Thesis

The global market for payments is projected to reach $2.2 trillion by 2027, up from $1.6 trillion in 2022. Within the global payments market, the cross-border payments market grew at a CAGR of 5% from 2018-2022. While many associate the cross-border payments market with consumer-to-consumer transfers, like sending a family member in another country money via Western Union, the largest contributor by volume to the cross-border payments market is business-to-business transfers.

Although cross-border payment systems have been around since at least the 1970s (when SWIFT was created), they remain slow and expensive. Sending a wire abroad can take up to five days and cost up to 7% of the value of a transaction. The primary technology used by banks and businesses for cross-border payments, as of May 2023, is SWIFT. 44.8 million messages were sent through SWIFT per day from December 2021 to December 2022. SWIFT is used by incumbents in the financial industry like JP Morgan, Bank of America, Citibank, Wells Fargo, HSBC, and Barclays to conduct international money transfers. It’s known for its long tenure of operation and extensive network connecting more than 11K financial institutions and more than 200 countries and territories.

Due to the inefficiencies of international payment exchanges, cryptocurrencies pose a compelling alternative by offering a low-cost alternative to traditional banking and wire transfers. Unlike higher-income countries, where crypto is often seen as an investment, individuals in countries like Argentina, Nigeria, and Turkey use digital assets primarily to protect against inflation and facilitate remittances. These users rely on stablecoins and other cryptocurrencies as a safeguard against volatile local currencies and to avoid the high fees associated with conventional remittance services.

For small business owners and families alike, crypto's efficiency and affordability are often seen as advantages and crypto can be used for quicker, more economical transfers across borders than traditional cross-border payments. Crypto adoption among lower-income demographics is further fueled by limited access to banking, hyperinflation, and restrictive capital controls, making crypto more attractive in regions where traditional financial systems are less accessible or prohibitively expensive.

Ripple offers an enterprise solution to expensive and time-inefficient cross-border money transfers. By eliminating intermediary banks, Ripple enables communication between sending and receiving banks, exchanging fiat currencies through its cryptocurrency, XRP. Using Ripple, transactions happen within three and five seconds, cost less than one cent, and are publicly available on its native blockchain ledger, reducing the additional management costs of tracking and reconciling payments. Additionally, Ripple utilizes a credit and debit system via its cryptocurrency wallets, removing the need for banks to lock up liquidity to conduct a transaction.

Founding Story

Ripple was founded in 2012 by Chris Larsen, Arthur Britto, David Schwartz (CTO and Chief Cryptographer), and Jed McCaleb. In 2011, before Larsen joined, Schwartz, Britto, and McCaleb developed the XRP Ledger (XRPL), the technical foundation upon which Ripple was built.

Schwartz started his engineering career as a software developer at RE/MAX after graduating with a degree in electrical engineering from the University of Houston in 1990. In January 1992, he co-founded a medical device manufacturing company, Cardiophonics, that sold an FDA-approved noninvasive medical device to provide measurements of heart murmurs and similar conditions. He then served as the director of network service for Internet Gateway Connections, in January 1995, joined Worldwide Internet Solutions as senior network engineer in January 1996, and then became CTO for WebMaster Incorporated in January 1998 before founding Ripple.

Britto was the CEO of Information Access Technologies Inc. prior to co-founding Ripple. After co-founding Ripple in 2012, he teamed up with Schwartz to co-found PolySign in 2017, a company developing infrastructure for financial institutions to leverage digital assets. As of October 2024, Britto serves as the president and board member at PolySign and it remains unclear how involved Schwartz is with the company. In 2018, Britto also founded Standard Custody and Trust Company which was focused on providing digital asset custody solutions. Standard Custody and Trust Company was acquired by Ripple in February 2024.

McCaleb grew up in Little Rock, Arkansas, and dropped out from the University of California Berkeley during his freshman year. McCaleb started his career as a tech founder in August 2000, when he created a ”popular” peer-to-peer file-sharing network called eDonkey2000. In February 2007, he founded Code Collective, a strategy game development company. In 2010, he founded Mt. Gox, an exchange for Bitcoin, allowing for Bitcoin-to-dollar trades. Although he was a fan of Bitcoin, he found the spending and energy consumption involved in Bitcoin mining excessive.

In 2011, McCaleb began work on “Newcoin” to explore a Bitcoin alternative with a more energy-efficient consensus algorithm. He recruited Schwartz and Britto, two developers, to help build the codebase. Britto, McCaleb, and Schwartz adapted concepts for this from the original Ripple Project. The Ripple Project was created in 2004 by Ryan Fugger. It was designed as a person-to-person exchange of personal credits or IOUs and functioned as a non-profit, run solely by Fugger. This person-to-person exchange mechanism influenced Newcoin’s path-finding algorithms, to allow the exchange of various assets. Newcoin ultimately led to the creation of the XRP Ledger and the digital asset XRP, which launched in June 2012.

Additionally, in 2012, Larsen joined the team. Larsen is a first-generation college student who completed his bachelor’s degree in accounting from San Francisco State University in 1984. After graduating, Larsen worked at Chevron as a financial auditor until 1989. He then attended the Stanford Graduate School of Business for his MBA in 1989. After graduating from Stanford in 1991, Larsen co-founded E-Loan, a mortgage lending service, where he expanded consumer access to credit scores. Then in 2005, he founded Prosper, a peer-to-peer lending marketplace. Not long after leaving Prosper in 2012, Larsen met Britto, McCaleb, and Schwartz and joined them to co-found his third business.

Newcoin was rebranded to OpenCoin in 2012 and then renamed Ripple Labs during the same year. The company ultimately settled on the name Ripple in September 2015. Ripple’s ecosystem was allocated 80 billion XRP, 80% of the pre-mined supply of 100 billion XRP to facilitate usage and additional development on the XRP Ledger. OpenCoin was originally created to facilitate peer-to-peer transactions between two parties in a trustless, decentralized system.”

In June 2013 McCaleb parted with the company over disagreements with the other founders on the vision for the company. He signed a separation agreement limiting the amount of XRP he could sell at once. In 2014 he founded a rival crypto project, Stellar (XLM), aiming to speed up cross-border payments. As of October 2024, Britto remains involved with Ripple as an advisor, and Schwartz remains the CTO. Larsen, however, stepped down from the CEO position to become the executive chairman in December 2016 where he planned to “continue to focus on steering the company's strategic direction.”

As of October 2024, Ripple is led by Brad Garlinghouse (CEO), David Schwartz (CTO and Chief Cryptographer), Monica Long (President), and Jon Bilich (CFO).

Product

Ripple is a fintech company that provides global payment solutions using blockchain technology. Its primary product is Ripple Payments, a blockchain-based solution designed to enable fast, cost-effective, and secure cross-border transactions for financial institutions, businesses, and banks. It operates as both a payment settlement system and a communications platform. Ripple Payments is built on the XRP Ledger, a blockchain that records and verifies transactions. To settle payments, Ripple utilizes XRP, the native token of the XRP Ledger, providing on-demand liquidity for cross-border financial transactions.

XRP Ledger

The XRP Ledger (XRPL) was created in 2011 by Britto, Larsen, and McCaleb and serves as a core component of Ripple’s technology since it allows for the secure transfer of money worldwide. XRPL is a decentralized, open-source blockchain managed by a peer-to-peer network. This structure allows for transactions on the blockchain to be verified and ordered by peers according to predefined rules. The original goal of XRPL in 2011 was to enable faster, more secure, and efficient global transactions. It was designed to be a more sustainable and scalable alternative to Bitcoin.

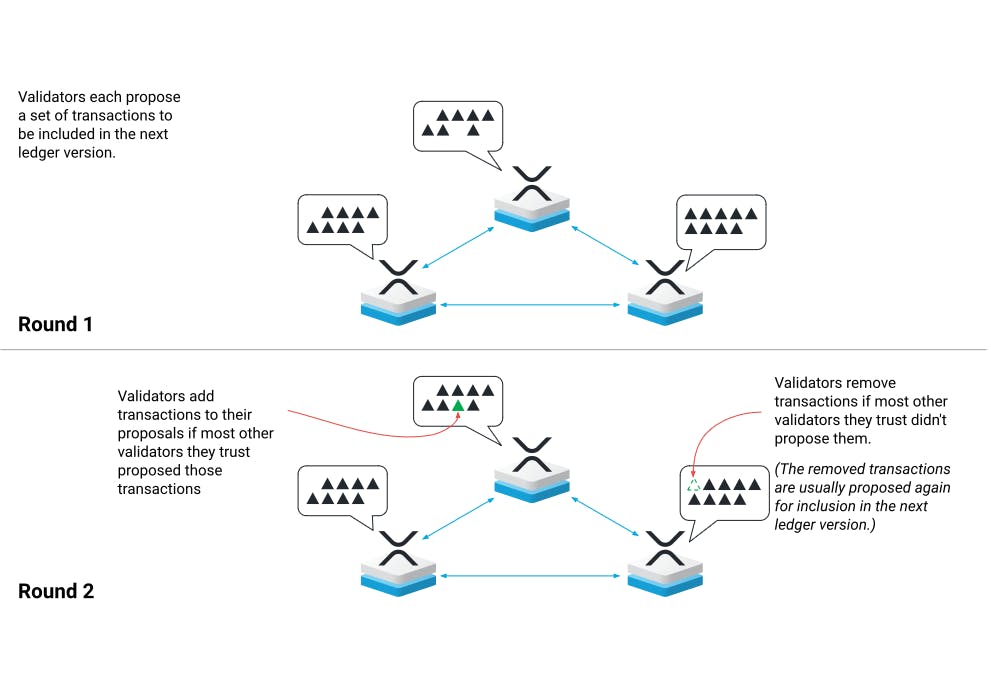

Similar to blockchain networks like Bitcoin and Ethereum, XRPL follows a protocol to confirm and execute transactions. XRPL uses a consensus protocol that enables users to agree on transaction order and validity without a central authority, allowing for secure progress even if some participants act unpredictably. Designated servers, known as validators, agree on the order and accuracy of XRP transactions. These validators are part of a peer-to-peer network that includes corporations, individuals, exchanges, wallet providers, foundations, and universities. Validators don’t receive monetary rewards and operate by forming trusted node lists, visible to everyone on the network to maintain transparency.

Source: XRPL

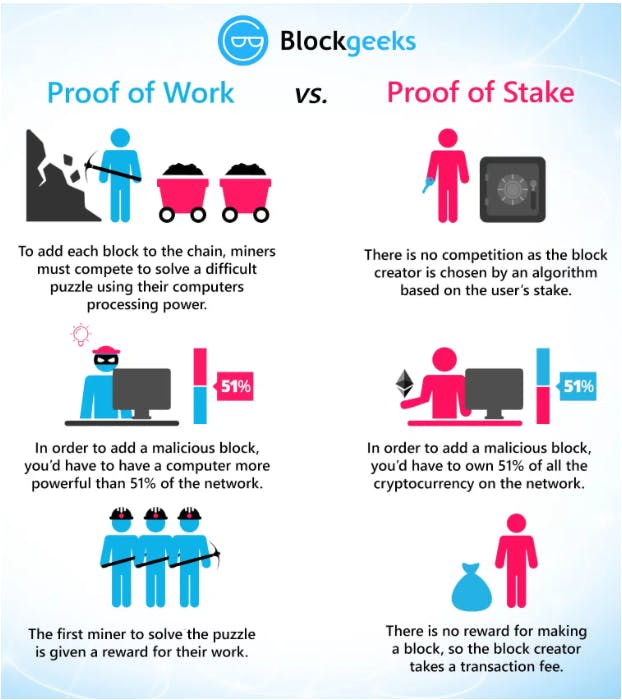

Meanwhile, Bitcoin uses the proof of work protocol, where miners compete to solve computational problems, requiring significant electricity and computing power. The miner that solves the problem first decides the order of transactions on the blockchain and is rewarded in the network's native currency. Ethereum, on the other hand, uses proof of stake, where validators stake their cryptocurrency to create a block and are rewarded by transaction fees.

Source: Blockgeeks

Another feature is that XRP, the native token, was pre-mined in 2012 with no future plans for mining. Changes to the XRPL protocol must be approved by the validator community, ensuring decentralized governance since anyone can transact on or view the ledger as of October 2024.

XRPL has transaction confirmations within three to five seconds and fees of less than one cent. In addition to payments, XRPL supports tokenization, NFTs, and decentralized finance. By 2021, XRPL had processed over 1.8 billion transactions, in comparison to Bitcoin, which processed its one billionth transaction in May 2024.

XRP

XRP is the native token of the XRPL, created in 2012 shortly after XRPL’s launch. XRP’s primary role is to improve liquidity between currencies, allowing financial institutions to exchange value between exchanges in international payments. XRP is also pre-mined with a fixed supply of 100 billion tokens, differentiating it in terms of scarcity and supply management from cryptos that rely on mining for issuance.

In September 2012, Ripple was gifted 80 billion XRP. This enabled Ripple to actively support the development of the XRP ecosystem. To ensure transparency, Ripple placed 55 billion XRP in escrow in 2017. This helped maintain that “the amount of XRP entering the general supply grows predictably for the foreseeable future” as of October 2024. 56.8 billion XRP are in circulation as of October 2024.

Ripple also uses XRP as a settlement layer, facilitating low-cost transactions on Ripple Net, Ripple’s commercial platform. It has been traded across exchanges including futures, options, and spot exchanges. By leveraging the processing capabilities of the XRPL, Ripple enables financial institutions and businesses to move value across international borders.

Payments

Ripple Payments is Ripple’s oldest product offering, launched in 2018. Ripple Payments was designed in part to provide an alternative to the SWIFT network by offering cross-border payments using XRPL and XRP.

SWIFT enables banks to communicate about money transfers using a standardized format, securing messages and transactions through a combination of physical and digital security measures. SWIFT remains the dominant method for processing cross-border payments as of March 2024, with an average of 44.8 million messages sent daily.

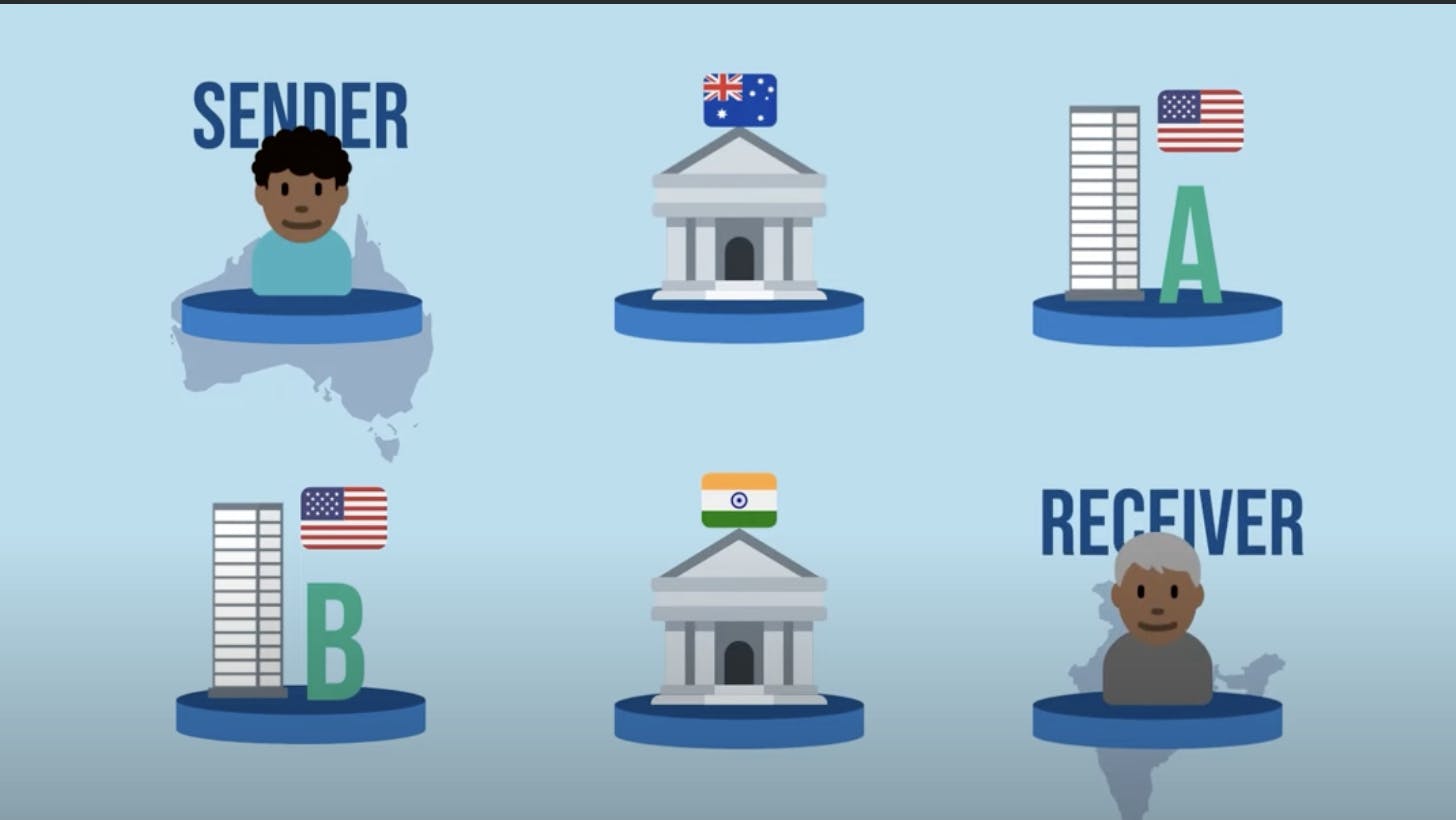

Transactions through SWIFT often involve intermediary banks, which hold a common currency, typically the US dollar, to facilitate currency exchange and ensure funds are delivered to the recipient in the correct currency. However, SWIFT transactions take between 1-5 days and involve fees ranging from 0.2-5%, largely due to intermediary banks, batch processing, and transaction timing during regular banking hours.

Source: Leapfrog crypto

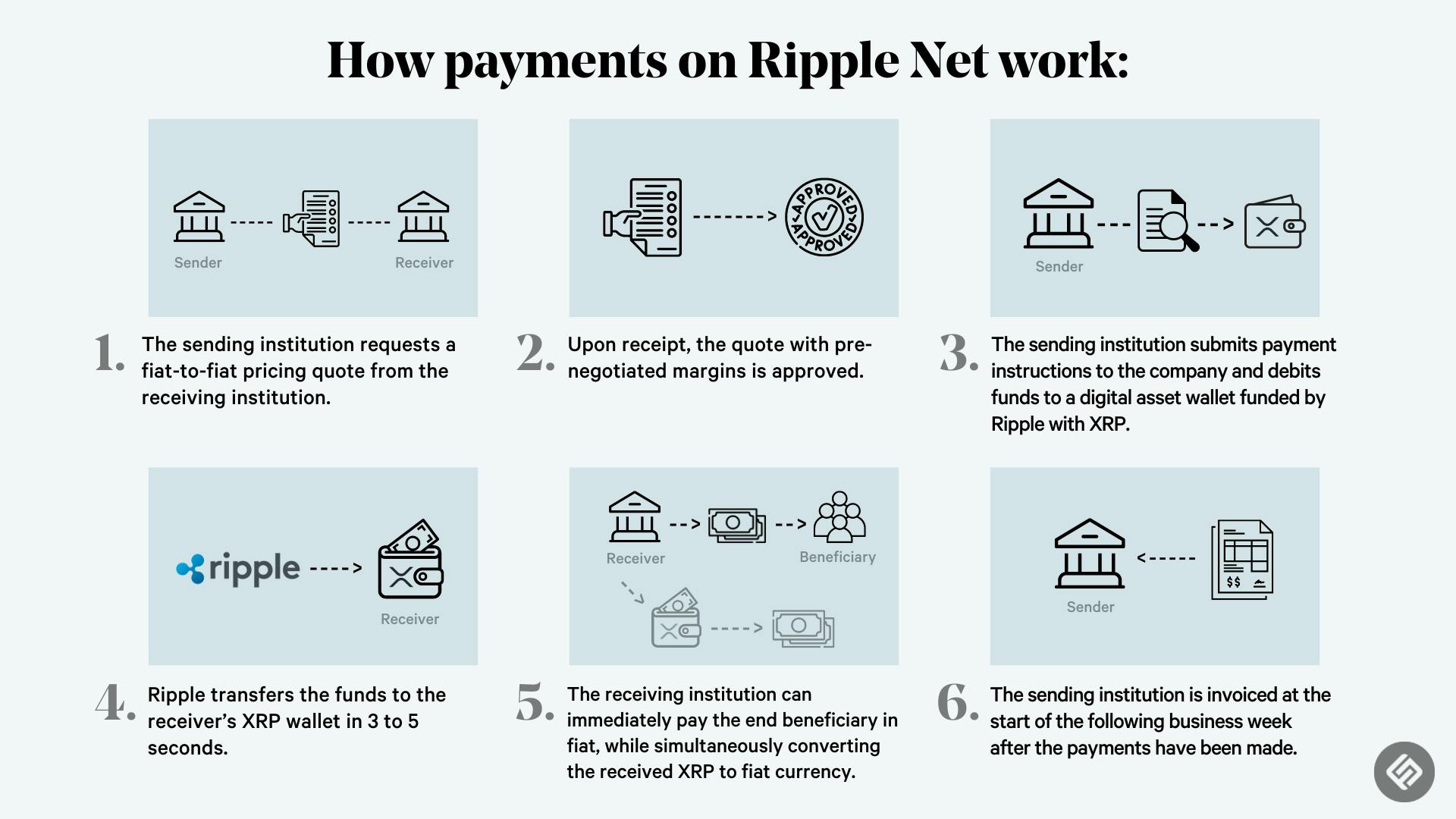

Ripple Payments offers cross-border transactions that take three to five seconds at a cost of $0.00001 per transaction as of September 2024. Ripple achieves this by facilitating direct communication between the sending and receiving institutions, eliminating the need for intermediary banks. The system transfers funds using XRP, with the receiving institution able to convert the XRP into local currency in seconds. This process eliminates the need for pre-funded accounts in foreign countries, where institutions typically hold capital to facilitate instant transactions. Ripple’s system uses a crediting-debiting mechanism, reducing the need to tie up trillions of dollars in pre-funded accounts.

Source: Forkast

All financial transactions are also reported in real-time publicly on the XRPL, which reduces the management costs of tracking and reconciling payments. While Ripple Payments provides client value in terms of cost and time, it lacks extensive network size and reputability.

In addition to its global transaction services, Ripple Payments allows clients to track payments, pre-validate transaction fees, and include supporting data such as invoices. This ensures transparency and reduces the management and settlement failure costs typically associated with cross-border payments.

Source: Harvard Business Review

The History of Ripple Payments

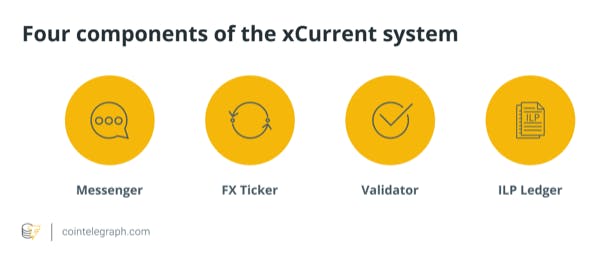

In 2018, Ripple’s business model was to develop and sell software built on top of XRPL. At the time, Ripple’s payment services were split into three products: xCurrent, xRapid, and xVia. xCurrent enabled secure, real-time communication between banks for international payments. xRapid facilitated liquidity for transactions using XRP as a bridge currency, particularly for lesser-traded currencies. xVia was an API that allowed companies, payment providers, and banks to send payments globally through Ripple’s network with ease, tracking payments and including details like invoices.

Source: Cointelegraph

In 2019, Ripple consolidated these products into RippleNet, a decentralized global network of banks, payment providers, digital asset exchanges, and corporates using Ripple’s technology for clearing and settling financial transactions. RippleNet continued to offer the functionality of xCurrent, xRapid, and xVia, but under one unified platform.

In November 2023, during the Ripple Swell Conference, RippleNet rebranded as Ripple Payments, continuing Ripple’s mission to streamline global transactions with faster speeds and lower costs.

Custody

Ripple’s digital asset custody includes the storage and protection of digital assets such as cryptocurrencies, stablecoins, and nonfungible tokens on behalf of their owners. Custody can be defined as solutions that store and safeguard investors’ digital assets by managing and securing their private keys. Ripple Custody is an institutional-grade custody software with regulatory approval from the New York Department of Financial Service. It offers an integrated solution to safe-keep private keys and manage access to these keys.

Ripple Custody is designed for banks, digital banks, neobanks, and crypto businesses, providing them with secure solutions for holding, managing, trading, and transferring digital assets. Ripple’s flexible deployment options allow these institutions to use cloud infrastructure, their own servers, or data centers, while key management solutions are also customizable to meet their specific needs.

In October 2024, Ripple expanded its crypto custody business with new features designed to help banks and fintech companies securely store digital assets for its clients. Ripple’s new Ripple Custody division offers tools such as pre-set operational and policy configurations, anti-money laundering (AML) monitoring, and seamless integration with the XRP Ledger (XRPL). A new, user-friendly interface simplifies the custody process. This marks Ripple’s strategic move to diversify beyond its payment solutions, branching further into asset custody to support its clients in the evolving digital asset landscape.

Banks use Ripple Custody to help clients diversify their portfolios with tokenized assets and ensure compliance with digital asset regulations. Neobanks and digital banks leverage Ripple’s custody solution to offer secure crypto trading and tokenized asset services, while cryptocurrency businesses use it to expand their service offerings, deploy offline (cold) storage, and minimize transaction fees.

Ripple Custody utilizes private keys which are alphanumeric codes, combinations of letters and numbers that serve as unique identifiers, generated by cryptocurrency wallets. Private keys are used to authorize transactions and prove ownership of blockchain assets. The security of digital assets is governed by the security of the owner’s private keys. As a result, the storage and safeguarding of these keys is paramount in protecting the owner’s digital assets from hacking or theft.

Ripple entered the digital custody services market in May 2023, through its acquisition of Metaco, a provider of institutional digital asset custody solutions. In June 2024, it acquired Standard Custody & Trust Company, a digital asset custodian dedicated to bringing security to institutions, to underscore its commitment to regulatory compliance and strengthen its existing offering.

The market cap for tokenized assets (excluding Bitcoin and stablecoins) is estimated to reach approximately $2 trillion by 2030, requiring digital custody solutions to manage these tokens. Companies like BlackRock, WisdomTree, and Franklin Templeton have begun adopting tokenized money market funds, with these funds surpassing $1 billion in total value in Q1 of 2024. These companies require custody solutions to effectively manage and safeguard their clients’ assets.

Stablecoin

Stablecoins are cryptocurrencies designed to maintain a stable value, typically collateralized by fiat or cryptocurrency and managed by companies or decentralized blockchains. Stablecoins have grown to become the third most popular crypto sector as of 2023, offering users the opportunity to borrow, lend, and conduct daily transactions with the security of a low-volatility currency.

As of May 2022, stablecoins provided around 45% of the liquidity in decentralized exchanges. Stablecoins can be used or purchased globally, provide the ability to engage with smart contracts across the public blockchain ecosystem, and offer lower transaction costs compared to traditional banking.

In April 2024, Ripple announced its intention to launch a US-dollar pegged stablecoin, Ripple USD (RLUSD). In September 2024, CEO Brad Garlinghouse indicated a launch timeline of weeks from the announcement. Garlinghouse stated that plans to launch the stablecoin were made after USD Coin lost its dollar peg in March 2023, due to a loss of collateral from Silicon Valley bank. In releasing RLUSD, Ripple aims to attract more users to the XRP Ledger ecosystem and further build partnerships with financial institutions that prefer stability over the volatility of unpegged digital assets.

Ripple’s strategy around RLUSD prioritizes compliance and transparency, especially given its institutional and government-focused clientele. As Ripple’s primary clientele is composed of institutions and governments, it is focusing on issuing a “compliance-first” stablecoin that aligns with global regulatory standards. Ripple is prioritizing transparency by employing periodic and independent audits of their stablecoin reserve to ensure security and maintain a strong reputation, particularly following the loss of trust USDC experienced after losing its peg in March 2023.

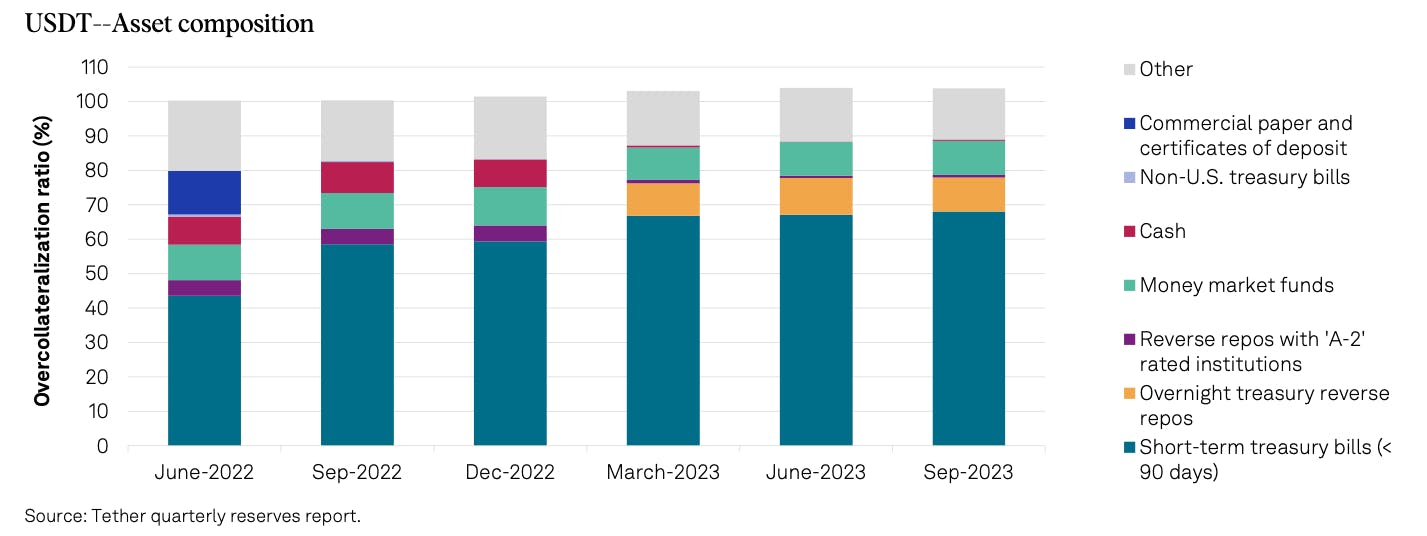

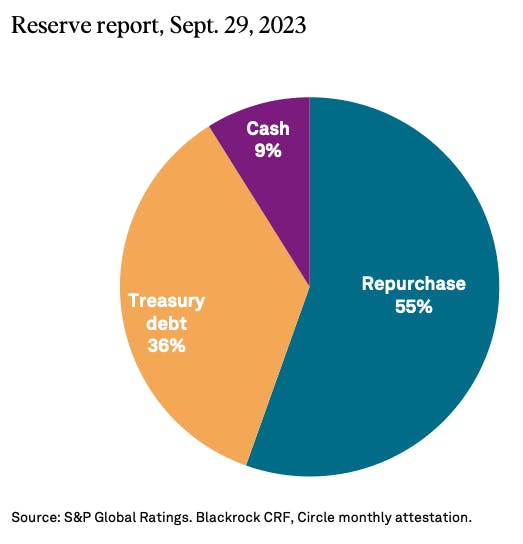

RLUSD is set to be backed fully by US dollar deposits, short-term US government treasuries, and other cash equivalents, representing a comparable profile to USDC and a relatively low-risk reserve composition compared to Tether. In 2023, approximately 10% to 12% of Tether’s reserves were comprised of “Other”. RLUSD’s reserve composition holds approximately the same risk as USDC, which is a fully fiat-collateralized stablecoin that is backed by repurchase agreements, treasury debt, and cash.

Ripple began beta testing RLUSD with enterprise partners on the Ethereum mainnet and XRP Ledger in August 2024, though it had not yet been widely released or gained full regulatory approval by that time. In addition to RLUSD, Ripple plans to offer both RLUSD and XRP for global payment services to its clients, further solidifying its presence in the stablecoin market.

CBDC Platform

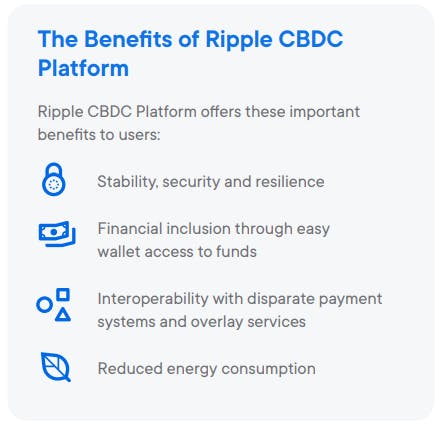

The Ripple Central Bank Digital Currency (CBDC) platform is designed as a comprehensive solution to help governments launch and manage their own secure and reliable CBDCs.

A CBDC is a digital form of fiat currency, issued and backed by a central bank, that can be used by individuals and businesses for everyday transactions, much like physical cash. Ripple's CBDC platform supports central banks in creating digital currencies that foster financial inclusion, reduce fraud, stimulate payment innovation, and offer a new avenue for monetary policy.

Ripple’s CBDC platform operates on a private ledger that leverages the same technology as the XRP Ledger (XRPL). This platform provides full support through the CBDC lifecycle, from minting and management to secure transactions. The tokenization feature further enhances payment privacy and efficiency, while integrating with existing systems.

Source: Ripple

Although Ripple does not prominently list its CBDC platform on its website, it is engaging directly with central banks for its soft launch. Ripple has announced partnerships with the governments of Palau, Bhutan, Montenegro, Hong Kong, and other undisclosed countries to pilot their CBDC initiatives.

Market

Customer

Ripple's core customers are primarily financial institutions and payment service providers. Its cross-border payments product is utilized by companies such as Azimo, Tranglo, and Novatti, all of which focus on enabling international payments. Ripple's extensive network is employed by hundreds of banks, from smaller institutions to large multinationals like Bank of America and Santander, to enhance the efficiency of cross-border transactions.

Ripple's technology is particularly aimed at banks, neobanks, payment service providers, and cryptocurrency businesses, addressing key pain points in the global payment system, including high fees and slow transaction times. Ripple’s products are also employed by organizations like the Bill and Melinda Gates Foundation to expand financial infrastructure and facilitate low-cost micro-payments in emerging markets.

Ripple also prioritizes partnerships with organizations that have a clear path to commercializing the technology, opting for long-term collaborations over short-term pilot programs. This focus allows Ripple to build relationships with players in the financial ecosystem.

Market Size

Ripple operates across three markets: global payments, digital asset custody services, and stablecoins.

Global Payments

The global payments market is projected to reach $2.2 trillion by 2027, up from $1.6 trillion in 2022. Between 2017 and 2022, the payments industry experienced an 8.3% annual growth rate, and growth is estimated at a CAGR of 6.2% from 2023 to 2027.

Transaction-related revenues are expected to increase by 7.1% through 2027, a drop of 1.9% compared to the five years prior to September 2023 due to shifts in the payments landscape. Consumer digital account-to-account payments are expected to surpass card payments in revenue contribution during this time. The global cross-border payments market was valued at $181.9 billion in 2022 and is expected to grow at a CAGR of 7.3% from 2023 to 2032.

Issuer revenues grew at an 8% CAGR between 2017 and 2022 but are projected to moderate to a 5.5% CAGR through 2027. Additionally, transaction banking, a $536 billion market in 2023, is expected to grow at 6.6% annually through 2027.

Digital Asset Custody Services

The global digital asset custody market was valued at $447.9 billion in 2022 and is expected to grow at a CAGR of 23.7% from 2022 to 2028. Key drivers of this growth include increased institutional adoption, greater participation from institutional investors, and the establishment of stricter regulatory frameworks around digital assets. Custodial services that align with these regulations offer enhanced security, regulatory compliance, and risk mitigation, which appeal to institutional clients.

Several major initiatives have marked the progression of this market, such as HSBC launching institutional-grade custody services for tokenized securities using Metaco’s technology in 2024, DZ Bank in Germany unveiling its institutional digital asset custody platform in 2023, and Taurus partnering with Deutsche Bank to provide digital asset custody and tokenization services.

Stablecoins

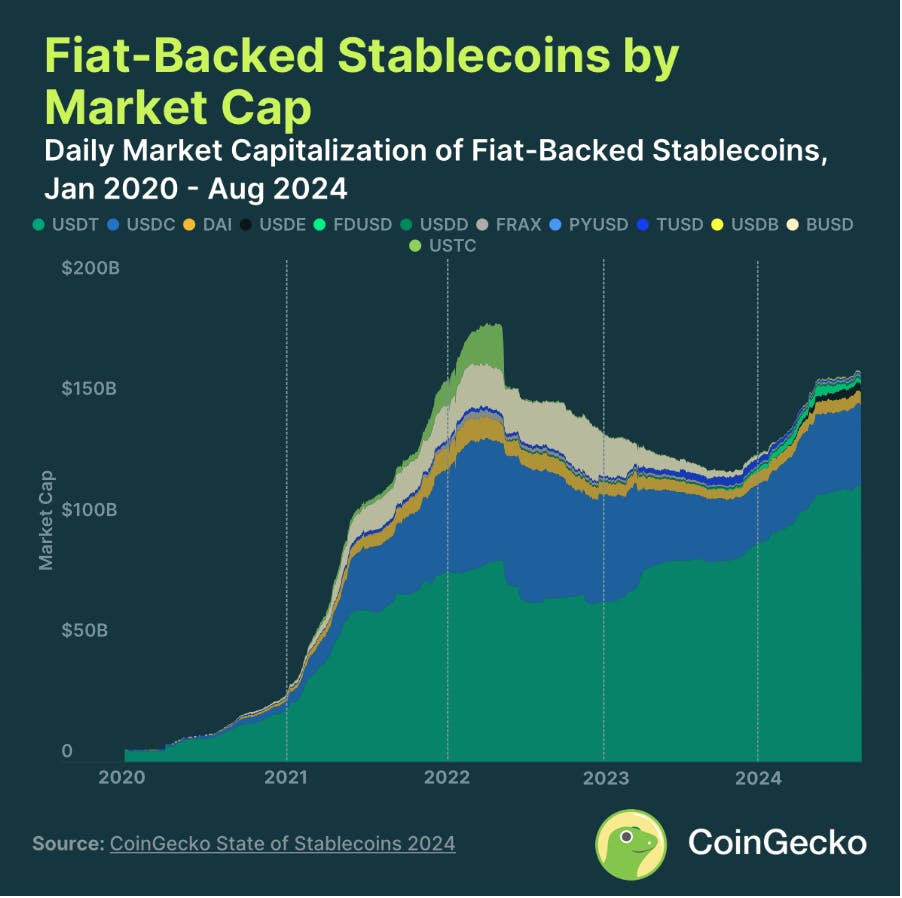

In 2024, the average market cap of stablecoins was $154.6 billion and ranged between $130 billion to $172.4 billion. This market cap has remained at an average market cap of $147.8 billion since 2022, with a $65.5 billion downward fluctuation through the crypto winter period beginning in late 2022.

Source: CoinGecko

Stablecoins are expected to continue growing due to their appeal to crypto enthusiasts and crypto skeptics which stems from their peg to fiat currencies and lower perceived risks compared to more volatile cryptocurrencies like Bitcoin and Ethereum. The market is also concentrated, with 69.8% of the stablecoin market dominated by USDT as of October 2024.

Competition

Competitive Landscape

The primary competitors for Ripple are companies that provide international transaction services, which represent Ripple’s legacy offering and its least experimental revenue source. Key factors that these companies optimize for include transaction speed, cost, global reach, currency support, security, and liquidity management. Most competitors leverage a combination of SWIFT technology and local payment networks, such as SEPA and ACH, to enhance their service offerings.

The continuous improvement of SWIFT technology allows these companies to quickly adapt and innovate, thereby diminishing Ripple’s competitive advantages in transaction cost and speed. Additionally, their reliance on trusted SWIFT technology aids in securing institutional clients.

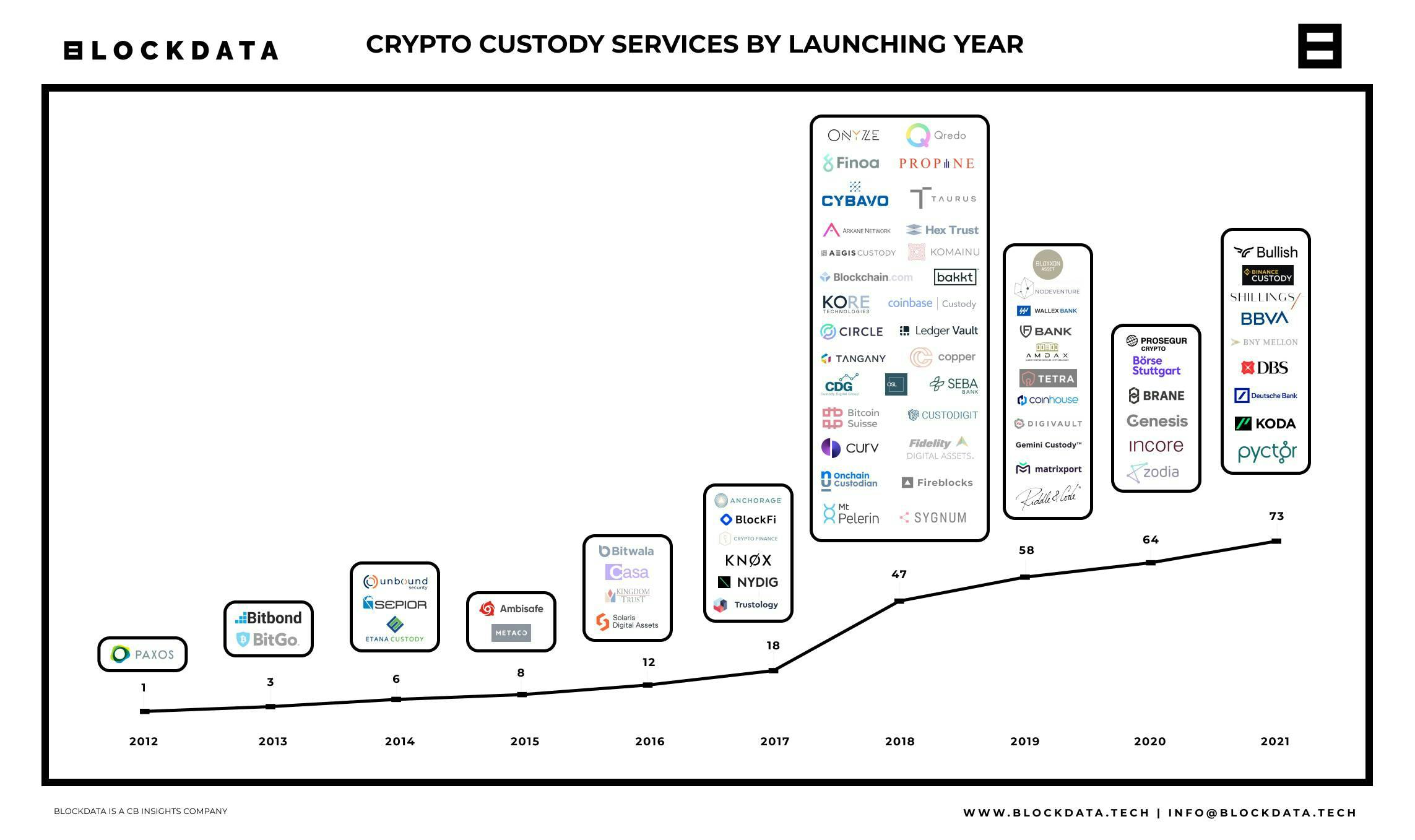

Ripple’s secondary competitors encompass firms that offer digital custody services and stablecoins. The company entered the digital custody services market in mid-2023 with its acquisition of Metaco and further solidified its presence in June 2024 through the acquisition of Standard Custody. Founded in 2015 in Switzerland, Metaco provided custody solutions for digital assets, including cold storage, hot wallets, and staking services, with a clientele that included DZ Bank, BNP Paribas, VP Bank, HSBC, and Citi. Standard Custody, established in 2018, developed a strong reputation in the blockchain space, particularly with Solana.

Source: CB Insights

The most important qualities of a digital custody service include strong security infrastructure, regulatory compliance, insurance coverage, and scalability options. Ripple's competitive advantages in the digital custody domain lie in its self-owned internal blockchain, third-party verification, end-to-end encryption, and distributed trust systems that extend beyond traditional multi-signature security. Furthermore, its approach does not require manual operations for handling cryptographic keys, making it safer than conventional cold storage custody solutions.

In the stablecoin market, which Ripple has not yet entered as of October 2024, maintaining stable value, ensuring security, offering transparency, and providing liquidity are paramount qualities. Ripple will need to build trust with users to gain market share in this highly concentrated market, which is currently dominated by Tether and Circle. Key competitors for Ripple’s RLUSD stablecoin include USDT, which has a market cap of approximately $56 billion, and USDC, with a market cap of around $6.8 billion.

Global Payment Services

Wise Business: Wise is a money services business provider and alternative to banks, providing banking services, money transfers, foreign exchange, and spending analytics. Wise’s money transfer offering competes with Ripple Payments, utilizing SWIFT to facilitate international transactions.

Though Wise uses SWIFT, it further cuts the costs of transactions by applying mid-market exchange rates with a small fixed fee and claims to conduct cross-border transactions in under 20 seconds. For example, transferring $100K to Euros costs $223 in fees (including the wire transfer fee and Wise’s fee), or 0.22% of the transaction amount. While Wise is more expensive than Ripple, Wise has an extensive network, offering more than 40 currencies, and is trusted by more than 600K businesses such as Del, Bolt, Ramp, Monzo, and Google.

Wise, previously known as TransferWise, was founded in 2011. It raised $1.7 billion across various funding rounds before its direct listing on the London Stock Exchange (LSE) in July 2021. Notable investors include Silicon Valley Bank UK and Fidelity. It has a market cap of £7.5 billion (approx. $9.7 billion) as of October 2024.

Revolut: Revolut, founded in 2015, is an app-based banking alternative that enables users to send, spend, and exchange money instantly. Revolut’s business offering allows enterprises to transfer money across borders securely and access funds in more than 25 currencies. Revolut is a competitor to Ripple Payments, but supports both SWIFT and SEPA transfers, automatically selecting the cheapest and fastest transfer service for the intended transaction.

Rather than utilizing a per transaction fee model, Revolut offers monthly plans that include a set number of no-fee international and local transfers. Revolut business is used by companies like Deel, Wild, TropicFeel, and Creditspring. Revolut claims to support more than 17K new businesses monthly as of October 2024. It has raised over $1.7 billion from investors including DST Global, Index Ventures, and Ribbit Capital, and has achieved a valuation exceeding $33 billion as of 2021.

Airwallex: Airwallex is a financial technology company providing cross-border payment solutions and global financial infrastructure for businesses. Airwallex utilizes SWIFT and local payment networks such as SEPA and ACH to power timely and inexpensive payments, claiming that over 90% of Airwallex payments go through these local payment rails rather than SWIFT. While Airwallex still relies on conversion rates, Airwallex offers interbank exchange rates and claims not to add hidden markups.

Compared to Ripple, Airwallex’s payment system is more vertically integrated, offering global transaction services, bill pay, borderless cards, expense management, and banking as a service. Founded in 2015, Airwallex has raised $902 million. Its key investors include DST Global, Sequoia Capital China, Tencent, Hillhouse Capital, and Salesforce Ventures.

Roxe: Roxe provides a blockchain-based global payments network aimed at improving the efficiency and reducing the costs of cross-border transactions. It leverages blockchain technology to offer payment solutions. Roxe runs on Roxe Chain, a private-public hybrid blockchain used for payments.

Though similar to Ripple through its use of blockchain technology, Roxe does not require its partners to transact with cryptocurrency within their workflow. Roxe claims to be currency agnostic and instead uses a variety of tokens like Roxe Cash, DO, and roFIAT. DO operates like a stablecoin and is collateralized by Roxe Cash and the US dollar, while roFIAT is the currency used for transfer. Roxe’s payment fee is $0.70-$1.50 per transaction.

Roxe has 38 partners, operates between 114 countries, and supports more than 50 currencies. Ripple appears to have more market coverage and media coverage than Roxe, despite similar product offerings and underlying technologies. Founded in 2018, Roxe raised $49 million in funding, through investors such as Alameda Research. In 2022, Roxe was set to go public through a $3.6 billion merger with Goldenstone Acquisition Ltd, however, both parties terminated the deal, likely due to the crypto winter period.

Digital Custody Services

BitGo: BitGo offers secure, institutional-grade custody solutions, serving over 1.5K institutional clients across more than 50 countries. It supports more than 300 coins and tokens, with services including custodial wallets, regulated cold storage, staking, and trading. BitGo pioneered multi-signature wallet technology and is responsible for custodial oversight of approximately 20% of all on-chain Bitcoin transactions by value. It charges clients based on a monthly percentage of assets under custody (AUC).

Over time, BitGo has expanded its offerings from wallets and storage to include trading, lending, borrowing, and DeFi participation. In 2022, it introduced the Threshold Signature Scheme (TSS), a multi-party computation (MPC) protocol, alongside its multi-signature technology. Multi-signature wallets require multiple approvals for transactions, which can increase costs and processing times due to the larger data requirements on the blockchain. In contrast, MPC distributes key shares among different parties, enhancing security without requiring multiple approvals. This TSS innovation has allowed BitGo to support more coins, lower transaction fees, and improve processing speed.

Both BitGo and Ripple employ similar technologies and offer comparable solutions; however, BitGo's long-standing presence in the market, extensive client base, and technological advancements have solidified its market position. Founded in 2013, BitGo has raised approximately $171.5 million. In August 2023, it secured $100 million in Series C funding at a valuation of $1.8 billion from investors such as Goldman Sachs and Redpoint.

Fireblocks: Fireblocks provides blockchain security services for institutions, facilitating the secure movement, storage, and issuance of digital assets. Its platform supports digital asset settlement, DeFi access, and crypto payments. Fireblocks serves exchanges, custodians, banks, and hedge funds by leveraging its patient-pending Intel SGX hardware enclave and multi-party computation technology to enhance asset security.

The Fireblocks Network connects to all major exchanges and trading venues, offering instant settlement, fiat banking integration, and API connectivity. With support for over 950 tokens and 30 protocols, Fireblocks eliminates the need for manual deposit addresses. It is SOC 2 Type II certified and offers up to $30 million in insurance coverage for assets both in storage and transit.

Fireblocks and Ripple provide similar digital asset custody solutions, focusing on secure management, trading, DeFi access, and tokenization. Fireblocks has seen significant growth, tripling its revenue from $50 million in 2021 to $150 million in 2022, and expanding its customer base from 150 in 2021 to 1.8K by 2023. The company has processed over $4 trillion in transactions and created more than 130 million wallets.

Founded in 2018, Fireblocks has raised $1 billion in funding, including a $550 million Series E round in 2022, led by Spark Capital and supported by General Atlantic, Iconiq Strategic Partners, and CapitalG.

Crypto Exchanges

Major crypto exchanges like Coinbase and Gemini also offer institutional custody products as part of their platforms.

Coinbase: Coinbase is an online platform for buying, selling, transferring, and storing cryptocurrency. Coinbase’s custody offering supports over 400 assets and provides cold storage, insurance, and audit trails while enabling access to other trading, lending, and borrowing products. Coinbase was founded in 2012 and went public in 2021 with a market cap of $86 billion. It has a market cap of $50.1 billion as of October 2024.

Gemini: Gemini is a regulated exchange and custodian that offers trading, lending, borrowing, and staking services. Gemini Custody uses multi-signature technology, role-based governance, and physical security measures such as biometric access to protect customer assets. The platform offers $75 million in insurance coverage for cold-stored assets and supports over 100 crypto assets. Gemini was founded in 2014 and has raised $424.9 million from investors like Jane Street Capital.

Stablecoin Companies

RLUSD’s key competitors in the stablecoin market include USDT (with a $56 billion market cap) and USDC (with a $6.8 billion market cap).

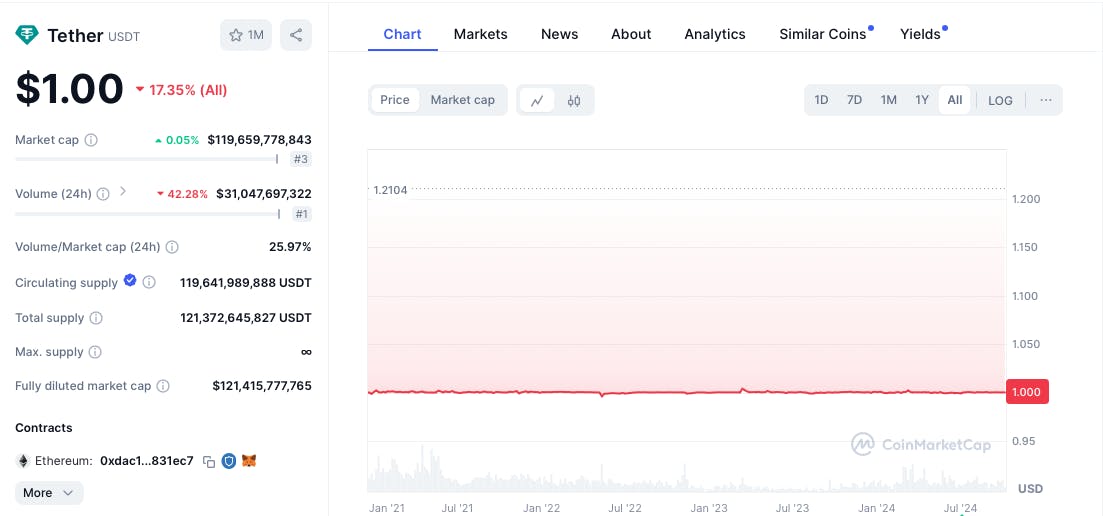

Tether: Tether Limited is the company that introduced USDT, an asset-backed stablecoin, in 2014. Tether is a blockchain-based platform that powers stablecoins pegged to the value of traditional currencies. USDT, which is tied to the US dollar, is the most popular stablecoin and is widely used in cryptocurrency trading as a stable store of value. As of September 2024, USDT held a 75% market share with a total supply of $118 billion, making it the dominant stablecoin.

USDT distinguishes itself as the first and most widely used stablecoin, consistently ranking among the highest in market capitalization, typically just below Bitcoin and Ethereum. Available on numerous cryptocurrency exchanges, USDT has maintained a high level of stability, even during the 2022 crypto winter, with a narrow fluctuation range between $0.9959 and $1.0041 from 2021-2024.

Source: Coinmarketcap

To maintain this stability, each USDT is 100% backed by reserves, consisting primarily of US treasury bills, overnight reverse repurchase agreements, and money market funds. This reserve structure ensures that USDT remains a reliable option for investors seeking a stable cryptocurrency.

Source: S&P Global

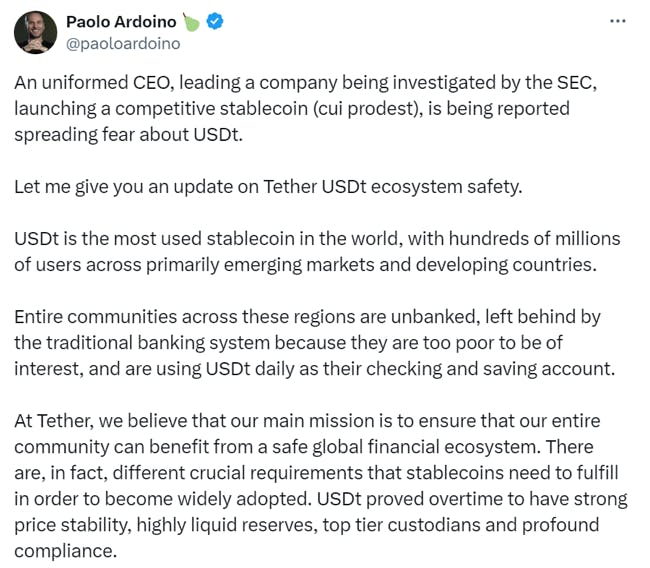

In May 2024, Ripple CEO Brad Garlinghouse remarked that “The U.S. government is going after Tether,” suggesting increased scrutiny on Tether. In response, Tether CEO Paolo Ardoino dismissed rumors about USDT’s compliance, emphasizing its regulatory adherence.

Source: X

USDT stands as a major competitor to RLUSD, Ripple’s stablecoin, due to its widespread use, stability, and entrenched position in the market. However, RLUSD is expected to gain market share as it becomes integral to the Ripple Payments ecosystem.

Circle: Circle is the company that issues USD Coin (USDC), the second-largest stablecoin by market capitalization. In 2018, after raising $110 million from notable investors like Goldman Sachs and Breyer Capital, General Catalyst, Access, and Bitmain Technologies, Circle launched USDC. The stablecoin is fully fiat-collateralized, with its reserves consisting mainly of treasury debt and US treasury repurchase agreements held at the CRF, an SEC-registered fund managed by BlackRock.

In March 2023, Circle faced a significant challenge when $3.3 billion of its assets were held with Silicon Valley Bank (SVB), which defaulted. This led to USDC briefly de-pegging from the US dollar. However, Circle quickly shifted its cash reserves to BNY Mellon, restoring the stability of USDC.

Source: S&P Global

As of October 2024, USDC ranks sixth in cryptocurrency market capitalization, with a value of $35.6 billion. Since the SVB incident, USDC has maintained a stable peg to the US dollar with minimal fluctuation.

Source: Coinmarketcap

Compared to USDT, USDC is often viewed as having better transparency and regulatory compliance. Circle publishes monthly reports on USDC's reserves and has a strong commitment to adhering to regulations. Despite USDT's larger market cap, USDC is favored in the US for higher transaction volumes and is experiencing faster growth internationally.

Business Model

Revenue

Ripple operates a software-as-a-service (SaaS) model, charging financial institutions subscription fees with tiered pricing based on the number of transactions processed annually. In place of traditional bookings and revenue-based incentive plans, Ripple implemented a commission system tied to a strategic point value. Points are assigned to financial institutions based on various factors, such as the number of transactions, forex activity, and whether they are international banks. Ripple also offers discounts and removes integration fees depending on transaction volume and the speed of implementation. XRP does not realize revenue from transaction fees (minimum of 0.00001 XRP) as the transaction cost is irrevocably destroyed and not paid to any party.

While Ripple’s primary revenue source in 2019 was its XRP sales, it prioritized maintaining healthy XRP markets. To this end, Ripple placed limits on the sale of its XRP holdings, capping it as a percentage of the token's traded volume. This strategy reflects Ripple's commitment to balancing its reliance on XRP sales with its broader goal of building a sustainable business model around its payment solutions. Ripple has also invested around $500 million in over 60 different companies including participating in Futurevere’s $54 million Series A funding round and investing in BitStamp, a European cryptocurrency exchange.

Costs

Human capital costs account for most of Ripple’s expenses. In a typical SaaS business, sales and product development each account for one-third of expenses, with the remaining costs going towards marketing and admin.

Traction

As of October 2024, more than 2.8 billion worth of transactions were processed between counterparties representing more than $1 trillion in value, and there were more than 5 million XRP wallets globally.

Customer Traction

Banks

More than 100 financial institutions use Ripple Payments. Customers include Bank of America, PNC Bank, American Express, Santander, Canadian Imperial Bank of Commerce, Kotak Mahindra Bank (India), Itaú Unibanco (Brazil), IndusInd (India), InstaReM (Singapore), BeeTech (Brazil), Zip Remit, LianLian, RAKBANK (UAE), IFX, TransferGo, Currencies Direct, Airwallex, SEB (Sweden), SBI Remit (Japan), Siam Commercial Bank (Thailand), and Krungsri (Thailand).

Governments

In June 2024, Ripple CEO Garlinghouse claimed that “Ripple has invested and is working with about 10 different governments around the world to do central bank digital currencies. A central bank digital currency is a stablecoin. It’s just issued by the government”. In May 2023, Ripple was reported to have been in discussions with more than 20 countries regarding central bank digital currency plans.

In 2023, Ripple stated that it is working with the governments of Palau, Bhutan, Montenegro, Hong Kong, and other unnamed countries to manage the full CBDC lifecycle. Bhutan’s central bank and the Central Bank of Montenegro have announced plans to work with the Ripple CBDC platform in a national pilot. The Republic of Pulau is working with Ripple to create a CBDC. Colombia’s central bank is exploring blockchain use cases with Ripple to pilot using Ripple’s CBDC platform.

Partnerships

In 2019, Ripple bought a $30 million stake in Moneygram. The deal allowed Moneygram to use Ripple Payment for cross-border payments and foreign settlement. For undisclosed reasons, Ripple terminated its partnership with Moneygram in March 2021.

In 2022, Ripple announced a partnership with Lunu to support its luxury retailers in accepting cryptocurrency as a form of payment in-store and online using Ripple’s liquidity hub. However, in January 2024, Lunu announced a partnership with Gate Pay to accept instant cryptocurrency payments which could create a conflict of interest. It is unclear whether the partnership between Ripple and Lulu remains intact.

Valuation

As of October 2024, Ripple had raised a total of $293.8 million across 14 fundraising rounds. It was valued at approximately $11.3 billion as of January 2024. It has previously attracted investors including The K Fund, Azure Ventures Group, 10x Capital, Pario Ventures, Abstract Ventures, Accenture, Andreessen Horowitz, Hinge Capital, Thirdstream Partners, CME Ventures, and Lightspeed Venture Partners.

In December 2019, Ripple announced $200 million in Series C funding which valued it at $10 billion. However, in January 2022, Ripple bought back all the Series C shares distributed from preferred shareholders at a $15 billion valuation. This buyback was motivated by strong company performance in 2021 and developments in the SEC’s case against Ripple. In January 2022, Ripple claimed to be cash flow positive, with $1 billion in the bank, and reported that the number of transactions on RippleNet had “more than doubled”.

In January 2024, Ripple announced a plan to buy back $285 million in shares from early investors and employees as part of a $500 million funding initiative. This buyback aimed to convert restricted stock units into shares and cover taxes, providing liquidity to early investors and employees while giving Ripple's leadership more strategic control over the company's equity. The motivation behind this move was Ripple's partial victory in its legal case with the SEC, where a 2023 ruling stated that programmatic sales of XRP were not considered securities, positively impacting Ripple's market confidence.

At the time of this buyback, Ripple indicated its intent to continue buybacks regularly, ensuring more liquidity for investors while avoiding immediate plans to go public in the US due to ongoing regulatory challenges. By repurchasing shares, Ripple is strategically positioning itself for greater control over its future direction.

Key Opportunities

Low Reliance on VC

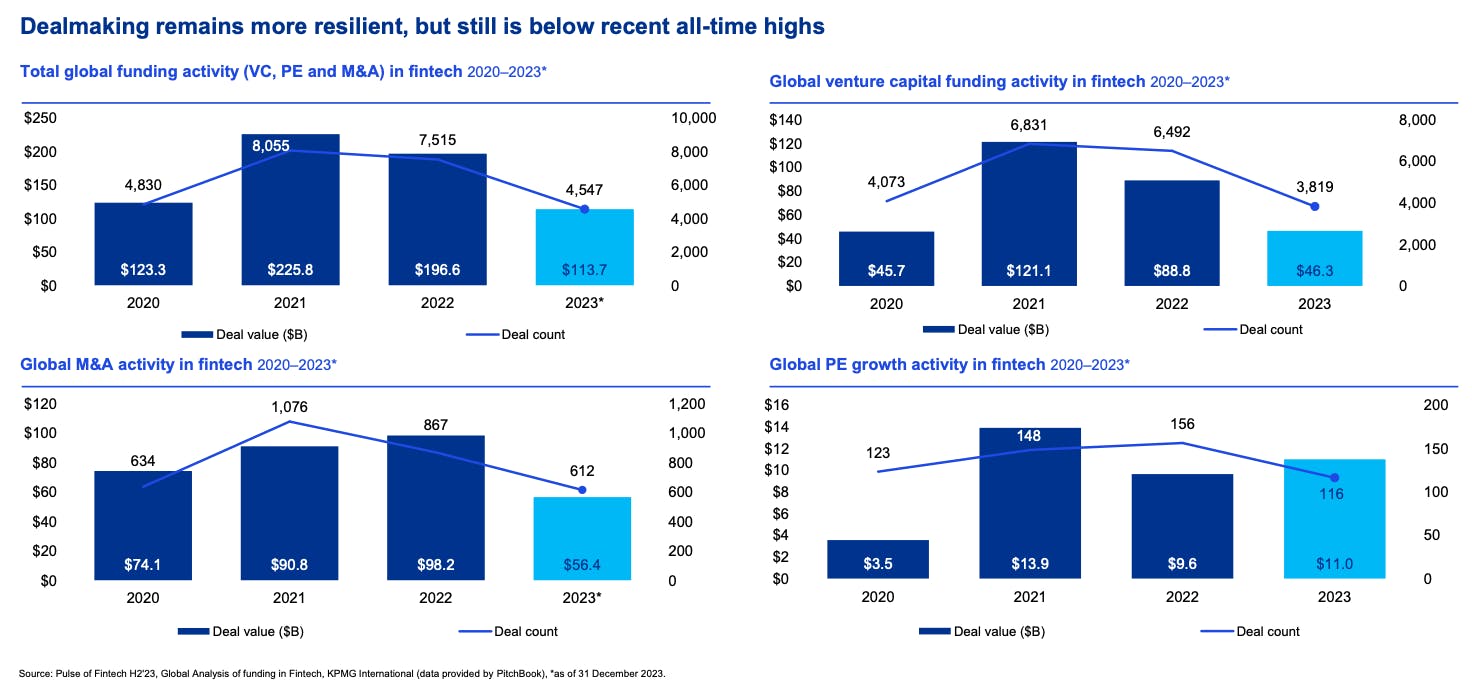

In 2023, investment sentiment in the fintech industry saw a notable decline, with total global funding activity declining by 50% from 2021 to 2023. The decline was particularly stark in VC funding, where both deal count and deal value decreased significantly, by 44% and 62% respectively. This trend has affected many of Ripple's competitors, such as Airwallex and Revolut, which have relied on raising additional capital from VC firms to fund operations and growth.

Source: KPMG

For example, Airwallex, one of Ripple's payment competitors, was valued at $5.5 billion in 2022 and processed $50 billion in annualized transactions. Despite raising $100 million in October 2022, Airwallex's valuation did not increase, reflecting the dwindling investor sentiment in the fintech space.

In contrast, Ripple has employed a different strategy — buying back shares from early investors and employees rather than relying on external fundraising. This approach allows Ripple to maintain strategic control and remain less vulnerable to the volatility of VC. While competitors' innovation and profitability might be negatively impacted by the decreased investment activity in fintech, Ripple could continue executing its long-term strategy with fewer disruptions.

Global Climate Regulations

In August 2024, the IMF proposed an 85% tax on crypto mining as part of an initiative to reduce carbon emissions from energy-intensive sectors like AI and crypto mining. Additionally, in July 2024, the Biden administration proposed a 30% digital asset mining energy tax. These tax policies could potentially slow down crypto mining activities, leading to longer transaction times, reduced participation in crypto networks, and negative market sentiment due to decreased miner activity.

Blockchains like Bitcoin, which require significant energy consumption for proof-of-work mining, may struggle to attract miners under these new tax burdens. In contrast, Ripple's XRPL operates on a more energy-efficient proof-of-consensus mechanism, allowing it to continue operations unaffected by such taxes. This energy efficiency presents a strategic advantage for Ripple, potentially attracting developers and increasing XRP usage on the XRPL. As a result, Ripple may have an opportunity to further vertically integrate its offerings within the XRPL ecosystem, strengthening its market position amidst changing regulatory landscapes.

XRPL’s consensus protocol is also more energy-efficient than proof of work. For example, processing 60 million transactions on XRPL uses 474K kWh of electricity, compared to Bitcoin’s 57.1 billion kWh for the same volume. Likewise, XRP emits 270 metric tons of CO2 compared to Bitcoin’s 28 million metric tons. As the first carbon-neutral blockchain, XRPL differentiates itself through its sustainability.

Government Interest in Central Bank Digital Currencies

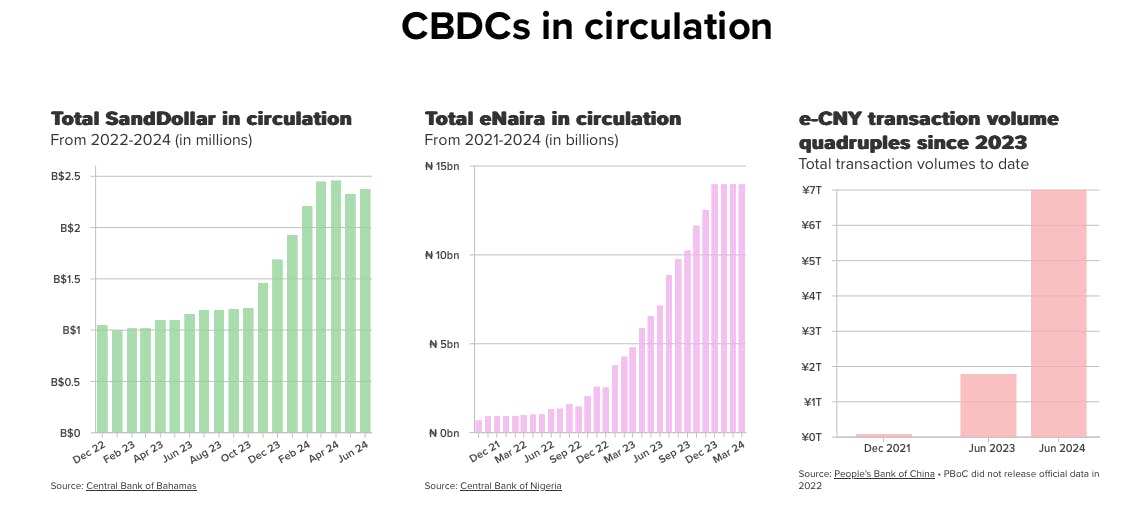

As of 2024, 130 countries, representing 98% of global GDP, are actively pursuing Central Bank Digital Currency (CBDC) projects, an increase from 35 countries in May 2020. Of these, three countries (The Bahamas, Jamaica, and Nigeria) launched a CBDC, 44 countries are piloting their own, 20 countries are in the active development stage (including the US), and 39 countries are researching potential CBDC options as of September 2024.

The rollout of CBDCs has led to substantial growth in transaction volumes and circulation. Most notably, China's e-CNY, the digital Yuan, saw its transaction volume quadruple from June 2023 to June 2024, indicating the rising adoption and effectiveness of CBDCs in real-world financial ecosystems.

Source: Atlantic Council

As global interest in CBDCs continues to grow, Ripple's CBDC platform could be positioned to leverage this momentum by expanding its partnerships with government central banks. Ripple can capitalize on the increasing demand for infrastructure to develop and launch CBDCs.

Integration of Ethereum-compatible Smart Contracts

In September 2024, Ripple announced the addition of Ethereum-compatible smart contracts through a new side chain to the XRPL. This side chain will leverage Axelar, a crypto bridging service, to facilitate cross-chain token transfers. The side chain will use wrapped XRP (eXRP) as the native asset and gas token, enabling transactions between the XRPL and Ethereum ecosystems.

This move enhances interoperability — allowing different computer systems or software to share and utilize information — between the XRPL and Ethereum. Enabling the development of decentralized applications (dApps) compatible with Ethereum standards could also boost engagement from developers. A more vibrant dApp ecosystem on the XRPL could increase both the price and liquidity of XRP, as well as further diversify the use cases of the XRPL. With this development, Ripple can expand its product offerings into areas such as decentralized finance (DeFi) and supply chain tracking, reducing its dependence on financial institutions as the primary market for its technology.

Key Risks

Regulatory uncertainty

In December 2020, the US Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs, claiming that it raised over $1.3 billion through the unregistered sale of XRP, which the SEC considers a security under US law. The case depended on whether XRP qualifies as a security, meaning it would be subject to the SEC’s regulations.

The SEC argued that Ripple used proceeds from XRP sales to fund its operations and compensate employees and that investors purchased XRP expecting to profit from Ripple's efforts to increase its value. Ripple, however, maintained that XRP is a digital currency, not a security, and criticized the SEC for a lack of regulatory clarity on how cryptocurrencies are classified.

In July 2023, a judge ruled that while Ripple violated securities laws through institutional sales of XRP, its retail exchange sales did not. The SEC's attempt to appeal this decision was denied. In August 2024, Ripple was fined $125 million, far less than the SEC's nearly $2 billion request. The fine's enforcement was delayed pending the SEC's appeal, which was filed as a notice of appeal in October 2024, extending the legal dispute over XRP’s status.

This case holds broad implications for the cryptocurrency industry, especially regarding the classification of digital assets. If XRP is ruled as a security, cryptocurrencies may need to comply with stricter SEC rules, such as registration, investor protection, and reporting requirements. A decision in favor of the SEC could extend the agency’s regulatory authority and shape the future of cryptocurrency fundraising and governance in the US Congress and other regulators may also use this ruling to craft clearer crypto regulations.

XRP Volatility

XRP’s fluctuations can impact Ripple's revenue, the health of the XRP Ledger, and the company's ability to forge strategic partnerships. Historically, XRP has experienced considerable volatility. After its listing in 2018, XRP's price surged by 1820%, rising from $0.20 to $3.84, but subsequently dropped 93% ”in a matter of months”. In 2021, XRP rose by 710% to $1.96, then declined again to $0.30. Following Ripple's partial legal victory in July 2023 against the SEC, XRP's value increased by over 80%. In October 2023, after the SEC dropped its case against Ripple’s CEO, XRP reached $0.71, but as of October 2024, it stands at $0.52.

Source: CoinMarketCap

Ripple holds an undisclosed amount of XRP, but a notable percentage of its revenue has historically come from XRP sales as it sold 150 million XRP for approximately $64.5 million in June 2024. An increase in XRP's market value can enhance the value of Ripple's holdings, while a decline may reduce the company’s liquidity and revenue from these sales.

RLUSD Cannibalizing XRP

As of October 2024, RLUSD is being developed as a settlement layer similar to XRP on the XRPL, and its overlap with XRP's use cases may impact XRP's value. By offering a stable alternative pegged to the US dollar, RLUSD provides price stability, making it more appealing for everyday transactions and for financial institutions seeking predictable value. Consequently, this could lead to a reduced reliance on XRP as an intermediary for liquidity.

Ripple has traditionally derived a significant portion of its revenue from selling XRP on the open market, meaning XRP's market value is closely tied to Ripple's financial health. A decline in XRP's value may limit Ripple's financial flexibility, restricting its ability to fund new projects, acquisitions, or partnerships.

However, a former Ripple employee has indicated that the launch of RLUSD could ultimately benefit Ripple. The expected pairing of XRP and RLUSD may enhance liquidity and help stabilize the stablecoin, mitigating de-pegging issues. Additionally, Schwartz believes that RLUSD will provide more advantages for XRP than disadvantages.

Interest in RLUSD Affecting XRP

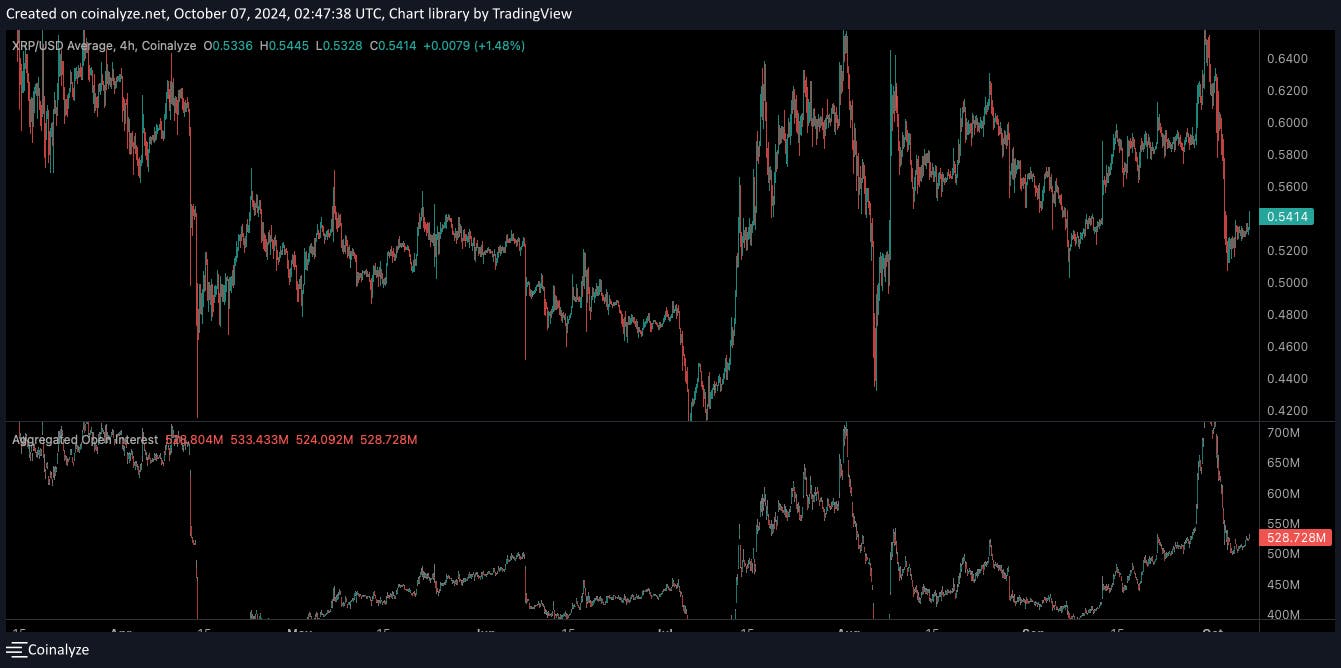

In August 2024, Ripple began initial testing of minting RLUSD. Despite this, XRP open interest reached a peak of $1 billion near the end of September 2024, before dropping to $846 million by the beginning of October 2024. Higher open interest typically indicates increased liquidity and new capital inflows into the market, which could potentially boost XRP's price.

Source: Coinalyze

If XRP's price rises in the future, Ripple may see its cost advantage over its competitors diminish. Conversely, if XRP's price continues to fall, Ripple risks losing crucial revenue generated from XRP sales, impacting its financial flexibility and strategic initiatives.

Trust in Cryptocurrency

Financial institutions remain skeptical about the value and stability of cryptocurrency technology. This hesitancy, particularly regarding its use in payment applications, could limit the growth potential for Ripple Payments, especially since there are viable international transfer options available that do not rely on cryptocurrency as of October 2024.

The skepticism is partly fueled by regulatory guidance concerning banks’ involvement in crypto, especially in the wake of the 2022 crypto winter. James Stevens, co-leader of the Financial Services Industry Group at Troutman Pepper, expressed in February 2023 that “it’s questionable whether crypto activities in the cryptocurrency space are safe and sound for banks. We’re not saying never, we’re not saying impossible, but we’re saying it’s a very, very high bar.”

Furthermore, banks engaging in crypto-related activities are required to comply with KYC and anti-money laundering requirements, along with implementing risk-prevention measures for potential crypto market downturns. These added regulatory burdens and negative sentiments can create significant barriers to the adoption of cryptocurrency services by banks.

SWIFT Innovation

Despite being established in 1973, SWIFT continues to strengthen its position as a leading provider of international transaction services. Products like SWIFT Go, launched in July 2021, and SWIFT GPI, available in January 2017, enable faster transactions, with funds arriving “within minutes” and providing clear information on fees, exchange rates, and payment tracking. SWIFT Go caters to low-value and cross-border payments and SWIFT GPI, which has no transaction size limit, requires banks to join its network for tracking benefits.

Additionally, SWIFT's pre-validation service reduces costly payment investigations by verifying beneficiary information upfront and ensuring compliance with local market requirements. As SWIFT narrows the gap in transaction speed and cost with Ripple Payments, Ripple’s competitive advantage in these areas could diminish. This shift could lead large financial institutions to prefer SWIFT as a trusted legacy partner, further challenging Ripple's growth in the international transaction market.

Summary

Ripple has positioned itself as an emerging provider of international transaction services and is actively expanding its product offerings both vertically and horizontally to mitigate its dependence on the value of XRP and the sentiment of traditional financial institutions, which may be cautious about using cryptocurrency. A significant portion of Ripple's revenue comes from the sale of XRP, which may be risky for its long-term growth and success.

Ripple is at an inflection point, advancing toward vertical integration within the digital assets sphere. By expanding its product offerings into the digital asset custody, stablecoins, and CBDC markets, and enhancing the development potential of the XRPL, it hedges against fluctuations in the value of XRP and fierce competition in the international payments market.