Thesis

The steady rise of passive investing globally since the 1990s has opened opportunities for software-enabled, passive solutions to wealth creation. Passive funds automatically invest in baskets of stocks instead of having equities chosen individually by a fund manager. In 2021, passive vehicles accounted for 53.8% of the total assets held in US domestic equity funds and 41.5% in non-domestic equity funds. This growing appetite for passive fund management has led to the rise of automated investment and advisory platforms, with the global robo-advisor investing market valued at $4.1 billion in 2021.

The inflow of capital to passive funds has coincided with another trend: the rising income levels of digitally-native millennials looking for ways to invest their money. Millennials are the biggest generation in US history. In 2020, nearly 3 in 4 were saving, up 10% in two years. Roughly a quarter of millennials have $100K or more set aside, up from 16% in 2018. 31% of millennials started investing before the age of 21, more than any other generation in US history. Almost a third of millennials with taxable accounts were under 21 when they started investing, a significantly higher percentage than their Generation X and Baby Boomer counterparts. Young people prefer technology-driven experiences that need to be met by traditional players.

Wealthfront is a robo-advisor that offers a combination of financial planning, investment management, and banking services through its investing platform. Wealthfront aims to make inconvenient financial advisor meetings a thing of the past and allow building a balanced portfolio of investments to become more accessible and frictionless. It integrates investing and saving products to help young professionals build long-term wealth in varying market conditions.

Founding Story

Wealthfront, initially named KaChing, was founded in 2008 by Andy Rachleff (executive chairman) and Dan Carroll (chief strategy officer). Both co-founders experienced personal frustrations with the state of investing in 2008 and knew that software could provide much-needed innovation to the industry. After retiring from the VC firm that he co-founded, Benchmark Capital, Rachleff began lecturing at the Stanford Graduate School of Business. While there, he found that he couldn’t give effective investing advice to students because the services he wanted to recommend had expensive minimums that made them inaccessible. At the same time, he was also serving on the Board of Trustees at the University of Pennsylvania Board of Trustees, his alma mater, where he noticed that even the best endowments and most high-end investors needed a better option for managing their investments.

Carroll, a former trader, was led to start working on the startup after having realized his parents were getting hit hard by bad investment advice and high advisory fees during the 2008 financial crisis. Rachleff reached out to Carroll in 2008 after learning about what he was creating, but Carroll rebuked this initial outreach because of his negative perceptions of VCs. Despite the initial rejection, Rachleff persisted and eventually tracked Carroll down, which led to an understanding that they both wanted the same thing: to democratize access to investing through automation.

During their tenures at Wealthfront, Rachleff has held several positions, including serving as CEO and president for several stints (2008-2013, 2016-2021) and executive chairman for others (2014-2016, 2021-current as of 2023), while Carroll has served as the company’s chief strategy officer since its founding. Wealthfront promoted David Fortunato to CEO in 2021 after working as the company’s CTO for 10 years (2009-2019) and President for 4 years (2019-current as of 2023). Fortunato was replaced as the company’s CTO by another internal hire, Julien Wetterwald, a software engineer at Wealthfront during its early years who has been at the company for approximately 13 years.

Product

Wealthfront is an end-to-end financial platform that helps users automate their finances and takes the guesswork out of how to achieve their financial goals with its suite of Self-Driving Money tools. Rachleff described this concept of Self-Driving Money in 2020 as follows:

“The vision is to get people to direct deposit their paycheck with us. Then, we automatically pay their bills, pay down their debts, and then take the remaining money and invest that in a way that's most appropriate for their situation and goals.”

While Wealthfront started out by enabling individuals to access previously exclusive money management practices, it has grown into a broader suite of financial products that let users take a hands-off approach to achieve financial goals.

Investing

Wealthfront offers two main strategies for investing that users can employ across various investment accounts, including retirement accounts, 529 college savings accounts, and normal individual brokerage accounts.

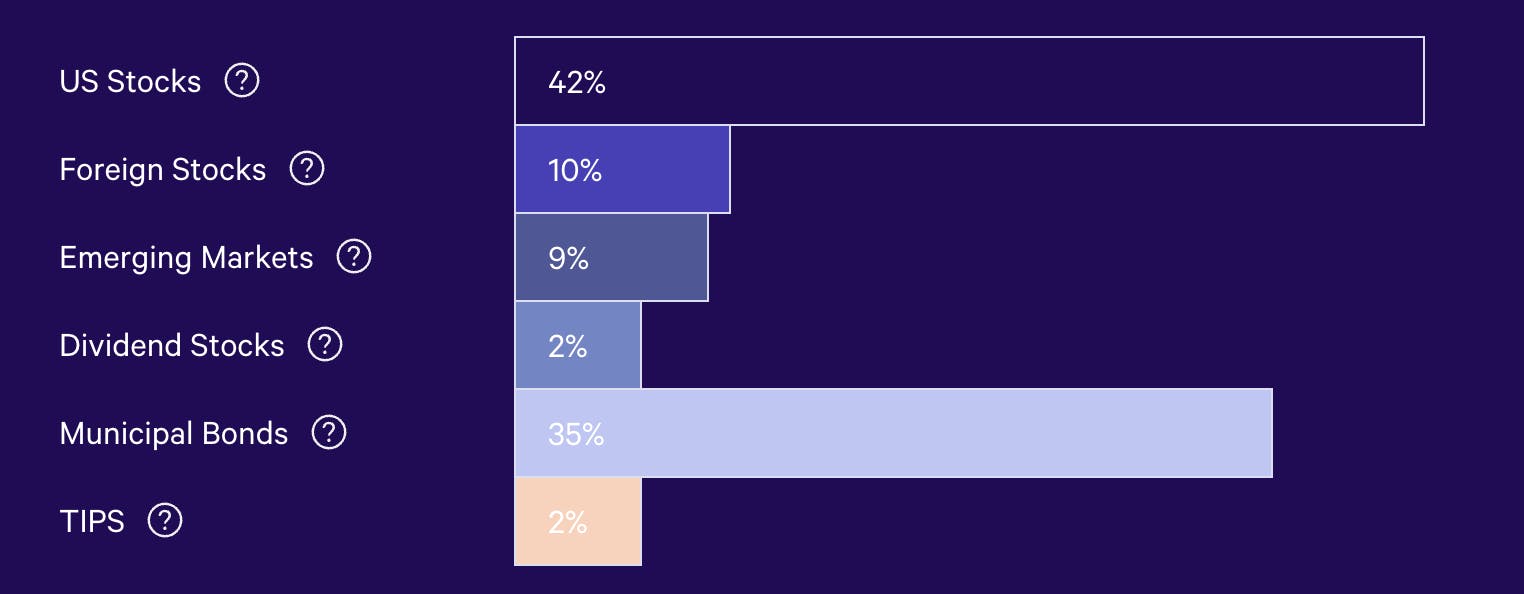

Automated Investing: The first strategy involving the company’s flagship “robo-advisor” product automates the investing process for individuals with differing investing experiences and risk tolerance levels. To get started, users answer a few questions pertaining to their risk tolerance, personal beliefs (i.e., socially responsible), and financial goals, which the robo-advisor then uses to produce a customized portfolio of ETFs across 17 global asset classes to help the client achieve their goals.

For example, the portfolio breakdown of a user with a medium risk tolerance would look like this:

Source: Wealthfront

After the portfolio is built and funded, Wealthfront’s automated platform continuously manages its risk. It utilizes tax-loss harvesting, a process that takes advantage of investment losses to lower a client’s tax bill to manage a client’s money effectively. The platform also automatically executes trades and rebalances a user’s portfolio to ensure consistent alignment with the investor’s prior specifications. The company found that its tax loss harvesting efforts added an extra 1.8% to its clients’ after-tax returns on average.

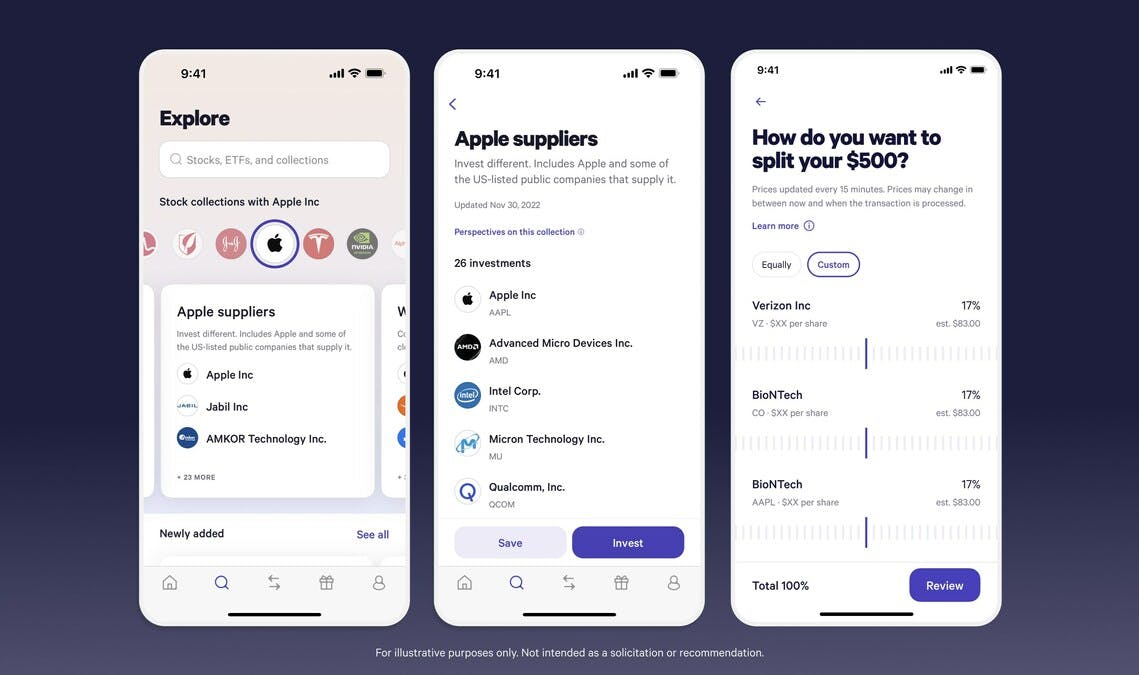

Stock Investing: Wealthfront announced its individual stock investing platform on March 1, 2023. The platform allows Wealthfront clients to invest in individual stocks. It has features similar to other consumer investing platforms, like investment minimums of $1, fractional shares, and $0 commissions on trades. Wealthfront also offers stock collections, like mini ETFs, that track a basket of stocks that share common characteristics and provides simplified due diligence to make stock research easy for users. While this product expansion could contradict the company’s core focus on passive investing, it represents Wealthfront’s aim to become a full-service fintech platform where consumers can go for all their financial needs.

Source: PR Newswire

Savings

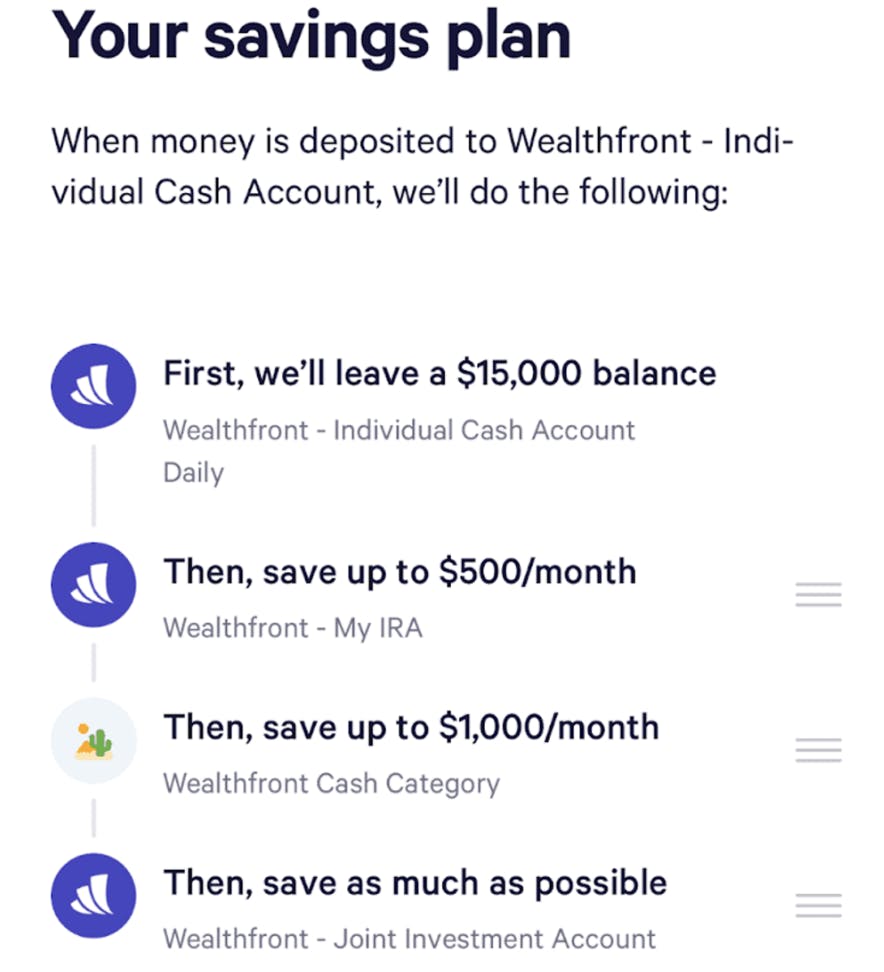

Wealthfront partners with banks to provide a high-yield cash savings account to its users. Features include no account minimums, zero account fees, a free debit card, unlimited fee-free transfers, and up to $2 million in FDIC insurance. This cash account is a key part of Wealthfront’s Self-Driving Money vision, as it allows users to set up direct deposit, automate budgeting, and easily direct a certain amount of a new deposit into the appropriate channel. Use cases may range from paying bills to contributing to short-term cash accounts to investing in retirement accounts. As of March 2023, the company’s high-yield cash account offers 4.3% APY.

Source: CNBC

Borrowing

Wealthfront allows clients with minimum automated investing account values of $25K to borrow up to 30% of their total account value using a portfolio line of credit. This type of loan allows users to access cash without having to liquidate their invested capital. Users’ portfolios act as collateral for borrowed money. Due to the relatively low-risk nature of portfolio lines of credit, Wealthfront offers borrowers automatic approval, no credit check or application fee, and no repayment schedule.

Market

Customer

Wealthfront core target persona includes tech-literate millennials and young professionals that value a tech-forward, low-friction investing experience. About 90% of Wealthfront users are under 45. In 2018, co-founder Andy Rachleff described the company’s strategy in targeting this demographic:

“Millennials are a good demographic to target. They’re in the wealth accumulation phase of their life versus the wealth preservation.”

Before Wealthfront, young professionals had seen older generations forced into a choice between struggling to manage their money themselves or paying high fees to a financial advisor for investment advice of varying quality. Robo-advisors like Wealthfront disrupted this status quo by being cheaper than traditional financial advisors, allowing younger people to passively invest towards their financial goals without having to manage their investment portfolios themselves.

Market Size

The size of the domestic financial planning and advice market is estimated to be $59.7 billion in 2023 and has grown at a pace of 2.1% between 2018 and 2023. Within this, however, the robo-advisor market, which was estimated to have a global market size of $4.1 billion in 2023, was expected to grow at a CAGR of 29.7% from 2022 to 2030 — more than 10x faster than the broader market.

There are over 12 million people between the ages of 18 and 20 and over 104 million people between the ages of 21 and 44 in the United States. With over 326 million US citizens in 2021, this demographic represents roughly 35.6% of the US population. 58% of American adults owned stock in 2022, up from 55% in 2020 but still below an average of 62% between 2001 and 2008. With Wealthfront’s passive and active investing options, an increasing percentage of Americans owning stock represents a growing market for the company’s services.

While Wealthfront’s services center around investing, its cash savings account offering is a major part of the company’s vision to become an end-to-end financial solution for everyday consumers. In 2019, the median transaction account balance, which includes data from both savings and checking account balances, was $5.3K in the US. Meanwhile, the average transaction account balance was $41.6K. Both of these statistics have increased steadily between 2010 and 2019.

Competition

As the popularity of automated investing increases and Wealthfront expands its offerings, the competitive landscape for the company is becoming increasingly crowded, with competitors falling into one of three categories: 1) robo-advisors, 2) incumbent investment management firms, and 3) other fintech platforms.

Robo-Advisors

Betterment: Betterment is a financial management platform with automated investments, financial planning, and cash accounts. It was founded in 2008 and was one of the first companies to introduce robo-advisors. Its suite of products mirrors Wealthfront’s, except for borrowing. The company has raised $435 million in funding and raised $160 million in a 2021 Series F round at a nearly $1.3 billion valuation. Betterment's revenue was $100 million in 2021, mostly from management fees charged as a percentage of total assets managed. Its AUM grew by 50% in 2020 and 18.5% in 2021.

M1: M1 was founded in 2015 and is self-described as “The Finance Super App.” Like Wealthfront, M1 offers investment, savings, banking, and loan offerings. Unlike Wealthfront, it offers an annual subscription service for $125 per year. M1 has raised $323.2 million in funding, having raised a $150 million Series E in 2021 at a $1.5 billion valuation led by SoftBank. It crossed $5 billion in client assets under management as of that 2021 Series E round, a 150% increase from 2020.

Incumbents

Vanguard: Vanguard was founded in 1975. In the past, it has offered various financial solutions for corporations and individuals, including its well-known mutual funds and ETFs. In 2015, Vanguard introduced its robo-advisor to compete with the growing number of startups in the space — including Wealthfront. The firm’s total assets under management (AUM) reached $7 trillion in 2020.

Fidelity: Founded in 1946, Fidelity offers investment management services for individuals, including its robo-advisor platform, which the company launched in 2016. As of March 2023, Fidelity had ~40.9 million individual investors and $10.3 trillion AUM.

Other Fintech Platforms

Robinhood: Robinhood was founded in 2013 and went public in 2021 after changing how individuals interact with active investing, including pioneering commission-free trading and fractional share investing. While Wealthfront’s previous focus on passive investing allowed the company to avoid competition with Robinhood, its 2023 foray into active stock investing puts it into direct competition with the public company. In 2022, Robinhood achieved total revenues of $1.36 billion and ended the year with a market cap of $7.22 billion.

Current: Current is a challenger bank that was founded in 2015. It offers a bank account that competes with Wealthfront’s high-yield cash account, including a checking account and a high-yield savings account. Current has raised $402.4 million since its inception and raised a $220 million Series D at a $2.2 billion valuation in 2021.

Business Model

Wealthfront charges an advisory fee of 0.25% for all managed assets on the platform, the company’s primary revenue driver. This fee is a fraction of the average 1% advisory fee in the financial planning industry, which Wealthfront accomplishes by cutting out the labor portion of a traditional cost structure. Additionally, Wealthfront also earns revenue from interest on its loans to users, interest on cash rewards, and interchange fees.

Traction

As of March 2023, Wealthfront has $35+ billion in AUM and 550k+ clients. Based on its 0.25% advisory fee for all managed assets on the platform and $35 billion in AUM, Wealthfront’s estimated revenue from advisory fees alone would be $87.5 million.

Valuation

Wealthfront raised a $75 million Series E round at an undisclosed valuation in January 2018, led by Tiger Global, with participation from several existing investors, including Benchmark Capital, Greylock Partners, and Index Ventures. Before its Series E, the company had raised a total of $130 million.

UBS Acquisition

In January 2022, UBS, a Switzerland-based wealth management conglomerate, agreed to acquire Wealthfront for a purchase price of $1.4 billion. This acquisition was intended to help UBS grow in the US market and allow the large firm to access Wealthfront’s technological prowess. However, the acquisition was nixed shortly after September 2022 due to growing concerns from regulators and shareholders. Instead, UBS invested $69.7 million into Wealthfront through a convertible note at the same $1.4 billion valuation, bringing the company’s total amount raised to $274.2 million.

Key Opportunities

UBS Partnership

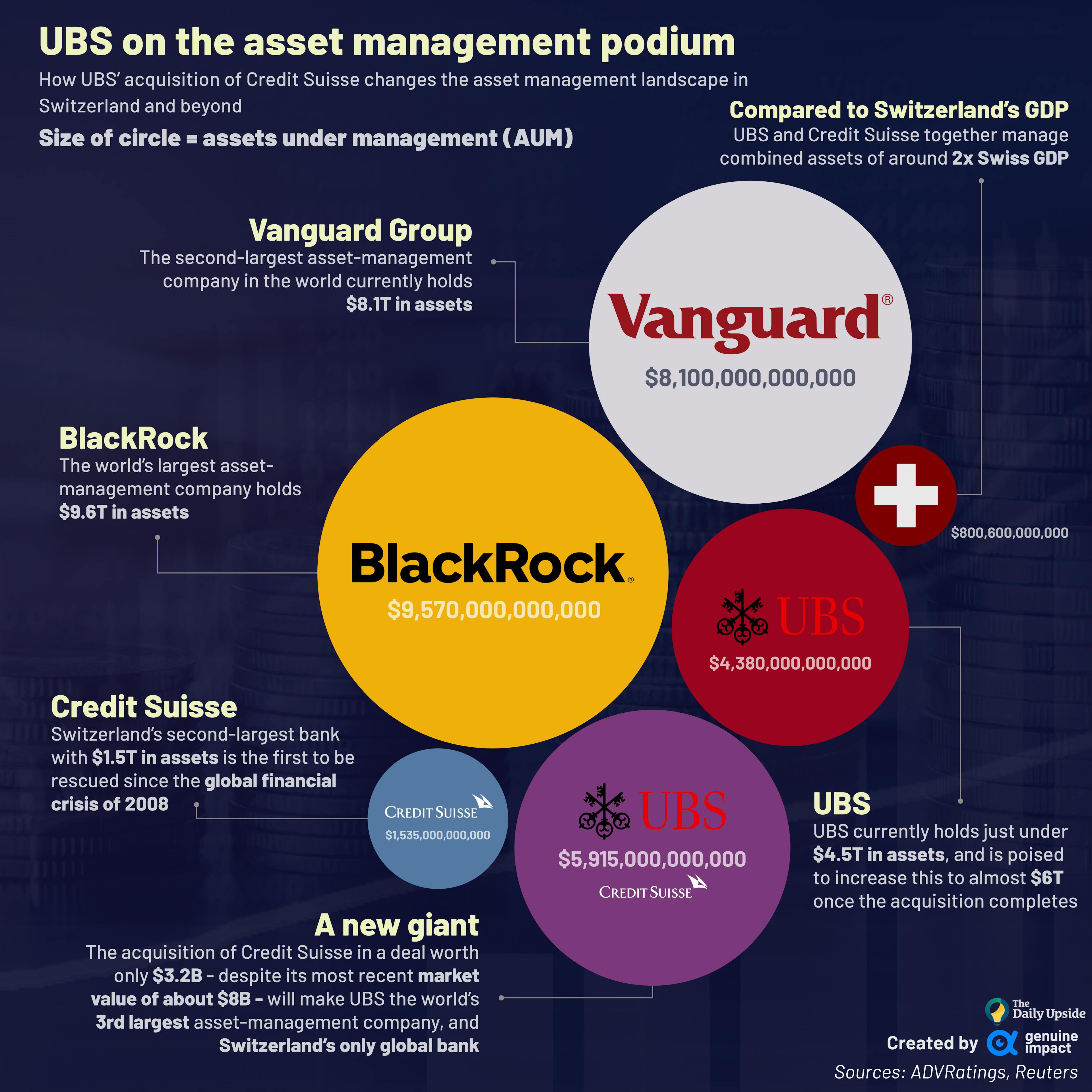

With its March 2023 acquisition of Credit Suisse, UBS became the world’s third-largest asset management firm behind BlackRock and Vanguard. The size of this firm, coupled with its desire to expand in the US market and its nearly $70 million investment in Wealthfront, represents a large opportunity for the fintech platform. Despite the firm’s unsuccessful acquisition attempt of Wealthfront in 2022, both sides have committed to working together. David Fortunato, Wealthfront’s CEO, has stated that the two would continue “to explore ways to work together in a partnership.” If that partnership materializes, Wealthfront could benefit greatly from UBS’s size and expertise as it expands in the US and abroad.

Source: Genuine Impact

Product Expansion

Although Wealthfront began as an automated investing platform, it has proven its ability to successfully add new products and become a full-suite asset management platform, evidenced by its cash account launched in 2019 and stock investing product that was launched in 2023. Looking forward, Wealthfront can continue strategically adding products to its offerings to appeal to more customers, retain current users, and increase assets under management. Possible product expansions could include expanding its crypto offerings, adding a credit card, or broadening the types of loans it offers.

Capturing Younger Generations

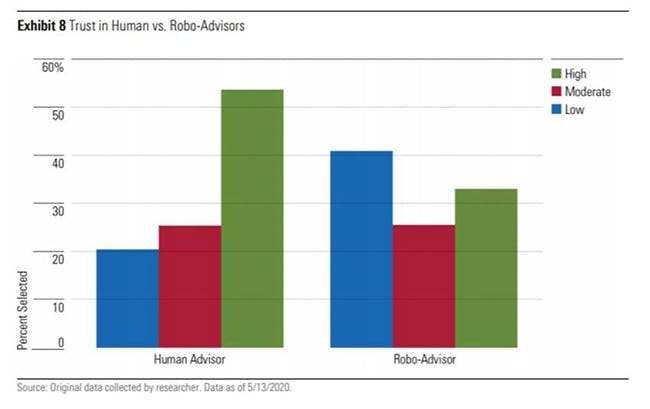

With its tech-enabled offerings, Wealthfront has the opportunity to benefit from the rising income levels of younger generations that are not yet in their prime financial years, like Gen Z. A 2022 survey found that 73% of Gen Z would be willing to use a robo-advisor, second in willingness only to 75% of millennials. However, a 2020 study showed that only 22% of Gen Z had used a robo-advisor and that this demographic had far more trust in human advisors than in robo-advisors. If Wealthfront can successfully gain the confidence of younger generations in the future, it can continue to displace incumbent competitors by capturing outsized market share among younger digitally-native generations who will eventually age into having a higher average net worth.

Source: Morningstar

Key Risks

Small Average Account Sizes

There are doubts that Wealthfront can successfully capture high-income demographics with its automated offerings due to the greater complexity of managing finances for people with a higher net worth. High net-worth individuals, defined as people with at least $1 million of investable assets, typically require a more hands-on approach to financial planning because of the size and intricacy of their accounts and financial needs. There is a risk that users in its target segments could “grow out” of Wealthfront’s digital offerings and move to a more established competitor with a wider array of offerings or the ability to support a more hands-on service.

Competitive Risks

It may prove increasingly difficult for Wealthfront to differentiate itself against competing robo-advisors like M1 and Betterment which have a similar range of products and are better capitalized than Wealthfront. Meanwhile, incumbents like Vanguard and Fidelity have the advantage of scale and are able to offer similar products. Both categories of competitors pose risks to Wealthfront’s growth prospects.

Summary

After being one of the first startups to succeed with its robo-advisor, Wealthfront has continuously expanded its product offerings to slowly become an individual’s sole source for investing, saving, spending, and borrowing. Wealthfront has positioned itself to take advantage of the growing income of millennials and younger generations that are more comfortable handing their money to a fintech platform to help them passively achieve their financial goals. However, the company faces strong competition across all its product offerings, including from massive incumbent firms with trillions of dollars in AUM. Despite a strong demand for Wealthfront’s products, this competition presents a troubling challenge to the company as it looks to grow past its current stage.