Thesis

Since the EU's implementation of the General Data Protection Regulation (GDPR) in 2018, privacy legislation has proliferated globally. GDPR violations have resulted in over 5.9 billion euros in fines between 2018 and 2024, with penalties reaching up to 4% of global revenue. In 2023 alone, five U.S. states implemented comprehensive privacy laws: California Privacy Rights Act, Virginia Consumer Data Protection Act, Connecticut Data Privacy Act, Colorado Privacy Act, and Utah Consumer Privacy Act. By 2024, the number of states with privacy laws had risen to 20, with some already in place, and others staged across 2025 to 2027. Each jurisdiction introduces distinct requirements for data collection, consumer rights, and compliance processes.

Organizations struggle to adapt — only 34% have conducted comprehensive data mapping and understand their data practices. The privacy management software market is projected to grow from $2.7 billion in 2023 to $15.2 billion by 2028 as manual compliance processes prove inadequate for organizations navigating requirements across jurisdictions while maintaining a competitive advantage.

OneTrust has evolved from a privacy compliance tool into a platform that helps organizations manage data usage and AI governance. Its foundation of regulatory intelligence from 1.7K legal experts across 300 jurisdictions in 2025 enables automation of complex compliance workflows, addressing the growing need for scalable privacy management in an AI-driven world. The platform processes over 3 billion consent and preference transactions weekly while serving 75% of the Fortune 100.

Founding Story

OneTrust was founded in 2016 by Kabir Barday (CEO), who grew up in Atlanta as the son of Indian immigrants. Barday was enrolled in community college programming classes at age 14, gaining early exposure to technology while working summers at his parents' gas stations.

After graduating from Georgia Tech with a computer science degree, Barday joined AirWatch, a mobile security software company. As Director of Product Management starting in 2010, he worked on software that helped companies secure employees' mobile devices by monitoring potential security threats. However, this process revealed a privacy paradox — users were unknowingly giving up personal information in the name of security. Barday recognized that privacy violations often stemmed not from malicious intent but from the unintended consequences of companies’ practices while trying to serve customers. He integrated privacy controls and transparency features into AirWatch's products, earning recognition from the International Association of Privacy Professionals.

Through privacy industry conferences during his AirWatch tenure, Barday identified a critical market gap: while privacy regulations were rapidly evolving, the industry wasn't prepared for upcoming government requirements. Solutions remained manual, handled primarily by lawyers and consultants. In 2015, after AirWatch's acquisition by VMware, Barday began building OneTrust. He started in his basement, using his savings and an investment from his father. His wife created the company's name and logo, and he convinced five engineers from previous work connections and AngelList to work without immediate compensation.

The company launched in 2016, ahead of GDPR implementation, initially targeting newly appointed chief privacy officers who needed tools for compliance. By 2019, OneTrust was acquiring over 1K customers quarterly and reached $100 million in revenue within three years.

The company expanded its leadership team in 2017 with Blake Brannon as Chief Product & Strategy Officer, JP Halebeed as Chief Technology Officer, and in 2021 with Guido Torrini joining as Chief Financial Officer. In 2024, Roger Egan joined as Chief Revenue Officer to lead global operations, and David Obstler, Datadog's CFO, became the first independent board member and Audit Committee Chair. As of May 2025, OneTrust employed over 2.3K people across five continents.

Product

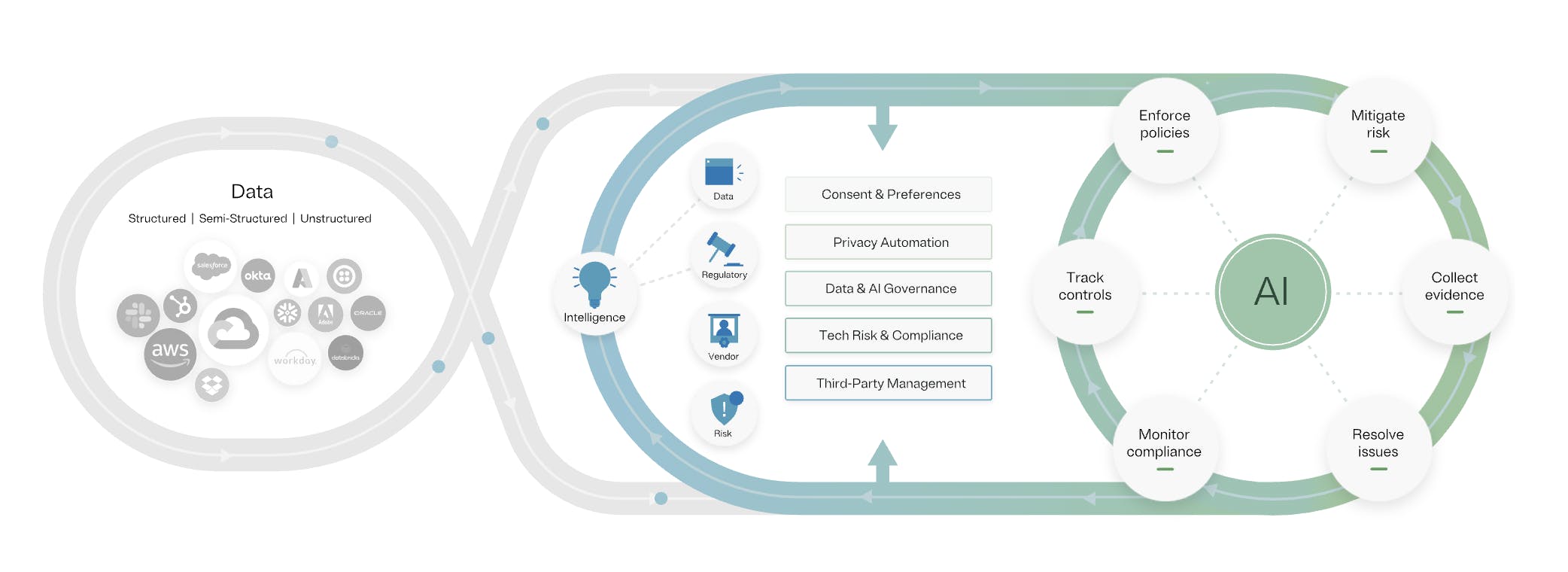

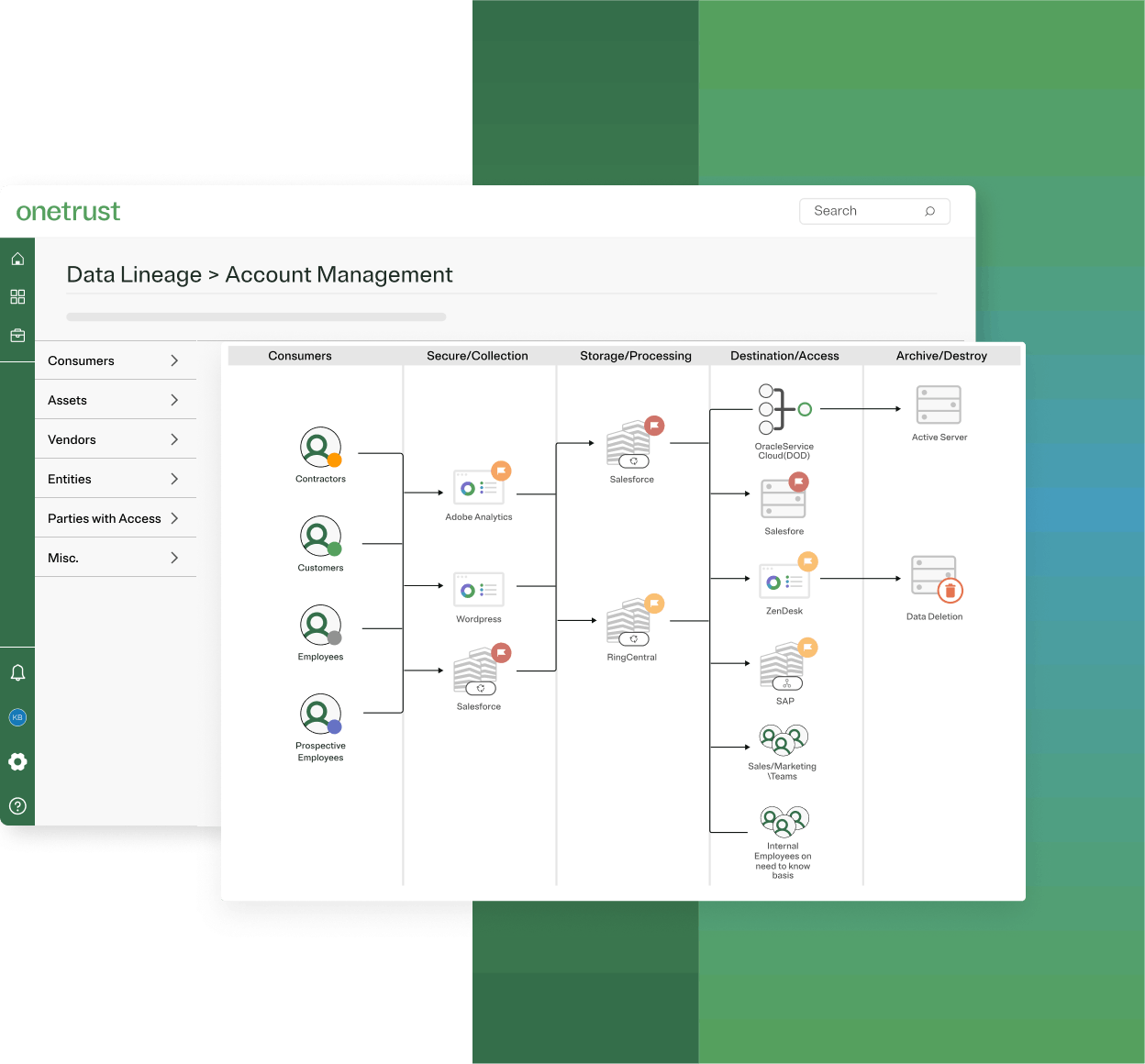

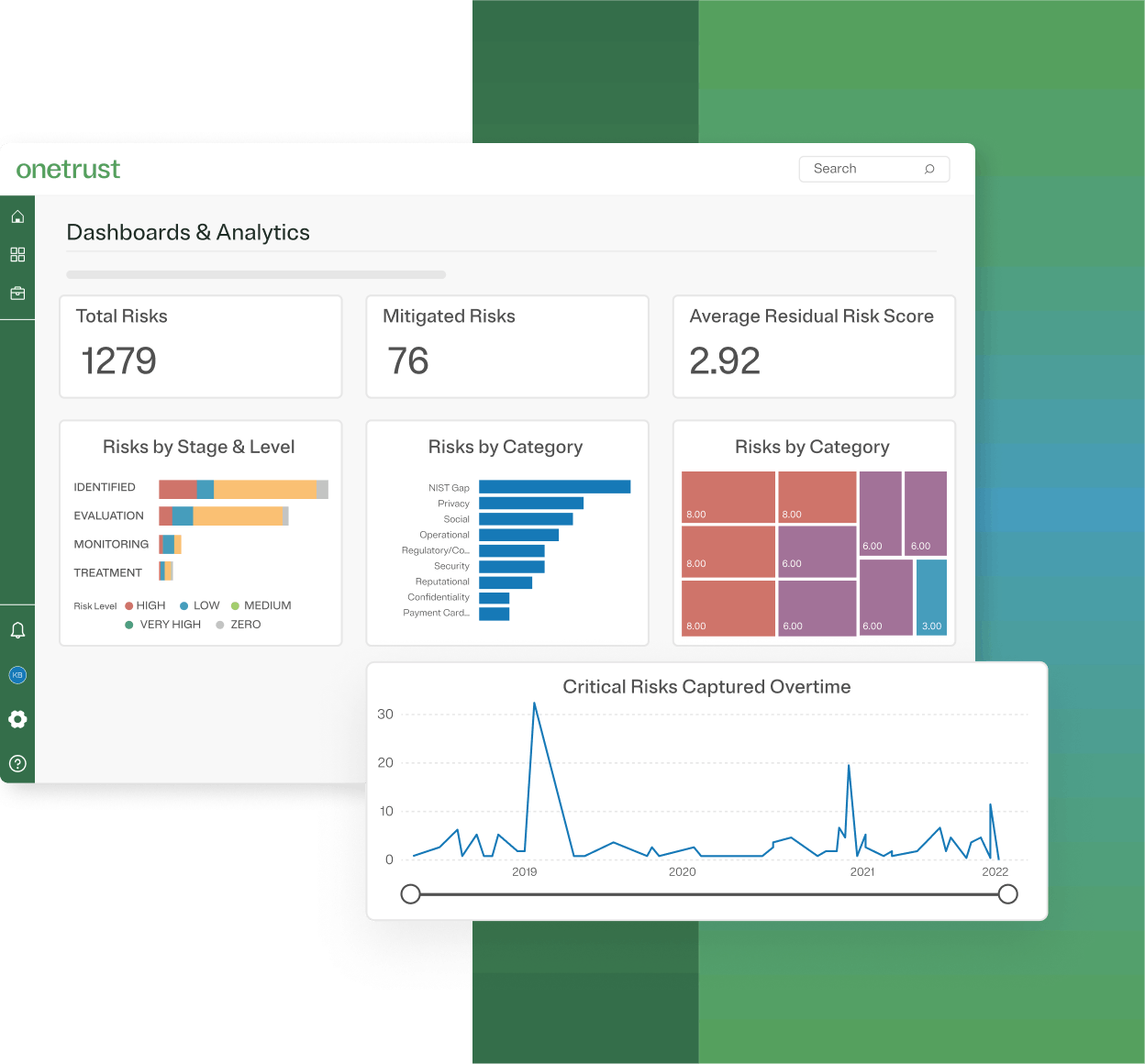

OneTrust's platform comprises five integrated solutions for data privacy, security, and compliance management. The unified architecture allows different modules to share data and workflows while maintaining access controls and compliance standards. The platform converts regulatory requirements into automated workflows that integrate with existing business processes.

Source: OneTrust

In April 2021, OneTrust had acquired Convercent to broaden its offering into ethics and compliance, alongside products like SpeakUp Trustline and Ethics Program Management. However, in December 2024, OneTrust transitioned its Ethics & Compliance module to EQS Group to join its existing ethics and compliance offering.

Consent & Preferences

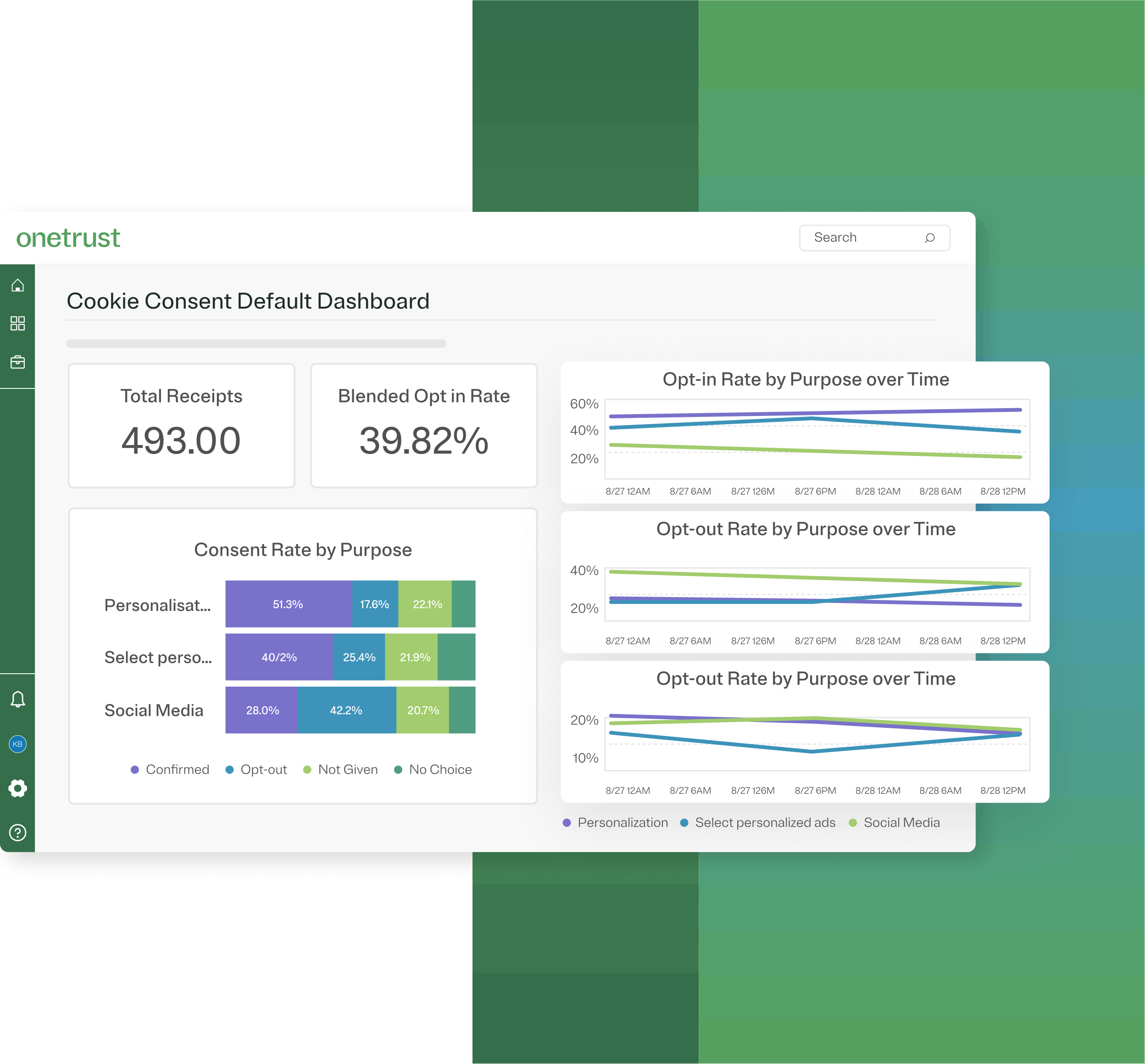

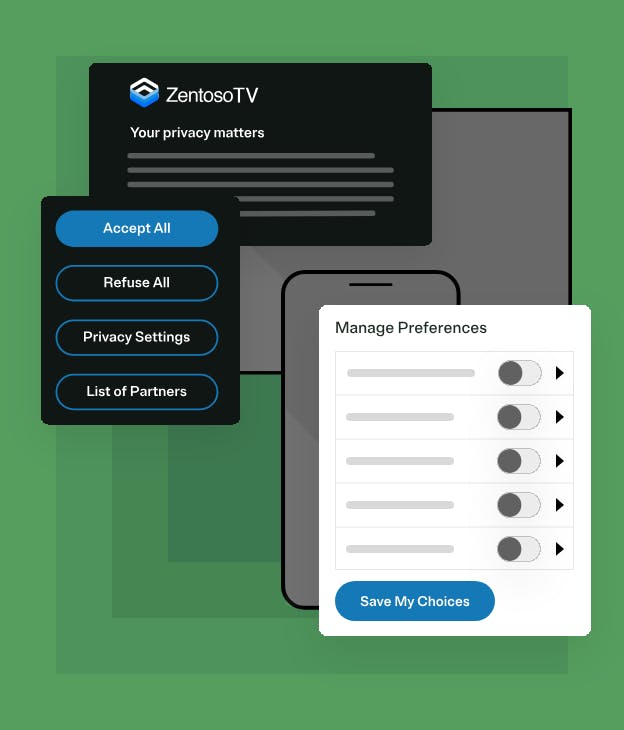

The consent and preferences management solution handles user consent collection across digital touchpoints. The system processes over 1 billion of consent transactions per day and manages compliance with various privacy regulations. It offers geolocation-based customization in over 250 languages and is deployable across websites, mobile apps, and connected TV platforms. Integration with marketing technology stacks ensures user preferences are enforced across email campaigns, advertising platforms, and analytics tools.

Source: OneTrust

Universal Consent & Preference Management

The Universal Consent and Preference Management (UCPM) system manages all aspects of user consent and preferences. It creates progressive preference profiles that evolve with the customer relationship, collecting preferences incrementally as users engage with different services. The UCPM includes customizable preference center capabilities that align with organizational branding. These preference centers allow users to set detailed preferences for data usage, communication channels, and contact frequency. Integration with major marketing platforms like Salesforce Marketing Cloud, Adobe Experience Platform, and Marketo ensures consistent enforcement of user preferences across all customer touchpoints.

Consent Management Platform

OneTrust's Consent Management Platform (CMP) extends beyond basic cookie consent banners to include comprehensive tracking technology management. The platform scans websites to detect and categorize cookies, trackers, and other technologies, maintaining an updated inventory of data collection mechanisms. It features a geographic rules engine that adapts consent experiences based on user location, essential for global organizations complying with various regional privacy regulations. The implementation includes no-code cookie-blocking capabilities that prevent data collection before consent is granted and integrates with major tag management solutions to adjust script loading based on user consent choices.

Source: OneTrust

Privacy Automation

OneTrust's privacy automation solution transforms complex privacy compliance requirements into manageable, automated workflows. Built on regulatory intelligence from over 1.7K privacy experts across 300 jurisdictions, it helps organizations stay updated with evolving privacy regulations without extensive in-house teams. The solution integrates privacy checks and controls into existing workflows. For example, when launching a new marketing campaign, the system triggers necessary privacy assessments, updates data mappings, and verifies consent processes.

Source: OneTrust

Privacy Operations

The privacy operations platform provides visibility into an organization's data landscape through automated discovery and classification. It maintains an up-to-date inventory of data assets and processing activities by continuously monitoring data handling practices and updating privacy documentation. Risk assessment features use AI to identify potential privacy risks in real time, enabling proactive issue management. Incident response functionality includes workflow automation to guide organizations through managing privacy incidents and analyzing incidents against notification requirements across different jurisdictions.

Source: OneTrust

DataGuidance

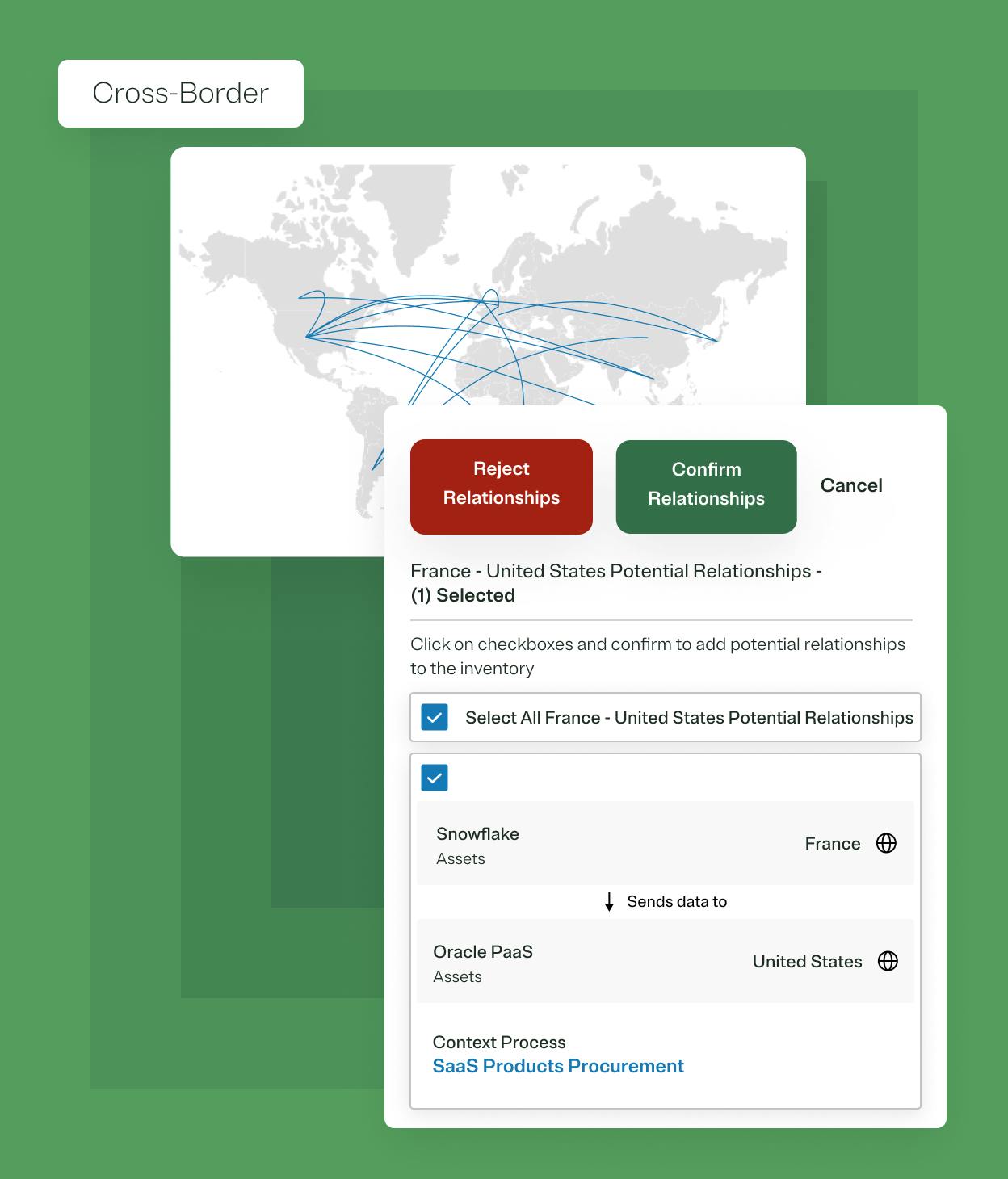

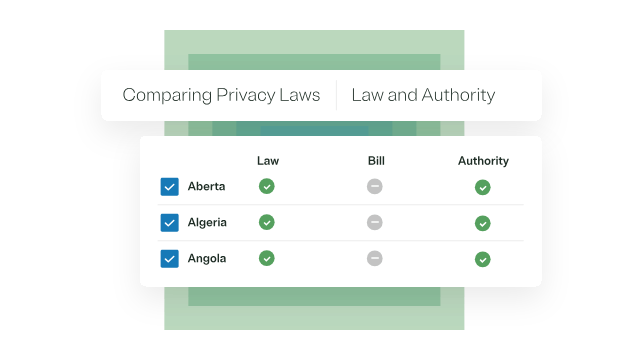

DataGuidance offers real-time regulatory intelligence through a network of privacy experts and AI enhancements. The platform monitors regulatory changes across 300 jurisdictions and provides analysis of their impact on various organizations. Its AI-powered research capabilities allow users to query privacy requirements in natural language and receive relevant guidance supported by primary sources. The platform includes comparison tools to help organizations understand interactions between different privacy laws, which is useful for those operating in multiple jurisdictions.

Source: OneTrust

Data & AI Governance

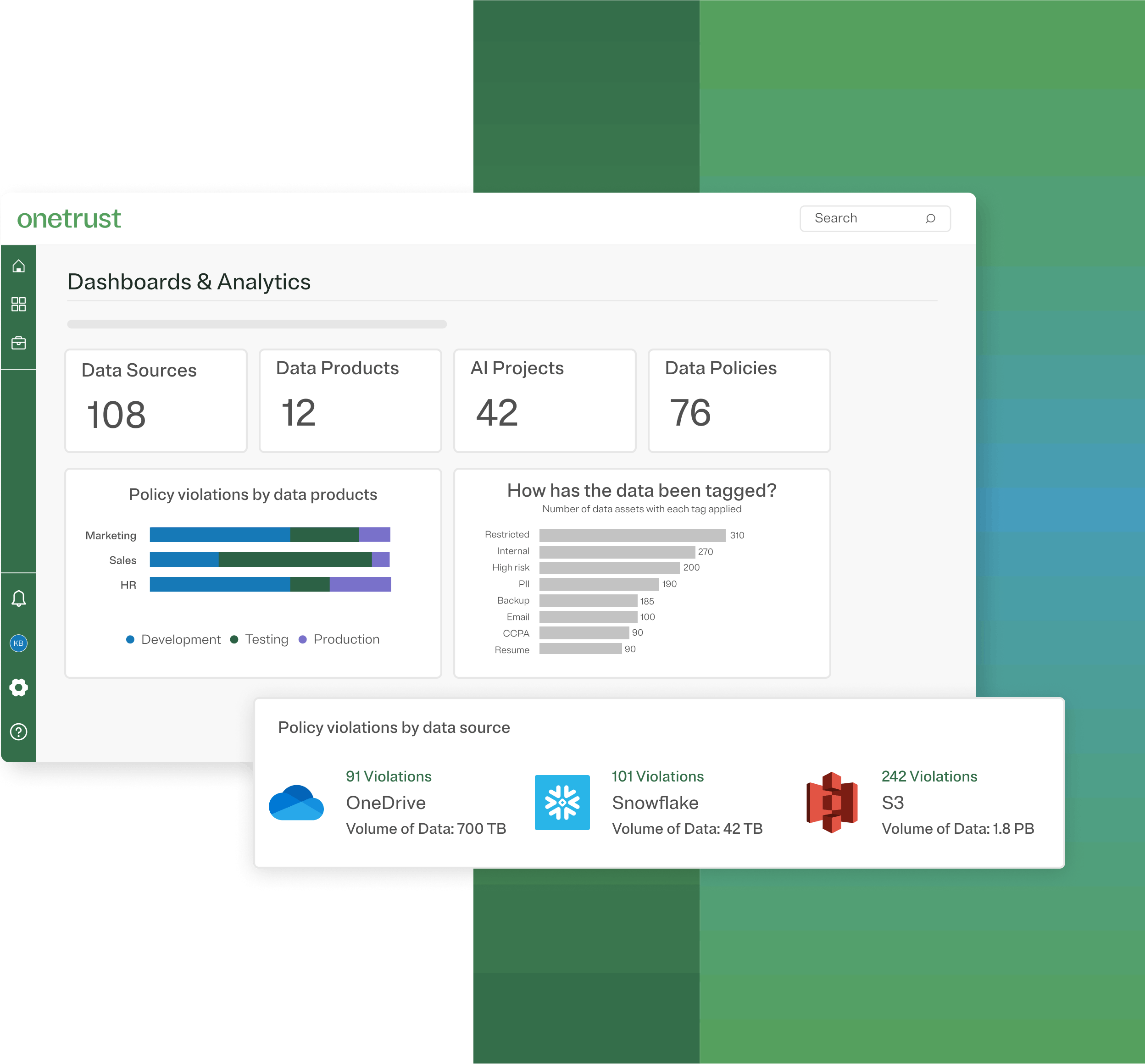

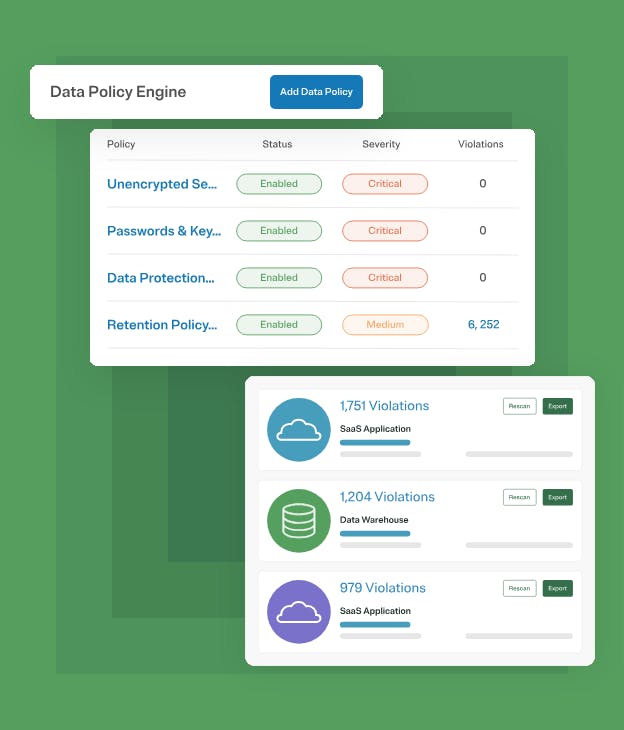

OneTrust's Data & AI Governance solution addresses the challenge of managing data and AI systems responsibly while maintaining innovation speed. It integrates governance controls with existing data infrastructure, allowing organizations to maintain governance across multiple cloud data warehouses without modifying their data architectures. This solution is beneficial for organizations developing AI systems by ensuring sensitive data used in model training is governed and regulatory requirements for model explainability are met. It helps reduce AI development cycles while maintaining compliance.

Source: OneTrust

Data Discovery & Classification

The Data Discovery & Classification engine automates data governance by scanning both structured and unstructured data sources at scale. It uses pattern recognition and machine learning to identify sensitive information accurately and supports numerous pre-built data patterns, with the ability to learn new ones as needed. The platform handles complex document formats using OCR technology to identify sensitive information in scanned PDFs or images, distinguishing between different types of data based on contextual clues. Integration with the modern data stack allows connection to cloud data warehouses, storage systems, SaaS applications, and on-premises systems. This automation helps organizations efficiently identify and manage sensitive data across various systems, improving compliance audit preparation time and accuracy.

Source: OneTrust

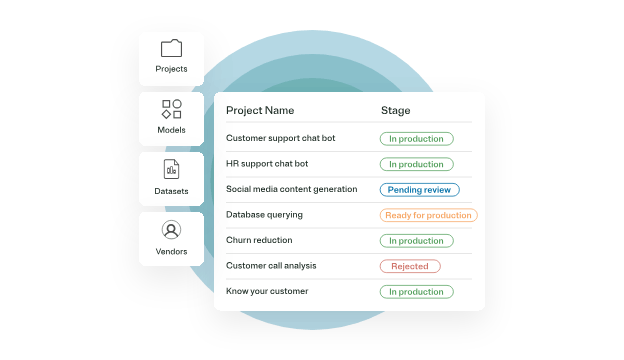

AI Governance

The AI Governance platform supports responsible AI practices by covering the entire AI lifecycle, from project intake to ongoing monitoring of deployed models. It manages risk assessments, data source validation, bias detection, and development documentation automatically. Bias detection analyzes training data and model outputs to identify potential biases, helping ensure fair decision-making in AI systems. The platform also monitors deployed AI systems for ethical considerations and regulatory compliance, aiding organizations in meeting new AI regulations without disrupting development processes.

Source: OneTrust

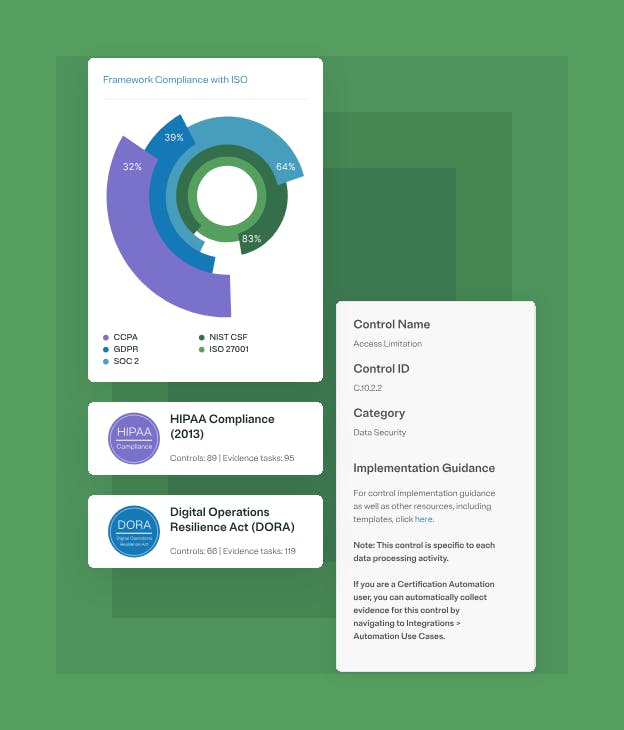

Tech Risk & Compliance

OneTrust's Tech Risk & Compliance solution automates compliance and risk management programs. It supports over 40 compliance frameworks and minimizes manual effort through automated evidence collection and control testing. This comprehensive support ensures organizations can efficiently adhere to diverse regulatory requirements without overburdening their teams.

The solution integrates compliance checks and controls into daily operations, such as automatically assessing compliance impact and updating documentation when new cloud infrastructure is deployed. This is particularly useful for organizations managing multiple compliance frameworks simultaneously, allowing for streamlined and consistent compliance management across all departments.

Source: OneTrust

Compliance Automation

The Compliance Automation platform employs a "collect once, comply many" framework, allowing evidence to demonstrate compliance across multiple frameworks. It maps control requirements across different frameworks, identifying where a single piece of evidence satisfies multiple requirements. This approach significantly reduces redundancy and accelerates the compliance process.

The platform automatically assesses the impact of new regulatory requirements on existing compliance programs and suggests necessary adjustments. Automated evidence collection and validation help organizations maintain continuous compliance, ensuring that they remain up-to-date with the latest regulatory changes without extensive manual intervention.

Source: OneTrust

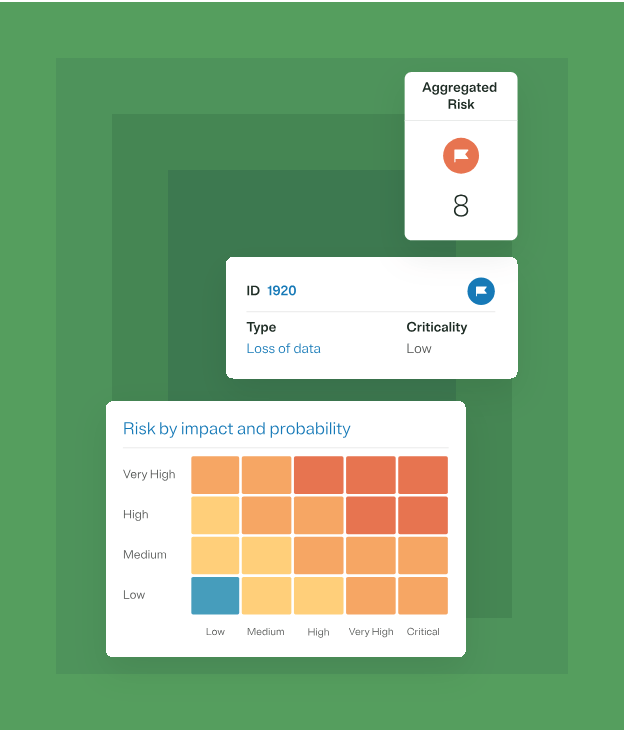

IT Risk Management

The IT Risk Management platform provides a real-time view of technology risks by automatically identifying and assessing risks as technology environments change. It monitors IT assets, configurations, and security controls, providing automated risk scoring based on threat intelligence, vulnerability data, and business context. This real-time insight enables organizations to respond swiftly to emerging threats.

The platform offers detailed risk scoring that considers both technical and business factors, aiding in prioritizing risk mitigation efforts. Automated workflows streamline risk management processes, including risk remediation, tracking, and maintaining an audit trail of risk management activities. Additionally, the platform can model potential risk scenarios to help organizations improve their risk management strategies by anticipating and preparing for possible future incidents.

Source: OneTrust

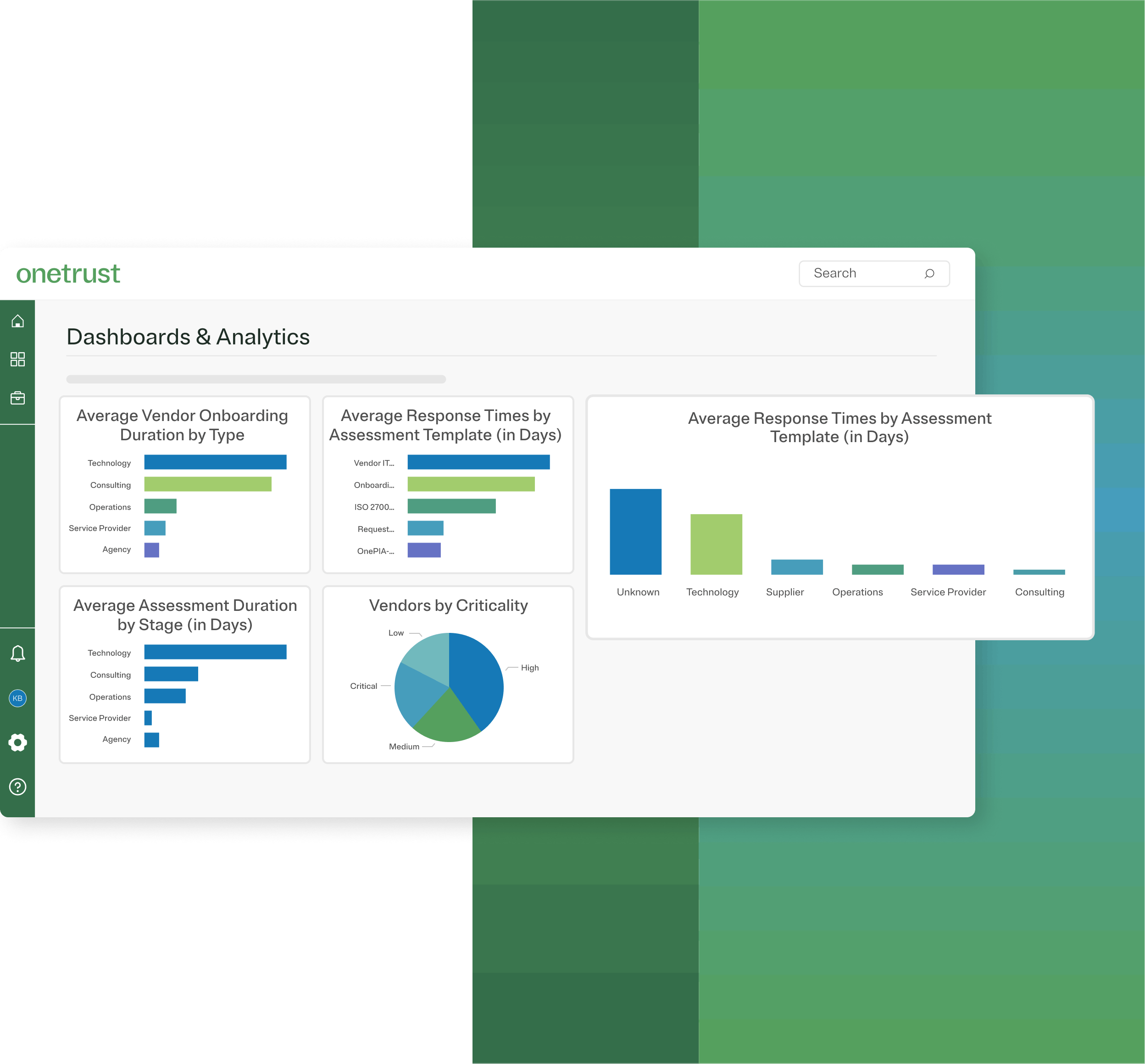

Third-Party Management

OneTrust's Third-Party Management solution assesses and monitors vendor risk across an organization's ecosystem. It utilizes a data-driven approach, incorporating real-time risk intelligence and automated monitoring to enhance vendor risk management. This ensures that all third-party relationships are continuously evaluated for potential risks.

The platform provides a comprehensive view of third-party relationships by gathering data from multiple sources, including financial data, security ratings, compliance status, and media coverage. Continuous monitoring helps maintain accurate risk profiles of suppliers, reducing vendor onboarding time by up to 80% and improving risk visibility. This holistic perspective allows organizations to make informed decisions about their vendor partnerships.

Source: OneTrust

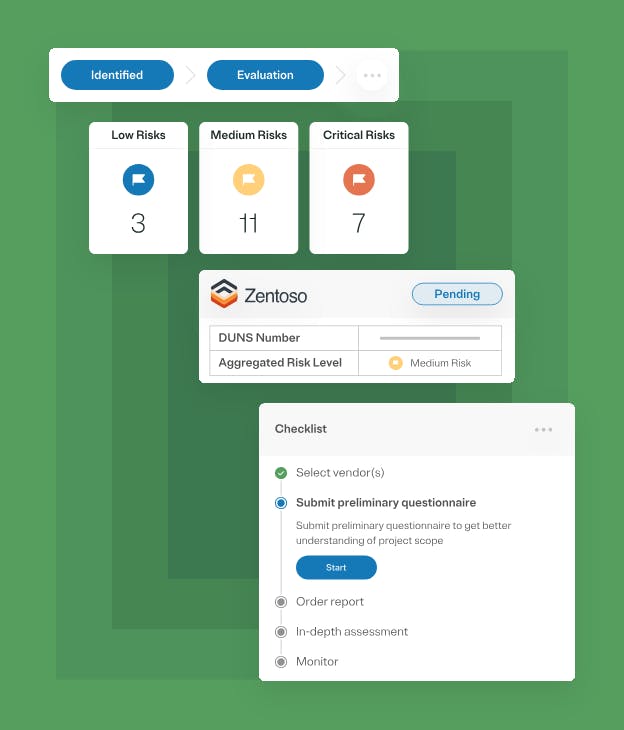

Third-Party Risk Management

The Risk Management platform automates the vendor lifecycle from onboarding to offboarding. It uses an intelligent assessment engine that tailors evaluation requirements based on vendor criticality, data access, and service type, ensuring appropriate scrutiny for different vendors. This targeted approach enhances the effectiveness of risk assessments.

The platform adjusts its assessment methodology based on the vendor's role and potential impact, applying stricter controls where necessary and streamlining assessments for lower-risk vendors. Automated workflows maintain consistent vendor governance and reduce manual effort throughout the vendor lifecycle, promoting efficiency and reliability in vendor management processes.

Third-Party Due Diligence

The Due Diligence platform automates risk intelligence gathering and analysis for vendor screening. It aggregates and analyzes risk data from multiple sources in real time, providing a comprehensive view of vendor risk profiles. Automated screening includes checks against global compliance databases, monitoring adverse media coverage, and tracking financial stability indicators. This thorough evaluation helps organizations identify and mitigate potential risks early.

Natural language processing helps identify potential risks in news coverage and public records, enhancing the thoroughness of vendor risk assessments and helping organizations avoid compliance issues and reputational damage. The platform ensures that all relevant risk factors are considered during the due diligence process.

Source: OneTrust

Third-Party Risk Exchange

The Risk Exchange facilitates the sharing of vendor risk profiles among OneTrust customers, reducing duplicate assessment efforts while maintaining data privacy. It normalizes assessment data across different frameworks, allowing organizations to leverage existing assessments even with varying requirements. This collaborative approach enhances efficiency and consistency in risk management practices.

Continuous monitoring capabilities ensure that any new risk information about a vendor is shared with all participants monitoring that vendor, providing real-time risk intelligence and maintaining accurate risk profiles within the third-party ecosystem. This dynamic sharing of information helps organizations stay informed about their vendors' risk statuses and respond promptly to any changes.

Source: OneTrust

Market

Customer

OneTrust serves three distinct customer segments, each with unique privacy and compliance needs:

Enterprise customers represent OneTrust's primary focus, typically representing contracts for OneTrust of over $100K, with several exceeding $1 million contracts. These customers’ requirements span multiple jurisdictions and departments, demanding comprehensive privacy automation, data governance, and compliance solutions. For example, a partnership with Adobe announced in 2024 exemplifies OneTrust's enterprise strategy, helping large marketing organizations navigate complex data privacy requirements while maintaining operational efficiency.

Mid-market customers usually begin with specific needs like consent management or vendor assessment before expanding platform usage. These organizations value OneTrust's ability to scale capabilities as their privacy programs mature. For example, PUMA initially adopted OneTrust for vendor risk assessment before expanding to broader privacy management functions.

High-growth technology companies form an emerging segment, particularly those building AI-powered products or handling large volumes of customer data. These customers value OneTrust's AI governance capabilities and automated privacy checks within development workflows. TitanOS demonstrates this use case, employing OneTrust's consent management platform to maintain compliance while rapidly scaling its user base.

The platform's adoption within organizations typically starts with a specific department's needs, often privacy or legal teams responding to particular regulatory requirements. Initial deployments frequently focus on basic compliance requirements like cookie consent or vendor assessment. As organizations become more familiar with the platform, usage often expands to other departments. Marketing teams begin using it for consent management, security teams for vendor risk assessment, and data teams for governance policies.

Market Size

The privacy management software market is projected to grow from $2.7 billion in 2023 to $15.2 billion by 2028, representing a 41% compound annual growth rate. This is driven by three key factors: expanding regulatory requirements, increasing privacy concerns, and the adoption of AI technology.

First, growing regulatory complexity is the largest catalyst. Since GDPR came into force, cumulative fines have reached €5.88 billion, signaling strict enforcement that pushes firms toward automated tooling. In the United States, 20 states now have comprehensive privacy statutes, creating overlapping obligations for multi-state businesses. Outside classic privacy law, the EU Artificial Intelligence Act entered into force in August 2024 and begins phased obligations in 2026-2027, adding documentation and risk-management duties for any organization that deploys higher-risk AI systems.

Second, rising consumer and enterprise concern about data misuse further expands demand. One 2024 report found that 84% of respondents were worried their personal data could be shared without permission. At the same time, another report placed the global average breach cost at $4.8 million, up 10% year-on-year. These headline numbers translate into concrete budget allocations for tools that can inventory data, enforce consent, and demonstrate compliance. As a result, the third-party risk management market is estimated to hit $24.3 billion by 2034.

Finally, rapid adoption of generative and predictive AI is creating new governance mandates. While the dedicated AI-governance software segment is estimated at about $900 million in 2024, it’s expected to rise to $5.8 billion by 2029. Organizations deploying LLMs as features now need systems that can trace training data lineage, log model-risk assessments, and apply region-specific rules such as the EU AI Act or upcoming US executive-order guidelines. These requirements dovetail with and accelerate spending on broader privacy-management platforms.

The combination of these markets suggests OneTrust's total addressable market could exceed $30 billion by 2028. OneTrust’s announced revenue projections of $500 million for May 2024 indicate less than 2% market penetration. OneTrust has already reportedly established market leadership in privacy management software, according to IDC, showing 29.7% market share, more than double its nearest competitor.

Competition

Competitive Landscape

The privacy management software market features a mix of specialized providers and enterprise software companies entering the space. The market remains relatively fragmented, with numerous players targeting different aspects of privacy compliance and data governance. Specialized providers focus on specific capabilities like consent management or data discovery, while larger enterprise software vendors integrate basic privacy features into their existing platforms.

OneTrust competes in multiple segments due to its comprehensive platform approach. The company faces specialized vendors like BigID, Securiti, TrustArc, and others in the core privacy management space. The consent management segment includes competition from Osano and Sourcepoint, while the data governance space sees overlap with larger enterprise software providers. Cloud providers like AWS, Google Cloud, and Microsoft Azure have also begun incorporating basic privacy features into their services, though these typically offer more limited functionality compared to dedicated solutions.

Direct Competitors

BigID: Founded in 2016, BigID has raised $306.1 million in total funding and positions itself as a full-stack data-intelligence and data-security platform. It combines data discovery, classification, and DSPM with privacy workflows and reported passing $100 million in ARR in March 2024, making it one of the largest independent vendors competing directly for the same enterprise budgets as OneTrust.

Securiti: Founded in 2019, Securiti provides an AI-driven platform for data intelligence and automated security compliance. The company raised a $75 million Series C led by Blue Owl in 2022, bringing total funding to $156 million from investors including General Catalyst and Capital One Ventures. The company differentiates through real-time data protection capabilities and automated data flow mapping across cloud environments. In late 2022, the company launched the Data Command Center, a unified platform that provides centralized data intelligence and controls across public clouds, data clouds, SaaS, and private cloud environments.

Source: Securiti

TrustArc: Founded in 1997 as TRUSTe, TrustArc raised $70 million in funding from Bregal Sagemount in 2019. The company has evolved to offer a full compliance platform from its privacy certification roots. TrustArc maintains particular expertise in international data transfer mechanisms and leverages its historical reputation in privacy certification to target enterprise customers.

Osano: Founded in 2018, Osano focuses on website compliance and consent management. The company raised $25 million in Series B funding led by Baird Capital in 2021, bringing total funding to $44.4 million. Unlike OneTrust's enterprise focus, Osano targets mid-market companies with streamlined implementation and automated policy updates. In December 2023, Osano announced the acquisition of WireWheel, a provider of privacy assessments, DSAR automation, and consent solutions for large enterprises. That acquisition enabled Osano to integrate those enterprise-grade workflows into the Osano platform and create a larger combined challenger to OneTrust at the upper end of the market.

Transcend: Founded in 2017, Transcend had raised $69 million in funding as of May 2025, including a $40 million Series B led by StepStone Group in 2024. The company specializes in privacy rights automation through advanced data discovery and orchestration capabilities. Transcend differentiates by focusing deeply on technical infrastructure for data subject request automation rather than broader compliance management.

DataGrail: Founded in 2018, DataGrail raised $45 million in Series C funding led by Third Point Ventures in 2022, bringing total funding to $84.2 million. The company targets mid-market customers with pre-built integrations for common business applications, emphasizing rapid deployment over comprehensive functionality.

Mine: Founded in 2019 and based in Tel Aviv, Mine focuses on automated data discovery and mapping capabilities. The company has raised $42.5 million as of May 2025, including a $30 million Series B round in December 2023 led by Battery Ventures. The company’s technology continuously scans enterprise systems to maintain updated data inventories and automate compliance workflows. The platform specializes in identifying personal data across structured and unstructured data sources, helping companies understand their data landscape for privacy compliance.

Ketch: Launched out of stealth in 2020 and co-founded by Krux alumni Tom Chávez and Vivek Vaidya, Ketch delivers “programmatic privacy” APIs that let engineering teams route, erase, or transform personal data dynamically across data stores. The company had raised $43 million to date as of May 2025 and sells primarily to mid-market SaaS and e-commerce firms looking for embedded privacy controls rather than a full compliance suite.

Adjacent Players

OneTrust’s broad product portfolio exposes it to competition from specific vendors who do not compete with OneTrust as a generalist platform, but may compete with one or few aspects of OneTrust’s product portfolio.

Collibra: Founded in 2008, Collibra supplies an enterprise data-catalog and governance cloud that now bundles privacy and AI-governance modules. The firm announced a $250 million round in November 2021 that valued it at $5.3 billion. It has raised a total of $596.5 million in capital as of May 2025.

Alation: Established in 2012, Alation provides a machine-learning-driven data catalog and stewardship suite used widely in regulated industries. It has raised $315 million in funding as of May 2025. The platform increasingly competes on policy-based data-access controls.

Cyera: Founded in 2021, Cyera offers cloud-native data-security-posture-management (DSPM) that discovers and classifies sensitive data across AWS, Azure, and GCP. The company closed a $300 million Series D in November 2024 at a $3 billion valuation. Its total funding as of May 2025 is $764.5 million.

Sentra: Tel-Aviv–based Sentra (founded 2021) also focuses on DSPM, adding automated remediation playbooks for exposed or mis-tagged data assets. It has raised $103 million in total funding, including a $30 million Series A in 2024 led by Standard Industries and Bessemer.

Incumbents

The major cloud providers, AWS, Google Cloud, and Microsoft Azure, have developed native privacy and security features to address growing data protection concerns within their respective ecosystems. These tools focus primarily on data protection, access control, and basic compliance measures.

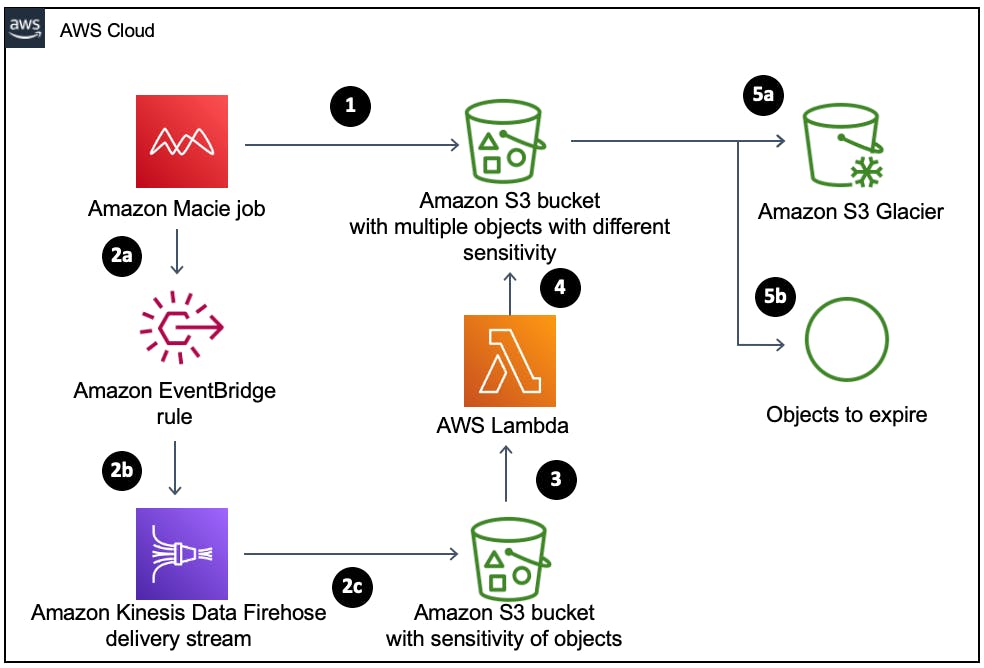

AWS offers several key security tools. Amazon Macie uses machine learning and pattern recognition to detect and safeguard sensitive data, automatically scanning S3 buckets to identify where sensitive information resides. AWS Secrets Manager securely manages sensitive information such as API keys, passwords, and certificates, offering features like automatic secrets rotation and secure, scalable storage. Amazon GuardDuty provides threat detection services, using anomaly detection and machine learning to monitor AWS environments for malicious or unauthorized activities.

Source: Amazon

Google Cloud’s Secret Manager offers a centralized repository for storing and managing confidential data across Google Cloud services. It integrates with Google Cloud's IAM for precise access control and supports automated rotation of secrets, enhancing security by ensuring sensitive information is updated regularly without manual intervention.

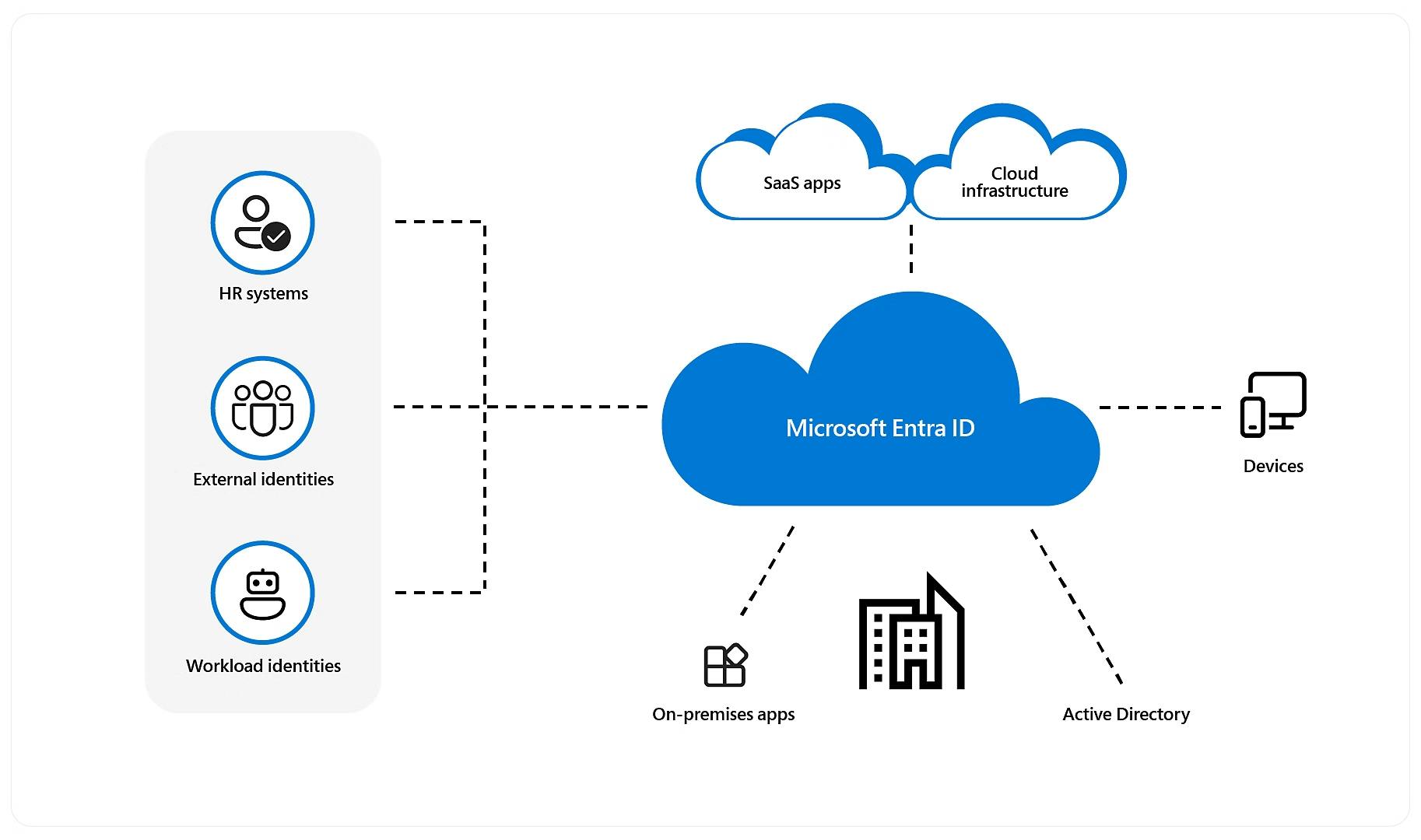

Microsoft Azure Key Vault safeguards critical secrets such as encryption keys, passwords, and certificates. It offers centralized management of secrets, secure access through role-based access control, and built-in monitoring capabilities for auditing key and secret usage. Microsoft Entra ID (formerly Azure Active Directory) serves as a centralized identity and access management solution, offering features like fine-grained access control, single sign-on, and multi-factor authentication.

Source: Microsoft

Business Model

OneTrust operates a subscription-based SaaS model built around five core modules that each scale based on different usage metrics. According to some customers in 2022, contract values range significantly, from under $40K annually for some enterprises to over $1.5 million for larger deployments, with Fortune 100 companies typically paying above $200K for limited-seat licenses.

The modular platform architecture enables a land-and-expand strategy. Customers typically enter through one or two modules to address specific compliance needs, then expand usage as they mature their trust programs. According to one customer, Privacy Automation - which handles assessments and data subjects - makes up the largest portion of most contracts, while Governance and Risk functionality typically comprises a smaller percentage of deal value. Variables that affect pricing include data volume, number of consent transactions, and employee count for certain modules.

OneTrust’s go-to-market motion combines direct sales with an expanding channel strategy. The direct sales team targets specific regulatory-driven roles like Chief Privacy Officers, while an enhanced partner program aims to scale distribution through resellers and implementation partners. Contract structures typically span 1-3 years, with one customer noting that annual increases are modest and not heavily enforced.

Traction

OneTrust serves over 14K customers, including 75% of the Fortune 100. Within this customer base, more than 1.2K customers generate over $100K in ARR, with several exceeding $1 million annually. According to one report commissioned by OneTrust, customers reported a 227% three-year ROI with a seven-month payback period, including a 75% improvement in privacy team productivity and $195K in annual technology cost savings.

Customer metrics demonstrate substantial platform usage, with OneTrust processing over 3 billion consent and preference transactions weekly. The company maintains a significant research and development presence, with over 40% of its 2,300 employees focused on product development. OneTrust has secured over 300 patents and operates from ten offices globally. The research team includes 1.7K contributing researchers providing regulatory intelligence across 300 jurisdictions.

The company has completed several acquisitions since its founding, including Tugboat Logic for security certification automation, Convercent for ethics and compliance solutions, which was later divested, and Planetly in December 2021.

Valuation

In July 2023, OneTrust was valued at $4.5 billion, which was a decrease from its $5.3 billion peak in 2021, with the company tracking to surpass $500 million in ARR in 2024 while reportedly maintaining positive free cash flow. The valuation represents approximately a 9x forward revenue multiple.

As of May 2025, the company had raised $1.1 billion across seven funding rounds since its founding, including a $150 million private equity round led by Generation Investment Management in July 2023, followed by a secondary market transaction in August 2023. Earlier rounds included a $210 million Series C extension led by SoftBank Vision Fund and a $300 million Series C led by TCV in 2021, a $210 million Series B from Coatue in 2020, and a $200 million Series A from Insight Partners in 2019.

The company's capital deployment efficiency is demonstrated by its 2.2x capital-to-ARR ratio. Market comparisons provide additional context. Direct competitors have secured significantly lower valuations in recent rounds: Securiti raised a $75 million Series C, implying a $750 million valuation, while DataGrail's $45 million Series C suggested a valuation near $500 million. Public companies in governance and compliance like Qualys and Rapid7 trade at 6-8x forward revenue, though with more modest growth rates.

Key Opportunities

AI Governance Expansion

AI regulation is driving enterprise demand for governance tools. The EU AI Act creates extensive requirements around model documentation, bias testing, and risk management. Most organizations lack systems to track AI development and deployment across teams. OneTrust's existing compliance infrastructure and enterprise relationships provide advantages in capturing this emerging market. However, successful expansion requires significant investment in technical capabilities beyond traditional privacy management.

Industry-Specific Solutions

Regulated industries face more complex compliance challenges as privacy and AI requirements intersect with existing frameworks. Healthcare organizations must reconcile AI deployment with HIPAA requirements, while financial institutions need integrated controls for model risk management and data privacy. Building industry-specific workflows requires deep domain expertise, but could increase customer lock-in and support higher pricing in these verticals.

Key Risks

Enterprise Software Competition

Large technology companies pose significant competitive pressure by integrating privacy features into core platforms. Microsoft, Google, and IBM collectively captured 22% of the privacy management software market in 2023 through native cloud platform capabilities. Microsoft's Azure compliance center offers data discovery, classification, and compliance tools included with existing cloud subscriptions. These incumbents leverage established customer relationships and can bundle basic privacy features without requiring additional vendor relationships. While OneTrust offers deeper functionality, enterprise software providers' ability to include basic privacy capabilities may limit growth where comprehensive privacy automation is not essential.

Regulatory & Market Fragmentation

The evolving regulatory environment strains product development and enables niche competitors. With 13 U.S. states implementing privacy laws by 2024 and new global requirements emerging, maintaining compliance requires substantial ongoing investment. Each regulation introduces distinct requirements for consent management, data subject rights, and documentation. Competitors can target specific segments - BigID in data discovery or Ketch in automated compliance. While OneTrust's regulatory network provides advantages, supporting an expanding set of requirements increases costs and could impact margins.

Potential Shift Away From Privacy

Rumours of a “GDPR 2.0” overhaul gained traction in April 2025 after multiple press reports said the European Commission is drafting a proposal to “scale back” the regulation and lighten obligations on small and mid-sized enterprises. Danish and Irish officials publicly endorsed easing consent and record-keeping rules to reduce business costs. If Brussels does dilute or delay core compliance duties, the near-term spending pressure that has fueled OneTrust’s European growth could soften as fewer firms would feel compelled to adopt automated data-mapping, assessment, and DSAR tooling, elongating sales cycles and intensifying price competition among vendors.

A shift in tone from the EU—the jurisdiction that set the global benchmark—may also embolden deregulatory voices elsewhere and encourage multinationals to treat privacy as a “nice-to-have” rather than an urgent risk item. That said, privacy activists point out that fundamental rights are anchored in EU law, and enforcement activity remains robust, with regulators levying record fines in 2024-25. The risk for OneTrust is a potential deceleration of its flagship privacy-automation market just as it is investing heavily in new modules; sustained growth would then rely more on adjacent pillars such as AI governance, vendor risk, and GRC automation.

Summary

OneTrust has grown to represent an estimated 29.7% market share in the privacy management software market, serving over 14K customers, including 75% of the Fortune 100. The company has evolved from a privacy compliance tool into a comprehensive platform for data governance, AI responsibility, and compliance automation. The company expected to surpass $500 million in annual recurring revenue in 2024 while maintaining positive cash flow, having raised $1.1 billion at a valuation of $4.5 billion as of July 2023.

While OneTrust has established clear market penetration and meaningful customer relationships, it faces emerging competition from both specialized vendors and large enterprise software providers integrating privacy features into their platforms. The company's success in capturing the growing demand for AI governance and automated compliance solutions will depend on its ability to manage implementation complexity while maintaining operational efficiency as it scales.