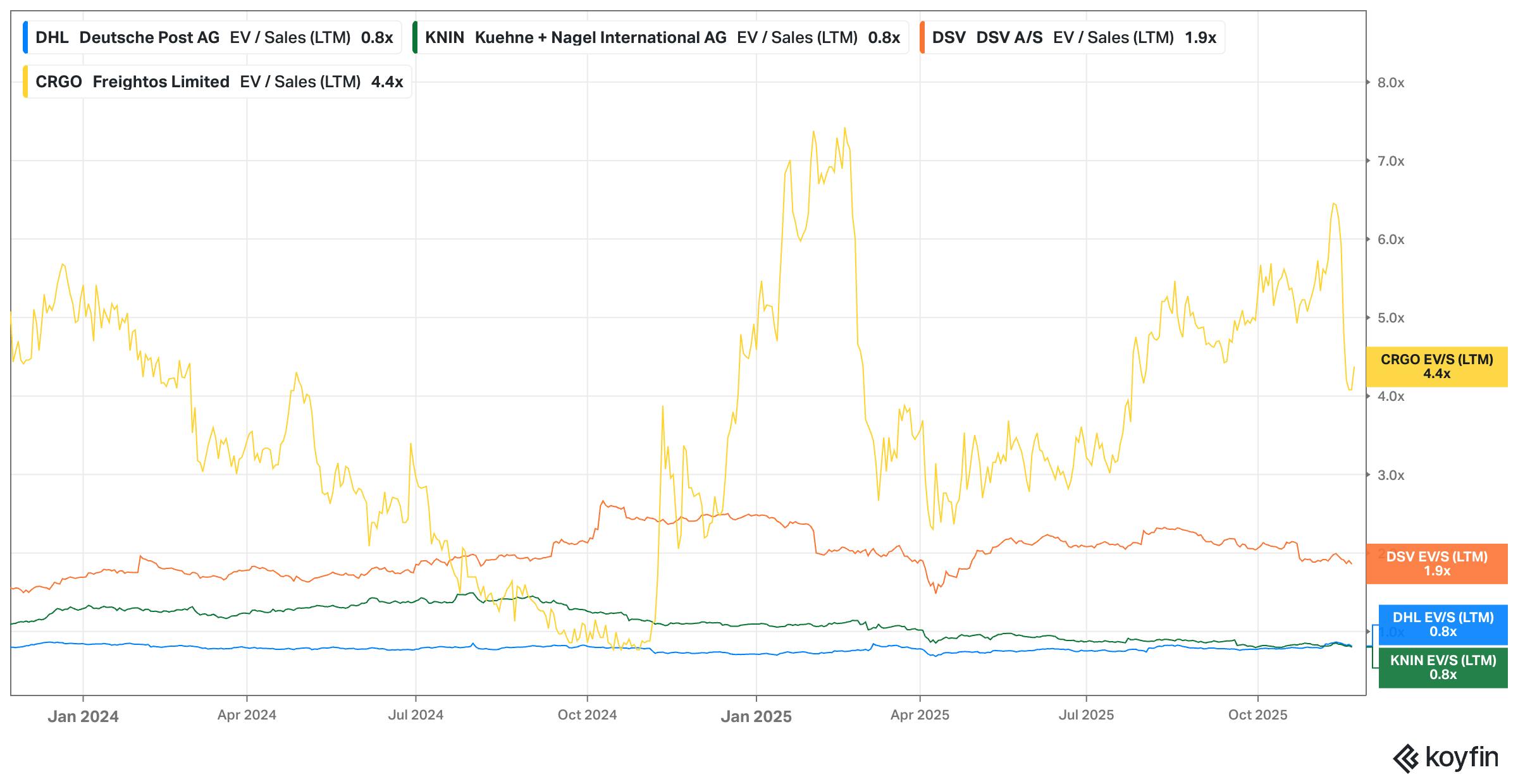

Sacra estimated Flexport’s 2024 revenue at $2.1 billion, while its valuation in the secondary markets was around $2.5 billion in the same time period, implying a 1.2x valuation multiple. As a proxy, DHL, Kuehne + Nagel, DSV, and Freightos are comparable companies that are publicly traded.

Source: Koyfin

At 1.2x, Flexport aligns with DSV but trails a premium SaaS-like multiple commanded by Freightos at 4.4x. Traditional freight giants like DHL and Kuehne + Nagel trade lower at 0.8x each, reflecting their asset-heavy models and thinner margins. Flexport’s multiple likely reflects a hybrid profile, positioned between tech-enabled platforms and traditional forwarders, with upside contingent on sustained software adoption, gross margin expansion, and container volume recovery.

Key Opportunities

Automated Logistics

Flexport is increasingly betting on AI to automate the fragmented and manual workflows that have long defined global trade. In February 2025, the company launched over 20 AI-powered tools, including Flexport Intelligence for natural language queries and Control Tower for real-time logistics visibility, even on freight not managed by Flexport. CEO Ryan Petersen has emphasized that Flexport’s edge comes from a combination of deep domain expertise, a large proprietary dataset, and built-in distribution across its customer base. As Petersen put it:

Technology is the cure to volatility. When we say the word volatile, what we're usually talking about is lots of information and the difficulty understanding how to make sense of it. AI tools, machine learning tools make sense of massive amounts of data. We believe technology is the cure to the volatility that we have today.

One area already showing results is duty drawback: Flexport’s automated platform generates refunds that are 20% higher than legacy systems, helping customers tap into the $6 billion in unclaimed duties left on the table each year. In parallel, Flexport has started deploying voice AI agents to assist truckers and warehouses with simple coordination tasks, replacing emails and calls with automated workflows. Longer-term, Petersen has hinted at full-stack ambitions to tackle physical infrastructure challenges like port automation, a notoriously inefficient bottleneck in global logistics. As these tools mature, they not only drive down Flexport’s cost to serve but also differentiate its platform in a margin-compressed, commoditized industry.

Labor accounts for roughly 10% of the end cost of containerized ocean freight, and Flexport believes its AI-driven planning, exception management, and workflow automation can reduce all-in shipping prices by up to 10% over the next few years. As operational automation rises toward Flexport’s internal target of 80-90%, the company gains a cost structure fundamentally different from legacy forwarders that still rely on fully staffed, manual processes.

Going Public

In April 2025, Petersen confirmed Flexport’s ambition to go public, but emphasized that there’s no fixed timeline – only a focus on sustained execution and strong cash flow. Unlike companies like Coinbase or Uber, which faced existential regulatory battles as test cases for new business models, Flexport operates within well-established legal frameworks and sees no need to build a large lobbying apparatus. Petersen believes this regulatory clarity makes Flexport well-positioned for public markets in the long run. Flexport is expected to become profitable by the end of 2025, narrowing down prospects for an IPO.

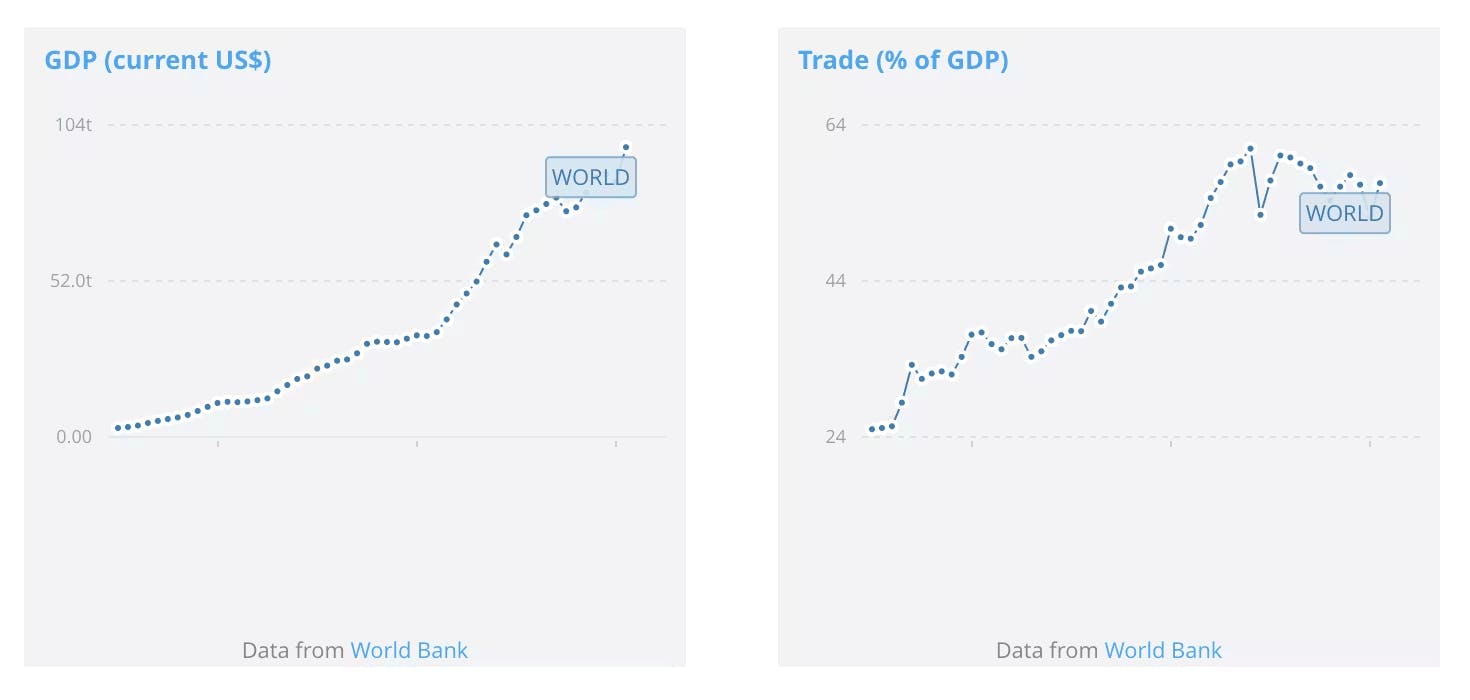

Global Trade and GDP Growth

From 1970 to 2021, global GDP grew from $3 trillion to almost $100 trillion. Over the same time frame, trade accounted for an increasing proportion of global GDP, rising from 25% in 1970 to 57% in 2021.

Source: World Bank; Global GDP and Trade as % of Global GDP

If global trade and GDP rise, that would provide a significant macro tailwind for Flexport, as it could facilitate the movement of those goods. However, some experts anticipate that the world economy will become increasingly de-globalized, resulting in less trade. Just as more global trade could propel Flexport, there is also ample opportunity for Flexport to boost international trade. Paul Graham mentioned the synergy between Flexport and global trade this way:

“Flexport is one of those rare startups that will not merely satisfy its market, but grow it. There will be more international trade because of Flexport, and international trade is a very big thing for there to be more of.”

According to Ryan Petersen, 97% of companies worldwide do not yet transact internationally. Flexport’s software and less-than-container offering make international shipping more accessible to SMBs, and Petersen has a vision of enabling merchants to easily expand to new geographic markets:

“Hey, you guys are selling in the United States and maybe in Western Europe, but why aren’t you selling in India? Why haven’t you added South Korea? Didn’t you know there is this button you can click over here to go live on Flipkart, Rakuten, Coupang, and Mercado Libre?”

Universal Global Trade Platform

By aggregating and digitizing data from across the industry, Flexport could become the universal source of truth for international supply chains. Then, the company could monetize shipments even when it’s not involved in actually moving them. This would improve its own products’ quality. Petersen expressed how under this vision, “the physical world, like software, becomes searchable, programmable, accessible.” Flexport is already working toward this vision through partnerships with smaller, regional freight forwarders.

Flexport’s supply chain data also leads to better products. The company already uses the data to more densely pack containers as well as provide real-time visibility and improve delivery window estimates. In the future, Flexport may be able to provide strong guarantees on delivery deadlines to customers as it collects more data and improves its models. The data is also used for intelligently underwriting trade financing and cargo insurance, which are higher-margin products. The more data Flexport collects, the more these benefits will compound.

Key Risks

Commoditized Industry

Freight forwarding lacks differentiation and stickiness. That may be why the industry remains highly fragmented. One may be tempted to point to Flexport’s software as a differentiator, but other freight forwarders are now investing in software, too. The commoditization of freight forwarding is being compounded by online freight marketplaces like Freightos. With Freightos, companies can compare prices from different freight forwarders before booking, fostering price competition among forwarders and putting additional pressure on margins.

Trade Tensions

Flexport is highly exposed to geopolitical tensions that disrupt global trade flows, particularly the escalating trade war between the United States and China. In April 2025, the US announced tariffs on Chinese goods as part of a new “reciprocal tariff” strategy. China retaliated in kind, resulting in combined tariffs as high as 145%.

According to Ryan Petersen, the new tariffs could delay Flexport’s return to profitability by 6-12 months and threaten the survival of a large portion of its customer base. After the tariff announcement, Petersen conducted over 100 calls with Flexport customers and found that many importers were in distress — he estimated that 80% of companies relying solely on Chinese manufacturing were at risk of going bankrupt if the policy environment doesn’t change. While Flexport benefits from helping customers relocate supply chains to countries like Mexico, Vietnam, and India, the broader chilling effect of trade wars introduces significant macro uncertainty for a business built around the seamless movement of goods across borders.

As of November 2025, the US and China reached an agreement in which China will suspend many retaliatory tariffs announced since March 2025, and the US will maintain certain exclusions and reciprocal duty pauses until November 2026. While this offers a temporary easing of risk, most analysts caution that the underlying structural tensions, such as export controls, rare earth metals, and supply chain dependencies remain unresolved. The baseline duty burden for many Chinese imports remains elevated compared to pre-2025 levels.

Government Initiatives

Given the importance of supply chains to economic health, governments are taking action to encourage digitization. In March 2022, the US government announced the Freight Logistics Optimization Works (FLOW) pilot program to improve data flow and supply chain visibility. As of August 2022, the program has 36 participants including Maersk (world’s second-largest shipping line), P&G, Target, the Port of Long Beach, and Flexport. Participants receive access to FLOW’s data by sharing their own data. Government initiatives such as FLOW could undercut any private company’s attempts to become a universal global trade platform, including Flexport’s.

Summary

Flexport is a digital freight forwarder and supply chain platform that streamlines global logistics through software. Initially focused on freight forwarding, it has expanded into a full-service logistics stack – including customs brokerage, cargo insurance, trade financing, and increasingly, fulfillment. Flexport’s platform powers shipments for over 10K customers in 112 countries. Its long-term upside lies in becoming a universal operating system for global trade, especially as AI unlocks new efficiency gains. Key risks include low-margin freight economics, government digitization initiatives and rising tensions between the US and its trading partners.