Thesis

The investment landscape is experiencing a generational shift. As of 2024, 70% of retail investors were under the age of 45, characterized by a more hands-on and tech-driven approach to wealth management. Gen-Z and Millennials are demanding greater control and transparency in their investment strategies, making monthly portfolio adjustments twice as frequently as older generations, with 60% actively trading or rebalancing their portfolios monthly. This shift is fueled by a combination of technological empowerment, economic uncertainty, and a desire to counter systemic financial challenges that have historically disadvantaged younger investors.

This new investing paradigm is marked by a willingness to take more risks and a preference for mobile-first, easily navigable platforms that provide deep insights into investment mechanisms. 41% of Americans under 35 were invested in the stock market as of 2021, reflecting a growing trend of active participation rather than passive investment. The cultural shift is further underscored by financial optimism and a belief in individual trading capabilities, with younger investors seeking to leverage technology and social coordination to create more personalized and dynamic investment strategies.

Younger investors are also demanding access to alternative investment options traditionally reserved for the ultra-wealthy. As of 2024, 93% of younger investors are likely to allocate more money into alternative investments, compared to only 28% of older investors, with younger investors valuing six alternative investment options over traditional stocks, including real estate, crypto, and private equity. However, the current system is akin to "a restaurant where the rich are given another menu," reflecting the systemic disparity that prevents average investors from exploring the same sophisticated financial products and strategies available to wealthy institutions and individuals.

Additionally, the financial landscape is characterized by an erosion of trust among younger investors towards legacy institutions, driven by a mix of digital expectations and systemic disillusionment. Millennials and Gen-Z are skeptical of traditional financial management, with half admitting they want to invest but feel lost. Their financial literacy challenges are compounded by a preference for non-traditional information sources, with social media, online articles, and videos ranking higher than conventional financial media as of 2024. Younger investors view current investment platforms as opaque "black boxes" that fail to provide meaningful context and alignment with their personal financial goals, creating a growing demand for new institutions that prioritize client incentives over institutional profits.

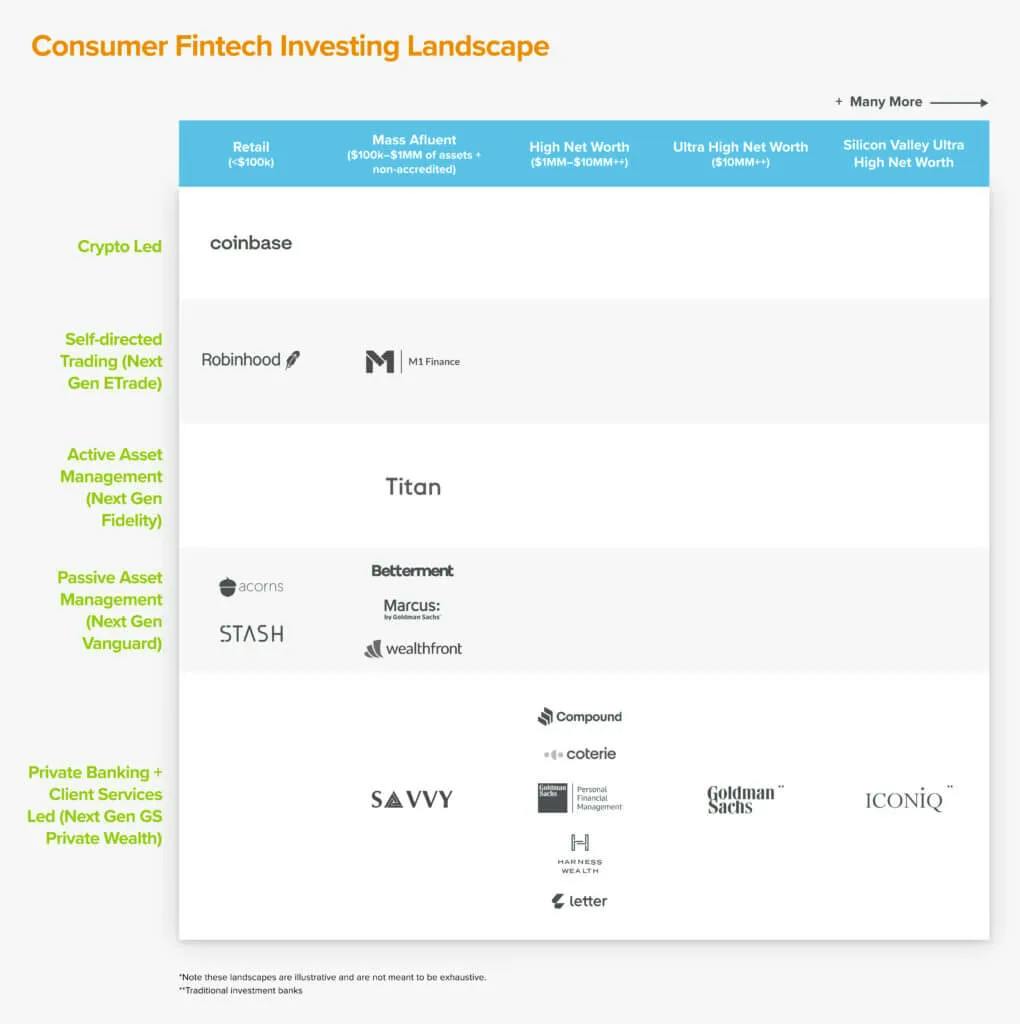

Titan is attempting to address the investment dilemma facing younger investors, positioning itself between the two paradigms of pure passive index funds and high-risk individual trading. Titan is a modern wealth management platform that combines financial advisory services with technology, offering actively managed investment strategies, personalized financial guidance, and access to exclusive opportunities traditionally reserved for high-net-worth individuals. By offering a unique "ride shotgun" approach, Titan allows customers to benefit from expert fund management and sophisticated investment strategies without requiring extensive capital, financial expertise, or constant personal portfolio monitoring, providing Millennial and Gen-Z investors with a third option that promises more engaged and transparent investing.

Founding Story

Source: TechCrunch

Titan was founded by Clayton Gardner (co-CEO), Joe Percoco (co-CEO), and Max Bernardy (CTO) in 2018.

Titan’s inspiration came from the personal experiences and frustrations of Gardner and Percoco, who met while attending the Wharton School of the University of Pennsylvania. Coming from different investment backgrounds — Gardner had been buying stocks since childhood, while Percoco only began investing after working at Goldman Sachs — they shared a common observation: the investment industry was fundamentally broken for everyday investors. As they worked in private equity, hedge funds, and consulting, they repeatedly encountered friends and family seeking investment advice, only to be directed towards generic ETFs and mutual funds that lacked the sophisticated strategies available to wealthy institutions.

Frustrated by what they saw as an "archaic industry" that perpetuated financial inequality, Gardner and Percoco, along with technical co-founder Bernardy, a Stanford computer science graduate with experience in startup engineering and a patent in hedge fund software, founded Titan in 2018. Their mission was clear: create an investment platform that would give everyday investors access to the types of investment products and experiences historically reserved for the ultra-wealthy. Gardner, who had a passion for understanding market behavior and human psychology, and Percoco, who had worked with tech companies at McKinsey, were determined to build a mobile-first investment operating system that could democratize investment strategies.

Product

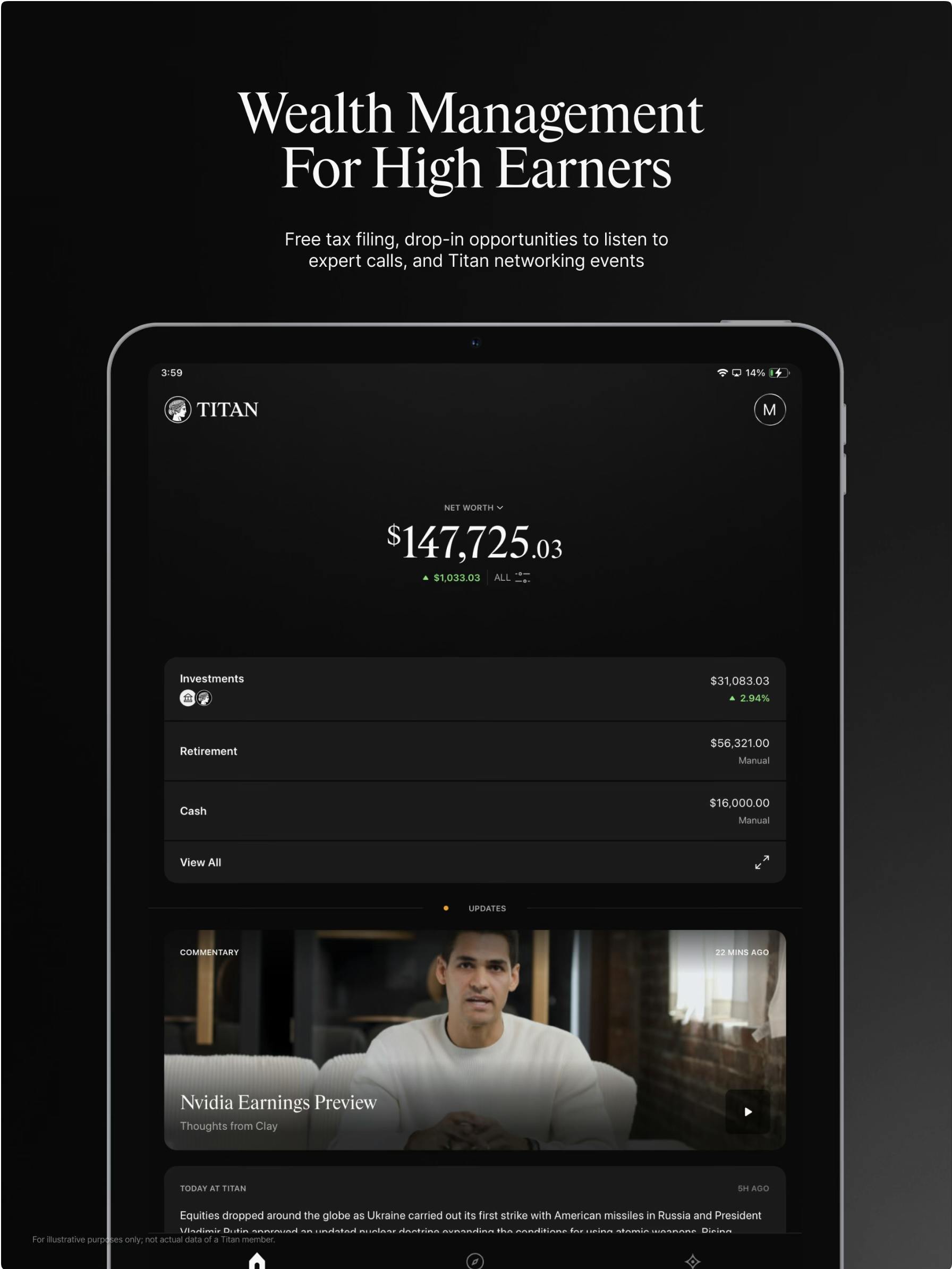

Source: Titan

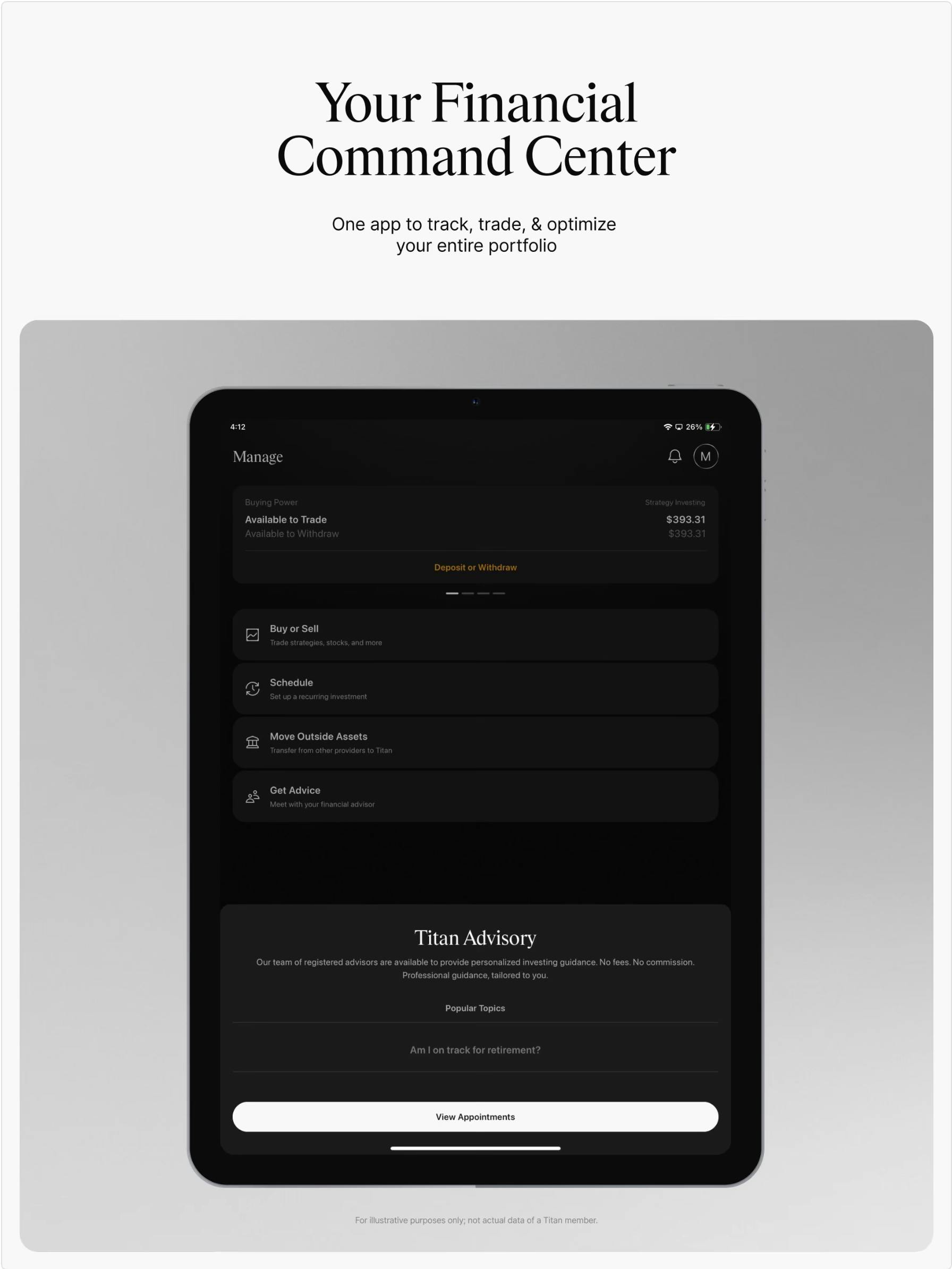

Titan is an SEC-registered investment advisory firm that provides an investment platform meant to be distinctly different from traditional hedge funds. Unlike hedge funds that pool investor dollars into a single collective fund, Titan offers individually managed accounts tailored to each investor's specific risk tolerance and financial goals. The platform allows investors to benefit from professional investment strategies typically reserved for high-net-worth individuals while maintaining personal account ownership and customization.

Managed Investment Strategies

Source: Titan

Titan offers four distinct, actively managed long-term investment strategies. For each of these strategies, there is typically a $500 minimum investment.

Opportunities: Targets small and mid-cap companies under $10 billion, with approximately 20 positions seeking to beat the Russell 2000.

Crypto: Comprises 5-10 large-cap cryptocurrency assets, with the goal of surpassing the Bitwise 10 Large Cap Crypto Index. As of 2021, this was the first actively managed crypto portfolio on the market. In 2021, Gardner described Titan’s crypto product as having investors deposit USD, which Titan converts to crypto and manages through hosted wallets. In May 2025, the product instead emphasized access to “Bitcoin and Ethereum ETFs.”

Automated Investment Strategies

Titan also offers managed stock and bond portfolios, similar to other robo-advisors on the market. These portfolios are made up of third-party ETFs that charge their own annual fees. Titan's investment offerings include three automated strategies tailored for diverse financial goals.

First, Titan’s Automated Stocks portfolio holds three ETFs: one focused on the total U.S. stock market (IVV), one targeting emerging markets (VWO), and one emphasizing domestic dividend stocks (VIG). This portfolio is rebalanced quarterly and maintains a low average expense ratio of approximately 0.04%.

Next, Titan’s Automated Bonds portfolio diversifies across five ETFs, including short-term treasuries (GBIL), short-term TIPS (VTIP), emerging market bonds (EMB), tax-exempt bonds (VTEB), and intermediate-term corporate bonds (VCIT). Lastly, Titan’s Treasury Strategy invests in Treasury money market funds, such as those offered by Schwab and Vanguard, providing an option for conservative investors.

Alternative Assets

Titan has partnered with private equity firms to give members the opportunity to invest in funds that are typically reserved for accredited investors.

The Carlyle Tactical Private Credit Fund provides loans to mid-sized businesses, generating returns primarily through interest income. Titan members can invest with a minimum of $2K, while external investors face a $10K threshold. Titan emphasizes that “as an interval fund, CTAC processes withdrawals at the end of each quarter, while quarterly liquidity is not guaranteed.”

Titan’s Apollo Diversified Credit Fund focuses on debt from public and private companies, requiring a $2.5K minimum for Titan brokerage accounts and $1K for retirement accounts, compared to a $1 million minimum for non-Titan investors. The Apollo Diversified Real Estate Fund allocates 75% of its assets to private real estate funds and 25% to real estate investment trusts (REITs), maintaining the same minimums as the Credit Fund for Titan members but requiring $1 million for outside investors. Lastly, the ARK Venture Fund, exclusive to Titan, invests in innovative public and private companies deemed “disruptive innovators” and has an investment minimum of $500.

Investment Hedging

Titan offers personalized hedging strategies to mitigate potential portfolio losses. Depending on an individual investor's risk profile, Titan allocates between 0% and 20% of the portfolio to inverse index funds (S&P 500 or Russell 2000), which are designed to increase in value if the primary investment portfolio experiences a downturn.

Education

Titan offers real-time content for all members who receive regular video updates from Titan’s team of wealth advisors, providing insights into their investments and market conditions. Titan also collaborates with industry leaders, including Federal Reserve Officials and seasoned entrepreneurs, to create educational content for members to deepen their understanding of wealth management. This “courtside seat” approach offers members a level of access and clarity not typically found in traditional financial services.

Educational content is a core pillar of Titan’s acquisition strategy, which is intended to drive acquisition by fostering engagement and driving organic user acquisition through word-of-mouth referrals.

Membership Benefits

Membership at Titan begins with a free consultation to understand the client’s financial goals and recommend tailored solutions. This initial process includes a portfolio recommendation and an opportunity to connect with a staff expert, ensuring that potential members are well-informed before committing to the service. Titan also prioritizes accountability by carefully vetting applicants to ensure they are ready to benefit from its platform. As Gardner explains:

“We liken it to giving someone the keys to the Tesla before they even have a driver’s license. They sign up quickly with the idea of getting rich quick, and it’s no surprise that many of those fiscally naive users unfortunately end up driving the Tesla off a cliff, destroying their wealth and ultimately blaming themselves for making dumb decisions…That’s a major part of why we have an application process for new members: we want to make sure we’re a good fit and can solve the problems you have.”

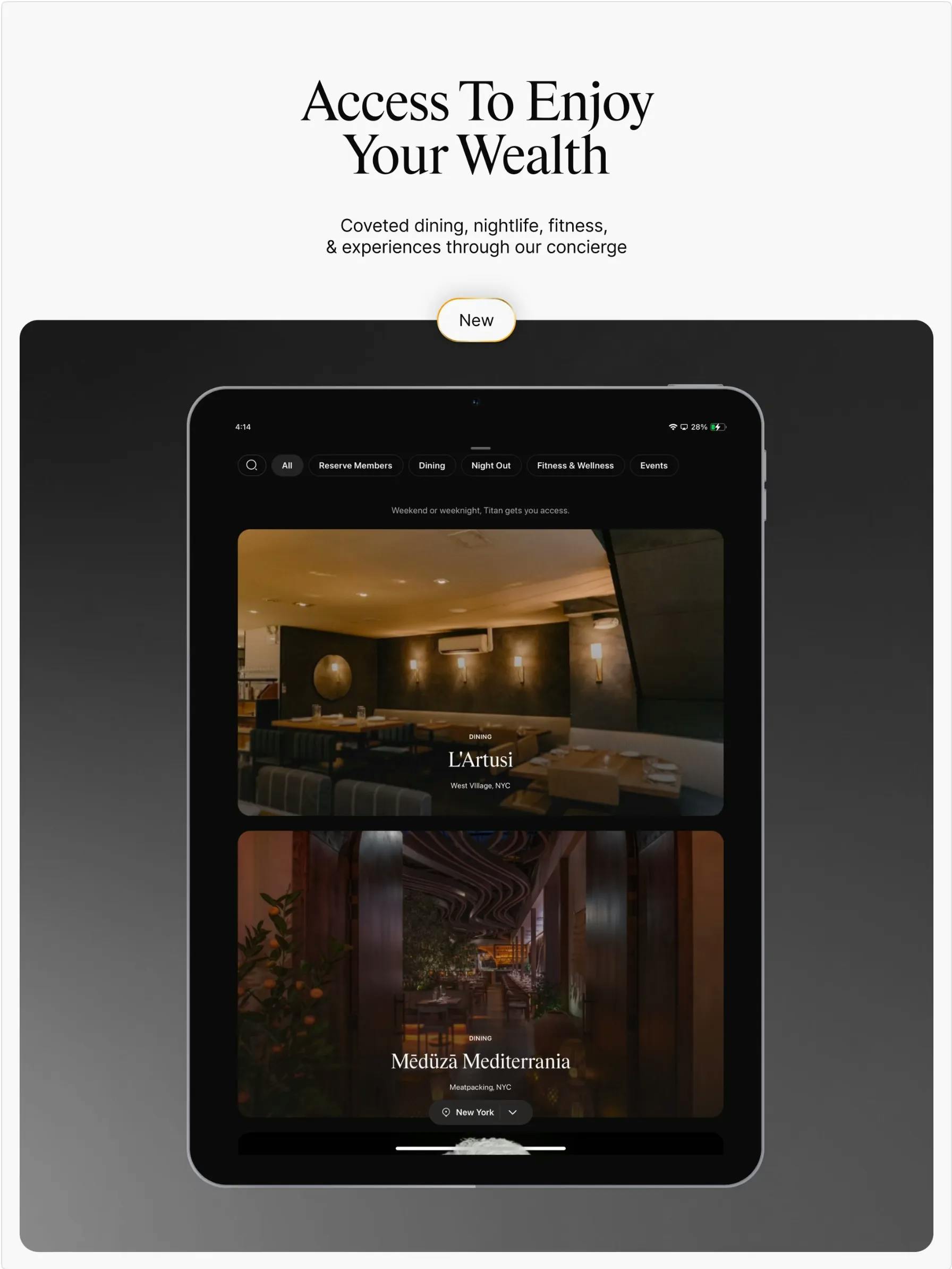

Members also receive "Titan Access," a concierge service offering exclusive opportunities such as concert passes, restaurant reservations, and invitations to private events or discussions with industry leaders. This service operates with a transparent supply of offerings, all displayed in real-time within the Titan app, allowing members to stay informed about available perks.

Source: Titan

Members are also given access to curated drops of investment opportunities in private and public markets.

Other Accounts

Titan members can create a variety of accounts tailored to their financial needs. These include a Cash Account, which features an actively managed high-yield cash portfolio offering 4.23% APY as of April 2025; Retirement Accounts, such as traditional and Roth IRAs; and Personal Trading Accounts, which allow members to invest in individual stocks and ETFs.

Future Plans

Titan envisions evolving into a platform that enables individual fund managers to establish direct relationships with their clients. By extending its infrastructure to legacy mutual fund managers and other financial professionals, Titan aims to provide these experts with the tools to create their own mobile-first wealth management experiences, aligning with Titan’s goal of becoming an operating system for wealth management.

Market

Customer

Titan’s target customer is a late 20s to early 30s investor seeking a more sophisticated approach to wealth management. Typically, this demographic consists of individuals who have established careers, earn in the low to mid-six figures, and are ready to move beyond beginner-friendly fintech apps. They often lack the time or expertise to actively manage their wealth but are serious about growing their investments. Titan’s service resonates with those looking to consolidate their assets in a transparent and proactive platform that matches their ambition and financial goals. Unlike traditional “set-it-and-forget-it” solutions, Titan appeals to individuals who value expert management coupled with clear and timely insights into their portfolios.

Within that customer persona, older clients may see Titan as a modern alternative to traditional mutual funds, appreciating its approach to wealth management. Younger, digitally native investors may also identify with Titan’s mobile-first, content-rich design. These users are often Millennials who seek a financial partner that aligns with their expectations for transparency, education, and engagement. Titan’s strategy is to capture a significant share of its clients’ wallet by positioning itself as the central hub for their investments, appealing to those eager to consolidate and elevate their financial management experience.

Market Size

Titan operates within several markets. The US mutual fund industry, valued at $34 trillion, spans a wide variety of asset classes, including stocks and bonds, and is projected to grow at a compound annual growth rate (CAGR) of 4.22% over the next five years. Meanwhile, the fintech sector, which Titan also competes in, expects global revenues to rise from $245 billion in 2023 to $1.5 trillion by 2030. This surge is fueled by underperforming incumbents — traditional banks score an average customer loyalty rating of 23 out of 100, compared to fintechs, which have reached scores as high as 90.

Additionally, the wealth management market is projected to double in size from $250 billion in 2021 to $500 billion by 2030. This growth is driven by the rising affluence of Millennials and Gen-Z customers, 250 million of whom are expected to earn over $100K annually by the decade's end. These younger investors bring a strong preference for digital-first, self-directed financial services. Additionally, the wealth management space is shifting toward alternative assets, with crypto projected to grow at a staggering 73% CAGR and private markets at 17% CAGR between 2021 and 2030. By 2030, nearly 60% of global assets under management will be allocated to ESG-compliant, crypto, or private market investments, highlighting the potential for platforms like Titan to meet evolving investor preferences in a transforming industry.

Competition

Competitive Landscape

Source: a16z

Large Institutional Players

BlackRock: BlackRock was founded in 1988. It is the world’s largest asset manager with $11.5 trillion in assets under management (AUM) and a market capitalization of $142 billion as of May 2025. Known for its vast array of investment strategies, BlackRock requires minimum investments ranging from $250K to $1 million, depending on the strategy. BlackRock’s iShares ETF can be bought for as little as $1 via fractional shares at Fidelity.

JPMorgan Chase: Founded in 1871, JPMorgan Chase manages $3.3 trillion in assets, and it is the largest bank globally by market capitalization at $693 billion as of May 2025. JPMorgan’s private wealth management services require a $150K minimum.

Goldman Sachs: Goldman Sachs, founded in 1869, manages $3.1 trillion in assets as of October 2024 and has a market cap of $169 billion as of May 2025. Its private wealth management division requires a significantly higher minimum investment of $10 million.

In contrast to these institutions, Titan differentiates itself by targeting an underserved segment of investors who seek a professional, transparent, and digital-first wealth management experience without the high barriers to entry. Titan is designed to be more accessible, with no six-figure minimums and a pricing structure that is over 70% cheaper than the typical 1% fee charged by traditional wealth managers. Titan also offers actively managed portfolios with real-time transparency and on-demand financial advice. While Titan focuses on long-term wealth creation and forgoes features like day trading or options, it attempts to add value through perks like its concierge service.

Alternative Assets

Fundrise: Founded in 2012, Fundrise is a real estate investment platform that allows individuals to invest in diversified portfolios of commercial and residential properties through private real estate investment trusts (REITs) with minimums as low as $10. As of December 2024, Fundrise manages $2.9 billion of equity for over 385K investors.

Yieldstreet: Yieldstreet is an alternative investment platform that provides access to a range of asset classes, including real estate, art, crypto, and private credit, aiming to democratize investing in traditionally exclusive markets with low minimums and a streamlined digital interface. Founded in 2015, it has over 500K members with $6 billion invested as of May 2025. Most investment opportunities on the platform require a $10K investment minimum. Yieldstreet has an estimated valuation of $850 million after it raised a $150 million Series C in 2021.

Coinbase: Coinbase is a cryptocurrency exchange platform that allows users to buy, sell, and store a wide range of digital assets. It was founded in 2012, has a market cap of $50 billion as of May 2025, and $404 billion in assets on the platform as of May 2025.

While each of these companies is fairly specialized, Titan positions alternative assets as part of a diversified, holistic portfolio, integrating these assets within broader portfolios that also include traditional investment products like stocks and bonds. Titan’s strategy is centered around consolidating a high percentage of a user’s total wealth into one platform, giving them access to a range of investment options, including alternative assets, aiming to give users a well-rounded financial strategy rather than isolating them within a single asset class.

Passive Asset Management

Wealthfront: Founded in 2008, Wealthfront is a robo-advisor platform that offers automated investment management, financial planning tools, and personalized strategies on its platform. As of November 2023, Wealthfront has $50 billion spread across over 700K client accounts. Wealthfront has a valuation of $1.4 billion as of September 2022.

Betterment: Betterment is also a robo-advisor that provides automated, goal-based investment management and financial planning, focusing on low fees and personalized portfolios. Betterment was founded in 2008 and has $56 billion in client assets as of March 2025 across over 900K client accounts. The company’s estimated valuation of $1.2 billion as of 2023.

Compared to these competitors, Titan offers a more hands-on, educational approach to wealth management. While robo-advisors provide automated, hands-off investing, Titan focuses on bringing clients closer to the decision-making process, helping them better understand the specific investments in their portfolio.

Self-Directed Trading

Robinhood: Robinhood is a commission-free trading platform that provides easy access to stocks, options, and cryptocurrencies, catering to retail investors with a focus on simplicity and low-cost investing. It was founded in 2013, and as of September 2024, it has 25.8 million funded customers and $180 billion of assets under custody as of April 2025. It has a market cap of $43 billion as of May 2025.

Unlike self-directed trading platforms such as Robinhood, Titan is looking to democratize access to investment classes, not financial tools or instruments.

Business Model

Titan operates on a membership-based model, with a $25 monthly fee ($250 if paid annually) that provides users access to its platform, alongside a 0.2% fee on assets under management (AUM). This fee structure excludes certain offerings like Titan Personal Trading and the ARK Venture Fund, which remain advisory-free. Titan's alternative investment products, however, come with fees charged by its partners. For example, the Carlyle Tactical Private Credit Fund charges 1% of AUM plus a 15% performance fee on returns exceeding 6%, while the Apollo Diversified Credit Fund charges a 2.35% fee on net assets. The ARK Venture Fund has a 2.9% net expense ratio with 4.7% gross expenses as management fees, though Titan waives its advisory fee for this specific fund.

Titan's crypto offering incurs transaction fees up to 0.15% through its custodian, Apex Crypto, making a $1K crypto investment subject to a $1.50 fee. Departure fees are also applicable for account closures, with $100 charged for IRA terminations or outgoing transfers, but no fee for closing individual accounts. To encourage growth, Titan has a referral program that offers both the referrer and referee $50 after a successful sign-up, with a 100-day free trial for the referred individual.

Traction

After quietly launching in August 2018, Titan surpassed $10 million in assets under management (AUM) within its first few months, highlighting the demand for a more sophisticated, accessible wealth management platform. At that time, Titan announced 10% growth year-to-date and a 33% increase over the past year in its portfolio, outpacing the S&P 500 during the same periods. The company's appeal was evident by its ability to attract larger pools of capital, with average investments north of $20K per account. Titan saw a 600% growth in assets, customers, and revenue in 2020, all with minimal marketing spend.

By mid-2021, the platform boasted 30K users and had grown by 500% in the past year. By September 2022, Titan had crossed the $792 million mark in assets under management and had expanded its client base to over 42.8K.

In 2023, Titan was charged by the SEC for misrepresenting the hypothetical performance of its Titan Crypto strategy, including misleading "annualized" performance figures based on short-term data. The company had failed to comply with SEC marketing rules requiring transparency and proper policies for using hypothetical performance metrics. Titan settled by paying $192K in forfeited profits and interest, plus an $850K fine that would be “distributed to affected clients.”

In September 2024, Titan launched Titan Access, its concierge product. According to 13Fs filed by the company, Titan manages $659 million in assets as of Q4 2024, though on the company’s website, it reports $1 billion of AUM.

Valuation

In January 2023, Titan raised an unannounced Series C. The round was reportedly $100 million of funding at a ~$1 billion valuation, though details of who invested in the round have not been disclosed.

Prior to Titan’s Series C, the company raised a $2.5 million seed round in October 2018, followed by a $12.5 million Series A round in 2021. In 2021, the company raised a $58 million Series B at a $450 million valuation led by Andreessen Horowitz. Titan’s other investors include General Catalyst, which had previously led Titan's Series A, BoxGroup, Sound Ventures, and a group of celebrities and athletes such as Kevin Durant, Odell Beckham Jr., Jared Leto, and Will Smith.

Key Opportunities

Demographic Shifts & Changing Investor Preferences

Younger investors, encompassing Millennials and Gen Z, represent a significant demographic shift in the wealth management industry. This cohort has a distinct set of expectations for financial services, emphasizing transparency, personalization, technological integration, and values-based investing. Traditional institutions and niche players have struggled to fully adapt to these demands, creating a gap in the market for firms that can align with this group’s priorities. Moreover, these investors are digital natives who expect seamless, tech-driven solutions and a user experience on par with leading technology platforms. Wealth managers who fail to deliver on these fronts risk losing relevance as this cohort gains financial influence.

Over the coming decades, Millennials and Gen Z will inherit unprecedented wealth through intergenerational transfers while also amassing their own earnings. As their wealth grows, so too will their participation in investment vehicles such as mutual funds, ETFs, and other wealth management products. This demographic evolution presents a competitive opportunity for Titan within the market, where younger investors’ preferences could redefine industry standards.

Demand For Financial Education

Low financial literacy among younger investors, coupled with widespread distrust of traditional financial institutions, has created a significant opportunity for new entrants to establish themselves as trusted sources of personal financial education. Millennials and Gen Z are often underserved in terms of accessible, transparent guidance tailored to their specific financial challenges and goals. This unmet demand for education opens the door for firms to build strong relationships with these investors by positioning themselves as credible, approachable resources.

Brands that effectively address this need are positioned to earn not only trust but also long-term loyalty. Financial literacy initiatives can serve as a gateway to deeper engagement, allowing firms to differentiate themselves in a competitive landscape. By empowering young investors with the knowledge and tools they need to manage their finances confidently, Titan can potentially secure a greater share of their investment activity as these individuals grow their wealth over time.

Shift Toward Transparent Digital Wealth Management

Younger investors demand digitally native solutions and transparency from their wealth managers. Having grown up in an era defined by rapid technological advancement, these cohorts expect the financial services they use to mirror the seamless, intuitive experiences provided by leading tech platforms. This includes easy-to-navigate interfaces, real-time updates, and mobile-first capabilities that enable investors to manage their portfolios on the go. The preference for technology-driven solutions has exposed gaps in the offerings of many traditional financial institutions, which often rely on outdated systems or fail to prioritize user experience.

Transparency is equally critical, as younger investors are skeptical of opaque fee structures and unclear decision-making processes that have historically defined the wealth management industry. They demand clear communication about costs, investment strategies, and performance metrics. Firms that embrace digital innovation and prioritize open, client-centric practices are better positioned to capture this market segment. By addressing these demands through its user-centric app, Titan can not only enhance their appeal to younger investors but also align with broader shifts in consumer expectations.

Key Risks

Expensive Fee Structure

A risk for Titan is the potential misalignment of its members-only fee structure with the preferences of the younger investor market. Titan requires a $25 monthly membership fee for access to its investment options, positioning itself as a premium service that combines education and concierge perks. However, with the increasing availability of low-cost or no-cost investment options, this pricing model may not resonate with cost-conscious Millennials and Gen Z investors.

Younger investors are particularly fee-sensitive and demonstrate low loyalty to financial platforms, often switching providers when they perceive better value elsewhere. This behavior demonstrates the challenge for Titan’s model: if its target market concludes that the membership fee does not deliver sufficient value, they are likely to migrate to competitors offering more affordable alternatives. Titan is betting that the added value of its educational resources and personalized services will earn loyalty, but the ever-growing array of low-cost investment options puts this bet at risk.

Competition

The growing demand for alternative assets, such as cryptocurrencies and real estate, has attracted attention from institutional players. As these incumbents also move to democratize access to these asset classes, they bring with them significant competitive advantages, including established reputations, extensive resources, and the trust of broader market segments. This poses a considerable risk to newer entrants like Titan, which lack the track record and brand recognition of larger financial institutions.

For Titan, the challenge lies in maintaining credibility and retaining customers in a market where traditional players can offer similar or superior alternative investment options. Established brands are likely to leverage their scale and regulatory expertise to create offerings that combine accessibility with the perceived stability of institutional backing. If these incumbents succeed in aligning with younger investors’ preferences for technology-driven solutions and transparency, Titan may find it difficult to differentiate itself in an increasingly crowded market.

Regulatory Scrutiny

Titan and other fintech or alternative investment platforms face the potential for heightened regulatory scrutiny. In 2023, Titan was charged by the SEC for misleading marketing practices related to hypothetical performance projections, highlighting the challenges fintech firms face in navigating complex regulatory environments. The SEC alleged that Titan violated the Advisers Act by failing to adhere to updated marketing rules, particularly regarding performance metrics communicated to prospective clients.

This incident highlights broader vulnerabilities for companies operating in the alternative investment space, as regulators increasingly focus on consumer protections, transparency, and compliance with evolving standards. Fintech firms often rely on innovative strategies and marketing, which can sometimes push the boundaries of regulatory norms. The risk of fines, legal battles, or reputational damage from regulatory action could undermine consumer trust and operational stability. As the SEC and other agencies continue to scrutinize the fintech sector, firms like Titan must prioritize compliance to mitigate these risks and maintain credibility.

Summary

Titan is a wealth management platform that combines traditional and alternative investments, catering to a younger demographic seeking more accessible, transparent, and lower-cost options compared to traditional wealth managers. The company has grown significantly, with rapid increases in assets under management and a user base that has grown substantially since its launch. The key question for Titan is whether its business model, dependent on membership fees and asset management charges, will continue to scale effectively as competition increases and regulatory challenges evolve.