Thesis

As of July 2022, musculoskeletal (MSK) disorders affected 1.7 billion people worldwide, with 50% of US adults impacted. These conditions limit mobility and dexterity, leading to a 1.3x higher likelihood of early retirement as of March 2024, reduced well-being, and decreased societal participation. While physical therapy is an important treatment for MSK disorders, access and adherence remain significant challenges. A 2022 study showed that only 43% of patients adhered to their in-clinic physical therapy program, with a loss of adherence primarily driven by personal issues, insufficient insurance authorization, and lack of geographic accessibility.

A projected care provider shortage in the US is expected to further exacerbate these issues into the late 2020s and early 2030s. Lack of adherence often leads patients to opt for surgeries, with over 50% of MSK pain surgeries being unnecessary, as of May 2019. Such surgeries contributed to an estimated $101.2 billion spent in 2019 on overtreatment and low-value care. This unnecessary spend adds to the $353 billion yearly cost of MSK care for employers, as of 2023. Productivity losses, absenteeism, and increased psychological distress further worsen health outcomes and impact employers.

The healthcare landscape is evolving in response to these challenges. An aging population, increased chronic disease incidence, and rising healthcare costs have driven a shift toward digital health services. The population of people over 65 years of age was projected to increase by 47% from 2022 to 2050 and requires more care, with those aged 65 and older visiting physicians two to three times more often than younger age groups.

Additionally, as of February 2024, over 42% of Americans had two or more chronic diseases, further increasing the demand for accessible and affordable healthcare services. In 2024, the cost of chronic disease was expected to reach $47 trillion by 2030. Meanwhile, the global digital health market, valued at $217 billion in 2022, was projected to reach a value of $1.6 trillion by 2032, growing at a CAGR of 25.3% from 2023 to 2032. These trends reflect the increasing need for accessible, efficient healthcare solutions that can address the growing burden of MSK disorders and other chronic conditions.

Sword Health is a digital health company offering virtual physical therapy for MSK care. Its mission is to free 2 billion people from pain. Sword Health serves employers and health plans to help their employees and members achieve clinically significant health outcomes for MSK conditions. Sword Health’s platform combines interaction and feedback from physical therapists with its AI monitoring and feedback tool to create personalized, at-home treatment plans for its patients to improve adherence and outcomes.

Founding Story

Source: Sword Health

Sword Health was founded in 2015 by Virgílio ("V") Bento (CEO) and Márcio Colunas (former CTO, current CSO).

Bento's inspiration for founding Sword Health began at the age of 10 after a car accident left his brother in a coma for a year. During his brother’s 12-year recovery, Bento witnessed firsthand the challenges families faced in accessing physiotherapy, often requiring long-distance travel to rehabilitation centers. This experience motivated him to leverage technology to make high-quality rehabilitation more accessible and modernize the outdated, 60+ year-old methods still used in MSK care. To pursue this goal, Bento studied Electronics and Telecommunications Engineering at Universidade de Aveiro, earning his master’s degree in 2007 and his PhD in Electronic Engineering in 2012, the latter funded by a research grant.

Colunas, whose passion for technology began at nine years old, studied computer and telematics engineering at Universidade de Aveiro, receiving a master’s degree in computer and telematics engineering in 2010. At Universidade de Aveiro, Colunas and Bento collaborated with two other students to develop the Stroke Wearable Operative Rehabilitation Device (S.W.O.R.D). This system used 3D wearable motion sensors, a vibratory module, and AI to provide real-time feedback for stroke rehabilitation patients, allowing patients to recover from home. Studies following its 2013 clinical trial showed increases in correct movements when patients received vibratory feedback. Recognizing the potential, Bento and Colunas founded Sword Health in 2015, spending the next four years developing their digital therapy technology and obtaining technology patents.

Facing challenges in securing investment in Portugal, Sword Health initially relied on small seed investments and grant funding. It received seed investments of $100K, $250K, and $400K in its first three years, respectively, along with a $1 million European research grant that accelerated its technology development. In 2016, its Digital Therapist became the first FDA-listed technology of its kind. During this time, it also began securing patents in the digital MSK care space and optimized its proprietary operating system to ensure motion sensor accuracy. Studies showed its remote rehabilitation technology could be as effective as clinic-based rehabilitation. After struggling with European investors, a cold email to Khosla Ventures led to a $17 million Series A funding round in early 2020.

Sword Health later expanded its leadership team with Valentina Longo as CFO in February 2022, Dr. Vijay Yanamadala as Chief Medical Officer (CMO) in February 2022, and Jorge Meireles as CTO in June 2023. Longo came to Sword Health after holding leadership positions at Cerberus and J.P. Morgan Chase, where she oversaw key investment decisions and drove business performance in various financial roles. Yanamadala, a board-certified spinal neurosurgeon with over 65 published scientific papers, had experience treating complex spinal conditions. Meireles joined in 2021 as Vice President of Engineering after serving as the CTO of On-Demand Services for Jumia Group and Head of Development at VentureOak, bringing experience in e-commerce and cloud platforms.

Product

Sword Health provides digital MSK care, enabling home-based physical therapy through clinical expertise, artificial intelligence, and physical devices. Its solutions, designed for employers and health plans, include tablets and wearable motion sensors. As of 2023, Sword Health's digital physical therapy had shown lower dropout rates and, as of 2024, higher engagement than conventional in-person therapy, while also reducing MSK-related medical claims by $2.5K per participant compared to those receiving conventional MSK care.

Thrive

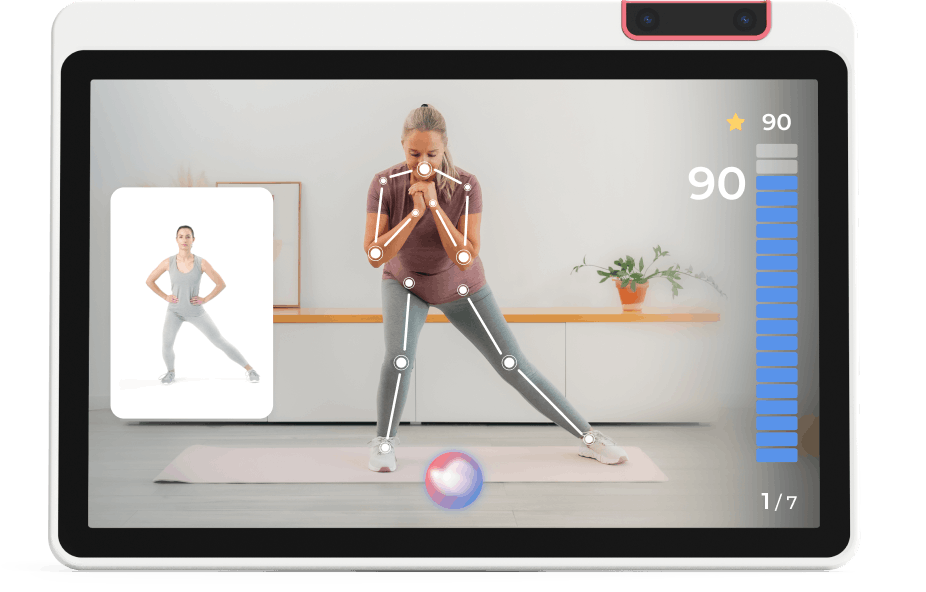

Thrive offers digital physical therapy for chronic joint and back pain. Thrive combines interaction and feedback from physical therapists with its AI monitoring and feedback tool, Phoenix, to provide personalized, home-based treatment as effective as in-person physical therapy (PT). Launched in June 2024, Phoenix, an AI Care Specialist, engages patients in real-time dialogue during sessions, adapting to their progress and verbal feedback while staying within the human clinician's program parameters. Phoenix summarizes performance data after each session, offering insights for the human clinician to optimize patient progress.

Source: Sword Health

Members begin with a questionnaire about their pain, health history, and current treatments, followed by a virtual consultation with a physical therapist who creates a personalized treatment plan. Members then receive a kit with a tablet, stand, and motion sensors. The tablet contains personalized exercise videos and educational resources. Wearable sensors or motion-tracking technologies guide users through sessions, providing real-time feedback via Phoenix AI conversations. Physical therapists connect with members about three times weekly and are available through direct chats. The program typically recommends three to five sessions per week, adjustable to individual needs.

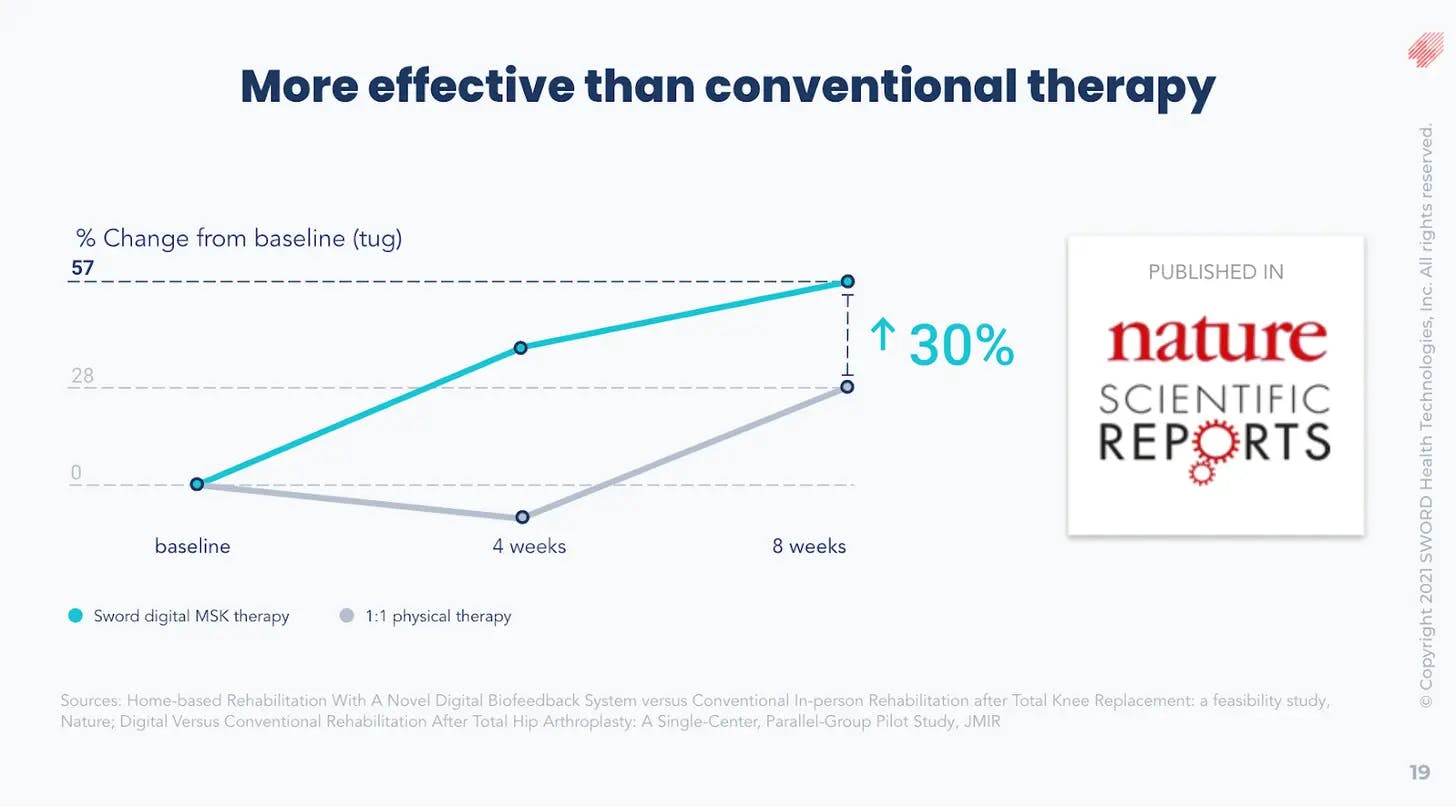

As of 2022, Thrive was found to have led to a 50% reduction in anxiety and a 64% reduction in depression for individuals with chronic shoulder pain among users. As of 2023, it was also associated with a 68% increase in productivity for those with chronic low back pain. Additionally, as of 2018, total knee arthroplasty patients using Thrive experienced 30% better recovery compared to those undergoing traditional physical therapy.

Source: Sword Health

Bloom

Bloom, Sword Health's women's pelvic health solution, offers therapy for sexual health issues, bowel or bladder problems, and pelvic pain disorders across various life stages including pregnancy, postpartum, and menopause. This non-invasive approach aims to enhance pelvic floor function and alleviate chronic pain, potentially reducing the need for pain medication or premature invasive treatments.

Members are matched with a Pelvic Health Specialist who guides them through a personalized program, typically consisting of four weekly sessions, adjustable to individual needs. The Bloom kit includes the Bloom Pod, an intravaginal device with a biofeedback sensor that monitors pelvic floor muscle activity. This device connects to the Sword Health app, providing real-time feedback during exercises and access to personalized programs and insights.

As of 2023, Bloom users reported significant improvements: 53% reduction in severe anxiety symptoms, 50% reduction in severe depression, 67% reduction in seeking additional healthcare interventions, 65% improvement in pelvic-health symptoms' impact on life, and 56% reduction in absenteeism and presenteeism. As of July 2024, Sword Health reported an average yearly direct cost savings of $2.2K per Bloom member for businesses.

Move

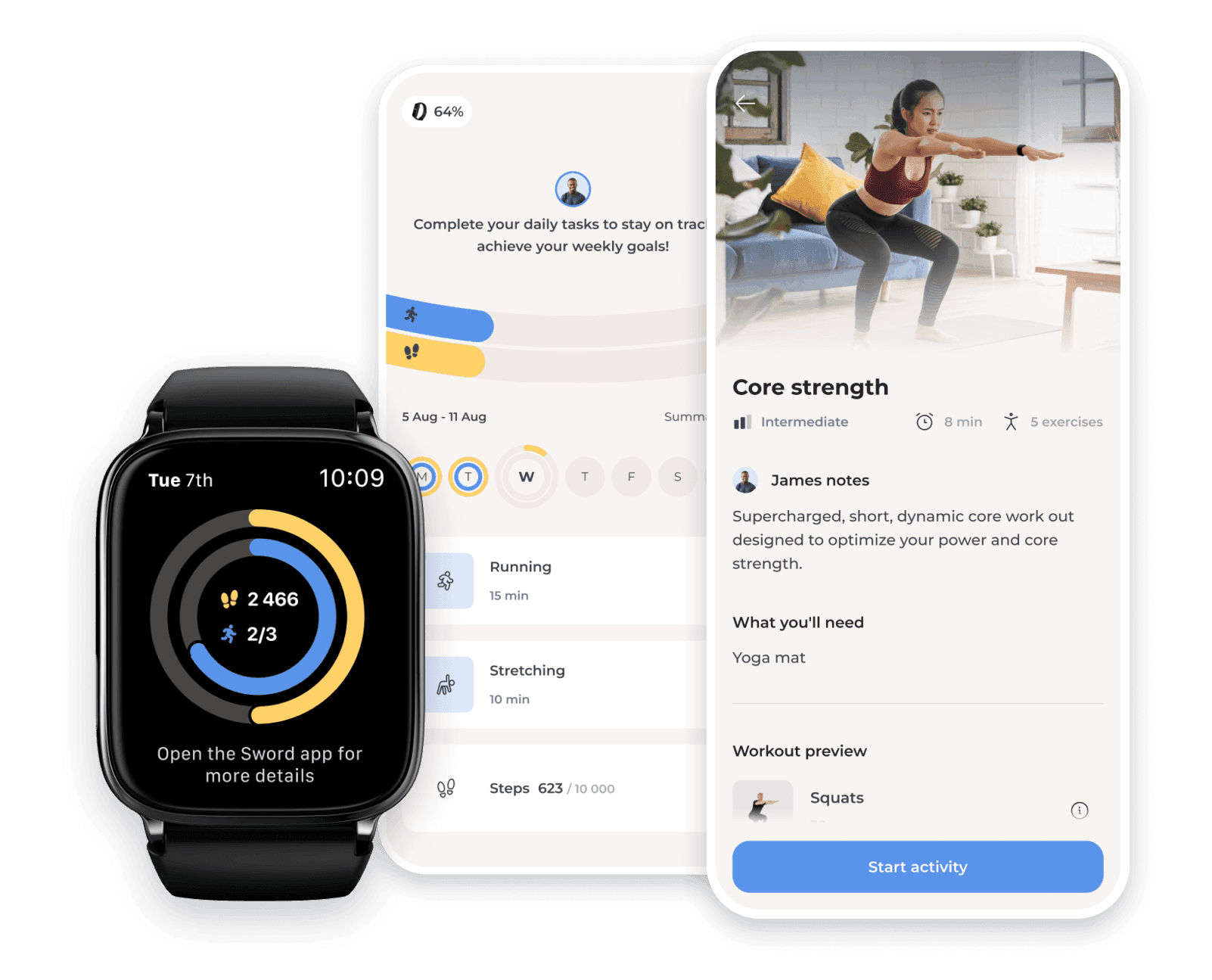

Move is Sword Health's movement health solution designed to help members initiate and maintain physical activity on their journey to living pain-free. Move integrates data from users' wearable devices with guidance from a dedicated personal trainer to deliver customized movement programs. Users receive a customized plan each week and are able to monitor their progress over time through Sword Health’s Move wearable device or their own Apple, Fitbit, or WearOS device. Users also have continuous access to and communication with their certified personal trainer, ensuring consistent engagement, support, and connection to their goals.

Members are initially matched with a physical health specialist based on their preferences, motivation style, needs, and goals. A brief physical assessment helps establish a baseline of movement abilities, which is then used to inform new Move Plans provided to members each week. The Sword Health app displays member progress, allowing them to track their improvement over time. It also offers direct chat functionality and the option for phone or video calls with their dedicated physical health specialist.

Source: Sword Health

Predict

Predict is Sword Health's AI solution to identify, engage, and treat members who are at-risk for needing surgery. Predict is an AI system that identifies members who have a higher likelihood of requiring MSK or pelvic surgery. As of February 2025, it could detect high-risk individuals up to eight months before a decision to operate is made and connect them with one of Sword Health’s products, helping them avoid unnecessary and expensive hip, knee, pelvic, and back surgeries.

As of February 2024, Predict had the potential to save employers and health plans $3.7K per member per year. It achieves this by intervening in the typical progression towards surgery and reducing the use of other costly services like CT/MRI scans and injections for the patients at the highest risk.

Predict employs Sword Health's AI-powered detection system to identify and engage high-risk members through personalized outreach before they become high-cost claimants. Instead of using generic marketing, high-risk members receive messages tailored to their specific needs. The system utilizes prior authorization and medical claims data to ensure that high-need members are informed about Sword Health's solutions in a timely manner. Predict identifies, engages, and treats the members most at risk for surgery with digital physical therapy, which had been shown to reduce surgery intent by up to 70% as of November 2023.

Other Services

Academy: Academy offers short videos from clinical experts to help members understand pain, reduce risks, and build healthy habits. Through the Sword Health app, users can explore content to stay informed, motivated, and pain-free. Content includes information on sleep, pain prevention, pelvic health, nutrition, and more.

On-Call: On-Call is a text-based solution that provides 24/7 access to pain specialists. In the Sword Health app, members can ask questions or discuss concerns with pain specialists, who respond directly in less than five minutes.

Atlas: Atlas is a solution for employers with global teams. It offers clinically validated pain-fighting exercises and education. Doctors of Physical Therapy develop exercises to address acute and chronic pain, with on-demand video content in the Sword Health app informing members from 150 countries. Global companies can use Atlas to improve equitable access to pain relief care, especially in non-US locations where other Sword Health products may not be available.

Market

Customer

Sword Health primarily targets self-insured employers, as these organizations directly bear their employees' healthcare costs and are incentivized to find cost-effective solutions. By selling to companies, Sword Health aims to be included in corporate health plans as a benefit. As of August 2023, the company reported serving over 10K employers across three continents, including more than 10% of the Fortune 50 and global employers such as Domino's, Cisco, and Danaher. Demographic data from the end of 2022 showed that 60.1% of Sword Health's users were female, 39.3% were male, and 0.6% identified as non-binary. The average user age was 47 years old, with low back pain, shoulder pain, and knee pain being the three most commonly treated conditions.

Market Size

Sword Health operates within the digital health market. In 2022, this global market was valued at $217 billion and was projected to reach $1.6 trillion by 2032, growing at a compound annual growth rate (CAGR) of 25.3% from 2023 to 2032. As of 2022, only 10% of employers had implemented solutions for employees with MSK injuries. However, 70% of employers expressed plans to adopt some form of MSK treatment by the end of that year, indicating an opportunity for market expansion in MSK employee benefit programs.

Competition

Competitive Landscape

Sword Health operates in the digital MSK care market, characterized by a mix of well-funded startups and established telehealth companies expanding into the MSK space. Major players in this landscape include Hinge Health, Kaia Health, IncludeHealth, and to some extent, broader digital health platforms like DarioHealth and Teladoc Health. These companies have taken diverse approaches to providing digital MSK care, from AI-powered motion tracking to wearable devices and smartphone apps.

Sword Health stands out with multi-sensor motion tracking and dedicated tablets for patient guidance, improving accuracy and user experience. Its focus on MSK care allows for deep expertise, but competitors like Hinge Health offer FDA-cleared hardware, while IncludeHealth partners with healthcare providers, keeping the market competitive.

Competitors

Hinge Health: Founded in 2015, Hinge Health provides digital therapy for chronic musculoskeletal conditions using AI-powered motion tracking and personalized exercise plans. The company raised $600 million in its Series E round at a $6.2 billion valuation in October 2021, led by Tiger Global Management and Coatue. As of February 2025, Hinge Health had raised a total of $826.1 million from investors including Alkeon Capital, Whale Rock Capital Management, TCV, and Bessemer Venture Partners.

Unlike Sword Health, Hinge Health offers Enso, an FDA-cleared wearable for pain relief, but doesn't provide proprietary motion sensors or tablets. Both companies use computer vision to track patient movements and offer dedicated physical therapist support, adjustable treatment plans, and live feedback during digital therapy sessions. Hinge Health laid off 10% of its workforce in April 2024 as it prepared for an IPO and aimed to reach profitability. In October 2023, Hinge Health was reported to have $400 million in cash on its balance sheet and had 1.7K employees, as of April 2024, before the layoffs.

Kaia Health: Kaia Health, established in 2016, offers digital therapeutics for MSK pain management and chronic obstructive pulmonary diseases. Through its smartphone app, it analyzes user movements to evaluate form and posture and provide feedback using motion analysis technology and AI algorithms. In April 2021, the company raised $75 million in Series funding. As of February 2025, Kaia Health had secured $123 million in total funding from investors such as Heartcore Capital, Balderton Capital, Eurazeo, and Optum Ventures. While its valuation was undisclosed as of February 2025, Kaia Health differentiates itself from Sword Health by offering pulmonary rehabilitation services in addition to MSK care.

IncludeHealth: Founded in 2018, IncludeHealth provides digital physical therapy through patients' phones and tablets without requiring sensors. The company raised $11 million in February 2023, led by CincyTech. As of February 2025, IncludeHealth had raised a total of $21.7 million from investors including Tamarind Hill, and grants from the US Air Force and Orgain. Unlike Sword Health, IncludeHealth focuses on collaborating with orthopedic practices and health systems, in addition to selling directly to employers and health plans.

DarioHealth: DarioHealth, established in 2011, offers digital health solutions for chronic condition management, including MSK disorders, cardiometabolic, and behavioral health. The company went public in 2013 and trades on NASDAQ under the ticker DRIO. As of February 2025, DarioHealth had raised $255.7 million in total funding from investors like Farallon Capital Management, Phoenix Financial, and OrbiMed. In contrast to Sword Health's multiple sensors, DarioHealth uses a single sensor system, Upright, for tracking patient movements in its MSK offerings. It also takes a broader approach to treating chronic health conditions like diabetes and hypertension by incorporating monitoring devices, whereas Sword Health focuses solely on MSK digital therapy.

Teladoc Health: Founded in 2002, Teladoc Health provides virtual healthcare services, including telemedicine consultations and chronic condition management. The company went public in July 2015 and is listed on the NYSE under the ticker TDOC. As of February 2025, Teladoc Health had raised a total of $172.9 million from investors such as Kleiner Perkins, Trident Capital, and Silicon Valley Bank. As of February 2025, its market cap was $1.75 billion. Unlike Sword Health, as of February 2025, Teladoc Health does not offer digital physical therapy for MSK conditions as a core product, but it provides solutions for other chronic conditions like obesity, hypertension, and diabetes.

Business Model

Sword Health generates revenue by selling its products and services to employers and health plans. The company attempted to sell to health providers directly but found it was more successful with employers and health plans. As of June 2024, Sword Health planned to stay away from direct sales to providers for the foreseeable future.

In 2020, Sword Health introduced Engagement Pricing, a model where clients only pay when members actively participate in care programs beyond an agreed-upon level. This approach evolved in September 2024 with Outcome Pricing. Under this model, Sword Health’s fees are directly tied to clinically significant outcomes for members. Clients don’t pay in full until the program achieves agreed-upon results, regardless of the number of sessions required.

Sword Health costs may include technology development and deployment costs, operational costs associated with the nurses, physical therapists, and other professionals on the Sword Health team, customer acquisition costs, and research costs the company incurs in efforts to launch new products and improve their existing offerings.

Sword Health employs an organizational structure centered around “waves”, or independent product solutions. A general manager (typically a strong generalist with founder experience) is hired to lead each wave. The team is given $1 million, treated as a seed round, to achieve product-market fit within 12 months. The capital is deployed to hire necessary finance, HR, legal, and engineering talent to support the independent product. If product-market fit is achieved within the 12-month period, additional funding (akin to an internal Series A) is provided by Sword Health to accelerate growth. This approach has been successful, as evidenced by the Bloom product, which in 2024 generated revenue equivalent to Sword Health’s entire 2022 revenue.

Traction

In the years following Sword Health’s commercial launch, the company experienced significant increases in therapy engagement and patient numbers. In 2018, it saw triple-digit growth in total therapy time, reaching 437K minutes and eliminating 11.7K in-person rehabilitation trips. By 2019, total therapy time had increased to 580K minutes, with patient numbers doubling for the second consecutive year. In 2020, Sword Health signed its first US customer, Concordia Plans, offering its digital physical therapy product. In 2020, revenue grew eightfold, making it the fastest-growing digital MSK vendor as of January 2021. In 2021, patients engaged in over 100K physical therapy sessions, totaling 2 million minutes on the platform.

At the time of its Series C funding in 2021, Sword Health reported a 10x YoY increase in patients treated and 600% YoY revenue growth. In 2022, the company delivered 7.5 million minutes of therapy and saw its employer customer base surge from 150 to 1.4K, representing an 833% YoY increase. By 2023, Sword Health nearly tripled its revenue and provided over 15 million minutes of therapy. Its reach expanded to more than 10K employers across three continents. As of January 2024, the company also reported that 64% of members became low-risk for surgery by the end of their program, resulting in client savings of $129 million in unnecessary healthcare costs.

As of May 2024, Sword Health members had completed over 2.5 million physical therapy sessions, with an 81% adherence rate and 62% reporting being pain-free. As of June 2024, Sword Health's program saved participants over $3K per engaged patient annually, the highest independently validated medical savings in the health-tech market. As of February 2025, Sword Health had never lost a client. In addition to 100% client retention, it has 10/10 reported satisfaction and takes 15 days to launch to new clients. Customers of Sword Health include Cisco, Domino’s, and Danaher.

As of February 2025, Sword Health held 37 patents across digital pain solutions including sensor calibration, data synchronization, movement tracking, and voice recognition in noisy environments. As of February 2025, it also had the most FDA-listed devices, published clinical studies, and regulatory clearances in the industry.

Valuation

In June 2024, Sword Health raised $30 million in Series E funding at a $3 billion valuation, bringing its total funding to $453.5 million as of February 2025. Alongside its Series E funding round, in June 2024, the company facilitated a $100 million secondary round, allowing employees to sell equity to new and existing investors, including Khosla Ventures. Other investors include Founders Fund, General Catalyst, Sapphire Ventures, Bond, and Transformation Capital.

Previous funding rounds included a $25 million Series B round in January 2021, a $85 million Series C round in June 2021, and a $163 million Series D round in November 2021. This capital supported expansion in its product suite.

Key Opportunities

Adoption of AI/ML in Healthcare

AI is becoming increasingly integrated into existing healthcare workflows across the patient engagement lifecycle. As of August 2024, more than 86% of healthcare providers, life science companies, and tech vendors used AI. New technologies open avenues to detect, diagnose, and treat patients across various disorders, including chronic conditions. Consumer health applications, early detection through wearables, and assisted decision-making with big health data are examples of how AI can improve existing healthcare workflows.

Sword Health utilizes AI through its Predict and Thrive product offerings. Predict helps reduce spending on surgeries by using algorithms to identify high-risk individuals for employers and intervene through digital physical therapy before conditions worsen. Its use of Phoenix, an AI care specialist within its Thrive product, provides real-time feedback and modifications to exercises or treatment plans.

As AI adoption continues to grow in healthcare, employers may gravitate towards offerings that put this technology at the forefront of their products and services, potentially giving Sword Health a competitive advantage.

Digital Health for Chronic Health Conditions

The prevalence and associated costs of chronic health conditions continue to rise in the United States. In 2022, 90% of the $4.5 trillion annual healthcare expenditure was spent on people with chronic and mental health conditions. As of May 2024, over 38 million Americans had diabetes, with another 98 million prediabetic adults at risk for type 2 diabetes. From 2019 to 2021, 53.2 million adults in the United States reported having arthritis, a leading cause of disability and chronic pain.

If Sword Health successfully expands into managing other chronic conditions beyond MSK disorders, it could broaden its market reach and revenue streams. The company has previously demonstrated its ability to expand into new product lines, including women’s pelvic health with Bloom and daily movement habits with Move. Sword Health’s operating model, which tests new product offerings as if they were independent startups, allows for rapid launch and evaluation of new services. As of June 2024, it was exploring opportunities to disrupt other areas of care where human resources, like clinicians or care specialists, are scarce.

Favorable Market Conditions for Telehealth

The COVID-19 pandemic drove widespread adoption of digital health. In 2023, 63% of individuals reported using virtual care, and Medicare telehealth flexibilities have reinforced its acceptance. The telerehabilitation market, valued at $5.3 billion in 2024, was projected to grow at a 13.2% CAGR from 2025 to 2030, driven by the increased demand for virtual care and technological advancements. These drivers have accelerated digital health integration into employer and health plan benefits, with 91% of organizations offering telemedicine in 2024.

Sword Health benefits from this regulatory support and growing acceptance of telerehabilitation. As virtual care becomes the norm, employer adoption of at-home therapy could rise, boosting demand for Sword Health’s digital physical therapy solutions.

Growing Need for MSK Care

MSK disorders have become increasingly prevalent, with their associated healthcare costs remaining a substantial financial burden. As of August 2024, over half of U.S. adults suffered from MSK conditions that cause pain, impair functioning, and substantially decrease workplace productivity. As of 2024, 75% of employers ranked MSK conditions among the top two health conditions driving their costs. As of July 2023, 36% of all MSK surgeries are not evidence-based, unnecessary, and potentially preventable. This pattern of low-value care had cost patients, employers, and health plans up to $90 billion annually as of July 2023.

The rise in MSK chronic conditions presents an opportunity for Sword Health to expand within the MSK treatment and rehabilitation space. As employers and health plans seek to reduce costs from low-value care and unnecessary surgeries, they may turn to digital health providers like Sword Health for more effective, cost-efficient solutions. Expanding into areas like pain or medication management could help Sword Health capture more market share in the growing digital MSK care sector while lowering healthcare costs and improving patient outcomes.

Key Risks

Expanding to New Markets

Sword Health has established a presence in North America, Europe, and Australia, serving over 10K employees across these three continents. As of October 2024, its primary markets included the United States, Australia, Canada, and the United Kingdom. Despite its success in these regions, Sword Health has faced challenges penetrating other European markets, particularly those with national healthcare systems. For example, countries like Portugal require extensive pilot testing to demonstrate platform value, creating friction in market entry.

To cater to global employers and health plans, Sword Health has expanded its product offerings, including the introduction of Atlas. However, this expansion primarily supports existing global U.S. organizations rather than attracting new international customers. The company views this strategy as a long-term investment, acknowledging that deep market penetration will require time and sustained effort.

In the near term, slow expansion can leave Sword Health vulnerable to market saturation in its existing regions and dependent on a narrow customer base. Prolonged delays in expanding to new markets could allow competitors to establish footholds, making it more difficult for Sword Health to gain market share when it eventually enters. If it fails to achieve considerable traction in key untapped regions, Sword Health’s long-term growth potential and positioning for global clients may be constrained.

Shift to Cost Efficiency for Benefits

The benefits industry has pivoted from prioritizing quality of care to emphasizing cost efficiency. This shift compels digital health providers like Sword Health to demonstrate or guarantee their return on investment (ROI) through contractual guarantees for specific cost savings or third-party evaluations. Sword Health has positioned itself to adapt to this trend through outcome-based pricing. The company only generates revenue when it delivers value and achieves meaningful improvement for employees, incentivizing it to actively market to employees through various channels to boost platform usage.

The shift in the benefits space to cost efficiency has potential implications for Sword Health’s financial stability. If platform usage declines or product quality deteriorates, Sword Health may struggle to expand and maintain its customer base. During financial downturns, employers might cut benefits programs, potentially impacting Sword Health’s revenue if long-term efficacy and cost-effectiveness are not demonstrated. If employee preferences shift away from digital physical therapy, Sword Health could face further challenges in retaining users on its platform, leading to revenue losses from existing and new contracts. Sword Health's ability to maintain its revenue despite potential changes in market dynamics depends on its ability to deliver tangible user improvements and adapt to evolving market demands.

Complex U.S. Regulatory Environment

Sword Health faces a challenging regulatory landscape in major markets, including the United States. As of June 2024, physical therapists are generally prohibited from treating patients across state lines. Different states can also impose diverse certification standards for physical therapists. Additionally, the complex interplay between payers, hospitals, digital health companies, and government regulators in the United States may lead to new regulations affecting reimbursement, patient data handling, and telerehabilitation requirements.

Changes in US regulatory frameworks for digital therapeutics pose logistical challenges for Sword Health with both existing and new products. Compliance issues may result in service disruptions or market access restrictions, requiring the allocation of resources or pause of certain products to ensure ongoing adherence to state and federal directives. As a result, the company’s growth strategy and competitive positioning in the US market may depend on its ability to anticipate regulatory changes and maintain agile compliance strategies.

Technology and Data Security Risks

The healthcare sector is becoming increasingly vulnerable to data breaches. Like other digital health platforms, Sword Health uses patient health data, including personal identifiers, family health history, and medical records, to personalize treatment plans. In 2023, 745 data breaches of 500+ records occurred, with an average of 364K healthcare records breached daily in the United States.

Data breaches can result in substantial costs for remediation, legal fees, and potential fines. Further, loss of trust among employers, health plans, and members could lead to slowed growth, increased customer churn, and difficulty acquiring new clients. If Sword Health fails to implement and maintain robust security measures, it could risk its market position and long-term viability in the MSK care space and digital health industry.

Summary

Sword Health is a digital health company focused on musculoskeletal (MSK) care through AI-driven therapy and rehabilitation solutions. With increasing MSK disorder diagnoses, an aging population, and provider shortages, digital physical therapy has gained traction among employers and health plans seeking to reduce costs and improve patient outcomes.

Despite competition from companies like Hinge Health and Kaia Health, Sword Health has maintained growth and customer retention by integrating AI technology into its offerings and adopting an Outcome Pricing model. This model aims to align with the benefits industry’s emphasis on cost efficiency and measurable returns. Key growth opportunities include vertical expansion with MSK care and horizontal expansion into other chronic condition treatments.