Thesis

In 2023, a report revealed that physicians spent an average of 15.5 hours per week on administrative tasks during scheduled work hours. Physicians in certain specialties, like physical medicine and rehabilitation, critical care, internal medicine, nephrology, neurology, and oncology, dedicated even more time, averaging between 18 and 19 hours per week. In 2024, even outside of work hours, about 21% of physicians reported spending more than eight hours per week on administrative tasks. As of October 2021, administrative expenses accounted for 15-25% of total national healthcare expenditures, or $600 billion to $1 trillion per year, of the total national health expenditures of $3.8 trillion in 2019. Billing and coding costs, physician administrative activities, and insurance administrative costs were the primary drivers of these expenses.

As of February 2024, 93% of physicians felt that they experienced burnout regularly, and 62% attributed it to excessive administrative burden. Administrative tasks disrupt patient visits, requiring physicians to simultaneously document notes for patient reference, care coordination, insurance, and billing purposes. This dual responsibility places a large cognitive load on physicians, forcing them to balance accurate documentation with patient engagement.

Data collected from 2021 to 2022 showed that physicians, regardless of specialty, spent an average of six hours on electronic health records (EHRs) for every eight hours scheduled for patient care. Effective health discussions rely on attentive communication, and physicians’ divided attention can leave patients feeling shortchanged. Physician burnout also has economic repercussions. A 2019 study estimated that physician turnover due to burnout costs the U.S. healthcare system $4.6 billion annually. In addition, a 2021 report estimated that recruiting a single physician to fill a vacancy can cost as much as $1 million. Burnout also increases the likelihood of medical errors, compromising the quality and safety of care.

Abridge offers an AI platform that simplifies clinical documentation. Its software listens to provider conversations with patients and summarizes medically relevant information for care teams and patients. Integrated into Epic, one of the most widely used EHRs, Abridge saved providers an average of two hours per day in 2023. In 2025, the company expanded beyond transcription by embedding revenue cycle intelligence into clinical conversations, checking and validating billing codes in real time. Its tools operate across both clinical care and financial operations, reducing physician workload and lowering administrative costs across the system.

Founding Story

Abridge was founded in 2018 by Shivdev Rao (CEO), Florian Metze (CSO), and Sandeep Konam (CTO). The company originated from the Pittsburgh Health Data Alliance, a collaboration between the University of Pittsburgh, the University of Pittsburgh Medical Center (UPMC), and Carnegie Mellon University.

Rao’s path to becoming a physician-founder was unconventional. Initially drawn to architecture and history, he earned a bachelor’s degree in history from Carnegie Mellon University in 2001. However, during his undergraduate studies, he was inspired to explore healthcare technology after learning about an ophthalmologist who developed a high-efficiency surgical platform to treat cataracts at scale.

Rao attended medical school at the University of Pittsburgh School of Medicine with a focus on improving patient care at scale. During his residency in Internal Medicine at the University of Michigan, he began programming in Ruby on Rails, developing web applications for residency programs. His early work in digital health, including an app that gained traction, deepened his interest in healthcare technology.

During his cardiology fellowship at the University of Pittsburgh Medical Center, Rao expanded his focus on the intersection of healthcare and technology, eventually serving as the primary check-writer and investor for UPMC while maintaining his clinical role at the Heart and Vascular Institute at the University of Pittsburgh Medical Center. In this role, he invested in businesses leveraging machine learning to enhance patient care and the provider experience. As a practicing physician, he encountered challenges in ensuring that patients retained and understood visit summaries. These experiences informed Abridge’s mission to improve clinical communication.

In 2018, Rao partnered with Konam, a senior product manager at UPMC Enterprise, and Metze, an associate research professor at Carnegie Mellon University, both of whom resonated with Abridge’s mission. Konam earned his master’s degree in robotics from Carnegie Mellon University in 2017 and had previous experience building an oncology clinical trial matching platform. Konam felt strongly about building Abridge to help patients capture, create, and curate their own healthcare data via audio recordings from their consultations. Prior to Abridge, Metze had been a member of the research faculty at the Language Technologies Institute at Carnegie Mellon University since 2009. His work primarily focused on speech recognition and multimedia analysis.

Rao left UPMC in March 2019 to focus on Abridge full-time. As of March 2025, Rao remained CEO and was the only founding member still on the executive team. While Konam still remained involved in an unspecified capacity as of September 2025, Metze left Abridge in 2019 to continue teaching and serving as a research scientist at Meta.

Since Abridge’s founding, the executive team has gradually expanded. In 2019, Julia Chou (COO) joined Abridge with experience as a former YouTube program manager and founder of a software platform for child welfare services. Tina Shah (Chief Clinical Officer), previously a senior advisor to the US Surgeon General and medical director at Wellstar Health System, also joined in 2019.

Zachary Lipton (CTO/CSO), an associate professor at Carnegie Mellon specializing in machine learning and healthcare applications, joined Abridge as an advisor in 2019 and became Chief Science Officer and Chief Technology Officer in 2023. Brian Wilson (Chief Commercial Officer), a former sales and revenue leader at NextGen Healthcare and SlickText, joined in 2023. In January 2025, Abridge hired Sagar Sanghvi, former CFO of Instacart and partner at Accel, as its first Chief Financial Officer to help lead its enterprise growth.

Product

Abridge captures and transcribes doctor-patient conversations with consent, using generative AI to structure notes using standard charting methods like SOAP (Subjective, Objective, Assessment, and Plan). It integrates with EHRs, particularly Epic, and serves clinicians across major hospital systems like UPMC, Emory Healthcare, and Yale New Haven Health. As of July 2025, the platform supported over 55 medical specialties and 28 languages, enabling deployment across outpatient, emergency, and inpatient care settings while reducing cognitive load and administrative friction

Traditionally, physicians multitasked during visits, manually taking notes while conversing with patients and later reconstructing details to fit SOAP documentation and billing requirements. In 2023, it was reported that physicians spent an average of 15.5 hours per week on administrative tasks during their work hours, with physicians in certain specialties spending between 18 and 19 hours per week. As of February 2024, 93% of physicians felt that they experienced burnout regularly, and 62% attributed it to excessive administrative burden.

Machine-learning tools like Abridge streamline this process, reducing administrative work by two to three hours per day. By automating documentation, Abridge allows physicians to focus more on diagnoses and patient care. As hospitals seek to improve efficiency and reduce physician burnout, AI-powered scribe tools like Abridge present a scalable solution to improve the provider experience and patient outcomes.

As of October 2024, Abridge’s technology was reported to automate 91% of medical note creation. One hypothetical analysis showed that in a hospital with 1K physicians, this could save 424K hours annually and result in $8.6 million in savings from reduced physician turnover and shorter working hours. Abridge is built to function across multiple appointment contexts, including in-person visits, phone calls, and chat transcripts. As of July 2025, usage reached over 150 enterprise health systems, supporting 50 million medical conversations per year.

Providers

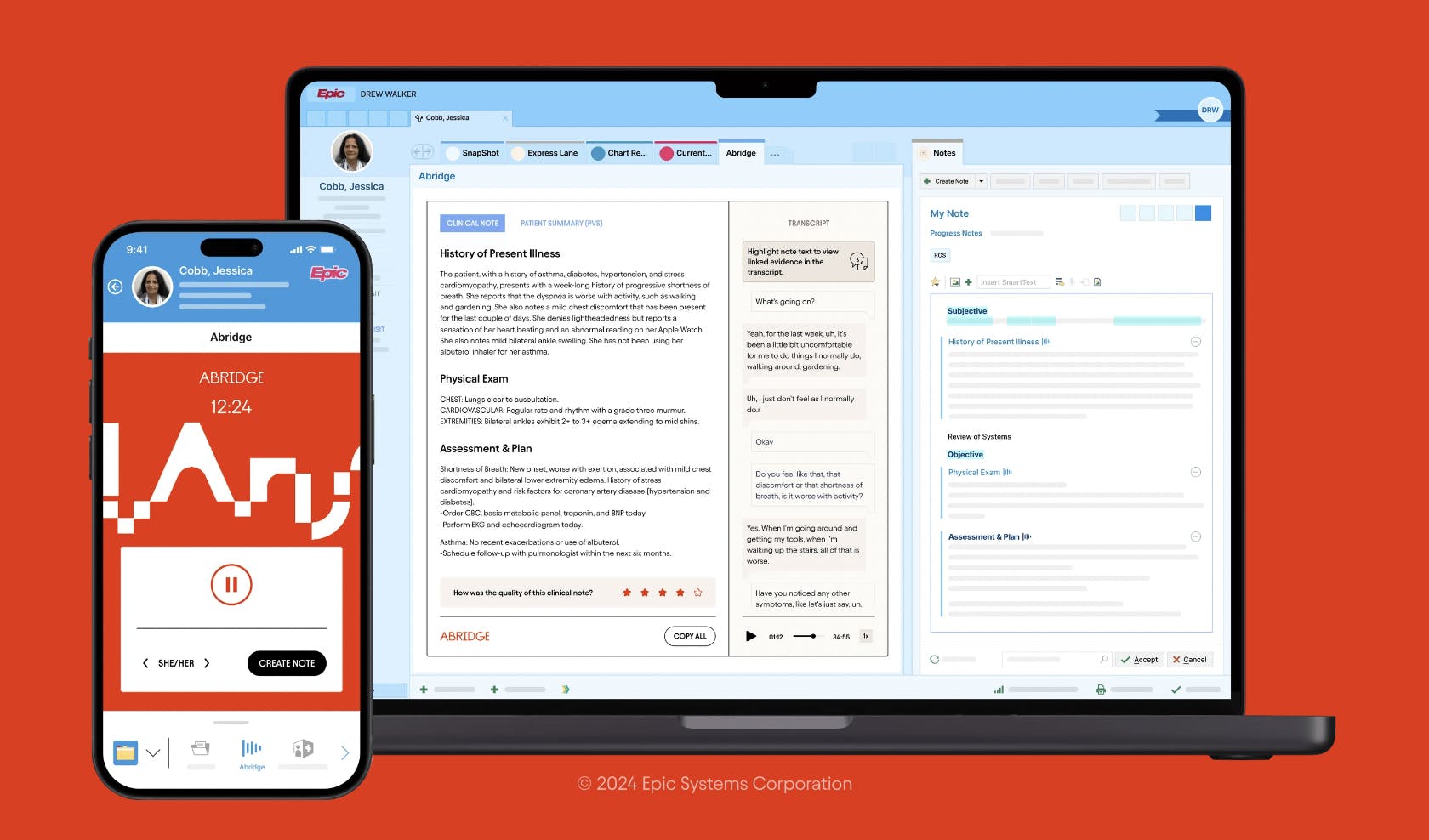

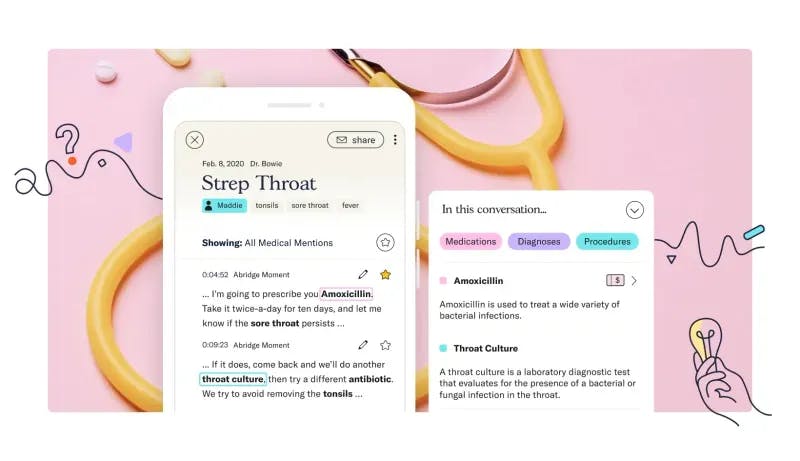

Physicians use Abridge to listen in on conversations with their patients for both in-person and telemedicine visits. They start recording on their device at the start of the visit and end the recording when the patient leaves. Abridge filters through topics in the conversation to capture medically relevant information such as patient symptoms, physician recommendations, and differential diagnoses.

Source: Abridge

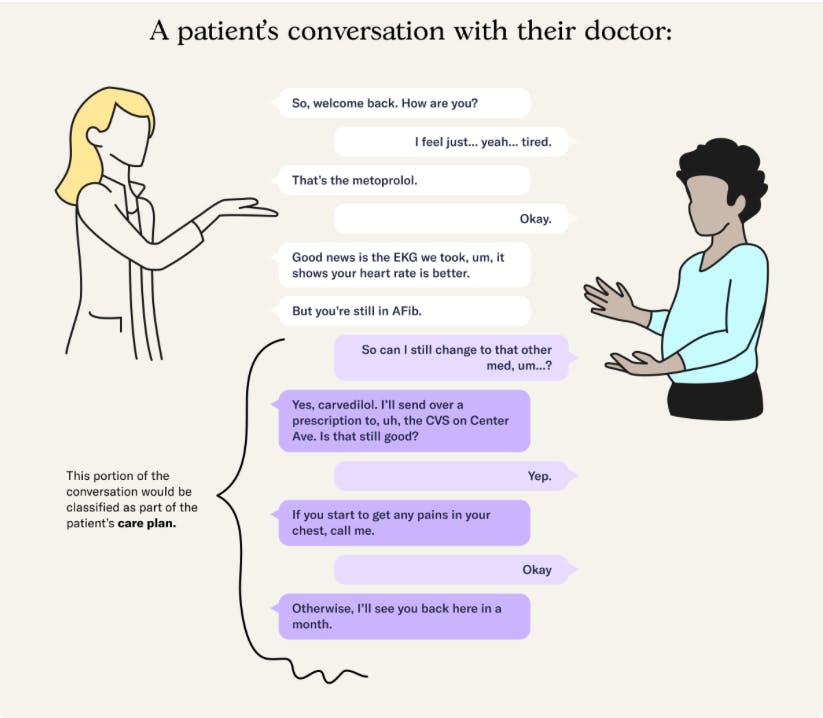

Abridge separates medically relevant information from the small talk that physicians use to build trust with patients throughout the course of a consultation. Abridge then presents this information to providers and patients. For providers, Abridge presents medically relevant information in the SOAP (Subjective, Objective, Assessment, and Plan) clinical notation format used by physicians for clinical documentation. This system covers the majority of information that patients and clinicians need to understand from their conversations.

Providers are able to focus their attention on patients, spend less time completing administrative paperwork, and can complete a patient visit using a smartphone or tablet. In 2024, Abridge reported the following example of feedback from a provider using its software:

“With Abridge, the fidelity of my notes is much higher because I remember all the details, all the details are there. If I don’t have time to document them that day, and instead, I document a few days later, I don’t lose fidelity. That’s one of the biggest deliverables.”

Physicians can audit the notes efficiently by highlighting any section to trace it back to the original transcript or audio, ensuring transparency in the AI-generated content. In the Abridge app, clinicians can edit, review, and verify notes, tailoring them to their personal documentation preferences. Providers can also edit and verify the accuracy of the note with “linked evidence”, a feature that links conversational snippets to parts of a summary to help jog the provider’s memory and connect notes to the conversation. This adaptability allows the platform to accommodate physicians’ individual stylistic choices. Abridge also offers an API for licensed developers to build on their medical scribe technology.

In 2025, providers using Abridge across UNC Health, Emory, KUMC, and Mayo Clinic reported 73% less after-hours documentation, 61% reduced cognitive burden, and 81% improved workflow satisfaction, underscoring Abridge’s impact on clinician wellbeing. Reception from providers has been positive, with more than 90% of providers continuing to use Abridge during care as of July 2023. This provider workflow is part of Abridge’s broader AI documentation suite, fully integrated into Epic, enabling scalable deployment across large health systems.

Source: Abridge

In August 2025, Abridge launched an integration with Highmark Health that enables real-time prior authorization during clinical encounters, reducing approval times from days or weeks to minutes. The AI system analyzes clinician–patient dialogue against payer requirements and alerts the clinician if documentation is incomplete, allowing them to capture the necessary details before the visit ends. All recommendations remain visible and editable by the clinician before secure submission.

Patients

For patients, Abridge’s platform provides access to transcribed appointment summaries, medication change confirmations, and secure sharing of conversation summaries with family members.

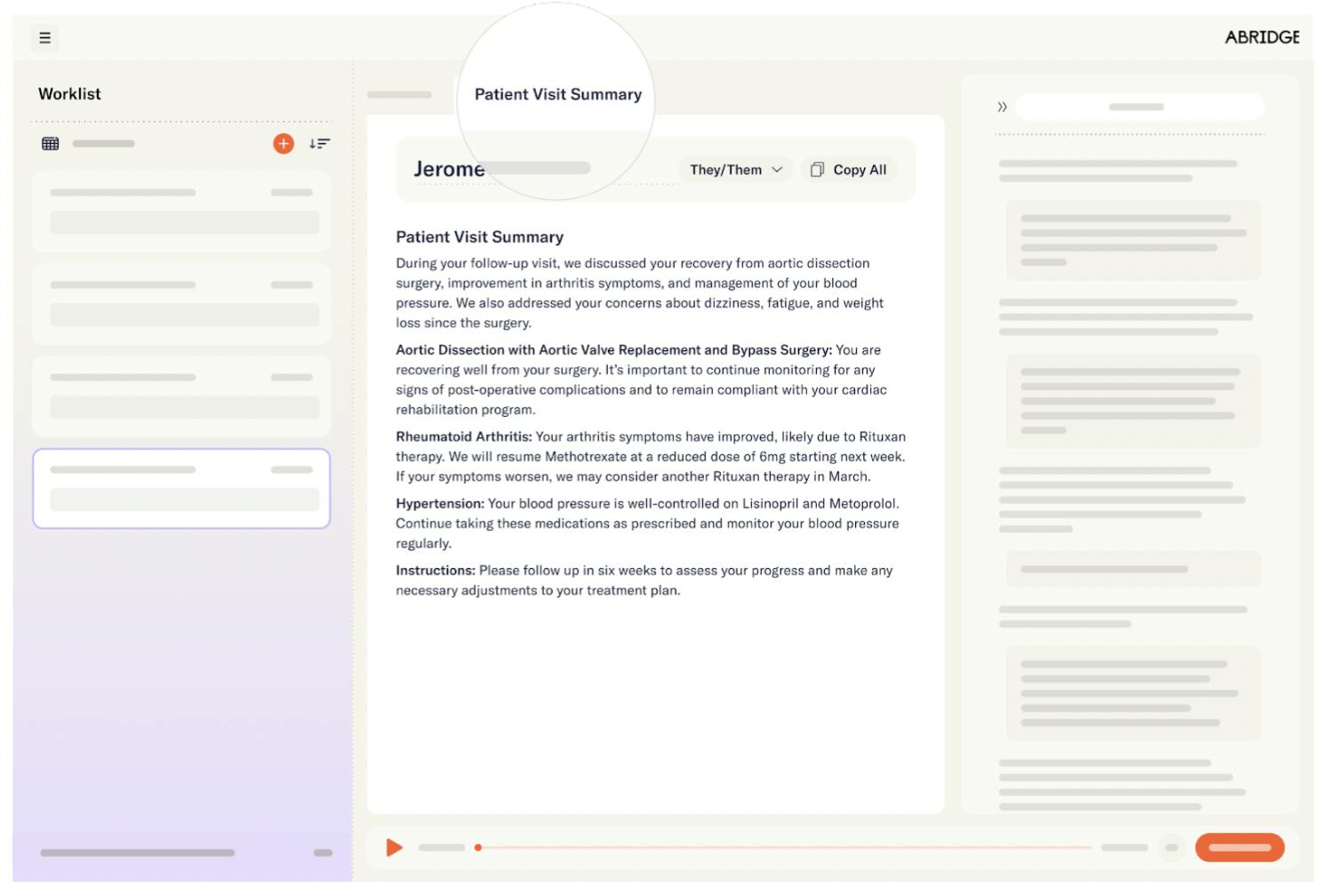

In April 2024, Abridge introduced a Patient Visit Summary (PVS) feature, which generates real-time appointment summaries at an 8th-grade reading level. The summary provides patients with a written transcript and audio clips from the conversation with their provider to help them remember and understand their conversation. This feature addresses the problem of patients forgetting 40-80% of medical information discussed during visits, with inaccuracies in nearly half of what they do remember.

These summaries also include a structured care plan and instructions, designed for readability and health literacy. Patient testimonials speak to the efficacy of Abridge’s visit summary, with one patient reporting: “I remember 50% of what happened at my last appointment, but Abridge filled in the gaps and corrected a misunderstanding”.

Additionally, Abridge automatically bookmarks complex medical concepts and terms and provides context and definitions. This helps patients better understand their diagnosis and medications to take a more active role in their care plan and health.

Source: Abridge

The patient summaries that Abridge develops can also be securely shared with concerned friends and family. Abridge’s various language offerings and summary notes also help improve comprehension for people with limited English proficiency, who represented 8% of Americans as of 2021. These patients may traditionally struggle to communicate their symptoms, thoughts, and feelings with their doctor and feel understood. Additionally, as of August 2025, the Highmark/AHN pilot showed that 92% of all patients felt their clinicians were more attentive when using Abridge technology during visits.

Source: Abridge

Technology

Abridge’s AI system, “Ears”, is comprised of a medical speech recognition model and a clinical note generation model built on a proprietary dataset containing over 1.5 million fully consented and de-identified medical encounters. Together, these models transcribe patient-clinician conversations and generate structured notes in real time. The speech recognition model converts audio from medical conversations into text, aligning the transcript with audio timestamps and attributing phrases to the correct speaker. This transcript is then processed by the note-generation model to produce medical summaries and identify key terms.

Abridge’s speech recognition model has shown superior performance compared to other models, particularly in medical contexts. For example, as of August 2025, it outperformed speech-to-text models like Google Medical Conversations and OpenAI’s Whisper v3 in medical conversation transcription, achieving a 16% reduction in word error rate and a 45% reduction in errors related to new medication names. The model also delivered high accuracy in Spanish, with a word error rate of 3.2%.

Source: Abridge

Abridge benchmarks its speech recognition models not only on public datasets like Librispeech but also on curated datasets specifically designed to identify weaknesses in medical transcription. These datasets include conversations with new medication names and complex interactions between multiple speakers. Abridge tests its models on over 10K hours of clinical conversations, using “challenge datasets” to assess model performance.

Promising note-generation models also undergo blinded head-to-head trials conducted by licensed clinicians, who evaluate the accuracy and clinical relevance of the notes produced. During these trials, clinicians select preferred notes and provide annotations to flag errors and suggest feedback. This process ensures that improvements to Abridge’s AI system are informed by both qualitative and quantitative data. Once a model version is deployed, Abridge continues to monitor its performance, which may include collecting passive input from clinicians who change any generated notes. “Ears” is updated weekly to enhance performance.

Abridge has also invested in ongoing human-computer interaction research. Typically, providers spend around 20 seconds editing the real-time generated SOAP notes and visit summary. Each time providers edit these SOAP notes and visit summaries, Abridge uses provider inputs to continuously improve the system’s accuracy in summarizing and processing conversation information. In August 2025, the company published a whitepaper describing its “Science of Confabulation Elimination,” a framework to reduce hallucinations in AI-generated clinical notes. In clinical test datasets, the system identified 97% of hallucinated content, compared to 82% by GPT-4o. To expand into financial operations support, in April 2025, Abridge introduced a Contextual Reasoning Engine that incorporates prior notes and encounter context to improve documentation accuracy and billing readiness in real time. The system generates notes that are auditable, billable, and tailored to specialty needs.

Abridge maintains data privacy by using de-identified data from fully informed and consenting patients to train their systems in compliance with HIPAA (Health Insurance Portability and Accountability Act) data-sharing regulations and PHI (protected health information) storage stipulations. It includes customizable governance controls and health system-wide analytics and reporting. It also maintains HIPAA compliance, with all data stored in U.S.-based data centers and protected by 256-bit encryption, both in transit and at rest.

Market

Customer

Inferring from its highlighted customers, Abridge operates in the US healthcare market with a focus on large health systems (e.g., Kaiser Permanente, Sutter Health). The platform’s primary end users are physicians across different specialties, but its reach has expanded to include nurses and other clinical staff. As of July 2025, Abridge reported adoption across 150+ health systems, with notable customers including Mayo Clinic, Duke Health, Johns Hopkins, and UNC Health, which moved from pilot to system-wide rollout in February 2025.

Abridge’s customer base has also diversified beyond large academic centers. In April 2025, the company partnered with AltaMed Health Services, an independent federally qualified health center in the US, to bring multilingual documentation support across its community clinics. The same year, Abridge expanded distribution into ambulatory practices through a partnership with Athenahealth, extending reach into smaller and independent practices. In August 2025, Abridge announced a collaboration with Highmark Health and Allegheny Health Network to embed real-time prior authorization into its platform, marking its entry into payer-adjacent workflows.

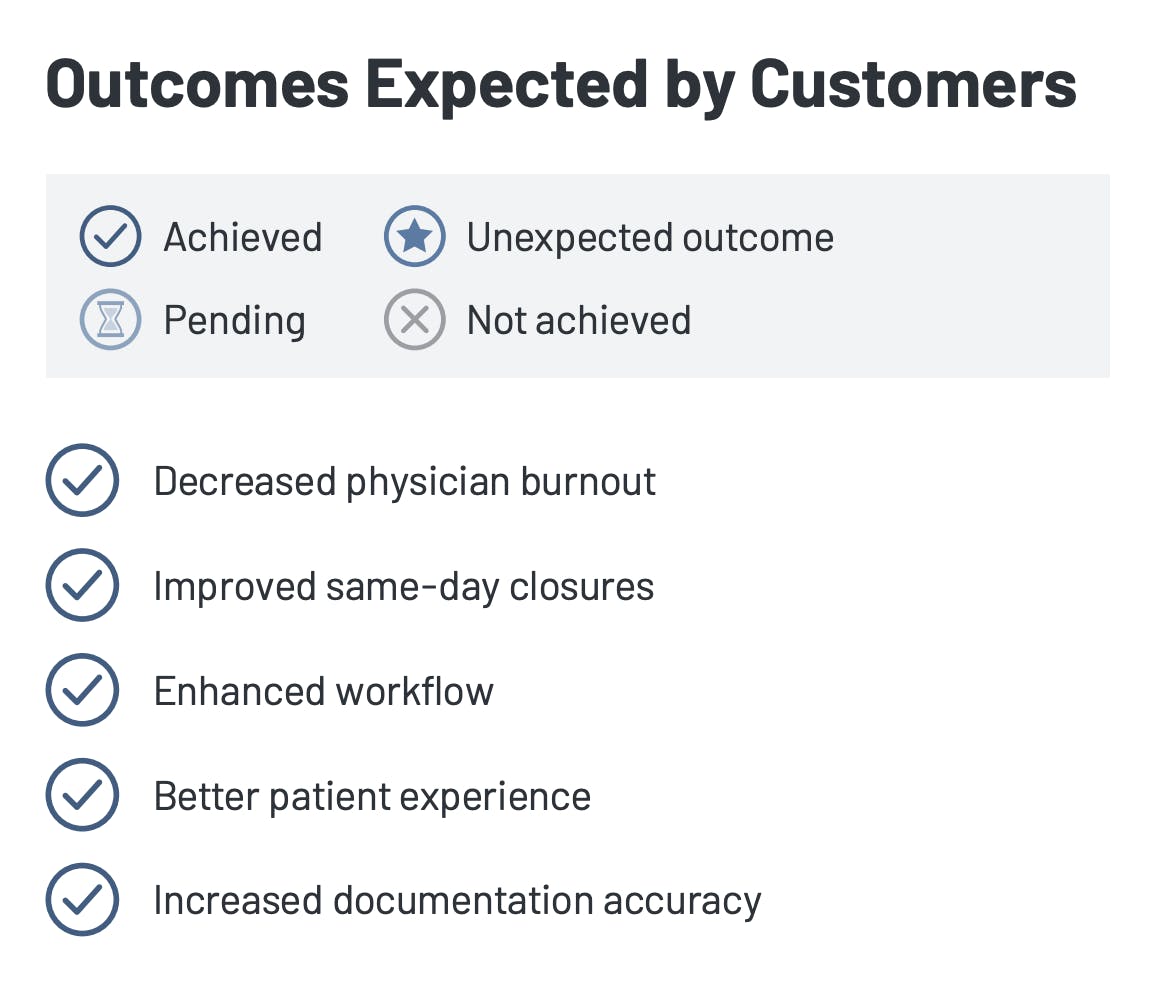

Hospital decision-makers, such as chief medical information officers and chief information officers, typically initiate and oversee partnerships/pilot programs when adopting AI scribes like Abridge. As of 2024, in an evaluation with 15 users, the platform successfully achieved all key outcomes, including reducing physician burnout, improving same-day note closures, streamlining clinical workflows, enhancing the patient experience, and increasing the accuracy of clinical documentation.

Source: Klas Research

Market Size

As of September 2025, Abridge operates within both the US medical transcription software market and the broader global AI healthcare market. In 2023, the US medical transcription software market was valued at approximately $764 million, while the global market was estimated at $1.9 billion, with a projected CAGR of 15.1% from 2024 to 2032.

More broadly, the global AI healthcare market size was estimated at $19.3 billion in 2023 and was expected to grow at a CAGR of 38.5% from 2024 to 2030. This trend was driven by the exponential growth in healthcare data and the shortage of healthcare workers, with an estimated global health worker deficit of 10 million by 2030 as of May 2023. As Abridge continues to expand its product offerings horizontally across applications of AI in healthcare, Abridge may enter new markets, like the global medical coding market, which was valued at $21.7 billion in 2024.

As of 2023, the 10 largest health systems in the US collectively managed over 1.2K hospitals, which made up 20% of all active hospitals nationwide. Since Abridge is targeting these large health systems, each new partnership has the potential to significantly expand its market presence across the US. Rising physician burnout across Europe also indicates potential for the adoption of Abridge’s technology beyond the US market.

Competition

Competitive Landscape

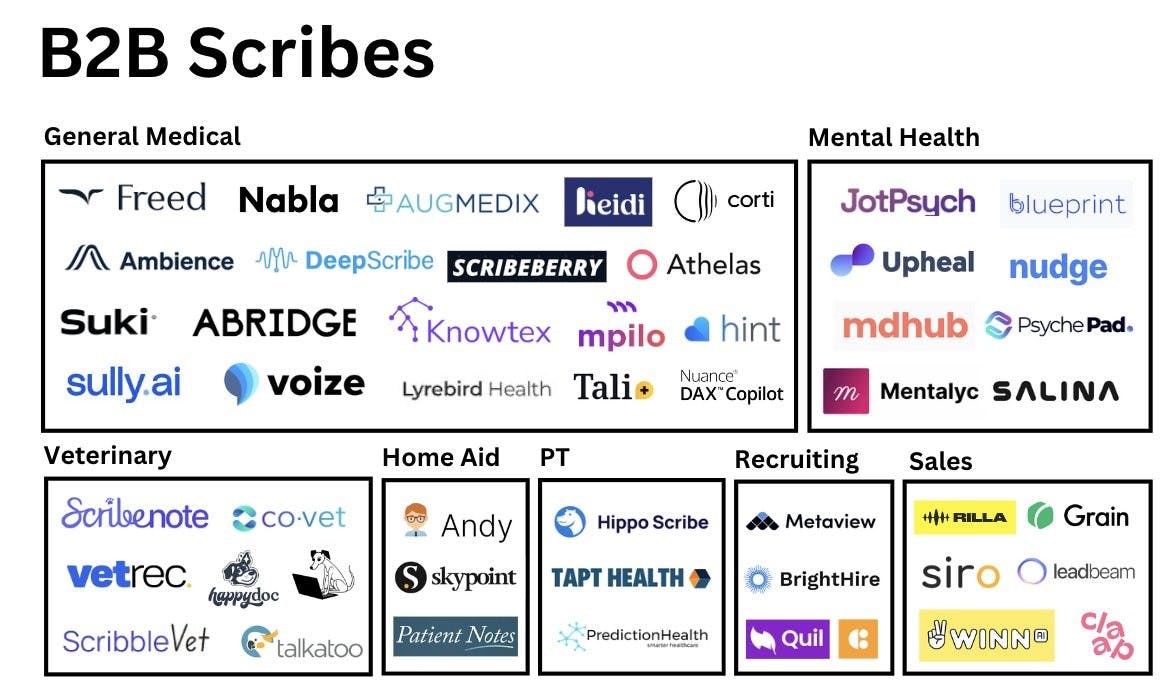

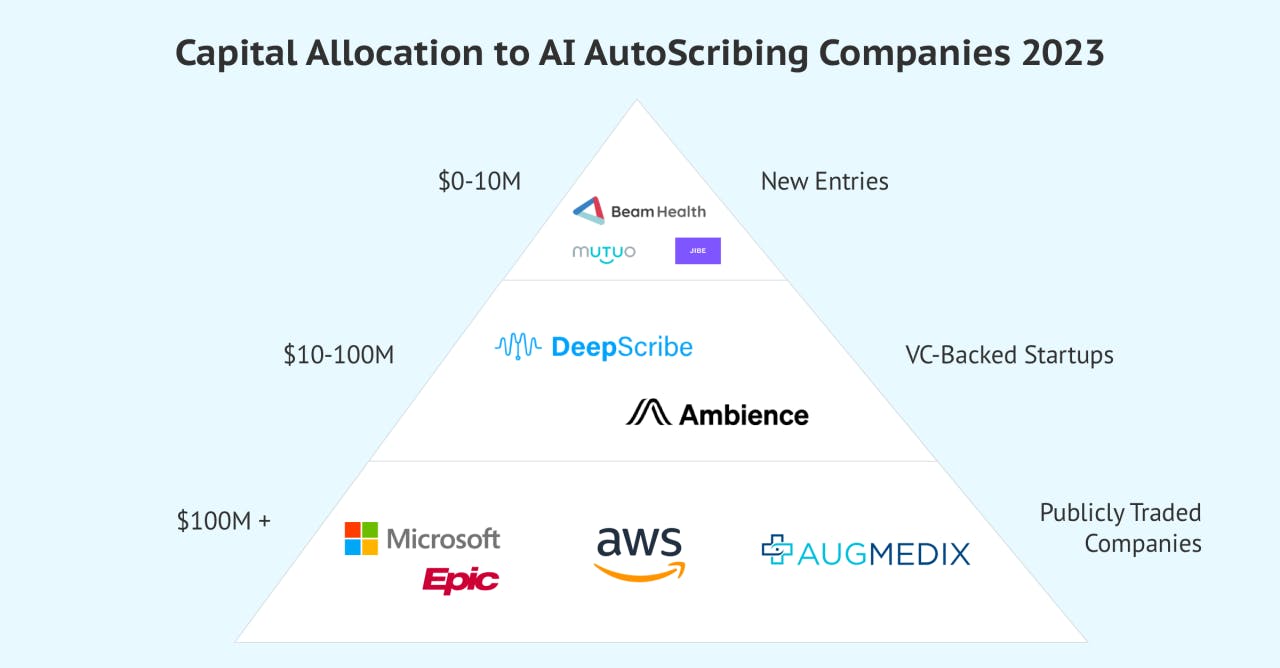

Source: a16z

Abridge operates in a competitive market for AI-powered clinical documentation. In 2024, KLAS Research identified Microsoft-owned Nuance as its primary competitor in ambient scribing, citing the long-standing Dragon Medical One platform and Microsoft’s distribution into health systems. In February 2024, Abridge launched Abridge Inside, an integration with Epic that enabled clinicians to use its AI documentation tools directly within the EHR. While this integration initially differentiated the company, the category has since become more crowded.

By August 2025, Epic entered the AI scribe market with “Art for Clinicians,” a native ambient documentation system that uses Microsoft’s Dragon Ambient AI and Epic’s Cosmos dataset of 300 million patient records to pre-populate notes directly within its EHR. With 42% of US hospitals using Epic, this gives the company a distribution advantage that may shift adoption toward in-platform solutions. The launch underscores the importance of AI scribes but shortens the period in which startups can differentiate. Although Epic’s system is still in early deployment, its scale, data resources, and control of the EHR platform make it a credible competitor.

Startups such as Suki, Nabla, DeepScribe, and Augmedix continue to compete on usability, price, and specialty tailoring. Most focus on smaller practices or niche use cases rather than enterprise health systems. As of July 2025, Abridge offered broader specialty coverage (55+ specialties), multilingual support (28 languages), and had expanded into revenue cycle intelligence and prior authorization workflows. This approach frames Abridge not only as a scribing tool but as infrastructure linking clinical care with healthcare finance, creating a potential moat in payer-facing workflows as EHR incumbents expand further into the market.

Source: Beam Health

Competitors

Nuance: Nuance, founded in 1992, specializes in conversational AI and ambient clinical intelligence. The company was acquired by Microsoft in March 2022 for $19.7 billion, making it Microsoft’s third-largest acquisition as of September 2025. Nuance’s Dragon products are widely used in healthcare, with adoption in 77% of hospitals across the US as of 2021.

Nuance, like Abridge, has a deep integration with Epic and was embedding its Dragon Ambient eXperience Express (DAX) copilot, rebranded to Microsoft Dragon Copilot, into Epic’s EHR system. Dragon Copilot is part of Microsoft Cloud for Healthcare and serves as an AI assistant for clinical workflows. Unlike Abridge, which uses its own model, Dragon Copilot runs on OpenAI’s GPT-4 model. As of July 2024, 77% of clinicians using it report improved documentation quality.

Dragon Copilot is part of Nuance’s Dragon family of speech recognition products and can pair with other Dragon products. Dragon Copilot may be better suited for larger health systems already integrated with the Microsoft suite of products and costs more per seat compared to Abridge. As of January 2024, it had been adopted by over 150 hospitals.

Dragon Copilot takes the form of a smartphone app, transcribing patient visits and generating SOAP notes from those transcripts, similar to Abridge. Physicians can also edit AI-generated notes using voice commands. Unlike Abridge, in addition to transcription and structuring clinical conversations, Dragon Copilot acts as a virtual assistant by automating workflows, such as generating referral letters from visit data. It also allows clinicians to customize note templates.

In August 2025, Epic launched its “Art for Clinicians” suite, which fully embeds Dragon Copilot into Epic workflows via Microsoft’s Cosmos AI platform, expanding Copilot’s reach across documentation and predictive analytics.

Augmedix: Founded in 2012, Augmedix went public in 2021 and was acquired by Commure, a healthcare software and AI platform, for $139 million in October 2024. The company offers a suite of medical documentation products with varying levels of AI integration, including Augmedix Go (a pure AI scribe), Augmedix Assist (which combines AI scribe functionality with AI-generated patient notes, coding, after-visit summaries, data entry, and referral letters), and Augmedix Live (for full clinical workflow support before and after visits by a real documentation specialist).

Augmedix’s products serve both ambulatory and acute care settings, including emergency departments. For example, Augmedix Go ED is designed to function in noisy environments where patients are seen by multiple clinicians. Instead of building a suite of specialized products, Abridge aims to develop an all-in-one solution that serves every situation.

Ambience: Founded in 2020, Ambience offers an AI-powered ecosystem of products designed to make clinical workflows, documentation, and billing more efficient. Its suite includes an AI ambient scribe for over 100 specialties, integrated coding assistance that extracts ICD-10 and CPT codes from conversations, after-visit summary generation, referral letter generation, and pre-charting support.

Like Nuance and Augmedix, Ambience offers a more comprehensive solution than Abridge by incorporating medical coding support and covering a wider range of specialties. In July 2025, the company raised $243 million in Series C funding at a $1.25 billion valuation, bringing its total funding to 320 million as of September 2025. Investors include Kleiner Perkins, Andreessen Horowitz, Oak HC/FT, and the OpenAI Startup Fund.

Suki: Founded in 2017, Suki provides an AI clinical assistant for healthcare professionals to dictate, generate notes ambiently, recommend codes, and answer medical questions. Like Ambience, Suki has more features but is more expensive than Abridge. In October 2024, the company raised $70 million in a Series D funding round led by Hedosophia at a valuation of $500 million, bringing its total funding to $165 million as of August 2025. Investors include Venrock, March Capital, and Flare Capital Partners.

DeepScribe: DeepScribe was founded in 2017 and has since launched two main products: an AI medical scribe tailored for specialty-specific workflows and an AI tool that ensures coding compliance by providing insights into relevant HCC (hierarchical classification category) codes based on patient conversation data before, during, and after visits. It also includes a note customization studio with over 50 charting templates and a transparency feature similar to Abridge’s “Linked Evidence”, helping clinicians understand how AI-generated insights draw from raw patient conversation data.

DeepScribe’s note-generation technology relies on a combination of fine-tuned large language models and task-specific models trained on millions of labeled patient conversations, with GPT-4 integrated into its stack. In contrast, Abridge has developed its own proprietary models specifically for speech recognition and note generation, eliminating its reliance on third-party LLMs. As of September 2025, DeepScribe had raised $61 million in funding, backed by investors like Index Ventures, 1984 Ventures, and Bee Capital. The company’s estimated valuation as of July 2023 was $180 million, and it integrated with seven EHR providers as of September 2025.

Nabla: Founded in 2018, Nabla is an ambient AI platform that offers pre-charting, clinical notes, EHR integration, medical coding, and patient summary-generating features. In January 2024, the company raised $24 million in a Series B funding round led by Cathay Innovation, bringing its total funding to $44.7 million as of March 2025. As of March 2025. Nabla supported three more clinical specialties than Abridge and had a broader focus on streamlining medical administrative tasks, such as coding. Another distinction is that Nabla fine-tunes open source models to power its features, while Abridge has built its own models.

Business Model

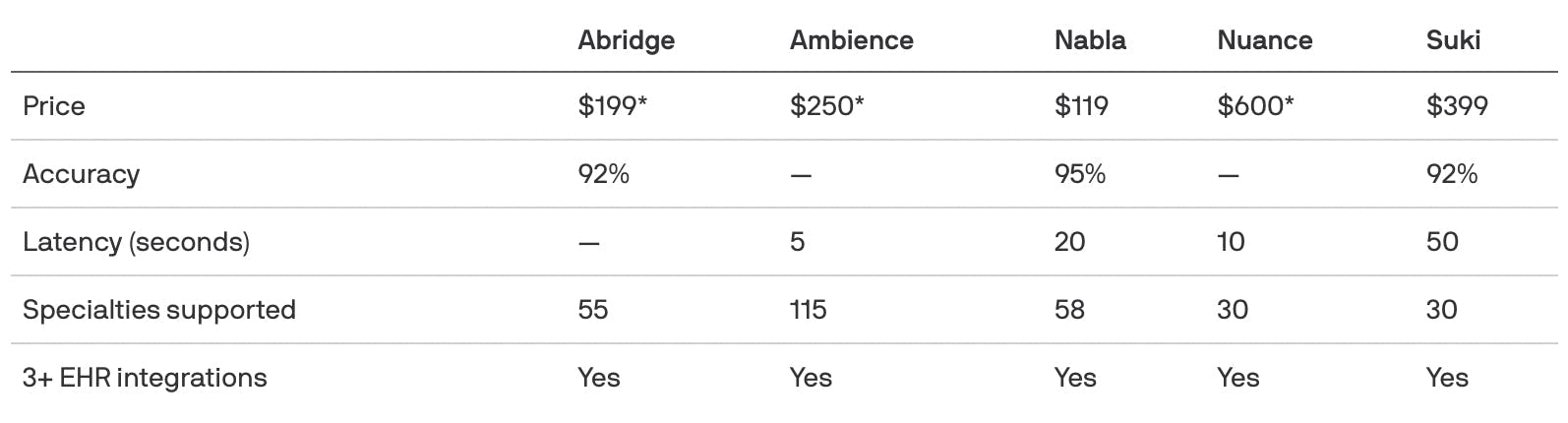

The price of an Abridge license starts at $199 per seat per month as of March 2025. A 2024 report from KLAS Research suggested that many customers chose Abridge because its pricing is more affordable than other medical scribes. Based on Abridge’s clinician terms of use agreement, clinicians may gain free access to the platform through their health system or health insurance provider.

Source: Axios

For health systems, Abridge determines pricing on a case-by-case basis, considering factors such as the number of physicians in the system, the system’s complexity, the features requested, and the EHR integrations required. Historically, Abridge has offered large health systems like UChicago and Sutter Health pilot programs to establish results and facilitate larger rollouts within one to three months after the health system has seen results within their own clinician populations.

As a healthcare AI-powered platform, Abridge may incur costs related to technology development and maintenance, compliance and regulation, and customer acquisition. Technology development and maintenance costs may include investments in AI and machine learning development, software infrastructure, and cloud data storage and hosting. Compliance and regulation costs may include investments in data security and encryption to comply with HIPAA regulations. Sales and acquisition costs may include building partnerships with healthcare providers, clinics, and hospitals, investing in digital marketing, and attending healthcare conferences to showcase the product and improve awareness.

Traction

Growth

As of 2025, hospitals were purchasing Abridge at a faster rate than typical for hospital sales cycles. Despite hospital sales cycles typically taking months, as of May 2023, the company has announced a new health system customer nearly every week in 2024. For example, in December 2024, UChicago Medicine expanded its usage of Abridge to more than 800 clinicians across its health system. In January 2025, Duke Health deployed Abridge’s clinical documentation platform to more than 5K clinicians. In March 2025, Sutter Health rolled out Abridge to more than 1K clinicians.

As of June 2025, Abridge was deployed in more than 150 health systems, including the University of Vermont Health System, Christus Health, UChicago Medicine, Sutter Health, Yale New Haven Health System, UCI Health, Emory Healthcare, The University of Kansas Health System, and UPMC.

Efficacy

In 2024, the platform achieved a KLAS rating of 95.3%, significantly higher than the industry average of 79.6%. According to KLAS Research, Abridge customers report decreased burnout and documentation time alongside streamlined patient communication and workflows. While some customers await deeper EHR integration and enhanced accuracy for certain specialties, it was reported that they appreciated Abridge’s responsiveness to feedback, Epic Workshop partnership, and intent to expand beyond clinical documentation.

Abridge has reported clinician improvements for numerous health systems through its pilot programs. For example, in March 2025, Abridge reported results from Sutter Health’s use of Abridge. Within a pilot program of three months, Sutter Health saw 78% of clinicians experience improved work satisfaction, 59% experience improved quality of note, 49% experience a reduction in cognitive load, and 53% report an increase in undivided attention. Similarly, following implementation with Lee Health in August 2024, Abridge reported that 86% of Lee Health clinicians did less after-hours work, 76% felt they had enough time to document, and 57% more clinicians completed notes the same day.

Partnerships

In October 2022, Abridge announced a partnership with Google Cloud. Google Cloud lists Abridge as a premier partner for structuring, summarizing, and generating insights on medical conversations.

In October 2024, Abridge partnered with Wolters Kluwer to increase documentation quality by embedding UpToDate, a clinical decision support product, directly within its platform. Through this integration, Abridge documentation can include links to the latest evidence-based recommendations. In November 2024, Abridge partnered with OpenNotes, a health transparency research group, to evaluate the usefulness of AI-generated patient visit summaries. The six-month study involves patient focus groups that rate summaries on criteria such as usefulness and accessibility.

In March 2025, Abridge joined the National Academy of Medicine’s Changemaker Campaign, an initiative to address health worker burnout and advance the National Plan for Health Workforce Well-Being. In April 2025, Abridge partnered with AltaMed Health Services, the largest Federally Qualified Health Center in the U.S., to bring its multilingual AI documentation platform to community clinics. The deployment supports AltaMed’s diverse patient population across English, Spanish, and additional languages.

In June 2025, Abridge launched Abridge Inside for Inpatient, extending its Epic integration into hospital workflows such as history and physical exams and progress notes. It also introduced outpatient order capabilities that surface medications and allow clinicians to generate structured orders during conversations. In July 2025, Abridge partnered with the Hospital for Special Surgery (HSS) to co-develop documentation tailored for orthopedic care, including imaging, laterality, and risk capture.

In August 2025, Abridge announced an enterprise-wide collaboration with Highmark Health and Allegheny Health Network (AHN) to enable real-time prior authorization during patient visits. The system analyzes clinician–patient dialogue, cross-references payer requirements, and prompts clinicians to capture missing documentation, allowing approvals in minutes rather than days. In September 2025, Abridge announced a partnership with Hartford HealthCare.

Valuation

In June 2025, Abridge raised a $300 million Series E round led by Andreessen Horowitz, with participation from Khosla Ventures, at a $5.3 billion post-money valuation. This marked a nearly twofold increase in valuation in just four months. The company stated it would use the new capital to expand its revenue cycle management capabilities and pursue strategic acquisitions.

Previously, In February 2025, Abridge raised $250 million in Series D funding, led by Elad Gil and Institutional Venture Partners, with participation from Alphabet Inc.’s CapitalG fund and NVIDIA’s NVentures, valuing the company at $2.8 billion. The funding was planned to be used to develop additional AI capabilities and invest in commercial growth. As of September 2025, Abridge had raised approximately $760 million in total since its founding in 2018.

Key Opportunities

Integrating Clinical Decision Support

As of April 2024, over 50% of patients forgot the recommendations discussed during their conversations with physicians. At the same time, increased communication between patients and providers has been shown to improve patient satisfaction and health outcomes. This underscores the need for continuous patient engagement to enhance the overall quality of care.

One potential extension of Abridge’s platform is the integration of clinical decision support features. Visit summaries and documentation could be used to send reminders, include a dedicated section for patient resources and recommendations, or incorporate AI-generated care plans, such as dietary or exercise guidance. By linking documentation with patient-generated health data, shown to aid in diagnosing and managing chronic conditions, the system could deliver more personalized recommendations.

In August 2025, Abridge published a whitepaper outlining its “Science of Confabulation Elimination,” a framework to reduce hallucinations in AI-generated clinical notes. In clinical testing, the system identified 97% of hallucinated content compared to 82% for GPT-4o. These results point to greater reliability in generated notes, a prerequisite for future decision support.

Supporting Financial Transaction Transparency

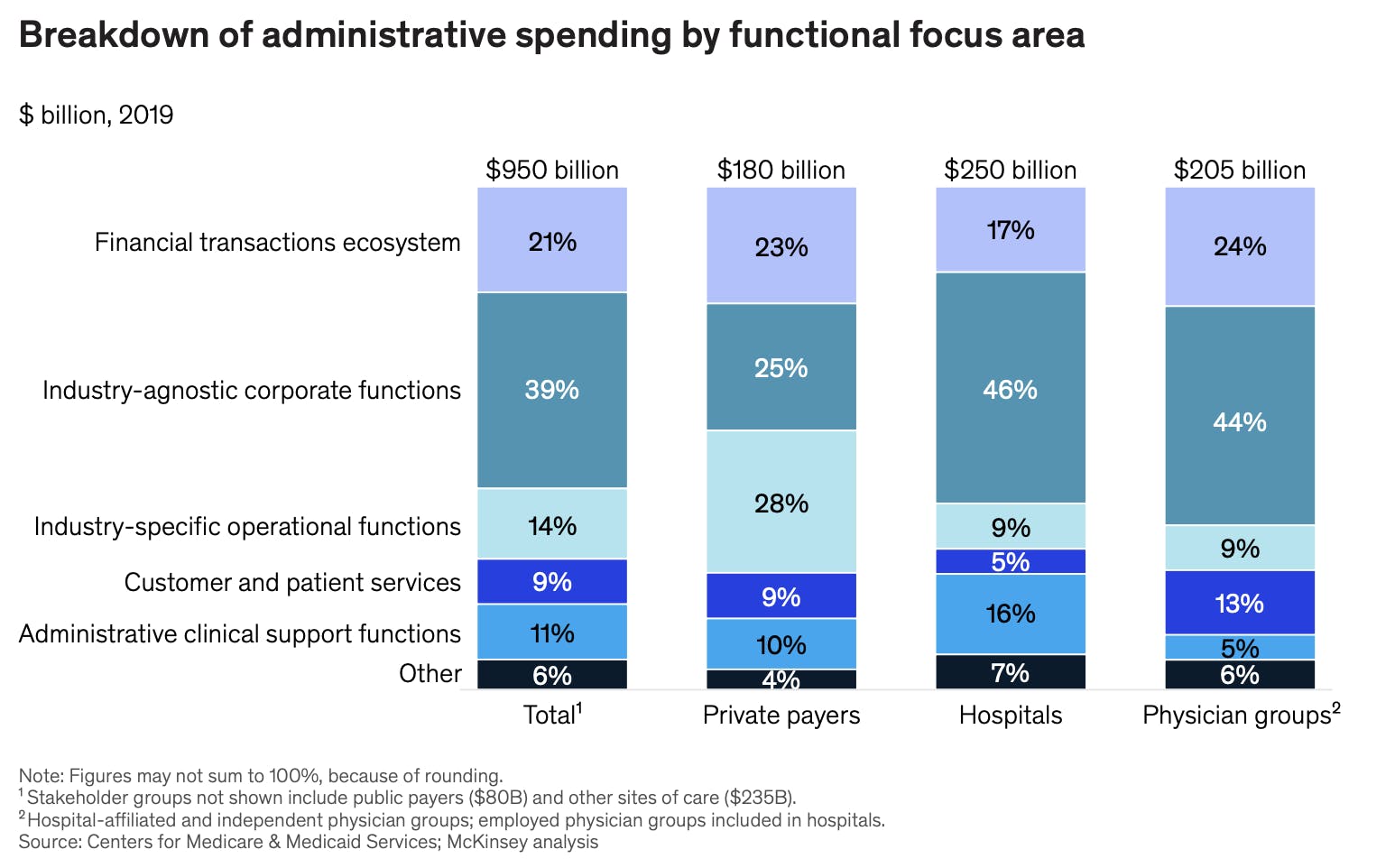

Source: McKinsey

As of October 2021, the financial transactions ecosystem represented up to 24% of administrative spending for care sites. Reducing costs and simplifying these processes could be a natural next step aligned with Abridge’s mission to alleviate the administrative burden in healthcare.

As of September 2023, half of insured adults reported experiencing some difficulty understanding insurance details, like their coverage limits or out-of-pocket costs. Additionally, as of 2021, 25% of patients had delayed or avoided care due to the complexity and lack of transparency of administrative tasks, such as completing insurance forms. Tools that clarify charges and link them to specific treatments could help patients better understand their expenses while reducing administrative barriers to care.

In August 2025, Abridge advanced into this space through a real-time prior authorization partnership with Highmark Health. The system listens during clinical encounters, compares dialogue with payer requirements, and enables approvals in minutes rather than days, reducing payer–provider friction while ensuring documentation completeness.

Expanding to Include More Healthcare Professions and Specialties

In April 2024, KLAS Research reported that Abridge customers wanted more detailed, accurate notes across a wider range of healthcare roles and specialties. In July 2024, Abridge began addressing this need through a partnership with Mayo Clinic to adapt the platform for nursing workflows. Documentation accounts for about 15% of a nurse’s shift as of 2023, making it a critical area for efficiency gains. In July 2025, Abridge partnered with the Hospital for Special Surgery (HSS) to co-develop orthopedic documentation that incorporates imaging, laterality, and surgical risk details, extending its expansion into specialty-specific workflows.

Other documentation-heavy specialties also represent opportunities. In psychiatric care, demand increased in 2024, and documentation requirements are more extensive than in many fields. Psychiatrists must record risk assessments, justify treatment plans, document medication adjustments, and provide narrative descriptions of mental state and behavior. Abridge’s repository of conversation transcripts could support longitudinal tracking of behavioral and mental health trends, though the sensitivity of psychiatric records requires stronger privacy protections.

Industry Awareness of Ambient AI Scribes

The adoption of ambient AI in healthcare is expanding as research highlights its impact on patient and provider outcomes. A 2024 study found that AI-assisted documentation produced higher-quality notes, while a 2025 study reported a 20% reduction in note-taking time and a 30% decrease in after-hours work. Additional studies have linked ambient AI to lower clinician burnout and higher patient satisfaction, reinforcing its role in streamlining workflows and enhancing healthcare delivery.

As of August 2024, more than 180 hospitals and medical centers have integrated ambient AI technology with Epic Systems' software, leveraging generative AI across 100+ applications. According to the Medical Group Management Association, as of January 2025, 30% of physician practices use ambient AI for clinical documentation. As of March 2025, leading institutions such as Stanford Medicine, Yale New Haven Health, and UChicago Medicine have implemented AI-driven scribing, recognizing its ability to enhance documentation quality, reduce physician workload, and improve patient interactions.

In 2025, Epic announced new native ambient documentation features embedded in its EHR, further validating the category and accelerating awareness among health systems considering third-party AI scribe solutions. The growing recognition of ambient AI’s benefits could help Abridge sell its technology to large hospital systems. As more hospitals adopt the technology, others may follow, making it easier for Abridge to expand its reach.

Key Risks

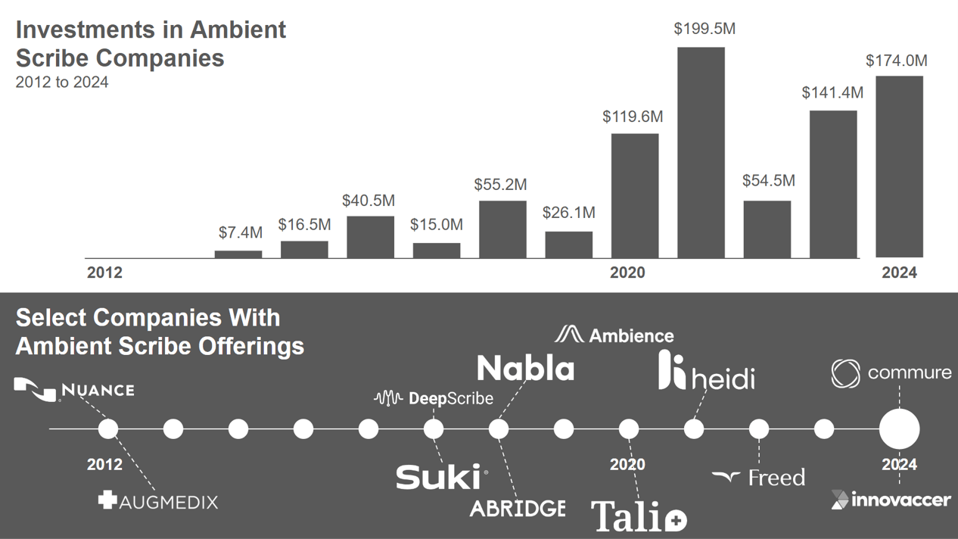

Market Saturation

Since 2020, investment in medical scribe startups has grown. As of September 2025, the market has become highly competitive as companies strive to stand out through end-to-end solutions and tailored support for specific medical specialties. Several competitors have expanded into coding, revenue integrity, and clinical documentation improvement (CDI). Ambience, for example, markets its platform around “documentation and coding” and “revenue integrity,” and in July 2025 raised $243 million in a Series C round to expand these capabilities. Suki also incorporates ICD-10 and HCC coding into its assistant.

In April 2024, Abridge introduced patient summaries, which convert clinician notes into patient-friendly versions at multiple reading levels. This approach extends beyond reducing administrative workload for clinicians to also reducing complexity for patients. However, differentiation among scribe companies remains limited, and Abridge’s long-term competitive advantage in the space has yet to be fully established.

Source: Forbes

EHR-Native Competition

As of December 2023, Epic was the world’s leading EHR provider, leveraging Cosmos, its proprietary dataset, and the largest global database of patient EHR information, to develop advanced AI tools. As of August 2024, Epic had more than 100 AI applications in development, including tools to automatically queue prescription and lab orders and facilitate claim submissions directly within its platform.

Epic has a long history of collaboration with ambient scribe companies, having worked with Nuance for more than a decade, as of 2023, and naming Abridge as its first “Pal” in the “Partners and Pals” program to integrate innovative technologies into its EHR system. However, once clinical conversations are stored in Epic, the company could augment its tools to cover functions that ambient scribe startups have specialized in. Since many physicians are comfortable working within Epic’s ecosystem, this could limit startups’ ability to gain market share in functions like revenue cycle management.

At its 2025 UGM, Epic formally launched a suite of native AI products: Art for Clinicians (ambient documentation), Penny (RCM-focused AI for coding and denial appeals), and Emmie (patient-facing assistant). These tools mark a broadening of Epic’s competitive footprint across documentation and revenue cycle workflows.

Regulatory Compliance and Data Safety

Healthcare data breaches pose severe legal and financial risks, particularly under HIPAA, which mandates strict protections for protected health information (PHI). As of September 2025, violations resulted in fines up to $50K per violation, with annual caps of up to $1.5 million, and may lead to civil lawsuits and criminal charges for willful neglect. International regulations like GDPR impose even stricter fines of up to €20 million or 4% of annual revenue, as of September 2025.

Beyond fines, breaches cause operational disruptions, lawsuits, and costly forensic investigations. For example, in February 2024, the Change Healthcare cyberattack compromised patient data and disrupted billing and prescription processing nationwide, delaying care and imposing financial strain on providers.

To address rising cybersecurity threats, HHS proposed updates to the HIPAA Security Rule in December 2024, including mandatory encryption, multifactor authentication, and routine risk assessments, later published in the Federal Register in early 2025. These changes are expected to increase compliance costs and operational complexity for AI documentation vendors such as Abridge. Smaller health systems have expressed concern about the burden of meeting these requirements.

In parallel, the Office for Civil Rights (OCR) reaffirmed that Section 1557’s nondiscrimination rules apply to AI and other technologies used in patient care, including documentation tools. Covered entities must identify and mitigate potential bias related to race, sex, age, or disability in decision support systems.

Together, these developments, tighter security mandates and expanded nondiscrimination obligations, raise compliance costs and complexity, creating scalability risks for AI-powered documentation platforms, particularly in safety-net and resource-constrained settings.

AI Hallucination

LLMs have been known to hallucinate in healthcare settings, sometimes producing incorrect information. As of 2024, 10% of doctors used ChatGPT in their day-to-day work. However, as of 2023, the hallucination rate of ChatGPT was suggested to be 20-25%. In 2024, another study showed that up to 30% of statements made by the GPT-4 RAG model were not supported by any sources provided. Gemini Pro, Google’s LLM, fully supported only 10% of its responses. The tendency of generative models to overstate or generate false information highlights the risks of relying on AI for medical decision-making without human oversight.

Misinformation in clinical documentation can lead to misdiagnosis or inappropriate treatment. If an AI-generated patient visit or SOAP note were inaccurate, care quality could be compromised. Abridge incorporates safeguards: clinicians can review and edit notes, replay audio recordings, and amend AI-generated summaries before finalizing records.

To strengthen reliability, Abridge published a whitepaper in August 2025 detailing its “Science of Confabulation Elimination,” an internal testing framework that detected 97% of hallucinated content, compared to 82% for GPT-4o. While this represents a marked improvement, hallucination risk remains, reinforcing the need for clinician oversight and review.

Summary

Clinical administrative burden contributes to clinician burnout, reduces time with patients, lowers care quality, and drives financial losses for hospitals. Abridge aims to address this burden by using generative AI to capture and structure patient conversations more efficiently. The company competes in a crowded ambient scribe market that includes both startups and EHR incumbents such as Epic, which are building their own documentation tools. Despite the competition, Abridge has continued to gain traction, securing new hospital partnerships and reaching a $5.3 billion post-money valuation in June 2025. The company is also exploring extensions of its platform, including clinical decision support, documentation for specialities like orthopedics, and real-time prior authorization. Looking ahead, Abridge plans to deepen its capabilities in billing automation, decision support, and care coordination, while allocating roughly 20% of capital toward acquisitions to add technology or talent. These initiatives signal a shift from standalone note-taking toward broader clinical infrastructure spanning documentation, workflow automation, and revenue cycle intelligence.