Thesis

From Q1 2020 to Q1 2022, the prevalence of Institutional investors trading in crypto increased by 10x and accounted for twice the volume of retail investors. In standard trading markets, institutions drive 80%+ of all trades. As crypto became more mainstream, institutional investors began to dwarf retail investors, with institutional investors trading more than $1.1 trillion worth of cryptocurrencies in 2022 on Coinbase alone.

Institutional investors looking to invest in cryptocurrencies have three potential concerns: security, liquidity, and compliance. Among these, security concerns loom largest and prevent a number of institutional funds from investing in crypto. In 2022, 79% of institutional investors and wealth managers said asset custody was the key consideration of whether to invest in cryptocurrency. Meanwhile, only 67% of survey respondents said price volatility was a primary concern, 56% cited market capitalization, 49% cited regulatory concerns, and 12% noted carbon footprint concerns.

Fireblocks is a blockchain technology company aiming to address these security and regulatory concerns. The company is seeking to enable institutional investors easier access to cryptocurrency by alleviating security concerns with digital custody. Its platform allows customers to outsource security and regulatory steps required to complete transaction orders. Through its treasury management and multi-party computation (MPC) wallet-as-a-service products, Fireblocks aims to alleviate the security and regulatory concerns that institutional investors cite when deciding whether or not to invest in digital assets.

Founding Story

Fireblocks was founded by Michael Shaulov (CEO), Pavel Berengoltz (CTO), and Idan Ofrat (CPO) in 2018. Before starting Fireblocks, Shaulov launched a mobile security company called Lacoon Mobile, where Berengoltz was an early employee. In 2015, Lacoon Mobile was acquired by Check Point, a multi-national IT security firm, for $100 million.

In 2017, while working for Check Point, Shaulov and Berengoltz were sent to investigate a security breach in a South Korean cryptocurrency exchange after $200 million of Bitcoin was stolen. After their investigation, Shaulov and Berengoltz realized that cryptocurrency exchanges lacked a solution for the protection of digital assets from hackers. Further, they realized digital assets had a critical need for robust security solutions to protect them from theft, cyberattacks, and unauthorized access. The blockchain industry was rapidly growing, and digital assets were susceptible to breaches. In 2018, Shaulov and Berengoltz left Check Point to launch Fireblocks with Ofrat, aiming to solve these issues in the nascent cryptocurrency industry.

As of September 2023, Fireblocks has made multiple notable hires and has a headcount of over 600 employees. Adam Levine, who joined as Head of Corporate Strategy in 2021, was the former head of Digital Partnerships at BNY Mellon. Fireblock’s Varun Paul, who became Fireblock’s Director of Central Bank Digital Currency (CBDC) in 2022, was previously the Bank of England’s Head of Fintech. Jason Allegrante, who joined as Chief Legal and Compliance Officer in 2020, worked in the Financial Institution Supervision Group at the Federal Reserve Bank of New York prior to joining Fireblocks. As of September 2023, all three original cofounders remain in their respective roles with Fireblocks.

Product

Fireblocks initially built a software custody solution to secure cryptocurrency assets and prevent theft. The company later pivoted to become a platform securing trading transaction connections between customers. Fireblocks offers four main products: Treasury Management, Wallets-as-a-Service, Tokenization, and Payments. Additionally, Fireblocks offers several integrations and partnerships, allowing it to provide features such as “Know Your Customer” software for compliance with anti-money laundering (AML) regulations that allow customers to transact with unknown parties on decentralized exchanges.

Treasury Management

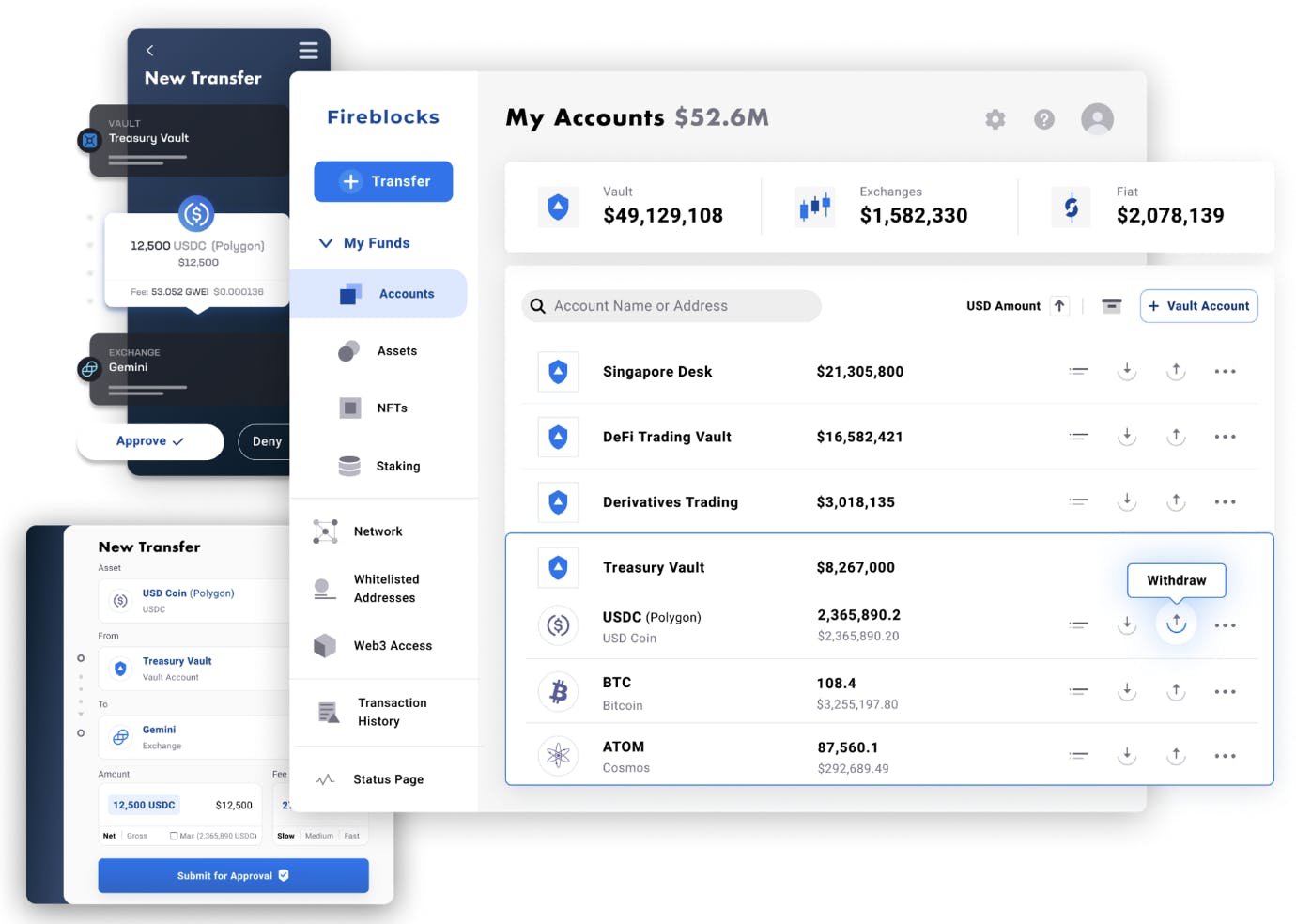

Fireblocks Treasury Management solution is a solution that enables security for digital assets, day-to-day digital asset treasury operations, exchange connection, DeFI access, and interaction with trading counterparties. Fireblocks emphasizes security for the treasury management product suite, claiming that it “eliminates a single point of private key compromise.”

The Fireblocks platform serves as the infrastructure for transactions between parties. The platform gives traders access to 1.8K+ liquidity partners, trading venues, exchanges, and counterparties for secure trading. The platform enables direct connectivity to 30+ exchanges and access to 1.1K+ tokens.

Without the Fireblocks platform, a cryptocurrency hedge fund might find an arbitrage opportunity to buy Bitcoin on Coinbase and sell it on Kraken’s exchange, but the arbitrager would have to create a separate account on each exchange and then move Bitcoin off Coinbase into a digital wallet, and then move it onto the Kraken exchange over hours or potentially days, hampering the ability to make profitable trades.

On Fireblocks, transactions happen from a single Fireblocks account and settle with trading partners in minutes. Fast transaction settlement is critical for the liquidity of Fireblocks customers and large “Over the Counter” (OTC) trades with 3rd party aggregators to buy assets across many exchanges/parties.

In summary, the treasury management platform enables clients to stake digital assets from the Fireblocks interface, access DeFi apps, access over 50 blockchains, swap between storage environments, and trade on multiple platforms within a single interface.

Source: Fireblocks

Wallets-as-a-Service

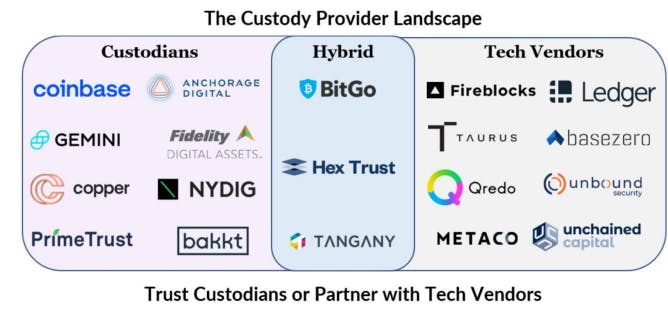

In financial systems, a custodian is a third party (e.g., a bank) holding and protecting the assets of individuals or other financial institutions. Although in crypto public blockchain ledgers store cryptocurrency assets themselves, custody providers still have a market to control and protect their clients’ “wallet keys” (e.g., account passwords). Several companies began modeling the financial system’s custody by taking on the liability of storing the keys and the number of assets they covered. Such custodians utilized variations of wallets with different methods of security and speed.

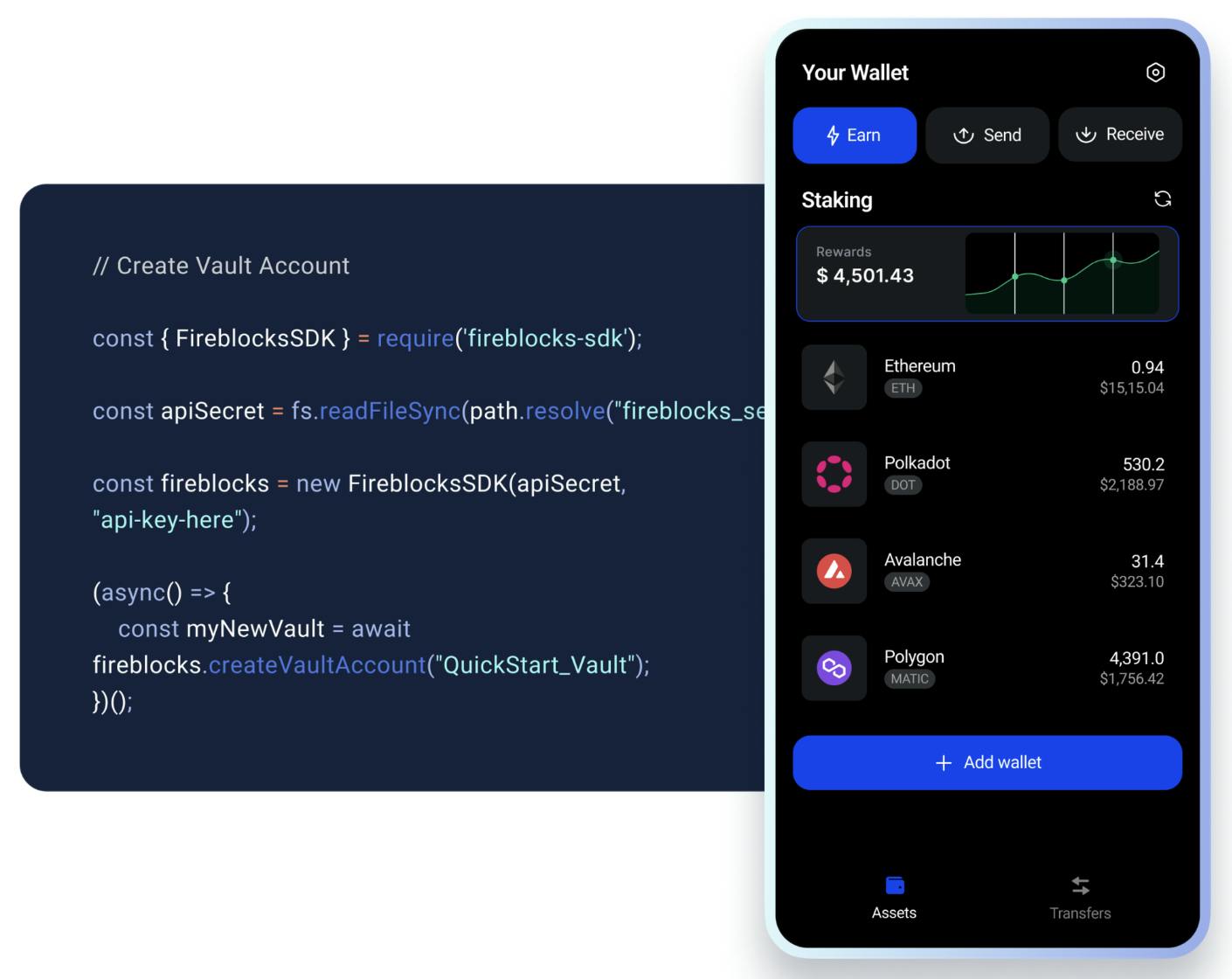

Since the early days of cryptocurrency, wallets have competed on security and speed of transaction. One type of wallet is a “hot” wallet — an encrypted online account. The other is a “cold” wallet, which stores keys on servers disconnected from the internet. Cold wallets are more secure but less convenient for transacting than hot wallets. Hot wallets are faster for transactions, but if anyone bypassed the security online, such as routing the computer’s information through a fake website or hacking a server, they could gain full access to the keys.

Later, a newer technology called “multi-party computation” (MPC) emerged to spread and coordinate the key’s data across several computers, lowering the chance of having keys compromised. Further, MPC enabled newer business models because customers could cheaply deploy wallet security themselves without 3rd party custodians taking on liability.

In 2020, Fireblocks developed an MPC called MPC-CMP to increase the speed of transactions by 800% by compressing the number of algorithm steps. Fireblocks provides its custody software as a stand-alone “wallet-as-a-service” competing with other 3rd party custodians or directly with custody software.

Source: Fireblocks

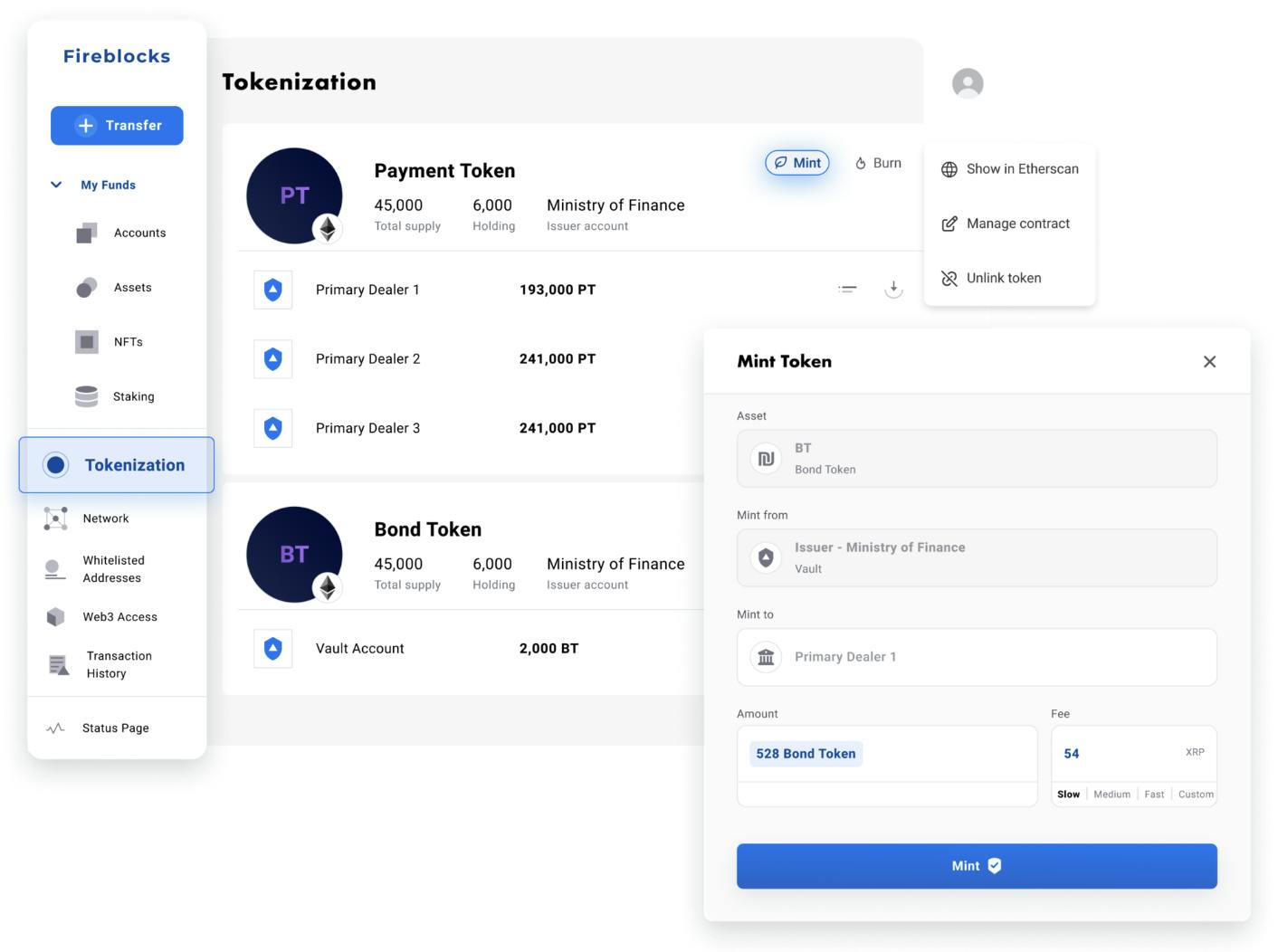

Tokenization

In cryptocurrency, tokenization is the process of issuing a new blockchain asset. Fireblocks’s tokenization product is a solution that enables clients to mint, custody, and transfer tokens. It can also be used to manage smart contracts. Further, the product allows users to connect to a network of market participations to distribute the assets. Fireblocks supports multiple assets, including public and private securities, stablecoins, carbon credits, and CBDCs.

Source: Fireblocks

Payments Engine

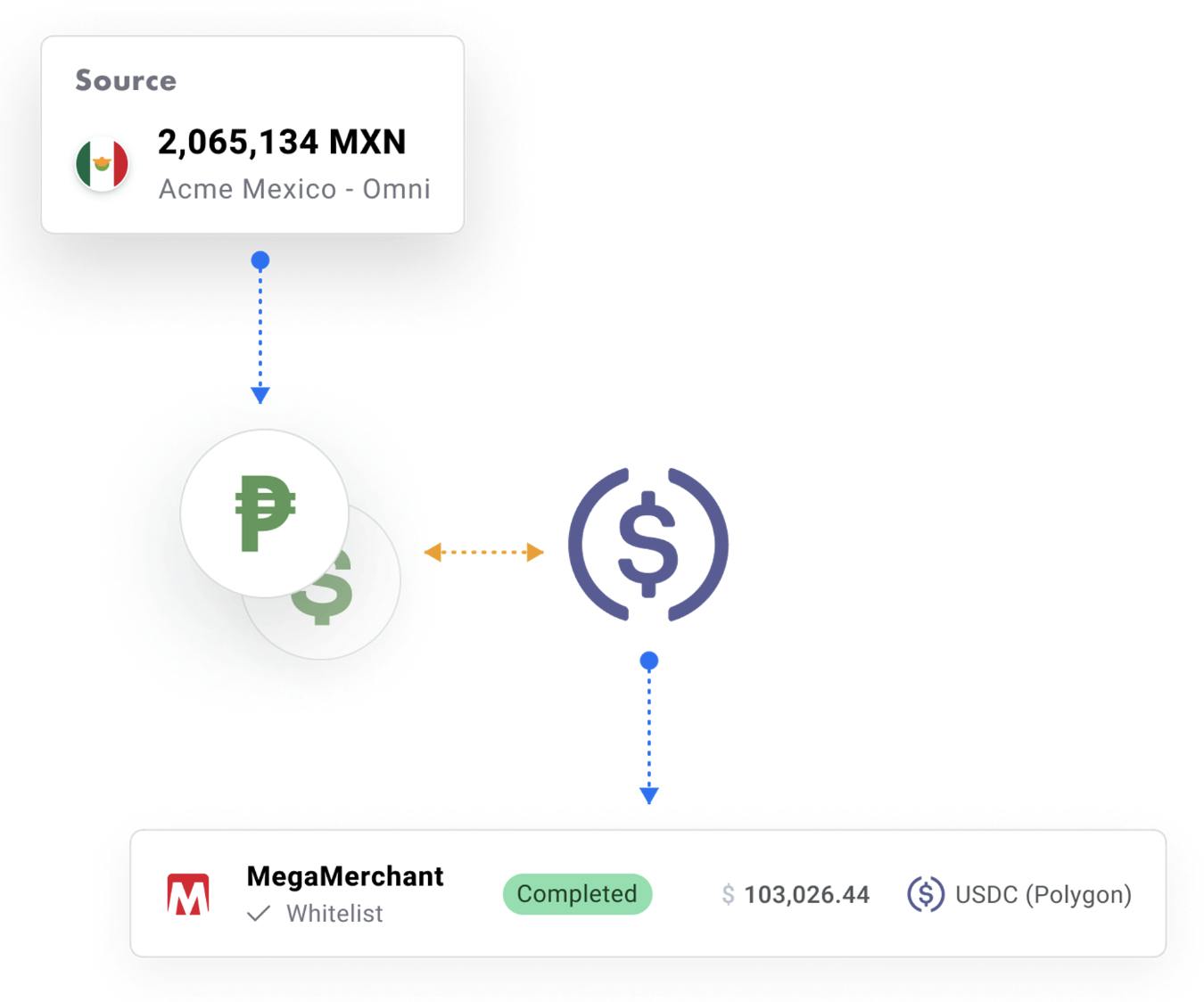

Fireblocks’s payments engine enables clients to build merchant services using digital assets. The product is a suite of tools to accept, manage, and settle digital asset payments across any blockchain. Use cases include settling merchant accounts with stablecoins, making fast cross-border internal payments without banking partners, initiating payments to creators, contractors, and gig economy workers, and enabling ecommerce merchants to accept crypto payments.

Source: Fireblocks

Compliance and Integrations

Fireblocks integrates with Elliptic and Chainalysis to reduce money laundering and criminal financing. The two software platforms support “Know Your Customer” (KYC) and “Know Your Transaction” (KYT) compliance. Elliptic, valued at $4.2 billion after its Series C in 2021, and Chainalysis, valued at $8.6 billion after its Series F in 2022, are leaders in KYC and KYT compliance. Without such integrations, Fireblocks’s customers would have to do hefty due diligence with each counterparty they traded with and could never interact with anonymous, decentralized finance exchanges. Fireblocks intends for users to spend less on due diligence to meet regulatory requirements.

Market

Customer

Fireblock’s target customers are financial institutions holding and trading cryptocurrencies. Its customers include banks, hedge funds, exchanges, and lending desks. In 2021, about one in four financial service companies reportedly planned to gain more exposure to cryptocurrencies by 2024.

As of September 2023, Fireblocks reported having over 1.8K customers on its platform. Notable customers include Worldpay, Revolut, BNY Mellon, Checkout.com, and BNP Paribas. In total, Fireblocks reported that it has secured over $4 trillion in transactions and created over 130 million wallets for its customers since its founding as of September 2023.

Source: Fireblocks

Market Size

Fireblocks competes in the crypto asset management and custody market. The market could still be viewed as nascent and in a growth phase. The crypto asset management market size was valued at $1.1 billion in 2023 and is forecast to grow to $3.1 billion by 2028 at a CAGR of 23%. The key growth driver of this market is the evolution of the asset management industry shifting to digital assets and the increasing investments in crypto funds.

In addition to crypto asset management and custody, Fireblocks is also adjacent to the crypto wallet market. In 2023, the market for crypto wallets was valued at approximately $8.1 billion, and is forecast to grow to $40.2 billion by 2028 at a CAGR of 30.8%.

Competition

Copper.co: Copper.co is a cryptocurrency custody firm that provides the infrastructure for the institutional digital asset investment community. Founded in 2018, the company offers solutions for trading firms, DeFi funds, hedge funds, buy-and-hold investors, fintech platforms, and exchanges. Like Fireblocks, Copper.co allows customers to trade on multiple exchanges from a single interface. It also offers custody and safekeeping of digital assets, provides wallet infrastructure, enables staking, and enables access to DeFi. As of September 2023, Copper.co has raised a total of approximately $281 million in disclosed funding. In 2022, Copper.co raised $196 million in Series C funding led by Barclay Ventures and Tiger Global Management. This funding was announced after Copper.co reportedly generated losses of $16 million in 2021. The company’s key customers include Flow Traders, B2C2, Algorand, and Stellar.

BitGo: BitGo is an institutional digital asset financial services company founded in 2013. The company provides regulated custody, financial services, and core infrastructure to investors and builders. Like Fireblocks, BitGo provides asset wallet security, capital deployment, and API technologies for builders. Key customers include Rakuten Wallet, Pantera, and BitStamp. As of September 2023, BitGo has raised approximately $171.5 million in disclosed capital. In August 2023, BitGo secured $100 million in Series C capital at a $1.8 billion valuation from investors including Goldman Sachs and Redpoint.

Anchorage Digital: Anchorage Digital is a crypto custody platform providing institutions with integrated financial services. The company was founded in 2017. Like Fireblocks, Anchorage Digital offers crypto custody and deployment services for institutions. Key customers of Anchorage Digital include a16zcrypto, Apollo, Goldman Sachs, KKR, and Visa. As of September 2023, the company has raised approximately $487 million in disclosed funding. In December 2021, the company announced a $350 million Series D led by KKR, valuing the company at over $3 billion.

MetaCo (Ripple): MetaCo is a provider of digital asset management solutions for financial service companies. The company was founded in 2015. Like Fireblocks, MetaCo offers products for digital asset custody management, trading, DeFi app access, governance, and tokenization. The company serves global custodians, universal banks, regulated exchanges, neobanks, fintechs, and corporations. As of September 2023, the MetaCo has raised a total of $20 million in funding. In August 2021, Ripple announced that it was acquiring MetaCo for $250 million.

Ripple offers cryptocurrency solutions for businesses including cross-border payments, crypto liquidity services, and CBDC implementation. Since its founding in 2012, Ripple has raised a total of approximately $293.8 million in disclosed funding as of September 2023. In 2019, the company raised $200 million in Series C funding at a valuation of around $10 billion. In 2022, Ripple announced that it was buying back its Series C at a $15 billion valuation.

Business Model

Fireblocks operates on a SaaS model. As of September 2023, the company charges subscriptions and does not monetize via transaction fees. Over time, Fireblocks may identify an opportunity to switch to a Shopify-like business model of charging fees per transaction instead of flat subscription costs. Each of Fireblocks’s four products has varying subscription SaaS fees.

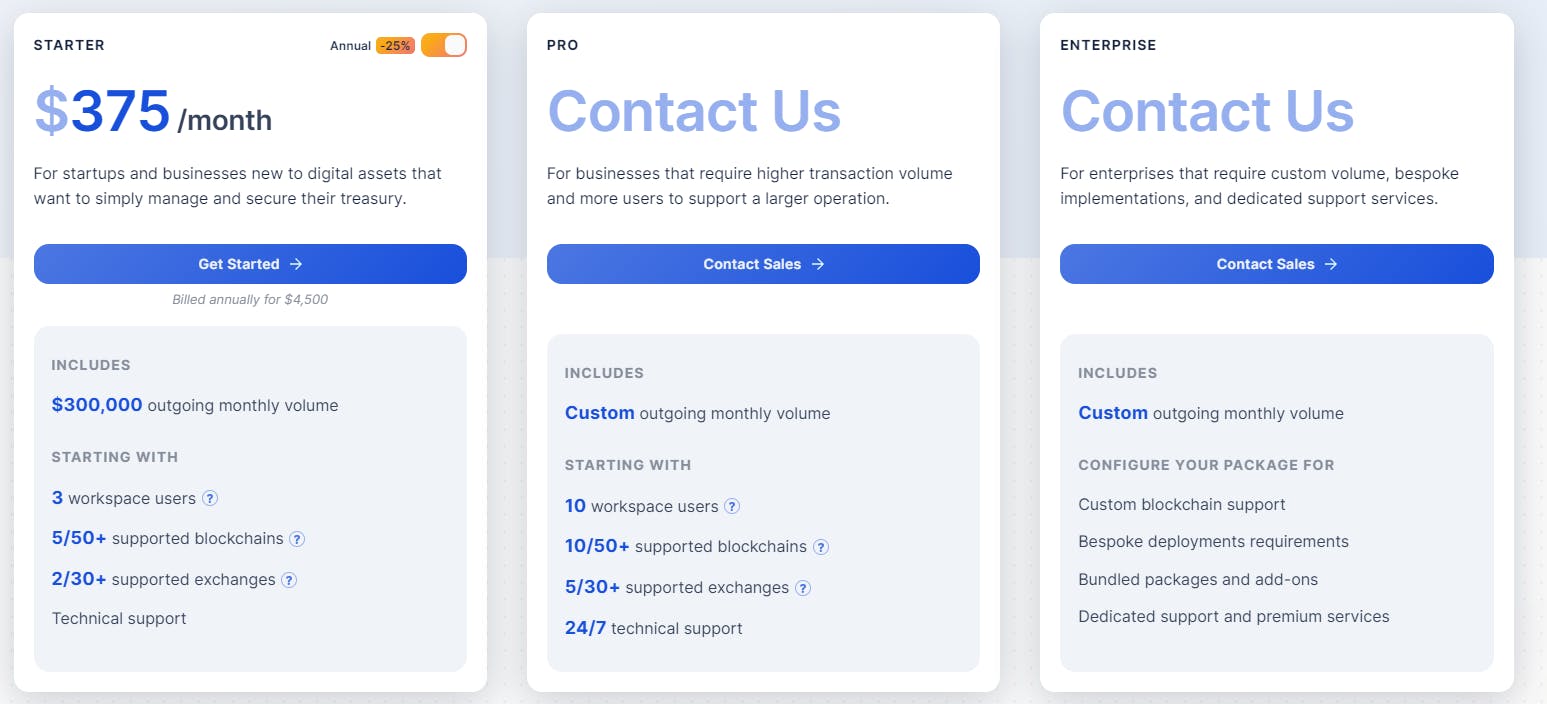

Treasury Management

Fireblocks treasury management platform starts at $375/month billed at $4.5K annually, or $500/month if billed monthly. This package supports three workspace users, five blockchains out of a list of over 50, two supported exchanges from a list of over 30, and $300K of outgoing monthly volume. For more users, blockchains, exchanges, and outgoing monthly volume, customers can build custom pricing plans with Fireblocks.

Source: Fireblocks

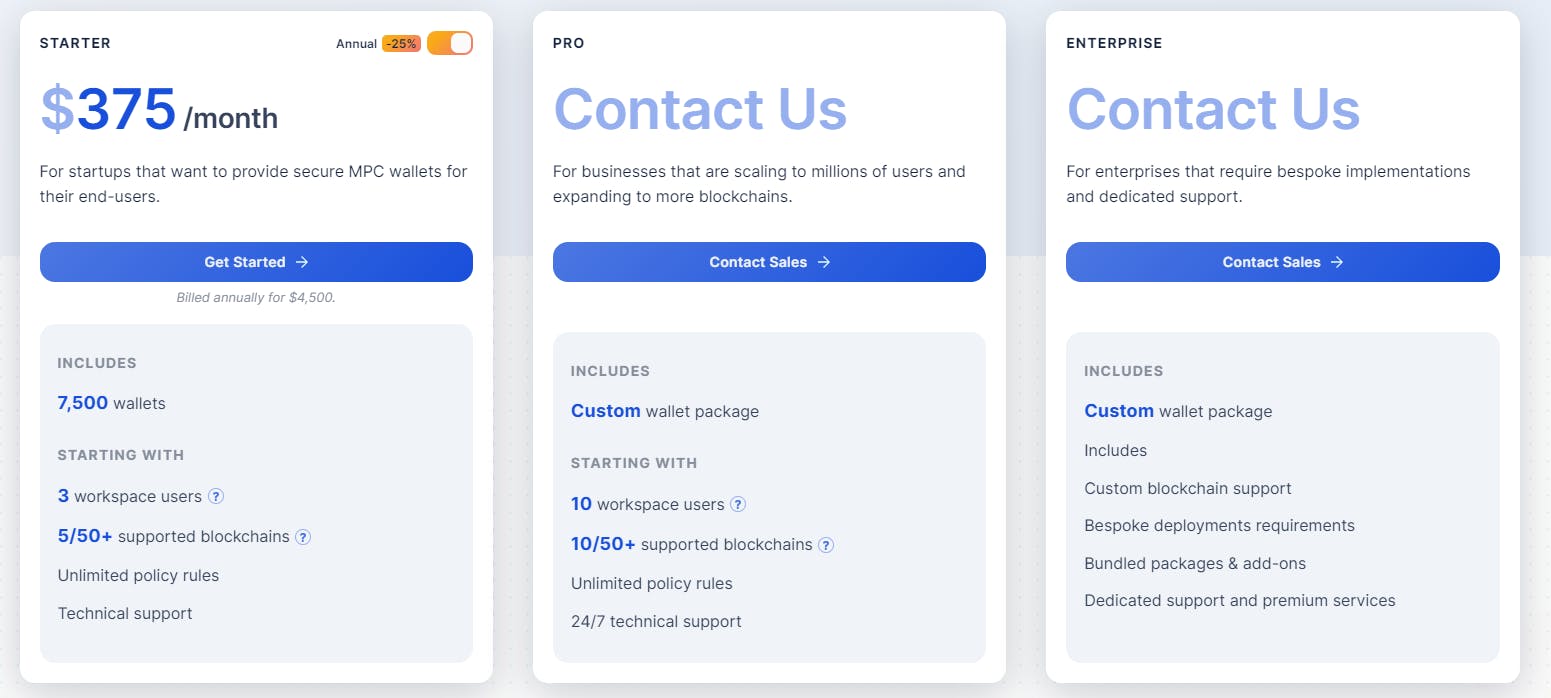

Wallets-as-a-Service

Fireblocks Wallets-as-a-Service product starts at $375/month billed at $4.5K annually, or $500/month if billed monthly. The starter packet supports 7.5K wallets, three workspace users, five blockchains from a list of 50, and limited technical support. For additional wallets, users, and blockchains, users can create a custom pricing plan with Fireblocks.

Source: Fireblocks

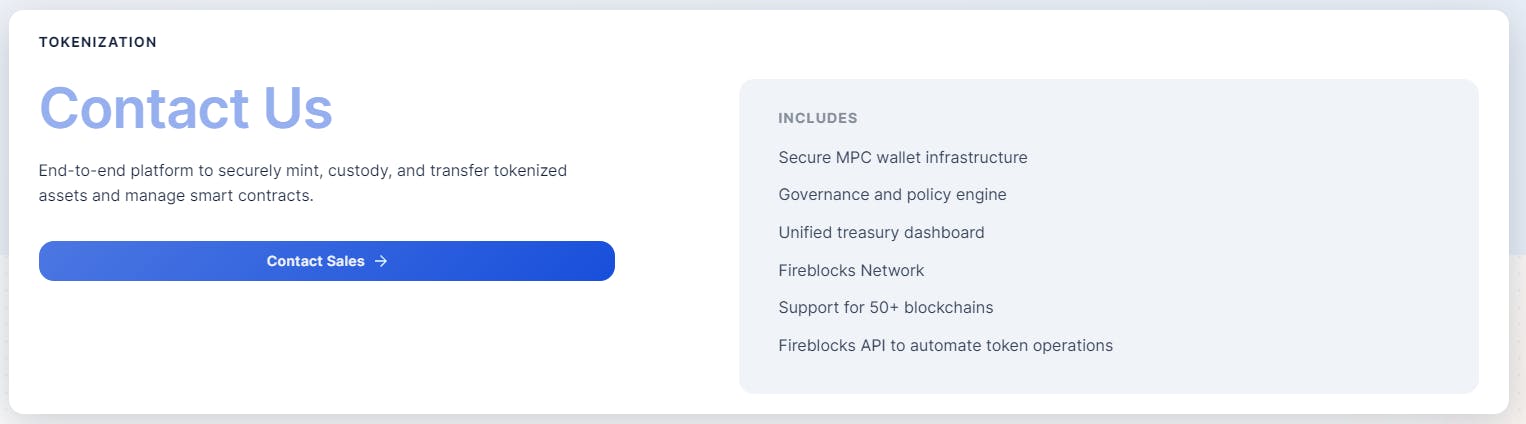

Tokenization

As of September 2023, Fireblocks does not publicly disclose its pricing for the tokenization product. However, the base package includes secure MPC wallet infrastructure, a governance/policy engine, a unified treasury dashboard, access to the Fireblocks network, support for over 50 blockchains, and the Fireblocks API.

Source: Fireblocks

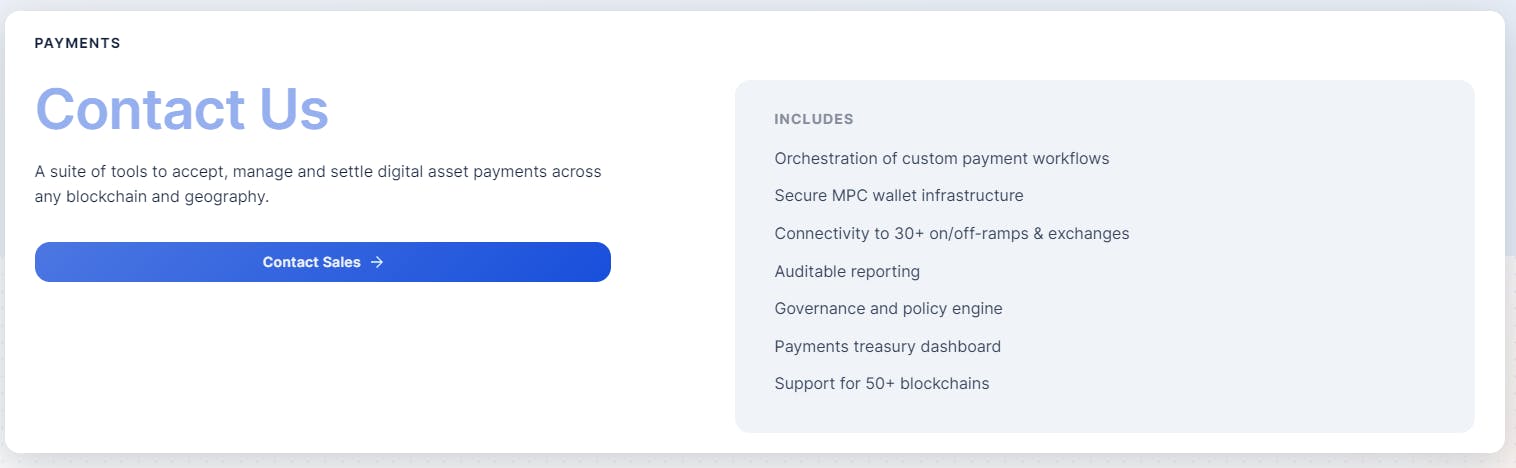

Payments

As of September 2023, Fireblocks does not publicly disclose its pricing for its payments product. However, the base product includes orchestration of custom payment workflows, secure MPC wallet infrastructure, connectivity to 30+ on/off-ramps and exchanges, auditable reporting, governance and policy engine, payments treasury dashboards, and support for 50+ blockchains.

Source: Fireblocks

Traction

As of September 2023, Fireblocks’ customers include 1.8K of the largest banks, cryptocurrency exchanges, and financial institutions. In 2022, 40% of the customers were US-based, over 30% were European, and around 25% were in the Asia-Pacific region. In 2021, the company increased revenue projections four times and ended the year with $60 million in revenue instead of the initial target of $8 million for the year.

In 2023, Fireblocks successfully helped the Tel Aviv Stock Exchange and the Ministry of Finance of Israel to create the first demonstrations of the use of smart contracts and tokenization for digital government bonds. Fireblocks has also partnered with NuBank, Latin America’s most valuable challenger bank, to elevate its crypto custody services.

The company tripled its 2021 revenue from $50 million to $150 million in 2022. Meanwhile, Fireblocks grew its customer base from 150 in 2021 to 1.8K customers in 2023. As of September 2023, the company claims to have processed over $4 trillion worth of transactions and has created over 130 million wallets.

Valuation

Fireblocks raised approximately $1 billion in total funding since inception in 2018. In January 2022, Fireblocks announced a $550 million Series E at an $8 billion valuation co-led by D1 Capital Partners and Spark Capital. That valuation represents more than a 160X revenue multiple in 2021 (assuming $50 million revenue) and a 53.3x multiple in 2022 (assuming $150 million revenue and the same $8 billion valuation). Shortly after that round from Feb to July 2022, crypto trading and prices dropped dramatically to less than January 2021’s prices under the threat of tightening monetary policy, less risk tolerance, and a potential recession. However, despite the wider downturn, Fireblocks’s two-year employee count grew 225% as of September 2023.

Key Opportunities

Institutional Trading

Fireblocks can become the SWIFT-comparable entrenched architecture underpinning all cryptocurrency movements between institutions. By becoming the most prominent platform for institutional traders, Fireblocks could create network effects driving more benefits to customers joining the platform. Further, Fireblocks could capitalize on fees incurred for trades between institutions. As of January 2023, 85% of Bitcoin’s trading volume was from US institutional investors, meaning the institutional trading opportunity is very large.

Central Bank Digital Currency Contracts

Fireblocks is building wallets and payment processing for Web3. Further, the company has worked with the Australian government to help create a stablecoin pegged to the Australian dollar; as of March 2022, about $30 million had been minted. Fireblocks could continue to capitalize on building partnerships with other governments to build similar central bank digital currencies.

19 of the G20 countries are in the advanced stage of CBDC dvelopment, and 130 countries are exploring CBDC opportunities. The European Central Bank is on pace to begin testing the digital Euro in 2023, while India and Brazil plan to launch in 2024. If these projects are successful, more countries may continue to explore the opportunity, presenting more large-customer opportunities for Fireblocks.

Key Risks

Market Volatility & Slowdowns

The most significant threat to Fireblocks is customer sentiment toward crypto. In 2021, financial institutions were bullish on cryptocurrencies, but in 2023 institutional investors have lost some of that interest. In the period since Q4 2022, there’s been a slowdown in trading volume; Coinbase reported the volume of trades remained flat from $146 billion in Q4 2022 to $145 billion in May 2023.

The market capitalization of cryptocurrencies has fallen by over 50% from January 2022 to July 2023 and may continue to decline. With an uncertain outlook, it is questionable when and why customers would enter or stay in the crypto market, threatening Fireblock’s potential revenue.

Competition

Fireblocks appears to be the leader in institutional infrastructure, but it has notable competition. Copper, BitGo, and Anchorage have scaled at similar paces to Fireblocks. Meanwhile, Ripple's acquisition of MetaCo could increase its resources and influence in the United States. As more competition enters the market and the competitors continue to scale, Fireblocks will have to find unique ways to differentiate itself from the competition to win large contracts.

Summary

Fireblocks is a platform that offers secure custody solutions for crypto assets. Its growth has been driven by the demand from financial institutions to safely and quickly trade cryptocurrencies while remaining compliant. Its platform provides liquidity and trading opportunities for its network customers and trading counterparties. If it is able to capture network effects with its platforms, Fireblocks may be able to establish a dominant position in this market as it matures. Its biggest threat is around the institutional appetite for cryptocurrency exposure.